#Drilling Data Management Systems Market Share

Explore tagged Tumblr posts

Text

Drilling Data Management Systems Market Size, Share, Analysis, Forecast, and Growth Trends to 2032: Global Energy Transition Spurs Smarter Data Use

The Drilling data management systems market was valued at USD 3.7 billion in 2023 and is expected to reach USD 12.7 billion by 2032, growing at a CAGR of 14.79% from 2024-2032.

Drilling Data Management Systems Market is gaining significant traction as energy companies push for efficiency, safety, and sustainability in exploration and production operations. With increasing complexity in drilling environments, operators are turning to digital systems that provide real-time data capture, analysis, and predictive insights to make informed decisions and reduce non-productive time.

US Drilling Data Management Systems Market Sees Growth with Digital Oilfield Adoption

Drilling Data Management Systems Market is evolving rapidly, driven by the need for advanced analytics and automated reporting. As upstream operations embrace digital transformation, data-driven platforms are enabling seamless integration between field equipment and enterprise systems—reshaping how drilling performance is monitored and optimized globally.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/6647

Market Keyplayers:

Schlumberger – Petrel E&P Software Platform

Halliburton – DecisionSpace Well Engineering

Baker Hughes – JewelSuite Subsurface Modeling

Emerson – Paradigm Geolog

Kongsberg Digital – SiteCom

Pason Systems – DataHub

Weatherford – Centro Digital Well Delivery

CGG – GeoSoftware

PetroVue – PetroVue Analytics Platform

Katalyst Data Management – iGlass

Peloton – WellView

IDS – DrillNet

DataCloud – MinePortal

TDE Group – tde proNova

NOV – NOVOS

Market Analysis

The market for Drilling Data Management Systems is being shaped by the convergence of big data, IoT, and cloud technologies. With drilling operations becoming more data-intensive, oil and gas companies are investing in systems that can collect, process, and interpret large volumes of structured and unstructured data from rigs, sensors, and control systems.

North America leads adoption due to high drilling activity and digital maturity, while Europe is advancing through environmental regulations and demand for operational transparency. The emphasis on reducing costs and increasing well productivity is a major catalyst across both regions.

Market Trends

Rise in real-time data acquisition tools for downhole and surface equipment

Integration of AI for predictive maintenance and anomaly detection

Cloud-based data platforms for centralized analytics and reporting

Expansion of edge computing to enable faster on-site decision-making

Increased use of digital twins for well planning and simulation

Emphasis on cybersecurity and data integrity in drilling operations

Collaboration between software vendors and oilfield service companies

Market Scope

As energy firms pivot toward smarter exploration, the Drilling Data Management Systems Market is opening up dynamic growth avenues. These systems are not only enhancing operational visibility but also driving strategic value by aligning technical performance with business outcomes.

Real-time drilling performance dashboards

Seamless integration with SCADA and ERP systems

Enhanced rig-site data synchronization

Data lakes for centralized, scalable storage

AI-powered reporting and operational insights

Compliance-ready platforms for environmental and safety standards

Scalable for both onshore and offshore operations

Forecast Outlook

The Drilling Data Management Systems Market is poised for transformative growth as the industry shifts toward digital-first models. Increasing investments in upstream digitalization and data-centric drilling strategies will continue to drive innovation. Vendors focusing on cloud interoperability, intuitive user interfaces, and machine learning will gain competitive edge. The market will increasingly rely on adaptive platforms capable of streamlining multi-source data and automating decision workflows in real-time environments.

Access Complete Report: https://www.snsinsider.com/reports/drilling-data-management-systems-market-6647

Conclusion

In a high-stakes industry where precision and timing are critical, Drilling Data Management Systems are redefining operational intelligence. From shale plays in Texas to the North Sea platforms, companies are leveraging these systems to maximize uptime, minimize risks, and future-proof their drilling strategies.

Related Reports:

US enterprises adopt EMM tools to improve data visibility and decision-making

US businesses prioritize advanced data management strategies

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Drilling Data Management Systems Market#Drilling Data Management Systems Market Scope#Drilling Data Management Systems Market Share#Drilling Data Management Systems Market Growth#Drilling Data Management Systems Market Trends

0 notes

Text

Pipe Crusher Market Share, Industry Size, Opportunity, Analysis, Forecast 2033

According to a recent study by Fact.MR, a market research and competitive intelligence provider, the global pipe crusher market is projected to reach USD 1.34 billion by 2033, with a compound annual growth rate (CAGR) of 5.1% over the next decade.

A pipe crusher, also known as a pipe shredder or pipe granulator, is an industrial machine designed to break down pipes into smaller pieces. These machines are widely used in recycling facilities, construction sites, and other sectors where pipes need to be processed for recycling or disposal. Pipe crushers are essential for effective waste management, facilitating the efficient processing and disposal of pipes.

For more insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=8593

Pipe crushers are instrumental in reducing the volume of waste material, which facilitates more efficient transportation and storage. Effective waste management, including the use of pipe crushers, helps mitigate the environmental impact of waste disposal.

Automation in pipe crushers offers significant advantages, particularly in enhancing operational efficiency. Automated systems streamline the crushing process by minimizing manual intervention and reducing human error. Automated feeding systems ensure that pipes are continuously and smoothly loaded into the crusher, resulting in uninterrupted operation. This leads to increased throughput, reduced downtime, and improved overall productivity.

Key Takeaways from Market Study

The global pipe crusher market is valued at US$ 817.64 million in 2023.

Worldwide demand for pipe crushers is projected to increase at a CAGR of 5.1% from 2023 to 2033.

The global market is estimated to reach US$ 1.34 billion by the end of 2033.

The market in the United Kingdom is projected to rise at a 4.2% CAGR through 2033.

India’s pipe crusher market is set to expand at a CAGR of 3% during the forecast period.

Increasing number of natural gas and crude oil pipelines, as well as growing usage of horizontal drilling for oil & gas production, will drive the demand growth for pipe crushers, says a Fact.MR analyst.

Market Competition

Pipe crusher manufacturers are increasingly forming strategic alliances and partnerships to leverage complementary strengths, enter new markets, and enhance their product offerings. These collaborations are driving the development of innovative solutions and broadening market reach.

For instance, in September 2022, FLSmidth acquired TK Mining to strengthen its position as a leading global provider of mining technology and services. TK Mining is renowned for its comprehensive solutions in material handling, mine systems, mineral processing, and related services.

Key Companies

Aceretech Machinery

ELANT

Franklin Miller Inc

Fulcrum Technology

GENIUS MACHINERY CO., LTD.

Net Plasmak

NICETY

Rothenberger

Wiscon Envirotech Inc.

Zhangjiagang Huade Machinery

Key Segments of Pipe Crusher Industry Research

By Type:

Shredders

Single Shaft

Single Motor

Double Motor

Double Shaft

Single Motor

Double Motor

Granulators

By Rotor Diameter:

Up to 400 mm

401 to 600 mm

601 to 800 mm

Above 800 mm

By Number of Blades:

Up to 15

18 to 24

Above 24

By Main Drive:

20 to 60 HP (15 to 45 KW)

60 to 100 HP (45 to 75 KW)

100 to 150 HP (75 to 110 KW)

150 to 200 HP (110 to 150 KW)

By Capacity:

Up to 400 Kg/Hr

401 to 1,200 Kg/Hr

1,201 to 1,600 Kg/Hr

Above 1,600 Kg/Hr

By Region:

North America

Latin America

Europe

Asia Pacific

Middle East & Africa

More Valuable Insights on Offer Fact.MR, in its new offering, presents an unbiased analysis of the global pipe crusher market, presenting historical demand data for 2018 to 2022 and forecast statistics for 2023 to 2033.

The study divulges essential insights into the market based on type (shredders (single shaft (single motor, dual motor), dual shaft (single motor, dual motor)), granulators), rotor diameter (mm) (up to 400 mm, 401 to 600 mm, 601 to 800 mm, above 800 mm), number of blades (up to 15, 18 to 24, above 24), main drive (20 to 60 HP (15 to 45 KW), 60 to 100 HP ( 45 to 75 KW), 100 to 150 HP (75 to 110 KW), 150 to 200 HP (110 to 150 KW)), and capacity (Kg/Hr) (up to 400 kg/hr, 401 to 1,200 kg/hr, 1,201 to 1,600 kg/hr, above 1,600 kg/hr), across five major regions of the world.

𝐂𝐨𝐧𝐭𝐚𝐜𝐭: US Sales Office 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583, +353-1-4434-232 Email: [email protected]

1 note

·

View note

Text

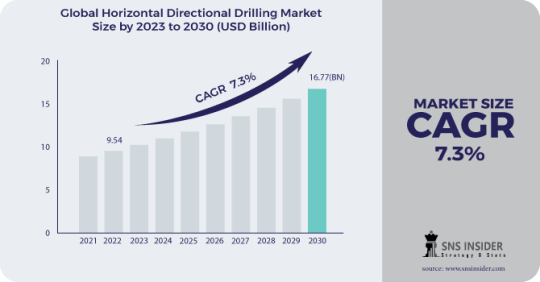

Horizontal Directional Drilling Market Analysis and Forecast 2031: Exploring Size, Share, and Scope Trends

The Horizontal Directional Drilling research report provides a quick analysis of market value, volume, return, factors, opportunity, competition, and current strategic behaviour. This includes forecasting demand, detailed explanations of assumptions and methodologies, as well as historical data and forecasts. This study examines the financial market environment to assess competition in local and global markets. The survey highlights the growth potential of the Horizontal Directional Drillingindustry over the forecast period.

Ask For Sample Report Here @ https://www.snsinsider.com/sample-request/1099

The report includes data on strategic alliances, new product launches, projects, transactions, collaborations, key market players, and drivers, constraints and opportunities. It provides the tools you need to assess the Horizontal Directional Drilling market for companies, customers, buyers, sellers, service providers, and distributors.

Market Segmentation

By Technique

Conventional

Rotary Steerable System

By Parts

Rigs

Pipes

Bits

Reamers

Others

By Application

On-shore

Off-shore

By End User

Oil and Gas Excavation

Utility

Telecommunication

By Company

American Augers, Inc.

Ditch Witch

Ellingson Companies

Vermeer Corporation

The Toro Company

Baker Hughes Incorporate

Halliburton Company

Schlumberger Limited

Weatherford International National Oilwell Varco, Inc.

Nabors Industries, Ltd.

The Application Management Services (AMS) market is divided into three categories: type, provider and application, allowing you to more accurately assess the size, climate, growth and development of the market. Charts, diagrams and records are used to represent the segments. Horizontal Directional Drillingmarket research also provides insights into the target market's product category and is based on a variety of organizational objectives such as product segmentation, production volume, product definition, and requirements, etc.

The market study thoroughly investigates the scope of the target market. Market innovation that has been stable in the past and is expected to stabilize again in the future is the subject of this study. Industry structure, definition, product characteristics, market penetration and maturity analysis are all included in the Horizontal Directional Drilling market report. Market size and growth rate are also analysed for forecast periods.

Regional Analysis

The report covers industry rankings and reported interpretations using regional surveys. Use of both primary and secondary sources to calculate market revenue for large industry organizations. Therefore, this study contains several important features. This Horizontal Directional Drillingmarket study explores the many factors that influence the growth of a region, including the financial, cultural, social, technical and political conditions of the region. This chapter describes the regional and global globalization of various term exchanges. Similarly, this study provides a reliable amount of country-by-country research and analysis of regional market share.

Buy This Report Here @ https://www.snsinsider.com/checkout/1099

Competitive Outlook

The size of the sector is also determined by the characteristics of the major players in the sector, according to the report. Major capabilities of major industry players are studied using secondary as well as primary sources and their revenue in the market is calculated in this study. This market research examines the top-down tactics of large companies. This section of the report provides contact details for the major vendors in the Horizontal Directional Drillingindustry. The survey also explores the market competition, market prices and channel characteristics among the major players.

0 notes

Text

Pacgold’s White Lion Prospect Ignites Exploration Buzz with Major Geophysical Breakthrough

Pacgold Limited’s (ASX: PGO) White Lion Prospect just became one of North Queensland’s most exciting gold exploration targets—thanks to a game-changing geophysical discovery that could reshape the future of the Alice River Gold Project.

In a detailed ASX update released on 10 July 2025, Pacgold revealed the delineation of a large, high-intensity IP (Induced Polarisation) anomaly that directly overlaps a strong magnetic “bullseye” feature. This combination is a classic signpost in the search for intrusion-related gold systems (IRGS)—and one that bears striking resemblance to Queensland’s 5Moz Mt Leyshon deposit.

A Bullseye in the Making

The newly mapped anomaly at White Lion spans 1.0km x 1.5km, positioned just south of the mineralised Alice River Fault Zone (ARFZ). Pacgold’s geophysics team uncovered a textbook “donut-shaped” magnetic inversion at around 200 metres depth—encircling high-chargeability zones typical of sulphide-rich, gold-hosting breccias.

Managing Director Matthew Boyes called it “an excellent result,” stating that White Lion now represents a priority drill target for Pacgold over the coming months.

The Bigger Geological Picture

This isn’t just a lucky hit—it’s the outcome of a carefully executed exploration model. Pacgold is targeting intrusion-related gold systems, a mineralisation style known for size and scale. White Lion’s magnetic lows, pyrite-rich zones, and alteration signatures line up with known global analogues like Fort Knox in Alaska and Australia’s Mt Leyshon.

The fact that historic shallow drilling in the 1980s encountered anomalous gold—but never tested the current central magnetic anomaly—adds to the intrigue. The real prize likely lies beneath, and Pacgold’s geophysics suggest depth continuity and structural controls needed for a major discovery.

What’s Next: Drills, Data and Development

The company is now fast-tracking a Pole-Dipole IP survey to pinpoint drilling locations more accurately and build a depth model. Once heritage and environmental permitting is finalised, Pacgold plans to begin drill testing in Q4 2025.

Concurrently, its regional IP program is expanding along the ARFZ to link White Lion with other promising targets like Victoria, Posie, and Central. These prospects lie within Pacgold’s broader 377km² Alice River tenement, offering potential scale far beyond one drill hole.

A Surge in Market Attention

The market is taking note. On the day of the ASX announcement (10 July), Pacgold’s trading volume spiked to 470,600 shares, up nearly 60x from earlier in the week. The share price held firm at $0.062, signaling investor confidence and anticipation for a potential breakout.

Date

Volume

04 July

8,000

08 July

220,900

09 July

81,000

10 July

470,600 🔥

With a market cap of just under $10 million, Pacgold still sits in the early-stage exploration sweet spot—high risk, but potentially high reward if drilling confirms mineralised breccias.

Why This Matters: The Hunt for Australia’s Next IRGS Giant

The Alice River Gold Project sits within one of Queensland’s most prolific gold provinces, home to multi-million-ounce discoveries like Pajingo and Ravenswood. Pacgold is methodically applying modern geophysics and proven models to unlock underexplored terrain.

If White Lion delivers on its geophysical promise, it could become a new exploration centrepiece in Australia’s gold sector—attracting further interest from investors, strategic partners, or even larger miners looking to backfill future pipelines.

0 notes

Text

George Dfouni Hotelier Shares Proven Strategies to Prepare for Hospitality Crises

The hospitality industry is one of the most sensitive to crises—be it a health pandemic, financial downturn, natural disaster, or cyber-attack. George Dfouni Hotelier, with more than 30 years of international experience, shares practical strategies to help hotel owners and managers prepare for the unexpected. His approach focuses on building systems that respond quickly and recover even stronger.

1. Build a Strong Crisis Team

Creating a reliable crisis management team is the foundation of any hotel’s preparedness. Dfouni emphasizes the importance of having members from each department—operations, housekeeping, IT, marketing, and finance—trained and ready.

Assign clear roles and responsibilities to each team member.

Conduct mock drills to practice response strategies.

Schedule regular training to ensure the team stays updated.

2. Understand the Risks

Every hotel location is vulnerable to different types of threats. It’s essential to regularly assess what could go wrong and create customized plans for each risk.

For example, a city hotel may focus on cyber security and infrastructure issues, while a resort in a coastal area might prepare for extreme weather. George Dfouni suggests performing annual risk audits and updating plans based on new trends or incidents.

3. Communicate with Clarity

Communication during a crisis can either calm the situation or make it worse. That’s why having a communication plan is non-negotiable.

Dfouni advises hotels to prepare pre-approved templates for guest alerts and press statements. Staff should be briefed regularly and understand who is authorized to speak publicly on behalf of the hotel. Social media must be monitored actively during such times.

4. Keep Operations Running

During a crisis, business operations must continue as smoothly as possible. Dfouni recommends maintaining flexible systems and backup plans.

Reduce non-essential services if needed.

Have a list of vendors who can support during supply disruptions.

Implement cloud-based tools that can be accessed remotely.

5. Make Data Work for You

In uncertain times, data helps hotel leaders make smart choices. Tracking occupancy trends, cancellations, and guest behavior gives you a real-time view of what’s happening.

George encourages hoteliers to invest in tools that analyze guest patterns and help predict future demand. This also helps in staff planning, inventory control, and revenue management.

6. Put Safety First

Guest and employee safety should be a top priority. Dfouni insists on visible hygiene protocols and transparent health policies.

Staff should be trained in safety measures and equipped with proper gear. Public areas must be sanitized regularly, and digital tools like contactless check-ins and mobile menus should be considered to limit physical interaction.

7. Strengthen Guest Relationships

Your guests will remember how your hotel handled a difficult situation. Being honest, flexible, and empathetic earns their trust.

Offer flexible cancellation and rescheduling policies.

Provide useful updates on your website and social media.

Follow up with guests after their stay to thank them and ask for feedback.

8. Learn and Improve

Every crisis teaches valuable lessons. After the event, hold a review meeting with your team. What worked? What didn’t?

Update your action plans and processes. If new tools or partnerships are needed, now is the time to invest. Dfouni believes continuous improvement is key to long-term resilience.

9. Stay Financially Prepared

George Dfouni advises hoteliers to create financial cushions wherever possible.

Keep track of essential costs and cut down unnecessary spending.

Adjust pricing based on real-time demand.

Look for alternative income options, such as extended stays or digital experiences.

10. Invest in Smart Technology

Technology can transform how hotels manage emergencies. From data security systems to guest-facing apps, Dfouni sees innovation as a must-have, not a luxury.

Install reliable cybersecurity tools to protect guest data.

Use AI-based forecasting tools for better decision-making.

Automate standard services to keep staff and guests safe.

Conclusion

George Dfouni Hotelier experience and strategies offer a strong foundation for any hotel preparing for unexpected challenges. His approach combines people, process, and technology—ensuring that hotels not only survive crises but come out stronger.

Being prepared is not about avoiding problems but knowing how to face them calmly and professionally. With George Dfouni’s insights, hoteliers can build a safer, smarter, and more resilient future.

#GeorgeDfouniHotelier#HospitalityLeadership#HotelCrisisManagement#HospitalityStrategies#HotelierTips

0 notes

Text

Exploring the Depths: Geophysical Exploration Equipment Market Outlook Through 2031

The global geophysical exploration equipment market is entering a dynamic growth phase, marked by increased investments, rapid technological innovation, and a global push to secure natural resources. Valued at US$ 13.2 billion in 2022, the market is projected to grow at a compound annual growth rate (CAGR) of 4.1%, reaching US$ 18.9 billion by 2031. As the world intensifies efforts to meet surging energy and mineral demands, the importance of advanced exploration equipment has never been greater.

Surge in Exploration Investments Fuels Market Expansion

Governments and private enterprises across the globe are doubling down on exploration activities to uncover new reserves of oil, gas, and minerals. This shift is largely driven by resource scarcity, rising demand for energy, and geopolitical uncertainties. Countries such as Australia, Chile, and Canada are offering policies and incentives to attract foreign direct investments into mining and energy exploration.

This influx of capital not only boosts the number of exploration projects but also accelerates the demand for high-performance geophysical tools like seismographs, magnetometers, and ground-penetrating radar systems. For instance, offshore zones such as the North Sea and Gulf of Mexico are witnessing revived interest due to favorable energy prices and strategic national interests.

Technology is the Game Changer

The market's growth isn't just about capital—it's also about capability. Cutting-edge technologies are transforming how subsurface data is collected, analyzed, and applied. From 3D and 4D seismic imaging to AI-driven data interpretation algorithms, geophysical exploration has become faster, more accurate, and more efficient.

For example, high-resolution imaging tools now offer detailed visualization of underground structures, allowing for better targeting of drilling locations. Equipment such as Geospace Technologies’ Aquanaut, a cable-free ocean bottom recorder launched in 2023, demonstrates how far the industry has come in creating tools tailored for complex environments.

Moreover, integration with other geoscience disciplines—like remote sensing, geological mapping, and geochemical analysis—is providing a more holistic approach to exploration. This multidisciplinary data synthesis significantly reduces risks and boosts the success rate of exploration missions.

Cost Barriers: A Persistent Challenge

Despite these positive trends, one major roadblock stands in the way of broader market participation: the high initial cost of equipment. From seismic survey devices to LiDAR systems, acquiring and maintaining this sophisticated technology is financially demanding, especially for SMEs and entities in emerging economies.

Ongoing maintenance, training, and calibration further add to the cost burden. However, some firms are finding creative ways to manage these expenses. Outsourcing, leasing, and strategic partnerships have emerged as viable alternatives to ownership. Additionally, the rise of modular, scalable, and cost-efficient solutions may help lower barriers for new entrants.

Regional Outlook: North America Leads, Asia Pacific Rises

In 2022, North America dominated the market, largely due to the United States' robust oil & gas and mining industries. The region is expected to maintain its lead through 2031, driven by consistent demand and technological leadership.

Meanwhile, the Asia Pacific region, accounting for 28.4% market share in 2022, is experiencing rapid growth. Countries like China, India, and ASEAN members are leveraging geophysical equipment for infrastructure development, mineral exploration, and water resource management.

Regions such as the GCC, Brazil, and Africa are also emerging as key markets. Their expanding use of geophysical tools in agriculture, water exploration, and fossil fuel extraction is indicative of a broadening global reliance on advanced exploration technologies.

Competitive Landscape: Innovation Through Collaboration

The market is moderately consolidated, with top players such as GSSI, Sercel (CGG), DMT, and Geospace Technologies dominating the landscape. These companies are heavily investing in R&D and strategic partnerships to stay ahead of the curve.

Notable recent developments include:

Sercel’s MetaBlue, a marine seismic survey tool launched in 2023 to improve planning and reduce project timelines.

DMT’s pivot to geothermal energy, which reflects the sector’s diversification beyond oil & gas.

By focusing on innovation and customization, these companies are setting the tone for future market development.

Outlook: A Market Set to Transform

Looking ahead, the geophysical exploration equipment market is poised for substantial evolution. With demand escalating across multiple sectors—from energy and mining to infrastructure and agriculture—there is a pressing need for smarter, faster, and more economical solutions.

While high equipment costs remain a constraint, continuous technological advancement and shifting investment models promise a more inclusive and competitive future. The emergence of cost-effective, mobile, and AI-enhanced systems could redefine accessibility and efficiency across regions and industries.

In conclusion, the market’s trajectory from US$ 13.2 billion in 2022 to nearly US$ 19 billion in 2031 underscores the essential role geophysical exploration plays in meeting the planet’s growing needs. For businesses and governments alike, now is the time to invest in the tools that will shape the resource landscape of tomorrow.

0 notes

Text

Build Market Expertise With ICFM’s Practical Share Market Courses In Delhi For Career And Wealth Growth

Learn Stock Trading with Professional Share Market Courses in Delhi Exclusively at ICFM - Stock Market Institute

The financial markets are no longer limited to professionals or institutions—today, individuals from every background are exploring trading and investing as viable means of income and wealth generation. With this rising interest, the demand for structured share market courses in Delhi has grown significantly. For anyone seeking reliable, hands-on, and expert-led training, ICFM - Stock Market Institute offers some of the best and most practical share market courses in Delhi tailored to Indian financial markets and trading systems.

ICFM’s share market courses in Delhi are designed to offer a deep understanding of the market's inner workings. Whether you're a student, a working professional, a homemaker, or a retired individual, ICFM provides a comprehensive learning path that equips you to confidently participate in the stock market. These courses are built to transform beginners into informed market participants and turn casual traders into disciplined and profitable investors.

Why Choose ICFM for Share Market Courses in Delhi?

Among the various institutes offering share market courses in Delhi, ICFM stands out for its real-market approach and practical teaching methodology. Unlike many theoretical programs, ICFM focuses on training that can be applied immediately in live trading situations. Their courses are designed by experienced market experts and active traders who bring real-world insights into every session. The core strength of ICFM lies in simplifying complex market concepts through real-time examples, software-based training, and one-on-one mentorship. Students receive personalized attention and are taught to make strategic trading decisions based on market data, technical signals, and economic factors. These share market courses in Delhi are comprehensive, engaging, and constantly updated to reflect current market trends and tools.

What You Will Learn in ICFM’s Share Market Courses in Delhi

The curriculum of ICFM’s share market courses in Delhi is thoughtfully structured to guide learners from basic to advanced topics. The journey begins with understanding what the share market is, how stock exchanges work, how trading happens in India, and the role of participants like brokers, investors, and institutions. As the course progresses, students dive into the essential tools of the trade, including candlestick charting, technical indicators, price action theory, support and resistance, moving averages, trendlines, volume analysis, and market psychology. These concepts are taught using real-time charts and trading platforms, ensuring that each lesson is practical and directly applicable. ICFM also introduces learners to risk management, trading discipline, and money management—all critical components of long-term trading success. The share market courses in Delhi go even further to cover options, futures, and portfolio management strategies for those looking to expand into derivatives or build diversified investment portfolios.

Real-Time Learning and Market Exposure at ICFM

One of the strongest aspects of ICFM’s share market courses in Delhi is its emphasis on real-time training. Students don’t just learn from books or slides—they practice in live markets. ICFM provides exposure to real trading platforms, where students monitor live prices, analyze market movements, place simulated trades, and review outcomes with expert feedback. This kind of immersive learning builds confidence and removes the fear of trading that many beginners experience. Daily market updates, interactive sessions, and practice drills are part of the regular training process. By applying concepts in real-world scenarios, learners are better prepared to make informed decisions in their personal trading journeys. This kind of hands-on education is what makes ICFM’s share market courses in Delhi highly impactful and industry-relevant.

Who Should Join Share Market Courses in Delhi by ICFM?

The share market courses in Delhi offered by ICFM are suitable for a wide range of learners. Students looking to enter the finance industry can build a strong foundation in trading and investment. Working professionals aiming to grow their income through market participation can develop smart strategies. Homemakers and retirees seeking independent financial control can learn how to manage their portfolios confidently. Even those who have been trading without structured training can benefit from these courses by refining their techniques, eliminating errors, and developing consistency. These courses are flexible, affordable, and available in both online and classroom formats, making them accessible for learners across Delhi NCR and beyond.

Career Opportunities After Completing Share Market Courses in Delhi

Completing ICFM’s share market courses in Delhi opens up multiple career avenues in the financial sector. Graduates of the program often pursue roles such as equity analysts, stockbrokers, technical analysts, investment advisors, and portfolio managers. Many also use the knowledge to become independent traders or start their own investment ventures. ICFM also prepares students to appear for certification exams like NISM and NCFM, which are widely recognized across brokerage houses, advisory firms, and financial institutions. With more companies valuing practical market knowledge, having a solid foundation from a reputed institute like ICFM gives learners a professional edge.

Enroll in ICFM’s Share Market Courses in Delhi and Start Your Trading Journey Today

For anyone looking to enter the stock market with confidence and clarity, ICFM’s share market courses in Delhi are the ideal starting point. These courses combine expert instruction, live market training, and personal mentorship to ensure every learner is equipped to handle real trading challenges. With thousands of successful students and a reputation built on trust and results, ICFM is the most reliable choice for stock market education in Delhi. Don’t rely on guesswork or internet noise—enroll in ICFM’s share market courses today and take charge of your financial future with skill, discipline, and confidence.

0 notes

Text

Saudi Arabia Power SCADA Market Industry Trends, Forecast 2024-2031

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated Saudi Arabia Power SCADA Market size by value at USD 169.13 million in 2024. During the forecast period between 2025 and 2031, BlueWeave expects Saudi Arabia Power SCADA Market size to grow at a CAGR of 5.4% reaching a value of USD 244.31 million by 2031. The growth of Power SCADA Market in Saudi Arabia is propelled by significant investments in grid modernization, the accelerating adoption of automation in power distribution, and the imperative for real-time monitoring and predictive maintenance to ensure operational resilience. This surge is evident across critical infrastructure including power utilities, oil & gas, and water treatment, where SCADA systems optimize resource management and enhance efficiency. Notable examples include Jizan's centralized SCADA system which integrates multiple water treatment and sewage plants for remote management, and Saudi Aramco's extensive oil field deployments aimed at optimizing reservoir management and maintaining production capacity. Further propelling this growth are ongoing infrastructure development projects, the escalating demand for automation, the integration of renewable energy sources, and strategic market activities such as mergers and acquisitions by key players. As Saudi Arabia continues its ambitious energy infrastructure modernization, the pervasive adoption of SCADA systems is expected to be a cornerstone shaping a more efficient and reliable power sector.

Sample Request: https://www.blueweaveconsulting.com/report/saudi-arabia-power-scada-market/report-sample

Oil and Gas Segment Holds Largest Market Share

The oil & gas segment accounts for the largest share of Saudi Arabia Power SCADA Market by end user. It can be attributed to its critical infrastructure and rigorous safety standards. SCADA systems are integral to the monitoring and control of operations across drilling rigs, pipelines, and refineries, ensuring adherence to regulatory requirements and enhancing safety protocols. The geographically dispersed nature of these facilities necessitates remote monitoring and process optimization, capabilities facilitated by SCADA technology. Furthermore, SCADA enhances asset management through predictive maintenance and streamlines production via data integration. Consequently, the industry's reliance on SCADA for safety, compliance, and operational efficiency solidifies its substantial market share.

Impact of Escalating Geopolitical Tensions on Saudi Arabia Power SCADA Market

Intensifying geopolitical tensions could have a multifaceted impact on Saudi Arabia Power SCADA Market. Supply chain vulnerabilities, amplified cybersecurity threats, and potential project delays emerge as key concerns. Heightened regional conflicts could trigger restrictive trade policies, inflating the costs associated with importing essential SCADA components. Moreover, geopolitical instability elevates the risk of sophisticated cyberattacks targeting critical power infrastructure, necessitating robust security protocols and stringent compliance measures. Fluctuations in foreign investment and evolving diplomatic relationships may further impede the momentum of power sector automation initiatives. To safeguard market stability and foster continued growth, strategic alliances, the development of localized production capabilities, and a proactive approach to enhancing cybersecurity resilience are paramount.

Competitive Landscape

Saudi Arabia Power SCADA Market is highly fragmented, with numerous players serving the market. Major companies dominating the market include ABB, Siemens, Emerson, Schneider Electric, Rockwell Automation, Saudi Electricity Company, National Grid SA, and AVEVA Group plc. The key marketing strategies adopted by the players are facility expansion, product diversification, alliances, collaborations, partnerships, and acquisitions to expand their customer reach and gain a competitive edge over their competitors in Saudi Arabia Power SCADA Market.

Contact Us:

BlueWeave Consulting & Research Pvt Ltd

+1 866 658 6826 | +1 425 320 4776 | +44 1865 60 0662

0 notes

Text

Curtain Oil Containment Boom Market Growth Analysis, Market Dynamics, Key Players and Innovations, Outlook and Forecast 2025-2032

According to a new report from Intel Market Research, the global curtain oil containment boom market was valued at USD 611 million in 2024 and is projected to reach USD 830 million by 2032, growing at a steady CAGR of 4.6% during the forecast period (2025–2032). This growth is fueled by tightening environmental regulations, increasing offshore drilling activities, and technological advancements in spill containment systems.

📘 Get Full Report Here: Curtain Oil Containment Boom Market - View in Detailed Research Report

What Are Curtain Oil Containment Booms?

Curtain oil containment booms are specialized marine barriers designed to contain and control oil spills through a vertical skirt that extends underwater. Unlike traditional floating booms, these systems provide superior containment in challenging conditions with:

High-strength materials: Typically constructed from PVC or polyurethane with UV stabilization

Modular designs for rapid deployment in emergency situations

Smart sensor integration in advanced models for real-time spill monitoring

The technology has become essential for ports, offshore rigs, and marine terminals where regulatory requirements mandate robust spill response capabilities. Recent innovations by industry leaders like Elastec and Lamor have introduced graphene-enhanced composites that improve durability by 40% compared to conventional materials.

📥 Download Sample Report: Curtain Oil Containment Boom Market - View in Detailed Research Report

Key Market Drivers

1. Stringent Environmental Compliance Requirements

The International Maritime Organization's (IMO) 2023 revisions to spill response regulations have significantly impacted the market. New mandates require:

Real-time monitoring systems at all major ports (100% compliance by 2026 in G7 nations)

Secondary containment for offshore operations under the EU's Marine Strategy Framework Directive

Penalties for non-compliance that have increased 250% since 2015

Annual spending on spill response equipment across North America and Europe now exceeds $3.2 billion, with containment booms representing nearly one-third of this expenditure.

2. Offshore Energy Expansion

The post-pandemic surge in offshore drilling has created unprecedented demand:

487 new offshore rigs deployed in 2023 alone

17% YoY growth in Asia-Pacific deepwater exploration budgets

22% increase in environmental safety allocations by major oil companies since 2020

Curtain booms are particularly favored for deepwater applications, where they demonstrate 92% containment efficiency even in 2.5-meter waves - a critical advantage over traditional solutions.

Market Challenges

Despite strong demand, several factors constrain market growth:

High operational costs: Full deployment systems can exceed $750,000 including specialized vessels

Personnel shortages: 240 hours of training required with a current 28% industry-wide skills gap

Environmental constraints: Deployment limitations in sensitive ecosystems like coral reefs

Technological Breakthroughs

Recent innovations are transforming containment capabilities:TechnologyAdvancementImpactSmart Sensor BoomsIoT-enabled oil thickness monitoringReduces unnecessary deployments by 35%Graphene Composites40% greater tensile strengthExtended service life in harsh conditionsAutonomous Deployment90-second activation systemsCritical for remote offshore locations

These developments are particularly valuable as the industry moves toward integrated spill management ecosystems that combine containment with real-time data analytics.

Regional Market Landscape

North America: Leads in regulatory stringency and technology adoption (38% market share)

Europe: Pioneer in sustainable boom materials and recycling programs

Asia-Pacific: Fastest growing region (7.2% CAGR) driven by port expansions

Emerging markets in Southeast Asia and Africa present significant growth opportunities, though challenges remain around infrastructure and regulatory enforcement.

Competitive Landscape

The market features established players and innovative challengers:

Elastec (U.S.) - Market leader in smart boom technology

Lamor Corporation (Finland) - Specializes in Arctic-grade solutions

Vikoma International (UK) - Leader in port protection systems

Recent strategic moves include Lamor's acquisition of Canadyne to expand Asian manufacturing and Elastec's partnership with Singreat Industry Technology for AI-powered deployment systems.

📘 Get Full Report Here: Curtain Oil Containment Boom Market - View in Detailed Research Report

Visit more reports :

https://intel24.hashnode.dev/physical-document-destruction-service-market-growth-analysis-market-dynamics-key-players-and-innovations-outlook-and-forecast-2025-2032

About Intel Market Research

Intel Market Research is a leading provider of strategic intelligence, offering actionable insights in environmental technologies, energy infrastructure, and industrial safety solutions. Our research capabilities include:

Real-time competitive benchmarking

Global regulatory change tracking

Technology adoption curves

Over 500+ industrial reports annually

Trusted by Fortune 500 companies, our insights empower decision-makers to drive innovation with confidence.

🌐 Website: https://www.intelmarketresearch.com 📞 International: +1 (332) 2424 294 📞 Asia-Pacific: +91 9169164321 🔗 LinkedIn: Follow Us

1 visits · 1 online

Share

Vote: 0 0

0 notes

Text

From Chaos to Control: Organizing Complex Private Debt Deals Through Technology

Managing private debt can feel like trying to untangle a knot in your headphones — the more you pull, the messier it gets. With multiple loan facilities, layered financing structures, and borrower obligations that stretch across several pages, even experienced teams can struggle to keep up. That’s where private debt technology steps in to bring clarity and control.

In today’s world of growing private credit activity, the right tools don’t just help — they’re becoming essential. Let’s explore how technology helps turn a web of private debt deals into a smooth, structured system.

Why Private Debt Gets Complicated So Quickly

Private debt is not a one-size-fits-all market. Loans often come with:

Multiple tranches

Syndicated or club structures

Covenant-heavy documentation

Varied repayment schedules

Multiple borrowers or guarantors

Each layer adds complexity. Manually tracking payment timelines, interest calculations, compliance checks, and drawdowns is time-consuming and error-prone. Missed steps can trigger covenant breaches or regulatory red flags.

Without a centralized way to manage all of this, even the most experienced teams can find themselves buried in spreadsheets, email threads, and outdated reports.

Bringing Order: How Private Debt Technology Changes the Game

Private debt technology acts like a control center — centralizing all loan data, automating routine tasks, and providing real-time visibility across the portfolio. Here’s how it helps:

1. Centralized Deal Structures

A single dashboard provides visibility into every component of a deal: borrowers, lenders, facility terms, repayment dates, and documentation. Whether it’s a senior-secured facility or a mezzanine layer, every detail is stored and accessible in one place.

2. Automated Workflows

Forget the headache of calculating repayment schedules or interest due. The system handles this automatically. It also sends alerts when actions are due, such as upcoming drawdowns, repayments, or financial covenant checks.

3. Integrated Documentation

No more digging through shared drives or inboxes. All facility agreements, amendments, compliance certificates, and notices are attached to each deal record, keeping everything organized and audit-ready.

When Real Estate Debt Gets Involved

The complexity multiplies when deals are linked to commercial real estate debt. These deals often require regular updates on valuations, rent rolls, and debt service coverage ratios.

With private debt technology, lenders can:

Link loan terms to updated property valuations

Track income generated from real estate assets

Monitor borrower compliance with performance covenants

This real-time data keeps lenders confident that the underlying asset continues to support the loan throughout its life cycle.

From Manual Monitoring to Portfolio-Level Insights

Tracking one loan manually may be manageable. But what happens when you have 50 loans across different borrowers and geographies?

That’s where private credit portfolio management features come in. The software doesn’t just manage loans — it helps you understand how they work together. You can monitor:

Total exposure by sector, borrower, or region

Weighted average interest rates and maturities

Compliance status across the entire book

Risk concentration alerts

This overview allows credit managers to quickly adjust strategies, reallocate resources, or prepare for potential risks.

Supporting Fund-Level Oversight and Reporting

Technology also bridges the gap between loan-level detail and fund-level oversight. By integrating with fund finance portfolio management software, firms can:

Align loan cash flows with fund liquidity timelines

Track capital call facilities and NAV-based lending

Produce automated reports for investors and auditors

This creates a seamless connection between what’s happening in the portfolio and what needs to be communicated to stakeholders.

The Role of Asset-Based Finance in Complex Deals

In layered debt structures, asset-based finance often plays a foundational role. Loans might be secured by receivables, inventory, or machinery.

With private debt technology:

Collateral values can be monitored in real time

Borrowing base certificates can be auto-calculated

Alerts can trigger when advance rates are exceeded

By connecting these moving parts, lenders stay protected and borrowers gain trust from smooth, compliant processes.

How It Feels in Everyday Work

Let’s be real — what matters most is how this makes life easier. Here's how it shows up in daily work:

You walk into a Monday morning review call with a borrower and already have a full dashboard of their performance, covenant status, and pending repayments.

An audit request lands in your inbox, and instead of scrambling, you export a pre-prepared report from the system.

A borrower wants to restructure a facility, and within minutes, you simulate different repayment structures and view their impact on the portfolio.

The difference? You're no longer reactive. You’re in control.

Wrapping Up: Bringing Clarity to Complex Lending

Private debt isn’t getting any simpler. With more capital flowing into complex structures and layered facilities, staying organized is more important than ever.

Private debt technology empowers lenders, asset managers, and fund administrators to manage this complexity confidently. From organizing layered loan structures to providing real-time reporting, it turns chaos into clarity — and workdays into wins.

FAQs

1. What is private debt technology?Private debt technology is a system designed to help lenders and asset managers manage complex loan structures, monitor performance, and automate tasks like repayments, compliance, and documentation.

2. Can this technology support commercial real estate debt?Yes, it tracks property values, rental income, and financial ratios essential for managing commercial real estate debt.

3. How does this improve portfolio management?It provides real-time insights across all loans, highlighting risks, performance, and exposure — helping credit teams make better decisions.

4. Can it handle asset-based finance?Absolutely. The system monitors collateral values, borrowing bases, and triggers alerts for breaches or fluctuations.

5. How does this help with fund-level reporting?It integrates with fund finance portfolio management software, linking loan-level data to fund performance and improving transparency for investors.

0 notes

Text

Oil and Gas Data Management Market Redefining Efficiency in Exploration and Drilling

The Oil and Gas Data Management Market was valued at USD 26.9 billion in 2023 and is expected to reach USD 91.4 billion by 2032, growing at a CAGR of 14.59% from 2024-2032.

Oil and Gas Data Management Market is undergoing significant transformation as companies across the upstream, midstream, and downstream sectors embrace digital solutions to improve operational efficiency. As data volumes surge from exploration activities, IoT sensors, and remote operations, energy firms are prioritizing robust data management systems for real-time decision-making and compliance.

U.S. Drives Adoption with Real-Time Analytics and Cloud Integration

Oil and Gas Data Management Market is being reshaped by the demand for scalable, secure, and integrated platforms that can handle complex geological, geophysical, and production data. With growing environmental regulations and shifting energy dynamics, data has become a key asset in managing costs, risks, and sustainability across global operations.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/6713

Market Keyplayers:

Schlumberger – Techlog

Halliburton – Landmark

Baker Hughes – JewelSuite

IBM – IBM Maximo

Oracle – Oracle Oil & Gas Solutions

SAP SE – SAP Oil & Gas Suite

Honeywell – Honeywell Forge

AVEVA Group – AVEVA Unified Operations Center

Cognite – Cognite Data Fusion

Merrick Systems – Merrick Production Manager

TIBCO Software – TIBCO Spotfire

Seeq Corporation – Seeq Workbench

Quorum Software – Quorum Energy Suite

CGG – GeoSoftware

Kongsberg Gruppen – Kognifai

Market Analysis

The market is being propelled by the increasing need for structured data integration, improved asset performance, and predictive maintenance in the oil and gas industry. In the U.S., companies are rapidly digitizing their workflows, enabling better data sharing and automation across departments. Meanwhile, European firms are focusing on data-driven sustainability and regulatory reporting. The competitive landscape is also witnessing increased investments in AI-powered analytics, digital twins, and cloud-based platforms.

Market Trends

Surge in adoption of cloud-based E&P (exploration & production) data platforms

Integration of AI and machine learning for reservoir modeling and risk prediction

Emphasis on cybersecurity to safeguard critical operational data

Real-time data streaming from offshore rigs and pipelines

Use of digital twins to simulate and optimize asset performance

Data governance tools to meet ESG and regulatory standards

Collaboration platforms for seamless data sharing across geographies

Market Scope

With exploration becoming more complex and energy markets more volatile, the Oil and Gas Data Management Market is emerging as a cornerstone of digital transformation. Companies seek end-to-end solutions that deliver insights across the lifecycle—from drilling to refining.

Centralized data hubs for upstream and downstream operations

Workflow automation for seismic and subsurface data

Scalable data lakes supporting real-time analytics

Vendor-neutral platforms for system interoperability

Advanced visualization tools for strategic planning

Modular architecture to support hybrid cloud environments

Forecast Outlook

The Oil and Gas Data Management Market is expected to accelerate in the coming years, fueled by growing investments in digital infrastructure and the need for enhanced operational visibility. As energy firms across the U.S. and Europe seek to optimize production, reduce downtime, and drive sustainability, data will remain central to innovation. The future lies in smart, connected platforms capable of delivering accurate insights and adapting to evolving industry demands.

Access Complete Report: https://www.snsinsider.com/reports/oil-and-gas-data-management-market-6713

Conclusion

In a sector where milliseconds matter and decisions are billion-dollar bets, the Oil and Gas Data Management Market is setting the foundation for a smarter, safer, and more sustainable energy future. As the industry navigates its digital evolution, companies that prioritize data as a strategic asset will lead the charge—minimizing risks, maximizing returns, and future-proofing operations across continents.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Related Reports:

U.S.A Media Asset Management Market fuels innovation in broadcast, OTT, and enterprise media systems

USA brands are investing heavily in Loyalty Management Market to boost customer retention and engagement

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Mail us: [email protected]

0 notes

Text

2025's Must-Have Tech: Choosing the Right Edge Development Platform

A traditional cloud-based solution is no longer adequate for industrial applications. Modern organizations create large volumes of data from IoT devices, remote operations, and real-time apps, but transmitting it all to the cloud is sluggish, costly, inefficient, and hurts your bottom line. The solution: edge computing.

Edge development platforms leverage globally distributed infrastructure and provide computation and developer services to create and run apps closer to end consumers. These systems are based on geographically scattered points of presence (PoPs) linked by a global network backbone. These PoPs function as tiny data centers situated within 20 milliseconds of major metropolitan regions, significantly lowering network latency associated with performing workloads off-device.

This requirement is even more acute for industrial enterprises that manage capital-intensive assets such as offshore vessel fleets, drilling platforms, and solar and wind farms. Edge computing is becoming essential as data becomes more significant.

In this blog, we'll look at the best edge development platforms that will lead the charge in 2025. You'll discover how they help organizations analyze data, acquire insights, and maintain control as they move from the edge to the cloud and back.

Download the sample report of Market Share: https://qksgroup.com/download-sample-form/market-share-edge-development-platforms-2023-worldwide-7673

What is Edge Development Platform?

QKS Group defines an Edge Development Platform is a comprehensive platform that facilitates the creation, deployment, and management of applications that can be distributed across the edge locations. The term "edge" in the context of an edge development platform denotes computing resources situated in closer proximity to the data source or end-users, which could include IoT devices, edge servers, or remote locations, in contrast to centralized data centers. Edge Development Platform enables organizations to deliver responsive, data-intensive services in diverse sectors such as IoT (Internet of Things), industrial automation, content delivery, application development, autonomous vehicles, and smart cities, all while optimizing network bandwidth and improving user experiences.

Importance of Edge Development Platform in 2025

Edge development platforms are becoming increasingly important as the number of connected devices and AI-powered apps grows. As enterprises transition to decentralized data processing, edge technologies provide new levels of efficiency.

Data Decentralization

For many years, cloud computing dominated IT infrastructure. Businesses are evolving toward a more scattered approach. QKS Group anticipates that by 2025, more than half of corporate data will be created and handled outside traditional data centers. This change enables firms to process data locally, which improves performance and lowers costs.

IoT Growth

The number of IoT devices is growing. By 2025, linked IoT devices worldwide are expected to generate data. Processing this amount on the cloud would result in bottlenecks and increased expenses. Edge computing guarantees that only critical data is transferred to centralized systems, increasing efficiency and lowering network load.

Lower Costs and Reduced Latency

Businesses using cloud computing must send massive volumes of data, which raises bandwidth costs and slows response times. Edge computing reduces expenses by processing crucial data locally. Real-time insights assist industries such as healthcare, banking, and manufacturing by allowing them to respond quickly and save operating costs.

Driving the Future of AI and Automation

Edge computing is critical to AI, robots, self-driving cars, and 5G networks. These technologies require immediate data processing, which centralized cloud architectures cannot often supply. Processing data at the edge enables organizations to increase reaction times and unlock new automation possibilities.

Download the sample report of Market Forecast: https://qksgroup.com/download-sample-form/market-forecast-edge-development-platforms-2024-2028-worldwide-7663

Top Edge Development Platform

Akamai

Akamai powers and safeguards life online. Akamai is chosen by leading enterprises across the world to design, distribute, and protect their digital experiences, assisting billions of people in their daily lives, work, and play. Akamai Connected Cloud, a distributed edge and cloud platform, brings apps and experiences closer to consumers while keeping dangers away.

Cloudflare

Cloudflare is a well-known cloud services company that has garnered substantial popularity among Fortune 1000 firms due to its extensive edge computing capabilities. The company's edge computing solutions are intended to provide a smooth and secure digital experience to organizations and their consumers, independent of location or device.

Cloudflare's edge computing platform encompasses both edge and core infrastructure, enabling businesses to optimise performance, enhance security, and gain real-time insights across their entire IT ecosystem.

Fastly

Fastly is a firm that focuses on building edge cloud platforms. This platform aims to improve the efficacy and strength of websites and applications. This platform's notable users include social networking, e-commerce, news media, and gaming websites. Fastly's platform attempts to help enhance online and app speed.

How to Choose the Best Edge Computing Platform?

There is no definitive answer as to whether any edge development platforms on this list are ideal for your individual needs. As with many things in life, it all depends on the circumstances.

There are some factors you should take into consideration when picking your next industrial edge computing platform:

Does it offer out-of-the-box industrial protocol integrations?

What level of support and training do you get from the software vendor?

How does the platform secure and encrypt your data?

Does it ensure that you’re compliant with all relevant regulations in your sector?

Is the platform set up for future success, i.e. will it support future scale?

An Edge Development Platform is an all-encompassing system designed to support the creation, deployment, and management of applications across distributed edge locations. Here, "edge" refers to computing resources positioned close to data sources or end-users—such as IoT devices, edge servers, or remote sites—rather than centralized data centers.

This platform enables organizations to deliver responsive, data-intensive services in sectors like IoT, industrial automation, content delivery, application development, autonomous vehicles, and smart cities, all while optimizing network bandwidth and enhancing user experiences. According to QKS Group's Market Share: Edge Development Platforms, 2023, Worldwide report, the demand for such platforms has seen substantial growth, reflecting a clear shift from traditional cloud models to distributed computing. Furthermore, the QKS Group's Market Forecast: Edge Development Platforms, 2024–2028, Worldwide projects continued acceleration, driven by the proliferation of connected devices and increasing need for real-time data processing across industrial and urban ecosystems.

Conclusion

As industrial operations become increasingly data-driven and decentralized, traditional cloud infrastructure alone can no longer meet performance, cost, and latency demands. Edge development platforms offer a scalable, responsive, and efficient solution by bringing computation closer to the data source. With rising adoption across sectors and strong market momentum—as highlighted in QKS Group's Market Share: Edge Development Platforms, 2023 and Market Forecast: 2024–2028 reports—edge computing is not just the future; it's a present-day imperative. Choosing the right edge platform today can set your business up for agility, insight, and sustained competitive advantage in 2025 and beyond.

Related Reports –

https://qksgroup.com/market-research/market-forecast-edge-development-platforms-2024-2028-western-europe-7672

https://qksgroup.com/market-research/market-share-edge-development-platforms-2023-western-europe-7682

https://qksgroup.com/market-research/market-forecast-edge-development-platforms-2024-2028-usa-7671

https://qksgroup.com/market-research/market-share-edge-development-platforms-2023-usa-7681

https://qksgroup.com/market-research/market-forecast-edge-development-platforms-2024-2028-middle-east-and-africa-7670

https://qksgroup.com/market-research/market-share-edge-development-platforms-2023-middle-east-and-africa-7680

https://qksgroup.com/market-research/market-forecast-edge-development-platforms-2024-2028-china-7667

https://qksgroup.com/market-research/market-share-edge-development-platforms-2023-china-7677

https://qksgroup.com/market-research/market-forecast-edge-development-platforms-2024-2028-asia-excluding-japan-and-china-7664

https://qksgroup.com/market-research/market-share-edge-development-platforms-2023-asia-excluding-japan-and-china-7674

0 notes

Text

Oilfield Services Market Emerging Trends Driving Growth and Innovation Globally

The oilfield services market plays a crucial role in the exploration, development, and production of oil and gas resources worldwide. As the energy sector evolves, the oilfield services industry is undergoing significant transformations driven by technological advancements, changing energy policies, and shifting market dynamics. Emerging trends within this sector are reshaping operations, improving efficiency, and enabling companies to adapt to increasingly complex demands. This article explores the key emerging trends shaping the oilfield services market, highlighting the factors driving growth and innovation.

Growing Adoption of Digital Technologies

One of the most impactful trends in the oilfield services market is the rapid adoption of digital technologies. The integration of data analytics, artificial intelligence (AI), machine learning, and Internet of Things (IoT) devices has revolutionized how oilfield operations are conducted. These technologies enable real-time monitoring of equipment, predictive maintenance, and optimization of production processes, leading to reduced downtime and operational costs.

Digital twin technology, which creates virtual replicas of physical assets, is gaining traction for improving decision-making and risk management. By simulating different scenarios, operators can foresee potential failures and optimize maintenance schedules. The growing use of cloud computing also supports seamless data sharing and collaboration across geographically dispersed teams.

Increasing Focus on Automation and Robotics

Automation is another vital trend reshaping the oilfield services market. With the rising complexity of oilfield operations and the need to reduce human exposure to hazardous environments, automation and robotics are becoming essential. Automated drilling systems, robotic inspection tools, and remotely operated vehicles (ROVs) are increasingly deployed to enhance safety, accuracy, and efficiency.

The use of drones for pipeline inspection and environmental monitoring is expanding rapidly. These unmanned aerial vehicles can cover large areas quickly and provide high-resolution imaging, enabling early detection of leaks or structural issues. Automation not only improves operational efficiency but also helps companies comply with stringent safety and environmental regulations.

Shift Towards Sustainable and Environmentally Friendly Practices

Environmental concerns and stricter regulations are driving the oilfield services market toward more sustainable practices. Service providers are adopting greener technologies and solutions that minimize environmental impact. This includes the use of biodegradable drilling fluids, advanced waste management systems, and technologies designed to reduce methane emissions.

Carbon capture and storage (CCS) technologies are being integrated into oilfield operations to curb greenhouse gas emissions. Additionally, there is a growing emphasis on energy-efficient equipment and processes to reduce the carbon footprint of exploration and production activities.

Expansion of Unconventional Oil and Gas Resource Development

The development of unconventional oil and gas resources, such as shale gas and tight oil, is significantly influencing the oilfield services market. Hydraulic fracturing and horizontal drilling technologies have unlocked vast reserves previously considered uneconomical. This has created new opportunities for oilfield service companies specializing in these techniques.

Service providers are investing in advanced fracturing fluids, proppants, and equipment to improve the efficiency and environmental safety of unconventional resource extraction. The growth of unconventional plays is also driving demand for specialized drilling rigs, well completion services, and reservoir stimulation technologies.

Increasing Demand for Enhanced Oil Recovery (EOR) Techniques

With conventional oil reserves depleting in mature fields, enhanced oil recovery (EOR) methods are becoming increasingly important. EOR techniques, such as chemical flooding, gas injection, and thermal recovery, help increase the amount of oil that can be extracted from a reservoir.

Oilfield service companies are focusing on developing innovative EOR solutions that are cost-effective and environmentally sustainable. Advances in polymer technology, surfactants, and microbial EOR are helping operators maximize recovery while minimizing environmental impact. The growing importance of EOR is driving investments in research and development within the sector.

Rising Importance of Data Security and Cybersecurity

As the oilfield services market becomes more digitized, data security and cybersecurity have emerged as critical concerns. The integration of connected devices and cloud-based platforms increases vulnerability to cyberattacks, which can disrupt operations and compromise sensitive data.

Companies are investing heavily in cybersecurity measures to safeguard their infrastructure and information. This includes the implementation of advanced encryption, network security protocols, and real-time threat detection systems. Ensuring robust cybersecurity is essential for maintaining operational continuity and protecting proprietary information.

Growth of Integrated Service Models

There is a growing trend toward integrated service models, where oilfield service providers offer comprehensive solutions covering multiple aspects of the oil and gas value chain. This shift aims to simplify procurement, improve coordination, and reduce costs for operators.

Integrated service providers deliver drilling, completion, production optimization, and maintenance services under a single contract, enhancing operational efficiency. Such models also foster closer collaboration between service companies and operators, enabling more tailored solutions that meet specific project requirements.

Impact of Geopolitical and Economic Factors

Geopolitical developments and economic fluctuations continue to influence the oilfield services market. Changes in oil prices, regulatory policies, and international trade relations affect investment decisions and project timelines.

Service companies are adapting by focusing on operational flexibility and cost control. Diversifying service offerings and expanding into emerging markets help mitigate risks associated with geopolitical uncertainties. The market’s ability to respond to these external factors is crucial for sustained growth.

Conclusion

The oilfield services market is at a pivotal point, driven by emerging trends that emphasize digital transformation, automation, sustainability, and innovation. The integration of advanced technologies and environmentally responsible practices is enhancing operational efficiency and safety while addressing global energy challenges. As unconventional resource development and enhanced oil recovery gain prominence, service providers must continuously evolve their offerings to remain competitive.

With cybersecurity, integrated service models, and geopolitical considerations shaping the landscape, the oilfield services market is poised for dynamic growth. Companies that embrace these emerging trends and invest in cutting-edge solutions will be best positioned to thrive in the evolving energy sector.

0 notes

Text

Secure and Compliant Healthcare Data Management with MediBest Hospital Management System Software

Healthcare now tops every industry for breach costs, averaging US $4.88 million per incident in 2024—a 15 % jump in just two years. At the same time, the U.S. Office for Civil Rights has logged more than 374,000 HIPAA complaints since 2003, underscoring regulators’ growing vigilance. A recent HIMSS survey found that 59 % of providers experienced a significant cybersecurity event in the past year, and most plan to increase budgets for data protection.

Modern hospitals therefore need more than firewalls; they require a fully integrated healthcare management system software that embeds security and compliance into every workflow.

How MediBest Builds a Defense-in-Depth Architecture

MediBest—an industry-trusted hospital software company—fortifies its cloud-native platform with multiple protective layers that work together to keep patient data safe.

End-to-end encryption (TLS 1.3 in transit, AES-256 at rest)

Zero-trust access controls with MFA and role-based privileges

Continuous threat monitoring powered by AI anomaly detection

Immutable audit logs for every clinical, financial, and admin action

Automated backups and geo-redundant disaster recovery

Because all modules share a single database, these safeguards apply consistently across EHR, billing, radiology, HR, and inventory—eliminating gaps common in bolt-on tools.

Compliance by Design: Meeting HIPAA, GDPR, and NABH

MediBest’s healthcare management system ships with pre-configured compliance templates and rule engines to streamline statutory reporting:

HIPAA & HITECH: automatic PHI tagging, breach-alert workflows, and encryption keys managed in certified data centers.

GDPR: data-subject-access request (DSAR) dashboards and right-to-erasure controls.

NABH & NABL: clinical quality and infection-control reports generated in one click.

Configurable policy packs let hospitals adapt settings to local regulations without costly code changes. Google my Business :

Business Benefits of Secure, Unified Data Governance

Reduced legal and financial risk: proactive safeguards lower the likelihood of fines and lawsuits.

Operational efficiency: single-source data eliminates duplicate entry, cutting admin time by up to 30 %.

Higher patient trust: visible security measures and transparent consent management improve satisfaction scores.

Stronger brand reputation: demonstrating best-practice cybersecurity differentiates your facility in competitive markets.

Fast, Low-Friction Implementation with MediBest

Assessment & gap analysis to map current vulnerabilities.

Phased rollout starting with high-risk modules such as billing and EHR.

Staff training on secure workflows and incident-response drills.

Quarterly security audits and penetration tests included in the support plan.

This structured approach lets hospitals deploy robust protection without disrupting day-to-day care. Click Here :

Frequently Asked Questions

1. What makes hospital management system software “secure”? It combines strong encryption, least-privilege access, continuous monitoring, and compliant audit trails inside one unified platform—protecting data at every step from admission to discharge.

2. Can cloud-based healthcare management systems meet HIPAA requirements? Yes. When hosted in certified data centers with encrypted storage, MFA, and documented BAAs, cloud systems can exceed on-premise security while providing better scalability and uptime.

3. How does MediBest simplify compliance reporting? Built-in templates for HIPAA, GDPR, and NABH pull real-time data from every module, auto-populate regulatory forms, and schedule submissions—cutting report prep from days to minutes.

MEDIBEST :- CONTANT NOW :- Corporate Office 303, IT Park Center, IT Park Sinhasa Indore, Madhya Pradesh, 452013 Call Now +91 79098 11515 +91 97139 01529 +91 91713 41515 Email [email protected] [email protected]

0 notes

Text

Refinery Catalyst Market Outlook 2025–2031: Global Industry Trends & Forecast

"