#FASB

Explore tagged Tumblr posts

Text

#headbands#headband#black hair#red fashion#fendi fashion#gyaru fashion#korea fashion#girl fashion#gucci fashion#paris fashion week#fashion trends#diy fashion#fasb#fashion#birthday gift#gift for her#unique gifts#valentinesgift#valentines day#gift for wife#giftforfriends#gift ideas#gifts#luxury

2 notes

·

View notes

Link

#AccountingStandards#Bitcoin#BlockchainGroup#corporatetreasury#CryptocurrencyRegulation#digitalassets#FASB#MicroStrategy

1 note

·

View note

Text

FASB asks for input on accounting for intangibles

The Financial Accounting Standards Board issued an invitation to comment on whether to pursue a project on accounting for intangible assets. By Michael Cohn

0 notes

Text

Exploring Current Expected Credit Loss solutions, transforming financial accounting by predicting credit losses, adhering to FASB standards

#CECL#CurrentExpectedCreditLoss#FinancialAccounting#CreditLosses#FASB#AccountingStandard#Loan#DebtSecurities#PCDAssets#Impairment#ALLL#BadDebt#PredictiveInformation#CECLModel#PotentialLosses#creditloss

0 notes

Text

New Year's Eve? More like Balance Sheet Day! 😂😂😂😂😂😂😂😂😂😂😂😂😂😂😂😂😂😂

#NYE#BSD#BDO#RSM#EY#KPMG#PWC#CPA#IRS#FASB#SEC#NRC#FERC#FDIC#OCC#BKD#AUM#ARO#DSI#DPO#DSO#LIFO#FIFO#CIAC#CWIP#COGS#GAAP#GAAS#IFRS#IASB

0 notes

Text

Tax Changes for Cryptocurrency Holders from FASB

Hi all!

Somehow, the news about the approval of new tax rules in the United States for the companies holding digital assets slipped past. Meanwhile, in my opinion, these changes catalyze the influx of investments into the crypto industry.

The point is that now companies owning cryptocurrencies evaluate them based on the value of the coin that was fixed upon purchase. And they are allowed to write off losses only if the price falls below the purchase price.

It turns out that, for example, a company bought 1000 BTC a year ago at a price of $16 thousand. And today, when its price is $26 thousand, it is still on the company’s balance sheet at a price of $16 thousand. That is, real capitalization has increased, but according to securities it has not.

Now, starting in 2025, companies in reporting periods will calculate the value of cryptocurrency based on the market value at the time of reporting. Consequently, they will be more transparent to investors.

An illustrative example is one of the largest BTC holders, MicroStrategy. As of the end of the second quarter of this year they had 152,300 BTC on their balance sheet; their reported dollar amount was $2.3 billion and the real price was almost 50% more.

The innovation will affect all companies that have crypto assets on their balance sheets. This will become mandatory from December 15 next year but if you wish you can switch to the new rules now.

At the FASB meeting, where it was decided (unanimously, by the way) to change tax rules, the issue regarding NFTs was separately considered. Everything here remains unchanged for now.

Why do I think this is good news? Well, imagine that you are an investor, you decided to invest in crypto, you come to a specialized company, they tell you: in three years we have earned millions on bitcoins. But the official reports show completely different figures - two or three years ago. Why do you need to delve into these tax jungles? You will find other investment projects in traditional markets where everything is clear. So I dare to assume that by the end of the year the number of investments in the crypto market will increase significantly.

0 notes

Text

How FASB’s New Ruling Will Benefit Bitcoin and Companies Holding Bitcoin

The recent announcement by the Financial Accounting Standards Board (FASB) regarding digital asset reporting can be seen as a leap forward for both Bitcoin and businesses holding it on their balance sheets.

Historically, the lack of a standardized accounting approach for Bitcoin has been a contentious issue, creating a fog of ambiguity for companies and potential investors alike. The FASB’s move to provide clear guidelines represents a significant effort to demystify Bitcoin’s place in corporate finance and instill greater confidence in the broader financial community. Read More

0 notes

Note

FASB(TTHNTDWF)

i'm intrigued lol tell me more

Yay! I'm really excited to talk about this one, I'm so glad you picked it. This is a foxiyo fic I've been working on for the past three weeks, and whilst it was originally supposed to be mainly fluff, I decided to add Fives to the mix, and things really tumbled out of control...

Here's a few lines, between Fives and Thorn, as proof:

“Look,” he continued, and Fives was sensing some sort of frustration bubbling to the surface. Good. “We can’t let you go, if you don’t tell us your name. We would have used the chip in your arm to identify you, but it would seem someone decided it was a good idea to cut it out on their own.” Well, that wasn’t good.

Fives may be a bit eccentric but it's for good reason (most of the time).

Anyway, this fic is Fives accidentally stumbling upon foxiyo and deciding to fanboy over them in secret. He gets Echo and Thorn involved and they all become one massive headache for Fox. Riyo thinks it's cute and though Fox would never admit it, he secretly likes the attention. It's all very cute, I promise 💖💖

Hopefully, I'll be able to start posting it soon because I'm honestly getting antsy with the wait 😭

Thank you so much for the ask!

#star wars#star wars the clone wars#foxiyo#commander fox#arc trooper fives#arc trooper echo#commander thorn#senator riyo chuchi#wip title ask

7 notes

·

View notes

Text

So let's read the whole paragraph:

In 2017, the Organization was the recipient of real property and intangible assets, conveyed by an agreement. The Organization recorded the real property and intangible assets using fair-value accounting standards. The Financial Accounting Standards Board’s Accounting Standards Codification (FASB ASC) precludes assets from being recorded for this transfer of assets at fair-value.

Translation: In 2017, BJU received a lot of stuff from ... somebody.

Now what was going on in 2017 where BJU would be getting stuff? Hmmmm..... Let's see here.....

2017 Feb 10 — Bob Jones University administration announces that the corporation’s assets will be split 50/50 on March 1. A new for-profit entity will be formed called Bob Jones Education Group, Inc. and will contain the BJU Press, the Bob Jones High School, the Bob Jones Middle School, the Bob Jones University Cleaners, and the Art Collection. Bob Jones University will house all the BJU Press writers so that the royalties will still go to Bob Jones University. The Bob Jones Education Group, Inc. will pay Bob Jones University for IT services, maintenance, HR, etc. And the Bob Jones Elementary School will be under Bob Jones University. Why? Because that’s how they can get their tax exemption. This is how it’s been established through the IRS. This is the pattern explained in Inside Higher Ed.

So BJU got caught (five years later) with their hand in the Press cookie jar.

#Bob Jones University#Steve Dickinson#BJUEG#TheEndIsHere#The End is Here#Accounting#Chief Financial Officer#Assets

2 notes

·

View notes

Text

#hairtutorials#hairtutorial#hairstyles#hairstyle#hair accessories#natural hair#pink hair#black hair#red hair#curly hair#long hair#hairy#short hair#beautiful hair#hair stuff#korea fashion#unique fashion#girl fashion#japanese fashion#gucci fashion#paris fashion week#fashion trends#diy fashion#fashion#fasb#birthday gift#gift for her#street fashion#streetwear#fashion unique style

0 notes

Text

IMPLEMENTATION OF NEW IFRS REVENUE RECOGNITION STANDARD

India will have a new revenue recognition standard outlining a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers. This supersedes most current revenue recognition standard.

In brief, the new standard seeks to streamline, and remove inconsistencies from, revenue recognition requirements; provide a more robust framework for addressing revenue issues; make revenue recognition practices more comparable; and increase the usefulness of disclosures.

Introduction

The Government has introduced two significant game-changers to financial reporting standards in 2018 to effective communication to investors by corporates.

International Financial Reporting Standards (IFRS) accounting framework replaces extant revenue and lease standards effective financial periods commencing from January 1, 2018. Both the new standards have a significant impact on financial statements for majority of sectors. Indian companies too have to brace up for the new Indian Accounting Standards (IND-AS) on revenue that would go live shortly.

The International Accounting Standards Board (IASB), as part of a joint convergence project with its United States Counterpart, the Financial Accounting Standards Board (FASB) has re-modeled the revenue recognition guidance. The new IFRS 15 — Revenue From Contracts With Customers replaces prevailing IAS’s and related interpretations, primary of them being (1) IAS 11- Construction Contracts and (2) IAS 18 — Revenue. A new principle for revenue recognition has emerged with the emphasis on the concept of transfer of control and a detailed accounting model, it has been launched as the Five Step Revenue Recognition Model and is to be followed for every revenue contract to account for the financial statement reporting consequences.

“IFRS 15 Revenue from Contracts with Customers provides a single revenue recognition model based on the transfer of control of a good or service to a customer. The new revenue standard marks a significant change from current requirements under IFRS. It provides a more structured approach to measuring and recognizing revenue, with detailed application guidance. Therefore, adoption may be a significant undertaking for many entities. Early assessment will be key to managing a successful implementation.”

Evaluation of contracts, customer agreements, pricing models, side-arrangements, revenue and delivery models, contractual clauses, underlying economics, deliverables analysis, et al, become very critical as companies’ transition to the new revenue recognition standard.

Standard operating procedures and internal controls also need to be geared up and fine-tuned to comply with this critical financial reporting standard.

The Exposure Draft on clarifications to Ind AS 115 proposes that Ind AS 115 would be applicable for accounting periods beginning on or after 1st April, 2018. The MCA is expected to notify the standard soon.

The effect on entities will vary, and some may face significant changes in revenue recognition. Entities should now be assessing how they will be affected so they can prepare an implementation plan for the new standard.

Core Principle of Revenue Recognition Changes

The global reporting standard moves from a “transfer of risks and rewards” model to a “transfer of control” model. This model determines the timing of revenue recognition. The new timing is when there is a transfer of control of promised deliverable by the seller (reporting entity).

The core principle of the new revenue standard under both IFRS and United States Generally Accepted Accounting Principles (USGAAP) is that an entity recognized revenue to depict the transfer of promised goods and services to customers in an amount that reflects the consideration to which it expects to be entitled in exchange for such promised goods and services. Henceforth, revenue needs to be recognized upon transfer of control of promised products or services to customers in an amount that reflects the consideration that the entity expects to receive in exchange for those products or services.

Where a company enters into contracts that could include various combinations of products and services, the company needs to isolate the various revenue components, based on whether each component is generally capable of being distinct and accounted for as separate performance obligations. IFRS reporting entities need to follow a detailed 5-step model to account for revenue as follows…

Read More: https://www.acquisory.com/ArticleDetails/67/Implementation-of-new-IFRS-Revenue-Recognition-Standard

#financial consultant#financial reporting#financial consulting services#financial freedom#financial planning

3 notes

·

View notes

Text

FASB proposes update on environmental credits

The proposed accounting standards update provides disclosure requirements related to environmental credits and obligations.

0 notes

Text

Exploring Current Expected Credit Loss Solutions & Their Impact on Standards

The development of Current Expected Credit Loss (CECL) solutions is underway to address the requirements of a new accounting standard set forth by the Financial Accounting Standards Board (FASB). This standard aims to facilitate the rapid calculation of estimated future credit losses throughout the lifespan of various financial instruments such as loans, debt securities, trade receivables, and purchased credit deteriorated (PCD) assets.

Previously, financial institutions (FIs) relied on traditional methods that primarily focused on incurred losses, marking loans as impaired only when they were deemed unrecoverable. These losses were then accounted for as expenses within the allowance for loan and lease losses (ALLL). Additionally, the determination of bad debts by FIs was often based on previous year's losses, with the same amount earmarked for potential credit impairment in the subsequent year.

However, the updated guidance from FASB mandates a shift towards incorporating predictive information into the calculation of bad debt. This necessitates the implementation of the CECL model, which enables companies to anticipate and account for potential credit losses more effectively. By doing so, FIs can address the inherent delay in recognizing credit losses across all financial assets.

The CECL model fundamentally requires organizations to take a proactive approach in assessing their exposure to credit losses. Rather than relying solely on historical data, companies must now factor in forward-looking information to better anticipate potential losses and subsequently adjust their financial records accordingly. This entails recording impairment, thereby deducting from revenues to reflect the impact of these anticipated losses.

By embracing the CECL model, FIs can enhance their risk management practices by gaining deeper insights into the potential credit risks associated with their portfolios. This proactive approach enables institutions to allocate appropriate reserves for expected credit losses, thereby strengthening their financial position and resilience against economic downturns or unforeseen events.

Furthermore, the Current Expected Credit Loss model encourages greater transparency and accountability in financial reporting. By requiring companies to incorporate forward-looking information into their calculations, stakeholders are provided with a more comprehensive understanding of the potential risks and uncertainties inherent within the institution's financial statements.

Implementing CECL solutions involves leveraging advanced analytical tools and methodologies to effectively model and predict future credit losses. This may include the utilization of statistical techniques, machine learning algorithms, and scenario analysis to assess various factors that could impact creditworthiness and repayment abilities.

Moreover, the adoption of CECL solutions necessitates a collaborative effort across different functional areas within an organization, including finance, risk management, and IT. By fostering cross-functional collaboration, companies can ensure the successful integration of CECL methodologies into their existing processes and systems.

Despite the benefits offered by CECL solutions, their implementation may pose certain challenges for FIs. These challenges may include data availability and quality issues, complexity in modeling forward-looking information, and the need for ongoing monitoring and validation of CECL models to ensure their accuracy and effectiveness.

In conclusion, the development and adoption of Current Expected Credit Loss solutions represent a significant evolution in credit risk management practices within the financial industry. By incorporating forward-looking information into the calculation of expected credit losses, FIs can better anticipate and prepare for potential risks, thereby enhancing their resilience and ability to navigate uncertain economic environments.

#CECL#CurrentExpectedCreditLoss#FinancialAccounting#CreditLosses#FASB#AccountingStandard#Loan#DebtSecurities#PCDAssets#Impairment#ALLL#BadDebt#PredictiveInformation#CECLModel#PotentialLosses#creditloss

0 notes

Text

ما هي القيمة العادلة؟ مفهومها وأهميتها في المحاسبة والتمويل

في عالم المحاسبة والمالية، يكثر استخدام مصطلحات تعكس واقع الأصول والالتزامات بطريقة دقيقة وواقعية، ومن أبرز هذه المصطلحات هو "القيمة العادلة". إذ تُعدّ القيمة العادلة من المفاهيم المحورية التي تسهم في تقديم صورة شفافة وعادلة عن الوضع المالي للمؤسسات. فالسؤال الذي يطرح نفسه هو: ما هي القيمة العادلة؟

تعريف القيمة العادلة

القيمة العادلة (Fair Value) هي التقدير المعقول لسعر الأصل أو الالتزام بناءً على ما سيتم الحصول عليه أو دفعه في سوق نشط بين أطراف مطلعة وراغبة في التعامل في التاريخ المحدد للقياس. بعبارة أخرى، هي القيمة التي يمكن من خلالها بيع أصل أو تحويل التزام بين أطراف غير مترابطة وتتمتع بالمعرفة الكافية وتتصرف بحرية في سوق نشط.

ولتبسيط المفهوم أكثر، فإن القيمة العادلة لا تعبر عن السعر الذي تم دفعه فعليًا مقابل الأصل، ولا عن السعر المدون في السجلات، بل عن السعر الذي يتوقع الحصول عليه أو دفعه في ظل ظروف السوق الحالية.

لماذا نستخدم القيمة العادلة؟

تكمن أهمية استخدام القيمة العادلة في المحاسبة والتمويل في كونها توفر معلومات مالية أكثر واقعية وشفافية. فبدلاً من الاعتماد فقط على التكاليف التاريخية التي قد تكون غير معبرة عن القيمة السوقية الفعلية، تسعى القيمة العادلة إلى تقديم تقييم دقيق ومحدث يعكس تغيرات السوق.

ويؤدي استخدام القيمة العادلة إلى:

تحسين جودة المعلومات المالية: إذ تعكس القيمة العادلة تقلبات السوق وتغيرات العرض والطلب.

توفير شفافية أكبر: من خلال إظهار القيمة الحقيقية للأصول والالتزامات.

تعزيز القدرة على اتخاذ قرارات مالية سليمة: سواء للمستثمرين، أو الدائنين، أو الإدارات الداخلية.

تحقيق العدالة في التقييمات: لا سيما في حالات الدمج والاستحواذ أو تصفية الشركات.

مصادر تحديد القيمة العادلة

يعتمد تحديد القيمة العادلة على عدة مداخل، بحسب توفر المعلومات ومدى نشاط السوق:

المدخل السوقي: يتم فيه استخدام أسعار السوق المباشرة لأصول أو التزامات مشابهة.

المدخل القائم على الدخل: يعتمد على ��قدير التدفقات النقدية المستقبلية المخصومة.

المدخل القائم على التكلفة: يتم فيه تقدير تكلفة استبدال الأصل مع خصم الاستهلاك أو التدهور.

يُفضّل استخدام المدخل السوقي كلما توفر سوق نشط للأصل، أما في غياب سوق نشط، يتم اللجوء إلى النماذج المالية لتقدير القيمة العادلة.

ما هي القيمة العادلة في السياق المحاسبي؟

في السياق المحاسبي، يُستخدم مصطلح "القيمة العادلة" ضمن إطار المعايير الدولية لإعداد التقارير المالية (IFRS) وكذلك في المعايير الأمريكية (GAAP). على سبيل المثال، تُستخدم القيمة العادلة في قياس الأصول المالية مثل الأسهم والسندات، وفي حالات إعادة التقييم لبعض أنواع الممتلكات أو المعدات.

ويوجد معيار خاص من مجلس معايير المحاسبة المالية (FASB) يُعرف بـ FAS 157 أو ASC 820، يحدد الإطار العام لقياس القيمة العادلة ويضع التسلسل الهرمي للمصادر التي تُستخدم في التقييم، مقسمًا إلى ثلاث مستويات:

المستوى الأول: أسعار مدرجة في أسواق نشطة لأصول أو التزامات متطابقة.

المستوى الثاني: مدخلات يمكن ملاحظتها، لكنها غير مباشرة.

المستوى الثالث: مدخلات غير قابلة للملاحظة وتعتمد على تقديرات الإدارة.

تطبيقات القيمة العادلة

تُستخدم القيمة العادلة في عدة مجالات مالية، مثل:

تقييم الأصول المالية في البنوك وشركات الاستثمار.

تحديد القيمة السوقية للعقارات والأراضي.

تقييم المشتقات المالية مثل عقود الخيارات والعقود المستقبلية.

إعادة تقييم الممتلكات في حالة الدمج أو الاستحواذ.

إعداد التقارير المالية العادلة في ظل المعايير الدولية.

التحديات في تطبيق القيمة العادلة

رغم الفوائد الكبيرة لاستخدام القيمة العادلة، فإن هناك بعض التحديات التي قد تواجه المحاسبين والمقيمين:

غياب السوق النشط: في بعض الأحيان لا يتوفر سعر سوقي يمكن الاعتماد عليه.

التحيز في التقدير: قد تعتمد التقديرات على افتراضات غير واقعية.

التقلبات السوقية الكبيرة: ما يجعل التقييم عُرضة لتغيرات مفاجئة.

صعوبة تقييم بعض الأصول غير الملموسة: مثل براءات الاختراع أو السمعة التجارية.

الخلاصة

في نهاية المطاف، ما هي القيمة العادلة؟ هي ببساطة القيمة التي تعكس السعر الحقيقي الذي يمكن تبادله في السوق، بين أطراف مطلعة ومتعاقدة طواعية. ويُعد هذا المفهوم أداة مهمة في تقديم تقارير مالية دقيقة، ويمنح المستثمرين والدائنين وأصحاب القرار قدرة أكبر على فهم المركز المالي الحقيقي للمؤسسة.

ورغم التحديات التي قد تعترض طريق تطبيقها، فإن القيمة العادلة تظل من الركائز الأساسية لتقييم الأصول والالتزامات، وهي عامل ضروري في تحقيق الشفافية والمصداقية في التقارير المالية.

0 notes

Text

رهان Semler بقيمة 11B Bitcoin. هل يمكن أن تصبح شركة Med-Tech الصغيرة الاستراتيجية التالية؟

كشفت شركة Semler Scientific ، وهي شركة صانع الأجهزة الطبية الغامضة سابقًا ، عن خطط للحصول على 105000 BTC مذهلة بحلول نهاية عام 2027. سيجعل طموحه Semler ثاني أكبر حامل لشركة Bitcoin في العالم ، وراء الإستراتيجية فقط (MicroStrategy سابقًا).ال إعلان، التي صنعت في 20 يونيو ، أرسلت أسهم Semler ما يقرب من 12 ٪ في تجارة ما قبل السوق ، وسط حماس للمستثمر لاستراتيجية خزينة Bitcoin العدوانية للشركة. بالأسعار الحالية ، يمثل هدف 105،000 BTC أكثر 60 مليون دولار في الإيرادات العام الماضي.من الأجهزة الطبية إلى الرهانات الكليةقامت شركة Semler Scientific ببناء أعمالها حول أدوات التشخيص مثل اختبار مؤشر الكاحل العنصر لمرض الشريان المحيطي. ولكن منذ مايو 2024 ، عندما اعتمدت الشركة بيتكوين كأصل احتياطي الخزانة الأساسي ، تحول ملفها الشخصي بشكل كبير.الشركة أولاً الشراء مقابل 40 مليون دولار تميزت بداية التحول المالي. بحلول أبريل ، عقد سيمر 3467 BTC تم الحصول عليها بتكلفة متوسط قدرها 88،263 دولار. وقد أضافت منذ ذلك الحين 982 BTC ، مما يجلب مجموعه إلى 4449 BTC ، بقيمة حوالي 471 مليون دولار.خارطة الطريق إلى الأمام أكثر طموحا. يستهدف Semler 10000 BTC بحلول نهاية عام 2025 ، 42000 بحلول نهاية عام 2026 ، و 105000 كامل بحلول ديسمبر 2027. إن تحقيق ذلك يتطلب الأمر الحصول على أكثر من 100000 BTC في أقل من ثلاث سنوات ، بمعدل تراكم لا مثيل له من قبل أي شركة عامة أخرى لتوفير MicroStrategy.بناء قوة بيتكوينلتنفيذ هذه الخطة ، يستمد Semler من كتاب Playbook الإستراتيجي. تقوم الشركة بتمويل مشترياتها من خلال مزيج من مبيعات الأسهم في السوق (ATM) ، والملاحظات القابلة للتحويل العليا ، والتدفق النقدي التشغيلي. رفعت 88.5 مليون دولار عبر الديون القابلة للتحويل في أوائل عام 2025 وتستمر في الاستفادة من أسواق رأس المال لتمويل عمليات شراء إضافية.في 19 يونيو ، استأجرت Semler محلل Bitcoin Joe Burnett كمدير لاستراتيجية Bitcoin ، وهو دور لم يكن موجودًا قبل محور الشركة. Burnett يجلب موقف Bitcoin-Maximalist الصوتي و ذكرت الهدف بصراحة: "لقد حان الوقت لبناء واحدة من أكثر الشركات قيمة في العالم".وأضاف إريك سيمر ، رئيس الشركة والاسم ، "نحن متحمسون لأن ينضم جو إلى فريق استراتيجية Bitcoin والمساعدة في قيادة خطتنا لمدة ثلاث سنوات لامتلاك 105،000 Bitcoins."ما وراء الضجيج: أسئلة الحجم والمخاطرفي حين أن BTC BET من Semler قد حصل على عناوين الصحف ، فإنه يدعو أيضًا إلى التدقيق. حجم التراكم ، يساوي ما يقرب من 0.5 ٪ من الحد الأقصى لتوريد البيتكوين ، يثير أسئلة أزمة السيولة حول عمق السوق والتنفيذ.هناك مخاطر داخلية أيضا. يحذر النقاد من أن التركيز بشكل كبير على عملة البيتكوين يمكن أن يصرف الانتباه عن عمليات Semler الأساسية لـ Med-Tech ، حيث يظل البحث والتطوير والامتثال التنظيمي كثيفًا رأس المال. علاوة على ذلك ، مع وجود مجلس معايير المحاسبة المالية (FASB) الذي يتطلب الآن حساب القيمة العادلة للأصول الرقمية ، يمكن أن تتأرجح أرباح الشركة بشكل كبير مع تقلب أسعار BTC.البصريات التنظيمية تضيف طبقة أخرى من التعقيد. بصفته لاعب رعاية صحية يخدم Medicare و FDA ، فإن محور Semler لاستراتيجية ثقيلة الأصول الرقمية غير مسبوقة ويمكن أن يجذب تدقيقًا جديدًا بموجب الأنظمة التنظيمية السابقة. ومع ذلك ، بالنظر إلى المناخ التنظيمي الحالي في الولايات المتحدة ، سيكون من المستغرب أن نرى أي شركة أمريكية محبطًا من شراء البيتكوين.مقارنات الاستراتيجية واتجاه الشركة الجديدحتما ، أطلق المراقبون على سيمر "MicroStrategy Junior". تتمسك شركة مايكل سيلور تقريبًا 592،100 BTC ويستخدم مجموعة مماثلة من إصدار الأسهم والديون لبناء صندوق الحرب. ولكن على عكس الإستراتيجية ، التي لا تزال شركة برمجيات مربحة ، فإن Semler يهتز بقاعدة تشغيل متواضعة نسبيًا مقابل وضع مالي هائل.هذا الانقسام لا يزال من الممكن أن يعمل لصالح Semler. إذا كانت BTC تقدر وتبقى معنويات المستثمرين قوية ، فقد يركب Semler موجة تقييم ، مثل الإستراتيجية ، تتخلص من مبيعات المنتجات الأساسية.تعزز هذه الخطوة أيضًا السرد الأوسع لدور البيتكوين المتزايد في تمويل الشركات. في حين أن شركات التكنولوجيا مثل Block و Tesla قد انخرطت في BTC Holdings ، فإن التزام Semler الكامل يجعلها عبارة عن موجة جديدة من الثيران الميزانية ، حتى خارج قطاع التكنولوجيا.قد يثبت محور Semler حتى الآن البصيرة ، أو محفوفة بالمخاطر. تقزّم Bitcoin Holdings بالفعل أعمالها الأساسية في قيمتها ، والشركة الآن على طريق قد تحدد فيها إدارة الأصول الرقمية مستقبلها أكثر من التشخيص الطبي.بفضل هدفه البالغ 10 مليارات دولار ، يراهن Semler على Bitcoin ، مع الرهان أيضًا أنه يمكنه إعادة تشكيل هويته أقرب إلى الاستراتيجية.

ما إذا كان المستثمرون يشترون هذه القصة على المدى الطويل لا يزال السؤال المفتوح. ولكن في الوقت الحالي ، يتوافق Semler إلى أقرب ما إلى مسرحية Bitcoin في Strategy ، على أمل أن لا يزال في وقت مبكر بما يكفي للحزب لرؤية مكاسب طويلة الأجل.المذكورة في هذه المقالةأحدث ألفا تقرير السوق

0 notes

Text

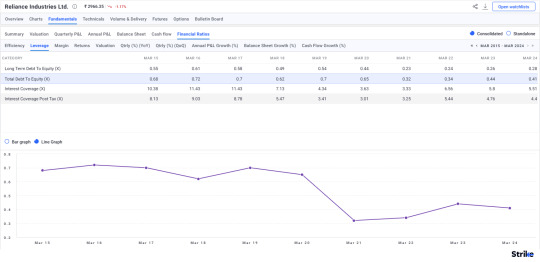

✅ Complete Guide to Debt to Equity Ratio: What It Means and Why It Could Make or Break a Company

Understanding a company’s financial health isn't just for seasoned investors. One of the most telling indicators is the Debt to Equity Ratio (D/E) — a powerful gauge of how a company finances its operations. Whether you're analyzing Tata Motors, investing in Infosys, or reviewing your own startup’s balance sheet, this ratio helps you see the financial risk clearly.

Let’s break it all down — no jargon, no fluff, and all with insights from both global principles and the Indian stock market 🧾

📊 What Exactly Is the Debt to Equity Ratio?

In simple words, the Debt to Equity Ratio shows how much debt a company uses to finance its assets relative to shareholder equity. It’s a measure of financial leverage — and tells you whether a company is overburdened with debt or conservatively managed.

🔍 Formula: D/E Ratio = Total Liabilities / Shareholder's Equity

For instance, if a company has ₹100 crore in debt and ₹50 crore in equity, the D/E ratio is 2. This means the company is using ₹2 of debt for every ₹1 of equity.

🏛 Recognized by financial bodies like FASB, SEC, and aligned with accounting principles such as GAAP and IFRS, this ratio is central to evaluating corporate solvency.

🚨 Why the Debt to Equity Ratio Isn’t Just a Number

The D/E ratio isn’t just about math — it reveals business philosophy, risk appetite, and even future performance potential.

✅ Low D/E Ratio: Indicates conservative financing, lower risk. Often seen in tech and IT firms like Infosys, which had a D/E ratio of nearly 0.02 in FY24, showing minimal reliance on debt.

⚠️ High D/E Ratio: May suggest aggressive growth, risk-taking, or financial stress. Companies like Tata Motors or Vedanta have historically shown higher D/E ratios due to capital-intensive operations.

🧠 Even legendary investors like Warren Buffett and Benjamin Graham emphasized examining leverage before investing in any stock.

📘 Here’s How to Calculate Debt to Equity Ratio Using a Balance Sheet

Let’s say you’re analyzing a company’s financials on Strike Money, a powerful charting tool tailored for Indian traders. You navigate to the balance sheet tab.

➡️ Look under Liabilities: Add both long-term and short-term borrowings. ➡️ Under Equity: Take shareholder’s funds, retained earnings, and reserves.

Plug into the formula and voilà — you’ve got the D/E ratio 💡

Using Strike Money, you can also plot historical trends to see how a company’s financial structure evolves over time — a great way to predict future moves 📈

📍 So, What’s a "Good" Debt to Equity Ratio in India?

There’s no universal “perfect” number — it depends on the industry and business model.

🏗️ Infrastructure/Manufacturing (e.g., L&T): D/E of 1.5 to 2 is considered normal 💻 IT Services (e.g., TCS, Wipro): D/E below 0.2 is ideal 🏦 Banking & Finance (e.g., HDFC, ICICI): D/E often above 5, but that’s typical due to their nature of operations

🎯 A 2023 report by CRISIL highlighted that Indian listed companies, on average, maintained a D/E ratio of 0.9 post-COVID, as they became cautious about debt due to interest rate hikes and global volatility.

🧪 Real Examples from Indian Companies You Know

🎯 Tata Motors: As of FY24, Tata Motors had a D/E ratio of 2.04, reflecting its high capital expenditure in EV and international ventures.

🧘 Infosys: Maintains a near-zero debt policy. Its D/E ratio has stayed under 0.05 for over a decade, making it a darling of conservative investors.

📦 Zomato: The food delivery player had a D/E ratio close to 0.12 in FY24 — thanks to equity-heavy funding rounds during its startup phase and IPO.

💡 If you’re investing or analyzing these companies, the D/E ratio gives insight into whether they’re managing growth or gambling on it.

🔍 High vs Low D/E Ratio: What Should You Really Worry About?

🟥 High Debt to Equity Ratio Risks: ⚠️ Higher interest payments → Pressure on profit margins ⚠️ Vulnerability to interest rate hikes → As seen post-2022 RBI hikes ⚠️ Lower credit ratings → Higher cost of future borrowing ⚠️ Potential for default → Especially in economic downturns (e.g., IL&FS Crisis in India)

🟩 Low D/E Ratio Pros: ✅ Stability → Attractive to long-term investors ✅ Better borrowing power when needed ✅ Stronger balance sheet in recession periods

But beware: too low a D/E ratio might also suggest under-utilization of available capital — which can be a red flag for growth investors 🚩

🔄 Debt vs Equity Financing: Which Makes Sense for Businesses?

When raising capital, companies often choose between debt and equity. Each has pros and cons.

💸 Debt Financing 🔹 No loss of ownership 🔹 Interest is tax-deductible 🔹 But comes with repayment obligation

📊 Equity Financing 🔹 No repayment burden 🔹 More flexibility 🔹 But dilutes ownership and control

In 2024, a survey by NASSCOM found that over 68% of Indian startups preferred equity over debt, citing investor interest and lower short-term liability.

However, traditional giants like Reliance Industries use a blend — borrowing strategically while also raising funds through rights issues or bonds.

🧠 What Top Investors and Analysts Say About Leverage

🔮 Warren Buffett: "If you’re smart, you don’t need leverage. If you’re dumb, it’ll ruin you.”

📖 Benjamin Graham, in The Intelligent Investor, advised always checking how a company funds growth — D/E ratio being key.

📉 In the 2008 Global Financial Crisis, over-leveraged firms collapsed like dominoes. Indian companies with high debt, such as Kingfisher Airlines, also failed spectacularly.

Knowing how much debt is "too much" is more important than ever in a volatile global economy.

💡 How to Use Strike Money to Analyze D/E Ratio Like a Pro

🛠️ Strike Money, a rising favorite among Indian retail investors, lets you: 🔍 Search by stock name and access financial ratios in seconds 📉 Visualize D/E ratio trends across years 🔔 Set alerts for sudden spikes in leverage

If you’re managing a portfolio or just analyzing a stock pre-earnings, Strike Money gives you the insight edge — fast, reliable, and visually intuitive.

🔎 When Should You Worry About the D/E Ratio?

📌 You should raise an eyebrow if: ❗ The D/E ratio suddenly doubles YoY ❗ It exceeds industry average by over 50% ❗ There's declining earnings alongside rising debt ❗ Interest coverage ratio is below 2

In these cases, it's time to dig deeper into financial statements, cash flows, and management commentary. Sometimes, the D/E ratio is a symptom of a deeper issue, not just a cause.

📚 Expert Resources to Dive Deeper

✅ Bloomberg and Morningstar: For ratio trends ✅ SEBI filings: To view detailed debt instruments ✅ RBI Bulletins: For macro insights on borrowing ✅ Company Investor Relations (IR) pages: For D/E breakdowns ✅ Strike Money: Best for real-time Indian market data and charts

According to a McKinsey 2023 study, companies with optimized capital structures (balanced D/E ratios) showed 20–30% higher valuation multiples than over-leveraged peers.

❓ FAQ: What Investors Ask About Debt to Equity Ratio

❓ What is a healthy debt to equity ratio? 👉 Between 0.5 and 1 is generally healthy. But it depends on industry norms.

❓ Can a D/E ratio be negative? 👉 Yes, if equity is negative — usually a big red flag 🚩

❓ How often should I check a company’s D/E ratio? 👉 Quarterly, or during major capital raising events

❓ Is high D/E always bad? 👉 Not necessarily. It can mean aggressive expansion — but needs strong earnings to back it up

❓ What’s the difference between debt ratio and D/E ratio? 👉 Debt ratio = Total Debt / Total Assets 👉 D/E = Total Debt / Shareholder Equity

🏁 Final Thoughts: Make D/E Ratio Part of Every Financial Check

Understanding the Debt to Equity Ratio isn’t just for accounting nerds — it’s an essential skill whether you’re an investor, a founder, or a finance student.

Before making any investment or strategic decision, ask: ➡️ How is this company funding its growth? ➡️ Is it leveraging wisely or borrowing blindly?

Keep tools like Strike Money in your pocket, and let the D/E ratio guide your financial radar.

0 notes