#Oil and Gas Data Management Market

Explore tagged Tumblr posts

Text

Oil and Gas Data Management Market Redefining Efficiency in Exploration and Drilling

The Oil and Gas Data Management Market was valued at USD 26.9 billion in 2023 and is expected to reach USD 91.4 billion by 2032, growing at a CAGR of 14.59% from 2024-2032.

Oil and Gas Data Management Market is undergoing significant transformation as companies across the upstream, midstream, and downstream sectors embrace digital solutions to improve operational efficiency. As data volumes surge from exploration activities, IoT sensors, and remote operations, energy firms are prioritizing robust data management systems for real-time decision-making and compliance.

U.S. Drives Adoption with Real-Time Analytics and Cloud Integration

Oil and Gas Data Management Market is being reshaped by the demand for scalable, secure, and integrated platforms that can handle complex geological, geophysical, and production data. With growing environmental regulations and shifting energy dynamics, data has become a key asset in managing costs, risks, and sustainability across global operations.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/6713

Market Keyplayers:

Schlumberger – Techlog

Halliburton – Landmark

Baker Hughes – JewelSuite

IBM – IBM Maximo

Oracle – Oracle Oil & Gas Solutions

SAP SE – SAP Oil & Gas Suite

Honeywell – Honeywell Forge

AVEVA Group – AVEVA Unified Operations Center

Cognite – Cognite Data Fusion

Merrick Systems – Merrick Production Manager

TIBCO Software – TIBCO Spotfire

Seeq Corporation – Seeq Workbench

Quorum Software – Quorum Energy Suite

CGG – GeoSoftware

Kongsberg Gruppen – Kognifai

Market Analysis

The market is being propelled by the increasing need for structured data integration, improved asset performance, and predictive maintenance in the oil and gas industry. In the U.S., companies are rapidly digitizing their workflows, enabling better data sharing and automation across departments. Meanwhile, European firms are focusing on data-driven sustainability and regulatory reporting. The competitive landscape is also witnessing increased investments in AI-powered analytics, digital twins, and cloud-based platforms.

Market Trends

Surge in adoption of cloud-based E&P (exploration & production) data platforms

Integration of AI and machine learning for reservoir modeling and risk prediction

Emphasis on cybersecurity to safeguard critical operational data

Real-time data streaming from offshore rigs and pipelines

Use of digital twins to simulate and optimize asset performance

Data governance tools to meet ESG and regulatory standards

Collaboration platforms for seamless data sharing across geographies

Market Scope

With exploration becoming more complex and energy markets more volatile, the Oil and Gas Data Management Market is emerging as a cornerstone of digital transformation. Companies seek end-to-end solutions that deliver insights across the lifecycle—from drilling to refining.

Centralized data hubs for upstream and downstream operations

Workflow automation for seismic and subsurface data

Scalable data lakes supporting real-time analytics

Vendor-neutral platforms for system interoperability

Advanced visualization tools for strategic planning

Modular architecture to support hybrid cloud environments

Forecast Outlook

The Oil and Gas Data Management Market is expected to accelerate in the coming years, fueled by growing investments in digital infrastructure and the need for enhanced operational visibility. As energy firms across the U.S. and Europe seek to optimize production, reduce downtime, and drive sustainability, data will remain central to innovation. The future lies in smart, connected platforms capable of delivering accurate insights and adapting to evolving industry demands.

Access Complete Report: https://www.snsinsider.com/reports/oil-and-gas-data-management-market-6713

Conclusion

In a sector where milliseconds matter and decisions are billion-dollar bets, the Oil and Gas Data Management Market is setting the foundation for a smarter, safer, and more sustainable energy future. As the industry navigates its digital evolution, companies that prioritize data as a strategic asset will lead the charge—minimizing risks, maximizing returns, and future-proofing operations across continents.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Related Reports:

U.S.A Media Asset Management Market fuels innovation in broadcast, OTT, and enterprise media systems

USA brands are investing heavily in Loyalty Management Market to boost customer retention and engagement

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Mail us: [email protected]

0 notes

Text

Occupations Signified by each Planet 👩🏻💻💼💰💸

Sun: Politics, entertainers, military and army commanders, directors, Government officials, public servants, ministers, Prime Ministers, Presidents, Governors.

Moon: Nursing, babysitters, chefs, coast guard, navy, real estate agents, kindergarten teachers, import export, restaurants, clothing, grocery shop.

Mars: Dentist, surgeon, butcher, real estate builders, mechanical/civil engineers, cooks, bodyguards, army, military, airforce, chemists, mechanics, hair cutters, fabrication, marital arts, firefighters, masseuses.

Mercury: Accountants, bookkeepers, data analyst, all types of data work, teachers (especially school), consultants, writers, businessmen, traders, astrologers, speech therapist, language translators, bankers, media personnel, journalist, social media manager, mathematicians, computer operators, customer support, lawyers, coders, programmers, minister.

Jupiter: Lawyers, judge, priest, mentors, advisors, coach, sports coaches, teachers, professors (college level), financial consultants, legal counsel, travel agent, preachers, spiritual teachers, Gurus.

Venus: Artist, movie stars, celebrity, musicians, dancers, singers, jewelers, luxury car dealers, sweet shops, marriage counselor, interior designers, fashion designers, textiles, perfume dealers, air hostess, sex workers, makeup artist, brokers, painters, designers, holiday or vacation agents, ambassadors.

Saturn: Manual jobs, masonry, carpenter, iron or steel worker, geologist, servants, oil and gas worker, executioner, mortician, social service, gardener.

Rahu: Technology, programmers, scientist, nuclear management, toxic chemicals, anesthesia, visa agents, advertising, online jobs, online marketing, drug specialists, alcolol dealers, smartphone service.

Ketu: Astrologers, psychics, monks, nuns, medical workers, doctors, pin hole surgeons, charity, social service, mathematicians, clock and watch makers, black magicians.

For Readings DM

#astrology#astrology observations#zodiac#zodiac signs#astro community#astro observations#vedic astrology#astro notes#vedic astro notes#astrology community#career astrology#10th house

889 notes

·

View notes

Text

Now that Donald Trump is returning to a second term as U.S. president, ascertaining the true state of Russia’s war economy is more important than ever. Trump’s advisors believe that Ukraine must settle for peace by whatever means necessary “to stop the killing.” Implicit in this argument is the view that Russia has the ability to sustain the war for many years to come. On close examination of the evidence, however, the narrative that Russia has the resources to prevail if it so chooses does not hold.

The apparent resilience of the Russian economy has confounded many strategists who expected Western sanctions to paralyze Moscow’s war effort against Ukraine. Russia continues to export vast quantities of oil, gas, and other commodities—the result of sanctions evasion and loopholes deliberately designed by Western policymakers to keep Russian resources on world markets. So far, clever macroeconomic management, particularly by Russian Central Bank Governor Elvira Nabiullina, has enabled the Kremlin to keep the Russian financial system in relative health.

At first glance, the numbers look surprisingly strong. In 2023, GDP grew by 3.6 percent and is expected to rise by 3.9 percent in 2024. Unemployment has fallen from around 4.4 percent before the war to 2.4 percent in September. Moscow has expanded its armed forces and defense production, adding more than 500,000 workers to the defense industry, approximately 180,000 to the armed forces, and many thousands more to paramilitary and private military organizations. Russia has reportedly tripled its production of artillery shells to 3 million per year and is manufacturing glide bombs and drones at scale.

Despite these accomplishments, Russia’s war economy is heading toward an impasse. Signs that the official data masks severe economic strains brought on by both war and sanctions have become increasingly apparent. No matter how many workers it tries to shift to the defense industry, the Kremlin cannot expand production fast enough to replace weapons at the rate they are being lost on the battlefield. Already, about around half of all artillery shells used by Russia in Ukraine are from North Korean stocks. At some point in the second half of 2025, Russia will face severe shortages in several categories of weapons.

Perhaps foremost among Russia’s arms bottlenecks is its inability to replace large-caliber cannons. According to open-source researchers using video documentation, Russia has been losing more than 100 tanks and roughly 220 artillery pieces per month on average. Producing tank and artillery barrels requires rotary forges—massive pieces of engineering weighing 20 to 30 tons each—that can each produce only about 10 barrels a month. Russia only possesses two such forges.

In other words, Russia is losing around 320 tank and artillery cannon barrels a month and producing only 20. The Russian engineering industry lacks the skills to build rotary forges; in fact, the world market is dominated by a single Austrian company, GFM. Russia is unlikely to acquire more forges and increase its production rate, and neither North Korea nor Iran have significant stockpiles of suitable replacement barrels. Only a decision by China to provide barrels from its own stockpiles could stave off Russia’s barrel crisis.

To resupply its forces, Russia has been stripping tank and artillery barrels from the vast stockpiles it inherited from the Soviet Union. But these stockpiles have withered since the start of the war. Combining current rates of battlefield loss, recycling from stockpiles, and production, Russia looks set to run out of cannon barrels some time in 2025.

Russia is consuming other weapons, too, at rates far faster than its ability to produce them. Open-source researchers have counted the loss of at least 4,955 infantry fighting vehicles since the war’s onset, which comes out to an average of 155 per month. Russian defense contractors can produce an estimated 200 per year, or about 17 per month, to offset these losses. Likewise, even Russia’s expanded production of 3 million artillery shells per year pales in comparison to the various estimates for current consumption at the front. While those estimates are lower than the 12 million rounds Russian forces fired in 2022, they are much higher than what Russian industry can produce.

We do not know when Russia will hit the end of the road with each equipment type. But there is little the Kremlin can do little to stave off that day. With the Russian economy essentially at full employment, Russian defense companies now struggle to attract workers. To make matters worse, these companies are competing for the same personnel as the Russian armed forces, which need to recruit 30,000 fresh troops each month to replace casualties. To this end, the military is offering lavish signing bonuses and greatly increased pay. Defense producers, in turn, have had to increase wages fivefold, contributing to an inflation rate that reached 8.68 percent in October.

Paradoxically, the same factors that are converging to restrict Russia’s ability to wage war also mean that it cannot easily make peace.

Russia’s economic performance—marked by low unemployment and rising wages—is a product of military Keynesianism. In other words: Vast military expenditures, which are unsustainable in the long term, are artificially boosting employment and growth. Almost all the new jobs are related to the military and produce little of value to the civilian economy, where most sectors have great difficulty finding workers.

Defense spending has officially jumped to 7 percent of Russia’s GDP and is projected to consume more than 41 percent of the state budget next year. The true magnitude of military expenditures is significantly higher. Russia’s nearly 560,000 armed internal security troops, many of which have been deployed to occupied Ukraine, are funded outside the defense budget—as are the private military companies that have sprouted across Russia.

Paring back these massive defense expenditures, however, will inevitably produce an economic downturn. If the Kremlin draws down the armed forces to a sustainable level, large numbers of traumatized veterans and well-paid defense workers will find themselves redundant. The experience of other societies—in particular, European states after World War I—suggests that hordes of demobilized soldiers and jobless defense workers are a recipe for political instability.

The magnitude of the post-war Russian recession will be all the worse because Russia’s civilian economy—particularly small- and medium-sized firms—has shrunk due to the war. In a phenomenon familiar to economists, high defense expenditures have bid up salaries and attracted labor away from nondefense firms. The Russian Central Bank’s policy of raising interest rates, which currently stand at 21 percent, has made it much more difficult for nondefense companies to raise capital through loans. In post-war Russia, a shrunken civilian sector will not be able to absorb the soldiers and workers cast off by the military and defense sector.

Therefore, Russia’s leaders face an unenviable set of dilemmas entirely of their own making. Russia cannot continue waging the current war beyond late 2025, when it will begin running out of key weapons systems.

Concluding a peace agreement, however, poses a different set of problems, as the Kremlin needs to choose between three unpalatable options. If it draws down the armed forces and defense industries, it will spark a recession that could threaten the regime. If Russian policymakers instead maintain high levels of defense spending and a bloated peacetime military, it will asphyxiate the Russian economy, crowding out civilian industry, and stifle growth. Having experienced the Soviet Union’s decline and fall for similar economic reasons, Russian leaders will probably seek to avoid this fate.

A third option, however, is available and likely beguiling: Rather than demobilizing or bankrupting themselves, Russian leaders could instead use their military to obtain the economic resources needed to sustain it—in other words, using conquest and the threat thereof to pay for the military.

Plenty of precedents exist. In 1803, French Emperor Napoleon Bonaparte ended 14 months of peace in Europe because he could not afford to fund his military based on French revenues alone—and he also refused to demobilize it. In 1990, Iraqi leader Saddam Hussein similarly invaded oil-rich Kuwait because he could not afford to pay the million-man army that he refused to downsize. In both cases, the mirage of conquest seemed attractive for sustaining overly large defense establishments without having to pay for them.

Russia could likewise exploit its expanded military to extract rents from other states. Even though Russia is running out of key weapons systems for its all-out war on Ukraine, its forces will still be capable of punctual acts of aggression. Indeed, it’s easy to imagine how Russia might pursue such a policy.

Substantial offshore gas reserves have been discovered in the Black Sea within Ukraine’s and Georgia’s internationally recognized exclusive economic zones (EEZs). Whenever Western states are distracted by other priorities, Russia could also renew its aggression against Ukraine in order to gain control of its agricultural, gas, and rare-earth resources. Finally, Russia might use threats of force rather than actually fighting in order to coerce European states to withdraw sanctions, unfreeze Russian assets, or reopen gas and oil pipelines.

Some important lessons emerge. First, Russia’s economy cannot indefinitely sustain its war against Ukraine. Labor and production bottlenecks will condemn Russia to defeat as long as Ukraine’s allies sustain it beyond the second half of 2025. Contrary to the myth of infinite Russian resources, the Kremlin’s armies are far from unbeatable. But Russia’s defeat demands a level of Western patience and commitment that a combination of vacillating Western leaders and volatile domestic politics renders questionable.

Second, the cessation of full-scale fighting in Ukraine will not end the West’s problems with Russia. Russia’s supersized military sector incentivizes the Kremlin to use its military to extract rents from neighboring states. The alternatives—demobilizing and incurring a recession or indefinitely funding a bloated military and defense industry—pose existential threats to Putin’s regime.

However Russia ends its current war, the country’s economic realities alone will generate new forms of insecurity for Europe. Far-sighted policymakers should focus on mitigating these future threats, even as they focus on how the current round of fighting in Ukraine will end.

13 notes

·

View notes

Text

Revolutionizing the Road: Upcoming Trends in Europe Sustainable Tire Materials Market

The automotive industry is accelerating toward sustainability, with the European Sustainable Tire Materials Market at the forefront of this transition. As environmental concerns and stringent government regulations rise, the focus has shifted to eco-friendly alternatives that minimize carbon footprints while maintaining high performance. This article dives deep into the emerging trends, industry applications, and the competitive edge that sustainable tire materials bring to the table.

Market Overview: A Rapidly Growing Opportunity

The Europe Sustainable Tire Materials Market is poised for substantial growth. According to latest industry research, the market is projected to grow at a compound annual growth rate (CAGR) of 35.05% during 2023-2032, reaching a valuation of approximately $358.5 million by 2032 from $24.0 million in 2023. The surge in demand is driven by the adoption of green mobility solutions and the increasing awareness of environmental sustainability among manufacturers and consumers alike.

Key Trends Shaping the European Market

Rise of Bio-Based Materials:

Tire manufacturers are shifting toward renewable raw materials such as natural rubber, biomass-based fillers, and bio-resins.

Companies like Michelin and Continental are investing heavily in developing tires made from dandelion rubber and other bio-sourced components.

These materials not only reduce dependency on petroleum-based inputs but also cut greenhouse gas emissions during production.

Circular Economy Initiatives:

Recycling and repurposing end-of-life tires have become crucial.

Innovations include devulcanization processes and the use of recycled carbon black and pyrolysis oil in new tire production.

This aligns with European Union policies like the Circular Economy Action Plan, which mandates efficient use of resources and reduced waste.

Adoption of Smart Tires:

Smart tires, integrated with sensors and IoT technologies, are gaining traction.

By combining sustainability with advanced functionality, these tires provide real-time data on wear, pressure, and performance, reducing premature disposal.

Demand from EV Manufacturers:

The electric vehicle (EV) boom has fueled demand for specialized tires that cater to EV-specific needs like lower rolling resistance and durability.

Sustainable materials are being incorporated to ensure that EV tires align with the overall green mobility ethos.

Legislation Driving Sustainability:

Governments across Europe are imposing stricter regulations on carbon emissions and resource efficiency.

These policies are compelling tire manufacturers to innovate and adopt eco-friendly materials.

Request for a sample research report on the Europe Sustainable Tire Materials Market

Key Market Segmentation

Segmentation 1: by Type of Material

Natural Rubber

Recycled Rubber

Sustainable Carbon Black

Silica

Plasticizers

Segmentation 2: by Propulsion Type

Internal Combustion Engine Vehicles

Electric Vehicles

Segmentation 3: by Vehicle Type

Passenger Vehicles

Commercial Vehicles

Electric Vehicles

Segmentation 4: by Country

Germany

France

Italy

Spain

Rest-of-Europe

How Industries Are Leveraging the Trend

Automotive OEMs:

Leading car manufacturers are collaborating with tire companies to develop sustainable tires that enhance vehicle efficiency. Partnerships like those between Bridgestone and EV makers demonstrate the alignment of goals for a greener future.

Logistics and Fleet Management:

Sustainable tires offer reduced rolling resistance, translating to lower fuel consumption and costs.

Companies like DHL are integrating eco-friendly tires into their fleets to meet sustainability targets.

Retail and Distribution Chains:

Tire retailers are capitalizing on the growing consumer demand for green products. Marketing campaigns emphasizing sustainability help these businesses attract eco-conscious customers.

Smart Mobility Solutions:

Firms integrating IoT and AI technologies with sustainable tires are tapping into the dual appeal of innovation and environmental responsibility.

Get more insights on the automotive market research reports.

Competitive Landscape

Major players in the European sustainable tire materials market include:

Michelin: Leading the way with initiatives like tires made from recycled and renewable materials.

Pirelli: Focused on reducing environmental impacts through cutting-edge technologies.

Goodyear: Developing sustainable materials and lightweight tires.

Continental: Pioneering the use of dandelion rubber and recycled PET bottles in production.

These companies are setting benchmarks in innovation, giving them a competitive edge while reshaping the industry.

Future Outlook: A Greener Road Ahead

The European sustainable tire materials market is expected to witness unprecedented growth as industries continue to innovate and adapt to stringent environmental standards. Key drivers include:

Increasing investments in R&D for bio-based materials.

Expanding EV markets demanding specialized, sustainable solutions.

Consumer preference for eco-friendly products and corporate social responsibility initiatives.

Predictions suggest that by 2032, a significant portion of tires in Europe will be composed entirely of renewable or recycled materials, setting a global precedent for sustainable practices.

Conclusion

As Europe's Sustainable Tire Materials Industry accelerates, it is redefining the way industries approach environmental challenges. By embracing bio-based materials, circular economy principles, and advanced technologies, companies are not just keeping pace with trends but also setting new standards in competition. This transformation is more than a response to regulations; it is a commitment to a greener future.

The time to invest in sustainable tire materials is now – and the journey toward revolutionizing mobility has only just begun!

#Europe Sustainable Tire Materials Market#Europe Sustainable Tire Materials Industry#Europe Sustainable Tire Materials Market Research#Europe Sustainable Tire Materials Market Analysis#Europe Sustainable Tire Materials Market Forecast#Europe Sustainable Tire Materials Market Growth#Automotive#BIS Research#Europe Sustainable Tire Materials Market Size

3 notes

·

View notes

Text

Energy Transfer Faces Market Challenges Amidst Growth Plans

Source: Image by MariuszBlach from Getty Images

Stock Performance and Market Reaction

Energy Transfer (ET), a key player in the midstream sector, has experienced a notable downturn in its stock value, witnessing a 16% decline over the past month. This significant drop has led to underperformance compared to the broader midstream Master Limited Partnership (MLP) sector. The primary contributors to this downturn include investor concerns over the company’s aggressive capital expenditure (CapEx) plans and growing uncertainty in the global trade landscape.

ET’s management recently announced a substantial increase in growth CapEx, jumping from $3 billion in 2024 to a projected $5 billion in 2025. While the company maintains that these investments will yield mid-teens rates of return, market analysts remain skeptical about achieving such high profitability. Many investors believe that redirecting funds toward share repurchases or higher distributions, as seen with competitors like MPLX and Plains All American, would have been a more favorable approach.

Additionally, tensions surrounding international trade have further impacted ET’s outlook. The recent trade conflicts between the United States and several major trading partners, with the potential for further escalation, have cast uncertainty over ET’s liquefied natural gas (LNG) export growth. Concerns about a potential economic slowdown are also affecting market sentiment, as reduced industrial demand could lead to lower utilization of ET’s extensive energy infrastructure.

Financial Performance and Strategic Investments

Despite the market concerns, Energy Transfer reported strong financial results for 2024, with a record adjusted EBITDA of $15.5 billion, hitting the upper end of its guidance range. The company remains well-positioned within the industry, with 90% of its projected 2025 adjusted EBITDA derived from fee-based revenue, minimizing exposure to fluctuations in commodity prices.

ET’s financial stability is further supported by a strong balance sheet, with leverage ratios falling within the 4.0x to 4.5x range. The company’s revenue streams are well-diversified, with 20% of EBITDA tied to crude oil, 27% to natural gas liquids (NGL) and refined products, 19% to midstream operations, and 21% to natural gas. The remaining 13% comes from investments in entities such as USA Compression Partners and Sunoco.

The firm’s capital allocation strategy highlights major investments in midstream operations, NGL and refined products, and interstate natural gas transportation. Management has identified key growth areas, including rising production in the Permian Basin, increasing demand for natural gas-powered data centers driven by artificial intelligence (AI) expansion, and heightened global demand for U.S. NGL exports. These strategic initiatives align ET with some of the most prominent growth drivers in the energy sector today.

Valuation and Growth Prospects

Energy Transfer’s management remains optimistic about its investment strategy, expecting strong returns on capital expenditures. The company anticipates an annualized EBITDA growth of approximately 5%, which is expected to support distribution increases within its target range of 3-5% annually. Analysts forecast a compounded annual growth rate (CAGR) of 4.2% in distributions through 2029, underpinned by a 6.7% CAGR in distributable cash flow per unit.

The company’s current valuation appears attractive, offering a 7.6% next-12-month distribution yield and trading at an 8.27x enterprise value-to-EBITDA multiple. Compared to peers such as Enbridge, Enterprise Products Partners, Kinder Morgan, and Targa Resources, ET’s valuation remains relatively modest despite its strong diversification and exposure to high-growth segments like AI-driven natural gas demand and global NGL exports.

While some concerns persist regarding the possibility of an economic downturn, Energy Transfer’s stable cash flow model, largely insulated from commodity price volatility, provides a cushion against market fluctuations. Even if return expectations on growth projects are not fully realized, the firm’s strong yield and growth potential suggest a favorable long-term outlook for investors.

4 notes

·

View notes

Text

Distributed Acoustic Sensing Market to Experience Significant Growth

Distributed Acoustic Sensing Market to Experience Significant Growth

Straits Research has published a comprehensive report on the global Distributed Acoustic Sensing Market, projecting a significant growth rate of 11.58% from 2024 to 2032. The market size is expected to reach USD 1,617.72 million by 2032, up from USD 673.32 million in 2024.

Market Definition

Distributed Acoustic Sensing (DAS) is a cutting-edge technology that enables real-time monitoring of acoustic signals along the entire length of a fiber optic cable. This innovative solution has far-reaching applications across various industries, including oil and gas, power and utility, transportation, security and surveillance, and environmental and infrastructure monitoring.

Request Sapmle Link:https://straitsresearch.com/report/distributed-acoustic-sensing-market/request-sample

Latest Trends

The Distributed Acoustic Sensing Market is driven by several key trends, including:

Increasing demand for real-time monitoring: The need for real-time monitoring and data analysis is on the rise, driven by the growing importance of predictive maintenance, asset optimization, and operational efficiency.

Advancements in fiber optic technology: Advances in fiber optic technology have enabled the development of more sensitive and accurate DAS systems, expanding their range of applications.

Growing adoption in the oil and gas industry: The oil and gas industry is increasingly adopting DAS technology for monitoring and optimizing well operations, reducing costs, and improving safety.

Emerging applications in smart cities and infrastructure monitoring: DAS technology is being explored for various smart city applications, including traffic management, public safety, and infrastructure monitoring.

Key Opportunities

The Distributed Acoustic Sensing Market presents several key opportunities for growth and innovation, including:

Integration with other sensing technologies: The integration of DAS with other sensing technologies, such as seismic and electromagnetic sensing, can enhance its capabilities and expand its range of applications.

Development of advanced data analytics and AI algorithms: The development of advanced data analytics and AI algorithms can help unlock the full potential of DAS technology, enabling more accurate and actionable insights.

Expansion into new markets and industries: The Distributed Acoustic Sensing Market has significant potential for growth in new markets and industries, including renewable energy, transportation, and smart cities.

Key Players

The Distributed Acoustic Sensing Market is characterized by the presence of several key players, including:

Halliburton Co.

Hifi Engineering Inc.

Silixa Ltd.

Schlumberger Limited

Banweaver

Omnisens SA

Future Fibre Technologies Ltd.

Baker Hughes Inc.

Qintiq Group PLC

Fotech Solutions Ltd.

Buy Now:https://straitsresearch.com/buy-now/distributed-acoustic-sensing-market

Market Segmentation

The Distributed Acoustic Sensing Market can be segmented into two main categories:

By Fiber Type: The market can be segmented into single-mode fiber and multimode fiber.

By Vertical: The market can be segmented into oil and gas, power and utility, transportation, security and surveillance, and environmental and infrastructure monitoring.

About Straits Research

Straits Research is a leading provider of business intelligence, specializing in research, analytics, and advisory services. Our team of experts provides in-depth insights and comprehensive reports to help businesses make informed decisions.

#Distributed Acoustic Sensing Market#Distributed Acoustic Sensing Market Share#Distributed Acoustic Sensing Market Size#Distributed Acoustic Sensing Market Research#Distributed Acoustic Sensing Industry

3 notes

·

View notes

Text

Ironically, Exxon is exploding the myth that natural gas is the enemy of the world. However, it also exposes the plan to create a separate power grid that serves only AI data centers; that is, it will not connect to the consumer grid to power homes, businesses, and factories, nor will it lower your power bill.

Exxon owns more the 40,000 producing natural gas wells in America and easily increase production with no other capital investments. Creating off-grid power plants excuses Exxon from the Green Agenda’s lust to cut power to consumers, while participating in the AI craze to take over the world.

Chevron may take the AI challenge with over 13,000 wells across the nation. Overall, there are over 300,000 (estimated) high-producing natural gas well in America. ⁃ Patrick Wood, Editor.

It isn’t just nuclear projects getting in on the “selling power to data centers” trend – now oil supermajor Exxon is joining the trend.

In fact, Exxon is planning a large natural gas-powered plant to supply electricity directly to data centers, incorporating technology to capture over 90% of its carbon emissions, according to the New York Times.

This would be Exxon’s first power plant not dedicated to its own operations. Carbon capture systems remain rare and costly, despite federal subsidies, limiting their broader adoption.

CEO Darren Woods said this week: “There are very few opportunities in the short term to power those data centers and do it in a way that at the same time minimizes, if not completely eliminates, the emissions.”

Exxon exec Dan Ammann added: “We’re being driven by the market demand here. It’s low carbon, it’s available on an accelerated timeline and it avoids all the grid interconnection challenges.”

Tech giants are increasingly willing to pay extra for reliable clean energy, including nuclear power. Here are Zero Hedge we spent most of 2024 documenting numerous tech giants like Google, Meta and Microsoft all inking deals with nuclear power generators to secure data center power in the future.

The New York Times adds that Exxon, having secured land and engaged potential customers, plans to launch its gas-powered plant within five years—faster than building new nuclear reactors.

Uniquely, the plant would operate off-grid, avoiding lengthy grid connection delays. This move highlights how the growth of data centers and AI is transforming the energy sector, pushing Exxon into a business it once avoided.

Chevron could be next, too. Its CEO Mike Wirth predicts off-grid power projects will become more common, and Exxon is exploring similar ventures, aiming to launch a gas-powered plant with carbon capture technology.

Exxon plans to spend $30 billion over six years on emission reduction and alternative energy while expanding oil and gas production. The company sees growing electricity demand from data centers as an opportunity to enter the power business, leveraging its expertise in carbon management and pipeline networks.

Read full story here…

3 notes

·

View notes

Text

How Nigeria’s Upstream Oil & Gas Sector is Adapting to Global Energy Shifts

Nigeria Oil and Gas Upstream Market Overview

Nigeria’s oil and gas upstream activities sector is positioned for robust growth, propelled by major advancements in exploration and production technologies, increasing investment in offshore assets, and supportive government reforms. In 2024, the nigeria oil and gas upstream market was valued at USD 221.4 million and is expected to surpass USD 280.3 million by 2032, growing at a CAGR of around 7%. This momentum reflects Nigeria’s strategic focus on energy security, revenue diversification, and industry modernization.

Request Sample Report PDF (including TOC, Graphs & Tables): https://www.statsandresearch.com/request-sample/40585-nigeria-oil-and-gas-upstream-market-report

Growth Catalysts Driving Upstream Expansion

Technological Breakthroughs in Exploration and Drilling

The integration of advanced technologies such as high-resolution seismic imaging, artificial intelligence-driven reservoir analysis, and next-generation deepwater drilling systems is revolutionizing Nigeria’s upstream sector. These innovations have significantly enhanced the accuracy of subsurface mapping, reduced exploration risks, and increased hydrocarbon recovery rates. Artificial intelligence enables real-time data processing from seismic surveys, while deepwater drilling rigs now operate at unprecedented depths with improved efficiency and safety.

Get up to 30%-40% Discount: https://www.statsandresearch.com/check-discount/40585-nigeria-oil-and-gas-upstream-market-report

Policy Reforms and Government Incentives

Recent regulatory overhauls, particularly through the Petroleum Industry Act (PIA), have improved the investment climate by clarifying fiscal terms, streamlining licensing processes, and promoting transparency. The Nigerian government continues to incentivize upstream participation by reducing bureaucratic bottlenecks and offering favorable tax structures to attract both foreign and indigenous investors. Increased government commitment to infrastructure development and local content policies has further strengthened the nigeria oil and gas upstream market foundation.

Detailed Nigeria Oil and Gas Upstream Market Segmentation:

Activity Type

The upstream sector is divided into exploration, development and production, and decommissioning and abandonment. Among these, development and production dominate the market due to their critical role in oil extraction, well stimulation, and reservoir management. This segment benefits the most from technological integration and field optimization strategies. Exploration activities are also on the rise, supported by new offshore licensing rounds and advanced subsurface mapping tools. Decommissioning, while still emerging, is becoming increasingly relevant due to the aging of certain onshore assets.

Resource Type

Conventional resources currently lead the sector due to established infrastructure and higher output volumes, especially from crude oil fields. However, unconventional resources such as shale oil, tight gas, and coalbed methane are gaining ground, with a projected growth rate exceeding conventional sources. This shift is driven by technological maturity in hydraulic fracturing and horizontal drilling, along with a national push toward energy diversification and sustainability.

Service Type

Drilling services remain at the core of upstream activities, driven by their indispensable role in field development and the expansion of both onshore and offshore drilling programs. Subsurface services are witnessing the fastest growth as operators increasingly focus on reservoir performance, enhanced oil recovery, and advanced logging techniques. Surface services and logistics support play a vital role in maintaining field efficiency and ensuring seamless operations across the supply chain, particularly in challenging offshore environments.

Operational Location

Offshore activities currently generate the largest share of revenue, largely due to the surge in deepwater and ultra-deepwater exploration. These operations are supported by significant investments in floating production systems, subsea infrastructure, and remote monitoring tools. Onshore operations, while traditionally strong, are being revitalized through improved security, community engagement initiatives, and focused development of marginal fields. Both environments continue to benefit from targeted government intervention and global technology partnerships.

Competitive Landscape and Industry Leaders

Nigeria’s upstream sector is moderately consolidated, with the top five players holding over one-third of the market share. Key participants include Nigerian National Petroleum Company Limited (NNPCL), Shell, Chevron, TotalEnergies, and ExxonMobil. These companies are advancing their presence through asset acquisitions, strategic divestitures, and long-term joint ventures.

In January 2024, Shell announced the divestment of its onshore subsidiary SPDC to the Renaissance consortium, aligning with its strategic shift towards deepwater and LNG operations. Meanwhile, NNPCL continues to lead the charge in promoting indigenous participation through capacity building and local joint ventures.

Emerging Opportunities and Nigeria Oil and Gas Upstream Market Trends:

Digitalization and Automation

Digital transformation is reshaping the upstream value chain, with automation, IoT, and machine learning being deployed to optimize operations. Real-time data analytics enhance decision-making in well performance monitoring, predictive maintenance, and field development planning. Cloud-based platforms are enabling remote collaboration and data sharing across geographically dispersed teams, improving operational agility.

Local Content Development

Nigeria is prioritizing local workforce development, manufacturing, and service delivery to build a more resilient energy ecosystem. The Nigerian Content Development and Monitoring Board (NCDMB) is driving initiatives to ensure that a significant portion of upstream project value is retained within the country. Fabrication yards, equipment assembly plants, and training institutions are emerging across regions to support this goal.

Energy Transition and ESG Compliance

As global stakeholders demand lower carbon footprints, Nigeria’s upstream sector is embracing environmental, social, and governance (ESG) principles. Operators are deploying carbon capture technologies, flare gas recovery units, and energy-efficient equipment to reduce emissions. There is also an increased focus on community engagement, transparency in reporting, and biodiversity protection in exploration zones.

Challenges Impacting Market Expansion

Despite its potential, the Nigerian upstream sector faces notable hurdles. Security threats, particularly in the Niger Delta, continue to pose risks to infrastructure and personnel, leading to production losses and higher insurance premiums. Additionally, stringent environmental regulations and complex permitting processes can delay project execution and inflate operational costs. However, strategic collaborations, community integration programs, and enhanced surveillance technologies are gradually mitigating these concerns.

Purchase Exclusive Report: https://www.statsandresearch.com/enquire-before/40585-nigeria-oil-and-gas-upstream-market-report

Nigeria Oil and Gas Upstream Market Forecast and Strategic Outlook

The outlook for Nigeria’s upstream oil and gas sector remains highly favorable through 2032. As operators deepen investments in deepwater projects, unconventional resources, and digital solutions, the sector is poised to deliver sustained growth and global competitiveness. Rising global energy demand, combined with Nigeria’s abundant reserves and proactive reforms, positions the country as a pivotal player in the evolving energy landscape.

Continued support from international oil companies, coupled with government-led initiatives to expand infrastructure and support local content, will ensure long-term viability and profitability. By embracing innovation, sustainability, and inclusive development, Nigeria’s upstream oil and gas industry will not only meet domestic energy needs but also strengthen its role in the global energy transition.

Our Services:

On-Demand Reports: https://www.statsandresearch.com/on-demand-reports

Subscription Plans: https://www.statsandresearch.com/subscription-plans

Consulting Services: https://www.statsandresearch.com/consulting-services

ESG Solutions: https://www.statsandresearch.com/esg-solutions

Contact Us:

Stats and Research

Email: [email protected]

Phone: +91 8530698844

Website: https://www.statsandresearch.com

1 note

·

View note

Text

SEO services for pipeline industry

SEO services for the pipeline industry are specialized to cater to the unique needs and challenges of companies within this sector. Here’s an overview of how SEO can benefit the pipeline industry and what specific strategies might be employed:

Key SEO Services for the Pipeline Industry:

Keyword Research and Strategy:

Identify and target industry-specific keywords such as SEO services for pipeline industry in the USA “oil and gas pipelines,” “pipeline maintenance services,” and other relevant terms that potential clients may search for. Long-tail keywords and location-based keywords are crucial for reaching a more targeted audience.

On-Page Optimization:

Optimize your website’s content, meta tags, headings, and images to align with targeted keywords. This includes ensuring that your website is user-friendly, mobile-responsive, and has fast loading times, which are important for search engine rankings.

Content Marketing:

Create and distribute high-quality, informative content that addresses the needs and interests of your target audience. Examples include blog posts about pipeline safety, case studies, industry news, and white papers on the latest technology in pipeline construction and maintenance.

Technical SEO:

Ensure your website’s technical elements are optimized, including site structure, crawlability, and indexing. Implementing structured data, improving site speed, and ensuring HTTPS security are critical for improving search engine rankings.

Local SEO:

Optimize your online presence for local searches, especially if your business operates in specific regions. This includes creating and optimizing Google My Business listings, managing online reviews, and ensuring consistent NAP (Name, Address, Phone number) information across directories.

Link Building:

Develop a strategic link-building campaign to acquire high-quality backlinks from reputable industry websites, trade publications, and professional associations. This increases your website’s authority and improves search engine rankings.

Competitor Analysis:Perform in-depth analysis of competitors within the pipeline industry to identify their SEO strategies and uncover opportunities to outperform them in search engine rankings.

Industry-Specific SEO Content:

Develop content that speaks directly to the challenges and opportunities in the pipeline industry, such as advancements in pipeline technology, regulatory changes, or sustainability practices.

Conversion Rate Optimization (CRO):

Improve the conversion rates of your website by optimizing landing pages, call-to-action buttons, and user experience, ensuring that visitors are more likely to contact you for pipeline services.

Analytics and Reporting:

Regularly track and analyze SEO performance using tools like Google Analytics and Google Search Console. Reporting helps you understand the effectiveness of your SEO strategies and make data-driven decisions.

Benefits of SEO for the Pipeline Industry:

Increased Visibility: SEO helps your company appear at the top of search results when potential clients search for SEO services for pipeline industry in the USA services.

Targeted Traffic: By focusing on industry-specific keywords, you attract more relevant visitors who are likely to convert into leads or customers.

Brand Authority: Consistent content creation and backlink strategies position your company as a thought leader in the pipeline industry.

Competitive Edge: Effective SEO strategies help you stand out against competitors, capturing a larger share of the market.

By leveraging these SEO services, companies in the pipeline industry can improve their online presence, attract more qualified leads, and ultimately grow their business in a competitive market.

#seo services for pipeline industry in usa

2 notes

·

View notes

Text

Why is Data Governance Paramount for Sustainable Growth in the Oil and Gas Data Management Sector?

The Oil and Gas Data Management Market was valued at USD 26.9 billion in 2023 and is expected to reach USD 91.4 billion by 2032, growing at a CAGR of 14.59% from 2024-2032.

The Oil and Gas Data Management Market is experiencing significant growth driven by the increasing need for efficient data handling, storage, and analysis across the upstream, midstream, and downstream sectors. As the industry grapples with vast amounts of geological, drilling, production, and operational data, robust data management solutions are becoming indispensable for optimizing processes, reducing costs, and enhancing decision-making. This market encompasses a wide range of technologies and services designed to organize, integrate, and leverage complex data sets, ultimately contributing to improved operational efficiency and strategic insights within the oil and gas landscape.

US Oil and Gas Data Management Market Driven by Digital Transformation and AI Adoption

The market is projected to reach USD 25.7 billion by 2032, growing at a CAGR of 14.24% from 2024 to 2032.

The Oil and Gas Data Management Market is currently undergoing a transformative phase, characterized by the adoption of advanced technologies such as artificial intelligence, machine learning, and cloud computing. These innovations are enabling companies to extract more value from their data, moving beyond traditional data storage to predictive analytics and real-time operational intelligence. The competitive landscape is dynamic, with both established energy technology providers and niche data management specialists vying for market share by offering tailored solutions that address the specific challenges of data intensive oil and gas operations.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/1846

Market Keyplayers:

Schlumberger – Techlog

Halliburton – Landmark

Baker Hughes – JewelSuite

IBM – IBM Maximo

Oracle – Oracle Oil & Gas Solutions

SAP SE – SAP Oil & Gas Suite

Honeywell – Honeywell Forge

AVEVA Group – AVEVA Unified Operations Center

Cognite – Cognite Data Fusion

Merrick Systems – Merrick Production Manager

TIBCO Software – TIBCO Spotfire

Seeq Corporation – Seeq Workbench

Quorum Software – Quorum Energy Suite

CGG – GeoSoftware

Kongsberg Gruppen – Kognifai

Market Summary

The global oil and gas data management market is witnessing robust expansion, fueled by the digital transformation initiatives within the energy sector. The sheer volume and complexity of data generated from exploration, production, and distribution activities necessitate sophisticated management solutions. Growth is particularly strong in areas related to real-time data analytics, wellbore data management, and seismic data interpretation, as companies seek to improve operational efficiency and mitigate risks. The market is also influenced by the fluctuating oil prices, which incentivize cost optimization through better data utilization. Regulatory compliance and environmental concerns further drive the need for transparent and well-managed data.

Market Analysis

The market for oil and gas data management is propelled by several key factors. The imperative for operational efficiency and cost reduction in a volatile commodity market is paramount. Advanced data management systems enable better asset performance monitoring, predictive maintenance, and optimized drilling operations. Furthermore, the increasing complexity of exploration and production (E&P) activities, including unconventional resource development, generates unprecedented data volumes, making effective data governance crucial. The integration of diverse data sources, from sensors on wellheads to seismic surveys, demands robust platforms that can centralize and normalize information. Cloud-based solutions are gaining traction due to their scalability, flexibility, and cost-effectiveness, facilitating remote access and collaboration. Data security and integrity remain critical considerations, with a growing emphasis on robust cybersecurity measures to protect sensitive operational and proprietary information.

Market Trends

Shift towards cloud-native and hybrid cloud data management solutions for enhanced scalability and accessibility.

Increasing adoption of AI and ML for predictive analytics, anomaly detection, and optimizing operational workflows.

Greater emphasis on data integration and standardization across disparate systems to create a unified data landscape.

Growing demand for real-time data processing and visualization for immediate operational insights.

Forecast Outlook

The Oil and Gas Data Management Market is projected to continue its upward trajectory, driven by ongoing digitalization efforts and the increasing maturity of data analytics technologies. Expect significant investments in advanced data platforms that support integrated asset management and field operations. The market will see further specialization in solutions for specific data types, such as subsurface data, drilling data, and production data. Furthermore, the push towards sustainability and emissions reduction will necessitate data management solutions that support environmental monitoring and reporting, ensuring continued market growth in the coming years.

Access Complete Report: https://www.snsinsider.com/reports/online-grocery-market-1859

Conclusion

Unlock peak performance and strategic foresight. In the dynamic oil and gas landscape, superior data management is no longer an option, but a competitive imperative for sustainable growth and operational excellence.

Related Reports:

U.S Data Monetization Market Poised for Significant Growth Through 2034

U.S. Data Integration Market Poised for Significant Growth and AI-Driven Transformation

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

0 notes

Text

#Oil and Gas Data Management Market#Oil and Gas Data Management Market size#Oil and Gas Data Management Market growth#Oil and Gas Data Management#Oil and Gas Data#Oil and Gas

0 notes

Text

Excerpt from this story from Inside Climate News:

In the early 2000s, a long-time Louisiana engineer and entrepreneur thought it would be natural for the oil and gas industry in the Gulf of Mexico to expand into offshore wind. The industry could use the same workforce, the same shipyards and possibly even the same platforms to generate renewable power.

With designs, data and offshore leases from Texas, Herman Schellstede and his team planned to build a 62-turbine wind farm off Galveston’s coast— one of the first such proposals in the United States and the first in the Gulf of Mexico.

The team approached banks and even Koch Industries seeking financing for the $300 million wind farm, he said. But financing nascent offshore wind was apparently too risky a proposition in the wake of the 2008 financial meltdown. The wind farm was eventually scuttled.

Now, 33 years after the first offshore wind farm was built in waters off Denmark, it’s still unclear if the time is right — or will ever be right — for the United States. In those years, only four wind farms generating 242 megawatts of power have been built off the U.S. coast; the largest just went into service in 2024.

Last year, inflation, supply chain problems and other macroeconomic issues led to the cancellation or renegotiation of about half of all proposed offshore wind projects. And while the Biden Administration is moving as quickly as possible to approve new lease sales and projects — expanding the amount of power generated by 10-fold — former President Donald Trump has promised to end offshore wind if elected.

The industry and advocates, however, do not seem daunted. Studies show offshore wind could meet 5% of the nation’s energy needs by 2035, and up to 25% by 2050.

“We’re all in this room today, not because we just see offshore wind as a massive opportunity — which it is to build you clean energy — but also we see the necessity of offshore wind,” said Amanda Lefton, vice president of offshore development for the renewable energy company RWE.

Lefton, speaking at an April conference of the offshore wind industry in New Orleans, said the technology is needed to meet national and state decarbonization goals. RWE is developing projects off the East Coast and California and working to create a supply chain for offshore wind in the Gulf of Mexico with a large Louisiana-based coalition.

“We know the fundamentals exist in these markets,” said Lefton, the former head of the U.S. Bureau of Ocean Energy Management who leads RWE’s East Coast operations. “We know that it’s not an if, it’s a when.”

2 notes

·

View notes

Text

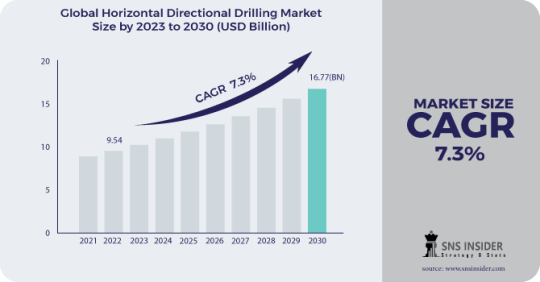

Horizontal Directional Drilling Market Analysis and Forecast 2031: Exploring Size, Share, and Scope Trends

The Horizontal Directional Drilling research report provides a quick analysis of market value, volume, return, factors, opportunity, competition, and current strategic behaviour. This includes forecasting demand, detailed explanations of assumptions and methodologies, as well as historical data and forecasts. This study examines the financial market environment to assess competition in local and global markets. The survey highlights the growth potential of the Horizontal Directional Drillingindustry over the forecast period.

Ask For Sample Report Here @ https://www.snsinsider.com/sample-request/1099

The report includes data on strategic alliances, new product launches, projects, transactions, collaborations, key market players, and drivers, constraints and opportunities. It provides the tools you need to assess the Horizontal Directional Drilling market for companies, customers, buyers, sellers, service providers, and distributors.

Market Segmentation

By Technique

Conventional

Rotary Steerable System

By Parts

Rigs

Pipes

Bits

Reamers

Others

By Application

On-shore

Off-shore

By End User

Oil and Gas Excavation

Utility

Telecommunication

By Company

American Augers, Inc.

Ditch Witch

Ellingson Companies

Vermeer Corporation

The Toro Company

Baker Hughes Incorporate

Halliburton Company

Schlumberger Limited

Weatherford International National Oilwell Varco, Inc.

Nabors Industries, Ltd.

The Application Management Services (AMS) market is divided into three categories: type, provider and application, allowing you to more accurately assess the size, climate, growth and development of the market. Charts, diagrams and records are used to represent the segments. Horizontal Directional Drillingmarket research also provides insights into the target market's product category and is based on a variety of organizational objectives such as product segmentation, production volume, product definition, and requirements, etc.

The market study thoroughly investigates the scope of the target market. Market innovation that has been stable in the past and is expected to stabilize again in the future is the subject of this study. Industry structure, definition, product characteristics, market penetration and maturity analysis are all included in the Horizontal Directional Drilling market report. Market size and growth rate are also analysed for forecast periods.

Regional Analysis

The report covers industry rankings and reported interpretations using regional surveys. Use of both primary and secondary sources to calculate market revenue for large industry organizations. Therefore, this study contains several important features. This Horizontal Directional Drillingmarket study explores the many factors that influence the growth of a region, including the financial, cultural, social, technical and political conditions of the region. This chapter describes the regional and global globalization of various term exchanges. Similarly, this study provides a reliable amount of country-by-country research and analysis of regional market share.

Buy This Report Here @ https://www.snsinsider.com/checkout/1099

Competitive Outlook

The size of the sector is also determined by the characteristics of the major players in the sector, according to the report. Major capabilities of major industry players are studied using secondary as well as primary sources and their revenue in the market is calculated in this study. This market research examines the top-down tactics of large companies. This section of the report provides contact details for the major vendors in the Horizontal Directional Drillingindustry. The survey also explores the market competition, market prices and channel characteristics among the major players.

0 notes

Text

0 notes

Text

Offshore Drilling Services for Safe and Sustainable Operations

In the modern energy landscape, safety and sustainability are no longer optional—they are essential. As oil and gas companies look to meet rising global energy demand, they must also operate responsibly. That’s where offshore drilling services play a vital role. When done right, offshore drilling can deliver the resources the world needs—without compromising safety or the environment.

At SCOFI, we specialize in delivering offshore drilling services that prioritize both performance and responsibility. Our approach integrates cutting-edge technology, industry-best safety practices, and a long-term commitment to sustainable offshore operations.

Why Safety Matters in Offshore Drilling

Offshore environments present unique risks. From deepwater pressure to extreme weather and remote locations, drilling operations must be carefully managed to protect personnel, equipment, and the ecosystem.

At SCOFI, safety isn’t just a procedure—it’s a culture. We implement:

✅ Rigorous Health, Safety & Environmental (HSE) standards

✅ Real-time monitoring and emergency preparedness systems

✅ Safety training and certification for all crew members

✅ Strict equipment inspections and maintenance protocols

Our offshore drilling services are designed to minimize incidents, prevent spills, and ensure every project runs with maximum safety and compliance.

How Offshore Drilling Can Be Sustainable

Sustainability in offshore drilling means reducing environmental impact while maintaining efficiency. SCOFI achieves this by using environmentally responsible practices, including:

🌱 Low-toxicity drilling fluids

🌊 Zero-discharge and closed-loop waste systems

💨 Emissions tracking and energy-efficient equipment

🐠 Marine ecosystem protection and environmental monitoring

We align our operations with international standards such as ISO 14001, MARPOL, and regional offshore environmental laws—ensuring your project meets both operational and environmental goals.

Smart Technology for Safer, Cleaner Drilling

Technology is at the heart of our commitment to safety and sustainability. SCOFI integrates digital solutions into every stage of drilling operations to reduce human error, lower emissions, and improve transparency.

Our smart offshore systems include:

📡 Real-time rig data and remote diagnostics

🤖 Predictive maintenance and fault detection

🧠 AI-powered performance optimization

📊 Environmental monitoring dashboards

🚁 Drone inspections and automated reporting

These tools help us make faster, better decisions while reducing the environmental footprint of each operation.

The SCOFI Approach: Responsible Energy Delivery

We believe that the future of energy depends on how we produce it today. That’s why SCOFI’s offshore drilling services are built around three pillars:

Safety First Every process, every project, every day.

Sustainability Always Low-impact drilling practices that respect ocean ecosystems.

Performance Without Compromise Advanced technologies and expert crews that deliver results.

With operations across key offshore markets, we offer scalable, flexible solutions tailored to each client's specific requirements.

Conclusion

The future of offshore energy depends on our ability to drill smarter, safer, and cleaner. With SCOFI’s offshore drilling services, you get a partner that combines operational excellence with an unwavering commitment to safety and sustainability.

0 notes