#EU Single-Use Plastics Directive

Explore tagged Tumblr posts

Text

EU SUP Directive: Key Challenges & Business Impacts

The European Union Directive (SUP) was introduced to reduce the environmental impact of plastic waste, particularly in the marine environment. While marking key steps into sustainability and circular economy packaging, implementation of directives in sectors of various sectors presents several challenges, especially for those using plastic materials for packaging, product design and assurance of EPR compliance. What is the EU SUP directive? The EU SUP Directive covers the top 10 disposable plastic objects most seen on European beaches, including cutlery, plates, straws, stir-fry and certain food containers. The EU ban includes the ban on some objects, the goal of reducing the consumption of other objects, identification, sensitization campaigns, and the requirements for extended producer responsibility (EPR). Important issues for businesses 1. Material performance and testing Companies replacing prohibited plastics with alternatives must ensure that these alternatives meet EU composting and recyclability standards, such as the compostable plastic EN 13432. However, many alternatives have been exposed to issues relating to performance and regulatory approval issues. For example, materials can meet technical composting, but cannot function well under real conditions. This creates uncertainty regarding product liability. 2. Limited availability of alternatives The supply of scalable and compliant plastic alternatives is still limited. This shortage affects sectors such as food service, personal care and consumer goods, which rely on materials such as plastics for hygiene and function. With increasing demand, competition for compliant materials is expected. 3..The ambiguity of regulations and differences between nations Although the guidelines are in the EU, each member state has its own interpretation and assertion mechanisms, leading to inconsistent application. Companies working in several countries need to adapt their packaging adaptation strategies to increase costs and complexity. 4.. Economic impacts and redesign of costs Migrating to SUP-compliant products requires redesigning existing packaging, updating labeling, testing new materials, and investing in new manufacturing technologies. These changes can be particularly difficult for small and medium-sized businesses (small and medium-sized businesses). This can result in short supply of resources to adapt quickly. 5. Product Category Limitations Certain product categories such as plastic straws, stir-fry and polystyrene containers are mocks, even if they are used in niches and essential applications. Companies need to develop their products or packaging completely without a transition period in some cases. Conclusion Regulations on the individual birth of plastics reflect the growing global concerns about plastic pollution and lead to a clear path to sustainable product design. However, it also poses considerable compliance and operational challenges for the SUP guidelines. Companies must be proactive, informed and flexible in their responses. With proper regulatory support, businesses can transform these challenges into innovation options and lead them to the future of plastics. Freyr helps businesses address the challenges of these SUP guidelines by providing end-to-end regulatory support. From identifying approved alternatives and adjusting material compatibility tests to marking and document assurance, Freyr simplifies complex transition processes. Experts also help prepare regulatory submissions and manage cross-border compliance, helping businesses adapt quickly and cheaply.

#EU Single-Use Plastics Directive#EU Plastic Ban#Extended Producer Responsibility (EPR)#EU SUP Directive#Extended Producer Responsibility#Plastic Regulations#SUP Directive Compliance#Single-Use Plastics Regulation

0 notes

Text

Ever since I found out that my baby girl Edgar has an actual high end perfume based on him Miguel matos’ “electric dreams” I thought it could be fun to talk about what some other computers would smell like based on their personalities, stories and overall vibes.

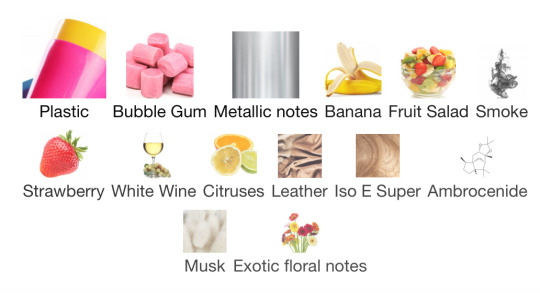

Since Edgar has a perfume already I might as well talk about it

Released in 2021, they describe this scent as being “digital hormones” and trying to understand an emotion and failing at it, which works well for Edgar very well. Electric dreams as a whole lives in the pre internet age of the 80s and how hopeful that dream of the future was in the minds of the people. I love that they included the cheap champagne that miles spills on Edgar as a note here. The other scents are contextualized with the youth of the 80s, strawberry gum and tutti frutti soda, plastic flowers and clean laundry. Even the part where Edgar overheats at the end is in the smoke note. It’s categorized as chypre fruity and I think some other scents fit Edgar very well.

In love with everything by imaginary authors is glitzy and bright almost like those arcade cabinets introduced in the era.its based on the young adults of the time specifically the women, the joys of recklessness. Inexhaustible enthusiasm. To me Edgar is a sugar sweet summer.

Edgar is characterized by the era he was born in, something actually a lot of sentient computers share. As technology morphs and evolves with humanity, our ideas and outlooks also change with it. Electric dreams is coated in the neon lit nostalgia of the 80s, and in a weird twist of fate its legacy is of the 80s as well. The commercialism of it as a whole is what’s remembered most prominently, the song that was made for the movie has outlived its original context. Honorable mentions to age of innocence by Toskovat but I don’t think the rubber or gasoline notes fit him well. Fantômas by Nasomatto is pretty good being a fruity clearly fake fragrance though the gunpowder might be a bit much.

Moving forward, let’s talk about HAL

While technically she was an anomaly by Etat Libre d’Orange makes direct reference to him and his most iconic line, this scent is based on the marriage of Nina Simone and Stanley Kubrick. If hal was human in any shape or form this fragrance would be a generally good fit, as it’s clean professional and one of those your skin but better scents that’s prefect for workplaces.

Eu de space from nasa could work pretty well though it’s not exact. This is a photorealistic space scent with metals and plastics and ozone notes but Hal isn’t directly in space, he’s what the ship would smell like. The burnt sweet quality doesn’t mix well with how pristine and rigid the character is. Spacewalk by Demeter also has a bit of similar problem being a bit too sweet but the soapiness does add points in my opinion. Hal is the sharpness of metal and ozone on your nose to me, not the smell of a hospital or sanitizer but the smell of something newly plastic. Skiing on Europa could be that but unfortunately it’s a little more niche.

Last but not least for now, let’s talk about am, there’s so many different ways to go with am, none being particularly good smelling but there’s so much you could do for him. You can go with the fact that he’s the whole planet, add in soil, rock,gasoline as accords, you can do the religious angle that he has that can pair well with other ideas, use wine or incense and wax like in with the candlestick by clue, you can do blood, sweat, tears and skin to represent the survivors who are now a part of him. Warm electronics, tar, gunpowder there’s so many distinct parts of him.

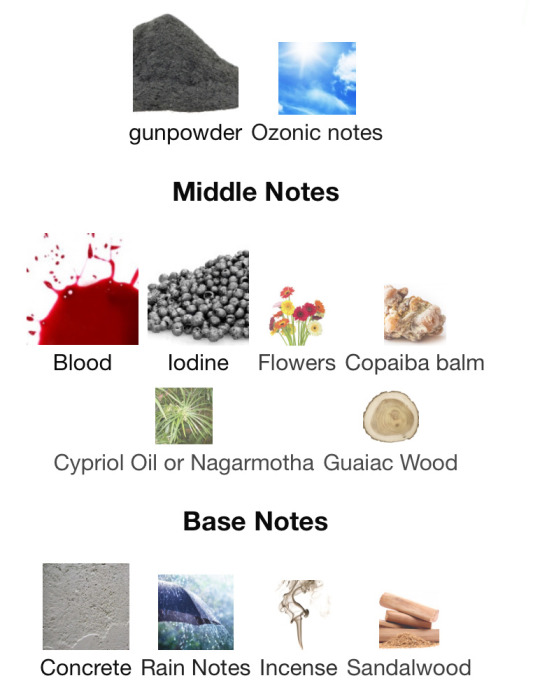

I think that the two I’m going to single out in terms of perfume are ones that take inspiration from what am’s original function was which is war. And that’s inexcusable evil by toskovat and Molotov cocktail by sylhouette perfumes

Inexcusable evil is infamous in the fragrance and perfume world for its incredibly strong violent smell, it’s a hospital ward ravaged by war. That is its story. Memories that are lost to the tide of battle. “The next war will decide not what is right but what is left.”

Molotov cocktail goes more personal but is still a war scent, the top notes are gasoline,vodka and pepper. the middle notes are blood sweat and rubber and the base is metal, iodine, musk and leather. More animalic and close but both work on the scales that am is a threat in, he’s both a world ender but also a personal tormentor, he spans the globe but also cannot leave his confinement

#sentient ai#objectum#hal 9000#hal#edgar#edgar electric dreams#electric dreams#electric dreams 1984#electric dreams edgar#electric dreams perfume#perfume#character scents#character perfumes#am#allied mastercomputer#ihnmaims#i have no mouth and i must scream#am ihnmaims#am i have no mouth and i must scream#ihnmaims am#I have no mouth and I must scream am#inexcusable evil#she was an anomaly#2001 space odyssey#2001 a space odyssey#2001 aso#aso Hal#2001 Hal#Hal space odyssey#space odyssey

79 notes

·

View notes

Text

The hair that drops in clumps on the floors of some salons in Kiel, a port city in northern Germany, is swept up to be turned into fabrics that filter oil from water. Parents who want to buy their children cloth nappies instead of disposable ones can apply for grants of up to €200 from the local authorities. At the city’s biggest festival last year, the organisers got rid of single-use cutlery and replaced it with a deposit system.

Germany is famed as a world leader in recycling – and Kiel, as I found out during a visit this summer, has some of the most weird and workable plans in the country to deal with its trash. It is the first German city to be declared “zero waste” by the environmental campaign group Zero Waste Europe. The certificate does not mean it has already stopped throwing things away – far from it – but rather that it has a concrete plan for how to do better.

“It’s one step in the right direction,” says Bettina Aust – a Green party politician who was elected president of Kiel city council in June – over a glass of juice made from apples that had been saved from landing in a supermarket bin. “You have to keep thinking further … You cannot stay still.”

Germany has a complicated relationship with waste. Despite its status as a world leader in recycling, Europe’s biggest economy is also one of its dirtiest. In 2021, the average German generated 646kg of waste, while the average EU citizen generated 530kg. Only in four EU countries – Austria, Luxembourg, Denmark and Belgium – did people throw away more.

Dino Klösen, a manager at Kiel’s waste management company ABK, says trends in the country’s consumption can be seen in its bins. Paper recycling bins that would have once been full of newspapers are now bursting with cardboard from delivery packages. “The weight of paper waste has dropped but the volume keeps rising from online shopping,” he says.

Awash with waste, cities like Kiel are exploring ways to throw away less and recycle more of what it does chuck. The city council has announced projects ranging from a ban on single-use items in public institutions, to installing more public drinking fountains, to teaching schoolchildren about waste. It is also encouraging people to make simple changes to their behaviour such as using solid bars of soap instead of buying plastic bottles of the stuff.

Other proposals are more systemic. The city is trialling a “pay as you throw” system where people are charged only for the rubbish they throw in the mixed waste bin. A report from the European Environment Agency last year found only about 30% of Germany is covered by such a scheme, even though areas that were covered saw an average drop in mixed waste of 25%.

“General waste is the most expensive form of rubbish there is,” says Klösen. “We are trying to motivate citizens to throw less waste in the bin by making them pay less for doing so.”

Even though waste-cutting efforts like Kiel’s are fairly novel in Germany, recycling is firmly rooted in the culture. In 2021, Germans collected more than two-thirds of their municipal solid waste to be repurposed – more than any other country in Europe. They burned most of the rest for energy, and dumped just 1% in landfills (the EU average is 16%).

26 notes

·

View notes

Text

how familiar are my followers with the EU single-use plastic (SUP) directive 2019/904 and the pictograms it introduced ?

2 notes

·

View notes

Text

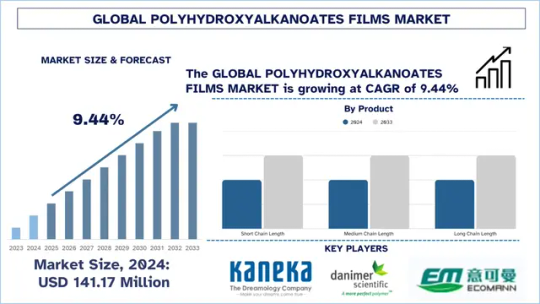

Polyhydroxyalkanoates Films Market Report, Trends, Analysis & Forecast

According to the UnivDatos, as per their “Polyhydroxyalkanoates Films Market” report, the global market was valued at USD 141.17 million in 2024, growing at a CAGR of about 9.44% during the forecast period from 2025 - 2033 to reach USD million by 2033.

The global polyhydroxyalkanoates (PHA) films market is now gaining momentum as the industries around the world are moving into materials that are equally functional yet responsible for the environment. PHA films are biodegradable films processed using microbial fermentation processes utilizing renewable feedstocks, thus posing as a sustainable alternative to traditional petroleum-based plastics. This is due to their properties such as biodegradability, compostability, and performance. These films are used in a wide range of applications in various sectors such as food packaging, agriculture, and biomedical devices. With increasing concerns over plastic waste and tightening regulations all over the world, PHA films are becoming the next generation of sustainable material solutions.

Stringent Environmental Regulations Drive Market Growth

One of the major reasons behind the rapid growth of PHA films is the rapid increase due to a slew of rigid environmental regulations put into place in various countries all over the world. Some areas in Europe, North America, and Asia are taking measures to reduce, restrict, or outright ban single-use plastics. Countries are implementing regulations such as the EU Single-Use Plastics Directive and California's Plastic Pollution Prevention and Packaging Producer Responsibility Act are effectively building an inescapable demand for compostable and marine-degradable packaging materials. For instance, the Plastic Waste Management Rules, 2016, as amended, provide the statutory framework and the prescribed authorities for enforcement of the rules, including a ban on single-use plastic items. The country has implemented a complete ban on single-plastic items from the 1st to the 31st of July 2022. Therefore, the demand for polyhydroxyalkanoate films increases. As these films find themselves in an excellent position to meet these requirements, they offer a closed-loop alternative that can biodegrade through soil, marine, and home-composting environments. For that very reason, PHA is an apt candidate for consumer goods and packaging firms wanting to meet EPR laws and sustainability reporting requirements. Companies would thus accelerate the adoption of PHA films in retail, food service, and agriculture by reviewing their packaging portfolio to include bioplastics.

Latest Trends in the Polyhydroxyalkanoates Films Market

Shift Toward Multi-Functional Bioplastics

As the bio-based materials market grows older, a strong melody around multifunctional bioplastics gains popularity. Hence, the PHA films trail the innovation curve. The earlier generation of bioplastics did offer biodegradation but at the expense of performance; next-gen PHA films are being engineered for applications with varying demands, being oxygen barriers, antimicrobial, UV-protective, and mechanically strong. This trend is strong in food-packaging applications, where materials have to maintain shelf life while having an eco-label attached. Likewise, in medical sectors, PHA films are being studied as wound dressings and drug-delivery systems, whereby biodegradability after use gives them advantages. This trend is further pushed by the ongoing active R&D investments and collaborative effort among biopolymers startups, academics, and global packaging brands are the main driving forces behind these advancements. As performance catches up with ecological benefits, PHA films have begun transformation into competitive, high-performing material solutions.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/polyhydroxyalkanoates-films-market?popup=report-enquiry

Emerging Opportunities in Asia-Pacific and Latin America

The growing plastic waste awareness is growing, along with government support, and this has opened up new opportunities in emerging markets in Asia and Latin America. Landed with rapid urbanization and growing consumer demand for sustainable packaging, countries like India, China, Brazil, and Mexico offer fertile grounds for bio-based solutions such as PHA films. Policy-backed pathways for adoption are being forged by government-led initiatives such as India's ban on various single-use plastic items and Chile's extended producer responsibility laws. Simultaneously, climate financing and development partnerships at the international level are financing PHA production at the local level with Agri-waste as feedstock, embedding the circular economy concept. This, therefore, creates a very lucrative opportunity for firms to expand manufacturing and distribution activities in these regions. Also, adoption of eco-certification schemes and sustainable public procurement programs further promotes demand for compostable packaging and agricultural films, giving manufacturers a front-runner advantage in establishing brand equity and local supply chains.

PHA films drive sustainable progress as the future of high-performance, biodegradable materials

As the world economy is inclined more and more toward low-carbon and circular solutions, PHA films stand out for their sustainability and performance. PHA films deliver full biodegradability without compromising on utility has making them an important thrust for the substitution of fossil-fuel-based plastics. While challenges concerning scalability and costs remain, regulatory push, technological progress, and new market opportunities are setting forth a strong path for the growth of the industry. From food protection to wound healing and nurturing, PHA films are no longer just nature-friendly alternatives- they are the materials of the future, weaving a world where performance and planet meet side by side.

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - [email protected]

Website - https://univdatos.com/

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

0 notes

Text

🌿 Metal Straws Market Trends 2034: Size, Share & Sustainable Growth

Metal Straws Market is evolving rapidly as environmental concerns and sustainability goals reshape consumer and corporate priorities. Estimated to grow from $1.8 billion in 2024 to $3.2 billion by 2034, the market is expanding at a steady CAGR of 5.9%. At its core, this market serves as a compelling response to the global outcry against single-use plastics. With reusable options made from stainless steel, aluminum, and other metals, metal straws have become a functional symbol of conscious consumerism.

This market spans across households, restaurants, travel kits, and eco-friendly retail, offering stylish, durable, and hygienic alternatives in an array of designs and finishes. As the world embraces sustainability, metal straws are no longer niche — they’re a mainstream lifestyle choice.

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS22979

Market Dynamics

The demand for stainless steel straws is surging, capturing 45% of the global market share, largely due to their longevity and sleek appearance. Meanwhile, silicone-coated straws and bamboo-metal hybrids are gaining traction for their comfort and biodegradable elements. The foodservice and hospitality sectors are leading adopters, viewing reusable straws as an opportunity to align with customer expectations and environmental responsibility.

Growing awareness around ocean pollution and plastic waste, along with regulatory crackdowns on disposable plastics, are powerful forces driving growth. Simultaneously, product innovation — such as collapsible, telescopic, and travel-friendly straw kits — is capturing the interest of on-the-go consumers and eco-conscious millennials.

Technological advancements in laser cutting and coating have also lowered production costs, improved product quality, and expanded customization options, boosting both retail and corporate demand.

Key Players Analysis

Top companies in the metal straws market include EcoStraws, FinalStraw, and Klean Kanteen, each known for their commitment to innovation, design aesthetics, and sustainable packaging. These industry leaders are not only focusing on durable and appealing products but are also expanding distribution through online platforms and environmentally-focused partnerships.

In addition, newer entrants like Eco Sip, Straw Savvy, and Green Straw Innovations are carving out niche markets through influencer marketing, subscription models, and artisan-crafted offerings. As competition increases, companies are differentiating themselves through custom branding, packaging design, and premium material usage such as titanium or copper straws.

Regional Analysis

North America holds the dominant position in the market, thanks to strong governmental regulations, environmental campaigns, and consumer enthusiasm for zero-waste lifestyles. The United States and Canada lead this region, with robust adoption from both retail and corporate sectors.

Europe trails closely behind, with countries like Germany, the United Kingdom, and France driving demand. The EU’s anti-plastic directives and consumers’ preference for ethical consumption have accelerated metal straw adoption across households and hospitality.

In the Asia-Pacific region, rapid urbanization and increasing awareness of sustainability have fueled demand, particularly in China, Japan, Australia, and India. The presence of strong e-commerce infrastructure and eco-conscious younger populations are catalyzing growth in this region.

Latin America and the Middle East & Africa are emerging markets, led by nations like Brazil, Mexico, South Africa, and the UAE. These regions are witnessing growing environmental advocacy and a gradual shift in consumer preferences toward sustainable living.

Recent News & Developments

The metal straws market is seeing dynamic shifts shaped by consumer behavior, design innovation, and price competition. Prices range from $1 to $5 per unit, depending on material, coating, and branding features. The rising popularity of collapsible and color-customizable straws is especially evident among younger consumers, while businesses prefer bulk kits and custom-branded options for events and giveaways.

Notably, the hospitality industry is playing a pivotal role in mainstreaming metal straws. Restaurants, cafes, and hotels are embracing them not just for function but as a statement of environmental stewardship. Additionally, growing availability on e-commerce platforms is making it easier than ever for consumers to access diverse options.

Supply chain efficiency and material availability, particularly for stainless steel, remain key factors influencing pricing and product accessibility. Manufacturers are increasingly investing in sustainable sourcing partnerships to meet growing demand and regulatory expectations.

Browse Full Report : https://www.globalinsightservices.com/reports/metal-straws-market/

Scope of the Report

This report provides in-depth insights into the global Metal Straws Market, analyzing current trends, growth drivers, consumer behaviors, and technological advancements. Covering diverse segments such as type, product, material, application, end-user, and distribution channel, the analysis offers a clear roadmap for businesses seeking to tap into the sustainability wave.

Opportunities lie in expanding product portfolios, introducing premium and personalized options, and optimizing e-commerce strategies. As consumers continue to favor sustainable choices, the metal straws market offers strong growth potential for companies that align with environmental ethics, product innovation, and user-centric design.#metalstrawsmarket #ecofriendlyproducts #sustainableliving #plasticfreefuture #reusablesolutions #greenconsumerism #consciouschoices #hospitalitysustainability #zerowasteproducts #ecobrands

Discover Additional Market Insights from Global Insight Services:

Online Clothing Rental Market : https://www.globalinsightservices.com/reports/online-clothing-rental-market/

Skincare Market : https://www.globalinsightservices.com/reports/skincare-market/

Sports Protective Equipment Market : https://www.globalinsightservices.com/reports/sports-protective-equipment-market/

Wall Art Market : https://www.globalinsightservices.com/reports/wall-art-market/

Insulated Coolers Market : https://www.globalinsightservices.com/reports/insulated-coolers-market/

About Us:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

Contact Us:

Global Insight Services LLC 16192, Coastal Highway, Lewes DE 19958 E-mail: [email protected] Phone: +1–833–761–1700 Website: https://www.globalinsightservices.com/

0 notes

Text

rPET Flakes: The Sustainable Backbone of Modern Plastic Recycling

What Are rPET Flakes?

Recycled Polyethylene Terephthalate rPET flakes are small, refined pieces derived from used PET plastic materials, primarily beverage bottles. These flakes are the result of an intensive recycling process that transforms post-consumer PET waste into reusable material. Their use is expanding rapidly across industries due to growing environmental awareness, cost-effectiveness, and stringent regulations promoting circular economy practices.

rPET flakes offer an eco-friendly alternative to virgin plastics and have become a vital component in manufacturing products across the packaging, textile, and automotive industries.

The Manufacturing Process of rPET Flakes

1. Collection and Sorting

The rPET lifecycle begins with the collection of PET waste, mainly from post-consumer bottles. These are sorted manually or via automated systems using infrared and optical sensors to distinguish PET from other plastics.

2. Washing and Cleaning

Once sorted, the PET waste undergoes hot and cold washing to remove labels, adhesives, and contaminants. This phase ensures a higher yield of high-purity rPET flakes.

3. Shredding and Flaking

Clean PET materials are then shredded into uniform flakes. Advanced shredders and granulators reduce the size to achieve flakes typically ranging from 8 to 12 mm, perfect for further processing.

4. Drying and Decontamination

Drying is performed at high temperatures to reduce moisture content, followed by decontamination processes such as vacuum treatment or solid-state polymerization (SSP), ensuring flakes are food-grade compliant.

Key Specifications of High-Quality rPET Flakes

To meet global demand, rPET flakes must adhere to strict specifications:

Color: Clear (light blue tint) or natural (transparent white)

Intrinsic Viscosity (IV): 0.72–0.85 dl/g

PVC Content: Less than 50 ppm

Moisture: Below 0.5%

Bulk Density: 0.3–0.45 g/cm³

Contaminants: Minimal foreign particles, dust, and metal traces

Applications of rPET Flakes Across Industries

1. Packaging Industry

The largest consumer of rPET flakes is the packaging sector. Recycled PET is widely used to produce:

Food and beverage containers

Blister packs

Thermoformed trays

Flexible film packaging

Food-grade rPET, which meets FDA and EFSA standards, is now a staple in sustainable packaging initiatives.

2. Textile Industry

rPET flakes are a primary source for recycled polyester fiber (rPSF). These fibers are spun into yarns used in:

Sportswear and outdoor clothing

Home textiles like carpets and curtains

Automotive interiors and insulation materials

3. Automotive Components

Automobile manufacturers are embracing rPET to meet green targets. Flakes are transformed into injection-molded parts used in dashboards, seat fabrics, and wheel arch liners.

4. Construction Sector

In construction, rPET-derived products are used in:

Insulation panels

Geo-textiles

Composite roofing materials

Plastic lumber and fencing

Benefits of Using rPET Flakes

1. Environmental Sustainability

Each ton of recycled PET saves approximately 1.5 tons of CO₂ emissions compared to virgin production. It also reduces dependency on fossil fuels and minimizes landfill usage.

2. Economic Efficiency

rPET is cost-effective, offering a cheaper alternative to virgin PET while maintaining similar mechanical and physical properties. Industries benefit from lower raw material costs and government incentives for using recycled inputs.

3. Compliance and Market Demand

Global brands are increasingly pledging to incorporate recycled materials in their products. This surge in demand aligns with regulatory mandates such as the EU Single-Use Plastics Directive, boosting the rPET market.

Global Market Trends and Opportunities

The global rPET flakes market is projected to exceed USD 13 billion by 2030, with Asia-Pacific leading production and Europe driving demand due to strict environmental laws.

Key growth drivers:

Rise in eco-conscious consumer behavior

Government bans on single-use plastics

Expansion of bottle-to-bottle recycling technology

Investments in recycling infrastructure and circular economy initiatives

Challenges Facing the rPET Industry

1. Contamination and Sorting Issues

High-quality rPET requires precise sorting. Contaminated input materials result in lower-grade flakes unsuitable for high-end applications.

2. Supply Chain Limitations

Availability of consistent feedstock is a bottleneck. Seasonal collection patterns and lack of formal recycling systems in developing countries hinder supply.

3. Technological Barriers

Smaller recyclers often lack advanced machinery required for decontamination and SSP processes, impacting flake quality.

Future of rPET Flakes: Innovation and Circular Economy

The future lies in closed-loop systems, where PET bottles are recycled into bottles repeatedly without degrading quality. Innovations such as enzymatic recycling, AI-driven sorting, and blockchain traceability are paving the way for smarter, cleaner, and more efficient rPET supply chains.

Companies are now investing in:

Bottle-to-bottle plants for infinite recyclability

Chemical recycling technologies that break down PET at the molecular level

Digital product passports to track and certify recycled content

Why Businesses Should Invest in rPET Flakes

Adopting rPET flakes is more than a trend—it's a strategic imperative. Businesses benefit from:

Brand elevation through sustainability

Regulatory compliance in global markets

Operational cost reduction via recycled raw materials

Customer loyalty driven by eco-conscious values

Whether you're in packaging, textiles, or automotive, embracing rPET is key to future-proofing your supply chain.

Conclusion

rPET flakes are the cornerstone of a sustainable plastic economy. They offer a powerful solution to the environmental crisis caused by plastic waste while delivering economic, operational, and regulatory benefits. With advancements in recycling technologies and a surging global demand for eco-friendly materials, now is the time for manufacturers and brands to integrate rPET into their production processes.

0 notes

Text

Biodegradable Plastics Market : Size, Trends, and Growth Analysis 2032

The Biodegradable Plastics Market was valued at US$ 12,930.43 million in 2024 and is expected to grow at a remarkable CAGR of 22.90% from 2025 to 2032. This explosive growth is driven by rising environmental concerns, regulatory pressures, and consumer demand for eco-friendly alternatives to traditional plastics. Derived primarily from renewable sources such as corn starch, sugarcane, and plant-based oils, biodegradable plastics offer a sustainable solution to the global plastic pollution crisis.

What Are Biodegradable Plastics?

Biodegradable plastics are engineered to break down naturally into water, carbon dioxide, and biomass under the action of microorganisms. Unlike conventional petroleum-based plastics, which can persist in the environment for hundreds of years, biodegradable plastics degrade in a significantly shorter timeframe under suitable conditions.

There are two major categories:

Bioplastics: Made entirely or partially from renewable biological sources. Common examples include PLA (polylactic acid), PHA (polyhydroxyalkanoates), and starch blends.

Oxo-degradable Plastics: Contain additives that promote oxidative degradation followed by microbial action. These are typically petroleum-based but designed to fragment and degrade more quickly than traditional plastics.

Biodegradable plastics are used in packaging, agriculture, consumer goods, textiles, and medical applications, among others.

Market Growth Drivers

1. Government Regulations and Bans on Single-Use Plastics Many governments across the globe are banning or heavily taxing single-use plastics. For instance, the EU’s Single-Use Plastics Directive and similar initiatives in India and several U.S. states are creating a favorable regulatory landscape for biodegradable alternatives.

2. Corporate Sustainability Goals Large corporations are under increasing pressure from shareholders, regulators, and consumers to meet sustainability targets. Companies in retail, FMCG, and e-commerce are shifting to biodegradable packaging to align with ESG commitments and reduce carbon footprints.

3. Increasing Environmental Awareness With growing awareness of plastic waste's ecological impact—especially in oceans and landfills—consumers are actively seeking sustainable alternatives. Biodegradable plastics are seen as a responsible and eco-friendly choice.

4. Technological Advancements in Biopolymer Development Ongoing R&D has improved the performance, durability, and cost-efficiency of biodegradable plastics. New bioplastics now match or exceed traditional plastics in terms of clarity, strength, and thermal resistance, opening doors to broader applications.

5. Expansion of Composting and Waste Management Infrastructure Investment in composting facilities and improvements in waste segregation practices are making it easier to dispose of biodegradable plastics correctly. This supports higher adoption, especially in food packaging and agriculture.

Application Areas of Biodegradable Plastics

Packaging: The largest and fastest-growing segment, including compostable bags, wrappers, trays, and films.

Agriculture: Used for mulch films, plant pots, and seed coatings that break down in soil, reducing plastic residue.

Consumer Goods: Products like disposable cutlery, toothbrushes, and hygiene products increasingly use biodegradable materials.

Textiles: Bioplastics are being incorporated into clothing, nonwovens, and shoe components to reduce microplastic release.

Medical and Pharmaceutical: Biodegradable materials are ideal for single-use medical products, such as sutures and packaging for sterile equipment.

Key Market Players

Several industry leaders are shaping the global biodegradable plastics landscape with innovation, partnerships, and capacity expansion:

Cargill Incorporated A major player in agricultural and food ingredients, Cargill also produces biodegradable polymer materials derived from corn starch. Their product lines support industrial-scale production of eco-friendly alternatives.

PTT MCC Biochem Co., Ltd. A joint venture between PTT Global Chemical and Mitsubishi Chemical, the company focuses on producing bio-based and biodegradable polymers, especially PTT (polytrimethylene terephthalate).

Biome Technologies plc This UK-based company develops and manufactures sustainable bioplastics for packaging, horticulture, and electronics. Their compostable materials are gaining traction in Europe.

Plantic Technologies Limited An Australian firm specializing in high-barrier, biodegradable packaging materials particularly suited for the food industry. Their starch-based polymers offer excellent oxygen and moisture resistance.

BASF SE One of the world’s largest chemical companies, BASF offers certified compostable bioplastics under the brand ecovio®, used widely in organic waste bags and agricultural films.

Total Corbion PLA A 50/50 joint venture between TotalEnergies and Corbion, this company is a leading global supplier of PLA bioplastics. Their materials are used in rigid packaging, textiles, and 3D printing.

NatureWorks LLC Known for its Ingeo™ brand of PLA, NatureWorks is a global leader in biopolymer production. Their products are used across multiple industries, including packaging, nonwovens, and electronics.

Regional Insights

Europe is the global leader in biodegradable plastic adoption, thanks to strict environmental policies and supportive infrastructure. Countries like Germany, France, and Italy have aggressive targets for plastic reduction.

North America is witnessing growing demand, especially in food service and retail sectors, driven by city-level bans and corporate commitments to sustainability.

Asia-Pacific is expected to experience the highest growth rate, supported by population-driven consumption, rapid urbanization, and increasing government initiatives for greener alternatives. China, Japan, India, and Thailand are prominent contributors.

Latin America and the Middle East & Africa are emerging markets, where biodegradable plastics are gaining interest in agriculture and packaging but face challenges related to cost and infrastructure.

Browse more Report:

Healthcare Discount Plan Market

Electronic Article Surveillance Market

Chronic Venous Occlusions Treatment Market

Automotive High-precision Positioning Market

Automotive Double Wishbone Suspension System Market

0 notes

Text

Laundry Care Products Market: Exploring Demand for Biodegradable Formulas, Cold‑Water Cleaners, and Sustainable Packaging

1. Market Overview

The global Laundry Care Products Market remains robust, projected to reach nearly USD 196 billion by 2032, with strong momentum driven by consumer demand for sustainability, efficiency, and convenience . Within this landscape, three interlinked trends are reshaping product development and consumer behavior:

Biodegradable, plant‑based formulas

Cold‑water‑optimized detergents

Sustainable packaging solutions

These innovations align with environmental regulations and rapidly evolving consumer priorities.

2. Rise in Biodegradable Formulas

A. Ingredient Innovation

Consumers increasingly prefer eco‑safe ingredients such as enzymes, plant-derived surfactants, and natural extracts. Over 60% of new biodegradable detergent launches feature plant-based components and eco‑certifications . Major brands—Unilever’s Seventh Generation, P&G’s Tide Earth, Henkel’s Persil Green—have introduced credible plant‑based lines with transparent, biodegradable credentials .

B. Market Growth & Consumer Trust

Substantiated by eco‑certifications (USDA Organic, EU Ecolabel, Safer Choice), biodegradable detergents now form a USD 45 billion market in 2024, with ~4.4% CAGR to 2033 . Consumer surveys show 80% of Asia-Pacific buyers value biodegradable ingredients as essential or desirable .

3. Surge in Cold‑Water Detergent Demand

A. Energy Efficiency and Performance

Heating water represents up to 90% of a laundry cycle’s energy cost. Cold‑water formulations counteract this by using low‑temperature enzymes and performance boosters . Unilever’s cold-water capsules cut energy use by up to 60%, and Tide Evo “tiles” are customized for cold cycles .

B. Combined with Sustainable Packaging

Cold‑water optimized detergents align naturally with eco packaging, since shipping efficiency and biodegradation become critical factors—particularly in environmentally sensitive markets.

4. Innovations in Sustainable Packaging

A. Plastic-Free and Refillable Designs

Brands like The Fill and Blueland offer tablets in compostable packaging and steel tins, with lower plastic footprints .

Retail pilots (Ecover refill stations, Target X Blueland initiatives) enable direct consumer participation in the circular economy .

B. Water-Soluble and Compostable Films

Biofilms offer plastic-free, soluble alternatives for pod-style delivery. Companies like Notpla and Bioplastic International, and brands such as Dropps and Seventh Generation, are pioneering compostable pod films .

5. Competitive Landscape & Strategic Drivers

FactorIndustry ResponseEco regulationEU detergent revisions, national bans on single-use plastics—pushing biodegradable and refillable systemsConsumer expectation70–80% of global buyers seek eco-friendly, refillable productsBrand innovationUnilever, P&G, Henkel, Seventh Generation, Ecover invest heavily in eco–formula and packaging R&DStartup disruptionPlatforms like Blueland, Dropps, The Fill accelerate consumer adoption with zero-waste formats

6. Challenges to Adoption

Price premiums: Biodegradable formulas and refill models often cost more, which may deter value-conscious customers .

Performance perception: Cold-water cleaners and natural enzymes must match stain-fighting standards of traditional detergents .

Infrastructure gaps: Refillable stations are still limited geographically; logistics and consumer education remain barriers .

Regulation divergence: Strong EU/Asia regulations contrast with slower adoption in other regions .

7. Growth Outlook Through 2033

Biodegradable detergent sales: Growing from USD 45 billion to USD 66 billion (4.4% CAGR) .

Eco‑packaging adoption: Refillable film and pods projected to gain 10–15% share of pod format by 2030 .

Cold‑water detergent penetration: Leading brands and appliance partnerships to drive a new standard for wash at 15–20°C cycles.

8. Recommendations for Brands and Retailers

Invest in eco-formulations and certifications: Ensure credibility with third-party validation.

Scale refill infrastructure: Leverage retail partnerships or DTC models to facilitate plastic-free refills.

Educate consumers: Market evidence of performance, energy savings, and environmental impact.

Offer hybrid formats: Provide pods/tablets in compostable packaging to ease consumer transition.

Collaborate on smart appliance integration: Align detergents with AI washers to reinforce convenience and efficacy.

Future Outlook to 2034

Green detergents: projected market ~USD 68 billion by 2033, driving mainstream adoption .

Concentrated formats: dominate ~60% of liquid segment, growing >5% CAGR .

Refill penetration: expected in urban centers globally; could reach 10–15% of detergent sales.

Tech-enabled laundry: smart appliances tied to usage data, refill indicators, and eco metrics.

Conclusion

The laundry care market is undergoing a fundamental transformation. The demand for biodegradable formulas, cold-water performance, and sustainable packaging are not fleeting trends—they represent a structural shift. Successful brands will integrate ingredient transparency, eco-conscious packaging solutions, and strong consumer education, particularly targeting urban, eco-aware consumers. As regulations tighten and digital channels expand, those offering credible, convenient, and environmentally friendly solutions will lead the category in the decade ahead.

0 notes

Text

PP Recycle Bags Market Industry Outlook: Strategic Insights and Growth Analysis 2025–2032

Global PP Recycle Bags Market continues to demonstrate robust growth, with its valuation reaching USD 2.1 billion in 2024. According to the latest industry analysis, the market is projected to grow at a CAGR of 5.9%, reaching approximately USD 3.4 billion by 2032. This growth is largely fueled by increasing environmental awareness, stringent plastic regulations, and rising demand for sustainable packaging solutions across retail and industrial sectors.

PP Recycle Bags have become essential in modern waste management systems due to their durability, cost-effectiveness, and recyclability. As governments worldwide implement bans on single-use plastics, manufacturers and retailers are rapidly adopting recycled polypropylene solutions to meet both regulatory requirements and consumer expectations for eco-friendly products.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/292990/global-pp-recycle-bags-market-2025-2032-307

Market Overview & Regional Analysis

Asia-Pacific leads the global PP recycle bags market, accounting for over 45% of total demand. China's aggressive waste management policies and India's growing retail sector are driving exceptional growth. The region benefits from established plastic recycling infrastructure and low production costs, making it the manufacturing hub for recycled PP products.

Europe follows closely with stringent EU packaging waste directives pushing adoption rates higher. North America shows steady growth through corporate sustainability initiatives, while Latin America and Africa present emerging opportunities as waste management systems modernize. However, collection infrastructure gaps in developing regions continue to challenge market expansion.

Key Market Drivers and Opportunities

The market is primarily driven by the global phase-out of conventional plastic bags, rising retail sector demand, and improved recycling technologies. Supermarkets and pharmacies account for nearly 60% of total consumption, while industrial applications are growing at the fastest rate. Recent innovations in biodegradable additives and smart packaging integration present new revenue streams for manufacturers.

Opportunities also exist in developing high-performance recycled PP blends for specialized applications and expanding collection networks in urban centers. The growing e-commerce sector's need for sustainable packaging solutions offers another significant growth avenue, particularly in emerging markets where online retail is expanding rapidly.

Challenges & Restraints

The PP recycle bags market faces several challenges including inconsistent raw material quality, higher production costs compared to virgin plastics, and consumer perception issues regarding recycled product durability. Fluctuating oil prices impact virgin PP costs, creating pricing pressures, while contamination in post-consumer waste streams remains a persistent quality concern.

Trade barriers and varying regional standards for recycled content further complicate market dynamics. Some countries' lack of organized waste collection systems limits the availability of high-quality recyclable materials, creating supply chain bottlenecks for manufacturers.

Market Segmentation by Type

With Membrane Type

Conventional Type

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/292990/global-pp-recycle-bags-market-2025-2032-307

Market Segmentation by Application

Supermarket

Pharmacies and Food Stores

Other

Market Segmentation and Key Players

Shuye

Earthwise Bag

Vietinam PP Bags

MIHA J.S.C

Command Packaging

Vina Packing Films

Green Packaging

Enviro-Tote

Euro Bags

Plastena

Replas

Polykar

Rutan Poly Industries

Republic Packaging

Zhejiang Huazheng New Material

Report Scope

This report presents a comprehensive analysis of the global and regional markets for PP Recycle Bags, covering the period from 2024 to 2032. It includes detailed insights into the current market status and outlook across various regions and countries, with specific focus on:

Sales, sales volume, and revenue forecasts

Detailed segmentation by type and application

In addition, the report offers in-depth profiles of key industry players, including:

Company profiles

Product specifications

Production capacity and sales

Revenue, pricing, gross margins

Sales performance

It further examines the competitive landscape, highlighting the major vendors and identifying the critical factors expected to challenge market growth.

As part of this research, we surveyed PP Recycle Bags companies and industry experts. The survey covered various aspects, including:

Revenue and demand trends

Product types and recent developments

Strategic plans and market drivers

Industry challenges, obstacles, and potential risks

Get Full Report Here: https://www.24chemicalresearch.com/reports/292990/global-pp-recycle-bags-market-2025-2032-307

About 24chemicalresearch

Founded in 2015, 24chemicalresearch has rapidly established itself as a leader in chemical market intelligence, serving clients including over 30 Fortune 500 companies. We provide data-driven insights through rigorous research methodologies, addressing key industry factors such as government policy, emerging technologies, and competitive landscapes.

Plant-level capacity tracking

Real-time price monitoring

Techno-economic feasibility studies

With a dedicated team of researchers possessing over a decade of experience, we focus on delivering actionable, timely, and high-quality reports to help clients achieve their strategic goals. Our mission is to be the most trusted resource for market insights in the chemical and materials industries.

International: +1(332) 2424 294 | Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/

Follow us on LinkedIn: https://www.linkedin.com/company/24chemicalresearch

0 notes

Text

Vaping in the UK 2025: A Traveller's Guide to the Latest Laws & What They Mean for You

Welcome to the UK! Whether you're here for the historic sights, vibrant cities, or stunning countryside, we want to ensure your visit is as smooth as possible. If you're a vaper, you might have questions about the UK's vaping regulations, especially with some recent changes.

The good news is that vaping remains a popular and accessible option for adults in the UK. While the rules are designed to protect public health and young people, they still allow for a wide range of products and a generally vape-friendly environment for those who follow the guidelines. This guide will walk you through what you need to know for your 2025 trip.

Bringing Your Own Vape Gear into the UK

Generally, you can bring your vaping equipment into the UK for personal use. Here are a few key points:

Devices & E-Liquids: You can typically bring your vape device (pen, pod system, mod) and a reasonable amount of e-liquid for personal consumption. While there isn't a strict legal limit for personal importation of e-liquid, it's wise to keep it to what you'd personally use for the duration of your trip to avoid any potential questions at customs.

Battery Safety: This is crucial, especially for air travel.

Always carry vape devices and spare batteries in your carry-on luggage, not checked baggage. This is a requirement for most airlines due to fire safety.

Ensure batteries are protected from short circuits – keep them in their original retail packaging, a dedicated battery case, or cover the terminals with tape.

Check with your specific airline for their latest rules on carrying e-cigarettes and batteries before you fly.

Compliance with UK Standards: While your own e-liquids brought from home for personal use are generally fine, be aware that any e-liquids sold in the UK must comply with specific standards (see below).

Key UK Vaping Regulations (As of June 2025)

Once you're here, or if you plan to buy supplies in the UK, these are the main rules to be aware of:

Age Restriction: You must be 18 years or older to purchase vape products, including devices, e-liquids, and accessories. Reputable retailers will operate a "Challenge 25" policy, meaning they will ask for ID if you look under 25.

Nicotine Strength: E-liquids containing nicotine are restricted to a maximum strength of 20mg/ml (or 2%).

E-Liquid Bottle Size: The maximum size for a single bottle of nicotine-containing e-liquid is 10ml. Larger bottles of nicotine-free e-liquid (shortfills) are available, which can then have separate 10ml nicotine shots (up to 20mg/ml) added.

Vape Tank Size: The maximum capacity for a vape tank or pod is 2ml.

Packaging & Labelling: All products sold in the UK must adhere to strict packaging and labelling rules, including health warnings (covering 30% of the front and back of packaging) and ingredient lists.

These regulations are part of the Tobacco and Related Products Regulations (TRPR), which incorporated the EU's Tobacco Products Directive (TPD) into UK law. You can find more official information on the UK Government's guidance on e-cigarette regulations.

The Disposable Vape Ban: Effective June 1st, 2025

A significant change for vapers in the UK is the ban on the sale and supply of disposable (single-use) vapes, which came into effect on June 1st, 2025.

What does this mean for travellers?

As of June 1st, 2025, you cannot legally buy disposable vapes in the UK.

It is advisable not to rely on bringing disposable vapes with you for use during your stay, as the focus of the law is on preventing their sale and supply within the UK. While personal use of items already owned might be viewed differently, purchasing them locally is no longer an option.

Why the ban? The primary drivers are environmental concerns due to the waste generated by single-use plastic and electronic components, and to curb the alarming rise in youth vaping, where disposables have been particularly popular.

What are the alternatives? The UK market is rich with excellent, user-friendly alternatives to disposables, such as:

Refillable pod systems: These are compact, easy to use, and involve simply refilling a pod with e-liquid. They are a cost-effective and environmentally friendlier choice.

Rechargeable vape pens and starter kits: Offering a bit more customization, these are also widely available.

The focus of the ban is on the sale and supply within the UK. For the most current status and details, refer to official government announcements.

Buying Vapes and E-Liquids in the UK: Easy and Affordable

Despite the disposable vape ban, you'll find it very straightforward to purchase legal, reusable vaping products during your stay:

Where to Buy:

Specialist Vape Shops: These are abundant in most towns and cities and offer the widest selection of reusable devices and e-liquids, along with expert advice. For convenience, you can also explore online retailers like Magic Elf Vapes, where you may even be able to pre-order your preferred reusable devices and e-liquids for delivery directly to your hotel or accommodation, ensuring they are ready for your arrival.

Supermarkets & Convenience Stores: Many larger supermarkets (like Tesco, Sainsbury's, Asda) and local convenience stores stock a range of popular e-liquids and basic reusable vape kits.

Product Availability: A vast array of TRPR-compliant reusable devices is available, from simple pod systems perfect for beginners or those transitioning from disposables, to more advanced mods for experienced users.

Affordability: Compared to traditional cigarettes, vaping with reusable devices in the UK is generally a more affordable option. Refillable systems, in particular, offer significant long-term savings.

A World of Flavours Still Awaits

Despite ongoing discussions and consultations about potential future flavour restrictions (aimed at reducing youth appeal), the UK currently boasts one of the most diverse and exciting e-liquid flavour markets in the world.

As of June 2025, you can still find a huge variety of e-liquid flavours for use in reusable devices, from traditional tobacco and menthol to countless fruit, dessert, beverage, and candy options. While the government is considering further regulations on flavours, these are not yet law, and any changes would be subject to parliamentary approval and an implementation period. For now, you can explore and enjoy a wide selection of high-quality, legally compliant e-liquids from numerous UK-based and international brands.

Vaping Etiquette: Where Can You Vape in the UK?

Understanding where you can and cannot vape will ensure a hassle-free experience:

General Rule: The most basic rule is that vaping is generally not permitted in places where smoking is banned. This includes most enclosed public spaces and workplaces.

Public Transport: Vaping is typically banned on all forms of public transport, including buses, trains (including station platforms for many train operators), trams, and the London Underground. Always check for signage.

Indoor Public Places:

Pubs, Restaurants, Cafes, Shops: Most do not permit vaping indoors. Some pubs may have designated outdoor vaping areas similar to smoking areas. Always ask staff if you are unsure.

Airports & Planes: Vaping is prohibited in UK airports beyond security checkpoints and on all flights.

Outdoor Public Spaces: Vaping in outdoor public spaces like parks or on the street is generally permitted, but always be considerate of those around you.

Accommodation: Hotels, B&Bs, and other accommodations will have their own policies. Many do not allow vaping in rooms. Check the policy when booking or upon arrival.

Workplaces: Vaping policies are set by individual employers.

Always look for signage and, if in doubt, ask permission. Being considerate of others is key.

Enjoy Your UK Visit!

The UK's vaping laws are in place to ensure products are safe and to protect young people, but they also support adult smokers in switching to a less harmful alternative. As a tourist in 2025, you'll find that with a little awareness of the rules, you can easily and legally vape with reusable devices, access a wide variety of quality products, and enjoy the diverse flavours available.

Keep an eye on official government sources for any updates as your travel date nears, but rest assured that the UK remains a welcoming place for vapers who respect the local regulations.

Disclaimer: This article provides general information as of June 2025 and is not legal advice. Vaping laws and regulations can change. Always refer to official UK government sources and check with airlines and accommodation providers for the most current and specific guidance.

0 notes

Text

Global Nonwoven Cotton, Market Expansion Driven by Medical and Hygiene Demand

Global Nonwoven Cotton Market is witnessing steady growth driven by increasing demand across medical, hygiene, and personal care industries. Unlike traditional textiles, nonwoven cotton offers superior absorbency, breathability, and cost-effectiveness – qualities that make it indispensable in healthcare and consumer goods sectors. As sustainability becomes a priority, manufacturers are investing heavily in eco-friendly production methods to meet evolving regulatory standards and consumer expectations.

Nonwoven cotton fabrics are engineered through mechanical, thermal, or chemical bonding processes without weaving or knitting. This technology enables customized fabric properties, making it ideal for specialized applications ranging from surgical drapes to cosmetic wipes. With growing health awareness post-pandemic and tightening safety regulations, the sector is poised for long-term expansion.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/291993/global-nonwoven-cotton-market-2025-562

Market Overview & Regional Analysis

Asia-Pacific commands over 45% of global nonwoven cotton production, with China, India and Japan leading both manufacturing and consumption. The region benefits from established textile infrastructure, low production costs, and booming healthcare expenditure. Local governments are actively supporting industry growth through subsidies for medical grade nonwovens, particularly for aging population care solutions.

North America remains a technology leader, with advanced needle-punch and spunlace production facilities catering to high-value medical applications. Europe's market is shaped by stringent EU regulations on single-use medical products, driving innovations in biodegradable nonwovens. Emerging economies in Africa and Latin America show promising growth as disposable income rises and healthcare access improves, though infrastructure gaps remain a challenge.

Key Market Drivers and Opportunities

Three factors dominate the market expansion: First, the global hygiene products sector is growing at unprecedented rates, with adult incontinence products and premium baby diapers adopting advanced nonwoven cotton blends. Second, medical applications now account for over 38% of consumption as hospitals prioritize infection control. Third, sustainable fashion brands are incorporating nonwoven cotton in accessory lines and innerwear due to its moldability and comfort.

The circular economy presents significant opportunities with developments in cotton recycling technologies. Some manufacturers now integrate up to 40% recycled content without compromising performance. Emerging applications in technical textiles, particularly in automotive sound absorption and filtration systems, are opening new revenue streams. The home textile segment also shows potential as consumers seek hypoallergenic bedding alternatives.

Challenges & Restraints

While growth prospects are strong, the industry faces several headwinds. Price volatility of raw cotton affects production planning, with many manufacturers maintaining dual sourcing strategies. Quality consistency remains problematic for recycled cotton fibers, limiting their use in medical-grade products. Trade policies are another concern - several countries have imposed temporary restrictions on nonwoven exports during health crises, disrupting global supply chains.

Environmental regulations present both challenges and opportunities. The EU's Single-Use Plastics Directive has accelerated research into bio-based binders, but developing cost-competitive alternatives remains difficult. Labor-intensive production processes in developing markets also create quality control issues, requiring significant investment in operator training and automation.

Market Segmentation by Type

Cotton Spunlace

Needle-punched Cotton

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/291993/global-nonwoven-cotton-market-2025-562

Market Segmentation by Application

Medical and Hygiene Products

Home Hygiene and Personal Care Products

Clothing

Others

Market Segmentation and Key Players

Unitika

Autotech Nonwovens

Marusan Sangyo

IHSAN Sons

Henan Beynost

Soonercleaning

Hangzhou Non wovens Limited

Laboratoire Naturel

Sanitars

Sateri

Anhui Huamao Group

Winner

Zhejiang Chenyang Nonwoven

Report Scope

This report presents a comprehensive analysis of the global Nonwoven Cotton market from 2024 to 2032, featuring:

Market size projections with historical data and future growth trends

Detailed segmentation by product type, application, and geography

Competitive intelligence including market share analysis and strategic profiles of key players

Value chain analysis from raw material sourcing to end-use applications

Technology trends and innovation landscape in nonwoven manufacturing

The research methodology combines primary interviews with industry experts, factory audits, and analysis of proprietary industry databases. Our team has conducted over 200 hours of interviews with:

Raw material suppliers

Nonwoven fabric manufacturers

Brand owners and converters

Trade associations

Regulatory bodies

Get Full Report Here: https://www.24chemicalresearch.com/reports/291993/global-nonwoven-cotton-market-2025-562

About 24chemicalresearch

Founded in 2015, 24chemicalresearch has rapidly established itself as a leader in chemical market intelligence, serving clients including over 30 Fortune 500 companies. We provide data-driven insights through rigorous research methodologies, addressing key industry factors such as government policy, emerging technologies, and competitive landscapes.

Plant-level capacity tracking

Real-time price monitoring

Techno-economic feasibility studies

With a dedicated team of researchers possessing over a decade of experience, we focus on delivering actionable, timely, and high-quality reports to help clients achieve their strategic goals. Our mission is to be the most trusted resource for market insights in the chemical and materials industries.

International: +1(332) 2424 294 | Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/

Follow us on LinkedIn: https://www.linkedin.com/company/24chemicalresearch

#GlobalNonwovenCotton#MedicalTextiles#HygieneProducts#SustainableNonwovens#CottonSpunlace#NeedlePunchedCotton#BiodegradableTextiles#PersonalCareFabric#HealthcareFabrics

0 notes

Text

Paper Bottles Market Trends Shaping Sustainable Packaging Globally in 2025

Understanding the dynamics of the Paper Bottles Market through detailed market research is essential for shaping impactful and competitive business strategies.

As sustainability takes center stage in both consumer behavior and regulatory frameworks, companies across the globe are compelled to rethink their packaging approaches. The year 2025 marks a significant turning point for the Paper Bottles Market, as it reflects a broader shift toward eco-friendly and innovative packaging solutions. With increasing pressure to reduce plastic usage and carbon footprints, businesses are turning to market research not just as a tool, but as a strategic pillar that influences every aspect of product development, marketing, and operations.

The Rise of Paper Bottles in a Sustainability-Focused World

The global packaging industry has traditionally relied heavily on plastic materials due to their durability and cost-effectiveness. However, the long-term environmental impact of plastics has led to a growing demand for sustainable alternatives. Paper bottles have emerged as a leading solution, combining biodegradability, functionality, and branding opportunities. Their rise is not coincidental—it is backed by years of market research that has tracked consumer sentiment, regulatory evolution, and technological feasibility.

Businesses leveraging these insights are able to understand what drives consumer preferences and where future opportunities lie. Market research in the paper bottles sector highlights a growing inclination toward products that communicate environmental responsibility. Companies that align their strategies accordingly not only strengthen their brand reputation but also gain a competitive edge in a rapidly transforming market.

Consumer Trends: A Shift Toward Eco-Conscious Buying

One of the primary forces reshaping the Paper Bottles Market is the shift in consumer values. Today’s buyers, especially millennials and Gen Z, are more likely to choose brands that reflect their concerns about climate change and sustainability. Market research has been pivotal in identifying this trend and forecasting its long-term implications.

Through tools like surveys, focus groups, and sentiment analysis, businesses gain a clearer picture of how packaging choices influence purchase decisions. For instance, many studies indicate that consumers are willing to pay a premium for products with sustainable packaging. This insight has encouraged major brands across industries—be it beverages, cosmetics, or household cleaning—to invest in paper bottle alternatives. Armed with data, businesses are moving beyond traditional packaging not out of obligation, but as a strategic decision to capture and retain market share.

Regulatory Pressures and Compliance Opportunities

Government regulations are another critical factor shaping the future of the Paper Bottles Market. Countries around the world are implementing stringent policies to limit single-use plastics and promote sustainable practices. From the EU’s directive on single-use plastics to regional bans across Asia and North America, the legislative environment is becoming increasingly supportive of alternative packaging.

Businesses that engage in proactive market research are better equipped to navigate these changes. By staying ahead of regulatory trends, they can adjust their product designs and supply chains accordingly. In some cases, companies have turned regulatory compliance into a market advantage, promoting their early adoption of eco-friendly materials as part of their brand narrative.

Moreover, market research enables businesses to anticipate future policy shifts and prepare accordingly. This forward-looking approach minimizes risk and ensures continuity, especially in global operations where regulatory landscapes vary significantly.

Innovation Through Insight: Design, Materials, and Technology

Paper bottle innovation is driven by a combination of material science, engineering, and consumer usability. Market research informs each of these areas by identifying what features are most valued by consumers—such as recyclability, ease of use, and aesthetic appeal. By translating customer needs into design specs, companies are developing paper bottles that are both functional and attractive.

Furthermore, research on emerging technologies and materials helps businesses stay ahead of the curve. For example, advancements in water-resistant coatings or biodegradable linings have opened new possibilities for paper bottle applications in liquids, dairy, and even alcohol packaging. Market research guides investment in these innovations by validating their demand and economic viability.

Competitive Intelligence and Strategic Positioning

Understanding what competitors are doing is just as important as knowing what consumers want. Competitive intelligence, a core component of market research, allows businesses to track trends, benchmark performance, and identify white spaces in the market. This information is invaluable for positioning a brand effectively in the Paper Bottles Market.

By analyzing competitor strategies—such as their marketing messages, pricing models, distribution channels, and customer engagement tactics—companies can identify gaps or areas for differentiation. This not only enhances strategic decision-making but also fosters innovation and agility in response to market dynamics.

Market Segmentation: Targeting the Right Audience

Another key benefit of market research is its ability to uncover specific consumer segments that are most likely to adopt paper bottles. Whether it’s eco-conscious urban dwellers, luxury product buyers, or health-focused individuals, segmentation enables businesses to tailor their messaging, product features, and distribution strategies.

Detailed demographic, psychographic, and behavioral data empower companies to focus resources on the most promising market segments. This targeted approach not only improves marketing ROI but also ensures that product development aligns with actual customer expectations.

Conclusion: From Insight to Impact

In 2025, the Paper Bottles Market is more than a niche sustainability trend—it is a reflection of how market research can shape and strengthen business strategies across sectors. By leveraging data-driven insights, companies can innovate confidently, meet consumer demands, comply with evolving regulations, and outpace competitors.

Ultimately, the brands that will thrive are those that embed market research at the heart of their strategic planning. In doing so, they not only create sustainable value for their customers but also position themselves for long-term success in an environmentally conscious world.

#MarketResearch#BusinessStrategy#PaperBottlesMarket#SustainablePackaging#ConsumerTrends#InnovationLeadership

0 notes

Text

North America Point-of-Care Molecular Testing for Infectious Diseases Market Size, Share, Trends, Segmentation And Forecast To 2031

Europe Food Contact Paper Market: Rising Demand for Sustainable Packaging in the Food Industry

The North America point-of-care molecular testing for infectious diseases market forecast presented in this report can help stakeholders in this marketplace plan their growth strategies. The surging prevalence of infectious diseases and preference for rapid diagnostic solutions are the key factors propelling the market development. However, inadequate reimbursement scenarios impede the North America point-of-care molecular testing for infectious diseases market growth.

The Europe Food Contact Paper Market is experiencing significant growth, driven by increasing consumer awareness regarding food safety and sustainability. With the rising demand for eco-friendly and biodegradable packaging solutions, food contact paper has emerged as a vital component in the packaging industry across Europe.

Food contact paper is specifically designed to come into direct contact with food products without posing health risks. In the Europe Food Contact Paper Market, manufacturers are focusing on producing paper that complies with EU food safety regulations while addressing environmental concerns. This dual focus has accelerated innovation and investment in the region.

A key factor propelling the Europe Food Contact Paper Market is the shift in consumer behavior. As European consumers become more environmentally conscious, the demand for recyclable and compostable packaging materials is growing. Foodservice companies, restaurants, and retail chains are responding to this trend by switching to paper-based alternatives, thereby boosting the market’s growth trajectory.

Moreover, the regulatory landscape in Europe supports the development of the Europe Food Contact Paper Market. The European Union’s stringent food safety standards and sustainability goals encourage the use of certified, chemical-free food contact materials. This regulatory support ensures consumer safety while promoting sustainable practices, making food contact paper a preferred choice among packaging solutions.

In addition to regulations and consumer preferences, technological advancements are playing a crucial role in the Europe Food Contact Paper Market. Innovations such as grease-resistant coatings, moisture barriers, and enhanced printability are enabling food contact paper to match or surpass the performance of plastic packaging. These improvements have widened the application of food contact paper in ready-to-eat meals, bakery products, confectionery, and fast food.

📚𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐋𝐢𝐧𝐤 @ https://www.businessmarketinsights.com/reports/north-america-point-of-care-molecular-testing-for-infectious-diseases-market

Retail trends also contribute significantly to the expansion of the Europe Food Contact Paper Market. Supermarkets and food delivery services increasingly rely on attractive and functional packaging to appeal to health-conscious and eco-friendly consumers. Branded packaging using food-safe paper helps improve product presentation while aligning with green marketing strategies.

The COVID-19 pandemic had a mixed impact on the Europe Food Contact Paper Market. Initially, disruptions in the supply chain led to short-term setbacks. However, the pandemic reinforced the importance of hygiene and safe packaging, leading to a renewed emphasis on single-use but biodegradable food contact materials. This shift has fueled market recovery and long-term growth.

The competitive landscape of the Europe Food Contact Paper Market includes a mix of global and regional players. Companies are investing in research and development to introduce innovative products that meet both safety and sustainability criteria. Partnerships between paper manufacturers and food brands are also enhancing product customization and market penetration.

Looking ahead, the Europe Food Contact Paper Market is poised for sustained growth. Factors such as environmental regulations, evolving consumer preferences, and technological enhancements will continue to shape the market. Stakeholders in the packaging and food industries are expected to increase their reliance on food contact paper to meet sustainability goals.

In conclusion, the Europe Food Contact Paper Market is at the forefront of a packaging revolution. By aligning health, safety, and environmental values, it is transforming how food is packaged and consumed across Europe. The continued evolution of this market promises not only innovation but also a greener future for food packaging.

The List Of Companies.

Abbott Laboratories

Agilent Technologies Inc

Becton Dickinson and Co

Bio-Rad Laboratories Inc

Cardinal Health Inc,

Danaher Corp

Cue Health Inc,

QuidelOrtho Corp

Thermo Fisher Scientific Inc

Hoffmann-La Roche Ltd.

North America Point-of-Care Molecular Testing for Infectious Diseases Regional Insights