#Graphics Processing Unit (GPU) Market

Explore tagged Tumblr posts

Text

#GPU Market#Graphics Processing Unit#GPU Industry Trends#Market Research Report#GPU Market Growth#Semiconductor Industry#Gaming GPUs#AI and Machine Learning GPUs#Data Center GPUs#High-Performance Computing#GPU Market Analysis#Market Size and Forecast#GPU Manufacturers#Cloud Computing GPUs#GPU Demand Drivers#Technological Advancements in GPUs#GPU Applications#Competitive Landscape#Consumer Electronics GPUs#Emerging Markets for GPUs

0 notes

Text

The Future of Gaming: The Role of Graphics Processing Units in Enhancing User Experience

The Graphics Processing Unit Market is projected to be valued at approximately USD 65.27 billion in 2024, with expectations to grow to around USD 274.21 billion by 2029, reflecting a compound annual growth rate (CAGR) of 33.20% during the forecast period from 2024 to 2029.

Market Overview: The Future of Gaming – The Role of Graphics Processing Units in Enhancing User Experience

The gaming industry has experienced rapid growth and transformation, driven by advancements in technology and changing consumer preferences. At the heart of this evolution is the Graphics Processing Unit (GPU), which plays a critical role in enhancing user experience. This overview examines the future of gaming, focusing on the pivotal role of GPUs in shaping the landscape.

Key Trends in the GPU Market for Gaming:

Technological Advancements: The GPU market is characterized by continuous technological innovations, including ray tracing, AI-driven graphics, and enhanced processing capabilities. These advancements enable more realistic graphics, smoother frame rates, and immersive gaming experiences, significantly elevating the overall user experience.

Increased Demand for High-Performance Gaming: As gaming enthusiasts demand more from their experiences, there is a growing preference for high-performance GPUs. This trend is evident in the rise of competitive gaming and eSports, where frame rates and graphics quality can impact performance. Consumers are willing to invest in advanced GPUs to achieve a competitive edge.

Cloud Gaming and GPU Integration: The rise of cloud gaming services has reshaped how games are delivered and played. GPUs are essential in these platforms, enabling remote processing of graphics-intensive games. As cloud gaming gains traction, the demand for powerful GPUs in data centers is expected to surge, enhancing accessibility and convenience for gamers.

Virtual Reality (VR) and Augmented Reality (AR): The integration of VR and AR technologies into gaming experiences necessitates advanced GPU capabilities. High-performance GPUs are crucial for rendering realistic environments and ensuring smooth interactions in immersive settings. As the popularity of VR and AR games grows, so does the demand for cutting-edge GPUs.

AI and Machine Learning in Gaming: The application of AI and machine learning in gaming is creating new opportunities for enhanced user experiences. GPUs facilitate the processing of complex algorithms, enabling smarter NPCs, adaptive gameplay, and personalized gaming experiences. This integration is expected to redefine how games are developed and played.

Challenges Facing the GPU Market:

Supply Chain Issues: The GPU market has faced challenges due to supply chain disruptions, leading to shortages and increased prices. These issues impact both consumers and manufacturers, potentially slowing the pace of technological advancement in the gaming industry.

Environmental Concerns: The environmental impact of GPU production and operation is becoming a critical consideration. As consumers become more eco-conscious, manufacturers are under pressure to develop more sustainable practices and energy-efficient GPUs to minimize their carbon footprint.

Market Competition: The GPU market is highly competitive, with several key players vying for market share. Companies must continually innovate to stay ahead, which requires significant investment in research and development. The rapid pace of change can make it challenging for smaller firms to compete effectively.

Future Outlook:

The future of gaming is intrinsically linked to the evolution of GPUs. As technology continues to advance, GPUs will play a central role in enhancing user experiences through improved graphics, performance, and interactivity. The growing demand for high-quality gaming experiences, along with the rise of cloud gaming and immersive technologies, will drive sustained growth in the GPU market.

Additionally, as AI and machine learning technologies become more integrated into gaming, the importance of powerful GPUs will only increase. Companies that invest in innovative GPU technologies and sustainable practices will be well-positioned to capitalize on these emerging trends.

In conclusion, the GPU market is at a pivotal point, with significant opportunities for growth driven by technological advancements and changing consumer preferences. By focusing on delivering high-performance, efficient, and sustainable solutions, stakeholders in the GPU market can contribute to the future of gaming, enhancing user experiences and driving industry growth.

For a detailed overview and more insights, you can refer to the full market research report by Mordor Intelligence https://www.mordorintelligence.com/industry-reports/graphics-processing-unit-market

#Graphics Processing Unit (GPU) Market#Graphics Processing Unit (GPU) Market size#Graphics Processing Unit (GPU) Market share#Graphics Processing Unit (GPU) Market trends#Graphics Processing Unit (GPU) Market analysis#Graphics Processing Unit (GPU) Market forecast#Graphics Processing Unit (GPU) Market outlook#Graphics Processing Unit (GPU) Market overview#Graphics Processing Unit (GPU) Market report#Graphics Processing Unit (GPU) industry report

0 notes

Text

0 notes

Text

Silicon Valley let out a sigh of relief on Wednesday when it learned that President Donald Trump’s tariff bonanza included an exemption for semiconductors, which, at least for now, won’t be subject to higher import duties. But just three days later, some US tech companies may be finding that the loophole actually creates more problems than it solves. After the tariffs were announced, the White House published a list of the products that it says are unaffected, and it doesn’t include many kinds of chip-related goods.

That means only a small number of American manufacturers will be able to continue sourcing chips without needing to factor in higher import costs. The vast majority of semiconductors that come into the US currently are already packaged into products that are not exempt, such as the graphics processing units (GPUs) and servers for training artificial intelligence models. And manufacturing equipment that domestic companies use to produce chips in the US wasn’t spared, either.

“If you are a major chip producer who is making a sizable investment in the US, a hundred billion dollars will buy you a lot less in the next few years than the last few years,” says Martin Chorzempa, a senior fellow at the Peterson Institute for International Economics.

The US Department of Commerce did not respond to a request for comment.

Stacy Rasgon, a senior analyst covering semiconductors at Bernstein Research, says the narrow exception for chips will do little to blunt wider negative impacts on the industry. Given that most semiconductors arrive at US borders packaged into servers, smartphones, and other products, the tariffs amount to “something in the ballpark of a 40 percent blended tariff on that stuff,” Rasgon says, referring to the overall import duty rate applied.

Rasgon notes that the semiconductor industry is deeply dependent on other imports and on the overall health of the US economy, because the components it makes are in so many kinds of consumer products, from cars to refrigerators. “They are macro-exposed,” he says.

To determine what goods the tariffs apply to, the Trump administration relied on a complex existing system called the Harmonized Tariff Schedule (HTS), which organizes millions of different products sold in the US market into numerical categories that correspond to different import duty rates. The White House document lists only a narrow group of HTS codes in the semiconductor field that it says are exempted from the new tariffs.

GPUs, for example, are typically coded as either 8473.30 or 8542.31 in the HTS system, says Nancy Wei, a supply chain analyst at the consulting firm Eurasia Group. But Trump’s waiver only applies to more advanced GPUs in the latter 8542.31 category. It also doesn’t cover other codes for related types of computing hardware. Nvidia’s DGX systems, a pre-configured server with built-in GPUs designed for AI computing tasks, is coded as 8471.50, according to the company’s website, which means it’s likely not exempt from the tariffs.

The line between these distinctions can sometimes be blurry. In 2020, for example, an importer of two Nvidia GPU models asked US authorities to clarify what category it considered them falling under. After looking into the matter, US Customs and Border Protection determined that the two GPUs belong to the 8473.30 category, which also isn’t exempt from the tariffs.

Nvidia’s own disclosures about the customs classifications of its products paint a similar picture. Of the over 1,300 items the company lists on its website, less than one-fifth appear to be exempt from Trump’s new tariffs, according to their correspondent HTS codes. Nvidia declined to comment to WIRED on which of its products it believes the new import duties apply to or not.

Bad News for US AI Firms

If a wide range of GPUs and other electronic components are subject to the highest country-specific tariffs, which are scheduled to kick in next week, US chipmakers and AI firms could be facing a significant increase in costs. That could potentially hamper efforts to build more data centers and train the world’s most cutting-edge artificial intelligence models in the US.

That's why Nvidia’s stock price is currently “getting killed,” Rasgon says, having shed roughly one-third of its value since the start of 2025.

“AI hardware, particularly high-end GPUs from Nvidia, will see rising costs, potentially stalling AI infrastructure development in the US,” says Wei from Eurasia Group. “Cloud computing, quantum computing, and military-grade semiconductor applications could also be impacted due to higher costs and supply uncertainties.”

Mark Wu, a professor at Harvard Law School who specializes in international trade, says the looming possibility that other countries embedded in the semiconductor supply chain could impose retaliatory tariffs on the US is creating a very unpredictable environment for businesses. Trump may also soon announce more tariffs specifically targeting chips, something he alluded to at a press briefing on Thursday. “There's so many different scenarios,” Wu says. “It’s almost futile to sort of speculate without knowing what's under consideration.”

More Challenges to Reshoring

Trump has said that his trade policies are intended to bring more manufacturing to the US, but they threaten to reverse what had been a bumper period for US chipmaking. The Semiconductor Industry Association recently released figures showing that sales grew 48.4 percent in the Americas between February 2023 and 2024, far above rates in China, where sales only increased 5.6 percent, and Europe, which saw sales decrease 8.1 percent.

The US has a relatively small share of the global chipmaking market as a whole, however, due to decades of offshoring. Fabrication plants located in the country account for just 12 percent of worldwide capacity, down from 37 percent in 1990. The CHIPS Act, introduced under the Biden administration, sought to reverse the trend by appropriating $52 billion for investment in chip manufacturing, training, and research. Trump called the law a “horrible thing” and recently set up a new office to manage its investments.

A glaring omission in the list of HTS code exempt from Trump’s tariffs are those that correspond to lithography machines, a highly sophisticated category of equipment central to chipmaking. Most of the world’s advanced lithography machines are made today in countries like the Netherlands (subject to a 20 percent tariff) and Japan (a 24 percent tariff). If these devices become significantly more costly to import, it could get in the way of bringing semiconductor manufacturing back to the US.

Also hit by Trump’s tariffs are a litany of less fancy but still essential ingredients for chipmaking: steel, aluminum, electrical components, lighting, and water treatment technology. All of those goods could become more expensive thanks to tariffs. “This is the classic tariff conundrum: If you put tariffs on something, it protects one kind of business, but everything upstream and downstream can lose out,” says Chorzempa.

US Allies Feel the Heat

While some countries that are already subject to US sanctions, like Russia and North Korea, were not included in the tariffs, many American allies are, like Taiwan, which plays an outsize role in the global semiconductor supply chain today compared to its size, because it’s home to companies like Taiwan Semiconductor Manufacturing Company (TSMC), which produces the lion's share of the world’s most advanced chips.

Taiwan will still feel the impact of the tariffs, despite the semiconductor carve-out, because most of what it actually exports to the US is not exempt, says Jason Hsu, a former Taiwan legislator and senior fellow at the Hudson Institute, a DC-based think tank.

Only about 10 percent of Taiwan’s exports to the US last year were semiconductor products that would be exempt from the new tariffs, according to trade data released by the Department of Commerce. The vast majority of Taiwan’s exports are things like data servers and will be taxed an additional 32 percent.

Unlike TSMC, Taiwanese companies that make servers often operate on thin margins, so they may have no choice but to raise prices for their American clients. “We might be looking at AI server prices going completely out of the roof after that,” Hsu says.

Hsu notes that the new tariffs will particularly hurt Southeast Asian countries, which could undermine a long-standing US strategic objective to decouple from supply chains in China. Countries in the region are being hit with some of the highest tariff rates of all—like Vietnam at 46 percent and Thailand at 36 percent—figures that could deter chipmaking companies like Intel and Micron from moving their factories out of China and into these places.

“I see no soft landing to this,” Hsu says. “I see this as becoming an explosion of global supply chain disorder and chaos. The ramifications are going to be very long and painful.”

9 notes

·

View notes

Text

How AMD is Leading the Way in AI Development

Introduction

In today's rapidly evolving technological landscape, artificial intelligence (AI) has emerged as a game-changing force across various industries. One company that stands out for its pioneering efforts in AI development is Advanced Micro Devices (AMD). With its innovative technologies and cutting-edge products, AMD is pushing the boundaries of what is possible in the realm of AI. In this article, we will explore how AMD is leading the way in AI development, delving into the company's unique approach, competitive edge over its rivals, and the impact of its advancements on the future of AI.

Competitive Edge: AMD vs Competition

When it comes to AI development, competition among tech giants Check out the post right here is fierce. However, AMD has managed to carve out a niche for itself with its distinct offerings. Unlike some of its competitors who focus solely on CPUs or GPUs, AMD has excelled in both areas. The company's commitment to providing high-performance computing solutions tailored for AI workloads has set it apart from the competition.

youtube

AMD at GPU

AMD's graphics processing units (GPUs) have been instrumental in driving advancements in AI applications. With their parallel processing capabilities and massive computational power, AMD GPUs are well-suited for training deep learning models and running complex algorithms. This has made them a preferred choice for researchers and developers working on cutting-edge AI projects.

Innovative Technologies of AMD

One of the key factors that have propelled AMD to the forefront of AI development is its relentless focus on innovation. The company has consistently introduced new technologies that cater to the unique demands of AI workloads. From advanced memory architectures to efficient data processing pipelines, AMD's innovations have revolutionized the way AI applications are designed and executed.

AMD and AI

The synergy between AMD and AI is undeniable. By leveraging its expertise in hardware design and optimization, AMD has been able to create products that accelerate AI workloads significantly. Whether it's through specialized accelerators or optimized software frameworks, AMD continues to push the boundaries of what is possible with AI technology.

The Impact of AMD's Advancements

The impact of AMD's advancements in AI development cannot be overstated. By providing researchers and developers with powerful tools and resources, AMD has enabled them to tackle complex problems more efficiently than ever before. From healthcare to finance to autonomous vehicles, the applications of AI powered by AMD technology are limitless.

FAQs About How AMD Leads in AI Development 1. What makes AMD stand out in the field of AI development?

Answer: AMD's commitment to innovation and its holistic approach to hardware design give it a competitive edge over other players in the market.

2. How do AMD GPUs contribute to advancements in AI?

Answer: AMD GPUs offer unparalleled computational power and parallel processing capabilities that are essential for training deep learning models.

3. What role does innovation play in AMD's success in AI development?

Answer: Innovation lies at the core of AMD's strategy, driving the company to introduce groundbreaking technologies tailored for AI work

2 notes

·

View notes

Text

MediaTek Kompanio Ultra 910 for best Chromebook Performance

MediaTek Ultra 910

Maximising Chromebook Performance with Agentic AI

The MediaTek Kompanio Ultra redefines Chromebook Plus laptops with all-day battery life and the greatest Chromebooks ever. By automating procedures, optimising workflows, and allowing efficient, secure, and customised computing, agentic AI redefines on-device intelligence.

MediaTek Kompanio Ultra delivers unrivalled performance whether you're multitasking, generating content, playing raytraced games and streaming, or enjoying immersive entertainment.

Features of MediaTek Kompanio Ultra

An industry-leading all-big core architecture delivers flagship Chromebooks unmatched performance.

Arm Cortex-X925 with 3.62 GHz max.

Eight-core Cortex-X925, X4, and A720 processors

Single-threaded Arm Chromebooks with the best performance

Highest Power Efficiency

Large on-chip caches boost performance and power efficiency by storing more data near the CPU.

The fastest Chromebook memory: The powerful CPU, GPU, and NPU get more data rapidly with LPDDR5X-8533 memory support.

ChromeOS UX: We optimised speed to respond fast to switching applications during a virtual conference, following social media feeds, and making milliseconds count in in-game battle. Nowhere is better for you.

Because of its strong collaboration with Arm, MediaTek can provide the latest architectural developments to foreign markets first, and the MediaTek Kompanio Ultra processor delivers the latest Armv9.2 CPU advantage.

MediaTek's latest Armv9.2 architecture provides power efficiency, security, and faster computing.

Best in Class Power Efficiency: The Kompanio Ultra combines the 2nd generation TSMC 3nm technology with large on-chip caches and MediaTek's industry-leading power management to deliver better performance per milliwatt. The spectacular experiences of top Chromebooks are enhanced.

Best Lightweight and Thin Designs: MediaTek's brand partners can easily construct lightweight, thin, fanless, silent, and cool designs.

Leading NPU Performance: MediaTek's 8th-generation NPU gives the Kompanio Ultra an edge in industry-standard AI and generative AI benchmarks.

Prepared for AI agents

Superior on-device photo and video production

Maximum 50 TOPS AI results

ETHZ v6 leadership, Gen-AI models

CPU/GPU tasks are offloaded via NPU, speeding processing and saving energy.

Next-gen Generative AI technologies: MediaTek's investments in AI technologies and ecosystems ensure that Chromebooks running the MediaTek Kompanio Ultra provide the latest apps, services, and experiences.

Extended content support

Better LLM speculative speed help

Complete SLM+LLM AI model support

Assistance in several modes

11-core graphics processing unit: Arm's 5th-generation G925 GPU, used by the powerful 11-core graphics engine, improves traditional and raytraced graphics performance while using less power, producing better visual effects, and maintaining peak gameplay speeds longer.

The G925 GPU matches desktop PC-grade raytracing with increased opacity micromaps (OMM) to increase scene depths with subtle layering effects.

OMM-supported games' benefits:

Reduced geometry rendering

Visual enhancements without increasing model complexity

Natural-looking feathers, hair, and plants

4K Displays & Dedicated Audio: Multiple displays focus attention and streamline procedures, increasing efficiency. Task-specific displays simplify multitasking and reduce clutter. With support for up to three 4K monitors (internal and external), professionals have huge screen space for difficult tasks, while gamers and content makers have extra windows for chat, streaming, and real-time interactions.

DP MST supports two 4K external screens.

Custom processing optimises power use and improves audio quality. Low-power standby detects wake-up keywords, improving voice assistant response. This performance-energy efficiency balance improves smart device battery life, audio quality, and functionality.

Hi-Fi Audio DSP for low-power standby and sound effects

Support for up to Wi-Fi 7 and Bluetooth 6.0 provides extreme wireless speeds and signal range for the most efficient anyplace computing.

Wi-Fi 7 can reach 7.3Gbps.

Two-engine Bluetooth 6.0

#technology#technews#govindhtech#news#technologynews#processors#MediaTek Kompanio Ultra#Agentic AI#Chromebooks#MediaTek#MediaTek Kompanio#Kompanio Ultra#MediaTek Kompanio Ultra 910

2 notes

·

View notes

Text

Motorola Edge 50 Neo Processor: Everything You Need to Know

Motorola has been making waves in the smartphone market with its Edge series, offering premium features at competitive prices. The Motorola Edge 50 Neo is no exception, delivering a stylish design, impressive display, and a capable processor that ensures smooth performance. But what exactly powers this device? Let’s take a closer look at the processor inside the Motorola Edge 50 Neo and what it brings to the table.

Which Processor Does the Motorola Edge 50 Neo Use?

The Motorola Edge 50 Neo is equipped with the MediaTek Dimensity 7030 processor. This is a mid-range chipset designed for efficient performance and power management, making it a great choice for users who want a balance between speed, battery life, and affordability.

MediaTek Dimensity 7030: Key Features and Performance

The MediaTek Dimensity 7030 is built on a 6nm process, ensuring better power efficiency and thermal management. Here’s what it offers:

1. Octa-Core CPU for Smooth Performance

The chipset features an octa-core CPU with two ARM Cortex-A78 cores clocked at up to 2.5GHz and six Cortex-A55 cores for efficiency.

This setup ensures smooth multitasking, allowing users to switch between apps seamlessly.

2. Mali-G610 GPU for Gaming

The Mali-G610 MC3 GPU enhances graphics performance, making the device suitable for gaming and media consumption.

Games like Call of Duty Mobile and PUBG should run smoothly at moderate settings.

3. 5G Connectivity for Faster Data Speeds

The Dimensity 7030 supports 5G connectivity, ensuring faster internet speeds and lower latency for streaming and online gaming.

It also supports Wi-Fi 6 and Bluetooth 5.2 for seamless wireless connectivity.

4. AI Enhancements and Camera Processing

The chipset includes MediaTek’s AI Processing Unit (APU), improving camera performance, image processing, and battery optimization.

With support for HDR video, AI-powered photography, and night mode enhancements, the Motorola Edge 50 Neo offers a great photography experience.

5. Power Efficiency for Better Battery Life

The 6nm architecture ensures better power management, helping the device last longer on a single charge.

Combined with the Edge 50 Neo’s 5000mAh battery and 68W fast charging, users can expect all-day usage with minimal downtime.

How Does the Motorola Edge 50 Neo Perform in Real Life?

With the MediaTek Dimensity 7030, the Motorola Edge 50 Neo delivers a smooth experience in day-to-day tasks like browsing, social media, and video streaming. Gamers can enjoy stable frame rates on popular titles, while multitasking remains fluid. The addition of 5G connectivity ensures users stay future-proofed for high-speed internet.

Upgrade to the Motorola Edge 50 Neo – Sell Your Old Phone on CashyGo.in!

If you're planning to upgrade to the Motorola Edge 50 Neo, you can sell your old smartphone for instant cash at CashyGo.in. This platform offers an easy and hassle-free way to trade in your old device and get the best price. Don't let your old phone sit unused—convert it into cash and upgrade to a new smartphone today!

Conclusion

The Motorola Edge 50 Neo, powered by the MediaTek Dimensity 7030, is a solid mid-range smartphone that balances performance, battery life, and 5G connectivity. Whether you’re a casual user, a mobile gamer, or someone who loves photography, this device offers a well-rounded experience at an affordable price.

Would you consider buying the Motorola Edge 50 Neo?Share your thoughts with us—leave a comment below!

2 notes

·

View notes

Text

How AMD is Leading the Way in AI Development

Introduction

In today's rapidly evolving technological landscape, artificial intelligence (AI) has emerged as a game-changing force across various industries. One company that stands out for its pioneering efforts in AI development is Advanced Check out the post right here Micro Devices (AMD). With its innovative technologies and cutting-edge products, AMD is pushing the boundaries of what is possible in the realm of AI. In this article, we will explore how AMD is leading the way in AI development, delving into the company's unique approach, competitive edge over its rivals, and the impact of its advancements on the future of AI.

Competitive Edge: AMD vs Competition

When it comes to AI development, competition among tech giants is fierce. However, AMD has managed to carve out a niche for itself with its distinct offerings. Unlike some of its competitors who focus solely on CPUs or GPUs, AMD has excelled in both areas. The company's commitment to providing high-performance computing solutions tailored for AI workloads has set it apart from the competition.

AMD at GPU

AMD's graphics processing units (GPUs) have been instrumental in driving advancements in AI applications. With their parallel processing capabilities and massive computational power, AMD GPUs are well-suited for training deep learning models and running complex algorithms. This has made them a preferred choice for researchers and developers working on cutting-edge AI projects.

Innovative Technologies of AMD

One of the key factors that have propelled AMD to the forefront of AI development is its relentless focus on innovation. The company has consistently introduced new technologies that cater to the unique demands of AI workloads. From advanced memory architectures to efficient data processing pipelines, AMD's innovations have revolutionized the way AI applications are designed and executed.

AMD and AI

The synergy between AMD and AI is undeniable. By leveraging its expertise in hardware design and optimization, AMD has been able to create products that accelerate AI workloads significantly. Whether it's through specialized accelerators or optimized software frameworks, AMD continues to push the boundaries of what is possible with AI technology.

The Impact of AMD's Advancements

The impact of AMD's advancements in AI development cannot be overstated. By providing researchers and developers with powerful tools and resources, AMD has enabled them to tackle complex problems more efficiently than ever before. From healthcare to finance to autonomous vehicles, the applications of AI powered by AMD technology are limitless.

youtube

FAQs About How AMD Leads in AI Development 1. What makes AMD stand out in the field of AI development?

Answer: AMD's commitment to innovation and its holistic approach to hardware design give it a competitive edge over other players in the market.

2. How do AMD GPUs contribute to advancements in AI?

Answer: AMD GPUs offer unparalleled computational power and parallel processing capabilities that are essential for training deep learning models.

3. What role does innovation play in AMD's success in AI development?

Answer: Innovation lies at the core of AMD's strategy, driving the company to introduce groundbreaking technologies tailored for AI work

2 notes

·

View notes

Text

How AMD is Leading the Way in AI Development

Introduction

In today's rapidly evolving technological landscape, artificial intelligence (AI) has emerged as a game-changing force across Click for more info various industries. One company that stands out for its pioneering efforts in AI development is Advanced Micro Devices (AMD). With its innovative technologies and cutting-edge products, AMD is pushing the boundaries of what is possible in the realm of AI. In this article, we will explore how AMD is leading the way in AI development, delving into the company's unique approach, competitive edge over its rivals, and the impact of its advancements on the future of AI.

Competitive Edge: AMD vs Competition

When it comes to AI development, competition among tech giants is fierce. However, AMD has managed to carve out a niche for itself with its distinct offerings. Unlike some of its competitors who focus solely on CPUs or GPUs, AMD has excelled in both areas. The company's commitment to providing high-performance computing solutions tailored for AI workloads has set it apart from the competition.

AMD at GPU

AMD's graphics processing units (GPUs) have been instrumental in driving advancements in AI applications. With their parallel processing capabilities and massive computational power, AMD GPUs are well-suited for training deep learning models and running complex algorithms. This has made them a preferred choice for researchers and developers working on cutting-edge AI projects.

Innovative Technologies of AMD

One of the key factors that have propelled AMD to the forefront of AI development is its relentless focus on innovation. The company has consistently introduced new technologies that cater to the unique demands of AI workloads. From advanced memory architectures to efficient data processing pipelines, AMD's innovations have revolutionized the way AI applications are designed and executed.

AMD and AI

The synergy between AMD and AI is undeniable. By leveraging its expertise in hardware design and optimization, AMD has been able to create products that accelerate AI workloads significantly. Whether it's through specialized accelerators or optimized software frameworks, AMD continues to push the boundaries of what is possible with AI technology.

The Impact of AMD's Advancements

The impact of AMD's advancements in AI development cannot be overstated. By providing researchers and developers with powerful tools and resources, AMD has enabled them to tackle complex problems more efficiently than ever before. From healthcare to finance to autonomous vehicles, the applications of AI powered by AMD technology are limitless.

FAQs About How AMD Leads in AI Development 1. What makes AMD stand out in the field of AI development?

Answer: AMD's commitment to innovation and its holistic approach to hardware design give it a competitive edge over other players in the market.

youtube

2. How do AMD GPUs contribute to advancements in AI?

Answer: AMD GPUs offer unparalleled computational power and parallel processing capabilities that are essential for training deep learning models.

3. What role does innovation play in AMD's success in AI development?

Answer: Innovation lies at the core of AMD's strategy, driving the company to introduce groundbreaking technologies tailored for AI work

2 notes

·

View notes

Text

How AMD is Leading the Way in AI Development

Introduction

In today's rapidly evolving technological landscape, artificial intelligence (AI) has emerged as a game-changing force across various industries. One company that stands out for its pioneering efforts in AI development is Advanced Micro Devices (AMD). With its innovative technologies and cutting-edge products, AMD is pushing the boundaries of what is possible in the realm of AI. In this article, we will explore how AMD is leading the way in AI development, delving into the company's unique approach, competitive edge over its rivals, and the impact of its advancements on the future of AI.

Competitive Edge: AMD vs Competition

When it comes to AI development, competition among tech giants is fierce. However, AMD has managed to carve out a niche for itself with its distinct offerings. Unlike some of its competitors who focus solely on CPUs or GPUs, AMD has excelled in both areas. The company's commitment to providing high-performance computing solutions tailored for AI workloads has set it apart from the competition.

AMD at GPU

AMD's graphics processing units (GPUs) have been instrumental in driving advancements in AI applications. With their parallel processing capabilities and massive computational power, AMD GPUs are well-suited for training deep learning models and running complex algorithms. This has made them a preferred choice for researchers and developers working on cutting-edge AI projects.

Innovative Technologies of AMD

One of the key factors that have propelled AMD to the forefront of AI development is its relentless focus on innovation. The company has consistently introduced new technologies that cater to the unique demands of AI workloads. From advanced memory architectures to efficient data processing pipelines, AMD's innovations have revolutionized the way AI applications are designed and executed.

AMD and AI

The synergy between AMD and AI is undeniable. By leveraging its expertise in hardware design and optimization, AMD has been able to create products that accelerate AI workloads significantly. Whether it's through specialized accelerators or optimized software frameworks, AMD continues to push the boundaries of what is possible with AI technology.

The Impact of AMD's Advancements

The impact of AMD's advancements in AI development cannot be overstated. By providing researchers and developers with powerful tools and resources, AMD has enabled them to tackle complex problems more efficiently than ever before. From healthcare to finance to autonomous vehicles, the applications of AI powered by AMD technology are limitless.

FAQs About How AMD Leads in AI Development 1. What makes AMD stand out in the field of AI development?

Answer: AMD's commitment to innovation and its holistic approach Click to find out more to hardware design give it a competitive edge over other players in the market.

2. How do AMD GPUs contribute to advancements in AI?

Answer: AMD GPUs offer unparalleled computational power and parallel processing capabilities that are essential for training deep learning models.

3. What role does innovation play in AMD's success in AI development?

Answer: Innovation lies at the core of AMD's strategy, driving the company to introduce groundbreaking technologies tailored for AI work

youtube

2 notes

·

View notes

Text

FinFET Technology Market Size, Share, Trends, Demand, Industry Growth and Competitive Outlook

FinFET Technology Market survey report analyses the general market conditions such as product price, profit, capacity, production, supply, demand, and market growth rate which supports businesses on deciding upon several strategies. Furthermore, big sample sizes have been utilized for the data collection in this business report which suits the necessities of small, medium as well as large size of businesses. The report explains the moves of top market players and brands that range from developments, products launches, acquisitions, mergers, joint ventures, trending innovation and business policies.

The large scale FinFET Technology Market report is prepared by taking into account the market type, organization volume, accessibility on-premises, end-users’ organization type, and availability at global level in areas such as North America, South America, Europe, Asia-Pacific, Middle East and Africa. Extremely talented pool has invested a lot of time for doing market research analysis and to generate this market report. FinFET Technology Market report is sure to help businesses for the long lasting accomplishments in terms of better decision making, revenue generation, prioritizing market goals and profitable business.

FinFET Technology Market, By Technology (3nm, 5nm, 7nm, 10nm, 14nm, 16nm, 20nm, 22nm), Application (Central Processing Unit (CPU), System-On-Chip (SoC), Field-Programmable Gate Array (FPGA), Graphics Processing Unit (GPU), Network Processor), End User (Mobile, Cloud Server/High-End Networks, IoT/Consumer Electronics, Automotive, Others), Type (Shorted Gate (S.G.), Independent Gate (I.G.), Bulk FinFETS, SOI FinFETS) – Industry Trends and Forecast to 2029.

Access Full 350 Pages PDF Report @

https://www.databridgemarketresearch.com/reports/global-finfet-technology-market

Key Coverage in the FinFET Technology Market Report:

Detailed analysis of FinFET Technology Market by a thorough assessment of the technology, product type, application, and other key segments of the report

Qualitative and quantitative analysis of the market along with CAGR calculation for the forecast period

Investigative study of the market dynamics including drivers, opportunities, restraints, and limitations that can influence the market growth

Comprehensive analysis of the regions of the FinFET Technology industry and their futuristic growth outlook

Competitive landscape benchmarking with key coverage of company profiles, product portfolio, and business expansion strategies

Table of Content:

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Global FinFET Technology Market Landscape

Part 04: Global FinFET Technology Market Sizing

Part 05: Global FinFET Technology Market Segmentation by Product

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Some of the major players operating in the FinFET technology market are:

SAP (Germany)

BluJay Solutions (U.K.)

ANSYS, Inc. (U.S.)

Keysight Technologies, Inc. (U.S.)

Analog Devices, Inc. (U.S.)

Infineon Technologies AG (Germany)

NXP Semiconductors (Netherlands)

Renesas Electronics Corporation (Japan)

Robert Bosch GmbH (Germany)

ROHM CO., LTD (Japan)

Semiconductor Components Industries, LLC (U.S.)

Texas Instruments Incorporated (U.S.)

TOSHIBA CORPORATION (Japan)

Browse Trending Reports:

Facility Management Market Size, Share, Trends, Growth and Competitive Outlook https://www.databridgemarketresearch.com/reports/global-facility-management-market

Supply Chain Analytics Market Size, Share, Trends, Global Demand, Growth and Opportunity Analysis https://www.databridgemarketresearch.com/reports/global-supply-chain-analytics-market

Industry 4.0 Market Size, Share, Trends, Opportunities, Key Drivers and Growth Prospectus https://www.databridgemarketresearch.com/reports/global-industry-4-0-market

Digital Banking Market Size, Share, Trends, Industry Growth and Competitive Analysis https://www.databridgemarketresearch.com/reports/global-digital-banking-market

Massive Open Online Courses (MOOCS) Market Size, Share, Trends, Growth Opportunities and Competitive Outlook https://www.databridgemarketresearch.com/reports/global-mooc-market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Email: [email protected]

#FinFET Technology Market Size#Share#Trends#Demand#Industry Growth and Competitive Outlook#market report#market share#market size#marketresearch#market trends#market analysis#markettrends#marketreport#market research

1 note

·

View note

Text

Autonomous Driving Chip Market, Emerging Trends, Regional Analysis, and Forecast to 2032

Global Autonomous Driving Chip Market size was valued at US$ 4.23 billion in 2024 and is projected to reach US$ 12.67 billion by 2032, at a CAGR of 14.7% during the forecast period 2025-2032.

Autonomous driving chips are specialized computing units that power artificial intelligence (AI) systems in self-driving vehicles. These chips process real-time sensor data, enable computer vision, and execute machine learning algorithms to make driving decisions. Key components include GPUs (Graphics Processing Units), FPGAs (Field-Programmable Gate Arrays), and ASICs (Application-Specific Integrated Circuits), each offering unique advantages for autonomous vehicle workloads.

The market growth is fueled by increasing demand for advanced driver assistance systems (ADAS), government regulations promoting vehicle safety, and rising investments in autonomous vehicle technology. While the semiconductor industry faced challenges in 2022 with only 4.4% global growth (USD 580 billion total market), autonomous driving chips remain a high-growth segment. Leading players like NVIDIA, Qualcomm, and Mobileye are driving innovation through partnerships with automakers and investments in next-generation chip architectures optimized for AI workloads.

Get Full Report : https://semiconductorinsight.com/report/autonomous-driving-chip-market/

MARKET DYNAMICS

MARKET DRIVERS

Rapid Advancements in AI and Machine Learning to Accelerate Autonomous Driving Chip Adoption

The autonomous vehicle industry is witnessing unprecedented growth due to breakthroughs in artificial intelligence and machine learning algorithms. Autonomous driving chips, which process vast amounts of sensor data in real-time, require increasingly sophisticated AI capabilities. The global AI chip market for automotive applications grew by over 35% in 2023, demonstrating the critical role these components play in enabling autonomous functionality. Leading automotive manufacturers are investing heavily in AI-powered autonomous solutions, creating a surge in demand for high-performance chips capable of processing complex neural networks while meeting stringent power efficiency requirements.

Government Initiatives and Safety Regulations Catalyzing Market Expansion

Governments worldwide are implementing policies and regulations to promote autonomous vehicle adoption while ensuring road safety. In numerous countries, substantial investments in smart city infrastructure and dedicated testing zones for autonomous vehicles are creating favorable conditions for market growth. Recent mandates requiring advanced driver-assistance systems (ADAS) in new vehicles have directly increased demand for autonomous driving chips. Furthermore, regulatory frameworks establishing safety standards for autonomous vehicle technology are driving chip manufacturers to develop more robust and reliable solutions that comply with these evolving requirements.

Increasing Preference for Luxury and Premium Vehicles to Fuel Demand

The automotive industry is experiencing a notable shift toward luxury and premium vehicles equipped with advanced autonomous features. Consumers are increasingly valuing safety, convenience, and cutting-edge technology in their vehicle purchases, with over 65% of new car buyers in developed markets considering autonomous capabilities a key purchase factor. Automakers are responding by incorporating more sophisticated autonomous systems into their premium offerings, requiring higher-performance chips with greater computational power. This trend is particularly evident in the electric vehicle segment, where autonomous features frequently accompany advanced powertrain technologies.

MARKET RESTRAINTS

High Development Costs and Complex Certification Processes Limiting Market Growth

The autonomous driving chip market faces significant restraints due to the substantial costs associated with research, development, and certification. Developing chips that meet automotive-grade reliability standards requires investments often exceeding hundreds of millions of dollars. The lengthy certification processes, which can take several years, create additional barriers to market entry. Moreover, the need for redundancy and fail-safe mechanisms in autonomous systems drives up both development timelines and production costs, making it challenging for smaller players to compete in this rapidly evolving market.

MARKET OPPORTUNITIES

Emergence of Software-Defined Vehicles to Create New Growth Avenues

The automotive industry’s shift toward software-defined vehicles presents significant opportunities for autonomous driving chip manufacturers. These next-generation vehicles require flexible hardware platforms capable of supporting over-the-air updates and evolving functionality throughout the vehicle’s lifecycle. Chip manufacturers that can deliver solutions with sufficient computational headroom and adaptable architectures stand to benefit from this transformation. The market for software-defined vehicle platforms is projected to grow exponentially as automakers seek to differentiate their offerings through continuously improving autonomous capabilities and user experiences.

MARKET CHALLENGES

Thermal Management and Power Efficiency Constraints in Chip Design

Designing autonomous driving chips that balance computational performance with power efficiency remains a formidable challenge. As autonomous systems require processing vast amounts of sensor data in real-time, chip manufacturers must develop solutions that deliver exceptional performance without exceeding thermal and power budgets. The automotive environment imposes strict limitations on heat dissipation, creating engineering challenges that often require innovative packaging solutions and advanced semiconductor manufacturing processes. These technical constraints significantly impact product development timelines and implementation costs, presenting ongoing challenges for industry players.

AUTONOMOUS DRIVING CHIP MARKET TRENDS

Advancements in AI and Edge Computing Accelerate Autonomous Driving Chip Demand

The autonomous driving chip market is experiencing rapid evolution, driven by breakthroughs in artificial intelligence and edge computing technologies. Modern autonomous systems now require chips capable of processing up to 300 TOPS (Tera Operations Per Second) for Level 4/5 autonomous vehicles, compared to just 10 TOPS for basic ADAS systems. Leading manufacturers are developing multi-core processors combining CPUs, GPUs, and dedicated AI accelerators to handle complex neural networks for real-time decision making. Additionally, the shift towards 7nm and 5nm process nodes has enabled significant improvements in power efficiency while maintaining computational throughput—a critical factor for electric vehicle applications where power consumption directly impacts range.

Other Trends

Regional Regulatory Developments

Government policies worldwide are significantly influencing autonomous chip adoption patterns. The EU’s upcoming Euro 7 emissions standards (effective 2025) include provisions incentivizing autonomous safety systems, while China’s New Energy Vehicle Industrial Development Plan (2021-2035) mandates increasing autonomy across vehicle segments. In the US, recent updates to Federal Motor Vehicle Safety Standards now explicitly address highly automated vehicles, creating clearer pathways for deployment. These regulatory tailwinds are prompting automakers to accelerate investments in autonomous driving hardware, with projected OEM spending on self-driving chips exceeding $10 billion annually by 2026.

Vertical Integration and Strategic Partnerships Reshape Competitive Landscape

The industry is witnessing a wave of strategic collaborations between semiconductor firms, automakers, and algorithm developers to create optimized hardware-software solutions. Notable examples include NVIDIA’s partnerships with over 25 automakers for its Drive platform, and Mobileye’s collaborations with 6 major OEMs for its EyeQ6 chipsets. Simultaneously, vehicle manufacturers are increasingly bringing chip development in-house—Tesla’s Full Self-Driving (FSD) chip now powers all its latest models, while BYD develops custom silicon through its semiconductor subsidiary. This vertical integration trend is compressing traditional supply chains, with some Tier 1 suppliers now offering complete autonomous driving computer modules integrating sensors, chips and middleware.

While the passenger vehicle segment currently dominates demand, increasing automation in commercial trucking, mining equipment, and agricultural machinery represents significant growth avenues. Recent pilot programs involving autonomous long-haul trucks have demonstrated potential fuel efficiency improvements up to 10% through optimized routing and platooning—capabilities heavily dependent on specialized computing hardware. Similarly, off-road autonomy applications require chips with enhanced durability and temperature tolerance, creating specialized niches within the broader market.

COMPETITIVE LANDSCAPE

Key Industry Players

Tech Giants and Innovators Battle for Dominance in Autonomous Driving Semiconductors

The global autonomous driving chip market exhibits a dynamic competitive landscape, combining established semiconductor giants with agile AI-focused startups. NVIDIA maintains its leadership position, capturing approximately 25% market share in 2024 through its advanced DRIVE platform that combines GPU, AI, and software capabilities. The company’s strength stems from its early investments in automotive-grade AI processors and partnerships with over 25 major automakers.

Qualcomm and Mobileye (an Intel subsidiary) follow closely, each holding 15-18% market share. Qualcomm’s Snapdragon Ride platform gained significant traction after securing design wins with BMW and General Motors, while Mobileye’s EyeQ chips power advanced driver-assistance systems (ADAS) in nearly 40 million vehicles globally. Both companies benefit from their specialized architectures optimized for power efficiency and machine learning tasks.

The competitive intensity increased recently with vertical integration moves by automakers. Tesla made waves by developing its Full Self-Driving (FSD) chip in-house, demonstrating how OEMs are bringing chip design capabilities internally. Meanwhile, Chinese players like Horizon Robotics and Black Sesame Technologies are gaining ground through government-supported initiatives, capturing nearly 30% of China’s domestic autonomous chip demand.

Emerging trends show semiconductor firms increasingly forming strategic alliances – NVIDIA partnered with Mercedes-Benz for its next-generation vehicles, while Qualcomm acquired Veoneer to bolster its automotive software stack. Such moves indicate the market is evolving toward integrated solutions combining hardware, algorithms, and vehicle integration expertise.

List of Key Autonomous Driving Chip Companies Profiled

NVIDIA Corporation (U.S.)

Qualcomm Technologies, Inc. (U.S.)

Mobileye (Intel Subsidiary) (Israel)

Tesla, Inc. (U.S.)

Huawei Technologies Co., Ltd. (China)

Horizon Robotics (China)

Black Sesame Technologies (China)

SemiDrive (China)

Texas Instruments (U.S.)

Renesas Electronics Corporation (Japan)

Infineon Technologies AG (Germany)

SiEngine Technology (China)

Segment Analysis:

By Type

ASIC Segment Dominates Due to High Efficiency in AI Processing for Autonomous Vehicles

The market is segmented based on type into:

GPU

FPGA

ASIC

Others (including hybrid architectures)

By Application

Passenger Car Segment Leads as OEMs Accelerate Adoption of L3+ Autonomous Features

The market is segmented based on application into:

Commercial Vehicle

Passenger Car

By Processing Type

Neural Network Accelerators Gain Prominence for Deep Learning Applications

The market is segmented based on processing capability into:

Computer Vision Processors

Neural Network Accelerators

Sensor Fusion Processors

Path Planning Processors

By Autonomy Level

L3 Systems Show Strong Adoption Though L4 Development Gains Momentum

The market is segmented based on SAE autonomy levels into:

L1-L2 (Driver Assistance)

L3 (Conditional Automation)

L4 (High Automation)

L5 (Full Automation)

Regional Analysis: Autonomous Driving Chip Market

North America The North American autonomous driving chip market is witnessing robust growth, driven by substantial investments in vehicle electrification and smart mobility infrastructure. The U.S. leads with companies like Tesla, NVIDIA, and Qualcomm pioneering advancements in AI-powered semiconductor solutions. Government initiatives, such as the Infrastructure Investment and Jobs Act, allocate funding for smart transportation, indirectly boosting demand for autonomous chips. Stringent safety regulations by the NHTSA and rapid adoption of L4 autonomous vehicles in commercial fleets further accelerate market expansion. However, high R&D costs and supply chain bottlenecks remain key challenges for chip manufacturers.

Europe Europe’s autonomous driving chip market thrives on strong automotive OEM partnerships and strict EU emissions norms pushing autonomous electrification. Germany dominates with BMW, Mercedes-Benz, and Volkswagen integrating advanced chips from Infineon and Mobileye. The EU’s 2030 Digital Compass policy emphasizes AI-driven mobility, creating favorable conditions for ASIC and FPGA chip developers. While the region excels in precision engineering, fragmented regulatory frameworks across member states and slower consumer adoption of fully autonomous vehicles limit mid-term growth potential. European manufacturers focus on radar-LiDAR fusion chips to comply with Euro NCAP safety protocols.

Asia-Pacific As the largest and fastest-growing market, APAC benefits from China’s aggressive Made in China 2025 semiconductor strategy and Japan’s leadership in automotive-grade chip manufacturing. Chinese firms like Huawei and Horizon Robotics capture over 30% regional market share through state-backed initiatives. India emerges as a dark horse with rising investments in local chip fabrication units to reduce import dependence. While cost-sensitive markets still prefer legacy GPU solutions, the shift toward L3 autonomy in passenger vehicles and government mandates for ADAS in commercial trucks drive demand. Intense price competition and IP theft concerns however deter foreign investors in some countries.

South America South America’s market remains nascent but shows promise with Brazil and Argentina piloting autonomous freight corridors. Local production is minimal as most chips are imported from North American and Asian suppliers. Economic instability and low vehicle automation penetration hinder large-scale adoption, though mining and agriculture sectors demonstrate early interest in off-road autonomous equipment chips. Regulatory bodies are gradually formulating ADAS policies, with Brazil’s CONTRAN Resolution 798/2020 setting basic autonomous vehicle testing standards. Infrastructure gaps and currency volatility continue to discourage major chip investments.

Middle East & Africa The MEA region is strategically positioning itself through smart city projects in UAE and Saudi Arabia, where autonomous taxis and ports require specialized chips. Dubai’s Autonomous Transportation Strategy aims for 25% of trips to be driverless by 2030, creating opportunities for edge-computing chip vendors. Israel’s tech ecosystem fosters innovation with Mobileye dominating vision-processing chips. African growth is uneven – while South Africa tests autonomous mining vehicles, most nations lack funding for large deployments. The absence of uniform regulations and low consumer purchasing power slows mainstream adoption across the region.

Get A Detailed Sample Report : https://semiconductorinsight.com/download-sample-report/?product_id=97531

Report Scope

This market research report provides a comprehensive analysis of the global and regional Autonomous Driving Chip markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments.

Segmentation Analysis: Detailed breakdown by product type (GPU, FPGA, ASIC, Others), technology, application (Commercial Vehicle, Passenger Car), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, including country-level analysis where relevant.

Competitive Landscape: Profiles of leading market participants, including their product offerings, R&D focus, manufacturing capacity, pricing strategies, and recent developments such as mergers, acquisitions, and partnerships.

Technology Trends & Innovation: Assessment of emerging technologies, integration of AI/IoT, semiconductor design trends, fabrication techniques, and evolving industry standards.

Market Drivers & Restraints: Evaluation of factors driving market growth along with challenges, supply chain constraints, regulatory issues, and market-entry barriers.

Stakeholder Analysis: Insights for component suppliers, OEMs, system integrators, investors, and policymakers regarding the evolving ecosystem and strategic opportunities.

Primary and secondary research methods are employed, including interviews with industry experts, data from verified sources, and real-time market intelligence to ensure the accuracy and reliability of the insights presented.

Customization of the Report

In case of any queries or customization requirements, please connect with our sales team, who will ensure that your requirements are met.

Related Reports :

Contact us:

+91 8087992013

0 notes

Text

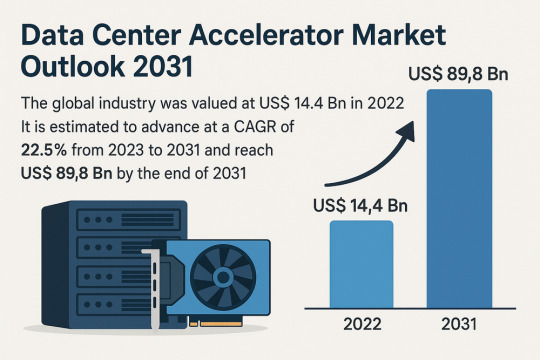

Data Center Accelerator Market Set to Transform AI Infrastructure Landscape by 2031

The global data center accelerator market is poised for exponential growth, projected to rise from USD 14.4 Bn in 2022 to a staggering USD 89.8 Bn by 2031, advancing at a CAGR of 22.5% during the forecast period from 2023 to 2031. Rapid adoption of Artificial Intelligence (AI), Machine Learning (ML), and High-Performance Computing (HPC) is the primary catalyst driving this expansion.

Market Overview: Data center accelerators are specialized hardware components that improve computing performance by efficiently handling intensive workloads. These include Graphics Processing Units (GPUs), Tensor Processing Units (TPUs), Field Programmable Gate Arrays (FPGAs), and Application-Specific Integrated Circuits (ASICs), which complement CPUs by expediting data processing.

Accelerators enable data centers to process massive datasets more efficiently, reduce reliance on servers, and optimize costs a significant advantage in a data-driven world.

Market Drivers & Trends

Rising Demand for High-performance Computing (HPC): The proliferation of data-intensive applications across industries such as healthcare, autonomous driving, financial modeling, and weather forecasting is fueling demand for robust computing resources.

Boom in AI and ML Technologies: The computational requirements of AI and ML are driving the need for accelerators that can handle parallel operations and manage extensive datasets efficiently.

Cloud Computing Expansion: Major players like AWS, Azure, and Google Cloud are investing in infrastructure that leverages accelerators to deliver faster AI-as-a-service platforms.

Latest Market Trends

GPU Dominance: GPUs continue to dominate the market, especially in AI training and inference workloads, due to their capability to handle parallel computations.

Custom Chip Development: Tech giants are increasingly developing custom chips (e.g., Meta’s MTIA and Google's TPUs) tailored to their specific AI processing needs.

Energy Efficiency Focus: Companies are prioritizing the design of accelerators that deliver high computational power with reduced energy consumption, aligning with green data center initiatives.

Key Players and Industry Leaders

Prominent companies shaping the data center accelerator landscape include:

NVIDIA Corporation – A global leader in GPUs powering AI, gaming, and cloud computing.

Intel Corporation – Investing heavily in FPGA and ASIC-based accelerators.

Advanced Micro Devices (AMD) – Recently expanded its EPYC CPU lineup for data centers.

Meta Inc. – Introduced Meta Training and Inference Accelerator (MTIA) chips for internal AI applications.

Google (Alphabet Inc.) – Continues deploying TPUs across its cloud platforms.

Other notable players include Huawei Technologies, Cisco Systems, Dell Inc., Fujitsu, Enflame Technology, Graphcore, and SambaNova Systems.

Recent Developments

March 2023 – NVIDIA introduced a comprehensive Data Center Platform strategy at GTC 2023 to address diverse computational requirements.

June 2023 – AMD launched new EPYC CPUs designed to complement GPU-powered accelerator frameworks.

2023 – Meta Inc. revealed the MTIA chip to improve performance for internal AI workloads.

2023 – Intel announced a four-year roadmap for data center innovation focused on Infrastructure Processing Units (IPUs).

Gain an understanding of key findings from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=82760

Market Opportunities

Edge Data Center Integration: As computing shifts closer to the edge, opportunities arise for compact and energy-efficient accelerators in edge data centers for real-time analytics and decision-making.

AI in Healthcare and Automotive: As AI adoption grows in precision medicine and autonomous vehicles, demand for accelerators tuned for domain-specific processing will soar.

Emerging Markets: Rising digitization in emerging economies presents substantial opportunities for data center expansion and accelerator deployment.

Future Outlook

With AI, ML, and analytics forming the foundation of next-generation applications, the demand for enhanced computational capabilities will continue to climb. By 2031, the data center accelerator market will likely transform into a foundational element of global IT infrastructure.

Analysts anticipate increasing collaboration between hardware manufacturers and AI software developers to optimize performance across the board. As digital transformation accelerates, companies investing in custom accelerator architectures will gain significant competitive advantages.

Market Segmentation

By Type:

Central Processing Unit (CPU)

Graphics Processing Unit (GPU)

Application-Specific Integrated Circuit (ASIC)

Field-Programmable Gate Array (FPGA)

Others

By Application:

Advanced Data Analytics

AI/ML Training and Inference

Computing

Security and Encryption

Network Functions

Others

Regional Insights

Asia Pacific dominates the global market due to explosive digital content consumption and rapid infrastructure development in countries such as China, India, Japan, and South Korea.

North America holds a significant share due to the presence of major cloud providers, AI startups, and heavy investment in advanced infrastructure. The U.S. remains a critical hub for data center deployment and innovation.

Europe is steadily adopting AI and cloud computing technologies, contributing to increased demand for accelerators in enterprise data centers.

Why Buy This Report?

Comprehensive insights into market drivers, restraints, trends, and opportunities

In-depth analysis of the competitive landscape

Region-wise segmentation with revenue forecasts

Includes strategic developments and key product innovations

Covers historical data from 2017 and forecast till 2031

Delivered in convenient PDF and Excel formats

Frequently Asked Questions (FAQs)

1. What was the size of the global data center accelerator market in 2022? The market was valued at US$ 14.4 Bn in 2022.

2. What is the projected market value by 2031? It is projected to reach US$ 89.8 Bn by the end of 2031.

3. What is the key factor driving market growth? The surge in demand for AI/ML processing and high-performance computing is the major driver.

4. Which region holds the largest market share? Asia Pacific is expected to dominate the global data center accelerator market from 2023 to 2031.

5. Who are the leading companies in the market? Top players include NVIDIA, Intel, AMD, Meta, Google, Huawei, Dell, and Cisco.

6. What type of accelerator dominates the market? GPUs currently dominate the market due to their parallel processing efficiency and widespread adoption in AI/ML applications.

7. What applications are fueling growth? Applications like AI/ML training, advanced analytics, and network security are major contributors to the market's growth.

Explore Latest Research Reports by Transparency Market Research: Tactile Switches Market: https://www.transparencymarketresearch.com/tactile-switches-market.html

GaN Epitaxial Wafers Market: https://www.transparencymarketresearch.com/gan-epitaxial-wafers-market.html

Silicon Carbide MOSFETs Market: https://www.transparencymarketresearch.com/silicon-carbide-mosfets-market.html

Chip Metal Oxide Varistor (MOV) Market: https://www.transparencymarketresearch.com/chip-metal-oxide-varistor-mov-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected] of Form

Bottom of Form

0 notes

Text

Graphics Add-in Board (AIB) Market 2025-2032

MARKET INSIGHTS

The global Graphics Add-in Board (AIB) Market size was valued at US$ 47,300 million in 2024 and is projected to reach US$ 89,600 million by 2032, at a CAGR of 9.67% during the forecast period 2025-2032.

Graphics Add-in Boards are dedicated hardware components that enhance visual processing capabilities in computing devices. These boards contain GPUs (Graphics Processing Units) that accelerate image rendering for applications ranging from gaming to professional visualization. AIBs come in two primary configurations: discrete (standalone units with dedicated memory) and integrated (embedded solutions sharing system resources).

The market growth is driven by several factors including increasing demand for high-performance gaming, expansion of AI and machine learning applications, and growing adoption in data centers. While the discrete segment dominates with 78% market share in 2024, integrated solutions are gaining traction in mobile devices. Key players like Nvidia Corporation and Advanced Micro Devices Inc. continue to innovate, with recent launches such as Nvidia’s RTX 40 series pushing performance boundaries. However, supply chain constraints and fluctuating component costs remain challenges for manufacturers.

Receive Your Sample Report at No Cost-https://semiconductorinsight.com/download-sample-report/?product_id=97892

Key Industry Players

Market Leaders Accelerate Innovation to Capture Evolving Demand

The global Graphics Add-in Board (AIB) market exhibits a semi-consolidated structure dominated by tech giants and specialized manufacturers. Nvidia Corporation leads the industry with a revenue share exceeding 80% in the discrete GPU segment as of 2024, owing to its cutting-edge RTX 40-series GPUs and dominant position in AI-powered graphics solutions. The company’s continuous R&D investments and strategic partnerships with OEMs solidify its market leadership.

Advanced Micro Devices Inc. (AMD) follows closely with its Radeon RX 7000 series, capturing approximately 19% market share through aggressive pricing strategies and energy-efficient designs. Recent advancements in chiplet technology and FSR upscaling have enabled AMD to challenge Nvidia’s dominance, particularly in the mid-range GPU segment.

While Intel Corporation entered the dedicated GPU market more recently with its Arc series, the company’s strong foothold in integrated graphics and strategic pricing have allowed it to carve out a niche. Other players including ASUS, Gigabyte, and MSI collectively account for significant aftermarket share through branded AIB offerings featuring custom cooling solutions and factory overclocking.

List of Key Graphics Add-in Board Manufacturers

Nvidia Corporation (U.S.)

Advanced Micro Devices Inc. (U.S.)

Intel Corporation (U.S.)

AsusTek Computer Inc. (Taiwan)

Gigabyte Technology Co. Ltd. (Taiwan)

EVGA Corporation (U.S.)

Micro-Star International Co. (Taiwan)

Sapphire Technology (Hong Kong)

ZOTAC (PC Partner Limited) (Hong Kong)

The competitive landscape continues evolving with emerging technologies like AI-powered rendering and ray tracing accelerating product refresh cycles. While Nvidia maintains technological leadership through its CUDA ecosystem, competitors are leveraging open standards and alternative architectures to diversify the market. The growing demand for both high-end gaming GPUs and workstation-class solutions ensures dynamic competition across price segments.

Segment Analysis:

By Type

Discrete Segment Dominates Due to High Performance Demand in Gaming and Professional Applications

The market is segmented based on type into:

Discrete

Integrated

By Application

Desktop Segment Leads Owing to Persistent Demand for High-End Graphics in PC Gaming

The market is segmented based on application into:

Desktops

Notebooks and Tablets

Workstations

Others

By End User

Gaming Segment Maintains Strong Position Due to Rising Esports and VR Adoption

The market is segmented based on end user into:

Gaming

Professional Visualization

Data Centers

Others

Claim Your Free Sample Report-https://semiconductorinsight.com/download-sample-report/?product_id=97892

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Graphics Add-in Board (AIB) Market?

-> Graphics Add-in Board (AIB) Market size was valued at US$ 47,300 million in 2024 and is projected to reach US$ 89,600 million by 2032, at a CAGR of 9.67% during the forecast period 2025-2032.

Which key companies operate in Global AIB Market?

-> Key players include NVIDIA Corporation, Advanced Micro Devices Inc., Intel Corporation, ASUS, MSI, Gigabyte Technology, EVGA, ZOTAC, and Sapphire Technology.

What are the key growth drivers?

-> Key growth drivers include gaming industry expansion, AI/ML workloads, professional visualization demands, and increasing GPU adoption in data centers.

Which region dominates the market?

-> North America currently leads with 35% market share, while Asia-Pacific is the fastest-growing region at 11.2% CAGR.

What are the emerging trends?

-> Emerging trends include AI-accelerated computing, real-time ray tracing, advanced cooling solutions, and increasing VRAM capacities.

About Semiconductor Insight:

Established in 2016, Semiconductor Insight specializes in providing comprehensive semiconductor industry research and analysis to support businesses in making well-informed decisions within this dynamic and fast-paced sector. From the beginning, we have been committed to delivering in-depth semiconductor market research, identifying key trends, opportunities, and challenges shaping the global semiconductor industry.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

Related Url-

0 notes

Text

On April 15, U.S. chipmaker Nvidia published a filing to the U.S. Securities and Exchange Commission indicating that the government has restricted the company from selling its less advanced graphics processing unit (GPU)—the H20—to China. The company is now required to obtain a license from the U.S. Commerce Department’s Bureau of Industry and Security to sell the H20 and any other chips “achieving the H20’s memory bandwidth, interconnect bandwidth, or combination thereof” to China, according to the filing.

Similarly, a filing from AMD stated that the firm is now restricted from selling its MI308 GPU to China—and likely any chips that have equal or higher performance in the future. Intel’s artificial intelligence accelerator Gaudi will also be restricted under the new control threshold, which reportedly appears to limit chips with total DRAM bandwidth of 1,400 gigabytes per second or more, input/output bandwidth of 1,100 GB per second or more, or a total of both of 1,700 GB per second or more.

The possible new threshold not only restricts the advanced chips that were already controlled but also the less advanced chips from Nvidia, AMD, and other chipmakers, including Nvidia’s H20, AMD’s MI308X, and Intel’s Gaudi, which were used to comply with the export control threshold and intended primarily for sale in the Chinese market.

The new restriction came roughly a week after NPR reported that the Trump administration had decided to back off on regulating the H20. Prior to that report, curbs on the H20 and chips with comparable performance had been widely anticipated by analysts on Wall Street, industry experts in Silicon Valley, and policy circles in Washington.

The latest set of chip controls could be seen as following on from export restrictions during the Biden administration and as continuation of the Trump administration’s efforts to limit China’s access to advanced AI hardware. But the new measure carries far-reaching industry implications that could fundamentally reshape the landscape of China’s AI chip market.

The impact of the new rule on the industry is profound. With the new controls, Nvidia is estimated to immediately lose about $15 billion to $16 billion, according to a J.P. Morgan analysis. AMD, on the other hand, faces $1.5 billion to 1.8 billion in lost revenue, accounting for roughly 10 percent of its estimated data center revenue this year.

Yet the implications go beyond immediate financial damage. If the restriction persists, it will fundamentally reshape the Chinese AI chip market landscape and mark the start of a broader retreat for U.S. AI accelerators from China. That includes not only GPU manufacturers such as Nvidia, AMD, and Intel but also firms providing application-specific integrated circuits—another type of chips targeting specific AI workloads, such as Google’s TPU and Amazon Web Servies’ Trainium.