#Cyclohexanone Market size

Explore tagged Tumblr posts

Text

#cyclohexanone market size analysis 2025 to 2035#global demand forecast for cyclohexanone in nylon production#cyclohexanone industry trends and growth drivers 2030#cyclohexanone price trends and supply chain insights#impact of crude oil prices on cyclohexanone production cost.

0 notes

Text

0 notes

Text

0 notes

Text

The 2025 Cyclohexanone Market: Price Trends, Growth, and Global Outlook

Cyclohexanone is a clear liquid chemical with a slightly sweet and pungent smell that is mainly used in making nylon and as a powerful solvent in various industries. Even though it's not something the average person thinks about, it's an essential building block in the chemical world, especially in manufacturing plastics and fibers. In 2025, there is growing interest in both the demand and prices of cyclohexanone, as industries around the globe rely heavily on it for their production processes. Prices of cyclohexanone are influenced by many changing factors, including the cost of raw materials, industrial activity, global trade conditions, and environmental regulations. Because of its central role in so many production chains, shifts in cyclohexanone prices can have ripple effects across several markets, making it a key chemical to watch this year.

👉 👉 👉 Please Submit Your Query for Cyclohexanone Price trends, forecast and market analysis: https://tinyurl.com/2wmppd7w

Market Size and Growth in 2025

The cyclohexanone market is seeing steady growth in 2025. The market was already valued at billions of dollars globally, and it is expected to keep rising over the next several years. Most of this growth is happening because of how much nylon is needed around the world. Since cyclohexanone is an important ingredient in making nylon, when the demand for nylon increases, so does the demand for cyclohexanone. This increase in use naturally causes the market to grow. Experts believe that the growth rate will remain moderate, but dependable, which makes cyclohexanone a stable and important product in the chemical market.

Prices of Cyclohexanone and What Affects Them

Prices for cyclohexanone in 2025 are changing due to several different things happening around the world. One of the main reasons is the cost of the materials used to make it. Cyclohexane and benzene, which are starting materials for cyclohexanone, often have prices that go up and down, and this directly affects how much cyclohexanone ends up costing. In some regions, prices are also influenced by local demand. For example, when factories in a country need more nylon, they start using more cyclohexanone, which pushes prices higher. On the other hand, when the demand slows down, prices may drop. Other things like shipping problems, environmental rules, and how much is being produced globally also affect the final cost that buyers have to pay.

Industry Trends and Market Shifts

In 2025, some interesting trends are shaping how cyclohexanone is used and produced. One of the biggest changes is the push for more eco-friendly and efficient production methods. Companies are looking for ways to make cyclohexanone with less waste and lower emissions. There’s also more focus on how to recycle materials that are made from it. In addition, the way industries are recovering after global disruptions in the past few years is changing how and where cyclohexanone is produced. Countries with large textile and automotive industries are using more of it, while others are still catching up. This shift is moving production centers and changing the balance of supply and demand in different regions.

Market Segmentation and Major Applications

Cyclohexanone is used mostly in making nylon, which itself is used for everything from clothing to industrial parts. This means the textile industry is one of the biggest customers. But it’s also used as a solvent in making paints, coatings, and adhesives. That means industries involved in construction and manufacturing rely on it as well. It even has a place in pharmaceuticals, where it’s used to help make certain medicines. Each of these segments pushes the demand in its own way, and together they shape the overall market. Understanding how each industry uses it helps explain why its importance and demand remain steady.

Regional Breakdown of the Cyclohexanone Market

Different parts of the world have very different relationships with cyclohexanone. Asia, especially China and India, is leading the market in both production and usage. This is because their industries, particularly textiles and chemicals, are growing quickly. North America is also a big player, though it has faced some price drops recently due to lower demand and more local supply. Europe is a stable market, with prices that vary depending on energy costs and industrial output. Other regions like South America and the Middle East are slowly increasing their share, though they still represent a smaller part of the global picture. Each region has its own challenges and advantages, and these differences shape how the global market moves.

Key Companies Involved in the Market

Several large chemical companies are deeply involved in the production of cyclohexanone. These include firms from the US, Japan, Germany, and India, all with long histories in chemical manufacturing. These companies control large parts of the supply chain, from the raw materials to final delivery. Their ability to produce efficiently, meet regulations, and ship globally gives them a strong position in the market. They also invest in research and development to find new uses for cyclohexanone and to make production cleaner and cheaper. Smaller companies are also joining in, especially in developing countries where local production is becoming more attractive.

Opportunities for Market Expansion

There are many opportunities in 2025 for growth in the cyclohexanone market. One major area is in the continued rise of nylon demand, especially as more products move toward lightweight and durable materials. Another opportunity is in the use of cyclohexanone in new types of coatings and advanced materials. As industries modernize and push for smarter, more efficient materials, the chemical’s usefulness becomes even more valuable. There's also room for new players to enter the market, particularly in regions where production is still developing. With the right investments and technology, these markets can grow and benefit from the global demand.

Forecast and Industry Outlook

Looking ahead, the cyclohexanone market is expected to keep growing at a steady pace. While the price might rise slowly due to raw material costs and increased demand, the outlook remains strong. The main driver of growth will continue to be the nylon industry, but solvent uses and other specialty applications will also support expansion. The biggest challenge for the industry will be managing costs and navigating new environmental rules, but companies that can adapt to these changes will likely succeed. As long as global manufacturing keeps evolving, cyclohexanone will continue to be a valuable material.

Final Thoughts on the Cyclohexanone Market in 2025

In summary, cyclohexanone is a quiet but powerful player in many industries, and its market in 2025 reflects that importance. While prices may fluctuate, the need for this chemical remains strong and steady. From textiles to coatings and medicine, its role in modern manufacturing is clear. As the world becomes more advanced and interconnected, the demand for materials like cyclohexanone will likely continue to rise. Understanding its market, its prices, and the factors behind them helps both suppliers and users make smarter choices in the months and years to come.

0 notes

Text

Adipic Acid Market: A Deep Dive into Key Industry Players

The global adipic acid market size is expected to reach USD 6,567.27 million by 2030 to expand at a CAGR of 3.8% from 2023 to 2030 as per the new report by Grand View Research, Inc. The growth is majorly propelled by growing consumption of adipic acid in the production of nylon 6, 6 fiber, polyurethane, adipate esters, and others, which are widely used by a range of end-use industries such as automotive, consumer goods, electronics, constructions, and more. The expansion of the construction sector to accommodate rapidly increasing global population is expected to drive product consumption in building components such as exterior panels, insulation materials, and housing electronics.

The rising disposable income of customers, coupled with their easy access to finances in the form of loans from banks, has contributed to the growth of the global automotive industry. In addition, electric vehicles and automatic cars, which offer easy and less effort-driving experiences to customers, are also witnessing surged demand globally. Thus, the increasing demand for automobiles worldwide is anticipated to fuel the consumption of nyx`lon 6, 6, thereby having a positive impact on the demand for adipic acid.

Adipic acid prices mainly depend on the availability of raw materials namely cyclohexanol and cyclohexanone and demand from end-use industries such as food & beverages, textile, pharmaceuticals, and personal care. The prices of adipic acid witnessed an increase in 2021 and 2022 in North America and Europe due to the Eastern European geopolitical conflict resulting in the disruption of the raw material supply chain.

Major companies operating in this space are BASF SE, Asahi Kasei Corporation, LANXESS, and INVISTA. Multinational corporations have established a global supply chain through third-party distributors or their in-house supply channels. The manufacturing and distribution of products on a global scale enables shorter lead times to the manufacturers operating in the market.

Gather more insights about the market drivers, restrains and growth of the Adipic Acid Market

Adipic Acid Market Report Highlights

• Polyurethane is the fastest growing application segment by revenue with an expected CAGR of 4.5% on the account of its growing consumption in electronics and construction industry

• Nylon 6, 6 resin is the second fastest growing application segment by revenue with an expected CAGR of 3.9% due to its application in the development of various parts in automotive industry

• Europe is the fastest growing region by revenue with a CAGR of 3.9% because of growing automobile production coupled with rapid increase in construction activities on the account of rising urbanization

• The COVID-19 resulted in a slight decline in the growth of the market due to temporary shutdown of chemical plants caused by prolonged lockdown. International border restriction affected the supply chain for adipic acid, which further deteriorated the growth of the market

• Adipic acid manufacturers are striving to elevate their production capacities in order to ensure regular supply of the product due to its growing demand from automotive industry

Adipic Acid Market Segmentation

Grand View Research has segmented the global adipic acid market report based on application, and region:

Adipic Acid Application Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

• Nylon 6, 6 Fiber

• Nylon 6, 6 Resin

• Polyurethane

• Adipate Esters

• Other Applications

Adipic Acid Regional Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o U.K.

o France

o Italy

• Asia Pacific

o China

o Japan

o India

• Central & South America

o Brazil

o Argentina

• Middle East & Africa

o Saudi Arabia

o South Africa

Order a free sample PDF of the Adipic Acid Market Intelligence Study, published by Grand View Research.

#Adipic Acid Market#Adipic Acid Market Analysis#Adipic Acid Market Report#Adipic Acid Market Size#Adipic Acid Market Share

0 notes

Text

𝐄𝐮𝐫𝐨𝐩𝐞 𝐂𝐲𝐜𝐥𝐨𝐡𝐞𝐱𝐚𝐧𝐨𝐧𝐞 𝐌𝐚𝐫𝐤𝐞𝐭: 𝐊𝐞𝐲 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 & 𝐓𝐫𝐞𝐧𝐝𝐬-IndustryARC™

The Europe Cyclohexanone Market size is forecasted to reach US$1.2 billion by 2027, after growing at a CAGR of 4.5% during the forecast period 2022-2027.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞

Cyclohexanone (C₆H₁₁O) is a key industrial solvent and chemical intermediate with a wide range of applications in various industries. It is classified as a ketone due to its molecular structure, which consists of a six-carbon chain with a carbonyl group (C=O) attached to one of the carbons. Cyclohexanone is highly valued for its ability to dissolve a variety of substances and its role in the synthesis of key chemicals.

𝐊𝐞𝐲 𝐓𝐫𝐞𝐧𝐝𝐬

𝐑𝐢𝐬𝐢𝐧𝐠 𝐃𝐞𝐦𝐚𝐧𝐝 𝐢𝐧 𝐍𝐲𝐥𝐨𝐧 𝐏𝐫𝐨𝐝𝐮𝐜𝐭𝐢𝐨𝐧:

The Europe Cyclohexanone market is experiencing sustained growth, driven primarily by the increasing demand for nylon and its derivatives. As industries like automotive and textiles expand, the need for nylon-6 and nylon-6,6 is pushing up cyclohexanone consumption, especially in countries like Germany and France.

𝐒𝐮𝐬𝐭𝐚𝐢𝐧𝐚𝐛𝐢𝐥𝐢𝐭𝐲 𝐚𝐧𝐝 𝐆𝐫𝐞𝐞𝐧 𝐂𝐡𝐞𝐦𝐢𝐬𝐭𝐫𝐲:

Environmental concerns are pushing manufacturers to adopt more sustainable practices. Bio-based cyclohexanone production is gaining traction as an eco-friendly alternative to traditional petroleum-based methods.

𝐈𝐧𝐜𝐫𝐞𝐚𝐬𝐞𝐝 𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐂𝐨𝐚𝐭𝐢𝐧𝐠𝐬 𝐚𝐧𝐝 𝐀𝐝𝐡𝐞𝐬𝐢𝐯𝐞𝐬:

Cyclohexanone's role as a solvent in paints, coatings, and adhesives is expanding due to its excellent ability to dissolve a variety of resins. With the growth of the construction and automotive industries, demand for high-performance coatings and adhesives continues to rise.

𝐒𝐡𝐢𝐟𝐭 𝐓𝐨𝐰𝐚𝐫𝐝𝐬 𝐀𝐮𝐭𝐨𝐦𝐚𝐭𝐢𝐨𝐧 𝐚𝐧𝐝 𝐀𝐝𝐯𝐚𝐧𝐜𝐞𝐝 𝐌𝐚𝐧𝐮𝐟𝐚𝐜𝐭𝐮𝐫𝐢𝐧𝐠:

The Europe Cyclohexanone market is seeing a shift toward advanced manufacturing technologies and automation. This trend is improving production efficiency, reducing costs, and meeting the growing demand for high-quality cyclohexanone in various industrial sectors.

𝐄𝐱𝐩𝐚𝐧𝐝𝐢𝐧𝐠 𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧𝐬 𝐢𝐧 𝐏𝐡𝐚𝐫𝐦𝐚𝐜𝐞𝐮𝐭𝐢𝐜𝐚𝐥𝐬 𝐚𝐧𝐝 𝐂𝐨𝐬𝐦𝐞𝐭𝐢𝐜𝐬:

Cyclohexanone's use in pharmaceuticals and cosmetics is increasing as demand for active ingredients and specialty fragrances grows. The compound is being utilized more in the formulation of certain pharmaceuticals and cosmetic products, which is opening new markets within the chemical industry.

0 notes

Text

The Spray Foam Insulation Market is projected to grow from USD 2,089.21 million in 2023 to an estimated USD 3,722.98 million by 2032, with a compound annual growth rate (CAGR) of 6.59% from 2024 to 2032. Adipic acid is a key chemical compound used primarily in the production of nylon, polyurethane, and plasticizers, as well as in various other industrial applications. Traditionally, adipic acid is synthesized from petrochemical sources. However, with the growing focus on sustainability, bio-based alternatives are gaining traction. The market for synthetic and bio-based adipic acid is undergoing significant transformations, driven by environmental regulations, technological advancements, and shifting consumer preferences.

Browse the full report at https://www.credenceresearch.com/report/spray-foam-insulation-market

Market Overview

The synthetic and bio-based adipic acid market is witnessing a paradigm shift. On one hand, the demand for synthetic adipic acid remains steady due to its widespread application in industries such as automotive, textiles, and construction. On the other hand, bio-based adipic acid is emerging as an eco-friendly alternative to synthetic variants, owing to growing awareness about carbon emissions and the environmental impact of petrochemical-based processes.

Synthetic Adipic Acid

Production Process: Synthetic adipic acid is primarily produced through the oxidation of cyclohexanol or cyclohexanone using nitric acid. This process has been widely used in the chemical industry for decades. While the synthetic route is cost-effective and well-established, it has significant environmental drawbacks, notably the release of nitrous oxide (N₂O), a potent greenhouse gas.

Applications: - Nylon 6,6: The majority of synthetic adipic acid is used in the production of nylon 6,6, a durable and versatile material that finds application in textiles, automotive components, and industrial equipment. - Polyurethanes: Adipic acid is a key component in the production of polyurethane foams, which are used in a range of industries including construction and packaging. - Plasticizers: Synthetic adipic acid is also employed in the production of plasticizers that enhance the flexibility of plastics in products like PVC.

Despite its widespread use, the environmental concerns associated with the synthetic production process are prompting industries to explore greener alternatives.

Bio-Based Adipic Acid

Emergence and Production: Bio-based adipic acid is produced from renewable feedstocks such as glucose, lignocellulosic biomass, and vegetable oils. The development of bio-based adipic acid has been accelerated by advancements in biotechnology, particularly microbial fermentation. This process involves genetically modified microorganisms that convert sugars into adipic acid, offering a more sustainable alternative to the petrochemical-based synthesis.

Environmental Benefits: Bio-based adipic acid significantly reduces greenhouse gas emissions compared to its synthetic counterpart. By using renewable resources, bio-based production processes can cut down on fossil fuel consumption and mitigate the release of harmful by-products like nitrous oxide. Moreover, it aligns with global efforts to promote the circular economy, minimize waste, and lower carbon footprints across industries.

Challenges: While bio-based adipic acid offers considerable environmental benefits, several challenges hinder its widespread adoption: - Cost: The production cost of bio-based adipic acid is currently higher than that of synthetic adipic acid, primarily due to the expensive feedstocks and the complexities of microbial fermentation. - Scaling Up: Achieving industrial-scale production is another challenge. Although technological advancements are helping to improve yield and reduce costs, scaling up bio-based processes to meet the growing demand remains a significant hurdle. - Compatibility with Existing Systems: Industries relying on synthetic adipic acid may need to make adjustments to adopt bio-based alternatives, which could increase short-term operational costs.

Market Drivers

Several factors are driving the growth of the synthetic and bio-based adipic acid market:

- Environmental Regulations: Governments worldwide are tightening environmental regulations, particularly around carbon emissions and waste generation. This has led industries to seek sustainable alternatives like bio-based adipic acid to comply with these regulations. - Rising Demand for Sustainable Products: Consumer awareness about environmental issues is rising, leading to an increase in demand for products made from sustainable and eco-friendly materials. This trend is pushing industries to adopt bio-based chemicals, including adipic acid. - Technological Advancements: Ongoing research and development in biotechnology and chemical engineering are improving the efficiency and cost-effectiveness of bio-based adipic acid production. Innovations in fermentation technology, enzyme engineering, and feedstock optimization are driving the market forward.

Regional Analysis

The synthetic and bio-based adipic acid market is globally dispersed, with significant growth observed in North America, Europe, and Asia-Pacific. North America and Europe have been early adopters of bio-based adipic acid due to stringent environmental regulations and consumer preferences for sustainable products. Meanwhile, Asia-Pacific remains a strong market for synthetic adipic acid, given its thriving industrial sectors in countries like China, India, and Japan.

Key players

BASF SE

Bayer AG

CertainTeed Corporation

Demilec

Icynene Inc

Lapolla Industries Inc

NCFI Polyurethanes

Premium Spray Products

Rhino Linings Corporation

The Dow Chemical Company

Henry

Greer Spray Foam Ltd.

Covestro AG

RHH Foam Systems, Inc.

General Coatings Manufacturing Corp.

Aristo Industries

ICP Building Solutions Group

Johns Manville, A Berkshire Hathaway Company

DAP Products Inc.

Segments

Based on Foam Type

Closed-cell Foam

Open-cell Foam

Based on Density

High-density Foam

Medium-density Foam

Low-density Foam

Based on Application

Wall Insulation

Attic Insulation

Roof Insulation

Concrete Rehabilitation

Other Applications

Based on End Use

Packaging

Building & Construction

Automotive & Transportation

Consumer Goods

Medical

Others

Based on Region

North America

US

Canada

Latin America

Brazil

Argentina

Mexico

Rest of Latin America

Europe

Germany

UK

Spain

France

Italy

Russia

Rest of Europe

Asia Pacific

China

India

Japan

Australia

South Korea

ASEAN

Rest of Asia Pacific

Middle East

GCC

Israel

Rest of Middle East

Africa

South Africa

North Africa

Central Africa

Browse the full report at https://www.credenceresearch.com/report/spray-foam-insulation-market

About Us:

Credence Research is committed to employee well-being and productivity. Following the COVID-19 pandemic, we have implemented a permanent work-from-home policy for all employees.

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

Website: www.credenceresearch.com

0 notes

Text

0 notes

Text

0 notes

Text

The Report Covers Adipic Acid Manufacturers and the Market is segmented by raw material (cyclohexanol and cyclohexanone), the end product (nylon 66 fibers, nylon 66 engineering resins, polyurethanes, adipate esters, and other end products), application (plasticizers, unsaturated polyester resins, wet paper resins, coatings, synthetic lubricants, food additives, and other applications), end-user industry (automotive, electrical and electronics, textiles, food, and beverages, personal care, pharmaceutical, and other end-user industries), and geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Download Free Sample Report - Adipic Acid Market

0 notes

Text

Cyclohexanone Market - Forecast(2022 - 2027)

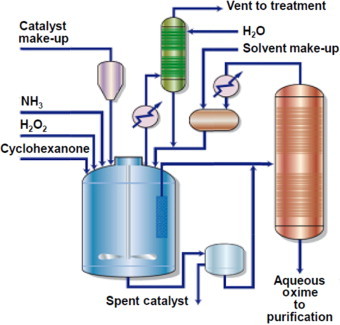

Cyclohexanone is the organic compound, produced by the oxidation of cyclohexane in air, typically using cobalt catalysts.

0 notes

Photo

Growth In Landscape Of Global Ortho Phenyl Phenol Market Outlook: Ken Research Buy Now The ortho phenyl phenol is also known as 2-phenyl phenol and a water-soluble salt which is antimicrobial agents utilized as the fungicides, bacteriostats, and sanitizers.

#Asia-Pacific Ortho Phenyl Phenol Market#Dow Ortho Phenyl Phenol Market Share#Europe Ortho Phenyl Phenol Market Analysis#Global Chlorobenzene Synthesis OPP Market#Global Cyclohexanone Synthesis OPP Market#Global Ortho Phenyl Phenol (OPP) Industry#Global Ortho Phenyl Phenol (OPP) Market#Global Ortho Phenyl Phenol (OPP) Market Revenue#Global Ortho Phenyl Phenol (OPP) Market Share#Global Ortho Phenyl Phenol (OPP) Market Size#Global Ortho Phenyl Phenol Industry Research Report#Global Ortho Phenyl Phenol Market Analysis#Global Ortho Phenyl Phenol Market Forecast#Global Ortho Phenyl Phenol Market Future Outlook#Global Ortho Phenyl Phenol Market Growth#Global Ortho Phenyl Phenol Market Growth Rate#Global Ortho Phenyl Phenol Market Research Report#Jinan Ortho Phenyl Phenol Market Report#Lanxess Ortho Phenyl Phenol Market Size#Middle East Ortho Phenyl Phenol Market Size#North America Ortho Phenyl Phenol Market#SANKO Ortho Phenyl Phenol Market Analysis#Shandong Ortho Phenyl Phenol Market Revenue#South America Ortho Phenyl Phenol Market

0 notes

Text

0 notes

Text

Adipic Acid Market Growth, COVID Impact, Trends Analysis Report Forecast to 2032

The global adipic acid market is forecasted to be valued at US$ 6,346 million in 2022 and is predicted to secure a slow-paced CAGR of 4.9% during the forecast period. Adipic acid is one of the most commercially crucial form of aliphatic dicarboxylic acids, particularly because of its considerable usage as a feedstock for the production of commercial fibers.

It’s far constituted of the oxidation of a mixture of cyclohexanol and cyclohexanone with nitric acid. As a substitute, adipic acid can also be constructed from butadiene carbonylation. There has been a considerable call for for chemically resilient, robust and durable fibers for the manufacture of automotive parts.

This has initiated a strong demand for adipic acid, due to the fact it is one of the key components for the manufacturing of composite materials. The foremost intake of adipic acid is as the feedstock for the manufacturing for nylon 6,6 resin and engineering fibers. The non-nylon applications of adipic acid consist of its usage within the manufacture of polyurethanes, plasticizers, food additives and prescription drugs.

Request for Sample @ https://www.futuremarketinsights.com/reports/sample/rep-gb-1348

Key Segments in The Adipic Acid Market

By Application:

Nylon 66 Fiber

Nylon 66 Resins

Polyurethanes

Adipate Esters

Others

By End-Use Industry:

Automotive

Electrical & Electronics

Home Appliances

Textiles

FMCG

By Region:

North America

Latin America

Asia Pacific

MEA

Europe

Adipic Acid Market: Key Players

Some of the key players include in the adipic acid market report include DSM, Ascend Performance Materials Inc., BASF SE , Verdezyne, PetroChina Liaoyang Petrochemical,Rennovia, Sumitomo Chemical Co., Ltd, Asahi Kasei Corporation, Invista, Lanxess Ag and Rhodia

The escalating demand for adipic acid from automobile, electrical & electronics, purchaser items and home equipment enterprise is one of the chief drivers for the adipic acid marketplace. The good sized research and development inside the fabric production era is also one of the key factors influencing the adipic acid market.

The agencies are that specialize in growing excessive high-quality, durable, lightweight and high absorption ability fibers which are able to enduring intense situations such as high temperatures and are chemically inert as properly.

The adipic acid marketplace has witnessed a sizable boom in the current decade and the fashion is expected to continue for the forecast duration. But, the presence of stringent environmental regulations in one of a kind areas and the rise of hybrid fibers is expected to restrain the adipic acid market.

The adipic acid market can be segmented on the idea of the regions as North america, Latin america, APEJ, Japan, japanese Europe, Western Europe and middle East & Africa. In phrases of production and intake APEJ is the most important market for the adipic acid.

Browse latest Market Reports@ https://www.futuremarketinsights.com/category/chemicals-and-materials

0 notes

Text

The Synthetic and Bio-Based Adipic Acid Market is projected to grow from USD 9,800 million in 2024 to USD 14,701.17 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.20% over the forecast period.Adipic acid is a key chemical compound used primarily in the production of nylon, polyurethane, and plasticizers, as well as in various other industrial applications. Traditionally, adipic acid is synthesized from petrochemical sources. However, with the growing focus on sustainability, bio-based alternatives are gaining traction. The market for synthetic and bio-based adipic acid is undergoing significant transformations, driven by environmental regulations, technological advancements, and shifting consumer preferences.

Browse the full report at https://www.credenceresearch.com/report/synthetic-and-bio-based-adipic-acid-market

Market Overview

The synthetic and bio-based adipic acid market is witnessing a paradigm shift. On one hand, the demand for synthetic adipic acid remains steady due to its widespread application in industries such as automotive, textiles, and construction. On the other hand, bio-based adipic acid is emerging as an eco-friendly alternative to synthetic variants, owing to growing awareness about carbon emissions and the environmental impact of petrochemical-based processes.

Synthetic Adipic Acid

Production Process: Synthetic adipic acid is primarily produced through the oxidation of cyclohexanol or cyclohexanone using nitric acid. This process has been widely used in the chemical industry for decades. While the synthetic route is cost-effective and well-established, it has significant environmental drawbacks, notably the release of nitrous oxide (N₂O), a potent greenhouse gas.

Applications: - Nylon 6,6: The majority of synthetic adipic acid is used in the production of nylon 6,6, a durable and versatile material that finds application in textiles, automotive components, and industrial equipment. - Polyurethanes: Adipic acid is a key component in the production of polyurethane foams, which are used in a range of industries including construction and packaging. - Plasticizers: Synthetic adipic acid is also employed in the production of plasticizers that enhance the flexibility of plastics in products like PVC.

Despite its widespread use, the environmental concerns associated with the synthetic production process are prompting industries to explore greener alternatives.

Bio-Based Adipic Acid

Emergence and Production: Bio-based adipic acid is produced from renewable feedstocks such as glucose, lignocellulosic biomass, and vegetable oils. The development of bio-based adipic acid has been accelerated by advancements in biotechnology, particularly microbial fermentation. This process involves genetically modified microorganisms that convert sugars into adipic acid, offering a more sustainable alternative to the petrochemical-based synthesis.

Environmental Benefits: Bio-based adipic acid significantly reduces greenhouse gas emissions compared to its synthetic counterpart. By using renewable resources, bio-based production processes can cut down on fossil fuel consumption and mitigate the release of harmful by-products like nitrous oxide. Moreover, it aligns with global efforts to promote the circular economy, minimize waste, and lower carbon footprints across industries.

Challenges: While bio-based adipic acid offers considerable environmental benefits, several challenges hinder its widespread adoption: - **Cost:** The production cost of bio-based adipic acid is currently higher than that of synthetic adipic acid, primarily due to the expensive feedstocks and the complexities of microbial fermentation. - **Scaling Up:** Achieving industrial-scale production is another challenge. Although technological advancements are helping to improve yield and reduce costs, scaling up bio-based processes to meet the growing demand remains a significant hurdle. - **Compatibility with Existing Systems:** Industries relying on synthetic adipic acid may need to make adjustments to adopt bio-based alternatives, which could increase short-term operational costs.

Market Drivers

Several factors are driving the growth of the synthetic and bio-based adipic acid market:

- Environmental Regulations: Governments worldwide are tightening environmental regulations, particularly around carbon emissions and waste generation. This has led industries to seek sustainable alternatives like bio-based adipic acid to comply with these regulations. - Rising Demand for Sustainable Products: Consumer awareness about environmental issues is rising, leading to an increase in demand for products made from sustainable and eco-friendly materials. This trend is pushing industries to adopt bio-based chemicals, including adipic acid. - Technological Advancements: Ongoing research and development in biotechnology and chemical engineering are improving the efficiency and cost-effectiveness of bio-based adipic acid production. Innovations in fermentation technology, enzyme engineering, and feedstock optimization are driving the market forward.

Regional Analysis

The synthetic and bio-based adipic acid market is globally dispersed, with significant growth observed in North America, Europe, and Asia-Pacific. North America and Europe have been early adopters of bio-based adipic acid due to stringent environmental regulations and consumer preferences for sustainable products. Meanwhile, Asia-Pacific remains a strong market for synthetic adipic acid, given its thriving industrial sectors in countries like China, India, and Japan.

Key Player Analysis:

BASF SE

Invista (Koch Industries, Inc.)

Rennovia Inc.

Verdezyne, Inc.

Ascend Performance Materials

Radici Group

Asahi Kasei Corporation

Genomatica, Inc.

DSM Engineering Plastics

LANXESS AG

Segmentations:

By Application:

Nylon 6,6 fiber

Nylon 6,6 resin

Polyurethanes

Adipate esters

Others

By Region:

North America

US

Canada

Latin America

Brazil

Argentina

Mexico

Rest of Latin America

Europe

Germany

UK

Spain

France

Italy

Russia

Rest of Europe

Asia Pacific

China

India

Japan

Australia

South Korea

ASEAN

Rest of Asia Pacific

Middle East

GCC

Israel

Rest of Middle East

Africa

South Africa

North Africa

Central Africa

Browse the full report at https://www.credenceresearch.com/report/synthetic-and-bio-based-adipic-acid-market

About Us:

Credence Research is committed to employee well-being and productivity. Following the COVID-19 pandemic, we have implemented a permanent work-from-home policy for all employees.

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

Website: www.credenceresearch.com

0 notes