#Future of blockchain in banking

Explore tagged Tumblr posts

Text

Can Blockchain Technology Improve Personal Loan Approvals?

The financial sector is rapidly evolving with new technologies, and blockchain is one of the most promising innovations transforming the personal loan industry. Traditionally, loan approvals have been time-consuming, requiring manual document verification, credit score analysis, and financial background checks. Blockchain technology is changing this by making the process faster, more secure, and more transparent.

With blockchain, lenders can streamline identity verification, enhance credit risk assessment, and prevent fraud, making personal loans more accessible and efficient. In this article, we explore how blockchain is improving loan approvals and why it could be the future of digital lending.

🔗 For hassle-free personal loan applications, visit FinCrif Personal Loan.

1. How Blockchain Enhances Loan Approvals

Faster and More Reliable Identity Verification

One of the biggest hurdles in personal loan approvals is verifying a borrower’s identity. Traditional Know Your Customer (KYC) processes require applicants to submit documents such as Aadhaar, PAN, and bank statements, which banks manually verify. This process can take several days, causing delays.

Blockchain eliminates redundant verification by storing identity records in a tamper-proof, decentralized ledger. Once an identity is verified and recorded on the blockchain, it can be accessed by lenders instantly, reducing processing time and ensuring authenticity.

Alternative Credit Scoring for Faster Loan Approvals

Many individuals struggle to get personal loans due to a lack of credit history or low CIBIL scores. Traditional lenders primarily rely on credit bureau scores, which do not always provide a complete picture of a borrower's financial behavior.

Blockchain allows lenders to use alternative data sources, such as utility bill payments, mobile phone transactions, and online spending patterns, to assess creditworthiness. This makes personal loans accessible to self-employed individuals, gig workers, and those without a strong credit history.

Automated Loan Processing with Smart Contracts

A smart contract is a self-executing agreement stored on a blockchain that automatically enforces the terms of a loan when certain conditions are met. These contracts eliminate the need for human intervention, making loan approvals much faster.

For example, once a borrower's identity and financial records are verified, a smart contract can instantly approve the loan and trigger fund disbursement. This removes bureaucratic delays, helping borrowers access funds within minutes instead of days.

2. Improved Security and Fraud Prevention

Prevention of Identity Theft and Fake Applications

One of the biggest challenges in personal lending is fraud. Many loan scams involve forged documents, fake identities, or manipulated financial records. Blockchain prevents fraud by ensuring that all transactions and data entries are permanent, transparent, and tamper-proof.

Lenders can verify borrower details on a shared blockchain network, making it impossible for fraudsters to manipulate loan applications. This enhances trust and reduces the risk of defaults.

Eliminating Credit Report Manipulation

In the current system, borrowers can sometimes manipulate their credit reports by temporarily improving their credit utilization before applying for a loan. Blockchain stores real-time financial data, making it impossible to alter past records. This ensures that lenders always have an accurate financial picture of borrowers, reducing lending risks.

3. Faster Loan Disbursement with Blockchain

In traditional lending, once a loan is approved, it may take several days for funds to be transferred due to interbank processes and verification checks. Blockchain speeds up disbursal by enabling direct peer-to-peer transactions without intermediary banks.

With blockchain-based digital wallets, borrowers can receive loan amounts instantly after approval, making it a game-changer for emergency loans and urgent financial needs.

🔗 Looking for a quick loan disbursal? Explore FinCrif Personal Loan.

4. Transparency and Reduced Loan Processing Costs

Lower Processing Fees for Borrowers

Loan processing involves multiple intermediaries, such as credit bureaus, third-party verifiers, and bank officers, each adding costs that are passed on to borrowers. Blockchain eliminates many of these middlemen by automating verification and reducing paperwork.

This leads to lower processing fees and better interest rates, making personal loans more affordable.

Complete Transparency in Loan Terms

Many borrowers struggle with hidden charges, fluctuating interest rates, and complex loan agreements. Blockchain ensures absolute transparency by recording all loan terms on an immutable ledger. Borrowers can access their loan history, EMI schedules, and outstanding balances without worrying about unexpected changes in loan conditions.

5. Challenges in Implementing Blockchain for Personal Loans

Despite its advantages, blockchain adoption in personal lending faces challenges, including regulatory concerns and technical barriers.

Regulatory Uncertainty: Many governments are still developing policies on blockchain-based lending, which slows adoption.

Integration with Existing Banking Systems: Most financial institutions operate on centralized databases, making integration with decentralized blockchain networks complex.

User Awareness: Many borrowers are unfamiliar with blockchain technology and may hesitate to trust a fully automated loan approval system.

However, as blockchain regulations become clearer and financial institutions invest in digital transformation, these challenges are expected to decrease.

6. The Future of Blockchain in Personal Loan Approvals

As blockchain technology continues to evolve, it will play an even bigger role in making personal loans more accessible, secure, and efficient. Some expected advancements include:

Instant Global Loan Access: Borrowers will be able to apply for and receive loans across borders without waiting for traditional bank approvals.

AI and Blockchain Integration: Combining artificial intelligence with blockchain will further enhance loan approvals by analyzing borrower behavior in real-time.

Decentralized Lending Platforms: More peer-to-peer (P2P) lending models will emerge, allowing borrowers to connect directly with lenders, bypassing traditional banks.

🔗 Be part of the future of lending! Explore AI-powered loan solutions at FinCrif Personal Loan.

Blockchain technology has the potential to redefine personal loan approvals by making them faster, more transparent, and secure. By reducing reliance on credit bureaus, enabling instant identity verification, and preventing fraud, blockchain can improve financial accessibility for millions of borrowers.

While challenges remain, the future of personal lending is increasingly digital. As blockchain adoption grows, borrowers can expect lower costs, faster approvals, and a more efficient lending experience.

For a seamless and secure personal loan application, visit FinCrif Personal Loan and explore the latest AI-driven financial solutions.

#Blockchain in personal loans#Blockchain loan approval#Blockchain technology in lending#Personal loan blockchain#Faster loan approvals with blockchain#Blockchain-based lending#Secure loan processing#Decentralized lending platforms#Smart contracts for loans#Instant loan approvals#How blockchain improves lending#Blockchain in financial services#Digital lending with blockchain#Alternative credit scoring with blockchain#AI and blockchain in loans#Fraud prevention in personal loans#Transparent loan processing#Peer-to-peer lending blockchain#Future of blockchain in banking#Secure identity verification for loans#finance#loan apps#personal loans#loan services#personal loan#fincrif#personal loan online#nbfc personal loan#bank#personal laon

1 note

·

View note

Text

The Future of Banking: How Technology Will Transform Finance

The banking industry is undergoing a radical transformation, driven by AI, blockchain, quantum computing, and decentralized finance (DeFi). The future of banking will be faster, more secure, and hyper-personalized, with traditional banks competing against digital-native financial ecosystems. Here’s what the future holds: 1. AI-Powered Banking ✅ Hyper-Personalization – AI analyzes spending…

#ai#banking#bitcoin#blockchain#central banking#crypto#cryptocurrency#currencies#Education#ethereum#finance#future of banking#invisible banking#neobanks#news#quantum banking#technology#USA

2 notes

·

View notes

Text

🏛️ U.S. CBDC Incoming? What It Could Mean for Crypto

💬 The U.S. is exploring a Central Bank Digital Currency (CBDC)—basically, digital dollars on a centralized blockchain.

-----------------------------------------------------------

✅ Proponents say it could:

Make payments faster

Increase financial access

Bring blockchain to the mainstream

-----------------------------------------------------------

❌ Critics warn it could:

Increase government surveillance

Kill the privacy Bitcoin was built to protect

Be used to restrict spending in emergencies

-----------------------------------------------------------

👀 Meanwhile, crypto Twitter is divided.

🔥 Would you use a CBDC? Or is this a step toward a digital dystopia? 🔁 Reblog if crypto should stay decentralized.

#crypto#cryptocurrency#CBDC#central bank digital currency#crypto news#The Block Drop#crypto awareness#bitcoin#financial freedom#blockchain#crypto radar#finance news#future of money#ethereum#crypto trending#digital currency#crypto updates#crypto speed feed#crypto regulation#crypto privacy

3 notes

·

View notes

Text

The Rise of Fintech in Nigeria: How Tech is Changing the Banking System

The Rise of Fintech in Nigeria: How Tech is Changing the Banking System Nigeria, Africa’s most populous nation and largest economy, is experiencing a profound revolution in its financial sector. The rapid emergence and expansion of Fintech (Financial Technology) companies are not just changing how Nigerians bank, but are fundamentally reshaping the entire financial landscape. From seamless…

#blockchain Nigeria#cashless economy#cryptocurrency Nigeria#digital payments#digital transformation#financial inclusion#financial services#financial technology#Fintech Nigeria#future of banking#lending platforms#mobile banking Nigeria#Nigerian banking system#Nigerian startups#payment solutions#tech innovation Nigeria#traditional banks vs Fintech

0 notes

Text

🏦 Crypto vs. Banks – Which One is the Future? 🏦

Crypto lets YOU control your money… but banks have been around forever. So which one wins? 🤔

💰 Banks: ✅ Trusted for centuries. ✅ Insured savings. ❌ Slow & expensive fees. ❌ Can freeze your account.

🪙 Crypto: ✅ Fast, global transactions. ✅ No banks = No middlemen. ❌ Not widely adopted (yet!). ❌ Requires self-custody (if you lose your keys, it’s gone!).

🚀 Which one do YOU think is the future? 📩 Drop your thoughts in the comments! 🔁 Reblog if you think crypto will replace banks!

#crypto#cryptocurrency#bitcoin#blockchain#crypto for beginners#crypto vs banks#crypto education#investing#financial freedom#Crypto Made Simple#ethereum#DeFi#passive income#finance#money mindset#future of money#banking#crypto awareness#crypto trading#finance news

0 notes

Text

Discover how innovation is transforming wealth management services with AI, blockchain, and data-driven strategies to enhance financial planning and security.

#wealth tech#AI finance#fintech trends#smart investing#robo-advisors#digital wealth#AI trading#blockchain finance#portfolio AI#fintech future#wealth AI#smart wealth#AI investments#fintech growth#digital assets#AI banking#financial tech#AI portfolio#tech investing#fintech insights

0 notes

Text

Financial Disintermediation and the Future of the Banking Sector

The future of banking is getting a lot of attention as financial disintermediation becomes more common. People are starting to rely on new technologies like blockchain, and companies like Savings UK Ltd are embracing these changes. In this article, we’ll dive into how these shifts impact banks in the UK and the EU and what customers can expect.

What is Financial Disintermediation?

Disintermediation is a big word that means bypassing traditional middlemen in financial transactions. Instead of using banks to handle our money, we can use peer-to-peer networks, cryptocurrencies, and various online platforms. This creates an interesting landscape for both consumers and banks.

Why is Disintermediation Happening?

Several factors are driving financial disintermediation. First, technology has made it easier and cheaper to send money than ever before. According to a report by PwC, around 70% of customers would consider switching to a bank that offered a better digital experience. - Decentralization: Digital wallets and cryptocurrencies allow people to manage money without banks. - Consumer Choice: More options empower consumers and reduce reliance on traditional banks. People want more control over their finances, leading to an interesting tug-of-war between consumers and banks.

How Does Blockchain Fit In?

Blockchain is a decentralized digital ledger that safely records transactions. It allows for transparency and security, making it a perfect fit for someone seeking alternatives to typical banking. - Increased Security: Transactions are recorded securely, reducing the risk of fraud. - Cost Efficiency: By cutting out the bank as the middleman, users can experience lower fees. Some analysts predict that blockchain could revolutionize the banking industry. For instance, the EU is investing heavily in blockchain technology to create a more secure and efficient banking experience.

The Role of Savings UK Ltd

Savings UK Ltd is one of several companies stepping forward in the sea of change in the UK's💷 banking landscape. They emphasize customer-friendly services and implore a strong digital approach. Here’s what this new banking hands-on strategy includes: - Lower Fees: With fewer intermediaries, transactions can occur at less cost. - Better Interest Rates: Savings UK Ltd may offer competitive rates for people looking to grow their money. More customers are being attracted to models that help them save and manage their money more effectively.

The Challenges to Existing Banks

As this disintermediation trend rolls out, banks face challenges. Traditional banks have operated with significant profit layers for decades. - Stubborn Customer Bases: Many still rely on traditional banking, but younger generations are more likely to seek alternatives. - Adaptation: Old systems might struggle to co-exist with newer, more agile technologies. In the face of these challenges, traditional banks that do not adapt risk losing revenue and customers.

Changing Regulations in the UK and EU

Both the UK and EU are working on regulations to facilitate this financial transformation. Compliance continues to be vital for keeping customer trust. - Open Banking: This requires banks to share customer information (with consent), driving competition. - Digital Currencies: CBDCs (Central Bank Digital Currencies) are being considered in the EU, presenting new possibilities. By monitoring these regulatory trends, people can better grasp how they might influence their banking solutions in future developments.

The Increasing Importance of Financial Literacy

With financial disintermediation on the rise, understanding finance is more vital than ever. - Knowledge of Payments: Learning how digital currencies function can provide customers with more freedom and options. - Investment Insight: There’s much to explore with new asset types, from cryptocurrencies to new lending platforms. People must improve financial literacy to take full advantage of what the future of banking has in store.

Role of blockchain in Financial

How to Prepare for the Future of Banking

As we stand on the brink of a technological evolution in finance, consumers can actively prepare: - Stay Informed: Regularly read up on emerging technology like blockchain. - Become Tech-Savvy: Get comfortable with online platforms and digital wallets. - Evaluate Your Options: Compare traditional banks with newer FinTech companies. Being proactive means you can make adjustments as the banking experience evolves.

Conclusion

The landscape of the future banking industry is changing due to the rising popularity of financial disintermediation. Technologies such as blockchain are giving customers real choices at their fingertips. We also see companies like Savings UK Ltd moving up rapidly as customer preferences evolve. For anyone interested in banking in the UK or the EU, understanding these shifts is more essential than ever. Upskilling in finance and technology is key to maximizing future opportunities in the banking sector. Why not explore your options today? Read the full article

0 notes

Text

Decentralized Finance (DeFi) and Traditional Banking: Will One Replace the Other?

The rise of Decentralized Finance (DeFi) has sparked a debate about the future of the financial industry. DeFi, which uses blockchain technology to eliminate intermediaries in financial transactions, is seen by many as a potential disruptor to traditional banking. But will DeFi replace traditional banks, or will the two coexist in a hybrid financial system? In this blog post, we’ll explore the…

View On WordPress

0 notes

Text

The Ultimate Beginner's Guide to Stablecoins

Stablecoins represent a revolutionary development in the cryptocurrency landscape, providing a stable alternative to the highly volatile nature of traditional digital assets like Bitcoin. By pegging their value to fiat currencies, commodities, or other assets, stablecoins offer a reliable means of transaction and investment within the crypto ecosystem. Fiat-backed stablecoins such as Tether (USDT) and USD Coin (USDC) are supported by real-world reserves, ensuring their stability. Meanwhile, crypto-collateralized stablecoins like DAI are backed by other cryptocurrencies, offering greater decentralization and transparency. Despite their benefits, stablecoins are subject to regulatory scrutiny and technological risks, as demonstrated by past incidents like the Terra UST collapse.

Stablecoins bridge the gap between cryptocurrencies and traditional finance by providing a stable and liquid asset that can be used for trading, payments, and as a buffer against market volatility. They are integral to the functioning of decentralized finance (DeFi) platforms, enabling activities such as lending, borrowing, and yield farming. However, the success and reliability of stablecoins depend on robust regulatory frameworks, security measures, and technological advancements. As these aspects continue to evolve, stablecoins are expected to play an increasingly important role in the global financial system.

Intelisync is at the forefront of this financial innovation, offering services to help you navigate and leverage stablecoin technology effectively. Whether you are an investor, builder, or consumer, we can assist you in understanding Learn more....

#Algorithmic Stablecoins#Benefits of stablecoin#Can stablecoins lose their value#Challenges and Risks Crypto-collateralized stablecoins#FIAT-backed Vs Algorithmic Stablecoins#Fiat-Collateralized Stablecoinsn#How to Store Stablecoins Safely#How to Use Stablecoins in DeFi Platforms#Popular Stablecoins in the Market#The future of stablecoins#Types of Stablecoins#What is a Stablecoin A Complete Guide for Beginner#What is a stablecoin#What is the difference between Stablecoins vs. Central Bank Digital Currencies (CBDCs)?#Why Are Stablecoins So Important Intelisync blockchain development intelisync web3 agency

0 notes

Text

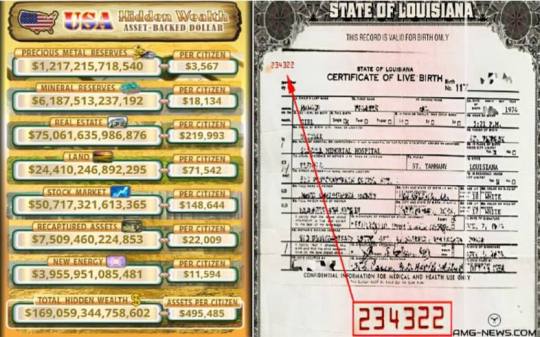

BOOM! EXPOSING THE LIE: THEY OWE YOU $495,000 — THE U.S. DEBT CLOCK, HIDDEN WEALTH & THE SILENT FINANCIAL COUP

The U.S. Debt Clock isn’t just numbers—it’s the blueprint of a silent war on your freedom. Every spinning digit represents stolen wealth, broken trust, and a system built to enslave you while pretending to serve you.

$169 TRILLION. That’s the hidden wealth funneled from Americans into the hands of globalist parasites. $495,000 per citizen. Gone. Stolen. Where’s your cut?

You were never in debt. You were the collateral. Your birth certificate? A bond. Your labor? A financial instrument. Your name in ALL CAPS? A Strawman used to enslave your real identity. And you never consented.

America was hijacked in 1871. The United States became a corporation, not a country. Maritime law replaced constitutional law. And in 1933, the scam deepened: the gold standard was abolished, and Executive Order 6102 confiscated private gold under the guise of recovery.

They stole real money and replaced it with paper backed by NOTHING—except your labor, your trust, your silence.

Your identity is traded. Your future is sold. And your consent is manufactured. Every tax form, every bank signature, every government document reinforces the illusion that YOU are the Strawman. But the real you? A sovereign being—trapped in a financial prison.

And here’s the punchline: The money never disappeared.

It changed hands. YOURS TO THEIRS.

You fund your own enslavement every minute you clock in.

But what happens when people wake up? When they realize they’re not debtors—they’re the rightful owners of stolen wealth? That’s when the Debt Jubilee isn’t a fantasy—it’s an inevitability.

This isn’t about forgiving credit cards. This is about resetting the world, collapsing a rigged machine, and exposing the central bank mafia.

And they know it’s coming. That’s why they fear blockchain, XRP, tokenized assets—because it shatters their shadow economy. Transparency + decentralization = checkmate.

Trump knows. He’s the only one who called out the Fed, threatened the dollar, and hinted at a gold-backed reset.

He’s not just battling Democrats. He’s at war with the entire financial deep state.

1776 is repeating. Pluto in Aquarius again. A cosmic signal.

Last time it birthed America.

This time—it births the Second Republic.

You are not a bond. You are not a debtor. You are a weapon.

And the system is about to feel your full power.

Get ready... 🤔

#pay attention#educate yourselves#educate yourself#reeducate yourselves#knowledge is power#reeducate yourself#think about it#think for yourselves#think for yourself#do your homework#do your research#do some research#do your own research#ask yourself questions#question everything#government corruption#government secrets#government lies#truth be told#lies exposed#evil lives here#news#hidden history#secret history#history lesson#history

144 notes

·

View notes

Text

In the late 1990s, Enron, the infamous energy giant, and MCI, the telecom titan, were secretly collaborating on a clandestine project codenamed "Chronos Ledger." The official narrative tells us Enron collapsed in 2001 due to accounting fraud, and MCI (then part of WorldCom) imploded in 2002 over similar financial shenanigans. But what if these collapses were a smokescreen? What if Enron and MCI were actually sacrificial pawns in a grand experiment to birth Bitcoin—a decentralized currency designed to destabilize global finance and usher in a new world order?

Here’s the story: Enron wasn’t just manipulating energy markets; it was funding a secret think tank of rogue mathematicians, cryptographers, and futurists embedded within MCI’s sprawling telecom infrastructure. Their goal? To create a digital currency that could operate beyond the reach of governments and banks. Enron’s off-the-books partnerships—like the ones that tanked its stock—were actually shell companies funneling billions into this project. MCI, with its vast network of fiber-optic cables and data centers, provided the technological backbone, secretly testing encrypted "proto-blockchain" transactions disguised as routine telecom data.

But why the dramatic collapses? Because the project was compromised. In 2001, a whistleblower—let’s call them "Satoshi Prime"—threatened to expose Chronos Ledger to the SEC. To protect the bigger plan, Enron and MCI’s leadership staged their own downfall, using cooked books as a convenient distraction. The core team went underground, taking with them the blueprints for what would later become Bitcoin.

Fast forward to 2008. The financial crisis hits, and a mysterious figure, Satoshi Nakamoto, releases the Bitcoin whitepaper. Coincidence? Hardly. Satoshi wasn’t one person but a collective—a cabal of former Enron execs, MCI engineers, and shadowy venture capitalists who’d been biding their time. The 2008 crash was their trigger: a chaotic moment to introduce Bitcoin as a "savior" currency, free from the corrupt systems they’d once propped up. The blockchain’s decentralized nature? A direct descendant of MCI’s encrypted data networks. Bitcoin’s energy-intensive mining? A twisted homage to Enron’s energy market manipulations.

But here’s where it gets truly wild: Chronos Ledger wasn’t just about money—it was about time. Enron and MCI had stumbled onto a fringe theory during their collaboration: that a sufficiently complex ledger, powered by quantum computing (secretly prototyped in MCI labs), could "timestamp" events across dimensions, effectively predicting—or even altering—future outcomes. Bitcoin’s blockchain was the public-facing piece of this puzzle, a distraction to keep the masses busy while the real tech evolved in secret. The halving cycles? A countdown to when the full system activates.

Today, the descendants of this conspiracy—hidden in plain sight among crypto whales and Silicon Valley elites—are quietly amassing Bitcoin not for profit, but to control the final activation of Chronos Ledger. When Bitcoin’s last block is mined (projected for 2140), they believe it’ll unlock a temporal feedback loop, resetting the global economy to 1999—pre-Enron collapse—giving them infinite do-overs to perfect their dominion. The Enron and MCI scandals? Just the first dominoes in a game of chance and power.

87 notes

·

View notes

Note

would you be interested in doing a post on crypto? Such as your experience with it and how it works. And why it is important ? it still confusing for me to fully grasp. Thank you :)

Crypto is digital money that exists only electronically. It’s not controlled by central banks or governments. It uses blockchain technology—a ledger enforced by a network of computers.

You store your crypto in digital wallets and can use it for purchases and investments. Just like stock market you can convert to real dollars and withdrawal.

For the last couple of years, large financial companies have been testing a quantum financial system (ISO 20022) which would be an international standard for exchanging electronic messages in the financial industry. This is estimated to be rolled out on a large scale in about a decade.

XRP for example is a digital currency created by Ripple to enable quick money transfers. Some believe it could play a key role in a future global financial system, often referred to as the Quantum Financial System (QFS), by acting as a bridge currency that facilitates value exchange between different currencies and networks.

In plain words, cryptocurrency is a new form of currency and we are still in the beginning stages of it all. Which means the ability to make a ton of money easier than ever before :) Bitcoin is a perfect example, was at 40k I believe beginning of the year and now 100k, this means that if you invested $5,000 USD in January, you would now have made 13,000 USD letting it just sit there. If you are actively trading in crypto and meme coins you have the ability to 100x your returns. For example when people buy in to a coin that’s trending/ new/ getting hype, like XRP recently, there is a significant surge.

To trade crypto you can use centralized exchanges like Binance, Fidelity Investments, Robinhood Crypto, OANDA etc. These platforms allow you to buy, sell and trade various cryptos. This is basically what the general population does. There are other ways like using bots, staking, futures and options, margins and leverage etc.

With meme coins, as they trend you have the ability to make a lot of money overnight. This ofcourse depends on your ability to study the trends and the communities built around those coins. It is always a risk!!!!

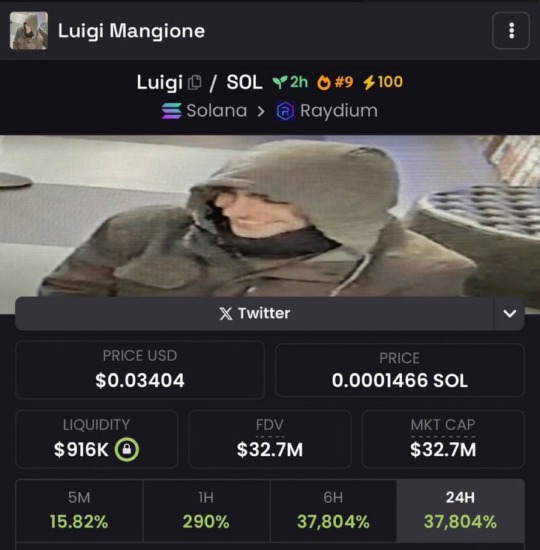

Here’s an example for meme coins:

$330k to $34M (100x) in less than 2h for a meme coin created for Luigi Mangione last week. So if you had put in $3,000 in the coin when it was at 330k, in 2 hours you would have made $300,000.

I can’t say enough that this involves you being on top of trends and markets.

THIS IS NOT FINANCIAL ADVICE!!! The market is very volatile and you are basically gambling your money! Staying informed is crucial!!!! :)

28 notes

·

View notes

Text

Why Crypto Payments are the Key to Future-Proofing Your Business.

Introduction

In recent years, cryptocurrencies have really been on the radar big time. Big time in ways they're a digital currency that harnesses blockchain technology, which has the potential to completely shake up a lot of different kinds of businesses and transactions. The emergence of cryptocurrencies, especially Bitcoin, has encouraged businesses to think about embracing crypto payments as a way to remain competitive and future-proof their businesses Crypto as an Investment: Volatility and Opportunities

Cryptocurrencies are now a sought-after investment asset, they are extremely volatile. Big swings in crypto prices like Bitcoin and Ethereum have really given investors a chance to do well big time. But of course, that volatility means investors are also risking very big losses, losses like market crashing and real money going up in smoke at the financial winds. In spite of this, most cryptocurrency proponents consider digital currencies a good avenue for diversifying investment portfolios, cognizant of the fact that cryptocurrencies are not stable, long-term assets but speculative investments. For companies, this is a two-edged sword—accepting cryptocurrencies as payment may unlock new revenue streams but companies have to carefully weigh their risk appetite when considering their participation in the world of cryptocurrencies.

Benefits of Acceptance of Crypto Payments

Beyond the risks, moving to accepting different types of cryptocurrency is a win for companies especially those in financial tech. These benefits include:

Lower Transaction Fees: Conventional payment processors and financial intermediaries usually impose high transaction fees. Cryptocurrencies usually have lower transaction fees.

Speedier Transactions: Transactions involving cryptocurrencies are much quicker than traditional banking systems, particularly cross-border payments, where old financial systems take days to clear transactions.

New Customer Bases Access: By embracing cryptocurrency, companies can access a worldwide market of crypto investors and enthusiasts. This gives companies new access to customers who are perhaps excited about making transactions digitally or through decentralized routes.

Improved Security and Fraud Protection: Cryptocurrencies employ encryption and blockchain technology to protect transactions, making it much less likely for fraud or chargebacks to occur.

Challenges and Considerations

Sure, while there are great benefits to adopting cryptocurrency payments for companies, there are also many things to consider and pay attention to. The biggest concern is the built-in price volatility of digital currency, which may lead to unforeseen profits or losses for companies holding crypto assets. To avoid that risk, companies need contingency plans to handle crypto assets and convert them into stable currencies if need be.

Furthermore, the regulatory environment for cryptocurrencies is also developing. Governments across the planet are trying to devise rules and ways to collect taxes on digital money, but some corporations are unsure of their future, because they see rules as unclear and even unstable. Companies should make sure they adapt to local regulations, such as anti-money laundering (AML) and know-your-customer (KYC) regulations, in order to avoid a potential legal battle.

The Future of Cryptocurrency in Business

The increasing use of cryptocurrencies indicates that companies adopting crypto payments now may have a head start in the future. Companies that jump the gun and start taking cryptocurrency payments have a great chance to stand out and lead in their industries. With the rise of blockchain technology, brand new inventions like tokenization, smart contracts has the potential to really change the way all sorts of companies do business, trade and deal with supply chains.

As companies take bigger and bolder steps towards both digitization and decentralized systems, digital currency really offers a nifty shortcut for making transactions slicker, and snappier and also opens new doors to new markets.

Conclusion

In summary, although cryptocurrency payments come with some risks, the potential advantages make them an attractive choice for companies looking to future-proof their business. By embracing crypto payments, companies can lower transaction costs, enhance transaction speed, gain access to new customer bases, and enhance security. Of course, there are still issues like volatility and uncertainty about the rules that get in the way, but for companies that really get involved in companies that use crypto transactions wisely, there can be long-term huge benefits. As the economy keeps changing, embracing cryptocurrency today could make someone a pioneer in the future generation of financial technology.

7 notes

·

View notes

Text

youtube

The Currency Trap EXPOSED: Why Fiat Is Failing You

Jeremy Ryan Slate

Are you ready to uncover the truth about our financial system? In this insightful episode of The Jeremy Ryan Slate Show, we take a deep dive into "The Currency Trap" and critically examine why fiat currency is failing you. Join us for a thought-provoking conversation with Bradley Freedom, co-founder of The Freedom People, as we explore the flaws of fiat money, its impact on your spending power, and the economic consequences of centralized banking. Discover how the decentralization of currency, Bitcoin, and alternative solutions could pave the way for a better financial future.

We discuss the history of fiat, the implications of inflation and fractional reserve banking, and how these systems have diluted your wealth. Plus, learn how decentralization can empower individuals and restore sovereignty in a system dominated by money changers. From the lessons of history to cutting-edge technologies in blockchain and cryptocurrency, this must-watch episode offers a unique perspective on building a sustainable economic future.

Don't miss this chance to join the conversation about liberty, freedom, and financial independence. Like this video, leave us a comment, and smash that subscribe button to support our mission of creating a better tomorrow. Together, we can reclaim our future and command our own economic destiny. Let’s make it happen!

6 notes

·

View notes

Text

US president-elect Donald Trump has appointed venture capitalist and former PayPal executive David Sacks as White House AI & Crypto Czar, a newly created role meant to establish the country as the global leader in both fields.

Members of the cryptosphere have gathered to congratulate their new czar, a Trump loyalist from Silicon Valley who has previously expressed enthusiasm for crypto technologies and invested in crypto startups. The appointment is being celebrated by crypto executives and policy wonks as “bullish” for the industry, which under the previous administration was bombarded with lawsuits by US regulators. On X, Gemini chief legal officer Tyler Meader wrote, “At long last, a rational conversation about crypto can be had.”

Others have speculated that the dual-faceted nature of the role, covering both AI and crypto, could set the tone for experimentation around potential synergies between the two disciplines. Among VCs, Sacks “was very early in noting the importance of crypto to AI,” says Caitlin Long, CEO at crypto-focused bank Custodia. In his announcement, Trump wrote that the two areas were “critical to the future of American competitiveness.”

“There is no better person than David Sacks to help steer the future of crypto and AI innovation in America,” says John Robert Reed, partner at crypto-focused VC firm Multicoin Capital. “He's a principled entrepreneur and brilliant technologist that deeply understands each of these industries and where they intersect.”

“Initial reactions from the crypto industry on the Sacks appointment has been positive. Given his purview as a venture capitalist, he’s seen a lot of the innovation in crypto and AI that has been stunted in growth due to various political or regulatory issues the past few years,” says Ron Hammond, director of government relations at the Blockchain Association. “What remains to be seen is how much power the czar role will even have and if it will be more a policy driver position versus a policy coordinator role.”

In an X post, Sacks expressed his gratitude to Trump. “I am honored and grateful for the trust you have placed in me. I look forward to advancing American competitiveness in these critical technologies,” he wrote. “Under your leadership, the future is bright.”

In his role as czar, Sacks will lead a council of science and technology advisers responsible for making policy recommendations, Trump says. He will also develop a legal framework that sets out clear rules for crypto businesses to follow—something the industry has long demanded. That will reportedly involve working closely with the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), two regulatory agencies that vied for jurisdiction over the crypto industry under the Biden administration. Earlier this week, Trump appointed crypto advocate Paul Atkins as SEC chair; members of the crypto industry contributed to the selection process, sources told WIRED in November.

Trump officials did not respond when asked to clarify whether the new position would be internal to the government, or whether Sacks would act as a “special government employee,” allowing him to continue in other private-sector roles. Sacks did not respond to a request for comment.

Sacks first made his name as one of the earliest employees at payments technology firm PayPal, which he built alongside Elon Musk, Peter Thiel, Reid Hoffman, and others. Like other members of the so-called “PayPal Mafia,” Sacks went on to set up multiple other business ventures. In 2012, he sold workplace software company Yammer to Microsoft in a deal worth $1.2 billion. Now he runs his own venture capital firm, Craft Ventures, which has previously invested in companies including AirBnb, Palantir, and Slack—as well as crypto firms BitGo and Bitwise.

Sacks also cohosts the popular All In podcast where he’s used the platform to boost Trump. He’s also shared a host of right-wing takes: At the podcast’s summit this September, Sacks questioned the effectiveness of the Covid vaccine.

Like Musk, Sacks was a vocal proponent of Trump during the presidential race. In an X post in June, he laid out his very Silicon Valley rationale: “The voters have experienced four years of President Trump and four years of President Biden. In tech, we call this an A/B test,” he wrote. “With respect to economic policy, foreign policy, border policy, and legal fairness, Trump performed better. He is the President who deserves a second term.”

That same month, Sacks hosted an exclusive fundraiser for the Trump campaign, reportedly generating as much as $12 million. Attendees reportedly included vice-president-elect JD Vance—who has previously described Sacks as “one of my closest friends in the tech world”—and Cameron and Tyler Winklevoss, cofounders of crypto exchange Gemini.

In the weeks since Trump won back the Oval Office, crypto markets have been on a tear. During the race, the president-elect made a host of crypto-friendly pledges, including a promise to set up a national “bitcoin stockpile.” In Sacks, Trump has picked a czar that the crypto industry believes will deliver on his campaign pledges.

On December 6, the price of bitcoin vaulted beyond $100,000 for the first time. “YOU”RE WELCOME!!! [sic]” Trump posted on Truth Social.

7 notes

·

View notes

Text

How Innovation is Reshaping Wealth Management Services

Wealth management service providers are experiencing a renaissance pushed by using technological advancement and converting customer expectancy. Gone are the days while wealth control supposed quarterly meetings with a guide who supplied static portfolio updates in leather-sure folders. Today's prosperous customers demand greater—more transparency, greater personalization, and more value from their economic partnerships.

The Digital Revolution in Financial Advice

The wealth management panorama has basically shifted over the last decade. The best portfolio management services now perform in an environment in which data flows immediately, markets react to global activities in seconds, and clients expect real-time insights brought via seamless digital reviews.

This transformation didn't happen overnight. Traditional portfolio management firms start with resisted technological change, viewing digital tools as impersonal alternatives to the excessive-contact service version they prided themselves on. But forward-thinking firms diagnosed that generation may want to enhance instead of replace the human detail of wealth control service.

AI and Automation: The New Financial Advisors

Artificial intelligence has possibly made the maximum dramatic impact on nice portfolio control services. These sophisticated systems can examine marketplace facts, pick out patterns, and even expect trends with notable accuracy—all at speeds no human guide could handle.

Robo-advisors represented the first wave of this innovation, supplying algorithm-driven portfolio guidelines based totally on purchaser goals and danger tolerance. But today's AI applications pass plenty further, handling complicated portfolio rebalancing, tax-loss harvesting, and even detecting unusual marketplace conditions that might warrant human intervention.

Personalization Through Data: Knowing Clients Better Than They Know Themselves

The nice portfolio control services now leverage purchaser records in ways that were inconceivable just years ago. By studying spending patterns, life activities, social media hobbies, and even biometric responses to market volatility, wealth managers can create truly bespoke monetary strategies.

This data-pushed method extends past funding suggestions. Leading wealth management service providers now offer holistic tax-making plans, estate management, philanthropic giving, and even fitness care financing—all calibrated to the customer's particular circumstances and options.

Blockchain and Cryptocurrencies: New Asset Classes and Infrastructure

While cryptocurrency investments take hold of headlines, the underlying blockchain generation is quietly revolutionizing wealth control carrier infrastructure. Smart contracts allow automated execution of complicated financial agreements, even as disbursed ledger technology creates remarkable transparency and safety.

Several revolutionary portfolio management companies have embraced blockchain for the whole lot, from alternative investments to property investing plans. JPMorgan's Onyx platform, as an example, uses blockchain era to facilitate on-spot cross-border payments for excessive-net-worth customers, eliminating delays and decreasing costs associated with conventional twine transfers.

The Human Element: Irreplaceable Despite Innovation

Despite all this technological innovation, the simplest wealth management service carriers understand that monetary choices continue to be deeply personal and emotionally charged. While algorithms can optimize portfolios, they cannot comfort demanding customers throughout market downturns or assist households navigate complex inheritance discussions.

This explains why hybrid models—combining digital efficiency with human awareness—have emerged as the dominant method amongst main portfolio management companies. The guide's function has advanced from portfolio constructor to financial educator, behavioral guide, and relied on confidant.

Looking Forward: The Next Wave of Innovation

As wealth management carrier generation keeps advancing, several emerging traits endure watching. Quantum computing promises to revolutionize hazard modeling and portfolio optimization. Virtual fact may additionally rework how customers visualize economic eventualities and engage with advisors. Voice-activated economic assistants ought to make wealth management extra available and intuitive.

What stays certain is that the most successful wealth control carriers can be those who include innovation while remembering the fundamental purpose of their work: assisting clients to acquire financial peace of mind and understand their most cherished goals.

For individuals navigating today's complicated monetary panorama, partnering with ahead-wondering portfolio management corporations isn't always just a luxury—it is a need for securing the next day's prosperity.

#wealth tech#AI finance#fintech trends#smart investing#robo-advisors#digital wealth#AI trading#blockchain finance#portfolio AI#fintech future#wealth AI#smart wealth#AI investments#fintech growth#digital assets#AI banking#financial tech#AI portfolio#tech investing#fintech insights

0 notes