#Graphics Processing Unit (GPU) Market trends

Explore tagged Tumblr posts

Text

#GPU Market#Graphics Processing Unit#GPU Industry Trends#Market Research Report#GPU Market Growth#Semiconductor Industry#Gaming GPUs#AI and Machine Learning GPUs#Data Center GPUs#High-Performance Computing#GPU Market Analysis#Market Size and Forecast#GPU Manufacturers#Cloud Computing GPUs#GPU Demand Drivers#Technological Advancements in GPUs#GPU Applications#Competitive Landscape#Consumer Electronics GPUs#Emerging Markets for GPUs

0 notes

Text

The Future of Gaming: The Role of Graphics Processing Units in Enhancing User Experience

The Graphics Processing Unit Market is projected to be valued at approximately USD 65.27 billion in 2024, with expectations to grow to around USD 274.21 billion by 2029, reflecting a compound annual growth rate (CAGR) of 33.20% during the forecast period from 2024 to 2029.

Market Overview: The Future of Gaming – The Role of Graphics Processing Units in Enhancing User Experience

The gaming industry has experienced rapid growth and transformation, driven by advancements in technology and changing consumer preferences. At the heart of this evolution is the Graphics Processing Unit (GPU), which plays a critical role in enhancing user experience. This overview examines the future of gaming, focusing on the pivotal role of GPUs in shaping the landscape.

Key Trends in the GPU Market for Gaming:

Technological Advancements: The GPU market is characterized by continuous technological innovations, including ray tracing, AI-driven graphics, and enhanced processing capabilities. These advancements enable more realistic graphics, smoother frame rates, and immersive gaming experiences, significantly elevating the overall user experience.

Increased Demand for High-Performance Gaming: As gaming enthusiasts demand more from their experiences, there is a growing preference for high-performance GPUs. This trend is evident in the rise of competitive gaming and eSports, where frame rates and graphics quality can impact performance. Consumers are willing to invest in advanced GPUs to achieve a competitive edge.

Cloud Gaming and GPU Integration: The rise of cloud gaming services has reshaped how games are delivered and played. GPUs are essential in these platforms, enabling remote processing of graphics-intensive games. As cloud gaming gains traction, the demand for powerful GPUs in data centers is expected to surge, enhancing accessibility and convenience for gamers.

Virtual Reality (VR) and Augmented Reality (AR): The integration of VR and AR technologies into gaming experiences necessitates advanced GPU capabilities. High-performance GPUs are crucial for rendering realistic environments and ensuring smooth interactions in immersive settings. As the popularity of VR and AR games grows, so does the demand for cutting-edge GPUs.

AI and Machine Learning in Gaming: The application of AI and machine learning in gaming is creating new opportunities for enhanced user experiences. GPUs facilitate the processing of complex algorithms, enabling smarter NPCs, adaptive gameplay, and personalized gaming experiences. This integration is expected to redefine how games are developed and played.

Challenges Facing the GPU Market:

Supply Chain Issues: The GPU market has faced challenges due to supply chain disruptions, leading to shortages and increased prices. These issues impact both consumers and manufacturers, potentially slowing the pace of technological advancement in the gaming industry.

Environmental Concerns: The environmental impact of GPU production and operation is becoming a critical consideration. As consumers become more eco-conscious, manufacturers are under pressure to develop more sustainable practices and energy-efficient GPUs to minimize their carbon footprint.

Market Competition: The GPU market is highly competitive, with several key players vying for market share. Companies must continually innovate to stay ahead, which requires significant investment in research and development. The rapid pace of change can make it challenging for smaller firms to compete effectively.

Future Outlook:

The future of gaming is intrinsically linked to the evolution of GPUs. As technology continues to advance, GPUs will play a central role in enhancing user experiences through improved graphics, performance, and interactivity. The growing demand for high-quality gaming experiences, along with the rise of cloud gaming and immersive technologies, will drive sustained growth in the GPU market.

Additionally, as AI and machine learning technologies become more integrated into gaming, the importance of powerful GPUs will only increase. Companies that invest in innovative GPU technologies and sustainable practices will be well-positioned to capitalize on these emerging trends.

In conclusion, the GPU market is at a pivotal point, with significant opportunities for growth driven by technological advancements and changing consumer preferences. By focusing on delivering high-performance, efficient, and sustainable solutions, stakeholders in the GPU market can contribute to the future of gaming, enhancing user experiences and driving industry growth.

For a detailed overview and more insights, you can refer to the full market research report by Mordor Intelligence https://www.mordorintelligence.com/industry-reports/graphics-processing-unit-market

#Graphics Processing Unit (GPU) Market#Graphics Processing Unit (GPU) Market size#Graphics Processing Unit (GPU) Market share#Graphics Processing Unit (GPU) Market trends#Graphics Processing Unit (GPU) Market analysis#Graphics Processing Unit (GPU) Market forecast#Graphics Processing Unit (GPU) Market outlook#Graphics Processing Unit (GPU) Market overview#Graphics Processing Unit (GPU) Market report#Graphics Processing Unit (GPU) industry report

0 notes

Text

FinFET Technology Market Size, Share, Trends, Demand, Industry Growth and Competitive Outlook

FinFET Technology Market survey report analyses the general market conditions such as product price, profit, capacity, production, supply, demand, and market growth rate which supports businesses on deciding upon several strategies. Furthermore, big sample sizes have been utilized for the data collection in this business report which suits the necessities of small, medium as well as large size of businesses. The report explains the moves of top market players and brands that range from developments, products launches, acquisitions, mergers, joint ventures, trending innovation and business policies.

The large scale FinFET Technology Market report is prepared by taking into account the market type, organization volume, accessibility on-premises, end-users’ organization type, and availability at global level in areas such as North America, South America, Europe, Asia-Pacific, Middle East and Africa. Extremely talented pool has invested a lot of time for doing market research analysis and to generate this market report. FinFET Technology Market report is sure to help businesses for the long lasting accomplishments in terms of better decision making, revenue generation, prioritizing market goals and profitable business.

FinFET Technology Market, By Technology (3nm, 5nm, 7nm, 10nm, 14nm, 16nm, 20nm, 22nm), Application (Central Processing Unit (CPU), System-On-Chip (SoC), Field-Programmable Gate Array (FPGA), Graphics Processing Unit (GPU), Network Processor), End User (Mobile, Cloud Server/High-End Networks, IoT/Consumer Electronics, Automotive, Others), Type (Shorted Gate (S.G.), Independent Gate (I.G.), Bulk FinFETS, SOI FinFETS) – Industry Trends and Forecast to 2029.

Access Full 350 Pages PDF Report @

https://www.databridgemarketresearch.com/reports/global-finfet-technology-market

Key Coverage in the FinFET Technology Market Report:

Detailed analysis of FinFET Technology Market by a thorough assessment of the technology, product type, application, and other key segments of the report

Qualitative and quantitative analysis of the market along with CAGR calculation for the forecast period

Investigative study of the market dynamics including drivers, opportunities, restraints, and limitations that can influence the market growth

Comprehensive analysis of the regions of the FinFET Technology industry and their futuristic growth outlook

Competitive landscape benchmarking with key coverage of company profiles, product portfolio, and business expansion strategies

Table of Content:

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Global FinFET Technology Market Landscape

Part 04: Global FinFET Technology Market Sizing

Part 05: Global FinFET Technology Market Segmentation by Product

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Some of the major players operating in the FinFET technology market are:

SAP (Germany)

BluJay Solutions (U.K.)

ANSYS, Inc. (U.S.)

Keysight Technologies, Inc. (U.S.)

Analog Devices, Inc. (U.S.)

Infineon Technologies AG (Germany)

NXP Semiconductors (Netherlands)

Renesas Electronics Corporation (Japan)

Robert Bosch GmbH (Germany)

ROHM CO., LTD (Japan)

Semiconductor Components Industries, LLC (U.S.)

Texas Instruments Incorporated (U.S.)

TOSHIBA CORPORATION (Japan)

Browse Trending Reports:

Facility Management Market Size, Share, Trends, Growth and Competitive Outlook https://www.databridgemarketresearch.com/reports/global-facility-management-market

Supply Chain Analytics Market Size, Share, Trends, Global Demand, Growth and Opportunity Analysis https://www.databridgemarketresearch.com/reports/global-supply-chain-analytics-market

Industry 4.0 Market Size, Share, Trends, Opportunities, Key Drivers and Growth Prospectus https://www.databridgemarketresearch.com/reports/global-industry-4-0-market

Digital Banking Market Size, Share, Trends, Industry Growth and Competitive Analysis https://www.databridgemarketresearch.com/reports/global-digital-banking-market

Massive Open Online Courses (MOOCS) Market Size, Share, Trends, Growth Opportunities and Competitive Outlook https://www.databridgemarketresearch.com/reports/global-mooc-market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Email: [email protected]

#FinFET Technology Market Size#Share#Trends#Demand#Industry Growth and Competitive Outlook#market report#market share#market size#marketresearch#market trends#market analysis#markettrends#marketreport#market research

1 note

·

View note

Text

Autonomous Driving Chip Market, Emerging Trends, Regional Analysis, and Forecast to 2032

Global Autonomous Driving Chip Market size was valued at US$ 4.23 billion in 2024 and is projected to reach US$ 12.67 billion by 2032, at a CAGR of 14.7% during the forecast period 2025-2032.

Autonomous driving chips are specialized computing units that power artificial intelligence (AI) systems in self-driving vehicles. These chips process real-time sensor data, enable computer vision, and execute machine learning algorithms to make driving decisions. Key components include GPUs (Graphics Processing Units), FPGAs (Field-Programmable Gate Arrays), and ASICs (Application-Specific Integrated Circuits), each offering unique advantages for autonomous vehicle workloads.

The market growth is fueled by increasing demand for advanced driver assistance systems (ADAS), government regulations promoting vehicle safety, and rising investments in autonomous vehicle technology. While the semiconductor industry faced challenges in 2022 with only 4.4% global growth (USD 580 billion total market), autonomous driving chips remain a high-growth segment. Leading players like NVIDIA, Qualcomm, and Mobileye are driving innovation through partnerships with automakers and investments in next-generation chip architectures optimized for AI workloads.

Get Full Report : https://semiconductorinsight.com/report/autonomous-driving-chip-market/

MARKET DYNAMICS

MARKET DRIVERS

Rapid Advancements in AI and Machine Learning to Accelerate Autonomous Driving Chip Adoption

The autonomous vehicle industry is witnessing unprecedented growth due to breakthroughs in artificial intelligence and machine learning algorithms. Autonomous driving chips, which process vast amounts of sensor data in real-time, require increasingly sophisticated AI capabilities. The global AI chip market for automotive applications grew by over 35% in 2023, demonstrating the critical role these components play in enabling autonomous functionality. Leading automotive manufacturers are investing heavily in AI-powered autonomous solutions, creating a surge in demand for high-performance chips capable of processing complex neural networks while meeting stringent power efficiency requirements.

Government Initiatives and Safety Regulations Catalyzing Market Expansion

Governments worldwide are implementing policies and regulations to promote autonomous vehicle adoption while ensuring road safety. In numerous countries, substantial investments in smart city infrastructure and dedicated testing zones for autonomous vehicles are creating favorable conditions for market growth. Recent mandates requiring advanced driver-assistance systems (ADAS) in new vehicles have directly increased demand for autonomous driving chips. Furthermore, regulatory frameworks establishing safety standards for autonomous vehicle technology are driving chip manufacturers to develop more robust and reliable solutions that comply with these evolving requirements.

Increasing Preference for Luxury and Premium Vehicles to Fuel Demand

The automotive industry is experiencing a notable shift toward luxury and premium vehicles equipped with advanced autonomous features. Consumers are increasingly valuing safety, convenience, and cutting-edge technology in their vehicle purchases, with over 65% of new car buyers in developed markets considering autonomous capabilities a key purchase factor. Automakers are responding by incorporating more sophisticated autonomous systems into their premium offerings, requiring higher-performance chips with greater computational power. This trend is particularly evident in the electric vehicle segment, where autonomous features frequently accompany advanced powertrain technologies.

MARKET RESTRAINTS

High Development Costs and Complex Certification Processes Limiting Market Growth

The autonomous driving chip market faces significant restraints due to the substantial costs associated with research, development, and certification. Developing chips that meet automotive-grade reliability standards requires investments often exceeding hundreds of millions of dollars. The lengthy certification processes, which can take several years, create additional barriers to market entry. Moreover, the need for redundancy and fail-safe mechanisms in autonomous systems drives up both development timelines and production costs, making it challenging for smaller players to compete in this rapidly evolving market.

MARKET OPPORTUNITIES

Emergence of Software-Defined Vehicles to Create New Growth Avenues

The automotive industry’s shift toward software-defined vehicles presents significant opportunities for autonomous driving chip manufacturers. These next-generation vehicles require flexible hardware platforms capable of supporting over-the-air updates and evolving functionality throughout the vehicle’s lifecycle. Chip manufacturers that can deliver solutions with sufficient computational headroom and adaptable architectures stand to benefit from this transformation. The market for software-defined vehicle platforms is projected to grow exponentially as automakers seek to differentiate their offerings through continuously improving autonomous capabilities and user experiences.

MARKET CHALLENGES

Thermal Management and Power Efficiency Constraints in Chip Design

Designing autonomous driving chips that balance computational performance with power efficiency remains a formidable challenge. As autonomous systems require processing vast amounts of sensor data in real-time, chip manufacturers must develop solutions that deliver exceptional performance without exceeding thermal and power budgets. The automotive environment imposes strict limitations on heat dissipation, creating engineering challenges that often require innovative packaging solutions and advanced semiconductor manufacturing processes. These technical constraints significantly impact product development timelines and implementation costs, presenting ongoing challenges for industry players.

AUTONOMOUS DRIVING CHIP MARKET TRENDS

Advancements in AI and Edge Computing Accelerate Autonomous Driving Chip Demand

The autonomous driving chip market is experiencing rapid evolution, driven by breakthroughs in artificial intelligence and edge computing technologies. Modern autonomous systems now require chips capable of processing up to 300 TOPS (Tera Operations Per Second) for Level 4/5 autonomous vehicles, compared to just 10 TOPS for basic ADAS systems. Leading manufacturers are developing multi-core processors combining CPUs, GPUs, and dedicated AI accelerators to handle complex neural networks for real-time decision making. Additionally, the shift towards 7nm and 5nm process nodes has enabled significant improvements in power efficiency while maintaining computational throughput—a critical factor for electric vehicle applications where power consumption directly impacts range.

Other Trends

Regional Regulatory Developments

Government policies worldwide are significantly influencing autonomous chip adoption patterns. The EU’s upcoming Euro 7 emissions standards (effective 2025) include provisions incentivizing autonomous safety systems, while China’s New Energy Vehicle Industrial Development Plan (2021-2035) mandates increasing autonomy across vehicle segments. In the US, recent updates to Federal Motor Vehicle Safety Standards now explicitly address highly automated vehicles, creating clearer pathways for deployment. These regulatory tailwinds are prompting automakers to accelerate investments in autonomous driving hardware, with projected OEM spending on self-driving chips exceeding $10 billion annually by 2026.

Vertical Integration and Strategic Partnerships Reshape Competitive Landscape

The industry is witnessing a wave of strategic collaborations between semiconductor firms, automakers, and algorithm developers to create optimized hardware-software solutions. Notable examples include NVIDIA’s partnerships with over 25 automakers for its Drive platform, and Mobileye’s collaborations with 6 major OEMs for its EyeQ6 chipsets. Simultaneously, vehicle manufacturers are increasingly bringing chip development in-house—Tesla’s Full Self-Driving (FSD) chip now powers all its latest models, while BYD develops custom silicon through its semiconductor subsidiary. This vertical integration trend is compressing traditional supply chains, with some Tier 1 suppliers now offering complete autonomous driving computer modules integrating sensors, chips and middleware.

While the passenger vehicle segment currently dominates demand, increasing automation in commercial trucking, mining equipment, and agricultural machinery represents significant growth avenues. Recent pilot programs involving autonomous long-haul trucks have demonstrated potential fuel efficiency improvements up to 10% through optimized routing and platooning—capabilities heavily dependent on specialized computing hardware. Similarly, off-road autonomy applications require chips with enhanced durability and temperature tolerance, creating specialized niches within the broader market.

COMPETITIVE LANDSCAPE

Key Industry Players

Tech Giants and Innovators Battle for Dominance in Autonomous Driving Semiconductors

The global autonomous driving chip market exhibits a dynamic competitive landscape, combining established semiconductor giants with agile AI-focused startups. NVIDIA maintains its leadership position, capturing approximately 25% market share in 2024 through its advanced DRIVE platform that combines GPU, AI, and software capabilities. The company’s strength stems from its early investments in automotive-grade AI processors and partnerships with over 25 major automakers.

Qualcomm and Mobileye (an Intel subsidiary) follow closely, each holding 15-18% market share. Qualcomm’s Snapdragon Ride platform gained significant traction after securing design wins with BMW and General Motors, while Mobileye’s EyeQ chips power advanced driver-assistance systems (ADAS) in nearly 40 million vehicles globally. Both companies benefit from their specialized architectures optimized for power efficiency and machine learning tasks.

The competitive intensity increased recently with vertical integration moves by automakers. Tesla made waves by developing its Full Self-Driving (FSD) chip in-house, demonstrating how OEMs are bringing chip design capabilities internally. Meanwhile, Chinese players like Horizon Robotics and Black Sesame Technologies are gaining ground through government-supported initiatives, capturing nearly 30% of China’s domestic autonomous chip demand.

Emerging trends show semiconductor firms increasingly forming strategic alliances – NVIDIA partnered with Mercedes-Benz for its next-generation vehicles, while Qualcomm acquired Veoneer to bolster its automotive software stack. Such moves indicate the market is evolving toward integrated solutions combining hardware, algorithms, and vehicle integration expertise.

List of Key Autonomous Driving Chip Companies Profiled

NVIDIA Corporation (U.S.)

Qualcomm Technologies, Inc. (U.S.)

Mobileye (Intel Subsidiary) (Israel)

Tesla, Inc. (U.S.)

Huawei Technologies Co., Ltd. (China)

Horizon Robotics (China)

Black Sesame Technologies (China)

SemiDrive (China)

Texas Instruments (U.S.)

Renesas Electronics Corporation (Japan)

Infineon Technologies AG (Germany)

SiEngine Technology (China)

Segment Analysis:

By Type

ASIC Segment Dominates Due to High Efficiency in AI Processing for Autonomous Vehicles

The market is segmented based on type into:

GPU

FPGA

ASIC

Others (including hybrid architectures)

By Application

Passenger Car Segment Leads as OEMs Accelerate Adoption of L3+ Autonomous Features

The market is segmented based on application into:

Commercial Vehicle

Passenger Car

By Processing Type

Neural Network Accelerators Gain Prominence for Deep Learning Applications

The market is segmented based on processing capability into:

Computer Vision Processors

Neural Network Accelerators

Sensor Fusion Processors

Path Planning Processors

By Autonomy Level

L3 Systems Show Strong Adoption Though L4 Development Gains Momentum

The market is segmented based on SAE autonomy levels into:

L1-L2 (Driver Assistance)

L3 (Conditional Automation)

L4 (High Automation)

L5 (Full Automation)

Regional Analysis: Autonomous Driving Chip Market

North America The North American autonomous driving chip market is witnessing robust growth, driven by substantial investments in vehicle electrification and smart mobility infrastructure. The U.S. leads with companies like Tesla, NVIDIA, and Qualcomm pioneering advancements in AI-powered semiconductor solutions. Government initiatives, such as the Infrastructure Investment and Jobs Act, allocate funding for smart transportation, indirectly boosting demand for autonomous chips. Stringent safety regulations by the NHTSA and rapid adoption of L4 autonomous vehicles in commercial fleets further accelerate market expansion. However, high R&D costs and supply chain bottlenecks remain key challenges for chip manufacturers.

Europe Europe’s autonomous driving chip market thrives on strong automotive OEM partnerships and strict EU emissions norms pushing autonomous electrification. Germany dominates with BMW, Mercedes-Benz, and Volkswagen integrating advanced chips from Infineon and Mobileye. The EU’s 2030 Digital Compass policy emphasizes AI-driven mobility, creating favorable conditions for ASIC and FPGA chip developers. While the region excels in precision engineering, fragmented regulatory frameworks across member states and slower consumer adoption of fully autonomous vehicles limit mid-term growth potential. European manufacturers focus on radar-LiDAR fusion chips to comply with Euro NCAP safety protocols.

Asia-Pacific As the largest and fastest-growing market, APAC benefits from China’s aggressive Made in China 2025 semiconductor strategy and Japan’s leadership in automotive-grade chip manufacturing. Chinese firms like Huawei and Horizon Robotics capture over 30% regional market share through state-backed initiatives. India emerges as a dark horse with rising investments in local chip fabrication units to reduce import dependence. While cost-sensitive markets still prefer legacy GPU solutions, the shift toward L3 autonomy in passenger vehicles and government mandates for ADAS in commercial trucks drive demand. Intense price competition and IP theft concerns however deter foreign investors in some countries.

South America South America’s market remains nascent but shows promise with Brazil and Argentina piloting autonomous freight corridors. Local production is minimal as most chips are imported from North American and Asian suppliers. Economic instability and low vehicle automation penetration hinder large-scale adoption, though mining and agriculture sectors demonstrate early interest in off-road autonomous equipment chips. Regulatory bodies are gradually formulating ADAS policies, with Brazil’s CONTRAN Resolution 798/2020 setting basic autonomous vehicle testing standards. Infrastructure gaps and currency volatility continue to discourage major chip investments.

Middle East & Africa The MEA region is strategically positioning itself through smart city projects in UAE and Saudi Arabia, where autonomous taxis and ports require specialized chips. Dubai’s Autonomous Transportation Strategy aims for 25% of trips to be driverless by 2030, creating opportunities for edge-computing chip vendors. Israel’s tech ecosystem fosters innovation with Mobileye dominating vision-processing chips. African growth is uneven – while South Africa tests autonomous mining vehicles, most nations lack funding for large deployments. The absence of uniform regulations and low consumer purchasing power slows mainstream adoption across the region.

Get A Detailed Sample Report : https://semiconductorinsight.com/download-sample-report/?product_id=97531

Report Scope

This market research report provides a comprehensive analysis of the global and regional Autonomous Driving Chip markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments.

Segmentation Analysis: Detailed breakdown by product type (GPU, FPGA, ASIC, Others), technology, application (Commercial Vehicle, Passenger Car), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, including country-level analysis where relevant.

Competitive Landscape: Profiles of leading market participants, including their product offerings, R&D focus, manufacturing capacity, pricing strategies, and recent developments such as mergers, acquisitions, and partnerships.

Technology Trends & Innovation: Assessment of emerging technologies, integration of AI/IoT, semiconductor design trends, fabrication techniques, and evolving industry standards.

Market Drivers & Restraints: Evaluation of factors driving market growth along with challenges, supply chain constraints, regulatory issues, and market-entry barriers.

Stakeholder Analysis: Insights for component suppliers, OEMs, system integrators, investors, and policymakers regarding the evolving ecosystem and strategic opportunities.

Primary and secondary research methods are employed, including interviews with industry experts, data from verified sources, and real-time market intelligence to ensure the accuracy and reliability of the insights presented.

Customization of the Report

In case of any queries or customization requirements, please connect with our sales team, who will ensure that your requirements are met.

Related Reports :

Contact us:

+91 8087992013

0 notes

Text

Data Center Accelerator Market Set to Transform AI Infrastructure Landscape by 2031

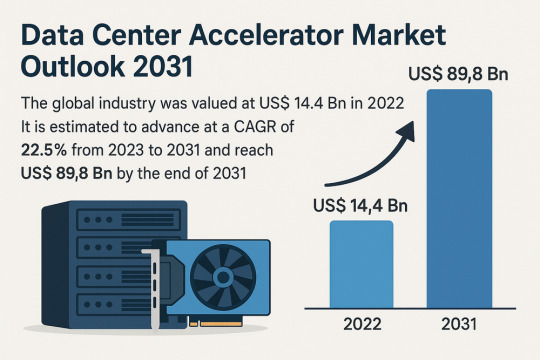

The global data center accelerator market is poised for exponential growth, projected to rise from USD 14.4 Bn in 2022 to a staggering USD 89.8 Bn by 2031, advancing at a CAGR of 22.5% during the forecast period from 2023 to 2031. Rapid adoption of Artificial Intelligence (AI), Machine Learning (ML), and High-Performance Computing (HPC) is the primary catalyst driving this expansion.

Market Overview: Data center accelerators are specialized hardware components that improve computing performance by efficiently handling intensive workloads. These include Graphics Processing Units (GPUs), Tensor Processing Units (TPUs), Field Programmable Gate Arrays (FPGAs), and Application-Specific Integrated Circuits (ASICs), which complement CPUs by expediting data processing.

Accelerators enable data centers to process massive datasets more efficiently, reduce reliance on servers, and optimize costs a significant advantage in a data-driven world.

Market Drivers & Trends

Rising Demand for High-performance Computing (HPC): The proliferation of data-intensive applications across industries such as healthcare, autonomous driving, financial modeling, and weather forecasting is fueling demand for robust computing resources.

Boom in AI and ML Technologies: The computational requirements of AI and ML are driving the need for accelerators that can handle parallel operations and manage extensive datasets efficiently.

Cloud Computing Expansion: Major players like AWS, Azure, and Google Cloud are investing in infrastructure that leverages accelerators to deliver faster AI-as-a-service platforms.

Latest Market Trends

GPU Dominance: GPUs continue to dominate the market, especially in AI training and inference workloads, due to their capability to handle parallel computations.

Custom Chip Development: Tech giants are increasingly developing custom chips (e.g., Meta’s MTIA and Google's TPUs) tailored to their specific AI processing needs.

Energy Efficiency Focus: Companies are prioritizing the design of accelerators that deliver high computational power with reduced energy consumption, aligning with green data center initiatives.

Key Players and Industry Leaders

Prominent companies shaping the data center accelerator landscape include:

NVIDIA Corporation – A global leader in GPUs powering AI, gaming, and cloud computing.

Intel Corporation – Investing heavily in FPGA and ASIC-based accelerators.

Advanced Micro Devices (AMD) – Recently expanded its EPYC CPU lineup for data centers.

Meta Inc. – Introduced Meta Training and Inference Accelerator (MTIA) chips for internal AI applications.

Google (Alphabet Inc.) – Continues deploying TPUs across its cloud platforms.

Other notable players include Huawei Technologies, Cisco Systems, Dell Inc., Fujitsu, Enflame Technology, Graphcore, and SambaNova Systems.

Recent Developments

March 2023 – NVIDIA introduced a comprehensive Data Center Platform strategy at GTC 2023 to address diverse computational requirements.

June 2023 – AMD launched new EPYC CPUs designed to complement GPU-powered accelerator frameworks.

2023 – Meta Inc. revealed the MTIA chip to improve performance for internal AI workloads.

2023 – Intel announced a four-year roadmap for data center innovation focused on Infrastructure Processing Units (IPUs).

Gain an understanding of key findings from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=82760

Market Opportunities

Edge Data Center Integration: As computing shifts closer to the edge, opportunities arise for compact and energy-efficient accelerators in edge data centers for real-time analytics and decision-making.

AI in Healthcare and Automotive: As AI adoption grows in precision medicine and autonomous vehicles, demand for accelerators tuned for domain-specific processing will soar.

Emerging Markets: Rising digitization in emerging economies presents substantial opportunities for data center expansion and accelerator deployment.

Future Outlook

With AI, ML, and analytics forming the foundation of next-generation applications, the demand for enhanced computational capabilities will continue to climb. By 2031, the data center accelerator market will likely transform into a foundational element of global IT infrastructure.

Analysts anticipate increasing collaboration between hardware manufacturers and AI software developers to optimize performance across the board. As digital transformation accelerates, companies investing in custom accelerator architectures will gain significant competitive advantages.

Market Segmentation

By Type:

Central Processing Unit (CPU)

Graphics Processing Unit (GPU)

Application-Specific Integrated Circuit (ASIC)

Field-Programmable Gate Array (FPGA)

Others

By Application:

Advanced Data Analytics

AI/ML Training and Inference

Computing

Security and Encryption

Network Functions

Others

Regional Insights

Asia Pacific dominates the global market due to explosive digital content consumption and rapid infrastructure development in countries such as China, India, Japan, and South Korea.

North America holds a significant share due to the presence of major cloud providers, AI startups, and heavy investment in advanced infrastructure. The U.S. remains a critical hub for data center deployment and innovation.

Europe is steadily adopting AI and cloud computing technologies, contributing to increased demand for accelerators in enterprise data centers.

Why Buy This Report?

Comprehensive insights into market drivers, restraints, trends, and opportunities

In-depth analysis of the competitive landscape

Region-wise segmentation with revenue forecasts

Includes strategic developments and key product innovations

Covers historical data from 2017 and forecast till 2031

Delivered in convenient PDF and Excel formats

Frequently Asked Questions (FAQs)

1. What was the size of the global data center accelerator market in 2022? The market was valued at US$ 14.4 Bn in 2022.

2. What is the projected market value by 2031? It is projected to reach US$ 89.8 Bn by the end of 2031.

3. What is the key factor driving market growth? The surge in demand for AI/ML processing and high-performance computing is the major driver.

4. Which region holds the largest market share? Asia Pacific is expected to dominate the global data center accelerator market from 2023 to 2031.

5. Who are the leading companies in the market? Top players include NVIDIA, Intel, AMD, Meta, Google, Huawei, Dell, and Cisco.

6. What type of accelerator dominates the market? GPUs currently dominate the market due to their parallel processing efficiency and widespread adoption in AI/ML applications.

7. What applications are fueling growth? Applications like AI/ML training, advanced analytics, and network security are major contributors to the market's growth.

Explore Latest Research Reports by Transparency Market Research: Tactile Switches Market: https://www.transparencymarketresearch.com/tactile-switches-market.html

GaN Epitaxial Wafers Market: https://www.transparencymarketresearch.com/gan-epitaxial-wafers-market.html

Silicon Carbide MOSFETs Market: https://www.transparencymarketresearch.com/silicon-carbide-mosfets-market.html

Chip Metal Oxide Varistor (MOV) Market: https://www.transparencymarketresearch.com/chip-metal-oxide-varistor-mov-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected] of Form

Bottom of Form

0 notes

Text

Exploring the FinFET Technology Market: Growth Drivers, Demand Analysis & Future Outlook

"Executive Summary FinFET Technology Market : The global FinFET technology market size was valued at USD 69.67 billion in 2023, is projected to reach USD 1,079.25 billion by 2031, with a CAGR of 40.85% during the forecast period 2024 to 2031.

The data within the FinFET Technology Market report is showcased in a statistical format to offer a better understanding upon the dynamics. The market report also computes the market size and revenue generated from the sales. What is more, this market report analyses and provides the historic data along with the current performance of the market. FinFET Technology Market report is a comprehensive background analysis of the industry, which includes an assessment of the parental market. The FinFET Technology Market is supposed to demonstrate a considerable growth during the forecast period.

The emerging trends along with major drivers, challenges and opportunities in the market are also identified and analysed in this report. FinFET Technology Market report is a systematic synopsis on the study for market and how it is affecting the industry. This report studies the potential and prospects of the market in the present and the future from various points of views. SWOT analysis and Porter's Five Forces Analysis are the two consistently and promisingly used tools for generating this report. FinFET Technology Market report is prepared using data sourced from in-house databases, secondary and primary research performed by a team of industry experts.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive FinFET Technology Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-finfet-technology-market

FinFET Technology Market Overview

**Segments**

- By Technology Node (10nm, 7nm, 5nm, 3nm) - By Product (Central Processing Unit (CPU), Field-Programmable Gate Array (FPGA), System-on-Chip (SoC), Network Processor, Graphics Processing Unit (GPU), Artificial Intelligence (AI)) - By End-User (Smartphones, Wearables, High-End Networks, Automotive, Industrial)

The global FinFET technology market is segmented based on technology node, product, and end-user. The technology node segment includes 10nm, 7nm, 5nm, and 3nm nodes, with increasing demand for smaller nodes to achieve higher efficiency. In terms of products, the market includes Central Processing Units (CPUs), Field-Programmable Gate Arrays (FPGAs), System-on-Chips (SoCs), Network Processors, Graphics Processing Units (GPUs), and Artificial Intelligence (AI) products that utilize FinFET technology for improved performance. The end-user segment covers smartphones, wearables, high-end networks, automotive, and industrial sectors where FinFET technology is being increasingly adopted for enhanced capabilities.

**Market Players**

- Intel Corporation - Samsung Electronics Co. Ltd. - Taiwan Semiconductor Manufacturing Company Limited - GLOBALFOUNDRIES - Semiconductor Manufacturing International Corp. - United Microelectronics Corporation - NVIDIA Corporation - Xilinx Inc. - IBM Corporation

Key players in the global FinFET technology market include industry giants such as Intel Corporation, Samsung Electronics Co. Ltd., Taiwan Semiconductor Manufacturing Company Limited, GLOBALFOUNDRIES, Semiconductor Manufacturing International Corp., United Microelectronics Corporation, NVIDIA Corporation, Xilinx Inc., and IBM Corporation. These market players are heavily investing in research and development to enhance their FinFET technology offerings and maintain a competitive edge in the market.

The global FinFET technology market is witnessing significant growth driven by the increasing demand for advanced processors in smartphones, data centers, and emerging technologies such as artificial intelligence and Internet of Things (IoT). The shift towards smaller technology nodes like 7nm and 5nm is enabling higher performance and energy efficiency in electronic devices. The adoption of FinFET technology in a wide range of applications such as automotive, industrial, and high-end networks is further fueling market growth.

The Asia Pacific region dominates the global FinFET technology market, with countries like China, South Korea, and Taiwan being major hubs for semiconductor manufacturing. North America and Europe also play vital roles in the market, with key technological advancements and investments driving growth in these regions. Overall, the global FinFET technology market is poised for significant expansion in the coming years, driven by advancements in semiconductor technology and increasing demand for high-performance electronic devices.

The FinFET technology market is characterized by intense competition among key players striving to innovate and stay ahead in the rapidly evolving semiconductor industry. As technology nodes continue to shrink, companies are focusing on developing more efficient and powerful processors to meet the growing demands of various applications. Intel Corporation, a long-standing leader in the market, faces increasing competition from companies like Samsung Electronics, Taiwan Semiconductor Manufacturing, and GLOBALFOUNDRIES, all of which are investing heavily in R&D to drive technological advancements.

One key trend in the FinFET technology market is the rising importance of artificial intelligence (AI) applications across industries. AI-driven technologies require highly capable processors to handle complex computations, leading to a surge in demand for FinFET-based products such as GPUs and AI chips. Companies like NVIDIA and Xilinx are at the forefront of developing cutting-edge solutions tailored for AI workloads, positioning themselves as key players in the AI-driven segment of the FinFET market.

The increasing adoption of FinFET technology in smartphones and wearables is another significant driver of market growth. The demand for high-performance mobile devices with energy-efficient processors is propelling the development of advanced FinFET-based SoCs tailored for the mobile industry. As smartphones become more powerful and capable of handling complex tasks, the need for FinFET technology to deliver optimal performance while conserving power becomes paramount.

Moreover, the automotive industry represents a lucrative segment for FinFET technology, with the growing integration of electronic systems in modern vehicles. From advanced driver-assistance systems (ADAS) to in-vehicle infotainment systems, automotive manufacturers are leveraging FinFET technology to enhance the efficiency and performance of onboard electronics. This trend is expected to drive further innovation in automotive semiconductor solutions and create new opportunities for market players.

Overall, the global FinFET technology market is on a trajectory of steady growth, fueled by advancements in semiconductor technology and the increasing demand for high-performance computing solutions across various sectors. With key players continuously pushing the boundaries of innovation and expanding their product portfolios, the market is poised for further expansion in the coming years. As technology nodes continue to shrink and new applications emerge, the FinFET market is likely to witness dynamic changes and evolving trends, shaping the future of the semiconductor industry.The global FinFET technology market is experiencing robust growth fueled by the increasing demand for advanced processors across various industries. One key trend shaping the market is the rapid adoption of FinFET technology in artificial intelligence (AI) applications. With the proliferation of AI-driven technologies in areas such as data analytics, autonomous vehicles, and robotics, there is a growing need for high-performance processors that can handle complex computations efficiently. Companies like NVIDIA and Xilinx are capitalizing on this trend by developing innovative FinFET-based products tailored for AI workloads, positioning themselves as key players in this segment of the market.

Another significant driver of market growth is the expanding use of FinFET technology in smartphones and wearables. As consumer demand for high-performance mobile devices continues to rise, there is a growing emphasis on developing energy-efficient processors that can deliver optimal performance while conserving power. FinFET-based System-on-Chips (SoCs) have emerged as a popular choice for mobile manufacturers looking to enhance the capabilities of their devices, leading to further adoption of FinFET technology in the mobile industry.

The automotive sector represents a lucrative opportunity for FinFET technology, driven by the increasing integration of electronic systems in modern vehicles. From advanced driver-assistance systems to in-vehicle infotainment, automotive manufacturers are leveraging FinFET technology to improve the efficiency and performance of onboard electronics. This trend is expected to fuel further innovation in automotive semiconductor solutions, presenting new growth avenues for market players operating in this segment.

Overall, the global FinFET technology market is poised for significant expansion in the coming years, driven by advancements in semiconductor technology and the rising demand for high-performance computing solutions across diverse sectors. With key players investing heavily in research and development to stay ahead in the competitive landscape, the market is likely to witness continuous innovation and the introduction of cutting-edge products tailored for emerging applications. As technology nodes continue to shrink and new use cases for FinFET technology emerge, the market is expected to undergo dynamic changes and shape the future of the semiconductor industry.

The FinFET Technology Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-finfet-technology-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

The report can answer the following questions:

Global major manufacturers' operating situation (sales, revenue, growth rate and gross margin) of FinFET Technology Market

Global major countries (United States, Canada, Germany, France, UK, Italy, Russia, Spain, China, Japan, Korea, India, Australia, New Zealand, Southeast Asia, Middle East, Africa, Mexico, Brazil, C. America, Chile, Peru, Colombia) market size (sales, revenue and growth rate) of FinFET Technology Market

Different types and applications of FinFET Technology Market share of each type and application by revenue.

Global of FinFET Technology Market size (sales, revenue) forecast by regions and countries from 2022 to 2028 of FinFET Technology Market

Upstream raw materials and manufacturing equipment, industry chain analysis of FinFET Technology Market

SWOT analysis of FinFET Technology Market

New Project Investment Feasibility Analysis of FinFET Technology Market

Browse More Reports:

North America Personal Care Ingredients Market Global FinFET Technology Market Global Paper Dyes Market Asia-Pacific Protein Hydrolysates Market Global Inline Metrology Market North America Retail Analytics Market Global Thrombosis Drug Market Europe Network Test Lab Automation Market Global Perinatal Infections Market Global Light-Emitting Diode (LED) Probing and Testing Equipment Market Global Mobile Campaign Management Platform Market Global Fruits and Vegetables Processing Equipment Market Global STD Diagnostics Market Asia-Pacific Microgrid Market Global Fluoxetine Market Global Food Drink Packaging Market Global Electric Enclosure Market Asia-Pacific Artificial Turf Market Global Hand Wash Station Market Global Prostate Cancer Antigen 3 (PCA3) Test Market Asia-Pacific Hydrographic Survey Equipment Market Global Cable Testing and Certification Market Global Leather Handbags Market Global Post-Bariatric Hypoglycemia Treatment Market Europe pH Sensors Market Global Linear Low-Density Polyethylene Market Global Ketogenic Diet Food Market Asia-Pacific Small Molecule Sterile Injectable Drugs Market Global Prescriptive Analytics Market Global Viral Transport Media Market Middle East and Africa Composite Bearings Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us: Data Bridge Market Research US: +1 614 591 3140 UK: +44 845 154 9652 APAC : +653 1251 975 Email:- [email protected]

Tag

"

0 notes

Text

E-Beam Wafer Inspection System : Market Trends and Future Scope 2032

The E-Beam Wafer Inspection System Market is poised for significant growth, with its valuation reaching approximately US$ 990.32 million in 2024 and projected to expand at a remarkable CAGR of 17.10% from 2025 to 2032. As the semiconductor industry evolves to accommodate more advanced technologies like AI, IoT, and quantum computing, precision inspection tools such as E-beam wafer systems are becoming indispensable. These systems play a pivotal role in ensuring chip reliability and yield by detecting defects that traditional optical tools might overlook.

Understanding E-Beam Wafer Inspection Technology

E-Beam (electron beam) wafer inspection systems leverage finely focused beams of electrons to scan the surface of semiconductor wafers. Unlike optical inspection methods that rely on light reflection, E-beam systems offer significantly higher resolution, capable of detecting defects as small as a few nanometers. This level of precision is essential in today’s era of sub-5nm chip nodes, where any minor defect can result in a failed component or degraded device performance.

These systems operate by directing an electron beam across the wafer's surface and detecting changes in secondary electron emissions, which occur when the primary beam interacts with the wafer material. These emissions are then analyzed to identify defects such as particle contamination, pattern deviations, and electrical faults with extreme accuracy.

Market Drivers: Why Demand Is Accelerating

Shrinking Node Sizes As semiconductor manufacturers continue their pursuit of Moore’s Law, chip geometries are shrinking rapidly. The migration from 10nm to 5nm and now toward 3nm and beyond requires metrology tools capable of atomic-level resolution. E-beam inspection meets this demand by offering the only feasible method to identify ultra-small defects at such scales.

Increasing Complexity of Semiconductor Devices Advanced nodes incorporate FinFETs, 3D NAND, and chiplets, which make inspection significantly more complex. The three-dimensional structures and dense integration elevate the risk of process-induced defects, reinforcing the need for advanced inspection technologies.

Growing Adoption of AI and HPC Devices Artificial intelligence (AI) chips, graphics processing units (GPUs), and high-performance computing (HPC) applications demand flawless silicon. With their intense performance requirements, these chips must undergo rigorous inspection to ensure reliability.

Yield Optimization and Cost Reduction Identifying defects early in the semiconductor fabrication process can help prevent downstream failures, significantly reducing manufacturing costs. E-beam inspection offers a proactive quality control mechanism, enhancing production yield.

Key Market Segments

The global E-Beam Wafer Inspection System Market is segmented based on technology type, application, end-user, and geography.

By Technology Type:

Scanning Electron Microscope (SEM) based systems

Multi-beam inspection systems

By Application:

Defect inspection

Lithography verification

Process monitoring

By End-User:

Integrated Device Manufacturers (IDMs)

Foundries

Fabless companies

Asia-Pacific dominates the market owing to the presence of major semiconductor manufacturing hubs in countries like Taiwan, South Korea, Japan, and China. North America and Europe also contribute significantly due to technological innovations and research advancements.

Competitive Landscape: Key Players Driving Innovation

Several global players are instrumental in shaping the trajectory of the E-Beam Wafer Inspection System Market. These companies are heavily investing in R&D and product innovation to cater to the growing demand for high-precision inspection systems.

Hitachi Ltd: One of the pioneers in E-beam inspection technology, Hitachi’s advanced systems are widely used for critical defect review and metrology.

Applied Materials Inc.: Known for its cutting-edge semiconductor equipment, Applied Materials offers inspection tools that combine speed and sensitivity with atomic-level precision.

NXP Semiconductors N.V.: Although primarily a chip manufacturer, NXP’s reliance on inspection tools underscores the importance of defect detection in quality assurance.

Taiwan Semiconductor Manufacturing Co. Ltd. (TSMC): The world’s largest dedicated foundry, TSMC uses E-beam systems extensively in its advanced process nodes to maintain top-tier yield rates.

Renesas Electronics: A leader in automotive and industrial semiconductor solutions, Renesas emphasizes defect detection in complex system-on-chip (SoC) designs.

Challenges and Opportunities

Despite its numerous advantages, E-beam wafer inspection systems face challenges such as:

Throughput Limitations: Due to the nature of electron beam scanning, these systems generally operate slower than optical tools, affecting wafer processing time.

High Capital Investment: Advanced E-beam systems are expensive, which can deter smaller fabs or start-ups from adopting the technology.

However, ongoing innovations like multi-beam inspection systems and AI-powered defect classification are paving the way for faster and more cost-effective inspection solutions. These enhancements are expected to mitigate traditional drawbacks and further fuel market expansion.

Future Outlook

With semiconductors becoming more ingrained in everyday life—powering everything from smartphones to electric vehicles and cloud data centers—the importance of precise defect detection will only intensify. The E-Beam Wafer Inspection System Market is set to benefit tremendously from this surge in demand.

The integration of machine learning algorithms to speed up defect classification, along with the emergence of hybrid inspection platforms combining optical and electron beam technologies, will revolutionize wafer inspection methodologies in the coming years.

In conclusion, the E-Beam Wafer Inspection System Market is not just growing—it’s transforming the foundation of quality assurance in semiconductor manufacturing. As fabrication becomes more intricate and expectations for reliability increase, E-beam systems will remain a cornerstone technology, ensuring the chips that power our digital lives meet the highest standards of performance and precision.

Browse more Report:

Muscle Strengthening Devices Market

Monopolar Electrosurgery Instrument Market

Medical Styrenic Block Copolymers Market

Hard-Wired Commercial Surge Protection Devices Market

Solar Street Lighting Market

0 notes

Text

Microprocessor and GPU Market Size, Strategic Trends, End-Use Applications

The microprocessor and GPU market was valued at USD 88.02 billion in 2022 and is expected to reach USD 178.25 billion by 2030, growing at a CAGR of 9.45% during the forecast period. The growth is driven by increasing demand for high-performance computing, AI acceleration, data centers, autonomous systems, and enhanced graphic processing needs across industries.

Overview

Microprocessors and graphics processing units (GPUs) serve as the core computational engines of modern digital devices. Microprocessors are designed for general-purpose processing, managing operating systems, and running applications. GPUs, originally developed for rendering graphics, are now widely used in parallel processing, machine learning, and real-time data analysis.

As digital transformation accelerates across the globe, the need for faster, more efficient, and specialized processors continues to rise. Applications ranging from cloud computing, gaming, and automotive electronics to edge AI and IoT devices are fueling demand. Moreover, the emergence of new technologies such as 5G, AI, and metaverse platforms is reinforcing the market’s long-term growth potential.

Market Segmentation

By Type

Microprocessor (CPU)

Graphics Processing Unit (GPU)

By Architecture

x86

ARM

MIPS

PowerPC

SPARC

RISC-V

By Application

Consumer Electronics

Automotive

Industrial Automation

Healthcare

Aerospace and Defense

Telecommunications

Data Centers

Gaming

By End-User

Enterprises

Government

Individuals

Cloud Service Providers

OEMs

Key Trends

Rise of heterogeneous computing combining CPU and GPU cores

Expansion of AI workloads, pushing GPU development in edge and cloud environments

Increasing integration of GPU-based accelerators in autonomous vehicles and smart devices

Growth in ARM-based microprocessors, especially for mobile and embedded applications

Miniaturization and energy efficiency trends in IoT devices and wearables

Segment Insights

Type Insights: Microprocessors dominate in traditional computing, smartphones, and embedded systems. However, GPUs are witnessing exponential demand due to their superior parallel processing capabilities, especially in AI training, inference engines, and 3D modeling.

Architecture Insights: x86 architecture leads the market due to widespread use in PCs and servers. ARM architecture is gaining traction in mobile, automotive, and low-power devices. RISC-V is emerging as an open-source alternative in academia and next-gen chip research.

Application Insights: Consumer electronics such as smartphones, tablets, and PCs remain the largest application segment. However, the fastest-growing sectors are automotive (for ADAS and autonomous driving), healthcare (for imaging and diagnostics), and telecommunications (for 5G infrastructure and network slicing).

End-User Insights

Enterprises: Rely on high-performance CPUs and GPUs for servers, data centers, and enterprise applications.

Cloud Providers: Heavily invest in GPU-based infrastructure for AI, machine learning, and virtual computing.

Government and Defense: Utilize advanced processors for simulation, encryption, and real-time intelligence.

OEMs: Integrate customized processors into devices such as AR/VR headsets, drones, and robots.

Individuals: High consumer demand for gaming PCs, laptops, and graphic-intensive applications.

Regional Analysis

North America: Leads in R&D, chip manufacturing (especially GPUs), and cloud computing infrastructure.

Europe: Focused on industrial automation, automotive processors, and green computing.

Asia-Pacific: Fastest-growing region, driven by electronics production in China, South Korea, Taiwan, and India.

Latin America: Rising demand for mobile devices, smart home electronics, and gaming consoles.

Middle East & Africa: Emerging applications in smart cities, telecom, and security analytics.

Key Players

Leading companies in the microprocessor and GPU market include Intel Corporation, AMD (Advanced Micro Devices), NVIDIA Corporation, Qualcomm Technologies, Samsung Electronics, Apple Inc., MediaTek, IBM Corporation, ARM Holdings, and Imagination Technologies.

These players are investing in chiplet design, advanced process nodes (like 3nm and below), AI accelerators, and integrated system-on-chip (SoC) platforms. Collaborations with cloud providers, automotive OEMs, and software developers are also driving performance-specific innovation and ecosystem expansion.

Future Outlook

The market for microprocessors and GPUs will remain a critical pillar of global digital infrastructure. Future growth will be shaped by quantum computing research, AI-native chipsets, neuromorphic processors, and photonic integration. Sustainable semiconductor manufacturing and energy-efficient chip designs will also gain strategic importance as environmental concerns intensify.

Trending Report Highlights

Beam Bender Market

Depletion Mode JFET Market

Logic Semiconductors Market

Semiconductor Wafer Transfer Robots Market

US Warehouse Robotics Market

0 notes

Text

How to Start Mining ETH quidminer.com

How to Start Mining ETH quidminer.com is a comprehensive guide for beginners looking to enter the world of cryptocurrency mining. If you're interested in mining Ethereum (ETH), understanding the basics and choosing the right tools are crucial steps. One reliable platform that can help you get started is https://paladinmining.com. This site offers a range of resources and support for miners, ensuring you have the best possible experience.

Mining ETH requires a good understanding of the technology behind it. Essentially, mining involves using computer hardware to solve complex mathematical problems. The first step is to acquire the necessary hardware. Graphics Processing Units (GPUs) are commonly used for ETH mining due to their efficiency and cost-effectiveness. Once you have the hardware, you need to set up a mining rig. This involves connecting multiple GPUs together and ensuring they are properly cooled to prevent overheating.

Next, you'll need to choose a mining software. Quidminer.com is a popular choice among miners for its user-friendly interface and efficient performance. After installing the software, you can connect to a mining pool. A mining pool combines the computing power of multiple miners, increasing the chances of solving blocks and earning rewards. Paladinmining.com provides access to various mining pools, making it easier for you to find one that suits your needs.

Finally, keep an eye on the market trends and adjust your mining strategy accordingly. Cryptocurrency prices can be volatile, and staying informed can help you maximize your profits. With the right approach and tools, such as those provided by https://paladinmining.com, you can successfully start mining ETH and join the growing community of crypto enthusiasts.

quidminer.com

PaladinMining

Paladin Mining

0 notes

Text

Third Point LLC Shifts Strategy: Bold Bets on NVIDIA and CoStar Group

Intro

Third Point LLC, a well-known hedge fund led by the savvy Daniel S. Loeb, has made some eye-catching updates to its investment strategies. Recently, they've disclosed new holdings which are turning heads in the finance world. These moves can be a great learning opportunity for anyone dipping their toes into investing.

What it is

Third Point LLC is a hedge fund that manages large sums of money by investing in various stocks and assets. A hedge fund pools money from investors and employs strategies to earn active returns. The recent updates share what they've bought and sold in the last quarter, ending March 31, 2025.

Why it matters

For new investors, understanding what successful hedge funds like Third Point do can provide insights into market trends and investment strategies. Hedge funds have teams of experts who analyze opportunities, so their actions can be a valuable learning tool.

Examples or breakdown

NVIDIA (NVDA): Third Point has taken a new position worth $157.2 million in NVIDIA, a tech company known for its graphics processing units (GPUs). This might suggest a belief in the future demand for tech hardware, possibly influenced by gaming or AI developments.

CoStar Group Inc. (CSGP): Another new position for $156.5 million. CoStar provides commercial real estate information, suggesting confidence in real estate data's value.

Selling Big Names: They've sold shares in Meta Platforms, Amazon, and Tesla. This move might indicate a shift in focus or assessment of these companies' future growth.

New Bets on Stability: Investments include Kenvue, SPDR S&P 500 ETF, and AT&T, pointing towards a strategy possibly favoring stable or diversified investments amidst broader market uncertainties.

Managing Losses: Despite a loss of 3.7% in their Offshore Fund and 4.4% in their Ultra Fund, Third Point is reducing its market exposure to prepare for future opportunities.

Tips or how-to

Stay Informed: Keep an eye on what hedge funds are doing; it can signal broader market trends.

Diversify: Just like Third Point, don't put all your eggs in one basket. Spread your bets across different sectors.

Be Flexible: Adjust your portfolio as market conditions change. Third Point's strategy shows flexibility in challenging times.

Learn from Losses: Even big funds experience losses. Focus on the long-term and adjust strategies when needed.

Summary

Third Point LLC's latest investment moves provide a fascinating snapshot of how hedge funds operate. By watching these shifts, beginner investors can glean insights into market dynamics and strategic flexibility. Remember, patience and adaptability are key in the investing world.

0 notes

Text

Crypto Lead in to Coin TG@yuantou2048

Crypto Lead in to Coin TG@yuantou2048 is an exciting journey into the world of virtual currency mining. In this digital age, cryptocurrency has become a lucrative investment opportunity for many. For those interested in becoming a miner, understanding the basics is crucial. Mining involves using computer hardware to solve complex mathematical problems, which in turn verifies transactions on the blockchain network. This process not only secures the network but also rewards miners with new coins.

To get started, one must choose the right mining equipment. Graphics Processing Units (GPUs) and Application-Specific Integrated Circuits (ASICs) are popular choices due to their efficiency and performance. However, the initial investment can be significant. Therefore, it's essential to research and compare different options before making a decision. Websites like https://paladinmining.com offer valuable resources and guides for beginners.

Moreover, joining a mining pool can increase your chances of earning rewards. A mining pool combines the computing power of multiple miners, making it easier to solve blocks and share the rewards. This collaborative approach is particularly beneficial for individuals with limited resources. Additionally, staying updated with the latest trends and technologies in the crypto space is vital. The market is constantly evolving, and being informed can help you make better decisions.

In conclusion, crypto mining can be a profitable venture if approached strategically. With the right knowledge and tools, anyone can become a successful miner. Remember to always prioritize security and continuously educate yourself about the industry. For more insights and support, connect with us on TG@yuantou2048 and visit https://paladinmining.com for comprehensive guides and updates.

https://t.me/yuantou2048

BCCMining

Sunny Mining

0 notes

Text

Future of GPU As A Service Market: Trends and Forecast

The global GPU as a Service (GPUaaS) market is projected to reach USD 12.26 billion by 2030, growing at a CAGR of 22.9% from 2025 to 2030, according to a recent report by Grand View Research, Inc. This growth is being largely fueled by the increasing deployment of Artificial Intelligence (AI) and Machine Learning (ML) technologies across a wide range of industries. These technologies require extensive computational resources, a demand that Graphics Processing Units (GPUs) are well-equipped to meet. GPUaaS offers users the advantage of scalability, enabling them to adjust computing power in alignment with project-specific needs. As a result, demand for GPUaaS is rising in tandem with the broader adoption of AI and ML.

The rapid expansion of cloud computing has further accelerated the growth of GPUaaS. Leading cloud service providers are offering GPU-powered virtual machines to support tasks such as deep learning, data processing, graphics rendering, and scientific computing. These services democratize access to powerful computing capabilities, making high-performance GPUs available to users who may not be able to afford or manage on-premise hardware. For example, Amazon Web Services (AWS) delivers a range of GPU instances through its Amazon EC2 platform, designed to support varying computational requirements.

GPUaaS gives users—whether enterprises or individual developers—the flexibility to scale their GPU usage dynamically, adapting to different workload demands. This elasticity is especially attractive for organizations with fluctuating or project-based GPU needs. Google Cloud Platform (GCP) exemplifies this flexibility by offering high-performance GPU instances such as NVIDIA A100 Tensor Core GPUs, which are built on the NVIDIA Ampere architecture. These GPUs provide significant performance gains, particularly for AI, ML, and high-performance computing (HPC) workloads.

North America leads the market in terms of revenue generation. The region’s strong emphasis on digital transformation, particularly among enterprise sectors, makes GPUaaS a strategic asset in deploying AI and big data technologies. North America plays a critical role in the global cloud ecosystem, with increasing investments in infrastructure to support GPU-intensive operations.

On the other hand, the Asia Pacific region is anticipated to be the fastest-growing market over the forecast period. This growth is attributed to the region’s proactive adoption of emerging technologies, with countries like China, India, Japan, South Korea, Australia, and Singapore leading the way. Their investments in AI research, smart cities, and digital platforms continue to fuel the demand for scalable GPU resources.

Curious about the GPU As A Service Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

GPU as a Service (GPUaaS) Market: Frequently Asked Questions

1. What is the expected size of the GPUaaS market by 2030?

The global GPUaaS market is projected to reach USD 12.26 billion by 2030, growing at a CAGR of 22.9% from 2025 to 2030.

2. What’s driving the demand for GPUaaS?

Rising adoption of AI and ML, increasing data volumes, demand for flexible cloud computing solutions, and growing use of GPU-accelerated applications across industries.

3. What are the benefits of GPUaaS?

• Scalability on demand

• Cost-efficiency

• Easy integration with AI and data analytics tools

• Faster time-to-market for compute-heavy applications

4. Which industries benefit most from GPUaaS?

Key sectors include:

• Healthcare (medical imaging, genomics)

• Finance (fraud detection, algorithmic trading)

• Automotive (autonomous vehicle training)

• Entertainment (3D rendering, VFX)

• Research & academia

5. Which region leads the GPUaaS market?

North America is the largest market, driven by strong cloud infrastructure, tech adoption, and enterprise digital transformation efforts

6. Which region is expected to grow the fastest?

Asia Pacific is anticipated to grow rapidly due to aggressive investment in emerging tech by countries like China, India, Japan, and South Korea.

Order a free sample PDF of the GPU As A Service Market Intelligence Study, published by Grand View Research.

#GPU As A Service Market#GPU As A Service Market Size#GPU As A Service Market Share#GPU As A Service Market Analysis

0 notes

Text

Explosive Growth: AI PC Market Valued at $260.43 Billion by 2031

The global AI PC market, in terms of value, is projected to reach 260.43 billion by 2031 from USD 91.23 billion in 2025, at a CAGR of 19.1%. The demand for AI PCs increases as users seek personalized, real-time computing experiences. With the rise of intelligent assistants and AI-powered applications, systems that can handle these tasks are becoming essential. Companies are adopting AI PCs to enhance decision-making and streamline workflows. Additionally, these devices are crucial for design, engineering, and data science professionals, offering improved speed, privacy, and offline capabilities.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=64905377

Current trends in the AI PC market focus on integrating Neural Processing Units (NPUs) with CPUs and SoCs to enhance on-device AI efficiency. Innovations in edge computing enable local data processing, reducing latency and bandwidth use. Additionally, thermal management and battery technology improvements allow AI PCs to handle demanding workloads effectively. The convergence of AI, high-performance graphics, multi-modal inputs (such as facial recognition and voice commands), and advanced algorithms transforms PCs into smart, context-aware devices.

North America leads the global AI PC market due to its advanced technological ecosystem and high innovation adoption. It is home to major companies such as Apple, Dell, HP, and Intel, which significantly invest in AI technologies to enhance productivity, automation, and data management. Government support for AI research and the digital transformation in sectors such as education, healthcare, finance, and defense has driven market growth. A strong network of AI software developers and cloud providers fosters innovation in AI hardware and applications. The region's robust edge computing and 5G infrastructure enable low-latency, high-speed data processing, reinforcing North America's dominance in the AI PC market.

The consumer segment is anticipated to grow fastest among AI-powered PC users, driven by rising demand for intelligent and personalized computing. Users expect real-time capabilities such as voice recognition, predictive typing, smart image editing, and adaptive power management without relying on cloud services. Increased content creation and e-learning have heightened the need for high-performance PCs with multitasking and AI features. Leading companies market AI PCs as essential lifestyle products, offering superior performance, extended battery life, and enhanced security. These devices are becoming more efficient and affordable by integrating AI-optimized hardware and software. As AI technologies evolve, consumers adopt these PCs to future-proof their computers and adapt to the changing digital landscape.