#FinancialAccounting

Explore tagged Tumblr posts

Text

Top 10 FAR Exam Practice Questions | Master Cash Flows, Leases and Earnings Per Share

youtube

Prepare for the FAR exam with these 10 essential practice questions covering key topics such as cash flows, leases, and earnings per share (EPS). In this video, I walk you through detailed solutions for each question, helping you understand the most important concepts needed to succeed. Pause the video to solve the problems on your own, then see how I approach the solutions for maximum learning. Perfect for anyone looking to strengthen their understanding and boost their confidence before the exam.

#farexam#cpaexamprep#accounting#cashflows#leases#earningspershare#exampractice#cpatips#financialaccounting#studytips#Youtube

1 note

·

View note

Text

"Empower Your Future: Learn Digital Marketing!"

2 notes

·

View notes

Text

What’s the Best Payroll Software for Small Teams?

Introduction

Managing payroll efficiently is one of the most crucial tasks for small businesses. With limited resources and staff, small teams need a payroll solution that is easy to use, cost-effective, and compliant with tax regulations. Whether you are a startup, freelancer, or a small enterprise, having the right payroll software can save time, reduce errors, and ensure timely salary disbursement. Read More

0 notes

Text

Accountancy with Tally ERP.9 Course

The Accountancy with Tally ERP.9 course provides in-depth knowledge of financial accounting and hands-on training in using Tally software. It covers essential topics like voucher entry, inventory management, GST, and financial reporting. This course is ideal for students and professionals aiming to build practical accounting skills. By the end of the course, learners can efficiently handle real-world accounting tasks using Tally ERP.9.

#AccountancyCourse#TallyERP9#AccountingSoftware#FinancialAccounting#TallyTraining#GSTAccounting#AccountingSkills#BusinessAccounting#TallyForBeginners

1 note

·

View note

Text

S&T Associates – Your Trusted Partner in Accounting & Business Growth

At S&T Associates, we do more than accounting—we become a part of your team. Our experienced professionals provide trusted, confidential, and cost-effective financial solutions designed to help businesses succeed. With transparent pricing, expert accounting and advisory services, and a focus on cost-saving strategies, we ensure accuracy and timely support for your financial needs.

As a firm of Financial Accountants, we equip businesses with the right insights, tools, and strategies to drive sustainable growth. With S&T Associates as your partner, your success is our priority.

0 notes

Text

Bad and Doubtful Debts

Bad debts refer to amounts that are deemed unrecoverable, allowing businesses to claim deductions under specific criteria outlined in the Income Tax Act of 1961. Doubtful debts, with uncertain recovery prospects, are handled differently, often requiring provisions for potential losses. The recovery of bad debts, as well as provisions for doubtful debts, is subject to specific tax guidelines, particularly for banks and financial institutions, ensuring proper accounting and tax treatment for these financial challenges.

What are Bad Debts?

If corporate and professional debt becomes unrecoverable in the preceding fiscal year, a deduction is permissible. If the debts cannot be wholly or partially recovered by the loans provided by banks or money lending institutions, a deduction may be allowed.

Eligibility Criteria for Deduction of Bad Debts

The eligibility of an individual for a deduction is contingent upon the existence of debts that are entirely unrecoverable under the law or by the courts. The Income Tax Act of 1961, Section 36(2), must be satisfied prior to the provision of any relief for delinquent debts. The circumstances are as follows:

The debt or loan is required for the assessee’s trade or occupation and is required to be associated with the applicable accounting period. Any debt irrelevant to the assessee’s occupation or business does not qualify for a deduction.

In case a debt due from retiring partners is non-recoverable, the assessee cannot disregard it and can file for a claim for a deduction due to capital loss.

Only those debts acknowledged throughout the present period or any preceding fiscal year's tax return calculation are entitled to receive a deduction by the assessee. Attention should be paid to the amount that is loaned in the ordinary course of business at the lending institute.

The deduction for bad debts should have been made in the accounting year in which any loan, debt, or portion thereof was considered bad.

The assessee is only eligible to claim the deduction for debts that were previously eliminated from their accounts books in the previous fiscal year, for which the reduction is also requested.

What are Doubtful Debts?

Debt with uncertain chances of recovery is known as doubtful debt. Consequently, the company can endure losses because of the presence of these debts.

The sum payable to customers’ accounts is tracked somewhere at the end of the financial year, and the probability that some of those amounts will be recovered is estimated to be not possible. In reality, the total whose recovery is uncertain cannot be classified as a loss on the day the accounting information is generated and, as a result, cannot be written off. It is necessary to apply it to the company's profit and loss account, contingent upon its prior performance.

A clause titled "Provision for Doubtful Debts" is also included to safeguard against the potential loss. The clause imposes a tax on profit. When we establish provisions to mitigate potential losses in the event that the uncertain debt proves to be detrimental, a specific sum is allocated.

Bad Debts from Closed Businesses

Bad debts from a no longer active firm examined before the commencement of the financial year cannot be written off from the assesse’s profits from their continuous operations.

As per Section 36(2)(iii), in case the bad debts have been removed from the accounts book but remain recoverable, A.O. declines to acknowledge them as a deduction. In the year when a debt or part of an obligation becomes unrecoverable, it should be subtracted from income.

How the Bad Debts are recovered?

In case the debt was classified as bad debt in the previous year and the necessary deduction was also accounted for. Nevertheless, the debt was subsequently recovered in whole or in part. The amount that was eventually recovered will be included in the income for the fiscal period in which it was recovered. Suppose that the assessee wrote off a portion of the debt in a previous year, the Assessing Officer approved the deduction, and the creditors subsequently repaid a portion of the debt. In that event, the recovered funds will be regarded as a standard realization of debts. If the amount recovered is less than the expected amount, the remaining balance will be considered bad debts.

Provision for doubtful and bad debts

The Income Tax Act of 1961, section 36(1) (viia), allows only banks and financial institutions to deduct expenses associated with provisions for poor and dubious loans. The deduction for the provisioning of problematic debts is not available to any other taxpayer.

The deduction that banks and other financial institutions may make is subject to the following restrictions:

Bank Types include Indian Banks, Foreign Banks, Public Financial Institutions and State Financial Corporations.

7.5% of the adjusted overall revenue plus 10% of the average total advances of rural branches

An adjusted 5% of the total income

An adjusted 5% of the total income Compute the advancements of each rural branch independently.

Divide the number of months outstanding by the average advances by branch.

The average total amount of advances made by each branch.

Treatment in accordance with the accounting standard

In accordance with Accounting Standard 29, "Provisions, Contingent Liabilities and Assets," the provisions that arise in the ordinary course of business must be recorded. The provisions are occasionally disallowed by the Income Tax Department, which leads to a temporal discrepancy between the accounting records and the accounts required by the I.T. Act.

Consequently, an assessee is also required to establish the requisite Deferred Tax Assets and Liabilities. For an assessee to have a deferred income tax asset or obligation, only the temporal mismatch of a transient transaction that has the potential to be undone in the future is necessary.

Conclusion

In conclusion, bad and doubtful debts are critical components of business accounting, with specific provisions for deduction under the Income Tax Act of 1961. While only banks and financial institutions can claim provisions for such debts, careful adherence to tax rules and accounting standards ensures proper financial management and tax compliance.

0 notes

Text

Are you a student in Spain struggling with your Accounting and Finance assignments?

Let us help you achieve the grades you deserve! Our expert writers provide high-quality, plagiarism-free, and timely assignment writing assistance. Whether it's financial accounting, management accounting, corporate finance, or investment analysis, we have you covered.

✨ Why Choose Us? ✅ Experienced Writers ✅ Plagiarism-Free Work ✅ On-Time Delivery ✅ Affordable Prices ✅ 24/7 Customer Support

Get in touch today for professional Accounting and Finance assignment help and take your academic success to the next level!

#AccountingAndFinance#AssignmentHelp#SpainStudents#FinanceAssignments#AccountingAssignments#PlagiarismFree#EssayWriting#StudentSuccess#AccountingHelp#FinanceHelp#ManagementAccounting#CorporateFinance#InvestmentAnalysis#FinancialAccounting#AssignmentExperts#StudyHelp#AffordableWriting#AssignmentExpertsES#EssayAssistance#StudentSupport#BusinessAccounting#AccountingEssay#FinanceEssay#ResearchPapers#DissertationHelp#AccountingStudies#TopGrades#ProfessionalWriters#CustomAssignments#FinanceAcademicHelp

0 notes

Text

Define Company in SAP

In SAP, a "Company" refers to a legal entity or business organization within the system. It is a key organizational unit used for financial accounting, representing a structure that processes financial transactions. Companies are linked to other entities like plants, sales organizations, and profit centers. Defining a company in SAP is crucial for managing financials, reporting, and legal requirements within the system.

#SAP#SAPConfiguration#ERP#SAPFinance#BusinessStructure#SAPImplementation#FinancialAccounting#SAPTutorial#SAPTips#EnterpriseSoftware

0 notes

Text

#Sriina#Books#education#online bookstore#FinancialAccounting#AccountingIllustrations#BusinessFinance#FinancialLiteracy#AccountingEducation#LearnAccounting#FinanceTips#BusinessAccounting#FinancialPlanning#AccountingSolutions

1 note

·

View note

Text

Scope Computers

Master Tally with Our Prime Tally Course! 🎓

Learn Tally from basics to advanced, including GST, payroll, and financial reporting. Perfect for students, professionals, and business owners.

✅ Hands-on Training ✅ Expert Guidance ✅ Certification Included

📅 Enroll Today and Elevate Your Accounting Skills

#tally#tallyprime#tallyeducation#tally course#tally training#financialaccounting#tally expert#tally certification#payroll management#skill development#boost your career#gst training

0 notes

Text

Master Revenue Recognition | CPA Exam Essentials | Maxwell CPA Review

youtube

Learn revenue recognition in this simple video! We cover the 5 steps, 3 examples (laptop, subscription, complex), and construction accounting. Easy explanations and journal entries included. Perfect for accounting students and anyone wanting to understand revenue recognition.

#revenue#revenuerecognition#accounting#cpaexam#gaap#ifrs15#asc606#financialaccounting#constructionaccounting#journalentries#businessfinance#Youtube

0 notes

Text

"Unlock your brand's potential with strategic digital marketing! 🚀💻

2 notes

·

View notes

Text

Master Business Accounting with Tally ERP9 & GST Integration

Discover the power of Tally ERP9 with GST in managing real-world business accounts. This course is designed to provide practical training on GST billing, return filing, inventory handling, voucher entry, TDS, and MIS reports using Tally.ERP9. Learn how to streamline financial operations, automate compliance, and confidently handle complete business accounting. Ideal for students, job seekers, and professionals aiming to master industry-ready accounting software with hands-on application.

📚 Learn Complete Tally ERP9 with GST Attitude Academy

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

0 notes

Text

"Understanding Trade Receivables: Key Concepts, Management, and Impact on Cash Flow"

Trade receivables, also known as accounts receivable, represent the amounts owed to a company by its customers for goods or services sold on credit. These assets arise when a company provides goods or services to customers on credit terms and hasn’t yet received the payment.

0 notes

Text

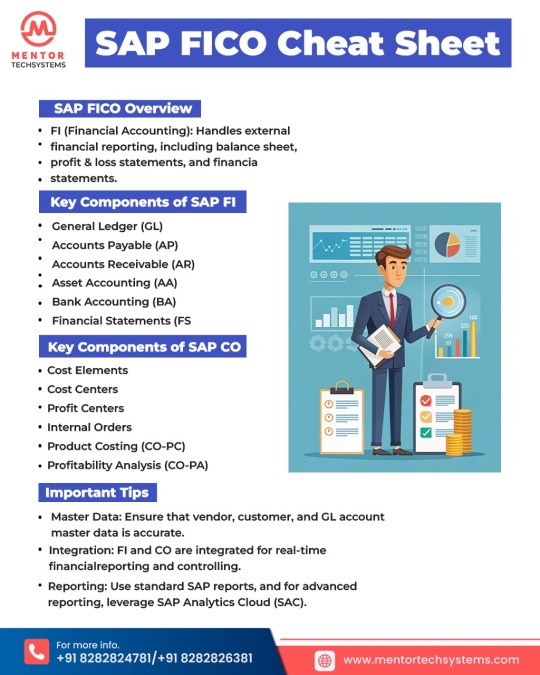

Mastering SAP FICO like a pro! 💼📊 With these quick tips and transactions, your financial processes will be smoother than ever! 🚀✨ Whether it’s General Ledger, Cost Center, or Profitability Analysis, #SAPFICO has you covered. Ready to take control of your financial future? 💡💰

For more info,

contact us at +91 8282 82 4781/+91 8282 82 6381

visit us at www.mentortechsystems.com

#Mentortechsystem#FinanceGoals#SAPTips#Controlling#FinancialAccounting#TechInFinance#SAPConsultant#BusinessTech#DataDriven#EfficiencyBoost#AccountingSolutions#ERP#CostManagement#ProfitAnalysis

0 notes