#How to trade in volatile markets

Explore tagged Tumblr posts

Text

Welcome to the Metaverse: Your Ultimate Asset Trading Guide

Welcome to the Metaverse: Your Ultimate Asset Trading Guide Hey there, fellow digital adventurer! 🤘 So you want to dive into the wild and wacky world of Metaverse asset trading, huh? Well, buckle up, because you’re in for a ride filled with virtual reality, sizzling pixels, and maybe a few cat videos (because who doesn’t love cats?). In this guide, we’re going to break down everything you need…

View On WordPress

#Best trading apps for passive income#High-frequency trading (HFT) regulations 2025#How to trade in volatile markets#Real-time sentiment analysis for traders#Tax-efficient trading strategies 2025#Tokenized asset trading explained#Web3 trading strategies for crypto portfolios

1 note

·

View note

Text

Expert Strategies to Protect Your Investments

In a world full of financial uncertainty, global tensions, and market swings, investors often find themselves on a rollercoaster. One minute, markets are soaring, and the next, they’re tumbling. But here’s the thing—panic never pays off. The best investors don’t react emotionally; they plan ahead.

So, how do you keep your portfolio safe while staying in the game? Let’s break it down.

What History Teaches Us

A 2020 Schroders’ Global Investor Study found that 78% of investors adjusted their portfolios when the market crashed in February-March. Meanwhile, 19% stayed put. Surprisingly, even seasoned investors made rash decisions during the panic. But as legendary investor Peter Lynch said, recessions and downturns are inevitable—the key is to be prepared.

How to Build a Rock-Solid Portfolio

1. Strategic Rebalancing: Stay in Control

Your portfolio should always match your goals and risk tolerance. While an annual check-up is the norm, big market swings might call for earlier adjustments. The idea? Trim overexposed assets when they’ve gained too much and add to sectors that are undervalued. This simple “sell high, buy low” method helps you stay balanced and seize opportunities when the market dips.

2. Go Beyond Basic Diversification

Everyone knows the golden rule: Don’t put all your eggs in one basket. But diversification is about more than just splitting money between different stocks. Here’s how to do it right:

Mix asset classes – Stocks, bonds, real estate, and commodities work differently in different conditions.

Spread across industries – Don’t just load up on tech; balance it with healthcare, agriculture, and other sectors.

Think globally – Developed markets offer stability, while emerging markets provide growth potential.

Add non-correlated assets – Investments like gold or Treasury bonds tend to rise when stocks fall, reducing overall risk.

Using the best trading apps makes it easier to monitor diverse assets and adjust investments as needed.

3. The Margin of Safety: Buy Smart

This classic value investing strategy means buying stocks when they’re trading below their real worth, reducing your risk of losses. Here’s how to do it:

Deep Value Hunting – Look for solid companies that are overlooked or underpriced.

GARP (Growth at a Reasonable Price) – Find growing companies that aren’t overhyped.

The more diversified your undervalued investments, the less risk you take.

4. Dividend Stocks: The Stability Factor

Dividends aren’t just extra cash—they’re a safety net. When markets dip, dividend-paying stocks keep the money flowing and can be reinvested for compounding gains. If you like steady, reliable returns, dividend stocks deserve a spot in your portfolio.

It’s all about keeping your money safe from institutional failures and financial malpractice.

Think Long-Term, Not Short-Term

Market swings are normal. The difference between winning and losing investors? Patience.

Stick with it – The market recovers over time, and long-term investors reap the benefits.

Use dollar-cost averaging – Investing a fixed amount regularly smooths out market ups and downs.

Follow Warren Buffett’s advice – “Rule #1: Never lose money. Rule #2: Never forget Rule #1.”

Mistakes to Avoid

Even the best investors slip up. Here’s what not to do:

Impulsive selling – Selling when the market drops locks in losses. Stick to your plan.

Emotional trading – Fear and excitement cloud judgment. Automate investments or limit portfolio checks.

Market timing – No one can predict market movements perfectly. Instead, focus on strong companies and long-term growth.

Final Takeaway: Be Smart, Stay Steady

The 2020 market crash showed us that being too concentrated or unprepared can be costly. By focusing on diversification, margin of safety, and strong broker protections, you can ride through market storms without losing sleep.

Remember: Downturns are temporary, but bad investment habits can have long-term consequences. Stay disciplined, stay diversified, and let time work in your favor.

At the end of the day, investing isn’t just about surviving volatility—it’s about thriving despite it.

For more information, visit https://www.indiratrade.com/

#Best online broker trading platform#Best trading apps#Broker company in India#Trading account opening#Best Indian stock broker#How to protect stock investments#Investing in volatile markets#Smart investment strategies#Stock market risk management#Long-term investment strategies

0 notes

Text

Unlocking Perpetual Futures Contracts: Essential 2024 Guide for Beginners

Are you ready to take your trading to the next level with a financial instrument that offers endless opportunities and flexibility?

Perpetual futures contracts have emerged as a revolutionary tool in the trading arena, particularly for cryptocurrency enthusiasts. These contracts, unlike traditional futures, do not have an expiration date, allowing traders to hold positions indefinitely. This feature provides a significant advantage, enabling continuous trading and the ability to take advantage of long-term market trends. The funding rate mechanism, which periodically adjusts to keep contract prices in line with the spot prices of the underlying assets, ensures a balanced and fair trading environment.

Leverage is a key feature of perpetual futures contracts, allowing traders to control larger positions with a smaller capital investment. This can significantly amplify profits, but also poses a risk of larger losses, making risk management a crucial aspect of trading these contracts. The real-time mark-to-market settlement process adjusts traders' margin balances continuously, ensuring that gains and losses are promptly accounted for. This mechanism helps prevent sudden liquidations and keeps traders informed about their margin requirements.

Despite the numerous benefits, perpetual futures come with their own set of risks, including market volatility and fluctuating funding rates. Traders must have a solid understanding of these risks and employ effective strategies to mitigate them.

Intelisync, a pioneer in blockchain technology and exchange development, offers advanced solutions to enhance the security and functionality of perpetual futures trading. Explore how Intelisync can enhance your trading experience and provide the tools you need to succeed in the dynamic world of perpetual futures.

Discover how Intelisync can transform your trading journey and provide you with the tools needed to succeed in the dynamic world of perpetual futures. Contact Intelisync today! Ready to revolutionize your trading journey? Contact Intelisync today and Learn more....

#Advantages of Perpetual Contracts#Crypto Market Liquidity#Cryptocurrency Trading#Funding Rate#Funding Rate Mechanism#Futures Trading Guide#How do Future contract work?#How does trading on perpetual contracts work?#Intelisync Blockchain solution#Main Features of Perpetual Futures#Margin Requirements#Market Volatility#PERP DEX Development: Intelisync’s Expertise in Perpetual Future Contracts#perpetual futures trading.#Perpetual Futures vs. Traditional Futures#Risks Associated with Perpetual Futures Contracts#Trading Strategies#What is Perpetual Futures Contracts

0 notes

Text

I want YOU to fuck with Elon Musk's finances!

Apologies for the nerd-talk here, but I have a easy political action for you!

Right now, the Tesla stock seems to be held afloat not so much by individual investors, but by investment banks which include the stock in index funds. The sort of funds that many people's 401ks are in. (I've been watching the stock, the 'sells' are many and small, the 'buys' are fewer and large, likely indicative of big-banks propping up a failing stock.)

And you, yes you, if you have a IRA, 401k, or other retirement investment which includes Tesla, can fuck Elon up today. (If you don't have one, send this post to any cool Boomers you know who might!)

What you're gonna do is call whoever you or your employer banks with (Vanguard, Schwab, TD, whoever) and tell them the following:

You're concerned by their reliance on TSLA in their indices, a volatile stock whose value is not based in investing fundamentals.

The intrinsic value of the stock (discounted cashflow / relative valuation) is $46 while the stock is trading at over $200

The current valuation is defended by the following flawed arguments:

a. Sales to consumer vehicle market - The majority revenue source. However sales across the globe are dropping compared to this time last year; 73% in Germany, 65% in Australia, and 49% in China. b. Potential Autonomous vehicle? - Promised for years, as a retrofit to existing vehicles - has not materialized, even after competitors (Waymo) succeeded in fielding the technology. c. Potential Humanoid Robotics? - An industry Tesla has no experience in, and is facing significant competition in from well-established well-funded competitors such as Boston Dynamics. d. Potential "AI"? - Unless specified further, with a concrete path to profitability this seems to be vaporware. e. Elon's personal brand - Has been losing credibility, due to partisan political behavior. He has also been failing to perform his fiduciary duty to shareholders, by neglecting his role as CEO to become politically involved. f. Battery Technology - Has a high reliance on imported materials such as Lithium, the availability of which is dependent on the unpredictable geopolitical situation in Ukraine.

And you are HUGELY worried about the impact on your finances when the stock corrects itself towards it's true value, and returns to trading along financial fundamentals. (If you want to get spicy with it, you can say you feel they too are failing in their fiduciary duties to you by continuing to invest in TSLA. But, from what i know of finance bros, that's fightin words, so use with discretion.)

So... If you want to have an outsized impact on this hair-plugged skinhead's finances, all you gotta do is call the finance nerds and speak their language a little. (I know phone calls suck but I literally gave u a script!) Most retirement investors are passive, so even a handful of upset callers can have an outsized impact.

Embrace your inner Karen if you want. (You're doing WHAT with my money? Propping up a failing overvalued business?)

Good luck, and tell me how it goes if you do this!! (disclaimer: this is not financial advice)

#elon musk#elon#musk#tesla#tsla#finance#activism#us politics#political#investments#stock market#banking#business#investors#ah yes stock analasys.... the reason u are all haere on tunglr

228 notes

·

View notes

Text

As President Donald Trump golfed in Florida over the weekend, his hefty new tariffs, which target everywhere from China to the Falkland Islands, started to go into effect, and businesses began to react to them. Jaguar Land Rover, the Anglo-Indian automaker, announced it was pausing shipments to the United States. The American company Howmet Aerospace, which builds parts for airliners made by Boeing and Airbus, also said it may halt sending products that are affected by the new duties.

On Wall Street, where stocks plunged by about ten per cent on Thursday and Friday, analysts and investors prepared for more selling. The widely followed VIX index, a measure of expected volatility, has risen to levels not seen since the early days of COVID. Financial markets often overreact, but this Trump slump is perfectly rational and explicable. Tariffs are taxes on goods, and imposing them reduces over-all buying power in the economy. On Friday, Jerome Powell, the chair of the Federal Reserve, noted that the new tariffs are “significantly larger than expected,” so the “same is likely to be true of the economic effects, which will include higher inflation and slower growth.” It is very unusual for a Fed chairman to say out loud that an Administration’s policies are bad for the economy. Also on Friday, JPMorgan Chase, America’s largest bank, predicted a recession later this year, despite the fact that the Labor Department’s employment report for March showed solid growth. “We now expect real GDP to contract under the weight of the tariffs,” Michael Feroli, the bank’s chief U.S. economist, wrote, in a note to clients.

To some extent, investors are simply anticipating the negative impact that slower growth, or an outright slump, will have on corporate profits. But there is more to it than that. Many people on Wall Street are also suffering from buyer’s remorse. From August to December of last year, the market rose by about twenty per cent. Investors, analysts, and business executives bought into the notion that a Trump Presidency would boost an economy that was already growing faster than the rest of the developed world, with a very low jobless rate. After the election, Jamie Dimon, the C.E.O. of JPMorgan Chase, said bankers were “dancing in the street.” They were also willfully ignoring Trump’s long record of recklessness in his own business dealings and his repeated pledges to upend the global trading system, on which he has now followed through.

In recent years, policy analysts on the left and the right have advocated a retreat from the hyper-globalization that reigned from roughly 1990 to 2016, and which had harmful side effects, including a hollowing out of many industrial regions, and a dependency on fragile global supply chains. Trump’s first term, in which he imposed tariffs on certain goods, including steel, aluminum, and washing machines, and on a much wider range of products from China, marked the end of the free-trade era. The Biden Administration left in place the tariffs that Trump had imposed on China and supplemented them with an ambitious industrial policy designed to boost the industries of the future, including green energy, E.V.s, and semiconductors. Although Trump dismissed these policies as the “Green New Scam,” some conservatives, such as those associated with American Compass, a think tank founded in 2020 by Oren Cass, a former aide to Mitt Romney, supported elements of them. (In an article for the Financial Times last year, Cass referred to “the essential role of public financing, subsidies and procurement in spurring innovation and production at scale.”)

But, even if these developments marked a cross-party revival of what some have termed “neo-mercantilism”—the strategic use of state power to shape trade relationships for national advantage—Trump’s new tariffs constitute a radical departure from previous policies, including his own. Rather than applying to countries that impose specific trade barriers on U.S. goods, they target any nation that runs a trade surplus with the U.S., regardless of how that surplus may have arisen. The arithmetic formula that the Administration used to determine its tariff rates simply takes the bilateral surplus in goods from a given country, divides this figure by the amount of goods imported from that country, and multiplies the resultant fraction by a half. Comically, it also includes some Greek symbols to make it look scientific, but nowhere does it include the level of tariffs that the country imposes on U.S. goods.

In other words, these are not “reciprocal” tariffs. Reciprocity involves an equal give-and-take. According to the World Trade Organization, the European Union imposes tariffs of five per cent on foreign goods, on average; Japan imposes tariffs of four per cent; and Cambodia imposes tariffs of nineteen per cent. Under Trump’s policy, the tariffs on goods from these places are twenty per cent, twenty-four per cent, and forty-nine per cent, respectively. As CNBC’s Steve Liesman noted online, Trump “straight up lied when he said the US is now charging tariffs at half the rate other countries charge.”

Immediately after Trump announced his tariffs, I noted that they represent not neo-mercantilism but a resurgence of the absolutist approach adopted during the sixteenth and seventeenth centuries by European mercantilists who viewed any trade deficit as an evil. In addition to affecting established industrial powers, including China, Japan, and the E.U., the tariffs also hit Asian economic success stories, such as Vietnam and Bangladesh, and impoverished African countries, such as Lesotho and Malawi. The main reason that Lesotho runs a trade surplus with the United States has nothing to do with trade restrictions; it is because of poverty. With a per-capita annual income of less than a thousand dollars a year, Lesothans can’t afford to buy very many iPhones or Caterpillar trucks. And the new tariffs are threatening one of the country’s main sources of income: factories that make textiles for Levi’s and other Western companies.

Trump’s avowed goal is to re-shore American factories and boost manufacturing employment in the long run, but will it work even on its own terms? In making multibillion-dollar capital investment decisions, such as building a new plant in the United States that could operate for decades, companies need to be pretty sure about the future. With Trump, the only certainty is that things could change. Another factor to consider is that many imports are components for domestically produced goods, and slapping tariffs on them raises the costs to American firms that rely on these parts. A Federal Reserve Board study of the tariffs that Trump imposed on China in 2018 found that, when this factor was taken into account, the duties didn’t lead to any increase in manufacturing jobs. In fact, they led to a reduction of 1.4 per cent.

Trump’s new tariffs are so high and wide-ranging that estimating their ultimate impact, assuming they stay in place, would be largely guesswork. We do know for sure that they represent an unprecedented shock to the economy, and they are being accompanied by policies that run directly counter to the goal of promoting American economic dominance. Guided by Elon Musk and his DOGE colleagues, the Trump Administration is busy making cutbacks at the National Science Foundation and National Institutes of Health, which finance basic scientific research on which American businesses rely for their product development. It’s also cancelling grants for clean-energy projects and undermining investments in E.V. manufacturing by, for example, reversing the Biden Administration’s rules on reducing tailpipe pollution. Last week it withdrew funding for a federal program that promotes technical progress and productivity growth at small and medium manufacturing companies across the country. If this is mercantilism, it is mercantilism gone mad.

In recent history, Brexit represents the only comparable act of economic self-harm. But the fallout from the U.K.’s vote, in 2016, to withdraw from the European Union was largely limited to its own inhabitants. This is different. Since the Second World War ended, the U.S. has been the global economic hegemon. While acting in its own interest, sometimes ruthlessly, it has taken the view that promoting international trade and development will ultimately benefit Americans as well as people overseas. The Trump Administration has now formally abandoned this leadership role as a champion of open trade, but it hasn’t stopped there. At least in the short run, it has committed to a policy of inflicting damage not only on itself but on the rest of the world, too, including some of the poorest countries. That’s bad in its own right, but it’s also bad for business. No wonder markets everywhere are tumbling.

23 notes

·

View notes

Text

April 6, 2025, 3:08 PM MST

By Rob Wile and Brian Cheung

U.S. stock futures plunged Sunday evening, an indication that the market turmoil that began last week will continue when trading opens Monday.

Looming over the markets: the retaliatory actions other countries are expected to enact as the American tariffs announced last week take effect.

As of early Sunday evening, S&P 500 futures had fallen 4.5%. Futures in the tech-heavy Nasdaq also fell 4.5%, while futures for the Dow Jones Industrial Average declined 1,600 points in volatile trading. Future for the Russell 2000, which tracks the stocks of smaller companies, were off 5.6%. (Futures markets are a way for traders to move stocks when the major exchanges are closed, and serve as a implied measure for how stocks will act when the markets do open, generally at 9:30 a.m. ET on weekdays.)

Even the price of bitcoin, which showed signs Friday of having resisted the wider market downturn, fell as much as 5%.

The declines mean another savage day awaits investors when trading officially opens Monday at 9:30 a.m ET. The losses would come on top of a two-day free-fall last week that represented the worst 48-hour period in market history, with some $6.6 trillion in value wiped out.

The main U.S. benchmark for crude oil fell 3.7%, to just under $60 per barrel, its lowest level since April 2021.

Over the weekend, President Donald Trump signaled little intention to back off his proposal, which would see tariffs rise as much as 79% — for countries like China.

"THIS IS AN ECONOMIC REVOLUTION, AND WE WILL WIN. HANG TOUGH," Trump wrote on his Truth Social platform Saturday. "it won’t be easy, but the end result will be historic. We will, MAKE AMERICA GREAT AGAIN!!!"

26 notes

·

View notes

Text

NFT Trading Opportunities in Decentralized Markets

NFT Trading Opportunities in Decentralized Markets Welcome to the Wild West of Digital Art! Hey there, fellow digital cowboy! Saddle up, because today we’re riding into the untamed territory of NFTs (non-fungible tokens) and decentralized markets. If you’ve been lurking in the shadows of the internet, contemplating whether to jump on the NFT bandwagon, now’s your chance! This article is all…

View On WordPress

#AI-driven stock market analysis tools#Best trading apps for passive income#High-frequency trading (HFT) regulations 2025#How to trade in volatile markets#Real-time sentiment analysis for traders#Tax-efficient trading strategies 2025#Web3 trading strategies for crypto portfolios

1 note

·

View note

Text

𝒎𝒂𝒈𝒊𝒄 𝒊𝒏 𝒂𝒆𝒕𝒉𝒆𝒓𝒐𝒔: 𝒑𝒐𝒔𝒕-𝒔𝒖𝒏𝒅𝒆𝒓𝒊𝒏𝒈 𝒂𝒓𝒄𝒂𝒏𝒂

𝒂𝒆𝒕𝒉𝒆𝒓𝒐𝒔 𝒅𝒓

𝒄𝒐𝒓𝒆 𝒑𝒓𝒊𝒏𝒄𝒊𝒑𝒍𝒆: 𝒕𝒉𝒆 𝒇𝒓𝒂𝒄𝒕𝒖𝒓𝒆 𝒐𝒇 𝒎𝒂𝒈𝒊𝒄

Before the Sundering, magic flowed like water—natural, intuitive, everywhere. After the Sundering, the leyline network ruptured. Magic became unpredictable, unstable, and in raw form, lethal.

Now, the people of Aetheros survive by regulating, refining, and replacing true magic with safer, imitative systems. But the real thing? It's still out there. And it remembers.

𝒓𝒖𝒏𝒆 𝒎𝒂𝒈𝒊𝒄

Controlled | Stable | Common

𝒅𝒆𝒔𝒄𝒓𝒊𝒑𝒕𝒊𝒐𝒏

Rune magic is the backbone of modern arcana—an artificial, heavily regulated scripting system.

Practitioners inscribe sigils (runes) onto surfaces—metal, bone, glass, even skin—to create localized magical effects.

Runes act like magical programming. Each symbol is precise, calculated, and must be drawn with exacting intent.

𝒂𝒑𝒑𝒍𝒊𝒄𝒂𝒕𝒊𝒐𝒏𝒔

Pressure triggers

Wardings and alarms

Light/heat generation

Momentum redirection

Magnetic locks

Stabilizers for small cargo

𝒍𝒊𝒎𝒊𝒕𝒂𝒕𝒊𝒐𝒏𝒔

Runes burn out, and misfire if scratched or improperly drawn.

Runes only operate in fixed patterns. They cannot adapt or improvise.

Cannot manipulate complex elements or living beings directly.

𝒄𝒖𝒍𝒕𝒖𝒓𝒂𝒍 𝒓𝒐𝒍𝒆

Taught in Guild-sanctioned academies.

Used in everything from skyship engines to automaton cores.

Unauthorized runes are a serious offense.

𝒂𝒍𝒄𝒉𝒆𝒎𝒚

Material-Based | Experimental | Academic

𝒅𝒆𝒔𝒄𝒓𝒊𝒑𝒕𝒊𝒐𝒏

A blend of magic and chemistry—alchemy uses refined substances to create temporary magical effects or alterations.

Functions through potions, infusions, bombs, salves, and catalytic reactions.

𝒂𝒑𝒑𝒍𝒊𝒄𝒂𝒕𝒊𝒐𝒏𝒔

Healing tinctures

Smoke bombs and volatile brews

Temporary strength or reflex enhancers

Arcane corrosion agents (for breaking enchantments)

𝒍𝒊𝒎𝒊𝒕𝒂𝒕𝒊𝒐𝒏𝒔

Highly volatile. Improper mixtures lead to explosions, poisoning, or arcrot contamination.

Ingredients often harvested from risky or ley-tainted environments.

Effects tend to be short-lived or single-use.

𝒄𝒖𝒍𝒕𝒖𝒓𝒂𝒍 𝒓𝒐𝒍𝒆

Considered a craft more than a “magic.”

Most formulas are closely guarded trade secrets.

Frequently used by combat medics, salvagers, and black-market dealers.

Enchantment

Object-Bound | Semi-Permanent | Rare

𝒅𝒆𝒔𝒄𝒓𝒊𝒑𝒕𝒊𝒐𝒏

A specialized craft that binds magical effects into objects, using stabilized runes, materials, and refined mana circuits.

Produces longer-lasting magical tools, weapons, or defensive equipment.

Most modern enchantment work is used for tools of war or status.

𝒂𝒑𝒑𝒍𝒊𝒄𝒂𝒕𝒊𝒐𝒏𝒔

Enchanted weapons (flame, frost, wind)

Wardstones and security fields

Communication crystals (short-range)

Skyborne filtration and temperature charms

𝒍𝒊𝒎𝒊𝒕𝒂𝒕𝒊𝒐𝒏𝒔

High-tier enchantments require rare materials, such as aetherglass or mana-infused alloys.

Overuse leads to enchantment breakdown or feedback loops—especially in volatile environments.

Enchanted items near leyline breaches often malfunction catastrophically.

Cannot function indefinitely—overuse or exposure to unstable mana zones causes degradation.

Enchantments require extreme precision in application.

𝒄𝒖𝒍𝒕𝒖𝒓𝒂𝒍 𝒓𝒐𝒍𝒆

Status symbols among the barons.

Maintained and licensed through the Arcanist Guild.

Forgedfolk often have enchantments as part of their bodies—binding or freeing, depending on design.

𝒂𝒓𝒕𝒊𝒇𝒊𝒄𝒊𝒏𝒈

Integrated | Inventive | Elite

𝒅𝒆𝒔𝒄𝒓𝒊𝒑𝒕𝒊𝒐𝒏

The merging of all magical disciplines—runes, enchantment, alchemy, and machinework—into sophisticated magical-engineering systems.

It’s how skyships fly, automatons think, and entire cities stay afloat.

Artificers are elite magitechnical engineers, licensed by the Arcanist Guild and usually employed by barons, guild lords, or research enclaves.

Artificing requires multi-disciplinary mastery, making it the most respected (and jealously guarded) arcane profession.

𝒂𝒑𝒑𝒍𝒊𝒄𝒂𝒕𝒊𝒐𝒏𝒔

Skyship engines and stabilization systems

Skyplate levitation cores

Sentient or semi-sentient automatons

Arc-reactive weapons and armor

Environmental management systems (air, pressure, storm dampening)

𝒍𝒊𝒎𝒊𝒕𝒂𝒕𝒊𝒐𝒏𝒔

Expensive, material-intensive, and susceptible to leyfield interference.

Most projects require teams, time, and careful calibration.

True sentience in constructs is unrepeatable—rumors say only a few pre-sundering blueprints remain.

𝒄𝒖𝒍𝒕𝒖𝒓𝒂𝒍 𝒓𝒐𝒍𝒆

Artificers are treated like royal engineers—half scientist, half sorcerer.

Their guild is rigid, elite, and deeply paranoid about theft or leaks.

The Free Skies Coalition seeks to train rogue artificers of their own, with… mixed success.

𝒕𝒓𝒖𝒆 𝒎𝒂𝒈𝒊𝒄

Raw | Elemental | Forbidden

𝒅𝒆𝒔𝒄𝒓𝒊𝒑𝒕𝒊𝒐𝒏

True magic is not cast—it is felt. Born from resonance with elemental forces, it moves with will and emotion.

Only rare individuals are capable of channeling it directly, and fewer survive its use.

True magic is feared across the skylands—associated with the Sundering, with leyline ruptures, and with death.

𝒎𝒂𝒏𝒊𝒇𝒆𝒔𝒕𝒂𝒕𝒊𝒐𝒏𝒔

It often aligns with a specific element or force: wind, water, flame, earth, storm, shadow, light, etc.

Powers vary wildly:

Aeromancers can control gusts, deflect bullets, or even create vacuums.

Pyromancers generate flame from within, but risk immolation.

Stormcallers may bend weather or call lightning—but it comes with pain.

𝒍𝒊𝒎𝒊𝒕𝒂𝒕𝒊𝒐𝒏𝒔

Untrained use often leads to arcrot, mental collapse, or death.

Even with training, true mages often experience physical backlash from use—bleeding, seizures, unconsciousness, or worse.

The body rejects it. The mind fractures under it. The soul becomes... something else.

Some believe repeated use draws the attention of things that survived the Sundering.

𝒄𝒖𝒍𝒕𝒖𝒓𝒂𝒍 𝒓𝒐𝒍𝒆

Outlawed nearly everywhere. True mages are hunted, studied, or executed.

Some survive in secret among the Free Skies or within cultic groups, such as some sects of the skyward faiths.

The Guild denies its viability. Skybarons fear it. But they would kill to control it.

𝒆𝒙𝒕𝒓𝒂

Ok, so I've talked about the laylines and arcrot before, but here's a bit about the actual magic system. It's kind of your standard magic system, but just sort of mechanized I guess. Idk I'm really bad at coming up with magic systems, so yeah. Anyways, I know I haven't talked about the factions yet, but I'm working on that, so in the meantime in case you're confused:

Skybarons: bad people, sort of in charge of everything, rich and in power and wanna keep it that way

Arcanist Guild, or "the Guild": the people in charge of researching and regulating magic. Work with the skybarons to exterminate true magic.

Free Skies Coalition: a rebel group who hates the skybarons and the control they have over everything.

There's a few more, but I'll talk about that in the next post. Hopefully.

@aprilshiftz @lalalian

#reality shifting#shiftblr#desired reality#shifters#scripting#original dr rambles#reality shifter#dr scrapbook#original dr scrapbook#shifting blog

13 notes

·

View notes

Note

would you be interested in doing a post on crypto? Such as your experience with it and how it works. And why it is important ? it still confusing for me to fully grasp. Thank you :)

Crypto is digital money that exists only electronically. It’s not controlled by central banks or governments. It uses blockchain technology—a ledger enforced by a network of computers.

You store your crypto in digital wallets and can use it for purchases and investments. Just like stock market you can convert to real dollars and withdrawal.

For the last couple of years, large financial companies have been testing a quantum financial system (ISO 20022) which would be an international standard for exchanging electronic messages in the financial industry. This is estimated to be rolled out on a large scale in about a decade.

XRP for example is a digital currency created by Ripple to enable quick money transfers. Some believe it could play a key role in a future global financial system, often referred to as the Quantum Financial System (QFS), by acting as a bridge currency that facilitates value exchange between different currencies and networks.

In plain words, cryptocurrency is a new form of currency and we are still in the beginning stages of it all. Which means the ability to make a ton of money easier than ever before :) Bitcoin is a perfect example, was at 40k I believe beginning of the year and now 100k, this means that if you invested $5,000 USD in January, you would now have made 13,000 USD letting it just sit there. If you are actively trading in crypto and meme coins you have the ability to 100x your returns. For example when people buy in to a coin that’s trending/ new/ getting hype, like XRP recently, there is a significant surge.

To trade crypto you can use centralized exchanges like Binance, Fidelity Investments, Robinhood Crypto, OANDA etc. These platforms allow you to buy, sell and trade various cryptos. This is basically what the general population does. There are other ways like using bots, staking, futures and options, margins and leverage etc.

With meme coins, as they trend you have the ability to make a lot of money overnight. This ofcourse depends on your ability to study the trends and the communities built around those coins. It is always a risk!!!!

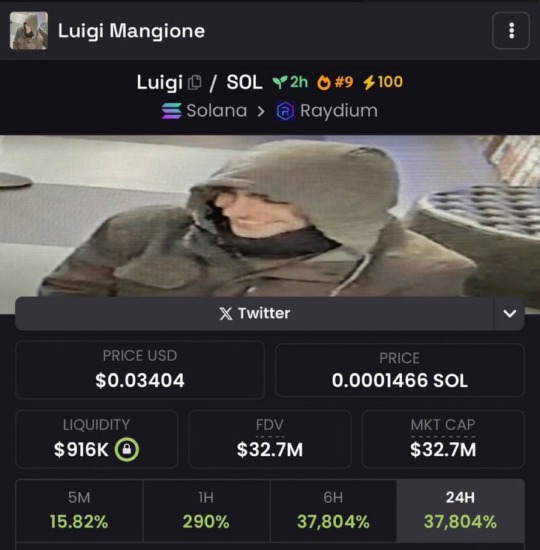

Here’s an example for meme coins:

$330k to $34M (100x) in less than 2h for a meme coin created for Luigi Mangione last week. So if you had put in $3,000 in the coin when it was at 330k, in 2 hours you would have made $300,000.

I can’t say enough that this involves you being on top of trends and markets.

THIS IS NOT FINANCIAL ADVICE!!! The market is very volatile and you are basically gambling your money! Staying informed is crucial!!!! :)

28 notes

·

View notes

Text

CNN 4/11/2025

BusinessEconomy• 5 min read

US consumer sentiment plummets to second-lowest level on records going back to 1952

By Bryan Mena, CNN

Updated: 12:40 PM EDT, Fri April 11, 2025

Source: CNN

Americans are rarely this pessimistic about the economy.

Consumer sentiment plunged 11% this month to a preliminary reading of 50.8, the University of Michigan said in its latest survey released Friday, the second-lowest reading on records going back to 1952. April’s reading was lower than anything seen during the Great Recession.

President Donald Trump’s volatile trade war, which threatens higher inflation, has significantly weighed on Americans’ moods these past few months. That malaise worsened leading up to Trump’s announcement last week of sweeping tariffs, according to the survey.

“This decline was, like the last month’s, pervasive and unanimous across age, income, education, geographic region and political affiliation,” Joanne Hsu, the survey’s director, said in a release.

“Sentiment has now lost more than 30% since December 2024 amid growing worries about trade war developments that have oscillated over the course of the year,” she added.

The Federal Reserve and Wall Street are watching closely how souring sentiment translates into consumer spending, which accounts for about 70% of the US economy, and whether Americans lose faith that inflation will return to normal in the coming years.

Trump on Wednesday paused his massive tariff hike on dozens of countries for 90 days, but kept in place a 10% baseline duty for all imports into the US and separate tariffs on specific products and commodities. The so-called reciprocal tariffs, albeit short lived, were the sharpest increase in US duties ever on data going back 200 years, Fitch Ratings told CNN

China, however, wasn’t included in Trump’s tariff reprieve, continuing a contentious tit-for-tat between the world’s two largest economies that stretched into Friday, with Beijing jacking up its retaliatory tariffs on US imports to 125% from 84%.

The Michigan survey was fielded between March 25 and April 8, so it doesn’t capture respondents’ reaction to the recently announced tariff delay.

The relationship between sentiment and spending

In economics, surveys are referred to as “soft data” and measures capturing actual economic activity, such as retail sales, are known as “hard data.”

The soft data has clearly deteriorated because of Trump’s tariffs: The latest Michigan survey showed that “the share of consumers expecting unemployment to rise in the year ahead increased for the fifth consecutive month and is now more than double the November 2024 reading and the highest since 2009,” according to a release.

Yet, the hard data still looks decent. Employers continue to hire at a brisk pace and shoppers haven’t convincingly reined in their spending just yet, though retail sales have come in weaker than expected recently.

“Sometimes the surveys are very negative, but they keep spending,” Fed Chair Jerome Powell said last week at an event near Washington, DC. “People spent right through the pandemic and they spent right through this time of higher inflation.”

Still, the hard data could take a turn for the worse. New York Fed President John Williams said Friday at an event in Puerto Rico that he expects economic growth to slow sharply this year, pushing up unemployment, and for inflation to accelerate.

“Given the combination of the slowdown in labor force growth due to reduced immigration and the combined effects of uncertainty and tariffs, I now expect real GDP growth will slow considerably from last year’s pace, likely to somewhat below 1%,” he said.

Spending by better-off Americans has played a key role in keeping the US economy humming along these past few years, but the recent turbulence on Wall Street, triggered by Trump’s tariffs, is putting that under threat.

“Wealthy consumers’ stock market gains kept the economy growing in 2024 despite high prices, but the wealthy won’t feel confident enough to keep spending if this keeps up,” Bill Adams, chief economist at Comerica Bank, wrote in a recent analyst note.

Larry Fink, chief executive of BlackRock, the world’s largest asset manager, said Friday that today’s dense fog of uncertainty, triggered by Trump’s tariffs, is reminiscent of the 2008 global financial crisis.

“We’ve seen periods like this before when there were large, structural shifts in policy and markets — like the financial crisis, Covid-19 and surging inflation in 2022. We always stayed connected with clients, and some of BlackRock’s biggest leaps in growth followed,” Fink said.

JPMorgan Chase CEO Jamie Dimon echoed that sentiment, noting Friday after the bank released its latest quarterly earnings: “The economy is facing considerable turbulence (including geopolitics), with the potential positives of tax reform and deregulation and the potential negatives of tariffs and ‘trade wars.’”

A growing worry for the Fed

There’s one survey-based measure that matters a whole lot for the Fed: Americans’ perception of prices. It’s critical because they can be self-fulfilling — if people expect inflation to climb and remain elevated in the long run, they adjust their spending accordingly.

So far, that measure has been trending in the wrong direction: Expectations for inflation rates in the year ahead surged to 6.7% this month from 5% in March, the highest level since 1981, while expectations for the next five to 10 years climbed to 4.4% from 4.1%.

If people do lose faith that inflation will ever get back to normal in the coming years, that would make it extremely difficult for the Fed’s monetary policy to fight inflation.

“History teaches that when higher inflation expectations become entrenched, the road back to price stability is longer, the labor market is weaker and the economic scars are deeper,” Dallas Fed President Lorie Logan said Thursday at an event in Dallas.

Inflation expectations these days may be more susceptible than usual to becoming “un-anchored,” since consumers just experienced a period of high inflation, leaving many Americans particularly sensitive to elevated prices.

12 notes

·

View notes

Note

What's the best case scenario for these tariffs? What's the worst?

I'll start with the worst-case scenario because I'm a pessimist, and because it's more likely to happen.

Given what we see with the bond market and the dollar both going down, what we're seeing is capital flight, where investors seek safer markets that the US for their money. This is rather unprecedented in modern history - the US and T-Bills have always been seen as a safe haven for volatility, when investors are seeking ultimately small but safe returns. If investors start departing en masse, because Trump decides that he needs to renew his tariffs and he can't negotiate his trade deals, that would cause significant disruption to the US economy, likely sparking a recession or exacerbating one if there is already one in effect.

Given Trump's previous business history, what he would probably do first is seek a cheap bailout and order the Fed to buy T-Bills. This is called quantitative easing and is used as a tool to push capital into the US economy. Since that requires the printing of a lot of new money, that would probably provoke a large bump in inflation, further straining the economy, especially for those people who lose their jobs in a recession. That would cause the interest rate to spike, and then I imagine Trump would blame foreign interference attempting to create an economic crisis. This fits Trump's business habits to a T, he frequently tried to stiff his creditors, and I imagine he would probably do the same here, by annulling selective amounts of US debt, amounting to a sovereign default (given how often Trump declared bankruptcy in his career, this seems a natural state for him). This would cause widespread capital flight and probably knock the US off of its economic perch. I imagine he'd also warn his cadre so they could move their money out of US markets, leaving US investors primarily holding the bag, since it's already been shown that Congress will not punish any instance of insider trading.

The best case scenario is that Trump realizes that he's being very stupid and cancels the tariffs (predictably declaring victory and saying it was according to keikaku all along to sell it to the Fox News crowd). His business backers finally accept that he's full of crap and won't just cater to business and GDP growth like his first term and back out. That combined with the massive stove-touching that was his tariffs and their impact to 401(k)'s means that Trumps goes deeply underwater in the approval ratings and the US sees large protests demanding his resignation. The lost support translates into a hostile Congress that restrains him by legislature, and then when he inevitably tries to rule as an autocrat (or for another matter like contempt of court for his mass deporations), he gets impeached and convicted and leaves Vance (or more preferably, Mike Johnson since he is ultimately spineless and can be easily cowed by a hostile Congress) as a lame duck President who largely passes consensus bills. Since we're going full best-case scenario, the internet dredges up tweets by Bernie Sanders and Chris DeLuzio in support of tariffs and realize that they're the same type of snake-oil salesman and progressives take a massive hit in their popularity, especially on economic platforms, and allow more rational people to take the lead in crafting economic policy.

Thanks for the question, Anon.

SomethingLikeALawyer, Hand of the King

13 notes

·

View notes

Text

April 18 (UPI) -- Democrats in Congress are renewing a call for legislation to ban members from trading stocks and securities following a flurry of trades during the April market slump.

Rep. Marjorie Taylor Greene, R-Ga., disclosed 38 trades made between April 2 -- when President Donald Trump imposed tariffs on most imports -- and April 9 -- when Trump paused many of the tariffs, according to Insider Finance's Congress Stock Tracker. The tariff announcement sent the stock market into a tailspin, bringing down prices during this time period.

"This is a great time to buy!" Trump posted on social media on April 9.

Greene traded 10 stocks on April 9 and 10 on April 8. Most of her reported trades were purchases valued at between $1,001 and $15,000. She sold off a U.S. Treasury bill valued between $50,001 and $100,000 on April 8.

Rep. Rick Larson, D-Wash., disclosed two trades on April 9. Otherwise Greene is the only other member of Congress to have disclosed trades during that time. Members of Congress have up to 45 days to disclose their stock market activity in accordance with the 2012 STOCK Act, so more disclosures could come in the following weeks.

House Minority Leader Hakeem Jeffries, D-N.Y., has joined the calls to ban members from trading stocks. In an appearance on MSNBC, Jeffries alleged that Greene acted on inside information to profit from the dip in the stock market.

Rep. Steven Horsford, D-Nev., shared similar concerns during a congressional hearing on tariffs with U.S. trade representative Jamieson Greer on April 9 as Trump pulled back many of the tariffs.

"Is this market manipulation?" Horsford asked of Trump's use of tariffs.

"No," Greer responded.

"Why not?" Horsford said. "If it was a plan, how is it not market manipulation?"

"It's not market manipulation, sir," Greer said.

Kedric Payne, vice president, general counsel and senior director of ethics at the Campaign Legal Center, told UPI that whether Congress members are actively engaged in corrupt activities by trading stocks or not, the appearance of corruption has the same effect on the public's trust in the government.

"In the situation where you have members of Congress disclosing that they're making trades in stocks, it can appear as though they're not focused on what the public needs during these volatile times in the stock market," Payne said. "But they're more focused on their personal profit. And that diminishes public trust in government."

Talk of a ban on congressional stock trading is not new, according to Payne. It has been discussed as long as members have traded stocks. The issue is raised because of the potential for lawmakers to have a direct influence on a stock's value and having access to information that the general public doesn't.

In a 2023 survey by the Program For Public Consultation, 86% of respondents said members of Congress and family members who live with them should be prohibited from trading stocks in individual companies. This includes 87% who identified as Republicans, 87% who identified as Democrats and 81% independents.

About 87% of respondents agreed that the president, vice president and Supreme Court justices should be prohibited from trading stocks.

Stock trading remains common in Congress. According to campaign financial disclosure reports in 2023 and 2024, 61% of new members of Congress owned stock. Forty-two of 71 new members owned both stocks and widely held investment funds, the Campaign Legal Center reported.

Members of Congress were only required to disclose their trade activities once a year until the STOCK Act was passed. This increased transparency and, for a time, deterred some members from engaging with the stock market, according to Craig Holman, government affairs lobbyist for Public Citizen.

Holman has drafted legislation for lawmakers to ban stock trading in Congress. It is an issue he said he has worked on for many years. After the STOCK Act was passed, he led a study into its impact, looking at congressional stock trading in the three years prior to its passage and the three years since.

Holman found that stock trading activity declined by two-thirds after the STOCK Act was passed.

"The STOCK Act was necessary legislation to get transparency in stock trading activity," Holman said. "Quite frankly, I thought that would be enough to stop stock trading by members of Congress simply because of the pitfalls for scandal. But as we've seen during the pandemic and once again today, that many members of Congress just don't seem to care. So we need to take this a step further and just ban stock trading activity altogether by members of Congress."

Holman referenced the onset of the COVID-19 pandemic, when congressional disclosures revealed dozens of lawmakers -- Republicans and Democrats -- made hundreds of moves in the stock market, some related to stocks that would be directly affected by the pandemic.

"The problem with insider trading still exists. We saw it in full color during the pandemic," Holman said. "And then we're seeing it again today."

Despite broad support from the public and some on both sides of the aisle on Capitol Hill over the years, a congressional stock trading ban has not been adopted.

"Inevitably with any kind of major reform of Congress, it requires the public to actually embarrass Congress into doing the right thing," Holman said. "Congress doesn't want to impose these types of restrictions that deny them the means of cashing in. They eventually do impose these types of restrictions when it becomes a very public issue and the public basically pushes Congress into acting."

Legislation to ban stock trading in Congress has seen a few iterations in recent years with some level of bipartisan support. In 2023, Rep. Pramila Jayapal, D-Wash., sponsored the Bipartisan Ban on Congressional Stock Ownership Act, seeking to force members to divest from stocks, bonds, commodities, futures or any other securities within 180 days of its enactment. This also applied to the spouses of members.

Sen. Jeff Merkley, D-Ore., introduced a bill to end trading and holdings for members of Congress in 2023. It passed the Senate Homeland Security and Government Affairs Committee in July.

The proposal prohibits members of Congress, the president and the vice president from purchasing stocks and cryptocurrencies. The prohibition extends to these individuals' spouses and any dependent children in 2027.

"The public doesn't think we should profit from having information that they don't have, and we shouldn't," Merkley said in a statement.

Jordan Libowitz, vice president of communications with Citizens for Responsibility and Ethics in Washington, told UPI his organization supports a ban on congressional stock trading but would prefer Congress go a step further.

"Banning stock trading in Congress is helpful. Banning stock ownership, banning the ownership of individual company stock is what's truly needed," Libowitz said. "Because as long as members own stocks, even if they're not looking to quickly profit by selling them, they can sit on a committee hearing and craft a bill that helps someone testifying from a company they own stock in."

Libowitz adds that CREW supports a ban that would move all congressional stock holdings to a blind trust.

The Merkley legislation would ban lawmakers from holding stocks in a blind trust, marking a significant difference from previous versions of such legislation.

"The average member of Congress outperforms the market and outperforms hedge funds and professional investors with their assets," Libowitz said. "Something seems off about that. When the general public hears these kinds of stories it's an easy ask for them. It shouldn't be a tough decision. Public service is a sacrifice."

12 notes

·

View notes

Text

April 7, 2025

HEATHER COX RICHARDSON

APR 8

READ IN APP

Major indexes on the stock market began down more than 3% today when, as Allison Morrow of CNN reported, a rumor that Trump was considering delaying his tariffs by three months sent stocks surging upward by almost 8%. The rumor was unfounded—it appeared to begin from a small account on X—but it indicated how desperate traders are to see an end to President Donald J. Trump’s trade war.

As soon as the rumor was discredited, the market began to fall again, although Treasury Secretary Scott Bessent’s announcement that he is opening trade negotiations with Japan and looking forward to talks with other countries appeared to reassure some traders that Trump's tariffs will not last. The wild swings made the day one of the most volatile in stock market history. It ended with the Dow Jones Industrial Average down by 349 points and the S&P 500 and the Nasdaq Composite staying relatively flat. Futures for tomorrow are up slightly.

Foreign markets fared badly today, suggesting that the reality of Trump’s tariffs is beginning to sink in. Sam Goldfarb of the Wall Street Journal notes that Hong Kong’s Hang Seng took its biggest dive since the 1997 Asian financial crisis, losing 13%, and that other markets also fell today.

Goldfarb reports that in the U.S., traders are deeply worried about losses but also anxious about missing a rebound if the administration changes its policies. Hence the extreme volatility of the market. Generally, values over 30 are considered indicators of increased risk and uncertainty in the Chicago Board Options Exchange (CBOE) Volatility Index, the so-called fear gauge. Today, it spiked to 60.

Business leaders are speaking out publicly against Trump’s tariffs. Today, Ken Langone, the co-founder of Home Depot and a major Republican donor, told the Financial Times: “I don’t understand the goddamn formula.”

Senate Republicans are also starting to push back. Seven Republican senators have now signed onto a bill that would limit Trump’s ability to impose tariffs. The power to levy tariffs belongs to Congress, but Congress has permitted a president to adjust tariffs on an emergency basis. Trump declared an emergency, and it is on that ground that he has upended more than 90 years of global economic policy.

Trump has threatened to veto any such legislation, but he will not need to if Senate majority leader John Thune (R-SD) and House speaker Mike Johnson (R-LA) refuse to bring the measure to a vote. Jordain Carney and Meredith Lee Hill of Politico report that while Republicans express concern about the tariffs in private, leaders will stand with the president because they must have the votes of MAGA lawmakers to pass any of their legislative agenda through Congress, and to get that they will need Trump’s support. Others are worried about incurring Trump’s wrath and, with it, a primary challenger.

“People are skittish. They’re all worried about it,” Senator Rand Paul (R-KY) told Carney and Hill. “But they are putting on a stiff upper lip to act as though nothing is happening and hoping it goes away.”

But so far, it does not look as if it’s going to go away. Today the European Commission has announced 25% countertariffs in retaliation for Trump’s tariffs.

Trump’s response to the crisis has been to double down on his tariff plan. This morning he wrote on his social media network that he will impose additional 50% tariffs on China effective on Wednesday unless it drops the retaliatory tariffs it has placed on U.S. products. Rather than backing down, China said it would “fight to the end.”

Today, in a press conference convened in the Oval Office, Trump explained his thinking behind why he has begun a global tariff war. "You know, our country was the strongest, believe it or not, from 1870 to 1913. You know why? It was all tariff based. We had no income tax,” he said. “Then in 1913, some genius came up with the idea of let’s charge the people of our country, not foreign countries that are ripping off our country, and the country was never, relatively, was never that kind of wealth. We had so much wealth we didn’t know what to do with our money. We had meetings, we had committees, and these committees worked tirelessly to study one subject: we have so much money, what are going to do with it, who are we going to give it to? And I hope we’re going to be in that position again.”

Aside from this complete misreading of American history—Civil War income taxes lasted until 1875, for example, tariffs are paid by consumers, the Panics of 1873 and 1893 devastated the economy, few Americans at the time thought the Gilded Age was a golden age, and I have no clue what he’s referring to with the talk about committees—Trump’s larger motivation is clear: he wants to get rid of income taxes.

Congress passed the 1913 Revenue Act imposing income taxes to shift the cost of supporting the government from ordinary Americans, especially the women who by then made up a significant portion of household consumers, to men of wealth. Tariffs were regressive because they fell disproportionately on working-class Americans through their everyday purchases. Income taxes spread costs more evenly, according to a man’s ability to pay. The switch from tariffs to income taxes helped to break the power of the so-called robber barons, the powerful industrialists who controlled the U.S. economy and government in the late nineteenth century.

To get rid of income taxes, Trump and his Republicans have backed the decimation of the government services that support ordinary Americans.

Today, in the Oval Office press conference, Trump and Defense Secretary Pete Hegseth suggested where they intend to put government money, promising a defense budget of $1 trillion, a significant jump from the current $892 defense budget. “[W]e have to be strong because you’ve got a lot of bad forces out there now,” Trump said.

Allison McCann, Alexandra Berzon, and Hamed Aleaziz of the New York Times reported today that the administration also intends to spend as much as $45 billion over the next two years on new detention facilities for immigrants. In the last fiscal year, the total amount of federal money allocated to the Immigration and Customs Enforcement was about $3.4 billion. The new facilities will be in private hands and will operate with lower standards and less oversight than current detention facilities.

—

10 notes

·

View notes

Text

Bill Bramhall

* * * *

LETTERS FROM AN AMERICAN

April 7, 2025

Heather Cox Richardson

Apr 08, 2025

Major indexes on the stock market began down more than 3% today when, as Allison Morrow of CNN reported, a rumor that Trump was considering delaying his tariffs by three months sent stocks surging upward by almost 8%. The rumor was unfounded—it appeared to begin from a small account on X—but it indicated how desperate traders are to see an end to President Donald J. Trump’s trade war.

As soon as the rumor was discredited, the market began to fall again, although Treasury Secretary Scott Bessent’s announcement that he is opening trade negotiations with Japan and looking forward to talks with other countries appeared to reassure some traders that Trump's tariffs will not last. The wild swings made the day one of the most volatile in stock market history. It ended with the Dow Jones Industrial Average down by 349 points and the S&P 500 and the Nasdaq Composite staying relatively flat. Futures for tomorrow are up slightly.

Foreign markets fared badly today, suggesting that the reality of Trump’s tariffs is beginning to sink in. Sam Goldfarb of the Wall Street Journal notes that Hong Kong’s Hang Seng took its biggest dive since the 1997 Asian financial crisis, losing 13%, and that other markets also fell today.

Goldfarb reports that in the U.S., traders are deeply worried about losses but also anxious about missing a rebound if the administration changes its policies. Hence the extreme volatility of the market. Generally, values over 30 are considered indicators of increased risk and uncertainty in the Chicago Board Options Exchange (CBOE) Volatility Index, the so-called fear gauge. Today, it spiked to 60.

Business leaders are speaking out publicly against Trump’s tariffs. Today, Ken Langone, the co-founder of Home Depot and a major Republican donor, told the Financial Times: “I don’t understand the goddamn formula.”

Senate Republicans are also starting to push back. Seven Republican senators have now signed onto a bill that would limit Trump’s ability to impose tariffs. The power to levy tariffs belongs to Congress, but Congress has permitted a president to adjust tariffs on an emergency basis. Trump declared an emergency, and it is on that ground that he has upended more than 90 years of global economic policy.

Trump has threatened to veto any such legislation, but he will not need to if Senate majority leader John Thune (R-SD) and House speaker Mike Johnson (R-LA) refuse to bring the measure to a vote. Jordain Carney and Meredith Lee Hill of Politico report that while Republicans express concern about the tariffs in private, leaders will stand with the president because they must have the votes of MAGA lawmakers to pass any of their legislative agenda through Congress, and to get that they will need Trump’s support. Others are worried about incurring Trump’s wrath and, with it, a primary challenger.

“People are skittish. They’re all worried about it,” Senator Rand Paul (R-KY) told Carney and Hill. “But they are putting on a stiff upper lip to act as though nothing is happening and hoping it goes away.”

But so far, it does not look as if it’s going to go away. Today the European Commission has announced 25% countertariffs in retaliation for Trump’s tariffs.

Trump’s response to the crisis has been to double down on his tariff plan. This morning he wrote on his social media network that he will impose additional 50% tariffs on China effective on Wednesday unless it drops the retaliatory tariffs it has placed on U.S. products. Rather than backing down, China said it would “fight to the end.”

Today, in a press conference convened in the Oval Office, Trump explained his thinking behind why he has begun a global tariff war. "You know, our country was the strongest, believe it or not, from 1870 to 1913. You know why? It was all tariff based. We had no income tax,” he said. “Then in 1913, some genius came up with the idea of let’s charge the people of our country, not foreign countries that are ripping off our country, and the country was never, relatively, was never that kind of wealth. We had so much wealth we didn’t know what to do with our money. We had meetings, we had committees, and these committees worked tirelessly to study one subject: we have so much money, what are going to do with it, who are we going to give it to? And I hope we’re going to be in that position again.”

Aside from this complete misreading of American history—Civil War income taxes lasted until 1875, for example, tariffs are paid by consumers, the Panics of 1873 and 1893 devastated the economy, few Americans at the time thought the Gilded Age was a golden age, and I have no clue what he’s referring to with the talk about committees—Trump’s larger motivation is clear: he wants to get rid of income taxes.

Congress passed the 1913 Revenue Act imposing income taxes to shift the cost of supporting the government from ordinary Americans, especially the women who by then made up a significant portion of household consumers, to men of wealth. Tariffs were regressive because they fell disproportionately on working-class Americans through their everyday purchases. Income taxes spread costs more evenly, according to a man’s ability to pay. The switch from tariffs to income taxes helped to break the power of the so-called robber barons, the powerful industrialists who controlled the U.S. economy and government in the late nineteenth century.

To get rid of income taxes, Trump and his Republicans have backed the decimation of the government services that support ordinary Americans.

Today, in the Oval Office press conference, Trump and Defense Secretary Pete Hegseth suggested where they intend to put government money, promising a defense budget of $1 trillion, a significant jump from the current $892 defense budget. “[W]e have to be strong because you’ve got a lot of bad forces out there now,” Trump said.

Allison McCann, Alexandra Berzon, and Hamed Aleaziz of the New York Times reported today that the administration also intends to spend as much as $45 billion over the next two years on new detention facilities for immigrants. In the last fiscal year, the total amount of federal money allocated to the Immigration and Customs Enforcement was about $3.4 billion. The new facilities will be in private hands and will operate with lower standards and less oversight than current detention facilities.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Bill Bramhall#Letters From An American#Heather Cox Richardson#American History#Income Tax#Pete Hegseth#immigration#robber barons#Civil War#Mike Johnson#Stock Market

7 notes

·

View notes

Text

Forex Trading Trends 2025: What’s Hot and What’s Not!

Forex Trading Trends 2025: What’s Hot and What’s Not! Hey there, fellow currency wranglers! Buckle up, because we’re diving headfirst into the wild world of Forex trading trends for 2025. If you thought 2024 was a rollercoaster, just wait until you see what’s coming around the bend! Grab your favorite beverage, and let’s get this party started! ⚡ Don’t Get Left Behind! Master Next-Gen AI…

View On WordPress

#Best trading apps for passive income#How to trade in volatile markets#Real-time sentiment analysis for traders#Swing trading techniques for stocks and crypto#Tax-efficient trading strategies 2025#Tokenized asset trading explained#Web3 trading strategies for crypto portfolios

1 note

·

View note

Text

Bullwaypro.com review Trading Times

Finding a reliable broker in the forex market can feel like searching for a needle in a haystack. With so many platforms out there, how do you know which ones are trustworthy? That’s exactly why we’re diving into Bullwaypro.com review—a broker that’s been gaining traction among traders.

Legitimacy in this industry isn’t just about having a sleek website. It’s about proper regulation, transparency, user satisfaction, and overall trading conditions. So, does Bullwaypro.com reviews check all the right boxes? We’ll break down everything you need to know—its licensing, customer reviews, trading conditions, and more—to see if this broker is as solid as it claims to be.

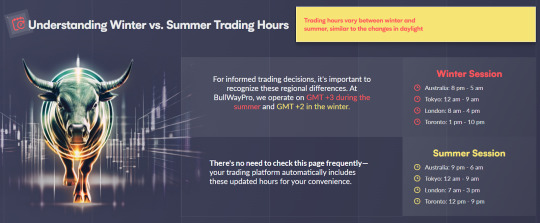

Bullwaypro.com Trading Times Review: Market Hours for Optimal Trading

Understanding the trading times of a broker is crucial for maximizing opportunities in the forex market. Bullwaypro.com review operates across major global trading sessions, ensuring that traders can engage in the market at the most active times.

Winter Session:

Australia: 8 PM - 5 AM

Tokyo: 12 AM - 9 AM

London: 8 AM - 4 PM

Toronto: 1 PM - 10 PM

Summer Session:

Australia: 9 PM - 6 AM

Tokyo: 12 AM - 9 AM

London: 7 AM - 3 PM

Toronto: 12 PM - 9 PM

This schedule aligns with the forex market's peak trading hours, ensuring liquidity and volatility—two key factors that traders look for. The London and New York overlap (12 PM - 4 PM GMT in winter, 11 AM - 3 PM GMT in summer) is particularly significant, as it's the most active period for currency trading.

Bullwaypro.com– Establishment and Domain Registration

When evaluating a broker’s legitimacy, one of the first things to check is its establishment date and domain registration. A reliable company will always have these dates aligned—meaning the brand should not be created after its official domain was registered. This is a key indicator of transparency.

Bullwaypro.com review was founded in 2022, while its domain was registered in November 2021. What does this tell us? It shows that the company planned its online presence in advance rather than setting up a website at the last minute for questionable operations.

There is no discrepancy here, which is already a good sign. Scammers often register domains retroactively or use brand-new websites with no history. In this case, everything checks out: the brand was officially launched in 2022, but preparations for its online presence started earlier. This looks like a strong argument in favor of legitimacy.

This approach is typical of companies that plan for long-term operations rather than short-term gains. Serious brokers care about their reputation from the very beginning.

Bullwaypro.com– Regulatory License

One of the strongest indicators of a broker’s legitimacy is its regulation. A broker operating under a well-known financial authority provides a layer of security for traders. It ensures that the company follows strict guidelines, adheres to fair trading practices, and protects client funds. So, what about Bullwaypro.com reviews?

This broker is regulated by the FCA (Financial Conduct Authority), which is one of the most respected financial regulators in the world. The FCA is known for its stringent requirements, which include financial transparency, capital adequacy, and strict anti-fraud measures. Not every broker can obtain this license—it’s granted only to companies that meet high operational and ethical standards.

Why does this matter? Because brokers regulated by the FCA are legally required to segregate client funds, meaning traders’ money is kept separate from the company’s operational funds. This significantly reduces the risk of mismanagement or fraud. Moreover, FCA-regulated brokers must participate in compensation schemes, which provide traders with financial protection in case of unexpected company failures.

This looks like a strong argument in favor of Bullwaypro.com’s legitimacy. A broker with an FCA license isn’t just an offshore entity operating without oversight—it’s a company that abides by strict regulatory standards. We think that’s a big deal when it comes to trust.

Bullwaypro reviews – Customer Reviews and Reputation

When assessing a broker’s trustworthiness, user feedback plays a crucial role. A high Trustpilot rating and a large number of reviews indicate that traders actively use the platform and, more importantly, are satisfied with its services. So, how does Bullwaypro.com review perform in this regard?

Bullwaypro.com reviews has an impressive Trustpilot score of 4.4, based on 2,995 reviews. That’s a significant number of ratings, which suggests that the platform is not only widely used but also maintains a high level of client satisfaction. In the forex industry, where scams are unfortunately common, it’s rare to see brokers with such consistently positive feedback.

Now, let’s break this down further. Out of the total reviews, 2,869 are rated 4 or 5 stars. This means that over 95% of users have had a positive experience with the broker. What does this tell us? First, that traders are successfully using the platform and are happy with its services. Second, that the company is not hiding behind fake reviews or limited feedback—it has a real and engaged user base.

Final Verdict: Is Bullwaypro.com reviews a Legit Broker?

After analyzing all key aspects of Bullwaypro.com review, the evidence strongly suggests that this broker is legitimate. Let’s quickly recap why:

Regulation: Bullwaypro.com reviews is regulated by the FCA, one of the most respected financial authorities. This ensures strict oversight, fund security, and compliance with industry standards.

Domain and Establishment Date: The broker was founded in 2022, with its domain registered in 2021, showing transparency and long-term planning.

User Reviews: A Trustpilot score of 4.4 based on 2,995 reviews—with over 95% positive ratings—indicates a strong reputation and high trader satisfaction.

Trading Conditions: The platform offers multiple account types, fast deposits & withdrawals, low fees, and a well-rated mobile app—features that serious traders look for.

Customer Support & Accessibility: A variety of contact options and a well-structured support system make it easy for traders to get help when needed.

Looking at all these factors together, Bullwaypro.com review appears to be a trustworthy and well-regulated broker. It has a solid reputation, a strong regulatory framework, and a growing community of satisfied traders. While every trader should conduct their own due diligence, all signs point to this being a reliable choice in the forex market.

9 notes

·

View notes