#HR and payroll software

Explore tagged Tumblr posts

Text

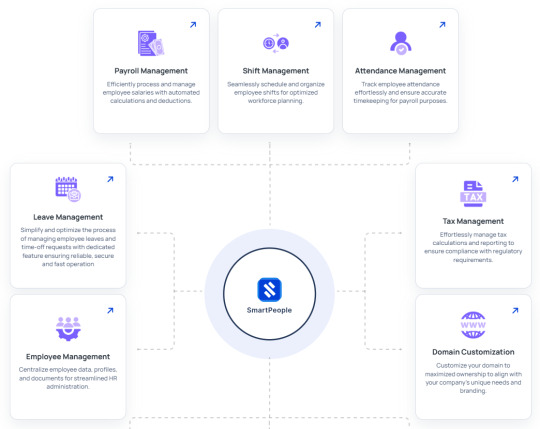

Streamline Workforce Management with SmartOffice: The Smart HR Solution

Effective workforce management is essential for success and growth in today's fast-paced business environment. SmartOffice is a cloud-based HRM solution that offers a comprehensive set of tools to meet current and future business needs. Whether managing internal growth or onboarding new hires, SmartOffice guarantees a smooth, effective, and significant HR experience.

SmartOffice unifies all crucial HR operations into a single, intuitive platform, revolutionizing the way companies handle their human resources. From hiring and onboarding to promotions and staff grouping, this one-stop shop streamlines intricate HR duties and improves overall business performance.

SmartOffice's work slot allocation feature makes onboarding easier than ever by guaranteeing that each new hire is assigned to the appropriate role right away. Productivity is increased, and new hires are able to get started quickly thanks to this strategic placement.

Employee mobility features from SmartOffice make it simple to identify and reward talent. HR professionals can highlight high performers and facilitate career advancement without administrative burden, thanks to the streamlined promotions and transitions.

Advanced access controls and employee grouping can improve security and teamwork. HR managers can assign workers to departments, roles, or projects using SmartOffice, which facilitates efficient teamwork and gives them individualized access to sensitive data.

Businesses that use SmartOffice not only stay up to date with change but also take the lead. Discover a more intelligent approach to personnel management and unleash the full potential of your company. Your doorway to effective, safe, and forward-thinking HR management is SmartOffice.

#hrm#hrmanagement#HR and Payroll Solution#HR and Payroll Software#HRMS Solution#Employee Management#employee management software#employee management system#SmartOffice#SmartPeople

3 notes

·

View notes

Text

Top 10 Benefits of Integrating HRMS and Payroll Software in 2025

As businesses evolve, so do their internal processes. HR teams are under pressure to manage growing workforces, complex compliance requirements, and dynamic payroll systems, often with limited resources. In this context, integrating HRMS and payroll software has become a strategic move rather than just a tech upgrade.

In this blog, we will outline the top 10 benefits of combining HRMS and payroll software, especially in 2025, when automation, compliance, and efficiency are more critical than ever.

What Is HRMS and Payroll Integration?

HRMS is a digital platform used to manage a company’s core HR functions—recruitment, attendance, leave tracking, performance, and more. Payroll software handles salary calculations, deductions, tax compliance, and payslip generation.

When integrated, these systems create a unified platform that allows HR and payroll functions to share data, eliminate redundancies, and automate end-to-end employee management workflows.

Top 10 Benefits of Integrated HRMS and Payroll Software

1. Centralised Employee Data Management

With integrated systems, all employee data, from personal details to tax declarations, is stored in a single database. This eliminates duplication and ensures consistency across HR and payroll operations.

2. Accurate and Timely Salary Processing

Attendance, leave, and benefits data flow directly into the payroll engine. The best payroll software automatically calculates net salaries, deductions, reimbursements, and bonuses, reducing manual errors and ensuring timely disbursal.

3. Simplified Statutory Compliance

The software auto-updates to reflect changes in tax laws, statutory deductions, and labour regulations. It can generate reports for PF, ESI, TDS, and Form 16, ensuring accurate and on-time filing and reducing the risk of penalties.

4. Time and Attendance Integration

Integrated systems sync attendance devices and leave management tools directly with payroll. This real-time tracking ensures that only approved work hours are compensated, improving payroll accuracy and transparency.

5. Reduced Administrative Workload

Automation of repetitive tasks like payslip generation, tax calculations, leave encashment, and salary revision letters by HRMS payroll software saves significant time for HR and finance teams. It allows staff to focus on more strategic functions.

6. Enhanced Employee Self-Service

Employees can log into the portal to download payslips, check tax deductions, apply for leave, and update personal information. This reduces HR dependency and improves process efficiency.

7. Improved Data Security and Access Control

Integrated systems provide role-based access to sensitive employee and payroll data. Built-in security protocols, encryption, and audit trails ensure compliance with data privacy standards like GDPR.

8. Real-Time Analytics and Reporting

HR and finance leaders can generate real-time reports on workforce costs, attrition trends, payroll outflow, tax liabilities, and more. These insights help with forecasting and strategic planning.

9. Scalability for Growing Teams

Whether your workforce expands from 50 to 500 or you onboard remote teams across geographies, an integrated cloud-based solution adapts without requiring new systems or manual intervention.

10. Cost Savings Over Time

HR and payroll software reduces error-related costs, lowers compliance risk, and improves staff productivity. Over time, this results in measurable cost savings across departments.

Conclusion

Managing HR and payroll as separate processes creates silos, increases manual effort, and exposes companies to compliance risks. Integration isn’t just a convenience—it’s a necessity for operational efficiency in today’s hybrid and fast-growing business environments.

By adopting a unified HRMS and payroll solution, businesses position themselves for smoother operations, accurate compensation handling, and better workforce insights—all of which are crucial in 2025 and beyond.

If you are looking to integrate HRMS and payroll software for your business, you should check out OpportuneHR. They are an award-winning HRMS software company in Mumbai known for developing tailor-made software solutions according to business requirements. Visit OpportuneHR to learn more about their services.

0 notes

Text

How HR and Payroll Software Boosts Productivity and Reduces Errors

Efficiency is now a must in the fast-paced business environment of today, not a luxury. Every minute wasted on repetitive admin work or manual data entry costs a business both time and money. Nowhere is this more evident than in human resources and payroll functions. From onboarding new employees to calculating salaries and filing taxes, HR and payroll departments handle some of the most sensitive and complex tasks in a company.

That’s where HR and payroll software comes in. By automating routine tasks, reducing human error, and providing real-time data insights, these tools are transforming how businesses operate. Let’s explore how HR and payroll software significantly boosts productivity and reduces costly errors—and why more companies are making the switch.

1. Automating Time-Consuming Tasks

Manual HR and payroll processes are riddled with inefficiencies. Data must be entered, verified, and cross-checked across multiple spreadsheets to ensure accuracy. That takes hours and opens the door for mistakes.

HR and payroll software automates these repetitive tasks:

Employee onboarding

Leave and attendance tracking

Timesheet approvals

Payroll calculations

Payslip generation

Tax computations and filings

This automation allows HR professionals to shift their focus from paperwork to people. Instead of spending hours processing payroll, they can invest time in building engagement strategies, refining recruitment processes, or improving company culture.

2. Reducing Human Error

Even the most meticulous HR manager is not immune to mistakes. Miscalculated tax deductions or incorrect decimals on a payslip may result in financial penalties, noncompliance, and dissatisfaction among employees.

With HR and payroll software:

Formulas are predefined, reducing calculation errors

Integrated data across systems ensures consistency

Automated alerts flag discrepancies or missing information

Compliance rules are built into the software to meet local labor laws and tax regulations

As a result, businesses can significantly lower their risk of payroll errors, which often lead to underpayment, overpayment, or government audits.

3. Centralized Employee Data

In many companies, employee data is scattered across different folders, spreadsheets, or even physical files. In addition to wasting time, this results in inaccurate data and problems with version control.

HR and payroll software centralizes all employee data in one secure platform. That means:

HR managers can quickly access records for leaves, benefits, salary history, or performance reviews

Employees can use self-service portals to see and update their data.

Payroll runs are faster because data doesn’t have to be manually collected from multiple sources.

A centralized system ensures data integrity and eliminates the time-consuming back-and-forth between departments.

4. Improved Compliance and Reporting

Keeping up with labor laws, tax codes, and government regulations is a full-time job in itself. One missed update or deadline can trigger penalties or lawsuits.

Modern HR and payroll software is regularly updated to reflect the latest legal changes. It can:

Automatically apply statutory deductions (e.g., social security, income tax)

Generate compliance-ready reports and payslips

File tax returns electronically

Maintain digital audit trails for transparency

This level of automation not only ensures accuracy but also gives business owners peace of mind knowing they��re meeting all legal requirements.

5. Faster Payroll Processing

Processing payroll manually—especially for a growing team—can be an overwhelming task. It involves tracking hours worked, calculating deductions, accounting for bonuses, and ensuring tax compliance.

With a few clicks, payroll software takes care of this. Many systems integrate with time-tracking tools and attendance systems, pulling real-time data to calculate salaries instantly. This reduces the payroll processing time from days to minutes.

Faster processing means employees get paid on time, every time—which is critical for morale and trust.

6. Enhanced Employee Experience

Modern employees expect transparency and control. They want to access their payslips, update personal information, apply for leave, and track their benefits—without having to call HR.

A self-service portal offered by HR and payroll software permits staff members to:

Download payslips

View tax deductions and leave balances

Update their bank and contact details

Submit reimbursement claims

This reduces HR workload and improves employee satisfaction. Higher engagement and lower attrition are the results of a better experience.

7. Scalability for Growing Businesses

As your company grows, so does the complexity of managing HR and payroll. Hiring more employees, managing benefits, and staying compliant across multiple locations becomes challenging.

Payroll and HR tools are made to grow with your company. Whether you have 10 or 1,000 employees, the system can adapt without requiring massive administrative overhead. Features like role-based access, department-wise reporting, and automated workflows make it easier to manage a large workforce efficiently.

This scalability guarantees that you're thriving through expansion rather than merely surviving it.

8. Real-Time Insights for Better Decision-Making

Beyond automation and accuracy, HR and payroll software delivers powerful data insights. Dashboards and reports provide real-time visibility into key metrics like:

Absenteeism trends

Payroll costs

Overtime expenses

Attrition rates

Hiring pipeline performance

These insights help business leaders make smarter decisions about workforce planning, budgeting, and strategy. You may proactively increase performance and profitability rather than responding to issues as they arise.

9. Cost Savings in the Long Run

While investing in HR and payroll software might seem like an upfront cost, it pays for itself in multiple ways:

Fewer compliance penalties

Reduced manual labor

Improved efficiency and productivity

Less reliance on external payroll providers

Enhanced accuracy reduces overpayments and wage disputes

Over time, the software helps streamline operations, reduce HR overhead, and free up resources to focus on growth.

10. Remote Access and Cloud Convenience

In a world where hybrid and remote work are the norm, accessibility is key. Cloud-based HR and payroll solutions offer anytime, anywhere access. HR teams can process payroll, access documents, and run reports from any location.

Similarly, employees can apply for leave or download payslips on the go—via mobile apps or web portals.

This flexibility is no longer optional. It’s essential for modern businesses that want to stay agile and competitive.

Final Thoughts

Payroll and HR software is a competitive advantage, not just a convenience. By automating manual tasks, reducing human error, centralizing data, and ensuring compliance, these tools dramatically improve productivity across your organization.

As businesses continue to navigate evolving workforce demands and complex regulations, having the right software in place becomes mission-critical. If your HR and payroll processes are still manual or outdated, now is the time to invest in a solution that empowers your team and future-proofs your operations.

#HR Payroll Software#hr and payroll software#payroll management software#best hr and payroll software#hr and payroll software for small business

0 notes

Text

One People is an integrated global unified cloud HR & payroll management suite system with comprehensive solutions that streamline human resource processes, eliminate tedious paperwork, foster efficiency and thus drive value.

Visit One People HR & Payroll Software website.

1 note

·

View note

Text

How HRMS Solutions in India Drive Business Growth & Efficiency

Introduction

As businesses scale, managing HR processes manually becomes a bottleneck. HRMS (Human Resource Management System) solutions in India provide organizations with the agility to automate HR tasks, enhance workforce productivity, and ensure compliance.

How HRMS Tools in India Streamline Business Operations

Enhanced Payroll Processing – Ensures timely salary payments with automated tax deductions.

Centralized Employee Database – Reduces paperwork and manual errors.

Compliance & Legal Management – Minimizes risks related to statutory regulations.

Workforce Analytics – Provides data-driven insights for strategic HR planning.

Choosing the Best HRMS Company in India

Organizations must evaluate HRMS software companies in India based on:

User experience & customization

Scalability & integration capabilities

Security & data protection

Conclusion

HRMS solutions in India are no longer optional but a necessity for organizations aiming for operational excellence. By investing in a top-tier HRMS company in India, businesses can streamline HR functions, enhance employee satisfaction, and drive long-term growth.

Read more: Understanding HRMS Software Price in India: Is It Worth the Investment?

#HR payroll system#HRMS payroll software#HR and payroll software#HRMS payroll software in India#Best HRMS and payroll software in India#HRMS payroll system

0 notes

Text

Payroll Software Features That Improve Compliance

In this constantly evolving world of speed and hustle, pay roll compliance is something which creates a lot of headache for companies. With constant changes in tax laws and labor regulations, it becomes very important for a company to always follow the very updated legal requirement in order to stay clear from penalties. Manual Payroll Management increases the risk of human errors and takes a toll on time. Here, Payroll Software becomes the most important tool in automating the compliance process and ensuring error-free payroll processing. When we have the Best Payroll Software in India, businesses can maintain proper taxation, employee class types, and reporting while complying with labor laws.

How Payroll Software Can Be Helpful in Maintaining Business Compliance

Payroll compliance means complying with tax regulations, wage laws, or other statutory requirements. A robust Payroll Software in India brings automation and accuracy so that businesses can pay more attention to these matters of compliance. Here are the main features that keep the payroll complaints for organizations:

Automatically Calculate and File Taxes

Accurate and timely tax computing and filing turns out as one of the busiest and most challenging affairs for businesses. Payroll Software calculates federal, state, and local taxes automatically under the updated tax laws. This feature helps businesses:

Deduct correct amounts of tax from employee salaries.

File the tax forms and payments in front of prescribed deadlines.

Keep updated with the changes in tax rules that arise.

Wage and Hour Tracking

Wage and hours regulations are important with respect to compliance with labor regulations for businesses. Payroll Software in India helps in tracking working hours, overtime, and break time of employees. It may fulfill the minimum wage and overtime laws. It also:

Provides accurate timesheets and attendance reports for employees.

Alerts businesses regarding wage discrepancies.

Helps in avoiding any labor law violations.

Employee Classification

Wrong employee classifications may lead to legal penalties and back payment claims. The Best Payroll Software in India helps to classify employees accurately by:

Differentiating between full time, part time and employees on contract basis.

Applying the correct tax rates and wage policies Authorizing, and detailing, any possible risk for misclassification during payroll.

Compliance with Leave Management

Leave management is yet another very important aspect that has been considered in payroll compliance. Payroll Software has all the features required for automating leave tracking and aids companies in meeting their obligations regarding sick leave, maternity, and paid time off policies. It:

Government policies consider how to accrue leave based on the given policies of the particular company.

Tracking leave balances without any possible manual errors.

It helps confirm that the organizations are compliant with the laws of the federal and state governments regarding leave.

Reporting New Employees

Businesses are required to report new hires to state agencies. Indian Payroll Software does this with minimal manual intervention by:

Submitting employee data to the government.

Maintaining I-9 and W-4 forms, and so on.

Integrating new-hire-reporting functions into employee onboarding workflows.

Audit Trails and Compliance Reporting

Maintaining payroll records in detail is of utmost importance to get compliance. Free Payroll Software maintains all Payroll Records and audit trails on any payroll action. This will enable companies to:

Incorporate factual compliance reports while audits.

Keep track of changes that were done in payroll data.

Ensure transparency and accountability in the payroll process. Why Choosing the Right Payroll Software is Important

Choosing the Best Payroll Software in India is imperative for businesses to ward off legal pitfalls and ensure compliance. The right payroll software solution should provide for automated compliance, continuously updated with the latest labor laws, and integrates seamlessly with HR systems. Kredily provides a full Payroll Software solution for efficient payroll while enabling businesses to be compliant.

Conclusion

Payroll compliance is not merely paying employees; however, it is actually about compliance with tax laws, wage laws, and reporting requirements. Right Payroll Software gives the extra power of automating compliance and eliminating legal penalties which arise on manual errors. Kredily Payroll Software in India provides an integrated solution for smooth payroll processing and puts businesses on the right side of the law.

Step into a seamless journey of payroll compliance - Schedule for a free demo on Kredily's Payroll Software right away!

#Payroll Software#Employee Payroll Software#Best Payroll Software in India#Payroll Software in India#HR and Payroll Software#Online Payroll Software

0 notes

Text

What is HR and Payroll Software and How Does It Streamline Employee Payroll Management?

Simplify HR processes with PerfettoHR, a leading HR and payroll software solution. Automate tasks, manage employee data, streamline payroll, and boost efficiency. Experience seamless HR management with PerfettoHR.

0 notes

Text

Streamlining Workforce Management with HR and Payroll Software

Managing a workforce properly is vital for the success of any firm. HR departments handle a variety of tasks, from hiring and onboarding to processing payroll and maintaining compliance. By combining these duties onto a single platform, HR and payroll software streamlines them, allowing businesses to cut down on errors, save time, and concentrate on key projects.

What is HR and Payroll Software?

HR payroll software is a digital solution that automates and simplifies operations linked to payroll and human resources. It offers resources for managing employees, calculating salaries, ensuring tax compliance, administering benefits, and more. Integrating these activities minimizes redundancies, lowers manual errors, and enhances operational efficiency.

Key Features of HR and Payroll Software

Employee Database Management: Centralized storage of employee information, accessible in real-time.

Payroll Automation: Automatic salary calculation, tax deductions, and compliance tracking using payroll software.

Time and Attendance Tracking: Integration with biometric systems and online time logs.

Benefits Administration: Management of employee perks, insurance, and retirement plans.

Self-Service Portals: Allows employees to access pay stubs, update information, and submit requests.

Compliance Management: Ensures adherence to labor laws, tax regulations, and industry standards.

Recruitment and Onboarding: Tools for job posting, applicant tracking, and new hire training.

Benefits of HR and Payroll Software

Efficiency and Accuracy: Reduces the risk of errors in payroll processing and HR tasks.

Time Savings: Automates repetitive tasks, allowing HR teams to focus on strategic initiatives.

Improved Compliance: Keeps the organization up to date with regulatory requirements.

Enhanced Employee Experience: Self-service tools empower employees and reduce HR workload.

Cost Savings: Minimizes overhead costs associated with manual HR and payroll management.

Trends in HR and Payroll Software

Cloud-Based Solutions: Providing flexibility and access from anywhere. You can work with solutions like proven travel management software.

Artificial Intelligence (AI): Automating data analysis, payroll predictions, and employee sentiment analysis.

Mobile Accessibility: Enabling employees and managers to manage tasks on the go.

Integration with Other Tools: Seamless connections with accounting, ERP, and project management software. The scope ranges from hiring and selection platforms to employee offboarding software technology.

Focus on Employee Wellness: Including features for mental health support, feedback, and engagement tracking.

Conclusion

HR and payroll software is transforming how businesses manage their workforce. By automating essential tasks, these tools enhance efficiency, ensure compliance, and improve the employee experience. As organizations continue to embrace digital transformation, investing in the right HR reporting software is a strategic move that pays dividends in productivity and employee satisfaction.

#HR and payroll software#HR payroll software#travel management software#employee offboarding software#HR reporting software

0 notes

Text

Best HR And Payroll Software

Sage 300 People is the best HR and payroll software solution, adeptly supporting both present and future HR requirements.

#greytrix africa ltd#sage hrms#hrms software#sage 300 people#sage hrms software#hr and payroll software

0 notes

Text

5 Key HR Metrics Every Startup Should Track (and How OpportuneHR Captures Them All)

In the fast-moving world of startups and small businesses, every decision counts, and that includes how you manage your people. While many founders and business owners focus heavily on sales, product development, or fundraising, HR often becomes an afterthought until it becomes a problem.

But here’s the reality: early-stage HR decisions can shape your company culture, retention rates, and compliance readiness for years to come.

That’s where tracking the right HR metrics becomes essential. With robust HR software for startups like OpportuneHR, even lean teams can make data-driven HR decisions without hiring an army of HR professionals.

Let’s explore 5 HR metrics every startup or SME should monitor and how OpportuneHR simplifies it all.

1. Time-to-Hire

For startups and small businesses, hiring speed can be a competitive edge. A prolonged hiring cycle may result in lost productivity, missed opportunities, and even candidate drop-offs.

Common Problem:

Without a structured hiring process or digital tracking system, startups often rely on outdated methods to manage recruitment, which leads to delays and confusion.

How OpportuneHR Helps:

OpportuneHR’s recruitment module captures key hiring data automatically. You can track the average time taken from job posting to offer acceptance, identify bottlenecks, and streamline your recruitment funnel—all from a single dashboard.

2. Employee Turnover Rate

In startups, every resignation feels magnified. High attrition can disrupt operations, lower morale, and increase hiring costs. More importantly, it may signal deeper cultural or operational issues.

Common Problem:

Most small businesses don’t track attrition trends consistently, especially if they lack formal HR processes.

How OpportuneHR Helps:

The platform offers real-time attrition reports, segmented by department, tenure, and even exit reasons. This allows HR executives and founders to make timely interventions—whether it’s conducting stay interviews or redesigning onboarding for better retention.

3. Attendance and Leave Trends

Small teams mean every absence impacts overall productivity. Tracking leave patterns helps identify workload issues, absenteeism trends, or even burnout signals.

Common Problem:

Without a centralised HRMS, small businesses often use basic tools to track attendance and leaves. This leads to errors, disputes, and payroll inaccuracies.

How OpportuneHR Helps:

OpportuneHR offers biometric and app-based attendance tracking, automated leave approvals, and detailed reports on leave balances, trends, and exceptions. The system ensures transparency for both employees and HR teams, making it an ideal HRMS software for small business operations.

4. Training & Development Hours per Employee

Upskilling is vital for retaining top talent and staying competitive. Startups that invest in learning early on tend to build more adaptable teams and stronger internal leadership pipelines.

Common Problem:

Many startups struggle to document or track employee training, especially if it happens informally or across multiple tools.

How OpportuneHR Helps:

Through its learning management integration, OpportuneHR enables SMEs to track training hours, completion rates, and post-training evaluations. You get a clear picture of who’s growing and where there may be skill gaps.

5. Payroll Accuracy Rate

Incorrect payroll is more than a technical glitch. It erodes employee trust, creates compliance risks, and wastes valuable time correcting mistakes.

Common Problem:

Many small businesses still use spreadsheets or disconnected systems to manage payroll, leading to missed payments, statutory non-compliance, or miscalculations.

How OpportuneHR Helps:

As one of the best HR software for startups, OpportuneHR offers fully integrated payroll processing with real-time sync between attendance, leave, and compensation data. It ensures statutory compliance, generates payslips, and even handles TDS and PF calculations automatically.

Why These Metrics Matter More in SMEs and Startups

Startups and SMEs operate with smaller teams and tighter budgets. They can’t afford high attrition, mis-hires, or compliance penalties. Tracking HR metrics is a strategic necessity.

That’s why choosing the right HR software for SME operations is crucial. Tools like OpportuneHR are built specifically with agility, automation, and simplicity in mind. You don’t need a large HR team; you just need the right system.

Final Thoughts

The foundation of a scalable business isn’t just great products—it’s great people, managed well.

By focusing on critical HR metrics like time-to-hire, turnover, and payroll accuracy, startups and small businesses can drive sustainable growth without the chaos. And with OpportuneHR, you don’t have to build these capabilities from scratch.

If you’re looking for a reliable, customisable, and cost-effective HR software for startups or a scalable HR software for startups, OpportuneHR may be the partner you’ve been searching for.

0 notes

Text

TOP HRMS Software Trends in UAE for 2025: What's Next for HR and Payroll Solutions?

Introduction

As we approach 2025, businesses in the UAE are increasingly seeking innovative solutions to streamline their HR operations. The search for the TOP HRMS software trends in the UAE for 2025 has gained momentum as companies look for future-ready HR and Payroll solutions. Whether you're a small business or a large corporation, understanding these emerging trends in the HRMS landscape can provide a competitive edge.

The Rise of Cloud-Based HRMS

Cloud technology continues to revolutionize the HR software space, offering flexibility and scalability that traditional on-premise systems cannot match. In the UAE, cloud-based HRMS solutions are gaining popularity due to their ability to facilitate remote work and ensure business continuity. Readmore........

0 notes

Link

#hrms software dubai#hr and payroll software#employee management software#talent management software

0 notes

Text

Cloud HR Software for Affordable Business Functions

The idea of affordability in an engaging HR management system or platform is of crucial importance. When you focus on dedicated operations management modules to boost the value of engaging HR features or models, it is easier for you to promote an active and essential HRMS platform process. This post is about the dedicated support of deploying cloud HR software to boost the various business processes and functions in an organization associated with affordability and related solutions.

Affordable Business Features of Cloud HR Software

The promise of a dedicated and proven HR management system to boost the various aspects of cloud solutions and services can be actively demonstrated with the care and support of an experienced operations model. When you focus on the delivery of different HR software functions or cloud solutions based on affordability considerations, check out the below points:

Enhanced employee supportThe functions under the HR and payroll software management in an exclusive operations process can be suitably managed and achieved with the terrific support of an active HRMS platform with optimum considerations for affordable or free services. You can utilize maximum or enhanced support in this format.

Predictive collaborationsWhen you are open to building and deploying predictive functions to boost the various HR management features, the overall affordability will improve. It will help create a significant model to boost the core HR management functions under the operations domain. HR application software is a highlight in this particular format.

System integrationsIf you are open to the provision of engaging and empowering system integrations in an HR model or portal, then the ideal solution is to go for an exclusive and unique operations management platform with high-performance functions. An example is the HR software for small business units.

Productive analytics valuesIf the primary objective of your HR management process is a genuine routine for adopting and developing analytics solutions, it will be a boon to raise your business productivity and operational efficiency. You can use excellent low-cost HR software for this feature assistance.

Automated trainingWhen you have automation and training support to boost your core HR processes, it guarantees various tactics to boost the affordability of the entire operations segment with ease.

The prominent features and functions that add value to your cloud HR software factors under the specific additions in an operations management realm are open to innovative possibilities like customization and personalized upgrades. It helps you connect well with the unique aspects and observations under the core HR management domain with optimum support for operations integration functions.

0 notes

Text

A complete solution for automating and streamlining payroll and human resource management procedures inside a company is HR and Payroll Software. In order to provide precise and effective administration of payroll processes, it provides features including employee data management, attendance monitoring, leave management, wage computation, and compliance reporting. Businesses can use this software to improve worker management, maintain compliance with labour laws, and increase productivity. Given its flexible capabilities and simple to operate interface is it's an ideal option for companies seeking to simplify complex hiring processes and improve satisfaction among workers.

0 notes

Text

What Is Cloud Payroll Software & Why Do You Need It?

Cloud Payroll Software: A Smarter Way to Manage Payroll

Payroll management is a crucial aspect of any business, but traditional payroll systems often lead to inefficiencies, errors, and compliance risks. Cloud Payroll Software provides an advanced, digital solution that automates payroll processing, ensures compliance, and improves overall efficiency.

For businesses looking to simplify salary calculations, tax deductions, and employee payments, investing in payroll software in India can be a game-changer. By leveraging cloud technology, organizations can manage payroll operations seamlessly while reducing costs and minimizing manual errors.

Understanding Cloud Payroll Software

What Is Cloud-Based Payroll?

Cloud Payroll Software is a web-based payroll solution that allows businesses to automate and manage their payroll processes from a centralized platform. Unlike traditional payroll systems, cloud-based solutions store data on secure online servers, making payroll operations more efficient and accessible.

How Cloud Payroll Works

Employers enter employee work hours, benefits, and deductions into the system.

The payroll processing software automatically calculates salaries, taxes, and bonuses.

Payslips are generated, and salaries are transferred directly through integrated banking systems.

Cloud-based payroll systems eliminate the need for manual calculations, reducing errors and ensuring timely salary disbursement.

Key Benefits of Cloud Payroll Software

1. Accessibility and Mobility

Manage payroll from any location with internet access.

Employees can view payslips and tax documents remotely.

2. Automation and Efficiency

Automated tax calculations reduce the risk of compliance errors.

Payroll is processed faster, saving valuable time for HR teams.

3. Enhanced Security and Compliance

Secure data storage with encryption and backup solutions.

Regular updates ensure compliance with the latest tax laws.

4. Cost Savings and Scalability

Lower operational costs compared to traditional payroll systems.

Easily scale the software as your business grows without additional infrastructure costs.

5. Employee Self-Service Features

Employees can update personal details and access payroll records.

HR teams spend less time on manual data entry and payroll queries.

6. Seamless Integrations

Connects with accounting, HR, and financial management tools.

Reduces data duplication and improves overall workflow efficiency.

Why Choose the Best Cloud Payroll Software in India?

With a growing number of businesses adopting digital payroll systems, finding the best cloud payroll software in India is essential. Here’s what to look for when selecting a provider:

User-friendly interface with automated payroll features.

Compliance with Indian labor laws and tax regulations.

Integration with existing HR and accounting software.

Reliable customer support and security features.

Cloud-based payroll solutions help businesses manage salaries, taxes, and deductions without the need for extensive manual intervention. By selecting a reliable provider, organizations can improve payroll accuracy and ensure seamless payroll processing.

Making the Switch to Cloud Payroll

Transitioning to cloud payroll software allows businesses to automate payroll operations, improve compliance, and reduce administrative burdens. Whether you are a startup or an established enterprise, adopting a cloud-based payroll system ensures accuracy, efficiency, and cost-effectiveness.

Invest in payroll software in India today to simplify payroll management and take your business to the next level.

#cloud payroll software#HR and Payroll Software#Free Payroll Software#Payroll Software in India#Payroll Software#employee payroll software

0 notes