#Custom Accounting CPA

Explore tagged Tumblr posts

Text

Expert Tax Accountant in NYC at Custom Accounting CPA

Navigating the intricate world of taxes in New York City can be overwhelming for both individuals and businesses. That’s where Custom Accounting CPA comes in. As a trusted and experienced tax accountant in NYC, we specialize in delivering precise, reliable, and personalized tax solutions that align with your financial goals and comply with ever-changing tax laws.

Why You Need a Professional Tax Accountant in NYC

NYC has one of the most complex tax systems in the country, with layers of city, state, and federal regulations. Whether you’re an entrepreneur, freelancer, small business owner, or high-net-worth individual, having a skilled tax accountant ensures you’re not missing deductions, overpaying taxes, or exposing yourself to compliance risks.

At Custom Accounting CPA, our licensed CPAs bring deep knowledge of New York tax codes and offer services including:

Personal and business tax preparation

Tax planning and strategy

IRS audit representation

Sales and payroll tax filing

Entity formation and restructuring advice

Tailored Solutions for Every Client

What sets Custom Accounting CPA apart is our commitment to personalized service. We take the time to understand your unique financial picture and customize our approach to meet your specific needs. Whether you're filing simple returns or dealing with complex business finances, we provide clear guidance and smart strategies.

Stay Compliant, Stay Ahead

Our proactive tax services help you stay compliant while also identifying opportunities to reduce tax liability and improve cash flow. We keep up with the latest updates in tax law and financial regulations, ensuring our clients always benefit from the most accurate and up-to-date advice.

Your NYC Tax Partner Year-Round

Unlike seasonal tax services, we work with clients year-round to manage their tax responsibilities and make informed financial decisions. Whether it's answering a question mid-year or planning ahead for next tax season, we’re here when you need us.

Contact Custom Accounting CPA TodayIf you're looking for a reliable tax accountant NYC, trust Custom Accounting CPA to deliver the expertise and service you deserve. Contact us today to schedule your consultation and take the stress out of taxes.

0 notes

Text

#CPA firms#specialized financial services#offshore staffing solutions#customized accounting solutions

0 notes

Text

Kickstarting a new Martin Hench novel about the dawn of enshittification

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/01/07/weird-pcs/#a-mormon-bishop-an-orthodox-rabbi-and-a-catholic-priest-walk-into-a-personal-computing-revolution

Picks and Shovels is a new, standalone technothriller starring Marty Hench, my two-fisted, hard-fighting, tech-scam-busting forensic accountant. You can pre-order it on my latest Kickstarter, which features a brilliant audiobook read by @wilwheaton:

http://martinhench.com

This is the third Hench novel, following on from the nationally bestselling The Bezzle (2024) and Red Team Blues (2023). I wrote Red Team Blues with a funny conceit: what if I wrote the final volume of a beloved, long-running series, without writing the rest of the series? Turns out, the answer is: "Your editor will buy a whole bunch more books in the series!"

My solution to this happy conundrum? Write the Hench books out of chronological order. After all, Marty Hench is a financial hacker who's been in Silicon Valley since the days of the first PCs, so he's been there for all the weird scams tech bros have dreamed up since Jobs and Woz were laboring in their garage over the Apple I. He's the Zelig of high-tech fraud! Look hard at any computing-related scandal and you'll find Marty Hench in the picture, quietly and competently unraveling the scheme, dodging lawsuits and bullets with equal aplomb.

Which brings me to Picks and Shovels. In this volume, we travel back to Marty's first job, in the 1980s – the weird and heroic era of the PC. Marty ended up in the Bay Area after he flunked out of an MIT computer science degree (he was too busy programming computers to do his classwork), and earning his CPA at a community college.

Silicon Valley in the early eighties was wild: Reaganomics stalked the land, the AIDS crisis was in full swing, the Dead Kennedys played every weekend, and man were the PCs ever weird. This was before the industry crystalized into Mac vs PC, back when no one knew what they were supposed to look like, who was supposed to use them, and what they were for.

Marty's first job is working for one of the weirder companies: Fidelity Computing. They sound like a joke: a computer company run by a Mormon bishop, a Catholic priest and an orthodox rabbi. But the joke's on their customers, because Fidelity Computing is a scam: a pyramid sales cult that exploits religious affinities to sell junk PCs that are designed to lock customers in and squeeze them for every dime. A Fidelity printer only works with Fidelity printer paper (they've gimmicked the sprockets on the tractor-feed). A Fidelity floppy drive only accepts Fidelity floppies (every disk is sold with a single, scratched-out sector and the drives check for an error on that sector every time they run).

Marty figures out he's working for the bad guys when they ask him to destroy Computing Freedom, a scrappy rival startup founded by three women who've escaped from Fidelity Computing's cult: a queer orthodox woman who's been kicked out of her family; a radical nun who's thrown in with the Liberation Theology movement in opposing America's Dirty Wars; and a Mormon woman who's quit the church in disgust at its opposition to the Equal Rights Amendment. The women of Computing Freedom have a (ahem) holy mission: to free every Fidelity customer from the prison they were lured into.

Marty may be young and inexperienced, but he can spot a rebel alliance from a light year away and he knows what side he wants to be on. He joins the women in their mission, and we're deep into a computing war that quickly turns into a shooting war. Turns out the Reverend Sirs of Fidelity Computer aren't just scammers – they're mobbed up, and willing to turn to lethal violence to defend their racket.

This is a rollicking crime thriller, a science fiction novel about the dawn of the computing revolution. It's an archaeological expedition to uncover the fossil record of the first emergence of enshittification, a phenomenon that was born with the PC and its evil twin, the Reagan Revolution.

The book comes out on Feb 15 in hardcover and ebook from Macmillan (US/Canada) and Bloomsbury (UK), but neither publisher is doing the audiobook. That's my department.

Why? Well, I love audiobooks, and I especially love the audiobooks for this series, because they're read by the incredible Wil Wheaton, hands down my favorite audiobook narrator. But that's not why I retain my audiobook rights and produce my own audiobooks. I do that because Amazon's Audible service refuses to carry any of my audiobooks.

Here's how that works: Audible is a division of Amazon, and they've illegally obtained a monopoly over the audiobook market, controlling more than 90% of audiobook sales in many genres. That means that if your book isn't for sale on Audible, it might as well not exist.

But Amazon won't let you sell your books on Audible unless you let them wrap those books in "digital rights management," a kind of encryption that locks them to Audible's authorized players. Under Section 1201 of the Digital Millennium Copyright Act, it's a felony punishable with a 5-year sentence and a $500k fine to supply you with a tool to remove an audiobook from Audible and play it on a rival app. That applies even if the person who gives you the tool is the creator of the book!

You read that right: if I make an audiobook and then give you the tools to move it out of Amazon's walled garden, I could go to prison for five years! That's a stiffer sentence than you'd face if you were to just pirate the audiobook. It's a harsher penalty than you'd get for shoplifting the book on CD from a truck-stop. It's more draconian than the penalty for hijacking the truck that delivers the CDs!

Amazon knows that every time you buy an audiobook from Audible, you increase the cost you'll have to pay if you switch to a competitor. They use that fact to give readers a worse deal (last year they tried out ads in audiobooks!). But the people who really suffer under this arrangement are the writers, whom Amazon abuses with abandon, knowing they can't afford to leave the service because their readers are locked into it. That's why Amazon felt they could get away with stealing $100 million from indie audiobook creators (and yup, they got away with it):

https://www.audiblegate.com/about

Which is why none of my books can be sold with DRM. And that means that Audible won't carry any of them.

For more than a decade, I've been making my own audiobooks, in partnership with the wonderful studio Skyboat Media and their brilliant director, Gabrielle de Cuir:

https://skyboatmedia.com/

I pay fantastic narrators a fair wage for their work, then I pay John Taylor Williams, the engineer who masters my podcasts, to edit the books and compose bed music for the intro and outro. Then I sell the books at every store in the world – except Audible and Apple, who both have mandatory DRM. Because fuck DRM.

Paying everyone a fair wage is expensive. It's worth it: the books are great. But even though my books are sold at many stores online, being frozen out of Audible means that the sales barely register.

That's why I do these Kickstarter campaigns, to pre-sell thousands of audiobooks in advance of the release. I've done six of these now, and each one was a huge success, inspiring others to strike out on their own, sometimes with spectacular results:

https://www.usatoday.com/story/entertainment/books/2022/04/01/brandon-sanderson-kickstarter-41-million-new-books/7243531001/

Today, I've launched the Kickstarter for Picks and Shovels. I'm selling the audiobook and ebook in DRM-form, without any "terms of service" or "license agreement." That means they're just like a print book: you buy them, you own them. You can read them on any equipment you choose to. You can sell them, give them away, or lend them to friends. Rather than making you submit to 20,000 words of insulting legalese, all I ask of you is that you don't violate copyright law. I trust you!

Speaking of print books: I'm also pre-selling the hardcover of Picks and Shovels and the paperbacks of The Bezzle and Red Team Blues, the other two Marty Hench books. I'll even sign and personalize them for you!

http://martinhench.com

I'm also offering five chances to commission your own Marty Hench story – pick your favorite high-tech finance scam from the past 40 years of tech history, and I'll have Marty bust it in a custom short story. Once the story is published, I'll make sure you get credit. Check out these two cool Little Brother stories my previous Kickstarter backers commissioned:

Spill

https://reactormag.com/spill-cory-doctorow/

Vigilant

https://reactormag.com/vigilant-cory-doctorow/

I'm heading out on tour this winter and spring with the book. I'll be in LA, San Francisco, San Diego, Burbank, Bloomington, Chicago, Richmond VA, Toronto, NYC, Boston, Austin, DC, Baltimore, Seattle, and other dates still added. I've got an incredible roster of conversation partners lined up, too: John Hodgman, Charlie Jane Anders, Dan Savage, Ken Liu, Peter Sagal, Wil Wheaton, and others.

I hope you'll check out this book, and come out to see me on tour and say hi. Before I go, I want to leave you with some words of advance praise for Picks and Shovels:

I hugely enjoyed Picks and Shovels. Cory Doctorow’s reconstruction of the age is note perfect: the detail, the atmosphere, ethos, flavour and smell of the age is perfectly conveyed. I love Marty and Art and all the main characters. The hope and the thrill that marks the opening section. The superb way he tells the story of the rise of Silicon Valley (to use the lazy metonym), inserting the stories of Shockley, IBM vs US Government, the rise of MS – all without turning journalistic or preachy.

The seeds of enshittification are all there… even in the sunlight of that time the shadows are lengthening. AIDS of course, and the coming scum tide of VCs. In Orwellian terms, the pigs are already rising up on two feet and starting to wear trousers. All that hope, all those ideals…

I love too the thesis that San Francisco always has failed and always will fail her suitors.

Despite cultural entropy, enshittification, corruption, greed and all the betrayals there’s a core of hope and honour in the story too.

-Stephen Fry

Cory Doctorow writes as few authors do, with tech world savvy and real world moral clarity. A true storyteller for our times.

-John Scalzi

A crackling, page-turning tumble into an unexpected underworld of queer coders, Mission burritos, and hacker nuns. You will fall in love with the righteous underdogs of Computing Freedom—and feel right at home in the holy place Doctorow has built for them far from Silicon Valley’s grabby, greedy hands."

-Claire Evans, editor of Motherboard Future, author of Broad Band: The Untold Story of the Women Who Made the Internet.

"Wonderful…evokes the hacker spirit of the early personal computer era—and shows how the battle for software freedom is eternal."

-Steven Levy, author of Hackers: Heroes of the Computer Revolution and Facebook: The Inside Story.

What could be better than a Martin Hench thriller set in 1980s San Francisco that mixes punk rock romance with Lotus spreadsheets, dot matrix printers and religious orders? You'll eat this up – I sure did.

-Tim Wu, Special Assistant to the President for Technology and Competition Policy, author of The Master Switch: The Rise and Fall of Information Empires

Captures the look and feel of the PC era. Cory Doctorow draws a portrait of a Silicon Valley and San Francisco before the tech bros showed up — a startup world driven as much by open source ideals as venture capital gold.

-John Markoff, Pulitzer-winning tech columnist for the New York Times and author of What the Doormouse Said: How the Sixties Counterculture Shaped the Personal Computer Industry

You won't put this book down – it's too much fun. I was there when it all began. Doctorow's characters and their story are real.

-Dan'l Lewin, CEO and President of the Computer History Museum

#pluralistic#books#audiobooks#weird pcs#religion#pyramid schemes#cults#the eighties#punk#queer#san francisco#armistead maupin#novels#science fiction#technothrillers#crowdfunding#wil wheaton#amazon#drm#audible#monopolies#martin hench#marty hench#crime#thrillers#crime thrillers

680 notes

·

View notes

Note

Hey, this is a group of Karrakin CPAs, right? Can I hire one of you to help me file my taxes? I'm in a lot of debt. Please help me.

...<AUTOMATED RESPONSE>

Good tidings, Cousin! Being a collective of Minor Houses under the House of Remembrance, we at the Crosslandic Praeseist Alliance have an abundance individuals at our disposal skilled in every manner of record keeping; this includes, of course, financiers, accountants, and tax consultants! Please hold while we connect thee unto a representative!

[Shitty customer support help desk hold music begins playing.]

7 notes

·

View notes

Text

B2B PPC in 2025: Smarter Lead Gen with AI and Intent Data

B2B advertisers have long been at odds with Google Ads. The high CPCs, long sales cycles, and poor-quality leads made it feel like a leaky funnel. But in 2025, that’s changing — fast.

With smarter AI, intent modelling, and CRM integration, B2B PPC in New Zealand and Australia is entering a new era of performance-led lead generation. The brands that embrace this shift are generating more pipeline, with less waste.

This blog explores what’s working now in B2B Google Ads, how to avoid common pitfalls, and why AI + intent data are changing everything.

Why B2B Needs a Different Strategy

B2B marketing is not e-commerce. Buyers don’t convert in a single click. Decision-making is slower, multi-stakeholder, and higher value.

2025 challenges include:

CPCs exceeding NZ$7.00 in legal, SaaS, or finance niches

Form-fills that don’t convert into sales

Lack of clarity between MQLs, SQLs, and true pipeline

To win, B2B advertisers must align media strategy with intent — and feed real conversion data back into the platform.

Smart Use of AI in B2B PPC

Smart Bidding with Offline Conversions: Link your CRM (like HubSpot or Salesforce) to Google Ads to pass back real revenue data.

Use Broad Match with Signals: Let Google’s AI expand reach — but guided by audience and keyword intent.

Performance Max with Precise Inputs: Create campaign structures based on service tiers, pain points, or use cases.

Responsive Search Ads with ABM Messaging: Build modular messaging that speaks to industries or roles.

Intent Data Is Your Competitive Advantage

Generic lead gen campaigns are no longer effective. B2B advertisers winning in 2025 are:

Using Customer Match lists from sales-qualified leads

Creating lookalikes based on CRM close data

Running remarketing to high-value content page visitors

Prioritising keywords that reflect high intent, not just high volume

Case Study – Auckland-Based B2B SaaS

A mid-sized SaaS company targeting finance teams across NZ used to run lead-gen ads driving eBook downloads. Leads were cheap, but MQL-to-SQL rates were under 4%.

They rebuilt their campaigns using:

Performance Max asset groups for each service module

Customer Match with closed deals

Offline conversion tracking tied to CRM stages

Result? 63% increase in pipeline-qualified leads within 90 days — with 22% lower CPA.

Top Tips for NZ & AU B2B Advertisers in 2025

Feed Google real sales data (not just form-fills)

Run branded campaigns to protect SERP real estate

Break up broad services into niche campaigns

Use remarketing lists built on behaviour (not just page visits)

Layer search with YouTube explainer videos for trust and education

Final Thoughts

B2B PPC in 2025 is smarter, faster, and more accountable — but only if you feed the machine with the right data. For NZ and AU marketers, this means treating Google Ads not as a volume game, but as an intent-led revenue engine.

With the right structure and strategy, even high-CPC industries can generate serious pipeline — efficiently and at scale.

At Metrics Media, we help NZ and AU B2B marketers scale smarter — using intent signals, AI, and CRM data to drive real pipeline.

📧 Book your lead generation audit today: [email protected]

Source URL- https://shorturl.at/nEWro

Contact us

361 New North Road, Kingsland. Auckland. New Zealand 0800 39 49 39

2 notes

·

View notes

Text

Hire a Bookkeeper in Atlanta & Save Cost- Centelli

Looking to Hire a Bookkeeper in Atlanta without the hefty costs? You have a smart option to outsource our bookkeeping services and get access to our reliable, and experienced team of accounting and bookkeeping experts.

Benefits of working with us:

Delegate full-service bookkeeping or specific tasks

US GAAP-trained bookkeeping specialists

Save 35-60% compared to in-house bookkeeper

Expertise in leading bookkeeping software

Flexible, secure, and scalable support

We cater to small to large companies (including CPA firms) across sectors helping them stay on top of their finances without adding overhead. You can rely on us for precise day to day financial records, reconciliations, month-end closing, chart of accounts, vendor & supplier records, financial summaries & custom reports.

Reach out to us to learn how outsourcing bookkeeping with us can keep your financial records organized and up to date at a fraction of the in-house department cost.

#Bookkeeping Services#Outsourcing Services#Accounting Services#Atlanta#Centelli#USA#Hire Bookkeeper#Finance Accounting

2 notes

·

View notes

Text

SEO vs. Paid Ads: Which Delivers Better ROI?

SEO vs. Paid Ads: Which Delivers Better ROI?

In the fast-evolving world of digital marketing, businesses often face a critical decision: should they invest in Search Engine Optimization (SEO) or Paid Advertising (Paid Ads)? Both strategies offer unique advantages, but when it comes to return on investment (ROI), understanding the strengths and limitations of each is essential for making the right choice.

Understanding SEO and Paid Ads

SEO focuses on organically improving your website’s visibility on search engines through techniques like keyword optimization, link building, and content creation. It builds long-term authority and attracts users actively searching for your products or services.

On the other hand, Paid Ads such as Google Ads or social media promotions offer immediate visibility by placing your brand in front of targeted audiences. This can generate quick traffic and leads but requires a continuous budget to maintain.

ROI Comparison: SEO vs. Paid Ads

SEO is widely recognized for delivering sustainable ROI. While it requires patience and consistent effort, the benefits are long-lasting. Businesses working with a trusted Top SEO company in Mumbai understand that SEO builds brand credibility and trust, leading to higher organic traffic and better-quality leads over time.

In contrast, Paid Ads provide instant traffic and measurable results. You can control your budget, target specific demographics, and quickly test campaigns. However, once the ad spend stops, the traffic typically drops immediately, limiting long-term benefits.

Why Choose SEO for Better Long-Term ROI?

Investing in SEO means you’re building a foundation that continues to pay off. Organic search accounts for a majority of website traffic, and ranking high on Google’s search results often leads to higher click-through rates compared to paid ads.

Partnering with a Top SEO company in Mumbai ensures you get expert guidance on keyword strategy, on-page optimization, and technical SEO that drives consistent growth. Over time, this approach can reduce your cost-per-acquisition (CPA) and increase customer lifetime value, making SEO a smarter long-term investment.

When Paid Ads Make Sense

Paid Ads are ideal for short-term goals like product launches, seasonal promotions, or immediate lead generation. They complement SEO efforts by driving targeted traffic while your organic rankings build momentum.

A combined strategy often works best—leveraging the immediate impact of Paid Ads and the lasting value of SEO. That’s why businesses trust the Top SEO company in Mumbai to design integrated campaigns that maximize ROI across channels.

Final Thoughts

Both SEO and Paid Ads have their place in a successful digital marketing strategy. If you seek lasting growth and cost-effective results, SEO with a proven Top SEO company in Mumbai is your best bet. For quick wins and specific campaigns, Paid Ads can accelerate your visibility.

Ultimately, the highest ROI comes from a strategic mix tailored to your business goals, budget, and timeline.

If you want expert help in choosing the right digital marketing path and maximizing your returns, connect with the Top SEO company in Mumbai today!

2 notes

·

View notes

Text

Boost Your Advertising Success with an ExoClick Ads Account

Are you looking to scale your online advertising campaigns and achieve maximum ROI? If so, an ExoClick Ads Account is the perfect solution for you. ExoClick is one of the most advanced and high-performing ad networks, offering powerful targeting options, high-quality traffic, and multiple ad formats to enhance your digital marketing strategy.

Why Choose ExoClick for Your Advertising Needs?

ExoClick stands out as a leading ad network, providing advertisers with exceptional opportunities to reach their target audience efficiently. Here’s why you should consider ExoClick for your marketing campaigns:

1. Diverse Ad Formats

ExoClick supports multiple ad types, including banner ads, popunders, native ads, and video ads, giving advertisers flexibility in their campaigns.

2. Advanced Targeting Features

With ExoClick, you can target your audience based on geo-location, device type, browser, language, and interests, ensuring maximum relevance for your ads.

3. High-Quality Traffic & Global Reach

ExoClick provides access to millions of users worldwide, delivering premium traffic that converts effectively.

4. Real-Time Optimization & Analytics

The platform offers powerful analytics tools, helping advertisers monitor campaign performance and make data-driven decisions for better results.

5. Affordable & Cost-Effective Solutions

ExoClick’s flexible pricing models (CPC, CPM, and CPA) ensure that businesses of all sizes can benefit from their advertising solutions.

Get an ExoClick Ads Account Hassle-Free

If you're looking to buy a verified and ready-to-use ExoClick Ads Account, we’ve got you covered! At VCCAccount.com, we provide high-quality ExoClick accounts that are fully verified and ready for advertising.

Why Buy from Us?

✅ Fully Verified ExoClick Accounts ✅ Instant Delivery & Secure Transactions ✅ 24/7 Customer Support ✅ Affordable Pricing ✅ Guaranteed Account Approval

Don’t miss out on the opportunity to grow your advertising campaigns with ease. Buy your ExoClick Ads Account now and take your online marketing to the next level!

Conclusion

ExoClick is a game-changer for advertisers looking for scalable and high-ROI campaigns. Whether you're an experienced marketer or just starting, having an ExoClick Ads Account can significantly enhance your digital advertising strategy. Visit VCCAccount.com today and start your journey toward profitable online advertising!

2 notes

·

View notes

Text

Expert Bookkeeping Services New Mexico: Streamlining Your Financial Success

Bookkeeping Services New Mexico

In today’s fast-paced business environment, accurate and reliable financial management is crucial to business success. One of the foundational pillars of sound financial practices is bookkeeping services. For businesses in the Southwestern region, especially in New Mexico, accessing professional bookkeeping services New Mexico can make all the difference between thriving and merely surviving.

The Importance of Bookkeeping for Modern Businesses

Every business, regardless of size, must maintain a clear and accurate financial record. Bookkeeping involves recording all financial transactions, including income, expenses, payroll, and taxes. This process ensures that a business remains compliant with local and federal regulations while also providing a clear snapshot of financial health.

Why Choose Bookkeeping Services in New Mexico?

1. Local Expertise

New Mexico has unique tax laws, business regulations, and economic opportunities. Working with a provider that specializes in bookkeeping services New Mexico means you benefit from professionals who understand local compliance standards and financial requirements.

2. Tailored Solutions

Professional bookkeeping services are not one-size-fits-all. Businesses in different industries require customized bookkeeping solutions. Whether you're a small business, a startup, or an established enterprise in New Mexico, tailored services ensure your finances are managed effectively.

3. Cost Efficiency

Outsourcing your bookkeeping services can save you money compared to hiring a full-time, in-house bookkeeper. With outsourced bookkeeping services New Mexico, you gain access to expert knowledge without the overhead costs.

4. Technology Integration

Modern bookkeeping relies heavily on software and cloud solutions. Experts offering bookkeeping services New Mexico use the latest tools to streamline data entry, automate recurring transactions, and generate insightful reports.

Services Offered by Bookkeeping Providers in New Mexico

Professional bookkeeping firms in New Mexico offer a range of services to meet the specific needs of their clients:

General Ledger Maintenance

Accurate recording and categorization of all financial transactions to ensure your general ledger remains up to date.

Accounts Payable and Receivable

Efficient tracking of incoming and outgoing payments, helping you manage cash flow and avoid late fees or missed invoices.

Bank Reconciliation

Matching bank statements with internal records to identify discrepancies and ensure accuracy.

Payroll Processing

Timely calculation and distribution of employee salaries, tax withholdings, and benefits.

Financial Reporting

Generation of monthly, quarterly, and annual reports including income statements, balance sheets, and cash flow statements.

Tax Preparation Support

Proper organization of financial documents and coordination with CPAs to simplify the tax filing process.

Advantages of Outsourcing Bookkeeping Services New Mexico

Outsourcing is a strategic move for businesses looking to optimize their financial operations. Here’s how outsourcing bookkeeping services New Mexico can be beneficial:

Time Savings: Focus on growing your business while experts handle the books.

Accuracy: Reduce errors and discrepancies with skilled professionals managing your finances.

Compliance: Stay up to date with local and federal tax laws and financial regulations.

Data Security: Access to secure digital storage and cloud-based accounting systems.

Scalability: Easily scale services as your business grows.

Who Can Benefit from Bookkeeping Services in New Mexico?

Small and Medium Enterprises (SMEs)

SMEs can manage their finances better and avoid costly errors by outsourcing their bookkeeping to professionals.

Startups

Startups can save valuable time and resources by relying on expert bookkeeping services to establish strong financial foundations.

Freelancers and Consultants

Independent professionals can gain peace of mind by ensuring their income and expenses are properly tracked.

Non-Profit Organizations

Proper financial reporting and transparency are essential for non-profits to maintain trust with donors and stakeholders.

Choosing the Right Bookkeeping Partner in New Mexico

When selecting a bookkeeping provider, keep the following in mind:

Experience: Look for a team with a proven track record in delivering top-notch bookkeeping services New Mexico.

Reputation: Check reviews, testimonials, and references from other clients.

Technology: Make sure they use modern tools for accuracy and efficiency.

Support: Ensure they provide ongoing support and personalized service.

Why Choose CFO Advisory India?

If you are looking for reliable bookkeeping services New Mexico, CFO Advisory India offers a comprehensive suite of financial services tailored to your business needs. With a team of skilled professionals, CFOAD delivers timely, accurate, and compliant bookkeeping that allows businesses to focus on core operations.

What Sets CFOAD Apart?

Expert knowledge in local New Mexico compliance and tax laws

Personalized solutions for businesses of all sizes

Efficient use of technology and secure cloud-based systems

Transparent communication and client-first approach

Conclusion

Accurate bookkeeping is the backbone of any successful business. Whether you're a growing startup, a seasoned entrepreneur, or a non-profit organization in New Mexico, professional bookkeeping services New Mexico are essential for financial clarity and success. Partnering with a trusted provider like CFOAD can help you navigate the complexities of financial management with ease, ensuring your business stays on the path to growth and profitability.

Embrace professional bookkeeping today and take the first step toward financial excellence in New Mexico.

1 note

·

View note

Text

How to Secure High-Paying Jobs in the Gulf Region

The Gulf region, known for its booming industries and dynamic job market, offers abundant opportunities for skilled professionals. From the bustling skyscrapers of Dubai to the thriving oil and gas sector in Saudi Arabia, Gulf countries attract talent worldwide. If you're aiming to land a high-paying job in this region, it’s crucial to strategize your job search and build a profile that stands out. This guide offers actionable tips to help you navigate the Gulf job market successfully.

1. Understand the Gulf Job Market

The Gulf region is unique in its employment dynamics. Industries such as construction, IT, healthcare, and hospitality dominate the landscape. High-paying roles are often available in oil and gas, finance, and technology. To find roles that align with your expertise:

Research the industries experiencing growth in the Gulf countries you’re targeting.

Stay updated on visa requirements and work permits for expatriates.

Network with professionals already working in the region.

For comprehensive insights into Gulf job trends, explore our career resources to get started.

2. Create a Gulf-Standard CV

Your CV is often the first impression you make on a potential employer. Gulf employers prioritize concise, well-organized CVs that highlight relevant experience and achievements.

Key elements to include:

Professional Photo: Many employers in the Gulf expect a formal photo on your CV.

Personal Details: Include your nationality, visa status, and contact information, including a WhatsApp number.

Tailored Skills: Customize your CV to reflect the job’s requirements, focusing on industry-specific skills.

Certifications: Highlight relevant certifications such as PMP for project managers, CCNA for IT professionals, or CPA for accountants.

By presenting your qualifications in a way that matches Gulf standards, you increase your chances of getting noticed by recruiters.

3. Leverage Online Job Portals

Online job portals are a gateway to Gulf employment opportunities. Many platforms specialize in connecting job seekers with employers in the region. To maximize your success:

Create a professional profile that aligns with your desired job role.

Set up job alerts to stay informed about new opportunities.

Apply only for jobs you’re genuinely qualified for to increase the likelihood of responses.

For tailored Gulf job listings, check out job opportunities to explore roles across various industries.

4. Develop In-Demand Skills

Employers in the Gulf seek candidates with specialized expertise. Upskilling in fields such as artificial intelligence, digital marketing, project management, and engineering can make your profile more competitive. Additionally:

Learn languages like Arabic to enhance communication in the workplace.

Familiarize yourself with tools and software commonly used in your field.

Attend workshops and training sessions to demonstrate your commitment to professional growth.

5. Prepare for Cultural Sensitivity

The Gulf region has a rich cultural heritage, and understanding workplace etiquette is vital. When working in the Gulf, consider the following:

Respect for Authority: Use formal titles and maintain professionalism in interactions.

Appropriate Dress Code: Dressing conservatively is essential, especially in interviews and formal settings.

Business Etiquette: Punctuality and politeness are highly valued.

Cultural awareness demonstrates your respect for the region’s traditions and norms, making you a more attractive candidate.

6. Network Effectively

Building connections can open doors to Gulf job opportunities. Utilize platforms like LinkedIn to network with industry professionals, recruiters, and hiring managers. Attend job fairs, webinars, and professional events focused on the Gulf region to expand your network.

7. Ace Your Interviews

Job interviews in the Gulf often test your technical skills and cultural fit. Prepare thoroughly by:

Researching the company and its values.

Practicing answers to common interview questions.

Demonstrating flexibility and a willingness to relocate.

8. Secure the Right Visa

A valid work visa is essential for employment in the Gulf. Many companies assist with visa processing, but understanding the requirements beforehand can help streamline the process.

Conclusion

Landing a high-paying job in the Gulf region requires preparation, persistence, and strategic planning. By tailoring your CV, upskilling, and demonstrating cultural awareness, you can make a strong case for your candidacy. Start your Gulf job journey by exploring trusted job portals for opportunities that align with your expertise.

If you’re ready to take the next step in your career, learn more about how we support job seekers on our website.

For more tips and expert resources on Gulf employment, visit our contact page and let us help you navigate your job search with ease.

2 notes

·

View notes

Text

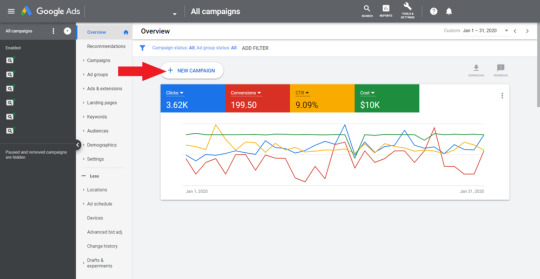

Google Ads Help to Grow Your Buisness

Mastering Google Ads: A Comprehensive Guide

As a leading Digital Marketing Agency with extensive experience in Google Ads, we understand the immense potential this platform offers for businesses of all sizes. Whether you're a small startup or an established enterprise, leveraging Google Ads effectively can be the key to driving growth, increasing brand visibility, and maximizing ROI. In this article, we’ll guide you through the intricacies of Google Ads, from setting up your first campaign to advanced optimization techniques.

1. Introduction to Google Ads

Google Ads is a powerful online advertising platform that allows businesses to reach their target audience through a variety of ad formats. Whether your goal is to generate leads, increase sales, or build brand awareness, Google Ads provides a range of tools and strategies to achieve your objectives.

2. How Google Ads Works

The Pay-Per-Click (PPC) Model: Google Ads operates on a Pay-Per-Click (PPC) model, meaning you only pay when someone clicks on your ad. This model ensures that your advertising budget is spent on potential customers who are actively interested in your products or services.

Ad Auction Process: Every time a user performs a search, Google Ads runs an auction to determine which ads will appear and in what order. The ad rank is determined by a combination of your bid amount, the quality of your ad, and the expected impact of your ad extensions.

Ad Formats: Google Ads offers a variety of ad formats, including:

Search Ads: Text ads that appear on Google search results pages.

Display Ads: Visual ads that appear on websites within Google’s Display Network.

Video Ads: Ads that appear on YouTube and other video partners.

Shopping Ads: Product-based ads that appear in Google Shopping results.

3. Setting Up a Google Ads Campaign

Creating an Account: To start using Google Ads, you need to create an account. This involves providing basic information about your business, such as your website and payment details. Once your account is set up, you can begin creating campaigns.

Choosing Campaign Objectives: Google Ads allows you to choose from several campaign objectives, such as Sales, Leads, or Website Traffic. Selecting the right objective is crucial, as it determines how your ads are optimized and where they appear.

Keyword Research and Selection: Effective keyword research is the foundation of a successful Google Ads campaign. Tools like Google’s Keyword Planner can help you identify relevant keywords that your potential customers are searching for. Selecting the right keywords ensures that your ads are shown to the right audience.

Ad Creation and Targeting: Writing compelling ad copy is essential for attracting clicks. Your ads should be clear, concise, and relevant to the user’s search intent. Google Ads also offers extensive targeting options, allowing you to reach your audience based on demographics, location, interests, and more.

Bidding Strategies: Google Ads provides various bidding strategies, including Manual CPC (Cost-Per-Click), Enhanced CPC, and Target CPA (Cost-Per-Acquisition). The choice of strategy depends on your campaign goals and budget. For example, Target CPA is ideal for campaigns focused on generating conversions.

4. Optimizing Google Ads Campaigns

Tracking and Measuring Performance: To assess the effectiveness of your Google Ads campaigns, it's crucial to set up conversion tracking. This allows you to measure actions taken by users after clicking on your ad, such as purchases or sign-ups. Key metrics to monitor include Click-Through Rate (CTR), Conversion Rate, and Quality Score.

A/B Testing: A/B testing, also known as split testing, involves running two or more variations of an ad to see which performs better. This can help you refine your ad copy, headlines, and calls-to-action to improve overall performance.

Budget Management: Effective budget management ensures that you maximize your ad spend without overspending. Google Ads allows you to set daily budgets and adjust them based on campaign performance. Allocating your budget to high-performing campaigns can lead to better results.

Continuous Optimization: Google Ads is not a “set it and forget it” platform. Regularly reviewing and optimizing your campaigns is essential for maintaining and improving performance. This might involve adjusting bids, refining keywords, or updating ad copy based on what’s working best.

5. Common Challenges and How to Overcome Them

High Competition and CPC: In competitive industries, the cost-per-click (CPC) can be high. To compete effectively, focus on improving your Quality Score by creating highly relevant ads and landing pages. Additionally, consider targeting long-tail keywords with less competition.

Ad Fatigue: Over time, users may become less responsive to your ads, a phenomenon known as ad fatigue. To combat this, regularly update your ad creatives and rotate different versions to keep your audience engaged.

Low Click-Through Rates (CTR): If your ads are not receiving enough clicks, it could indicate that they are not resonating with your audience. Improving your ad relevance, crafting stronger calls-to-action, and testing different headlines can help increase CTR.

Budget Management Issues: It’s easy to overspend on Google Ads if you’re not careful. Regularly monitoring your spend and adjusting your budgets based on performance is crucial. Focus on campaigns that deliver the best ROI and reduce spending on underperforming ones.

6. Advanced Google Ads Strategies

Remarketing: Remarketing allows you to target users who have previously visited your website but didn’t convert. By showing them tailored ads as they browse other websites, you can re-engage them and increase the likelihood of conversion.

Using Google Ads Extensions: Ad extensions provide additional information about your business, such as contact details, additional links, or promotional offers. Using extensions can improve your ad’s visibility and performance by making it more informative and appealing to users.

Automated Bidding and Smart Campaigns: Google’s automated bidding strategies use machine learning to optimize your bids in real-time, based on factors like user behavior and conversion history. Smart Campaigns are a fully automated option that can simplify campaign management, especially for small businesses.

Integration with Google Analytics: Linking your Google Ads account with Google Analytics provides deeper insights into user behavior on your website. This data can help you refine your campaigns and improve targeting by understanding how users interact with your site after clicking on your ads.

7. Case Studies and Success Stories

Examples of Successful Google Ads Campaigns: We've seen numerous success stories across various industries where Google Ads played a pivotal role in driving business growth. For instance, a client in the e-commerce sector achieved a 200% increase in online sales within six months by leveraging a combination of Search Ads and remarketing strategies.

What Can Be Learned from Failures: Not every campaign is a success, and there are valuable lessons to be learned from failures. Common pitfalls include poor keyword selection, lack of targeting, and inadequate budget management. Learning from these mistakes can help you avoid them in your future campaigns.So get attach with expertise of Imagency Media Ad Service

8. Future Trends in Google Ads

Automation and AI in Google Ads: The future of Google Ads is increasingly focused on automation and artificial intelligence. These technologies are enabling more precise targeting and bid optimization, allowing advertisers to achieve better results with less manual intervention.

Privacy Concerns and Regulations: As privacy regulations evolve, Google Ads is adapting by offering more privacy-focused solutions. This includes new ways to target users without relying on third-party cookies, ensuring that advertisers can continue to reach their audience while respecting user privacy.

9. Conclusion

Google Ads remains one of the most effective tools for driving online traffic and achieving business goals. By understanding how the platform works and continuously optimizing your campaigns, you can achieve significant results. As a trusted digital marketing agency, we are here to help you navigate the complexities of Google Ads and unlock its full potential for your business. Whether you're just starting or looking to optimize existing campaigns, our expertise can help you achieve your marketing objectives.

#digital marketing#digital services#google ads#search engine optimization#seo#social media marketing#branding#business

2 notes

·

View notes

Text

Smart Tax Planning for Chiropractors: A Guide by Custom Accounting CPA

Running a chiropractic practice requires more than clinical expertise—it demands savvy financial and tax planning to ensure long-term success. At Custom Accounting CPA, we understand the unique tax challenges chiropractors face, from managing fluctuating income to maximizing deductions. Here’s how strategic tax planning can help chiropractors keep more of what they earn and stay compliant year-round.

1. Entity Structure Optimization The right business structure—whether sole proprietorship, S corporation, or LLC—can significantly impact your tax liability. For many chiropractors, electing S-corp status can help reduce self-employment taxes and offer greater flexibility for income distribution. At Custom Accounting CPA, we help evaluate your current structure and recommend changes that could lead to substantial tax savings.

2. Deduction Opportunities Chiropractors often miss out on eligible deductions such as continuing education, professional licensing fees, equipment purchases, office space, and even mileage for business travel. A tailored tax strategy ensures you take advantage of every deduction available, minimizing your taxable income.

3. Retirement Planning & Tax Deferral Investing in retirement plans like a SEP IRA or Solo 401(k) not only secures your future but also reduces current tax liability. We guide chiropractors in setting up and contributing to the right retirement accounts based on their income levels and practice goals.

4. Quarterly Estimated Tax Payments Chiropractors with inconsistent cash flow can struggle with estimating taxes accurately. Custom Accounting CPA provides personalized quarterly tax projections, helping you avoid penalties and stay on top of your obligations without surprises.

5. Equipment & Technology Expensing Upgrading chiropractic tables, computers, or patient management software? Section 179 allows you to deduct the full cost of qualifying equipment in the year of purchase. Our team ensures these expenses are properly classified and maximized.

Partner With Experts Who Understand Your Practice At Custom Accounting CPA, we specialize in working with healthcare professionals like chiropractors. Our proactive Tax planning for chiropractors approach helps you reduce your tax burden, stay compliant, and focus more on patient care. Contact us today for a consultation and start planning smarter for your financial future.

0 notes

Text

Accounting Offshoring in 2025: Top 7 Countries to Consider

In the evolving field of accounting, businesses are continually seeking efficient ways to streamline operations and reduce costs while maintaining quality. Offshoring accounting services is gaining momentum as a strategic move for firms looking to focus on core activities while delegating routine tasks to specialized experts. With the global market adapting to technological advancements, knowing where to outsource can be crucial to achieving sustained growth and efficiency. This blog explores the top 7 countries for offshoring accounting services in 2025 and provides insights into why these locations are ideal for US-based CPAs and accounting firms.

1. India: The Leading Destination for Offshore Bookkeeping and Accounting Services

India continues to dominate the offshore accounting market in 2025, thanks to its robust infrastructure, vast talent pool, and cost-effectiveness. US-based CPAs and firms prefer India for its extensive experience in handling complex accounting tasks, including tax preparation, bookkeeping, and financial analysis.

Indian accounting professionals are not only highly skilled but also familiar with global accounting standards such as GAAP and IFRS. Furthermore, the widespread use of advanced accounting and bookkeeping software and excellent English proficiency among Indian professionals make communication and collaboration seamless.

Key Services Offered: Offshore bookkeeping and accounting services, tax preparation, and compliance management.

2. Philippines: An Upward Hub for Accounting Outsourcing

The Philippines has made a significant mark in the offshoring industry by focusing on high-quality service and customer satisfaction. The country’s accounting professionals are known for their strong grasp of English, and their accounting training aligns well with US standards. The Philippines’ BPO (Business Process Outsourcing) industry is heavily supported by government initiatives, making it a reliable partner for US-based firms.

Filipino accounting professionals are adept at offering offshore bookkeeping for CPAs and accounting firms looking for expertise in managing routine tasks like accounts payable and receivable, payroll processing, and financial reporting.

Key Services Offered: Payroll management, financial reporting, and outsourced bookkeeping.

3. Vietnam: Rising Star in Offshore Accounting

Vietnam is becoming an attractive destination for accounting outsourcing services due to its competitive costs and well-educated workforce. In recent years, Vietnam has focused on developing specialized training programs in finance and accounting to meet international standards. The government’s initiatives to foster a friendly business environment have further boosted its appeal to American firms.

US-based CPAs and accounting firms seeking reliable and cost-efficient solutions often choose Vietnam for basic accounting tasks and offshore bookkeeping and accounting services.

Key Services Offered: Basic bookkeeping, tax processing, and data management.

4. Poland: A European Powerhouse for Accounting Offshoring

For US-based firms with clients or operations in Europe, Poland serves as an ideal destination. Known for its strong financial and accounting expertise, Poland offers the advantage of being in a similar time zone to the rest of Europe. This makes it an ideal partner for accounting firms needing real-time support for their European operations.

Polish professionals are highly skilled in handling tasks such as financial analysis, risk management, and offshore bookkeeping and accounting for American CPAs operating in European markets.

Key Services Offered: Financial analysis, tax consultancy, and regulatory compliance.

5. South Africa: A Strategic Choice for Cost-Effective Offshoring

South Africa has emerged as a promising choice for offshore accounting and bookkeeping services near me searches due to its relatively lower costs and a well-trained workforce proficient in English. The country’s strategic time zone overlap with both the US and European markets makes it a viable option for accounting firms looking for real-time collaboration and support.

South African accounting professionals excel in using modern accounting and bookkeeping software, ensuring seamless integration with US-based firms’ systems.

Key Services Offered: Bookkeeping, financial reporting, and internal audit services.

6. Malaysia: Southeast Asia’s Hidden Gem for Accounting Outsourcing

Malaysia is often overshadowed by its larger neighbor, India, but it’s steadily gaining recognition in the offshoring industry. The country’s accounting professionals are proficient in multiple languages and well-versed in international accounting standards. The Malaysian government’s initiatives to boost the BPO sector have led to an influx of expert accountants and bookkeepers.

With its diverse talent pool and modern infrastructure, Malaysia is an excellent choice for firms seeking a reliable offshore partner for specialized accounting tasks.

Key Services Offered: Management accounting, payroll processing, and tax compliance.

7. Mexico: Nearshore Solution for US-Based Firms

For accounting firms in the USA, Mexico presents a strategic nearshore solution. Its close geographical proximity means easier collaboration and shorter turnaround times. Mexican accounting professionals are increasingly adapting to international standards, making them a viable choice for offshore bookkeeping and accounting services.

Additionally, the cost advantage of offshoring to Mexico, combined with a skilled workforce, makes it an attractive choice for firms seeking bookkeeping and compliance-related services.

Key Services Offered: Tax compliance, financial reporting, and accounts reconciliation.

Strategic Offshoring for Accounting Excellence in 2025

Offshoring accounting services in 2025 is no longer just about cost-cutting; it’s about finding strategic partners who can deliver quality and efficiency. The right choice of an offshore destination can significantly impact a firm’s productivity and profitability. Whether it’s India’s vast experience, the Philippines’ customer-centric approach, or Mexico’s nearshore convenience, each country offers unique advantages to meet the growing demands of US-based CPAs and accounting firms.

By leveraging offshore bookkeeping and accounting services, firms can focus on their core activities and growth strategies while leaving routine tasks to seasoned professionals. As the offshoring landscape continues to evolve, selecting the right destination will remain a critical factor for success.

Ready to explore offshore bookkeeping and accounting solutions fitted for your firm?

Connect with Unison Globus for expert-led services that drive efficiency and excellence.

Blog Original source: https://unisonglobus.com/accounting-offshoring-in-2025-top-7-countries-to-consider/

#accounting#accounting firms#small business accounting#outsourced accounting services#accounting services#small business accounting services#business#cpa#unison globus#bookkeeping firms#bookkeeping#bookkeeping services#outsourced bookkeeping services#outsourcing bookkeeping#Accounting Offshoring 2025#Offshoring#Accounting Offshoring

1 note

·

View note

Text

CPA in India from Raaas is a Smart Business Decision

Introduction: Navigating the complexities of financial management and taxation in India can be a daunting task for businesses and individuals alike. That’s where a Certified Public Accountant (CPA) comes in. When you choose a CPA in India from Raaas, you’re not just hiring an accountant; you’re partnering with experts who bring unparalleled knowledge and expertise to the table. In this blog, we’ll explore the benefits of working with a CPA from Raaas and how they can help streamline your financial operations. Understanding the Role of a CPA A Certified Public Accountant (CPA) is a highly qualified financial professional who has met stringent education and experience requirements, and passed a rigorous examination. CPAs are trusted advisors who provide a range of services, including auditing, tax planning, financial consulting, and compliance. Why You Need a CPA in India

Expertise in Indian Tax Laws India’s tax laws are complex and ever-changing. A CPA from Raaas is well-versed in the intricacies of these regulations, ensuring that your business remains compliant and optimized for tax efficiency. Their expertise can help you navigate everything from GST to corporate tax, minimizing liabilities and avoiding penalties.

Strategic Financial Planning Financial planning is crucial for long-term business success. CPAs from Raaas provide strategic advice tailored to your business needs, helping you make informed decisions. They analyze your financial data, identify trends, and offer insights that drive growth and profitability.

Accurate Financial Reporting Accurate financial reporting is essential for stakeholders, investors, and regulatory bodies. A CPA from Raaas ensures that your financial statements are precise and compliant with Indian Accounting Standards (Ind AS). This accuracy not only builds trust but also aids in securing financing and investment.

Audit and Assurance Services Regular audits are necessary to maintain transparency and integrity in financial operations. CPAs from Raaas conduct thorough audits, providing assurance that your financial practices are sound and your records are accurate. This is especially important for publicly traded companies and organizations seeking funding. Why Choose Raaas for Your CPA Needs

Experienced Professionals Raaas boasts a team of experienced CPAs who bring a wealth of knowledge and expertise to the table. Our professionals have extensive experience across various industries, ensuring that they understand the unique challenges and opportunities your business faces.

Customized Solutions We understand that every business is unique. Raaas offers customized accounting and financial solutions tailored to your specific needs. Whether you’re a small startup or a large corporation, our CPAs provide services that align with your goals and requirements.

Commitment to Excellence At Raaas, we are committed to delivering excellence in every service we provide. Our CPAs undergo continuous training to stay updated with the latest industry trends and regulatory changes. This commitment ensures that you receive the highest quality service at all times.

Proactive Approach We don’t just react to financial issues; we anticipate them. Raaas takes a proactive approach to financial management, identifying potential problems before they arise and implementing strategies to mitigate risks. This forward-thinking mindset helps you stay ahead in a competitive market. Services Offered by Raaas CPAs in India

Tax Planning and Compliance Our CPAs provide comprehensive tax planning and compliance services, ensuring that you meet all regulatory requirements while optimizing your tax position.

Audit and Assurance Raaas offers rigorous audit and assurance services to help you maintain transparency and trust with stakeholders.

Financial Consulting Our financial consulting services include budgeting, forecasting, and strategic planning to drive business growth and profitability.

Bookkeeping and Accounting Raaas provides accurate and timely bookkeeping and accounting services, helping you maintain clear and up-to-date financial records. Conclusion Choosing a CPA in India from Raaas is a strategic move for any business seeking to enhance financial management and ensure compliance. With our team of experienced professionals, customized solutions, and commitment to excellence, Raaas stands out as a trusted partner in your financial journey. Contact us today to learn more about how we can support your business with our top-tier CPA services.

#cashflow#charted accountant#form 16#msme registration#private limited company registration in india#setting up a subsidiary in india#company registration in india#startup in india#cpa in india

2 notes

·

View notes

Text

Why MAS LLP Stands Out Among CPA Firms in India

Introduction: In today’s dynamic business environment, the role of CPA (Certified Public Accountant) firms is more crucial than ever. For businesses seeking top-notch financial advisory and accounting services, MAS LLP stands out as a leading choice among CPA firms in India. In this blog, we will explore why MAS LLP is the go-to firm for comprehensive accounting solutions and how they can help your business thrive. What Sets MAS LLP Apart?

Expertise and Experience MAS LLP boasts a team of highly skilled and experienced CPAs who bring a wealth of knowledge to the table. Their expertise spans across various industries, ensuring that clients receive tailored solutions that meet their specific needs. Whether you are a small startup or a large multinational corporation, MAS LLP has the experience to handle complex financial challenges. Comprehensive Services As a full-service CPA firm, MAS LLP offers a wide range of services including: Audit and Assurance: Thorough audits that provide transparency and credibility to your financial statements. Tax Advisory: Expert tax planning and compliance services to optimize your tax liabilities. Accounting and Bookkeeping: Accurate and efficient management of your financial records. Business Consulting: Strategic advice to help you make informed business decisions and achieve your growth objectives. Client-Centric Approach At MAS LLP, client satisfaction is the top priority. Their client-centric approach involves understanding your business goals and challenges, and then crafting customized solutions to address them. This personalized service ensures that each client receives the attention and expertise they deserve. Why Choose MAS LLP Among CPA Firms in India? Proven Track Record MAS LLP has a proven track record of delivering exceptional services to a diverse clientele. Their long list of satisfied clients is a testament to their commitment to excellence and integrity. Innovative Solutions In the rapidly evolving business landscape, staying ahead requires innovative solutions. MAS LLP leverages the latest technologies and industry best practices to provide forward-thinking solutions that drive efficiency and growth. Strong Ethical Standards Integrity and ethical practices are the foundation of MAS LLP’s operations. Clients can trust that their financial matters are handled with the utmost professionalism and confidentiality. Global Reach As businesses increasingly operate on a global scale, having a CPA firm with international expertise is invaluable. MAS LLP’s global reach ensures that clients receive consistent and reliable service, no matter where they operate. The MAS LLP Process Initial Consultation The process begins with an in-depth consultation to understand your business, its goals, and its challenges. This helps MAS LLP tailor their services to meet your specific needs. Customized Strategy Based on the initial consultation, MAS LLP develops a customized strategy that aligns with your business objectives. This strategy is designed to optimize your financial performance and ensure compliance with all regulatory requirements. Implementation and Support Once the strategy is in place, MAS LLP works closely with you to implement the recommended solutions. Their team provides ongoing support to ensure that your financial operations run smoothly and efficiently. Continuous Improvement MAS LLP believes in continuous improvement. They regularly review and assess the effectiveness of their strategies, making adjustments as needed to ensure optimal performance. Conclusion Choosing the right CPA firm is crucial for the financial health and success of your business. MAS LLP stands out among CPA firms in India for their expertise, comprehensive services, client-centric approach, and commitment to excellence. Whether you need audit and assurance, tax advisory, accounting, or business consulting services, MAS LLP is the trusted partner you can rely on. Contact MAS LLP today to learn more about how their expert services can help your business thrive in the competitive landscape of India.

#accounting & bookkeeping services in india#businessregistration#chartered accountant#foreign companies registration in india#ap management services

3 notes

·

View notes

Text

DIGITAL MARKETING

Digital Marketing Course Content

Fundamentals of Digital marketing & Its Significance, Traditional marketing Vs Digital Marketing, Evolution of Digital Marketing, Digital Marketing Landscape, Key Drivers, Digital Consumer & Communities, Gen Y & Netizen’s expectation & influence wrt Digital Marketing. The Digital users in India, Digital marketing Strategy- Consumer Decision journey,

POEM Framework, Segmenting & Customizing messages, Digital advertising Market in India, Skills in Digital Marketing, Digital marketing Plan. Terminology used in Digital Marketing, PPC and online marketing through social media, Social Media Marketing, SEO techniques, Keyword advertising, Google web-master and analytics overview, Affiliate Marketing, Email Marketing, Mobile marketing

Display adverting, Buying Models, different type of ad tools, Display advertising terminology, types of display ads, different ad formats, Ad placement techniques, Important ad terminology, Programmatic Digital Advertising.

Social Media Marketing

Fundamentals of Social Media Marketing& its significance, Necessity of Social media Marketing, Building a Successful strategy: Goal Setting, Implementation. Facebook Marketing: Facebook for Business, Facebook Insight, Different types of Ad formats, Setting up Facebook Advertising Account, Facebook audience & types, Designing Facebook Advertising campaigns, Facebook Avatar, Apps, Live, Hashtags LinkedIn Marketing: Importance of LinkedIn presence, LinkedIn Strategy, Content Strategy, LinkedIn analysis, Targeting, Ad Campaign Twitter Marketing:- Basics, Building a content strategy, Twitter usage, Twitter Ads, Twitter ad campaigns, Twitter Analytics, Twitter Tools and tips for mangers. Instagram & Snapchat basics.

Search Engine Optimization

Introduction to SEO, How Search engine works, SEO Phases, History Of SEO, How SEO Works, What is Googlebot (Google Crawler), Types Of SEO technique, Keywords, Keyword Planner tools On page Optimization, Technical Elements, HTML tags, Schema.org, RSS Feeds, Microsites, Yoast SEO Plug-in Off page Optimization- About Off page optimization, Authority & hubs, Backlink, Blog Posts, Press Release, Forums, Unnatural links. Social media Reach- Video Creation & Submission, Maintenance- SEO tactics, Google search Engine, Other Suggested tools

Advertising Tools & Its Optimization

Advertising & its importance, Digital Advertising, Different Digital Advertisement, Performance of Digital Advertising:- Process & players, Display Advertising Media, Digital metrics Buying Models- CPC, CPM, CPL, CPA, fixed Cost/Sponsorship, Targeting:- Contextual targeting, remarking, Demographics , Geographic & Language Targeting. Display adverting, different type of ad tools, Display advertising terminology, types of display ads, different ad formats, Ad placement techniques, Important ad terminology, ROI measurement techniques, AdWords & Adsense. YouTube Advertising:- YouTube Channels, YouTube Ads, Type of Videos, Buying Models, Targeting & optimization, Designing & monitoring Video Campaigns, Display campaigns

Website Hosting Using Word Press

Website Planning & Development- Website, Types of Websites, Phases of website development, Keywords: Selection process Domain & Web Hosting:- Domain, Types of Domain, Where to Buy Domain, Webhosting, How to buy Webhosting Building Website using Word press-What is Word press, CMS, Post and Page Word press Plug-ins- Different Plug-ins, social media Plug-ins, page builder plug-ins: the elementor, how to insert a section, how to insert logo, Google Micro sites

2 notes

·

View notes