#FinancialConsulting

Explore tagged Tumblr posts

Text

Best Outsourced Accounting Services in the UAE: Elevating Financial Efficiency

Are you feeling overwhelmed by a mountain of financial paperwork? At Nordholm, our Best Outsourced Accounting Services in the UAE act as a beacon, transforming financial challenges into smooth sailing. Let’s say you’re tired of chasing after invoices, and you’re drowning in piles of numbers.

Our Outsourcing Accounting isn't just about crunching numbers; it's your pass to a finely tuned financial machine. Our services streamline your processes with precision, handling bookkeeping, payroll, and invoicing expertly. Picture financial co-pilots guiding you through management intricacies while preserving your sanity.

Our services go beyond mere outsourcing; they're about leveraging expertise. Access a pool of accounting virtuosos armed with cutting-edge tools. Uncovering insights that have the power to revolutionize your business strategies, they bring numbers to life.

Their expertise extends beyond balance sheets; they navigate UAE's financial regulations effortlessly. Bid adieu to sleepless nights over regulatory changes. With their guidance, navigating financial rules becomes as smooth as sailing on a calm sea.

Our outsourcing isn’t just about efficiency; it's a cost-effective wizardry that slashes expenses. Say farewell to hefty in-house costs—from salaries to software expenses. Outsourcing simplifies your financial landscape, eradicating worries about training expenses or software upgrades.

At Nordholm, we merge expertise with knowledge to help you meet UAE's accounting obligations under International Financial Reporting Standards (IFRS).

Our services encompass the preparation and maintenance of daily transactions, including:

Accounts Payable

Bank Reconciliation

General Bookkeeping Duties

Profit & Loss Statement

Accounts Receivable

End of Service Benefit

Payroll Management

Financial Reporting and Analysis

Expert Accounting Advice

#OutsourcedAccounting#FinancialManagement#AccountingServices#BusinessSolutions#FinancialExpertise#BookkeepingServices#BusinessInsights#FinancialConsulting

8 notes

·

View notes

Text

Trust in our solutions at MFiling.com to make tax season a breeze. Contact us today!

#TaxSolutions#ConsultingExperts#MFiling#TaxAdvice#TaxServices#TaxSeason#FinancialConsulting#Taxation#FinancialSolutions#TaxProfessionals#AuditServices#CorporateTaxation#TaxPreparation#TaxCompliance#FinanceExperts#IncomeTax#SmallBusinessTax#AccountingServices#TaxPlanning#TaxStrategies#TaxHelp#TaxationLaw#BusinessFinance#FinancialFreedom#BusinessStrategy#MoneyMatters#InvestingTips#FinancialGoals#TaxTips#SmallBusiness

2 notes

·

View notes

Text

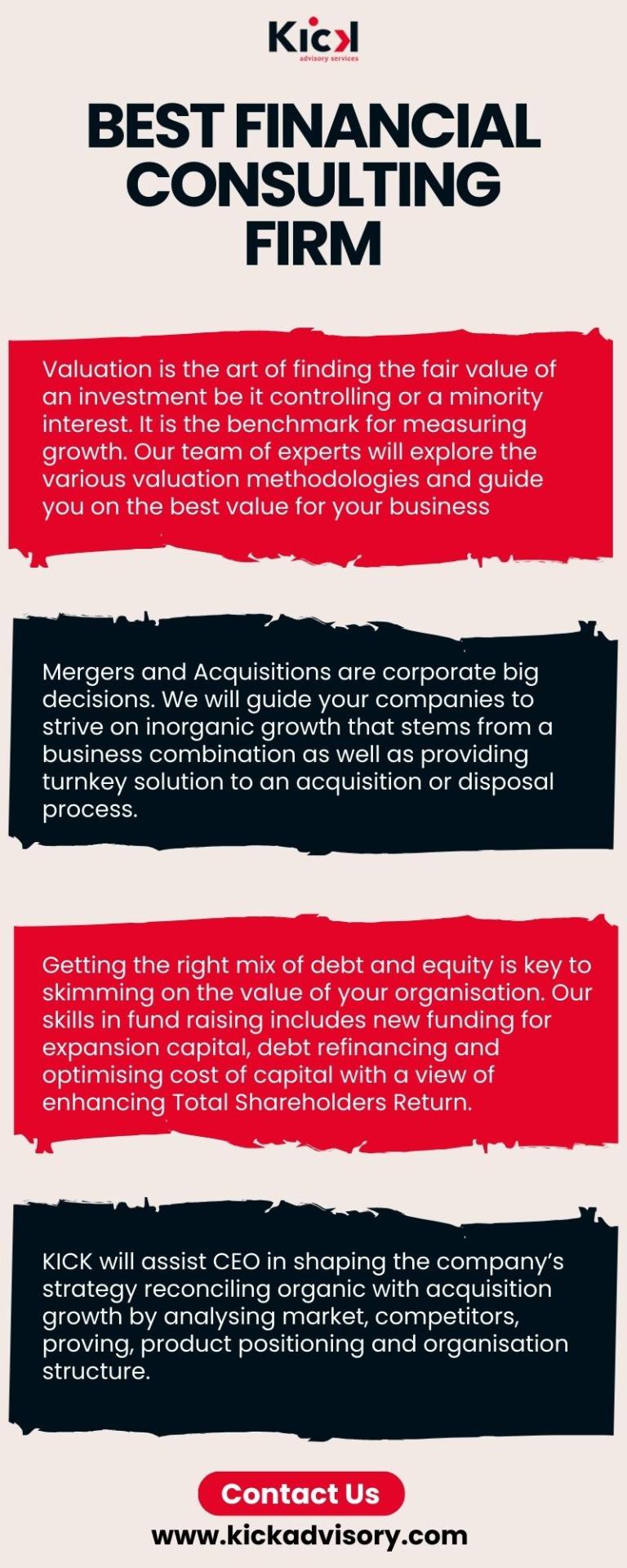

Best Financial Consulting Firm- KICK Advisory

Discover excellence in financial consulting Firm with KICK Advisory - Your trusted partner for top-tier financial solutions. Unlock growth, optimize strategies, and secure your financial future with one of the best financial consulting firms at your side. Explore our expert services today

1 note

·

View note

Text

CFO Services for CPG Companies: Top 5 Financial Strategies that Foster Growth

The consumer packaged goods (CPG) industry is in growth mode, but scaling profitably is no easy feat. With rising demand comes rising pressure, from supply chain disruptions to inflation, along with retail expansion to product proliferation. Canadian and North American CPG brands are especially challenged by complex cost structures and thin margins.

That’s where strategic CFO services for CPG companies come in. Whether you're scaling into retail, expanding DTC, or preparing for funding, a full-time CFO isn’t always the answer. A fractional CFO for CPG brands can deliver big results without the full-time price tag.

Here are five proven strategies where CFOs (especially fractional) bring immediate impact and long-term growth.

1. Cash Flow Is King: Forecasting for Inventory-Heavy Businesses

Why CPG brands can’t rely on generic cash flow models

CPG companies often spend heavily on packaging, raw materials, and production before a single product hits the shelf. And cash flow gets even tighter when you're waiting on retail payments.

How fractional CFOs improve cash visibility and timing

Implementing a rolling 13-week cash flow forecast

Aligning demand planning with supplier payment terms

Building scenario models for best- and worst-case inventory needs

This helps brands avoid cash crunches, even during seasonal surges or launches.

2. Price Intelligently: SKU-Level Profitability and Margin Analysis

Not all SKUs are created equal

Many brands keep selling products that lose money without realizing it. CFOs help pinpoint exactly which SKUs are pulling their weight and which ones are not.

Tools CFOs use to protect your margins

Landed cost tracking (by SKU, not just by category)

True margin analysis per product line

Bundling strategies that preserve profitability

With fractional CFO services, you get the data you need to raise prices strategically, not randomly.

3. Maximize ROI on Trade Spend and Promotions

The hidden cost of discounts and chargebacks in CPG

Trade spend often becomes a black hole with too many discounts and too little accountability.

What CFO services track (and improve)

Promotion planning with clear ROI targets

Post-promotion audits to see what worked (and what didn’t)

Chargeback reduction strategies through data tracking

For any brand spending 15% or more on trade promotions, this is non-negotiable.

4. Get Funding-Ready: Financial Modeling and Investor Decks

What investors want from CPG brands in 2025

Today’s investors expect sharp financials, not just pretty packaging.

How CFOs prep your brand for due diligence

Clear burn rate and cash runway metrics

Forecasts built for scale scenarios

Data-backed investor decks and valuations

Knowledge of Canadian grants like SR&ED and IRAP

CFO consulting services help you speak the language investors want to hear.

5. Build Systems That Scale: From QuickBooks to ERP

When financial ops break down as CPG brands grow

What worked at $1M in revenue won't work at $10M. Systems, processes, and people need structure.

How CFOs align the team

Cleaning up your chart of accounts

Integrating tools (Shopify, Amazon, ERP)

Creating dashboards that connect marketing, ops, and finance

This alignment is critical to scale without chaos.

Conclusion: Structure Fuels Scale, Not Just Sales

“CPG companies rarely fail from lack of demand. They fail from lack of financial clarity.”

Whether you need budgeting support, trade-spend analysis, or help prepping for funding, the right CFO services for CPG companies make all the difference. And for most growing brands, a fractional CFO for CPG is the smartest place to start.

Eightx offers the best fractional CFO services for ambitious Canadian CPG brands.

Book your free consultation today at eightx.co and learn how we can help you grow with more cash and less stress.

#CFOservices#CPGcompanies#financialstrategies#businessgrowth#CPGstrategy#FinancialConsulting#FinancialAdvisory#FinanceExpert#CorporateFinance

0 notes

Text

Corporate Tax Consultancy – Business & Beyond

Grasping taxes might be difficult, particularly when you are operating a business in the UAE. That is why Business & Beyond provides Corporate Tax Consultancy services to assist you in grasping, handling, and complying with all tax regulations without hassle. In the UAE, corporate tax is unfamiliar to most businesses. Most companies do not know how it operates or what they should do. That is where we are here to help. Business & Beyond simplifies corporate tax. We break down the process in a manner that you can comprehend and assist you with everything in the correct manner.

What Is Corporate Tax?

Corporate tax refers to a tax that companies are required to pay on the profit they earn. The UAE has brought in corporate tax to ensure businesses contribute to the economic development of the country. If you own a company in the UAE, you need to understand when and how you should pay your taxes appropriately.

How We Can Help At Business & Beyond, our Corporate Tax Consultancy services assist you at each step. We provide you with clear, simple, and dependable counsel so you can concentrate on expanding your business while we take care of the tax aspect.

Here's how we can assist you: 1) Get Familiar with the Tax Law: We make the UAE corporate tax law easy to comprehend. 2) Check Whether You Have to Pay Tax: We assist you in knowing whether your business is required to pay corporate tax. 3) File Your Tax Returns: We do all the paper work and ensure your tax is filed on time. 4) Tax Planning: We assist you in planning your finances so that you can save legally. 5) Stay Informed: Tax laws can change, but we always keep you updated on the latest developments.

Why Business & Beyond? There are a lot of corporate tax consultants in the UAE, but we are different because we make things simple. We don't complicate the process with big words or difficult language. We provide honest advice, quick service, and complete support.

Our staff is well-versed in UAE tax law, and we consult with all kinds of companies—small and medium-sized businesses, big firms, Free Zone companies, and so forth.

The Benefit of Corporate Tax Consultancy When you opt for our corporate tax advisory, you are assured of peace. You don't need to worry about delayed submissions or additional fines. We ensure that your tax is always done the right way. At Business & Beyond, what we aim for is to simplify your business life.

If you need Corporate Tax Consultancy in the UAE, we are here to assist you in understanding, handling, and planning your taxes hassle-free.

#CorporateTax#TaxConsultancy#BusinessAdvisory#TaxPlanning#BusinessGrowth#FinancialConsulting#BusinessAndBeyond

0 notes

Text

At Black Box Consultancy, we specialize in Corporate Financial Services tailored to Ontario businesses. From strategic planning to financial restructuring, we help you navigate complexity and drive success.

Let’s turn challenges into opportunities — together. Visit: https://blackboxinc.ca/services/corporate-financial-services/ Call us: (519) 376 6464

#BlackBoxConsultancy#CorporateFinance#OntarioBusiness#FinancialConsulting#FinanceStrategy#OntarioFinance#FinancialSolutions

0 notes

Text

Our expert financial consulting services help you plan, grow, and protect your wealth with confidence. Partner with Syriac CPA for personalized strategies that work! 💼✅

💰📈Looking to make smarter financial decisions? 💡📊

#FinancialConsulting#CPAServices#SyriacCPA#WealthPlanning#SmartFinance#BusinessConsulting#TaxAndAccounting#FinancialAdvisor

0 notes

Text

Our expert financial consulting services help you plan, grow, and protect your wealth with confidence. Partner with Syriac CPA for personalized strategies that work! 💼✅

Looking to make smarter financial decisions? 💡📊

#FinancialConsulting#CPAServices#SyriacCPA#WealthPlanning#SmartFinance#BusinessConsulting#TaxAndAccounting#FinancialAdvisor

0 notes

Text

Payroll Made Simple: Let Me Take the Stress Off Your Plate

Payroll can be one of the most stressful tasks for a business owner. Between calculating hours, making sure taxes are right, and ensuring everyone gets paid on time, it’s no surprise that it can feel like a full-time job on top of your full-time job. 😵💫

But guess what? It doesn’t have to be that way.

Here’s why professional payroll management can save you time, money, and headaches:

Accuracy: I’ll make sure your employees are paid correctly, with all the right deductions and taxes taken out.

Timeliness: No more worrying about missing deadlines. Payroll will be done on time, every time.

Compliance: Keep up with ever-changing labor laws and tax regulations to avoid fines and penalties.

Peace of Mind: Knowing that your payroll is in good hands means less stress for you and more time to focus on your business.

Let me take payroll off your plate so you can focus on growing your business with confidence.

📩 DM me to get started on streamlining your payroll process today!

#PayrollMadeSimple#BusinessEfficiency#AdminSupport#SmallBizTips#ConsultingServices#SaveTime#WorkSmart#FinancialConsulting

0 notes

Text

MBA in Finance: Unlocking Lucrative Careers and Elite Education Paths in India

In today’s competitive job market, earning an MBA in Finance isn’t just a step forward—it’s a strategic leap into the heart of global business. With the financial world growing more complex and interconnected than ever before, finance professionals with advanced management training are in high demand across industries.

From investment banking and corporate finance to fintech and wealth management, an MBA in Finance can unlock doors to lucrative roles, global opportunities, and career acceleration. But what exactly makes this specialization so powerful—and what can students really expect from the journey?

Let’s explore the career prospects, salary expectations, and top colleges in India for aspiring MBA Finance professionals, drawing on expert insights from Edunet Educare, one of India’s emerging educational guidance platforms.

Why Choose an MBA in Finance?

Finance is the backbone of every organization. From budgeting and investment planning to risk analysis and financial reporting, companies need finance professionals who not only understand numbers but can interpret them for smart decision-making.

An MBA in Finance equips you with deep knowledge in areas like:

Financial modeling and forecasting

Capital markets

Mergers & acquisitions

Corporate valuation

Risk and portfolio management

International finance

And it’s not just technical skills—finance MBA programs also hone your leadership, analytical thinking, communication, and strategic decision-making capabilities.

Whether you're aiming to become a CFO, work in private equity, or launch your own fintech venture, this degree builds a solid foundation.

Career Prospects After an MBA in Finance

The career options after completing an MBA in Finance are both diverse and rewarding. Some of the most popular roles include:

1. Investment Banker

One of the highest-paying roles in the finance world. Investment bankers help companies raise capital, manage IPOs, and guide mergers and acquisitions.

2. Financial Analyst

Financial analysts evaluate data to help businesses make informed decisions. These roles are available in investment firms, banks, corporations, and even startups.

3. Corporate Finance Manager

Focuses on managing a company’s financial health, including budgeting, forecasting, and identifying cost-saving opportunities.

4. Risk Manager

Identifies and minimizes risks associated with financial decisions and market volatility. This role is crucial in banking and insurance sectors.

5. Portfolio Manager / Asset Manager

Manages investment portfolios for individuals or institutions, making strategic decisions to maximize returns.

6. Financial Consultant / Advisor

Helps clients plan for financial success, including retirement, taxes, investments, and estate planning.

7. Chief Financial Officer (CFO)

The ultimate leadership role in finance, overseeing a company’s entire financial strategy and performance.

With industries like banking, insurance, manufacturing, IT, and healthcare expanding rapidly, the demand for finance MBAs continues to grow.

Salary Expectations in India

One of the most attractive aspects of an MBA in Finance is the earning potential. Salaries vary depending on experience, company size, and location, but here’s a general breakdown in India:

Entry-Level (0–2 years): ₹6 – ₹10 LPA

Mid-Level (3–7 years): ₹12 – ₹20 LPA

Senior-Level (8+ years): ₹25 LPA and above

Top recruiters include Goldman Sachs, JPMorgan Chase, ICICI Bank, HDFC, Deloitte, PwC, KPMG, and Tata Capital, among others.

For graduates from top-tier institutions, starting packages can even reach ₹20–25 LPA right out of campus placements.

Top Colleges in India for MBA in Finance

If you're serious about a finance career, where you study matters. Here are some of the top institutions offering MBA (Finance) programs in India:

1. IIM Ahmedabad (IIMA)

Renowned for its rigorous academics and unmatched placement record. Finance grads from IIMA often land roles at top global banks and consulting firms.

2. IIM Bangalore (IIMB)

Another premier IIM known for finance specialization and strong alumni network in the banking sector.

3. XLRI Jamshedpur

Offers a PGDM in Business Management with a strong focus on financial management and ethics.

4. FMS Delhi

One of the most cost-effective B-schools with ROI among the best in the country.

5. SPJIMR Mumbai

Excellent industry integration and electives focused on financial services and fintech.

6. JBIMS Mumbai

Centrally located in India’s financial capital—ideal for internships and exposure.

7. ISB Hyderabad / Mohali

Though a one-year program, ISB’s PGPM is finance-heavy and recognized globally.

8. NMIMS, Symbiosis (SIBM), IMT Ghaziabad

Top private institutions with strong finance curricula and placement support.

Each of these institutions not only provides theoretical knowledge but also emphasizes practical exposure, with case studies, live projects, and industry interaction.

The Global Edge: MBA in Finance with International Scope

The beauty of finance is that its principles are universal. An MBA in Finance from a reputed Indian institute opens doors to global careers in places like:

Dubai

Singapore

London

New York

Toronto

Indian finance grads are now sought after in investment firms, global banks, multinational corporations, and consulting companies around the world.

Is an MBA in Finance Right for You?

If you:

✅ Enjoy working with numbers ✅ Have strong analytical skills ✅ Are detail-oriented ✅ Want a high-paying, stable career ✅ Aspire for leadership in business

… then an MBA in Finance is an ideal choice.

Still unsure? Edunet Educare provides personalized career counseling to help you evaluate your aptitude, goals, and the right programs to match your aspirations.

Final Thoughts

In a world driven by financial intelligence, an MBA in Finance isn’t just a degree—it’s an investment in your future. With endless career paths, lucrative salaries, and opportunities across sectors and borders, this specialization continues to attract ambitious professionals from all walks of life.

So if you’re ready to take the plunge into the dynamic world of finance, start by choosing the right course—and the right guidance.

👉 Learn more from Edunet Educare and set your career in motion today.

#MBAinFinance#FinanceCareers#BusinessEducationIndia#TopBschoolsIndia#FinanceJobs#MBAAdmissions#FinancialConsulting#InvestmentBanking#CareerInFinance#EducationGuidance#EdunetEducare#FinanceSalaryIndia#TopCollegesForMBA#StudyFinance#PostgraduatePrograms

0 notes

Text

Let's Boost Your Business with FundWise! 💼

FundWise thinks fresh ideas lead to great work! We've spent over 10 years helping clients get clear on finances, grow , and handle risks.

Our team knows their stuff when it comes to Provident Funds, Insurance, and Taxes. We can help you move your PF, take money out, check your coverage, and file taxes without the hassle. We give each client personal attention and get real results.

We also show you how to invest in mutual funds. We can make your portfolio better tell you how it's doing, and help you pay less in taxes — so you can grow with confidence.

📍Come see us in Nashik or Thane, or text us on WhatsApp at +91 9112013515 / +91 7738758601.

📧 Email us at [email protected]

🌐 Find out more: https://fund-wise.in/

At FundWise, we want to see you succeed ! 🚀

#FundWise#FinancialConsulting#TaxFiling#PFServices#InsuranceAdvice#MutualFunds#NashikBusiness#ThaneBusiness#CodingBit#BusinessSupportIndia

0 notes

Text

Unveiling the Power of Outsourced Accounting Services by Nordholm

Are you submerged in a sea of financial paperwork, desperately seeking a lifeboat? We offer a beacon of hope through our unparalleled Outsourced Accounting and Bookkeeping Services in the Dubai. No more chasing invoices or drowning in numerical chaos – we transform financial challenges into a seamless journey.

Beyond mere number-crunching, our services act as the catalyst for your financial engine's optimal performance. Imagine having financial co-pilots manoeuvring you through intricate management processes, ensuring sanity amidst complexity.

We're not just outsourcing; we're elevating your financial strategies with expert precision. Access a pool of accounting virtuosos armed with cutting-edge tools. These experts don't just handle your books; they breathe life into numbers, revealing insights that revolutionize your business strategies.

Navigating UAE's financial regulations becomes a breeze with our seasoned expertise. Bid adieu to sleepless nights over regulatory changes. Our guidance ensures smooth sailing through the evolving financial landscape, ensuring compliance without hassle.

Outsourcing Accounting with us isn't just about efficiency; it's a wizardry that slashes expenses. Say goodbye to in-house costs – from salaries to software expenses. We simplify your financial landscape, eliminating worries about training or software upgrades. Combine our expertise with comprehensive knowledge to meet the UAE's Accounting and Bookkeeping requirements aligned with International Financial Reporting Standards (IFRS).

Our Services

Accounts Payable

Bank Reconciliation

General Bookkeeping Duties

Profit & Loss Statement

Accounts Receivable

End of Service Benefits

Payroll Management

Financial Reporting and Analysis

Expert Accounting Advice

Advantages of choosing us for Outsourced Accounting:

Timely Service: High-quality service delivered promptly.

Stability: Your data and accounts are secure with a licensed service provider.

Affordable & Cost-Effective: Small and medium enterprises benefit from cost-effective solutions without the overheads of hiring in-house accountants.

Outsourcing your Accounting and Bookkeeping needs to Nordholm is the gateway to financial optimization in the Dubai. We grasp the intricacies of the local business terrain, offering expertise that goes beyond numerical figures. Enhance your financial efficacy – opt for Nordholm as your ally in maneuvering the intricate accounting complexities within the UAE.

#OutsourcedAccounting#FinancialManagement#AccountingServices#BusinessSolutions#FinancialExpertise#BookkeepingServices#BusinessInsights#FinancialConsulting

5 notes

·

View notes

Text

Afsar Ebrahim- Executive Director, Kick Advisory | Corporate Strategist

Afsar Ebrahim is a skilled Corporate Strategist with over 25 years of experience. He helps businesses grow by creating smart strategies and solving challenges. As the Founding Partner of KICK Advisory Services, he works with companies worldwide, guiding them toward success. With his deep knowledge and experience, Afsar specializes in planning, decision-making, and finding the best solutions to help businesses achieve their goals and build a strong future.

0 notes

Text

Investment Advisory Services in Mauritius

KICK Advisory offers premier investment advisory services in Mauritius. With a deep understanding of the local market and global financial trends, we provide expert guidance to clients seeking to optimize their investments. Our team leverages industry insights to craft personalized strategies for wealth growth and financial security.

1 note

·

View note

Text

Struggling to keep your financials organized? 📊

Our NetSuite Accounting Consultants at Codinix are here to help you take control of your books with precision and clarity. From automating core accounting tasks to customizing reports and ensuring compliance, we make sure your financial systems run smoothly.

✅ General Ledger & Journal Entries ✅ Accounts Payable/Receivable ✅ Financial Reporting & Dashboards ✅ Tax Compliance & Audit Readiness

Let’s simplify your accounting with the power of NetSuite and the expertise of Codinix.

Call us: ☎️ +1 (771) 333-2222 | +91 (881) 485-2222 Email us: ✉️ [email protected] Visit Us: 🌐 www.codinix.com

0 notes

Text

Corporate Tax Services in UAE /BMS Auditing /Essential Solutions for Modern Businesses

BMS Auditing is one of the most recommended firms to provide Corporate Tax services in the UAE. BMS provides professional and effective services concerning Corporate Tax. Flourishing for over a decade, BMS has a history of working with several governmental, non-governmental, public and private organizations with a great deal of expertise and extensive knowledge. BMS offers robust advisory on assessing the compliance requirements of the businesses.

In the UAE, businesses are required to comply with tax laws and regulations set by the government. Corporate tax will be levied at 0% for taxable income up to AED 375,000 and 9% for taxable income over AED 375,000. Large multinational corporations that fulfill particular requirements related to 'Pillar Two' of the OECD Base Erosion and Profit Shifting initiative will be taxed at a different rate. Corporate tax services help companies to navigate this new complex tax system and ensure compliance with tax regulations.

Some of the benefits of using corporate tax services in the UAE include:

Accurate calculation and filing of taxes

Minimization of tax liability through tax planning

Compliance with tax laws and regulations

Avoidance of penalties for non-compliance

Access to professional advice on tax-related matters

In addition, corporate tax services can also help businesses make informed decisions by providing insights into tax implications of business transactions. FTA Approved Corporate tax consultants in Dubai such as BMS Auditing can help companies to prepare for corporate tax by offering tax assessment and tax advisory services.

Since the UAE Corporate Tax will be in effect from June this year and businesses across the UAE are preparing for it by strengthening their strategies and goals, also staying compliant with the tax regulations. A business is required to prepare and file only one UAE corporate tax return and other related supporting schedules with the FTA for each tax period.

0 notes