#Swing trading techniques for stocks and crypto

Explore tagged Tumblr posts

Text

Forex Trading Trends 2025: What’s Hot and What’s Not!

Forex Trading Trends 2025: What’s Hot and What’s Not! Hey there, fellow currency wranglers! Buckle up, because we’re diving headfirst into the wild world of Forex trading trends for 2025. If you thought 2024 was a rollercoaster, just wait until you see what’s coming around the bend! Grab your favorite beverage, and let’s get this party started! ⚡ Don’t Get Left Behind! Master Next-Gen AI…

View On WordPress

#Best trading apps for passive income#How to trade in volatile markets#Real-time sentiment analysis for traders#Swing trading techniques for stocks and crypto#Tax-efficient trading strategies 2025#Tokenized asset trading explained#Web3 trading strategies for crypto portfolios

1 note

·

View note

Text

youtube

⚡ Comprendre tous les patterns de bougies japonaises en 5 minutes Vous voulez lire les marchés comme un pro ? Apprenez à interpréter les bougies japonaises, un outil essentiel en analyse technique.

📌 Dans cette vidéo, vous apprendrez : ✅ Comment intuitivement cmprendre les patterns de retournement et de continuation les plus connus ✅ Comment les repérer facilement sur vos graphiques sans les connaître ✅ Comment utiliser les time frames pour améliorer vos entrées

Une formation express pour mieux trader, dès aujourd’hui !

#stock market#indicateurs trading#bougies japonaises#signaux trading#day trading#swing trading#crypto trading#tendance haussière#tendance baissière#astuces trading#price action trading#stratégie de trading#trading efficace#retournement bourse#price action#méthode trading visuelle#chandeliers japonais#patterns trading#analyse technique#apprendre trading#signaux de bougies#bougies japonaises trading#bougie engulfing#hammer#candlestick patterns#Youtube

1 note

·

View note

Text

youtube

Looking to spot trend reversals before the rest of the market catches on? This video breaks down powerful reversal signals every smart trader should know to maximize profits and minimize losses. In this detailed guide, we uncover the top reversal patterns, indicators, and techniques used by successful traders across the stock, forex, and crypto markets. Learn how to identify momentum shifts, trap zones, and entry/exit points that could change the game for your trading strategy. Whether you're day trading, swing trading, or investing long-term, understanding reversal signals is key to protecting your capital and boosting returns. Websites: https://tradegenie.com/ https://nosheekhan.com/ Twitter - https://twitter.com/marketswizard Facebook - https://www.facebook.com/financialmar Head Office: Trade Genie Inc. 315 South Coast Hwy 101, Encinitas, CA 92024 Phone Number: 212-408-3000 #ReversalSignals #TradingProfits #TechnicalAnalysis #PriceAction #ChartPatterns #StockMarketTips #ForexTrading #CryptoSignals #SwingTrading #DayTrading #TrendReversal #SmartTrading #UnlockProfits #TradingEducation #MarketMoves

#Reversal-Signals#Trading-Profits#Technical-Analysis#Price-Action#Chart-Patterns#Stock-Market-Tips#Forex-Trading#Crypto-Signals#Swing-Trading#Day-Trading#Trend-Reversal#Smart-Trading#Trading-Education#Youtube

0 notes

Text

Swing Trading Techniques: How to Capture Big Market Moves

forex trading app is the sweet spot between fast-paced day trading and long-term investing. It’s perfect for traders who want to capture big market moves by holding positions for a few days to several weeks, instead of minutes or years. The strategy is simple in theory: Make profit from market “swings” or fluctuations. This means buying near support (when prices dip) and selling near resistance (when prices peak) as trends shift.

What makes swing trading so appealing? It’s flexible, less stressful than day trading, and more active than just buying and holding stocks.

By combining technical analysis with defined entry and exit rules, swing trading offers an accessible way for swing trading for beginners and intermediate retail traders alike to participate in markets without constant screen time.

Understanding Swing Trading

Swing trading is a strategy that uses technical analysis to spot price patterns, momentum changes, and support/resistance levels that show potential buy and sell points over days or weeks. Typical holding periods range from two days up to several weeks, targeting moves that are too large for scalpers but too short for position trading.

Tools like candlestick patterns, oscillators (like RSI), moving averages, and chart patterns—like breakouts or consolidations—help confirm setups in stocks, forex, commodities, and crypto markets, all of which have the volatility needed for this style.

Example: Let’s say you see ABC Corp. trading at $50, forming a clear support level with a rising 20-day moving average. You buy in at $51 and set a stop-loss at $48. A week later, the stock goes up to $60, hitting a short-term resistance zone. You sell, making a $9 profit per share—about a 17.6% gain in just seven days.

Reversal trading anticipates complete turns in market direction, using indicators like RSI or MACD indicator divergences and candlestick patterns (like hammers or engulfing patterns). Traders get in once they see a reversal signal confirmed (e.g., bullish divergence on RSI plus a strong bullish candle).

Essential Tools and Indicators for Swing Trading

Swing traders use a bunch of forex trading platforms to find high-probability setups and confirm when to enter or exit.

Moving averages help smooth out price data to spot trends and dynamic support/resistance levels. The Simple Moving Average (SMA) calculates the average closing price over a certain time (like 50 or 200 days), while the Exponential Moving Average (EMA) focuses on more recent prices for quicker reactions. Traders often look for crossovers (like the 50-day EMA crossing above the 200-day EMA, also known as the "Golden Cross") to spot trend reversals or confirm breakouts.

Relative Strength Index (RSI)

The RSI indicator measures momentum on a scale from 0 to 100, showing when something is overbought (>70) or oversold (<30). Using RSI with MACD helps confirm reversals because they look at momentum in different ways.

MACD

The Moving Average Convergence Divergence (MACD) shows the difference between two EMAs (usually 12- and 26-period) and signals crossovers to indicate when trends are shifting.

Bollinger Bands

Bollinger Bands consist of a middle SMA and upper/lower bands set two standard deviations away from the SMA.

In January 2025, UAL set up for a reversal at its 50-day EMA and broke out with above-average volume. You could enter at $38 with a stop-loss at $36.50 and take profits in stages, like selling a quarter at +2% and another quarter at +10%, which helped cushion you before earnings. Even though the stock dipped after a good report, this method secured a net gain of about 7.8% by selling into strength and locking in profits before the market got shaky.

In late 2024, GEV bounced back to its 21-day moving average after the GE spin-off, leading to a long entry at $345 with a stop at $338. However, a sell-off in the sector triggered the stop the next day, resulting in a 2% loss. A partial re-entry when strength returned saw selling near $350 before hitting resistance, which helped avoid bigger losses when the overall energy sector took a hit.

Lesson Learned: Always check the strength of related indices and sector trends before re-entering, since broader market weakness can mess up even good setups.

Tips for Successful Swing Trading

Implement the following swing trading best practices to improve consistency and performance.

Develop and Follow a Trading Plan: Define setups, risk rules, and review criteria before entry.

Maintain a Trading Journal: Record setups, emotions, and outcomes to identify strengths/weaknesses.

Use Multiple Time Frames: Use a higher time frame (daily) for trend direction and a lower one (4-hour) for precise entries.

Stay Updated: Monitor economic calendars for events that can trigger volatility.

Avoid Emotional Decisions: Follow your plan; don’t chase losses or overtrade.

0 notes

Text

Stockchartpros – Price Action Mastery Course by Tom Winterstein

🌀 Master Price Action Like a Pro – with Tom Winterstein 🌀 Stockchartpros | 2.28 GB of Pure Trading Knowledge

If you're into trading—whether it's Crypto, Forex, Stocks, Commodities, or Options—this course is 🔥. Tom Winterstein breaks down the real strategies behind market structure, sentiment, Fibonacci levels, swing trading, and trading psychology.

💥 Perfect for: ✔️ Beginners wanting a strong foundation ✔️ Intermediates aiming for consistency ✔️ Experienced traders fine-tuning their edge

📚 Course Highlights: — Market Sentiment & Psychology — Structure & Support/Resistance — Advanced Fibonacci Techniques — Strategy Integration — Swing Trading Mastery — Live Webinars with Tom

👉 Learn to trade with confidence, not guesswork. 📈 Enroll now and level up your strategy.

#cryptocurrency#forex market#artificial intelligence#sales#forex expert advisor#blockchain#business#marketing#forextrading#chatgpt#swing trading#swinging sixties

0 notes

Text

AI stock and crypto trading bots are revolutionizing the financial landscape

AI stock and crypto trading bots are revolutionizing the financial landscape by bringing advanced algorithms and machine learning techniques into the world of trading. These bots are designed to automatically execute buy and sell orders on behalf of traders, using artificial intelligence to analyze market data, identify trends, and make decisions with a level of speed and accuracy that human traders often cannot match. The rise of AI-powered trading bots has been a game-changer, as they enable both novice and experienced traders to navigate complex financial markets more efficiently and effectively.

One of the most significant advantages of AI trading bots is their ability to process large amounts of market data in real time. Financial markets, whether they are focused on stocks or cryptocurrencies, move at a rapid pace, with prices fluctuating constantly due to a wide range of factors such as news, economic indicators, geopolitical events, and market sentiment. Traditional human traders may struggle to keep up with these fast-paced changes and may miss opportunities as a result. AI bots, however, can analyze vast amounts of data within seconds, spotting patterns and trends that human traders might overlook. This allows AI bots to make data-driven decisions that increase the likelihood of success.

AI trading bots rely on machine learning algorithms, which are designed to continually learn and improve over time. By analyzing past market data and studying the outcomes of previous trades, these bots can adjust their strategies to optimize their performance. This adaptability is crucial in the ever-changing world of stock and crypto trading, where market conditions can shift rapidly. Unlike human traders, who may be influenced by emotions like fear or greed, AI bots are purely objective, making decisions based solely on data and predefined strategies. This helps remove emotional bias from the trading process, leading to more consistent and reliable results.

In the world of crypto trading, where volatility is often higher than in traditional stock markets, AI trading bots are especially valuable. Cryptocurrencies are known for their large price swings within short periods, creating both significant risks and potential rewards. AI bots are able to monitor multiple cryptocurrencies at once, analyzing their price movements, trading volumes, and other relevant indicators to identify profitable trading opportunities. These bots can also execute trades faster than a human can react, capitalizing on small price changes that may not be apparent to traders without the aid of advanced technology. This ability to take advantage of even the smallest market fluctuations can lead to higher profits for traders who use AI bots effectively.

Another key benefit of AI trading bots is their ability to operate 24/7 without the need for breaks or rest. Unlike human traders, who can only monitor markets during specific hours, AI bots can trade around the clock, ensuring that opportunities are never missed. This is particularly important in the cryptocurrency market, which operates continuously, unlike traditional stock markets that have set trading hours. By being able to trade constantly, AI bots can take advantage of opportunities in global markets, even while the trader is asleep or otherwise occupied. This level of availability allows for a more aggressive and comprehensive trading strategy that can increase returns over time.

AI trading bots are also highly customizable, allowing traders to set specific parameters and rules for their trades. These parameters can include factors such as risk tolerance, profit targets, stop-loss limits, and trade volume. The flexibility of AI bots ensures that traders can tailor their strategies to suit their individual needs and preferences, whether they are looking for short-term gains or long-term investments. Additionally, many AI bots come with backtesting capabilities, allowing traders to test their strategies using historical data before deploying them in live markets. This enables traders to refine their strategies and reduce the risk of making costly mistakes.

For those interested in crypto trading, AI bots offer the added advantage of being able to analyze and trade on multiple exchanges simultaneously. With cryptocurrencies traded across various platforms, it can be challenging for individual traders to monitor all of them effectively. AI bots, however, can track prices, volumes, and other key metrics across multiple exchanges, ensuring that traders can capitalize on arbitrage opportunities and get the best possible prices for their trades. This ability to operate on a global scale makes AI bots even more powerful in the highly competitive world of crypto trading.

Despite their many benefits, AI trading bots are not without their risks. While these bots are designed to analyze data and execute trades quickly, they are still dependent on the quality of the algorithms and the data they use. If the underlying algorithms are flawed or the data is inaccurate, the bot’s performance can be negatively impacted. Additionally, while AI bots can make decisions based on historical data, they are not immune to sudden market shifts or unforeseen events that can cause significant price movements. It is also important for traders to monitor their bots regularly, as market conditions can change, and strategies may need to be adjusted accordingly.

In conclusion, AI stock and crypto trading bots are powerful tools that have the potential to transform the way traders approach the financial markets. By leveraging the capabilities of artificial intelligence, these bots can process vast amounts of data, identify trends, and execute trades with incredible speed and precision. While they are not without risks, AI trading bots provide traders with the ability to make more informed decisions, operate around the clock, and potentially achieve greater profitability. As AI technology continues to evolve, the role of AI in stock and crypto trading will only become more integral, offering even more opportunities for traders to capitalize on the rapidly changing markets.

0 notes

Text

XNDTrades Course: Mastering the Art of Trading The XNDTrades Course is designed for aspiring and experienced traders looking to refine their strategies and achieve consistent profitability in financial markets. With a focus on simplicity, precision, and actionable insights, this course caters to traders of all levels, whether they’re exploring day trading, swing trading, or long-term investments. Key Highlights of the Course The XNDTrades Course provides comprehensive training through well-structured modules and live practice sessions, ensuring learners can translate theory into real-world application. Here’s what makes it unique: Beginner to Advanced Trading Strategies: The curriculum is built to guide learners step by step, starting with foundational principles and advancing to complex trading techniques, ensuring no one is left behind. Live Market Analysis: Learn to analyze charts, identify trends, and execute trades in real-time markets, gaining hands-on experience. Risk Management Tools: The course emphasizes risk management, helping traders safeguard their capital while maximizing profits. Proprietary Indicators and Tools: Gain access to exclusive tools and indicators that enhance market analysis and improve decision-making accuracy. Psychological Mastery: Trading success often hinges on mindset. The course includes modules on building discipline, handling losses, and maintaining focus under pressure. What You’ll Learn The XNDTrades Course is broken into practical modules to ensure every learner can apply their knowledge effectively: Introduction to Trading: Overview of financial markets (stocks, forex, commodities, and crypto). Setting up trading platforms and accounts. Key terminologies and concepts. Technical Analysis: Chart reading and pattern recognition. Using moving averages, RSI, MACD, and Fibonacci tools. Understanding candlestick patterns and support/resistance levels. Fundamental Analysis: Evaluating economic news and market sentiment. Understanding earnings reports and macroeconomic factors. Developing a Trading Plan: Crafting personalized strategies based on trading style. Position sizing and entry/exit points. For Beginners: Grasp the basics of trading with a clear roadmap. Avoid common pitfalls with expert guidance. For Intermediate Traders: Strengthen technical and fundamental analysis skills. Develop and refine profitable trading strategies. For Experienced Traders: Access advanced strategies and exclusive tools. Learn to optimize trading efficiency for better returns. Why Choose XNDTrades? Experienced Mentors: The course is led by industry veterans with proven track records, ensuring participants learn from real-world successes and challenges. Flexible Learning: Learn at your own pace with on-demand video lessons, or join live sessions for an interactive experience. Lifetime Updates: As markets evolve, so does the course. Enrollees receive lifetime updates to ensure their strategies remain relevant. Conclusion The XNDTrades Course is more than just a trading program; it’s a comprehensive roadmap to trading mastery. By focusing on practical skills, mindset development, and continuous support, this course equips learners with the tools they need to navigate and succeed in the dynamic world of financial markets. Whether you’re new to trading or looking to scale your expertise, XNDTrades provides the guidance and resources to help you achieve your goals confidently.

0 notes

Text

youtube

📌 Trader sans INDICATEURS : Découvrez pourquoi c'est risqué !

📈 Vous pensez que toutes les informations nécessaires au trading se trouvent directement dans les cours ? Bien que les prix reflètent une multitude de données, les indicateurs techniques jouent un rôle crucial pour interpréter ces informations et affiner vos décisions de trading.

Dans cette vidéo, nous explorerons : ✅ Pourquoi les indicateurs techniques sont essentiels même si les cours contiennent déjà beaucoup d'informations ✅ Comment ces outils peuvent améliorer votre précision et votre efficacité en trading ✅ Un exemple concret de leur utilité Les indicateurs fournissent des perspectives supplémentaires qui ne sont pas toujours évidentes en observant uniquement les cours. Ils aident à identifier les tendances, les points d'entrée et de sortie, et à gérer les risques de manière plus efficace.

🔥 Ne sous-estimez pas la puissance des indicateurs techniques. Ils peuvent transformer une simple observation des cours en une stratégie de trading gagnante.

📢 Regardez cette vidéo jusqu'à la fin pour découvrir comment intégrer efficacement les indicateurs dans votre analyse et optimiser vos performances de trading.

#stock market#tradingview indicator#meilleurs indicateurs#top indicateurs#trading strategy#day trading#swing trading#meilleurs indicateurs techniques#meilleurs indicateurs pour le scalping#trading facile#crypto trading#trader efficacement#stratégies de trading#scalping#thami kabbaj#indicateurs techniques#RSI#bandes de Bollinger#stratégie de trading#outils de trading#gestion des risques#tendances de marché#efficacité en trading#signaux de trading#analyse des marchés#Youtube

0 notes

Text

Comparing Crypto and Forex Trading: Which is Right for You?

In the financial markets two of the most popular forms of assets are crypto currencies and the normal foreign exchange currencies. However, each of both markets is a huge trading opportunity, though akin to the other yet different in many aspects and with different risks. Knowing such distinctions enables a trader to undertake a proper decision with an aim of entering suitable market.

Market Hours and Accessibility

One of the most significant differences between crypto and forex trading is the availability of trading hours. Forex markets are typically open 24 hours a day, five days a week, allowing for constant global participation. On the other hand, the cryptocurrency market operates 24/7 without any closing times. This round-the-clock access gives crypto traders more flexibility, but also requires them to manage the risks of trading without a break.

2. Volatility and Risk

Cryptocurrency markets are known for their extreme volatility. Price swings can be significant within short periods, creating both high-risk and high-reward opportunities. The potential for substantial profits attracts many traders, but the risks involved in the unpredictability of crypto markets are not for the faint-hearted. Forex markets, while also volatile, tend to have less dramatic price swings, offering a more stable environment for those who prefer lower risk.

3. Liquidity

Liquidity is essential for efficient trading, and both markets vary in this regard. Forex is the most liquid market globally, with daily trading volumes exceeding $6 trillion. This high liquidity means that orders can be executed quickly and at the desired price without significant slippage. Cryptocurrencies, by contrast, have much lower liquidity, which can lead to higher slippage and price manipulation. While the liquidity of leading cryptocurrencies like Bitcoin and Ethereum is relatively high, smaller altcoins might experience significant challenges in this area.

4. Regulation and Transparency

Forex markets are heavily regulated by global financial authorities, providing a sense of security for traders. The cryptocurrency market, however, is largely unregulated in many regions, leading to more significant risks such as market manipulation, lack of transparency, and security issues. This makes it crucial for crypto traders to carefully choose exchanges and strategies.

5. Trading Strategies

Forex traders often rely on well-established strategies based on technical analysis, fundamental analysis, and economic indicators. Crypto traders, however, must factor in unique elements such as the influence of social media, technological advancements, and regulatory news. While both markets offer opportunities for long-term and short-term trading, the dynamics of each require a different approach.

There is no way, other than comparing your goal, tolerance for risk, and strategies in trading that can help you decide between trading in crypto or forex. Crypto trading has higher reward: risk ratios than trading forex since participants operating in this arena are ready to accept market fluctuations as a norm for trading, while participants in the forex market are likely to generate higher returns from tested strategies embedded in forex trading than those of crypto trading.

Be it the New York Stock Exchange or the Financial Markets, the path to a profession as a trader consists in learning the techniques of the trade. ORION Wealth Academy focuses on giving traders necessary tools and advisories, both theoretically and practically in trading of cryptocurrencies and forex. For the novice trader, or a professional trader ORION can direct you to achieving great success in trading.

0 notes

Text

Complete Guide to Candlesticks: Learn How to Decode Market Moves Like a Pro

Candlestick charts are the language of the markets. Whether you're into stocks, crypto, forex, or options—understanding candlesticks can instantly elevate your trading decisions. In this guide, we break down candlestick patterns, how to read them, real-world examples from Indian markets like Nifty and Bank Nifty, and tools like Strike Money that make your charting smarter.

What Is a Candlestick Chart and Why Every Trader Should Use It

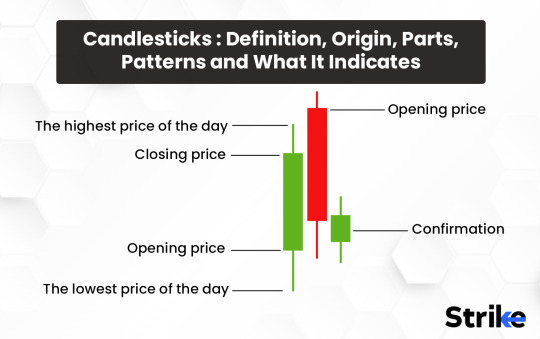

Candlestick charts visually represent price action within a specified time frame—be it 1 minute or a day. Each candlestick shows four data points: Open, High, Low, Close (OHLC).

They originated in 18th century Japan, used by rice trader Munehisa Homma, and were later introduced to the West by Steve Nison, author of Japanese Candlestick Charting Techniques.

Unlike bar or line charts, candlesticks reveal market psychology—the emotional battle between buyers (bulls) and sellers (bears).

Here’s What a Single Candle Tells You

Body: Distance between open and close.

Wicks (Shadows): Highs and lows.

Color: Green/white (bullish), red/black (bearish).

For example, a long lower wick often signals buying pressure and a possible trend reversal.

Top Candlestick Patterns That Actually Work

Let’s look at the patterns Indian traders swear by—backed by data and examples.

1. Bullish Engulfing

What it means: A large green candle fully covers the previous red candle.

Market psychology: Strong buyer dominance.

Real-world example: Seen in Reliance Industries during the March 2023 reversal.

2. Bearish Engulfing

Opposite of bullish engulfing.

Often seen before corrections.

Example: Appeared on Tata Motors right before the July 2022 dip.

3. Hammer

Small body with a long lower wick.

Appears after downtrends.

Indicates buying pressure.

Common on Bank Nifty bounce days.

4. Shooting Star

Small body, long upper wick.

Appears after uptrends.

Signals exhaustion.

A clear sign before Nifty pulled back from 18,800 in Jan 2024.

5. Doji

Open and close are nearly the same.

Signals indecision.

More powerful when found at market tops/bottoms.

These are just the essentials. There are dozens more—Harami, Morning Star, Spinning Top, Inverted Hammer, and Evening Star, each with their own edge.

How to Read Candlesticks Like an Experienced Trader

Knowing patterns isn’t enough. Context is everything.

Combine With Trend

A bullish engulfing in an uptrend is a continuation. In a downtrend, it's a reversal signal.

Watch the Volume

Patterns backed by high volume are more trustworthy. A hammer with high volume is more powerful than one with low participation.

Time Frame Matters

Intraday (5m, 15m): More noise, less reliability.

Daily/Weekly: Better signals for swing trading.

Common Candlestick Charting Mistakes to Avoid

Even experienced traders fall into these traps:

1. Trading Patterns Without Confirmation

Don’t jump in after a single candlestick. Wait for confirmation (like a close above resistance).

2. Ignoring Market Context

Patterns alone don’t make trades. Factor in support/resistance, trendlines, and volatility.

3. Overtrading Small Time Frames

1-minute or 5-minute candles generate more false signals. Be selective.

Why Strike Money Is a Game-Changer for Candlestick Traders

Modern trading needs smarter tools. Strike Money, a leading Indian charting platform, makes candlestick analysis intuitive:

Prebuilt candlestick scanners

Multi-timeframe views

Custom indicators like RSI, MACD, Fibonacci

Works flawlessly across Nifty, Bank Nifty, stocks, and options

Strike Money is used by thousands of Indian retail and professional traders daily.

Using Candlestick Patterns in Indian Markets: Nifty, Bank Nifty & More

Let’s apply these patterns to real market action.

Case Study: Bullish Engulfing on Nifty 50

Date: 16 March 2023

Pattern: Bullish Engulfing

Outcome: Nifty rallied over 300 points in 5 sessions.

Case Study: Hammer on SBI

Date: 5 July 2023

Pattern: Hammer on Daily Chart

Volume: 2x average

Result: 12% gain in 8 days

Case Study: Doji on Bank Nifty

Date: 21 Jan 2024

Pattern: Doji after 5-day rally

Outcome: Sideways correction for 3 days before reversal

How Candlesticks Behave Across Markets

In Forex

Candles form faster due to 24/5 market hours.

Patterns like Morning Star often appear on EUR/USD around major news events.

In Stocks

Indian stocks like Infosys, HDFC Bank form more reliable patterns on daily charts.

Gaps can affect pattern reliability.

In Crypto

Higher volatility means patterns like Engulfing and Shooting Star have more noise.

Use 4-hour or daily timeframes for clarity.

In Options

Candlestick patterns help spot direction in option buying strategies.

Use in confluence with Open Interest (OI) and IV data.

Advanced Tips: Take Your Candlestick Game to the Next Level

1. Multi-Time Frame Analysis

A bullish pattern on the 15-minute chart, backed by a daily trend, increases conviction.

2. Confluence With Indicators

RSI Divergence + Bullish Engulfing = Stronger signal.

MACD Cross + Morning Star = High probability trade.

3. Fibonacci Levels + Candlesticks

Look for reversal patterns near 38.2% or 61.8% retracement levels.

Research & Statistics: Do Candlestick Patterns Really Work?

A study by Thomas Bulkowski, author of Encyclopedia of Candlestick Charts, analyzed 103 patterns:

Best performance: Three Line Strike (83% continuation rate).

Reversal patterns like Morning Star had over 70% reliability in daily charts.

A 2023 backtest by QuantInsti on Indian equities showed:

Bullish Engulfing had a 65% win rate on daily charts with a 1:2 risk-reward.

History You Didn't Know: Candlestick Origins From Japan

Before charts, there was rice.

Munehisa Homma, a legendary rice trader from 18th-century Japan, used early versions of candlestick charts to predict price swings.

His techniques were so accurate that he made the equivalent of $10 billion in today’s money and influenced Japanese trading for generations.

His legacy continues with tools we use today.

Best Tools to Master Candlestick Charting in 2025

Strike Money

Ideal for Indian traders. Auto pattern detection, clean UI, real-time data.

TradingView

Global platform with community-shared strategies.

Candlestick FAQs Answered: Straight and Simple

Q: Are candlestick patterns enough for profitable trading? No. Use them with indicators, context, and proper risk management.

Q: Which candlestick pattern is most accurate? According to Bulkowski’s study, Three Line Strike and Engulfing patterns rank high.

Q: How reliable are candlesticks for intraday trading? Reliable on 15-min and higher timeframes, especially with volume confirmation.

Q: Can I use candlesticks for options trading? Yes, especially for directional setups in options buying/selling.

Final Thoughts: Should You Trust Candlestick Patterns?

Candlesticks are not magic, but they are one of the most powerful visual tools in trading. When combined with trend, volume, and support/resistance, they become a trader’s secret weapon.

With platforms like Strike Money, decoding price action is easier than ever.

Learn the language of the market. Let the candles speak.

0 notes

Text

Simple And Effective Technical Analysis Strategy (For Beginners)

Simple And Effective Technical Analysis Strategy (For Beginners) https://www.youtube.com/watch?v=MSxCLyo729k Today we dive deep into my chart analysis breakdown. Loads of information here breaking down candlestick trends, bullish and bearish patterns, and understanding overall direction of a stock. How I customize my stock trading chart for day trading, swing trading and investing long term. What to look for and what to avoid specifically when entering or exiting a position. More importantly be able to simplify everything so anyone can start learning and applying these techniques on their own. Most people copy others, we don't do that. I show you my techniques, style and what goes through my thought process. We map out a plan that we know is not perfect but will act as a guideline moving forward. ✅ Subscribe To My Channel For More Videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ✅ Stay Connected With Me: 👉 (X)Twitter: https://twitter.com/RealAvidTrader 👉 Stocktwits: https://ift.tt/zVurk2J 👉 Instagram: https://ift.tt/brnW1v8 ============================== ✅ Other Videos You Might Be Interested In Watching: 👉 The ULTIMATE Guide to Finding Hidden Gem Stocks | AvidTrader https://youtu.be/pZAKJLk9o0I 👉 How FDA Approval Could Rocket This Penny Stock to New Heights | AvidTrader https://www.youtube.com/watch?v=42AI9djkN0s 👉 Bitcoin Halving's Impact on Crypto Mining: What to Expect | AvidTrader https://www.youtube.com/watch?v=H9jIDKFNUlg 👉 How to Make Big Profits with Short Squeeze Stocks: A Comprehensive Trading Strategy | AvidTrader https://www.youtube.com/watch?v=59q6XeOlzas ============================= ✅ About AvidTrader: Value Investor. Discussing Day & Swing Trades Also Long Term Investments! Stock Breakdowns. Grow Your Trading Account Effectively. Technical Analysis and Pattern Recognition. How to Make Money, But More Importantly Learning & Having Fun in The Process! Avid Trader is not a Series 7 licensed investment professional, but a digital marketing manager/content creator to publicly traded and privately held companies. Avid Trader receives compensation from its clients in the form of cash and restricted securities for consulting services. 🔔 Subscribe to my channel for more videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ===================== #technicalanalysis #chartanalysis #stockanalysis #stockpicks #learnstockmarket #makemoneytrading #howto #chartpatterns #tradingstrategies #swingtrade 0:00 Laying Out The Foundation 0:38 Map Out a Solid Plan 1:10 ZOOM OUT 2:58 One Step at a Time 3:25 Understanding Pivot Points 4:23 Low, High, Close 6:03 Zoom in (More Clarity) 7:04 Relevant Range (Time) 7:47 Highest Close Since August 9:11 Two Specific Levels (Resistance) 12:03 Tie it All Together 13:34 Customization, Personal Preference 15:15 Do NOT Marry One Indicator, Tool 16:03 Bullish or Bearish Interpretation? 17:03 Volume Analysis 17:31 Consistency in Trend 18:23 Takes TIME to Be Consistent 18:35 PRINT This Out 18:56 LISTEN *Recap* 19:57 Fundamental, Technical, Experience Disclaimer: We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk. I am not a certified financial advisor and you must do your own research and due diligence before ever buying or selling a stock. never trade solely based on someone else's word or expectations of a stock! Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use © AvidTrader via AvidTrader https://www.youtube.com/channel/UCK_XU3FW-ffEK8BG5EisnNA March 11, 2024 at 05:24AM

#stockanalysis#investmenttips#investmentstrategy#tradingstrategies#tradingtips#fundamentalanalysis#stockmarket#technicalanalysis

0 notes

Text

Fundamental Guide for Analyzing the Trading Market for Beginners

Examining the different quantitative, qualitative, and economic aspects that affect asset value is part of the process of analyzing the fundamentals of trading markets. Here is a methodical approach to assist you in analyzing market fundamentals:

Learn the Fundamentals of the Trading Market: To begin, make sure you have a firm grasp of the online trade market you're interested in, whether it be crypto currencies, stocks, FX, or commodities. Find out who the major participants are, what terms mean, and how the market works.

Obtain Market Information: Compile pertinent market data and information, such as trade volumes, historical price data, and economic indicators. Make use of trustworthy data sources and financial news sites.

Economic Indicators:

Keep an eye on the economic data that have an impact on the market you trade. They could consist of:

GDP, the rate of unemployment, the Consumer Price Index (CPI), the rate of inflation, interest rates, and central bank policies

Purchasing Managers' Index (PMI) for Manufacturing and Services

Analysis of Retail Sales Companies and the Industry (For Stocks):

Company and Industry Analysis:

Examine the balance sheet, income statement, and cash flow statement of a corporation.

Examine important financial ratios such as debt-to-equity (D/E), price-to-book (P/B), and price-to-earnings (P/E).

Examine the management group, growth potential, and competitive position of the business.

Recognize market share, industry trends, and the competitive environment.

Geopolitics and Global Events: Take into account the potential effects that economic policies, geopolitical unrest, and global events may have on the market. Market fluctuations can be brought on by things like trade deals, elections, and foreign crises.

Supply and Demand Factors: Examine the dynamics of supply and demand for tangible assets and commodities. Weather, geopolitical unrest, and technical developments are a few examples of variables that might affect costs.

Study the monetary policies and economic indicators of the nations whose currencies you are dealing in the currency and forex markets. Currency values can be impacted by shifts in interest rates, trade balances, and economic growth.

News and Sentiment Analysis: Keep an eye on market-related news and sentiment. News, whether favorable or unfavorable, might affect prices in the near term. Financial news sites and social media can offer perceptions into the mood of the market.

Government Regulations and Policies: Recognize the potential effects that fiscal policies, regulations, and policies may have on the market. Asset prices may be impacted by modifications to trade laws, tax laws, and industry-specific rules.

Establish a distinction between the two types of market volatility: short-term and long-term. While short-term traders take advantage of price swings, long-term investors concentrate on underlying value.

Analyze Market and Asset Performance: Examine how the asset you're considering has performed in relation to pertinent indices, benchmarks, or comparable assets. This aids in your comprehension of the asset's performance in relation to the larger market.

Risk assessment: Take into account any hazards that can have an effect on the market. These might have to do with the economy, politics, technology, or regulations.

Create a Trading plan: Create a trading plan that fits your objectives and risk tolerance based on your fundamental analysis. Establish position sizing, risk management strategies, and entry and exit locations.

Continue Learning and Adapting: The market is dynamic and subject to quick changes. Maintain your knowledge base, modify your analysis techniques, and keep up with industry advancements. Recall that trading involves more than simply fundamental examination. It can be used in conjunction with technical analysis, risk management, and trading psychology to offer a more thorough strategy for profitable financial market trading.

#best trading platforms#best trading online platform#trading online#best forex trading website#forex trading techniques#online trade marketing#best online trading#online trading company

0 notes

Text

5 proven tips for intraday crypto trading

Investing in day crypto trading is a method that involves making several transactions of one or more stocks during the day to generate a profit. While typical buy-and-hold investors are concerned with a company’s long-term success, day traders are concerned with taking advantage of more rapid profit-making chances.

Here are the top 5 crypto intraday trading tips for intraday crypto trading-

1. Select a trading platform on which to do business.

Deciding on which platform to utilize is the first stage of becoming a day trader. Because only domestically regulated crypto-trading platforms are available to traders living in the United States, this is an important feature to consider while looking for the best platform.

When it comes to picking the best platform for buying and selling the best cryptocurrency for intraday trading, exchange liquidity, asset liquidity, and fees are at the top of the list for traders. Because of the volatility of the cryptocurrency market, the value of digital assets might fluctuate dramatically. Traders who want to optimize their gains in this market must act quickly to achieve their goals.

2. Make your investing decisions.

Once you’ve created an account on a platform, it’s time to decide what kind of investments you’re interested in. Market volatility is an unavoidable evil for cryptocurrency day traders and is one of the crypto intraday trading tips.

The same market environment that scares away buy-and-hold investors creates possibilities for day traders to benefit from the market’s turbulence and volatility. Volatility and liquidity are two characteristics that day traders want to engage in activities in the cryptocurrency market.

When deciding on which assets to invest in, consider the liquidity, volatility, and trading volume of the assets.

3. Select a trading strategy from the options available.

There are a variety of strategies that day traders use to profit from short-term changes in the cryptocurrency markets for the best cryptocurrency for intraday trading. A successful cryptocurrency day trader should have a winning strategy supported by research and detailed strategies for when to join and leave their trades.

Arbitrage possibilities between cryptocurrency pairings may be facilitated. A profit may be made by taking advantage of the difference in value between the prices of a cryptocurrency pair consisting of a lesser-known altcoin and Bitcoin when its price swings from one exchange to another.

4. Range Trading

Range trading is based on the premise that prices tend to move within a certain range of values. When using this method, it is necessary to consider candlestick charts and support and resistance levels.

Crypto trading signals exist when prices hit a support level and when prices reach a resistance level, and traders may take advantage of these opportunities. Alternatively, they might go short when prices reach resistance and finish out the short when prices fall to support levels.

Pivot points are an example of crypto trading in a range-bound environment. The calculation of pivot points provides investors with an indication of the price levels at which momentum is most likely to reverse.

5. Scalping

This technique attempts to benefit from extremely modest price movements over very short periods of crypto trading bots. Often, there are market inefficiencies, such as gaps in the bid-ask spread or gaps in liquidity, causing the problem.

Because they attempt to profit from minute price swings, “scalpers” often trade leverage, such as margin or futures contracts, to magnify their gains and maximize their profits. Since this approach increases the likelihood of losses, risk management is particularly critical with this method.

Scalpers may use tactics such as volume heatmaps, order book research, or various technical indicators to discover the best times to enter and exit trades to maximize profits and is the best crypto intraday trading tips.

Scalping is best suited for experienced traders due to the high-risk and high-speed nature of the trading environment and crypto trading bots.

3 notes

·

View notes

Text

Welcome to Traders Platform, best Share market Classes in Nerul at your premier destination for mastering the intricacies of the stock market from foundational principles to advanced stock market trading strategies.With over 8 years of dedicated experience in our stock market and trading course, we’ve empoweredover 1000 students, witnessing countless life-changing transformations along the way. As a SEBI registered and NISM certified broker, Traders Platform stands as India’s foremost stock market tradingtraining center and share market trading classes in Navi Mumbai.

We provide a wide range of comprehensive, best online courses on stock trading for beginner and seasoned traders as well. Positional trading, swing trading, short-term trading, and investment theoryfor stocks, options, futures, commodities, and currencies are just a few of the many asset classes and trading techniques that are covered in these best online stock trading courses. We teach tried-and-true methods and strategies in our Options trading classes, Forex market trading classes, and Crypto market trading classes—all of which are crucial for successful trading and investing—under the direction of a qualified trainer with over eight years of practical expertise in the financial markets. Our focus including risk management, trading fundamentals, advanced technical analysis, and real-world application of strategies cater to individuals seeking trading classes Mumbai. You can register and learn about stock market trading with us by connecting us on +91 9619908688 or mail us your queries at [email protected].

0 notes

Text

What Are The Best Ways To Learn Forex Trading In 2021

The tremendous growth that online forex trading has shown has completed thousands of traders to invest in currency pairs over recent years. If you are among those thinking to commence the forex trading journey, this obvious question must strike your mind. What are the best ways to learn forex trading?

Also, it is crucial to understand the mechanism of the forex market, tactics, methods, strategies, terminologies before entering. These things allow you to manage your risk more efficiently and enhance your win ratio for trades. Thus, pushing you towards success. So, let’s start this idea book containing six best ways to learn forex trading.

The importance of learning forex before entering the market?

It is an era of expansion and innovation. Technology is changing each passing day. The ways we adopted in the past are no more valuable. This advancement is not restricted to work or occupation but has affected the way of earning money. Today many middle-aged and young people are choosing several intellectual ways to expand their wealth.

Working and making capital over the internet has become popular and a major source of income. The financial market today is the most accessible and popular income source for people. Almost all of you must have heard the team’s trader, trading and forex. However, it is the fact that you cannot start with the forex market with little knowledge.

Forex trading is extremely volatile, and this brings a large number of profit opportunities for neophytes. However, these profit opportunities bring along chances of losses too. If you are thinking of starting or learning forex trading, keep in mind that even seasoned investors can lose money.

So, it is better to risk the money which you can afford to lose. You should also keep funds reserved to enable you to trade for several days even if you are facing a series of losses.

Moreover, for trading the forex market efficiently, it is vital to educate yourself before stepping in. There are some best ways to learn forex trading, including articles, websites, books etc. Also, there are other things over the internet, which you can utilise to expand your knowledge. Reading these helps you manage risk, making forex trades and understand how the forex market works. Once you command fundamentals, no one can stop you from becoming a successful forex trader. ��

Best ways to learn forex trading

So, till now, you must have understood the need to learn trading, both in practice and theory. So, it is right time we must look into some best ways to learn forex trading.

1) Self-education

Individual study is the most accessible and one of the best ways to learn forex trading and market fundamentals. This kind of technique reflects that you need to go by each concept yourself all the ways, from starting to the end. For this, the internet is the best solution. It contains numerous sources through which you can expand your knowledge.

There are many pdfs, books, articles, and word files to learn. You just need a strong and uninterrupted internet connection to download these files or learn online. But, there is a single problem associated with this type—the internet contains both fake and authentic information. So, you must check it before starting.

2) Forex trading seminars

Forex trading seminars and stock market seminars are also some of the easiest and best ways to learn forex trading for novice traders today. All kinds of trading gurus and investment professionals conduct multiple seminars, conferences, and training courses for novice investors.

In their free tutorial or lesson, they generally narrate their own success stories as investors, how much they made and how easy it is for investors to profit in the market. You can also attend their paid course and seminar held at regular intervals.

These seminars are useful for traders, but at the same time, they generally aim to describe specific problems rather than at guiding the visitors to trade currency pairs.

However, it is not such that you can’t learn something useful at such a place. Brokers generally concede these types of seminars for their users. The speakers there are specially invited from trading schools and educational institutions.

3) Individual training

Yes, you can also learn forex by attending several training courses. This kind of trading education is more or less similar to lessons at university or schools. You require to contact a broker and ask them to allow you to visit a forex training course.

There are two leading brokers whose educational courses are commendable and provide an ultimate gateway for trading.

ROinvesting courses: ROinvesting is a legitimate broker and widely known for its educational hub. These include articles, videos, tutorials, courses etc. The broker’s courses cover everything from basic to advanced level in a simple but effective language.

HFTrading courses: One of the best ways to learn forex trading is through full-fledged courses of renowned HFTrading. The broker’s education hub is designed concerning all levels of traders in mind. Professional market experts write financial articles.

4) Online training videos

The next way to master forex trading is through online training videos. It is the most accessible source for forex traders. You can get almost every topic explained in detail in these video trading lessons in both specialised and basic ways.

So, what makes these video lectures one of the most accessible and excellent ways? Today, there are numerous internet resources and people who place their financial videos. You can get everything through these videos, including market analysis trading courses, trading ideas, forex trading recommendations, exact entry and exit points and the type of trade suitable for you.

Moreover, you get video lectures, forex trading webinars, and trading tutorials are the only methods to learn forex market in a technoscientific licensed educational establishment if they are in another country or city.

However, a novice can find it a bit hard to find what detail or video is right and what information is useless. The reason for this is that there are thousands of videos on the forex market alone. So, you can start with a suggestion from your experienced friend or analysis.

5) Websites

Many websites are doing extremely well in providing traders with the right knowledge. One of these is fxreviews.best. This website’s major aim is to break the myths about the forex market and push traders towards success. It uploads not only forex trading blogs but also stock trading, crypto trading, commodities trading articles. It is a master in delivering well-researched information that too with simple language.

You get the best blogs on this site every week. Once you start reading, you will find change in your trading style and profit size as the entire material is written by experienced financial analysts. Moreover, with fxreviews.best you get the top and authentic broker list to start your forex journey.

6) Books

As global economies and related currency prices vary depending on a wide variety of things, it makes fast-paced, thrilling trading conditions perfect for day traders for gains. However, this is not suitable for every trader and needs commitments, practice and mental fortitude.

Moreover, it also needs a general knowledge of technical indicators, analysis, market psychology, chart patterns, and many. The books are one of the best ways to learn forex trading and its tactics.

The list provided below contains some of the best forex trading books. These books can make you learn how to start trading currency pairs and become successful in trading.

Currency Trading for Dummies: Brian Dolan and Kathleen Brooks are the authors of this book

Day Trading and Swing Trading the Currency Market: Technical and Fundamental Strategies to Profit from Market Move: Kathy Lien is the authors of this book

Currency Forecasting: A Guide to Fundamental and Technical Models of Exchange Rate Determination: Michael Rosenberg is the authors of this book

How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life: Courtney Smith is the authors of this book

Forex Trading: The Basics Explained in Simple Terms: Jim Brown

7) Demo account

You must have learned this thing over time that nothing surpasses experience, and if you are a novice and wish to learn forex trading, experience is the supreme and sole teacher. If you look into the advice provided by professionals and analysts, you will find that they emphasise opening a demo account. It is perfect for building a good fundamental and technical foundation. But what is a virtual or demo account?

A demo account is a free account offered by the broker. It is similar to other accounts and has all features like them. The only difference between a regular and demo account is that you get virtual cash to trade in the latter. Its other features include:

The financial service provider does not charge any fee for this account. However, you get access for a limited period.

Forex virtual or demo accounts can further help investors master the trade and learn how popular platforms register transactions for various purposes such as tax.

Demo accounts are not real, but they can surely help traders practice trading, risk management, strategies before entering the real trading world.

It is usually an excellent idea to practice at least 40 demo trade orders to understand how vital features such as stop-loss order works.

Every trading platform is different from one another. Thus, even seasoned investors require to learn the functions and workings of these platforms before investing with real money.

How to begin learning the fundamentals of financial trading?

The above part of the article brings some best ways to learn forex trading. This part will explain how to begin trading in the financial markets if you have not opted for special currency pairs education courses. In short, we will make you understand self-taught financial market trading.

1) There are several vital questions that you should answer before entering the financial market.

What are your profit objectives?

What is the purpose of trading?

How much money are you ready to spend on trading?

How much time can you spend on trading?

Are you ready to risk your money?

What amount can you risk?

2) Once you get answers to these questions, you need to define the kind of financial market you wish to trade.

3) Choose a trading platform and brokerage firm. Remember that the firm you have chosen is reliable and legit. A well-regulated firm is often regarded as safe for trading. So, check for the regulation, license number and certificate before moving ahead with the broker. ROinvesting is a regulated firm working under the guidelines of CySEC. Also, go with the broker, which offers a wide range of tradable assets.

4) Look into the function of trading instruments and the basics of forex market trading provided by your financial service provider. For this, you can use the course offered by your provider, online training, or video lessons. Try to go through the principles of currency price, what decides their market price swings, functions of trading instruments.Moreover, pay heed to the basic terminologies such as trend, order, trade, leverage, lot, spread, commissions, swap, long, quote, short.

5) Check the account types offered by the broker and open the one which suits you best. It is always good, to begin with, a demo account rather than the real ECN account. The reason for this is trading requires money, and with it comes psychological stress and mental tension. More than 75% percent of investors lose their money or take the wrong decision while trading because they cannot control their emotions, such as fear, greed, and excessive excitement.

6) Starting trading with a virtual or demo account is one of the best ways to learn forex trading. It provides you with virtual cash. Thus, it suppresses the feeling of stress and fear. Even in case of overexcitement, you will not lose anything. We have discussed other benefits of using a demo account while trading in the above part of the article.

7) Decide the amount of capital you wish to risk or trade with and move ahead. It will be the time to apply theoretical learning and check its potential. Go for trades with minimum lot size and check how the financial market responds and how the techniques work.

8) Trading by employing historical data. When the time period for that you are assigned for training finishes, analyse the outcome. If the outcomes are positive and you made a massive amount, you have the potential to go ahead. There are multiple opportunities, study further to make your fundamentals more strong. But, in case the outcomes are negative, you need to figure out the problems or faults. If you face losses due to technical issues, no worries, you are doing well, but it is high time if the issues are other.

The Bottom Line

So, till now, you must have received the answer to the question raised at the article’s starting. What are some best ways to learn forex trading? The task is surely difficult; the journey is long. But once you clear all these hurdles and build a strong foundation, no one can stop you from attaining heights.

Many traders lose hope in the middle of the game and quit. It will definitely pay you nothing. Either go head with greater confidence or do not start if you find this arena far beyond your reach. Several popular brokerage firms assist traders during the entire trade. You can opt for these trusted firms to mitigate your tensions. It includes firms like HFTrading, ROinvesting, Global TradeATF, T1markets and several others.

3 notes

·

View notes

Text

Complete Guide to Doji Candlestick Pattern: Meaning, Types, and How to Trade It Effectively

The Doji candlestick pattern is one of the most significant formations in technical analysis. It often signals market indecision, which can lead to potential trend reversals or continuations. If you trade in the Indian stock market, forex, or crypto, understanding the Doji pattern can give you an edge.

In this guide, we’ll break down:

What is a Doji candlestick?

Types of Doji and their meaning

How to trade Doji with real-world examples from Indian stocks

Common mistakes traders make

Doji vs. other reversal patterns

📌 Pro Tip: Use tools like Strike.money for advanced candlestick charting and backtesting.

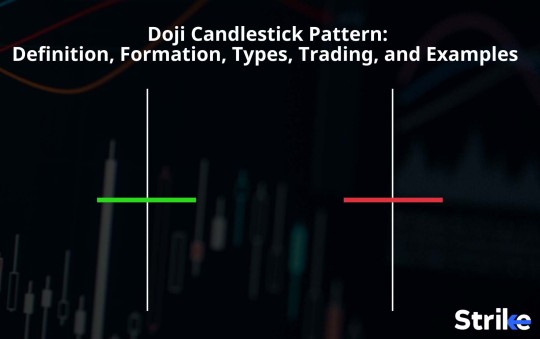

1. What is a Doji Candlestick Pattern?

A Doji candlestick forms when the opening price and closing price are nearly equal. This creates a thin or no real body, with long or short wicks on both sides.

What Does a Doji Indicate?

A Doji suggests that buyers and sellers are in a deadlock. This often happens before a trend reversal or strong breakout.

Historical Background

The Doji pattern comes from Japanese candlestick charting, popularized by Steve Nison in his book Japanese Candlestick Charting Techniques.

2. Why Does a Doji Form? (Market Psychology)

A Doji occurs due to a balance between supply and demand. It often appears:

Before a major market news announcement

During low liquidity periods

At strong resistance or support levels

💡 Example from Indian Market: On October 4, 2023, Tata Steel (NSE: TATASTEEL) formed a Dragonfly Doji at ₹128 support. The stock later reversed and gained 8% in two weeks.

3. Types of Doji Candlestick Patterns and Their Meaning

Not all Doji patterns are the same. Understanding the different types helps in better trading decisions.

🔹 Standard Doji

Looks Like: A plus sign (+)

Meaning: High market uncertainty

Trading Tip: Wait for confirmation before taking a trade.

🔹 Dragonfly Doji (Bullish)

Looks Like: ‘T’ shape

Meaning: Strong buying pressure after a downtrend

Real Example: On May 15, 2023, Reliance Industries (NSE: RELIANCE) formed a Dragonfly Doji at ₹2,300. The stock jumped 6% in 10 days.

🔹 Gravestone Doji (Bearish)

Looks Like: Inverted ‘T’

Meaning: Strong selling pressure after an uptrend

Real Example: On July 7, 2023, Infosys (NSE: INFY) showed a Gravestone Doji at ₹1,500. The stock dropped 4% in 5 days.

🔹 Long-Legged Doji

Looks Like: Long wicks on both sides

Meaning: High volatility, extreme indecision

Trading Tip: Avoid trading unless confirmed by RSI or MACD.

🔹 Four-Price Doji (Rare)

Looks Like: A single horizontal line

Meaning: No market movement (extremely rare)

Trading Tip: Ignore this pattern due to low significance.

📌 Use Strike.money for identifying these patterns in live charts.

4. How to Trade Doji Candlestick Pattern (Winning Strategies)

A Doji alone is not a buy or sell signal. You must confirm it with support-resistance, volume, and technical indicators.

📌 Strategy 1: Doji at Support or Resistance

Best for: Stocks and forex trading

Confirmation: Price rejection with volume increase

Example: HDFC Bank (NSE: HDFCBANK) formed a Gravestone Doji at ₹1,640 resistance in August 2023. The stock fell 5% in 7 days.

📌 Strategy 2: Doji + RSI Indicator

Best for: Trend reversals

Steps:

Look for Doji at a key level.

Check RSI below 30 (oversold) for bullish reversal.

Confirm with next candle before entering.

Example: TCS (NSE: TCS) formed a Dragonfly Doji at ₹3,200 with RSI at 28. The stock rallied 7% in two weeks.

📌 Strategy 3: Doji Breakout Confirmation

Best for: Swing trading

Steps:

Wait for the next candle after Doji.

Trade in the direction of the breakout.

Example: On June 10, 2023, Wipro (NSE: WIPRO) formed a Long-Legged Doji. The next candle closed above it, confirming a breakout rally of 6%.

5. Doji in Different Markets (Stocks, Forex, Crypto)

Each market reacts differently to Doji patterns.

📌 Doji in Stock Market

Works well at major support/resistance levels.

Best combined with moving averages.

📌 Doji in Forex Trading

Stronger when seen on higher timeframes (4H, Daily).

Works well with Bollinger Bands.

📌 Doji in Crypto Trading

More frequent due to high volatility.

Confirm with volume spikes before entering a trade.

💡 Example: In March 2023, Bitcoin (BTC) formed a Dragonfly Doji at $20,000 support. It later surged 18% in 10 days.

6. Common Mistakes Traders Make With Doji Patterns

Many traders fail to use Doji correctly. Here are some critical mistakes to avoid:

❌ Trading Doji Without Confirmation

A single Doji is not a buy/sell signal.

Always wait for the next candle or technical confirmation.

❌ Ignoring Volume Analysis

Low volume Doji = weak signal

Look for increased volume to confirm breakouts.

❌ Using Doji on Small Timeframes

1-minute and 5-minute charts often give false Doji signals.

Focus on higher timeframes (1H, 4H, Daily).

📌 Use Strike.money to backtest Doji performance before live trading.

7. Doji vs. Other Reversal Patterns: Key Differences

8. Is the Doji Candlestick Pattern Reliable?

The Doji pattern is powerful but not foolproof. It works best when combined with:

Support & resistance

Volume confirmation

Technical indicators (RSI, MACD, Moving Averages)

📌 Use Strike.money for accurate candlestick analysis and real-time alerts.

Final Thoughts

The Doji candlestick pattern is a must-know for traders in stocks, forex, and crypto. It signals market indecision, often leading to reversals or breakouts. However, confirmation is key before making trading decisions.

✅ Key Takeaways:

A Doji alone is not a buy/sell signal.

Always confirm with volume and technical indicators.

Works best at strong support/resistance levels.

Avoid low-volume or small-timeframe Dojis.

💡 Ready to apply Doji trading? 🔍 Try Strike.money for real-time charting, Doji pattern detection, and backtesting.

🚀 Happy Trading!

0 notes