#How to manage EMI payments

Explore tagged Tumblr posts

Text

What Are the Consequences of Missing a Personal Loan EMI?

Introduction

A personal loan is a convenient financial tool that helps individuals cover expenses such as medical emergencies, home renovations, education, or debt consolidation. However, missing an Equated Monthly Installment (EMI) can have serious financial consequences. A missed payment can affect your credit score, increase financial penalties, and even lead to legal action if not managed properly.

Understanding the consequences of missing a personal loan EMI and learning how to prevent it can help borrowers maintain financial stability. In this guide, we’ll discuss the impacts of missing EMIs, how to recover from a missed payment, and preventive measures to avoid future defaults.

Immediate Consequences of Missing a Personal Loan EMI

1. Late Payment Fees and Penalties

Lenders charge late payment fees when an EMI is not paid by the due date. The penalty amount varies from lender to lender and typically ranges from 2% to 5% of the overdue EMI. This additional charge increases your repayment burden.

2. Negative Impact on Credit Score

Missing an EMI negatively affects your CIBIL score and overall creditworthiness. A lower score can reduce your chances of obtaining future loans and credit cards at favorable interest rates.

3. Increase in Interest Accumulation

If you miss an EMI, the unpaid amount continues to accrue interest, increasing the total loan cost. Over time, repeated missed payments can make repayment significantly more expensive.

4. Loan Default Risk

If multiple EMIs are missed, the lender may classify the loan as a Non-Performing Asset (NPA), leading to legal action or loan recall.

Long-Term Consequences of Repeated EMI Defaults

1. Legal Action from Lenders

Banks and NBFCs can initiate legal proceedings against borrowers who repeatedly default on payments. This can lead to severe financial and legal troubles.

2. Difficulty in Getting Future Loans

A poor repayment history makes it challenging to secure future personal loans, home loans, or car loans. Lenders view defaulters as high-risk borrowers and may reject new loan applications.

3. Asset Seizure (For Secured Loans)

If your personal loan is secured by collateral, such as a fixed deposit or property, the lender has the legal right to seize the asset if EMIs are consistently missed.

4. Higher Interest Rates on Future Loans

Even if you qualify for a loan after defaulting, lenders may charge higher interest rates due to your damaged credit history.

What to Do If You Miss a Personal Loan EMI?

If you’ve missed an EMI, follow these steps to minimize the impact:

1. Make the Payment Immediately

If possible, pay the overdue EMI at the earliest to avoid additional penalties and interest accumulation.

2. Contact Your Lender for an EMI Extension

Many lenders offer grace periods or flexible repayment plans for borrowers facing temporary financial difficulties.

3. Opt for a Loan Restructuring

If you’re struggling with multiple debts, request a loan restructuring to extend the repayment tenure and lower EMI amounts.

4. Use an Emergency Fund

If available, use your savings or emergency fund to cover missed EMIs and avoid financial penalties.

5. Consider a Balance Transfer

If the current EMI is too high, transferring your loan to another lender with a lower interest rate can help reduce the financial burden.

How to Avoid Missing a Personal Loan EMI?

1. Set Up Automatic Payments

Enroll in auto-debit or standing instructions to ensure EMIs are paid on time without manual intervention.

2. Maintain an EMI Emergency Fund

Keep at least three to six months’ worth of EMI payments in a separate savings account to cover unexpected financial difficulties.

3. Choose an EMI Date That Matches Your Salary Cycle

Selecting an EMI date right after your salary is credited reduces the chances of missed payments.

4. Opt for a Loan with Flexible Repayment Options

Some lenders offer personal loans with flexible EMI options, allowing borrowers to increase or decrease EMIs based on financial conditions.

5. Reduce Unnecessary Expenses

If your financial situation is tight, cut back on non-essential spending to ensure EMIs are always paid on time.

Top Lenders Offering Flexible EMI Repayment Plans

For borrowers seeking low-interest rates and flexible EMI options, the following lenders provide some of the best personal loan offers:

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

Axis Finance Personal Loan

Axis Bank Personal Loan

InCred Personal Loan

Conclusion

Missing a personal loan EMI can lead to serious consequences, including late fees, credit score damage, increased interest costs, and legal troubles. However, timely action, such as contacting the lender, making partial payments, and opting for restructuring, can help minimize the impact.

To prevent EMI defaults, borrowers should use automatic payments, maintain an emergency fund, and choose flexible repayment plans.

For the best personal loan options with easy repayment terms, visit:

Apply for a Personal Loan

By managing your EMIs effectively, you can avoid financial stress and maintain a healthy credit profile.

#personal loan#loan apps#personal loan online#finance#fincrif#nbfc personal loan#bank#personal loans#loan services#personal laon#Personal loan#Missed EMI#Loan default consequences#Personal loan EMI payment#Late payment charges on personal loan#Personal loan repayment#EMI penalty fees#Credit score impact#Personal loan overdue#Loan restructuring#Loan repayment options#Loan moratorium#Personal loan late fees#How to manage EMI payments#Loan balance transfer#Loan settlement process#EMI payment delay consequences#Best personal loan repayment plans#Flexible EMI options#Personal loan non-payment effects

0 notes

Text

The Real Reason The Police Split Up

You've probably heard of all the whitewashed stories about how the band and why, at the very point they were in terms of sales the biggest band in the world, they fell apart? Well for those of you who have never saw the following, here it is, in full technicolour.

To give you some background, the band was in the middle of a world tour, yet Sting insisted on them recording miming a song for Kenny Everett's Christmas Special due later that year - Kenny Everett being a DJ with a even more successful sideline running a series of alternative comedy shows. Kenny had been very generous to the band in their earlier days when most mainstream DJs had been lukewarm, and Sting wasn't too big for his boots to feel that they always owed him one, especially as the Christmas Special was to be themed in defence of Everett's naughty humour, which now had him in danger of being what people would call today 'cancelled'. A new controller had taken charge of the BBC, Michael Grade, and was openly reconsidering Everett's entire employment with the corporation.

(In the early 1980s, a combination of what later was deemed 'political correctness' along with an increasingly militant Christian lobby in the UK that had supplanted the tea room tut-tuts of the likes of Mary Whitehouse, was to put a lot of acts reliant on comedy considered lewd or irreverent in serious danger of being finished) To let you know how influential a DJ Kenny Everett was, he was the man largely responsible for turning 'Bohemian Rhapsody' into one of the biggest hits of all time by saturation playing it on his Capitol Radio show, even though Queen's record company EMI said it was too long and listeners 'would get bored'.

However the other two, Stewart Copeland and Andy Summers, as Americans, really didn't give a toss - as far as they were concerned the band as international superstars had long outgrown needing to be chummy with parochial celebrities.

But the band's manager (and former CIA agent) Miles insisted Sting was right and they must do the show, the UK was a big record market in those days and the vanishing of all their musical peers from the punk/new wave era was a sharp reminder that in a fickle business they always needed to keep their friends close.

It already exacerbated tensions with Copeland and Summers feeling Sting was treating them too much like they were his backing band (The Jam had already split messily earlier that year amid similar circumstances, along with recriminations and legal writs concerning non-payment of royalties by Paul Weller's dad, who just happened to be their manager) and had held back good material for his own solo record project (a charge Sting in turn labelled at both of them)

Thus the stage was set for a bit of a disaster ...

youtube

Afterwards, the band completed their world tour by March 1984, but it was clear something had changed, and it came as no surprise to anyone in the UK that, apart from a few charity concerts, some rather awkward appearences at music award ceremonies, and a half hearted meeting about recording new material, they were never to record together ever again.

8 notes

·

View notes

Text

HOUNDS OF LOVE

m.fushiguro x fem oc (she/her pronouns)

jjk fanfic (roughly follows anime storyline)

WARNING:

‼️ gore descriptions, violence, nsfw, smut ‼️

☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩

PART ONE: Fearsome Womb Arc

☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩

No. 1

This was her life, at least the past four years of it, boisterous, rude people, dirty ramen bowls, stingy management, shitty payment, and unnecessary stress. She supposed this was what it was like being sixteen and living alone.

She sighed as she wriggled her way through the busy restaurant. She placed the dirty bowl in the bin before wiping her hands on her apron, then brushed the hair out of her face.

“Emi…” The girl perked up at the sound of her name as she looked over to find her coworker motioning her over. “He’s here again.”

“Huh?” Emiri questioned as she moved to the front of the restaurant.

Her confusion dispersed at the sight of the familiar man. His height was towering, with his white hair pushed up and his usual blindfold covering his eyes.

“Gojo,” She sighed as she watched the man linger across the street.

For the rest of her shift, Emiri’s mind lingered on Gojo. This wasn’t the first time he had loitered outside her place of work.

It wasn’t the first time she had caught him lurking around her in general. The sun began to set on the city as Emiri accepted why Gojo stood patiently outside.

Emiri sighed as she exited the empty restaurant, being the last to leave she locked the door behind her. Finally, she turned and looked at Gojo across the street.

The road was silent as she stared down the tall white-haired man. Suddenly he took a step forward and smiled as he neared her.

“Emiri Hara,” he chortled as she remained unamused. “Wow, you sure look happy to see me!”

“What do you want?” she crossed her arms not letting up on her serious attitude despite his jokes. “You’re acting like I haven’t seen you hanging around…watching me.”

Gojo laughed as he removed his hands from his pockets and took a stance beside her. He was wearing his usual all-black uniform as Emiri stood in front of him in a mangey yellow and orange uniform.

Gojo’s smile never faded as he towered over Emiri, to him she was still a ten-year-old with dead parents whom he had just saved from certain death.

“Gojo,” She urged getting sick of his attempts at mystery.

“What? I can’t just stop by to see you?” He huffed in response to her annoyance.

She sighed as she untied her apron and shoved it in her bag. Then she unpinned her hair letting it fall to its natural length, stopping just above her hips. Her hair was a mangled mess of black and white strands of hair.

The two-toned hair was a genetic marvel her mother had passed down to her. Emiri recalled when she first met Gojo and how amazed he was by her hair, but she brushed away the faint memory of Gojo.

“When I haven’t seen you in six years, no. No, you can’t,” Emiri stated coldly.

Saturo Gojo was something of a savior to her back then, when she was a naive child. Now she saw right through his attempts to make her a Jujutsu Sourcer. She wanted nothing to do with the matter.

Emiri had grown up around the power of cursed energy and had mastered it at the mere age of seven. Her parents had trained her tirelessly, and subjected her to torture, all in hopes she would follow in their footsteps as assassins.

Gojo was the one who found her the night they were killed, the night they tried to sacrifice their child to save themselves.

“Emiri,” Gojo smirked as he raised his finger. “I have a proposition for you-”

“I don’t want to go to your school,” she cut him off curtly. “I’ve already told you.”

“Yeah, yeah you’ve sworn off your cursed energy…” Gojo mocked before he turned to her with a serious demeanor. “That doesn’t change what you can do. Who you could save…”

He could tell his words struck a chord with her. Although she wasn’t his child, Gojo had a habit of looking at his students as children of his own.

“My whole life…I’ve been used as a weapon,” she began softly as she looked down. “I won’t do it anymore.”

“Come and learn…I think you’d be the perfect addition to the first-years. Let us teach you that you can use that power as you please, Emiri, to save people,” he gave a cheeky smile as he patted her shoulder and then began down the street. “Think about it, kid.”

Emiri watched as Gojo walked away, his words lingering in the air like a whispered promise. She stood there for a moment, the weight of his proposition heavy on her shoulders.

For years, she had tried to distance herself from the world of cursed energy, from the memories of her parents' dark legacy. The thought of stepping back into that world filled her with a mixture of fear and defiance. But despite her reluctance, there was a part of her that couldn't help but be drawn to the allure of Gojo's offer.

As she walked home through the dimly lit streets, her mind raced with conflicting thoughts. On one hand, the idea of using her powers on her terms was enticing.

On the other hand, the thought of getting tangled up in the dangerous world of Jujutsu Sorcery was enough to send shivers down her spine.

Arriving at her small apartment, Emiri smiled softly at the large black dog awaiting her arrival. He was massive with pointed ears and a square jaw resembling a Pitbull with the muscular body of a Mastiff. She reached down scratched the dog ears and chuckled.

“Seven,” She placed a kiss on his head. “Good boy.”

She sighed as she sank onto her futon, exhaustion washing over her. Seven assumed position on the floor by her feet in a protective manner.

She stared up at the ceiling, lost in thought. Gojo's words echoed in her mind, reminding her of the potential she held within her.

But as she drifted off to sleep, she made a silent vow to herself. She would not let her past define her future. Whatever path she chose, it would be on her terms, no one else's. And with that resolve, she closed her eyes, ready to face the future held as she decided that it held accepting Gojo’s offer.

The next morning, Emiri woke up with a newfound determination coursing through her veins. As she prepared for the day ahead, she couldn't shake the feeling that accepting Gojo's offer was the right decision for her. Next thing she knew she found herself calling Saturo Gojo and boarding a train to Tokyo.

As the train rattled along the tracks, Emiri’s mind buzzed with anticipation and uncertainty. She glanced out of the window, watching the landscape blur past as she headed towards Tokyo, towards a new chapter of her life.

Emiri navigated her way through the crowded streets, Seven faithfully by her side every step of the way. Eventually, she found herself standing outside the gates of the prestigious Jujutsu High School, the place where Gojo had offered her a chance at a different kind of life.

“Emiri!"

She turned to see Gojo striding towards her, his signature grin lighting up his face.

“I'm glad you decided to come," he said, his tone genuine. “Welcome to Jujutsu High."

With a smile of her own, Emiri nodded, feeling a sense of belonging wash over her. She may have been hesitant at first, but deep down, she knew that this was where she was meant to be. Gojo’s eyes fell to the large dog standing beside her.

“Oh, wow! Who’s this?” Gojo gawked as he leaned toward Seven.

“Oh, I wouldn’t,” Emiri warned as Gojo reached to pet the dog receiving a harsh bark and snarl. “He doesn’t really like…people.”

She shrugged as Gojo shuddered. “And you traveled with that thing?!”

“He’s a shikigami,” she informed calmly. “By manipulating my own blood I made him a real dog, but if I die he dies. Most people can’t see him, only curse users.”

“I see,” Gojo hummed, yet he was still terrified of the hound in front of him. “Well, I suppose it’s time to meet the other first-years! No need to meet with Principle Masamichi, he’s been awaiting your arrival for years.”

Emiri followed Gojo through the campus. As they walked through the campus, she couldn't help but feel a sense of excitement building within her.

Gojo led her into a building with a narrow hall, he went on to explain the dormitory as he stopped at the third door from the end. He triumphantly announced that this would be Emiri’s room.

She nodded as she entered and was quick to set down her bags. Seven pounced around the room in excitement causing Emiri to laugh as she watched him spin.

“Ah, there he is!” Gojo shouted from the hallway. Emiri wandered out of the room to find Gojo grinning at a tall boy with dark spikey hair and hazy green eyes. “The other first-year!”

“Megumi,” Emiri huffed as she stood in the doorway.

The boy's eyes locked with hers. Megumi Fushiguro was a pretty boy, his hair was jet black and styled in a spikey mess on his head. He was lean and muscular despite his baggy uniform and his eyes were dark but a piercing green.

Before another word could leave her mouth, Seven came bounding out of the room at the scent of Megumi. Emiri watched as the dog leaped past her and towards Megumi. Megumi prepared himself for the dog's weight as Seven happily lunged at him.

“Seven, no…” Emiri warned as Seven attacked Megumi with kisses.

“Thought he didn’t like people…” Gojo chuckled as he watched Emiri pull the dog off Megumi.

“No, he does…” Emiri turned back to Gojo with a smirk. “He just doesn’t like you, Gojo. You didn’t remember him…I’ve had Seven since I was seven,” she continued reluctantly. “Yet, somehow turns out Megumi seems to be his favorite person.”

Megumi gave a stiff smile as Emiri looked over at him and Seven settled to sit at her feet.

“Never thought you’d join Jujutsu High,” He stated curtly as he brushed off his uniform and Emiri huffed at the remark.

“I knew you two would be happy to see each other,” Gojo beamed, despite the clear animosity between the two first-years.

Megumi’s eyes followed to the open door behind Emiri. His eyes fell to the bag sitting on the floor of the bare. He heaved a sigh.

“There are so many vacancies,” he lamented. “She had to go in the room next to me?”

Gojo laughed lightly with a shrug as he looked between the two. He noticed their lack of playfulness at his attempts to joke with them.

“Oh, come one! Like I don’t know you two despise each other,” he huffed. “Think of this as team bonding, you’ll be working together all year!”

Gojo spoke as if the two had just won the lottery and their prize was spending time with each other and the fabulous Saturo Gojo. Emiri crossed her arms as she sighed at Gojo’s news.

“This isn’t welcome,” Megumi stated coldly.

“Lovely,” Emiri soughed under her breath.

Saturo Gojo had found Megumi when he was six years old after his father tried to sell him to the Zenin Clan. Then Gojo took in Emiri when she was ten he introduced her to the boy her age.

Emiri would admit she was drawn to Megumi, but his attitude was off-putting and they never got along as children. Emiri and Megumi found themselves competing for Gojo’s attention until he decided to send them back to school. They two hadn’t seen each other since.

Emiri gave Megumi a stiff smile. She couldn’t necessarily place why she disliked the boy. Perhaps, she felt he was condescending, as a child she always found herself adoring him and being met with his cold demeanor.

Now that he was here, as a fellow first-year, he was nothing more than her competition. On the other hand, Megumi knew that Emiri disliked him and he assumed that he had welcomed that hatred.

Now, she thought, they saw each other through the same lens, they would never be friends.

☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩ ☩

Word count: 2,048

#megumi x reader#megumi fushiguro#gojo satoru#jujustu kaisen#jjk#jjk x reader#megumi x you#megumi x y/n#megumi smut#jjk x y/n#jjk fanfic#fem oc#megumi x female reader#megumi x oc#yuji itadori#nobara kugisaki#jjk fluff#jujutsu megumi#jujutsu gojo#jujutsu itadori#anime

32 notes

·

View notes

Text

The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth.

The Art of Saving Money

One of the toughest challenges for any individual is mastering the art of budgeting and having a consistent amount of savings every month.

I just learned about Kaikebo, a Japanese technique for budgeting that's over 100 years old. It combines mindfulness with spending decisions and helps you simply take control of your finances.

The kakeibo is a simple budgeting journal from Japan that helps you save money by setting goals and tracking spending. It encourages mindful thinking and reflection to improve your saving habits every month.

Kakeibo is a budgeting method that involves tracking every purchase, categorizing spending into needs, wants, culture, and unexpected expenses, and regularly reviewing expenses to track progress toward financial goals. The four categories of spending in kakeibo are needs, wants, culture, and unexpected expenses. Kakeibo is popular because it aligns with the Japanese value of "mottainai" and provides a straightforward way to manage finances.

Saving money is essential in today's fast-paced world for achieving financial independence, planning for life events, and creating a safety net. Developing a habit of saving can give you greater control over your financial future.

Kakeibo, a budgeting technique created by Japanese journalist Hani Motoko in 1904, helps individuals manage monthly expenses, understand spending habits, and practice frugality. It has gained popularity among young individuals for its effectiveness in saving for financial goals and accounting for unexpected costs.

Why i trust japanese art of saving money?

Between 1960 and 1994, Japanese households saved an average of one-sixth of their after-tax income, sometimes reaching nearly one-fourth, significantly higher than the 7.1% average savings rate of American households during the same period. While official statistics indicate that Japanese households are big savers, comparisons can be misleading due to differences in measurement across countries. Adjusting for these discrepancies, it appears that while Japan still saves more than the U.S., the actual difference is smaller than reported. Japan also has a higher savings rate in comparison to other countries, although there are various nations with differing savings behaviours.

Understanding the Kakeibo Method of Budgeting

The Kakeibo method is a Japanese budgeting technique that helps individuals manage their household expenses effectively. Created by journalist Hani Motoko in 1904, Kakeibo encourages mindful spending and can result in savings of up to 35% when practised consistently. The method involves categorizing all expenditures into four main areas: Needs (essential items for survival), Wants (non-essential luxuries), Culture (spending on cultural experiences), and Unexpected expenses (unforeseen costs). Practitioners maintain two notebooks to track their spending—one large notebook for categories and a smaller notebook for jotting down daily expenses. This process instils a sense of accountability and promotes financial discipline, aiding individuals in achieving their savings goals and preparing for emergencies.

How do you use Kakeibo in your life? An individual should use the following steps to incorporate Kakeibo in his life fruitfully:

1. Understand your fixed expenses You start with analyzing the monthly expenses, including your monthly fixed expenses such as rent, utility expenses, loan emis etc.

Fixed expenses are consistent monthly costs that are predictable and easy to incorporate into a budget, unlike variable expenses which fluctuate based on production levels. Key examples of fixed expenses include rent or mortgage payments, car payments, insurance premiums, property taxes, utility bills, child care costs, tuition fees, and gym memberships. To calculate fixed expenses, one should gather their budget or income statement, identify the non-variable expense categories, and sum the amounts from each category. Managing fixed expenses is crucial as they can significantly impact overall spending and understanding these costs can lead to better resource allocation and budgeting decisions

2. Effective Budgeting: Tracking Income and Expenses Here you include all the sources of income you are going to have over the next month. For salaried employees, these include their monthly income, and you also add back the deduction such as health insurance premiums or provident funds that are deducted first before giving you your salary. Non-salaried individuals such as entrepreneurs and freelancers can work with a future income they expect to generate over the next month.

The text outlines the steps necessary for effective budgeting, which includes tracking income and expenses, and comparing the two to ensure spending is managed. Key points include: 1. **Tracking Income**: Monitor gross monthly income, which includes salary and bonuses. To calculate annual gross income, multiply your hourly wage by your weekly hours, then multiply by 52 and divide by 12 for monthly figures. 2. **Tracking Expenses**: Understand fixed costs (e.g., rent, insurance) and flexible expenses (e.g., food, entertainment). Utilize tools such as bank statements and receipts for accurate tracking. 3. **Comparing Income and Expenses**: Subtract total expenses from total income. A positive result indicates that you are spending less than you earn while a negative result shows overspending. 4. **Creating a Budget**: Set financial goals, adjust spending accordingly, and apply budgeting rules like the 50/30/20 rule to effectively allocate your income. This guidance helps individuals maintain financial health by promoting awareness of their earnings and expenditures.

The 50/30/20 Budget Rule with Examples

Explore the power of the 50:30:20 budget rule for effective financial planning. Learn how to manage your money wisely and achieve financial balance using this proven budgeting principle. Take control of your finances and pave the way for financial freedom.

3. Determining Your Ideal Savings Rate

Here you decide how much exactly you wish to save over the next month. The goals should be such that they are not easily achievable or unrealistic that you can’t save anything.

Determining your ideal savings rate is influenced by individual financial situations, lifestyles, and goals. Experts recommend setting aside at least 20% of monthly income for savings, which aids in creating an emergency fund, managing unexpected expenses, and planning for long-term objectives such as retirement.

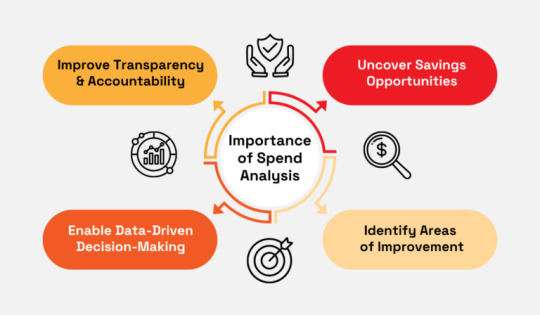

4. Analyze how much you can spend These expenses include all the expenses apart from your fixed expenses. Let’s try to understand all of these with an example. Let us assume you have an Income = 50000 Fixed Expenses (Rent, Utilities etc.) = 20000 Saving Goals = 10000 Then considering the above four points, the amount of money you are left to spend monthly is as follows: The money you can spend = Income – Fixed Expenses – Saving i.e. The money you can spend = 50000 – 20000 – 10000 = 20000 Thus, as an individual with a 50000 income, you are left with 20000 to manage all your expenses apart from your fixed expenses. Spend analysis is a method for understanding spending habits and identifying cost-saving opportunities. 1. Goal Identification: Clearly define what you aim to achieve with spend analysis, whether it's cost reduction or enhancing supplier performance. 2. Data Gathering: Collect all relevant spending data to ensure comprehensive analysis. 3. Data Management: Clean and organize this data to enhance accuracy and usability. 4. Spending Categorization: Group expenditures into categories to facilitate analysis. 5. Trend Analysis: Examine spending patterns to identify trends and recurring expenses. 6. Improvement Opportunities: Highlight areas where costs can be lowered or supplier performance can be enhanced. 7. Ongoing Monitoring: Regularly revisit and update insights to ensure they remain relevant. 8. Cost Reduction: Leverage insights to pinpoint specific areas for spending cuts. 9. Efficiency Improvement: Use findings to streamline operations for better efficiency. 10. Risk Mitigation and Strategic Support: Assess potential risks and utilize insights for informed strategic decision-making regarding investments or expansions.

By analyzing total expenditures, and zeroing in on specific business units, products, quantities, payment terms, and more, you get the answers to four crucial questions: What are we spending money on? Who are we spending it with? Are we getting what we need? Is there a better way to do this? The analysis can either be a comprehensive one or target just different categories of spend. Make your track record up to date regularly.

5. Divide the spending money by 4 The assumption being we have four weeks within a month. As an individual with 20000 spending money, you are allowed to spend a maximum of 5000 every week. Thus it would be best if you restricted your weekly expenses to 5000 such that you do not ever go over budget

The 40/30/20/10 rule is a budgeting method that allocates income into four distinct categories to help individuals manage their finances effectively. Key insights include: 1. Categories Explained:

The rule divides income into needs (40%), discretionary spending (30%), savings or debt repayment (20%), and charitable giving or financial goals (10%).

2. Needs Definition:

The 40% allocated for needs covers essential expenses like rent, mortgage, utilities, and groceries.

3. Discretionary Spending:

The 30% set aside for discretionary spending includes activities such as dining out, entertainment, and shopping.

4. Savings and Debt:

The 20% portion is intended for saving money or paying off existing debts, promoting financial security.

5. Charitable Giving:

The 10% of income is earmarked for donations or other financial goals, encouraging philanthropy.

6. Comparison to 50/30/20 Rule:

An alternative budgeting method, the 50/30/20 rule, simplifies the approach by categorizing income into needs (50%), wants (30%), and savings/investments (20).

7. Flexibility:

Both rules allow individuals to customize their financial plans according to personal priorities and circumstances.

8. Promotes Financial Awareness:

Adopting such rules encourages individuals to reflect on their spending habits and make informed financial decisions. The 40-30-20-10 rule offers a structured approach to budgeting that divides income into specific percentages for necessities, discretionary spending, savings, and charitable giving. The rule is grounded in long-standing financial wisdom, emphasizing the importance of living within one's means. It suggests allocating 40% of income for necessities like housing and groceries, 30% for discretionary expenses, 20% for savings or debt repayment, and 10% for charitable contributions.This budgeting method helps individuals create a balanced financial plan, tailoring it to their unique situations Differentiating between needs (essentials for survival) and wants (desires) is crucial for making informed financial decisions.The rule serves as a guideline, allowing for flexibility based on individual financial circumstances. Understanding and applying the rule can lead to improved financial health and future savings. Alternative budgeting methods similar to the 40-30-20-10 rule exist, offering variations in allocations while maintaining core principles. It provides a clear framework for managing finances, making it easier to track and control spending.

The Kakeibo method is a Japanese budgeting technique designed to help individuals manage their expenses and maximize savings by fostering mindful spending habits. 1. Definition of Kakeibo: Kakeibo translates to "household financial ledger" and was developed by journalist Hani Motoko in 1904 to aid homemakers in budget management. 2. Spending Awareness: The method encourages individuals to reflect on their spending habits, distinguishing between needs, wants, cultural expenses, and unexpected costs to better allocate their finances. 3. Categorization of Expenses: Kakeibo divides expenses into four categories: needs (essentials), wants (luxuries), culture (enriching experiences), and unexpected expenses (unforeseen costs). 4. Expense Tracking: Practitioners maintain two notebooks—one for ongoing expense tracking and another for summarizing weekly expenditures according to the four categories, promoting accountability. 5. Establishing Fixed Expenses: Users should first determine their fixed monthly costs, such as rent and utilities, which are critical for accurate budgeting. 6. Income Analysis: Assessing all sources of income and accounting for deductions (like health insurance) is essential for creating a realistic spending plan. 7. Setting Savings Goals: It is crucial to establish a specific savings target each month that is neither overly ambitious nor too easy to achieve, ensuring financial growth. 8. Budgeting Monthly Spending: After determining fixed expenses and savings goals, the remaining income is allocated as monthly spending money, which can be divided into weekly limits to maintain discipline. 9. Weekly Review: A comparison of planned versus actual spending at the end of each week fosters reflection on financial behavior and allows for adjustments in future spending to stay within budget. 10. Mindful Spending: The method encourages ongoing evaluation of expenses, helping individuals distinguish between essential and non-essential purchases to preserve their savings goals.

Other Kakeibo Lessons Delay any non-essential purchase till the next month. If you still feel the urge for that item after a month, analyze its affordability and what value it may add to your life. Always carry a shopping list when going to market for your monthly purchase.

The Kakeibo method is a disciplined approach towards expense management. This method teaches us the value of each expense made and the sacrifices that need to be made to achieve our targets.

We don't have to be smarter than the rest. We have to be more disciplined than the rest.

Warren Buffet said

Expense management is important because it helps companies control costs, meet budgets, and comply with regulations.

Thanks to all authors who wrote

Date of Publish: 10/ Jan / 2025

3 notes

·

View notes

Text

Loan Against Property for Buying Commercial Real Estate

A Loan Against Property is a secured loan where borrowers pledge residential, commercial, or industrial property as collateral to borrow funds. Lenders typically offer up to 50–70% of the property’s market value. For purchasing commercial real estate, LAP provides a cost-effective solution with lower interest rates compared to unsecured loans like personal loans.

Why Choose LAP for Buying Commercial Real Estate?

Access to High Loan Amounts: Since commercial real estate requires significant investment, LAP enables borrowers to secure large funds based on the value of the pledged property.

Lower Interest Rates: Being a secured loan, LAP comes with lower interest rates, reducing the overall cost of financing.

Flexible Repayment Tenures: LAP offers longer repayment periods (up to 15–20 years), making monthly installments manageable.

Unrestricted Usage: Funds from LAP can be used for any purpose, including purchasing, constructing, or renovating commercial real estate.

Retention of Property Ownership: You retain ownership of the collateral property as long as you repay the loan on time.

How to Use LAP for Commercial Real Estate

1. Assess Loan Eligibility:

Lenders evaluate the market value of the collateral property and your repayment capacity to determine eligibility.

Submit all necessary documents, including property deeds and identity proofs.

Maintain a good credit score for better loan terms.

2. Choose the Right Property:

Opt for commercial real estate with high rental potential or appreciation value.

Ensure the property is free of legal disputes and meets lender requirements.

3. Calculate the Loan Amount:

Lenders typically offer 50–70% of the collateral property’s value. Choose an amount that covers your needs without exceeding repayment capacity.

4. Compare Lenders:

Evaluate loan terms, interest rates, and processing fees across banks and NBFCs.

Consider lenders with expertise in commercial real estate financing.

5. Plan Your Finances:

Account for down payments, registration charges, and additional costs associated with buying commercial real estate.

Ensure steady income or rental potential to cover EMIs comfortably.

Benefits of Using LAP for Commercial Real Estate

High Loan-to-Value (LTV) Ratio: Enables significant funding for large-scale commercial projects.

Tax Benefits: If the loan is used for business purposes, the interest paid may be claimed as a business expense under tax laws.

Increased Investment Potential: Buying commercial real estate enhances income potential through rentals and long-term appreciation.

Retained Asset Ownership: Leverage your existing property while acquiring a new one without liquidating assets.

Eligibility and Documents Required

Eligibility:

Indian residents aged 21–65 years.

Clear ownership of the collateral property.

Good credit score and financial stability.

Documents Required:

Identity proof (Aadhaar, PAN).

Address proof.

Property documents of collateral.

Proof of business or rental income (if applicable).

Bank statements (6–12 months).

Challenges and How to Overcome Them

High Initial Costs: Commercial real estate investments involve significant upfront costs, including registration fees and down payments. Solution: Use LAP to cover a substantial portion of these costs while planning for additional expenses.

Risk of Property Seizure: Failure to repay the loan can result in foreclosure of the pledged property. Solution: Choose a loan amount within your repayment capacity and ensure timely EMI payments.

Market Volatility: The commercial property market can fluctuate, affecting returns. Solution: Conduct thorough market research and choose a property with stable demand and appreciation potential.

Conclusion

A Loan Against Property is a versatile and cost-effective way to fund your commercial real estate purchase. By leveraging the value of your existing property, you can secure large funds at competitive interest rates while retaining ownership of both properties. Careful planning, choosing the right lender, and understanding the terms can help you make the most of this financing option, ensuring long-term financial growth and success.

1 note

·

View note

Text

🏡 What to Consider When Buying a House in Gurgaon?

Gurgaon has become one of India’s top real estate hotspots, thanks to its growing infrastructure, corporate hubs, and modern lifestyle. But with so many options across various sectors, choosing the right home can feel overwhelming.

At PropertyDekho247, we simplify your journey with 100% owner-verified listings, direct communication with sellers, and zero brokerage or subscription fees. Before you dive into any property listing in Gurgaon, here are key things every smart homebuyer should consider.

✅ 1. Location is Everything

Gurgaon is divided into several sectors, each with its own price range, development status, and livability score.

Questions to ask:

Is it close to your workplace or public transport?

Are schools, hospitals, and shopping centres nearby?

Is the area safe and well-connected?

Hot areas to consider: DLF Phase 1–5, Sector 46, Sector 57, Golf Course Extension, Sohna Road, and New Gurgaon.

💡 Use our free property listing in Gurgaon to explore different sectors based on your lifestyle and budget.

✅ 2. Budget Planning & Financial Readiness

Gurgaon’s property prices range from affordable to ultra-premium. Be clear about:

How much down payment you can manage

EMI affordability

Additional costs like registration, taxes, interiors

Pro tip: PropertyDekho247 lets you compare real-time owner listings without broker inflation. You deal directly with the owner, saving lakhs in hidden fees.

✅ 3. Verify the Property & Seller

One of the biggest risks in real estate is unverified sellers or hidden property issues. That’s why PropertyDekho247 offers:

✔ 100% owner-verified listings

✔ No brokers or fake ads

✔ No subscriptions or charges

What this means for you:

Transparent conversations

Direct negotiations

No middlemen cutting into your deal

✅ 4. Legal Checks & Property Condition

Before making any offer:

Inspect the house physically (we help you schedule visits online)

Review the sale deed, NOC, and occupancy certificate

Confirm land title and builder credentials (for under-construction projects)

We also encourage buyers to use a lawyer for document vetting — especially for resale properties.

✅ 5. Future Growth Potential

Even if you’re buying to live, always think like an investor.

Is the area developing or saturated?

Are rental returns decent (3–5% per year)?

Are new infrastructure projects planned nearby?

Explore long-term potential by browsing sector-wise property listings in Gurgaon on PropertyDekho247 — no login or subscription required.

🚀 Why Buyers Choose PropertyDekho247

At PropertyDekho247, we believe in transparency and simplicity. That’s why:

✅ All listings are 100% owner-verified ✅ You contact sellers directly — no middlemen ✅ No fees, no subscriptions, and no commissions ✅ You can make offers and schedule visits online ✅ You explore real properties at real prices

🏁 Final Thoughts

Buying a house in Gurgaon is a big step — but it doesn’t have to be complicated or expensive. Use trusted platforms like PropertyDekho247 to explore genuine free property listings in Gurgaon and connect directly with owners — without paying brokers or middlemen.

👉 Ready to start your search? Visit PropertyDekho247.com and explore homes that match your lifestyle — no charges, no pressure, just real properties from real owners.

Let me know if you'd like:

A meta description and title tag for SEO

A LinkedIn or Instagram caption to promote this blog

Or a short version for email marketing or WhatsApp posts

#property listing in gurgaon#propertyforsale#sellproperty#realestate#sellpropertyingurgaon#city#gurgaonrealestate#builderfloorgurgaon#buyproperty

0 notes

Text

Your Guide to Easy Car Refinancing and Second-Hand Car Finance

Let's face it, vehicles are expensive. However, if you've already borrowed against your automobile and feel like you're paying more than you should, there is some good news. Car refinancing may be the little magic trick your pocketbook has been waiting for. Whether you're hoping to reduce your enormous EMIs, upgrade to more favourable loan conditions, or just find a better way to manage your money, refinancing your car loan might be the smooth ride you've been waiting for.

So, how does all of this apply to second hand car financing? Well, the market for second hand cars has grown in popularity, and rightfully so. It's less expensive, offers better value, and is more accessible than ever before thanks to flexible financing. Used auto financing is more than just getting a loan; it's getting the best terms to fit your current lifestyle and future financial goals. Whether you're looking for a used SUV or a sporty, tiny hatchback, second hand car finance allows you to acquire it without breaking the bank.

Okay, now let's talk about the miracle of vehicle refinancing. Here's the scenario: you took out a higher-interest loan a year ago. But now your credit score has improved, interest rates have dropped, or you simply prefer cheaper payments. Car refinancing allows you to exchange your existing loan for a new one, hopefully with better conditions. It's a technique to tune up your money. And the good news? It's a simple procedure owing to the technologies we have now. No hours of paperwork, no cryptic tiny print; just simple actions and smart savings.

When you combine auto refinancing with intelligent second-hand car lending arrangements, you're in control, both physically and financially. You have the freedom to reschedule your budget, reduce your stress, and maybe even free up funds for other activities. And, with more lenders offering online services, comparing estimates and finding better offers for your specific needs has never been easier.

In an age where savings and flexibility are more crucial than ever, car finance for used car and hassle-free refinancing programs are your best bets. So sit back, look around, and take command of your ride - your next wise move is only a click away.

0 notes

Text

Amity University Online: Courses, Fees, Admission & Why It’s a Great Choice in 2025

Online education is becoming a top choice for students who want to study at their own pace, from anywhere in the world. Whether you’re a working professional, a student in a remote area, or someone looking to balance work and study, Amity University Online offers a flexible and recognized way to earn your degree.

In this blog, we’ll explore everything you need to know about Amity University Online—from the courses it offers, fees, admission process, and key benefits to why it’s a smart option in 2025. We’ll also explain why applying through Online Universitiess makes your journey easier and more secure.

About Amity University Online

Amity University Online is part of the Amity Education Group, a well-known name in Indian and global education. Amity was among the first private universities in India to offer UGC-approved online degree programs.

With strong academic roots, world-class infrastructure, and a focus on digital learning, Amity University Online brings classroom-quality education to your device. It is the first university in India to be awarded UGC approval for online degrees, and it holds NAAC A+ accreditation, making it a trustworthy option.

Courses Offered by Amity University Online

Amity offers a wide range of Undergraduate (UG), Postgraduate (PG), and Diploma/Certificate programs to suit students from all backgrounds.

Undergraduate Programs (UG)

Bachelor of Business Administration (BBA)

Duration: 3 Years

Ideal for students aiming for careers in business, management, or entrepreneurship.

Bachelor of Commerce (B.Com)

Duration: 3 Years

Designed for those who want to build careers in finance, accounting, and banking.

Bachelor of Arts (BA)

Duration: 3 Years

Offers flexible learning in humanities, public policy, economics, and more.

Bachelor of Computer Applications (BCA)

Duration: 3 Years

Best for students interested in IT, software, and computer applications.

Postgraduate Programs (PG)

Master of Business Administration (MBA)

Duration: 2 Years

Offers multiple specializations including HR, Marketing, Finance, Data Science, and more.

Master of Commerce (M.Com)

Duration: 2 Years

Advanced learning for commerce graduates focusing on corporate finance and accounting.

Master of Arts (MA)

Duration: 2 Years

Offers specializations such as English, Public Administration, and more.

Master of Computer Applications (MCA)

Duration: 2 Years

Designed for students aiming to work in Online MCA in cloud computing, AI, and related fields.

Diploma and Certificate Programs

Diploma in Business Management

Diploma in HRM

Certificate in Digital Marketing

Certificate in Financial Planning

And many more…

These short-term programs are great for upskilling or improving your resume.

Admission Process (2025)

The admission process at Amity University Online is simple, fast, and completely online.

Eligibility Criteria

UG Courses: 10+2 from a recognized board.

PG Courses: Bachelor’s degree in any stream.

Diplomas: Vary by course—generally open to working professionals or graduates.

How to Apply

Visit the official website or apply through a trusted platform like Online Universitiess.

Choose your preferred course and fill out the application form.

Upload required documents (marksheets, ID proof, etc.).

Pay the registration fee.

Get confirmation and access to the Learning Management System (LMS).

Amity University Online Fee Structure

Amity offers affordable programs with excellent value. Below is an estimated fee structure:

Program

Total Fees (Approx.)

BBA

₹1,50,000

B.Com

₹1,10,000

BA

₹1,00,000

BCA

₹1,30,000

MBA

₹2,55,000

M.Com

₹1,20,000

MCA

₹1,80,000

MA

₹1,00,000

Diploma

₹30,000 – ₹60,000

Payment Options

EMI options available (monthly payments)

Pay online via debit/credit card, net banking, or UPI

Discounts available for early applicants and selected categories

Key Features of Amity University Online

UGC and NAAC Approved

All degrees are valid across India and globally. Students can apply for government jobs, private sector jobs, or further education using their online degree.

Advanced Learning Platform

Amity’s digital learning system includes:

Recorded video lectures

Live interactive sessions

Online exams

Real-time student support

eBooks, assignments, and discussion forums

Placement Support

Amity Online has a dedicated career support team that helps students with:

Resume building

Interview training

Job matching with top companies

Alumni network access

Companies like TCS, Wipro, HDFC Bank, Infosys, and Accenture recruit from Amity Online.

Who Should Choose Amity University Online?

Students who cannot relocate for college

Working professionals looking to upskill or change careers

Housewives or parents restarting their careers

Entrepreneurs seeking formal education

Freshers preparing for competitive exams while studying

Comparison with Other Online Universities

Feature

Amity Online

NMIMS Online

Jain Online

Manipal Online

UGC Approved

✅

✅

✅

✅

NAAC Grade

A+

A+

A++

A+

Placement Support

Strong

Moderate

Good

Good

LMS Quality

Excellent

Good

Good

Good

Course Variety

Wide

Limited

Moderate

Moderate

Amity stands out for its course variety, high-end LMS, and placement support, especially for business and IT-related programs.

Why Choose Online Universitiess?

Applying to a university can be confusing—different websites, unclear deadlines, and fake counselors. That’s why thousands of students trust Online Universitiess.

Benefits:

Verified University Tie-Ups: Only shows UGC-approved universities.

Free Counseling: Get honest, expert advice on the right course for your career.

Smooth Admission Process: From documentation to enrollment, get complete support.

Scholarship Alerts: Stay updated on discounts and scholarships.

Zero Hidden Charges: 100% transparent and secure.

Whether you're interested in Amity University Online or exploring other options, Online Universitiess helps you compare, choose, and apply stress-free.

Final Thoughts

If you're looking for a trusted, flexible, and career-focused online degree program, Amity University Online is a strong option in 2025. With recognized degrees, expert faculty, digital learning tools, and job support, you get everything you need for a successful future.

And when you apply through Online Universitiess, you get expert guidance, transparent admissions, and the peace of mind that you're choosing the right course and university.

Take the Next Step

Explore Amity University Online programs at OnlineUniversitiess.com

Get free admission support and expert career advice

Enroll today and move one step closer to your dream career!

0 notes

Text

Tips for Using Personal Loans to Consolidate Debt Efficiently

Managing multiple debts can feel overwhelming. Different due dates, various interest rates, and varying repayment amounts can make it difficult to keep track of your financial obligations. One practical way to simplify this is through debt consolidation and using an instant personal loan can be an effective strategy. In this blog, we’ll share essential tips on how to consolidate debt efficiently using an instant loan app like Kissht, helping you regain control over your finances.

1. Understand Debt Consolidation

Debt consolidation is the process of combining several outstanding debts into a single loan. This may include credit card dues, medical expenses, or small personal loans. The idea is to replace multiple EMIs with one structured repayment.

By using an instant personal loan, you can convert multiple high-interest debts into a single monthly EMI, making your repayments more manageable. It also helps streamline your monthly cash flow and potentially lowers your financial stress by offering a fixed repayment plan.

2. Choose the Right Instant Loan App

Not every app offers the same experience or features. Choosing a secure and well-established instant loan app like Kissht can ease the debt consolidation process with:

Quick application process

Simple documentation

Easy-to-navigate interface

Kissht is an online loan app that offers instant access to personal loans, making it easier for users to manage debt consolidation without visiting a physical branch.

3. Evaluate Interest Rates and Loan Terms Carefully

Before you consolidate, assess your current debts and the personal loan interest rate offered on the new loan. The goal is to choose an instant personal loan that helps reduce the overall interest paid over time.

When reviewing options, pay attention to:

Tenure flexibility

EMI amount

Total cost of borrowing

Any processing or administrative charges

Use a personal loan interest rate calculator or a PL loan EMI calculator to assess how the new loan compares to your current financial obligations. Apps like Kissht typically provide easy access to these tools.

4. Avoid Taking On New Debt During or After Consolidation

One of the main purposes of consolidating your debts with an instant personal loan app is to regain control not to create more debt. Once your existing obligations are merged into one loan, focus on managing that repayment responsibly.

Avoid using credit cards or applying for additional loan online options unless absolutely necessary. Cultivating better financial habits during and after the consolidation process will help you stay on track toward long-term financial stability.

5. Use a Personal Loan EMI Calculator

Before you apply for instant personal loan using platforms like Kissht, it’s wise to check how the EMI fits into your monthly budget. A personal loan EMI calculator can give you a clear picture of:

Monthly installment amount

Interest component

Total repayment value

This step ensures that you’re not overextending yourself and helps you choose the most suitable loan tenure. The tool also helps in comparing multiple loan structures based on your needs.

6. Prioritize Timely Repayments

Repayment discipline is a critical part of any successful debt consolidation strategy. Paying your EMIs on time not only helps in maintaining a healthy credit score but also ensures you avoid unnecessary late charges.

Instant personal loan apps like Kissht often offer features such as payment reminders and auto-debit facilities to make repayments more convenient. Making use of these options can help you avoid missed payments and keep your financial record clean.

Final Thoughts

Consolidating multiple debts with the help of an instant personal loan through an instant loan app like Kissht can be a smart move if done with proper planning. It simplifies your financial life, helps you stay organized, and offers a structured path toward becoming debt-free.

By focusing on selecting the right personal loan app, evaluating loan terms carefully, and sticking to a disciplined repayment schedule, you can take meaningful steps toward better financial management.

Whether you’re looking to manage personal loans, explore a business loan, or even evaluate loan against property interest rates, the right tools and mindset make all the difference.

#advance loan#cash loan app#instant loan#loan app#loan apps#low-interest loan#short-term loan#quick loans#quick loan#personal loan app#online personal loans#online instant loans#instant money

0 notes

Text

Top Agriculture Loan Options and Using Loan Against Property to Supplement Finance

In India, agriculture forms the backbone of the economy, supporting nearly 60% of the population. As farming becomes increasingly dynamic, having the right financial support can make a significant difference. Whether it's seasonal cropping, infrastructure development, or value-added farm projects, timely credit is crucial. In this article, we’ll explore the top agriculture loan options and how a loan against property can effectively supplement your farming finance.

Understanding the role of agriculture loans in modern farming

A well-structured agriculture loan does more than just fund crop cultivation. It empowers farmers to invest in irrigation, upgrade machinery, build storage units, and even adopt sustainable practices like solar irrigation or organic farming. Financial institutions, including government-backed banks, offer a wide range of agriculture loan schemes with subsidized interest rates and flexible repayment options.

Top agriculture loan schemes every farmer should know

Here are some of the most impactful agriculture loan schemes available to Indian farmers:

1. Kisan Credit Card (KCC)

The KCC scheme provides short-term credit for crop production and related needs. It’s one of the most popular schemes with features like:

Collateral-free loans up to ₹1.6 lakh

Interest subvention up to 3% for timely repayments

Flexible repayment post-harvest

2. Pradhan Mantri Fasal Bima Yojana (PMFBY)

Though technically an insurance scheme, PMFBY works hand-in-hand with agri-loans by offering coverage for crop failure, ensuring farmers can repay loans even in bad seasons.

3. NABARD Refinance Scheme

Under this, banks offer long-term loans for activities like land development, farm mechanization, horticulture, and dairy.

4. Agri Infrastructure Fund (AIF)

Ideal for those looking to build post-harvest infrastructure such as cold storage or packaging units. This scheme provides credit with interest subvention for 7 years.

5. State-level Subsidy Loans

Several state governments offer targeted agriculture loan schemes with partial interest waivers or upfront subsidies for tractors, pump sets, and greenhouses.

These schemes serve farmers with diverse needs—but sometimes, they aren’t enough, especially for large or urgent investments. That’s where a loan against property becomes a powerful companion tool.

Why consider a loan against property as a supplement?

A loan against property (LAP) allows farmers to unlock the financial value of their existing real estate—be it residential, commercial, or agricultural land (depending on the lender). This type of loan can supplement traditional agriculture loans in the following ways:

1. Higher Loan Amounts

Agriculture loans may have capped limits, especially unsecured ones. LAP, however, offers funds based on property value—sometimes up to 70% of market worth. This helps fund larger projects like barn construction, land purchase, or farm equipment upgrades.

2. Longer Tenure and Lower EMI

While most crop loans have a short tenure of 12–18 months, LAPs can go up to 15–20 years. The extended repayment period translates to smaller EMIs, making it manageable for farmers with seasonal income.

3. Flexible Usage

Unlike agriculture loans, which must be used for farming purposes only, LAP funds can be utilized for multiple needs—children’s education, medical expenses, or farm diversification into dairy, poultry, or fisheries.

4. Competitive Interest Rates

Being a secured loan, the interest rate on LAP is usually lower than unsecured personal loans—ranging between 9% and 12%. This makes it a cost-effective option for long-term investments.

5. Tax Benefits

If the LAP is used for business expansion or home construction, borrowers can avail of tax deductions on interest payments under applicable sections.

A smart strategy: Combining both loans

Here’s how combining both can work:

Crop Loan via KCC: Use the Kisan Credit Card to fund input costs like seeds, pesticides, and irrigation.

LAP for Infrastructure: Use a loan against property to construct a warehouse or install drip irrigation.

Insurance from PMFBY: Protect your crop and secure your loan repayment.

By integrating both, farmers ensure liquidity for short-term needs and capital for long-term improvements.

Things to consider before applying

Eligibility: For LAP, ensure clear ownership and legal documents of the property.

Loan terms: Compare interest rates, processing fees, and prepayment charges.

Repayment planning: Always align repayment schedules with your income cycles (harvest or business income).

Risk factor: If LAP EMIs are not paid, there’s a risk of losing the property. So, only borrow what you can repay confidently.

How Bank of Maharashtra can help

When it comes to farmer-focused finance, Bank of Maharashtra stands out with its robust portfolio. From agriculture loan schemes like crop loans, tractor loans, and dairy loans to tailored loan against property products, the bank ensures that every customer finds the right financial solution.

With competitive interest rates, digital banking support, and a wide branch network, Bank of Maharashtra offers a seamless experience for farmers and rural entrepreneurs. Whether you're planning the next sowing season or looking to scale your agri-business, BoM’s expert guidance and flexible loan options make it a reliable partner.

Final thoughts

In today’s fast-changing agricultural landscape, relying on a single loan product may not be enough. Smart financial planning involves combining short-term agriculture loan schemes with long-term backing like a loan against property. This approach can fuel innovation, sustainability, and profitability for modern Indian farmers.

Choose financial partners who understand farming. Choose solutions that grow with you. Choose Bank of Maharashtra—your trusted ally in agri-finance.

0 notes

Text

How Do Utility Payment Platforms Support Multiple Billers?

In the rapidly evolving digital economy, utility payments are no longer restricted to single service providers or offline channels. Today, Utility Payment Solutions have transformed the landscape of how consumers pay for their day-to-day services—electricity, water, gas, broadband, DTH, and more. One of the most impactful innovations within this space is the capability of modern payment solutions to support multiple billers under a unified platform. This multipurpose functionality is not only beneficial to users but also crucial for utility companies and financial service providers looking to streamline their payment ecosystems.

So, how exactly do Utility Payment Platforms support multiple billers, and why is this feature essential for the future of digital payments? Let's explore this in depth.

1. Centralized Billing Framework

At the core of a multi-biller Utility Payment Solution is a centralized billing framework. This framework is designed to integrate various utility service providers into one platform. It allows the payment system to communicate with multiple billing systems in real-time, retrieve the latest billing information, and enable quick payments.

For users, this means they can view and settle all their bills—electricity, gas, water, phone, internet, and more—from a single dashboard without switching between apps or portals. This unified approach enhances user convenience and simplifies monthly bill management.

2. API Integrations with Service Providers

Supporting multiple billers requires seamless integration with various utility companies’ systems. This is usually done through API integrations, where the Utility Payment Solution connects directly with each biller's backend to fetch real-time data like billing amounts, due dates, and transaction status.

By maintaining these direct integrations, the platform ensures accurate, timely, and secure bill payments. Whether it's a regional electricity provider or a national telecom operator, the platform can efficiently fetch and update data from all connected service entities.

3. Dynamic Biller Management System

A major technical feature that supports multiple billers is a Dynamic Biller Management System (DBMS). This backend tool allows the platform operator to add, remove, or update billers without affecting the core platform functionality.

It offers administrators the ability to manage biller-specific configurations such as unique customer ID formats, validation rules, billing cycles, and payment limits. This ensures that each biller is served according to its specific requirements while maintaining a consistent user interface for consumers.

4. Multiple Payment Channels and Methods

To support multiple billers effectively, a payment platform must accommodate diverse payment preferences. Most advanced payment solutions now offer multi-channel options such as mobile apps, web portals, kiosks, and POS machines.

Moreover, these platforms support a wide range of payment methods including debit cards, credit cards, UPI, net banking, mobile wallets, and even EMI options. Users can pay for any utility service through their preferred method, regardless of which biller they are transacting with, thanks to the platform’s robust multi-channel and multi-method support.

5. Real-Time Status and Notifications

Multi-biller platforms also provide real-time transaction updates and bill payment confirmations. Once a user makes a payment, the system updates the respective biller instantly through integrated APIs or secure gateways.

These platforms also send automated notifications via SMS, email, or in-app alerts, keeping users informed about due dates, payment confirmations, and bill status. This transparency reduces customer complaints and boosts user trust in the Utility Payment Solution.

6. Scalability for Future Billers

Scalability is a crucial benefit of multi-biller support. A well-designed Utility Payment Platform can quickly onboard new billers with minimal effort. This is especially valuable in emerging markets where digital payments are still gaining traction, and new service providers are continually entering the ecosystem.

For users, this means more utility categories and service providers are added over time, making the platform a one-stop solution for all recurring payments.

7. Improved Customer Experience

For the end-user, supporting multiple billers under one payment solution translates to less hassle, reduced late payments, and easier financial tracking. They don’t have to remember multiple logins, due dates, or platforms. Everything is consolidated in one place.

Features like saved biller profiles, auto-pay options, usage tracking, and digital receipts make it easier for users to manage household or business utility expenses. Enhanced UX/UI, secure login mechanisms, and easy navigation further improve customer satisfaction.

8. Use Case: Xettle Technologies

One excellent example of a modern utility payment platform supporting multiple billers is Xettle Technologies. The company’s Utility Payment Solution is engineered to aggregate a wide range of utility providers under a single umbrella. It includes advanced integrations, real-time updates, and customizable features for service providers. With Xettle Technologies, both urban and rural users gain access to an inclusive, reliable, and easy-to-use system for all their utility payment needs.

Conclusion

In today’s connected world, a Utility Payment Platform that supports multiple billers is not a luxury—it's a necessity. By integrating various services into a unified system, these payment solutions offer unmatched convenience, better financial oversight, and greater trust among users. With robust back-end architecture, flexible billing integrations, and customer-centric features, such platforms are transforming how people pay for essential services.

Companies like Xettle Technologies are leading the charge, making digital utility payments accessible, efficient, and future-ready for millions of users. As the utility sector continues to digitize, the demand for versatile, scalable, and user-friendly Utility Payment Solutions will only continue to grow.

0 notes

Text

What Happens to Your Loan If You Take a Career Break?

A personal loan is a convenient financial tool that helps individuals manage various expenses, including medical emergencies, home renovations, education, or travel. However, repaying a personal loan requires consistent income, which can become challenging if you decide to take a career break due to personal reasons, higher studies, maternity leave, or unforeseen circumstances.

If you’re planning a career break, you might wonder, “What happens to my personal loan repayment?” The good news is that there are ways to manage your EMIs without defaulting, provided you plan your finances wisely.

In this article, we explore how a career break can affect your personal loan, strategies to continue payments smoothly, and how to renegotiate with your lender if necessary.

1. How Does a Career Break Affect Personal Loan Repayment?

When you take a career break, your primary source of income is paused, making it difficult to continue repaying your personal loan EMIs. This can lead to financial stress, penalties, and even a negative impact on your credit score.

✅ Key Challenges During a Career Break:

Reduced or No Income: Paying EMIs without a salary becomes challenging.

Risk of EMI Defaults: Missing payments can lead to late fees and legal actions.

Credit Score Impact: Late or missed payments lower your creditworthiness.

Higher Debt Burden: If unpaid, interest accrues, increasing your total outstanding balance.

📌 Tip: Before taking a career break, assess your financial obligations and create a plan to manage your loan payments.

2. Strategies to Manage Personal Loan EMIs During a Career Break

To avoid loan repayment issues during a career break, consider the following strategies:

A. Build an Emergency Fund Before Taking a Break

If you’re planning a voluntary career break, start saving at least 6-12 months’ worth of EMIs before quitting your job.

✅ Benefits of an Emergency Fund:

Ensures timely loan repayments.

Prevents reliance on high-interest loans or credit cards.

Reduces financial stress while you are unemployed.

📌 Tip: Allocate 20-30% of your salary into a dedicated emergency fund to prepare for your break.

B. Opt for Loan Restructuring or EMI Reduction

Most lenders offer loan restructuring options for borrowers facing financial difficulties. You can request:

✅ Loan Tenure Extension: Increases tenure to reduce monthly EMI burden. ✅ Lower Interest Rate Negotiation: Some banks allow rate reductions for long-term customers. ✅ Step-Up EMI Plan: Pay lower EMIs during the career break and increase payments once you resume work.

📌 Tip: Contact your lender before missing an EMI to discuss restructuring options.

C. Apply for a Temporary EMI Moratorium

In case of unexpected career breaks (e.g., layoffs, medical emergencies), some lenders provide an EMI moratorium, allowing you to pause payments for 3-6 months.

✅ Pros:

Gives temporary relief from EMI payments.

Prevents loan default during financial hardship.

🚫 Cons:

Interest continues accruing during the moratorium.

Increases overall repayment cost.

📌 Tip: Use a moratorium only if absolutely necessary and resume payments as soon as possible.

D. Consider Loan Refinancing or Balance Transfer

If your personal loan has a high-interest rate, you can transfer it to another lender offering better repayment terms.

✅ Benefits of Loan Refinancing:

Lowers interest rates, reducing EMI burden.

Offers flexible repayment options during financial uncertainty.

Helps consolidate multiple loans for better management.

📌 Tip: Compare loan balance transfer options and check processing fees before switching lenders.

E. Use Investments or Side Income to Cover EMIs

If you have fixed deposits, mutual funds, or other savings, consider using them to cover EMIs during your career break.

✅ Alternative Income Sources:

Freelancing or part-time work.

Renting out property or assets.

Passive income from investments.

📌 Tip: Avoid liquidating long-term investments unless necessary. Instead, use dividends or interest earnings for EMI payments.

3. What Happens If You Default on Your Personal Loan?

Failing to make EMI payments can have serious financial consequences.

🚨 Consequences of Loan Default:

Late Payment Fees: Lenders charge penalties on overdue EMIs.

Credit Score Drop: A single missed EMI can reduce your CIBIL score by 50-100 points.

Legal Action: Repeated defaults may lead to loan recovery proceedings.

Higher Debt Accumulation: Unpaid interest increases the total loan amount.

📌 Tip: If you are unable to pay your EMI, communicate with your lender immediately to avoid serious consequences.

4. Steps to Take Before and After a Career Break

If you’re planning a career break, follow these steps to ensure smooth loan management:

✅ Before Taking a Career Break:

Build an emergency fund to cover EMIs for at least 6-12 months.

Check with your lender for EMI reduction or restructuring options.

Consider prepaying part of the loan to reduce future EMIs.

Explore passive income sources like freelancing or investments.

✅ During the Career Break:

Prioritize loan repayments over discretionary spending.

Use savings or side income to pay EMIs.

If struggling, request an EMI moratorium or loan restructuring.

✅ After Resuming Work:

Increase EMI payments to repay any deferred amount faster.

Maintain on-time payments to restore your credit score.

Avoid taking new loans until financially stable.

📌 Tip: If planning a career sabbatical for studies, check if lenders offer special repayment terms for students.

Final Thoughts: Can You Manage Your Loan During a Career Break?

Taking a career break does not mean you have to default on your personal loan. With proper financial planning, emergency savings, and communication with your lender, you can manage repayments smoothly without affecting your credit health.

🚀 Best Practices for Loan Management During a Career Break: ✔ Plan in advance and create an emergency fund. ✔ Negotiate EMI restructuring with your lender. ✔ Use savings or side income to maintain timely repayments. ✔ Consider an EMI moratorium if facing unexpected financial difficulties. ✔ Avoid loan default by exploring alternative repayment options.

By following these strategies, you can ensure that your personal loan repayments remain stress-free, even during your career break.

For expert financial advice and the best personal loan repayment solutions, visit www.fincrif.com today!