#Electro Optical Targeting System

Explore tagged Tumblr posts

Text

Electro Optical Targeting System Market Set for Rapid Growth Due to Increased Military Modernization Programs

The electro optical targeting system market comprises precision electro optic and infrared technologies that provide day and night targeting capabilities across air, land and naval platforms. EOTS offer enhanced situational awareness and precision strike abilities to armed forces worldwide. The growing emphasis on network centric warfare, target tracking and engagement has led to a surge in EOTS integration across fighter aircraft, helicopters, battle tanks and warships.

Global electro optical targeting system market is estimated to be valued at USD 13.96 Bn in 2024 and is expected to reach USD 20.18 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 5.4% from 2024 to 2031.

Key Takeaways Key players operating in the electro optical targeting system market include BAE Systems, Elbit Systems, FLIR Systems, General Atomics, Harris Corporation, Hensoldt, Leonardo S.p.A., L3 Technologies, Northrop Grumman, and Raytheon Technologies. These market leaders have strong footholds across geographies and possess comprehensive EOTS capabilities from sensors to fully integrated targeting pods. The Electro Optical Targeting System Market Growth offers significant opportunities owing to integration across emerging platforms such as unmanned combat vehicles, loitering munitions and space assets. Add-on considerations such as augmented reality overlays, targeting algorithms and deep learning are widening EOTS functional scopes. Furthermore, the demand for mobile and transportable EOTS from security forces and special operations is on the rise. The global expansion of EOTS suppliers and original equipment manufacturers is being driven by burgeoning defense budgets and military modernization programs across Asia Pacific, Middle East, Eastern Europe and Latin America. Partnerships with local defense firms are enabling international EOTS players to participate in co-development and offset programs. Market drivers The key driver for the Electro Optical Targeting System Companies growth is increased military modernization programs by major armed forces globally. Leading countries are aggressively procuring new generation aircraft, helicopters, Armored Vehicles and warships equipped with advanced EOTS. Furthermore, continuous upgradation of existing military hardware and platforms with improved targeting and sensor suites is propelling aftermarket revenues. Rising global threats, border conflicts and expansion of strategic deterrence roles have strengthened the business case for sophisticated EOTS among defense organizations.

PEST Analysis Political: The electro optical targeting system market is influenced by defense budgets and spending allocated by governments. Changes in defense priorities and geopolitical risks affects procurement of these systems. Economic: Economic growth impacts defense modernization plans of armed forces. Defense expenditure is dependent on macroeconomic conditions of nations. Social: Rising threats relating to security and terrorism drives demand for advanced targeting solutions for precision strikes. Growing awareness regarding national security concerns influences investments. Technological: The market is witnessing integration of computer vision, AI and connectivity features in electro optical targeting systems. Advanced sensors and technologies enable improved detection, tracking and engagement capabilities. Geographical Regions of Concentration North America holds the major share of the electro optical targeting system market in terms of value. This can be attributed to large defense budgets and ongoing modernization initiatives of US, Canada and Mexico. Significant expenditure on military hardware supports demand from regional armed forces and allied nations. Fastest Growing Region Asia Pacific is poised to witness the fastest growth during the forecast period. Rapid defense capability enhancement of China, India, Japan, South Korea and other nations is a key factor driving the market. Initiatives to develop indigenous manufacturing capacities along with import of advanced technologies will propel the APAC electro optical targeting system market.

Get more insights on Electro Optical Targeting System Market

Alice Mutum is a seasoned senior content editor at Coherent Market Insights, leveraging extensive expertise gained from her previous role as a content writer. With seven years in content development, Alice masterfully employs SEO best practices and cutting-edge digital marketing strategies to craft high-ranking, impactful content. As an editor, she meticulously ensures flawless grammar and punctuation, precise data accuracy, and perfect alignment with audience needs in every research report. Alice's dedication to excellence and her strategic approach to content make her an invaluable asset in the world of market insights.

(LinkedIn: www.linkedin.com/in/alice-mutum-3b247b137 )

#Coherent Market Insights#Electro Optical Targeting System Market#Electro Optical Targeting System#Military Technology#Targeting Systems#Defense Systems#EO/IR#Infrared Targeting#Optical Sensors#Precision Targeting

0 notes

Text

The U.S. Air Force Has Released The First Official Images Of The B-52 In Orange Paint Scheme

David CenciottiLast updated: October 4, 2024 1:54 PM

B-52 orange

The B-52 sporting the amazing throwback paint scheme has returned at Barksdale Air Force Base.

As reported in details a few days ago, a U.S. Air Force B-52H Stratofortress bomber was photographed by our friend Rob Stephens at Redhome Aviation, taking off from Tinker Air Force Base, Oklahoma, home of the Oklahoma City Air Logistics Complex, on Sept. 30, 2024 sporting an eye catching paint scheme.

The B-52 sporting the amazing throwback paint scheme has returned at Barksdale Air Force Base.Under testing after six decades of operationsThe previous orange BUFFs

The B-52H 61-0028 “Wolfpack” had forward fuselage, wings near the wingtips, engine nacelles, and vertical stabilizer painted in dayglo orange, contrasting the typical overall dark gray paint of the Stratofortress aircraft. As explained, the bomber was not given any markings, as the “OT” and “49 TES” tail markings, black arrow point on the tail, and “U.S. Air Force” on the fuselage will be applied upon return to Barksdale AFB, Louisiana.

The U.S. Air Force has now released some official images of the test aircraft.

These photographs depict the “throwback B-52” arriving at Barksdale. According to the captions, “the test orange scheme was used to remind everyone of the B-52’s incredible journey and continuous progress made in the U.S. Air Force.”

A B-52H Stratofortress with a special orange paint scheme parks after landing at Barksdale Air Force Base, La., Sept. 30, 2024. The orange paint scheme was used to signify the B-52’s modernization while paying respect to its legacy. (U.S. Air Force photo by Airman 1st Class Aaron Hill)

The B-52 with orange accents that touched down at Barksdale is part of the 49th Test and Evaluation Squadron, which leads operational testing for the bombers.

U.S. Air Force Aircrew from the 49th Test and Evaluation Squadron, 53d Wing, gather beside a U.S. Air Force B-52H Stratofortress with a special orange paint scheme at Barksdale Air Force Base, La. Sept. 30, 2024. The orange color represents a test and evaluation paint scheme based on the test and evaluations conducted during the 1950s and 1960s, honoring the B-52’s history. (U.S. Air Force photo by Airman 1st Class Aaron Hill)

Under testing after six decades of operations

In the next few years, the Air Force plans to modernize its fleet of B-52H bombers with a series of upgrades that will extend the bomber’s service life into the 2050s, by which time the aircraft will be nearing 100 years in operation.

The “new” B-52s will be designated B-52J.

Rolls-Royce F130 engines will replace the aging Pratt & Whitney TF33-PW-103 engines through its remaining operational life, significantly improving fuel efficiency, range, and reducing maintenance costs. Another key upgrade is the installation of a modified version of the APG-79 AESA radar, used in the F/A-18EF Super Hornet. This radar will enhance the B-52’s range and situational awareness while freeing up space for additional electronic warfare capabilities. Externally, the removal of the AN/ASQ-151 Electro-Optical Viewing System (EVS) will streamline the bomber’s appearance, as modern targeting pods have made the EVS obsolete.

Inside, the B-52 cockpit will receive new digital multifunction displays, a hybrid mechanical-to-digital throttle system, new data concentrators, and an upgraded engine management system. While not a fully modern glass cockpit, these upgrades will improve functionality. Additionally, crew size will be reduced from five to four members.

The B-52J will also feature humps near the wing roots, possibly for classified equipment such as satellite communications systems, further enhancing the bomber’s capabilities.

The Air Force aims to complete integration and deliver the first modified B-52s by 2026-2027, with full operational capability anticipated by 2030.

U.S. Air Force Airmen from the 49th Test and Evaluation Squadron, 53rd Wing, gather beside a B-52H Stratofortress with a special orange paint scheme at Barksdale Air Force Base, La. Sept. 30, 2024. The orange color represents a test and evaluation paint scheme based on the test and evaluations conducted during the 1950s and 1960s, honoring the B-52’s history. (U.S. Air Force photo by Airman 1st Class Aaron Hill)

The previous orange BUFFs

In mid-1957, NASA made the decision to replace the B-36 Peacemaker with the B-52 Stratofortress as the launch aircraft for the X-15 hypersonic research program. The B-36 was nearing the end of its operational life, and it was anticipated that finding spare parts to maintain it after retirement would be challenging.

As the X-15 project advanced, two B-52 Stratofortresses, the NB-52A and NB-52B, were chosen to serve as the launch platforms. The NB-52B, designated 52-0008 and nicknamed “The Challenger,” continued in this role until its last mission in November 2004, while the NB-52A, known as “The High and Mighty One” with tail number 52-0003, was retired earlier in 1969. “The High and Mighty One” is still preserved and displayed at the Pima Air & Space Museum in Arizona, with its distinctive orange markings.

High-altitude contrails frame the B-52 mothership as it carries the X-15 aloft for a research flight on 13 April 1960 on Air Force Maj. Robert M. White’s first X-15 flight. The X-15s were air-launched so that they would have enough rocket fuel to reach their high speed and altitude test points. For this early research flight, the X-15 was equipped with a pair of XLR-11 rocket engines until the XLR-99 was available. (Image credit: NASA)

The NB-52B served as an airborne launch platform, essentially acting as a flying launch pad. It operated at altitudes of nine miles, providing the rocket planes it carried with necessary fuels, gases, and electrical power. To handle this role, the right wing of the aircraft was reinforced and equipped with a pylon capable of carrying over 50,000 pounds—approximately a fifth of the aircraft’s total weight. This made the Stratofortress a crucial asset in various aeronautical research endeavors, including those that eventually contributed to the development of the Space Shuttle.

One of the NB-52B’s key contributions was helping validate the Space Shuttle’s steep gliding landings. It accomplished this by launching wingless lifting bodies, which demonstrated that such landings were possible. The aircraft also played a vital role in testing parachutes for recovering the Shuttle’s solid rocket boosters and the drag chute used during Shuttle landings. Despite its increasing age and the growing cost of maintenance, the NB-52B continued to support a wide array of cutting-edge research throughout the 1970s and 1980s, launching drones, remotely piloted vehicles, and experimental payloads.

In addition to its launch duties, the NB-52B was used in research on wake turbulence, served as a target for gunnery exercises, and tested fuel additives aimed at reducing pollution. At one point, it flew with ten engines when additional engines were mounted under the bomb bay for testing purposes. During the X-38 program, the aircraft deployed the largest parafoil in history, with a surface area larger than a Boeing 747’s wing.

The NB-52B’s last mission took place in 2004, when it launched the X-43A, which reached a speed of Mach 9.6 using the most powerful air-breathing engine ever built. After a long and significant career contributing to both aviation and space research, the NB-52B was officially retired on December 17, 2004, during a ceremony at NASA’s Dryden Flight Research Center.

At the time of its retirement, “Balls 8” (a nickname derived from its NASA tail number 52-008, where military slang refers to leading zeroes as “Balls”) was the oldest B-52 still in active service and the only one that wasn’t an H model. It also had the lowest total flight hours of any operational B-52. The aircraft is now displayed permanently near the north gate of Edwards Air Force Base in California.

@TheAviationist.com

14 notes

·

View notes

Text

By downing three enemy stealth fighters, Iranian air defenses have shattered the long-standing myth of Israeli “air superiority” cultivated over two decades.

The fact that these aircraft were destroyed within 48 hours, while their crews were captured, killed, or remain missing, demonstrates a high level of tactical sophistication in the command and control of Iranian armed forces.

Notably, Israeli aircraft operated with relative impunity on the first night, underscoring the strategic tactics employed by Iran to plan and execute the successful shootdowns later.

Falling for the bait

The Israeli F-35s were destroyed in Iranian airspace on the second day of Israeli aggression on Iran, after the regime commanders believed they had severely damaged Iranian air defenses on the first day, Friday.

While the number and usual deployment of Iranian radar batteries can be estimated from open-source and intelligence data, distinguishing real air defenses from decoys remains challenging. These decoys are intended to mislead anti-radiation missiles, cruise missiles, and drones.

During the attacks, Israeli regime forces primarily used drones equipped with electro-optical (EO) and infrared (IR) sensors to strike radar installations. However, once these drones detonate, their sensors are destroyed, leaving operators uncertain whether they eliminated real radar systems or decoys.

Reconnaissance drones and satellites offer insufficient resolution for precise damage assessment. The only reliable verification would require agents on the ground deep inside Iran—a high-risk and unlikely scenario.

Iran has long been known to employ sophisticated military decoys, including radar batteries. These decoys are far more advanced than simple wooden mock-ups; some emit false radar signals to mimic real activity and can cost upwards of $10,000 each.

On the first night of the Israeli regime’s attacks on mostly civilian areas in Tehran, Iran combined decoys with strategic deception by withdrawing many real radar batteries from service and hiding them, while exposing only mock-ups.

Israeli drones targeted these apparent radar sites, believing they had crippled Iranian defenses and gained air superiority.

This miscalculation proved costly. On subsequent attacks, Israeli fighter jets ventured deeper into Iranian airspace, unaware that functional radar systems had been reactivated. Iranian air defenses surprised the Israeli Air Force by engaging and shooting down several advanced stealth fighters.

Had Iranian forces attempted to down jets on the first night without this element of surprise, their success would have been doubtful. Additionally, any wreckage from early shootdowns would likely have fallen into neighboring Iraq, offering Iran little opportunity for technological study.

2 notes

·

View notes

Text

Arms factory invaders told they caused £1million in damage

News, Jun 19th

Palestine Action targeted Elbit subsidiary Instro Precision in Kent

During their 36-hour arrest, police told Palestine Action members that their invasion of Elbit Systems’ electro-optics factory in Kent had caused over £1 million in damage. Tens of activists stormed the premises in the early hours of Monday (17.6), seven were detained.

full report:

#arms factory#invaders#damage#palestine#palestine activism#palestine action#161#1312#elbit systems#shut elbit down#kent#free palestine#freepalastine🇵🇸#free gaza#gaza strip#gaza genocide#gazaunderattack#gaza#all eyes on rafah#free rafah#save rafah#rafah under attack#rafah#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals

5 notes

·

View notes

Text

The Navy and Lockheed Martin are planning to demonstrate a beyond-the-horizon anti-ship missile detection and defense technology using an F-35 Joint Strike Fighter.

More info on Fox News

And according to a story by Kris Osborn published on January 22, 2015 on the Defense Tech website:

“The Navy and Lockheed Martin are planning to demonstrate a beyond-the-horizon anti-ship missile detection and defense technology using an F-35 Joint Strike Fighter.

The system, referred to as Naval Integrated Fire Control-Counter Air, or NIFC-CA, uses Aegis radar, an airborne sensor and SM-6 missile to find, track and destroy approaching threats such as cruise missiles at ranges well beyond the typical radar horizon, Navy officials said.

Alongside Aegis radar and an SM-6 missile, NIFC-CA uses an E-2D Hawkeye aircraft as an airborne sensor to help relay threat information to the ship from beyond its normal radar range.

Lockheed is working closely with Naval Sea Systems Command, or NAVSEA, to plan a NIFC-CA demonstration at White Sands Missile Range, N.M., sometime this year or next year, a Lockheed executive said.

“We are looking at alternative airborne sensors,” the executive said.

The idea with a demonstration, sources indicate, would be to use the F-35 as an airborne relay node or sensor in place of the E-2D Hawkeye. This could allow NIFC-CA to operate against an increasingly complex set of targets such as stealthy targets, the Lockheed executive explained.

Sensors on the F-35 include the Active Electronically Scanned Array, or AESA, radar as well as a system called Distributed Aperture System, or DAS, which combines input from as many as six different electro-optical cameras on the aircraft. The aircraft also draws upon a technology called Electro-optical Targeting System, or EOTS, which helps identify and pinpoint targets. EOTS, which does both air-to-air and air-to-ground targeting, is able to combine forward-looking infrared and infrared search and track technology.”

1 note

·

View note

Text

Palestine [Action] actionists broke into Elbit’s Instro Precision, an Israeli weapons factory in Kent, UK. Causing the ‘highly secure’ factory extensive damage.

-- Eye on Palestine, 17 Jun 2024

Palestine Action say that their activists targeted Instro Precision, a subsidiary of Israeli arms company Elbit Systems, and the offices of Canadian Scotiabank, which activists say has not completely divested from Elbit. Instro Precision, which described itself as a leading supplier of “support equipment for military and commercial electro-optical sensors”, had their Kent factory targeted overnight. Activists blocked entrances and others invaded the facory where thay began “dismantling technology, machinery and parts” involved in the “manufacture of scopes, sights, and targeting equipment for Israel’s exterminationist military”, the group said in a press release.

-- From "Palestine Action targets Kent arms factory and Scotiabank offices in London" from Freedom, 17 Jun 2024

4 notes

·

View notes

Text

Drones have changed war. Small, cheap, and deadly robots buzz in the skies high above the world’s battlefields, taking pictures and dropping explosives. They’re hard to counter. ZeroMark, a defense startup based in the United States, thinks it has a solution. It wants to turn the rifles of frontline soldiers into “handheld Iron Domes.”

The idea is simple: Make it easier to shoot a drone out of the sky with a bullet. The problem is that drones are fast and maneuverable, making them hard for even a skilled marksman to hit. ZeroMark’s system would add aim assistance to existing rifles, ostensibly helping soldiers put a bullet in just the right place.

“We’re mostly a software company,” ZeroMark CEO Joel Anderson tells WIRED. He says that the way it works is by placing a sensor on the rail mount at the front of a rifle, the same place you might put a scope. The sensor interacts with an actuator either in the stock or the foregrip of the rifle that makes adjustments to the soldier’s aim while they’re pointing the rifle at a target.

A soldier beset by a drone would point their rifle at the target, turn on the system, and let the actuators solidify their aim before pulling the trigger. “So there’s a machine perception, computer vision component. We use lidar and electro-optical sensors to detect drones, classify them, and determine what they’re doing,” Anderson says. “The part that is ballistics is actually quite trivial … It’s numerical regression, it’s ballistic physics.”

According to Anderson, ZeroMarks’ system is able to do things a human can’t. “For them to be able to calculate things like the bullet drop and trajectory and windage … It’s a very difficult thing to do for a person, but for a computer, it’s pretty easy,” he says. “And so we predetermined where the shot needs to land so that when they pull the trigger, it’s going to have a high likelihood of intersecting the path of the drone.”

ZeroMark makes a tantalizing pitch—one so attractive that venture capital firm Andreesen Horowitz invested $7 million in the project. The reasons why are obvious for anyone paying attention to modern war. Cheap and deadly flying robots define the conflict between Russia and Ukraine. Every month, both sides send thousands of small drones to drop explosives, take pictures, and generate propaganda.

With the world’s militaries looking for a way to fight back, counter-drone systems are a growth industry. There are hundreds of solutions, many of them not worth the PowerPoint slide they’re pitched from.

Can a machine-learning aim-assist system like what ZeroMark is pitching work? It remains to be seen. According to Anderson, ZeroMark isn’t on the battlefield anywhere, but the company has “partners in Ukraine that are doing evaluations. We’re hoping to change that by the end of the summer.”

There’s good reason to be skeptical. “I’d love a demonstration. If it works, show us. Till that happens, there are a lot of question marks around a technology like this,” Arthur Holland Michel, a counter-drone expert and senior fellow at the Carnegie Council for Ethics in International Affairs, tells WIRED. “There’s the question of the inherent unpredictability and brittleness of machine-learning-based systems that are trained on data that is, at best, only a small slice of what the system is likely to encounter in the field.”

Anderson says that ZeroMark’s training data is built from “a variety of videos and drone behaviors that have been synthesized into different kinds of data sets and structures. But it’s mostly empirical information that’s coming out of places like Ukraine.”

Michel also contends that the physics, which Anderson says are simple, are actually quite hard. ZeroMark’s pitch is that it will help soldiers knock a fast-moving object out of the sky with a bullet. “And that is very difficult,” Michel says. “It’s a very difficult equation. People have been trying to shoot drones out of the sky [for] as long as there have been drones in the sky. And it’s difficult, even when you have a drone that is not trying to avoid small arms fire.”

That doesn’t mean ZeroMark doesn’t work—just that it’s good to remain skeptical in the face of bold claims from a new company promising to save lives. “The only truly trustworthy metric of whether a counter-drone system works is if it gets used widely in the field—if militaries don’t just buy three of them, they buy thousands of them,” Michel says. “Until the Pentagon buys 10,000, or 5,000, or even 1,000, it’s hard to say, and a little skepticism is very much merited.”

3 notes

·

View notes

Text

Missile Seekers Market Gaining Momentum With Growth in Air-to-Air and Surface-to-Air Missile Programs

Market Overview

The missile seekers market is gaining strategic prominence as global defense forces increasingly modernize their missile guidance systems to enhance precision and performance. A missile seeker serves as the “eyes” of a missile, enabling it to detect, track, and engage targets with high accuracy. These systems play a vital role in boosting the effectiveness of missile guidance, especially in complex warfare environments involving high-speed targets, electronic countermeasures, and multiple threats.

From air-to-air and surface-to-air missiles to anti-ship and air-to-surface variants, seekers are embedded with advanced technologies like infrared, radar, laser, and electro-optical capabilities. As nations continue to invest heavily in defense modernization, especially across North America, Europe, and Asia-Pacific, the missile seekers market is set for robust growth through 2034.

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS20605

Market Dynamics

A multitude of factors are shaping the dynamics of the missile seekers market. One of the primary drivers is the rising global focus on national security and border surveillance, leading to a surge in demand for next-generation missile systems. Governments are emphasizing defense autonomy, leading to increased R&D investments in seeker technology such as dual-mode seekers and advanced electro-optical sensors.

Technological advancements in guidance systems, tracking solutions, and target acquisition capabilities are also contributing to market growth. Integration of AI and machine learning in data processing units is revolutionizing real-time decision-making during missile deployment. Additionally, improvements in materials—such as the use of composites, ceramics, and lightweight polymers—are enhancing the thermal and structural integrity of seekers under extreme operational conditions.

However, market expansion is tempered by challenges such as high development costs, complex integration requirements, and the need for highly skilled technical personnel. Moreover, stringent defense export regulations and geopolitical instability can hinder cross-border collaborations and international deals.

Key Players Analysis

The missile seekers market is characterized by the presence of several key global and regional players competing on innovation, customization, and strategic collaborations. Prominent names in the industry include Raytheon Technologies, Lockheed Martin Corporation, Thales Group, BAE Systems, Northrop Grumman, Leonardo S.p.A., MBDA, and Rafael Advanced Defense Systems.

These companies are focusing heavily on R&D and forming partnerships with defense agencies to develop next-gen seekers with multi-spectral sensing, AI-powered navigation, and countermeasure-resilient features. For example, Raytheon’s multi-mode seekers combine radar and infrared systems for enhanced accuracy in high-threat environments, while Lockheed Martin continues to refine electro-optical guidance systems for precision air-to-surface strikes.

Regional Analysis

North America dominates the global missile seekers market, driven by massive defense budgets, robust R&D ecosystems, and an increasing emphasis on missile defense programs. The United States, in particular, is a key contributor, with ongoing projects under the Department of Defense (DoD) and strong support from defense contractors.

Europe follows as another significant market, with countries like France, the UK, and Germany advancing their missile technology programs to maintain military readiness and sovereignty. NATO’s defense modernization efforts are also expected to spur demand for sophisticated seeker systems.

The Asia-Pacific region is witnessing rapid growth, largely fueled by rising geopolitical tensions, increased military spending by countries such as China, India, and South Korea, and indigenous missile development initiatives. Meanwhile, the Middle East continues to invest in advanced air defense systems, bolstering market potential in the region.

Recent News & Developments

Recent developments in the missile seekers market highlight a wave of technological innovation and international collaborations. In 2024, Northrop Grumman unveiled a new-generation radar seeker designed for hypersonic missile applications, emphasizing fast reaction times and high tracking accuracy.

Lockheed Martin secured a major contract to supply dual-mode seekers for the U.S. Navy’s precision strike missiles, while India’s DRDO successfully tested an indigenously developed passive infrared seeker system, marking a significant milestone for domestic defense capabilities.

Moreover, global focus on electronic warfare and countermeasures has led to growing interest in AI-enabled seekers that can distinguish decoys from actual targets, increasing operational reliability even in contested environments.

Browse Full Report @ https://www.globalinsightservices.com/reports/missile-seekers-market/

Scope of the Report

This report provides a comprehensive analysis of the missile seekers market, offering insights into critical growth drivers, market segmentation, key technology trends, and future opportunities through 2034. It covers various seeker types, including active, semi-active, and passive seekers, as well as product variants like radar, infrared, laser, and electro-optical seekers.

Additionally, the report breaks down the market by components such as sensors, processors, transceivers, and antennas, and explores their application across missile types and end users including military forces, government agencies, and defense contractors. It also provides detailed information on material innovations and their impact on seeker durability, weight, and thermal resilience.

As the global defense ecosystem continues to evolve, the missile seekers market is poised to play a critical role in defining the future of precision warfare, with enhanced focus on smart targeting, autonomous guidance, and integrated tracking solutions.

Discover Additional Market Insights from Global Insight Services:

Monosodium Glutamate (MSG) Market: https://www.openpr.com/news/4088184/monosodium-glutamate-msg-market-recent-developments

Hot Sauce Market: https://www.openpr.com/news/4087724/hot-sauce-market-global-trends-key-players-growth-outlook

Frozen Potato Market: https://www.openpr.com/news/4087802/frozen-potato-market-trends-growth-and-forecast-outlook

Hydroponics Market: https://www.openpr.com/news/4089566/hydroponics-market-to-reach-25-3-billion-by-2034-growing

Whiskey Market: https://www.openpr.com/news/4090493/whiskey-market-to-reach-123-billion-by-2034-amid-rising-global

0 notes

Text

Fibre Optic Combiner Market: Market Segmentation and Regional Insights 2025–2032

Fibre Optic Combiner Market, Trends, Business Strategies 2025-2032

Fibre Optic Combiner Market was valued at 1730 million in 2024 and is projected to reach US$ 3189 million by 2032, at a CAGR of 9.4% during the forecast period.

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis https://semiconductorinsight.com/download-sample-report/?product_id=103478

MARKET INSIGHTS

The global Fibre Optic Combiner Market was valued at 1730 million in 2024 and is projected to reach US$ 3189 million by 2032, at a CAGR of 9.4% during the forecast period.

Fibre optic combiners are specialized passive devices that merge multiple optical signals into a single output fibre while minimizing insertion loss. These components leverage fused biconical taper (FBT) technology or micro-optics to achieve efficient signal combination. Key product types include power combiners for high-power laser applications and pump combiners essential for optical amplifier systems.

The market growth is driven by increasing bandwidth demands in telecom networks and rapid adoption in data center interconnects. Furthermore, advancements in wavelength division multiplexing (WDM) technologies and growing investments in 5G infrastructure are accelerating deployment. Key players like Thorlabs and Newport Corporation are expanding their portfolios through strategic partnerships, with the Asia-Pacific region emerging as the fastest-growing market due to intensive fibre network rollouts.

List of Key Fibre Optic Combiner Companies Profiled

Newport Corporation (U.S.)

Thorlabs, Inc. (U.S.)

IDIL Fibres Optiques (France)

MilesTek Corporation (U.S.)

Electro Optical Components, Inc. (U.S.)

Advantech (Taiwan)

L-com, Inc. (U.S.)

S.I. Tech, Inc. (U.S.)

Corning Optical Communications (U.S.)

M2 Optics, Inc. (U.S.)

OFS (U.S.)

Segment Analysis:

By Type

Power Combiners Lead the Market Due to Growing Demand in High-Power Fiber Laser Systems

The global fibre optic combiner market is segmented based on type into:

Power Combiners

Subtypes: (2+1)x1, (6+1)x1, and others

Pump Combiners

Wavelength Division Multiplexers (WDM)

Polarization Maintaining Combiners

Others

By Application

Telecommunications Segment Dominates with Increasing Fiber Optic Network Deployments

The market is segmented based on application into:

Telecommunications

Data Centers

Medical Equipment

Military & Aerospace

Industrial Applications

By End-User Industry

IT & Telecom Sector Accounts for Major Share Due to 5G Infrastructure Development

The market is segmented based on end-user industry into:

IT & Telecommunications

Healthcare

Defense & Aerospace

Energy & Utilities

Others

Regional Analysis: Fibre Optic Combiner Market

North America The North American fibre optic combiner market is driven by rapid advancements in 5G infrastructure and robust investments in telecommunications upgrades. The U.S. leads the region with initiatives such as the $42.5 billion Broadband Equity, Access, and Deployment (BEAD) Program, accelerating demand for high-efficiency optical combiners in data centers and WDM systems. Canada follows closely, focusing on rural broadband expansion, while Mexico shows steady growth due to increasing private-sector telecom investments. Strict regulatory standards for network reliability and performance further push innovation in combiner technology, particularly in minimizing insertion loss and improving signal integrity.

Europe Europe’s market thrives on stringent data privacy laws and the region’s push for fiber-to-the-home (FTTH) deployment, with the EU targeting 100% high-speed broadband coverage by 2030. Germany and France dominate, leveraging their industrial automation sectors to adopt fibre optic combiners for precision applications like medical lasers and aerospace testing. The UK’s emphasis on smart cities and Italy’s growing data center footprint contribute to demand. However, high costs of raw materials and labor pose challenges, nudging manufacturers toward localized production to mitigate supply chain risks.

Asia-Pacific Asia-Pacific, accounting for over 40% of global fibre optic combiner demand, benefits from China’s “Digital Silk Road” initiative and India’s BharatNet project, which aim to connect millions via optical networks. Japan and South Korea lead in R&D for compact, high-power combiners used in semiconductor manufacturing and autonomous vehicles. Southeast Asian nations like Vietnam and Indonesia are emerging hotspots due to expanding submarine cable projects. The region’s cost-competitive manufacturing ecosystem, however, faces pressures from fluctuating silica prices and trade tensions impacting component supplies.

South America South America’s market grows moderately, driven by Brazil’s oil & gas sector deploying combiners for offshore pipeline monitoring and Argentina’s renewable energy projects requiring precise optical sensing. Economic instability and currency volatility hinder large-scale infrastructure spending, though Chile’s data localization laws are spurring localized data center builds. The lack of domestic combiner production forces reliance on imports, creating opportunities for suppliers offering financing solutions to cash-strapped telecom operators.

Middle East & Africa The Middle East’s fibre optic combiner market expands with smart city projects like Saudi Arabia’s NEOM and UAE’s 5G rollouts, prioritizing low-latency network components. Africa’s growth is uneven—South Africa and Nigeria lead in backbone network deployments, while East African nations adopt combiners for mobile money infrastructure. Geopolitical risks and underdeveloped last-mile connectivity slow adoption, but undersea cable investments (e.g., 2Africa Cable) signal long-term potential for optical component demand.

MARKET DYNAMICS

The market faces significant technical hurdles in developing combiners capable of handling high-power laser inputs common in industrial and defense applications. Thermal management becomes problematic as power levels exceed 100W, with potential for nonlinear optical effects that degrade signal quality. This limitation restricts the use of conventional combiners in critical applications such as laser material processing and directed energy systems, where power handling capabilities above 500W are increasingly required.

Material science limitations further complicate product development, as standard fused fiber technologies struggle to maintain beam quality at extreme power densities. While emerging solutions using specialty fibers show promise, their commercial viability remains constrained by prohibitively high production costs and limited manufacturing scalability.

These technical barriers are particularly significant given the growing demand for high-power fiber combiners in emerging sectors such as laser weapon systems and advanced manufacturing, where performance reliability cannot be compromised.

The development of space division multiplexing (SDM) technologies presents significant opportunities for advanced fibre optic combiner systems. As traditional WDM approaches approach theoretical capacity limits, network operators are increasingly exploring multi-core and few-mode fiber solutions that could multiply capacity by an order of magnitude. This technological shift requires innovative combiner architectures capable of managing multiple spatial channels while maintaining low crosstalk and insertion loss.

Early SDM prototypes have demonstrated the potential to increase fiber capacity by 10-100 times, creating substantial demand for next-generation combining solutions. Manufacturers investing in SDM-compatible combiner technologies now stand to gain first-mover advantages in what could become a multi-billion dollar market segment within the next decade. The transition to SDM is particularly relevant for submarine cable systems and metropolitan area networks where fiber real estate is constrained.

Additionally, the growing adoption of fiber lasers in industrial and medical applications is driving demand for specialized pump combiners with enhanced power handling capabilities, opening new revenue streams for manufacturers able to address these niche requirements.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=103478

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Fibre Optic Combiner Market?

Which key companies operate in Global Fibre Optic Combiner Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

Related Reports:

https://semiconductorblogs21.blogspot.com/2025/07/global-market-for-gas-scrubbers-for_9.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/through-hole-slip-rings-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/semiconductor-test-consumables-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/antibacterial-medical-grade-computer.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/wireless-power-controller-ics-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/multi-purpose-diodes-for-esd-protection.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/ceramic-heating-components-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/dc-linear-voltage-regulators-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/led-dimming-interface-ics-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/enhancement-mode-gan-transistor-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/automatic-lighting-control-sensors.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/single-sided-copper-clad-laminate.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/glucose-ketone-meter-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/programmable-timers-and-oscillators.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/smart-plug-for-personal-use-market-size.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/battery-reliability-test-system-market.html

CONTACT US: City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 [+91 8087992013] [email protected]

0 notes

Text

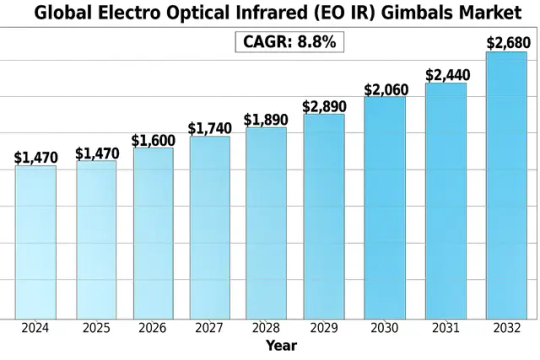

Electro Optical Infrared (EO IR) Gimbals Market, Emerging Trends, Technological Advancements, and Forecast to 2032

Global Electro Optical Infrared (EO IR) Gimbals Market size was valued at US$ 1,470 million in 2024 and is projected to reach US$ 2,680 million by 2032, at a CAGR of 8.8% during the forecast period 2025-2032. The U.S. market accounted for 35% of global revenue in 2024, while China is expected to witness the highest growth rate at 7.9% CAGR through 2032.

EO IR gimbals are precision stabilization systems that integrate electro-optical and infrared sensors for target acquisition, tracking, and surveillance applications. These systems enable stable imaging and targeting capabilities across land, air, and maritime platforms even in challenging environmental conditions. The market primarily comprises 2-axis and 3-axis gimbal configurations, with the latter gaining prominence for superior stabilization performance.

The market growth is driven by increasing defense modernization programs worldwide and rising adoption of unmanned systems. Recent geopolitical tensions have accelerated procurement of ISR (Intelligence, Surveillance, and Reconnaissance) systems, with gimbal manufacturers reporting order backlogs exceeding 18 months in some cases. For instance, in Q1 2024, Lockheed Martin secured a USD 320 million contract from the U.S. Department of Defense for advanced EO IR gimbal systems. Key technological trends include miniaturization of payloads and integration of AI-powered image processing capabilities directly into gimbal systems.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/electro-optical-infrared-eo-ir-gimbals-market/

Segment Analysis:

By Type

2-Axis EO IR Gimbals Drive Market Growth Due to Cost-Effectiveness and Versatile Deployment

The market is segmented based on type into:

2-Axis EO IR Gimbals

3-Axis EO IR Gimbals

By Application

Military Applications Dominate the Market Owing to Rising Defense Expenditure Globally

The market is segmented based on application into:

Military

Subtypes: Surveillance, Targeting, Reconnaissance

Civilian

Subtypes: Commercial drones, Law enforcement, Search and rescue

By Component

Electro-Optical Sensors Lead the Segment Due to Enhanced Imaging Capabilities

The market is segmented based on component into:

Electro-Optical Sensors

Infrared Sensors

Stabilization Units

Control Systems

Others

By Platform

Airborne Platforms Account for Largest Market Share Due to Increased UAV Deployments

The market is segmented based on platform into:

Airborne

Subtypes: Manned Aircraft, UAVs

Naval

Ground Vehicles

Regional Analysis: Electro Optical Infrared (EO/IR) Gimbals Market

North America The North American EO/IR gimbals market is the most advanced globally, driven by significant defense spending and technological innovation. The U.S. Department of Defense’s increasing focus on unmanned systems and ISR (Intelligence, Surveillance, and Reconnaissance) capabilities has fueled demand for high-precision gimbal systems. Major players like Lockheed Martin and L3Harris Technologies dominate this space, with multi-axis gimbals being widely adopted for military drones and border surveillance. Canada is also emerging as a key market, particularly in Arctic surveillance applications. However, strict export controls and ITAR regulations sometimes limit market expansion opportunities.

Europe European demand for EO/IR gimbals is experiencing steady growth, primarily led by France, Germany, and the UK as they modernize their defense capabilities. The region benefits from strong aerospace manufacturing capabilities and collaborative defense programs like the European Defence Fund. Companies such as Leonardo DRS are pioneering compact, multi-sensor gimbal solutions for both military and civilian applications. While defense remains the primary driver, there’s growing adoption in law enforcement and critical infrastructure monitoring. The market faces challenges from budget constraints in some countries and increasing competition from U.S. and Israeli manufacturers.

Asia-Pacific This region represents the fastest-growing market for EO/IR gimbals, with China, India, and South Korea leading the expansion. China’s indigenous defense industry has made significant strides in gimbal technology, reducing reliance on imports. India’s focus on drone-based border surveillance and recent military modernizations are creating substantial opportunities. The commercial sector is also expanding, particularly in thermal imaging for industrial inspections. However, geopolitical tensions and technology transfer restrictions create a fragmented market landscape. Southeast Asian nations are increasingly adopting gimbal solutions for maritime surveillance amid territorial disputes.

South America The South American market shows moderate growth potential, with Brazil and Argentina being the primary adopters. These countries primarily use EO/IR gimbals for border security and counter-narcotics operations, often through U.S. security assistance programs. The commercial market remains underdeveloped due to high costs and limited industrial applications. Economic instability in the region sometimes delays defense procurement programs. Nevertheless, growing security concerns and the need for better surveillance capabilities suggest steady long-term demand, particularly for cost-effective solutions from second-tier suppliers.

Middle East & Africa This region demonstrates highly variable market conditions. Wealthy Gulf states like Saudi Arabia and the UAE are major buyers of advanced gimbal systems for their military drones and armored vehicles. Israel’s domestic defense industry produces cutting-edge gimbal solutions that compete globally. In contrast, African markets show sporadic demand, primarily driven by peacekeeping operations and anti-poaching initiatives. The region faces challenges from political instability in some areas, though counterterrorism efforts continue to drive gimbal adoption for surveillance purposes. Commercial applications remain limited outside the oil and gas sector.

MARKET OPPORTUNITIES

Emerging AI Integration Creates Value-added Solutions

The integration of artificial intelligence with EO IR systems presents transformative opportunities. Advanced algorithms now enable real-time object recognition, automatic tracking, and predictive analytics directly on the gimbal platform. This capability significantly enhances operational efficiency across both military and commercial applications. Early adopters are already deploying AI-enabled gimbals for automated surveillance, wildlife monitoring, and industrial inspection tasks.

Expanding Border Security Needs Drive Specialized Demand

Global border security budgets are increasing, with particular focus on surveillance technologies. Long-range EO IR gimbals capable of continuous monitoring in challenging environments are seeing heightened demand. Manufacturers responding to this need are developing ruggedized versions with extended detection ranges and improved environmental resistance, creating specialized product segments with premium pricing potential.

ELECTRO OPTICAL INFRARED (EO IR) GIMBALS MARKET TRENDS

Military Modernization and Homeland Security Fuels EO IR Gimbals Demand

The growing emphasis on military modernization and homeland security is driving significant investments in advanced EO IR gimbal systems. These systems provide critical surveillance, reconnaissance, and targeting capabilities for defense applications, particularly in unmanned aerial vehicles (UAVs) and ground-based platforms. The global defense sector witnessed a 6.5% increase in EO/IR gimbal procurement in 2023, with North America accounting for nearly 40% of total demand. Furthermore, rising geopolitical tensions have accelerated the adoption of high-precision gimbal systems for border security and intelligence gathering. Manufacturers are responding with lightweight, multi-sensor payloads capable of day/night operations with enhanced stabilization accuracy.

Other Trends

Expansion of Commercial Drone Applications

While military applications dominate the market, commercial drone adoption has unlocked new opportunities for EO IR gimbals. Industries such as infrastructure inspection, agriculture, and disaster management increasingly rely on stabilized imaging systems for thermal mapping, pipeline monitoring, and search/rescue operations. The agricultural sector alone contributed to 22% of civilian EO IR gimbal shipments last year, driven by precision farming techniques requiring high-resolution infrared imagery. Innovations in miniaturized gimbal designs and AI-powered image processing are broadening accessibility for small-to medium-sized enterprises.

Technological Convergence with AI and Machine Learning

Integration of artificial intelligence into EO IR gimbals is revolutionizing real-time data analysis and decision-making. Modern systems now incorporate automated target recognition (ATR) algorithms that reduce operator workload while improving detection ranges by up to 30%. This synergy enables predictive maintenance features and enhances operational efficiency in both defense and commercial deployments. Concurrently, machine learning models are being trained to filter environmental noise—such as weather interference—from critical thermal signatures, significantly boosting signal-to-noise ratios in challenging conditions.

Material Science Breakthroughs Enhance Performance

Recent advancements in composite materials and manufacturing techniques are addressing longstanding limitations in gimbal durability and weight. Carbon fiber-reinforced polymer frames now achieve vibration damping coefficients surpassing conventional aluminum alloys by 45%, while reducing overall system mass. These improvements directly translate to extended flight times for UAV-mounted systems and higher payload capacities. Additionally, novel anti-jamming stabilization technologies have demonstrated sub-milliradian accuracy even in high-vibration environments—a critical requirement for naval and armored vehicle applications.

COMPETITIVE LANDSCAPE

Key Industry Players

Technological Advancements and Defense Contracts Drive Market Competition

The global Electro Optical Infrared (EO IR) Gimbals market exhibits a consolidated competitive landscape dominated by established defense contractors and specialized EO IR solution providers. Leonardo DRS and Teledyne FLIR jointly command approximately 28% of global market revenue as of 2024, leveraging their extensive defense sector partnerships and continuous innovation in multi-spectral imaging technologies.

Lockheed Martin maintains a strong position through its integration of EO IR systems with advanced UAV platforms, while L3Harris Technologies has gained significant traction with its compact gimbal solutions for tactical unmanned systems. Both companies benefit from long-term military contracts, enabling sustained R&D investment in next-generation stabilization and targeting systems.

The market has witnessed accelerated competition in commercial applications, with CONTROP Precision Technologies and ZHIYUN making notable strides in civilian drone-mounted gimbal systems. These companies are capitalizing on the growing demand for aerial photography, industrial inspection, and border surveillance applications through cost-optimized product portfolios.

List of Key EO IR Gimbals Manufacturers

Leonardo DRS (U.S.)

Teledyne FLIR (U.S.)

Lockheed Martin (U.S.)

CONTROP Precision Technologies (Israel)

L3Harris Technologies (U.S.)

CACI International (U.S.)

i2Tech (UAE)

Harris Aerial (U.S.)

Ukrspecsystems (Ukraine)

ZHIYUN (China)

AeroVironment (U.S.)

Recent industry movements include strategic acquisitions of smaller EO IR specialists by major defense primes, aiming to vertically integrate critical imaging technologies. Meanwhile, Asian manufacturers are progressively challenging Western dominance through competitively priced alternatives, particularly in the commercial and governmental surveillance segments.

Learn more about Competitive Analysis, and Global Forecast of Electro Optical Infrared (EO/IR) Gimbals Market : https://semiconductorinsight.com/download-sample-report/?product_id=97676

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global EO IR Gimbals Market?

-> Electro Optical Infrared (EO IR) Gimbals Market size was valued at US$ 1,470 million in 2024 and is projected to reach US$ 2,680 million by 2032, at a CAGR of 8.8% during the forecast period 2025-2032.

Which key companies operate in Global EO IR Gimbals Market?

-> Key players include Leonardo DRS, Teledyne FLIR, Lockheed Martin, CONTROP Precision Technologies, L3Harris Technologies, and CACI International, among others.

What are the key growth drivers?

-> Key growth drivers include increasing defense budgets (USD 2.2 trillion globally), growing demand for ISR capabilities, and commercial drone market expansion (35% CAGR forecast).

Which region dominates the market?

-> North America holds the largest market share (32%), while Asia-Pacific shows the highest growth potential (8.2% CAGR).

What are the emerging trends?

-> Emerging trends include AI-powered image processing (adopted in 40% of new systems), multi-sensor fusion, and SWaP-optimized designs for small UAVs.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 +91 8087992013 [email protected]

Follow us on LinkedIn: https://www.linkedin.com/company/semiconductor-insight/

0 notes

Text

The report "Military Electro-Optics/Infrared (EO/IR) Systems Industry by Platform, Product Type, Component, Cooling Technology Sensor Technology, Imaging Technology (Hyperspectral, Multispectral), point of sale and Region - Global Forecast to 2028" The Military Electro-Optics/Infrared (EO/IR) Systems Industry is estimated to be USD 7.8 billion in 2023 and is projected to reach USD 9.5 billion by 2028, at a CAGR of 4.0% during the forecast period. The driving factor for the EO/IR (Electro-Optical/Infrared) system market is the increasing demand for these systems in various applications such as military and defense, surveillance and security, aerospace and aviation, and others. EO/IR systems are used for gathering information from the visible, infrared, and ultraviolet parts of the electromagnetic spectrum, and they are widely used for target acquisition, tracking, and identification.

#Military Electro-Optical Systems#Military Electro-Optical Systems Market#Military Electro-Optical Systems Industry#Military Electro-Optical Systems Market Companies#Military Electro-Optical Systems Market Size#Military Electro-Optical Systems Market Share#Military Electro-Optical Systems Market Growth#Military Electro-Optical Systems Market Statistics

0 notes

Text

Periodically Poled Crystals Market 2025-2032

MARKET INSIGHTS

The global Periodically Poled Crystals Market size was valued at US$ 73.9 million in 2024 and is projected to reach US$ 118.7 million by 2032, at a CAGR of 7.0% during the forecast period 2025-2032. The U.S. currently dominates the market with an estimated share of 32% in 2024, while China is expected to emerge as the fastest-growing region with a projected CAGR of 6.7% through 2032.

Periodically poled crystals are specialized nonlinear optical materials that enhance second-harmonic generation efficiency through their unique periodic domain structure. These engineered crystals utilize quasi-phase-matching (QPM) technology to optimize wavelength conversion processes. The most common materials include lithium niobate (PPLN), potassium titanyl phosphate (PPKTP), and lithium tantalate (PPLT), with PPLN accounting for approximately 58% of the market share in 2024 due to its superior thermal stability and broad transparency range.

The market growth is driven by increasing demand from medical laser systems, optical communication networks, and quantum computing applications. The defense sector’s adoption of these crystals for advanced laser targeting systems has also contributed significantly. Recent developments include HC Photonics’ 2023 introduction of high-power PPLN crystals with 30% improved damage thresholds, addressing the growing need for durable materials in industrial laser processing applications.

Access Your Free Sample Report Now-https://semiconductorinsight.com/download-sample-report/?product_id=97506

Key Industry Players

Innovation and Strategic Partnerships Drive Market Leadership in Periodically Poled Crystals

The global Periodically Poled Crystals market exhibits a competitive yet fragmented landscape, with prominent players leveraging technological advancements and regional expansions to maintain dominance. ALPHALAS and Covesion emerged as key market leaders in 2024, collectively holding a significant share of the revenue. Their success stems from specialized production capabilities in PPLN (periodically poled lithium niobate) crystals, which accounted for approximately 42% of the total market by type in 2024.

While established players dominate in Europe and North America, Asia Pacific manufacturers like HC Photonics and Hangzhou Shalom Electro-optics Technology are gaining traction through cost-competitive offerings and expanding applications in consumer electronics.

The market is witnessing increased R&D investment, particularly in quasi-phase-matching (QPM) technologies, as companies strive to improve conversion efficiency in nonlinear optical applications. Photonic Solutions recently announced a 15% increase in production capacity to meet growing demand from laser manufacturers.

List of Key Periodically Poled Crystals Manufacturers

ALPHALAS (Germany)

Photonic Solutions (UK)

Covesion Ltd (UK)

G and H Group (UK)

GWU-Lasertechnik (Germany)

SRICO, Inc. (U.S.)

Opton Laser International (China)

Deltronic Crystal Industries (U.S.)

HC Photonics (Taiwan)

Hangzhou Shalom Electro-optics Technology (China)

Market competition is intensifying as companies develop customized crystals for specific wavelength ranges. GWU-Lasertechnik’s recent breakthrough in broadband periodically poled crystals demonstrates the industry’s move toward more versatile solutions.

Segment Analysis:

By Type

PPLN Segment Leads Due to High Efficiency in Nonlinear Optical Applications

The market is segmented based on type into:

PPLN (Periodically Poled Lithium Niobate)

PPKTP (Periodically Poled Potassium Titanyl Phosphate)

PPLT (Periodically Poled Lithium Tantalate)

Others

By Application

Medical Industry Dominates Due to Rising Demand for Laser-Based Therapies

The market is segmented based on application into:

Medical Industry

Consumer Electronic

Defense Industry

Others

By End User

Research Institutions Hold Significant Share Due to Advanced Material Studies

The market is segmented based on end user into:

Research Institutions

Industrial Manufacturers

Military & Defense Organizations

Healthcare Providers

Download Your Complimentary Sample Report-https://semiconductorinsight.com/download-sample-report/?product_id=97506

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Periodically Poled Crystals Market?

-> Periodically Poled Crystals Market size was valued at US$ 73.9 million in 2024 and is projected to reach US$ 118.7 million by 2032, at a CAGR of 7.0% during the forecast period 2025-2032.

Which key companies operate in Global Periodically Poled Crystals Market?

-> Key players include ALPHALAS, Covesion, HC Photonics, Photonic Solutions, GWU-Lasertechnik, and SRICO, with the top five companies holding approximately 42% market share in 2024.

What are the key growth drivers?

-> Primary growth drivers include increasing adoption in medical laser systems, advancements in optical communication technologies, and defense sector applications.

Which region dominates the market?

-> North America currently leads the market, while Asia-Pacific is expected to witness the highest CAGR of 7.8% during the forecast period.

What are the emerging trends?

-> Emerging trends include development of customized periodic structures, integration with quantum computing systems, and miniaturization of nonlinear optical devices.

About Semiconductor Insight

Established in 2016, Semiconductor Insight specializes in providing comprehensive semiconductor industry research and analysis to support businesses in making well-informed decisions within this dynamic and fast-paced sector. From the beginning, we have been committed to delivering in-depth semiconductor market research, identifying key trends, opportunities, and challenges shaping the global semiconductor industry.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

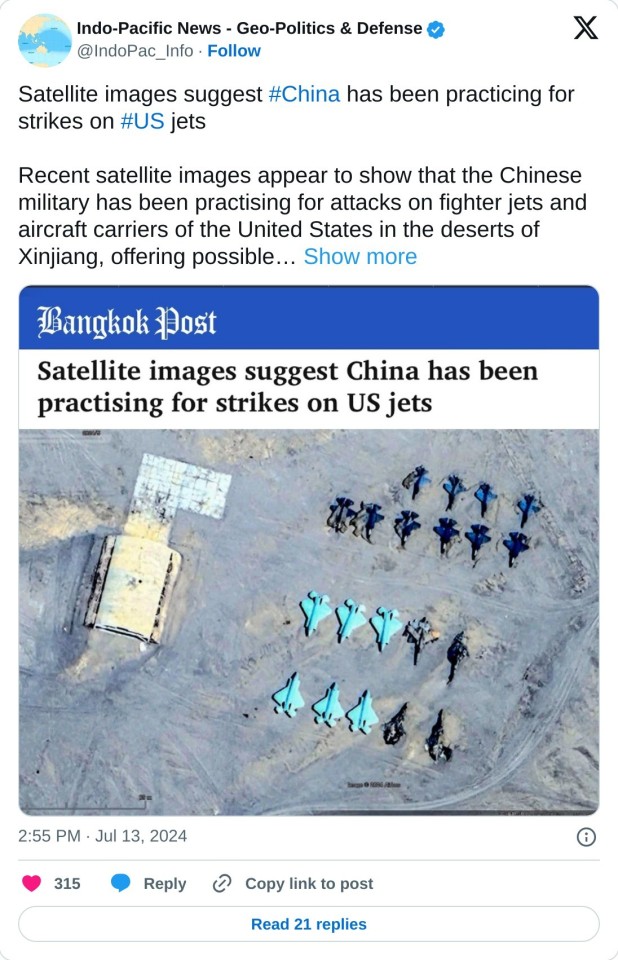

possible clues about what its strategy would be in the event of conflict.

The images, taken by Google Earth on May 29, feature a model aircraft carrier and more than 20 replicas of jets resembling US stealth fighters.

"Chinese PLA Air Force pilots are learning to practice air strikes on American F-35 and F-22 mock-ups," said a post containing four satellite pictures published on X, formerly Twitter, by the Turkey-based Clash Report.

The military blogging account identified the location as Qakilik in the Taklamakan Desert. The Post has not been able to verify the images and there has been no official confirmation from China.

Several of these replicas appeared to be severely damaged.

The exercises reflect the People's Liberation Army's efforts to build up its long-range ballistic and cruise missile systems to neutralise the threats from US naval forces, according to Collin Koh, a research fellow at the S. Rajaratnam School of International Studies in Singapore.

"US and allied naval forces in general would be a natural target because of their power projection capabilities, which are perceived by Beijing as a threat," he said.

Koh continued that it would be in line with Beijing's growing emphasis on simulating realistic campaigns and "by and large, Beijing's wartime scenarios appear aimed at counter-intervention against the Americans" especially in the event of conflict in the South China Sea or Taiwan.

If the drill involved the PLA's intercontinental-range systems, it may have been practising strikes on targets such as Guam, Alaska and Hawaii, he added.

The PLA has long held that its exercises are not aimed at any specific party, but mock targets can sometimes give away its thinking - either by accident or design.

In 2015, state broadcaster China Central Television (CCTV) broadcast footage of PLA troops taking part in mock battles near a building that closely resembled Taiwan's presidential office.

Malcolm Davis, a senior analyst at the Australian Strategic Policy Institute, said the exercise appeared to fit the PLA's counter-intervention strategy, designed to deny US and allied naval forces in the Western Pacific access to potential war zones further east.

"This implies the PLA's strike capabilities will probably have either an electro-optical or synthetic aperture radar terminal guidance system to image the target and guide the warhead prior to precisely striking at a specific location on a military base," he said.

The exercise would allow the PLA to improve its precision in scenarios such as a ballistic missile "seeking to strike a moving target at sea, such as an aircraft carrier".

He also said that practising in the desert would help the PLA to improve its ability to carry out long-range conventional precision strikes on land targets, such as airfields.

Hong-Kong based military commentator Leung Kwok-leung said the satellite images suggested a simulated strike on Alaska, where most F-22s were based.

"Alaska is also the base of the most important national missile defence system in the United States. Last year, an F-22 was used to shoot down China's so-called spy balloon, which shows that the F-22 also undertakes the task of the missile defence system," Leung said.

Timothy Heath, a senior international defence researcher at the Rand Corporation think tank, also said "the Chinese are not hiding the mock-ups, so they may not care if Westerners observe them".

"It may also be the case that the Chinese want the US military to see this as a reminder that China is serious about military training and preparation and as a warning against the United States," Heath said.

14 notes

·

View notes

Text

GaAs Photodiodes Gain Traction in High-Speed Data Transmission

The global gallium arsenide (GaAs) photodiode market is poised for steady growth through 2031, fueled by rising demand for high-speed communication technologies and optoelectronic devices. The industry was valued at USD 73.4 Mn in 2022 and is expected to reach USD 105.0 Mn by the end of 2031, expanding at a CAGR of 4.1% during the forecast period.

Market Overview: GaAs photodiodes are pivotal components in optical communication systems, converting light into electrical current with exceptional efficiency. Known for their high sensitivity, low noise, and rapid response times, these semiconductors are increasingly integrated into fiber-optic networks, 5G infrastructure, and advanced industrial applications.

The global GaAs photodiode market is witnessing robust adoption due to increasing investments in telecom networks, surge in Internet of Things (IoT) applications, and technological advancements in optical components.

Market Drivers & Trends

1. Fiber-optic Network Expansion: With the rapid proliferation of broadband infrastructure and high-speed internet, fiber-optic communication is becoming ubiquitous. GaAs photodiodes serve as critical receivers in these networks, converting light signals into electronic data with minimal latency or distortion. Companies like Lasermate Group offer photodiode arrays optimized for data rates up to 14Gbps, specifically tailored for these networks.

2. Rise of 5G and IoT: The emergence of 5G technologies and increasing adoption of IoT-enabled devices are creating new use cases for GaAs photodiodes. Their ability to function effectively in high-frequency, short-wavelength optical systems makes them ideal for next-gen telecom infrastructure. Notably, Kyoto Semiconductor’s KP-H series targets high-speed 400Gbps systems using PAM4 modulation—critical for data centers and 5G applications.

3. Miniaturization and High-speed Demand: GaAs photodiodes with smaller active areas (less than 70 µm) are gaining traction due to their faster response times. In 2022, this segment accounted for 57.6% of market share and is expected to dominate through 2031.

Key Players and Industry Leaders

The global GaAs photodiode market features a moderately fragmented competitive landscape. Leading players are focusing on innovation, performance enhancement, and expanding production capacity to maintain their market position. Key players include:

Albis Optoelectronics AG

AMS Technologies AG

Broadcom Inc.

Electro-Optics Technology Inc.

Global Communication Semiconductors, LLC

II-VI Incorporated

Kyoto Semiconductor Co., Ltd.

Lasermate Group, Inc.

Microsemi Corporation

OSI Optoelectronics Ltd.

TRUMPF Photonic Components GmbH

These companies are leveraging strategic partnerships, R&D investments, and M&A to address growing demand and develop cost-effective, high-performance photodiodes.

Recent Developments

November 2021 – Kyoto Semiconductor launched the KPDE008LS-A-RA-HQ, a monitor photodiode designed for optical communication devices.

October 2020 – II-VI Incorporated began high-volume production of edge-emitting diodes on a 6-inch GaAs platform for high-speed datacom and 3D sensing.

October 2020 – TRUMPF Photonic Components GmbH acquired an advanced Solstice S4 wet-processing system to enhance GaAs VCSEL and photodiode production.

Explore pivotal insights and conclusions from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=74423

Latest Market Trends

Integration in DWDM Systems: GaAs photodiodes are increasingly used in Dense Wavelength Division Multiplexing (DWDM) monitors due to their precision and reliability in high-data-rate environments.

High Responsivity and AR Coatings: Manufacturers are enhancing photodiodes with features like anti-reflective coatings and wraparound submounts to increase responsivity and durability in challenging environments.

Demand for Small Form-factor Components: Compact, efficient photodiodes are crucial for communication devices, especially in mobile and handheld electronics.

Market Opportunities

Emerging Markets and Automation: Growth in industrial automation, particularly in Asia Pacific and Latin America, is opening new avenues for GaAs photodiode applications in robotics, monitoring systems, and smart manufacturing.

Healthcare and Spectroscopy: GaAs photodetectors are gaining popularity in medical imaging and X-ray spectroscopy, expanding beyond their traditional telecom applications.

High-bandwidth Data Centers: The transition to cloud computing and edge data centers is increasing the need for faster optical receivers, presenting an opportunity for high-speed GaAs photodiodes.

Future Outlook

Analysts predict a consistent demand trajectory for GaAs photodiodes through 2031, primarily driven by continued investments in 5G, expansion of fiber networks, and technological integration across industries. As the demand for low-latency, high-bandwidth communication grows, the GaAs photodiode market is expected to play a critical role in the global optoelectronics landscape.

Challenges such as raw material costs and supply chain disruptions remain, but proactive investments in R&D and localized manufacturing may help mitigate these risks. Overall, the market outlook is positive, with a focus on developing next-generation devices tailored for evolving telecom and data communication needs.

Market Segmentation

By Active Area Size:

Less than 70 µm

70 µm - 100 µm

Above 100 µm

By Application:

Optical Detectors

Laser Detectors

Communication Devices

Others (Televisions, Smoke Detectors)

By End-use Industry:

IT & Telecommunications

Industrial

Consumer Electronics

Healthcare

Others (Aerospace & Defense, Automotive)

Regional Insights

Asia Pacific dominated the market in 2022, accounting for 37.6% of global revenue, and is expected to maintain its lead through 2031. Key factors driving this dominance include:

Strong presence of electronics and semiconductor manufacturing in China, Japan, South Korea, and Taiwan.

Government support for 5G infrastructure deployment.

Rising adoption of automation in industries across India and Southeast Asia.

North America and Europe also represent significant markets due to early adoption of optical technologies and the presence of major telecom and data center operators. The U.S., Germany, and France are notable contributors to market expansion.

Why Buy This Report?

This report offers a comprehensive and data-driven analysis of the GaAs photodiode market, enabling stakeholders to:

Understand key growth drivers, restraints, and trends shaping the market

Assess competitive dynamics and benchmarking of top players

Identify high-potential segments and regional hotspots

Strategize investments based on emerging opportunities and future forecasts

Access detailed market segmentation and country-level insights

Receive qualitative and quantitative analysis including Porter’s Five Forces and value chain assessment

0 notes

Text

A Deep Dive into Anti Drone Systems Technology for Sensitive Areas

The Rising Demand for Anti-Drone Systems in Sensitive Areas Escalating Drone Threats to Critical Infrastructure Drone threats to critical infrastructure have surged significantly, posing grave risks to national security and public safety. Facilities like airports, power plants, and military installations have become prime targets for drone-related incidents. Reports indicate a marked increase in unauthorized drone activities, including espionage, smuggling, and sabotage. Notably, incidents at various international airports like Gatwick and Heathrow have highlighted the vulnerabilities of essential services to drone intrusions. According to security agencies, drone intrusions at critical sites have risen by approximately 40% over the last five years, underscoring the urgency of deploying effective anti-drone measures. These threats risk not only infrastructure damages and public safety but also endanger military operations, calling for immediate and robust counter-drone strategies.

Global Market Growth Projections Through 2030 The global anti-drone market is projected to experience remarkable growth by 2030, driven by technological advancements and increasing security concerns. According to industry analyses, the market is expected to grow from $1.1 billion in 2023 to $7 billion by 2030, with a compound annual growth rate (CAGR) of 30.2%. As highlighted by market reports, key regions such as the U.S. and China are set to witness substantial developments, with China forecasted to grow at a 28.7% CAGR, reaching $1.0 billion by 2030. This growth is fueled by the expanding defense sector, the rising need for securing civil aviation, and heightened requirements for event security. Regulatory mandates across various regions further propel the adoption of anti-drone systems, ensuring these technologies continue to evolve to meet complex security challenges worldwide. In particular, innovations in radio frequency jamming and AI-driven detection are shaping the industry, promising a robust future for anti-drone technologies.

Core Technologies Powering Modern Anti-Drone Systems Detection Methods: Radar, RF Analysis, and EO/IR Sensors Detection technologies serve as the foundation of modern anti-drone systems, playing a critical role in identifying drone threats. Radar, RF analysis, and Electro-Optical/Infrared (EO/IR) sensors are widely used methods, each offering unique capabilities. Radar systems detect drones by emitting radio waves and measuring their echo reflections, effectively identifying larger, metallic drones. RF analysis examines the specific frequencies emitted by drones, allowing identification of control signals, while EO/IR sensors utilize visual and thermal imaging to track drones in various conditions. However, each method has its limitations, such as radar’s difficulty in detecting smaller drones and RF analysis's dependence on signal strength. Systems like Dedrone have successfully implemented these technologies, combining multiple methods to enhance detection accuracy and coverage.

Dedrone Anti-Drone System Dedrone effectively integrates radar, RF, and EO/IR sensors, providing comprehensive protection against diverse drone types, ensuring airspace security.