#FxPro cTrader

Explore tagged Tumblr posts

Text

Como utilizar a FxPro cTrader para operar com eficiência

A young businessman working from his office – the concept of hard work Introdução A tecnologia tem transformado a forma como investidores de todo o mundo operam no mercado financeiro. Plataformas como o FxPro cTrader se destacam por oferecer ferramentas avançadas e uma interface amigável, ideal para traders que buscam uma experiência eficiente e profissional. Neste artigo, vamos explorar como…

#Análise Técnica#Automação no Mercado#Estratégias de Investimento#Ferramentas para Trader#Forex e CFDs#FxPro cTrader#Operações Financeiras#Plataforma de Negociação#Trading Online

1 note

·

View note

Text

#FxPro#forex broker#CFD trading#MetaTrader 4#MetaTrader 5#cTrader#FxPro Edge#no dealing desk#NDD execution#negative balance protection#fast order execution#trading platforms#trading instruments#account types#leverage#spreads#demo account#trading tools#economic calendar#trading calculators#VPS#regulated broker#FCA#CySEC#FSCA#SCB#trading 2025#broker review

0 notes

Text

Best PayPal Forex Brokers for Beginners

Entering the world of forex trading can be both exciting and overwhelming, especially for beginners. Selecting the right broker plays a critical role in your trading journey. In 2025, the combination of accessibility, low fees, and secure payments has positioned PayPal as a top method for managing trading funds. That’s why this guide focuses on helping new traders identify the best PayPal forex brokers that offer ease of use, educational support, and fast, secure transactions.

Whether you're starting with a demo account or planning to invest real capital, working with a PayPal-friendly forex broker can simplify your experience and build your confidence in trading.

Why Beginners Should Consider PayPal for Forex Trading?

Fast and Easy Deposits/Withdrawals: With PayPal, you avoid the delays of bank transfers and complex wire setups.

User-Friendly Interface: PayPal’s mobile and web platforms are intuitive and widely used.

Enhanced Security: PayPal’s encryption and fraud detection tools add a layer of protection to your funds.

Choosing the best PayPal forex brokers means aligning with platforms that not only offer PayPal support but also provide resources specifically tailored to beginners.

What to Look for in a Beginner-Friendly Forex Broker?

Simple Account Setup: Registration and verification processes should be quick and uncomplicated.

Low Minimum Deposits: Ideal for those who want to start small while learning.

Educational Tools: Access to tutorials, webinars, and demo accounts is crucial.

Responsive Customer Support: Timely assistance helps beginners resolve issues quickly.

Regulated Operations: Ensures the broker operates under strict guidelines and provides fund security.

Real-Life Success Story

Luca Fernandez, a 26-year-old graphic designer from Madrid, had never traded forex until late 2023. He chose FBS because it supported PayPal and had a beginner-friendly platform. Starting with just $100, Luca used educational videos and demo accounts to learn the basics. By mid-2024, he turned his $100 into $2,700 through careful analysis and practice. The ability to deposit and withdraw using PayPal gave him the freedom and confidence to trade without worrying about complex banking procedures.

Top PayPal Forex Brokers for Beginners in 2025

Eightcap

Regulated by ASIC and SCB

Offers a low entry point and educational resources

Compatible with MT4, MT5, and TradingView

Eightcap is user-friendly and offers excellent integration with analytical tools. Its PayPal support allows quick transactions, ideal for those just getting started.

FP Markets

Regulated by ASIC and CySEC

Provides comprehensive learning materials

Offers demo and micro accounts

FP Markets is well-suited for beginners who want to explore trading without high risk. Its PayPal feature ensures smooth deposit and withdrawal processes.

FBS

Regulated by IFSC and CySEC

Offers cent and micro accounts

Features an extensive education center

FBS is designed with beginners in mind. From low minimum deposits to responsive PayPal transactions, it supports traders at every step.

XM

Licensed by ASIC, CySEC, and IFSC

Provides multilingual educational webinars

Offers negative balance protection

XM’s beginner-friendly platform includes a wide range of learning tools. It allows PayPal transactions for easy funding and withdrawals.

IC Markets

Regulated by ASIC, CySEC, and FSA

Offers tight spreads and excellent execution

Supports MT4, MT5, and cTrader platforms

IC Markets balances ease of use with professional-grade tools. Beginners benefit from its PayPal support and quick access to funds.

FxPro

Regulated by FCA, CySEC, FSCA

Offers educational content and market analysis

Supports multiple trading platforms

FxPro offers a guided learning experience for new traders. PayPal integration provides easy access to your trading capital.

Axi

Regulated by FCA and ASIC

Features MT4 trading with risk management tools

Provides beginner tutorials and blog content

Axi is simple yet powerful for new traders. With PayPal support, it offers quick fund access and minimal barriers to entry.

Pepperstone

Regulated by ASIC, FCA, BaFin, and DFSA

Low minimum deposits and rich learning hub

No dealing desk intervention

Pepperstone offers great customer support and detailed tutorials. PayPal compatibility enhances its beginner appeal.

HFM (HotForex)

Regulated by FCA, CySEC, DFSA, FSCA

Offers a wide range of account types

Provides market education and support tools

HFM helps new traders get comfortable with forex through structured content. It processes PayPal payments quickly and reliably.

Octa

Regulated by CySEC and FSCA

Offers fixed and floating spreads

Features a dedicated educational section

Octa is suitable for beginners looking for mobile-first access and responsive PayPal transactions. The interface is clean and easy to navigate.

How to Know if a Forex Broker is Secure?

Online safety is essential, especially for beginners handling real money. Here’s how to assess whether a broker is trustworthy:

Check Regulatory Licenses: Ensure the broker is licensed by major bodies like ASIC, FCA, or CySEC.

Secure Website Indicators: A secure URL (https) and SSL encryption are must-haves.

Two-Factor Authentication: Adds protection beyond just a password.

Transparent Terms: Make sure withdrawal and trading conditions are clearly outlined.

Segregated Client Funds: Reliable brokers keep client money separate from operating funds.

Frequently Asked Questions

Is PayPal a safe option for forex trading? Yes. PayPal uses advanced encryption and buyer protection, making it a trusted option for online transactions, including forex trading.

Do beginner brokers charge fees for PayPal deposits? Most beginner-friendly brokers do not charge additional fees, though PayPal may apply a nominal fee depending on your location.

How can I practice trading as a beginner? Choose brokers that offer demo accounts. These allow you to practice in real-time market conditions without risking actual money.

Is it easy to withdraw funds with PayPal? Yes. Most brokers process PayPal withdrawals within 24 hours, and some even offer same-day processing.

What makes a forex broker suitable for beginners? Low deposit requirements, educational support, demo accounts, and user-friendly platforms are all essential features.

youtube

Final Thoughts

Getting started in forex trading doesn't have to be complicated. The best PayPal forex brokers for beginners offer the ideal mix of simplicity, security, and support. Brokers like FBS, FP Markets, and XM lead the way with beginner-friendly platforms and seamless PayPal transactions. If you're ready to step into forex trading, choosing a broker with strong PayPal integration can help you build confidence and maintain full control over your funds from day one.

2 notes

·

View notes

Text

FxPro Review: Unveiling the World's Leading Online Forex Broker

In the dynamic realm of financial trading, the significance of efficient and reliable online forex brokers cannot be overstated. Among the myriad options available, FxPro stands out as a beacon of excellence, earning its reputation as the world’s number one online forex (FX) broker. This detailed FxPro review aims to explore the unique features, offerings, and overall experience that have established this broker as a preferred choice for traders globally.

youtube

Discovering FxPro: A Legacy of Trust and Innovation

Founded in 2006, FxPro has carved a niche for itself in the competitive forex market, showcasing a steadfast commitment to providing an exceptional trading experience. As a Top Forex Brokers review, FxPro has successfully built a reputation for transparency, reliability, and innovation, making it a trusted partner for thousands of traders around the world. With a user-centric approach, the broker continuously evolves to meet the needs of its clients, ensuring they have the tools and resources necessary to thrive in the fast-paced world of forex trading.

The FxPro Trading Platforms: A Gateway to Success

Central to FxPro's appeal is its diverse array of trading platforms, designed to cater to the varied preferences of both novice and experienced traders. Each platform boasts unique features that facilitate seamless trading, empowering users to make informed decisions in real-time.

MetaTrader 4 (MT4): The Industry Standard

The MetaTrader 4 (MT4) platform is a cornerstone of the forex trading experience, and FxPro offers an optimized version that enhances its functionality. Known for its user-friendly interface, MT4 provides traders with powerful charting capabilities, a plethora of technical indicators, and automated trading options through Expert Advisors (EAs). This platform is particularly favored by those who appreciate a straightforward yet effective trading environment.

MetaTrader 5 (MT5): The Next Generation

For traders seeking a more advanced experience, FxPro also provides access to the MetaTrader 5 (MT5) platform. MT5 is a comprehensive trading environment that includes advanced order management, a greater array of analytical tools, and an integrated economic calendar. Its multi-asset capabilities extend beyond forex, allowing traders to delve into commodities, stocks, and futures, making it an excellent choice for those looking to diversify their trading portfolio.

cTrader: Innovative and Intuitive

In addition to MT4 and MT5, FxPro offers the cTrader platform, which is designed for traders who prefer a more innovative and user-friendly experience. cTrader features a clean interface, advanced charting tools, and customizable workspaces, catering to both manual traders and algorithmic trading enthusiasts. The platform also includes a community-driven marketplace where traders can share and access trading tools, fostering collaboration and innovation.

Competitive Spreads and Pricing Structure

When it comes to trading costs, FxPro excels in providing competitive spreads and transparent pricing. The broker’s commitment to low trading costs is evident across its various account types, allowing traders to choose an option that best fits their trading style and budget.

FxPro offers several account types—each tailored to different trading needs—ensuring that clients can find a suitable option. For instance, the FxPro MT4 account is popular for its tight spreads and no commission trading, while the FxPro cTrader account provides a commission-based structure with slightly tighter spreads. This flexibility allows traders to optimize their trading strategies while minimizing costs.

Moreover, the broker’s commitment to transparency ensures that traders are always aware of the costs associated with their trades, allowing for effective financial planning and decision-making.

A Diverse Selection of Trading Instruments

One of the standout features of FxPro is its extensive range of trading instruments. While the broker is predominantly known for its forex offerings, it also provides access to a wide array of asset classes, including commodities, indices, and cryptocurrencies.

Forex Trading

FxPro covers a vast selection of currency pairs, encompassing major, minor, and exotic pairs. This diversity enables traders to capitalize on global economic trends and currency fluctuations, providing ample trading opportunities.

Commodity Trading

For those interested in commodities, FxPro offers trading in popular assets such as gold, silver, oil, and agricultural products. This allows traders to hedge against inflation or geopolitical risks while diversifying their investment portfolios.

Indices and Cryptocurrencies

In addition to traditional forex and commodities, FxPro provides access to global indices and a selection of cryptocurrencies. Traders can engage with major indices like the S&P 500 and FTSE 100, or explore the burgeoning cryptocurrency market, including popular coins such as Bitcoin and Ethereum. This extensive range of instruments empowers traders to explore various market dynamics and seize opportunities across different sectors.

Robust Security and Regulatory Oversight

In an industry where security is paramount, FxPro stands out for its commitment to safeguarding client funds and personal information. The broker is regulated by multiple reputable financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa. This multi-tiered regulatory framework offers clients peace of mind, knowing that their investments are protected by stringent regulations.

FxPro also employs advanced security measures to ensure the safety of its clients’ funds. These measures include SSL encryption for data protection and two-factor authentication for account security. The broker’s proactive approach to security and regulatory compliance underscores its dedication to maintaining a trustworthy trading environment.

Enhanced Customer Support

Exceptional customer support is a hallmark of a reputable broker, and FxPro does not disappoint in this regard. The broker offers a robust support system designed to assist traders at any stage of their trading journey.

FxPro’s customer support team is available 24/7, providing multilingual assistance to cater to its diverse global clientele. Whether you require help with account management, technical inquiries, or trading strategies, the knowledgeable support staff is always ready to assist.

Additionally, FxPro offers a wealth of educational resources, including webinars, trading tutorials, and market analysis, empowering clients to enhance their trading skills and knowledge. This commitment to client education is a testament to FxPro’s dedication to fostering a supportive trading community.

Educational Resources and Trading Tools

FxPro goes beyond offering trading platforms and customer support by providing a comprehensive suite of educational resources and trading tools. The broker recognizes that informed traders are successful traders, and it strives to equip its clients with the knowledge they need to navigate the complexities of the forex market.

Webinars and Tutorials

FxPro hosts regular webinars led by industry experts, covering a variety of topics ranging from trading strategies to market analysis. These interactive sessions provide valuable insights and allow traders to ask questions in real time, fostering a collaborative learning environment. Additionally, the broker offers a library of tutorials and articles, catering to traders of all experience levels.

Market Analysis

To help traders make informed decisions, FxPro provides daily market analysis and insights. This analysis includes technical and fundamental reports, helping traders understand market trends and identify potential trading opportunities. By staying informed about market developments, traders can enhance their strategies and improve their overall performance.

Trading Tools

FxPro also offers a range of trading tools to enhance the trading experience. These tools include economic calendars, calculators, and trading signals, all designed to assist traders in making informed and timely decisions. Such resources are invaluable for both novice and experienced traders, facilitating a more strategic approach to trading.

Conclusion: The Ultimate Choice for Forex Traders

In this comprehensive FxPro review, we have explored the myriad features and advantages that make this broker a top choice for forex traders worldwide. From its cutting-edge trading platforms and competitive pricing structure to its diverse selection of trading instruments and robust security measures, FxPro has established itself as a leader in the online forex brokerage space.

Through its unwavering commitment to customer support and education, FxPro empowers traders to hone their skills and navigate the complexities of the financial markets with confidence. Whether you are a seasoned trader or just starting your journey in forex trading, FxPro offers the tools, resources, and support to help you succeed.

In conclusion, FxPro stands as a testament to what a premier forex broker should aspire to be. With its extensive offerings and client-focused approach, FxPro is not just a broker; it is a partner in your trading journey, ready to elevate your forex trading experience to new heights.

2 notes

·

View notes

Text

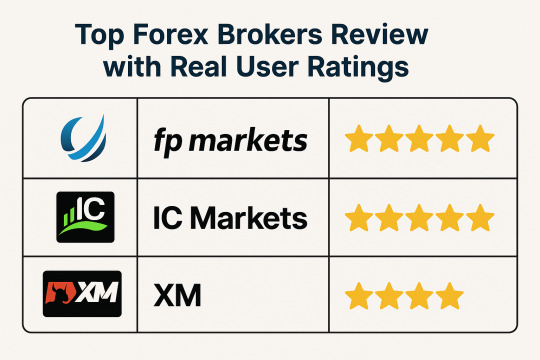

Top Forex Brokers Review with Real User Ratings

Choosing the right forex broker can be a critical step in a trader’s journey. In this Top Forex Brokers Review, we provide a clear and professional evaluation of the most trusted brokers in the market, incorporating real user ratings and insights. Whether you're a novice or an intermediate trader, this guide will help you compare the best platforms based on regulation, features, platform performance, and overall user satisfaction.

Key Qualities of a Top Forex Broker

Before diving into the Top Forex Brokers Review, it's important to understand what distinguishes a reliable broker:

Strong regulatory oversight by ASIC, FCA, or CySEC

Tight spreads with transparent fee structures

High-speed order execution

Dependable trading platforms such as MetaTrader 4, MetaTrader 5, or cTrader

Solid customer support and educational resources

Positive user reviews and community feedback

Broker Reviews Based on Features and User Experience

Eightcap

Regulated by ASIC and SCB with tight spreads

Integrates TradingView with MT4 and MT5

Offers a wide range of crypto CFDs and forex instruments

Eightcap is favored by traders who value innovation and advanced charting tools. Its crypto offering adds a competitive edge for diversified traders.

FP Markets

Licensed by ASIC and CySEC, providing strong regulatory safety

ECN-style execution with access to Iress, MT4, and MT5

Consistently high user ratings for customer service and execution speed

FP Markets is ideal for serious traders who want reliable pricing and a platform that’s proven to perform well under market pressure.

FBS

Regulated by IFSC and CySEC with flexible account types

Offers high leverage up to 1:3000 and strong promotional bonuses

Known for user-friendly support and localized services

FBS attracts beginners with its low entry requirements and variety of learning tools. Many users rate it highly for customer support responsiveness.

XM

Regulated by ASIC, IFSC, and CySEC with multi-lingual support

Low spreads from 0.0 pips and negative balance protection

Praised for educational materials and community outreach

XM remains a user favorite for its consistent performance and excellent learning ecosystem. It’s a well-rounded platform suitable for most traders.

IC Markets

Overseen by ASIC, CySEC, and FSA with true ECN trading

Raw pricing with ultra-low spreads and deep liquidity

Popular among algorithmic and professional traders

IC Markets consistently receives high user ratings for its stable infrastructure and efficient execution. A top choice for experienced traders.

FxPro

Regulated by FCA, CySEC, and FSCA with NDD execution

Offers MT4, MT5, and cTrader platforms

Rated highly for reliability and order transparency

FxPro is suitable for traders who value a mix of automation and discretion. Users commend its consistent uptime and trade execution.

Axi

Regulated by ASIC, FCA, and FMA with global recognition

Offers MT4 with integrated PsyQuation analytics

Well-rated for analytical tools and trader support

Axi provides a data-driven edge for traders who like to track performance and optimize strategies. Its educational services are also appreciated.

Pepperstone

Regulated by ASIC, FCA, and DFSA for broad international access

Offers low-latency trading with MetaTrader, cTrader, and TradingView

Frequently top-rated for speed and reliability

Pepperstone is a go-to broker for fast execution and deep liquidity. Scalpers and technical traders give it consistent five-star ratings.

HFM (HotForex)

Overseen by FCA, FSCA, and DFSA for global credibility

Offers multiple account types including Zero, PAMM, and copy trading

Rated well for its comprehensive educational content

HFM is a strong choice for both individual and social traders. New users often cite its ease of use and well-structured training programs.

Octa

Regulated by CySEC and FSA with bonus offers

Provides cashback and commission-free trading options

Known for a user-friendly mobile trading experience

Octa is best for entry-level traders who need simplicity and mobile-first functionality. User reviews highlight its intuitive platform and reward systems.

Real User Success Story: Learning Through Experience

Carlos Mendoza, a 29-year-old engineer from Peru, started trading part-time in 2022 with Pepperstone. Initially, he was drawn to the platform’s fast execution and tight spreads. Carlos spent months refining his strategy through demo accounts and later shifted to a live ECN account. With consistent support and educational tools, he scaled his capital from $500 to over $12,000 in 18 months. Carlos credits his growth to Pepperstone’s transparent pricing and the support of a strong online trading community.

How to Check If a Broker's Website is Safe?

Security is a vital concern when trading online. Here's how to assess a forex broker’s website for safety:

Regulatory Proof: Check for valid licenses from financial authorities such as ASIC, FCA, or CySEC.

SSL Encryption: Look for “https” and a padlock icon in the address bar.

Two-Factor Authentication: A secure platform will offer 2FA to protect user accounts.

Fund Segregation: Ensure client funds are kept separate from broker operational funds.

Clear Legal Documentation: Terms, privacy policies, and risk warnings should be readily available.

Click Now

Frequently Asked Questions (FAQs)

How can I tell if a broker is regulated?

Visit the official website and scroll to the footer where license numbers are usually listed. Verify them on the regulator’s site.

What’s the best platform for beginners?

Platforms like XM and FBS offer beginner-friendly tools, demo accounts, and educational resources for starting out.

Can I make money in forex with little capital?

Yes, but it requires discipline, strategy, and realistic expectations. Brokers like FBS and Octa offer micro and cent accounts.

What’s the difference between raw spreads and standard spreads?

Raw spreads come with lower pip differences but include commissions. Standard spreads are wider but often commission-free.

Are mobile trading apps reliable?

Yes, if offered by reputable brokers like Pepperstone, Octa, or IC Markets. Always download apps from official stores.

youtube

Final Words: Make an Informed Choice

This Top Forex Brokers Review provides a transparent look at the best forex brokers as rated by real users. From Pepperstone to XM and FBS, each platform has its unique advantages. The right choice depends on your trading needs, experience level, and desired features. Take time to compare offerings, use demo accounts, and ensure platform safety. With informed decision-making, you’ll be well-positioned to succeed in your forex journey. Revisit this Top Forex Brokers Review anytime you need guidance on choosing the right broker.

0 notes

Text

Safe CySEC Regulated Forex Brokers to Trade

In the world of online forex trading, regulatory oversight is essential. With the abundance of brokers offering tempting deals, traders need more than just tight spreads and bonus offers — they need safety, transparency, and reliability. That's why CySEC Regulated Forex Brokers have become the preferred choice for traders who value secure trading environments.

This guide explores the safest CySEC-regulated brokers you can trade with today. We’ll break down what CySEC regulation means, how it helps protect traders, provide a real-life success story, and share essential security insights to help you evaluate any forex platform more confidently. You’ll also find frequently asked questions and compact broker reviews to help you make an informed decision.

Why Choose CySEC Regulated Forex Brokers?

The Cyprus Securities and Exchange Commission (CySEC) is one of the most respected regulatory bodies in the financial industry. Brokers regulated by CySEC must comply with strict rules that ensure client fund protection, transparency in pricing, and ethical trading practices.

When choosing from CySEC Regulated Forex Brokers, traders can feel more confident knowing:

Funds are held in segregated accounts, separate from broker operating capital.

Brokers are regularly audited and monitored by the regulator.

There is access to compensation schemes in the event of broker insolvency.

These safeguards significantly reduce the risks of trading with unreliable or fraudulent platforms.

Quick Reviews: Safe CySEC Regulated Forex Brokers

Here are brief reviews of some of the most trusted CySEC Regulated Forex Brokers for both new and seasoned traders:

Eightcap

Licensed by CySEC and ASIC

Supports MT4 and MT5 platforms

Offers forex, crypto, and indices trading

Eightcap provides fast execution and ultra-tight spreads, making it attractive for traders seeking performance and security.

FP Markets

Regulated by CySEC and ASIC

ECN pricing with spreads from 0.0 pips

Extensive trading tools and education

Known for transparency and deep liquidity, FP Markets is ideal for both beginner and advanced traders.

FBS

Holds CySEC and IFSC licenses

Offers cent, standard, and ECN accounts

User-friendly interface with bonus offers

FBS suits micro-lot traders and those starting small, without compromising on regulation and protection.

XM

CySEC-regulated and globally recognized

No re-quotes with real-time execution

Platforms include MT4, MT5, and XM mobile

XM combines strong regulatory backing with flexible account types and low trading costs.

IC Markets

Regulated by CySEC, ASIC, and FSA

Raw spreads with ultra-low latency execution

Ideal for algorithmic and day trading strategies

IC Markets offers professional-grade tools for serious traders, backed by CySEC-regulated reliability.

FxPro

Overseen by CySEC, FCA, and FSCA

Supports MT4, MT5, and cTrader

Competitive spreads and risk management tools

FxPro is well-known for reliability and is trusted by millions due to its long-standing regulatory track record.

Axi

CySEC-licensed and ASIC approved

Commission-free and low-spread account types

Offers copy trading and education center

Axi is a trusted choice for traders who want a clean, beginner-friendly interface with full regulation.

Pepperstone

Fully licensed by CySEC, ASIC, and FCA

Razor accounts with raw spreads

Dedicated customer service and fast execution

Pepperstone remains one of the most popular choices for safety-focused traders, particularly scalpers and pros.

HFM (HotForex)

Licensed under CySEC and other top regulators

Wide variety of accounts and PAMM services

Offers advanced analytics and tools

HFM is perfect for traders who want flexibility with the added peace of CySEC regulatory control.

Octa

Regulated under CySEC as Octa Markets Cyprus

Swap-free Islamic accounts and zero commission

Strong mobile and web-based platform

Octa caters to a broad audience with beginner tools and is backed by robust CySEC regulation.

Real-Life Trader Success: Learning and Earning with XM

Luca, a 32-year-old web designer from Italy, started trading part-time to supplement his income. After researching regulated brokers, he selected XM because of its CySEC license, user-friendly app, and zero-requote policy. Starting with a demo account, Luca gradually gained confidence and switched to live trading. By following a disciplined trading strategy and using XM's market research tools, Luca now earns consistent profits monthly. He credits his growth to the stability and support offered by a CySEC Regulated Forex Broker.

How to Identify a Safe Forex Broker Platform?

While CySEC regulation already adds a layer of safety, users should take a few extra steps to ensure their broker platform is secure:

HTTPS Encryption: Always check that the broker’s website is encrypted. Look for “https://” at the start of the web address.

Two-Factor Authentication (2FA): Reputable brokers offer 2FA to add an extra layer of account protection.

Regulatory Confirmation: Cross-check the broker’s license number on CySEC’s official website.

Transparent Fees and Spreads: Reliable brokers clearly state their charges without hidden costs.

Client Fund Segregation: Ensure that the broker keeps your money in separate, protected accounts.

Evaluating these elements helps reduce the risk of identity theft, unauthorized access, or fund mismanagement.

Click Now....!

Frequently Asked Questions (FAQs)

What makes CySEC regulated brokers trustworthy? CySEC enforces strict financial rules, audits, and consumer protection policies, ensuring that traders' interests come first.

Are CySEC brokers suitable for new traders? Yes, many offer beginner-friendly tools like demo accounts, low minimum deposits, and trading education.

Can I trust a broker just because it's CySEC regulated? CySEC regulation is a strong sign of trust, but it's still important to research the broker's trading conditions and user feedback.

Do CySEC brokers offer lower spreads? Many do. Brokers like IC Markets and FP Markets provide ECN-style trading with spreads from 0.0 pips.

How do I know if a broker is truly regulated by CySEC? Visit the official CySEC website, and use the broker’s license number to verify their registration and compliance status.

youtube

Final Thoughts

The forex market is full of opportunities, but choosing the right broker is crucial for safe and profitable trading. CySEC Regulated Forex Brokers provide traders with confidence, transparency, and a secure environment — all essential for long-term success.

By comparing trusted brokers like Eightcap, FP Markets, XM, and IC Markets, you can find a platform that fits your goals and trading style while keeping your funds and data protected. Prioritize regulation, evaluate platform security, and trade with confidence.

Whether you’re just starting or looking to upgrade, trading with a CySEC regulated broker is one of the smartest decisions you can make in today’s forex landscape.

1 note

·

View note

Text

Best Forex Broker in Ireland: A Complete Guide for 2025

Navigating the forex trading landscape can be overwhelming, especially when you're trying to identify the best forex broker in Ireland. With numerous platforms claiming to offer top-tier services, choosing the right broker requires careful consideration of multiple factors—regulation, fees, user experience, trading tools, and customer support, to name a few.

Let’s break down what makes a forex broker the right choice for traders based in Ireland and explore the top names that stand out in 2025.

Why Choosing the Right Broker Matters

Your forex broker acts as your gateway to the global currency market. Whether you're trading EUR/USD, GBP/JPY, or exotic pairs, the broker determines not just your access to these instruments, but also how much you pay in spreads, commissions, and overnight fees.

More importantly, a good broker ensures a secure, regulated trading environment that protects your capital and gives you peace of mind. In Ireland, the most reputable brokers are often regulated by the Central Bank of Ireland or by top-tier bodies like the FCA (UK) and CySEC (Cyprus).

Key Features to Look for in a Forex Broker:

Before jumping in, it’s important to consider the following when evaluating a broker:

1. Regulation and Security

Ensure the broker is licensed and regulated by a trusted financial authority. This offers trader protection and ensures the broker adheres to strict compliance standards.

2. Trading Platforms

The availability of platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and proprietary apps can impact your experience. Look for brokers that offer stable, user-friendly platforms with technical analysis tools.

3. Fees and Spreads

Low fees don't always mean better. Look at spreads, commissions, and non-trading fees (like withdrawal or inactivity fees) to get the full picture.

4. Deposit and Withdrawal Methods

A good broker offers flexible and fast payment options with transparent policies.

5. Customer Support

Accessible and responsive customer service can make a huge difference when facing technical or account issues.

Top Forex Brokers in Ireland (2025):

Based on user reviews, regulatory status, and trading conditions, here are some brokers that stand out for Irish traders:

1. FP Markets

Regulated by ASIC and CySEC

Offers ECN pricing and tight spreads from 0.0 pips

Supports MT4, MT5, and IRESS platforms

Known for excellent execution speed and transparency

2. Eightcap

Regulated by ASIC and SCB

Features over 800 tradable instruments including forex, indices, and crypto

MT4 and MT5 platforms plus integration with TradingView

Ideal for traders using expert advisors and trading automation

3. IC Markets

Regulated by ASIC, CySEC, and FSA

True ECN broker with ultra-low latency execution

Offers MT4, MT5, and cTrader platforms

Preferred by professional traders and scalpers

4. Octa

Regulated by CySEC

Commission-free trading with competitive spreads

Offers MT4, MT5, and a mobile-first trading app

Great for beginners with strong educational resources

5. FxPro

Regulated by FCA, CySEC, and FSCA

Offers both fixed and floating spreads

Supports MT4, MT5, and cTrader

Well-suited for all levels of traders with a reliable reputation

6. FBS

Regulated by CySEC and IFSC

High leverage up to 1:3000 and attractive bonuses

MT4, MT5, and FBS Trader app available

Designed for traders looking for aggressive trading flexibility

✅ Ready to trade? Choose a broker from the list above and start your forex journey with confidence.

👉 Visit now..

How to Start Trading with a Forex Broker in Ireland:

Getting started is easier than you think. Here's a step-by-step guide:

Research and Compare Brokers: Use broker comparison tools or read reviews.

Open a Demo Account: Practice trading without risking real money.

Verify Your Identity: Complete KYC by submitting ID and proof of address.

Fund Your Account: Use bank transfer, credit card, or e-wallet.

Start Trading: Begin with small trades and manage risk using stop-loss orders.

Choosing the best forex broker in Ireland isn't just about picking a name you’ve heard before. It’s about aligning your trading goals with the broker’s offerings—whether that means tight spreads, low commissions, rich educational resources, or robust mobile platforms.

FAQs:

1. Is forex trading legal in Ireland?

Yes, forex trading is legal in Ireland and is regulated by the Central Bank of Ireland. Traders should always choose brokers regulated by credible authorities.

2. Do I need to pay tax on forex profits in Ireland?

Yes, forex profits are subject to capital gains tax. It's important to keep records of your trades and consult a tax professional for proper reporting.

3. Can I trade forex with EUR accounts in Ireland?

Most brokers support EUR-denominated accounts, especially those targeting European clients. Always confirm this before opening an account.

4. Is MT4 better than MT5 for forex trading?

MT4 is ideal for beginners and supports most trading strategies. MT5 is more advanced, with extra timeframes and features. Your choice depends on your trading needs.

In conclusion

selecting the best forex broker in Ireland involves evaluating a mix of regulation, platform quality, fees, and customer support. Whether you're new to forex or looking to upgrade your broker, doing your homework now can save you money—and headaches—later.

#forex trading#forex indicators#forex broker#forexsignals#forex market#forex#forex expert advisor#stockmarket#forex robot

0 notes

Text

Best Islamic Forex Brokers Offering Sharia-Compliant Trading Solutions

Forex trading is generally considered impermissible under Islamic law unless conducted through an Islamic trading account. This is due to the fact that conventional forex accounts often involve interest (known as Riba), which is strictly prohibited in Islam. As a result, devout Muslim traders historically refrained from participating in the forex market until the introduction of swap-free or Sharia-compliant accounts—commonly known as Islamic forex accounts.

Today, a number of reputable brokers offer tailored best Islamic forex broker trading services that adhere to Sharia law. However, not all brokers provide the same conditions or levels of compliance. This makes it crucial for traders to conduct thorough research before selecting an Islamic forex broker.

This guide provides a comprehensive overview of Islamic forex accounts, the financial principles they follow, and how to choose the best Sharia-compliant broker.

What Is an Islamic Forex Account?

An Islamic forex account, often referred to as a swap-free account, is a trading account that complies with the principles of Islamic finance. The primary distinction from standard trading accounts is the elimination of overnight interest charges, also known as swaps or rollover fees.

According to Sharia law, any form of financial gain through interest (Riba) is strictly forbidden. Therefore, traditional trading practices that involve earning or paying interest are considered haram (impermissible). Islamic forex accounts are designed to eliminate this element, enabling Muslim traders to engage in the forex market without compromising their religious beliefs.

Although these accounts cater primarily to practicing Muslims, most brokers do not actively promote them, as they may be less profitable due to the absence of interest-related income. Nonetheless, nearly all leading brokers now offer swap-free accounts upon request.

Top 10 Picks for the Best Islamic Forex Broker in 2025

Below are the ten brokers offering robust Islamic trading environments with institutional-grade infrastructure and regulatory oversight.

1. FP Markets

FP Markets, regulated by ASIC and CySEC, provides a seamless swap-free trading experience. Their true ECN execution ensures ultra-tight spreads and low latency, especially suitable for intraday traders. Islamic accounts are available upon request with no hidden fees.

2. HFM (HF Markets)

HFM is regulated across multiple jurisdictions including the FSCA and FCA. The broker offers permanent Islamic account status with no time constraints, making it a viable option for long-term traders. With multilingual support and tailored education, HFM appeals strongly to clients across the MENA region.

3. FxPro

A reputable broker under FCA and CySEC, FxPro supports Islamic accounts on MT4, MT5, and cTrader. Their infrastructure offers market execution without dealing desk intervention. Swap-free accounts can be activated on request, suitable for those seeking transparency and technical reliability.

4. Octa

Octa is widely used in Muslim-majority countries like Indonesia and Bangladesh. It enables swap-free trading by default on request and avoids inflating spreads or applying hidden fees. With its user-friendly mobile app, Octa appeals to retail traders prioritizing simplicity and compliance.

5. Eightcap

Eightcap operates under ASIC and SCB licenses. Their Islamic accounts support trading across forex, indices, and crypto CFDs without swap charges. The broker is also known for its tight integration with TradingView and MT5, offering analytical depth and charting flexibility.

6. Axi

Axi, licensed by FCA and ASIC, offers professional-grade execution and swap-free accounts tailored for Islamic traders. These accounts are available on both MT4 and MT5 and are backed by deep liquidity and reliable execution speeds. Particularly suitable for algorithmic and EA-based strategies.

7. XM

XM delivers Islamic trading accounts across all its account types, including Micro, Standard, and Ultra Low. Regulated by ASIC and CySEC, XM provides strong global support, including localized services for clients in the Middle East, Southeast Asia, and Africa.

8. FBS

FBS offers one of the most accessible Islamic account structures in the market. With zero interest on overnight trades and a low minimum deposit, FBS is well-suited for beginner and intermediate traders seeking compliance and affordability.

9. Pepperstone

Pepperstone is a globally recognized ECN broker regulated by FCA, ASIC, and DFSA. Its Islamic accounts offer fast execution across cTrader, MT4, and MT5 with no hidden markups or fees. Ideal for scalpers and day traders looking for religiously compliant, high-frequency execution.

10. IC Markets

IC Markets stands out as a top candidate for the best Islamic forex broker in 2025. It offers genuine ECN trading conditions with no swaps on Islamic accounts, subject to approval. The broker maintains a zero-dealing-desk environment and is regulated by ASIC and CySEC, making it a top-tier choice for professional Islamic traders.

Core Principles of Islamic Finance

Understanding the foundational principles of Islamic finance is essential before engaging with an Islamic forex broker. Here are the key components:

1. Riba (Interest)

Riba refers to any guaranteed interest on loaned money. In Islamic finance, profiting from interest—whether paid or received—is strictly prohibited. This is the core reason behind the exclusion of swaps in Islamic forex accounts.

2. Gharar (Uncertainty)

Gharar pertains to excessive risk and ambiguity in contracts. Trading in assets that are not owned or not in the trader's possession is forbidden. This prohibits short-selling and speculative trading based on uncertain outcomes.

3. Mudarabah (Profit-Sharing)

This is a partnership where one party provides the capital while the other offers expertise. Profits are shared as per agreement, while losses are borne solely by the capital provider, making it a fair and ethical financial arrangement under Sharia law.

4. Musharakah (Joint Venture)

Musharakah is a joint enterprise where all partners contribute capital and share both profits and losses. It fosters transparency and discourages exploitative practices.

Islamic Financial Prohibitions in Forex Trading

To maintain compliance with Islamic principles, traders using Islamic accounts must avoid the following prohibited activities:

Interest on Margin Deposits: Any interest earned from margin deposits is considered Riba and is thus haram.

Overnight Rollover Charges: Traditional accounts charge or credit interest for holding positions overnight, which is not permissible under Sharia law.

Interest-Based Loans: Taking loans that involve repayment with interest is forbidden.

Short Selling: Borrowing assets to sell them with the expectation of repurchasing at a lower price is not allowed.

Forward Contracts: Agreements involving future transactions at preset prices are prohibited due to uncertainty and delayed ownership.

Margin Trading: Trading using borrowed funds with interest is strictly disallowed.

How Islamic Forex Brokers Generate Revenue

Since interest income is off-limits, Islamic forex brokers implement alternative models to sustain profitability. These typically include:

Administrative Fees: Fixed fees charged for maintaining the account.

Commissions per Trade: A flat-rate or variable commission applied to trades.

Wider Spreads: Some brokers compensate for the absence of swaps by slightly widening the bid-ask spread.

It’s essential to compare commission structures and fee transparency when selecting an Islamic broker.

Key Considerations When Choosing an Islamic Forex Broker

To ensure a secure and Sharia-compliant trading experience, consider the following criteria when evaluating Islamic forex brokers:

1. Regulation & Licensing

Only engage with brokers that are licensed by reputable regulatory authorities such as ASIC, FCA, CySEC, or FSCA. Regulation ensures the broker adheres to strict financial and operational standards.

2. Swap-Free Duration

Some brokers offer permanent swap-free conditions, while others limit them to 30 or 60 days. Ensure the broker's policy aligns with your trading strategy.

3. Account Terms

Review spreads, leverage, minimum deposit requirements, and available trading platforms. These should align with both your risk appetite and trading goals.

4. Assets Offered

Confirm that the broker offers access to a wide range of Sharia-compliant instruments, such as major forex pairs, indices, and commodities—excluding assets related to alcohol, gambling, or other haram industries.

5. Customer Support

Efficient and multilingual customer service, particularly with support in Arabic, can be crucial for seamless trading.

Opening an Islamic Forex Account

Opening a swap-free trading account typically involves the following steps:

Select a regulated Islamic broker.

Register an account online.

Submit required identity verification documents.

Request swap-free status during or after account registration (some brokers offer this on request only).

Fund your account and begin trading within the framework of Islamic finance.

Tradable Assets with Islamic Accounts

Islamic trading accounts generally offer access to all major asset classes, including:

Forex pairs

Commodities (e.g., gold, oil)

Indices

Cryptocurrencies (if permitted by Sharia scholars)

However, traders must personally ensure they avoid trading assets tied to industries that violate Islamic ethical codes.

Advantages of Using an Islamic Forex Account

Sharia Compliance: Trade without compromising religious beliefs.

No Interest Charges: Avoid Riba with zero overnight fees.

Ethical Profit-Sharing Models: Transparent commission structures and Mudarabah-based practices.

Access to Long-Term Positions: Hold trades over extended periods without incurring interest.

Conclusion

Islamic forex accounts provide an ethical and Sharia-compliant trading environment for Muslim traders. While it's technically permissible for Muslims to use standard accounts, doing so may raise religious concerns due to the involvement of Riba. Swap-free accounts resolve these issues, offering a viable path for faith-based investing.

To ensure optimal trading conditions, always verify regulatory compliance, swap-free policies, fee structures, and supported instruments when choosing your broker.

Start by comparing the best Islamic forex broker to find the one that best meets your financial and religious needs.

0 notes

Text

FCA Regulated Brokers You Can Trust Today

In today’s evolving financial landscape, choosing a reliable forex broker is one of the most critical decisions a trader can make. FCA Regulated Brokers stand out as the most trusted options available, thanks to their adherence to strict regulatory standards, transparent operations, and strong commitment to client protection. Whether you’re a novice or an experienced trader, working with an FCA regulated broker ensures a higher level of trust, safety, and professionalism in your trading journey.

The Financial Conduct Authority (FCA) is a respected regulatory body in the UK that imposes stringent requirements on brokers operating under its license. These brokers are required to segregate client funds, maintain strong financial standards, and operate under clear and honest business practices. As a result, FCA Regulated Brokers are often preferred by traders around the world who prioritize security and ethical conduct.

Why Trust Matters in Forex Trading

Forex trading is inherently risky, but selecting a trustworthy broker significantly reduces potential losses tied to fraud or mismanagement. FCA Regulated Brokers are bound by law to act in the best interest of their clients. This level of accountability is essential, especially in a market where large sums of money can change hands within seconds.

Traders who value transparency, quick issue resolution, and the protection of client funds consistently gravitate toward FCA-regulated platforms. This level of oversight not only fosters peace of mind but also allows traders to focus more on strategy and execution, knowing that their funds are safe.

Top FCA Regulated Brokers You Can Rely on Today

FxPro

FxPro continues to be one of the leading FCA Regulated Brokers, offering robust trading tools and ultra-fast execution speeds. Known for its diverse range of platforms, including MetaTrader 4, MetaTrader 5, and cTrader, FxPro provides excellent trading conditions with tight spreads and no commission on many accounts. The broker's consistent regulatory compliance and client fund protection policies make it a standout choice for serious traders.

XM

XM is another broker operating under FCA regulation that has earned the trust of thousands of traders. With low spreads, zero commissions, and high-quality educational resources, XM is especially appealing to beginners. It also offers negative balance protection and multiple account types tailored to individual trading styles. As one of the most transparent FCA Regulated Brokers, XM provides a secure and supportive environment for all types of traders.

AXI

AXI, formerly known as AxiTrader, offers a strong balance of low-cost trading and advanced features. FCA-regulated and globally respected, AXI prioritizes client satisfaction with 24/5 customer support, competitive spreads, and AI-driven analytics. Traders looking for a broker that emphasizes affordability without compromising on safety consistently rate AXI among the most reliable FCA Regulated Brokers available today.

Pepperstone

Pepperstone has built a solid reputation for its low-latency execution and institutional-grade spreads. As an FCA-regulated broker, it offers a high level of transparency and fund security. Pepperstone is ideal for active and algorithmic traders due to its access to raw spreads and low commission rates. It combines technology, regulation, and client-first practices, making it a trusted option for traders at any level.

HFM (formerly HotForex)

HFM is widely recognized for its client-focused approach and regulatory compliance. Holding an FCA license, HFM offers multiple account types, tight spreads, and access to a wide range of assets. The broker’s dedication to transparency and trader education strengthens its reputation as one of the most accessible and dependable FCA Regulated Brokers in the market.

Success Story: A Trader’s Journey to Consistency and Growth

James Callahan, a 34-year-old IT consultant from Manchester, entered the world of forex with high hopes but little guidance. His first experience with an unregulated broker ended in frustration due to hidden fees and poor trade execution. Determined to find a safer alternative, James researched FCA Regulated Brokers and decided to sign up with Pepperstone.

With access to high-quality educational tools and real-time analytics, James gradually developed a sound trading strategy. He began trading part-time, initially with modest goals. Within a year, James turned a £3,000 investment into a £20,000 portfolio. Today, he credits his success to both disciplined trading and the secure, transparent environment provided by an FCA regulated broker. His story underscores the value of regulation and trust in achieving long-term trading success.

How to Evaluate Broker Platform Security

Even with FCA regulation, it is important for traders to take additional steps to assess platform security. A safe broker website should use HTTPS encryption to protect user data. Traders should also look for two-factor authentication (2FA) and biometric login capabilities for enhanced security.

All FCA Regulated Brokers are legally required to safeguard client information, keep funds in segregated accounts, and submit to regular audits. Before registering, traders should verify a broker’s FCA license number on the official FCA website. This simple step helps ensure the platform is operating within legal and ethical boundaries.

Your forex future starts here — click now

Frequently Asked Questions (FAQs)

What makes FCA regulated brokers more trustworthy? FCA regulated brokers must comply with strict financial rules, separate client funds, and offer compensation if the company fails. This makes them significantly more secure than unregulated alternatives.

Are there any hidden fees with FCA regulated brokers? Transparency is a core requirement for FCA-regulated entities. Brokers must clearly list all costs, including spreads, commissions, and swap rates.

Can international traders use FCA regulated brokers? Yes. Many FCA Regulated Brokers accept clients from outside the UK, offering them the same high level of protection and service.

Do FCA brokers offer demo accounts? Most of them do. Demo accounts are essential for new traders to practice without financial risk, and FCA brokers typically offer these for free.

How can I check if a broker is really FCA regulated? Visit the FCA's official website and search for the broker using their name or license number. This ensures the broker is properly regulated and listed.

youtube

Final Thoughts: Choose FCA Regulated Brokers for Safer, Smarter Trading

In the ever-changing world of forex trading, aligning yourself with a trusted broker is crucial. FCA Regulated Brokers such as FxPro, XM, AXI, Pepperstone, and HFM continue to set the standard for reliability, cost-efficiency, and trader protection. Whether you’re looking to build a new trading strategy or secure your capital, partnering with an FCA-regulated broker ensures you're starting with a solid, trustworthy foundation. By prioritizing transparency, safety, and performance, these brokers help traders focus on what truly matters: consistent growth and lasting success.

0 notes

Text

¡DOMINA LOS MERCADOS CON FxPro!

Tu Broker de Confianza con Tecnología de Vanguardia

🔥 ¿Por qué elegir FxPro?

✅ Plataformas Premium: Opera con MetaTrader 4, MetaTrader 5, cTrader y FxPro Edge en PC, web y móvil. ✅ Más de 2,100+ Instrumentos: Forex, Acciones, Índices, Metales, Energía y Criptomonedas. ✅ Ejecución Ultra Rápida: Más del 99.87% de órdenes ejecutadas en menos de 13.3 ms (sin rechazos ni re-cotizaciones). ✅ Apalancamiento Competitivo: Hasta 1:500 (según la jurisdicción). ✅ Cuentas Adaptadas: Standard, Raw, Elite – para traders de todos los niveles. ✅ Regulación de Alto Nivel: Autorizado por FCA (UK), CySEC (UE), SCB (Bahamas) y FSCA (Sudáfrica).

🎁 BONO EXCLUSIVO: ¡Abre tu cuenta hoy y accede a webinars gratuitos, señales de trading y análisis exclusivos!

📉 ¿Eres nuevo? FxPro te ofrece recursos educativos premium:

Guías para principiantes.

Seminarios en vivo con expertos.

Herramientas de análisis avanzado.

💡 "En FxPro, no solo operas, sino que evolucionas como trader."

👉 ¡Regístrate AHORA y comienza a operar con ventaja!

0 notes

Text

Sàn Forex có Spread thấp nhất hiện nay 2025, So sánh các sàn forex uy tín nhất

Danh sách các sàn forex có phí spread thấp nhất, uy tín nhất hiện nay, được trader việt tin lựa chọn

Exness: Mở tài khoản ngay

XM: Mở tài khoản ngay

Justmarkets: Mở tài khoản ngay

Peppertstone: Mở tài khoản ngay

XTB: Mở tài khoản ngay

Fxpro: Mở tài khoản ngay

FBS: Mở tài khoản ngay

Deriv: Đi đến website

Top 10 Sàn Forex Có Phí Spread Thấp Nhất Hiện Nay: Lựa Chọn Tối Ưu Cho Trader Việt

Giới thiệu

Phí spread là yếu tố sống còn đối với bất kỳ trader forex nào, đặc biệt là những người giao dịch thường xuyên như scalper hoặc day trader. Một mức spread thấp có thể giúp bạn tối ưu lợi nhuận và giảm thiểu chi phí giao dịch. Trong bài viết này, chúng tôi sẽ tổng hợp Top 10 sàn Forex có phí spread thấp nhất hiện nay – cập nhật mới nhất năm 2025 – kèm theo phân tích, tư vấn và hướng dẫn chi tiết giúp trader Việt Nam chọn được sàn phù hợp.

Spread là gì? Tại sao trader cần quan tâm?

Spread là chênh lệch giữa giá mua (Ask) và giá bán (Bid) của một cặp tiền tệ. Đây là khoản phí ẩn mà bạn phải trả mỗi khi mở một giao dịch. Có hai loại spread phổ biến:

Spread cố định: Không thay đổi dù thị trường biến động.

Spread thả nổi (variable): Biến động theo thanh khoản thị trường, thường thấp hơn khi thị trường ổn định.

Tại sao spread thấp lại quan trọng?

Giảm chi phí giao dịch: Đặc biệt quan trọng với những trader mở nhiều lệnh/ngày.

Tăng cơ hội chốt lời: Spread thấp giúp bạn đạt điểm hòa vốn sớm hơn.

Hiệu quả hơn cho EA (robot giao dịch): Spread thấp giúp bot hoạt động chính xác và hiệu quả hơn.

Tiêu chí lựa chọn sàn có spread thấp

Để chọn ra top sàn có spread thấp, chúng tôi đánh giá theo các tiêu chí sau:

Spread trung bình của cặp EUR/USD (cặp phổ biến nhất).

Tài khoản ECN hoặc Raw Spread.

Đòn bẩy hấp dẫn nhưng an toàn cho trader Việt Nam.

Hỗ trợ tiếng Việt, nạp rút dễ dàng, có văn phòng hoặc cộng đồng tại Việt Nam.

Độ uy tín, giấy phép rõ ràng.

Top 10 sàn Forex có phí Spread thấp nhất năm 2025

1. Exness

Spread trung bình EUR/USD: 0.1 pip (tài khoản Raw).

Giấy phép: FCA, CySEC, FSCA.

Ưu điểm: Nạp rút siêu nhanh (5 giây), hỗ trợ tiếng Việt 24/7, đòn bẩy không giới hạn.

Phù hợp: Trader mới đến chuyên nghiệp.

Tài khoản nên dùng: Raw Spread hoặc Zero.

Gợi ý từ Sói: Exness là lựa chọn cực kỳ phù hợp nếu bạn cần tính ổn định, rút tiền tức thì về tài khoản ngân hàng Việt.

2. IC Markets

Spread trung bình EUR/USD: 0.1 pip (Raw Spread).

Giấy phép: ASIC, CySEC, FSA Seychelles.

Ưu điểm: Khớp lệnh nhanh, không báo giá lại, phù hợp scalping.

Nền tảng: MT4, MT5, cTrader.

Phù hợp: Trader kỹ thuật, scalper.

3. Pepperstone

Spread trung bình EUR/USD: 0.0 – 0.2 pip.

Giấy phép: ASIC, FCA, DFSA.

Ưu điểm: Giao dịch nhanh, nền tảng đa dạng.

Phù hợp: Trader chuyên nghiệp, yêu thích giao dịch nhanh.

4. FXTM (ForexTime)

Spread EUR/USD: từ 0.0 pip (tài khoản ECN).

Giấy phép: FCA, CySEC, FSCA.

Ưu điểm: Hỗ trợ nhiều hình thức nạp rút, tài khoản đa dạng.

Phù hợp: Trader trung cấp và chuyên nghiệp.

5. AvaTrade

Spread EUR/USD: từ 0.9 pip (Fixed).

Giấy phép: ASIC, Central Bank of Ireland, FSA Japan.

Ưu điểm: Spread cố định – dễ kiểm soát chi phí.

Phù hợp: Trader không thích biến động spread.

6. Tickmill

Spread EUR/USD: 0.0 – 0.2 pip.

Giấy phép: FCA, CySEC, FSA.

Ưu điểm: Phí hoa hồng thấp, spread cực kỳ cạnh tranh.

Phù hợp: Trader chuyên nghiệp, giao dịch lớn.

7. XM

Spread trung bình: từ 0.1 pip (Ultra Low Account).

Giấy phép: ASIC, CySEC, IFSC.

Ưu điểm: Bonus hấp dẫn, giao diện dễ dùng.

Phù hợp: Trader mới, học viên.

8. FBS

Spread trung bình: từ 0.2 pip (Zero Spread account).

Giấy phép: IFSC, CySEC.

Ưu điểm: Hỗ trợ tốt tại Việt Nam, chương trình thưởng hấp dẫn.

Phù hợp: Trader mới, giao dịch nhỏ.

9. RoboForex

Spread EUR/USD: từ 0.0 pip.

Giấy phép: IFSC Belize.

Ưu điểm: Copytrade tốt, VPS miễn phí.

Phù hợp: Trader kết hợp nhiều chiến lược.

10. Admiral Markets

Spread trung bình: 0.1 – 0.3 pip.

Giấy phép: FCA, ASIC, CySEC.

Ưu điểm: Chất lượng lệnh tốt, uy tín cao.

Phù hợp: Trader dài hạn, đầu tư Forex CFD.

Hướng dẫn mở tài khoản sàn có spread thấp

Bước 1: Chọn sàn phù hợp với phong cách giao dịch

Scalper → IC Markets, Exness, Tickmill

Day Trader → Pepperstone, XM, RoboForex

Swing Trader hoặc Hedging → AvaTrade, Admiral

Bước 2: Xác minh tài khoản

Chuẩn bị: CCCD hoặc Passport, hóa đơn điện/nước hoặc sao kê ngân hàng.

Nên dùng email chuyên dụng, mật khẩu mạnh.

Bước 3: Nạp tiền

Khuyên dùng: Internet Banking (Vietcombank, MB, TPBank…).

Lưu ý: Kiểm tra phí nạp rút, tỷ giá quy đổi (USD → VNĐ).

Bước 4: Bắt đầu giao dịch thử với tài khoản Demo

Trước khi nạp tiền thật, hãy test spread trên MT4/MT5.

Quan sát spread lúc bình thường và lúc tin tức mạnh.

Lưu ý cho trader Việt khi chọn sàn spread thấp

Không nên chọn spread thấp mà bỏ qua yếu tố uy tín.

Ưu tiên sàn có hỗ trợ tiếng Việt, cộng đồng mạnh, xử lý rút tiền nhanh.

Tránh lạm dụng đòn bẩy cao, dễ cháy tài khoản.

So sánh kỹ phí hoa hồng (commission) trên tài khoản ECN.

Cập nhật chính sách sàn định kỳ – nhiều sàn thay đổi phí mà không báo.

Kết luận: Sàn nào phù hợp nhất cho bạn?

Mục tiêuSàn đề xuấtSpread siêu thấp + rút tiền nhanhExnessScalping mạnh, khớp lệnh cực nhanhIC Markets, TickmillGiao dịch ổn định, bonus tốtXM, FBSƯu tiên pháp lý vững, spread cố địnhAvaTrade, Pepperstone

Việc chọn đúng sàn không chỉ giúp bạn tiết kiệm chi phí mà còn tăng hiệu suất giao dịch và bảo vệ vốn đầu tư. Hãy luôn test thử bằng tài khoản demo, đọc kỹ điều khoản và đừng quên quản lý rủi ro mỗi khi vào lệnh.

#sàn forex có phí spread thấp#Sàn forex#forex spread#so sánh các sàn forex#sàn forex#sàn forex uy tín#giao dịch forex#spread là gì

0 notes

Text

Top Forex Brokers Review 2025: Best Regulated Platforms for Global Traders

Choosing the right forex broker is one of the most important steps in your trading journey. With thousands of brokers operating globally, traders must carefully assess which platforms offer the best trading conditions, security, and support. This comprehensive forex brokers review highlights the top 10 regulated brokers for 2025. Each broker featured is recognized for strong regulatory compliance, competitive spreads, and advanced trading platforms.

Whether you're a beginner exploring forex for the first time or an experienced trader looking to scale, this guide will help you make an informed decision.

Why Choosing a Regulated Forex Broker Matters

Not all forex brokers offer the same level of transparency or reliability. Regulated brokers are licensed by financial authorities like the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA) in the UK, or the Cyprus Securities and Exchange Commission (CySEC). These bodies ensure brokers operate fairly and securely.

When reviewing brokers, consider:

Regulation and Safety: Ensure proper licensing and fund segregation.

Trading Platforms: MT4, MT5, and cTrader support ensures flexibility.

Spreads and Fees: Low-cost trading conditions benefit long-term success.

Customer Support: Fast and multilingual assistance is essential.

Deposit and Withdrawal Options: Secure, fast, and flexible payment gateways.

Education and Tools: Quality learning materials help traders grow.

Let’s explore the top brokers that meet these standards in our updated forex brokers review.

Top 10 Forex Brokers for 2025

1. FP Markets – Best for ECN Execution and Low Spreads

Regulated by: ASIC, CySEC

Platforms: MT4, MT5, IRESS

Minimum Deposit: $100

Why Choose: ECN pricing with raw spreads from 0.0 pips

FP Markets offers an institutional trading experience with deep liquidity and fast execution. It's a preferred choice for scalpers, day traders, and algorithmic systems due to its reliable infrastructure and ultra-tight spreads.

2. HFM (HF Markets) – Best for Beginners and Educational Support

Regulated by: FCA, FSCA, CySEC

Platforms: MT4, MT5

Minimum Deposit: $5

Why Choose: Educational webinars, demo accounts, and low entry requirements

HFM is well-suited for new traders, providing a robust learning environment, free courses, and helpful tools. Its zero-fee deposits and wide range of account types make it accessible to global traders.

3. FxPro – Multi-Platform Broker with Global Trust

Regulated by: FCA, CySEC, FSCA

Platforms: MT4, MT5, cTrader

Minimum Deposit: $100

Why Choose: Wide platform support and excellent execution speed

FxPro is trusted by over 2 million clients globally. Its availability of multiple platforms and support for automated trading strategies makes it ideal for both retail and professional traders.

4. Octa – Best for Cashback Offers and Mobile Trading

Regulated by: CySEC

Platforms: MT4, MT5, OctaTrader

Minimum Deposit: $25

Why Choose: Commission-free trading and mobile-friendly interface

Octa stands out for its cashback promotions and easy-to-use platform. It’s a solid choice for budget-conscious traders who prioritize mobile accessibility and simple account management.

5. Eightcap – Excellent for Crypto and CFD Trading

Regulated by: ASIC, SCB

Platforms: MT4, MT5

Minimum Deposit: $100

Why Choose: Offers over 250 crypto CFDs in addition to forex

Eightcap is ideal for traders seeking exposure to crypto markets. It supports automated trading via TradingView and Capitalise.ai, making it popular among tech-savvy users and diversification-focused investors.

6. Axi – Strong Risk Management Tools for Serious Traders

Regulated by: ASIC, FCA

Platforms: MT4

Minimum Deposit: $0

Why Choose: Enhanced MT4 features with advanced tools for professionals

Axi provides a clean trading environment with useful tools like Autochartist and sentiment indicators. Its commission-free accounts and tight spreads attract experienced forex and CFD traders worldwide.

7. XM – Best for Learning Resources and Micro Trading Accounts

Regulated by: CySEC, ASIC, IFSC

Platforms: MT4, MT5

Minimum Deposit: $5

Why Choose: Accessible trading with strong education support

XM offers a wide range of account types suitable for traders of all levels. Its educational content, market research, and multilingual customer service provide strong support for those learning to trade.

8. FBS – High Leverage and Flexible Bonus Programs

Regulated by: CySEC, IFSC

Platforms: MT4, MT5

Minimum Deposit: $1

Why Choose: Up to 1:3000 leverage and frequent promotional bonuses

FBS is highly accessible, especially in emerging markets. With high leverage options and various promotions, it appeals to traders with smaller starting capital who are willing to manage higher risk.

9. Pepperstone – Advanced Execution for Fast-Paced Traders

Regulated by: ASIC, FCA, DFSA

Platforms: MT4, MT5, cTrader

Minimum Deposit: $200

Why Choose: Lightning-fast order execution and raw spread accounts

Pepperstone is well-known for its ECN-like execution and support for scalping and algorithmic trading. It’s a top pick for traders who value speed, reliability, and flexibility in their strategy.

10. IC Markets – Industry Leader in Raw Spread Trading

Regulated by: ASIC, CySEC, FSA

Platforms: MT4, MT5, cTrader

Minimum Deposit: $200

Why Choose: Raw pricing and high-volume trading support

IC Markets offers direct market access with some of the lowest spreads in the industry. It’s favored by institutional traders and EA developers for its performance and liquidity.

Final Thoughts on This Forex Brokers Review

This forex brokers review for 2025 highlights the top choices for traders based on security, cost-efficiency, tools, and ease of use. Each broker in this list offers unique advantages that cater to different trading styles and experience levels.

If you’re a beginner, XM and HFM offer strong educational support. For advanced traders focused on tight spreads and execution speed, FP Markets, Pepperstone, and IC Markets are excellent options. If you're interested in cryptocurrency or CFD diversification, Eightcap leads the way.

Before investing real capital, always start with a demo account, verify regulatory compliance, and review each broker’s terms and fees. Choosing the right broker can make a significant difference in your forex trading performance.

Frequently Asked Questions (FAQ)

What is the most reliable forex broker in 2025?

IC Markets, FP Markets, and Pepperstone are among the most reliable brokers, offering strong regulatory oversight, low trading costs, and transparent execution models.

Which broker is best for beginners?

HFM and XM are ideal for beginners due to their low deposit requirements, educational tools, and user-friendly platforms.

Can I trade crypto with these brokers?

Yes, Eightcap, IC Markets, and Pepperstone offer crypto CFDs in addition to traditional forex trading.

Are these brokers available in Africa and Asia?

Yes. Brokers like HFM, FBS, Octa, and XM have strong regional support and services tailored for traders in Asia and Africa.

What is the benefit of using an ECN broker?

ECN brokers offer direct market access, faster execution, and lower spreads—making them ideal for professional and high-frequency traders.

0 notes

Text

Unbiased Direct Forex Signals Review – Real Results or Just Empty Promises?

The rise of forex signal providers has reshaped how traders approach the market. With so many platforms offering trade calls, success seems just a subscription away. But how many of these services deliver on their promises? In this Direct Forex Signals Review, we take a deep dive into one of the most talked-about services of 2025 to determine: Are the results real or just marketing hype?

Using expert analysis from seasoned trader Sangram Mohanta, insights from Top Forex Brokers Review, and a real trader's experience, we cut through the noise to uncover the truth.

What Are Forex Signals, and Why Do They Matter?

Forex signals are trade recommendations based on technical or fundamental analysis. These signals typically include:

Entry points

Stop-loss levels

Take-profit targets

Market commentary

For busy or beginner traders, forex signals offer a shortcut to decision-making. However, the value of any forex signal service lies in the accuracy, transparency, and credibility of its provider.

Who Is Behind This Review?

This review has been compiled by a research team led by Sangram Mohanta, a forex expert with 15 years of hands-on trading experience. With a reputation for dissecting platforms without bias, Sangram’s analysis focuses on real results, long-term viability, and risk transparency.

I’ve seen hundreds of forex signal services come and go. The few that remain consistent are the ones that build trust through performance and accountability. — Sangram Mohanta

Direct Forex Signals – An Overview

Direct Forex Signals is a signal service designed for retail traders seeking professional guidance. With a growing user base in 2025, the platform claims to offer high-accuracy signals generated through algorithmic filters and human market analysis.

Key Features:

Platform: Signals delivered via Telegram and Email

Markets Covered: Major and minor FX pairs, gold, and occasionally crypto

Frequency: 2–6 trade signals per day

Risk/Reward: Targeted minimum 1:2 R: R ratio

Support: Basic to premium mentorship available

These signals aim to reduce emotional trading and improve entry accuracy across different market conditions.

Direct Forex Signals Performance – Expert Assessment

Our team tracked 6 weeks of real-time signals and evaluated them based on win rate, R:R ratio, and overall consistency. The results were impressive, especially for a service that doesn’t overpromise.

Sangram Mohanta’s Evaluation:

Win Rate: Averaged 70%+ weekly accuracy

Consistency: Maintained performance even during major economic events

Risk Control: Signals maintained logical stop-loss levels

Transparency: Weekly recaps and updates provided

What makes Direct Forex Signals stand out is its disciplined structure. The trades are not just copied from trend indicators—they’re built around price action and risk metrics that most beginners overlook.– Sangram Mohanta

Top 5 Recommended Brokers to Use With Direct Forex Signals

A good signal is only as effective as the broker you use. That’s why pairing signal services with regulated, low-spread brokers is crucial. Based on Top Forex Brokers Review, here are the most compatible brokers for Direct Forex Signals:

1. FP Markets

ASIC & CySEC regulated

Tight spreads and fast execution

MT4, MT5, and cTrader support

2. IC Markets

Raw spreads from 0.0 pips

High leverage and ultra-low latency

Ideal for EA and manual signal trading

3. BlackBull Markets

True ECN execution model

Advanced trading tools and analytics

Great for high-frequency traders

4. FxPro

Multi-platform support (MT4/MT5/cTrader)

Deep liquidity and regulated across regions

Ideal for discretionary and strategy-based traders

5. XM

Trusted by global traders

Flexible leverage and bonus offerings

User-friendly interface for beginners

All five brokers are fully regulated and provide the trading infrastructure needed to execute signals with precision.

How Secure Is Direct Forex Signals?

In an age of data breaches and online fraud, security is critical, especially when dealing with financial information.

Direct Forex Signals demonstrates a serious commitment to security, implementing the following features:

256-bit SSL encryption: Safeguards data during transactions

Verified payment gateways: Transactions are processed securely via Stripe and PayPal

Two-factor authentication (2FA): Optional account protection

Privacy policy compliance: Full transparency on data handling and user confidentiality

No shady upselling tactics: Users are not bombarded with unnecessary “add-ons” or fake urgency

This robust setup shows Direct Forex Signals is more than a flashy Telegram channel—it’s a structured business with accountability.

Real Trader Success: Daniel’s Journey from Loss to Profit

Daniel Lopez, a 29-year-old trader from Mexico, spent over a year struggling to stay profitable. After two account wipeouts and inconsistent strategies, he found Top Forex Brokers Review, which led him to try Direct Forex Signals and register with FP Markets.

“For the first time, I felt like I had a roadmap. The signals weren’t just telling me what to trade, but also why it made sense. I learned risk management and timing.��

Within five months, Daniel turned a $1,200 account into $5,300—without over-leveraging or chasing unrealistic goals. He credits his success to consistent signals, solid broker support, and newfound discipline.

Frequently Asked Questions (FAQs)

Is Direct Forex Signals legit? Yes. The service shows transparency in performance reporting and does not overpromise unrealistic results.

Do I need to be experienced to use these signals? No. The signals are structured for both beginners and intermediate traders, complete with clear instructions.

How much does the service cost? Pricing varies by package, with a 7-day trial available. Most traders opt for the monthly plan, which includes full support and recaps.

Can I use any broker with Direct Forex Signals? Yes, but using brokers like IC Markets or FP Markets—as recommended by Top Forex Brokers Review—ensures faster execution and lower spreads.

Are refunds available? Refund policies are transparent. Full terms are provided at sign-up, and support is responsive via email.

Conclusion – Real Results or Just Hype?

After reviewing dozens of signals and hearing from real users, we can confidently say: that Direct Forex Signals delivers real value.

Its transparent approach, consistent results, and security-conscious platform offer a refreshing change from signal services that rely purely on hype. When paired with one of the top-rated brokers from Top Forex Brokers Review, the trading edge becomes even sharper.