#Defect detection in semiconductor wafers

Explore tagged Tumblr posts

Text

Machine learning applications in semiconductor manufacturing

Machine Learning Applications in Semiconductor Manufacturing: Revolutionizing the Industry

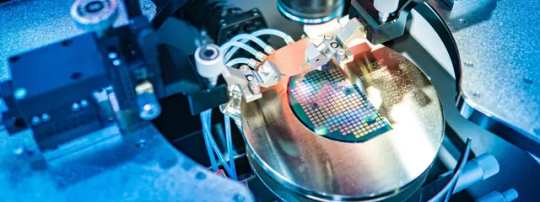

The semiconductor industry is the backbone of modern technology, powering everything from smartphones and computers to autonomous vehicles and IoT devices. As the demand for faster, smaller, and more efficient chips grows, semiconductor manufacturers face increasing challenges in maintaining precision, reducing costs, and improving yields. Enter machine learning (ML)—a transformative technology that is revolutionizing semiconductor manufacturing. By leveraging ML, manufacturers can optimize processes, enhance quality control, and accelerate innovation. In this blog post, we’ll explore the key applications of machine learning in semiconductor manufacturing and how it is shaping the future of the industry.

Predictive Maintenance

Semiconductor manufacturing involves highly complex and expensive equipment, such as lithography machines and etchers. Unplanned downtime due to equipment failure can cost millions of dollars and disrupt production schedules. Machine learning enables predictive maintenance by analyzing sensor data from equipment to predict potential failures before they occur.

How It Works: ML algorithms process real-time data from sensors, such as temperature, vibration, and pressure, to identify patterns indicative of wear and tear. By predicting when a component is likely to fail, manufacturers can schedule maintenance proactively, minimizing downtime.

Impact: Predictive maintenance reduces equipment downtime, extends the lifespan of machinery, and lowers maintenance costs.

Defect Detection and Quality Control

Defects in semiconductor wafers can lead to significant yield losses. Traditional defect detection methods rely on manual inspection or rule-based systems, which are time-consuming and prone to errors. Machine learning, particularly computer vision, is transforming defect detection by automating and enhancing the process.

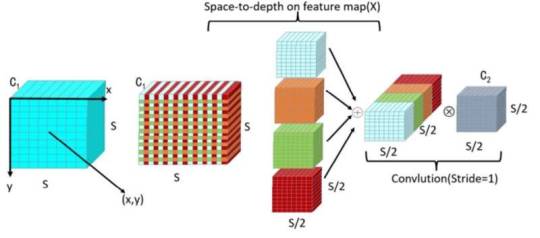

How It Works: ML models are trained on vast datasets of wafer images to identify defects such as scratches, particles, and pattern irregularities. Deep learning algorithms, such as convolutional neural networks (CNNs), excel at detecting even the smallest defects with high accuracy.

Impact: Automated defect detection improves yield rates, reduces waste, and ensures consistent product quality.

Process Optimization

Semiconductor manufacturing involves hundreds of intricate steps, each requiring precise control of parameters such as temperature, pressure, and chemical concentrations. Machine learning optimizes these processes by identifying the optimal settings for maximum efficiency and yield.

How It Works: ML algorithms analyze historical process data to identify correlations between input parameters and output quality. Techniques like reinforcement learning can dynamically adjust process parameters in real-time to achieve the desired outcomes.

Impact: Process optimization reduces material waste, improves yield, and enhances overall production efficiency.

Yield Prediction and Improvement

Yield—the percentage of functional chips produced from a wafer—is a critical metric in semiconductor manufacturing. Low yields can result from various factors, including process variations, equipment malfunctions, and environmental conditions. Machine learning helps predict and improve yields by analyzing complex datasets.

How It Works: ML models analyze data from multiple sources, including process parameters, equipment performance, and environmental conditions, to predict yield outcomes. By identifying the root causes of yield loss, manufacturers can implement targeted improvements.

Impact: Yield prediction enables proactive interventions, leading to higher productivity and profitability.

Supply Chain Optimization

The semiconductor supply chain is highly complex, involving multiple suppliers, manufacturers, and distributors. Delays or disruptions in the supply chain can have a cascading effect on production schedules. Machine learning optimizes supply chain operations by forecasting demand, managing inventory, and identifying potential bottlenecks.

How It Works: ML algorithms analyze historical sales data, market trends, and external factors (e.g., geopolitical events) to predict demand and optimize inventory levels. Predictive analytics also helps identify risks and mitigate disruptions.

Impact: Supply chain optimization reduces costs, minimizes delays, and ensures timely delivery of materials.

Advanced Process Control (APC)

Advanced Process Control (APC) is critical for maintaining consistency and precision in semiconductor manufacturing. Machine learning enhances APC by enabling real-time monitoring and control of manufacturing processes.

How It Works: ML models analyze real-time data from sensors and equipment to detect deviations from desired process parameters. They can automatically adjust settings to maintain optimal conditions, ensuring consistent product quality.

Impact: APC improves process stability, reduces variability, and enhances overall product quality.

Design Optimization

The design of semiconductor devices is becoming increasingly complex as manufacturers strive to pack more functionality into smaller chips. Machine learning accelerates the design process by optimizing chip layouts and predicting performance outcomes.

How It Works: ML algorithms analyze design data to identify patterns and optimize layouts for performance, power efficiency, and manufacturability. Generative design techniques can even create novel chip architectures that meet specific requirements.

Impact: Design optimization reduces time-to-market, lowers development costs, and enables the creation of more advanced chips.

Fault Diagnosis and Root Cause Analysis

When defects or failures occur, identifying the root cause can be challenging due to the complexity of semiconductor manufacturing processes. Machine learning simplifies fault diagnosis by analyzing vast amounts of data to pinpoint the source of problems.

How It Works: ML models analyze data from multiple stages of the manufacturing process to identify correlations between process parameters and defects. Techniques like decision trees and clustering help isolate the root cause of issues.

Impact: Faster fault diagnosis reduces downtime, improves yield, and enhances process reliability.

Energy Efficiency and Sustainability

Semiconductor manufacturing is energy-intensive, with significant environmental impacts. Machine learning helps reduce energy consumption and improve sustainability by optimizing resource usage.

How It Works: ML algorithms analyze energy consumption data to identify inefficiencies and recommend energy-saving measures. For example, they can optimize the operation of HVAC systems and reduce idle time for equipment.

Impact: Energy optimization lowers operational costs and reduces the environmental footprint of semiconductor manufacturing.

Accelerating Research and Development

The semiconductor industry is driven by continuous innovation, with new materials, processes, and technologies being developed regularly. Machine learning accelerates R&D by analyzing experimental data and predicting outcomes.

How It Works: ML models analyze data from experiments to identify promising materials, processes, or designs. They can also simulate the performance of new technologies, reducing the need for physical prototypes.

Impact: Faster R&D cycles enable manufacturers to bring cutting-edge technologies to market more quickly.

Challenges and Future Directions

While machine learning offers immense potential for semiconductor manufacturing, there are challenges to overcome. These include the need for high-quality data, the complexity of integrating ML into existing workflows, and the shortage of skilled professionals. However, as ML technologies continue to evolve, these challenges are being addressed through advancements in data collection, model interpretability, and workforce training.

Looking ahead, the integration of machine learning with other emerging technologies, such as the Internet of Things (IoT) and digital twins, will further enhance its impact on semiconductor manufacturing. By embracing ML, manufacturers can stay competitive in an increasingly demanding and fast-paced industry.

Conclusion

Machine learning is transforming semiconductor manufacturing by enabling predictive maintenance, defect detection, process optimization, and more. As the industry continues to evolve, ML will play an increasingly critical role in driving innovation, improving efficiency, and ensuring sustainability. By harnessing the power of machine learning, semiconductor manufacturers can overcome challenges, reduce costs, and deliver cutting-edge technologies that power the future.

This blog post provides a comprehensive overview of machine learning applications in semiconductor manufacturing. Let me know if you’d like to expand on any specific section or add more details!

#semiconductor manufacturing#Machine learning in semiconductor manufacturing#AI in semiconductor industry#Predictive maintenance in chip manufacturing#Defect detection in semiconductor wafers#Semiconductor process optimization#Yield prediction in semiconductor manufacturing#Advanced Process Control (APC) in semiconductors#Semiconductor supply chain optimization#Fault diagnosis in chip manufacturing#Energy efficiency in semiconductor production#Deep learning for semiconductor defects#Computer vision in wafer inspection#Reinforcement learning in semiconductor processes#Semiconductor yield improvement using AI#Smart manufacturing in semiconductors#AI-driven semiconductor design#Root cause analysis in chip manufacturing#Sustainable semiconductor manufacturing#IoT in semiconductor production#Digital twins in semiconductor manufacturing

0 notes

Text

Solving long-standing challenge in semiconductor manufacturing—a refined algorithm for detecting wafer defects

Research published in the International Journal of Information and Communication Technology may soon help solve a long-standing challenge in semiconductor manufacture: the accurate detection of surface defects on silicon wafers. Crystalline silicon is the critical material used in the production of integrated circuits and in order to provide the computing power for everyday electronics and advanced automotive systems needs to be as pristine as possible prior to printing of the microscopic features of the circuit on the silicon surface. Of course, no manufacturing technology is perfect and the intricate process of fabricating semiconductor chips inevitably leads to some defects on the silicon wafers. This reduces the number of working chips in a batch and leads to a small, but significant proportion of the production line output failing. The usual way to spot defects on silicon wafers has been done manually, with human operators examining each wafer by eye. This is both time-consuming and error-prone due to the fine attention to detail required. As wafer production has ramped up globally to meet demand and the defects themselves have become harder to detect by eye, the limitations of this approach have become more apparent.

Read more.

#Materials Science#Science#Semiconductors#Defects#Manufacturing#Materials processing#Silicon#Computational materials science

15 notes

·

View notes

Text

Semiconductor Manufacturing Equipment Market Future Trends Driven by AI, Miniaturization, and Sustainability Goals

The semiconductor manufacturing equipment market is undergoing a significant transformation, with future trends signaling a new era of technological sophistication, sustainability, and global competitiveness. As the world increasingly relies on digital infrastructure, artificial intelligence, cloud computing, and smart devices, the demand for high-performance, energy-efficient chips is skyrocketing. This, in turn, is reshaping the requirements for semiconductor manufacturing tools and equipment, from wafer fabrication and lithography to testing and packaging systems.

Rise of Advanced Lithography Technologies

One of the most prominent future trends in the semiconductor manufacturing equipment market is the rise of advanced lithography. As chipmakers push the boundaries of Moore’s Law, there’s a growing need for more precise and capable lithography systems to enable smaller, more powerful, and more energy-efficient transistors.

Extreme ultraviolet (EUV) lithography is at the center of this trend. While EUV has already been adopted in leading-edge manufacturing, its evolution will play a critical role in sub-3nm process nodes. Equipment manufacturers are investing heavily in EUV technology to meet demand from major foundries and integrated device manufacturers (IDMs). Future developments will likely include higher-powered EUV sources and multi-patterning capabilities to support next-generation chip designs.

Integration of Artificial Intelligence and Machine Learning

Another key trend is the integration of artificial intelligence (AI) and machine learning (ML) into semiconductor equipment. These technologies are being used to enhance precision, reduce defects, and improve yield rates. AI-driven analytics can monitor equipment performance in real time, detect anomalies, and make automatic adjustments during production.

This trend is especially valuable in advanced process nodes, where tolerances are extremely tight. Equipment that can self-optimize using AI will not only reduce human error but also shorten development cycles and lower manufacturing costs. As fabs become more automated, AI-enabled equipment will be the norm rather than the exception.

Shift Toward Green and Sustainable Manufacturing

Sustainability is emerging as a central theme in the future of semiconductor manufacturing. The production of chips is an energy- and resource-intensive process. As environmental regulations tighten and companies commit to carbon neutrality, equipment suppliers are under pressure to deliver tools that support greener manufacturing.

Future semiconductor equipment will focus on energy efficiency, reduced chemical usage, and water conservation. For example, advancements in plasma etching, chemical vapor deposition (CVD), and cleaning technologies are being geared toward minimizing waste and emissions. Equipment designed for recycling process gases and reusing deionized water will also see increasing demand.

Additionally, sustainability goals are driving investment in equipment that supports low-temperature processes and alternative materials, reducing environmental impact without compromising chip performance.

Demand for Heterogeneous Integration and Advanced Packaging

As traditional scaling becomes more challenging, the industry is turning to heterogeneous integration and advanced packaging techniques to boost chip performance. This shift is creating new demand for packaging equipment capable of handling complex architectures such as chiplets, 3D stacking, and system-in-package (SiP) solutions.

Future semiconductor equipment will need to support ultra-thin wafers, high-density interconnects, and thermal management solutions. Tools for wafer-level packaging, die bonding, and through-silicon vias (TSVs) will become increasingly vital as device makers explore new ways to integrate multiple functions into smaller footprints.

Growth of Specialized Equipment for Emerging Applications

The rise of new technologies such as quantum computing, 5G, automotive electronics, and the Internet of Things (IoT) is driving demand for application-specific semiconductor manufacturing equipment. These sectors often require chips built on unique process technologies or alternative materials like gallium nitride (GaN) and silicon carbide (SiC).

Future trends suggest a growing focus on flexible equipment platforms that can adapt to different wafer sizes, material properties, and device architectures. Equipment manufacturers that can offer modular, scalable solutions will be better positioned to meet the diverse needs of next-generation applications.

Expansion of Global Semiconductor Supply Chains

Geopolitical dynamics and the global chip shortage have led to a renewed focus on supply chain resilience and regional manufacturing independence. Governments in the U.S., Europe, China, and other regions are investing billions to establish or expand local semiconductor fabrication capacities.

This shift is generating strong demand for manufacturing equipment across geographies. Equipment providers that can support localized production, offer timely service, and customize tools for regional compliance will see expanded business opportunities. Furthermore, collaboration between governments and private players is expected to drive innovation and accelerate equipment development across multiple regions.

Emphasis on Reliability, Uptime, and Predictive Maintenance

As production lines become increasingly automated, equipment uptime and reliability are more critical than ever. Downtime can result in significant financial losses, especially in high-volume fabs. Future equipment trends will emphasize predictive maintenance using IoT sensors and cloud-based analytics to forecast failures and schedule servicing proactively.

These smart maintenance systems will help fabs avoid costly shutdowns and extend the life of their capital-intensive tools. This will not only improve operational efficiency but also enhance ROI for semiconductor manufacturers investing in advanced equipment.

Conclusion

The semiconductor manufacturing equipment market is entering an exciting phase of innovation and transformation. Driven by trends like EUV lithography, AI integration, sustainable manufacturing, and advanced packaging, the future landscape promises significant opportunities for growth. As the digital world continues to expand, equipment manufacturers that invest in cutting-edge technologies and align with emerging industry demands will be at the forefront of shaping the next generation of semiconductor production.

#SemiconductorManufacturingEquipmentMarket#SemiconductorEquipment#TechTrends#EUVLithography#AIinManufacturing

0 notes

Text

Guidelines for Electrostatic Protection of CCD Sensors

The core advantages and application fields of CMOS compared to CCD

Although most civil scenarios are now replaced by CMOS, CCD still has irreplaceable advantages in professional fields with strict requirements for image quality, sensitivity, and noise:

l Scientific research: astronomical telescope imaging, particle physics detectors, spectral analysis equipment;

l Medical field: X-ray imaging equipment, fluorescence microscopes, mammography machines;

l Industrial inspection: high-precision machine vision (such as semiconductor wafer defect detection, dimension measurement of auto parts);

l Aerospace and military: satellite remote sensing cameras, infrared night-vision equipment, missile guidance systems.

Electrostatic Protection Schemes for CCD Sensors

In scenarios such as high-precision industrial vision and aerospace equipment, electrostatic surges on CCD sensors mainly intrude through the following paths: power ports: industrial power supplies (e.g., 24V) are susceptible to lightning-induced surges; data interfaces: high-speed image transmission interfaces (e.g., Camera Link, LVDS); trigger signal lines: external control signal input ports.

1. Input Power Protection

24V industrial power supplies need to consider both surge and overcurrent protection:

Surge protection: It is recommended to use the TVS device LM1K24CA (package SMB, VC=35V, low clamping voltage) with a protection level of 2kV;Overcurrent protection: SMD1812 series PTC (6–60V, 0.1–3.5A) with fast response speed and reusability; Reverse polarity protection: Schottky diode SK56C (60V/5A) to reduce the risk of damage when the power supply is connected reversely.

2. High-Speed Data Interface Protection

Camera Link interface (maximum transmission rate 2.38Gbps):

ESD protection: Use ULC3304P10LV ESD array (parasitic capacitance < 0.5pF), which meets IEC61000–4–2 Level 4 (contact discharge 8kV, air discharge 15kV) to ensure high-frequency signal integrity; Common-mode interference suppression: Series common-mode chokes to reduce crosstalk in data lines.

1. Power Rail Electrostatic Protection

CCD sensors usually require multiple sets of power rails:

Analog power supply (3.3V): ESD0321CW (DFN0603 package, 30pF capacitance, 21A discharge current);

Leiditech is committed to becoming a leading brand in electromagnetic compatibility solutions and component supply, offering products such as ESD, TVS, TSS, GDT, MOV, MOSFET, Zener, and inductors. Leiditech has an experienced R&D team that can provide personalized customization services according to customer needs and offer the highest quality solutions.

If you’d like to learn more or have any questions, don’t hesitate to reach out:

Visit us at [en.leiditech.com]

#CCDProtection #ElectrostaticSafety #ImagingTech #ESDProtection #IndustrialVision #AerospaceTech #MachineVision #Leiditech #TechSolutions #SensorShielding #SurgeProtection #CameraInterface #PrecisionEngineering #HighSpeedData

0 notes

Text

CMP Slurry Monitoring Market, Key Industry Insights, and Forecast to 2032

Global CMP Slurry Monitoring Market size was valued at US$ 183.4 million in 2024 and is projected to reach US$ 326.7 million by 2032, at a CAGR of 8.5% during the forecast period 2025-2032. The U.S. market is estimated at USD 92.4 million in 2024, while China is expected to grow at a faster pace reaching USD 134.6 million by 2032.

CMP (Chemical Mechanical Planarization) slurry monitoring systems are critical quality control solutions used in semiconductor manufacturing to analyze and maintain slurry properties. These systems measure key parameters including Large Particle Counts (LPC), density, viscosity, pH levels, and particle size distribution to ensure optimal polishing performance. The technology plays a vital role in improving wafer yield and reducing defects in advanced node semiconductor production.

Market growth is driven by the semiconductor industry’s transition to smaller process nodes (below 7nm) which requires stricter slurry quality control. The Large Particle Counts (LPC) segment dominates with 38% market share in 2024 due to its direct impact on wafer surface defects. Key players like ENTEGRIS, INC and HORIBA are expanding their monitoring portfolios through acquisitions, with the top five companies holding 62% market share. Recent innovations include real-time monitoring systems that integrate AI for predictive maintenance in fab operations.

Get Full Report : https://semiconductorinsight.com/report/cmp-slurry-monitoring-market/

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Advanced Semiconductor Manufacturing to Boost CMP Slurry Monitoring Adoption

The global semiconductor industry is experiencing unprecedented growth, with manufacturing complexity increasing as chip designs shrink below 10nm nodes. This drives the need for precise chemical mechanical planarization (CMP) processes where slurry quality directly impacts yield rates. Leading foundries report that improper slurry monitoring can reduce wafer yields by up to 15-20% due to defects like scratching or incomplete polishing. As a result, semiconductor manufacturers are increasingly adopting automated CMP slurry monitoring systems to maintain optimal particle size distribution, viscosity, and chemical composition throughout the polishing process.

Technology Miniaturization Trends Accelerating Market Growth

The relentless push toward smaller semiconductor nodes below 7nm is creating new challenges in CMP processes that require real-time slurry monitoring. Modern slurry formulations contain engineered abrasives with particle sizes under 100nm, where even minor deviations in particle concentration can cause catastrophic wafer defects. This technological evolution has led to a threefold increase in demand for advanced monitoring solutions capable of detecting sub-100nm particles across multiple CMP process steps. Leading manufacturers now integrate monitoring systems directly into CMP tools to enable closed-loop control, driving market growth as foundries upgrade equipment for next-generation nodes.

Increasing Focus on Predictive Maintenance Creating New Opportunities

Semiconductor manufacturers are shifting from reactive to predictive maintenance strategies, with CMP slurry monitoring playing a pivotal role. Continuous monitoring of slurry parameters allows for early detection of quality degradation before it impacts production. Analysis shows that predictive maintenance enabled by slurry monitoring can reduce unplanned tool downtime by 30-40% while extending consumable lifecycles. Major players now offer AI-powered analytics platforms that correlate slurry data with tool performance, helping fabs optimize polish rates and reduce material waste. This trend is particularly strong in memory chip production, where CMP processes account for over 25% of total manufacturing costs.

MARKET RESTRAINTS

High Implementation Costs Creating Barriers for Smaller Fabs

While CMP slurry monitoring delivers substantial ROI for high-volume manufacturers, the capital expenditure required creates significant barriers for adoption. A complete monitoring system including sensors, analytics software, and integration with CMP tools can cost $500,000-$1 million per toolset. This represents a major investment for smaller foundries or research facilities that may process fewer wafers. Additionally, the need for specialized installation and calibration further increases total cost of ownership, limiting market penetration among cost-sensitive operations.

Technical Complexity of Multi-Parameter Monitoring Presents Challenges

Modern CMP slurries require monitoring of 10+ critical parameters simultaneously, including particle counts, zeta potential, pH, and chemical concentrations. Integrating sensors for all relevant measurements without disrupting slurry flow or introducing measurement artifacts remains an engineering challenge. Many existing monitoring solutions compromise by measuring only 2-3 key parameters, potentially missing critical quality variations. The industry also faces difficulties in developing non-invasive sensors that can withstand the corrosive chemical environment of CMP slurries over extended periods without drift or contamination.

Lack of Standardization Across Slurry Formulations

The CMP slurry market includes hundreds of proprietary formulations from different suppliers, each requiring customized monitoring approaches. This lack of standardization forces equipment vendors to develop numerous sensor configurations and calibration methods. Foundries using multiple slurry types face additional complexity in maintaining separate monitoring protocols for each chemistry. The situation is particularly challenging for advanced materials like ceria-based slurries where oxidation state monitoring becomes critical but lacks established industry standards.

MARKET OPPORTUNITIES

Emerging Advanced Packaging Technologies Creating New Application Areas

The rapid growth of advanced packaging technologies like 3D IC and chiplets is opening new applications for CMP slurry monitoring. These packaging approaches require planarization of multiple material layers including copper, dielectrics, and through-silicon vias (TSVs). Each material combination demands specialized slurry formulations with tight process control. Market analysis indicates the packaging segment will grow at a 12-15% CAGR as next-generation devices increasingly adopt heterogeneous integration. This creates opportunities for monitoring solutions that can handle the diverse material sets used in advanced packaging workflows.

AI-Powered Analytics Transforming Slurry Process Control

The integration of machine learning with CMP slurry monitoring represents a major growth opportunity. Advanced algorithms can now predict slurry degradation patterns and optimize replenishment schedules with 90-95% accuracy. This enables significant reductions in slurry consumption while minimizing quality excursions. Leading manufacturers are developing cloud-based platforms that aggregate data across multiple fabs to identify global optimization opportunities. These AI solutions are particularly valuable for memory manufacturers where small improvements in CMP efficiency can translate to millions in annual savings.

Expansion in Compound Semiconductor Manufacturing

The growing production of compound semiconductors for power electronics, RF devices, and photonics is creating new markets for specialized CMP monitoring solutions. Materials like GaN and SiC present unique planarization challenges due to their hardness and chemical stability. The compound semiconductor market is projected to grow at 18-20% annually as electric vehicle and 5G adoption accelerates. This drives demand for monitoring systems capable of handling the aggressive chemistries and high-pressure conditions required for compound semiconductor CMP processes.

MARKET CHALLENGES

Maintaining Measurement Accuracy in High-Volume Production

Ensuring consistent monitoring accuracy across thousands of wafer polishing cycles remains a significant challenge. Sensor drift, slurry residue buildup, and calibration inconsistencies can degrade measurement precision by 10-15% between maintenance cycles. This variability creates quality control risks as manufacturers push CMP tools to higher throughput levels. The industry is responding with self-calibrating sensors and automated cleaning systems, but achieving six-sigma reliability in production environments continues to challenge equipment developers.

Integration Challenges with Legacy CMP Equipment

Many semiconductor fabs operate CMP tools that are 7-10 years old, lacking modern interfaces for real-time monitoring integration. Retrofitting these systems with advanced slurry monitoring capabilities often requires extensive tool modifications that can cost $200,000+ per tool. The compatibility issues create adoption barriers as manufacturers weigh the benefits against potential production disruptions during installation. Equipment vendors are developing modular solutions to ease integration, but the diverse installed base continues to present technical challenges.

Environmental Regulations Impacting Slurry Formulations

Increasing environmental regulations are forcing changes to CMP slurry chemistries, particularly regarding heavy metal content and wastewater discharge. Each formulation change requires corresponding updates to monitoring protocols and sensor configurations. The EU’s recent restrictions on certain abrasive materials have already impacted 15-20% of traditional slurry formulations. These regulatory shifts create uncertainty as monitoring system providers must continuously adapt to evolving material restrictions while maintaining measurement accuracy across changing chemistries.

CMP SLURRY MONITORING MARKET TRENDS

Increasing Semiconductor Manufacturing Complexity Driving Demand for Advanced CMP Slurry Monitoring

The semiconductor industry’s relentless push toward smaller node sizes below 7nm has significantly increased the importance of precise Chemical Mechanical Planarization (CMP) slurry monitoring. As feature sizes shrink below 5nm, particle contamination becomes exponentially more critical, with even nanometer-scale impurities capable of causing device failures. This technological imperative has driven adoption rates of advanced slurry monitoring systems to over 65% among leading semiconductor foundries. The integration of real-time analytics with IoT-connected monitoring devices allows for immediate corrective actions, reducing wafer scrap rates by approximately 25%. Furthermore, the emergence of artificial intelligence and machine learning applications in slurry monitoring has enabled predictive maintenance capabilities, further enhancing yield optimization.

Other Trends

Transition to Copper Interconnects and New Materials

The industry-wide transition from aluminum to copper interconnects and the adoption of novel low-k dielectric materials have introduced new challenges in CMP processing. Copper slurry monitoring now accounts for nearly 40% of total monitoring system deployments, requiring specialized capabilities to detect electrochemical interactions and maintain optimal oxidation states. Additionally, the introduction of cobalt interconnect technology in advanced nodes has created demand for monitoring solutions capable of tracking multiple slurry parameters simultaneously, including pH levels, oxidation-reduction potential, and abrasive particle distribution.

Expansion of 300mm Wafer Fabs and Emerging 450mm Transition

The continued expansion of 300mm wafer manufacturing facilities worldwide has created substantial demand for slurry monitoring systems. With approximately 130 operational 300mm fabs globally and 20 more under construction, monitoring equipment must handle higher throughput requirements while maintaining precision. Meanwhile, pilot lines for 450mm wafer processing are driving development of next-generation monitoring solutions capable of handling larger slurry volumes and more complex fluid dynamics. This transition presents both challenges and opportunities in slurry monitoring, requiring innovations in sensor technology and data processing capabilities to ensure consistent performance across larger wafer surfaces.

Increasing Regulatory Scrutiny on Environmental Compliance

Stringent environmental regulations governing chemical usage and waste management in semiconductor manufacturing are prompting greater investment in comprehensive slurry monitoring solutions. Facilities are implementing closed-loop systems that reduce chemical consumption by up to 30% while maintaining process quality. Advanced monitoring technologies now track not only slurry composition during use but also degradation byproducts for proper disposal classification. This regulatory pressure, combined with corporate sustainability initiatives, has made environmental monitoring capabilities a key differentiator in slurry monitoring system procurement decisions.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovative Monitoring Solutions Reshape the Competitive Dynamics

The global CMP Slurry Monitoring market exhibits a moderately consolidated structure dominated by specialized technology providers catering to semiconductor fabrication needs. ENTEGRIS, INC leads the competitive landscape with approximately 22% market share in 2024, owing to its comprehensive portfolio of real-time slurry monitoring systems and strong partnerships with leading foundries.

HORIBA and Rheonics collectively account for nearly 30% of the market, leveraging their expertise in precision measurement technologies. These companies gained significant traction through their ability to integrate viscosity monitoring with particle counting capabilities – a critical advancement for 3nm and below process nodes.

Recent developments show competitors accelerating R&D investments to address emerging requirements. Spheryx, Inc. made strategic moves in 2023 with its patented xSight system that offers inline zeta potential measurements alongside traditional LPC detection – a functionality gaining importance in advanced node production.

Meanwhile, Colloidal Dynamics LLC strengthened its position through the 2022 acquisition of Nanolytica’s spectroscopy patents, enhancing its multi-parameter analysis capabilities. The company currently holds about 12% of the global monitoring solutions market.

List of Leading CMP Slurry Monitoring Solution Providers

ENTEGRIS, INC (U.S.)

Rheonics (Switzerland)

Colloidal Dynamics LLC (U.S.)

HORIBA (Japan)

Entegris (U.S.)

Spheryx, Inc. (U.S.)

Applied Analytics, Inc. (U.S.)

Segment Analysis:

By Type

Large Particle Counts (LPC) Segment Dominates Due to Critical Role in Semiconductor Quality Control

The market is segmented based on type into:

Large Particle Counts (LPC)

Subtypes: In-line sensors and off-line analyzers

Density

Viscosity

Others

By Application

Semiconductor Manufacturing Segment Leads Owing to Rising Demand for Advanced Chip Fabrication

The market is segmented based on application into:

Integrated Circuit

Semiconductor Manufacturing

Others

By End User

Foundries Dominate Market Share Due to High-Volume Production Requirements

The market is segmented based on end user into:

Foundries

IDMs (Integrated Device Manufacturers)

Research Institutions

Regional Analysis: CMP Slurry Monitoring Market

North America The North American CMP slurry monitoring market is thriving due to robust semiconductor manufacturing and significant investments in advanced wafer fabrication technologies. The U.S., in particular, holds a dominant position, accounting for over 40% of the regional market share. Key semiconductor hubs such as Silicon Valley and Arizona drive demand for real-time slurry monitoring systems that optimize chemical mechanical planarization (CMP) processes. Strict quality control standards set by semiconductor giants like Intel and Micron intensify the need for high-precision monitoring of slurry properties, including Large Particle Counts (LPC) and viscosity. Rising adoption of Industry 4.0 and IoT-enabled monitoring solutions further accelerates growth in this region. Challenges include high costs of advanced monitoring equipment, though these are offset by strong R&D investments from leading players.

Europe Europe’s market is driven by a combination of environmental regulations and demand for high-performance semiconductor manufacturing. Countries like Germany and Belgium—home to major fabrication plants—are investing in automated slurry-monitoring solutions to enhance production efficiency. EU directives on waste reduction and chemical sustainability push manufacturers toward slurry-monitoring technologies that minimize defects and optimize slurry usage. High labor costs in Europe make automation particularly appealing, fostering growth opportunities for vendors offering AI-driven monitoring systems. However, smaller semiconductor manufacturers in Eastern Europe face cost-related barriers, slowing adoption in those areas. Collaboration between research institutions and industry players is addressing these hurdles while maintaining compliance with stringent regulatory frameworks.

Asia-Pacific Asia-Pacific dominates the global CMP slurry monitoring market, accounting for over 50% of global revenues as of 2024. China, Taiwan, and South Korea lead due to massive semiconductor production capacity—Taiwan’s TSMC alone contributes significantly to regional demand. The rapid expansion of new semiconductor fabs, particularly in China, fuels adoption of density and viscosity monitoring tools. However, cost sensitivity among smaller foundries in Southeast Asia still favors manual monitoring, restricting penetration in some markets. Government initiatives like India’s Semiconductor Mission and Japan’s subsidies for domestic chip production are expected to further accelerate demand. Meanwhile, South Korea’s Samsung and SK Hynix drive innovations in slurry reuse, necessitating highly precise monitoring solutions.

South America The South American market remains nascent, hindered by limited semiconductor manufacturing infrastructure. Brazil shows marginal growth potential due to investments in electronic component production, but overall adoption of CMP slurry monitoring technologies is low. Economic instability and reliance on imported chips discourage capital-intensive slurry monitoring investments. However, multinational companies expanding assembly operations in Mexico and Argentina are gradually introducing basic monitoring tools to improve yield rates. Regulatory frameworks for chemical handling remain underdeveloped, slowing adoption of advanced slurry management systems. Despite these challenges, long-term opportunities exist if local governments prioritize semiconductor industry development.

Middle East & Africa This region represents an emerging market with focused growth in select countries like Israel and the UAE. While semiconductor manufacturing is limited, Israel’s tech-driven economy fosters demand for slurry monitoring in specialized IC production. The UAE’s push for industrial diversification, including semiconductor packaging, presents niche opportunities. However, the lack of large-scale wafer fabs and reliance on imports constrain market expansion. Recent collaborations between Middle Eastern governments and global semiconductor firms hint at future potential, particularly in smart city projects requiring localized chip production. High costs and technical skill gaps remain barriers though, limiting immediate growth.

Get A Sample Report : https://semiconductorinsight.com/download-sample-report/?product_id=97732

Report Scope

This market research report provides a comprehensive analysis of the global and regional CMP Slurry Monitoring markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global CMP Slurry Monitoring market was valued at USD million in 2024 and is projected to reach USD million by 2032, at a CAGR of % during the forecast period.

Segmentation Analysis: Detailed breakdown by product type (Large Particle Counts (LPC), Density, Viscosity, Others), application (Integrated Circuit, Semiconductor Manufacturing, Others), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America (U.S., Canada, Mexico), Europe (Germany, France, U.K.), Asia-Pacific (China, Japan, South Korea), Latin America, and the Middle East & Africa, including country-level analysis.

Competitive Landscape: Profiles of leading market participants including ENTEGRIS, INC, Rheonics, Colloidal Dynamics LLC, HORIBA, Entegris, Spheryx, Inc., and Applied Analytics, Inc., covering their product offerings, market share (top five players held approximately % share in 2024), and recent developments.

Technology Trends & Innovation: Assessment of emerging monitoring technologies, integration of AI/IoT in slurry monitoring, and evolving semiconductor fabrication standards.

Market Drivers & Restraints: Evaluation of factors driving market growth along with challenges in semiconductor manufacturing processes, supply chain constraints, and technical barriers.

Stakeholder Analysis: Insights for component suppliers, semiconductor manufacturers, equipment OEMs, investors, and policymakers regarding the evolving ecosystem and strategic opportunities.

Primary and secondary research methods are employed, including interviews with industry experts, data from verified sources, and real-time market intelligence to ensure the accuracy and reliability of the insights presented.

Customisation of the Report

In case of any queries or customisation requirements, please connect with our sales team, who will ensure that your requirements are met.

Related Reports :

Contact us:

+91 8087992013

0 notes

Text

Strobe Overdrive Digital Controller Market: Key Developments and Investment Opportunities 2025–2032

MARKET INSIGHTS

The global Strobe Overdrive Digital Controller Market size was valued at US$ 156.8 million in 2024 and is projected to reach US$ 223.4 million by 2032, at a CAGR of 4.5% during the forecast period 2025-2032.

Strobe Overdrive Digital Controllers are specialized electronic devices that regulate stroboscopic lighting in LED applications through precise voltage pulse modulation. These controllers enhance LED lifespan by minimizing heat generation through controlled short-duration illumination cycles. The technology finds extensive application in machine vision systems, industrial inspection, and high-speed imaging where precise lighting control is critical.

The market growth is driven by increasing automation in manufacturing sectors and rising demand for machine vision systems, which grew 12% year-over-year in 2023. While North America currently dominates with 38% market share, Asia-Pacific is emerging as the fastest-growing region due to rapid industrialization. Key players including Basler AG and CCS Inc. are expanding their product portfolios to include multi-channel controllers, which accounted for 62% of 2024 sales.

MARKET DYNAMICS

MARKET DRIVERS

Growing Adoption of Machine Vision Systems to Fuel Demand for Strobe Overdrive Digital Controllers

The global surge in industrial automation is accelerating demand for machine vision systems, which rely heavily on precision lighting solutions like strobe overdrive digital controllers. These controllers enable high-speed imaging by synchronizing ultra-short LED flashes with camera exposures, eliminating motion blur in fast-moving production lines. The machine vision market is projected to grow at over 7% annually, driven by quality inspection needs in automotive, electronics, and pharmaceutical sectors. Strobe controllers have become indispensable in applications requiring microsecond-level timing accuracy, such as semiconductor wafer inspection where defects as small as 10 microns must be detected.

Energy Efficiency Regulations Driving LED Lighting Upgrades

Stringent global energy efficiency standards are prompting widespread replacement of conventional lighting with advanced LED systems. Strobe overdrive controllers extend LED lifespan by 300-400% through precise thermal management, making them essential components in commercial and industrial lighting upgrades. The lighting control market is experiencing 15% year-over-year growth in smart buildings segment, where strobe-enabled emergency lighting systems now represent over 35% of new installations. Production facilities implementing Industry 4.0 standards particularly benefit from the combination of high-efficiency lighting and machine vision capabilities enabled by advanced digital controllers.

Technological Advancements in High-Speed Imaging

Recent breakthroughs in CMOS sensor technology allow industrial cameras to capture images at over 1,000 frames per second, creating parallel demand for ultra-fast lighting synchronization. Modern strobe overdrive controllers now achieve pulse widths below 1 microsecond with rise times under 100 nanoseconds, enabling crisp imaging of rapidly moving machinery components. The automotive manufacturing sector alone accounts for 28% of high-speed imaging applications, where strobe controllers help detect assembly line defects in real-time. Continued R&D investments by major players have yielded controllers with 32-bit resolution timing and Ethernet-based synchronization capabilities that support Industry 4.0 networking standards.

MARKET RESTRAINTS

Supply Chain Disruptions Affecting Electronic Components Availability

The strobe overdrive controller market faces significant challenges from ongoing semiconductor shortages and supply chain volatility. Critical components like high-power MOSFETs and precision timing ICs have seen lead times extend to 52 weeks in some cases, disrupting production schedules across the industry. A recent survey indicated that 68% of industrial automation suppliers experienced delays in controller shipments due to component shortages. This has created a ripple effect, with machine vision system integrators reporting project postponements worth an estimated $450 million in deferred revenue during the past fiscal year.

Complex Integration Requirements in Legacy Systems

While modern industrial facilities readily adopt advanced controllers, retrofitting legacy manufacturing equipment presents significant technical hurdles. Many older systems lack standardized communication interfaces, requiring custom integration solutions that can increase project costs by 40-60%. The automotive sector reports that nearly 35% of its existing production lines require substantial modifications to implement modern strobe lighting systems. Additionally, synchronization between multiple controllers in large-scale applications remains challenging, with timing jitter below 10 nanoseconds proving difficult to maintain across distributed systems.

High Initial Costs for Advanced Systems

Premium multi-channel strobe controllers with network synchronization capabilities command price points 2-3 times higher than basic models, creating adoption barriers for small and medium enterprises. Industrial users report that complete vision system overhauls including advanced controllers require capital expenditures averaging $250,000 per production line. While the ROI justification exists for high-volume manufacturers, the upfront costs deter many potential customers in lower-margin industries. This pricing sensitivity has slowed market penetration in developing regions where industrial automation adoption is still in early stages.

MARKET CHALLENGES

Thermal Management in High-Density Applications

As industrial applications demand higher flash intensities and faster repetition rates, thermal dissipation becomes a critical challenge. Modern controllers must manage instantaneous power levels exceeding 5 kW while maintaining case temperatures below automotive-grade specifications of 85°C. Field failures due to thermal stress account for approximately 18% of warranty claims in the industry. The transition to gallium nitride (GaN) power semiconductors promises improvements but introduces new challenges in circuit design and manufacturing consistency.

Precision Timing in Distributed Systems

Synchronization accuracy deteriorates as strobe systems scale across large facilities spanning hundreds of meters. Maintaining sub-microsecond timing precision requires complex network architectures with specialized timing protocols. The aerospace manufacturing sector reports unacceptable variation (>50 ns) in 12% of multi-controller installations, forcing expensive workarounds. Emerging IEEE 1588 Precision Time Protocol implementations show promise but require extensive validation in industrial environments with electromagnetic interference.

Standardization Across Ecosystem

The lack of uniform communication protocols between controllers, cameras, and automation systems creates integration bottlenecks. While GenICam provides a framework for vision components, proprietary extensions from major vendors fragment the market. System integrators report spending 30-45% of project time on custom interface development rather than application optimization. The industry's transition to OPC UA over TSN promises long-term solutions but will require substantial retooling of existing installations.

MARKET OPPORTUNITIES

Emerging Applications in Autonomous Robotics

The rapid growth of mobile robotics in warehouses and fulfillment centers presents significant opportunities for advanced strobe controllers. Autonomous guided vehicles (AGVs) require robust vision systems capable of operating under variable ambient light conditions. Early adopters report 40% improvement in barcode reading reliability when implementing strobe synchronization at throughput rates exceeding 2,000 packages per hour. The global AGV market is projected to maintain 12% CAGR through 2030, creating parallel demand for ruggedized controllers that withstand vibration and environmental stressors.

Expansion into Biomedical Imaging

High-speed microscopy and surgical imaging systems increasingly incorporate strobe lighting for reduced phototoxicity and improved image contrast. The life sciences sector represents one of the fastest growing verticals for precision controllers, with adoption increasing at 22% annually. Recent developments in multi-spectral strobe systems enable advanced fluorescence imaging techniques while meeting stringent medical safety standards. Controller manufacturers specializing in biomedical applications command premium pricing with gross margins exceeding 60%.

Integration with AI-Based Visual Inspection

The convergence of machine vision with artificial intelligence creates new requirements for adaptive lighting control. Modern defect detection algorithms achieve highest accuracy when provided with optimally illuminated multi-angle views. Smart controllers that dynamically adjust strobe parameters based on AI feedback demonstrate 35% improvement in detection rates compared to static configurations. Leading automotive manufacturers report first-pass yield improvements of 2-3% when implementing AI-driven strobe systems, translating to annual savings exceeding $15 million per production facility.

STROBE OVERDRIVE DIGITAL CONTROLLER MARKET TRENDS

Growth in Machine Vision Applications Driving Market Expansion

The global strobe overdrive digital controller market is experiencing significant growth due to increasing adoption in industrial machine vision systems. These controllers enable precise synchronization between cameras and LED lighting, improving inspection accuracy in manufacturing lines. The food packaging sector alone accounts for approximately 28% of industrial machine vision applications, creating substantial demand for advanced lighting controllers. Furthermore, automotive quality control systems are integrating strobe controllers at a compound annual growth rate of 12.4%, driven by the need for high-speed defect detection in production environments.

Other Trends

Energy Efficiency Regulations

Stringent energy efficiency mandates worldwide are accelerating the shift toward digital lighting control solutions. Strobe overdrive controllers reduce LED power consumption by up to 40% compared to continuous lighting modes, while maintaining equivalent illumination output. This energy-saving capability has become particularly valuable in Europe, where industrial facilities face mounting pressure to meet EU Ecodesign Directive 2021 requirements. The technology's ability to extend LED lifespan through thermal management further enhances its sustainability credentials.

Industrial Automation Integration

The proliferation of Industry 4.0 initiatives is creating robust demand for smart lighting control solutions that can interface with automated production systems. Leading manufacturers are developing controllers with EtherCAT and PROFINET compatibility, enabling seamless integration into digital factory networks. In 2024, nearly 62% of new industrial strobe controllers shipped included industrial Ethernet connectivity, reflecting this trend. Smart Vision Lights and other innovators are now offering controllers with built-in machine learning algorithms that automatically adjust lighting parameters based on object detection feedback.

Technological Advancements in Controller Design

Recent product developments focus on improving pulse timing precision below 1 microsecond accuracy, critical for high-speed manufacturing applications. Multi-channel configurations now represent 38% of the market, allowing synchronized control of multiple light sources from a single unit. The introduction of touchscreen interfaces and wireless configuration options has significantly improved usability, reducing setup times by approximately 25% compared to traditional rotary dial controllers. Meanwhile, IP65-rated enclosures are becoming standard for harsh industrial environments, with demand growing at 15% annually in the chemicals and pharmaceuticals sectors.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Strategic Expansion Define Market Leadership

The global Strobe Overdrive Digital Controller market features a mix of established leaders and emerging innovators, all competing to secure a stronger foothold in this specialized segment. The landscape is semi-consolidated, with key players leveraging technological expertise and strategic partnerships to differentiate themselves. Leading the market is CCS Inc, which holds a significant share due to its advanced strobe control solutions and robust presence across industrial and commercial applications. The company’s success stems from its high-precision controllers that optimize LED performance in machine vision and automation.

Basler AG and SVS-Vistek follow closely, capitalizing on their strong R&D capabilities and diversified product portfolios. These companies have been pivotal in driving adoption across North America and Europe, where demand for energy-efficient lighting control solutions continues to grow. Their focus on integrating smart diagnostics and IoT compatibility into strobe controllers has further strengthened their market position.

Meanwhile, MORITEX Corporation and Smart Vision Lights are expanding aggressively in Asia-Pacific, particularly in Japan and China, where industrial automation investments are surging. These players are actively launching multi-channel strobe controllers with enhanced synchronization features, catering to high-speed imaging applications in manufacturing and logistics. Their ability to offer customized solutions gives them a competitive edge in niche markets.

Smaller but rapidly growing companies like Gardasoft and VS Technology are making strides through innovation, particularly in enhancing pulse-width modulation (PWM) efficiency. These firms are gaining traction among SMEs by offering cost-effective alternatives without compromising on performance. Their agility in adapting to customer-specific requirements positions them well for long-term growth.

The market is witnessing a surge in partnerships as companies collaborate to integrate strobe controllers with broader automation ecosystems. For instance, recent alliances between strobe controller manufacturers and machine vision software providers aim to streamline operations in smart factories, further expanding revenue opportunities.

List of Key Strobe Overdrive Digital Controller Companies Profiled

CCS Inc (Japan)

SVS-Vistek (Germany)

Basler AG (Germany)

MORITEX Corporation (Japan)

Smart Vision Lights (U.S.)

Gardasoft (U.K.)

Opto Engineering (Italy)

Stemmer Imaging (Germany)

OPT Machine Vision Tech (China)

VS Technology (Japan)

Segment Analysis:

By Type

Single Channel Segment Dominates Owing to Cost-Effective Deployment in Small-Scale Applications

The market is segmented based on type into:

Single Channel

Multi-channel

By Application

Business Premises Application Leads Due to Rising Demand for Industrial Machine Vision Systems

The market is segmented based on application into:

Residential

Business Premises

Others

By Technology

LED-Based Controllers Gain Traction Due to Energy Efficiency and Extended Lifespan

The market is segmented based on technology into:

LED-based

Xenon-based

Others

By End-Use Industry

Manufacturing Sector Accounts for Major Share with Increasing Automation Adoption

The market is segmented based on end-use industry into:

Manufacturing

Automotive

Electronics

Healthcare

Others

Regional Analysis: Strobe Overdrive Digital Controller Market

North America North America remains a critical market for strobe overdrive digital controllers, driven by the strong presence of automation-focused industries and technological advancements. Major manufacturers like Smart Vision Lights and OPT Machine Vision Tech operate extensively in this region, particularly benefiting from the U.S. market, which accounts for a significant revenue share. The demand is bolstered by applications in machine vision, industrial inspection, and LED-based lighting solutions. Additionally, regulatory pressures for energy-efficient lighting systems further accelerate adoption. While Canada and Mexico show steady growth, investment in automation and IoT-driven processes positions North America as a leader in high-performance strobe controller adoption.

Europe Europe's strobe overdrive digital controller market thrives on stringent industrial automation standards and a mature manufacturing sector. Countries like Germany, France, and the U.K. lead the adoption of advanced strobe lighting solutions, primarily driven by automotive, pharmaceuticals, and electronics sectors. Compliance with EU directives on energy efficiency and precision lighting has pushed companies such as Basler AG and Stemmer Imaging to innovate in multi-channel controllers. However, high operational costs and saturation in certain industrial segments moderate growth. Nonetheless, increasing automation in Eastern Europe presents untapped potential for the market.

Asia-Pacific The Asia-Pacific region dominates the strobe overdrive digital controller market in terms of volume, propelled by rapid industrialization in China, Japan, and India. Leading suppliers like MORITEX Corporation and Opto Engineering capitalize on expanding manufacturing bases and infrastructure investments. China’s electronics and semiconductor industries fuel substantial demand for precision lighting controls, while India’s growing automation sector presents emerging opportunities. Despite cost sensitivity favoring single-channel controllers, the shift toward smart factories and inspection technologies drives gradual adoption of advanced solutions across the region.

South America South America’s strobe overdrive digital controller market is evolving, with Brazil and Argentina witnessing growing applications in food processing and automotive manufacturing. However, economic instability and fragmented industrial policies hinder widespread adoption. Local players struggle with import dependencies, while multinational suppliers target niche high-value applications. The market shows potential in Brazil due to incremental automation investments, but overall progress remains sluggish compared to global counterparts.

Middle East & Africa The Middle East & Africa exhibit nascent but promising growth opportunities, particularly in GCC countries like the UAE and Saudi Arabia, where industrialization and smart city initiatives gain traction. Turkey and Israel also demonstrate increasing adoption in manufacturing and security applications. However, limited local production capabilities and reliance on imports delay market penetration. Africa’s potential remains largely untapped due to infrastructure gaps, though rising foreign investments in automation signal gradual market expansion.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Strobe Overdrive Digital Controller markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The Global Strobe Overdrive Digital Controller market was valued at USD million in 2024 and is projected to reach USD million by 2032.

Segmentation Analysis: Detailed breakdown by product type (Single Channel, Multi-channel), application (Residential, Business Premises, Others), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The U.S. market size is estimated at USD million in 2024, while China is projected to reach USD million by 2032.

Competitive Landscape: Profiles of leading market participants including CCS Inc, SVS-Vistek, Basler AG, MORITEX Corporation, and Smart Vision Lights, covering their product offerings, R&D focus, and recent developments.

Technology Trends & Innovation: Assessment of emerging technologies in LED stroboscopic lighting control and pulse width modulation techniques.

Market Drivers & Restraints: Evaluation of factors driving market growth such as increasing demand for energy-efficient lighting solutions, along with challenges like supply chain constraints and regulatory issues.

Stakeholder Analysis: Insights for component suppliers, OEMs, system integrators, and investors regarding strategic opportunities in the evolving market ecosystem.

Primary and secondary research methods are employed, including interviews with industry experts, data from verified sources, and real-time market intelligence to ensure the accuracy and reliability of the insights presented.

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Strobe Overdrive Digital Controller Market?

->Strobe Overdrive Digital Controller Market size was valued at US$ 156.8 million in 2024 and is projected to reach US$ 223.4 million by 2032, at a CAGR of 4.5% during the forecast period 2025-2032.

Which key companies operate in Global Strobe Overdrive Digital Controller Market?

-> Key players include CCS Inc, SVS-Vistek, Basler AG, MORITEX Corporation, Smart Vision Lights, Gardasoft, Opto Engineering, and Stemmer Imaging, among others.

What are the key growth drivers?

-> Key growth drivers include increasing demand for energy-efficient lighting solutions, growth in industrial automation, and need for extended LED lifespan in commercial applications.

Which region dominates the market?

-> Asia-Pacific is expected to be the fastest-growing region, while North America currently holds a significant market share.

What are the emerging trends?

-> Emerging trends include integration of IoT capabilities, development of smart lighting systems, and adoption of advanced pulse width modulation techniques.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/binary-gas-analyzer-market-size-share.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/inverted-light-microscopy-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/insulating-functional-devices-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/multi-core-computer-processors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/power-factor-correction-choke-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/tunable-ultrafast-source-market-key.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/solid-state-remote-power-controller.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/panel-interface-connector-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/semiconductor-process-components-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/automotive-high-mount-stop-light-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/indium-antimonide-detector-alarm-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/din-rail-mounted-thermocouple-terminal.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/hbm2-dram-market-competitive-landscape.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/aptamer-based-quartz-crystal.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/helium-neon-laser-tubes-market-analysis.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/semiconductor-structural-components.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/optical-power-and-energy-market-size.html

0 notes

Text

E-beam Wafer Inspection Industry Expands with Need for Nanometer-Level Defect Detection

The global e-beam wafer inspection system market, valued at US$ 1.1 Bn in 2022, is projected to grow at a stellar CAGR of 20.3% from 2023 to 2031, reaching a market size of US$ 6.1 Bn by the end of 2031. As the semiconductor industry scales down to ever-smaller nodes and complex 3D architectures, electron beam (e-beam) wafer inspection systems are emerging as critical tools for defect detection and process optimization.

Market Overview: E-beam wafer inspection systems utilize high-energy electron beams to scan semiconductor wafers at nanoscale resolutions. These tools are essential in identifying particles, pattern anomalies, and line-width variations that are undetectable by traditional optical inspection systems. Their increasing application across memory and logic chip production lines highlights their importance in ensuring device reliability and performance.

Market Drivers & Trends

Miniaturization of Semiconductor Nodes: As manufacturers move toward 7nm, 5nm, and even smaller nodes, traditional optical inspection is insufficient. E-beam inspection offers the resolution and sensitivity required for these dimensions.

EUV Lithography Integration: EUV (Extreme Ultraviolet) lithography is now a standard in cutting-edge chip manufacturing. However, it introduces new stochastic defects and patterning challenges. E-beam inspection tools provide essential capabilities to detect these elusive defects early in the production cycle.

Rise of Advanced Packaging: The industry's transition to 2.5D and 3D architectures such as TSV (through-silicon vias) and RDL (redistribution layers) necessitates repeated, high-resolution inspection. E-beam systems are ideally suited for these tasks.

Key Players and Industry Leaders

The competitive landscape includes both established giants and niche innovators. Key players include:

Applied Materials Inc.

ASML Holding N.V.

Hitachi Ltd.

Holon co., ltd.

KLA Corporation

MKS Instruments, Inc.

PDF Solutions

Photo electron Soul Inc.

TASMIT, Inc.

Telemark Factory

ZEISS Semiconductor Manufacturing Technology

Recent Developments

Hitachi Ltd. (2021) launched its GS1000 e-beam inspection system, targeting defect inspection challenges in 3nm and 5nm EUV lithography processes.

KLA Corporation (2020) introduced the eSL10TM, a next-generation e-beam defect inspection platform designed to support rapid development and yield enhancement for EUV-based logic and memory devices.

Download to explore critical insights from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=15884

Latest Market Trends

A major trend shaping the industry is the rise of multibeam e-beam wafer inspection systems. These systems tackle two core challenges: increasing throughput and improving defect sensitivity. With more beams operating simultaneously, they scan wafers faster while maintaining the precision necessary for advanced nodes. Multibeam technology is expected to gain significant market share in the coming years.

Market Opportunities

The rise in electric vehicle (EV) production, 5G infrastructure deployment, and AI/ML chip manufacturing are fueling demand for semiconductors—and by extension, wafer inspection technologies. Additionally, government-backed initiatives like the CHIPS and Science Act in the U.S. offer a significant boost to semiconductor R&D and domestic production.

Future Outlook

According to analysts, the e-beam wafer inspection system market will continue to experience robust growth due to:

Continuous scaling of device architectures.

Complexity in back-end packaging and integration.

Demand for real-time yield learning and root-cause analysis.

Global expansion of fab capacity in response to chip shortages.

By 2031, multibeam inspection systems are expected to become the default standard for high-volume manufacturing environments.

Market Segmentation

By Type:

Single Beam

Multi Beam (Fastest growing segment)

By Wafer Node:

Mature Nodes (Above 10nm)

Advanced Nodes (10nm, 7nm, 5nm, below)

By Application:

Logic Chips

Memory Chips

Others

By End-use Industry:

Automotive

Consumer Electronics

IT & Telecom

Industrial

Others (Aerospace, Healthcare)

Regional Insights

Asia Pacific dominates the global market, led by powerhouse semiconductor hubs in China, Taiwan, South Korea, and Japan. Rapid expansion in consumer electronics, EVs, and 5G rollout is driving massive investments in chip fabrication and inspection technologies.

North America follows closely, supported by a robust R&D ecosystem, the rise of AI data centers, and federal funding through the CHIPS Act to bolster domestic semiconductor manufacturing.

Europe and South America are emerging as key regions, with growing investments in clean tech, automotive chips, and industrial IoT requiring advanced IC inspection systems.

Why Buy This Report?

Comprehensive Analysis: Covers market dynamics, drivers, trends, and competitive landscape.

Quantitative Forecasts: Value (US$ Bn) and volume (units) projections from 2023–2031.

Company Profiles: Includes strategic insights, product offerings, and recent developments of key players.

Regional Coverage: Provides market insights from major regions and economies.

In-depth Segmentation: Enables clear understanding of sub-market trends.

Frequently Asked Questions (FAQs)

Q1. What is the current size of the global e-beam wafer inspection system market? The market was valued at US$ 1.1 Bn in 2022.

Q2. What is the projected market size by 2031? It is expected to reach US$ 6.1 Bn, growing at a CAGR of 20.3%.

Q3. What are the major growth drivers? Key drivers include shrinking device nodes, EUV lithography adoption, and advanced packaging technologies.

Q4. Who are the major players in the market? Some of the major players include KLA Corporation, Hitachi Ltd., Applied Materials Inc., ASML, and ZEISS SMT.

Q5. Which region leads the market? Asia Pacific currently leads, followed by North America.

Q6. Which segment will grow fastest during the forecast period? The multibeam e-beam inspection system segment is projected to grow the fastest due to its throughput and sensitivity advantages.

Explore Latest Research Reports by Transparency Market Research: Semiconductor Metrology Equipment Market: https://www.transparencymarketresearch.com/semiconductor-metrology-equipment-market.html

Quantum Processing Units (QPU) Market: https://www.transparencymarketresearch.com/quantum-processing-units-qpu-market.html

Solid State Transformer Market: https://www.transparencymarketresearch.com/solid-State-transformer.html

Tactile Switches Market: https://www.transparencymarketresearch.com/tactile-switches-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

InGaAs Image Sensors Market Drivers Include Rising Demand for Infrared Industrial Vision Systems

Introduction

Rising automation, stricter quality standards, and the quest for reliable low-light inspection are propelling the InGaAs Image Sensors Market toward unprecedented growth. Made from indium-gallium-arsenide, these sensors capture visible-to-short-wave-infrared (SWIR) wavelengths, making them indispensable for modern industrial vision systems that must see beyond what silicon-based detectors can perceive. The market is expected to grow significantly as manufacturers intensify investments in photonics-enabled production lines.

1. Industrial Vision Systems Lead Demand

The strongest driver is the integration of SWIR cameras into production-floor machine-vision systems. Silicon detectors become ineffective above 1 µm, leaving inspection gaps in semiconductor wafer probing, electrolyte checks in lithium-ion batteries, and mixed-plastic sorting. In contrast, InGaAs arrays can detect moisture, organic compounds, and silicon defects through protective coatings, enabling complete, non-destructive in-line inspection. As automation expands, factories demand sensors that offer high-speed imaging and reliability under harsh operational conditions.

2. Process-Automation Economics: Why Infrared Pays for Itself

SWIR-enabled imaging reduces false rejects and rework by revealing invisible contaminants or layer thickness variations. Automotive paint shops can minimize scrap by identifying solvent pockets, while pharmaceutical production lines using InGaAs systems achieve quick return on investment due to improved defect detection. These gains help justify the higher upfront costs of InGaAs-based solutions, especially in high-volume or high-value manufacturing sectors.

3. Low-Light Advantages and Spectral Selectivity