#Financial insights

Explore tagged Tumblr posts

Text

Best Way Profit

Your Gateway to Financial Freedom!

Start Your Journey Today Don't let another day pass without taking control of your financial future. Explore our articles, sign up for our newsletter, and join the Best Way Profit community now. Your best way to profit starts here.

#Financial freedom#Wealth building#Personal finance#Financial education#Income growth#Financial management#Investment strategies#Money-saving tips#Financial security#Financial tools#Empowering financial decisions#Profit optimization#Financial insights#Wealth creation#Finance community#Financial success#Increase wealth#Financial planning#Smart investing#Financial newsletter.

2 notes

·

View notes

Text

Mastering Financial Insights: Understanding Tally Balance Sheet

When it comes to managing your finances, understanding where your business stands is super important. It's like taking a snapshot of your company's money matters at a specific time. The Tally balance sheet is one of the most critical financial statements for any business. It provides a snapshot of a company's financial position at a given moment in time, showing its assets, liabilities, and shareholders' equity. The balance sheet is prepared using the fundamental accounting equation, which states that Assets = Liabilities + Shareholders' Equity. For more details, visit us at https://www.suvit.io/

#Financial Insights#tally automation#excel to tally import#excel to tally#excel to tally software#e invoice in tally#automation for accountants

2 notes

·

View notes

Text

Important Update Every Business Owner Should Know

Discover key financial insights that could impact your business strategy. Our latest blog from Vantage Financial Partners breaks down what business owners need to know to stay ahead. Don’t miss this essential update.

Read More...

0 notes

Text

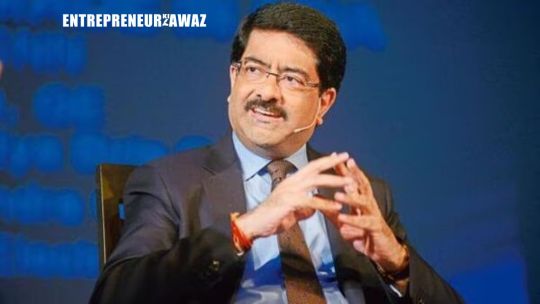

Kumar Mangalam Birla: ₹1 Crore Isn't Enough to Start a Business

In an exclusive interview, Kumar Mangalam Birla stated that ₹1 crore is insufficient for starting up a business in India. He advises up-and-coming entrepreneurs to adopt scalable models, seek partnerships, and understand the market dynamics for successful ventures.

But, if you want to start a business with a capital of ₹1 crore, thinking you’ve got enough cash to manage running it, then most probably you should say goodbye to that idea.

In an unguarded conversation with Nikhil Kamath, co-founder of Zerodha, Kumar Mangalam Birla, chairman of the Aditya Birla Group, turned to that burning issue for youth: Is ₹1 crore really enough to start a business?

Spoiler alert—Mr. Birla doesn’t think so.

Wondering about a start-up aspiration and reality check from the economic perspective, Kamath threw that oft-asked question by many young would-be business owners, “If a young entrepreneur had sticky ₹1 or 2 crores, would there be an industry that would recommend entering with strong tailwinds?” Read more

0 notes

Text

Transforming Financial Services with GenAI Solutions

The financial services industry is experiencing a major shift, driven by the rapid adoption of Generative Artificial Intelligence (GenAI). This advanced technology is reshaping how financial institutions work, from improving customer service to streamlining operations and managing risks. Businesses are embracing GenAI for its ability to boost efficiency and productivity, with an impressive 92% of Fortune 500 companies already using OpenAI’s technology. This trend highlights the growing importance of AI in helping organizations stay competitive and deliver better services.

As technology evolves, GenAI is proving to be a game-changer for the financial sector. It offers innovative solutions to enhance customer experiences, optimize workflows, and address challenges more precisely. The adoption of GenAI not only reflects the industry’s drive for innovation but also opens the door to new possibilities for the future. With its transformative potential, GenAI is set to redefine the way financial services operate in the years ahead.

An Overview of Generative AI in Finance

Generative AI is revolutionizing the financial sector by offering practical solutions that enhance decision-making, accuracy, and efficiency. GenAI in finance is empowering banks and institutions to streamline their operations by automating repetitive tasks, creating predictive models, and improving customer interactions through conversational agents. With its ability to generate new content, such as data models and reports, GenAI implementation is transforming how financial institutions approach problem-solving and innovation, making processes faster and more reliable.

The impact of GenAI in financial services extends to areas like personalized banking, risk management, and fraud detection. By leveraging tools like Generative AI reports and predictive analytics, institutions can gain deeper insights into market trends and customer behaviour. This fusion of GenAI and finance enables financial institutions to deliver tailored solutions, reduce costs, and stay competitive in an increasingly digital world. The integration of this advanced technology is not just reshaping operations but also setting new standards for efficiency and customer satisfaction.

How GenAI is Transforming Financial Services

Generative AI is driving innovation in financial services, optimizing processes and services. Here are a few examples.

Enhanced Customer Service and Experience

Customer service is one of the primary areas where GenAI in finance is gaining traction. Financial institutions may provide 24-hour customer service, individualized product recommendations, and speedier response times by deploying AI-powered chatbots and virtual assistants. These AI technologies may also recognize client preferences and anticipate their demands, resulting in a considerably better customer experience.

Automated Risk Management and Compliance

GenAI implementation in risk management allows financial institutions to more correctly analyse potential threats. GenAI’s capacity to process large amounts of data allows it to find patterns and abnormalities that may indicate fraud or credit problems. It also helps to ensure regulatory compliance by automating report generation and spotting non-compliance concerns in real time, which saves time and resources.

Streamlining Operations

In financial services, efficiency is essential. GenAI in financial services can automate repetitive processes including data entry, report preparation, and transaction monitoring. This allows staff to concentrate on higher-level strategic duties, resulting in increased overall productivity. For example, GenAI may generate thorough financial summaries and forecasts to help financial analysts make informed judgments.

Improving Financial Predictions and Forecasts

GenAI excels at predictive analytics, making it an effective tool for financial forecasting. By studying previous data, GenAI can forecast future market patterns, asset values, and economic situations. These forecasts assist financial organizations in adjusting their strategy and making informed investment decisions, so lowering risk while increasing profits.

Top 10 Generative AI Use Cases in Finance

Generative AI is unlocking innovative solutions across the financial sector. Below are the top 10 use cases transforming the industry.

Customer Service Chatbots Generative AI powers 24/7 smart chatbots that quickly answer customer queries, solve problems, and provide personalized support, improving overall customer experience while reducing response time and operational costs for financial institutions.

Fraud Detection AI can analyze large datasets to identify suspicious patterns and unusual transactions, helping banks detect and prevent fraud before it causes significant financial harm, ensuring greater security and trust in financial services.

Automated Reports Generative AI automatically generates detailed financial reports in seconds, saving valuable time for employees. This ensures accurate, real-time insights that improve decision-making and overall operational efficiency within financial organizations.

Personalized Financial Advice AI analyzes an individual’s financial data to offer tailored advice on savings, investments, and spending, ensuring personalized financial guidance that helps customers make smarter decisions and achieve their financial goals effectively.

Credit Scoring and Loan Approval AI evaluates a range of financial data to determine creditworthiness quickly and accurately, speeding up the loan approval process and ensuring fairer, more reliable decisions while minimizing human error in evaluating loans.

Risk Management Generative AI helps financial institutions predict potential risks by analyzing market trends and other data points, enabling smarter, proactive decisions to safeguard assets, minimize losses, and ensure long-term business stability.

Investment Forecasting AI uses historical and real-time market data to provide informed investment predictions, helping investors identify the best opportunities and optimize their portfolio for better returns and reduced risk in an ever-changing market.

Regulatory Compliance Generative AI automates the process of checking compliance with financial regulations, ensuring that financial institutions remain up to date with laws and standards while reducing human error and minimizing the risk of costly fines.

Data-Driven Marketing AI analyses customer behaviour and preferences to create highly personalized marketing campaigns, allowing banks to target the right audience with tailored offers and improving customer engagement, retention, and conversions.

Automated Document Processing Generative AI streamlines document processing by automatically reading and analysing documents like loan applications, contracts, and agreements, reducing manual work, speeding up approvals, and enhancing overall operational efficiency within financial institutions.

GenAI’s Role in Reporting

One significant advantage of Generative AI is its ability to streamline the reporting process. Financial firms frequently deal with large amounts of data in this data-driven world that must be efficiently evaluated and reported. Financial institutions can use generative AI reports to automate report generation, saving time while maintaining accuracy. These reports can be adjusted to meet individual requirements, giving information on financial performance, risk assessments, and regulatory compliance.

For example, a Generative AI report can be used to generate extensive evaluations of quarterly profitability, allowing executives and stakeholders to make data-driven decisions.

The Future of GenAI in Financial Services

The future of GenAI in finance and GenAI in financial services looks very bright. As AI technology improves, it will become even more powerful in areas like customer service, risk management, and predicting financial trends. Financial companies using GenAI now will have a big advantage over their competitors.

Additionally, as AI gets better, Generative AI reports will offer deeper insights and quicker real-time data. GenAI in finance and financial services will be able to analyse large amounts of data in seconds, making companies faster and more flexible in responding to changes in the market.

Conclusion

Integrating GenAI in finance is more than just a technology improvement; it is a change that will determine the financial industry’s future. GenAI in financial services has numerous benefits, including improved customer service and operational efficiency, as well as enhanced risk management and compliance. Financial institutions can use Generative AI technologies to streamline their operations, improve decision-making, and provide a better client experience. As AI advances, the potential for GenAI in financial services will grow, creating exciting new prospects for development and innovation.

For advanced financial GenAI services, leverage EzInsights AI to streamline operations and enhance decision-making. Register today for a free trial and experience the future of finance, transforming how you manage and optimize financial services.

For more related blogs visit: EzInsights AI

0 notes

Text

Finance Write for Us: How to Contribute Your Financial Insights and Expertise

In today’s ever-evolving economic landscape, sharing reliable financial insights is essential for anyone interested in the world of finance. If you’re passionate about personal finance, investing, economics, or business, we invite you to share your expertise with a wider audience. we encourage seasoned professionals, finance enthusiasts, and aspiring writers alike to contribute valuable knowledge to our platform. If you’ve been searching for an opportunity to "finance write for us" you’re in the right place.

Why Write for Us?

We understand the importance of credible financial information. With the vast amount of content online, it can be difficult to find dependable resources on finance. By joining our platform, you’ll contribute to a community that values accuracy, practicality, and engagement. We accept articles on various topics, including but not limited to personal finance, investing, wealth management, economic trends, financial planning, and financial technology (fintech). When you “finance write for us,” you gain the opportunity to build your writing portfolio, grow your personal brand, and help readers make informed financial decisions.

Who Can Contribute?

Our platform is open to a wide range of writers, from finance professionals to passionate enthusiasts. Here’s who we’re looking for:

Financial Professionals – If you’re a certified financial advisor, accountant, or investment expert, your insights are invaluable to our readers. We welcome industry-backed expertise that can guide readers through complex financial matters.

Experienced Writers – For writers who specialize in finance or business topics, our platform is a great space to publish your work and reach a larger audience.

Passionate Enthusiasts – If you have a deep interest in finance and are eager to share your knowledge, we encourage you to "finance write for us." You don’t need to be a certified expert; simply bring your unique perspective and a commitment to accurate, well-researched content.

What Topics Do We Cover?

Our readers come to us for insightful, practical, and comprehensive finance content. Here’s a list of popular topics, although we’re open to unique ideas that might benefit our audience:

Personal Finance – Tips on budgeting, saving, and managing personal debt are always welcome.

Investing and Wealth Management – Articles on stocks, bonds, mutual funds, retirement planning, and investment strategies.

Financial Planning – Topics like tax planning, estate planning, and long-term financial goal setting are highly sought after.

Economic Trends – If you have insights on market trends, inflation, or the global economy, this is a perfect platform to share your analysis.

Financial Technology (Fintech) – The fintech industry is transforming finance; we welcome articles on new technologies like blockchain, cryptocurrency, and digital banking.

When you choose to “finance write for us,” you can tap into these subjects and much more. As long as your content offers clear, actionable insights and is well-researched, we’re interested in hearing from you.

Submission Guidelines

To maintain high standards and ensure our readers receive top-quality information, we have set submission guidelines. Here’s what we look for when you “finance write for us”:

Original Content – Articles should be 100% original and unpublished. We’re looking for fresh perspectives, not content that’s already widely available online.

Comprehensive Research – Financial information should be accurate and backed by research or professional expertise. If you’re making claims or providing specific advice, support it with credible sources.

Clear and Engaging Writing – We value clear, concise writing that avoids jargon whenever possible. Make your content accessible to readers of all financial knowledge levels.

Word Count – Our standard articles range from 800 to 1,500 words, allowing for depth and nuance in each topic. However, longer pieces are welcome if they add value to the reader.

Format – Use headings, subheadings, bullet points, and numbered lists to break up the text. A well-structured article is easier for readers to digest and more enjoyable to read.

Include Actionable Tips – Readers appreciate practical takeaways, so try to offer actionable advice they can implement in their financial lives.

Benefits of Writing for Us

When you “finance write for us,” you gain more than just a byline. Here are some benefits:

Expand Your Reach – Our platform has a wide readership, which means your insights will reach an engaged and interested audience.

Build Your Portfolio – Publishing with us is an excellent way to build your portfolio if you’re looking to grow as a finance writer.

Strengthen Your Personal Brand – With each article, you establish yourself as an authority in finance, gaining visibility and credibility in the industry.

Connect with a Community – By joining our network of contributors, you connect with others in the finance community who share your passion for financial knowledge and expertise.

Tips for Creating Standout Finance Articles

To stand out among our contributors, here are some tips for crafting compelling finance articles:

Keep It Relevant – Finance is a dynamic field. Stay current with market trends, tax laws, and new technologies to provide timely and relevant information.

Be Clear and Concise – Avoid overwhelming readers with technical jargon. Use straightforward language and clarify terms that might be unfamiliar.

Make It Engaging – Use real-life examples, case studies, or hypothetical scenarios to illustrate your points. Finance can be an abstract subject, so bring it to life with relatable examples.

Add Value with Practical Tips – Offer practical steps that readers can take to improve their financial situations. Whether it’s advice on investing or saving, make your tips actionable.

Optimize for SEO – Use keywords naturally throughout your article. By doing this, you’ll help your article reach more readers who are searching for finance information online.

How to Submit Your Article

If you're ready to “finance write for us,” submit your article directly through our submission portal. Be sure to include a short bio with relevant credentials and a link to your portfolio or website if available. After submitting, our editorial team will review your article and provide feedback or edits if needed. If accepted, your piece will be published on our platform, reaching thousands of readers looking for reliable finance advice.

Conclusion

Writing about finance allows you to share knowledge that can genuinely improve others’ lives, from helping them save money to making informed investments. Whether you’re an industry expert or a finance enthusiast, your perspective matters. When you “finance write for us,” you become part of a community that values accuracy, practicality, and reader engagement. So, bring your best insights, polish your writing, and let’s create impactful finance content together. We look forward to reading your submissions and sharing your expertise with our readers.

Ready to start? Contribute your first article today, and let’s make a difference in the world of finance!

0 notes

Text

Stock Market Analysis: Understanding Trends and Making Informed Decisions

Stock market analysis involves examining market data, company performance, and economic indicators to assess stock trends and value. This process includes technical analysis of price charts and fundamental analysis of financial statements. Accurate analysis helps investors make informed decisions, manage risk, and identify profitable opportunities in the stock market.

Trading stocks can be both rewarding and challenging. Whether you're a beginner or an experienced investor, having a solid strategy can enhance your chances of success. Here are some essential stock trading tips to consider.

Educate Yourself

Before diving into the stock market, take the time to educate yourself about basic concepts, terminologies, and market mechanics. Understanding how the stock market operates will help you make informed decisions.

Set Clear Goals

Define what you want to achieve with your trading. Are you looking for short-term gains, or are you focused on long-term investment? Setting clear, achievable goals will guide yourstock market analysis and help you stay disciplined.

Develop a Trading Plan

Create a comprehensive trading plan that outlines your strategy, risk tolerance, and the criteria for entering and exiting trades. A well-defined plan helps reduce emotional decision-making and keeps you focused on your goals.

Diversify Your Portfolio

Don’t put all your eggs in one basket. Diversifying your portfolio across different sectors and asset classes can reduce risk and increase potential returns. Consider including stocks, bonds, and other investment vehicles.

Use Stop-Loss Orders

A stop-loss order helps protect your investment by automatically selling a stock when it reaches a certain price. This tool can limit your losses and is particularly useful in volatile markets.

Stay Informed

Keep up with financial news and market trends. Economic indicators, earnings reports, and geopolitical events can significantly impact stock prices. Being informed will help you make timely and relevant decisions.

Be Patient

trading signals not a get-rich-quick scheme. Successful traders know the importance of patience. Avoid impulsive trades based on fear or greed. Stick to your trading plan and allow your investments time to grow.

Practice Risk Management

Always assess the risk involved in any trade. Never risk more than you can afford to lose, and consider using tools like position sizing to manage your exposure. A disciplined approach to risk can help preserve your capital.

Keep Emotions in Check

Emotional trading often leads to mistakes. Fear and greed can cloud judgment, causing you to deviate from your trading plan. Practice mindfulness and develop a routine to help manage your emotions.

Review and Adjust

Regularly review your trades and overall portfolio performance. Analyze what worked and what didn’t, and be willing to adjust your strategy based on your findings. Continuous improvement is key to long-term success.

Stock trading requires a blend of knowledge, strategy, and discipline. By educating yourself, setting clear goals, and following these tips, you can enhance your trading experience and increase your chances of success in the stock market. Remember, patience and persistence are vital in this journey. Happy trading!

Read for more info:

stock trading tips

market trends

investment tools

1 note

·

View note

Text

AI Market Predictions: Shaping the Future of Financial Insights

Artificial Intelligence (AI) is transforming the landscape of financial insights, offering a revolutionary approach to analyzing stock markets and shaping investment strategies. With its ability to process massive amounts of data in real time, AI market predictions have become a crucial tool for traders and investors alike. By leveraging machine learning and predictive algorithms, AI helps anticipate market trends, making it easier to make informed decisions.

The Role of AI in Stock Market Analysis

Stock market analysis has traditionally relied on human expertise and historical data. However, AI takes this a step further by using advanced data processing techniques to identify patterns that may not be immediately visible to human analysts. Platforms like Trending Neurons utilize AI to analyze vast amounts of financial data, providing traders with more accurate and timely insights. This level of analysis allows for deeper market understanding, ultimately improving investment outcomes.

Enhancing Trading Intelligence with AI

AI has significantly improved trading intelligence by automating the analysis process and eliminating human biases. AI-powered tools can track market shifts, evaluate risks, and make real-time recommendations. As a result, traders can respond more quickly to market changes, seizing profitable opportunities and avoiding potential losses. The integration of AI into trading platforms has made it possible to continuously refine trading strategies, ensuring more intelligent and data-driven decisions.

Investment Strategies Powered by AI

Investment strategies are no longer solely based on historical performance and manual analysis. AI-driven models can create tailored investment strategies by evaluating individual risk profiles and market conditions. These intelligent systems can monitor global financial indicators, geopolitics, and social trends, enabling more comprehensive and agile investment approaches. For those looking to optimize their portfolios, AI offers dynamic solutions that adjust to both short-term market fluctuations and long-term financial goals.

Conclusion: AI as the Future of Finance AI is revolutionizing the way we approach financial markets, offering unprecedented levels of accuracy in stock market analysis and trading intelligence. With AI-driven investment strategies becoming the norm, tools like those provided by Trending Neurons are essential for staying ahead of the curve. As AI continues to evolve, its role in financial insights will only expand, ensuring smarter, more efficient market predictions and enhanced trading opportunities.

0 notes

Text

Unlock Financial Clarity and Gain Critical Insights with Moolamore

Struggling to grasp your company's inflows and outflows due to complicated and time-consuming reports that leave you feeling more perplexed than confident? Finding it difficult to gain the critical insights needed to position your SME company for long-term and sustainable success?

Achieving financial clarity is critical for every organization looking to thrive in today's competitive environment. Moolamore is a cutting-edge financial management solution that gives businesses the information they need to make informed decisions, maximize cash flow, and achieve long-term success. Here's how Moolamore can smoothly provide financial clarity and key insights.

#financial clarity#financial insights#moolamore#financial management platform#data-driven financial insights#personal finance management

0 notes

Text

Understanding the Economic Factors Behind Mortgage Rate Fluctuations

As someone considering buying or selling a home, you’re likely keeping a close eye on mortgage rates and wondering about the future. One key factor influencing these rates is the Federal Funds Rate, which affects the cost for banks to borrow money from each other. While the Federal Reserve (the Fed) doesn’t set mortgage rates directly, it does control the Federal Funds Rate.

The interplay between these rates is why many are eagerly awaiting any potential changes from the Fed. A reduction in the Federal Funds Rate could put downward pressure on mortgage rates. With the Fed meeting next week, here are three crucial metrics they’ll review:

1. The Rate of Inflation

Inflation has been a hot topic lately, affecting the prices of everyday goods. The Fed aims to bring inflation back down to 2%. Currently, inflation remains above this target but is showing signs of improvement (see graph below).

2. How Many Jobs the Economy Is Adding

The Fed monitors monthly job creation closely. They aim to see a slowdown in job growth before making any changes to the Federal Funds Rate. Fewer new jobs signal a still-strong but slightly cooling economy, aligning with their goal. This trend seems to be emerging now. As Inman notes:

“. . . the Bureau of Labor Statistics reported that employers added fewer jobs in April and May than previously thought and that hiring by private companies was sluggish in June.”

So, while employers are still creating jobs, the pace has slowed compared to before. This suggests the economy is cooling down from its previous overheated state, which is a positive sign for the Fed.

3. The Unemployment Rate

The unemployment rate reflects the percentage of people actively seeking work but unable to find jobs. A low rate indicates a healthy job market with many people employed, which is generally positive. However, it can also contribute to higher inflation, as increased employment leads to more spending and higher prices. Currently, the unemployment rate is low but has been gradually rising over the past few months (see graph below).

It might seem tough, but a consistently rising unemployment rate is a key indicator the Fed looks for before considering a cut to the Federal Funds Rate. A higher unemployment rate typically signals reduced spending, which can help bring inflation under control.

What Does This Mean Moving Forward?

Mortgage rates are expected to remain volatile in the near future. However, the current economic trends are moving in the direction the Fed desires. Despite this, it’s unlikely they’ll lower the Federal Funds Rate during their upcoming meeting. Jerome Powell, Chair of the Federal Reserve, recently stated:

“We want to be more confident that inflation is moving sustainably down toward 2% before we start the process of reducing or loosening policy.”

We're starting to see early signs of economic trends, but the Fed needs more data and time to be confident this trend will continue. If the direction holds, experts predict a 96.1% chance that the Fed will lower the Federal Funds Rate at their September meeting, according to the CME FedWatch Tool.

Keep in mind, while the Fed doesn’t set mortgage rates directly, a cut in the Federal Funds Rate generally leads to lower mortgage rates.

However, timing can be affected by new economic reports, global events, and other factors. That’s why trying to time the market is usually not advisable.

Bottom Line

Recent economic data may signal that hope is on the horizon for mortgage rates. Let’s connect so you have an expert to keep you up to date on the latest trends and what they mean for you.

Read more

#mortgage rate fluctuations#economic factors#interest rates#housing market#mortgage trends#real estate economics#financial insights#realestate

1 note

·

View note

Text

Free Financial Webinars on Wills, Pensions and Investments | Wills & Trusts Wealth

Join our free webinars for expert financial insights on wills, pensions, and investments. Learn from industry experts David Batchelor, Alison Parker, and Dean Hobbs. Get practical advice and speak one-on-one with financial specialists from the comfort of your home. Secure your financial future with Wills & Trusts Wealth Management.

#free financial webinars#wills and pensions#investment advice#financial insights#Wills & Trusts Wealth#expert financial speakers#secure financial future#online financial seminars#UK financial planning

1 note

·

View note

Text

Comprehensive Digital Currency and Market Analysis

Explore in-depth insights on major digital currencies like Bitcoin and Ethereum, alongside stock indices such as Dow Jones and Nasdaq 100. Discover detailed moving averages, indicators, and summaries for each asset, providing a clear perspective on current market trends and investment opportunities.

#Digital Currencies#Bitcoin Analysis#Ethereum Insights#Stock Indices#Dow Jones#Nasdaq 100#Market Trends#Investment Opportunities#Moving Averages#Market Indicators#Financial Summaries#Cryptocurrency Trends#Stock Market Analysis#Investment Strategies#Financial Insights#Trading Recommendations#Crypto Market#Stock Trading#Market Analysis#Investment Tips

0 notes

Text

Trading Signals

Step into the future of trading with the IndieCATR App for Trade Signals! Unleash the power of the first mobile-only platform offering AI-based timing signals for everyone. Elevate your trading experience and align yourself with professional technical traders for unparalleled success.

Embark on a revolutionary journey as we introduce a groundbreaking upgrade, seamlessly integrating cutting-edge technologies, including artificial intelligence, machine learning, and extensive backtesting. The IndieCATR App's fully-automated daily trading signals redefine the trading landscape, providing a gateway for the average trader to enhance accuracy and make well-informed entries and exits. This upgrade goes beyond, introducing refined risk management strategies, ensuring a comprehensive and user-friendly trading experience.

Our vision is clear—to empower amateur traders with the same technical signal analysis capabilities enjoyed by high-performance and professional traders worldwide. We believe in leveling the playing field, making advanced trading strategies accessible to everyone.

Key Features: • Mobile-Only Platform: Access AI-based timing signals conveniently on your mobile device. • Professional Insights: Align with the strategies of high-performance technical traders. • Cutting-Edge Technologies: Benefit from AI, machine learning, and extensive backtesting. • Fully-Automated Signals: Daily signals for accurate entries and exits, empowering every trader. • Risk Management: Refined strategies for a comprehensive and secure trading experience. Know more here Trading Signals

The IndieCATR App is not just an upgrade; it's a revolution in democratizing trading expertise. Join us in reshaping the future of trading—download now and unlock the potential for success in every trade!

#Trading Signals#Financial Insights#Market Alerts#Investment App#Stock Alerts#Crypto Signals#AI Trading#Market Predictions#Trading Tips#Market Analysis#Investment Signals#Algorithmic Insights#Smart Investing#Asset Signals#Stock Tips#Cryptocurrency Alerts#Market Guidance#Investment Tools

0 notes

Text

Balancing the Technicals & Fundamentals in Investing with Mr. Vivek Mashrani

Join Mr. Vivek Mashrani in this engaging course as he unveils the art of Tecno-Funda investing - a fusion of technical and fundamental analysis that can revolutionize your approach to investment. This course goes beyond the conventional methods, teaching you the power of patterns and analysis, optimal entry points identification, navigation in investments, and a deeper understanding of the market. Get ready to enhance your investing skills and unleash your inner investing guru under the guidance of an industry expert with a wealth of experience in both Technical and Fundamental analysis. Let Mr. Vivek Mashrani empower you with the right financial insights to make informed investment decisions and elevate your investment game to new heights.

0 notes

Text

when a fandom person links to their kofi/patreon/etc i always click on the link to go and see how much money they're making doing things that i've stupidly been doing for free

#i know these are the days of Everyone Needs A Side-Hustle but like... it feels odd when it's a fandom thing doesn't it?#because thousands of people do the same thing for free and plenty of them could use the extra cash#but if everyone charged for their fanfic/art (handwave any legalities for a moment) there'd be no fandom at all.#yet professional fans who write official tie-in novels (etc) has always been a thing hasn't it?#so there's always been someone making a career from everyone else's hobby.#i remember someone wanting a living wage for review a tv show and thinking 'but what makes YOUR reviews so valuable?'#'we'd probably miss them if you stopped but we managed just fine before you were doing it so...'#not just fandom i suppose - see also people who want paid for tweeting about things they choose to tweet about.#'pay me for my emotional labour!' maybe stop doing it for free then?#and how many of us could actually afford to financially support every creative type person they like online?#idk maybe i'm just really gullible for not charging £2 per meme and £5 per 2000 words of pornographic fanfiction.#50p per tweet; for an extra 25p i will add an emoji of your choice. don't forget to like comment and subscribe.#ring that bell to be notified of my next upload! today's concerned tweet thread is sponsored by lockheed martin!#i don't even have tumblr tipping turned on (is that still a thing?) why am i like this#the punchline of this post is availble to my higher tier patrons. it is very funny and insightful! for only £20 a month or more!

5 notes

·

View notes