#cTrader

Explore tagged Tumblr posts

Text

Ultimate Guide: Connect NinjaTrader to Rithmic Trader Pro (2024)

Boost Your Prop Firm Trading with NinjaTrader + Rithmic Setup! Hey traders, welcome to TradingFXVPS, your go-to for ultra-low latency trading solutions.

In this video, we guide you through connecting your VPS portal and accessing your Rithmic account from your prop firm directly on the NinjaTrader platform. Perfect for Forex VPS and Futures trading, we'll show you how to set up for optimal performance and security.

Don't forget to like, subscribe, and hit that notification bell for more trading tech tips. Questions? Email us at [email protected] and visit us on https://www.tradingfxvps.com/

#ForexVPS #PropFirmTrading #NinjaTrader #Rithmic #LowLatencyTrading #apextraderfunding #tradeideas #forexvps #orderflowtrading #ninjatrader

#tradingfxvps#forexvps#windowsvps#metatradervps#forexvpsfree#ninjatrader#mt4#mt5#ctrader#tradecopier#propfirmtrading#lowlatencytrading#tradeideas#orderflowtrading

1 note

·

View note

Text

컬쳐캐피탈 씨트레이더 국내 서비스 정식 오픈 ! 2023 소비자평가, 한국브랜드평가대상 수상 ! 외환, 지수, 원자재, 암호화폐, CFD, 선물 종목 거래 가능 ! 최대 53% 증거금 지원 이벤트 진행중 ! 최소 증거금 10만원부터 투자가 가능합니다 ! 무료 차트 교육과 입금 수수료 평생 무료 ! 5 가지의 차트와 총 127개의 차트 주기 지원 ! 트레이더만을 위한 최적화 플랫폼, cTrader ! 지금 컬쳐캐피탈을 통해 새로운 경험을 누려보세요 !

★ 컬쳐캐피탈 24시간 CS센터 ★ < 070 - 4554 - 3227 >

2 notes

·

View notes

Text

#IC Markets#forex broker#CFD trading#MetaTrader 4#MetaTrader 5#cTrader#Raw Spread accounts#low spreads#scalping#automated trading#ECN broker#ASIC regulated#CySEC regulated#Seychelles FSA regulated#trading platforms#forex trading#cryptocurrency CFDs#stock CFDs#commodity CFDs#futures trading#trading fees#no inactivity fees#Islamic accounts#leverage up to 1:1000#trading 2025#broker review

0 notes

Text

Which are the Most Popular Automated Forex Trading Platforms?

When it comes to Forex trading, automation is the name of the game. Whether you're a beginner looking for a hands-free approach or a seasoned trader optimizing complex strategies, automated trading platforms can make all the difference.

But with so many options out there, which ones stand out? Let’s dive into the most popular automated Forex trading platforms that traders swear by.

MetaTrader 4

MetaTrader 4 (MT4) is the OG of automated trading. It’s packed with Expert Advisors (EAs) that let you automate just about everything. With its wide adoption and tons of customization options, MT4 is the go-to choice for many traders.

MetaTrader 5

If you’re looking for more advanced features, MetaTrader 5 (MT5) is your upgrade. With extra timeframes, more order types, and an economic calendar, MT5 is made for traders who want to take things up a notch.

cTrader

cTrader is known for its smooth interface and high-speed execution. Plus, it’s got cAlgo, which lets you program your own automated strategies if you’re into coding.

DXTrade

DXTrade is built for the professional crowd. It’s got all the features you’d expect from a top-tier platform, including support for automated trading strategies. Great for those who want to go pro.

TradeLocker

TradeLocker is an up-and-comer that packs a punch. It offers solid charting and a range of automated trading tools to keep you on top of your game.

#Automated trading#Ai trading#Automated trading platform#trading platform#Forex trading platforms#Telegram Signal Copier#TSC#MetaTrader#MT4#MT5#cTrader#DXTrade#TradeLocker

0 notes

Text

コピートレードや最大100万ユーロまで保護するブローカーErrante(エランテ)について詳しく解説!

コピートレードや最大100万ユーロまで保護するブローカーErrante(エランテ)について詳しく解説! #Errante #エランテ #copytrading, #dynamicleverage #投資者保護基金

2019年に設立された Errante(エランテ)は、キプロス(Notely Trading Ltd)とセイシェル(Errante (Seychelles) Securities Ltd)に本社を置く外国為替および CFD…

0 notes

Text

Introducing Hola Prime's Price Transparency Report!

In a decentralized forex market, we are proud to be the first and only prop firm to publish complete tick-by-tick data alongside its comparison with market prices. Our commitment to transparency ensures you have all the information you need to make informed trading decisions.

Why is this important?

- Full Transparency: Get a clear, detailed view of every market movement.

- Informed Decisions: Make smarter trades with precise data at your fingertips.

- Trustworthy Trading: Build confidence with our unmatched data transparency.

Join the revolution in transparent trading with Hola Prime.

#proprietary trading#ctrader#trading prop firms#what is a prop firm#meta trader 5#trader mt4#best prop trading firms#prop trading companies#prop trading firm#proprietary trading firm#propfirm#what is a pip in trading#prop traders#funded prop firms#trader funding#whats skrill#best prop firms forex#prop firms forex

0 notes

Text

What is a Signal Copier?

A signal copier automates trades from Telegram channels to platforms like MT4.

How It Works:

Automatic: Once linked to Telegram, it handles trades for you.

Manage Trades: It looks after lot sizes and stop-loss settings.

Time-Efficient: Makes executing trades quick and easy.

Why It’s Great for Beginners: It’s simple to use and costs $39 a month or just a trial $5 for 10 days. I think everyone should give it a shot! Look out for the best Halloween signal copier offers!

1 note

·

View note

Text

Como utilizar a FxPro cTrader para operar com eficiência

A young businessman working from his office – the concept of hard work Introdução A tecnologia tem transformado a forma como investidores de todo o mundo operam no mercado financeiro. Plataformas como o FxPro cTrader se destacam por oferecer ferramentas avançadas e uma interface amigável, ideal para traders que buscam uma experiência eficiente e profissional. Neste artigo, vamos explorar como…

#Análise Técnica#Automação no Mercado#Estratégias de Investimento#Ferramentas para Trader#Forex e CFDs#FxPro cTrader#Operações Financeiras#Plataforma de Negociação#Trading Online

1 note

·

View note

Text

The Future of MT4 and MT5: What Traders Should Know

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) have been around for a long time, almost unbeatable as platforms for retail traders and algo traders. But with the financial markets moving so quickly, there are many traders and developers asking, —What's next for MT4 and MT5?

Let's take a look at MT4 and MT5 and their situation and future relevance in trading.

MT4 v. MT5: A Quick History

MT4 has been around since 2005 and is very commonly used for forex and CFDs. It is renowned for its straightforward user experience and for the vast ecosystem of indicators and Expert Advisors (EAs) available.

MT5 was released in 2010 and has better specifications, supports more assets, processes trades faster, has multi-threaded backtesting, and allows an economic calendar.

There is no question that MT5 is technically superior—so why does MT4 continue to command the market, with brokers placing more importance on it than MT5, if they even offer MT5?

Why MT4 Will Continue to Thrive in 2025 Extensive Community Support: Thousands of traders and developers are still using the MT4 codebase and ecosystem.

Lightweight Environment: MT4 has a smaller memory footprint in terms of running resources and can be easily implemented on older PCs or in stable environments.

Supported Orders in MetaConnector | TradingView to MT4/MT5

Broker Supported: There are still many brokers working with MT4 as their most preferred version due to so much interest in the platform. But can this last? Reasons Why MT4 and MT5 Will Remain Relevant 1. Extensive International User Base Millions of traders continue to use MT4 and MT5, especially for forex and CFD trading, and brokers globally still continue to reveal both platforms. 2. Sophisticated Automation Options The growth of copy trading and algorithmic trading means that with MT4 and MT5 there are different solutions available for integrating several options: MetaConnector and TradingView to MT5 Copier allow people to automate, even those new to the industry. 3. Broker and 3rd Party Connectivity Currently, although new platforms continue to arrive on the market, MT4 and MT5 remain intimately embedded in systems amongst brokers and will not be replaced overnight. The Challenges Ahead 1. MetaQuotes Licensing Approach MetaQuotes ceased providing MT4 to new brokers in 2022 and will only be providing MT5 in the future. Over time, this will inevitably diminish the availability of MT4, but not at a rapid rate. 2. Regulatory Pressure Regulators in some areas have recently become more stringent around MetaTrader platforms after many prominent scam brokers have exploited the platforms. This has required it to now be temporarily removed from app stores in those areas. Competing Platforms New web-based platforms are arriving, such as cTrader, TradingView, and broker-specific terminals, offering non-proprietary, intuitive design and social options that dynamically update in real time, which is attracting younger traders. Copy Trading / MT5 Future The growth in copy trading continues and is making the MT5 platform alive again, with the integral tools that firms such as Combiz Services Pvt are offering. Copy Trading & the MT5 Platform: An Exciting Future The thrilling rise of copy trading is reinvigorating the MT5 platform. With incredible capabilities existing between companies like Combiz Services Pvt. Ltd., traders can copy trades across MT4, MT5, and from other platforms like TradingView, all without programming. This is a tremendous value added to the MT5 ecosystem since it allows new and experienced traders a great deal of flexibility with available integrations for tools like Master-Child Auto Copy System Broker API Integrations Real-time Trade Copier Techniques The Outlook Here are a few different views on what we may see in the future: Declining MT4: As MetaQuotes continues to withdraw the license for MT4, we may see it decline slowly, but relevant support is foreseen for years. Dominating MT5: With more features and constant updates, MT5 will undoubtedly become the universal MetaTrader platform, maintained by strict regulations. Leading Custom Integrations: With automation products like MetaConnector and amazing companies like Combiz Services Pvt. Ltd., MT5 will futuristically become the nucleus for all of your next-generation algo and copy trading thinking plans. Conclusion While MT4 has had a historical run, the predominance of the future is MT5. Obviously, traders and brokers are slowly transitioning over to MT5. Everyone is seeing the benefits of having more functionality and compliance. That said, both platforms are extremely valuable—especially when used with smart automation tools. So if you are a trader, simply stay ahead of the game and make sure you are using the best tools (including those offered by Combiz Services Pvt Ltd)!

2 notes

·

View notes

Text

#FxPro#forex broker#CFD trading#MetaTrader 4#MetaTrader 5#cTrader#FxPro Edge#no dealing desk#NDD execution#negative balance protection#fast order execution#trading platforms#trading instruments#account types#leverage#spreads#demo account#trading tools#economic calendar#trading calculators#VPS#regulated broker#FCA#CySEC#FSCA#SCB#trading 2025#broker review

0 notes

Text

Best PayPal Forex Brokers for Beginners

Entering the world of forex trading can be both exciting and overwhelming, especially for beginners. Selecting the right broker plays a critical role in your trading journey. In 2025, the combination of accessibility, low fees, and secure payments has positioned PayPal as a top method for managing trading funds. That’s why this guide focuses on helping new traders identify the best PayPal forex brokers that offer ease of use, educational support, and fast, secure transactions.

Whether you're starting with a demo account or planning to invest real capital, working with a PayPal-friendly forex broker can simplify your experience and build your confidence in trading.

Why Beginners Should Consider PayPal for Forex Trading?

Fast and Easy Deposits/Withdrawals: With PayPal, you avoid the delays of bank transfers and complex wire setups.

User-Friendly Interface: PayPal’s mobile and web platforms are intuitive and widely used.

Enhanced Security: PayPal’s encryption and fraud detection tools add a layer of protection to your funds.

Choosing the best PayPal forex brokers means aligning with platforms that not only offer PayPal support but also provide resources specifically tailored to beginners.

What to Look for in a Beginner-Friendly Forex Broker?

Simple Account Setup: Registration and verification processes should be quick and uncomplicated.

Low Minimum Deposits: Ideal for those who want to start small while learning.

Educational Tools: Access to tutorials, webinars, and demo accounts is crucial.

Responsive Customer Support: Timely assistance helps beginners resolve issues quickly.

Regulated Operations: Ensures the broker operates under strict guidelines and provides fund security.

Real-Life Success Story

Luca Fernandez, a 26-year-old graphic designer from Madrid, had never traded forex until late 2023. He chose FBS because it supported PayPal and had a beginner-friendly platform. Starting with just $100, Luca used educational videos and demo accounts to learn the basics. By mid-2024, he turned his $100 into $2,700 through careful analysis and practice. The ability to deposit and withdraw using PayPal gave him the freedom and confidence to trade without worrying about complex banking procedures.

Top PayPal Forex Brokers for Beginners in 2025

Eightcap

Regulated by ASIC and SCB

Offers a low entry point and educational resources

Compatible with MT4, MT5, and TradingView

Eightcap is user-friendly and offers excellent integration with analytical tools. Its PayPal support allows quick transactions, ideal for those just getting started.

FP Markets

Regulated by ASIC and CySEC

Provides comprehensive learning materials

Offers demo and micro accounts

FP Markets is well-suited for beginners who want to explore trading without high risk. Its PayPal feature ensures smooth deposit and withdrawal processes.

FBS

Regulated by IFSC and CySEC

Offers cent and micro accounts

Features an extensive education center

FBS is designed with beginners in mind. From low minimum deposits to responsive PayPal transactions, it supports traders at every step.

XM

Licensed by ASIC, CySEC, and IFSC

Provides multilingual educational webinars

Offers negative balance protection

XM’s beginner-friendly platform includes a wide range of learning tools. It allows PayPal transactions for easy funding and withdrawals.

IC Markets

Regulated by ASIC, CySEC, and FSA

Offers tight spreads and excellent execution

Supports MT4, MT5, and cTrader platforms

IC Markets balances ease of use with professional-grade tools. Beginners benefit from its PayPal support and quick access to funds.

FxPro

Regulated by FCA, CySEC, FSCA

Offers educational content and market analysis

Supports multiple trading platforms

FxPro offers a guided learning experience for new traders. PayPal integration provides easy access to your trading capital.

Axi

Regulated by FCA and ASIC

Features MT4 trading with risk management tools

Provides beginner tutorials and blog content

Axi is simple yet powerful for new traders. With PayPal support, it offers quick fund access and minimal barriers to entry.

Pepperstone

Regulated by ASIC, FCA, BaFin, and DFSA

Low minimum deposits and rich learning hub

No dealing desk intervention

Pepperstone offers great customer support and detailed tutorials. PayPal compatibility enhances its beginner appeal.

HFM (HotForex)

Regulated by FCA, CySEC, DFSA, FSCA

Offers a wide range of account types

Provides market education and support tools

HFM helps new traders get comfortable with forex through structured content. It processes PayPal payments quickly and reliably.

Octa

Regulated by CySEC and FSCA

Offers fixed and floating spreads

Features a dedicated educational section

Octa is suitable for beginners looking for mobile-first access and responsive PayPal transactions. The interface is clean and easy to navigate.

How to Know if a Forex Broker is Secure?

Online safety is essential, especially for beginners handling real money. Here’s how to assess whether a broker is trustworthy:

Check Regulatory Licenses: Ensure the broker is licensed by major bodies like ASIC, FCA, or CySEC.

Secure Website Indicators: A secure URL (https) and SSL encryption are must-haves.

Two-Factor Authentication: Adds protection beyond just a password.

Transparent Terms: Make sure withdrawal and trading conditions are clearly outlined.

Segregated Client Funds: Reliable brokers keep client money separate from operating funds.

Frequently Asked Questions

Is PayPal a safe option for forex trading? Yes. PayPal uses advanced encryption and buyer protection, making it a trusted option for online transactions, including forex trading.

Do beginner brokers charge fees for PayPal deposits? Most beginner-friendly brokers do not charge additional fees, though PayPal may apply a nominal fee depending on your location.

How can I practice trading as a beginner? Choose brokers that offer demo accounts. These allow you to practice in real-time market conditions without risking actual money.

Is it easy to withdraw funds with PayPal? Yes. Most brokers process PayPal withdrawals within 24 hours, and some even offer same-day processing.

What makes a forex broker suitable for beginners? Low deposit requirements, educational support, demo accounts, and user-friendly platforms are all essential features.

youtube

Final Thoughts

Getting started in forex trading doesn't have to be complicated. The best PayPal forex brokers for beginners offer the ideal mix of simplicity, security, and support. Brokers like FBS, FP Markets, and XM lead the way with beginner-friendly platforms and seamless PayPal transactions. If you're ready to step into forex trading, choosing a broker with strong PayPal integration can help you build confidence and maintain full control over your funds from day one.

2 notes

·

View notes

Text

Unlock Your Trading Potential with Hola Prime!

Are you ready to take your trading game to the next level? Get up to $4 Million to trade with our scaling plan!

Join Hola Prime today and start trading with confidence. Let's turn those market opportunities into profits!

#Hola Prime#economic calendar#metatrader 5#prop firms#prop trading#prop trading firms#ctrader#how to login to dxtrade account#forex prop firm#instant funding prop firm#instant funding prop firms#prop firm trading#best trading platform#proprietary trading firms#proprietary trading company#proprietary trader

0 notes

Text

Take Advantage of TSC $5 Trial Offer!

Are you ready to boost your trading game? Telegram Signal Copier is offering an incredible 10-day trial for just $5! Here’s what you’ll gain:

1 MT4/MT5/cTrader Account to maximize your trading experience.

Unlimited Signals to keep you ahead in the market.

Unlimited Channel and Group Access for a constant flow of trading signals to automate execution from your favorite Telegram channels and groups.

24/7 Support because your success is their priority.

Plus, you’ll SAVE 25% when you subscribe for only $29/month after your trial!

Don’t let this opportunity pass you by. Sign up for your trial today and see firsthand how they can help you succeed in trading!

https://telegramsignalcopier.com/#pricing

#signal copier#forexsignals#forex#forextrading#mt4#mt5#ctrader#telegramsignalcopier#traderslife#offerprice

1 note

·

View note

Text

Best Forex Trading Platforms in 2025

Explore the top forex trading platforms trusted by millions of traders worldwide. This infographic, presented by ApexMarkets, highlights the most reliable and feature-rich platforms—MetaTrader 4, MetaTrader 5, TradingView, and cTrader. Whether you're a beginner or an experienced trader, these platforms offer powerful tools, advanced charting, and user-friendly interfaces to enhance your trading experience. Start trading with confidence at app.apexmarkets.io.

2 notes

·

View notes

Text

Best Platforms to Trade for Forex in 2025

Forex trading continues to captivate traders worldwide, offering a dynamic and lucrative avenue for financial growth. In 2025, identifying the best platforms to trade for forex has become more crucial than ever, as technology and market demands evolve. From user-friendly interfaces to advanced tools for technical analysis, these platforms are tailored to meet the needs of both novice and seasoned traders. Whether you're diving into major currency pairs, exploring exotic options, or utilizing automated trading strategies, choosing the right platform is the foundation for success.

Core Features of Top Forex Trading Platforms

Forex trading platforms in 2025 must combine advanced functionality with accessibility to meet diverse trader needs. The following core features highlight what distinguishes the best platforms.

User-Friendly Interface

A user-friendly interface enhances efficiency and reduces errors, especially for beginners. Key features include:

Intuitive navigation for rapid trade execution.

Customizable layouts to match user preferences.

Comprehensive tutorials for ease of onboarding.

Efficient design with minimal lag, even during high volatility.

Example Platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are renowned for streamlined interfaces designed to accommodate traders at all levels.

Comprehensive Charting Tools

Forex trading requires precision, and advanced charting tools are critical for analysis. The following charting tools enhance strategy formulation:

Drawing Tools: Support for trendlines and channels.

Indicators: Integration of MACD, RSI, Bollinger Bands, and Fibonacci Retracement.

Timeframes: Options to analyze data across multiple periods.

Custom Indicators: Flexibility to program and integrate personal strategies.

Automation and Algorithmic Trading

Automation is indispensable for modern forex trading. Platforms like cTrader and NinjaTrader excel with features like:

Pre-built Strategies: Ready-to-use templates for scalping and trend following.

Custom Algorithms: Integration with programming languages such as C# and Python.

Backtesting: Evaluate strategies with historical data.

Integration with APIs: Seamless syncing with advanced trading bots.

Mobile Accessibility

Forex traders increasingly require the flexibility of trading on-the-go. Mobile accessibility ensures:

Synchronization: Real-time updates between desktop and mobile devices.

Push Notifications: Alerts for market changes and trade execution.

Compact Design: Optimized for smaller screens without losing functionality.

App Examples: MT4 and MT5 apps, offering full trading capabilities on iOS and Android.

Key Takeaway: Platforms combining a robust desktop experience with seamless mobile integration empower traders with unmatched convenience.

The best forex trading platforms for 2025 excel in usability, advanced charting, automation, and mobile functionality. By integrating these features, platforms like MT5, cTrader, and TradingView offer versatile solutions for traders of all expertise levels.

Trading Instruments Supported by Leading Platforms

The diversity of trading instruments available on forex platforms is crucial for building effective strategies and achieving long-term trading success. This section explores the breadth and advantages of various trading instruments.

1. Major Currency Pairs

Major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, dominate forex markets due to their high liquidity and tighter spreads. Leading platforms like MetaTrader 5 and TradingView offer advanced tools for analyzing these pairs, enabling traders to capitalize on predictable movements.

Key Features:

High liquidity ensures minimal price fluctuations during trades.

Access to real-time market data for precise decision-making.

Supported by most trading strategies, including scalping and swing trading.

These pairs are ideal for traders seeking consistent opportunities in stable market conditions.

2. Exotic Pairs

Exotic pairs combine major currencies with currencies from emerging markets, such as USD/TRY or EUR/SEK. While they offer higher potential rewards, they also come with increased volatility and wider spreads.

Risks and Rewards:

Volatility: Significant price movements create potential for larger profits.

Higher Spreads: Costs can be prohibitive for short-term trading strategies.

Economic Dependence: Price movements often correlate with specific geopolitical or economic conditions.

Platforms like cTrader often feature analytical tools tailored for exotic pair trading, helping traders manage the associated risks.

3. CFDs and Futures

Contracts for Difference (CFDs) and futures are derivatives enabling traders to speculate on forex price movements without owning the underlying assets. Futures contracts are often traded on platforms like NinjaTrader, while CFDs are supported on MetaTrader platforms.

CFDs vs. Futures in Forex Trading

Wider spreads but no commissionCommissions and exchange fees

CFDs and futures cater to traders seeking flexibility and hedging opportunities in volatile markets.

4. Spot Forex vs. Forward Contracts

Spot forex trades settle instantly at prevailing market rates, making them ideal for day traders. Forward contracts, however, lock in future exchange rates and are often used by businesses to hedge against currency fluctuations.

Spot Forex:

Instant execution for quick trades.

Supported by platforms like TradingView, which offers robust charting tools.

Forward Contracts:

Customizable settlement dates.

Reduced risk of unfavorable exchange rate changes.

Forward contracts are frequently utilized for long-term strategies requiring stability.

5. Options Trading in Forex

Forex options provide traders the right, but not the obligation, to buy or sell currencies at a predetermined price. Options trading is supported on platforms like MetaTrader 5, offering flexibility for speculative and hedging strategies.

Advantages:

Defined risk due to limited loss potential.

Compatibility with advanced trading strategies like straddles and strangles.

Access to multiple expiration dates for tailored strategies.

Options trading is an excellent choice for traders seeking diversification and controlled risk in uncertain markets.

Market Indicators for Effective Forex Trading Forex trading in 2025 requires mastery of market indicators for successful trades. Platforms integrating technical tools like RSI, Bollinger Bands, and Fibonacci retracements provide invaluable support for analyzing currency pairs and spotting trends.

1: Moving Averages and RSI

Moving averages and RSI (Relative Strength Index) are staples in forex trading for spotting trends and identifying overbought or oversold market conditions. Here's how they work:

Moving Averages:

Smooth out price data for better trend analysis.

Common types: Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Platforms like MetaTrader 5 (MT5) allow customizable moving average periods for traders’ needs.

RSI:

Measures the speed and change of price movements.

Values above 70 indicate overbought conditions, while below 30 signals oversold.

Both indicators are excellent for detecting market reversals and consolidations, making them essential for scalping and swing trading strategies.

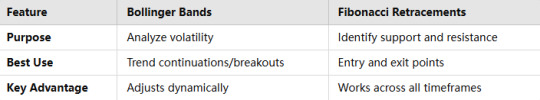

2: Bollinger Bands and Fibonacci Retracements

Bollinger Bands and Fibonacci retracements are complementary tools for determining price ranges and potential reversals.

Bollinger Bands:

Comprised of a central moving average and two bands (standard deviations).

Highlights volatility and identifies breakout opportunities in exotic pairs and minor pairs.

Fibonacci Retracements:

Based on key levels derived from the Fibonacci sequence (23.6%, 38.2%, 61.8%, etc.).

Used to forecast retracement zones for entry and exit points.

Platforms like TradingView provide advanced integration of these tools for technical analysis.

3: Pivot Points and Volume Analysis

Pivot points and volume analysis serve as complementary methods for intraday traders.

Pivot Points:

Calculate potential support and resistance levels based on previous trading sessions.

Widely used in day trading to set intraday targets.

Volume Analysis:

Measures market activity to validate price movements.

Higher volume during breakouts confirms trends.

Together, these indicators help traders plan risk-reward ratios effectively and refine strategies. Platforms offering integrated market indicators like RSI, Fibonacci retracements, and volume analysis provide forex traders with precise insights for decision-making. Combining these tools with strategic risk management and discipline ensures a competitive edge in forex trading for 2025.

Risk Management Tools in Forex Platforms

Risk management is the cornerstone of sustainable forex trading. Platforms offering advanced tools like Stop-Loss Orders and Position Sizing empower traders to mitigate risks while optimizing potential gains.

1. Stop-Loss Orders

Stop-loss orders safeguard capital by automatically closing trades at pre-set levels. Key benefits include:

Capital Protection: Prevents losses from spiraling during volatile markets.

Emotional Discipline: Reduces impulsive decisions by automating exit points.

Wide Platform Integration: Available on MetaTrader 4, TradingView, and cTrader for seamless trading execution.

2. Take-Profit Orders

Take-profit orders lock in profits when the market reaches a target price. Steps for setting take-profit orders effectively:

Analyze Moving Averages and RSI to determine target levels.

Input the price level in trading platforms like NinjaTrader or MT5.

Monitor trade performance and adjust as needed.

3. Position Sizing Calculators

Accurate position sizing minimizes overexposure to any single trade. Here’s how these calculators work:

Calculate lot sizes based on account balance, risk percentage, and stop-loss distance.

Adjust trade sizes to align with Risk-Reward Ratios.

Enable traders to maintain diversified exposure.

4. Risk-Reward Ratio Analysis

Risk-reward ratios evaluate trade viability by comparing potential profits to losses. Tips for effective use:

Aim for a minimum ratio of 1:2 or higher.

Utilize tools like Bollinger Bands to estimate price movements.

Integrated calculators on platforms like MT4 simplify these computations.

5. Diversification Tools

Diversification spreads risk across multiple trading instruments. Features on platforms include:

Multi-asset trading options: CFDs, Futures, and Currency Pairs.

Portfolio analysis tools to track exposure by instrument type.

Real-time updates for Exotic Pairs and niche markets.

6. Backtesting Strategies

Backtesting allows traders to evaluate strategies using historical data. Its advantages are:

Testing risk management techniques like Stop-Loss Orders without live market risk.

Platforms such as TradingView support customizable backtesting scripts.

Insights into strategy weaknesses improve long-term profitability.

With advanced tools for Stop-Loss Orders, Position Sizing, and Backtesting, modern forex trading platforms empower traders to proactively manage risks. Leveraging these features leads to more disciplined and effective trading.

Psychological and Strategic Insights for Forex Trading

Mastering trading psychology is key to navigating the complexities of forex. Platforms enhance this through features that promote discipline, performance tracking, and trader confidence, empowering strategic growth and mitigating psychological pitfalls.

Building Discipline Through Alerts

Platforms offering robust alert systems, like MetaTrader 5, help instill discipline by:

Preventing Overtrading: Custom alerts signal market entry points, limiting impulsive trades.

Time Management: Reminders help traders stick to predefined schedules.

Market Trend Notifications: Alerts for moving averages or Relative Strength Index (RSI) changes enable focused decisions.

Tracking Performance Metrics

Trading platforms integrate tools that help traders evaluate performance, including:

Win/Loss Ratio Analysis: Shows trade success rates.

Equity Curve Monitoring: Visualizes account performance trends.

Journal Features: Logs trade entries and exits for review.

Customizable Dashboards

Platforms like TradingView allow traders to configure dashboards by:

Adding favorite currency pairs and indicators like MACD or Bollinger Bands.

Creating multi-screen setups to monitor multiple trades.

Integrating news feeds to stay updated with central bank announcements.

Educational Resources

The inclusion of in-platform education fosters confidence through:

Interactive Tutorials: Step-by-step videos on strategies like swing trading or technical analysis.

Webinars and Live Sessions: Experts discuss trading instruments like CFDs and options.

AI-based Learning Modules: Adaptive lessons based on trader performance.

By integrating tools for discipline, self-awareness, and strategy refinement, trading platforms empower users to overcome psychological challenges, enhance risk management, and make data-driven decisions for long-term success.

Conclusion

Forex trading in 2025 offers exciting opportunities, but success begins with choosing the right platform. As highlighted throughout this content pillar, top trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView stand out for their robust features, diverse trading instruments, and advanced integrations. These platforms empower traders to navigate the complexities of the forex market through tools such as technical indicators like Moving Averages and RSI, risk management solutions like stop-loss orders and position sizing calculators, and integrations with vital economic indicators such as GDP, inflation, and central bank announcements.

The best forex trading platforms not only provide access to currency pairs, CFDs, and other instruments but also integrate cutting-edge charting tools, educational resources, and analytics to build confidence and discipline—critical factors in mastering the psychological demands of trading.

By understanding the interplay between platform features, market tools, and strategy development, traders can optimize their approach to trading forex in 2025. Whether you're focused on scalping, day trading, or long-term swing trading, the right platform will be your foundation for executing trades effectively, managing risk, and staying informed in a fast-paced market.

Take the insights from this guide to make an informed decision, choosing a platform that aligns with your trading goals and enhances your ability to trade forex with precision and confidence. With the right tools and strategies in hand, you're poised to navigate the evolving forex market and unlock its full potential in 2025 and beyond.

2 notes

·

View notes

Text

FxPro Review: Unveiling the World's Leading Online Forex Broker

In the dynamic realm of financial trading, the significance of efficient and reliable online forex brokers cannot be overstated. Among the myriad options available, FxPro stands out as a beacon of excellence, earning its reputation as the world’s number one online forex (FX) broker. This detailed FxPro review aims to explore the unique features, offerings, and overall experience that have established this broker as a preferred choice for traders globally.

youtube

Discovering FxPro: A Legacy of Trust and Innovation

Founded in 2006, FxPro has carved a niche for itself in the competitive forex market, showcasing a steadfast commitment to providing an exceptional trading experience. As a Top Forex Brokers review, FxPro has successfully built a reputation for transparency, reliability, and innovation, making it a trusted partner for thousands of traders around the world. With a user-centric approach, the broker continuously evolves to meet the needs of its clients, ensuring they have the tools and resources necessary to thrive in the fast-paced world of forex trading.

The FxPro Trading Platforms: A Gateway to Success

Central to FxPro's appeal is its diverse array of trading platforms, designed to cater to the varied preferences of both novice and experienced traders. Each platform boasts unique features that facilitate seamless trading, empowering users to make informed decisions in real-time.

MetaTrader 4 (MT4): The Industry Standard

The MetaTrader 4 (MT4) platform is a cornerstone of the forex trading experience, and FxPro offers an optimized version that enhances its functionality. Known for its user-friendly interface, MT4 provides traders with powerful charting capabilities, a plethora of technical indicators, and automated trading options through Expert Advisors (EAs). This platform is particularly favored by those who appreciate a straightforward yet effective trading environment.

MetaTrader 5 (MT5): The Next Generation

For traders seeking a more advanced experience, FxPro also provides access to the MetaTrader 5 (MT5) platform. MT5 is a comprehensive trading environment that includes advanced order management, a greater array of analytical tools, and an integrated economic calendar. Its multi-asset capabilities extend beyond forex, allowing traders to delve into commodities, stocks, and futures, making it an excellent choice for those looking to diversify their trading portfolio.

cTrader: Innovative and Intuitive

In addition to MT4 and MT5, FxPro offers the cTrader platform, which is designed for traders who prefer a more innovative and user-friendly experience. cTrader features a clean interface, advanced charting tools, and customizable workspaces, catering to both manual traders and algorithmic trading enthusiasts. The platform also includes a community-driven marketplace where traders can share and access trading tools, fostering collaboration and innovation.

Competitive Spreads and Pricing Structure

When it comes to trading costs, FxPro excels in providing competitive spreads and transparent pricing. The broker’s commitment to low trading costs is evident across its various account types, allowing traders to choose an option that best fits their trading style and budget.

FxPro offers several account types—each tailored to different trading needs—ensuring that clients can find a suitable option. For instance, the FxPro MT4 account is popular for its tight spreads and no commission trading, while the FxPro cTrader account provides a commission-based structure with slightly tighter spreads. This flexibility allows traders to optimize their trading strategies while minimizing costs.

Moreover, the broker’s commitment to transparency ensures that traders are always aware of the costs associated with their trades, allowing for effective financial planning and decision-making.

A Diverse Selection of Trading Instruments

One of the standout features of FxPro is its extensive range of trading instruments. While the broker is predominantly known for its forex offerings, it also provides access to a wide array of asset classes, including commodities, indices, and cryptocurrencies.

Forex Trading

FxPro covers a vast selection of currency pairs, encompassing major, minor, and exotic pairs. This diversity enables traders to capitalize on global economic trends and currency fluctuations, providing ample trading opportunities.

Commodity Trading

For those interested in commodities, FxPro offers trading in popular assets such as gold, silver, oil, and agricultural products. This allows traders to hedge against inflation or geopolitical risks while diversifying their investment portfolios.

Indices and Cryptocurrencies

In addition to traditional forex and commodities, FxPro provides access to global indices and a selection of cryptocurrencies. Traders can engage with major indices like the S&P 500 and FTSE 100, or explore the burgeoning cryptocurrency market, including popular coins such as Bitcoin and Ethereum. This extensive range of instruments empowers traders to explore various market dynamics and seize opportunities across different sectors.

Robust Security and Regulatory Oversight

In an industry where security is paramount, FxPro stands out for its commitment to safeguarding client funds and personal information. The broker is regulated by multiple reputable financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa. This multi-tiered regulatory framework offers clients peace of mind, knowing that their investments are protected by stringent regulations.

FxPro also employs advanced security measures to ensure the safety of its clients’ funds. These measures include SSL encryption for data protection and two-factor authentication for account security. The broker’s proactive approach to security and regulatory compliance underscores its dedication to maintaining a trustworthy trading environment.

Enhanced Customer Support

Exceptional customer support is a hallmark of a reputable broker, and FxPro does not disappoint in this regard. The broker offers a robust support system designed to assist traders at any stage of their trading journey.

FxPro’s customer support team is available 24/7, providing multilingual assistance to cater to its diverse global clientele. Whether you require help with account management, technical inquiries, or trading strategies, the knowledgeable support staff is always ready to assist.

Additionally, FxPro offers a wealth of educational resources, including webinars, trading tutorials, and market analysis, empowering clients to enhance their trading skills and knowledge. This commitment to client education is a testament to FxPro’s dedication to fostering a supportive trading community.

Educational Resources and Trading Tools

FxPro goes beyond offering trading platforms and customer support by providing a comprehensive suite of educational resources and trading tools. The broker recognizes that informed traders are successful traders, and it strives to equip its clients with the knowledge they need to navigate the complexities of the forex market.

Webinars and Tutorials

FxPro hosts regular webinars led by industry experts, covering a variety of topics ranging from trading strategies to market analysis. These interactive sessions provide valuable insights and allow traders to ask questions in real time, fostering a collaborative learning environment. Additionally, the broker offers a library of tutorials and articles, catering to traders of all experience levels.

Market Analysis

To help traders make informed decisions, FxPro provides daily market analysis and insights. This analysis includes technical and fundamental reports, helping traders understand market trends and identify potential trading opportunities. By staying informed about market developments, traders can enhance their strategies and improve their overall performance.

Trading Tools

FxPro also offers a range of trading tools to enhance the trading experience. These tools include economic calendars, calculators, and trading signals, all designed to assist traders in making informed and timely decisions. Such resources are invaluable for both novice and experienced traders, facilitating a more strategic approach to trading.

Conclusion: The Ultimate Choice for Forex Traders

In this comprehensive FxPro review, we have explored the myriad features and advantages that make this broker a top choice for forex traders worldwide. From its cutting-edge trading platforms and competitive pricing structure to its diverse selection of trading instruments and robust security measures, FxPro has established itself as a leader in the online forex brokerage space.

Through its unwavering commitment to customer support and education, FxPro empowers traders to hone their skills and navigate the complexities of the financial markets with confidence. Whether you are a seasoned trader or just starting your journey in forex trading, FxPro offers the tools, resources, and support to help you succeed.

In conclusion, FxPro stands as a testament to what a premier forex broker should aspire to be. With its extensive offerings and client-focused approach, FxPro is not just a broker; it is a partner in your trading journey, ready to elevate your forex trading experience to new heights.

2 notes

·

View notes