#E-Invoice

Explore tagged Tumblr posts

Text

Optech Software offers one of the most reliable and user-friendly billing software solutions in India, designed to streamline invoicing, accounting, inventory, and GST compliance for businesses of all sizes. Whether you're a small retailer, a growing enterprise, or a service provider, our billing software ensures smooth and accurate billing operations tailored to Indian tax regulations.

#billing software#gst billing software#invoice software development bd#e-invoice#billing software in coimbatore#gst accounting software for retail#gst services#accounting services

0 notes

Text

入不敷出再不改变 重蹈覆辙

黎正兴:入不敷出再不改变 重蹈覆辙Source: China Press

0 notes

Text

What is E-invoicing?

Electronic invoicing (e-Invoicing) allows the digital exchange of invoices between a supplier’s software and a buyer’s software or systems. E-Invoices are exchanged using a secure network and a common proven standard such as Peppol, which allow different software or systems to communicate with each other.

GET STARTED!

0 notes

Text

youtube

Generating an e-invoice is a simple yet crucial step for businesses registered under GST. It involves creating a standardized invoice format and uploading it to the Invoice Registration Portal (IRP), where it is validated and assigned a unique Invoice Reference Number (IRN). By using accounting software integrated with the government portal or manually entering details through authorized platforms, businesses can seamlessly generate e-invoices, ensuring compliance, accuracy, and efficient record-keeping.

0 notes

Text

Activities to be Undertaken for GST Compliances of FY 2024-25

As the FY 2024-25 comes to an end, businesses need to complete important tasks to stay GST-compliant and smooth transition into the new financial year. Key important points to consider:

Submission of Letter of Undertaking (LUT)

Compliance with Rule 96A of CGST Rules, 2017

Opting for the Composition Scheme

Quarterly Return Monthly Payment (QRMP) Scheme Selection

Implementation of the New Invoice Series

Reassessment of Aggregate Turnover

Check Applicability of E-Invoice

Check the Applicability of the E-Way Bill

Reconciliation of Outward Supplies

Issuance of Credit Notes

GST TDS/TCS credit

Reconciliation of Input Tax Credit (ITC)

Common ITC Reversal at the year-end

Compliance with Goods Sent on Approval Basis

Check the requirement to register as an Input Service Distributor (ISD)

GST Amnesty Scheme 2025

#Input Tax Credit#GST Amnesty#GST TDS/TCS credit#E-Way Bill#E-Invoice#96A of CGST Rules#uja global advisory

0 notes

Text

GST: Updates On E-Way Bill And E-Invoice Systems You Must Know

GST: Updates On E-Way Bill And E-Invoice Systems You Must Know GST: The GSTN has issued an advisory on updates related to e-way bill and e-invoice systems. The advisory is produced as under: GSTN is pleased to announce that NIC will be rolling out updated versions of the E-Way Bill and E-Invoice Systems effective from 1st January 2025. These updates are aimed at enhancing the security of the…

0 notes

Text

Navigating the GST E-Invoice Mandate: A Practical Guide for SAP Users

As business compliance rapidly evolves, India’s Goods and Services Tax (GST) mandated electronic invoices are an integral component. Over time, this system was implemented to simplify business operations while increasing tax compliance; beginning October 1st, 2020, electronic invoicing became mandatory for companies with over INR 500 crore turnover during 2019-2020. This blog discusses how SAP…

View On WordPress

0 notes

Text

Discover My Fatoorah: Simplifying Your Payment Process

In today's fast-paced digital age, businesses require efficient, secure, and user-friendly payment solutions to thrive. Enter Fatoorah, a revolutionary platform designed to streamline payment processes for businesses of all sizes. By integrating cutting-edge technology with seamless user experiences, Fatoorah is transforming the landscape of financial transactions.

Understanding Fatoorah

Fatoorah is not just another payment gateway. It’s a comprehensive solution that caters to the diverse needs of businesses. Whether you are a small startup or a large enterprise, Fatoorah offers tailored services to ensure your payment processes are as smooth as possible. The platform supports various payment methods, including credit cards, debit cards, and online banking, providing flexibility to both businesses and customers.

Key Features of Fatoorah

User-Friendly Interface

One of the standout features of Fatoorah is its intuitive interface. The platform is designed to be user-friendly, ensuring that even those with minimal technical knowledge can navigate and use it effectively. This ease of use reduces the time spent on training and allows businesses to focus on what they do best.

Robust Security

In an era where cyber threats are rampant, security is paramount. Fatoorah employs state-of-the-art encryption technologies to safeguard sensitive information. This ensures that all transactions are secure, giving both businesses and customers peace of mind.

Seamless Integration

Fatoorah integrates effortlessly with various e-commerce platforms, accounting software, and CRM systems. This compatibility means businesses can incorporate Fatoorah into their existing infrastructure without significant modifications, thus saving time and resources.

Multi-Currency Support

For businesses operating globally, handling multiple currencies can be challenging. Fatoorah simplifies this process by supporting numerous currencies, enabling businesses to accept payments from customers worldwide without any hassle.

Benefits of Using Fatoorah

Increased Efficiency

By automating many aspects of the payment process, Fatoorah helps businesses increase their operational efficiency. Automated invoicing, real-time payment tracking, and detailed financial reporting are just a few of the features that contribute to smoother operations.

Enhanced Customer Experience

A seamless payment process enhances the overall customer experience. With Fatoorah, customers can complete transactions quickly and securely, leading to higher satisfaction rates and increased customer loyalty.

Cost Savings

Traditional payment processing methods often come with high fees and hidden charges. Fatoorah offers transparent pricing and competitive rates, helping businesses save money on transaction fees.

Real-Time Analytics

Understanding payment trends and customer behavior is crucial for any business. Fatoorah provides real-time analytics and detailed reports, giving businesses valuable insights that can inform strategic decisions.

How to Get Started with Fatoorah

Easy Setup

Setting up Fatoorah is a straightforward process. Businesses can sign up on the platform, complete the necessary documentation, and start accepting payments in no time. The onboarding process is designed to be quick and hassle-free, ensuring minimal disruption to business operations.

Customization Options

Fatoorah offers various customization options to cater to the unique needs of each business. From personalized invoices to tailored payment pages, businesses can modify the platform to reflect their brand identity.

Dedicated Support

A dedicated support team is available to assist businesses with any issues or queries they may have. Whether it's technical assistance or guidance on optimizing the platform, Fatoorah's support team is always ready to help.

Case Studies: Success Stories with Fatoorah

Small Business Transformation

A small online retailer struggled with managing payments and keeping track of invoices. After integrating Fatoorah, they saw a significant improvement in their payment processing efficiency. Automated invoicing reduced manual errors, and real-time tracking allowed them to manage their cash flow better. The business owner noted a 30% increase in customer satisfaction due to the smoother transaction process.

Scaling Up with Ease

A medium-sized enterprise looking to expand internationally faced challenges with multi-currency transactions and high processing fees. Fatoorah's multi-currency support and competitive pricing helped them overcome these obstacles. With Fatoorah, they were able to streamline their global payment processes and focus on scaling their operations. The company's CFO highlighted how the platform's real-time analytics provided valuable insights into international sales trends.

Future of Payments with Fatoorah

As technology continues to evolve, Fatoorah remains at the forefront of innovation in the payment processing industry. The platform is continuously updated with new features and improvements to meet the changing needs of businesses and customers alike.

Embracing Digital Wallets

Digital wallets are becoming increasingly popular among consumers. Fatoorah is poised to integrate digital wallet functionalities, allowing customers to store and use their preferred payment methods with ease. This addition will further enhance the convenience and flexibility of the platform.

AI-Powered Fraud Detection

To stay ahead of cyber threats, Fatoorah is investing in artificial intelligence (AI) to enhance its fraud detection capabilities. AI algorithms can identify suspicious patterns and flag potential fraudulent activities in real time, providing an additional layer of security.

Conclusion

In a world where efficient and secure payment processing is crucial for business success, Fatoorah stands out as a comprehensive solution that simplifies and enhances the entire payment process. Its user-friendly interface, robust security measures, seamless integration, and multi-currency support make it an invaluable tool for businesses of all sizes. By choosing Fatoorah, businesses can enjoy increased efficiency, enhanced customer experience, cost savings, and valuable real-time insights, positioning themselves for growth and success in the competitive market.

0 notes

Text

Implementations of E-Invoice System in Malaysia

The implementation of e-invoice systems in Malaysia has marked a significant milestone in the country’s digital transformation journey. As businesses strive to adapt to the digital economy, e-invoicing offers numerous benefits, including increased efficiency, cost savings, and improved compliance. This comprehensive guide explores the various facets of e-invoice implementation in Malaysia, shedding light on its importance, benefits, and the steps involved.

The Importance of E-Invoice Implementation in Malaysia

E-invoicing is not merely a trend but a strategic move towards enhancing business operations. The Malaysian government’s push for digitalization, especially in the context of the Industrial Revolution 4.0, underscores the importance of adopting e-invoice systems. Electronic invoicing ensures accuracy, reduces manual errors, and facilitates seamless transactions between businesses.

Government Initiatives and Support

The Malaysian government has been proactive in encouraging the adoption of e-invoice systems. Through agencies like the Malaysian Administrative Modernisation and Management Planning Unit (MAMPU) and the Malaysia Digital Economy Corporation (MDEC), various initiatives and support systems have been introduced. These include training programs, incentives, and regulatory frameworks designed to ease the transition to digital invoicing.

Regulatory Framework and Compliance

Compliance with the regulatory framework is crucial for the successful implementation of e-invoice systems. The Malaysian government has established clear guidelines and standards for e-invoicing, ensuring that businesses can integrate these systems smoothly into their operations. Adhering to these regulations not only ensures legal compliance but also fosters trust and transparency in business transactions.

Benefits of E-Invoice Systems

Efficiency and Cost Savings

One of the most significant advantages of e-invoicing is the enhanced efficiency it brings to business operations. By automating the invoicing process, businesses can save time and reduce operational costs. Manual invoicing processes are prone to errors and delays, which can be costly. E-invoicing eliminates these issues, leading to faster processing times and reduced administrative burdens.

Improved Accuracy and Reduced Errors

Accuracy is critical in invoicing. Traditional invoicing methods are often plagued by human errors, which can lead to disputes and payment delays. E-invoicing ensures that all invoices are accurate and compliant with the required standards, significantly reducing the likelihood of errors. This accuracy fosters better business relationships and ensures timely payments.

Environmental Benefits

The environmental impact of e-invoicing is another significant benefit. By reducing the need for paper-based invoices, businesses can contribute to environmental sustainability. The reduction in paper usage not only helps in conserving natural resources but also reduces the carbon footprint associated with the transportation and storage of paper documents.

Steps for Implementing E-Invoice Systems in Malaysia

Assessment and Planning

The first step in implementing an e-invoice system is conducting a thorough assessment of the current invoicing processes. This involves identifying the pain points and areas that can benefit from digitalization. Planning is crucial to ensure a smooth transition. Businesses need to set clear objectives, timelines, and budgets for the implementation process.

Choosing the Right E-Invoice Solution

Selecting the right e-invoice solution is critical to the success of the implementation. Businesses should look for solutions that are compliant with Malaysian regulations and standards. The chosen solution should also be scalable, user-friendly, and capable of integrating with existing accounting and ERP systems. Consulting with industry experts and conducting thorough research can help in making an informed decision.

Training and Change Management

Training is a vital component of the implementation process. Employees need to be adequately trained on the new system to ensure a smooth transition. Change management strategies should be employed to address any resistance to the new system. Clear communication about the benefits and functionalities of the e-invoice system can help in gaining employee buy-in and ensuring successful adoption.

Integration and Testing

Once the e-invoice solution is selected, the next step is integration with existing systems. This involves configuring the e-invoice solution to work seamlessly with the business’s accounting and ERP systems. Rigorous testing should be conducted to identify and resolve any issues before full-scale deployment. Testing ensures that the system functions correctly and meets all regulatory requirements.

Deployment and Monitoring

After successful testing, the e-invoice system can be deployed across the organization. Continuous monitoring is essential to ensure that the system operates smoothly and efficiently. Businesses should establish metrics to evaluate the performance of the e-invoice system and make necessary adjustments to optimize its functionality.

Challenges and Solutions in E-Invoice Implementation

Resistance to Change

One of the common challenges in implementing e-invoice systems is resistance to change. Employees accustomed to traditional invoicing methods may be hesitant to adopt new technologies. Addressing this challenge requires effective change management strategies, including clear communication, training, and support.

Technical Issues

Technical issues can arise during the implementation process, especially during integration and testing phases. To mitigate these issues, businesses should work closely with their e-invoice solution providers and IT teams. Regular updates and maintenance are also crucial to ensure the system’s smooth operation.

Compliance and Security

Ensuring compliance with regulatory requirements and maintaining the security of sensitive financial data are critical concerns. Businesses should choose e-invoice solutions that offer robust security features, such as encryption and secure access controls. Regular audits and compliance checks can help in maintaining the integrity of the e-invoice system.

Future of E-Invoicing in Malaysia

The future of e-invoicing in Malaysia looks promising, with increasing adoption rates and continuous advancements in technology. The Malaysian government’s commitment to digital transformation and the growing awareness of the benefits of e-invoicing are driving factors behind this positive outlook.

Technological Advancements

Advancements in technology, such as blockchain and artificial intelligence, are expected to further enhance the capabilities of e-invoice systems. These technologies can provide additional security, transparency, and automation, making e-invoicing even more efficient and reliable.

Expansion to SMEs

While larger corporations have been quick to adopt e-invoicing, there is a growing focus on encouraging small and medium-sized enterprises (SMEs) to embrace this technology. The government and industry bodies are likely to introduce more initiatives and support systems tailored to the needs of SMEs, making it easier for them to transition to e-invoicing.

Global Integration

E-invoicing is not just a national initiative but part of a global movement towards digitalization. Malaysia’s e-invoice systems are expected to integrate with global standards, facilitating international trade and transactions. This global integration will enhance Malaysia’s competitiveness in the global market and open up new opportunities for businesses.

The implementation of e-invoice systems in Malaysia is a transformative step towards digitalization, offering numerous benefits such as increased efficiency, accuracy, and environmental sustainability. By following a structured implementation process and addressing potential challenges, businesses can successfully transition to e-invoicing and reap its rewards.

0 notes

Text

Looking for a reliable and efficient e-invoice solution? Optech Software delivers the best e-invoice software in Coimbatore, built to meet all your GST e-invoicing needs with precision and ease. Our software is developed with powerful automation tools that simplify invoice creation, auto-generate IRNs, and ensure seamless GST portal compliance.

#gst billing software#billing software#e-invoice#invoice software development bd#billing software in coimbatore#gst accounting software for retail

0 notes

Text

SST征税门槛应更具针对性,勿加剧中小企业压力

我接收到近期不少中小企业主针对SST扩大征税范围,尤其是部分非必需品如美容美发业的征税提出疑虑���我理解政府持续优化税收结构的必要性。销售与服务税(SST)体系的扩大,尤其涵盖美容服务业,确实是出于国家财政自主与税基扩张的战略考量。然而,我们同样不能忽视中小企业当前面临的现实困境。 根据政府宣布,从今年7月1日起,年营业额达50万令��的美容服务业者将被征收8%的服务税,涵盖脸部护理、美甲、美发、造型、去纹身、瘦身等服务。尽管设有门槛,这项措施依然引发许多业内人士的忧虑,担心“税压”将加剧运营成本,冲击企业存续与客户信任。 我听见许多美容与美发从业者的声音。他们中多数是女性、小型业主,甚至是自雇人士,原本已因原料上涨、人力成本、电子发票转型等因素承压,如今再叠加服务税,恐怕连喘息空间都难以保留。 有业者指出,商场租金高昂,月营业额轻易就能突破4万令吉,这使得50万令吉的年营业额门槛形同…

0 notes

Text

E-Invoice And HSN Code

6-Digit HSN Code to be Mandatory in E-Invoices for Taxpayers with AATO of 5 Cr and above from December 15, 2023. Learn more about HSN Codes here https://busy.in/hsn/

0 notes

Text

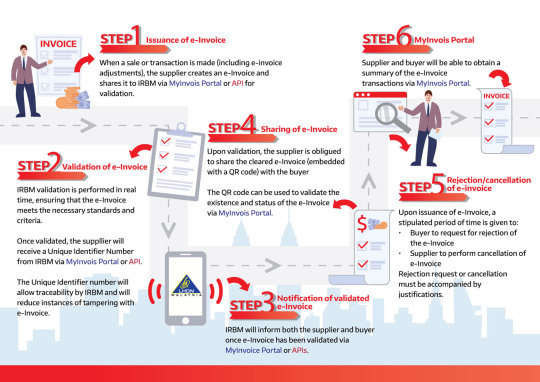

Bagaimana sebenarnya E-Invois berfungsi?

Mungkin ramai yang tertanya-tanya, jika E-Invois yang diperkenalkan oleh LHDN menggalakkan proses invois yang cekap, menjimatkan masa dan lebih telus, bagaimanakah prosedur dan aliran kerja e-invois dan bagaimana ia akan membantu perniagaan membuat invois malah berurus niaga dengan lebih baik? Apakah e-Invois LHDN? Dengan pengenalan e-invois oleh LHDN di Malaysia, yang bertujuan untuk…

View On WordPress

0 notes

Text

E-invoice system

𝐕𝐚𝐫𝐭𝐡𝐚𝐠𝐚𝐦𝐬𝐨𝐟𝐭 𝐄-𝐈𝐧𝐯𝐨𝐢𝐜𝐞: 𝐓𝐡𝐞 𝐔𝐥𝐭𝐢𝐦𝐚𝐭𝐞 𝐬𝐨𝐥𝐮𝐭𝐢𝐨𝐧 𝐟𝐨𝐫 𝐬𝐭𝐫𝐞𝐬𝐬-𝐟𝐫𝐞𝐞 𝐄-𝐢𝐧𝐯𝐨𝐢𝐜𝐢𝐧𝐠

✅ 𝐀𝐮𝐭𝐨 𝐔𝐩𝐥𝐨𝐚𝐝 𝐭𝐨 𝐈𝐑𝐏 𝐏𝐨𝐫𝐭𝐚𝐥: Upload your invoices directly to the GST portal with our Auto Upload feature.

✅ 𝐈𝐧𝐬𝐭𝐚𝐧𝐭 𝐒𝐭𝐚𝐭𝐮𝐬 𝐍𝐨𝐭𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧𝐬: Stay informed every step of the way! Receive notifications for both successful and unsuccessful uploads right in our software.

✅ 𝐒𝐢𝐦𝐩𝐥𝐢𝐟𝐢𝐞𝐝 𝐃𝐚𝐭𝐚 𝐕𝐞𝐫𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧: Say goodbye to manual checks. Our Varthagamsoft E-invoice simplifies data verification, reducing errors and saving your time.

✅ 𝟏𝟎𝟎% 𝐃𝐚𝐭𝐚 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲: Your data's safety is our priority. We never use third-party servers, ensuring 100% data security.

✅ 𝐃𝐮𝐩𝐥𝐢𝐜𝐚𝐭𝐞 𝐄-𝐟𝐢𝐥𝐢𝐧𝐠 𝐏𝐫𝐞𝐯𝐞𝐧𝐭𝐢𝐨𝐧: Varthagamsoft E-invoice automatically detects and prevents duplicate filing.

✅ 𝐋𝐢𝐯𝐞 𝐈𝐧𝐯𝐨𝐢𝐜𝐞 𝐓𝐫𝐚𝐜𝐤𝐢𝐧𝐠: Keep track of your invoices in real-time.

✅ 𝐄𝐟𝐟𝐨𝐫𝐭𝐥𝐞𝐬𝐬 𝐆𝐒𝐓 𝐅𝐢𝐥𝐢𝐧𝐠: Manage your GST filing with one-time reporting of B2B invoice details.

𝐆𝐞𝐭 𝐢𝐧 𝐭𝐨𝐮𝐜𝐡 𝐰𝐢𝐭𝐡 𝐔𝐬:

☎️ Contact No: 044 40 139 140

️🌐 Web: www.varthagamsoft.com

#Varthagamsoft#billingsoftware#e-invoice#pharmadistributionsoftware#pharmacybillingsoftware#fmcgbillingsoftware#textailbillingsoftware#gramentsbillingsoftware#groceryshopbillingsoftware#billingsoftwareinchennai#medicalbillingsoftware#retailbillingsoftware

0 notes

Text

GST e-Invoice: Steps For e-Invoice Reporting

GST Invoice: Steps For e-Invoice Reporting GST e-Invoice: ‘e-Invoicing’ means reporting details of specified GST documents to a Government-notified portal i.e., Invoice Registration Portal (IRP) and obtaining an invoice reference number. It doesn’t mean the generation of invoices by a Government portal. In e-invoicing, taxpayers continue to create their GST invoices on their own Accounting/…

0 notes