#Challenges and Risks Crypto-collateralized stablecoins

Explore tagged Tumblr posts

Text

The Ultimate Beginner's Guide to Stablecoins

Stablecoins represent a revolutionary development in the cryptocurrency landscape, providing a stable alternative to the highly volatile nature of traditional digital assets like Bitcoin. By pegging their value to fiat currencies, commodities, or other assets, stablecoins offer a reliable means of transaction and investment within the crypto ecosystem. Fiat-backed stablecoins such as Tether (USDT) and USD Coin (USDC) are supported by real-world reserves, ensuring their stability. Meanwhile, crypto-collateralized stablecoins like DAI are backed by other cryptocurrencies, offering greater decentralization and transparency. Despite their benefits, stablecoins are subject to regulatory scrutiny and technological risks, as demonstrated by past incidents like the Terra UST collapse.

Stablecoins bridge the gap between cryptocurrencies and traditional finance by providing a stable and liquid asset that can be used for trading, payments, and as a buffer against market volatility. They are integral to the functioning of decentralized finance (DeFi) platforms, enabling activities such as lending, borrowing, and yield farming. However, the success and reliability of stablecoins depend on robust regulatory frameworks, security measures, and technological advancements. As these aspects continue to evolve, stablecoins are expected to play an increasingly important role in the global financial system.

Intelisync is at the forefront of this financial innovation, offering services to help you navigate and leverage stablecoin technology effectively. Whether you are an investor, builder, or consumer, we can assist you in understanding Learn more....

#Algorithmic Stablecoins#Benefits of stablecoin#Can stablecoins lose their value#Challenges and Risks Crypto-collateralized stablecoins#FIAT-backed Vs Algorithmic Stablecoins#Fiat-Collateralized Stablecoinsn#How to Store Stablecoins Safely#How to Use Stablecoins in DeFi Platforms#Popular Stablecoins in the Market#The future of stablecoins#Types of Stablecoins#What is a Stablecoin A Complete Guide for Beginner#What is a stablecoin#What is the difference between Stablecoins vs. Central Bank Digital Currencies (CBDCs)?#Why Are Stablecoins So Important Intelisync blockchain development intelisync web3 agency

0 notes

Text

Revolutionize Finance with Mobiloitte’s DeFi Lending and Borrowing Platform

Introduction

The financial world is undergoing a seismic shift, and decentralized finance (DeFi) is at the forefront of this transformation. Traditional banking systems, with their inefficiencies and centralized control, are being challenged by innovative DeFi Lending Platforms that offer transparency, speed, and accessibility. At Mobiloitte, we’re proud to lead this revolution with our cutting-edge DeFi Lending and Borrowing Platform. Designed to empower individuals and businesses alike, our platform redefines how lending and borrowing work in the digital age. Whether you’re a lender looking to earn interest or a borrower seeking quick access to funds, our platform is your gateway to a decentralized financial future.

Why DeFi Lending and Borrowing?

DeFi is more than just a buzzword—it’s a paradigm shift in how financial transactions are conducted. Unlike traditional systems, DeFi Lending eliminates intermediaries, reduces costs, and ensures transparency through blockchain technology. With Mobiloitte’s DeFi Lending and Borrowing Platform, users can:

Earn Passive Income: Lenders can deposit crypto assets into liquidity pools and earn competitive interest rates.

Access Instant Loans: Borrowers can secure loans using crypto as collateral, bypassing lengthy approval processes.

Enjoy Full Transparency: Every transaction is recorded on the blockchain, ensuring trust and immutability.

Key Features of Mobiloitte’s DeFi Platform

Our DeFi Lending and Borrowing Platform Development is built with user experience, security, and scalability in mind. Here’s what sets us apart:

Secure DeFi Wallet Integration

Our platform supports multi-currency wallets, allowing users to store, deposit, and withdraw a wide range of cryptocurrencies and stablecoins securely.

Smart Contract Automation

Smart contracts handle everything from loan approvals to repayments, ensuring a seamless, trustless, and error-free process.

Intuitive User Dashboard

A user-friendly interface makes it easy for both lenders and borrowers to manage their accounts, track transactions, and monitor earnings or repayments.

Robust Risk Management

We’ve implemented advanced risk management protocols to protect lenders from market volatility and ensure the stability of the platform.

Liquidity Pools

Our liquidity pools ensure that funds are always available for borrowing, creating a dynamic and efficient marketplace for lenders and borrowers.

Institutional-Grade Security

With state-of-the-art encryption and security measures, your assets are always safe on our platform.

Benefits of Choosing Mobiloitte for DeFi Platform Development

When you partner with Mobiloitte, you’re not just getting a platform—you’re gaining a competitive edge in the DeFi space. Here’s why businesses and individuals trust us for DeFi Lending Platform Development Services:

Expertise: Our team of 150+ blockchain and finance experts ensures your platform is built to the highest standards.

Custom Solutions: We tailor our DeFi Lending Platform to meet your specific business needs, ensuring maximum ROI.

Rapid Development: Our agile development process ensures your platform is launched quickly without compromising quality.

End-to-End Support: From DeFi Lending and Borrowing Platform Development to post-launch maintenance, we’re with you every step of the way.

The Future of Finance is Here

DeFi is not just the future—it’s the present. By leveraging blockchain technology and smart contracts, Mobiloitte’s DeFi Lending and Borrowing Platform offers a faster, cheaper, and more transparent alternative to traditional financial systems. Whether you’re a fintech startup, a financial institution, or an individual investor, our platform provides the tools you need to thrive in the decentralized economy.

Conclusion

The rise of DeFi Lending Platforms marks a new era in finance—one that prioritizes accessibility, transparency, and efficiency. Mobiloitte’s DeFi Lending and Borrowing Platform Development services are designed to help you capitalize on this transformative trend. With our expertise, cutting-edge technology, and commitment to excellence, we empower you to build a platform that not only meets but exceeds market expectations.

Don’t wait to be part of the DeFi revolution. Whether you’re looking to develop a DeFi Lending Platform or enhance your existing financial ecosystem, Mobiloitte is your trusted partner. Let’s build the future of finance together.

#Mobiloitte offers DeFi crowdfunding platform development services to help businesses create decentralized#secure#and transparent crowdfunding platforms that empower entrepreneurs and investors in the new era of finance. [Length:221]

0 notes

Text

What Are Stablecoins and Why Are They Essential in Crypto?

The cryptocurrency market has revolutionized the world of finance, offering new opportunities for investors and users. However, one significant challenge in the crypto space is the extreme volatility associated with many digital currencies, like Bitcoin and Ethereum. These fluctuations make it difficult to use cryptocurrency for everyday transactions or as a stable store of value. This is where stablecoins come into play. Stablecoins are digital currencies designed to minimize volatility by pegging their value to a more stable asset, like a fiat currency or a commodity. The need for stablecoins has become more evident as people seek ways to enjoy the benefits of blockchain technology while avoiding the unpredictable price swings that have characterized the crypto market. In this blog, we will explore what stablecoins are, why they are essential in the crypto space, and how they work. We will also address the key benefits, risks, and their growing role in decentralized finance (DeFi) and the broader cryptocurrency ecosystem.

What Are Stablecoins?

Stablecoins are a class of cryptocurrencies designed to maintain a stable value, unlike many other cryptocurrencies that experience significant price fluctuations. The value of stablecoins is typically pegged to a reserve of assets like a fiat currency (such as the US dollar) or a commodity (such as gold). The idea behind stablecoins is to provide the stability of traditional currencies with the added benefits of blockchain technology, such as decentralization, transparency, and faster transactions.

There are different types of stablecoins, each employing a distinct method to maintain its value stability:

Fiat-Collateralized Stablecoins: These stablecoins are backed by fiat currencies such as the US dollar, Euro, or other traditional currencies. The issuer holds a reserve of the fiat currency in a bank or other trusted institution. The most well-known examples of fiat-collateralized stablecoins are Tether (USDT) and USD Coin (USDC).

Crypto-Collateralized Stablecoins: These stablecoins are backed by other cryptocurrencies, such as Ethereum or Bitcoin. The value of these stablecoins is maintained through a collateralized system where users lock up cryptocurrency in smart contracts to ensure the stability of the stablecoin. Examples of crypto-collateralized stablecoins include DAI.

Algorithmic Stablecoins: Unlike collateralized stablecoins, algorithmic stablecoins rely on algorithms and smart contracts to manage the supply of the coin to keep its value stable. These stablecoins are not backed by any physical assets but adjust their supply based on demand. Examples of algorithmic stablecoins include Terra (LUNA) and Ampleforth (AMPL).

Why Are Stablecoins Essential in Crypto?

One of the primary reasons stablecoins are essential in the crypto ecosystem is that they help address the volatility problem inherent in traditional cryptocurrencies. While assets like Bitcoin and Ethereum have seen incredible growth, they are also subject to sharp declines in value, which makes them unsuitable for everyday transactions or as a store of value. Stablecoins provide an alternative that combines the benefits of blockchain technology with the stability of traditional currencies.

Stablecoins also play a crucial role in facilitating the bridge between the crypto world and traditional financial systems. They allow users to transact seamlessly between fiat and digital currencies without worrying about the high volatility typically associated with cryptocurrencies.

Moreover, stablecoins are a critical component of decentralized finance (DeFi), a rapidly growing sector within the crypto space. DeFi platforms use stablecoins to offer lending, borrowing, and trading services without relying on traditional intermediaries like banks. This opens up new possibilities for financial inclusion, as anyone with an internet connection can access these services.

How Do Stablecoins Work?

Stablecoins maintain their value by being pegged to an asset that is relatively stable. There are two primary mechanisms by which stablecoins achieve this stability:

Collateralized Models: In fiat-collateralized stablecoins, the issuer holds a reserve of fiat currency equivalent to the value of the stablecoins issued. For example, if a user holds 1 USDC, the issuer will have 1 USD in reserve. Similarly, crypto-collateralized stablecoins are backed by cryptocurrencies like Ethereum. If the price of the collateral falls, the system automatically adjusts to maintain the stablecoin's value.

Algorithmic Models: Algorithmic stablecoins, on the other hand, use smart contracts and algorithms to regulate supply and demand. When the price of the stablecoin goes above or below its pegged value, the algorithm either issues more coins or reduces the supply to stabilize the price.

What Are the Benefits of Stablecoins?

Stablecoins offer several key benefits that make them valuable in the crypto ecosystem:

Low Volatility: Stablecoins provide a predictable and stable value, making them ideal for transactions and as a store of value.

Ease of Use for Transactions: Users can easily send and receive stablecoins for payments, remittances, or investments, with fewer concerns about sudden value fluctuations.

Increased Liquidity in the Crypto Market: Stablecoins make it easier to move in and out of cryptocurrency positions, as they can be traded on exchanges without exposing users to the risks of market volatility.

DeFi Use Cases: Stablecoins are widely used in decentralized finance platforms for lending, borrowing, staking, and earning yield, further increasing their utility in the crypto space.

Are Stablecoins Safe?

While stablecoins offer many advantages, they are not without their risks. One of the primary concerns is the regulatory uncertainty surrounding them. Governments around the world are still figuring out how to regulate stablecoins, and some countries have imposed or are considering bans on their use. Additionally, there are risks associated with the backing assets—if the reserve is not properly managed or audited, users may face losses.

To ensure the safety of stablecoins, it’s crucial to choose well-established stablecoins backed by reputable institutions or decentralized mechanisms that have undergone thorough audits. Transparency and regular audits are essential in maintaining trust in the system.

Demand Queries Related to Stablecoins

What is the difference between stablecoins and Bitcoin? Stablecoins are designed to maintain a stable value, whereas Bitcoin is known for its volatility.

Can stablecoins replace traditional currencies? While stablecoins can serve as a medium of exchange, it is unlikely that they will fully replace traditional currencies in the near future.

What are the most popular stablecoins in the market? USDC, Tether (USDT), and DAI are among the most widely used stablecoins.

How to buy stablecoins? Stablecoins can be purchased through exchanges like Coinbase, Binance, and Kraken using fiat currency or other cryptocurrencies.

Conclusion

In conclusion, stablecoins are an essential part of the crypto ecosystem. They provide a stable medium of exchange, reducing the volatility that often hampers the adoption of cryptocurrencies. As the demand for decentralized finance and blockchain-based solutions grows, stablecoins will continue to play a critical role. For businesses or individuals looking to build solutions based on stablecoins, Blockchain App Factory offers expertise in creating and deploying stablecoin-based systems.

0 notes

Text

"Stablecoins in Ecommerce: A Revolution in Digital Payments"

```html

The Rise of Stablecoins in E-Commerce

In recent years, stablecoins have emerged as a game-changer in the world of digital currencies, especially in the realm of e-commerce. Unlike traditional cryptocurrencies, which are known for their volatility, stablecoins are designed to maintain a stable value, making them an appealing option for online transactions. In this article, we will explore the reasons behind the growing popularity of stablecoins and their impact on e-commerce.

What are Stablecoins?

Stablecoins are a specific type of cryptocurrency that are pegged to a reserve of assets, such as fiat currencies or commodities. This mechanism ensures that their value remains relatively stable compared to other cryptocurrencies like Bitcoin or Ethereum. There are several types of stablecoins, including:

Fiat-collateralized stablecoins: These are backed by a reserve of fiat currency, such as the US dollar. For every stablecoin issued, there is an equivalent amount of fiat currency held in reserve.

Crypto-collateralized stablecoins: These are secured by an underlying crypto asset. The system over-collateralizes to absorb price fluctuations in the underlying asset.

Algorithmic stablecoins: These use smart contracts to regulate their supply, creating a balance between demand and supply.

Why Use Stablecoins in E-Commerce?

There are several compelling reasons why e-commerce businesses should consider integrating stablecoins into their payment systems:

Price Stability: With stablecoins, consumers and merchants can avoid the risks associated with price volatility. This predictability is crucial for wearing the transactions and planning for costs.

Lower Transaction Fees: International transactions with traditional banking systems often come with high fees. Stablecoins enable lower transaction costs, making them more attractive for cross-border commerce.

Fast Transactions: Transactions made with stablecoins are processed quickly, allowing for instant payments without the delays typically associated with bank transfers.

Global Reach: Stablecoins can facilitate international transactions without the barriers imposed by traditional currencies, making it easier for businesses to enter global markets.

The Challenges Ahead

While the benefits of stablecoins are plentiful, there are still challenges that e-commerce businesses must navigate. Regulatory uncertainty looms large as governments around the world grapple with how to classify and regulate stablecoins. Additionally, the need for consumer education on these new forms of payment is critical for wider adoption.

Conclusion

Stablecoins are paving the way for a more efficient and equitable e-commerce landscape. As more businesses realize the benefits of using stablecoins for transactions, we can expect to see widespread adoption in the coming years. However, it’s crucial for both businesses and consumers to stay informed about the developments in this space and to approach it with a sense of caution and understanding.

Whether you are an e-commerce business owner looking to innovate or a consumer interested in using stablecoins, the future is looking bright. Stablecoins could potentially transform the way we conduct online transactions, making them more secure, affordable, and transparent.

``` "Stablecoins in Ecommerce: A Revolution in Digital Payments"

0 notes

Text

The Role of Decentralized Finance (DeFi) in Shaping the Future of Cryptocurrency

The world of finance is undergoing a seismic shift, driven by the rapid development and adoption of decentralized finance, commonly known as DeFi. As an innovative ecosystem of financial applications built on blockchain technology, DeFi is set to revolutionize traditional financial systems. This article delves into the impact of DeFi on the future of cryptocurrency and its potential to reshape the global financial landscape.

Understanding Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, refers to a broad range of financial services and products that operate without centralized intermediaries like banks or financial institutions. Instead, DeFi leverages blockchain technology, smart contracts, and cryptocurrencies to create an open, permissionless, and transparent financial system. Key components of DeFi include decentralized exchanges (DEXs), lending and borrowing platforms, stablecoins, and yield farming protocols.

The Core Principles of DeFi

The foundation of DeFi rests on several core principles:

Decentralization: DeFi eliminates the need for central authorities, allowing users to retain full control over their assets and transactions.

Transparency: Transactions and smart contracts are publicly verifiable on the blockchain, enhancing trust and security.

Permissionless Access: Anyone with an internet connection can participate in DeFi, promoting financial inclusion.

Interoperability: DeFi protocols can interact seamlessly with one another, creating a cohesive ecosystem of financial services.

Key DeFi Innovations

DeFi has introduced several groundbreaking innovations that challenge traditional financial models:

Decentralized Exchanges (DEXs): Platforms like Uniswap, SushiSwap, and PancakeSwap enable peer-to-peer trading of cryptocurrencies without intermediaries. DEXs use automated market makers (AMMs) to facilitate liquidity provision and ensure continuous trading.

Lending and Borrowing Platforms: DeFi platforms like Aave, Compound, and MakerDAO allow users to lend and borrow cryptocurrencies without relying on traditional banks. Users can earn interest on their deposits and access loans by collateralizing their crypto assets.

Stablecoins: Stablecoins like USDC, DAI, and Tether (USDT) are cryptocurrencies pegged to stable assets such as the US dollar. They offer stability and act as a bridge between traditional finance and the volatile crypto market.

Yield Farming and Liquidity Mining: DeFi protocols incentivize users to provide liquidity by offering rewards in the form of tokens. Yield farming and liquidity mining have gained popularity as lucrative investment strategies within the DeFi ecosystem.

The Impact of DeFi on Traditional Finance

The rise of DeFi poses both opportunities and challenges for the traditional financial sector:

Increased Financial Inclusion: DeFi's permissionless nature enables individuals in underserved regions to access financial services, promoting global financial inclusion. This can empower millions of unbanked and underbanked individuals to participate in the global economy.

Reduced Costs and Fees: DeFi eliminates intermediaries, reducing transaction costs and fees associated with traditional financial services. This can lead to more efficient and cost-effective financial transactions.

Enhanced Security and Transparency: Blockchain technology and smart contracts enhance the security and transparency of financial transactions. Users can verify transactions on the blockchain, reducing the risk of fraud and enhancing trust.

Regulatory Challenges: The decentralized and borderless nature of DeFi presents regulatory challenges for governments and financial authorities. Establishing a regulatory framework that balances innovation and consumer protection is crucial for the sustainable growth of DeFi.

The Future of DeFi and Cryptocurrency

The future of DeFi is promising, with several trends and developments poised to shape its trajectory:

Interoperability and Cross-Chain Solutions: As DeFi matures, the need for interoperability between different blockchain networks becomes increasingly important. Cross-chain solutions and protocols like Polkadot, Cosmos, and Chainlink are working to enable seamless communication between various blockchain ecosystems.

Institutional Adoption: Institutional investors are beginning to recognize the potential of DeFi and are exploring ways to participate in this burgeoning ecosystem. The entry of institutional capital can provide liquidity, stability, and legitimacy to DeFi projects.

Decentralized Identity and Privacy Solutions: Privacy and identity verification are critical concerns in DeFi. Projects like zk-SNARKs and decentralized identity solutions aim to enhance user privacy while ensuring compliance with regulatory requirements.

Integration with Traditional Finance: The convergence of DeFi and traditional finance is likely to accelerate. Financial institutions may integrate DeFi protocols into their services, offering hybrid solutions that combine the best of both worlds.

Regulatory Developments: As DeFi continues to grow, regulatory clarity and compliance will be essential. Governments and regulators are working to establish frameworks that protect consumers while fostering innovation. Collaborative efforts between the DeFi community and regulators can lead to a more robust and sustainable ecosystem.

Decentralized Finance (DeFi) is at the forefront of a financial revolution, challenging traditional systems and offering a glimpse into the future of finance. With its core principles of decentralization, transparency, and permissionless access, DeFi has the potential to democratize finance, increase financial inclusion, and create a more efficient and secure global financial system. As the DeFi ecosystem continues to evolve, it will undoubtedly play a pivotal role in shaping the future of cryptocurrency and the broader financial landscape.

0 notes

Text

Table of ContentsIntroductionThe Rise, Fall, and Rebirth of Terra (LUNA): Lessons for the Future of Algorithmic StablecoinsTerra 2.0: Analyzing the Revival Plan and Its Implications for the Crypto EcosystemThe Evolution of Algorithmic Stablecoins: Terra's Impact and What's Next for Decentralized FinanceQ&AConclusion"Empowering the Future of Finance: Terra (LUNA) - Stability Meets Innovation in Algorithmic Stablecoins"IntroductionTerra (LUNA) is a blockchain platform that was designed to support stablecoins pegged to various fiat currencies through algorithmic mechanisms. The Terra ecosystem aimed to combine the price stability and wide adoption of fiat currencies with the censorship resistance of Bitcoin and offer fast and affordable settlements. The native token of the Terra blockchain is LUNA, which is used to stabilize the price of the protocol's stablecoins (e.g., TerraUSD, UST) and to participate in the governance of the Terra ecosystem. The future of algorithmic stablecoins, following the Terra ecosystem's challenges, is a subject of intense scrutiny and debate. The collapse of Terra's UST stablecoin in May 2022 raised significant concerns about the viability of algorithmic stablecoins, which attempt to maintain their peg through algorithms and smart contracts rather than through collateralization. The incident has led to increased regulatory attention and skepticism regarding the stability and security of these financial instruments. Moving forward, the future of algorithmic stablecoins likely involves a combination of stricter regulatory frameworks, improved transparency, and more robust mechanisms to maintain their pegs during market stress. Innovations in design, such as hybrid models that incorporate elements of both collateralized and algorithmic stablecoins, may emerge to address the vulnerabilities exposed by Terra's collapse. The industry is expected to focus on building trust, ensuring sustainability, and enhancing the resilience of stablecoins to avoid similar systemic risks in the future.The Rise, Fall, and Rebirth of Terra (LUNA): Lessons for the Future of Algorithmic StablecoinsTerra (LUNA) and the Future of Algorithmic Stablecoins The cryptocurrency landscape has been marked by the dramatic rise and fall of Terra (LUNA), a project that sought to revolutionize the concept of stablecoins through algorithmic means. Terra's native token, LUNA, and its stablecoin, TerraUSD (UST), were at the heart of a complex mechanism designed to maintain UST's peg to the US dollar without reliance on traditional collateral. The innovative approach attracted significant attention and investment, but the subsequent collapse of the Terra ecosystem in May 2022 served as a sobering reminder of the risks inherent in such novel financial systems. Initially, Terra's algorithmic stablecoin model appeared to be a success, with UST maintaining its peg through a system that incentivized users to swap LUNA and UST to manage supply and demand. The promise of decentralization and scalability attracted a community of supporters and developers, who saw Terra as a potential cornerstone for a new era of decentralized finance (DeFi). However, the reliance on market confidence and the absence of a tangible backstop proved to be a critical vulnerability. The downfall of Terra was swift and devastating. A combination of factors, including waning investor confidence and a series of large withdrawals, triggered a death spiral for UST. As the stablecoin's value plummeted, the mechanism designed to stabilize it instead accelerated its decline, with the creation of vast amounts of LUNA flooding the market and diluting its value. The collapse not only wiped out billions in market value but also shook the faith in algorithmic stablecoins as a whole. In the aftermath, the crypto community has been grappling with the lessons learned from Terra's implosion. The event underscored the importance of robust design and risk management in the creation of stablecoins.

It became clear that algorithmic models, while innovative, require more rigorous stress testing and possibly the integration of additional safeguards to prevent similar catastrophes. Despite the setback, the idea of algorithmic stablecoins has not been abandoned. The rebirth of Terra, marked by the launch of a new blockchain and the rebranding of its token, reflects a determination to address past mistakes and to continue exploring the potential of decentralized stable currencies. The new iteration of Terra has distanced itself from the original algorithmic peg, signaling a shift in strategy and an acknowledgment of the need for more resilient mechanisms. The future of algorithmic stablecoins now hinges on the ability of developers and the broader crypto community to apply the lessons from Terra's failure. Innovators are exploring hybrid models that combine algorithmic elements with collateralization, aiming to strike a balance between decentralization and stability. The emphasis is on transparency, governance, and community involvement to ensure that the pitfalls encountered by Terra are not repeated. As the crypto industry continues to evolve, the role of stablecoins remains pivotal. They are the bridge between the volatile world of cryptocurrencies and the stability required for everyday transactions and financial applications. Algorithmic stablecoins, despite their challenges, represent a frontier in the quest for a truly decentralized financial system. With careful consideration and improved designs, they may yet play a significant role in shaping the future of finance. In conclusion, the saga of Terra (LUNA) serves as a cautionary tale and a catalyst for innovation in the realm of stablecoins. The journey from its rise to its fall, and the subsequent efforts to revive the project, reflect the resilience and adaptability of the crypto community. As we look ahead, the lessons learned from Terra's experience will undoubtedly inform the development of more robust and reliable algorithmic stablecoins, contributing to the maturation of the cryptocurrency ecosystem.Terra 2.0: Analyzing the Revival Plan and Its Implications for the Crypto EcosystemTerra (LUNA) and the Future of Algorithmic Stablecoins In the ever-evolving landscape of cryptocurrency, the Terra ecosystem and its native token, LUNA, have been at the forefront of a significant experiment in the realm of algorithmic stablecoins. The original Terra blockchain, with its stablecoin UST, aimed to maintain a peg to the US dollar through a complex mechanism of minting and burning LUNA. However, the dramatic collapse of this peg in May 2022 sent shockwaves through the crypto community, leading to widespread skepticism about the viability of algorithmic stablecoins. In response, the Terra community proposed a revival plan, giving birth to Terra 2.0, which has since been a subject of intense scrutiny and debate within the crypto ecosystem. The revival plan, spearheaded by Terraform Labs and its CEO Do Kwon, involved a hard fork of the original Terra blockchain, effectively creating a new network without the algorithmic stablecoin UST. This new chain, Terra 2.0, was launched with the intention of distancing itself from the failed experiment, while still preserving the innovative spirit that had initially attracted a robust community of developers and users. The plan also included airdropping new LUNA tokens to the holders of the original tokens, as a form of compensation and to incentivize participation in the new ecosystem. The implications of this revival are manifold. Firstly, it serves as a case study for the resilience of blockchain communities and their ability to pivot and adapt in the face of adversity. The Terra community's response demonstrates a strong commitment to the project and a belief in the potential of decentralized finance (DeFi) to innovate and overcome challenges. Moreover, the Terra 2.0 initiative has sparked a broader conversation about the role

of governance and community decision-making in the crypto space, highlighting the importance of transparent and inclusive processes. However, the collapse of UST and the subsequent launch of Terra 2.0 have also raised important questions about the future of algorithmic stablecoins. These digital assets, which aim to maintain their value relative to a reference asset without the backing of physical reserves, rely on complex algorithms to adjust supply in response to changes in demand. The failure of UST has led to increased regulatory scrutiny and a call for more robust mechanisms to ensure stability and prevent systemic risks. Despite these challenges, the concept of algorithmic stablecoins remains an intriguing proposition for the crypto industry. Proponents argue that with improved designs and better risk management protocols, these digital assets could offer a decentralized alternative to traditional fiat-backed stablecoins, reducing reliance on centralized entities and enhancing the autonomy of DeFi platforms. As Terra 2.0 continues to evolve, it will be closely watched by investors, regulators, and the broader crypto community. The lessons learned from the Terra saga will undoubtedly inform the development of future algorithmic stablecoins and contribute to the maturation of the DeFi sector. While the path ahead is uncertain, the innovative spirit that underpins the Terra community and the broader crypto ecosystem suggests that experimentation with algorithmic stablecoins is far from over. In conclusion, Terra 2.0 represents both a cautionary tale and a beacon of hope for the crypto world. It underscores the need for caution and rigorous testing in the deployment of complex financial mechanisms, while also showcasing the potential for recovery and reinvention. As the crypto ecosystem continues to navigate the aftermath of the Terra incident, the future of algorithmic stablecoins hangs in the balance, with their ultimate fate likely to be determined by the collective efforts of developers, users, and regulators to address the challenges and harness the opportunities presented by this innovative financial technology.The Evolution of Algorithmic Stablecoins: Terra's Impact and What's Next for Decentralized FinanceTerra (LUNA) and the Future of Algorithmic Stablecoins In the dynamic world of cryptocurrency, the quest for stability amidst volatility has given rise to an innovative class of digital assets known as stablecoins. Among these, algorithmic stablecoins have emerged as a groundbreaking solution, aiming to maintain a stable value without the direct backing of fiat currency or commodities. Terra (LUNA), a prominent player in this field, has significantly impacted the decentralized finance (DeFi) landscape, demonstrating both the potential and the challenges inherent in algorithmic stablecoin systems. Terra's approach to achieving price stability is distinct from traditional stablecoins, which are typically pegged to a fiat currency and backed by reserves of that currency or other assets. Instead, Terra utilizes a dual-token system where its stablecoin, TerraUSD (UST), maintains its peg to the US dollar through an algorithmic process that involves the contraction and expansion of its supply, facilitated by its sister token, LUNA. When UST's price deviates from its peg, the system incentivizes users to either burn UST to mint LUNA or vice versa, thus restoring equilibrium. This innovative mechanism has garnered significant attention, as it offers a decentralized alternative to fiat-collateralized stablecoins, which are often criticized for their reliance on traditional financial systems. Terra's success in maintaining a stable peg while fostering a vibrant ecosystem of DeFi applications has showcased the potential of algorithmic stablecoins to revolutionize the way we think about digital currency. However, the journey of Terra and other algorithmic stablecoins has not been without turbulence. The DeFi sector has witnessed

instances where these mechanisms have been put to the test, leading to periods of intense volatility and raising questions about the long-term viability of such systems. Concerns about regulatory scrutiny, the robustness of the underlying algorithms, and the ability to maintain stability under extreme market conditions have been at the forefront of discussions within the crypto community. Despite these challenges, the future of algorithmic stablecoins remains a topic of keen interest. Innovators in the space are continuously refining their models, learning from past experiences, and exploring new ways to enhance the resilience and efficiency of these digital assets. The potential benefits of a successful algorithmic stablecoin are substantial, offering a decentralized, scalable, and potentially more democratic form of stable digital currency. As the DeFi ecosystem evolves, it is likely that we will see further experimentation with different models of algorithmic stablecoins. These may include hybrid systems that combine algorithmic mechanisms with partial collateralization or novel approaches to governance and monetary policy that leverage the unique capabilities of blockchain technology. The lessons learned from Terra's implementation will undoubtedly inform the development of future projects, contributing to a more mature and sophisticated DeFi landscape. In conclusion, Terra (LUNA) has played a pivotal role in the evolution of algorithmic stablecoins, highlighting both the promise and the perils of this innovative approach to digital currency. As the DeFi sector continues to expand and adapt, the insights gained from Terra's experience will be invaluable in shaping the future of decentralized finance. With careful consideration of the risks and a commitment to ongoing innovation, algorithmic stablecoins may yet realize their potential as a cornerstone of a new financial paradigm.Q&A1. What led to the collapse of Terra (LUNA) and its stablecoin UST? The collapse of Terra (LUNA) and its stablecoin UST in May 2022 was primarily due to a loss of confidence leading to a 'bank run' scenario. UST was an algorithmic stablecoin pegged to the US dollar through a mechanism that allowed users to swap UST for LUNA at a guaranteed price. When large amounts of UST were sold off, the mechanism could not maintain the peg, leading to hyperinflation of LUNA as more of it was minted to absorb UST. This devaluation spiraled out of control, causing both assets to crash. 2. What are the challenges facing the future of algorithmic stablecoins post-Terra (LUNA) collapse? Post-Terra collapse, algorithmic stablecoins face several challenges: - **Regulatory scrutiny**: Governments and financial authorities are more likely to impose strict regulations on stablecoins to prevent systemic risks. - **Loss of investor confidence**: The failure of UST has led to skepticism about the viability of algorithmic stablecoins, making it harder for new projects to gain trust. - **Technical and economic model viability**: The collapse highlighted flaws in the design of some algorithmic stablecoins, necessitating more robust and resilient economic models to prevent similar failures. - **Competition from fiat-backed stablecoins**: Algorithmic stablecoins must compete with fiat-collateralized stablecoins, which are perceived as more stable due to their tangible reserves. 3. What innovations or improvements could potentially stabilize future algorithmic stablecoins? To stabilize future algorithmic stablecoins, several innovations or improvements could be considered: - **Improved collateralization**: Introducing or increasing collateral with other assets could help buffer against volatility and maintain the peg. - **Dynamic monetary policies**: Implementing more sophisticated algorithms that can react to market conditions in real-time to adjust supply and demand. - **Circuit breakers**: Incorporating mechanisms that can temporarily halt trading or conversions to prevent panic selling and extreme volatility.

- **Transparency and audits**: Regular audits and transparent operations can build trust with users and investors. - **Diversified governance**: Ensuring that decision-making is distributed among stakeholders to avoid concentration of power and improve the response to crises.ConclusionConclusion: The collapse of Terra (LUNA) and its associated algorithmic stablecoin TerraUSD (UST) in May 2022 has raised significant concerns about the viability and stability of algorithmic stablecoins. The incident highlighted the risks inherent in the design of such cryptocurrencies, which attempt to maintain a peg to another asset, like the US dollar, through algorithms and smart contracts rather than through reserves of the asset they are pegged to. The future of algorithmic stablecoins is uncertain. On one hand, the failure of Terra has led to increased scrutiny from regulators and investors, who may now be more cautious about the risks associated with these types of digital assets. On the other hand, the innovative nature of blockchain technology and the potential benefits of decentralized financial systems may drive continued experimentation and development in the space. For algorithmic stablecoins to gain widespread trust and adoption, they will likely need to address the issues of transparency, governance, and robustness of their stabilization mechanisms. This could involve incorporating lessons learned from the Terra incident, such as the importance of having sufficient reserves or alternative stabilization methods that do not solely rely on confidence and network effects. In conclusion, while the Terra (LUNA) collapse has cast doubt on the current models of algorithmic stablecoins, the concept may evolve with improved designs and regulatory frameworks, potentially leading to more resilient and trustworthy iterations in the future. However, the path forward will require careful navigation of the complex interplay between technology, economics, and regulation.

0 notes

Text

Stablecoin Integration: Enhancing Financial Systems

In recent years, stablecoins have emerged as a pivotal innovation in the realm of digital currencies. Unlike traditional cryptocurrencies such as Bitcoin or Ethereum, stablecoins are designed to minimize price volatility by pegging their value to assets like fiat currencies, precious metals, or even other cryptocurrencies. This stability makes them a promising tool for integrating into existing financial systems, offering benefits ranging from improved transaction efficiency to broader financial inclusion.

Understanding Stablecoins

Stablecoins are a category of cryptocurrencies that aim to maintain a stable value relative to a specific asset or a basket of assets. This stability is achieved through various mechanisms, commonly involving collateralization, algorithmic controls, or a combination of both. Unlike volatile cryptocurrencies, stablecoins provide a reliable medium of exchange and a store of value, which are essential characteristics for widespread adoption in financial transactions.

Types of Stablecoins

There are several types of stablecoins, each with its own method of achieving price stability:

1. Fiat-Collateralized Stablecoins

These stablecoins are backed by reserves of fiat currencies held in bank accounts. Each unit of the stablecoin is directly backed by a corresponding unit of the fiat currency. Examples include Tether (USDT) and USD Coin (USDC).

2. Crypto-Collateralized Stablecoins

These stablecoins are collateralized by other cryptocurrencies held in reserve. Smart contracts manage the collateral to ensure that the value of issued stablecoins remains stable. Dai (DAI) is a prominent example, collateralized by Ethereum.

3. Algorithmic Stablecoins

Algorithmic stablecoins use algorithms to automatically adjust the supply of the stablecoin in response to market demand, aiming to maintain a stable value. Examples include Ampleforth (AMPL) and Frax (FRAX).

Benefits of Stablecoin Integration

Enhancing Efficiency in Financial Transactions

Stablecoins streamline financial transactions by offering faster settlement times and reduced transaction costs compared to traditional banking systems. Businesses can leverage stablecoins for international payments without the delays associated with fiat currency transfers or the volatility of traditional cryptocurrencies.

Promoting Financial Inclusion

In regions with unstable local currencies or limited access to banking services, stablecoins can serve as a reliable alternative. Individuals and businesses can access digital financial services, such as savings, loans, and remittances, using stablecoins, thereby fostering economic inclusion.

Mitigating Volatility Risks

For investors and businesses exposed to cryptocurrency markets, stablecoins provide a safe haven against price volatility. By holding stablecoins, users can protect the value of their assets during market downturns, facilitating more confident investment decisions.

Facilitating Decentralized Finance (DeFi) Growth

Stablecoins are integral to the expansion of DeFi applications, which include lending platforms, decentralized exchanges (DEXs), and synthetic asset creation. These applications rely on stablecoins for liquidity, enabling users to engage in various financial activities without exposure to cryptocurrency volatility.

Challenges and Considerations

While stablecoins offer significant advantages, their adoption and integration into financial systems are not without challenges. Regulatory scrutiny, concerns over centralization (in the case of fiat-collateralized stablecoins), and maintaining algorithmic stability are critical factors that require careful consideration.

The Future of Stablecoin Integration

As financial institutions, governments, and businesses continue to explore the potential of blockchain technology and digital currencies, stablecoins are poised to play a pivotal role in shaping the future of finance. Their ability to combine the benefits of cryptocurrencies with the stability of traditional assets positions them as a transformative force in global financial systems.

Conclusion

In conclusion, stablecoins represent a significant advancement in digital finance, offering stability, efficiency, and inclusivity to financial systems worldwide. Whether used for everyday transactions, investment purposes, or as a fundamental component of decentralized applications, the integration of stablecoins marks a crucial step towards a more accessible and resilient financial ecosystem. As adoption grows and technology evolves, the impact of stablecoins on financial innovation is expected to expand, creating new opportunities and redefining the landscape of modern finance.

By understanding the diverse types of stablecoins, their benefits, challenges, and future potential, stakeholders can navigate the evolving landscape of digital currencies with confidence and foresight.

0 notes

Text

Spider Swap's Bridge : A Gateway for Cross-Chain Transactions

In the rapidly evolving world of decentralized finance (DeFi), interoperability between different blockchain platforms has become a critical need. As users and developers alike seek more seamless ways to interact across ecosystems, tools that facilitate these interactions are increasingly in demand. Spider Swap, known for its innovative approach to decentralized exchanges, has recently launched a groundbreaking new feature: the Bridge. This functionality not only enhances the platform’s offerings but also pioneers a more interconnected blockchain environment. In this blog, we’ll dive deep into what Spider Swap’s Bridge is, how it works, and what it means for users wanting to swap crypto across platforms like Ethereum and Solana.

What is Spider Swap’s Bridge?

Spider Swap’s Bridge is a decentralized application (DApp) designed to connect disparate blockchain networks, enabling the transfer and exchange of assets between them. This tool is crucial for users who want to leverage the strengths of multiple blockchains — like Ethereum’s extensive development infrastructure and Solana’s high-speed, low-cost transactions — without being limited by the boundaries of any single platform.

Key Features and Capabilities

Cross-Chain Swaps: The primary function of the Bridge is to allow users to swap cryptocurrencies across different blockchains directly. For example, a user can exchange Ethereum (ETH) for Solana (SOL) seamlessly, without needing to convert ETH to a stablecoin or use centralized exchanges as intermediaries.

Decentralized: Operates in a fully decentralized manner, meaning that it does not rely on any central authority for the processing of transactions. This ensures that the swaps are secure, adhering to the core principles of DeFi.

User-Friendly Interface: Despite the complex technology underlying it, the Bridge boasts a user-friendly interface that simplifies the process of cross-chain transactions for the average user. This accessibility opens up more opportunities for non-technical users to engage with multiple blockchains.

Lower Transaction Costs: By facilitating direct swaps, Spider Swap’s Bridge can significantly reduce the transaction fees and slippage usually associated with multiple exchange steps. This efficiency is particularly beneficial in a market where transaction costs can be a barrier to participation.

How Does the Bridge Work?

The technology behind Spider Swap’s Bridge involves several innovative components:

Smart Contracts: At the heart of the Bridge are smart contracts that are deployed on each participating blockchain. These contracts handle the verification, locking, and unlocking of assets as they are transferred between chains.

Relayers: These are nodes that observe the state of one blockchain and report it to another. They play a crucial role in ensuring that transactions are validated across the ecosystems without the need for an intermediary.

Liquidity Pools: To facilitate swaps, the Bridge uses liquidity pools that hold reserves of various tokens on multiple blockchains. Users provide liquidity to these pools and, in return, earn transaction fees generated from the swaps.

Practical Applications and Benefits

The practical applications of Spider Swap’s Bridge are vast:

Enhanced Liquidity: Users from different blockchains can pool their resources, leading to enhanced liquidity, which in turn reduces price volatility and improves trade execution.

Broader Asset Access: Users can access a wider range of assets across different blockchains, potentially leading to better investment opportunities and risk diversification.

Innovative Financial Products: Developers can create complex financial products that leverage capabilities from multiple blockchains, such as combined yield farming strategies or multi-chain collateralized loans.

Challenges and Considerations

While the Bridge offers numerous advantages, there are also challenges to consider:

Security Risks: Cross-chain bridges are complex and potentially expose new attack vectors. Ensuring the security of the smart contracts and relayer systems is paramount.

Regulatory Uncertainty: The regulatory framework for cross-chain activities is still unclear, and users must navigate these uncertainties which could impact the adoption and functionality of such tools.

Conclusion

Spider Swap’s new Bridge functionality marks a significant step forward in the quest for a truly interconnected blockchain ecosystem. By allowing seamless swaps between major platforms like Ethereum and Solana, it not only broadens the scope of what’s possible within DeFi but also enhances the overall user experience. As the technology matures and more users and developers engage with it, we can expect even more innovative solutions to emerge, further solidifying the role of interoperability in the future of finance.

0 notes

Text

Streamlining International Transactions: Cross-Border Payments with Stablecoins

Today sending and receiving money across borders is a frequent necessity. However, traditional cross-border payments can be slow, expensive, and riddled with paperwork. This is where stablecoins come in as a potential game-changer. Let's look into how these digital assets can change cross-border transactions.

What are Cross-Border Payments?

According to Anbruggen Capital, cross-border payments refer to any financial transfer that originates in one country and lands in a bank account of another. These transactions often involve multiple intermediaries, leading to delays and hefty fees.

What are Stablecoins?

Stablecoins are a type of cryptocurrency pegged to a real-world asset, typically a fiat currency, like the US dollar. This peg aims to minimize the price volatility that plagues most cryptocurrencies, making them suitable for everyday transactions.

Imagine a cryptocurrency that doesn't swing wildly in value like Bitcoin. That's the idea behind a stablecoin. It's a digital asset pegged to something stable, like a dollar or gold, so its value stays relatively steady.

Think of it like this: you put a dollar into a special vault, and you get a digital token in return. That token (the stablecoin) should always be worth around $1 because there's a dollar backing it up. This way, you get the benefits of cryptocurrency – fast, secure transactions – but with less risk of wild price swings.

Stablecoins come in three flavors:

Fiat-backed: Like a digital dollar, pegged to real currencies and backed by reserves (think vault full of cash).

Crypto-backed: Collateralized by other cryptos (like using Bitcoin to guarantee a stablecoin).

Algo-magic: No reserves, uses smart contracts to buy/sell the stablecoin itself, keeping the price in check (think automated price adjuster).

The Role of Stablecoins in Cross-Border Transactions

Stablecoins offer several advantages for cross-border payments. Here are some examples from Dave Martin, one of Anbruggen Capital’s directors:

Faster Settlements: Unlike banks that can take days, stablecoin transactions on blockchains settle in minutes. Imagine sending money to family overseas and they receive it almost instantly.

Reduced Costs: Stablecoins bypass intermediaries, slashing fees. Startups like RippleNet use them for near instant and low-cost international payments.

Transparency & Security: Blockchain tech ensures secure and transparent transactions. Every step is recorded, visible to all participants, reducing fraud risks.

Financial Inclusion: Anyone with a smartphone and internet access can hold and transact with stablecoins, potentially reaching the unbanked population. For example, charities like Mercy Corps are using them for faster and cheaper money transfers in developing countries.

Reducing Remittance Costs with Stablecoins Solutions

Migrant workers often face exorbitant fees when sending money back home. Stablecoins have the potential to disrupt the remittance industry by offering faster, cheaper, and more secure money transfers.

Regulatory Challenges and Compliance in Cross-Border Payments

While stablecoins offer exciting possibilities, regulatory uncertainty remains a major hurdle. Governments are still grappling with how to oversee these new financial instruments, and regulations vary considerably across borders. Compliance with evolving regulations will be crucial for the widespread adoption of stablecoins in cross-border payments.

Stablecoins face regulatory hurdles despite their potential. Here's a breakdown:

Concerns: Regulators worry about systemic risk (widespread financial instability), investor protection (ensuring user safety), and impact on monetary policy (central bank control over money supply).

Examples: China has cracked down on cryptocurrencies, while the US is still developing its framework. The Financial Action Task Force (FATF), an international body, has issued guidelines for stablecoin regulation to address money laundering and terrorist financing risks.

In conclusion, stablecoins hold immense promise for streamlining and democratizing cross-border transactions. However, as per Dave Martin, addressing regulatory concerns and ensuring compliance will be key to unlocking the full potential of this innovative financial tool.

Concerns and Regulatory Goals:

Financial Stability: Regulators worry that a large-scale stablecoin collapse could disrupt the traditional financial system if they're not properly backed or managed.

Consumer Protection: Since stablecoins are a relatively new asset class, regulators want to ensure consumers understand the risks involved and aren't misled.

Anti-Money Laundering (AML) & Countering Financing of Terrorism (CFT): Just like cash, stablecoins could be attractive to criminals. Regulations aim to track transactions and prevent illegal activities.

Examples of Regulatory Approaches:

US Office of the Comptroller of the Currency (OCC): While the browsing extension couldn't find details on specific proposals, the OCC has shown openness to banks working with stablecoin companies. This suggests a potential path for legitimizing stablecoin use within the existing US financial system. You can find more details on Global Legal Insights.

European Union (EU): The EU's Markets in Crypto Assets (MiCA) regulation, coming into effect in July 2024, establishes a comprehensive framework for stablecoins. Here are some specific requirements:

Maintain adequate reserves: This ensures stablecoins are backed by sufficient assets to maintain their peg to the underlying fiat currency.

Ensure redemption rights: This guarantees that holders can exchange their stablecoins for the equivalent value in fiat currency upon request.

Safeguard and segregate assets: This protects stablecoin reserves from unauthorized access or misuse.

These requirements aim to address concerns around financial stability by ensuring stablecoins are well-capitalized, consumer protection by guaranteeing redemption rights, and anti-money laundering (AML) by requiring proper asset segregation.

0 notes

Text

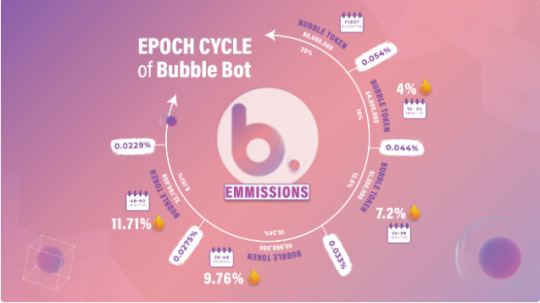

Bubblebot

In a single Telegram bot, Bubblebot offers a full range of services, including spot trading, futures trading, multi-token staking, and hedging/risk management for several crypto assets. The goal of this all-in-one platform is to provide traders and cryptocurrency fans with a practical and adaptable experience.

Our main goal is to strengthen the Telegram bot ecosystem, promoting development and innovation within this thriving community. We are dedicated to giving our consumers a rich and satisfying experience so they may explore the many opportunities presented by Bubble Token.

BubbleBot has many features to boost your chances of success

· The main problem with on-chain trading is that it suffers from limited liquidity. Due to low liquidity, forced liquidations may occur as a result of pricing and financing manipulations. As a result, market makers (MMs) don’t always have an incentive to provide liquidity on the blockchain.

· These contracts provide the same flexibility as traditional futures or perpetual contracts, allowing for long and short trades throughout their duration.

· Trading cryptocurrencies may be difficult, whether you’re using a controlled exchange (CEX) or a decentralized exchange (DEX). Like the need for collateral, weighing risks, interest rates, liquidity, and the unknown nature of regulations.

· Self-directed trading calls for expertise in technical and fundamental analysis, trading methods, and risk management, as well as the willingness to make all trading choices independently. The human emotions of greed and fear might influence trading decisions.

· Stablecoins are susceptible to risk due to the likelihood of their peg breaking, which would result in a decrease in value relative to the underlying asset due to factors such as market circumstances, liquidity concerns, and regulatory changes.

· Tokens staked by one user will provide rewards in the same token staked by another user, thus the name “single token staking rewards.” This method is simple, however Multi-Token staking presents more of a challenge and potentially higher rewards for the community as a whole.

· The Bitcoin industry is full of inflationary initiatives. In which fresh tokens are generated and added to the existing supply on a regular basis.

A DeFi insurance system called Hedge/Risk enables outside users to make predictions about the performance of different pegged assets, including USDC, DAI, USDT, and countless other stable tokens, based on those assets’ prior performance data.

Bubblebot is an innovative multi-token staking platform that is closely associated with bot tokens. By utilizing the capabilities of multi-token technology on the Ethereum network, anyone within the community has the opportunity to safely deposit their Bubble tokens into Bubble bot staking pools. Consequently, individuals have the potential to get rewards in many bot token currencies, including UniBot, OCD, AIM Bot, and ETH. Bubblebot functions as the primary staking token for any BOT token currencies that implement a comparable approach. The website offers users the opportunity to access a wide range of staking pools that cater to their individual interests and investment objectives.

It’s critical for you to evaluate your trading patterns as a member of the Bubblebot community, whether you trend toward riskier or more volatile trading, and choose the techniques that best meet your goals. Our Hedge/Risk vault uses a bubble-catastrophe bond (BCP) to make this procedure easier. The BCP bond is an essential financial tool that rewards users for conducting thorough analyses and evaluating the durability of pegged crypto assets. Users who correctly estimate the value of the underlying asset are rewarded with BCP. Users also have the choice to protect themselves against pegged assets by investing ETH in exchange for $Bubble tokens.

Users initially have the choice to protect themselves against a small selection of cryptocurrencies, such as USDC, USDT, and DAI. The future expansion of this product is predicted, nevertheless.

Consider the case when a user is concerned that the stablecoin USDT would deviate from its market-pegged value. They have the choice in this scenario to place some of their ETH as collateral in the Bubble vault. They receive Bubble tokens in exchange, which would appreciate in value if the stablecoin USDT really deviates from its fixed price.

Highly secure, convenient, and sustainable are all characteristics of bubble farms. The neighborhood may invest in these farms with confidence and perhaps earn an amazing APR of up to 9,860% over each seven-day period. It’s important to note that the smart contracts powering these farms have passed meticulous audits to make sure there are no security flaws, giving customers additional piece of mind.

For more information visit:

Website

Whitepaper

Twitter

Telegram

Discord

AUTHOR

Bitcoin talk Username: Caplex Bitcoin talk profile link: https://bitcointalk.org/index.php?action=profile;u=3414222 BEP-20 Wallet Address: 0x93eB3A28E59a6541A5fa9d27e84dA1c7abb3ceCE

0 notes

Text

The Federal Reserve has released a comprehensive working paper delving into asset tokenization and Risk-Weighted Assets (RWA). As the financial landscape continues to evolve, these innovative financial instruments garner significant attention for their potential to revolutionize investment strategies and reshape traditional markets. The paper explains that tokenization, similar to stablecoins, consists of five core components: a blockchain, a reference asset, a valuation mechanism, storage or custody, and redemption mechanisms. These elements establish connections between crypto markets and reference assets, enhancing understanding of their impact on conventional financial systems. Tokenized Assets Have Been Surging According to the paper, the estimated market value of tokenized assets on permissionless blockchains stands at an impressive $2.15 billion as of May 2023. This valuation encompasses tokens issued by decentralized protocols like Centrifuge and established companies such as Paxos Trust. The variability in tokenization designs and levels of transparency poses a challenge in obtaining comprehensive time-series data. Nevertheless, insights from DeFi Llama data highlight a burgeoning trend in tokenization within the DeFi ecosystem. While the total value locked (TVL) in the DeFi ecosystem has remained relatively stable since June 2022, categories related to real-world assets have grown, both in absolute value and as a proportion of the overall DeFi ecosystem. Of the estimated $2.15 billion in tokenized assets, approximately $700 million is currently locked in DeFi. The paper explains that asset tokenization offers access to previously inaccessible or costly markets, such as real estate, where investors can acquire shares in specific properties. Its programmable nature and smart contract capabilities allow liquidity-saving mechanisms in settlement processes, enhancing efficiency. Tokenizations also facilitate lending using tokens as collateral, providing a new financing avenue. Transactions involving tokenized assets settle more swiftly than traditional reference assets, potentially revolutionizing settlement processes in the financial industry. The Issue of Financial Stability Despite tokenization’s promise, there are notable considerations regarding financial stability. While tokenized markets’ current value remains relatively small compared to broader financial systems, the potential for growth raises concerns about fragility within crypto-asset markets and implications for the traditional financial system. The primary long-term concern centers around the interconnections between the digital asset ecosystem and the traditional financial system through tokenization redemption mechanisms. In instances where reference assets lack liquidity, stress transmission vulnerabilities may arise. This risk mirrors concerns raised in the ETF market, where the paper explains that liquidity, price discovery, and volatility of ETFs closely align with their underlying assets. As tokenization expands, traditional financial institutions may become increasingly exposed to crypto-asset markets through direct ownership or collateralization. This shift introduces new dynamics and interconnections, potentially influencing market behaviors in unforeseen ways. Source

0 notes

Text

Positive Impact of Ripple's RLUSD Stablecoin on Crypto

```html

The Rise of RLUSD: Stablecoin Innovation from Ripple

In recent years, the world of cryptocurrency has witnessed an influx of stablecoins, each designed to mitigate the infamous volatility seen in traditional cryptocurrencies. Among these, RLUSD stands out as a promising new contender developed by Ripple. This article explores the features and potential impact of RLUSD in the crypto market.

What is RLUSD?

RLUSD is a stablecoin pegged to the value of the US Dollar, designed to provide a reliable medium of exchange and store of value. Its primary aim is to facilitate transactions and act as a bridge between fiat currency and the world of digital assets. By being tied to a stable asset, RLUSD offers a way for users to engage with cryptocurrencies without the fear of drastic price swings.

Key Features of RLUSD

Stability: As a stablecoin, RLUSD maintains its value relative to the US Dollar, allowing users to hold their assets with confidence.

Efficiency: Built on Ripple's revolutionary technology, RLUSD promises fast transaction times, enhancing the overall efficiency of payments.

Low Fees: One of the key advantages of using RLUSD is the significantly lower transaction fees compared to traditional banking systems.

Decentralization: RLUSD operates on a decentralized network, reducing the risks associated with centralized systems and promoting transparency.

How Does RLUSD Work?

RLUSD functions on the Ripple network, harnessing its unique consensus algorithm to ensure security and speed. The mechanism behind its stability involves collateralization, where RLUSD is fully backed by equivalent US Dollar reserves, providing a solid foundation that supports its value.

Moreover, RLUSD transactions can be processed quickly and are settled almost instantaneously, making it an attractive option for individuals and businesses alike. This immediacy is crucial in today's fast-paced digital economy.

The Importance of Stablecoins in Cryptocurrency

Stablecoins like RLUSD play a vital role in the overall ecosystem of cryptocurrency. They provide a safe haven for investors during market volatility, enabling users to convert their assets into a stable form without leaving the crypto environment. Furthermore, stablecoins facilitate international transactions, improving global commerce and making financial services accessible to everyone.

Challenges and Considerations

While the launch of RLUSD presents numerous opportunities, there are also challenges to consider. Regulatory scrutiny on stablecoins is increasing, and the fluctuating nature of fiat currencies can still impact the stablecoin's reliability. It's essential for investors to remain informed about these factors when engaging with RLUSD or any stablecoin.

Conclusion

In conclusion, RLUSD emerges as a significant player in the stablecoin landscape, leveraging Ripple's advanced network technology to provide users with a stable, fast, and efficient means of transaction. As more people and businesses recognize the benefits of stablecoins, the demand for RLUSD is likely to grow.

As we continue to explore the rapidly evolving world of cryptocurrency, RLUSD may prove to be a game changer, creating new opportunities for users around the globe. It is a unique development that showcases the innovative spirit of Ripple and the potential of stablecoins to reshape our financial future.

``` Positive Impact of Ripple's RLUSD Stablecoin on Crypto

0 notes

Text

Unraveling the Curve Finance Attack: How DeFi Survived the Contagion

The recent Curve Finance attack sent shockwaves through the DeFi ecosystem, prompting concerns about its stability and resilience. However, JPMorgan analysts offer a glimmer of hope, stating that the contagion has been contained. In this article, we explore the aftermath of the exploit, collaborative efforts to save Curve Finance, and the overall state of the DeFi landscape amidst the challenges it faces. Join us on this journey as we navigate the complexities and potential impact on the future of decentralized finance.

Curve Finance Attack: Vulnerability and Consequences

The exploit that struck Curve Finance was due to a vulnerability in Vyper, a widely-used programming language in DeFi applications. As a result, the price of the native CRV token plummeted, putting over $100 million worth of loans at risk of being liquidated, including those of its founder, Michael Egorov. Egorov had taken multiple loans on different DeFi lending platforms, with CRV as collateral, mostly receiving stablecoins in return. The potential liquidation of these loans raised concerns about the impact on other DeFi protocols, given CRV's role as a trading pair in various liquidity pools.

Egorov's Response and Ongoing Status

In the aftermath of the attack, Michael Egorov acted swiftly to protect his loan position and prevent liquidation. He sold a total of 72 million CRV to 15 institutions/investors through over-the-counter deals at a price of $0.4 per token, receiving $28.8 million in total to repay the debts, according to on-chain analyst Lookonchain. Presently, Egorov still holds 374.18 million CRV ($220.4 million) in collateral and owes $79 million on five DeFi platforms.

Collaborative Efforts to Save Curve Finance

Several prominent investors, including Tron founder Justin Sun, Huobi co-founder Jun Du, crypto trader DCFGod, and Mechanism Capital co-founder Andrew Kang, have united their efforts to salvage Curve Finance. Their coordinated response has played a crucial role in limiting the contagion effect, as stated by JPMorgan analysts.

DeFi Ecosystem: Stalling Growth and Bright Spots

Beyond the immediate impact of the Curve Finance attack, the overall DeFi ecosystem has experienced challenges over the past year. Collapse of projects like Terra and FTX, the U.S. regulatory crackdown and uncertainty, hacks, and higher transaction fees have collectively eroded investor confidence, leading to fund outflows and user exits from DeFi platforms, according to the analysts. Despite these challenges, some parts of DeFi continue to thrive. Notably, the Tron ecosystem and Ethereum Layer 2 networks, including Arbitrum and Optimism, have seen a rise in their total value locked (TVL) over recent months. This growth can be attributed to their ability to offer faster and more cost-effective transactions compared to the congested Ethereum network.

Conclusion

While the Curve Finance attack shook the DeFi ecosystem, the prompt containment efforts by stakeholders have mitigated its impact on a larger scale. However, the sector still faces challenges that demand careful attention and innovative solutions. As investors and users remain cautious, projects that can offer improved efficiency and lower costs will likely lead the way in driving the DeFi ecosystem towards its next phase of growth and stability. For more articles visit: Cryptotechnews24 Source: theblock.co

Related Posts

Read the full article

#CRVtokenprice#CryptoNews#CurveFinanceattack#decentralizedfinance(DeFi)#DeFilendingplatforms#liquiditypools#MichaelEgorov#Vyperprogramminglanguage

0 notes

Text

How to Use Cryptocurrency For Your Business

Nowadays, cryptocurrency is considered one of the mainstream forms of investment in the market. A survey shows that about 23% of adult Americans have personally invested in crypto. And because of its increased demand and utilization, business owners are now wondering how they can incorporate cryptocurrency into their businesses.

And we can’t blame them because as crypto gains more traction, it’s not surprising to know that it could improve numerous aspects of your organization.

Different Ways Your Business Can Use Cryptocurrency

Utilize A No-Risk Credit Card For Crypto Rewards

If you’re still unsure whether to incorporate crypto into your business or invest in it, you may try crypto rewards credit card. It’s a great starting point that allows business owners like you to leverage your personal or business spending, accumulating crypto or points. And at the end of the day, you can convert the points into cryptocurrency.

And because there are certain card variations, you should look for ones without additional annual fees. It will help you earn an unlimited 1% in crypto for every purchase – and maybe even more. It’s a convenient and risk-free option to incorporate crypto into your business slowly.

Accept Crypto As A Mode Of Payment

Although it’s pretty controversial, there are certain benefits to accepting crypto as a mode of payment in your business. Both you and your customers will enjoy secure transactions and significantly lower fees. Because, unlike traditional card payments, which usually costs 2% to 4% per transaction, crypto payment can reduce it to less than 1%.

In addition, your business won’t be charged back, unlike credit card payments. And because there isn’t any third-party involved, crypto payments are final. As a result, your business will enjoy the benefits of being protected by the blockchain, ensuring safe and secure transactions.

And did you know that accepting crypto as payment will help you reach international customers? With this, your products and services will reach a new target market. It could ultimately lead to a business expansion and higher business revenue.

Accepting crypto is relatively simple – you may receive it using a crypto wallet using payment gateways like Paypal or invest in a crypto payment service like Coinbase Commerce.

Invest Using A Retirement Account

One of the most clever ways to trade crypto without triggering capital gains is investing in it using a tax-advantaged retirement account. Some common accounts include Individual Retirement Account (IRA) and Simplified Employee Pension (SEP-IRA).

By using a traditional IRA, all your contributions will remain tax-deductible, and you’ll pay ordinary income tax on money withdrawn in retirement. And don’t worry because although contributions to a crypto IRA are taxable, future withdrawals are tax-free during retirement.

Finance Your Business With A Crypto Loan

It’s no secret that one of the most significant challenges of running a business is a lack of financial access. So if you’re looking for a safe and effective way to get extra funds, you might want to check out crypto lending. To get a crypto loan, you must own some assets while maintaining a specific loan-to-value ratio. And instead of selling all your crypto coins, you can use them as collateral to generate cash or a stablecoin.

Of course, your final loan amount will depend on how much crypto collateral you can provide. For example, you can use $20,000 worth of crypto with a 60% LTV. This will give you a $12,000 cost loan. However, it’s important to note that crypto loans pose potential risks just like other financial services. For example, if your collateral’s value decreases due to price volatility, you might be required to increase it or pay some portions of the loan. And if you can’t comply with the lender’s requirement, they could take a portion or all of your collateral as payment.

With this in mind, you must do proper research before applying for a crypto loan. Make sure to find a lender with a great reputation and excellent reviews. And by now, you should know to steer clear of lenders with messy track records, such as:

Taking legal actions against their customers

Suspending services without adequate notice