#Financialoperations

Explore tagged Tumblr posts

Text

Healthcare data is exploding: EHRs, imaging, AI training data, and real-time monitoring. This growth fuels innovation but can also balloon your cloud bills overnight. ITTStar’s FinOps team helps healthcare orgs right-size storage, move cold data to lower-cost options, and remove waste. We build predictive models to forecast future data storage spend, too. Your teams get freedom to innovate, without the CFO getting surprise invoices. Turn your data growth into a managed, predictable investment. Link: https://ittstar.com/financial-operations-solutions-finops

#ittstar#aws#financialoperations#cloudforhealthcare#virtualhealthcare#healthcaredata#cloudcostoptimization#finops#finopssolutions

0 notes

Text

Why Businesses Choose to Outsource Receivables for Financial Efficiency

Modern businesses are increasingly turning to finance and accounting outsourcing to streamline operations and cut costs. One of the most strategic areas in this shift is the decision to outsource receivables, a move that ensures better cash flow, reduced bad debt, and quicker collections. By outsourcing, companies gain access to specialized teams who manage invoicing, follow-ups, and client communication with precision and professionalism. This not only strengthens financial health but also frees up internal resources for growth-oriented tasks.

In addition to receivables, many organizations are also outsourcing General Ledger services to improve the accuracy and consistency of financial reporting. Managing the general ledger in-house can be time-consuming and prone to human error. With finance and accounting outsourcing, businesses benefit from expert reconciliation, journal entry management, and real-time financial visibility. These services provide clear insights into a company’s financial position while maintaining compliance and audit-readiness.

When companies outsource receivables and other financial functions, they gain more than just cost savings—they achieve operational excellence. The integration of General Ledger services with broader finance and accounting outsourcing strategies creates a streamlined, end-to-end financial system. This allows leadership to make informed decisions backed by reliable financial data. Whether you're a startup or an established enterprise, outsourcing these critical functions can give you the agility and insight needed to compete in today’s fast-paced market.

0 notes

Text

Create Sundry Creditors in SAP

Creating sundry creditors in SAP is crucial for managing accounts payable effectively. This process involves setting up vendor master records to track outstanding liabilities and ensure smooth financial operations. By entering accurate data like vendor information, payment terms, and tax details, businesses can efficiently manage payments, reduce errors, and maintain transparent financial records.

0 notes

Text

Tax Planning Template using Xero | Future Proof Accountants

youtube

Tax planning is a very important area in any Public practice. Neha goes over what she created recently in her webinar

#accounting#accountants#accountingandfinance#taxplanning#TaxPlanning#XeroSoftware#FutureProofAccountants#FinancialOperations#TaxStrategy#Compliance#DeductionsMaximization#EfficientTaxManagement#Youtube

0 notes

Text

Streamline your financial operations with our expert accounts payable services

0 notes

Text

Optimize Your Financial Operations with Avanz AI: Tips and Tricks

Avanz AI offers a suite of features to enhance your financial operations. Here are some tips to help you leverage the platform effectively:

Main Content:

Tip 1: Leverage Event-Driven Workflows

Explanation: Automate processes that respond instantly to market changes or data updates, ensuring timely execution and dynamic portfolio management.

Tip 2: Integrate Communication Channels

Explanation: Transform emails and Slack messages into automation triggers, launching workflows directly from your daily communications.

Tip 3: Connect Diverse Data Sources

Explanation: Upload CSVs, PDFs, link Google Sheets, or integrate with Snowflake and SQL databases to power scenario analysis and drive smarter decision-making.

Tip 4: Customize AI Workflows

Explanation: Tailor inputs, outputs, and AI agent behavior to match your investment process and decision-making requirements.

Tip 5: Automate Routine Tasks

Explanation: Deploy customized workflows to automate routine tasks, freeing time for strategic initiatives.

Implement these strategies to enhance your financial operations with Avanz AI. Visit aiwikiweb.com/product/avanzai

0 notes

Text

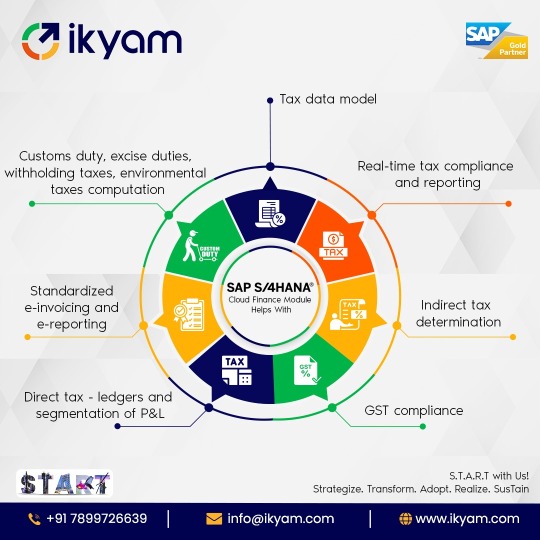

Empower Your Financial Operations with S/4HANA Cloud Finance Module

Unlock the full potential of your financial operations with the S/4HANA Cloud Finance Module. Designed to meet the complex needs of modern businesses, this powerful solution offers a range of features that ensure comprehensive and compliant financial management. The S/4HANA Cloud Finance Module empowers businesses with real-time insights, enhanced compliance, and streamlined tax operations. Transform your financial processes and ensure robust tax management with S/4HANA.

Take the Next Step Discover how the S/4HANA Cloud Finance Module can transform your financial operations. Schedule your free demo today and experience the benefits firsthand.

Phone: +91 7899726639 Email: [email protected] Website: https://ikyam.com/ For More Details:https://ikyam.com/sap-s-4-hana/

#S/4HANACloudFinanceModule#Taxdatamodel#RealtimetaxCompliance#TaxreportingwithS/4HANA#FinanceModule#ikyam#ikyamsolutions#SAP#sappartner#sapprovider#sapservices#Sapgoldpartner#SAPS/4hana#BestSAPS/4hanaprovider#SAPS/4HANAFinancebenefits#Financialoperations#bestsapprovider#Bestsappartnerforfinancialprovider

0 notes

Text

💳 Streamline your business finances with corporate cards! Simplify expense tracking, enhance control, and optimize cash flow management while earning rewards and integrating with accounting systems. #CorporateCards #ExpenseManagement #BusinessFinances

0 notes

Text

How AR Automation transforms financial operations

Accounts Receivable (AR) automation is revolutionizing financial operations. By automating tasks like invoicing, payment processing, and reconciliation, businesses can streamline their processes, improve cash flow, and reduce errors. With AR automation, finance teams can focus on more strategic initiatives, such as analyzing customer data and identifying opportunities for growth.

ARAutomation #FinancialOperations #CashFlow #Efficiency #BusinessGrowth

0 notes

Text

Streamline Your Financial Operations HammerJack’s Outsource Accounting

At HammerJack, we specialize in outsource accounting services that optimize your financial processes. Our experienced team ensures accuracy and efficiency, allowing you to focus on growing your business. By partnering with HammerJack, you gain reliable support for seamless financial management. #OutsourceAccounting #HammerJack #FinancialOperations #BusinessGrowth #AccountingExperts

#outsource accounting#outsourced accountant#hammerjack#offshore accountant#offshoring companies in the philippines

0 notes

Photo

🚀 Thriving in the digital age requires more than just adopting new technology; it demands maximizing its benefits for seamless operations and enhanced customer experiences. Here's how businesses, especially SMEs, can leverage e-invoicing to not just comply with regulations but to drive growth. 📈 ### Here are five key strategies you should consider: **1. 🎨 Customize Your Invoices:** Make your invoices more than just bills. Personalize them to reflect your brand's identity—incorporate your logo, colors, and even personalized messages. This not only enhances customer experience but also reinforces brand loyalty. **2. 💳 Simplify Payment Collection:** Use e-invoicing to provide direct payment links. This ease of payment can significantly improve your cash flow and overall financial health. **3. 🌐 Integrate with Other Platforms:** Connect e-invoicing systems like Zoho Books with other Zoho platforms for CRM, analytics, inventory, and project management to streamline your processes from a single dashboard. **4. 🧮 Automate Tax Calculation:** Integrating your invoicing with accounting software to automate tax calculations can save time and reduce errors, ensuring compliance and accuracy in your financial operations. **5. 🔒 Secure Customer Financial Information:** Opt for solutions that offer secure cloud storage to protect sensitive data and ensure you can access your financial information anytime, anywhere. 🔗 For those intrigued by the power of integration and how it can transform your business operations, consider leveraging platforms like Zoho Books combined with DIAN Electronic Invoicing to fully harness the advantages of e-invoicing. What success stories or challenges have you encountered in implementing e-invoicing in your business? Let's share and learn together! 🔄 #EInvoicing #DigitalTransformation #Zoho #SMEs #FinancialOperations #BusinessGrowth #BrandLoyalty #FinTech #CloudSecurity #Innovation Discover valuable insights and tips on our blog https://zurl.co/P4EZ, and start with your free account today! https://zurl.co/qCHA

0 notes

Text

IME Life Insurance (ILI) has made adjust... #Amends #AnnualGeneralMeeting #Cashdividends #Compliancemeasures #Corporateaccountability #Corporateadjustments #Corporatecompliance #CorporateGovernance #Corporateresponsibility #Corporatetransparency #Distributionadjustment #Dividend #dividendallocation #DividendAnnouncement #dividenddistribution #dividendpolicy #Dividendprocess #dividendproposal #Financialadjustments #Financialdecisionmaking #Financialdirectives #Financialdiscipline #Financialgovernance #Financialgovernancemeasures #Financialguidelines #Financialintegrity #Financialoperations #Financialoversight #Financialregulations #Financialreporting #financialtransparency #Fiscalcompliance #Fiscaltransparency #fiscalyear #ILI #IME #IMELifeInsurance #insurance #life #NepalInsuranceAuthority #proposal #Regulatoryadherence #regulatorycompliance #Regulatorydirective #Regulatoryguidelines #Regulatoryoversight #Regulatorystandards #ShareholderBenefits #Shareholdercommunication #Shareholderdividends #Shareholderinterests #Shareholderresolutions #Shareholderreturns #Stockdividends #Taximplications

0 notes

Text

Become an SAP TRM expert with the Best Online Training Course.

SAP TRM Online Training Institute Best Online Career provides LIVE ONLINE Sessions. Well-experienced trainers will conduct the training.

Get Your Free Demo Session Now!

Register here: https://lnkd.in/dMrQMkGX

Call: +919146039100 Website: https://www.bestonlinecareer.com/sap-trm-online-training/

2 notes

·

View notes

Text

#FinanceJobs#FinancialOperations#Controller#JobOpening#Hiring#JobOpportunity#FinanceCareer#FinanceRole#JobSearch#NowHiring#JobPosting#FinanceManagement#FinanceLeadership#JobAlert#CareerOpportunity#FinancePosition#FinancialController#JobSeekers#FinanceIndustry#NewJob

0 notes

Text

Top 5 Best Paying Jobs in Real Estate Investment Trusts (REITs)

Top 5 Best Paying Jobs in Real Estate Investment Trusts Discovering the best paying jobs in Real Estate Investment Trusts (REITs) with high salaries and lucrative career opportunities, Real Estate Investment Trusts (REITs) are a popular investment option that allows investors to own a portion of real estate assets without the need to purchase and manage properties themselves. REITs offer high yields and strong returns, making them an attractive investment opportunity for many investors. In this blog, we will discuss the top 5 best-paying jobs in REITs.

Chief Executive Officer (CEO):

The CEO of a REIT is responsible for overseeing the overall operations of the company, including strategic planning, financial management, and business development. They also set the direction of the company, implement policies and procedures, and ensure that the company meets its financial goals. CEOs of REITs typically earn a median salary of around $1.5 million per year.

Chief Investment Officer (CIO):

The CIO of a REIT is responsible for managing the company's investment portfolio and developing investment strategies. They are also responsible for evaluating potential real estate acquisitions, managing asset portfolios, and assessing the financial performance of the company. CIOs of REITs typically earn a median salary of around $700,000 per year.

Chief Financial Officer (CFO):

The CFO of a REIT is responsible for managing the financial operations of the company, including financial reporting, budgeting, and forecasting. They also oversee the accounting and tax functions, manage debt and equity financing, and ensure compliance with regulatory requirements. CFOs of REITs typically earn a median salary of around $500,000 per year.

Real Estate Investment Manager:

Real estate investment managers are responsible for managing the real estate assets of a REIT. They identify potential investment opportunities, negotiate contracts, and manage tenant relationships. They also analyze market trends and make recommendations on when to buy, sell, or hold real estate assets. Real estate investment managers of REITs typically earn a median salary of around $180,000 per year.

Real Estate Analyst:

Real estate analysts are responsible for analyzing real estate data and trends to identify potential investment opportunities for a REIT. They also conduct market research, assess the financial performance of real estate assets, and make recommendations to senior management. Real estate analysts of REITs typically earn a median salary of around $80,000 per year.

Conclusion:

REITs are a lucrative investment option that offers high yields and strong returns. The real estate industry is a competitive and lucrative industry that offers many high-paying jobs. If you're looking for a career in the real estate industry, then REITs can be an excellent option. The jobs mentioned above are some of the best-paying jobs in REITs. Pursuing a career in any of these roles requires experience, skills, and education. To succeed in these roles, it's essential to have a deep understanding of the real estate industry, financial management, and investment strategies. Read the full article

#AssetManagement#BestPayingJobs#Business#Careers#CEO#CFO#CIO#Finance#FinancialManagement#FinancialOperations#FinancialPerformance.RealEstate#HighYields#InvestmentOpportunities#InvestmentPortfolio#InvestmentStrategies#Investments#LucrativeCareer#Management#MarketAnalysis.#MarketTrends#PortfolioManagement#RealEstateAnalyst#RealEstateAssets#RealEstateIndustry#RealEstateInvestmentManager#RealEstateInvestmentTrusts#RealEstateMarket#REITs#Salary#StrongReturns

0 notes

Link

We offer Online Oracle ARCS Training by experts Best Institute for Oracle Arcs Online Training We Provides Certification Material Pdf Attend Live Account Reconciliation Cloud Service Demo for Free Oracle ARCS Tutorial Videos for Beginners Download Enroll for Oracle ARCS Course Dumps within Reasonable Cost in Hyderabad Bangalore Mumbai Delhi India UAE USA Canada Toronto Australia Singapore Malaysia South Africa Brazil Spain Japan China UK Germany London England Dubai Qatar Oman Mexico France Srilanka Pune Noida Chennai Pakistan

#https://www.spiritsofts.com/oracle-arcs-online-training/#Oracle ARCS Online Training: Master Account Reconciliation Cloud Service#Unlock the full potential of Oracle Account Reconciliation Cloud Service (ARCS) with our comprehensive online training program. Discover the#OracleARCS AccountReconciliation CloudFinancialManagement AutomatedReconciliation ARCSTraining FinanceTraining FinancialOperations CloudTech

0 notes