#ForexTradingforBeginners

Explore tagged Tumblr posts

Text

Forex Tools Checkers - MONEY MAKER TURBO MT4 FX EA Download Now...

#FX自動売買・EA#forexrobot#tradingforex#forexsignals#forexsuccess#forexinvesting#forextradingstrategy#automatedtrading#howtotradeforexforbeginners#metatrader#forexprofit#tradingbot#FOREX#tradingsoftware#forextrading#howtotradeforex#forexstrategy#forextradingforbeginners#forextrader#howtostartforex#forexforbeginners#forextradingsystem#forextips#algorithmictrading#forexmarket#forextradingstrategies#forexea

0 notes

Text

O mercado quer o seu rico dinheirinho! Estude uma estratégia, aplique e aprenda com ela... Em busca de uma Estratégia com longo histórico de sucesso? A Estratégia das Agulhadas do Didi Aguiar é a escolha certa, basta estudar e aplicar, mas pra facilitar e agilizar o processo, que tal uma ferramenta que busca oportunidades de trade em mais de 300 janelas gráficas em alguns segundos? Além de contar com sistema de alertas, log de agulhadas e muito mais...

Saiba sobre nossa solução em nosso site https://atmsystems.com.br

A Estratégia das agulhadas do Didi Aguiar é a escolha certa, basta estudar e aplicar, mas pra facilitar e agilizar o processo, que tal uma ferramenta que busca oportunidades de trade em mais de 300 janelas gráficas em alguns segundos? Além de contar com sistema de alertas, log de agulhadas e muito mais...

Saiba sobre nossa solução em nosso site https://atmsystems.com.br

#didiaguiar#agulhadasdodidi#mediamovelforex#mediamovel#adx#trix#forex#forextrader#forextrading#forextradingforbeginners#forexlifestyle#forextips#eurusd#bolsadevalores#btcusd#scalping#scalping_trading#scalping_trading_strategy#goldusd#goldust#didialert#didiindex#didiindexindicador#indicator#indicators#daytrade#daytrader#daytraderbrasil#daytraderlifestyle#daytraderlife#swingtrade#swingtrader#swingtraderbrasil#analisetecnica#indicadores#mediamovel#mediamovelexponencial#graficotrade#graficos#candle#candles#candlestick#padraografico#ografico#rendapassiva#trader#mercadofinanceiro#mercadofinanceiro📊#mercadofinanceirobrasil#mercadofinanceirohoje#dolar#euro#criptomoedas#criptomoedasbrasil#bitcoin#ethereum#suporteresistencia#resistencia#Fibonacci#fibonacci#fibonaccisequence#fibonaccitrading#MACD#MACD#BollingerBand#opcoesbinarias#opcoesbinariasparainiciantes#acoes#acoesdabolsa#ETFs#aprendaainvestir#educacaofinanceira#analisedemercado#gestaoderisco#planodetrade#sinais#comunidadetrader#forexBrasil#investidoriniciante#investidores#investidorsardinha#investidor

#forex#forextrading#adx#agulhadasdodidi#bolsadevalores#branding#btcusd#candle#daytrade#didiaguiar#mediamovelforex#mediamovel#trix#forextrader#forextradingforbeginners#forexlifestyle#forextips#eurusd#scalping#scalping_trading#scalping_trading_strategy#goldusd#goldust#didialert#didiindex#didiindexindicador#indicator#indicators#daytrader#daytraderbrasil

1 note

·

View note

Text

A Session Is Just Adding 20% To My Trade

#forextrading #tradingtips #learntrading #tradingbeginner #tradingtip #tradinglessons #fyp #forextradingforbeginners #forextradingtips #forextradingstrategy #tradingstrategy #tradingstrategyforbeginners #tradingstructure

24 notes

·

View notes

Photo

In every case when you consider taking a position, the overall trading success will be improved if you take account the following trade establishment mechanism: 1.Multiple perspectives: Here, multiple perspectives means the following: Using multiple time frames Two way analysis; Technical & Fundamental Using Multiple technical indicators Multi-market analysis Multi- sector/industry analysis 2. News & social-media-mania analysis 3. Sentiment analysis 4. Fundamentals of Market Mechanism (long term market cycles, Business cycles, debt cycles, debt crisis, bubbles etc.) These four points cover so much subject matter that, at first, it seems impossible for practical purpose. Of course. If you consider short time frames, it is almost impossible. History shows an interesting fact that, people who take Financial markets seriously and consider it like a business, learn accordingly and adapt to the market-ecosystem will likely be very successful one day. Those who don't think this way will likely to be expelled and punished so badly that they never return to the same Business. It's all about the matter of time. Respect Markets, only then it will Respect you back. . . . . . . . #tempertrader #trader #tradingbasics #tradingforliving #tradingforbeginners #tradingforex #tradeconsciously #tradefromhome #chartpartterns #charts #phycological #technicalanalysisforbeginners #technicalanalysis #forex #forextradingforbeginners #stocks #stockmarkettips #stockmarket #lowrisk #lowriskinvesting #lowrisktrading #strategies #strategictrading #strategictradeplanning #strategictradeplan #letsdoit #challengeaccepted https://www.instagram.com/p/CCi3q9mH7w-/?igshid=v0kc63tv3dv8

#tempertrader#trader#tradingbasics#tradingforliving#tradingforbeginners#tradingforex#tradeconsciously#tradefromhome#chartpartterns#charts#phycological#technicalanalysisforbeginners#technicalanalysis#forex#forextradingforbeginners#stocks#stockmarkettips#stockmarket#lowrisk#lowriskinvesting#lowrisktrading#strategies#strategictrading#strategictradeplanning#strategictradeplan#letsdoit#challengeaccepted

65 notes

·

View notes

Text

Role of Discipline in Forex Trading

In Forex trading, discipline is paramount. It helps build a strong trading mindset and improves decision-making. Stick to your trading plan, manage risk effectively, and avoid emotional reactions. Discipline ensures consistent execution and keeps emotions in check. Mastering discipline is the key to success in the dynamic world of Forex trading. Visit Valiant Markets for more information.

#FinancialSuccess#SaveAndInvest#ValiantMarkets#SmartChoices#CryptocurrencyAdvantages#CryptoTrading#ExpertAnalysis#PersonalizedSupport#TradeLikeAPro#RiskToReward#SuccessJourney#TradingCommunity#ProfitPotential#forextradingforbeginners

1 note

·

View note

Text

The Key Events that Shaped the History of Forex Trading!

Forex trading, a financial market that transcends borders and currencies, has a history deeply intertwined with the evolution of human civilization. From the barter system in ancient times to the modern global market, forex trading has undergone significant transformations, shaping the way nations, businesses, and individuals engage in international trade.

In this article, we delve into the captivating journey of forex trading, tracing its origins, pivotal milestones, and the factors that have propelled its growth into the largest and most liquid market in the world. The Barter System: The Genesis of Trade Human civilization has always thrived on the need for exchange and specialization. Before the advent of currencies, people relied on the barter system, a simple yet ingenious method of trading goods and services. Dating back to 6000 BC, this system enabled individuals to exchange commodities they possessed for ones they desired, fostering economic interactions and facilitating the fulfillment of diverse needs within communities. The Emergence of Currency: From Gold Coins to Global Trade As societies progressed, the barter system presented certain limitations, such as the need for a mutually desired item and the challenge of evaluating the relative value of different goods. To overcome these obstacles, the concept of currency emerged. During the 6th century BC, the first gold coins were minted, marking a significant shift in trade dynamics. These standardized units of value provided greater convenience, portability, and fungibility, laying the foundation for future advancements in monetary systems. The Medici Family: Pioneers of Forex Trading Fast forward to the 15th century, when the influential Medici family of Florence played a crucial role in the development of forex trading. With their extensive network of banks across different locations, the Medicis facilitated currency exchange and international trade. Their visionary approach not only enabled merchants to conduct business in foreign lands but also set the stage for the establishment of specialized financial markets dedicated to foreign exchange. The Birth of the First Forex Market in Amsterdam The 17th century marked a significant turning point in the history of forex trading. In Amsterdam, the world's first dedicated forex market came into existence, serving as a central hub for foreign exchange transactions. This pivotal development revolutionized the way currencies were traded, providing a platform for buyers and sellers to come together and establish exchange rates based on supply and demand. The Amsterdam forex market laid the groundwork for the modern forex market we know today. The Collapse of the Bretton Woods System: A Paradigm Shift The 1970s brought forth a transformative event that would shape the future of forex trading—the collapse of the Bretton Woods system. Previously, major currencies were pegged to the value of gold, fostering stability and predictability. However, as economic dynamics shifted, the fixed exchange rate system became unsustainable. The dissolution of the Bretton Woods system heralded the era of free-floating exchange rates, where currency values were determined by market forces. This fundamental change opened up new opportunities for traders to profit from fluctuations in currency values. The Technological Revolution: Empowering Individual Traders The 1980s witnessed a revolution in technology, particularly with the rise of personal computers and the internet. These advancements democratized forex trading, making it more accessible to individual traders worldwide. Previously, forex trading was predominantly the domain of large financial institutions and corporations. However, with the advent of user-friendly trading platforms, real-time data feeds, and online brokers, individuals gained the ability to participate in the forex market from the comfort of their own homes. This paradigm shift in accessibility and convenience marked a crucial milestone in the history of forex trading. Innovations in Trading Technologies: Breaking Down Barriers Continuing the trajectory set in the 1980s, the 1990s witnessed further advancements in trading technologies that revolutionized the forex market. The development of electronic communication networks (ECNs), algorithmic trading, and high-frequency trading brought unprecedented speed, efficiency, and transparency to forex transactions. These innovations not only reduced the barriers to entry for traders but also enhanced market liquidity, facilitating seamless execution of trades and enabling participants to capitalize on market opportunities with greater precision. A Global Market: Trading Around the Clock Today, the forex market transcends time zones and operates 24 hours a day, five days a week. This continuous nature of the market ensures that traders can engage in transactions at any time, regardless of their geographic location. The forex market's global reach has created a truly interconnected world of currencies, where traders can profit from fluctuations in exchange rates across different economies. The accessibility and liquidity of the forex market make it an enticing arena for investors seeking diversification, hedging, and speculative opportunities. The Future of Forex Trading: Unlimited Potential As we gaze into the future, the growth and importance of forex trading are poised to continue. With the world becoming increasingly interconnected and globalized, the opportunities for traders to profit from currency movements will expand. Technological advancements, including artificial intelligence, machine learning, and blockchain, are expected to revolutionize the forex market further. These innovations may enhance trading efficiency, provide new analytical tools, and foster increased transparency. As the forex market evolves, traders can expect a more dynamic, accessible, and rewarding trading experience. Overall, the history of forex trading is a captivating narrative that spans centuries of economic evolution and technological progress. From the barter system to the establishment of the first forex market in Amsterdam, and from the collapse of the Bretton Woods system to the digital age of algorithmic trading, each chapter in this journey has left an indelible mark on the forex landscape. Today, the forex market stands as the largest and most liquid financial market globally, inviting traders from all walks of life to explore its vast potential. If you aspire to delve deeper into the world of forex trading, a plethora of online resources and libraries offer valuable insights and knowledge to equip you on your trading journey. Read the full article

#beginner'sguidetoforextrading#forextradingforbeginners#forextradinghistory#futureofforextrading#historyofforexmarket#howforextradingstarted#howtotradeforex#keyeventsinforextradinghistory#learnforextrading#originsofforextrading#stockmarket#UK#unitedkingdom#unitedstates#USeconomy#USA

0 notes

Text

ATENÇÃO TRADER. PARE DE PERDER TEMPO E DINHEIRO. "O DIDI Alert é a ferramenta ideal para traders que utilizam a excelente estratégia das agulhadas criada pelo Didi Aguiar, trader reconhecido internacionalmente e com mais de 40 anos de experiência no mercado. A nossa solução rastreia e identifica o cenário ideal em até 300 gráficos ao mesmo tempo, monitorando ativos, buscando por oportunidades de negociação e enviando alertas sonoros, gráficos e via celular, tudo isso em tempo real! É Simples, rápido e eficiente!" Não perca essa oportunidade, visite nossa página e saiba mais!

Nossa página >> atmsystems.com.br

#didiaguiar#agulhadasdodidi#mediamovelforex#mediamovel#adx#trix#forex#forextrader#forextrading#forextradingforbeginners#forexlifestyle#forextips#eurusd#bolsadevalores#btcusd #scalping#scalping_trading #scalping_trading_strategy#goldusd#goldust#didialert#didiindex#didiindexindicador#indicator#indicators#daytrade#daytrader#daytraderbrasil#daytraderlifestyle#daytraderlife#swingtrade#swingtrader #swingtraderbrasil #analisetecnica #indicadores #mediamovel #mediamovelexponencial #graficotrade #graficos #candle #candles #candlestick #padraografico #ografico #rendapassiva #trader #mercadofinanceiro #mercadofinanceiro📊 #mercadofinanceirobrasil #mercadofinanceirohoje #dolar #euro #criptomoedas #criptomoedasbrasil #bitcoin #ethereum #suporteresistencia #resistencia #Fibonacci #fibonacci #fibonaccisequence #fibonaccitrading #MACD #MACD #BollingerBand #opcoesbinarias #opcoesbinariasparainiciantes #acoes #acoesdabolsa #ETFs #aprendaainvestir #educacaofinanceira #analisedemercado #gestaoderisco #planodetrade #sinais #comunidadetrader #forexBrasil #investidoriniciante #investidores #investidorsardinha #investidor

0 notes

Text

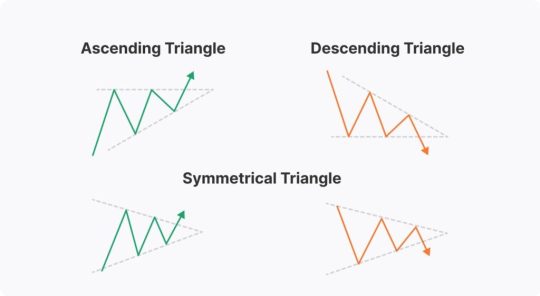

Mastering Forex Chart Patterns: 4 Keys to Identifying Reversal and Continuation Signals

Forex trading involves analyzing various indicators to predict market movements and make informed trading decisions. One of the most powerful tools in a trader's arsenal is the study of Forex chart patterns. These patterns offer valuable insights into potential price movements, helping traders spot both trend reversals and continuation signals. In this article, we'll explore ten key Forex chart patterns, providing clear explanations and real-life examples to make understanding these patterns easier for traders of all levels.

Reversal Chart Patterns

Which Forex broker is reliable for Forex trading and has less spread and instant withdrawal? Head and Shoulders: The head and shoulders pattern is a reliable trend reversal indicator. It consists of three peaks, with the middle peak (the head) being higher than the other two (the shoulders). The pattern signals a potential shift from an uptrend to a downtrend or vice versa. Let's take a look at a real-life example:

In this example, the head and shoulders pattern formed after a prolonged uptrend. Once the price broke below the neckline (the line connecting the two shoulders), it confirmed the trend reversal, leading to a bearish move. Double Tops and Double Bottoms: Double tops and double bottoms are reversal patterns that form after an uptrend or downtrend, respectively. A double top consists of two peaks at roughly the same price level, while a double bottom comprises two troughs at approximately the same level. These patterns suggest a potential reversal in the current trend. Here's a practical illustration:

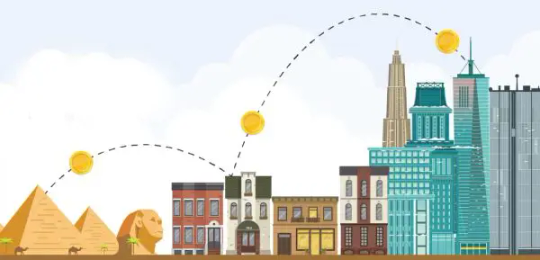

In this example, we can observe both a double top and a double bottom pattern. The double top signals a shift from an uptrend to a downtrend, while the double bottom indicates a shift from a downtrend to an uptrend. Triple Tops and Triple Bottoms: Triple tops and triple bottoms are similar to double tops and double bottoms but involve three peaks or troughs. They indicate even stronger potential reversals in the current trend. Here's an example:

In this case, we see a triple top formation, which preceded a significant downtrend as the price broke below the support level.

Continuation Chart Patterns

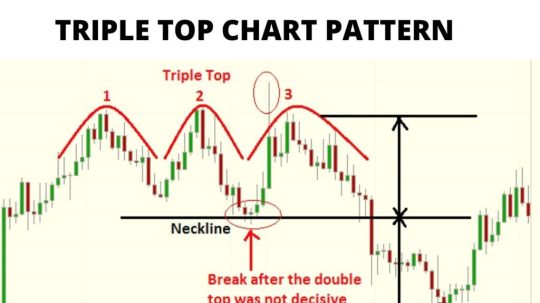

CL2. What is the Forex market and how does it's work? Flags and Pennants: Flags and pennants are continuation patterns that occur after strong price moves. A flag resembles a small rectangle, while a pennant looks like a small symmetrical triangle. These patterns suggest that the market is taking a breather before resuming the previous trend. Let's see a real-life example:

In this example, we can observe both a flag and a pennant pattern. After a sharp upward move, the price consolidated within the flag and pennant formations before continuing its uptrend. Symmetrical Triangles: Symmetrical triangles are continuation patterns that show a period of consolidation before a potential trend continuation. These triangles have converging trendlines and imply an imminent breakout. Let's examine an illustration:

In this example, the symmetrical triangle formed during a downtrend. Once the price broke above the upper trendline, it confirmed the continuation of the upward movement. Ascending and Descending Triangles: Ascending triangles and descending triangles are also continuation patterns. An ascending triangle features a horizontal resistance line and an upward-sloping support line, while a descending triangle has a horizontal support line and a downward-sloping resistance line. Let's explore an example:

In this instance, both ascending and descending triangles are present. The ascending triangle preceded an upward breakout, while the descending triangle led to a downward breakout.

Combining Chart Patterns with Other Technical Indicators

CL4. What are Support Resistance and Chart types in Forex trading? Successful Forex trading often involves combining chart patterns with other technical indicators for better confirmation and accuracy. Here are some popular indicators to consider: - Moving Averages: Moving averages help smooth out price fluctuations and identify trends. Combining moving averages with chart patterns can provide additional confirmation of potential trend reversals or continuations. - RSI (Relative Strength Index): The RSI measures the strength of price movements and can signal overbought or oversold conditions. When RSI aligns with a chart pattern's signals, it strengthens the overall trading strategy. - MACD (Moving Average Convergence Divergence): The MACD is a trend-following indicator that highlights the relationship between two moving averages. When used with chart patterns, it can offer insights into trend direction and momentum.

Tips for Chart Pattern Trading

How to Use Forex Custom Indicators, Templates, and Profiles in MT4? - Risk Management: Set appropriate stop-loss levels to protect your capital in case the market moves against your trade. - Setting Proper Stop-Loss and Take-Profit Levels: Determine your risk-reward ratio and identify suitable points to exit trades both in profit and loss scenarios. - Practicing Patience and Discipline: Be patient and wait for strong chart pattern confirmations before entering a trade. Stick to your trading plan and avoid emotional decisions.

Frequently Asked Questions

Q: What are the most common Forex chart patterns? - A: The most common Forex chart patterns include head and shoulders, double tops, double bottoms, ascending triangles, and flags. These patterns provide valuable insights into potential price movements and can be used to identify both trend reversals and continuation signals. Q: How can I trade Forex chart patterns effectively? - A: To trade Forex chart patterns effectively, start by identifying the pattern and wait for a clear breakout confirmation. Use additional technical indicators like moving averages and RSI to strengthen your analysis. Set proper stop-loss and take-profit levels, practice patience, and stick to your trading plan. Q: What is the difference between a continuation pattern and a reversal pattern? - A: A continuation pattern indicates a temporary pause in the current trend before it continues in the same direction. Examples include flags and pennants. On the other hand, a reversal pattern signals a potential change in the current trend. Examples include head and shoulders and double tops/bottoms. Q: Can I rely solely on chart patterns for Forex trading? - A: While chart patterns are powerful tools, relying solely on them for Forex trading is not recommended. It's essential to consider other factors like fundamental analysis, market sentiment, and economic indicators to make well-informed trading decisions. Q: How do I avoid false signals in Forex chart patterns? - A: To avoid false signals, look for patterns that are well-defined and have strong breakout confirmations. Consider using multiple time frames for analysis to increase accuracy. Combining chart patterns with other technical indicators can also help filter out false signals and improve your trading success.

Conclusion

Forex chart patterns provide valuable insights into market behavior, offering traders the opportunity to identify trend reversals and continuations. By understanding these patterns and combining them with other technical indicators, traders can enhance their trading strategies and make more informed decisions. Remember, practice and discipline are key to mastering chart pattern trading, so keep honing your skills and stay dedicated to becoming a successful Forex trader. Do you need a Deep Road Map for Forex learning? Structural Forex Trading Learning Road Map We hope you found our article on "Mastering Forex Chart Patterns: Identifying Reversal and Continuation Signals" insightful and informative. We believe that your thoughts, experiences, and questions are invaluable to the trading community. We invite you to share your feedback, ideas, and any additional chart patterns you've come across in the Forex market. Your comments will not only enrich our content but also foster a collaborative learning environment for all traders. So, don't hesitate to join the discussion, and let's grow together as knowledgeable and successful Forex traders. We look forward to hearing from you! Read the full article

#ForexChartPatterns#ForexContinuationSignals#ForexReversalSignals#ForexTradingCourseforBeginners#ForexTradingforBeginners#ForexTradingStrategies

0 notes

Photo

Copy Trading Is A Method Of Social Trading Where A User Can Follow Profiles Of Other Traders And Even Copy Their Trading Strategies To Increase Their Trade Profits, Either For Free Or For Money.

Modern Copy Trading Platforms Let Users Subscribe To Other Traders, Buy And Sell Trading Signals, And Connect To Broker Platforms On Which They Can Automate Copy Trading.

#copytradingforexbrokers#forexbrokersinmalaysia#copytrading#copytradingbrokers#copyprotraders#copytrader#forexcopytrading#bestcopytradingplatform#copytradingplatform#copytradingapp#octafxcopytrading#fxtmcopytrading#forexfactory#forex#forexbrokers#forextrading#forexmarkets#forextradingforbeginners#foreignexchangemarket#Servlogin

0 notes

Photo

"Cash is Trash." - Ray Dalio . . . . @temper_trader . . . . . . . #tempertrader #trader #tradingbasics #tradingforliving #tradingforbeginners #tradingforex #tradeconsciously #tradefromhome #chartpartterns #charts #phycological #technicalanalysisforbeginners #technicalanalysis #forex #forextradingforbeginners #stocks #stockmarkettips #stockmarket #lowrisk #lowriskinvesting #lowrisktrading #strategies #strategictrading #strategictradeplanning #strategictradeplan #letsdoit #challengeaccepted https://www.instagram.com/p/CBHh3Pun-EK/?igshid=l53qsif0naz9

#tempertrader#trader#tradingbasics#tradingforliving#tradingforbeginners#tradingforex#tradeconsciously#tradefromhome#chartpartterns#charts#phycological#technicalanalysisforbeginners#technicalanalysis#forex#forextradingforbeginners#stocks#stockmarkettips#stockmarket#lowrisk#lowriskinvesting#lowrisktrading#strategies#strategictrading#strategictradeplanning#strategictradeplan#letsdoit#challengeaccepted

61 notes

·

View notes

Text

In This Video We Learn About The The Best Copy Trading Forex Brokers In Malaysia. How It Works, Their Regulation, Platforms.

Copy Trading Has Become A Very Popular Trading Strategy. Copy Trading Allows Traders To Automatically Copy Positions Of Traders That Are Successful. The Good News For Traders Is That Copy Trading Is Not Just About Copying Trades. Copy Trading Is Also About Copying The Trading Style Of A Trader So That Traders Can Learn From The Smarter Traders.

Copy Trading Can Be A Difficult And Intimidating Topic To Get In To. However, With The Increasing Popularity Of Copy Trading Trading, There Are More And More Options Available For The Retail Investor. This Video Will Take A Look At Some Of The Top Copy Trading Brokers In Malaysia As Well As The Ins And Outs Of Copy Trading .

#copytrading#copytradingforexbrokers#copytradingforexbrokersinmalaysia#copytradingbrokers#copyprotraders#copytrader#forexcopytrading#bestcopytradingplatform#copytradingplatform#copytradingapp#octafxcopytrading#fxtmcopytrading#forexfactory#forex#forexbrokers#forextrading#forexmarkets#forextradingforbeginners#foreignexchangemarket#Onlinestockbrokersreviews

0 notes

Text

#supermarketfx#forextrading#forex#scalping#forexscalpingstrategy#1-minutescalping#tradingforex#tradingstrategies#bestscalpingstrategies#howtotrade#howtotradeforex#besttradingstrategy#foreign exchange trading#tradingcurrencies#forextradingforbeginners#howtotradingthe1minutechart#learnforex#forexscalptrading#metatrader#tradingview

1 note

·

View note

Text

Copy Trading is a way to automate your trading by copying the trades of other traders. It is often used by newbies that might not yet know how to trade, with the added benefit of helping to teach them on the way. For more experienced traders, it can enable them to step away from their screens if they need to, as all trades are automated.

Copy Trading is not only for the inexperienced, a lot of expert traders use copy trading as a means of market research, it saves time and could be part of a new strategy that could be implemented and profitable.

#copytrading#copytradingbrokers#copyprotraders#copytrader#forexcopytrading#bestcopytradingplatform#copytradingplatform#copytradingapp#octafxcopytrading#fxtmcopytrading#forexfactory#forex#forexbrokers#forextrading#forexmarkets#forextradingforbeginners#foreignexchangemarket#Loginuncle

0 notes

Text

The Best ECN Brokers Provide Traders With More Than Just The Standard Features That You Can Find On A Typical Retail Forex Broker, There Are More Features And More Benefits To Leverage From. Here Is A List Of Ecn Brokers That Offer More Than That.

ECN Brokers Have Been Around For A Number Of Years. However, There Are Still A Lot Of People Who Are Not Aware Of What They Are And How They Operate. For This Reason, Here We Are Taking A Look At Five Different Ecn Brokers That We Have Tested And Researched. This Will Provide You With The Information You Need So You Can Decide Which One Is The Best To Use.

#ecn#ecnforexbrokers#forexbrokersinmalaysia#forexbrokers#ecnbrokers#ecntrading#bestecnforexbrokers#topecnforexbrokers#ecnaccount#bestecnbrokers#ecnaccountforex#bestforexbrokers#forextrading#forexmarkets#forex#foreignexchangemarket#forextradingforbeginners#Liveforextrading

0 notes

Video

tumblr

Copy Trading Is A Method Of Social Trading Where A User Can Follow Profiles Of Other Traders And Even Copy Their Trading Strategies To Increase Their Trade Profits, Either For Free Or For Money.

Modern Copy Trading Platforms Let Users Subscribe To Other Traders, Buy And Sell Trading Signals, And Connect To Broker Platforms On Which They Can Automate Copy Trading.

#copytrading#copytradingbrokers#copyprotraders#copytrader#forexcopytrading#bestcopytradingplatform#copytradingplatform#copytradingapp#octafxcopytrading#fxtmcopytrading#forexfactory#forex#forexbrokers#forextrading#forexmarkets#forextradingforbeginners#foreignexchangemarket#Servlogin

0 notes

Photo

“All things being equal, people will buy from a friend. All things being not quite so equal, people will still buy from a friend.” The bottom line: It’s to your benefit to cultivate friendships, not just collect business cards. #tempertrader #trader #tradingbasics #tradingforliving #tradingforbeginners #tradingforex #tradeconsciously #tradefromhome #chartpartterns #charts #phycological #technicalanalysisforbeginners #technicalanalysis #forex #forextradingforbeginners #stocks #stockmarkettips #stockmarket #lowrisk #lowriskinvesting #lowrisktrading #strategies #strategictrading #strategictradeplanning #strategictradeplan #letsdoit #challengeaccepted https://www.instagram.com/p/CAu69abp1MH/?igshid=obt5eg5om5rt

#tempertrader#trader#tradingbasics#tradingforliving#tradingforbeginners#tradingforex#tradeconsciously#tradefromhome#chartpartterns#charts#phycological#technicalanalysisforbeginners#technicalanalysis#forex#forextradingforbeginners#stocks#stockmarkettips#stockmarket#lowrisk#lowriskinvesting#lowrisktrading#strategies#strategictrading#strategictradeplanning#strategictradeplan#letsdoit#challengeaccepted

21 notes

·

View notes