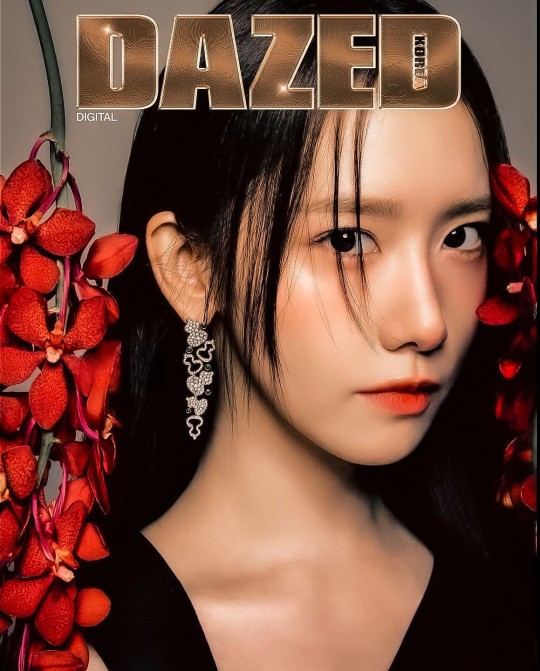

#Digital Issue- Dec 2023

Explore tagged Tumblr posts

Text

YOONA × Qeelin × Dazed Korea digital (2023 Dec issue)

#yoona#im yoona#snsd#girls generation#dailysnsd#onlysoshi#kdramaladies#femaleidolsedit#kgoddesses#ggnet#idolady#kpopccc#ultkpopnetwork#femaleidol#kpopedit#femadolsedit#tyty edits

122 notes

·

View notes

Text

10 stories they chose not to tell you this week.

The Vigilant Fox

Dec 08, 2024

10 - COVID “Vaccines” Hit By New Bombshell

First, a court ruled that the COVID shots aren’t vaccines after all.

Now, a new Florida lawsuit takes it even further, calling them “weapons of mass destruction.”

Dr. Francis Boyle states: “It is my expert opinion that ‘COVID-19 nanoparticle injections’ or ‘mRNA nanoparticle injections’ or ‘COVID-19 injections meet the criteria of biological weapons and weapons of mass destruction according to Biological Weapons 18 USC § 175; Weapons and Firearms § 790.166 Fla.Stat. (2023).”

Dr. Boyle’s words hold tremendous weight because he is the architect of the 1989 Biological Weapons Anti-Terrorism Act.

The lawsuit, filed on December 1, demands an immediate BAN on COVID-19 injections in Florida, claiming they violate multiple laws, including Florida’s Weapons of Mass Destruction statute, Fraud statute, and Medical Consent Law. The lawsuit also argues the shots are classified as bioweapons under state and federal definitions.

Leading the charge is Dr. Joseph Sansone, joined by a team of experts: Dr. Francis Boyle, Dr. Ana Mihalcea, Dr. Rima Laibow, Dr. Marivic Villa, Dr. Andrew Zywiec, Karen Kingston, and Dr. Avery Brinkley.

This lawsuit comes as a new study has just confirmed alarming levels of DNA contamination in the COVID-19 injection vials.

Dr. Sansone, the mastermind behind the lawsuit, adds that the COVID shots are a “threat to the human genome” and, therefore, a threat to “the future existence of our species.”

He joins the show to discuss. This is a jaw-dropping conversation.

(See 9 More Revealing Stories Below)

9 - Joy Behar Dies Inside as John Fetterman Drops an Uncomfortable Reality on Her

8 - James O’Keefe Drops Shocking New Video Exposing FEMA in North Carolina

7 - Tony Blinken Pushes for Unimaginable Evil in Ukraine

6 - Serial Liar Adam Schiff Officially Resigns From Congress Effective December 8

While you’re here, don’t forget to subscribe to this page for more weekly news roundups.Subscribe

#5 - UnitedHealthcare CEO's murder mocked and celebrated by far-left

#4 - Peter Hotez Sends an Ominous Message to the Trump administration.

#3 - WEF Document Seeks Global Government & Digital ID for Life “Within” the Internet

#2 - New documentary exposes the US government for running the largest child trafficking network in the history of the world.

#1 - Australian Medical Icon Breaks Down in Tears Confronting Gov’t Officials Over COVID Vaccine Disaster

Share

BONUS #1 - Trump Issues Powerful Statement on Dramatic Fall of Assad Regime in Syria

BONUS #2 - Stephen A. Smith Unexpectedly Turns the Tables on the Hunter Biden Pardon Scandal

BONUS #3 - BOOM! Trump to Pardon Jan. 6 Protesters on Day One

BONUS #4 - Fed-Up Liberal ERUPTS on Democratic Party in Epic Rant

BONUS #5 - NYPD Releases New Photos of UnitedHealthcare CEO Assassin Escaping in Taxi

19 notes

·

View notes

Text

WhatMatters

Your guide to California policy and politics

By Lynn La

June 16, 2025

Presented by California Housing Consortium, Californians for Energy Independence, California Resources Corporation and Climate-Smart Agricultural Partnership

Good morning, California.

Californians hit the streets after Trump’s LA deployment

People gather at City Hall to protest the federal administration during the “No Kings” national rally in San Francisco on June 14, 2025. Photo by Nic Coury, AFP via Getty Images

A week after President Donald Trump sent the military to Los Angeles, tens of thousands of Californians took to the streets Saturday to protest his policies on his birthday.

Known as No Kings Day, the rallies took place in the northern part of the state including Shasta County, as well as Sacramento, the Bay Area, the Central Valley, the Inland Empire and across Southern California, including San Diego and Orange counties.

In San Francisco, protestors of all ages — some with young kids or dogs in tow — chanted “ICE out of our streets” and “sanctuary for us all,” as they marched nearly two miles from Dolores Park to City Hall. They waved California, Pride, Mexico and U.S. flags and carried anti-Trump signs, many of which denounced the administration’s immigration raids and the deployment of federal troops in L.A.

Many of the state’s Democratic officials appealed for calm: Both Gov. Gavin Newsom and L.A. Mayor Karen Bass urged demonstrators to “rise above” and “refuse” chaos, respectively, while California Attorney General Rob Bonta asked people to protest “peacefully, safely, and lawfully.”

But in L.A., protestors and law enforcement clashed, according to CalMatters’ Sergio Olmos and Mikhail Zinshteyn. After issuing a dispersal order, local police in the early evening began to fire less-lethal munitions, flash bangs and tear gas canisters at crowds in downtown. U.S. Marines armed with live munitions also faced demonstrators while protecting federal buildings, and federal troops were reported tackling at least one protester to the ground.

The majority of the protests in California and nationwide were peaceful, however. The vibe in San Francisco was energetic and cheerful among the presence of police officers, though some demonstrators grew somber when asked why they attended the rally.

Mike Kaiser, San Francisco resident: “Every day there’s new outrages with Trump, with ICE. … I feel that we’re very close to the end of democracy in the United States and that deserves a very big response.”

As National Guard soldiers remain in L.A. following a ruling by a federal appeals court, life for residents and communities located near the city’s government center continue to be disrupted, writes CalMatters’ Joe Garcia.

Since last week, locals have been under an 8 p.m. curfew, and some businesses report recurring vandalism and plummeting sales. While the sounds of helicopters flying at all hours induce anxiety for some residents, others say the presence of federal troops make the situation “worse for us.” Read more here.

CalMatters wins an Emmy: CalMatters’ Digital Democracy collaboration with CBS-TV was awarded an Emmy from the Northern California chapter of the National Academy of Television Arts & Sciences. “This is one of many accountability stories that I did this year that I could not have done without this incredible tool,” said CBS correspondent Julie Watts when accepting the award on Saturday.

Honoring Walters: Join CalMatters columnist Dan Walters and the Sacramento Press Club on Tuesday in Sacramento to celebrate Walters’ 50 years covering the Capitol and California politics. He will discuss his expansive career with his longtime editor at The Sacramento Bee, Amy Chance. Register today.

Other Stories You Should Know

Health care in sights of immigration enforcement

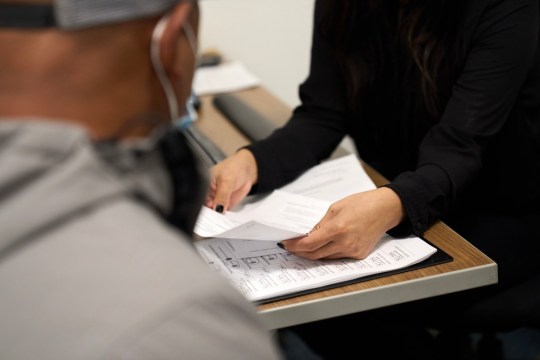

A benefits counselor assists an undocumented adult at St. John’s Community Health in Los Angeles on Dec. 19, 2023. Photo by Lauren Justice for CalMatters

Let’s dive into some immigration news:

Divulging Medi-Cal info: On Friday Newsom blasted the federal administration after reports emerged that the federal Centers for Medicare & Medicaid Services gave personal information, including immigration status, to deportation officials at the U.S. Department of Homeland Security. The data transfer includes information about California Medi-Cal patients. The program allows immigrants without legal status to enroll in state-supported health insurance. The move to share private enrollee information reverses a longstanding federal policy. Read more from CalMatters’ Kristen Hwang.

Hospitals on high alert: Fears about possible immigration sweeps at California hospitals and health clinics have patients who are immigrants canceling their medical appointments. Staff working at an L.A.-area clinic system said armed officers last week tried to enter a parking lot where doctors and nurses were treating patients in a mobile health clinic. Though the agents eventually left after being refused entrance, the encounter rattled patients and staff. Read more from CalMatters’ Ana B. Ibarra.

Leading L.A. border patrol: In January U.S. Border Patrol agents in California conducted a controversial immigration raid in Kern County, where a lawsuit alleges that Border Patrol unlawfully targeted “people of color who appeared to be farm workers.” In the months following the sweep, the career of the man who led the operation, Sergeant Gregory Bovino, appears to have taken off within the Trump administration. He is now in charge of border protection operations in L.A., and appeared alongside the Secretary of Homeland Security during a press conference last week. Read more from CalMatters’ reporters.

A state budget banking on hope

State Sen. Shannon Grove speaks before other lawmakers during a floor session at the state Capitol in Sacramento on April 24, 2025. Photo by Fred Greaves for CalMatters

On Friday the Legislature passed a state budget agreement to close a $12 billion shortfall, reports CalMatters’ Alexei Koseff. The $325 billion spending plan rejects many of the social services cuts Newsom included in his updated budget proposal. Negotiations will continue, however, as both the Legislature and the governor must approve the budget by the start of California’s fiscal year on July 1.

Other budget takeaways:

Homelessness funding: Both Newsom and the Legislature propose gutting California’s main source of homelessness funding, which has grown to $1 billion last year. Without that money, local government leaders and homelessness service providers argue that some shelters and housing programs would likely close, and the limited progress they have made toward tackling homelessness will be reduced. Read more from CalMatters’ Marisa Kendall.

Cuts to Medi-Cal: For unauthorized immigrants enrolled in Medi-Cal, the Legislature’s budget plan is a mixed bag. It rejects Newsom’s proposal to cancel home care for immigrants, and lowers from $100 to $30 the monthly premium the governor proposed for immigrants. But the plan also wants to expand Newsom’s proposal to block adults without permanent legal status from enrolling in Medi-Cal to the broader category of non-citizens with “unsatisfactory immigration status,” which includes some legal permanent residents. Read more from CalMatters’ Kristen Hwang.

Legal aid services: The budget plan also prohibits $40 million in state funds to go towards the legal defense of immigrants convicted of any felony. The proposal follows repeated criticism from Republican legislators who argue that the state needs to do more to address voters’ concerns about crime. But legal experts and advocates say that the rule change would harm low-income families, and that felony crimes aren’t always violent, such as shoplifting or writing a bad check. Read more from CalMatters’ Cayla Mihalovich and Jeanne Kuang.

And lastly: Changed rules for AI and juror pay?

The Dreamforce conference, the largest AI event in the world according to its host Salesforce, in San Francisco on Sept. 18, 2024. Photo by Florence Middleton for CalMatters

Under pressure from tech giants and lawmakers, California’s privacy agency watered down proposed rules that would have regulated behavioral advertising for AI. CalMatters’ Khari Johnson and video strategy director Robert Meeks have a video segment on why the draft rules are raising concerns among privacy advocates as part of our partnership with PBS SoCal. Watch it here.

And check out another video from CalMatters’ Joe Garcia and Robert on Newsom’s proposal to terminate a pilot program that increased juror pay. Watch it here.

SoCalMatters airs at 5:58 p.m. weekdays on PBS SoCal.

California Voices

California Voices deputy editor Denise Amos: A bill that would provide funding for phonics-based instruction in K-12 public schools would help address California’s reading crisis, but it should also mandate school districts to transition to more phonics-friendly curricula.

Other things worth your time:

Some stories may require a subscription to read.

Newsom changes his tune on running for president // CalMatters

Federal DEI, ‘wokeness’ restrictions put CA homeless providers in a bind // CalMatters

In CA, Trump finds his perfect antagonist // The Guardian

The week that changed everything for Newsom // The Atlantic

California’s MAGA prosecutor makes Democrats squirm // Politico

CA leaders react to Minnesota lawmaker shootings // The Sacramento Bee

Silicon Valley wants to ban Chinese drones while ‘covering’ SF in their own // The San Francisco Standard

The mad scramble to track ICE immigration raids across LA County // Los Angeles Times

After Ambiance Apparel raid, Fashion District businesses, workers wait in fear // Los Angeles Times

Southern CA immigration raids continue, including at Santa Fe Springs Swap Meet // Los Angeles Daily News

See you next time!

Tips, insight or feedback? Email [email protected]. Subscribe to CalMatters newsletters here. Follow CalMatters on Facebook and Twitter.

About Us· How We're Funded· Subscribe· Donate

CalMatters 1017 L Street #261 Sacramento, CA 95814 United States

2 notes

·

View notes

Text

Zines Read 2024

The Desert Sun #53 / Billy (Dec. 2023)

The Desert Sun #54 / Billy (Jan. 29, 2024)

Proof I Exist #45: A 2023 Reading Log / Billy McCall (Jan. 2024)

Proof I Exist #46: Looking Back at 2023 / Billy McCall & Ed Kemp (Jan. 2024)

Trent Reznor, the Girls Who Wanted to Fuck Him, and the Boys They Grew Up to Be / David Leo

Behind the Zines #17 / Billy McCall (ed.) (Mar. 2024)*

The Desert Sun #55 / Billy (Feb. 29, 2024)

Lifecycle of the Moon Jelly / Qufu-lee

Birds I’ve Seen Outside, v. 1 / Alyx White (2020)

Birds I’ve Seen Outside, v. 2 / Alyx White (2020)

Birds I’ve Seen Outside, v. 3 / Alyx White (2020)

KnowhutIzine: An Attempt to Document All Things Worrell / Dakota Floyd & Rick V. (June 2021)

Notes on Anarchism / Noam Chomsky (x)

The Desert Sun #56 / Billy (Mar. 2024)

[private]

[private]

Self-Harm: A Zine About NSSI / Sharaya O

Leave Me Alone, Mom! How Conservative Christianity Ruins Everything / Sharaya O

People Think I’m Weird / Billy McCall

What Is Home?

Local Honey / Madison Greer (ed.) (2020)*

A Zine for Pride: Archiving LGBTQ+ History at UGA! / Kathryn Manis (2024)

Lover’s Eye / Mandy Mastrovita (Jan. 2023)

I’m Blue / Mandy Mastrovita (Mar. 2024)

[private]

The Desert Sun #58 / Billy (May 29, 2024)

Love Letters to ATL / Haley Lazerface & Tazza Moon (eds.) (June 2024)

Voting Vs Direct Action / crimethInc (2004)

[You will see your own reflection…] / SAD (2024)

Grow Your Own (for, like, cheap): The Ultimate Space Bucket DIY Guide (x)

C.U.N.T.S. Magazine: The Women’s Issue (2024)

The Desert Sun #59 / Billy (June 30, 2024)

[Tax Forms Enclosed: 1040EZ, 1040A, 1040] / S. Brooks (1996) (x)

Super/Simple Majority / Tony White (dir.) (July 2024)*

Notes on Libraries, Lesbians, and Pulp / Aiden M. Bettine (2023)

IT? / Jamison Lung

ZiNetwork Invitation / Dr. Tambone

Leftist Leaflets in Little Libraries #1 / Peter Miles Bergman (Summer 2017; 5th ed., 2023)

The East Village Inky #66 / Ayun Halliday (June 2022)

Pirate Jenny (2nd ed.) / Ina Wudtke (2024)

Rut Zine #296 / Bianca Martin (x)

Rut Zine #343 / Bianca Martin (x)

Sappy Gazette #1: Transpiring Time & Space / Abbie (2024)

Culays [Heavy] / Mustafa Saeed (2024)

Offset Printed Artists' Books: A Chronology, 1960-2005 / Tony White (cur.) (Jan. 2018)

Robert Blackburn / [Robert Blackburn Printmaking Workshop]

The Desert Sun #60 / Billy (July 30, 2024)

Overdue Books; Returning Palestine’s “Abandoned Property” of 1948 / Hannah Mermelstein (2014)

The Desert Sun #61 / Billy (Aug. 24, 2024)

Lost Constellations of Athens: Five Legends / Lauren Fancher (2024) (x)

If These Walls Could Talk: A PhotoJournal Look Inside the Crumbling Campus of Central State Hospital, Milledgeville, Georgia / Janet Fugett (2015)

The Booty Keeps the Score: The Disorganized Attachment Dating Skillbuilder Workbook / tawnee smith (Spring 2021)

Cathode Ray Mission #3 / K Ratticus (ed.) (Fall 2024)*

The Desert Sun #62 / Billy (Sept. 29, 2024)

The Desert Sun #63 / Billy (Oct. 29, 2024)

The Desert Sun #63.5: Political Edition / Billy (mid-November 2024)

Behind the Zines #18 / Billy McCall (ed.) (Sept. 2024)

Tin Can Telephone #9: Test Cards & Radio Phonics / DJ Frederick Moe

where you from? #7: this is how I know I will be okay. / hope amico (Sept. 2024)

Straightaway Tangent #3: In Parallax / Sheila B. Ackerman & August Personage (Nov. 2024)

The Desert Sun #64 / Billy (Nov. 28, 2024)

The Desert Sun #65 / Billy (Dec. 24, 2024)

Zines read in 2024; asterisks * denote zines I’m in! When available, I have tried to provide links for: a digital version of the zine, a page from which to purchase the zine, the author’s website or social media, an alternate version of the text online, or further information about the author/title. I’m not cluttering the list up with individual links for all of Billy’s zines; his stuff can be found at Behind the Zines Distro.

5 notes

·

View notes

Text

Deadline: December 15th, 2023 Payment: Fiction: 2¢ per word for original, 1¢ per word for reprints. Poetry: $20 per original poem and $10 for reprints. Artwork: $100 for issue cover art, $30 for back cover art, and $20 for art used on our site. Theme: Stories and poetry containing elements of science fiction, anarchism, transhumanism, or dystopia. Note: Reprints Welcome Radon welcomes short stories and poetry containing elements of science fiction, anarchism, transhumanism, or dystopia. We publish quality work every January, May, and September. Submissions accepted year-round. Simultaneous subs are welcome. Reprints taken if writer has rights. AI submissions are not allowed. We kindly request a third person bio that is 100-words or shorter in your cover letter.Author rights: For original work, Radon asks for first English digital rights and non-exclusive, indefinite archival rights. Authors published in Radon cannot be accepted into the issue immediately following, but may submit after this period. Our reading periods are: January issue: Aug. 16 - Dec. 15 May issue: Dec. 16 - April 15 September issue: April 16 - Aug. 15 Prose We accept flash fiction and short story submissions up to 3,000 words. Radon pays a semi-professional rate of 2¢ per word for original work and 1¢ for reprints. For quicker processing, please use a submission style similar to the modern manuscript format. We ask that you utilize single-spacing. Please note that we do not publish fantasy stories and are looking for work that includes leftist social commentary. Poetry Please submit up to five poems in a single Word document. There is no line limit. Radon pays a semi-professional rate of $20 per original poem and $10 for reprints.We request single-spaced formatting using a standard 12pt font such as Times New Roman, Calibri, or Lato. The poetry editor prefers free verse poems with narrative elements. Page and spoken word poems are equally welcome. Are you an artist? Radon is looking for evocative digital art to showcase in our published issues and on our website. We pay $100 for issue cover art, $30 for back cover art, and $20 for art used on our site. Please use our Submittable system to submit your art, accessible via the Submit button on this page. Due to ethical concerns, we do not accept AI-generated artwork. As an online publisher, we request digital artwork that is at least 300 DPI. Cover art submissions should fit in a 5.5 x 8.5 aspect ratio. Click through to the link below to find the submission button Via: Radon Journal.

4 notes

·

View notes

Text

THE TANGIBLE, INTANGIBLE and the DIGITAL

Call below, thanks ...

THE TANGIBLE, INTANGIBLE and the DIGITAL

Cultural Pasts – Urban Futures

-

A conference held between 15-17 July, 2024

Hosted in Barcelona, Spain, with virtual presentation options

Abstracts are due on 20 Dec, 2023

CALL SUMMARY:

This conference track call is interested in exploring the intersection of smart cities, medias and technologies with issues of heritage and culture. Building on previous events and publications form the organisers on questions of digital heritage, this CFP is particularly interested in how we integrate technologies into heritage cities such as Barcelona and how technology helps us better preserve, explore and share that heritage with local and international communities. It welcomes presentations in-person and virtually. It seeks practical cases studies, theoretical papers, historical examinations and technologically experimental ideas on the increasingly complex realm of digital heritage. For a fuller exposition of the track call and the broader full conference, visit the conference website: Digital Heritage Track: https://amps-research.com/barcelona-cultural-pasts/

Full Conference Call: https://amps-research.com/conference/barcelona/

2 notes

·

View notes

Text

Dental Equipment Market Global and Regional Industry Analysis 2032

The global dental equipment market was valued at USD 6.66 billion in 2023 and is projected to grow from USD 7.38 billion in 2024 to USD 12.62 billion by 2032, registering a CAGR of 6.9% over the forecast period. North America led the dental equipment market in 2023, accounting for a dominant share of 41.44%.

The Dental Equipment Market represents a vital segment of the healthcare industry, encompassing a wide range of tools and technologies used for diagnosing, treating, and preventing oral health issues. It includes products such as dental chairs, imaging systems, handpieces, lasers, and sterilization equipment that support various dental procedures in clinics, hospitals, and laboratories. Driven by technological advancements, increasing awareness of dental hygiene, and growing demand for cosmetic and restorative dentistry, the market continues to expand globally. Factors such as aging populations, rising dental disease prevalence, and improvements in healthcare infrastructure are also contributing to its growth. As dental practices modernize and digital solutions become more integrated into oral care, the Dental Equipment Market is expected to evolve rapidly, offering more efficient and patient-friendly solutions.

Tariff Impact Analysis for Dental Equipment Market: https://www.fortunebusinessinsights.com/dental-equipment-market-104549

List Of Top Dental Equipment Market Companies:

Institut Straumann AG (Switzerland)

Dentsply Sirona (U.S.)

VATECH (South Korea)

A-dec Inc. (U.S.

BIOLASE, Inc. (U.S.)

Carestream Health, Inc. (U.S.)

Ivoclar Vivadent AG (Liechtenstein)

Danaher (U.S.)

Midmark Corporation (U.S.)

OSSTEM IMPLANT CO., LTD. (South Korea)

Dental Equipment Market: Market Growth

The Dental Equipment Market is poised for substantial growth due to increasing oral health awareness and a higher prevalence of dental diseases. The aging population, coupled with growing expenditure on dental care, is boosting market growth. Furthermore, the surge in dental tourism, particularly in emerging economies, and advancements in dental implants and orthodontic equipment are contributing significantly to the expansion of the Dental Equipment Market.

Dental Equipment Market: Market Segmentation

In terms of segmentation, the Dental Equipment Market is categorized by product type, end-user, and region. By product, the market includes diagnostic equipment like dental radiology systems and intraoral cameras, therapeutic devices such as dental lasers and electrosurgical systems, and general equipment including chairs, handpieces, and sterilization tools. Dental consumables like impression materials and whitening products also form a significant portion of the market. End-users include dental hospitals and clinics, academic and research institutes, and dental laboratories, all of which require a range of equipment depending on their services.

Dental Equipment Market: Restraining Factors

Despite its promising outlook, the Dental Equipment Market faces several restraining factors. High capital investment required for advanced equipment can limit adoption, particularly in small or underfunded dental practices. Regulatory barriers and the time-consuming approval processes for new technologies can slow product launches. Additionally, in some regions, a lack of trained professionals to operate modern equipment and inadequate reimbursement policies can hinder market penetration. Economic constraints and inconsistent healthcare infrastructure also pose challenges in certain developing regions.

Dental Equipment Market: Regional Analysis

From a regional perspective, North America currently dominates the Dental Equipment Market due to its advanced healthcare systems, high patient awareness, and substantial spending on dental care. Europe follows with consistent growth supported by established public health programs and strong dental service coverage. Meanwhile, the Asia-Pacific region is expected to witness the fastest growth owing to increasing healthcare investments, rising disposable incomes, and growing dental tourism in countries like India, China, and Thailand. Latin America and the Middle East & Africa are showing gradual improvements in dental infrastructure and awareness, positioning them as emerging regions in the global Dental Equipment Market.

Key Industry Developments:

May 2024 – SprintRay unveiled its Pro 2 series, an advanced desktop 3D printing system designed for dental applications. Alongside this launch, the company introduced two innovative resins developed by its BioMaterial Innovation Lab, further expanding its dental materials portfolio.

Contact Us:

Fortune Business Insights™ Pvt. Ltd.

9th Floor, Icon Tower,

Baner - Mahalunge Road,

Baner, Pune-411045,

Maharashtra, India.

Phone:

U.S.: +1 424 253 0390

U.K.: +44 2071 939123

APAC: +91 744 740 1245

Email: [email protected]

0 notes

Text

Bitcoin Price Prediction: Can Bitcoin Reach $1,000,000 by 2025?

2024 began with significant momentum for cryptocurrencies, especially like Bitcoin and Ethereum, eliciting enthusiasm among crypto enthusiasts. As of Dec. 05, 2024, Bitcoin hyped to an exceptional all-time high at $103,900, with a market capitalization of $2.02 trillion, representing a 6.80% increase in the last week. Bitcoin has surged due to certainty fuelled by the U.S. presidential elections and Republican candidate Donald Trump’s victory. BTC traded around $95,000 in the last few days after nearly touching $100,000. As of today, Dec. 05, 2024, it surged to the extreme high of $103,900. The anticipation that Trump’s administration will usher in a friendly regulatory environment for cryptocurrencies has fueled the surge. As of Dec. 5, 2024, the world’s largest cryptocurrency is trading at $102,706. After Trump’s victory on Nov. 5, the price has surged around 45%, driven by a swathe of buying and pouring capital into U.S. bitcoin-backed exchange-traded funds.

Bitcoin’s Recovery Journey Bitcoin has endured a tumultuous period, shedding approximately 65% of its market value over the past year. Crypto enthusiasts were taken aback by unforeseen events such as the Terra Luna crash, FTX decline, macroeconomic factors, and Binance’s legal issues. Nonetheless, the crypto market exhibited a remarkable recovery toward the end of the year, with BTC showing promising growth. Bitcoin surged to impressive heights, surpassing its all-time highs multiple times following the U.S. presidential elections, reaching $103,900 as of Dec. 05, 2024. BTC ETF options on the Nasdaq may have also contributed to the surge. This surge propelled its market capitalization to $2.03 trillion, contributing to the overall crypto market capitalization of $3.69 trillion, reflecting exceptional performance. After surpassing the psychological threshold of the $31,000 mark, Bitcoin started exhibiting a bearish trend and traded below $30K levels for most of the last year. However, it has shown remarkable recovery in the latter months of the year. The world’s largest cryptocurrency, BTC, which was on a recovery path, has increased around 147.39% in one year. As of Dec. 05, 2024, it is currently trading at $102,658, with a market capitalization of $2.03 trillion and a global cryptocurrency market capitalization of $3.69 trillion. Cryptocurrency experts believed that if BTC maintained its level of $30,000, it could likely bounce back from there. Looking at the current scenario, Bitcoin surpassed its all-time high in March but witnessed a downtrend later.

In April 2023, the top cryptocurrency Bitcoin, touched the critical resistance of the $30,000 level for the first time since June 10, 2022, and then started dipping below $26,000. It significantly rose to $45,203 after May 2022. Crypto experts believe that if Bitcoin maintains the $45,000 level and beyond, it could reach $60,000 by the end of 2024. In the first three months of the year, BTC has already touched the level of $73,750 and set a new record for an all-time high. While the future of Bitcoin is unknown, retail investors must be very cautious about every move of Bitcoin, as it has witnessed tumultuous before. Moreover, India’s stance on cryptocurrencies continues to be firm, with the government bringing all crypto-related transactions under the ambit of the Money Laundering Act. In a specific gazette notification, the Union Finance Ministry of India stated that all the transactions related to digital assets or virtual currency would fall under the purview of the Prevention of Money Laundering Act (PMLA). The new development may appear damaging to the cryptocurrency community in India. However, the industry has praised the move as a step towards regulating this space. Without regulators, the enforcement agencies will immediately take recourse to any discrepancies.

The Spot Bitcoin ETFs have been a tremendous factor in Bitcoin’s growth. After the SEC approved the ETFs in the U.S., retail investors showed great interest, leading to Bitcoin surpassing its all-time high. By the end of September, after the U.S. Federal Reserve’s rate cut, BTC is, as of Oct. 16, 2024, trading at $67,000. The U.S. Fed cut rates by 50 basis points, and the Bank of Japan kept interest rates steady. BTC rose around 3% a day after both central banks’ announcements. One of the other reasons crypto experts were hopeful about Bitcoin is that this year, 2024, was a year for Bitcoin’s halving event. The Bitcoin halving event happens every four years, during which BTC rewards to its miners are cut by 50% (the miner’s payout will be reduced to 3.125 BTC). This event is usually positive for Bitcoin’s price, as it helps contract supply. Historically, halving has been seen as an excellent sign for bringing momentum to Bitcoin’s price. So far, this year’s halving that took place on April 20, 2024, has not caused the surge to the BTC, as experts anticipated. The current state of Bitcoin reflects a significant downtrend.

Bitcoin Halving History It shows that past halving events have established long-term bullish drivers for Bitcoin’s price. The Bitcoin halving event relates to its deflationary tendency and crushing its supply, which helps the Bitcoin price to rise further. As BTC is a decentralized cryptocurrency, any central banks or governments can’t print it, and thus, Bitcoin’s total supply is limited. Moreover, “Bitcoin Whales,” referring to large investors, have started accumulating Bitcoin again. According to data from CoinMarketCap, these large Bitcoin whales, holding as of Dec. 3, 2024, have 248.60K BTC in their wallets, indicating that investors have been filling their wallets with a substantial amount of Bitcoins. This accumulation may contribute to boosting the price of Bitcoin.

Bitcoin Reached $100,000 In 2024 The year’s second half has been full of surprises and growth for cryptocurrencies. After the 2024 U.S. presidential elections, Republican candidate Trump’s race and victory have made people expect favorable regulations around crypto investment. The political change has made BTC reach its expected heights and surge past $100,000 in 2024, with few days left before the year ends. Himanshu Maradiya, chairman and founder of CIFDAQ, said, “Bitcoin’s leap past the $100,000 mark isn’t just a financial milestone—it’s a historic moment that cements the growing clout of decentralized assets in the mainstream. For investors, the spotlight now shifts to long-term planning: keeping an eye on market cycles, diversifying portfolios, and staying updated on regulatory shifts. While this breakthrough fuels optimism, he signals caution. “Seasoned investors see this as a chance to reassess risk strategies, while newcomers are urged to prioritize learning the ropes before diving in. The road ahead will demand both patience and conviction,” said Maradiya.

Can Bitcoin Reach $1,000,000 by 2025? According to Binance’s price prediction input for Bitcoin, the value of BTC may increase by +5% and reach 137,394.62 by 2030. The consensus rating indicates a bullish current sentiment. This indication is based on 3857 users’ crypto ratings for Bitcoin (BTC); 36.71% of users are bullish on BTC.Bitcoin enthusiasts often make overly optimistic and sometimes unrealistic predictions for their favorite cryptocurrency. After the surge, numerous discussions have occurred around Bitcoin, the world’s largest digital coin. Vikram Subburaj, chief executive officer of Giottus, said that speculation is rife about how high BTC can go, with many predicting $1,000,000. Gold has a market capitalization of $17 trillion, and BTC is highly unlikely to reach the $1 million mark in 2025. However, BTC hitting the $1 million mark in subsequent years cannot be ruled out.

Bottom Line Among the myriad predictions on Bitcoin, the bottom line remains that it has experienced several downfalls and has emerged stronger than before each time. Its resilient nature instills a belief in crypto enthusiasts who see value in investing in decentralized currencies. Only time can tell whether Bitcoin continues to rise or face downfall, and trading Bitcoin should be done with full awareness; your investment may yield a different return than the anticipated return.

www.cifdaq.com

0 notes

Text

Bitcoin Price Prediction: Can Bitcoin Reach $1,000,000 by 2025?

2024 began with significant momentum for cryptocurrencies, especially like Bitcoin and Ethereum, eliciting enthusiasm among crypto enthusiasts. As of Dec. 05, 2024, Bitcoin hyped to an exceptional all-time high at $103,900, with a market capitalization of $2.02 trillion, representing a 6.80% increase in the last week.

Bitcoin has surged due to certainty fuelled by the U.S. presidential elections and Republican candidate Donald Trump’s victory. BTC traded around $95,000 in the last few days after nearly touching $100,000. As of today, Dec. 05, 2024, it surged to the extreme high of $103,900. The anticipation that Trump’s administration will usher in a friendly regulatory environment for cryptocurrencies has fueled the surge.

As of Dec. 5, 2024, the world’s largest cryptocurrency is trading at $102,706. After Trump’s victory on Nov. 5, the price has surged around 45%, driven by a swathe of buying and pouring capital into U.S. bitcoin-backed exchange-traded funds.

Bitcoin’s Recovery Journey

Bitcoin has endured a tumultuous period, shedding approximately 65% of its market value over the past year. Crypto enthusiasts were taken aback by unforeseen events such as the Terra Luna crash, FTX decline, macroeconomic factors, and Binance’s legal issues. Nonetheless, the crypto market exhibited a remarkable recovery toward the end of the year, with BTC showing promising growth.

Bitcoin surged to impressive heights, surpassing its all-time highs multiple times following the U.S. presidential elections, reaching $103,900 as of Dec. 05, 2024. BTC ETF options on the Nasdaq may have also contributed to the surge. This surge propelled its market capitalization to $2.03 trillion, contributing to the overall crypto market capitalization of $3.69 trillion, reflecting exceptional performance.

After surpassing the psychological threshold of the $31,000 mark, Bitcoin started exhibiting a bearish trend and traded below $30K levels for most of the last year. However, it has shown remarkable recovery in the latter months of the year.

The world’s largest cryptocurrency, BTC, which was on a recovery path, has increased around 147.39% in one year. As of Dec. 05, 2024, it is currently trading at $102,658, with a market capitalization of $2.03 trillion and a global cryptocurrency market capitalization of $3.69 trillion.

Cryptocurrency experts believed that if BTC maintained its level of $30,000, it could likely bounce back from there. Looking at the current scenario, Bitcoin surpassed its all-time high in March but witnessed a downtrend later.

In April 2023, the top cryptocurrency Bitcoin, touched the critical resistance of the $30,000 level for the first time since June 10, 2022, and then started dipping below $26,000. It significantly rose to $45,203 after May 2022. Crypto experts believe that if Bitcoin maintains the $45,000 level and beyond, it could reach $60,000 by the end of 2024. In the first three months of the year, BTC has already touched the level of $73,750 and set a new record for an all-time high.

While the future of Bitcoin is unknown, retail investors must be very cautious about every move of Bitcoin, as it has witnessed tumultuous before. Moreover, India’s stance on cryptocurrencies continues to be firm, with the government bringing all crypto-related transactions under the ambit of the Money Laundering Act. In a specific gazette notification, the Union Finance Ministry of India stated that all the transactions related to digital assets or virtual currency would fall under the purview of the Prevention of Money Laundering Act (PMLA).

The new development may appear damaging to the cryptocurrency community in India. However, the industry has praised the move as a step towards regulating this space. Without regulators, the enforcement agencies will immediately take recourse to any discrepancies.

The Spot Bitcoin ETFs have been a tremendous factor in Bitcoin’s growth. After the SEC approved the ETFs in the U.S., retail investors showed great interest, leading to Bitcoin surpassing its all-time high. By the end of September, after the U.S. Federal Reserve’s rate cut, BTC is, as of Oct. 16, 2024, trading at $67,000. The U.S. Fed cut rates by 50 basis points, and the Bank of Japan kept interest rates steady. BTC rose around 3% a day after both central banks’ announcements.

One of the other reasons crypto experts were hopeful about Bitcoin is that this year, 2024, was a year for Bitcoin’s halving event. The Bitcoin halving event happens every four years, during which BTC rewards to its miners are cut by 50% (the miner’s payout will be reduced to 3.125 BTC). This event is usually positive for Bitcoin’s price, as it helps contract supply.

Historically, halving has been seen as an excellent sign for bringing momentum to Bitcoin’s price. So far, this year’s halving that took place on April 20, 2024, has not caused the surge to the BTC, as experts anticipated. The current state of Bitcoin reflects a significant downtrend.

The above table shows that past halving events have established long-term bullish drivers for Bitcoin’s price. The Bitcoin halving event relates to its deflationary tendency and crushing its supply, which helps the Bitcoin price to rise further. As BTC is a decentralized cryptocurrency, any central banks or governments can’t print it, and thus, Bitcoin’s total supply is limited.

Moreover, “Bitcoin Whales,” referring to large investors, have started accumulating Bitcoin again. According to data from CoinMarketCap, these large Bitcoin whales, holding as of Dec. 3, 2024, have 248.60K BTC in their wallets, indicating that investors have been filling their wallets with a substantial amount of Bitcoins. This accumulation may contribute to boosting the price of Bitcoin.

Bitcoin Reached $100,000 In 2024

The year’s second half has been full of surprises and growth for cryptocurrencies. After the 2024 U.S. presidential elections, Republican candidate Trump’s race and victory have made people expect favorable regulations around crypto investment. The political change has made BTC reach its expected heights and surge past $100,000 in 2024, with few days left before the year ends.

Himanshu Maradiya, chairman and founder of CIFDAQ, said, “Bitcoin’s leap past the $100,000 mark isn’t just a financial milestone—it’s a historic moment that cements the growing clout of decentralized assets in the mainstream. For investors, the spotlight now shifts to long-term planning: keeping an eye on market cycles, diversifying portfolios, and staying updated on regulatory shifts.

While this breakthrough fuels optimism, he signals caution. “Seasoned investors see this as a chance to reassess risk strategies, while newcomers are urged to prioritize learning the ropes before diving in. The road ahead will demand both patience and conviction,” said Maradiya.

Note: The figures are sourced from CoinMarketCap.

Can Bitcoin Reach $1,000,000 by 2025?

According to Binance’s price prediction input for Bitcoin, the value of BTC may increase by +5% and reach 137,394.62 by 2030. The consensus rating indicates a bullish current sentiment. This indication is based on 3857 users’ crypto ratings for Bitcoin (BTC); 36.71% of users are bullish on BTC.

Bitcoin enthusiasts often make overly optimistic and sometimes unrealistic predictions for their favorite cryptocurrency. After the surge, numerous discussions have occurred around Bitcoin, the world’s largest digital coin.

Vikram Subburaj, chief executive officer of Giottus, said that speculation is rife about how high BTC can go, with many predicting $1,000,000. Gold has a market capitalization of $17 trillion, and BTC is highly unlikely to reach the $1 million mark in 2025. However, BTC hitting the $1 million mark in subsequent years cannot be ruled out.

Bottom Line

Among the myriad predictions on Bitcoin, the bottom line remains that it has experienced several downfalls and has emerged stronger than before each time. Its resilient nature instills a belief in crypto enthusiasts who see value in investing in decentralized currencies.

Only time can tell whether Bitcoin continues to rise or face downfall, and trading Bitcoin should be done with full awareness; your investment may yield a different return than the anticipated return.

www.cifdaq.com

0 notes

Text

Bitcoin Price Prediction: Can Bitcoin Reach $1,000,000 by 2025?

2024 began with significant momentum for cryptocurrencies, especially like Bitcoin and Ethereum, eliciting enthusiasm among crypto enthusiasts. As of Dec. 05, 2024, Bitcoin hyped to an exceptional all-time high at $103,900, with a market capitalization of $2.02 trillion, representing a 6.80% increase in the last week.

Bitcoin has surged due to certainty fuelled by the U.S. presidential elections and Republican candidate Donald Trump’s victory. BTC traded around $95,000 in the last few days after nearly touching $100,000. As of today, Dec. 05, 2024, it surged to the extreme high of $103,900. The anticipation that Trump’s administration will usher in a friendly regulatory environment for cryptocurrencies has fueled the surge.

As of Dec. 5, 2024, the world’s largest cryptocurrency is trading at $102,706. After Trump’s victory on Nov. 5, the price has surged around 45%, driven by a swathe of buying and pouring capital into U.S. bitcoin-backed exchange-traded funds.

Bitcoin’s Recovery Journey

Bitcoin has endured a tumultuous period, shedding approximately 65% of its market value over the past year. Crypto enthusiasts were taken aback by unforeseen events such as the Terra Luna crash, FTX decline, macroeconomic factors, and Binance’s legal issues. Nonetheless, the crypto market exhibited a remarkable recovery toward the end of the year, with BTC showing promising growth.

Bitcoin surged to impressive heights, surpassing its all-time highs multiple times following the U.S. presidential elections, reaching $103,900 as of Dec. 05, 2024. BTC ETF options on the Nasdaq may have also contributed to the surge. This surge propelled its market capitalization to $2.03 trillion, contributing to the overall crypto market capitalization of $3.69 trillion, reflecting exceptional performance.

After surpassing the psychological threshold of the $31,000 mark, Bitcoin started exhibiting a bearish trend and traded below $30K levels for most of the last year. However, it has shown remarkable recovery in the latter months of the year.

The world’s largest cryptocurrency, BTC, which was on a recovery path, has increased around 147.39% in one year. As of Dec. 05, 2024, it is currently trading at $102,658, with a market capitalization of $2.03 trillion and a global cryptocurrency market capitalization of $3.69 trillion.

Cryptocurrency experts believed that if BTC maintained its level of $30,000, it could likely bounce back from there. Looking at the current scenario, Bitcoin surpassed its all-time high in March but witnessed a downtrend later.

In April 2023, the top cryptocurrency Bitcoin, touched the critical resistance of the $30,000 level for the first time since June 10, 2022, and then started dipping below $26,000. It significantly rose to $45,203 after May 2022. Crypto experts believe that if Bitcoin maintains the $45,000 level and beyond, it could reach $60,000 by the end of 2024. In the first three months of the year, BTC has already touched the level of $73,750 and set a new record for an all-time high.

While the future of Bitcoin is unknown, retail investors must be very cautious about every move of Bitcoin, as it has witnessed tumultuous before. Moreover, India’s stance on cryptocurrencies continues to be firm, with the government bringing all crypto-related transactions under the ambit of the Money Laundering Act. In a specific gazette notification, the Union Finance Ministry of India stated that all the transactions related to digital assets or virtual currency would fall under the purview of the Prevention of Money Laundering Act (PMLA).

The new development may appear damaging to the cryptocurrency community in India. However, the industry has praised the move as a step towards regulating this space. Without regulators, the enforcement agencies will immediately take recourse to any discrepancies.

The Spot Bitcoin ETFs have been a tremendous factor in Bitcoin’s growth. After the SEC approved the ETFs in the U.S., retail investors showed great interest, leading to Bitcoin surpassing its all-time high. By the end of September, after the U.S. Federal Reserve’s rate cut, BTC is, as of Oct. 16, 2024, trading at $67,000. The U.S. Fed cut rates by 50 basis points, and the Bank of Japan kept interest rates steady. BTC rose around 3% a day after both central banks’ announcements.

One of the other reasons crypto experts were hopeful about Bitcoin is that this year, 2024, was a year for Bitcoin’s halving event. The Bitcoin halving event happens every four years, during which BTC rewards to its miners are cut by 50% (the miner’s payout will be reduced to 3.125 BTC). This event is usually positive for Bitcoin’s price, as it helps contract supply.

Historically, halving has been seen as an excellent sign for bringing momentum to Bitcoin’s price. So far, this year’s halving that took place on April 20, 2024, has not caused the surge to the BTC, as experts anticipated. The current state of Bitcoin reflects a significant downtrend.

The above table shows that past halving events have established long-term bullish drivers for Bitcoin’s price. The Bitcoin halving event relates to its deflationary tendency and crushing its supply, which helps the Bitcoin price to rise further. As BTC is a decentralized cryptocurrency, any central banks or governments can’t print it, and thus, Bitcoin’s total supply is limited.

Moreover, “Bitcoin Whales,” referring to large investors, have started accumulating Bitcoin again. According to data from CoinMarketCap, these large Bitcoin whales, holding as of Dec. 3, 2024, have 248.60K BTC in their wallets, indicating that investors have been filling their wallets with a substantial amount of Bitcoins. This accumulation may contribute to boosting the price of Bitcoin.

0 notes

Text

Bitcoin Price Prediction: Can Bitcoin Reach $1,000,000 by 2025?

2024 began with significant momentum for cryptocurrencies, especially like Bitcoin and Ethereum, eliciting enthusiasm among crypto enthusiasts. As of Dec. 05, 2024, Bitcoin hyped to an exceptional all-time high at $103,900, with a market capitalization of $2.02 trillion, representing a 6.80% increase in the last week.

Bitcoin has surged due to certainty fuelled by the U.S. presidential elections and Republican candidate Donald Trump’s victory. BTC traded around $95,000 in the last few days after nearly touching $100,000. As of today, Dec. 05, 2024, it surged to the extreme high of $103,900. The anticipation that Trump’s administration will usher in a friendly regulatory environment for cryptocurrencies has fueled the surge.

As of Dec. 5, 2024, the world’s largest cryptocurrency is trading at $102,706. After Trump’s victory on Nov. 5, the price has surged around 45%, driven by a swathe of buying and pouring capital into U.S. bitcoin-backed exchange-traded funds.

Bitcoin’s Recovery Journey

Bitcoin has endured a tumultuous period, shedding approximately 65% of its market value over the past year. Crypto enthusiasts were taken aback by unforeseen events such as the Terra Luna crash, FTX decline, macroeconomic factors, and Binance’s legal issues. Nonetheless, the crypto market exhibited a remarkable recovery toward the end of the year, with BTC showing promising growth.

Bitcoin surged to impressive heights, surpassing its all-time highs multiple times following the U.S. presidential elections, reaching $103,900 as of Dec. 05, 2024. BTC ETF options on the Nasdaq may have also contributed to the surge. This surge propelled its market capitalization to $2.03 trillion, contributing to the overall crypto market capitalization of $3.69 trillion, reflecting exceptional performance.

After surpassing the psychological threshold of the $31,000 mark, Bitcoin started exhibiting a bearish trend and traded below $30K levels for most of the last year. However, it has shown remarkable recovery in the latter months of the year.

The world’s largest cryptocurrency, BTC, which was on a recovery path, has increased around 147.39% in one year. As of Dec. 05, 2024, it is currently trading at $102,658, with a market capitalization of $2.03 trillion and a global cryptocurrency market capitalization of $3.69 trillion.

Cryptocurrency experts believed that if BTC maintained its level of $30,000, it could likely bounce back from there. Looking at the current scenario, Bitcoin surpassed its all-time high in March but witnessed a downtrend later.

In April 2023, the top cryptocurrency Bitcoin, touched the critical resistance of the $30,000 level for the first time since June 10, 2022, and then started dipping below $26,000. It significantly rose to $45,203 after May 2022. Crypto experts believe that if Bitcoin maintains the $45,000 level and beyond, it could reach $60,000 by the end of 2024. In the first three months of the year, BTC has already touched the level of $73,750 and set a new record for an all-time high.

While the future of Bitcoin is unknown, retail investors must be very cautious about every move of Bitcoin, as it has witnessed tumultuous before. Moreover, India’s stance on cryptocurrencies continues to be firm, with the government bringing all crypto-related transactions under the ambit of the Money Laundering Act. In a specific gazette notification, the Union Finance Ministry of India stated that all the transactions related to digital assets or virtual currency would fall under the purview of the Prevention of Money Laundering Act (PMLA).

The new development may appear damaging to the cryptocurrency community in India. However, the industry has praised the move as a step towards regulating this space. Without regulators, the enforcement agencies will immediately take recourse to any discrepancies.

The Spot Bitcoin ETFs have been a tremendous factor in Bitcoin’s growth. After the SEC approved the ETFs in the U.S., retail investors showed great interest, leading to Bitcoin surpassing its all-time high. By the end of September, after the U.S. Federal Reserve’s rate cut, BTC is, as of Oct. 16, 2024, trading at $67,000. The U.S. Fed cut rates by 50 basis points, and the Bank of Japan kept interest rates steady. BTC rose around 3% a day after both central banks’ announcements.

One of the other reasons crypto experts were hopeful about Bitcoin is that this year, 2024, was a year for Bitcoin’s halving event. The Bitcoin halving event happens every four years, during which BTC rewards to its miners are cut by 50% (the miner’s payout will be reduced to 3.125 BTC). This event is usually positive for Bitcoin’s price, as it helps contract supply.

Historically, halving has been seen as an excellent sign for bringing momentum to Bitcoin’s price. So far, this year’s halving that took place on April 20, 2024, has not caused the surge to the BTC, as experts anticipated. The current state of Bitcoin reflects a significant downtrend.

The above table shows that past halving events have established long-term bullish drivers for Bitcoin’s price. The Bitcoin halving event relates to its deflationary tendency and crushing its supply, which helps the Bitcoin price to rise further. As BTC is a decentralized cryptocurrency, any central banks or governments can’t print it, and thus, Bitcoin’s total supply is limited.

Moreover, “Bitcoin Whales,” referring to large investors, have started accumulating Bitcoin again. According to data from CoinMarketCap, these large Bitcoin whales, holding as of Dec. 3, 2024, have 248.60K BTC in their wallets, indicating that investors have been filling their wallets with a substantial amount of Bitcoins. This accumulation may contribute to boosting the price of Bitcoin.

Also Read: Why Is Bitcoin Rising?

Bitcoin Reached $100,000 In 2024

The year’s second half has been full of surprises and growth for cryptocurrencies. After the 2024 U.S. presidential elections, Republican candidate Trump’s race and victory have made people expect favorable regulations around crypto investment. The political change has made BTC reach its expected heights and surge past $100,000 in 2024, with few days left before the year ends.

Himanshu Maradiya, chairman and founder of CIFDAQ, said, “Bitcoin’s leap past the $100,000 mark isn’t just a financial milestone—it’s a historic moment that cements the growing clout of decentralized assets in the mainstream. For investors, the spotlight now shifts to long-term planning: keeping an eye on market cycles, diversifying portfolios, and staying updated on regulatory shifts.

While this breakthrough fuels optimism, he signals caution. “Seasoned investors see this as a chance to reassess risk strategies, while newcomers are urged to prioritize learning the ropes before diving in. The road ahead will demand both patience and conviction,” said Maradiya.

Note: The figures are sourced from CoinMarketCap.

Can Bitcoin Reach $1,000,000 by 2025?

According to Binance’s price prediction input for Bitcoin, the value of BTC may increase by +5% and reach 137,394.62 by 2030. The consensus rating indicates a bullish current sentiment. This indication is based on 3857 users’ crypto ratings for Bitcoin (BTC); 36.71% of users are bullish on BTC.

Bitcoin enthusiasts often make overly optimistic and sometimes unrealistic predictions for their favorite cryptocurrency. After the surge, numerous discussions have occurred around Bitcoin, the world’s largest digital coin.

Vikram Subburaj, chief executive officer of Giottus, said that speculation is rife about how high BTC can go, with many predicting $1,000,000. Gold has a market capitalization of $17 trillion, and BTC is highly unlikely to reach the $1 million mark in 2025. However, BTC hitting the $1 million mark in subsequent years cannot be ruled out.

Also Read: Bitcoin Price History

Bottom Line

Among the myriad predictions on Bitcoin, the bottom line remains that it has experienced several downfalls and has emerged stronger than before each time. Its resilient nature instills a belief in crypto enthusiasts who see value in investing in decentralized currencies.

Only time can tell whether Bitcoin continues to rise or face downfall, and trading Bitcoin should be done with full awareness; your investment may yield a different return than the anticipated return.

0 notes

Text

Bitcoin Price Prediction: Can Bitcoin Reach $1,000,000 by 2025?

2024 began with significant momentum for cryptocurrencies, especially like Bitcoin and Ethereum, eliciting enthusiasm among crypto enthusiasts. As of Dec. 05, 2024, Bitcoin hyped to an exceptional all-time high at $103,900, with a market capitalization of $2.02 trillion, representing a 6.80% increase in the last week.

Bitcoin has surged due to certainty fuelled by the U.S. presidential elections and Republican candidate Donald Trump’s victory. BTC traded around $95,000 in the last few days after nearly touching $100,000. As of today, Dec. 05, 2024, it surged to the extreme high of $103,900. The anticipation that Trump’s administration will usher in a friendly regulatory environment for cryptocurrencies has fueled the surge.

As of Dec. 5, 2024, the world’s largest cryptocurrency is trading at $102,706. After Trump’s victory on Nov. 5, the price has surged around 45%, driven by a swathe of buying and pouring capital into U.S. bitcoin-backed exchange-traded funds.

Bitcoin’s Recovery Journey

Bitcoin has endured a tumultuous period, shedding approximately 65% of its market value over the past year. Crypto enthusiasts were taken aback by unforeseen events such as the Terra Luna crash, FTX decline, macroeconomic factors, and Binance’s legal issues. Nonetheless, the crypto market exhibited a remarkable recovery toward the end of the year, with BTC showing promising growth.

Bitcoin surged to impressive heights, surpassing its all-time highs multiple times following the U.S. presidential elections, reaching $103,900 as of Dec. 05, 2024. BTC ETF options on the Nasdaq may have also contributed to the surge. This surge propelled its market capitalization to $2.03 trillion, contributing to the overall crypto market capitalization of $3.69 trillion, reflecting exceptional performance.

After surpassing the psychological threshold of the $31,000 mark, Bitcoin started exhibiting a bearish trend and traded below $30K levels for most of the last year. However, it has shown remarkable recovery in the latter months of the year.

The world’s largest cryptocurrency, BTC, which was on a recovery path, has increased around 147.39% in one year. As of Dec. 05, 2024, it is currently trading at $102,658, with a market capitalization of $2.03 trillion and a global cryptocurrency market capitalization of $3.69 trillion.

Cryptocurrency experts believed that if BTC maintained its level of $30,000, it could likely bounce back from there. Looking at the current scenario, Bitcoin surpassed its all-time high in March but witnessed a downtrend later.

In April 2023, the top cryptocurrency Bitcoin, touched the critical resistance of the $30,000 level for the first time since June 10, 2022, and then started dipping below $26,000. It significantly rose to $45,203 after May 2022. Crypto experts believe that if Bitcoin maintains the $45,000 level and beyond, it could reach $60,000 by the end of 2024. In the first three months of the year, BTC has already touched the level of $73,750 and set a new record for an all-time high.

While the future of Bitcoin is unknown, retail investors must be very cautious about every move of Bitcoin, as it has witnessed tumultuous before. Moreover, India’s stance on cryptocurrencies continues to be firm, with the government bringing all crypto-related transactions under the ambit of the Money Laundering Act. In a specific gazette notification, the Union Finance Ministry of India stated that all the transactions related to digital assets or virtual currency would fall under the purview of the Prevention of Money Laundering Act (PMLA).

The new development may appear damaging to the cryptocurrency community in India. However, the industry has praised the move as a step towards regulating this space. Without regulators, the enforcement agencies will immediately take recourse to any discrepancies.

The Spot Bitcoin ETFs have been a tremendous factor in Bitcoin’s growth. After the SEC approved the ETFs in the U.S., retail investors showed great interest, leading to Bitcoin surpassing its all-time high. By the end of September, after the U.S. Federal Reserve’s rate cut, BTC is, as of Oct. 16, 2024, trading at $67,000. The U.S. Fed cut rates by 50 basis points, and the Bank of Japan kept interest rates steady. BTC rose around 3% a day after both central banks’ announcements.

One of the other reasons crypto experts were hopeful about Bitcoin is that this year, 2024, was a year for Bitcoin’s halving event. The Bitcoin halving event happens every four years, during which BTC rewards to its miners are cut by 50% (the miner’s payout will be reduced to 3.125 BTC). This event is usually positive for Bitcoin’s price, as it helps contract supply.

Historically, halving has been seen as an excellent sign for bringing momentum to Bitcoin’s price. So far, this year’s halving that took place on April 20, 2024, has not caused the surge to the BTC, as experts anticipated. The current state of Bitcoin reflects a significant downtrend.

Bitcoin Halving HistoryBitcoin Halving EventPrice on Halving DayPrice 150 days later2012$12.35$1272016$650.53$758.812020$8,821.42$10,9432024$62,205.94$60,308(Source: cointelegraph.com)

The above table shows that past halving events have established long-term bullish drivers for Bitcoin’s price. The Bitcoin halving event relates to its deflationary tendency and crushing its supply, which helps the Bitcoin price to rise further. As BTC is a decentralized cryptocurrency, any central banks or governments can’t print it, and thus, Bitcoin’s total supply is limited.

Moreover, “Bitcoin Whales,” referring to large investors, have started accumulating Bitcoin again. According to data from CoinMarketCap, these large Bitcoin whales, holding as of Dec. 3, 2024, have 248.60K BTC in their wallets, indicating that investors have been filling their wallets with a substantial amount of Bitcoins. This accumulation may contribute to boosting the price of Bitcoin.

0 notes

Text

BLOG 10

Joy of Gaming for Older Adults

In an age when stereotypes rule how we view things, I find it interesting to see how the digital gaming world is changing, especially with older people. Those are the days when gaming was the niche of the young. As of today, more and more 50plus folks are enjoying the fun of digital games, tipped towards being an activity for young people only.

Consider this: Sitting down in their living room, a retiree may have recently entered their golden years, or is maybe a few decades out yet, but is engrossed in a puzzle game on their tablet. In an era where mental stimulation, social interaction, and entertainment are sought-after things, you might be thinking that what was seemingly a simple pastime can actually open a gateway to a world of all three. But why do such people as older adults like these digital experiences so very much?

First of all, digital games involve a different kind of mental exercise. Additionally, they call for players to have to mind, and think critically, solve problems, and make quick decisions. That can be incredibly fulfilling, a sense of achievement, and keep the mind sharp. Furthermore, numerous games were created with social interactivity in mind, so players could connect with folks, even if they're apart by miles. In an age where you’re always on the lookout for social solutions, the game also provides a new approach to solving this problem.

Of course, entertainment is another important thing. Games are a passionate escape from routine for most of us living in the daily grind. From the excitement of strategy in a game of chess to the calming influence of a casual puzzle game, everyone is sure to find something that catches their attention. Of course there are the cognitive benefits too — research has pointed to how gaming can actually improve memory, attention and problem solving skills, so important for keeping the old noggin in good working order.

So, what kinds of games are older adults being drawn to? "Games like Minecraft and Candy Crush, other puzzle games, are attractive because there is an addictive feeling when you play, but it's also a relaxing, cool time." Mental challenges are best served by strategy games such as 'Civilization,' while easy and stress free play are answered with casual game types like Sudoku or crossword puzzles. On the other hand, multi player games promote social interaction such as "Among Us."

Naturally, there are things to keep in mind. Some can be put off by accessibility issues, such as complex controls or small text. Further, there is an opportunity for too much screen time. Despite these challenges, all is not lost, and with thoughtful consideration, these issues can be minimized, enabling older adults to enjoy the full benefits of gaming.

Games and brain exercises can keep certain cognitive functions up to par in people with dementia: memory, problem-solving. These games have been proved by research to increase cognitive reserve and delay the progression of dementia symptoms to prolong a good life; as well as more specifically prevent and treat depression.

SOURCES

https://www.healthline.com/health/alzheimers-dementia/memory-games-for-dementia (ACCESSED ON 20 DEC 2024)

https://doi.org/10.1177/1555412015594273 (ACCESSED ON 20 DEC 2024)

https://www.theesa.com/the-power-of-video-games-in-aging/ (ACCESSED ON 20 DEC 2024)

https://www.aarp.org/politics-society/advocacy/info-2023/jenkins-gaming-for-grownups.html (ACCESSED ON 20 DEC 2024)

0 notes

Text

Submission Window: December 1st, 2023 - January 31st, 2024 Payment: $25 and a contributor's copy Theme: Horror/suspense stories that take place in swamps, bayous, and marshlands The Cellar Door - Issue #5: Marshland Horrors Compiled & Edited by Aric Sundquist Short Story Submission Call: Dec 1, 2023 - Jan 31, 2024 The Cellar Door is a biannual anthology of dark fiction. Each issue will contain 8 to 12 stories based around a specific theme and will include a brand new story from a featured author. The majority of the anthology will be filled from the open submissions. Title: The Cellar Door - Issue #5: Marshland Horrors Theme: Looking for horror/suspense stories that take place in swamps, bayous, and marshlands. Special preference for stories with backwater cults/legends, cryptid monsters, and other slimy creatures lurking just below the water. Type: Creature feature, serial killer, undead/zombies, voodoo/witchcraft, suspense/thriller, cosmic horror. Word Count: 2,000 - 10,000 words. Payment: $25.00 + digital & paperback copy. Featured Author: Scotty Milder Accepted Authors (so far): Cover Art: Mikio Murakami Rights: We are seeking first time rights for 1 year after publication. After that time all rights revert back to the author. The publication will appear in both print and digital formats. Reprints: None. Previously unpublished only. Multiple Submissions: None. Simultaneous Submissions: Yes, but state in your email that it is a simultaneous submission, and please email us immediately if the story is sold elsewhere. Also, be sure to follow the Manuscript Format guidelines below when submitting. File Format: Include your story as an attachment in MS Word, LibreOffice, or Rich Text Format. Manuscript Format: Use the Modern Shunn Format. Include a short bio in the body of your email. Your subject line should read, MH Submission: ("Title") by (Author's Name). For Example, MH Submission: "The Raft" by Stephen King. Attach the story as a separate document. Response Time: 4 weeks after submissions close, if not sooner. Submission Period: Dec 1, 2023 to Jan 31, 2024. Send Submissions to: darkpenpress (at) gmail (dot) com Back to Main Submissions Page: Influential Movies/TV: The Serpent and the Rainbow, Pumpkinhead, Annihilation, Hatchet, The Skeleton Key, Rogue (2007), The Beyond, A House on the Bayou, True Detective (Season 1) Influential writings/series: Man-Thing (Marvel comic series), Swamp Thing (DC comic series), The Call of Cthulhu by HP Lovecraft, Gone South by Robert R. McCammon, Seed by Ania Ahlborn Note on 9-17-23: To get a good sense of what I'm looking for, read the free short story "The Bird is the Werd" by Xariffa Suarez, appearing in Negative Space 2. Good luck! A.S. Via: Dark Peninsula Press.

2 notes

·

View notes