#Accounting Offshoring

Explore tagged Tumblr posts

Text

Key Factors to Consider When Choosing an Offshoring Accounting and Tax Partner in India

Offshoring accounting and tax services has become a strategic choice for CPA firms, EAs, and accounting businesses in the U.S. With its skilled workforce, advanced technological capabilities, and cost advantages, India stands out as a preferred destination for these services. However, the success of offshoring depends heavily on choosing the right partner. Asking the right questions and evaluating key considerations can help you make an informed decision and establish a fruitful partnership.

Questions to Consider Before Hiring Offshore Accountants

#1: Should I Hire Offshore Accountants?

The decision to offshore accounting services depends on identifying your current challenges and goals. Here are some signs it might be time to consider offshoring:

Feeling Time-Crunched and Disconnected from Clients: Are routine tasks leaving you with little time to engage with clients and build relationships?

Difficulty Finding Skilled Local Accountants: Struggling with recruitment challenges or high turnover rates in your region?

Rising Costs and Errors with Previous Outsourcing Experiences: Have past outsourcing solutions led to increased costs or frequent mistakes?

Cash Flow Concerns Affecting Operations: Need to reduce overheads while maintaining service quality?

Desire to Focus on Core Activities: Wish to redirect resources toward strategic and client-centric operations?

If these challenges resonate with your firm, offshoring could be a transformative solution.

#2: What Accounting Services Should I Offshore?

Determining which tasks to offshore is critical to maximizing efficiency. Commonly offshored accounting services include:

Bookkeeping: Managing day-to-day financial records and reconciliations.

Tax Preparation: Filing returns, handling multistate taxes, and staying compliant with regulations.

Payroll Management: Ensuring accurate and timely payroll processing.

Financial Analysis: Providing insights into financial performance and growth strategies.

Advisory Services: Delivering tailored recommendations for clients.

Focus on offshoring repetitive or time-intensive tasks, allowing your in-house team to focus on strategic activities.

#3: Will My Offshore Partner Be Able to Scale as My Client List Grows?

Scalability is a critical factor for long-term success. A good offshore partner should be able to:

Adapt to Increased Demands: Handle a growing client base without compromising on quality.

Provide Flexible Resource Allocation: Allocate resources dynamically based on workload and priorities.

Manage Seasonal Surges: Handle peak periods such as tax seasons efficiently.

Evaluate a partner’s scalability by discussing their resource management strategies, team expansion capabilities, and infrastructure readiness.

Financial and Client Perception Considerations

#4: Will Offshoring Cost Me More Money?

Offshoring often delivers cost savings, but it’s essential to evaluate the financial implications:

Lower Operational Costs: Save on overhead expenses like office space, equipment, and employee benefits.

Flexible Pricing Models: Choose from options such as hourly rates, fixed fees, or task-based pricing.

Long-Term Value: Minimize errors and ensure compliance to avoid penalties and rework costs.

Request transparent pricing details from potential partners to avoid hidden fees and ensure value for money.

#5: What Will My Clients Think About Offshoring?

Client perception is crucial when implementing offshoring. Common concerns include:

Data Security and Confidentiality: Clients need assurance that their financial data is protected. Choose a partner with robust encryption, SOC 2 compliance, and secure systems.

Quality Deliverables: Demonstrate how offshoring enhances service accuracy and efficiency.

Building Trust: Openly communicate the benefits of offshoring to your clients, emphasizing how it improves service quality and responsiveness.

Proactively addressing these concerns helps build trust and maintain strong client relationships.

How to Choose the Right Offshore Accounting Partner

#6: Key Factors to Evaluate

Selecting the right partner involves evaluating their expertise, infrastructure, and compatibility with your firm. Here are the key attributes to consider:

Industry Knowledge: Ensure the partner understands U.S. accounting standards, tax regulations, and industry-specific requirements.

Team Qualifications: Look for certifications such as CPA, EA, or equivalent credentials among their team members.

Communication Style: Assess their responsiveness, clarity, and ability to adapt to your preferred communication tools and schedules.

Future Growth Potential: Verify that the partner has the capacity and infrastructure to support your firm’s long-term growth.

Cost Transparency: Insist on clear pricing models without hidden fees.

Time Zone Compatibility: Ensure their work hours align with your firm’s operational needs for seamless collaboration.

Real Also: Accounting Offshoring in 2025: Top 7 Countries to Consider

Key Considerations When Choosing a Partner

When evaluating potential partners, prioritize the following factors to ensure a successful relationship:

Communication: Establish clear and consistent communication channels to minimize misunderstandings.

Turnaround Time: Verify their ability to meet deadlines, especially during critical periods.

Data Security: Ensure the partner adheres to strict data protection policies and complies with international standards.

Scalability: Confirm their ability to scale resources up or down based on your evolving needs.

Technology Compatibility: Ensure their software and tools align with your firm’s existing systems.

Compliance and Certifications: Validate their adherence to U.S. regulations and possession of necessary certifications.

Cultural Compatibility: Assess their alignment with your firm’s values, work culture, and professional standards.

Client Support: Look for dedicated account managers and regular updates to maintain transparency and trust.

Conclusion

Offshoring accounting and tax services to India offers significant advantages, including cost savings, access to skilled professionals, and improved operational efficiency. By addressing the right questions and carefully evaluating potential partners, your firm can unlock new growth opportunities while maintaining high-quality client service.

Unison Globus, with its proven expertise in offshoring accounting and tax services, is a trusted partner for CPA firms, EAs, and accounting businesses in the U.S. Our skilled professionals, robust technological infrastructure, and commitment to excellence make us the ideal choice to assist you streamline operations and achieve your business goals.

Are you prepared to advance your accounting firm?

Visit Unison Globus today and discover how we can support your success.

Let’s grow together!

This Blog is originally posted here: https://unisonglobus.com/top-considerations-for-choosing-an-offshoring-accounting-and-tax-partner-in-india/

#Offshoring accounting services#accounting offshoring#Offshoring#Offshore Partner#accounting services#outsourced accounting services for cpas#professional accounting services#outsourced accounting services#bookkeeping#Offshore Accountants#Tax Partner in India#tax services

1 note

·

View note

Note

Imagine:

Cass and Ivy argument/conversation on plant lives

@but-a-humble-goon made a great post once that was basically Cass and Ivy standing over the body of a rich polluter Ivy killed and both of them just screaming "Why don't you CARE?" at each other. Really sums up the core dynamic they would have.

I do think that while Cass would never be able to be convinced that plant lives matter the way humans do, if Ivy can point out that the loss of plant life is killing humans? Yeah that would do the trick. Imagine she's trying to kill a billionaire who's destroying Gotham's conservation habitats to make houses and Cass is like killing is wrong! And Ivy's like oh you care so much about killing? What about the seventeen people who've suffered fatal illnesses due to pollution from HIS work? And Cass is like. What.

Cass: Why isn't he in jail?

Ivy: Because nothing he does is illegal.

Cass: Why not? He's killing people.

Ivy: Well he pays the people who make the laws. So they don't make any laws that can hurt him.

Cass:

Ivy: So can I kill him now?

Cass: Wait hang on. Let me try something.

Bruce, a few hours later, entering the cave and seeing Cass carefully building pipe bombs: Batgirl. What are you doing?

Cass: Oracle called it non lethal ecoterrorism.

Bruce:

#dc#cassandra cain#poison ivy#batfam#dc rambles#asks#the man gets every house he owns blown up and all his money mysteriously stolen from his offshore accounts#he later turns himself in for the murders and pleads guilty. refuses to explain why but also refuses to be in a room with too many shadows

90 notes

·

View notes

Text

This man rob banks for a living but need $4 🤨🤨🤨

20 notes

·

View notes

Text

I've been trying to think this through, and would like to know what others foresee...

[ PREFACE ] I'm not going to try to rehash or recap everything going on within the US and its Republican Party. If you need that from me, just disqualify yourself from this thought exercise for stupidly being part of the problem. FUCK OFF & DIE if this offends you...

We, the American people, need Congress to officially declare War with Russia!

Among other things, this would legally open up the death penalty to those who intercede - who provide aid and comfort - on behalf of Russia...

Can you see where I'm going with this?

Instead of talking DEI, the conversation needs to be more focused on DIE. We need an Orange Scare that works for us!

This administration and those that support it - such as the New NAZIs at Heritage, Elon Musk Evil Incorporated, all of the PACs, and those cowardly candy-ass Billionaire & Business backers - need to be instantly on notice that they should be fearing for their lives - WHICH IS WHAT WE'VE BEEN DOING!

Are you still reading this?

WE THE PEOPLE are the majority in this country, and HEADS NEED TO ROLL!

[ REMINDER ] The last time that Congress declared war - after the attack on Pearl Harbor - it took less than a day...

#we the people#declaration of war#heads will roll#accountability#justice for all#life#liberty#pursuit of happiness#ukraine#billionaires#tech bros#elon musk#mark zuckerberg#jeff bezos#leonard leo#heritage#1%#putin#russia#donald trump#dei#die#nato#peter thiel#influencers#death penalty#apple has how much money offshore???#eat the rich#politics#us politics

22 notes

·

View notes

Text

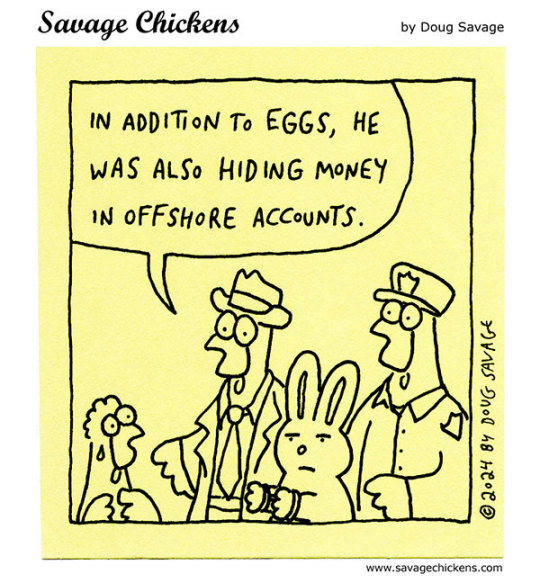

Hiding.

And more Easter comics.

#easter#easter bunny#bunny#hiding#egg#money#tax evasion#offshore accounting#arrest#police#disappointment

116 notes

·

View notes

Text

So imagine you're Ishmael except you're sneaking aboard an unmanned vessel, and then when you're well out to sea the boat starts talking to you and basically says "hey I'm god and I could smite you on a whim." You're understandably scared so you just start reading one of the many novels you packed for the journey, but the the boat that is god starts reading over your shoulder and almost using your brain as a filter to understand human emotion. Boat-god has blorbos now, you're besties, and then you go on to the next leg of the journey and don't see boat-god again for a while. When you do, boat-god has been almost killed to death by the fish people from Portsmoth or wherever Lovecraft said they're from, so you kill the fish people and save boat-god. Boat-god's crew is here this time and when you're done tying up loose ends, and help arrives, you find out that the organization that made boat-god has been shoving a lot of god into a lot of boats and your boat-god might actually be one of the slightly less powerful ones.

That's what Murderbot's friendship with ART has been like

#murderbot#asshole research transport#i'm mixing metaphors badly here but i think it's just funnier to say Murderbot is Ishmael as a lovecraft character.#i've read very little lovecraft and just the first little bit of moby dick btw#it'd be sooooo funny if ART is actually a little bit dumb by god boat standards and makes up for it with the offshore accounts and bombs

121 notes

·

View notes

Text

My brain woke up today and decided to choose violence

#trigun posting#vash posting#Feniverse doodles#posting this to the offshore account because yeah no don’t want this in with my other artwork lmao#it’s v traced and not good but my Brian wouldn’t let me rest until I drew it#vash#trigun#Vash the stampede#Johnny test#trigun 98#feniverse posts#trigun shitpost

98 notes

·

View notes

Text

Literally nothing happened..

#Literally nothing happened..#panama papers#rich people#tax dodging#stolen wealth#offshore accounts#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government

19 notes

·

View notes

Text

the most fitting alternate title for the Nice AU (UTDP/Summer Camp) is the Jin Kirigiri Tax Evasion Bad Father Arc, for many reasons

not the least of which is that it's implied class 77, 78, and the v3 class (fanon name: 79, but this is never confirmed) all were accepted at once, are graduating at once, and spent 3 years together

so this dude accepted his daughter, then accepted another unrelated boy who is clearly worse, both as SHSL detective, at the same time, in the same year.

he probably forgot which was his real kid, Honestly

#danganronpa#jin kirigiri#kyoko kirigiri#shuichi saihara#(no offense shuichi)#(but it's canonical in the AU that shuichi is...not on kyoko's level)#(not that she's really Rude about it)#he also went ahead and accepted the kid in the jokey n*zi uniform calling himself “ultimate Evil Overlord”#and never bothered to find out Rantaro's Real Talent apparently#jin “fuck it who cares. i'm transferring all this money to an offshore account anyway” kirigiri

38 notes

·

View notes

Text

transfering money from wherever to russia feels like a money launderig and I FEEL LIKE I WITH BESTIES ARE GONNA OPEN FUCKING OFFSHRES SOON

#bestie said lol lets open offshores and i exploded from laughing for solid three minutes#i have 5 diff bank accounts for you to understand.#and wheres 5 theres 6 and so on and on

12 notes

·

View notes

Text

Accounting Offshoring in 2025: Top 7 Countries to Consider

In the evolving field of accounting, businesses are continually seeking efficient ways to streamline operations and reduce costs while maintaining quality. Offshoring accounting services is gaining momentum as a strategic move for firms looking to focus on core activities while delegating routine tasks to specialized experts. With the global market adapting to technological advancements, knowing where to outsource can be crucial to achieving sustained growth and efficiency. This blog explores the top 7 countries for offshoring accounting services in 2025 and provides insights into why these locations are ideal for US-based CPAs and accounting firms.

1. India: The Leading Destination for Offshore Bookkeeping and Accounting Services

India continues to dominate the offshore accounting market in 2025, thanks to its robust infrastructure, vast talent pool, and cost-effectiveness. US-based CPAs and firms prefer India for its extensive experience in handling complex accounting tasks, including tax preparation, bookkeeping, and financial analysis.

Indian accounting professionals are not only highly skilled but also familiar with global accounting standards such as GAAP and IFRS. Furthermore, the widespread use of advanced accounting and bookkeeping software and excellent English proficiency among Indian professionals make communication and collaboration seamless.

Key Services Offered: Offshore bookkeeping and accounting services, tax preparation, and compliance management.

2. Philippines: An Upward Hub for Accounting Outsourcing

The Philippines has made a significant mark in the offshoring industry by focusing on high-quality service and customer satisfaction. The country’s accounting professionals are known for their strong grasp of English, and their accounting training aligns well with US standards. The Philippines’ BPO (Business Process Outsourcing) industry is heavily supported by government initiatives, making it a reliable partner for US-based firms.

Filipino accounting professionals are adept at offering offshore bookkeeping for CPAs and accounting firms looking for expertise in managing routine tasks like accounts payable and receivable, payroll processing, and financial reporting.

Key Services Offered: Payroll management, financial reporting, and outsourced bookkeeping.

3. Vietnam: Rising Star in Offshore Accounting

Vietnam is becoming an attractive destination for accounting outsourcing services due to its competitive costs and well-educated workforce. In recent years, Vietnam has focused on developing specialized training programs in finance and accounting to meet international standards. The government’s initiatives to foster a friendly business environment have further boosted its appeal to American firms.

US-based CPAs and accounting firms seeking reliable and cost-efficient solutions often choose Vietnam for basic accounting tasks and offshore bookkeeping and accounting services.

Key Services Offered: Basic bookkeeping, tax processing, and data management.

4. Poland: A European Powerhouse for Accounting Offshoring

For US-based firms with clients or operations in Europe, Poland serves as an ideal destination. Known for its strong financial and accounting expertise, Poland offers the advantage of being in a similar time zone to the rest of Europe. This makes it an ideal partner for accounting firms needing real-time support for their European operations.

Polish professionals are highly skilled in handling tasks such as financial analysis, risk management, and offshore bookkeeping and accounting for American CPAs operating in European markets.

Key Services Offered: Financial analysis, tax consultancy, and regulatory compliance.

5. South Africa: A Strategic Choice for Cost-Effective Offshoring

South Africa has emerged as a promising choice for offshore accounting and bookkeeping services near me searches due to its relatively lower costs and a well-trained workforce proficient in English. The country’s strategic time zone overlap with both the US and European markets makes it a viable option for accounting firms looking for real-time collaboration and support.

South African accounting professionals excel in using modern accounting and bookkeeping software, ensuring seamless integration with US-based firms’ systems.

Key Services Offered: Bookkeeping, financial reporting, and internal audit services.

6. Malaysia: Southeast Asia’s Hidden Gem for Accounting Outsourcing

Malaysia is often overshadowed by its larger neighbor, India, but it’s steadily gaining recognition in the offshoring industry. The country’s accounting professionals are proficient in multiple languages and well-versed in international accounting standards. The Malaysian government’s initiatives to boost the BPO sector have led to an influx of expert accountants and bookkeepers.

With its diverse talent pool and modern infrastructure, Malaysia is an excellent choice for firms seeking a reliable offshore partner for specialized accounting tasks.

Key Services Offered: Management accounting, payroll processing, and tax compliance.

7. Mexico: Nearshore Solution for US-Based Firms

For accounting firms in the USA, Mexico presents a strategic nearshore solution. Its close geographical proximity means easier collaboration and shorter turnaround times. Mexican accounting professionals are increasingly adapting to international standards, making them a viable choice for offshore bookkeeping and accounting services.

Additionally, the cost advantage of offshoring to Mexico, combined with a skilled workforce, makes it an attractive choice for firms seeking bookkeeping and compliance-related services.

Key Services Offered: Tax compliance, financial reporting, and accounts reconciliation.

Strategic Offshoring for Accounting Excellence in 2025

Offshoring accounting services in 2025 is no longer just about cost-cutting; it’s about finding strategic partners who can deliver quality and efficiency. The right choice of an offshore destination can significantly impact a firm’s productivity and profitability. Whether it’s India’s vast experience, the Philippines’ customer-centric approach, or Mexico’s nearshore convenience, each country offers unique advantages to meet the growing demands of US-based CPAs and accounting firms.

By leveraging offshore bookkeeping and accounting services, firms can focus on their core activities and growth strategies while leaving routine tasks to seasoned professionals. As the offshoring landscape continues to evolve, selecting the right destination will remain a critical factor for success.

Ready to explore offshore bookkeeping and accounting solutions fitted for your firm?

Connect with Unison Globus for expert-led services that drive efficiency and excellence.

Blog Original source: https://unisonglobus.com/accounting-offshoring-in-2025-top-7-countries-to-consider/

#accounting#accounting firms#small business accounting#outsourced accounting services#accounting services#small business accounting services#business#cpa#unison globus#bookkeeping firms#bookkeeping#bookkeeping services#outsourced bookkeeping services#outsourcing bookkeeping#Accounting Offshoring 2025#Offshoring#Accounting Offshoring

1 note

·

View note

Text

BADBOYHALO ON THAT TAX EVASION GRIND 💪💪💪💪💪

#txt#qsmp#liveblogging#Tubbo just said he thinks bad is moving his money to an offshore account. For context LMAO

20 notes

·

View notes

Text

Ready-Made Banks: A Fast-Track Solution for Financial Entrepreneurs

In the ever-evolving financial sector, setting up a new bank from scratch can be a complex, time-consuming, and heavily regulated process. This is where ready made banks offer a strategic advantage. Acquiring a pre-established banking institution with the necessary licenses in place allows financial entrepreneurs to bypass lengthy approval procedures and start operations quickly. In this article, we explore the benefits, processes, and considerations of purchasing a ready-made bank.

What Are Ready-Made Banks?

Ready-made banks, also known as shelf banks, are pre-licensed financial institutions that are available for sale. These banks have already been incorporated, undergone regulatory approvals, and in some cases, have an operational history. Investors and financial service providers can acquire these institutions to accelerate their entry into the banking industry.

Benefits of Acquiring a Ready-Made Bank

Time Efficiency – One of the most significant advantages of purchasing a ready-made bank is the time saved. Establishing a new bank requires extensive regulatory approvals, which can take years. A pre-established bank allows buyers to commence operations almost immediately.

Regulatory Compliance – Ready-made banks typically already comply with financial regulations and have obtained the necessary banking licenses. This reduces the burden of going through rigorous application procedures.

Established Reputation – A bank with an operational history may already have established relationships with regulatory bodies, financial institutions, and clients, providing an easier path to business development.

Access to Banking Infrastructure – Many ready-made banks come with existing banking infrastructure, including financial software, payment processing systems, and client portfolios, enabling seamless transitions.

Global Business Expansion – Investors looking to expand their financial services globally can benefit from acquiring a licensed bank in a strategic jurisdiction.

Considerations Before Buying a Ready-Made Bank

Jurisdiction & Regulations – Different countries have varying regulatory requirements. Buyers should assess the jurisdiction to ensure it aligns with their business goals and legal considerations.

Due Diligence – Conducting thorough due diligence is essential to verify the financial health, compliance status, and potential liabilities of the bank before purchase.

Operational Readiness – Some ready-made banks may be dormant or inactive. Investors should evaluate the bank’s readiness for immediate operations.

Cost Factors – Acquiring a ready-made bank involves substantial investment. Buyers should consider initial costs, operational expenses, and any additional licensing or compliance fees.

Regulatory Approvals for Ownership Transfer – Although a ready-made bank is pre-licensed, regulatory authorities often require approvals for changes in ownership, which should be factored into the timeline.

How to Acquire a Ready-Made Bank

Identify the Right Bank – Research available banks for sale in preferred jurisdictions that match your business objectives.

Engage Financial and Legal Experts – Work with professionals who specialize in banking acquisitions to navigate legal and regulatory complexities.

Due Diligence & Negotiation – Assess the bank’s history, financials, and compliance status before finalizing the purchase.

Regulatory Approval Process – Submit necessary documentation and seek regulatory consent for ownership transfer.

Operational Launch – Once approvals are secured, the new owners can rebrand, implement business strategies, and commence full-scale operations.

Conclusion

Acquiring a ready-made bank is a strategic move for financial entrepreneurs looking to enter the banking industry swiftly. With pre-existing licenses, compliance frameworks, and operational structures, these institutions offer a fast-track solution to financial success. However, due diligence, regulatory compliance, and strategic planning are crucial to ensuring a smooth transition and sustainable operations. Whether for global expansion or niche financial services, a ready-made bank provides a unique opportunity to accelerate growth in the financial sector.

#Banking License for sale#Ready-made financial licenses for sale#Opening offshore bank account in seychelles online#bank license for sale#Banks with licenses for sale

2 notes

·

View notes

Text

Offshore Merchant Accounts

Expanding your business globally comes with challenges, especially in payment processing. This blog explores offshore merchant accounts, explaining how they help businesses accept international payments, reduce restrictions, and support high-risk industries. Read the whole blog to know more.

#offshore merchant accounts#merchant accounts#offshore#payment processing#payments#payment processor#high risk industries#payment solutions

1 note

·

View note

Text

#New methods of money laundering revealed: Home Ministry#Money laundering#Cybercrime#Financial crime#Illegal digital payment gateways#Mule accounts#Rented bank accounts#Offshore betting and gambling#Fake investment scams#Home Ministry#India

1 note

·

View note

Text

Outsource Bookkeeping Services to India: A Smart Business Move

In today’s competitive business environment, companies are constantly looking for ways to streamline operations and reduce costs. One effective strategy is to outsource bookkeeping services to India. This approach not only provides access to skilled professionals but also offers significant cost savings. Let's explore why outsourcing bookkeeping services to India can be a game-changer for your business.

Why Outsource Bookkeeping Services?

1. Cost-Effectiveness

Delegating your bookkeeping tasks to an external provider can result in significant financial savings. By choosing to outsource bookkeeping services to India, businesses can reduce overhead expenses associated with hiring in-house staff, such as salaries, benefits, and training costs. Indian firms offer competitive pricing due to lower labor costs, providing high-quality services at a fraction of the cost.

2. Access to Expertise

India is known for its vast pool of highly skilled and qualified professionals. When you outsource bookkeeping services, you gain access to experts who are proficient in international accounting standards and practices. These professionals are equipped with the latest tools and technologies to ensure accurate and efficient bookkeeping.

3. Focus on Core Business Activities

By outsourcing bookkeeping services, companies can focus more on their core business activities. This allows management and staff to dedicate their time and resources to areas that directly impact growth and profitability, such as sales, marketing, and product development.

Benefits of Outsourcing Bookkeeping Services in India

1. High-Quality Services

Indian bookkeeping firms are known for their commitment to quality. They employ stringent quality control measures and adhere to international accounting standards. This ensures that the financial records are accurate, reliable, and compliant with regulatory requirements.

2. Scalability

Outsourcing bookkeeping services in India offers flexibility and scalability. Whether you are a small business or a large corporation, Indian service providers can scale their services to meet your specific needs. This flexibility is particularly beneficial during periods of growth or seasonal fluctuations in business activity.

3. Time Zone Advantage

The time zone difference between India and Western countries can be leveraged to your advantage. By outsourcing bookkeeping services to India, you can benefit from round-the-clock operations. Work can be completed overnight, providing you with updated financial information by the start of your business day.

How to Choose the Right Bookkeeping Service Provider

1. Experience and Expertise

When outsourcing bookkeeping services, it’s crucial to choose a provider with extensive experience and expertise in the field. Seek out companies that have a history of success and favorable reviews from their clients. Ensure they have experience in your specific industry and are familiar with relevant regulations.

2. Technology and Security

Ensure the service provider uses the latest accounting software and technologies. Data security is paramount, so choose a provider that implements robust security measures to protect your financial information from unauthorized access and cyber threats.

3. Transparent Pricing

Opt for a service provider with a transparent pricing model. Avoid firms with hidden fees and unclear contracts. A clear understanding of the costs involved will help you make an informed decision and avoid any unexpected expenses.

4. Communication and Support

Effective communication is essential when outsourcing bookkeeping services. Choose a provider that offers reliable customer support and maintains clear and consistent communication channels. This guarantees that any problems or questions will be handled quickly and efficiently.

Conclusion

Outsourcing bookkeeping services to India is a strategic decision that can offer numerous benefits, including cost savings, access to expertise, and improved focus on core business activities. By carefully selecting the right service provider, businesses can enjoy high-quality, scalable, and secure bookkeeping services. Embrace this opportunity to enhance your business efficiency and drive growth.

In summary, outsourcing bookkeeping services to India is not just a cost-saving measure; it is a smart business strategy that can lead to improved operational efficiency and long-term success.

#Outsource bookkeeping services to India#outsourcing bookkeeping services in India#outsource bookkeeping services#outsourcing bookkeeping services#offshore bookkeeping services#CPA outsourcing services#outsourced accounting firms#finance#accounting#bookkeeping

2 notes

·

View notes