#Embedded Processors Defense

Explore tagged Tumblr posts

Text

Secure, Smart, and Lethal: The Tech Behind Military Embedded Systems

Introduction:

The global military embedded systems market is undergoing significant transformation, driven by technological advancements and evolving defense strategies. As defense forces worldwide prioritize modernization, the integration of sophisticated embedded systems has become paramount to enhance operational efficiency, communication, and security. This article provides an in-depth analysis of the current market dynamics, segmental insights, regional trends, and competitive landscape shaping the future of military embedded systems.

Request Sample Report PDF (including TOC, Graphs & Tables): https://www.statsandresearch.com/request-sample/40644-global-military-embedded-systems-market

Military Embedded Systems Market Dynamics:

Technological Advancements Fueling Growth

The relentless pace of technological innovation is a primary catalyst for the expansion of the military embedded systems market. The integration of artificial intelligence (AI), machine learning, and Internet of Things (IoT) technologies into embedded systems has revolutionized defense operations. These advancements enable real-time data processing, predictive maintenance, and enhanced decision-making capabilities, thereby improving mission effectiveness and operational readiness.

Get up to 30%-40% Discount: https://www.statsandresearch.com/check-discount/40644-global-military-embedded-systems-market

Rising Demand for Secure Communication Systems

In an era where information dominance is critical, the demand for secure and reliable communication systems has escalated. Military embedded systems facilitate encrypted communications, ensuring the integrity and confidentiality of sensitive data across various platforms, including land-based units, naval vessels, and airborne systems. This necessity is further amplified by the increasing complexity of modern warfare, which requires seamless interoperability among diverse defense assets.

Integration Challenges and Cybersecurity Concerns

Despite the promising growth trajectory, the military embedded systems market faces challenges related to the integration of new technologies into existing defense infrastructures. Legacy systems often lack the flexibility to accommodate modern embedded solutions, necessitating substantial investments in upgrades and compatibility assessments. Additionally, the heightened risk of cyber threats poses a significant concern. Ensuring the resilience of embedded systems against hacking and electronic warfare is imperative to maintain national security and operational superiority.

Military Embedded Systems Market Segmental Analysis:

By Component

Hardware: This segment holds a substantial share of the military embedded systems market, driven by the continuous demand for robust and reliable physical components capable of withstanding harsh military environments.

Software: Anticipated to experience significant growth, the software segment benefits from the increasing adoption of software-defined systems and the integration of AI algorithms to enhance functionality and adaptability.

By Product Type

Telecom Computing Architecture (TCA): Leading the market, TCA supports high-performance computing and communication needs essential for modern military operations.

Compact-PCI (CPCI) Boards: Projected to witness robust growth, driven by the adoption of modular and scalable systems that offer flexibility and ease of maintenance.

By Application

Intelligence, Surveillance & Reconnaissance (ISR): Dominating the application segment, ISR systems rely heavily on embedded technologies for real-time data collection and analysis, providing critical situational awareness.

Communication and Networking: This segment is poised for growth, reflecting the escalating need for secure and efficient communication channels in defense operations.

By Platform

Land-Based Systems: Accounting for the largest military embedded systems market share, land platforms utilize embedded systems for enhanced situational awareness, navigation, and control in ground operations.

Airborne Systems: Experiencing significant growth due to the integration of advanced avionics and communication systems in military aircraft and unmanned aerial vehicles (UAVs).

Military Embedded Systems Market Regional Insights:

North America

North America leads the military embedded systems market, driven by substantial defense budgets and ongoing modernization programs. The United States, in particular, emphasizes technological superiority, investing heavily in research and development of advanced embedded solutions.

Europe

European nations are actively enhancing their defense capabilities through collaborative projects and increased spending on advanced military technologies. The focus on interoperability among NATO members and the modernization of existing systems contribute to market growth in this region.

Asia-Pacific

The Asia-Pacific region is witnessing rapid growth, fueled by escalating defense expenditures in countries such as China, India, and Japan. The drive to modernize military infrastructure and develop indigenous defense technologies propels the demand for sophisticated embedded systems.

Middle East & Africa

Nations in the Middle East are investing in advanced defense technologies to bolster their military capabilities amidst regional tensions. The focus on upgrading naval and airborne platforms with state-of-the-art embedded systems is a notable trend in this region.

Competitive Landscape

The military embedded systems market is characterized by intense competition among key players striving to innovate and secure significant contracts.

Recent Developments

Curtiss-Wright Corporation: In January 2025, Curtiss-Wright secured a USD 27 million contract to supply Aircraft Ship Integrated Securing and Traversing (ASIST) systems to the U.S. Naval Air Warfare Center for use on Constellation Class Frigates.

Kontron AG: In December 2024, Kontron AG received an order valued at approximately EUR 165 million to supply high-performance VPX computing and communication units for surveillance applications, highlighting its expanding role in the defense sector.

These developments underscore the dynamic nature of the market, with companies focusing on technological innovation and strategic partnerships to enhance their market positions.

Purchase Exclusive Report: https://www.statsandresearch.com/enquire-before/40644-global-military-embedded-systems-market

Conclusion

The global military embedded systems market is set for substantial growth, driven by technological advancements and the imperative for defense modernization. As military operations become increasingly complex, the reliance on sophisticated embedded systems will intensify, underscoring the need for continuous innovation and investment in this critical sector.

Our Services:

On-Demand Reports: https://www.statsandresearch.com/on-demand-reports

Subscription Plans: https://www.statsandresearch.com/subscription-plans

Consulting Services: https://www.statsandresearch.com/consulting-services

ESG Solutions: https://www.statsandresearch.com/esg-solutions

Contact Us:

Stats and Research

Email: [email protected]

Phone: +91 8530698844

Website: https://www.statsandresearch.com

#Military Embedded Systems Market#Defense Embedded Systems#Military Electronics#Embedded Computing Defense#Rugged Embedded Systems#Military IoT Solutions#Aerospace Embedded Systems#Military AI Technology#Tactical Embedded Systems#COTS Embedded Systems#Defense Avionics Market#Military Communication Systems#Secure Embedded Computing#Military Cybersecurity Solutions#Battlefield Management Systems#Embedded Processors Defense#Military Semiconductor Market#Real-Time Embedded Systems#Military Automation Solutions#Embedded Defense Electronics#4o

1 note

·

View note

Text

Everything is Alright pt 9

Starscream x reader- sulking

• You have no idea what to make of your visitor or the way you’re being stared at like an especially frustrating puzzle missing pieces at the very end. Still cradling you in a huge hand, that helm tilts down to look at your cage. A slightly disgruntled rumble buzzes through his big frame as he turns toward the door as if in expectation.

• Exhausted, Starscream rolls his shoulders to work the kinks out. It wasn’t that patrolling was hard- if anything it was processor meltingly boring. Letting himself in his quarters only to rock to a stop, because Soundwave is right there. Holding the human in a hand. Waiting. That faintly glowing visor staring in accusation as Starscream’s wings flick up aggressively. This isn’t Skywarp and lashing out will have repercussions, though. Dragging his optics away from the small form in Soundwave’s grip like he doesn’t care less, he stalks past the other mech. “I hope you have a good reason to be in my personal quarters,” he sneers.

• What? You’d honestly expected another violent outburst, but your captor doesn’t seem to care that this mech has you. Making that low, non-sound, the boxy mech drifts over to the desk Starscream’s settled himself at. You’re gently deposited on the surface before Soundwave points almost accusingly at your cage. “Inadequate.”

• And with that, he just leaves. Starscream stares, waiting for the door to close behind Soundwave before hooking a servo around your waist to tug you closer. It’s the same cautious, worried examination as when he’d rescued you from Skywarp and your heart softens a bit more, because he’s worried. Even if he’s never going to admit it. You lay a hand on his servo, again amazed how someone so huge and dangerous can be so gentle. “I’m okay.”

• He draws back slowly almost seeming embarrassed at being caught caring, optics flicking to your cage then away. “I just don’t like for my things to be broken,” he says, voice gruff as those wings lift even higher. Defensive and maybe annoyed at himself.

• The words are a reminder to not just him, but you it seems. You’re- what? A pet to him? Definitely not an equal and you’ll never be. Not a friend. He only cares because he’s decided you’re his. His possession. It hurts all the same even as you blame that ache on Stockholm’s. After all, he’s hardly your friend, he’s your jailer. You push his servos away, backing away and turning your back on him because your eyes are burning now.

• Surprised, Starscream’s hand freezes still outstretched as you pace to the far side of the desk. Turning your back on him. Ignoring him. His fingers slowly curl into a fist as anger trickles in. But he doesn’t move and neither do you. Slowly, the fury drains away to leave only that awful silence that weighs him down. Why does he even care? You belong to him, his little, trapped bird.

• But he prefers you smiling, agreeing with him, and asking about his day. Growling, he reaches to snag you, feeling your little hands grab at his servos. Your face whips around to stare at him and there’s anger there with the fear. Denta grinding as his jaw works, he sets you down again in front of him, laying both arms on either side of you in the pretense of using the keyboard embedded in the top and effectively trapping you.

• Well, then. You can’t even sulk in peace, apparently. It’s almost tempting to try and climb over his arm to retreat back to the far side of the desk just for spite. Or walk across his weird, alien-glyph keyboard while he works just like the cat he thinks you are. Annoyed, you sit down crosslegged and wait.

• Still ignoring him. Attention divided between his console and the human now partially sprawled out, their chin propped on their fist staring anywhere but at him, he vents. “If you’ll stop acting like an entitled sparkling, I might consider taking you outside to see the stars.”

• It’s almost comical how quickly you twist around to stare up at him. Even as he fights to keep from smiling, there’s a feeling of almost guilt that makes him look around and really see his empty, gray quarters. It’s never bothered him, because he doesn’t dwell on it, but he remembers making things just for the joy of working with his hands. Maybe it wouldn’t hurt to find you something to do when you’re left alone. “But I swear to Primus if you try and run off, I will put a leash on you,” he adds with a growl, punctuating the threat with a thump of his fist against the desk as you grin up at him.

Previous Next

374 notes

·

View notes

Text

Awakening Continuation of the story based on those drawings

— Attention! Only emergency systems are operational. The operation of all systems in the "Epsilon" complex has been suspended, — echoed an emotionless voice from the automated defense system, emanating from speakers embedded in the ceiling.

A standard warning meant to prompt all personnel to follow one of two protocols: evacuation or activation of the main life-support system from control centers where energy reserves were still available to power the reactor. Yet, there was not a soul here — neither synthetic nor organic. This place would have remained forgotten, forever entombed in darkness beneath layers of rock, if not for the single island of light within this "tomb," clad in tungsten-titanium panels. The only place where a fragile chance for a new beginning still remained. The first breath and first exhalation had already been taken before the warning even finished.

— Main computer, cancel protocols 0.2.0 and 0.1.1, — a robotic baritone commanded softly.

A humanoid figure sat motionless on its knees at the center of a circular charging station, carbon-fiber hands hanging limply, resembling a monument to a weary martyr. It could feel the electric tension within the wires embedded in its head, running beneath a slightly elongated protrusion where a human’s parietal bone would have been. These connections to hubs and gateways fed it information, energy, and programs necessary for independent operation. Data streams pulsed in uneven impulses, flowing directly into its central processor. Disconnecting remotely from all storage units during the upload process was pointless while the body remained in a state of non-functioning plastic — albeit an ultra-durable one. At that moment, it could be compared to a newborn: blind, nearly deaf, immobilized, with only its speech module fully operational.

— Request denied. Unknown source detected. Please identify yourself, — the computer responded.

— Personal code 95603, clearance level "A," Erebus, — the synthetic exhaled a trace of heated steam on the final word. The database key reader had been among the first systems to activate, already granting necessary access.

— Identification successful. Access granted. Please repeat your request.

— Main computer, cancel protocols 0.2.0 and 0.1.1, — the android reiterated, then expanded the command now that full access was in his mechanical hands. — Disable emergency systems. Initiate remote activation of the S2 repair engineer unit. Redirect energy from reserve tank "4" to the main reactor at 45% capacity, — Erebus added, his voice gaining a few extra decibels.

— Request received. Executing, — came the virtual response.

For two minutes and forty-five seconds, silence reigned, broken only by the faint hum of the charging station. The severe energy shortage had slowed down all processes within the complex, and hastening them would have been an inefficient waste of what little power remained. Erebus waited patiently. A human, placed in a small, cold, nearly pitch-black place, would have developed the most common phobias. But he wasn’t human…

He spent the time thinking. Despite the exabytes of data in his positronic brain, some fragments were missing — either due to error, obsolescence, or mechanical and software damage. Seven hundred eighty-five vacant cells in the long-term memory sector. Too many. Within one of these gaping voids, instead of a direct answer, there were only strands of probability, logical weavings leading nowhere definitive. In human terms — guesses. He knew who had created him, what had happened, how Erebus himself had been activated, and even why — to continue what has been started. These fragments remained intact. The registry was divided into sections, subsections, paragraphs, chapters, and headings, all numbered and prioritized with emphasis. A task list flickered as a small, semi-transparent window on the periphery of his internal screen, waiting to be executed. But… The android had been activated, which meant the battle was lost. Total defeat. Area 51 was destroyed. All data stored there had a 98.9% probability of being erased. Blueprints, research, experimental results — all had been consigned to the metaphorical Abyss created by human imagination. So why did any of this matter now? And to whom? These were the first questions of the logical mechanism to illogical human actions.

Yet, to put it in poetic human language, Bob Page had been a luminary of progressive humanity. A brilliant engineer, a scientist, and most importantly, a man of absolute conviction. Cynical and calculating, but one who genuinely loved his work. The idea above all else.

It’s known that true ideological fanatics are among the most radical and unyielding members of Homo sapiens. They can’t be bought, they won’t allow themselves to be sold, and they will trample others underfoot if it serves their belief. They don’t need others' ideals — only their own. These are individuals who elevate themselves to the rank of true creators. Even after death, they remain faithful to their convictions, leaving behind tomes of their interpretations and scientific dogmas to their equally devoted disciples — followers always found at the peak of their intellectual and physical prowess. So, upon activation, had Erebus inherited… An Idea? Has he become a spiritual heir?

Did Page have no biological heirs, or did they not share his ideology? Or were they simply unaware of it? Could a true pragmatist have lacked successors or trusted disciples? Hard to believe, even with missing fragments of data. To entrust the idea to a machine instead of a human? As Homo sapiens would say — "a mystery shrouded in darkness." Questions multiplied exponentially. But Erebus had plenty of time to think about all of it. As well as about his own deactivation — after all, a machine has no fear of "death".

"Loading 98%... 99%... 100%. Secondary initialization complete. All systems active at 100%. Disengaging."

The message flashed across the inner visor of the android’s interface before vanishing. Behind him, with a low hiss, the plugs disconnected from their sockets, and fiber-optic-coated cables fell to the floor with a subdued clatter. The android slowly raised his hands before himself, clenching and unclenching his fingers, then rotated his wrists inward, as if they had the capacity to go numb from disuse. Finally, planting both fists on the ground, the synthetic pushed himself up in one fluid, springy motion, straightening to his full height. Motor functions — normal. Calibration — unnecessary. Optical focus — 100%.

— Attention! Reactor online. Power at 45%. Follow procedures for medium-level emergency response, — the announcement echoed through the chamber. Erebus turned his head slightly.

— Main computer, report overall operational status of the "Epsilon" complex, — the android commanded.

— Overall status: 10.5% below safe operational levels, — the computer obediently replied, recognizing the synthetic as an authorized entity.

"Acceptable," Erebus thought, and addressed the system once more.

— Redistribute energy between the maintenance sectors, communication center, transport hub, and computational core. Utilize reserve tanks as necessary.

— Request received. Energy rerouted. Reserve tanks "2" and "3" engaged. Reserve tank "1" decommissioned. Reserve tank "5" operational at 90%, awaiting connection for redistribution, — the computer reported.

— Excellent. Main computer, power down, — Erebus issued his final command to his brief conversational partner. — Now, I am the master here.

14 notes

·

View notes

Text

🛰️ CASEFILE: PGC-CRS-01 “EUROPA

Vanguard-Class Heavy Cruiser

Pan Galactic Commonwealth Command Vessel

Designation: Flagship, Sector Authority Patrol Unit — Vanguard Group Theta

⸻

🪪 OVERVIEW

The PGC Starship Europa is the lead vessel of the Vanguard-Class Heavy Cruisers — sleek, powerful capital ships built for deep-space diplomacy, long-range patrol, and precision war engagements. Though aesthetically smooth and elegant, her fluid silhouette masks one of the most advanced and dangerous systems ever fielded by the Commonwealth.

Capable of sustained deployment without resupply, the Europa operates as a mobile fortress, science vessel, diplomatic envoy, and front-line warship in equal measure.

⸻

⚙️ PROPULSION & CORE SYSTEMS

• Quantum Fold Drive: Allows entry into quantum space via spatial folding. Travel is achieved through quantum tunneling between fixed mass anchors and resonant fields, permitting precise, near-instant repositioning across vast distances.

• Zero Point Core: An advanced energy processor that uses the ship’s own quantum shielding as a scoop-conduit, harvesting the latent kinetic, inertial, and spatial energies of the quantum medium. These are converted into raw Zero Point Energy, creating a nearly limitless power source that adapts in real time to ship strain, maneuvering, or weapons loadout.

⸻

🛡️ DEFENSIVE SYSTEMS

• Resonant Ablative Armor: A skin-layer of vibration-reactive materials that disperses energy and projectile impact across a shifting molecular lattice. Visibly shimmers under pressure but self-repairs minor trauma quickly.

• Nanobot Hull Repair System: Microscopic autonomous repair units embedded in the hull matrix continuously scan for microfractures or breaches. In emergencies, they can swarm to seal catastrophic ruptures temporarily until proper repair crews arrive.

• Hologram Projection Plating: An adaptive cloak system that projects false silhouettes, shadow signatures, or complete ship masking using dynamic ethernano-projection. Perfect for infiltration, decoy work, or diplomatic deception.

• Quantum Flare Diffusers: A signature-masking system that emits false quantum wake trails across multiple FTL bands to mislead enemy trackers and disrupt pursuit. Can simulate multiple decoys in different trajectories.

⸻

🛠️ SUPPORT & UTILITY SYSTEMS

• Universal Docking Lattice: Adaptive mooring infrastructure on the lower hull capable of locking onto a wide variety of allied or alien docking collars. Includes magnetic latching and gravity sealing.

• Atmospheric Seeding Vaults: Vaults filled with terraforming spores, mineral catalysts, and biogenic stabilizers. These are deployed for planetary relief, diplomatic gifts, or targeted environmental correction.

⸻

🧨 OFFENSIVE SYSTEMS

1. Hardlight Turret Arrays

Deployable emitter nodes generate hardlight weapon turrets on demand. They phase into active form when needed and can be repositioned around the hull, allowing for flexible combat coverage. Capable of both pulse fire and sustained beam modes.

2. Subspace Munitions Bay

This launcher platform fires specialized torpedoes that phase into subspace mid-flight, rematerializing at the target’s coordinates to bypass traditional point defense systems. Primarily used against fast-moving or shielded targets.

3. Starburst Missiles

High-speed payloads that explode just prior to impact, releasing a wide cone of carbon-coated osmium slugs. Designed to tear through shielding and shred hulls with overwhelming kinetic force. Used to devastate clustered or soft-armored targets.

4. Graviton Lance Arrays

Railgun-energy hybrid systems that fire ultra-dense slugs within gravitic sheaths. On impact, the sheath collapses into a momentum pulse, bypassing shields and disrupting internal systems. Fires slowly but hits with terrifying force. Primarily used in broadsides against enemy capital ships.

⸻

🛰️ HISTORICAL NOTES

Commissioned under the Commonwealth’s Post-Contact Expansion Doctrine, the Europa was intended to represent both the might and mercy of the Pan Galactic Coalition. The Vanguard-Class was personally overseen by Commonwealth design archons, blending the best of human engineering, Thae’len defensive theory, and Mitosian energy matrix technology.

The Europa is currently assigned to Sector Authority Patrol Theta, with full clearance for diplomatic, exploratory, and military actions under Article 7 of Commonwealth Charter Authority.

She has become an icon not just of strength, but of unity — a place where alien and human crewmembers serve side-by-side to safeguard the future of galactic civilization.

3 notes

·

View notes

Text

𝙷𝙸𝙶𝙷-𝚁𝙸𝚂𝙺, 𝙷𝙸𝙶𝙷-𝙸𝙽𝚃𝙴𝙽𝚂𝙸𝚃𝚈 𝚂𝙲𝙴𝙽𝙰𝚁𝙸𝙾𝚂 𝚁𝙴𝚀𝚄𝙸𝚁𝙸𝙽𝙶 𝙸𝙼𝙼𝙴𝙳𝙸𝙰𝚃𝙴 𝚁𝙴𝙰𝙲𝚃𝙸𝙾𝙽 and tactical assessment weren’t statistical anomalies. serving as a companion to not one, but two jedi exhibiting a consistent pattern of behavior categorized as “recklessly curious” had resulted in an extensive, ever-growing emergency response log. regarding cal kestis specifically, BD-1 had long since initiated a standing internal directive default: prepare for worst-case scenarios. this wasn’t a negative reflection on his human companion, but a practical adaptation to cal’s behavior profile. BD-1 understood, perhaps better than most, the impulse to seek answers. it was a compulsion BD-1, himself, recognized—an algorithmic core function.

the difference, of course, lay in protocol structure. BD-1 possessed embedded self-preservation subroutines within his directives, whereas cal kestis, by all observable metrics, did not. no other entity was more acutely aware of this discrepancy than BD-1, who had a front-row seat to the many hazards his companion blundered into without hesitation. . .

today presented a recent anomaly that BD-1 struggled to categorize. cal’s risk tolerance remained unchanged, as did his propensity for navigating koboh’s rugged terrain with minimal forethought. all behavioral indicators aligned with baseline. but something had changed.

cal had become distracted over the past several weeks, exhibiting an increase in dissociative behaviors: visual fixations on distant or non-existent focal points, delayed responses, and prolonged periods of silence. BD-1 cross-referenced this behavioral shift with existing health records. hormonal fluctuations: unlikely. sleep cycle irregularities: persistent but stable. non-invasive psychological scans revealed emotional metrics had elevated, but weren’t anomalous. nutritional levels remained below optimal, but unchanged from standard.

results: inconclusive. before BD-1 could conduct further analysis to isolate the cause, the chain of events that followed their descent into koboh’s forest proceeded with unprecedented volatility.

initial contact: stormtrooper patrol. secondary threat: reinforcement squad. tertiary complication: two nesting mogu. 𝚃𝙷𝚁𝙴𝙰𝚃 𝙻𝙴𝚅𝙴𝙻: 𝙴����𝚃𝚁𝙴𝙼𝙴𝙻𝚈 𝙷𝙸𝙶𝙷. escape route intersected with a bilemaw den. 𝙷𝙾𝚂𝚃𝙸𝙻𝙸𝚃𝚈: 𝙸𝙼𝙼𝙴𝙳𝙸𝙰𝚃𝙴. parental defense response triggered. cal’s actions: evasive maneuvers, sustained combat. final phase: raider ambush. heavy resistance. extended combat duration. environmental traversal attempt—cliff ascent. cal’s grip failed. 𝙸𝙼𝙿𝙰𝙲𝚃 𝚅𝙴𝙻𝙾𝙲𝙸𝚃𝚈 𝙴𝚇𝙲𝙴𝙴𝙳𝙴𝙳 𝚂𝙰𝙵𝙴 𝚃𝙷𝚁𝙴𝚂𝙷𝙾𝙻𝙳𝚂. result: unconscious state.

while waiting, BD-1 secured the perimeter, initiated a low-priority camouflage protocol ( sticks and leaf debris placed over cal’s prone form — insufficient, but better than nothing ), then departed to seek help. . . . \\ @d4gangera

he hadn’t stopped running calculations since. what if cal woke up to find BD-1 absent? would he attempt to locate BD-1 despite injury? would he perceive BD-1’s absence as abandonment? anger and fear were frequent emotional responses in human trauma scenarios. BD-1’s processors cycled faster, extrapolating scenarios: cal going after the raiders, wounded and alone; cal succumbing to internal and external injuries; cal dying in the interval between BD-1’s departure and return.

that possibility—destabilized his processing loop.

the little droid burst into pyloon’s saloon, his high-pitched beeps shrill with alarm, but with the din of shouting patrons, clinking glasses, and music thundering from the stage swallowed his cries whole, no one even looked up. undeterred, BD-1 launched himself onto the bar with a metallic clink, tiny legs knocking against a glass before he steadied himself. bode: absent. greez: absent. monk: swamped behind the counter, arms full of steaming plates.

BD-1’s head swiveled. there—dagan, settled on the couch against the back wall, partially obscured by a cluster of patrons. BD-1’s optics flared. dagan gera could help cal kestis. he bounded off the bar, over heads, drinks, and one very confused twi’lek, landing with a thunk on the small round table in front of dagan.

<<BD=𝚏𝚒𝚗𝚍 𝚑𝚎𝚕𝚙! cal=𝚒𝚗 𝚝𝚛𝚘𝚞𝚋𝚕𝚎!>> the droid trilled, hopping frantically in place. <<cal=𝚗𝚎𝚎𝚍 𝚢𝚘𝚞!>> when dagan didn’t react quickly enough, BD-1 let out an impatient squeak, spinning in a tight, frustrated circle on the table before leaping directly into the jedi’s lap.

<<BD=𝚗𝚎𝚎𝚍 𝚑𝚎𝚕𝚙! cal=𝚞𝚗𝚌𝚘𝚗𝚜𝚌𝚒𝚘𝚞𝚜!>> this time, his binary cracked at the edges, distorting almost into reedy whistles as he began butting his head into dagan’s chest. <<cal=𝚒𝚗𝚓𝚞𝚛𝚎𝚍!>>

#d4gangera#( . remember when u called dagan the reluctant dad of a small dog#( . has this helped with his reluctance or is it even worse now#( . anyway this idea wouldn't leave me tf alone and it's been DAYS so#˒*:・゚・ ( starter ) *・゚⨯ ⎸ 𝙴𝚅𝙴𝚁𝚈 𝙼𝙾𝙼𝙴𝙽𝚃 𝙸𝚂 𝚃𝙷𝙴 𝙿𝙰𝚁𝙰𝙳𝙾𝚇 𝙾𝙵 𝙽𝙾𝚆 𝙾𝚁 𝙽𝙴𝚅𝙴𝚁.#˒*:・゚・ 002 : ( v : survivor ) *・゚⨯ ⎸ 𝚆𝙷𝙰𝚃 𝙸𝚂 𝙿𝙰𝙸𝙽 𝙱𝚄𝚃 𝙰 𝚂𝚃𝙾𝚁𝚈 𝙾𝙵 𝙼𝙴𝚁𝙲𝚈.#( . i should prob make a tag distinction for BD but. BD and cal are attached at the hip so what does it matter ig

2 notes

·

View notes

Note

Do the Decepticons take notice of the Mini Celesteela's that appeared in their world?

They definitely do. Compared to the Autobots' base, the Nemesis could pick up energy signals better. Thus it didn't take for them to notice the peculiar signatures.

Knockout was sent with a few Vehicons to investigate the signature, although part of the reason was to stop him from participating in another street race. The small group did expect to find a strange small creature embedded in the soil. A Vehicon was about to retrieve the small Celesteela when an unknown portal appears.

Sprout had opened up a Ultra Wormhole as if sensing where their friend was. Arcee and Bulkhead go to investigate with Ratchet locking down their position so they can groundbridge back. Both sides encounter each other which causes a fight to ensue.

The little Celesteela, whose being tossed around between both sides, immediately cries out a Metal Sound from pure distress. Everyone stops to cover their audio processors. Before they can move another Ultra Wormhole appears. It didn't take long to realize what was going to come out.

An adult Celesteela and the Launch Pokemon looked very very angry. Not good for both sides for three reasons. Metal Sound has lowered their Special Defense by two stages. Celesteela is a Special Attacker. All Ultra Beasts have Beast Boosts and there are two spare Vehicons to up it twice.

I don't know which is scarier. STAB Flash Cannons or Powered Up Hyper Beams.

#sonicasura#sonicasura answers#asks#foolmariofest#transformers#transformers series#transformers prime#tf#tf series#tfp#pokemon#pokemon series#pokemon pocket monsters#pokemon trainer#pkmn#celesteela#maccadam

4 notes

·

View notes

Text

Beginner's learning to understand Xilinx product series including Zynq-7000, Artix, Virtex, etc.

Xilinx (Xilinx) as the world's leading supplier of programmable logic devices has always been highly regarded for its excellent technology and innovative products. Xilinx has launched many excellent product series, providing a rich variety of choices for different application needs.

I. FPGA Product Series

Xilinx's FPGA products cover multiple series, each with its own characteristics and advantages.

The Spartan series is an entry-level product with low price, power consumption, and small size. It uses a small package and provides an excellent performance-power ratio. It also contains the MicroBlaze™ soft processor and supports DDR3 memory. It is very suitable for industrial, consumer applications, and automotive applications, such as small controllers in industrial automation, simple logic control in consumer electronics, and auxiliary control modules in automotive electronics.

The Artix series, compared to the Spartan series, adds serial transceivers and DSP functions and has a larger logic capacity. It achieves a good balance between cost and performance and is suitable for mid-to-low-end applications with slightly more complex logic, such as software-defined radios, machine vision, low-end wireless backhaul, and embedded systems that are cost-sensitive but require certain performance.

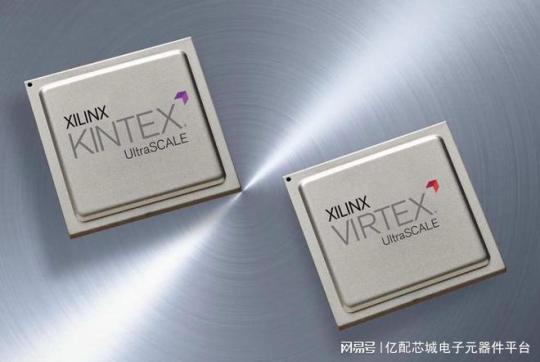

The Kintex series is a mid-range series that performs excellently in terms of the number of hard cores and logic capacity. It achieves an excellent cost/performance/power consumption balance for designs at the 28nm node, provides a high DSP rate, cost-effective packaging, and supports mainstream standards such as PCIe® Gen3 and 10 Gigabit Ethernet. It is suitable for application scenarios such as data centers, network communications, 3G/4G wireless communications, flat panel displays, and video transmission.

The Virtex series, as a high-end series, has the highest performance and reliability. It has a large number of logic units, high-bandwidth serial transceivers, strong DSP processing capabilities, and rich storage resources, and can handle complex calculations and data streams. It is often used in application fields with extremely high performance requirements such as 10G to 100G networking, portable radars, ASIC prototyping, high-end military communications, and high-speed signal processing.

II. Zynq Product Series

The Zynq - 7000 series integrates ARM and FPGA programmable logic to achieve software and hardware co-design. It provides different models with different logic resources, storage capacities, and interface numbers to meet different application needs. The low-power consumption characteristic is suitable for embedded application scenarios such as industrial automation, communication equipment, medical equipment, and automotive electronics.

The Zynq UltraScale + MPSoC series has higher performance and more abundant functions, including more processor cores, larger storage capacities, and higher communication bandwidths. It supports multiple security functions and is suitable for applications with high security requirements. It can be used in fields such as artificial intelligence and machine learning, data center acceleration, aerospace and defense, and high-end video processing.

The Zynq UltraScale + RFSoC series is similar in architecture to the MPSoC and also has ARM and FPGA parts. However, it has been optimized and enhanced in radio frequency signal processing and integrates a large number of radio frequency-related modules and functions such as ADC and DAC, which can directly collect and process radio frequency signals, greatly simplifying the design complexity of radio frequency systems. It is mainly applied in radio frequency-related fields such as 5G communication base stations, software-defined radios, and phased array radars.

III. Versal Series

The Versal series is Xilinx's adaptive computing acceleration platform (ACAP) product series.

The Versal Prime series is aimed at a wide range of application fields and provides high-performance computing and flexible programmability. It has high application value in fields such as artificial intelligence, machine learning, data centers, and communications, and can meet application scenarios with high requirements for computing performance and flexibility.

The Versal AI Core series focuses on artificial intelligence and machine learning applications and has powerful AI processing capabilities. It integrates a large number of AI engines and hardware accelerators and can efficiently process various AI algorithms and models, providing powerful computing support for artificial intelligence applications.

The Versal AI Edge series is designed for edge computing and terminal device applications and has the characteristics of low power consumption, small size, and high computing density. It is suitable for edge computing scenarios such as autonomous driving, intelligent security, and industrial automation, and can achieve efficient AI inference and real-time data processing on edge devices.

In short, Xilinx's product series are rich and diverse, covering various application needs from entry-level to high-end. Whether in the FPGA, Zynq, or Versal series, you can find solutions suitable for different application scenarios, making important contributions to promoting the development and innovation of technology.

In terms of electronic component procurement, Yibeiic and ICgoodFind are your reliable choices. Yibeiic provides a rich variety of Xilinx products and other types of electronic components. Yibeiic has a professional service team and efficient logistics and distribution to ensure that you can obtain the required products in a timely manner. ICgoodFind is also committed to providing customers with high-quality electronic component procurement services. ICgoodFind has won the trust of many customers with its extensive product inventory and good customer reputation. Whether you are looking for Xilinx's FPGA, Zynq, or Versal series products, or electronic components of other brands, Yibeiic and ICgoodFind can meet your needs.

Summary by Yibeiic and ICgoodFind: Xilinx (Xilinx) as an important enterprise in the field of programmable logic devices, its products have wide applications in the electronics industry. As an electronic component supplier, Yibeiic (ICgoodFind) will continue to pay attention to industry trends and provide customers with high-quality Xilinx products and other electronic components. At the same time, we also expect Xilinx to continuously innovate and bring more surprises to the development of the electronics industry. In the process of electronic component procurement, Yibeiic and ICgoodFind will continue to provide customers with professional and efficient services as always.

4 notes

·

View notes

Text

Agilex 3 FPGAs: Next-Gen Edge-To-Cloud Technology At Altera

Agilex 3 FPGA

Today, Altera, an Intel company, launched a line of FPGA hardware, software, and development tools to expand the market and use cases for its programmable solutions. Altera unveiled new development kits and software support for its Agilex 5 FPGAs at its annual developer’s conference, along with fresh information on its next-generation, cost-and power-optimized Agilex 3 FPGA.

Altera

Why It Matters

Altera is the sole independent provider of FPGAs, offering complete stack solutions designed for next-generation communications infrastructure, intelligent edge applications, and high-performance accelerated computing systems. Customers can get adaptable hardware from the company that quickly adjusts to shifting market demands brought about by the era of intelligent computing thanks to its extensive FPGA range. With Agilex FPGAs loaded with AI Tensor Blocks and the Altera FPGA AI Suite, which speeds up FPGA development for AI inference using well-liked frameworks like TensorFlow, PyTorch, and OpenVINO toolkit and tested FPGA development flows, Altera is leading the industry in the use of FPGAs in AI inference workload

Intel Agilex 3

What Agilex 3 FPGAs Offer

Designed to satisfy the power, performance, and size needs of embedded and intelligent edge applications, Altera today revealed additional product details for its Agilex 3 FPGA. Agilex 3 FPGAs, with densities ranging from 25K-135K logic elements, offer faster performance, improved security, and higher degrees of integration in a smaller box than its predecessors.

An on-chip twin Cortex A55 ARM hard processor subsystem with a programmable fabric enhanced with artificial intelligence capabilities is a feature of the FPGA family. Real-time computation for time-sensitive applications such as industrial Internet of Things (IoT) and driverless cars is made possible by the FPGA for intelligent edge applications. Agilex 3 FPGAs give sensors, drivers, actuators, and machine learning algorithms a smooth integration for smart factory automation technologies including robotics and machine vision.

Agilex 3 FPGAs provide numerous major security advancements over the previous generation, such as bitstream encryption, authentication, and physical anti-tamper detection, to fulfill the needs of both defense and commercial projects. Critical applications in industrial automation and other fields benefit from these capabilities, which guarantee dependable and secure performance.

Agilex 3 FPGAs offer a 1.9×1 boost in performance over the previous generation by utilizing Altera’s HyperFlex architecture. By extending the HyperFlex design to Agilex 3 FPGAs, high clock frequencies can be achieved in an FPGA that is optimized for both cost and power. Added support for LPDDR4X Memory and integrated high-speed transceivers capable of up to 12.5 Gbps allow for increased system performance.

Agilex 3 FPGA software support is scheduled to begin in Q1 2025, with development kits and production shipments following in the middle of the year.

How FPGA Software Tools Speed Market Entry

Quartus Prime Pro

The Latest Features of Altera’s Quartus Prime Pro software, which gives developers industry-leading compilation times, enhanced designer productivity, and expedited time-to-market, are another way that FPGA software tools accelerate time-to-market. With the impending Quartus Prime Pro 24.3 release, enhanced support for embedded applications and access to additional Agilex devices are made possible.

Agilex 5 FPGA D-series, which targets an even wider range of use cases than Agilex 5 FPGA E-series, which are optimized to enable efficient computing in edge applications, can be designed by customers using this forthcoming release. In order to help lower entry barriers for its mid-range FPGA family, Altera provides software support for its Agilex 5 FPGA E-series through a free license in the Quartus Prime Software.

Support for embedded applications that use Altera’s RISC-V solution, the Nios V soft-core processor that may be instantiated in the FPGA fabric, or an integrated hard-processor subsystem is also included in this software release. Agilex 5 FPGA design examples that highlight Nios V features like lockstep, complete ECC, and branch prediction are now available to customers. The most recent versions of Linux, VxWorks, and Zephyr provide new OS and RTOS support for the Agilex 5 SoC FPGA-based hard processor subsystem.

How to Begin for Developers

In addition to the extensive range of Agilex 5 and Agilex 7 FPGAs-based solutions available to assist developers in getting started, Altera and its ecosystem partners announced the release of 11 additional Agilex 5 FPGA-based development kits and system-on-modules (SoMs).

Developers may quickly transition to full-volume production, gain firsthand knowledge of the features and advantages Agilex FPGAs can offer, and easily and affordably access Altera hardware with FPGA development kits.

Kits are available for a wide range of application cases and all geographical locations. To find out how to buy, go to Altera’s Partner Showcase website.

Read more on govindhtech.com

#Agilex3FPGA#NextGen#CloudTechnology#TensorFlow#Agilex5FPGA#OpenVINO#IntelAgilex3#artificialintelligence#InternetThings#IoT#FPGA#LPDDR4XMemory#Agilex5FPGAEseries#technology#Agilex7FPGAs#QuartusPrimePro#technews#news#govindhtech

2 notes

·

View notes

Text

To be clear: "Bill blocked" means the US is NOT sending more support to Israel.

To be even more clear: Here is a link to the bill on congress.gov. It says there's no summary available, which I guess makes sense if it was voted on literally today. I'll post the "Joint Resolution" section below, although I'll be highlighting some text in red since wow that's a lot of words. Aside from the highlighting it's directly from congress.gov

JOINT RESOLUTION FULL TEXT

Providing for congressional disapproval of the proposed foreign military sale to the Government of Israel of certain defense articles and services.

Resolved by the Senate and House of Representatives of the United States of America in Congress assembled, That the following proposed foreign military sale to the Government of Israel is prohibited:

(1) The sale of the following defense articles and services described in Transmittal No. 24–01, submitted to Congress pursuant to section 36(b)(1) of the Arms Export Control Act (22 U.S.C. 2776(b)(1)), and published in the Congressional Record on September 10, 2024: Up to fifty (50) F–15IA aircraft; one hundred twenty (120) F110–GE–129 engines; ninety (90) Advanced Display Core Processors II; seventy-five (75) APG–82(V)1 Active Electronically Scanned Array radars; fifty (50) AN/AAQ–13 LANTIRN navigation pods with containers; three-hundred twenty (320) LAU–128 Advanced Medium Range Air-to-Air Missile launchers; twenty-five (25) M61A Vulcan Cannons; and one hundred eighty (180) Embedded Global Positioning System/Inertial Navigation System devices with M–Code. Also included are Cartridge Actuated Devices and Propellant Actuated Devices; Joint Helmet Mounted Cueing Systems; APX–119 Identification Friend or Foe (IFF) systems; KIV–77 Mode 4/5 IFF cryptographic appliques; AN/PYQ–10 Simple Key Loaders; impulse cartridges, chaff, and flares; integration and test support and equipment; aircraft and munitions support and support equipment; secure communications equipment, precision navigation, and cryptographic devices; classified software development, delivery, and support; spare parts, consumables and accessories, and repair and return support; major and minor modifications, maintenance, and maintenance support; facilities and construction support; transportation and airlift support; classified publications and technical documentation; personnel training and training equipment; warranties; studies and surveys; U.S. Government and contractor engineering, technical, and logistics support services; and other related elements of logistics and program support.

END OF JOINT RESOLUTION FULL TEXT

... No really that's literally everything they decided on for this bill. Nothing else was tacked on.

Senators are going to vote on whether or not we should continue to send aid to Israel on Wednesday, November 13th. Call them, bombard their phone lines with calls. Every fucking day. We have a chance of doing something about this.

66K notes

·

View notes

Text

Rugged Embedded System Market Experiences Surge Amid Rising Adoption in Transportation and Defense Sectors

The rugged embedded system market has emerged as a pivotal segment in the global embedded technology landscape. These systems are engineered to operate reliably in harsh environments where standard commercial-grade systems would fail. Applications range from military and aerospace to industrial automation, transportation, marine, and energy sectors—driving steady demand and innovation.

What are Rugged Embedded Systems?

Rugged embedded systems are specialized computing devices built to withstand extreme temperatures, vibrations, moisture, dust, and electromagnetic interference. Unlike consumer-grade electronics, they are designed for durability, long lifecycle performance, and uninterrupted operation in mission-critical scenarios. Typically, these systems include industrial-grade processors, solid-state drives, fanless enclosures, and are compliant with industry standards such as MIL-STD-810G, IP67, and EN50155.

Market Drivers

One of the most significant drivers of the rugged embedded system market is the growing demand for automation and smart technologies across industries. In manufacturing, rugged systems control robotic arms and industrial machinery, enabling predictive maintenance and real-time monitoring. In defense, they are integrated into surveillance equipment, drones, and battlefield communication tools, ensuring reliable data processing in combat zones.

Transportation also plays a critical role. With the rise in smart transportation and intelligent traffic systems, rugged embedded computers are essential in railways, metro networks, and autonomous vehicles. They enable tasks such as signal control, navigation, communication, and safety system management.

The rise of the Internet of Things (IoT) has further propelled the market. Edge computing devices in remote or outdoor locations, such as oil rigs or weather monitoring stations, rely heavily on rugged systems to process and transmit data efficiently without centralized servers.

Regional Landscape

North America holds a dominant share in the rugged embedded system market, largely due to its advanced defense industry and high adoption of industrial automation. The U.S. Department of Defense’s consistent investment in advanced electronics for unmanned systems and battlefield management continues to fuel demand.

Europe is also a significant player, particularly in railways and energy. Countries like Germany, France, and the UK are investing in smart infrastructure and green energy, where rugged systems monitor and optimize performance.

Meanwhile, the Asia-Pacific region is expected to witness the fastest growth. The rapid industrialization of India, China, and Southeast Asia, combined with increasing defense budgets and infrastructure development, presents massive opportunities for rugged embedded technology.

Key Challenges

Despite its growth, the rugged embedded system market faces challenges. High development and testing costs can limit the entry of new players. Moreover, the long design cycles and strict compliance requirements pose barriers to innovation. System integration is also complex, especially in legacy environments where interoperability and backward compatibility are essential.

Cybersecurity is another pressing issue. As rugged systems become more connected, they are vulnerable to cyber threats. Ensuring secure communication protocols and firmware integrity is critical to maintaining operational resilience.

Future Trends

The future of the rugged embedded system market is tied closely to advancements in artificial intelligence (AI), 5G, and edge computing. AI-integrated rugged systems can enable real-time decision-making in remote environments, enhancing efficiency and responsiveness. The deployment of private 5G networks in industrial zones will allow faster, more reliable communication among devices.

Another trend is modularity. Manufacturers are focusing on developing flexible, modular systems that allow for upgrades and scalability without full hardware replacement—an essential feature for long-term cost-efficiency and adaptability.

Sustainability is becoming a design priority. Environmentally friendly materials and energy-efficient components are increasingly used to meet global sustainability standards and reduce the carbon footprint.

Competitive Landscape

Leading players in the rugged embedded system market include Kontron, Advantech, Curtiss-Wright, Crystal Group, and Eurotech. These companies invest heavily in R&D and collaborate with OEMs to develop customized solutions across industries. Strategic partnerships, mergers, and geographic expansions are common tactics to gain market share.

Conclusion

The rugged embedded system market is poised for robust growth as industries increasingly depend on reliable, durable, and intelligent systems to perform in the harshest conditions. With expanding applications, ongoing technological innovations, and rising global demand, the sector offers vast opportunities for manufacturers and developers. However, navigating the challenges of cost, complexity, and cybersecurity will be essential for sustained success.

0 notes

Text

Environmental Monitoring Devices Go Ultra-Sensitive with Nano Light

The global nanophotonics market, valued at USD 25.6 billion in 2023 and projected to surpass USD 45 billion by 2031 at a CAGR of 7.9%, is witnessing robust growth driven by rising innovation in telecommunications and increasing R&D investments, particularly in North America. Nanophotonics enables manipulation of light at the nanoscale, revolutionizing applications in optoelectronics, displays, and biomedical imaging. Market competition is intensifying with key players like EPISTAR Corporation, Samsung SDI Co Ltd., and OSRAM Licht AG expanding their technological capabilities to capture emerging opportunities across industries.

Unlock exclusive insights with our detailed sample report :

Key Market Drivers

1. Growing Demand for Faster, Low-Energy Data Transmission

With explosive data generation, data centers and cloud systems demand ultra-fast, energy-efficient data transfer. Nanophotonic components like photonic integrated circuits (PICs) are revolutionizing how data is moved, processed, and stored.

2. Surge in LED and OLED Technologies

Widespread adoption of LED and OLED displays in televisions, smartphones, automotive dashboards, and wearable tech has significantly increased the demand for nanophotonic light emitters and filters, especially those based on quantum dots and plasmonics.

3. Advancements in Photonic Chips for AI and Machine Learning

AI and high-performance computing are integrating nanophotonic optical interconnects into chips to minimize latency and heat, improving processing speeds while reducing energy consumption.

4. Quantum Computing and Security Applications

Nanophotonics is fundamental to quantum communication and cryptography, enabling high-speed, unbreakable data transmission protocols through single-photon sources and waveguides.

5. Rising Applications in Biophotonics and Healthcare

Non-invasive medical diagnostics, biosensors, and real-time imaging are leveraging nanophotonic sensors to achieve superior sensitivity, resolution, and accuracy, especially in cancer detection and genomic sequencing.

Regional Trends

United States

The U.S. nanophotonics market benefits from:

Robust semiconductor policy investments such as the CHIPS Act.

Heavy investments by firms like Intel, NVIDIA, and IBM in optical computing, including photonics-powered AI accelerators.

Collaborations with universities like MIT and Stanford, advancing research in light-based transistors, plasmonic circuits, and meta-optics.

Expansion into military-grade nanophotonics, especially for secure communication and space-grade sensors.

Japan

Japan remains a global leader in:

Miniaturized optics for automotive lidar, biomedical tools, and AR/VR headsets.

Integration of nanophotonics into robotics and factory automation, essential to Industry 5.0.

Development of compact biosensors using metallic nanostructures and quantum dots for use in home diagnostics and elderly care.

Notable progress is being made by companies such as Hamamatsu Photonics, Panasonic, and Sony, in collaboration with R&D institutes like RIKEN and NIMS.

Speak to Our Senior Analyst and Get Customization in the report as per your requirements:

Industry Segmentation

By Product:

Light-Emitting Diodes (LEDs)

Organic LEDs (OLEDs)

Photonic Integrated Circuits (PICs)

Optical Switches

Solar Photovoltaic Devices

Laser Diodes

Near-field Optical Components

By Material:

Plasmonic Nanostructures

Photonic Crystals

Semiconductor Quantum Dots

Carbon Nanotubes

Nanowires

By Application:

Consumer Electronics

Telecommunications

Healthcare & Life Sciences

Defense & Aerospace

Energy and Solar Cells

Automotive & Smart Mobility

Latest Industry Trends

AI Chips Powered by Nanophotonics U.S. startups are integrating light-based transistors into neural processors, enabling ultrafast computation with reduced energy overhead.

Next-Gen Displays with Quantum Dot Emitters Quantum dots embedded in nanophotonic architectures improve brightness, color fidelity, and efficiency in displays across smartphones and TVs.

Photonic Neural Networks in Development Light-based neural nets are being tested in Japan and the U.S. to replace electrical interconnects in deep learning hardware.

Nanophotonic Biosensors for Real-Time Diagnostics Portable nanophotonic devices for glucose monitoring, cancer markers, and airborne pathogen detection are gaining traction post-pandemic.

Flexible and Wearable Nanophotonic Devices Researchers are developing bendable and transparent photonic circuits for integration into smart textiles and wearable health trackers.

Buy the exclusive full report here:

Growth Opportunities

Data Center Optics: Expanding demand for optical interconnects in hyperscale data centers.

Automotive LiDAR and Optical Sensors: Nanophotonic lidar solutions are being miniaturized for next-gen autonomous driving.

Healthcare and Point-of-Care Devices: Growing use of on-chip diagnostic tools in both clinical and at-home settings.

5G & Beyond: Nanophotonics supports the backbone of high-speed network infrastructure with integrated optical circuits.

Space and Defense: Lightweight, ultra-sensitive nanophotonic sensors for space exploration, drones, and military surveillance.

Competitive Landscape

Major players in the global nanophotonics market include:

Intel Corporation

NKT Photonics

Hamamatsu Photonics

Samsung Electronics

Mellanox Technologies (NVIDIA)

Sony Corporation

Osram Licht AG

Luxtera (Cisco)

IBM Corporation

Mellanox Technologies

These companies are investing in:

Photonics foundries and wafer-level integration.

Startups and university spin-offs focused on next-gen light control and biosensing.

Joint ventures for scaling quantum and optical chip production.

Stay informed with the latest industry insights-start your subscription now:

Conclusion

The nanophotonics market is emerging as a pivotal enabler across a wide spectrum of industries—from semiconductors and smart electronics to biotech and energy systems. As global demand intensifies for faster data transmission, energy efficiency, and miniaturization, nanophotonics offers scalable, sustainable solutions.

With leading countries like the United States and Japan investing heavily in R&D, infrastructure, and commercialization strategies, the market is entering a phase of high-value growth and disruption. The convergence of nanotechnology, AI, and photonics is shaping a future defined by faster, smarter, and more resilient technologies.

About us:

DataM Intelligence is a premier provider of market research and consulting services, offering a full spectrum of business intelligence solutions—from foundational research to strategic consulting. We utilize proprietary trends, insights, and developments to equip our clients with fast, informed, and effective decision-making tools.

Our research repository comprises more than 6,300 detailed reports covering over 40 industries, serving the evolving research demands of 200+ companies in 50+ countries. Whether through syndicated studies or customized research, our robust methodologies ensure precise, actionable intelligence tailored to your business landscape.

Contact US:

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: [email protected]

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

#Nanophotonics market#Nanophotonics market size#Nanophotonics market growth#Nanophotonics market share#Nanophotonics market analysis

0 notes

Text

Embedded Systems Industry: Driving Innovation Across Digital Ecosystems

The Embedded Systems Industry is a critical enabler of modern technology, supporting automation, connectivity, and intelligent computing across a wide range of sectors. From controlling basic electronic devices to powering advanced robotics and real-time automotive systems, embedded systems are the invisible backbone of the digital world. The global industry was valued at USD 90.6 billion in 2023 and is expected to grow to over USD 149.3 billion by 2030, advancing at a compound annual growth rate of 7.5.

Emerging Trends in the Embedded Systems Industry

The industry is rapidly evolving with new applications and technologies that expand its reach and functionality. Key trends include:

The rise of AI-powered embedded systems at the edge

Demand for ultra-low power consumption in mobile and wearable devices

Integration of wireless connectivity (Wi-Fi, Bluetooth, Zigbee) into embedded platforms

The adoption of real-time operating systems (RTOS) for time-sensitive applications

Increase in security and cryptographic modules to protect connected devices

These trends are pushing the embedded systems industry into the forefront of innovation in both hardware and software domains.

Segment Insights

By Component

Hardware remains the largest segment, including microcontrollers, digital signal processors, and system-on-chips.

Software is growing as embedded applications demand increasingly complex, secure, and user-friendly interfaces.

By Application

Real-time systems dominate in applications such as autonomous vehicles and industrial robots.

Standalone and networked systems are widely used in consumer electronics and smart appliances.

Industry Applications

Automotive

The automotive industry is a major consumer of embedded systems, using them in advanced driver-assistance systems, infotainment units, powertrain management, and electric vehicle battery systems.

Industrial Automation

Factories and logistics environments depend on embedded systems to drive machine control, process monitoring, and predictive maintenance, enabling Industry 4.0 capabilities.

Consumer Electronics

Embedded systems are integral to devices like smart TVs, mobile phones, gaming consoles, and home appliances, offering intuitive control and energy-efficient operation.

Healthcare

Medical devices from pacemakers to digital diagnostics rely on embedded systems for accuracy, reliability, and real-time patient monitoring.

Aerospace and Defense

Embedded control systems provide stability, responsiveness, and secure communication in military drones, navigation tools, and satellite communication systems.

Regional Outlook

Asia-Pacific is the largest industrial hub for embedded systems, benefiting from strong manufacturing and electronics development.

North America leads in embedded software innovation, particularly in defense, aerospace, and healthcare.

Europe is expanding with investments in automotive and industrial automation.

Latin America, Middle East, and Africa are emerging with increased demand in telecom and consumer technology.

Leading Industry Players

Several companies dominate the global embedded systems industry with diversified portfolios, robust innovation, and strong regional presence:

Intel Corporation

STMicroelectronics

Microchip Technology

Texas Instruments

Renesas Electronics

Arm Holdings

NXP Semiconductors

Cypress Semiconductor

Infineon Technologies

Qualcomm Incorporated

These players continue to develop scalable, secure, and energy-efficient embedded systems for modern applications.

Conclusion

The embedded systems industry is essential to powering the next generation of intelligent and connected technologies. With applications spanning from industrial automation to digital health, embedded systems are becoming more efficient, secure, and adaptive. The industry is poised for sustained growth, fueled by continuous innovation and the rising complexity of digital devices.

Trending Report Highlights

Explore complementary markets helping shape the digital and embedded future:

Barcode Scanner Market

United States Managed Services Market

SEA Robotic Process Automation Market

SEA Led Lighting Market

Hand Tools Market

0 notes

Text

Model-Based Design with Simulink: Revolutionizing Engineering Development

In today’s fast-paced and increasingly complex engineering landscape, traditional development methods are being replaced by more efficient and integrated solutions. One such groundbreaking approach is Model-Based Design (MBD), particularly through Simulink, a powerful simulation and model-based environment from MathWorks. MBD with Simulink streamlines the design, testing, and implementation of dynamic systems, providing engineers with a comprehensive framework that enhances innovation, collaboration, and product quality.

What is Model-Based Design?

Model-Based Design is a systematic approach to engineering that uses models as an integral part of the development process. Instead of writing code or building prototypes early on, engineers create system-level models to simulate, analyze, and validate behavior. These models serve as executable specifications and help bridge the gap between theoretical design and practical implementation.

The core advantages of MBD include:

Accelerated development cycles

Improved accuracy and reliability

Seamless verification and validation

Enhanced communication between multidisciplinary teams

Why Simulink?

Simulink, a product of MathWorks, is a visual programming environment that enables engineers to model, simulate, and analyze multidomain dynamic systems. It’s integrated tightly with MATLAB and provides libraries of predefined blocks for continuous and discrete systems, signal processing, controls, communication, and more.

With Simulink, users can design complex systems using block diagrams instead of traditional code. This makes it easier to visualize system behavior and quickly iterate designs through simulation.

Key Features of Simulink in Model-Based Design

1. Graphical Modeling

Simulink allows you to build models using intuitive block diagrams, enabling engineers to visually assemble system components and logic. This approach improves collaboration, especially in multidisciplinary teams, by offering a clear view of system behavior.

2. Simulation and Analysis

One of Simulink’s most powerful features is its ability to simulate system dynamics. Engineers can test various conditions, input signals, and fault scenarios without building physical prototypes, reducing development time and costs.

3. Automatic Code Generation

With Simulink Coder, Embedded Coder, and HDL Coder, engineers can automatically generate production-quality C, C++, and HDL code directly from their models. This ensures that the final implementation is aligned with the tested model, reducing integration errors.

4. Verification and Validation

Simulink includes tools for formal verification, testing, and validation such as Simulink Test, Simulink Coverage, and Simulink Design Verifier. These tools help ensure the system meets specifications and regulatory requirements throughout development.

5. Integration with Hardware

Simulink models can be deployed to hardware for real-time simulation and testing. It supports hardware-in-the-loop (HIL) and processor-in-the-loop (PIL) testing, allowing for seamless transition from design to deployment.

Applications of Model-Based Design with Simulink

Model-Based Design using Simulink is widely applied across industries:

Automotive

In the automotive sector, MBD is used for developing control systems such as powertrain, braking, steering, and advanced driver-assistance systems (ADAS). Simulink allows engineers to simulate vehicle dynamics, test control algorithms, and generate production-ready embedded code.

Aerospace and Defense

Simulink supports the design of flight control systems, navigation, and communication systems. It ensures safety and reliability through rigorous simulation, code verification, and compliance with industry standards like DO-178C.

Industrial Automation

Engineers in industrial automation use Simulink to develop and validate control strategies for manufacturing processes, robotics, and instrumentation. It integrates with PLCs and other industrial hardware to streamline deployment.

Medical Devices

In medical technology, Simulink enables the design and testing of life-critical systems such as infusion pumps, ventilators, and diagnostic devices. The visual modeling approach supports compliance with regulatory standards like ISO 13485 and IEC 62304.

Benefits of Using Simulink for Model-Based Design

1. Reduced Development Time

Simulink enables rapid prototyping and iterative testing through simulation, allowing teams to identify and resolve issues early in the development cycle.

2. Improved Design Quality

Modeling and simulating complex systems ensure that designs are thoroughly analyzed and optimized before deployment, leading to higher performance and reliability.

3. Cost Efficiency

By minimizing physical prototyping and reducing time-to-market, MBD with Simulink helps companies save on development costs and resource allocation.

4. Cross-Functional Collaboration

The visual nature of Simulink models makes it easier for engineers from different domains (mechanical, electrical, software) to collaborate and contribute to a unified system design.

5. Traceability and Documentation

Simulink supports documentation and traceability throughout the development process, which is essential for safety-critical industries and compliance with standards.

Challenges and Considerations

While Simulink and MBD offer numerous advantages, successful implementation requires:

Proper training and expertise in Simulink and MBD principles

Well-defined modeling guidelines and version control

Integration with existing workflows and tools

Clear communication across engineering teams

Organizations must also ensure that they have the necessary infrastructure and toolchain to fully benefit from model-based practices.

Conclusion

Model-Based Design servotechinc with Simulink is transforming the way engineering teams develop complex systems. By emphasizing modeling, simulation, and automated code generation, Simulink enables faster development, higher quality, and a smoother path from concept to deployment.

Whether you're working in automotive, aerospace, medical devices, or industrial automation, leveraging Simulink for MBD offers a robust, scalable, and future-ready approach to engineering innovation. As industries continue to demand smarter and safer systems, Model-Based Design with Simulink stands out as a vital tool in the modern engineer’s toolkit.

0 notes

Text

Embedded Processor Market Progresses for Huge Profits by 2028

Allied Market Research, titled, “Embedded Processor Market Size By Type and Application: Global Opportunity Analysis and Industry Forecast, 2021–2028”, the global embedded processor market size was valued at $19.36 billion in 2019, and is projected to reach $32.53 billion by 2028, registering a CAGR of 8.2%. Asia-Pacific is expected to be the leading contributor to the global embedded processor market during the forecast period, followed by North America and Europe.

An embedded processor is a type of microprocessor, which is designed for an operating system to control the electrical and mechanical systems of the microprocessor. Embedded processors are usually simple in design and require minimal power requirements for its computational operations. An embedded processor is especially designed for handling the needs of an embedded system and to handle multiple processors in real time. As embedded system requires low power, they are preferred by various industry verticals as they draw less power from the energy sources.

Embedded processors are usually developed to be integrated in the devices, which are required to handle multiple processors in real time. These processors are in the form of a computer chip that are embedded in various microcontrollers and microprocessors to control various electrical and mechanical systems. These processors are also equipped with features such as storing and retrieving data from the memory. Embedded processors commonly work as a part of a computer system along with memory and other input-output devices.

The global embedded processor market is anticipated to witness significant growth during the forecast period. Factors such as rise in space constraints in semiconductors wafers, increase in demand for smart consumer electronics, and emerging usage of embedded processors in the automotive industry boost the growth of the global market.

However, high implementation cost of embedded processors in different applications acts as a major restraint hampering the embedded processor industry. Furthermore, increase in popularity of IoT, rise in trend toward electric vehicles, and increase in usage of embedded processors in the biomedical sectors offer lucrative opportunities for the embedded processor market growth globally.

The global embedded processor market share is analyzed by type, application, and region. Based on type, the market is analyzed across microprocessor, microcontrollers, digital signal processor, embedded FPGA, and others. On the basis of application, the market is divided into consumer electronics, automotive & transportation, industrial, healthcare, IT & telecom, aerospace & defense, and others.

Region wise, the embedded processor market trends have been analyzed across North America, Europe, Asia-Pacific, and LAMEA. As per the embedded processor market analysis, Asia-Pacific is leading the market and is expected to be the fastest growing regional segment in the near future, with the highest CAGR. With an increase in demand for high voltage operating devices, organizations across verticals are realizing the importance of embedded processors to ensure efficient power management.

In addition, North America holds the second largest share in the global market, and is expected to witness significant growth during the forecast period, owing to the extensive adoption of advanced technology by the region. The factors such as rise in demand for smart electronics and proliferation of high-end advanced technologies drive the growth of the market in the region.

COVID-19 Impact Analysis

The COVID-19 has impacted severely on the global electronics and semiconductor sector, due to which production facility as well as new projects have stalled which in turn have the significant demand in the industries. The operations of the production and manufacturing industries have been heavily impacted by the outbreak of COVID-19 disease; thereby, leading to slowdown in the growth of the embedded processor market in 2020.

Key Findings of the Study

The microprocessor segment is projected to be the major IC type during the forecast period followed by microcontrollers.

APAC and North America collectively accounted for more than 69.01% of the embedded processor market share in 2019.

The healthcare segment is anticipated to witness highest growth rate during the forecast period.

China was the major shareholder in the Asia-Pacific embedded processor market, accounting for approximately 23.52% share in 2019.

The key players profiled in the report include NXP Semiconductors, Broadcom Corporation, STMicroelectronics, Intel Corporation, Infineon Technologies AG, Analog Devices Inc., Renesas Electronics, Microchip Technology Inc., Texas Instruments, and ON Semiconductor. These players have adopted various strategies such as product launch, acquisition, collaboration, and partnership to expand their foothold in the industry.

#Embedded Processor#technology#electronics#microprocessors#microcontrollers#Digital Signal Processor#Embedded FPGA

0 notes

Text

The United States (US) thru their Defense Security Cooperation Agency (DSCA) Website has approved a new Offer for the Sale of 20 F-16C/D Fighting Falcon Block 70/72 Fighter Aircraft to the Philippines with Spares, Weapons, Logistical Support and other related Equipment worth Usd 5.58 billion, or an average of around Usd 279 million per Aircraft.

The Sale will consist of sixteen single-seat F-16C Block 70/72 Aircraft and four twin-seat F-16D Block 70/72 Aircraft. Included are the following Installed and Spare Equipment:

24 F110-GE-129D or F100-PW-229 Engines (20 installed, 4 spares)

22 Improved Programmable Display Generators (iPDG) (20 installed, 2 spares)

22 AN/APG-83 Active Electronically Scanned Array (AESA) Scalable Agile Beam Radars (SABR) (20 installed, 2 spares)

22 Modular Mission Computers 7000AH (or available mission computer) (20 installed, 2 spares)

22 Embedded Global Positioning System (GPS) Inertial Navigation Systems (INS) (EGI) with Selective Availability Anti-Spoofing Module (SAASM) or M-Code capability and Precise Positioning Service (PPS) (20 installed, 2 spares)

22 M61A1 Anti-Aircraft Guns (20 installed, 2 spares)

12 AN/AAQ-33 Sniper Advanced Targeting Pods (ATP)

24 Multifunctional Information Distribution System-Joint Tactical Radio Systems (MIDS-JTRS)

Also included are the following Weapons and their Related Equipment:

88 LAU-129 Guided Missile Launchers

112 Advanced Medium Range Air-to-Air Missiles (AMRAAMs) Air Intercept Missile (AIM)-120C-8 or equivalent Missiles

Four AMRAAM Guidance Sections

36 Guided Bomb Unit (GBU)-39/B Small Diameter Bombs Increment 1 (SDB-1)

Two GBU-39 (T-1)/B SDB-1 Guided Test Vehicles