#Exchange Rates

Explore tagged Tumblr posts

Text

Applied arithmetic.

#vintage books#books#book pages#coins#coinage#money#u.s. money#united states money#english money#french money#pound sterling#british pound#french franc#franc#dollars cents#exchange rates#applied arithmetic#applied math#math#arithmetic#information#knowledge#infographics#learning

2 notes

·

View notes

Text

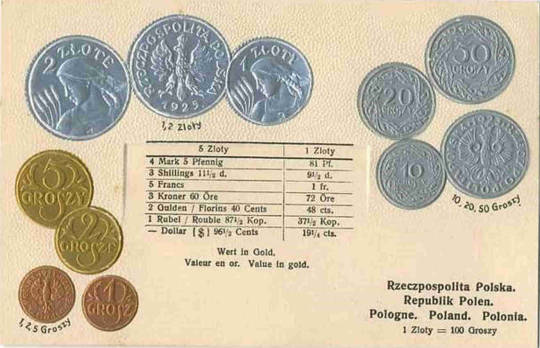

Post cards with coins from POLAND & SOUTH AFRICA (RSA) with exchange rates.

#postkarte#post card#litografia#litho#coins#monety#South Africa#Transvaal#Polska#Poland#exchange rates#kartka#Polonaise#Polonia#kursy walut#Polen#ansichtskarte#cartolina#carte postale

3 notes

·

View notes

Text

00000010.

Ancient vending droid;

Children gather around its light.

What secrets lie within?

It takes before-times currency,

But the kids only bring rocks.

23 notes

·

View notes

Text

Crypto-Forex Arbitrage: Strategies for Maximizing Profits

Crypto-Forex arbitrage involves leveraging the price differences between cryptocurrencies and traditional currencies across various exchanges. This strategy aims to maximize profits by exploiting these discrepancies. Understanding and implementing effective arbitrage strategies can help traders capitalize on market inefficiencies. Understanding Arbitrage Arbitrage is a trading strategy that…

#Arbitrage Strategies#Automated Trading#Bitcoin#Crypto#Crypto-Forex Arbitrage#Cryptocurrency#Exchange Rates#Forex#Forex Trading#Liquidity#Market Conditions#Market Inefficiencies#Market News#Market Volatility#Price Movements#Profitability#Security#Spatial Arbitrage#Statistical Arbitrage#Trading Bots#Trading Strategy#Transaction Costs#Triangular Arbitrage#Volatility

3 notes

·

View notes

Text

Understanding How to Convert USD to CAD in 2025: A Complete Guide

What Drives the USD to CAD Exchange Rate?

The USD to CAD exchange rate indicates how much one US Dollar is worth in Canadian Dollars. This rate fluctuates continuously due to various economic, political, and market factors:

1. Economic Indicators

Inflation: Countries with lower inflation rates generally have stronger currencies, as their purchasing power is maintained.

GDP Growth: A strong economy boosts investor confidence, often leading to currency appreciation.

Interest Rates: The policies set by the Federal Reserve (Fed) in the US and the Bank of Canada (BoC) have a direct impact. Higher interest rates in one country tend to strengthen its currency because they offer better returns on investments.

2. Commodity Prices

Canada is a major exporter of natural resources, especially oil. Changes in oil prices significantly affect the CAD. When oil prices rise, the Canadian Dollar tends to strengthen against the US Dollar and vice versa.

3. Trade Relations and Political Stability

Cross-border trade agreements, tariffs, and political events influence currency stability. Stronger economic ties and stable governance typically support a stable or stronger currency.

4. Market Sentiment and Speculation

Currency traders and investors also influence exchange rates through their expectations of future events. Sudden geopolitical events, global economic conditions, or changes in market sentiment can cause rapid fluctuations.

Latest USD to CAD Exchange Rate Trends in 2025

As of mid-2025, the USD to CAD exchange rate has seen moderate volatility but remains close to historical averages around 1 USD = 1.35 to 1.40 CAD. Several factors have contributed:

The US Federal Reserve has signaled a cautious approach, balancing inflation concerns with economic growth.

Oil prices have fluctuated but are generally steady, supporting the Canadian Dollar.

Trade relations between the US and Canada remain strong, supporting currency stability.

The Bank of Canada recently maintained steady interest rates, signaling economic stability.

How to Convert USD to CAD Efficiently

Now that we understand the factors influencing USD to CAD, let’s dive into the practical side: how to convert USD to CAD in ways that save you money and hassle.

1. Banks

Most people convert USD to CAD through banks. Banks offer a safe and convenient way to exchange currency, though their rates may be less competitive and can include extra fees. It’s advisable to review their rates beforehand and compare them with alternative providers.

2. Currency Exchange Services

Specialized currency exchange companies or kiosks at airports offer conversion services. While convenient, airport kiosks tend to have the worst rates due to higher overhead costs. Currency exchange outlets in cities can be more competitive.

3. Interchange Financial: A Trusted Partner

When it comes to converting USD to CAD, Interchange Financial stands out as a reliable and cost-effective option. Interchange Financial specializes in transparent currency exchange with competitive rates and low fees. Their online platform allows you to convert money seamlessly from anywhere, making international transfers simple and affordable.

Customers appreciate Interchange Financial’s real-time rate updates and excellent customer service, which ensures you get the best value whether you’re sending money for business, travel, or investment purposes.

4. Online Currency Exchange Platforms

Other online services like Wise (formerly TransferWise), Revolut, or currency conversion apps also offer competitive rates with low fees. They allow you to lock in rates and send money internationally without visiting a physical location.

5. ATMs

Using an ATM in Canada to withdraw cash in CAD with your US bank card can be convenient and often provides a fair exchange rate. However, watch out for foreign transactions and ATM fees from your bank.

6. Credit Cards

Many credit cards automatically convert USD to CAD when you make purchases in Canada. Cards with no foreign transaction fees and competitive currency conversion rates are ideal for travelers.

Tips to Get the Best USD to CAD Conversion Rate

Avoid Airport Currency Exchanges: They are convenient but usually offer poor rates and high fees.

Plan Your Conversion Timing: If you’re exchanging large amounts, timing the market by watching for rate dips can save you money.

Consider Interchange Financial: For both casual and frequent currency conversion needs, Interchange Financial provides transparent, reliable service that can help you maximize value.

Opt for Cards Without Foreign Transaction Fees: While traveling, choose credit or debit cards that don’t charge extra for international purchases.

Beware of Hidden Fees: Always ask about all fees upfront, including commission, service charges, or minimum exchange amounts.

Monitor Exchange Rates: Use websites like XE, OANDA, or financial news outlets to track real-time USD to CAD rates.

Currency Conversion Calculator: A Handy Tool

Before converting USD to CAD, use a currency converter tool to estimate the value you will receive. Most financial websites and mobile apps provide up-to-date calculators. They factor in the latest exchange rates but usually exclude fees. This helps you budget better and avoid surprises.

Interchange Financial also offers a user-friendly currency calculator on their platform, making it easy to see how much CAD you’ll receive before committing to the exchange.

Why Is Understanding USD to CAD Conversion Important?

For Travelers

Whether visiting Toronto, Vancouver, or Montreal, knowing the current USD to CAD rate helps you budget for accommodations, food, and entertainment. It also informs decisions on when to buy CAD before traveling.

For Businesses

Cross-border trade and e-commerce between the US and Canada require accurate currency conversion for pricing products, paying suppliers, and accounting. Fluctuating exchange rates can impact profit margins, so businesses often hedge currency risks.

For Investors

Investing in Canadian stocks, bonds, or real estate involves currency exchange. Currency fluctuations can either add risk or opportunity to international investments.

The Future Outlook for USD to CAD

Looking ahead, several trends could influence the USD to CAD exchange rate:

Economic Policies: Ongoing monetary policies from the Fed and BoC will continue to shape rates.

Global Market Events: Unexpected geopolitical events or global economic shifts could cause volatility.

Cryptocurrency Influence: While not yet mainstream for currency exchange, some experts speculate that digital currencies might eventually play a role in cross-border payments.

Technological Advances: Faster, cheaper, and more secure online currency exchange platforms are increasing competition and transparency. Interchange Financial is among the innovators improving the customer experience.

Final Thoughts

Converting USD to CAD is more than just a simple exchange; it requires awareness of current economic conditions, market trends, and smart financial planning. Whether you’re a traveler, business owner, or investor, understanding the USD to CAD exchange rate and how to convert usd to cad efficiently can save you money and make your transactions smoother.

For those looking for a trusted, transparent, and user-friendly service,

For More Information,

Contact Us:-

Website https://www.interchangefinancial.com/

Phone : 1888 972–7799

Address:- Toronto Downtown (20 Dundas St. West, Toronto North York, Markham, Brampton

0 notes

Text

Understanding Exchange Rates: Reporting Guidelines for Government Agencies

The role of exchange rates remains crucial within the global financial markets because these rates directly influence international trade and investment together with economic stability. Government agencies need precise exchange rate monitoring and reporting to develop policies as well as handle finances and create economic projections. Visit: Understanding Exchange Rates: Reporting Guidelines for Government Agencies

1 note

·

View note

Text

💸 Looking for low-cost international money transfers? Wise offers transparent fees and great exchange rates! 🌍 Send money worldwide with ease and no hidden charges. 🚀 Join millions who trust Wise for fast and secure transfers today!

#Wise#moneytransfers#InternationalPayments#send money#finance#GlobalBanking#WiseTransfers#moneymatters#low fees#exchange rates

1 note

·

View note

Text

The Dynamics of Exchange Rates: Factors that Influence Currency Values

A forex exchange rate dramatically affects the world and/or global economy, whether directly related to business operations, travel, or political settings of countries. But what are these exchange rates, and what causes them to be a constant-moving target? Visit: The Dynamics of Exchange Rates: Factors that Influence Currency Values

1 note

·

View note

Text

EURJPY Tests 18-Month Trendline Amid Rising Bank of Japan Rate Hike Bets and Political Risks in France

EURJPY is currently testing a crucial 18-month trendline as market sentiment shifts due to rising expectations of a rate hike by the Bank of Japan and growing political risks in France. The currency pair's movement is heavily influenced by these factors, with traders closely monitoring the developments in both Japan's monetary policy and the political stability in France. As bets on a potential rate increase from the Bank of Japan rise, the Japanese yen is showing signs of strength, putting pressure on EURJPY. At the same time, ongoing political chaos in France is creating additional uncertainty, impacting the Euro's performance. This combination of factors is making EURJPY a focal point for forex traders as they assess the risks and opportunities in the currency pair

#EURJPY#forex market#Bank of Japan#rate hike#political risks#France politics#currency trading#forex analysis#EURJPY trendline#exchange rates#Japanese yen#Euro#market volatility#financial markets#political uncertainty

0 notes

Text

A Professional Examination of Forex Trading in Light of Current Market Dynamics and Historic Evidence

In forex trading, success often depends on understanding complex market forces and an informed ability to navigate the unpredictable swings in global economic conditions. The events detailed in recent reports, including the anticipation surrounding U.S. Non-Farm Payroll (NFP) data and the potential shifts in monetary policy, provide a foundation for assessing how political events, data releases, and central bank decisions impact trading strategies. Historically, such market factors have significantly influenced the currency landscape, and traders who harness knowledge of these shifts can develop more resilient trading approaches.

Political and Economic Factors Impacting Forex Markets

The U.S. NFP data release, widely regarded as a crucial indicator of economic health, often influences currency strength by impacting central bank policies and interest rates. For instance, a strong NFP report signals job growth, which may lead the Federal Reserve to consider a hawkish stance, potentially increasing interest rates to curb inflation. A weak report, conversely, might suggest economic slowdown, urging caution among traders who anticipate potential rate cuts or pauses. This anticipation is deeply rooted in historical data analysis. For instance, in the post-2008 financial crisis recovery period, the NFP report played a pivotal role in influencing market sentiment, as the Federal Reserve’s quantitative easing (QE) policy led to significant dollar volatility. Traders with insights into these factors could better anticipate dollar strength and other market movements.

In recent weeks, expectations have shifted to include the Federal Reserve's possible interest rate cuts as early as November and December of 2024. Historic evidence shows that, in past cycles, rate cuts during economic slowdowns often spur dollar depreciation. With historical parallels, such as the Fed’s rate cuts in 2001 and 2007, traders can anticipate a similar trajectory, positioning themselves for the effects on currency values and volatility.

The Influence of Global Economic Data and Central Bank Policy

One recent report highlighted a significant selloff in the Swiss Franc, triggered by a lower-than-expected inflation rate in Switzerland. This development points toward the Swiss National Bank (SNB) possibly implementing a 50 basis-point rate cut in December 2024. Such moves by central banks are not unprecedented; the SNB’s decisions often reflect Switzerland’s high economic integration and its historical stance on maintaining a stable currency. For example, during the Eurozone debt crisis of 2010-2012, the SNB implemented drastic measures to limit the Franc’s overvaluation, including pegging the Franc to the Euro. Forex traders aware of this historical context could better interpret recent actions by the SNB and anticipate future moves, such as further adjustments in response to inflation or other economic indicators.

The U.S. Dollar, on the other hand, has displayed mixed performance in the current market environment, with slight gains against commodity-linked currencies while maintaining relative stability. Such movement underscores how economic data, particularly inflation and employment metrics, have traditionally impacted the dollar’s performance. Historically, the dollar has often served as a “safe haven” currency during periods of global economic uncertainty. During the COVID-19 pandemic, for instance, the dollar’s strength was amplified due to increased demand from investors seeking stability. A historical lens shows that traders who can effectively balance market sentiment with fundamental data interpretation often fare better in volatile markets.

The Role of Risk Management and Historical Lessons

An essential aspect of successful forex trading involves implementing a robust risk management strategy, especially given the high-risk nature of leveraged trading. The ForexLive disclaimer emphasizes the need for traders to approach trading with an understanding of leverage risks and the potential for significant financial loss. Historical evidence, such as the impact of the 1992 “Black Wednesday” event, where the British pound was forced out of the European Exchange Rate Mechanism, underscores the importance of prudent risk management. This incident illustrated the potentially devastating effects of market volatility, and it remains a cautionary tale for traders who may underestimate the risks involved in forex markets.

Conclusion: The Importance of Contextual Knowledge in Forex Trading

In light of recent events, from central bank decisions to the anticipation of the U.S. elections, traders are reminded that forex markets are heavily influenced by a complex interplay of economic data, political events, and historical context. An understanding of historical patterns, such as the 2008 financial crisis recovery and key monetary policy decisions from central banks like the Fed and SNB, can equip traders with valuable insights into potential market reactions. For forex traders, knowledge is more than just analyzing current events; it is about learning from the past and applying that understanding to build strategies that can weather both expected and unexpected market shifts.

#Forex Trading#Market Dynamics#Professional Examination#Currency Markets#Trading Strategies#Risk Management#Market Analysis#Economic Indicators#Technical Analysis#Fundamental Analysis#Forex Market Trends#Market Volatility#Trading Psychology#Investment Strategies#Global Economy#Financial Markets#Exchange Rates#Currency Pairs

1 note

·

View note

Text

Beware of the Change Scam: My Personal Experience & How to Avoid Falling Victim

#bureaudechange #scam #fakemoney Beware of the Change Scam: My Personal Experience & How to Avoid Falling VictimVideo Time Stamp: https://youtu.be/C239tTr55g40:301:001:30Have you ever been targeted by scammers while trying to exchange currency? Unfortunately, I and my brother fell victim to this scam, but our experiences were vastly different. In this video, I’ll share how the scam works and…

View On WordPress

#Bureaux de change#Bureaux de change scams#Change scam#Common scams in Nigeria#Counterfeit money#Currency exchange#Currency exchange scam#Exchange rate manipulation#Exchange rates#Fake money#Financial security#How to avoid currency exchange scams#Money safety#Nigeria scams#Personal experience#Personal stories of scam victims#Protect yourself#Protecting yourself from financial scams#Safe currency exchange practices#Safety precautions#Scam alert#Scam prevention#Scammer tactics#Signs of counterfeit money#Street smarts#Street vendor scams in Nigeria#Street vendors#Tips for travelers exchanging currency#Travel tips#Warning signs

0 notes

Text

But in many cases the 'greed factor' obscured the risk.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quote#westpac#edna carew#nonfiction#greed#banking#finance#lending#loans#foreign currency#exchange rates#obscurity#risk assessment

0 notes

Text

Unlocking Seamless International Money Transfers: A Guide to Interchange Financial's Secure and Competitive Services

Interchange Financial is a leading provider of international money transfer services, offering a seamless and secure way to send money across borders. With a focus on customer satisfaction and competitive exchange rates, Interchange Financial has established itself as a trusted partner for individuals and businesses alike.

International Money Transfers are essential for a variety of reasons, including sending funds to family members abroad, paying for overseas education or healthcare, and conducting business with international partners. Interchange Financial understands the importance of these transactions and has developed a range of services to meet the diverse needs of its customers.

One of the key benefits of using Interchange Financial for international money transfers is the competitive exchange rates it offers. By leveraging its extensive network of global partners and staying up-to-date with market trends, Interchange Financial is able to provide customers with Favorable Rates that help them save money on their transfers.

In addition to competitive rates, Interchange Financial also prioritizes security and reliability. With advanced encryption technologies and robust compliance measures in place, customers can rest assured that their funds will reach their intended destination safely and on time.

Furthermore, Interchange Financial offers a user-friendly online platform that makes it easy for customers to initiate and track their transfers from anywhere in the world. Whether you're sending money for personal or business purposes, Interchange Financial ensures a smooth and hassle-free experience.

Overall, Interchange Financial is a reputable provider of international money transfer services that prioritizes customer satisfaction, competitive rates, security, and convenience. Whether you're sending money across borders for personal or business reasons, Interchange Financial is a reliable partner you can trust.

For More Information,

Contact Us:-

Website https://www.interchangefinancial.com/

Phone : 1888 972-7799

Address:- Toronto Downtown (20 Dundas St. West, Toronto North York, Markham, Brampton

0 notes

Text

The Ultimate Guide to Using a Currency Calculator

In the latest globalized international, financial transactions often pass global borders, requiring conversions among exclusive currencies. Whether you are a commercial enterprise proprietor managing global sales, a vacationer making plans a trip abroad, or an investor maintaining an eye on overseas markets, expertise exchange rates and making accurate conversions is essential.

This is in which a dependable currency calculator is available in accessible.

What is a Currency Calculator?

A forex calculator is a web device designed to transform one forex into any other based on cutting-edge trade rates. It simplifies the process of figuring out how a lot of 1 foreign money you'll get in alternate for another, saving time and lowering the chance of manual errors. By the use of a currency calculator, you could quickly and correctly decide the value of your money in extraordinary currencies.

Why You Need a Currency Calculator

Convenience: With a foreign money calculator, you can convert currencies right away while not having to appearance up the latest trade quotes manually.

Accuracy: Exchange rates range continuously. A currency calculator uses actual-time records to make certain you get the most correct conversions.

Planning: Whether you are budgeting for a trip or calculating international charges, a Forex calculator helps you propose extra efficaciously.

Business Transactions: For agencies handling international customers or suppliers, a forex calculator is essential for pricing, invoicing, and economic making plans.

How to Use a Currency Calculator

Using a foreign money calculator is simple. Here’s a step-through-step guide:

Access the Calculator: Visit the Spectra Global Ltd Currency Calculator.

Select Currencies: Choose the currencies you want to transform from and to. Most calculators aid a huge range of world currencies.

Enter Amount: Input the amount you want to transform.

View Results: The calculator will display the converted quantity based on the present-day change price.

Benefits of the Spectra Global Ltd Currency Calculator

The forex calculator from Spectra Global Ltd stands proud for numerous reasons:

User-Friendly Interface: Its intuitive design makes it smooth for absolutely everyone to apply, irrespective of their tech-savviness. Real-Time Rates: The calculator uses up-to-date alternate prices, ensuring your conversions are correct.

Comprehensive Currency List: It helps a wide variety of currencies, making it versatile for numerous desires.

Reliable and Secure: Spectra Global Ltd is known for its reliability and protection, giving customers peace of thoughts when the usage of their services.

Conclusion

In a international wherein global monetary transactions are common, a dependable forex calculator is an vital tool. Whether you're managing commercial enterprise budget, making plans a trip, or absolutely curious about change quotes, the Spectra Global Ltd Currency Calculator presents a quick, accurate, and handy answer.

Try the Spectra Global Ltd Currency Calculator Today! Ready to simplify your forex conversions? Visit the Spectra Global Ltd Currency Calculator now and enjoy the benefit and accuracy of real-time currency conversions. Don't permit complicated calculations sluggish you down – let the forex calculator do the work for you!

0 notes

Text

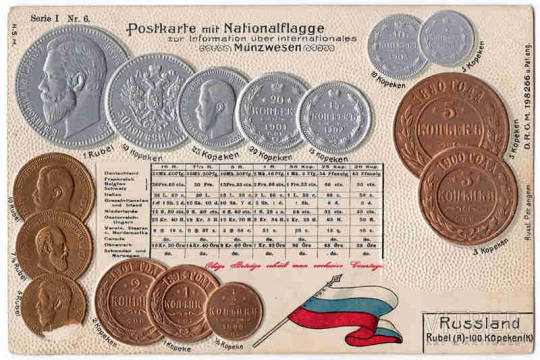

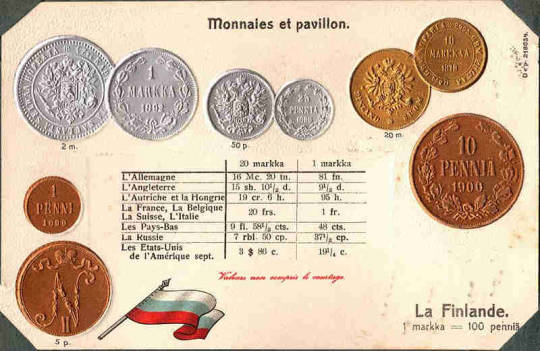

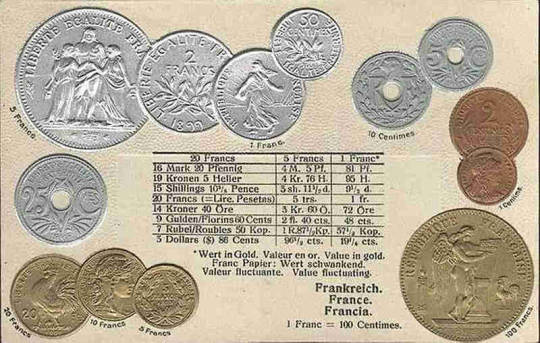

COINS used in RUSSIA, FINLAND & FRANCE at the end of 19th and at the beginning of 20th century. Note the russian flag and eagle on coins of Finland, as well as the N II = the symbol of russian tsar Nikolai 2nd. Also the different coins of France on 2 postcards. Note also which coins were at that time made of gold, silver and copper. Depending on the country of issue, the tables show exchange rates of the currencies at that time.

#coins#pocztówka#post card#kartka#monety#currency#exchange rates#litho#litografia#russian#french#finnisch#Russia#Francja#Finlandia#Finland#France

0 notes