#IGBT Transistor Module

Explore tagged Tumblr posts

Text

Power Up Performance with Toshiba MG400Q1US65H: High-Efficiency IGBT Module from USComponent

When it comes to high-power switching applications, the Toshiba MG400Q1US65H IGBT Module stands out as a top-tier solution. Designed for demanding industrial environments, this insulated gate bipolar transistor module (IGBT) offers a robust performance with a collector-emitter voltage of 1200V and a continuous collector current of 400A. It’s the preferred choice for engineers and system designers working on renewable energy systems, motor drives, welding equipment, UPS systems, and power inverters.

The MG400Q1US65H Toshiba IGBT Module is built for reliability, featuring a high-speed switching capability and superior thermal management. Its compact and durable construction helps reduce overall system size while maintaining consistent power output, even in high-temperature or high-stress environments. Whether you're integrating it into solar inverters, electric vehicles, or industrial motor controls, this Toshiba IGBT module delivers reliable, energy-efficient power conversion.

As a ranked Toshiba distributor, USComponent offers authentic and factory-new Toshiba MG400Q1US65H modules at competitive prices. We understand the urgency of keeping your systems up and running, which is why we provide fast shipping, excellent customer service, and expert technical support to ensure you get the right component when you need it. When you source the MG400Q1US65H from USComponent, you're not only investing in a high-performance IGBT module but also partnering with a trusted Toshiba supplier recognized for quality and reliability. Visit USComponent’s product page to learn more or to place your order today. Boost your system’s performance with the power and precision of Toshiba engineering, delivered by the official distributor you can rely on.

#IGBT#IGBT Module#Toshiba Supplier#IGBT Transistor#Toshiba IGBT Module#IGBT Transistor Module#IGBT Power Module#IGBT Distributor#IGBT Suppliers#IGBT Module Price#IGBT Price#Toshiba IGBT#Toshiba Distributor#MG400Q1US65H

0 notes

Text

https://www.futureelectronics.com/p/semiconductors--discretes--transistors--silicon-carbide-mosfets-sic-mosfets/sct2750nytb-rohm-1080295

ROHM, SCT2750NYTB, Transistors, Silicon Carbide MOSFETs (SiC MOSFETs)

N-Channel 1700 V 0.75 Ohm Surface Mount SiC Power Mosfet - TO-268-2

#ROHM#SCT2750NYTB#Transistors#Silicon Carbide MOSFETs (SiC MOSFETs)#sic mosfet module#high voltage sic module#igbt#Power MOSFET#mosfet Transistors#Surface Mount SiC Power Mosfet#Transistors mosfet

1 note

·

View note

Text

Intelligent Power Module Market Size Empowering High-Efficiency Power Solutions

The Intelligent Power Module Market Size is rapidly transforming the power electronics landscape by integrating power switches, gate drivers, protection circuits, and thermal sensors into compact, high-performance modules. These modules play a critical role in smart power conversion, renewable energy systems, electric vehicles, industrial automation, and consumer electronics—offering efficiency, reliability, and simplified system design.

According to Market Size Research Future, the global intelligent power module sector is projected to reach USD 12.2 billion by 2030, advancing at a CAGR of 10.8% between 2023 and 2030. This surge is driven by the increasing demand for energy-efficient technologies, regulatory pressure on emissions, and broadening adoption in high-growth verticals like EVs and Market Size 4.0.

Market Size Overview

Intelligent Power Modules (IPMs) combine insulated gate bipolar transistors (IGBTs) or MOSFETs with integrated control circuitry—enabling precise switching, fault protection, and thermal management in compact packages. These features simplify power system design while enhancing performance and robustness.

Key applications span motor drives for HVAC and industrial automation, inverter systems for solar and UPS installations, EV powertrains, and power supplies for telecommunications. With growing complexity in power requirements, IPMs serve as essential building blocks for modern electronic systems.

Major Market Size Drivers

1. Electric Vehicle Proliferation

The shift toward electric and hybrid vehicles is a major growth driver. IPMs are vital for efficient drivetrain control, onboard chargers, and powertrain cooling systems.

2. Renewable Energy Integration

IPMs are integral to solar inverters and wind power systems, providing high-volume, high-frequency switching with reduced switching losses and enhanced thermal handling.

3. Industrial Automation

Factories and robotics systems demand reliable motor control solutions with built-in protection. IPMs simplify system design and improve uptime.

4. Compliance and Regulations

Global energy efficiency standards and emission norms (such as MINER Act, EU Tier regulations) are pressuring OEMs to implement efficient power electronics—boosting IPM usage for compliance.

Market Size Segmentation

By Device Type:

IGBT-Based IPMs

MOSFET-Based IPMs

By Power Rating:

Below 1 kW

1 kW–10 kW

Above 10 kW

By Application:

EV Motor Drives

Solar and Wind Inverters

UPS and Power Supplies

HVAC Systems

Robotics and Industrial Motors

By Distribution Channel:

Direct OEM Sales

Aftermarket Suppliers

Regional Snapshot

Asia-Pacific

Leading the charge, China, Japan, and South Korea are major producers and adopters—driven by EV manufacturing and renewable energy projects.

North America

The U.S. and Canada emphasize industrial automation and EV infrastructure growth, supported by technology incentives and a robust semiconductor industry.

Europe

European IPM adoption is bolstered by energy-efficient factory mandates, EV deployments, and green building certifications in Germany, the UK, and France.

Competitive Landscape

Leading semiconductor and module manufacturers are focusing on thermal performance, higher switching frequencies, and greater system integration:

Infineon Technologies AG

STMicroelectronics NV

Infineon Technologies AG

Mitsubishi Electric Corporation

Fuji Electric Co. Ltd.

TDK Corporation

Rohm Semiconductor

ON Semiconductor

Texas Instruments

Fuji Electric Co.

These players are developing high-voltage, compact IPMs with embedded sensing, diagnostics, and robust protection features.

Trends to Watch

SiC and GaN Adoption: Innovations in silicon carbide (SiC) and gallium nitride (GaN) materials are enabling higher switching speeds, greater efficiency, and smaller IPM footprints.

Smart Monitoring: Embedded thermistors and current sensors enable real-time data logging and predictive maintenance.

Modular Architectures: Stackable IPMs are simplifying power system scalability and serviceability in industrial fleets and energy storage systems.

Automotive-Grade Solutions: IPMs certified with AEC-Q standards are gaining traction in EVs and automotive applications.

Challenges and Opportunities

Challenges:

High initial cost of wide-bandgap-based IPMs

Intense competition from power discrete solutions

Design complexity in integrating custom power topologies

Opportunities:

Rising adoption in fast-growing sectors such as EV charging and smart grids

Retrofitting industrial motors with upgraded IPMs for energy savings

Development of AI-driven energy management solutions combining IPMs with edge computing

Future Outlook

The future of IPMs lies in greater intelligence, material advancement, and standardization. Modules incorporating SiC/GaN, compact packaging, embedded diagnostics, and 5G-enabled data exchange will become standard. The emerging IPM ecosystem will extend energy resilience from smart homes to smart cities, and from EV fleets to green manufacturing.

Trending Report Highlights

Explore related high-tech segments influencing IPM adoption:

Flash Field Programmable Gate Array Market Size

Fluid Pressure Sensor Market Size

Communication Standard Logic IC Market Size

Gallium Arsenide GaAs Radio Frequency RF Semiconductor Market Size

Thin Film Deposition Equipment Market Size

Audio Power Amplifier Market Size

Semiconductor Bonding Equipment Market Size

Semiconductor Diode Market Size

Surveillance Digital Video Recorder Market Size

Transportation Lighting Market Size

Ultrasonic Gas Leak Detector Market Size

Wireless Flow Sensor Market Size

0 notes

Text

Silent Powerhouses: How igbt rectifiers Are Redefining Industrial Energy Conversion

Picture a bustling manufacturing floor at dawn. Conveyor belts glide, robotic arms pivot with precision, and high-power motors hum in perfect synchrony. All of this choreographed action relies on stable direct current—even though the utility grid delivers alternating current. Converting AC to DC might sound mundane, yet it’s the unglamorous heartbeat of virtually every modern factory, data center, and electric-rail system. Tucked inside control cabinets and power bays, igbt rectifiers are the silent powerhouses making this conversion cleaner, smarter, and dramatically more efficient.

From Diodes to Digital Brains

For decades, silicon diodes and thyristors dominated rectification. They were sturdy, inexpensive, and—let’s be honest—fairly dumb. They could only switch on and off in crude, bulk fashion, producing DC that was rife with voltage ripple and harmonic distortion. That was acceptable in an analog world, but today’s precision-driven operations need better. Enter the Insulated Gate Bipolar Transistor (IGBT): a semiconductor that marries the high-current capability of a bipolar transistor with the fast switching of a MOSFET.

When engineers embed IGBTs in rectifier topologies, the result is a new class of high-frequency converters capable of pulse-width modulation (PWM), soft-start functions, and active power-factor correction. Suddenly, rectification isn’t just about flipping waveform polarity—it’s about sculpting perfect current for sensitive loads, saving megawatts in the process.

A Day in the Life: Humanizing High Tech

Let’s walk in the shoes of Ananya, maintenance lead at a sprawling metro-rail depot in Bengaluru. She remembers the era when traction substations ran on mercury-arc or SCR rectifiers. “It was like taming a dragon,” she jokes. Voltage spikes chewed through bearings, transformers overheated, and harmonics crept back onto the grid. Then came the retrofit: a modular cabinet stuffed with igbt rectifiers. Overnight, the depot saw a 6 % drop in energy losses and, more surprisingly, quieter lines. “Passengers didn’t notice the upgrade,” Ananya says, “but my team sleeps better knowing the system’s self-diagnostics flag issues before they escalate.”

That’s the hidden human upside—less emergency call-outs, more predictive maintenance, and a work culture that shifts from crisis mode to optimization mode.

Under the Hood: Why IGBT Architecture Shines

High-Frequency Switching IGBTs can switch tens of kilohertz, shrinking bulky transformers and filters. Smaller magnetics mean lighter enclosures and better thermal management.

Low Conduction Losses Compared to MOSFETs at high voltage, IGBTs maintain lower on-state resistance, translating into cooler operation and longer component life.

Built-In Protection Advanced gate-driver ICs monitor temperature, current, and voltage in real time, shutting down the device within microseconds if thresholds are breached.

Bidirectional Capability Paired with appropriate circuitry, they enable regenerative braking in electric locomotives, feeding energy back to the grid instead of dumping it as heat.

Sustainability by Design

Energy efficiency isn’t just a line on a spec sheet—it’s a planetary necessity. Traditional 12-pulse SCR rectifiers often hover near 90 % efficiency under ideal loads. Modern PWM-controlled igbt rectifiers push beyond 97 %, slicing gigawatt-hours off cumulative utility bills over their service life. Multiply that by thousands of installations and you have a tangible dent in global CO₂ emissions.

Moreover, precise DC output means motors run cooler, electrolytic capacitors last longer, and upstream generators experience smoother load profiles. Less wear equals fewer raw materials mined, shipped, and processed for replacements—a virtuous cycle of resource conservation.

Beyond the Factory: Emerging Frontiers

Data Centers – Hyperscale operators love IGBT rectifiers for redundant, hot-swappable power shelves that squeeze more watts per rack while meeting stringent harmonic limits (IEEE 519).

Electrolysis for Green Hydrogen – Stable, low-ripple DC is crucial for membrane longevity. As electrolyzer farms scale into the gigawatt realm, PWM rectifiers slash idle losses and enable dynamic ramp-up tied to renewable generation.

EV Hyper-Chargers – Ultra-fast DC stations (350 kW and higher) rely on modular IGBT blocks to convert grid AC into tightly regulated DC that won’t fry delicate vehicle battery chemistries.

Challenges on the Road Ahead

No technology is perfect. IGBT modules are sensitive to over-voltage transients and require sophisticated snubber networks. Their thermal cycling limits call for meticulous heatsink design and, in harsh climates, liquid cooling. Meanwhile, wide-bandgap semiconductors—silicon carbide (SiC) and gallium nitride (GaN)—are nipping at IGBT heels, promising even faster switching and lower losses.

Yet cost remains king. For high-power (≥ 1 MW) applications, mature supply chains and proven robustness keep igbt rectifiers solidly in the lead. Hybrid topologies that mix SiC diodes with IGBT switches already deliver incremental gains without breaking budgets.

Skills and Workforce Implications

Technicians who once wielded soldering irons on analog boards now brandish oscilloscopes with gigahertz bandwidth to capture nanosecond edge transitions. Training programs are evolving: power-electronics courses in Indian ITIs and polytechnics now include gate-drive design, thermal simulation, and module-level repair practices.

For young engineers, this field offers a blend of hands-on tinkering and digital analytics. Predictive-maintenance dashboards stream real-time data—junction temperatures, switching losses, harmonic spectra—turning power rooms into high-tech command centers.

Final Reflections: Small Silicon, Massive Impact

It’s easy to overlook the humble converter tucked behind a metal door. But in the grand choreography of electrification, igbt rectifiers are the quiet conductors, synchronizing renewable surges, feeding smart grids, and keeping industry humming. They exemplify how incremental innovations—faster switches, smarter firmware, better cooling—compound into game-changing efficiency.

Next time you glide on an electric train, boot up a cloud server, or see a wind farm blinking on the horizon, remember: somewhere underneath, tiny gates are opening and closing thousands of times a second, silently shaping the clean-energy era. And that is technology worth celebrating, even if it never seeks the spotlight.

0 notes

Text

Renewable Energy Surge Elevates Demand for Power Modules

The global power semiconductor market reached US$ 56,155 million in 2022 and is projected to grow to US$ 171,709 million by 2031, at a CAGR of 15.0% during 2024–2031, fueled by rising demand across automotive, industrial, consumer electronics, and defense sectors. Asia Pacific leads the surge, driven by booming EV adoption and industrial automation. Power semiconductors like MOSFETs, IGBTs, and diodes are critical for efficient energy conversion, while key players such as STMicroelectronics, Toshiba, and Texas Instruments drive innovation in the competitive landscape.

Unlock exclusive insights with our detailed sample report :

Key Market Drivers

1. Electrification of Transportation

With EVs gaining global momentum, power semiconductors are essential in managing electric drive systems, inverters, DC/DC converters, and battery management systems. Their role in achieving efficiency and thermal control is critical in both vehicles and EV charging stations.

2. Renewable Energy Integration

Power semiconductors are pivotal in solar inverters, wind power systems, and energy storage solutions. These devices ensure efficient energy conversion, grid synchronization, and load balancing, essential for stable and sustainable energy infrastructure.

3. Wide Bandgap Material Adoption

The shift from silicon to SiC (Silicon Carbide) and GaN (Gallium Nitride) semiconductors is transforming power electronics. These materials offer superior switching speeds, thermal resistance, and power density, critical for next-gen EVs, 5G, and aerospace.

4. Smart Grids and Industrial Automation

As smart cities and Industry 4.0 evolve, power semiconductors underpin intelligent energy management, motor control, and automation systems, allowing real-time efficiency in manufacturing and smart infrastructure.

5. 5G Network Expansion

The rapid deployment of 5G networks requires high-performance RF components, power amplifiers, and energy-efficient base stations, creating robust demand for advanced power semiconductor devices.

Regional Insights

United States

The U.S. remains a major consumer and innovator in power semiconductors due to:

Massive investment in semiconductor manufacturing (CHIPS and Science Act).

Booming EV market led by Tesla, GM, and Ford, all reliant on SiC and GaN power components.

High demand for data center power solutions to support AI, cloud computing, and 5G networks.

U.S. companies such as Texas Instruments, ON Semiconductor, and Wolfspeed are leading domestic innovation in wide bandgap technologies.

Japan

Japan is renowned for its expertise in high-efficiency, compact power electronics. Key developments include:

Leadership in SiC development with companies like ROHM, Mitsubishi Electric, and Fuji Electric.

Advanced integration of power semiconductors in robotics, railway systems, and renewables.

Government-backed efforts to secure local chip production and reduce import dependency.

Japanese innovation focuses on packaging technology, ultra-low-loss switching, and EV-grade reliability.

Speak to Our Senior Analyst and Get Customization in the report as per your requirements:

Market Segmentation

By Device Type:

Power MOSFET

IGBT

Diode & Rectifier

Thyristor

Bipolar Junction Transistor (BJT)

By Material:

Silicon

Silicon Carbide (SiC)

Gallium Nitride (GaN)

Others

By Application:

Automotive & Transportation

Consumer Electronics

Industrial

ICT (5G, IoT, Cloud)

Energy & Utilities (Solar, Wind, Smart Grid)

By Packaging Type:

Surface Mount Devices (SMD)

Through-Hole Devices

Chip-scale Packages

Wafer-Level Packages

Latest Industry Trends

Shift Toward Wide Bandgap (WBG) Devices Automakers and energy firms increasingly shift to SiC and GaN to reduce energy losses and improve high-voltage application efficiency.

Integration of AI in Power Management Systems AI-enabled power modules allow predictive control in electric grids, optimizing load sharing, energy storage, and consumption.

Advancements in Thermal Management and Packaging New materials like copper sintering, ceramic substrates, and 3D packaging enhance heat dissipation and longevity.

Collaborative R&D Projects Between U.S. and Japan Research alliances focus on compound semiconductor scalability, reliability testing, and supply chain development.

Miniaturization and Integration for Consumer Devices Compact, high-efficiency power semiconductors are being integrated into smartphones, wearables, and VR systems to manage battery and power usage.

Buy the exclusive full report here:

Growth Opportunities

Fast-Growing EV Ecosystem: Demand for SiC-based inverters and DC/DC converters in EVs and charging stations.

Offshore Wind and Solar Energy: New power conversion architectures using WBG devices to improve offshore energy output efficiency.

Asia-Pacific Smart Grid Projects: Growth in APAC utilities deploying next-gen power modules for smart metering and substation automation.

Defense and Aerospace Applications: Lightweight, ruggedized power semiconductors essential for drones, satellites, and avionics.

Data Center Electrification: Rising need for high-efficiency power supplies to handle AI and cloud computing workloads.

Competitive Landscape

Major players include:

Infineon Technologies AG

Texas Instruments Inc.

ON Semiconductor

STMicroelectronics

Mitsubishi Electric Corporation

Toshiba Corporation

Wolfspeed, Inc.

ROHM Semiconductor

Vishay Intertechnology

Renesas Electronics Corporation

These companies are:

Expanding SiC and GaN production lines.

Collaborating with automotive OEMs for integrated solutions.

Investing in next-gen fabrication plants and foundries across the U.S. and Japan.

Stay informed with the latest industry insights-start your subscription now:

Conclusion

The power semiconductor market is experiencing a major growth phase as global industries shift toward electrification, renewable energy, and smart technologies. Driven by advances in wide bandgap materials, packaging, and AI integration, power semiconductors are becoming essential to energy-efficient design across sectors.

With ongoing support from governments, rising sustainability mandates, and transformative innovations in the U.S. and Japan, the market is set to play a central role in the next wave of global industrial and technological progress.

About us:

DataM Intelligence is a premier provider of market research and consulting services, offering a full spectrum of business intelligence solutions—from foundational research to strategic consulting. We utilize proprietary trends, insights, and developments to equip our clients with fast, informed, and effective decision-making tools.

Our research repository comprises more than 6,300 detailed reports covering over 40 industries, serving the evolving research demands of 200+ companies in 50+ countries. Whether through syndicated studies or customized research, our robust methodologies ensure precise, actionable intelligence tailored to your business landscape.

Contact US:

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: [email protected]

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

#Power semiconductor market#Power semiconductor market size#Power semiconductor market growth#Power semiconductor market share#Power semiconductor market analysis

0 notes

Text

Float-Zone Silicon Crystal Market: Demand Rising Across Industrial Sectors

MARKET INSIGHTS

The global Float-Zone Silicon Crystal Market was valued at US$ 542 million in 2024 and is projected to reach US$ 834 million by 2032, at a CAGR of 5.6% during the forecast period 2025-2032. The U.S. market accounted for 35% of global revenue share in 2024, while China is expected to witness the fastest growth with a projected CAGR of 6.8% through 2032.

Float-Zone Silicon Crystal is a high-purity form of monocrystalline silicon produced through the float-zone refining process, which eliminates impurities and defects. These crystals are essential for manufacturing high-performance semiconductor devices due to their superior resistivity uniformity and lower oxygen content compared to Czochralski (CZ) silicon. Primary diameter variants include below 100mm, 100-150mm, 150-200mm, and above 200mm wafers, with the 150-200mm segment currently dominating the market with 42% revenue share.

The market growth is driven by increasing demand for power electronics and advanced semiconductor devices across automotive and industrial applications. However, supply chain constraints for high-purity polysilicon feedstock pose challenges. Key players like Shin-Etsu Chemical and SUMCO CORPORATION are expanding production capacities, with Shin-Etsu commissioning a new 300mm wafer facility in 2023 to meet growing demand for electric vehicle power modules.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for High-Purity Silicon in Semiconductor Manufacturing Accelerates Market Growth

The global semiconductor industry’s relentless pursuit of miniaturization and performance enhancement is significantly driving demand for float-zone silicon crystals. These ultra-pure silicon wafers exhibit exceptional resistivity and minority carrier lifetime characteristics, making them indispensable for power devices, RF components, and radiation detectors. The ongoing transition to smaller process nodes below 5nm has elevated the importance of defect-free silicon substrates, with market leaders increasingly adopting float-zone silicon for specialized applications where conventional Czochralski silicon falls short. The semiconductor industry’s projected expansion at a compounded annual growth rate of over 6% through 2030 underscores this upward trajectory.

Electrification of Automotive Sector Creates New Application Horizons

Automotive electrification represents a transformative opportunity for float-zone silicon crystal manufacturers. The proliferation of electric vehicles demanding high-voltage power semiconductors has triggered unprecedented demand for silicon wafers with superior breakdown voltage characteristics. Float-zone silicon’s unique properties enable the production of insulated-gate bipolar transistors (IGBTs) and silicon carbide (SiC) power devices that can withstand the rigorous thermal and electrical stresses in EV drivetrains. With the electric vehicle market projected to grow at over 25% annually through 2030, tier-one suppliers are increasingly securing long-term contracts with silicon wafer manufacturers to ensure stable supply chains.

Strategic collaborations between automotive OEMs and wafer producers are emerging as a prominent market trend. For example, several leading German automakers have recently entered into joint development agreements with major silicon wafer manufacturers to co-engineer next-generation power semiconductor solutions.

MARKET RESTRAINTS

High Production Costs and Complex Manufacturing Process Limit Market Penetration

The float-zone process presents formidable economic challenges that restrict broader adoption. Compared to conventional Czochralski crystal growth methods, float-zone refinement requires specialized equipment and consumes significantly more energy per wafer produced. The capital expenditure for establishing a float-zone silicon production facility can exceed $100 million, creating substantial barriers to market entry. Additionally, the stringent purity requirements for feedstock silicon rods – typically requiring 99.9999% pure polysilicon – contribute to elevated production costs that are ultimately passed on to end users.

Yield optimization remains an ongoing challenge in float-zone crystal growth, with even leading manufacturers experiencing rejection rates between 15-20% for diameter control and crystallographic perfection. These technical hurdles constrain production scalability at a time when wafer diameters are transitioning from 200mm to 300mm standards.

MARKET CHALLENGES

Competition from Alternative Semiconductor Materials Intensifies

The silicon wafer industry faces mounting pressure from emerging wide-bandgap semiconductor materials that threaten to displace certain float-zone silicon applications. Silicon carbide and gallium nitride substrates are gaining traction in high-power and high-frequency applications, offering superior performance characteristics in some use cases. While float-zone silicon maintains cost advantages for mainstream applications, the accelerating adoption of these alternative materials in automotive and industrial power electronics presents a significant long-term challenge.

The materials science community continues to debate whether incremental improvements in float-zone silicon properties can compete with the fundamental material advantages of wide-bandgap semiconductors. This technological uncertainty creates hesitation among some device manufacturers considering long-term capital investments in float-zone silicon production capacity.

MARKET OPPORTUNITIES

Expansion in Photovoltaic and Sensor Applications Opens New Growth Channels

Beyond traditional semiconductor applications, float-zone silicon is finding growing acceptance in advanced photovoltaic systems and precision sensors. The solar industry’s pivot towards high-efficiency N-type silicon heterojunction cells has created demand for ultra-pure substrates that maximize carrier lifetimes. Similarly, emerging MEMS sensor applications in medical devices and industrial automation systems increasingly specify float-zone silicon for its superior mechanical and electrical consistency.

Forward-thinking manufacturers are capitalizing on these opportunities through vertical integration strategies. Several leading wafer producers have begun offering customized doping profiles and surface treatments tailored specifically for these emerging applications, creating value-added product lines with improved margins.

FLOAT-ZONE SILICON CRYSTAL MARKET TRENDS

Rising Demand for High-Purity Silicon in Semiconductor Manufacturing

The float-zone silicon crystal market is experiencing significant growth due to the increasing demand for high-purity silicon in semiconductor applications. Unlike conventional Czochralski (CZ) silicon, float-zone (FZ) silicon offers superior resistivity and lower oxygen content, making it ideal for power devices, sensors, and high-frequency chips. The global semiconductor shortage has further accelerated investments in advanced wafer production, with the FZ silicon segment projected to grow at a CAGR of over 7% from 2024 to 2032. Emerging applications in electric vehicles and 5G infrastructure are driving demand for larger wafer diameters, particularly in the 150-200 mm segment, which accounts for nearly 35% of total market revenue.

Other Trends

Miniaturization of Electronic Components

The relentless push toward smaller, more efficient electronic components continues to influence silicon wafer specifications. Float-zone silicon’s excellent minority carrier lifetime and defect uniformity make it indispensable for manufacturing advanced MOSFETs and IGBTs. Recent innovations in epitaxial layer deposition have enabled wafer thickness reductions below 725 microns while maintaining structural integrity. This trend aligns with the consumer electronics sector’s requirements, where over 60% of new smartphones and tablets now utilize power management ICs built on FZ silicon substrates.

Geopolitical Factors Reshaping Supply Chains

The float-zone silicon crystal market is undergoing supply chain realignments due to geopolitical tensions and export restrictions. While China continues aggressive capacity expansion—targeting 300,000 wafers/month by 2025—Western manufacturers are diversifying production facilities across Southeast Asia and Europe. The U.S. CHIPS Act has allocated $52 billion for domestic semiconductor infrastructure, directly benefiting specialty silicon producers. Furthermore, Japan’s recent partnership with GlobalWafers to establish a new 200mm FZ silicon plant underscores the strategic importance of securing high-purity silicon supplies outside traditional manufacturing hubs.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Leaders Invest in R&D and Production Capacity to Maintain Dominance

The global float-zone silicon crystal market features a moderately consolidated competitive landscape, with Japanese manufacturers currently holding the strongest positions. Shin-Etsu Chemical emerges as the clear market leader, commanding approximately 25% of global revenue share in 2024. The company’s dominance stems from its vertical integration strategy and proprietary crystal growth technologies that deliver superior resistivity and purity levels exceeding 99.9999%.

SUMCO Corporation and Siltronic follow closely, collectively accounting for around 30% of market share. These companies have strengthened their positions through strategic long-term supply agreements with major semiconductor manufacturers. While Japanese firms currently lead in technology, Taiwanese player GlobalWafers has been rapidly expanding its market presence through a combination of acquisitions and capacity expansions, particularly in the 200mm wafer segment.

The competitive environment is intensifying as Chinese manufacturers like Sino-American Silicon Products and GRINM Semiconductor Materials increase their production capabilities. These companies benefit from strong government support and growing domestic demand, though they still face challenges in matching the purity standards of established Japanese producers. Across the industry, companies are allocating 15-20% of revenues to R&D, focusing on improving crystal uniformity and reducing oxygen content for high-power device applications.

List of Key Float-Zone Silicon Crystal Manufacturers

Shin-Etsu Chemical (Japan)

SUMCO CORPORATION (Japan)

Siltronic (Germany)

GlobalWafers (Taiwan)

Wafer World Quality Management System (U.S.)

Sino-American Silicon Products (China)

SVM (South Korea)

FSM (U.S.)

GRINM Semiconductor Materials (China)

Segment Analysis:

By Type

Below 100 mm Segment Holds Significant Share Due to Cost-Effective Production for Niche Applications

The market is segmented based on type into:

Below 100 mm

100-150 mm

150-200 mm

Above 200 mm

By Application

Semiconductor Segment Leads Owing to High Demand for Power Devices and IC Manufacturing

The market is segmented based on application into:

Semiconductor

Consumer Electronic

Automotive

Others

By Region

Asia Pacific Emerges as Dominant Regional Market Due to Concentration of Semiconductor Manufacturers

The market is segmented based on region into:

North America

Europe

Asia Pacific

South America

Middle East & Africa

Regional Analysis: Float-Zone Silicon Crystal Market

North America The North American float-zone silicon crystal market is driven by strong demand from the semiconductor and consumer electronics industries. The U.S. alone accounts for a significant portion of the region’s market share, supported by extensive R&D investments in advanced semiconductor manufacturing. Government initiatives, such as the CHIPS and Science Act allocating $52 billion for domestic semiconductor production, are further accelerating market growth. Leading manufacturers like Shin-Etsu Chemical and SUMCO CORPORATION have a strong presence here, catering to the high-purity requirements of U.S.-based tech firms. However, stringent environmental regulations regarding silicon production processes add complexity to operations.

Europe Europe’s market is characterized by stringent quality standards and a focus on sustainable production methods. Germany remains the regional leader due to its robust semiconductor ecosystem, with companies like Siltronic playing a pivotal role. The European Union’s push for self-sufficiency in semiconductor production through initiatives like the European Chips Act is expected to drive demand for high-quality float-zone silicon crystals in the coming years. Challenge-wise, energy-intensive manufacturing processes face scrutiny under the EU’s Green Deal framework, pushing manufacturers toward cleaner production techniques. Meanwhile, the U.K. and France are emerging as key markets, supported by localized government incentives for semiconductor component production.

Asia-Pacific The Asia-Pacific region dominates global float-zone silicon crystal consumption, accounting for over 50% of market share, led by manufacturing hubs in China, Japan, and South Korea. China’s aggressive semiconductor self-sufficiency policies and its $150 billion investment in domestic chip production continue to fuel demand. Meanwhile, Japanese players like SUMCO and Shin-Etsu maintain technological leadership in high-purity crystal production. Cost competitiveness remains a key advantage for the region as manufacturers optimize production scales, though geopolitical trade tensions occasionally disrupt supply chains. Southeast Asia is also emerging as an alternative manufacturing base to diversify away from China, with Thailand and Malaysia attracting investments in silicon material production facilities.

South America The South American market remains small but shows gradual growth potential. Brazil represents the primary market, with increasing adoption in automotive electronics and industrial applications. However, the region faces significant challenges, including limited local manufacturing capabilities and reliance on imported silicon materials. Economic instability in key markets like Argentina further restricts investments in semiconductor-grade material production. While some local players are attempting to establish float-zone silicon capabilities, the market currently depends on global suppliers, with price sensitivity influencing purchasing decisions more than pure technical specifications.

Middle East & Africa This region is in early stages of market development. Saudi Arabia and UAE are showing initial interest in semiconductor material production as part of broader economic diversification strategies, though current consumption remains minimal. South Africa has some niche applications in specialized electronics. The lack of established semiconductor ecosystems and high energy costs for crystal production continue to hinder market growth. However, long-term potential exists as regional governments increase technology investments, and global suppliers begin evaluating the area for future manufacturing footprint diversification strategies outside traditional Asian production bases.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Float-Zone Silicon Crystal markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global Float-Zone Silicon Crystal market was valued at USD 380.5 million in 2024 and is projected to reach USD 520.8 million by 2032, growing at a CAGR of 4.8%.

Segmentation Analysis: Detailed breakdown by product type (Below 100 mm, 100-150 mm, 150-200 mm, Above 200 mm), application (Semiconductor, Consumer Electronic, Automotive, Others), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, including country-level analysis where relevant. Asia-Pacific dominates with 42% market share in 2024, driven by semiconductor manufacturing growth in China, Japan, and South Korea.

Competitive Landscape: Profiles of leading market participants including Shin-Etsu Chemical, SUMCO CORPORATION, Siltronic, GlobalWafers, their product offerings, R&D focus, manufacturing capacity, pricing strategies, and recent developments such as mergers, acquisitions, and partnerships.

Technology Trends & Innovation: Assessment of emerging fabrication techniques, high-purity crystal growth methods, and evolving industry standards for power electronics and advanced semiconductor applications.

Market Drivers & Restraints: Evaluation of factors driving market growth including 5G infrastructure, electric vehicles, and IoT devices along with challenges such as high production costs and supply chain constraints.

Stakeholder Analysis: Insights for semiconductor manufacturers, wafer suppliers, equipment vendors, investors, and policymakers regarding the evolving ecosystem and strategic opportunities.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/global-gaas-power-amplifier-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ambient-light-sensor-for-display-system.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/solar-obstruction-light-market-to-reach.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ac-dc-power-supply-converter-market-to.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/boost-charge-pump-ics-market-to-reach.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-motion-detector-sensor-market-to.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/x-ray-inspection-for-security-market-to.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-spatial-filters-market-to-reach.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-e-beam-liner-market-advancements.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-active-quartz-crystal-oscillator.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-ultrasonic-radar-market-share.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-ammeter-shunt-resistors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-wifi-and-bluetooth-rf-antenna.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-industrial-control-printed.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-scanning-transmission-electron.html

0 notes

Text

How the IGBT and Super Junction MOSFET Market is Shaping the Future of Power Electronics

Strategic Analysis of the IGBT and Super Junction MOSFET Market

The global market for Insulated-Gate Bipolar Transistors (IGBTs) and Super Junction MOSFETs is experiencing rapid transformation, driven by the accelerating demand for energy efficiency, electric mobility, and advanced industrial automation. With a projected compound annual growth rate (CAGR) of 6.0% from 2023 to 2030, this IGBT and Super Junction MOSFET Market is poised for sustained expansion across power electronics ecosystems.

As global electrification efforts intensify—from renewable energy systems to consumer electronics and electric vehicles—the necessity for efficient power semiconductor devices becomes paramount. IGBT and Super Junction MOSFETs are at the heart of this evolution, offering high-speed switching, reduced conduction losses, and superior thermal performance.

Request Sample Report PDF (including TOC, Graphs & Tables): https://www.statsandresearch.com/request-sample/40259-global-igbt-and-super-junction-mosfet-market

IGBT and Super Junction MOSFET Market Segmentation Overview

By Type

Discrete IGBTs Utilized in low to medium power applications, discrete IGBTs offer cost-effective switching solutions for single-purpose systems.

IGBT Modules Engineered for high-power applications, IGBT modules integrate multiple transistors into a single package, enabling enhanced power density and scalability for industrial drives and electric vehicles.

Super Junction MOSFETs These devices leverage a vertical structure to reduce R<sub>DS(on)</sub> while withstanding high voltages, making them ideal for high-efficiency, high-frequency switching in compact designs.

Key Insight: While IGBTs currently dominate revenue share, Super Junction MOSFETs are growing fastest, especially in applications requiring high-frequency operation and low power loss, such as solar inverters and fast-charging stations.

Get up to 30%-40% Discount: https://www.statsandresearch.com/check-discount/40259-global-igbt-and-super-junction-mosfet-market

Application Segmentation

Energy and Power

Modern smart grids and renewable installations demand highly efficient power conversion. Both IGBT modules and Super Junction MOSFETs play critical roles in inverters, power factor correction (PFC), and smart metering infrastructure.

Consumer Electronics

The proliferation of energy-efficient appliances, power adapters, and air conditioners has increased the integration of Super Junction MOSFETs, which allow miniaturization and energy savings.

Inverter and UPS

Uninterruptible power supplies (UPS) and inverters rely on fast-switching devices for seamless operation, particularly in mission-critical environments like hospitals and data centers.

Electric Vehicles (EVs)

IGBT modules are integral to EV traction inverters, onboard chargers (OBCs), and DC-DC converters. As the global EV fleet expands, so does the demand for compact, thermally stable, high-voltage switching components.

Industrial Systems

From motor drives to robotics and factory automation, IGBTs provide high current handling capabilities and ruggedness required for continuous industrial operations.

IGBT and Super Junction MOSFET Market Regional Dynamics

Asia-Pacific (APAC)

China, Japan, South Korea, and India lead in both production and consumption. APAC’s dominance is supported by:

Government incentives for green energy

Massive EV adoption

Local semiconductor fabrication capacity

North America

The U.S. market is gaining traction due to:

A rising focus on domestic chip manufacturing

Growing EV penetration

Grid modernization initiatives

Europe

Germany and France, propelled by aggressive climate targets, are major adopters of high-efficiency switching devices in wind, solar, and transportation sectors.

Middle East & Africa / South America

These regions, while nascent in market size, are showing promise through utility-scale renewable deployments and electrification of rural infrastructure.

Competitive Landscape

Major players are consolidating their market position via strategic M&A, R&D investments, and vertically integrated supply chains. The most active participants include:

Infineon Technologies AG – Leading in Super Junction technology with the CoolMOS™ series.

Mitsubishi Electric Corporation – Strong in IGBT modules for industrial and railway traction.

ABB Ltd. – Focused on grid and energy infrastructure with high-reliability devices.

STMicroelectronics – Offering wide-bandgap alternatives alongside traditional silicon.

Fuji Electric, Toshiba, Renesas, NXP, Semikron Danfoss, and IXYS – Each maintaining specialized portfolios across automotive, industrial, and consumer domains.

Emerging Trend: Players are accelerating adoption of SiC (Silicon Carbide) and GaN (Gallium Nitride) technologies, which outperform silicon in thermal resistance and switching efficiency, especially under high voltages.

Future IGBT and Super Junction MOSFET Market Drivers (2024–2030)

EV Market Growth: With EV sales forecasted to exceed 50 million units annually by 2030, high-efficiency inverters and fast-charging technologies will be pivotal.

Grid Decentralization: Distributed generation (solar rooftops, wind microgrids) will boost the need for smart, adaptable power electronics.

Industrial 4.0 Expansion: Robotics, automation, and AI-driven control systems require compact, reliable high-speed switching.

Government Regulations: Mandates for energy efficiency in appliances and industrial operations drive adoption of low-loss semiconductors.

IGBT and Super Junction MOSFET Market Challenges and Constraints

Raw Material Volatility: Silicon wafer supply and prices remain unpredictable.

Thermal Management: Maintaining performance under high-density loads demands innovations in packaging and cooling.

Design Complexity: Integration with digital control systems and software-defined power architectures raises the bar for product development cycles.

Strategic Recommendations

Invest in WBG Technologies: Companies should align R&D with SiC and GaN innovations to future-proof their product lines.

Strengthen Local Supply Chains: Reducing dependency on geopolitically sensitive supply routes enhances resilience.

Partner with EV OEMs: Early involvement in automotive platforms guarantees long-term contracts and scalability.

Diversify Applications: Target adjacent markets such as medical devices, aerospace, and data centers to cushion against sector-specific downturns.

Purchase Exclusive Report: https://www.statsandresearch.com/enquire-before/40259-global-igbt-and-super-junction-mosfet-market

Conclusion

The IGBT and Super Junction MOSFET market is evolving into a cornerstone of next-generation power electronics. Its relevance spans industries from transportation to energy, consumer technology to industrial automation. As global decarbonization, electrification, and digitalization continue to accelerate, these semiconductor devices will underpin efficiency, reliability, and sustainability in critical infrastructure.

The companies best positioned to lead are those embracing innovation, vertical integration, and a strategic focus on emerging markets and wide-bandgap technologies. The next wave of market leaders will not only deliver superior semiconductors but will redefine the future of power conversion, distribution, and control.

Our Services:

On-Demand Reports: https://www.statsandresearch.com/on-demand-reports

Subscription Plans: https://www.statsandresearch.com/subscription-plans

Consulting Services: https://www.statsandresearch.com/consulting-services

ESG Solutions: https://www.statsandresearch.com/esg-solutions

Contact Us:

Stats and Research

Email: [email protected]

Phone: +91 8530698844

Website: https://www.statsandresearch.com

0 notes

Text

⚡ IGBT & Thyristor Market Grows to $7B by 2034 | Stable 2.2% CAGR Forecast

IGBT and Thyristor Market is steadily expanding, projected to grow from $5.6 billion in 2024 to $7.0 billion by 2034, at a compound annual growth rate (CAGR) of 2.2%. This growth is underpinned by rising global demand for efficient power management systems across key industries like automotive, energy, industrial manufacturing, and consumer electronics. IGBTs (Insulated Gate Bipolar Transistors) and thyristors serve as crucial components for switching and controlling high-voltage power in various applications — particularly in electric vehicles, renewable energy infrastructure, and motor drive systems.

Market Dynamics

The core driver behind the market’s momentum is the global shift toward energy-efficient technologies. Electric vehicles, powered by advanced electronics, have been a catalyst, demanding high-performance semiconductors such as IGBTs for efficient power conversion. Similarly, wind and solar energy projects are increasing reliance on these components to ensure stability and effective energy transformation. Industry automation is another dynamic force, with factories requiring real-time control and robust energy systems. However, challenges like high production costs, supply chain vulnerabilities, and stiff regulatory requirements continue to test market resilience. Technological competition from emerging alternatives also places pressure on existing players to innovate rapidly.

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS10187

Key Players Analysis

The IGBT and Thyristor space is dominated by technology giants such as Infineon Technologies, Mitsubishi Electric, ABB Ltd., and STMicroelectronics. These companies are at the forefront of innovation, with strong R&D portfolios and strategic mergers enhancing their global footprint. Alongside them, a new wave of emerging companies such as IGBT Nexus, Thyro Wave Systems, and Voltage Vision Industries is gaining momentum by focusing on niche applications and flexible design solutions. Many of these players are moving towards sustainability, investing in environmentally friendly manufacturing and compact product designs, reflecting broader industry trends.

Regional Analysis

Asia-Pacific leads the global market, fueled by rapid industrialization, urban growth, and strong government investments in clean energy and smart infrastructure. China’s push toward electric mobility and India’s infrastructure boom significantly contribute to this region’s dominance. Europe stands as a strong second, driven by its environmental mandates and leadership in automotive electrification, especially in countries like Germany and the UK. North America, with its focus on innovation and adoption of electric vehicles, also holds a significant share. Meanwhile, Latin America and the Middle East & Africa show promising growth potential, especially in energy infrastructure and industrial automation, although political and economic uncertainties present hurdles.

Recent News & Developments

Recent years have seen a surge in demand for high-efficiency, compact IGBT and thyristor modules due to the miniaturization trend in power electronics. Market prices for IGBT units now range from $1 to $15, depending on complexity and voltage capabilities. There’s also an uptick in collaborations and acquisitions aimed at expanding technological capabilities. Compliance with international standards like IEC and UL has become more critical, driving manufacturers to invest in rigorous testing and certification. Environmental concerns are also shaping production strategies, with many companies now prioritizing eco-friendly materials and processes to minimize carbon footprint.

Browse Full Report : https://www.globalinsightservices.com/reports/igbt-and-thyristor-market/

Scope of the Report

This report offers comprehensive insights into the IGBT and Thyristor market, covering key segments by type, application, technology, material, and end user. It includes both historical analysis (2018–2023) and forecasts through 2034. Our study evaluates regional growth dynamics, competitor strategies, regulatory environments, and cross-segmental opportunities. From import-export trends to demand-supply shifts, and from local consumer behaviors to international trade policies, this report equips stakeholders with actionable data and forecasts to guide strategic decisions. The research also analyzes innovation drivers, market barriers, and potential investment avenues, helping businesses navigate an evolving landscape marked by technological advancement and sustainability.

Discover Additional Market Insights from Global Insight Services:

Artificial Intelligence (AI) Robots Market : https://www.globalinsightservices.com/reports/artificial-intelligence-ai-robots-market/

Machine Control System Market : https://www.globalinsightservices.com/reports/machine-control-system-market/

Wires And Cables Market : https://www.globalinsightservices.com/reports/wires-and-cables-market/

Asset Integrity Management Market : https://www.globalinsightservices.com/reports/asset-integrity-management-market/

GPS Tracking Device Market : https://www.globalinsightservices.com/reports/gps-tracking-device-market/

#igbt #thyristor #powerelectronics #energyefficiency #electricvehicles #renewableenergy #greentechnology #industrialautomation #semiconductors #smartgrids #solarpower #windenergy #motorcontrol #invertertechnology #hvdc #evcharging #sustainabletech #futuretech #automotiveelectronics #electronicsmarket #marketresearch #techinnovation #chipmanufacturing #transistors #energyconversion #techtrends #digitalelectronics #cleantechnology #gridintegration #siliconcarbide #galliumnitride #energymanagement #powerconversion #manufacturingtech #nextgenpower #compactelectronics #smartmanufacturing #energystorage #carbonneutral #circuittopology #thermalmanagement

About Us:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

Contact Us:

Global Insight Services LLC 16192, Coastal Highway, Lewes DE 19958 E-mail: [email protected] Phone: +1–833–761–1700 Website: https://www.globalinsightservices.com/

0 notes

Text

Thermal Conductive Silicone Pad: A Comprehensive Guide

Our company can customize thermal conductive silicone sheets with a thermal conductivity ranging from 1.0 to 15W. We also have products such as thermal conductive sealants, thermal conductive adhesives, and liquid adhesives. Regarding exports, our products have low thermal resistance and excellent flame retardancy. We can customize various sizes according to customers' requirements, and the colors can also be customized. For products of the same type, we also have thermal conductive silicone.

Our technicians have been engaged in the industry for more than 10 years and possess rich experience.

Introduction

In the world of electronics and thermal management, efficient heat dissipation is crucial for maintaining performance and longevity. One of the most effective solutions for heat transfer between components is the thermal conductive silicone pad. This versatile material plays a vital role in cooling electronic devices, ensuring optimal thermal conductivity while providing electrical insulation.

This guide explores the properties, applications, advantages, and selection criteria of thermal conductive silicone pads, helping engineers, designers, and enthusiasts make informed decisions for their thermal management needs.

What Is a Thermal Conductive Silicone Pad?

A thermal conductive silicone pad is a soft, compressible material designed to fill gaps between heat-generating components (such as CPUs, GPUs, or power transistors) and heat sinks or cooling solutions. These pads are made from silicone elastomers embedded with thermally conductive fillers like ceramic particles, aluminum oxide, or boron nitride.

Unlike thermal pastes or greases, thermal conductive silicone pads are solid yet flexible, offering ease of installation and reusability. They eliminate the mess associated with liquid thermal compounds while providing consistent thermal performance.

Key Properties of Thermal Conductive Silicone Pads

1. High Thermal Conductivity

The primary function of a thermal conductive silicone pad is to transfer heat efficiently. These pads typically offer thermal conductivity ranging from 0.8 W/mK to 6.0 W/mK, depending on the filler material used. Higher thermal conductivity ensures better heat dissipation.

2. Electrical Insulation

Since silicone is inherently non-conductive, these pads provide excellent electrical insulation, preventing short circuits in sensitive electronic applications.

3. Softness and Compressibility

The silicone base allows the pad to conform to uneven surfaces, ensuring maximum contact between the heat source and the heat sink. This property minimizes thermal resistance and enhances heat transfer.

4. Durability and Stability

Thermal conductive silicone pads are resistant to aging, oxidation, and chemical degradation. They maintain performance over a wide temperature range (-50°C to 200°C), making them suitable for harsh environments.

5. Easy Installation and Reusability

Unlike thermal pastes, these pads can be easily cut to size and reused if necessary, reducing waste and simplifying maintenance.

Applications of Thermal Conductive Silicone Pads

Due to their excellent thermal and electrical properties, thermal conductive silicone pads are widely used in various industries:

1. Consumer Electronics

Smartphones, tablets, and laptops use these pads to cool processors and batteries.

LED lighting systems rely on them for heat dissipation in high-power LEDs.

2. Automotive Electronics

Electric vehicle (EV) battery packs and power control units use thermal conductive silicone pads to manage heat in confined spaces.

Onboard charging systems and inverters benefit from their insulation and thermal transfer capabilities.

3. Industrial and Power Electronics

Power supplies, motor drives, and IGBT modules use these pads to prevent overheating.

Renewable energy systems, such as solar inverters, require efficient thermal management for optimal performance.

4. Telecommunications and Networking

Servers, routers, and 5G base stations generate significant heat, making thermal conductive silicone pads essential for reliability.

5. Medical Devices

Medical imaging equipment and portable diagnostic devices use these pads to ensure stable operation without overheating.

Advantages Over Other Thermal Interface Materials

While thermal pastes, greases, and phase-change materials are common, thermal conductive silicone pads offer unique benefits:

1. No Pump-Out Effect

Unlike liquid thermal pastes, which can dry out or migrate over time, silicone pads remain stable, ensuring long-term performance.

2. No Messy Application

Thermal pastes require precise application, whereas pads can be easily placed and repositioned without spillage.

3. Better Gap Filling

For components with uneven surfaces or large gaps, thermal conductive silicone pads provide better coverage than thin thermal pastes.

4. Reusability

Pads can often be reused after disassembly, reducing material waste and cost.

How to Choose the Right Thermal Conductive Silicone Pad

Selecting the appropriate thermal conductive silicone pad depends on several factors:

1. Thermal Conductivity Requirements

Low-power devices may only need pads with 1-3 W/mK.

High-performance computing or power electronics may require 4-6 W/mK.

2. Thickness and Hardness

Thicker pads (1-5mm) are ideal for larger gaps.

Softer pads (low Shore hardness) conform better to irregular surfaces.

3. Operating Temperature Range

Ensure the pad can withstand the device’s maximum and minimum temperatures.

4. Dielectric Strength

For high-voltage applications, choose pads with high dielectric strength to prevent electrical leakage.

5. Adhesive vs. Non-Adhesive

Some pads come with adhesive backing for secure placement, while others rely on compression for stability.

Installation Tips for Optimal Performance

To maximize the effectiveness of a thermal conductive silicone pad, follow these best practices:

Clean Surfaces – Remove dust, grease, and old thermal material from both the heat source and heat sink.

Cut to Size – Trim the pad to match the component’s dimensions for full coverage.

Apply Even Pressure – Ensure proper compression to eliminate air gaps.

Avoid Over-Tightening – Excessive pressure can damage the pad or the component.

Check for Air Bubbles – Smooth out any wrinkles or trapped air to maintain thermal efficiency.

Conclusion

The thermal conductive silicone pad is an indispensable component in modern thermal management solutions. Its ability to efficiently transfer heat while providing electrical insulation makes it ideal for a wide range of applications, from consumer electronics to industrial systems.

By understanding its properties, advantages, and selection criteria, engineers and designers can optimize thermal performance, enhance device reliability, and extend the lifespan of electronic components. Whether replacing traditional thermal pastes or addressing complex cooling challenges, thermal conductive silicone pads offer a reliable and efficient solution.

For your next thermal management project, consider integrating a thermal conductive silicone pad to achieve superior heat dissipation with minimal maintenance.

1 note

·

View note

Text

Second Intelligent completed the capacity upgrade of an IGBT production line for a leading manufacturer of new energy vehicles.

IGBT (Insulated Gate Bipolar Transistor) is a kind of energy conversion and transmission of the core device, known as the industry power electronic device “CPU”, widely used in motor energy saving, rail transportation, smart grid, aerospace, home appliances, automotive electronics, new energy generation, new energy vehicles and other fields.

as the power electronics industry "CPU", IGBT is internationally recognized as the most representative product of the electronic revolution. Multiple IGBT chips are integrated and packaged together to form an IGBT module, which has greater power and better heat dissipation capability, and plays an extremely important role in the field of new energy vehicles.

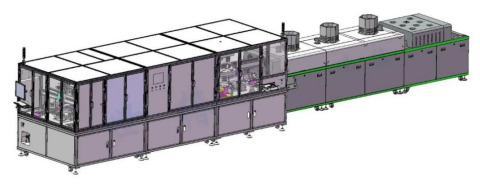

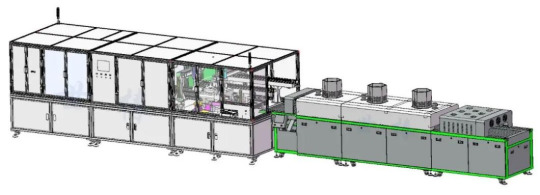

In order to meet the growing market demand , a leading new energy vehicle manufacturer ,will upgrade the production capacity of IGBT production line, and it is proposed to adopt the assembly line form of online production for gluing, framing, and baking processes. After the bidding in China, Shenzhen Second Intelligent Equipment Co., Ltd (“Second Intelligent”) successfully won the bidding for the project, and provided the whole line technical solutions such as IGBT laser marking, code scanning confirmation, automatic glue application, AOI inspection, framing, screwing, riveting, automatic baking and MES docking to realize the automation, intelligentization and integration of the production line. After completion, IGBT module production line capacity from the original 45S/PCS to 30S/PCS, will meet the brand of new energy vehicles, photovoltaic on the demand for IGBT modules.

The IGBT production line has higher and more comprehensive requirements for production timing, test stability and equipment reliability. After receiving the order, under the overall guidance of the company's senior management, the Product Management Center assigned a group of experienced engineers in mechanical design, electrical design, automation design to set up a technical team to focus on completing the optimal design of the program, energy-saving production evaluation and production line layout planning. at the same time ,while conducting stability and feasibility testing and verification of the key processes in the program.

After several months of hard work, Second Intelligent overcame all the difficulties and has completed the manufacturing and in-house debugging of more than ten lines of the IGBT project.

The technical solution of the IGBT automatic gluing, framing and baking section realises digital, intelligent and automated production through effective management of all production links, so that the production line runs efficiently and stably. This technical solution is configured with process equipment such as marking machine, gluing machine, automatic screwing machine, pressure ring pressing machine, in-line oven, etc., which ensures that the products produced have higher yield of encapsulation test, more stable parameters and better reliability. It can carry out laser marking, code scanning, dispensing, visual inspection, assembly, screwing, compression ring loading, baking and other various processes, the flexibility of module configuration to complete the integration of various automation applications, to get rid of the past automation platform function of the disadvantages of a single.

The open interface of the whole line is docked with the customized MES management system of Second Intelligent, which can obtain various information of the production line required by customers in real time through the MES management system, such as program usage, real-time status of equipment, historical alarm information, etc., to realize the informatization, intelligence and unmannedness of the production process, etc., so as to realize the transformation from manufacturing to intelligent manufacturing and accelerate the industrial upgrading.

The project adopts Second Intelligent's self-developed dispensing valve, which can effectively solve the problems of uneven dispensing, broken glue, leakage, overflow and other bad problems, and the dispensing path can be edited by itself. The visual inspection system developed by Second Intelligent will visually inspect the finished dispensing product of the previous process to detect whether it is broken, leaking, overflow and other defective problems, AOI inspection such as qualified transfer mechanism will transport the shell to the next process for the next operation, AOI inspection such as unqualified will be transported to the outside of the equipment through the transfer module by the NG conveyor line, so as to ensure that the system without stopping. This ensures that the system can automatically eject the faulty products without stopping and improves the stability of the dispensing system.

Second Intelligent focuses on fluid application and service, is committed to promoting the intelligent upgrading of fluid application in the industrial equipment industry with technology and innovation. At present, the self-developed IGBT coating and assembly line solution has solved the problem and improved the performance for many customers, such as famous brands of new energy vehicles, demonstrating the company's strong strength in design, project management and production quality, and laying a solid foundation for the expansion and cooperation of subsequent projects.

0 notes

Text

Power Electronics Market to Reach $51.3 Billion by 2034 with Steady 5.3% CAGR

At a compound annual growth rate (CAGR) of 5.3%, the power electronics market is expected to develop significantly over the next ten years, from USD 30.7 billion in 2024 to USD 51.3 billion by 2034. Power electronics, which uses semiconductor devices to manage and convert electrical power, is becoming more and more popular across a range of sectors, especially in industrial automation, electric vehicles (EVs), and renewable energy.

With the ongoing shift towards clean energy and the rapid expansion of the EV market, power electronics are playing a critical role in improving energy efficiency and managing electrical power across multiple sectors. The market’s growth is underpinned by technological advancements in power semiconductor devices such as IGBTs and MOSFETs, as well as the growing demand for high-efficiency power solutions.

Request a Sample of this Report: https://www.futuremarketinsights.com/report-sample#5245502d47422d31303234

Key Takeaways from the Market Study

The Power Electronics Market is projected to grow at a CAGR of 5.3% from 2024 to 2034, reaching a valuation of US$ 51.3 billion by 2034.

The increasing penetration of renewable energy systems and electric vehicles is significantly boosting demand for power electronics.

Asia-Pacific is expected to dominate the market, driven by rapid industrialization and strong growth in the automotive and renewable energy sectors.

The energy & power and automotive segments will likely be key contributors to market growth over the forecast period.

Drivers and Opportunities

Several key factors are driving the growth of the Power Electronics Market. One of the primary drivers is the global push for renewable energy sources such as solar and wind power, which require power electronic devices to convert and manage energy efficiently. With many countries aiming to reduce carbon emissions, the installation of renewable energy systems is expected to surge, creating a significant demand for power electronics in inverters, converters, and power management systems.

The rise of electric vehicles (EVs) is another major growth driver. Power electronics are essential for the functioning of EVs, playing a critical role in battery management, motor control, and charging infrastructure. As EV adoption accelerates globally, the demand for power electronics is expected to rise sharply.

Additionally, the growing trend of industrial automation and the adoption of smart grids are presenting lucrative opportunities for market players. As industries increasingly adopt energy-efficient systems, power electronics are becoming essential for optimizing electrical power use in smart manufacturing and grid systems.

Components Insights

The Power Electronics Market is segmented based on components, including power discrete, power modules, and power ICs. Among these, power modules are expected to witness significant growth due to their widespread use in high-power applications such as solar inverters, EV powertrains, and industrial motor drives.

Power integrated circuits (ICs) are also gaining traction, particularly in consumer electronics and telecommunication devices, where compact and efficient power solutions are required. The demand for power discrete components, including diodes, transistors, and thyristors, is expected to remain strong in various industrial and automotive applications.

Application Insights

The Power Electronics Market finds extensive applications in industries such as automotive, energy & power, consumer electronics, and industrial automation. The automotive sector, especially in the context of electric and hybrid vehicles, is expected to be one of the largest contributors to market growth. Power electronics are used in electric vehicle charging systems, battery management systems, and traction inverters, all of which are vital for EV performance.

In the energy & power sector, the growing adoption of solar and wind energy solutions is driving the need for power converters and inverters, which manage the conversion of renewable energy into usable power. Additionally, the rise of smart grids is fueling the demand for advanced power electronics that improve energy distribution and efficiency.

The consumer electronics segment also represents a growing market, as power electronics are increasingly used in portable devices, smartphones, and laptops to improve battery performance and energy efficiency.

Deployment Insights

The Power Electronics Market is witnessing both on-premise and cloud-based deployments, with on-premise solutions dominating sectors like automotive and energy, where high power efficiency and reliable control are essential.

Cloud-based deployment is becoming increasingly popular in smart energy management systems and industrial automation, enabling real-time monitoring and control over power systems remotely. This trend is expected to grow, particularly in smart city projects and the integration of IoT-enabled devices.

Key Companies & Market Share Insights

Leading companies in the Power Electronics Market include Infineon Technologies AG, ON Semiconductor Corporation, Texas Instruments Incorporated, Mitsubishi Electric Corporation, Fuji Electric Co., Ltd., and Toshiba Corporation. These companies are focusing on developing innovative solutions that cater to the rising demand for high-efficiency power devices across multiple industries.

The competitive landscape is characterized by strategic partnerships, mergers, and acquisitions. For example, Infineon Technologies AG expanded its product portfolio by acquiring Cypress Semiconductor, which enhanced its capabilities in power management solutions. ON Semiconductor has been investing heavily in research and development to produce energy-efficient devices aimed at the automotive and industrial sectors.

Recent Developments

Mitsubishi Electric introduced a new line of SiC (silicon carbide) power modules aimed at improving the efficiency of power inverters in EVs and renewable energy systems.

Texas Instruments launched an innovative range of GaN (gallium nitride) power transistors that offer superior performance in high-power applications, including EVs and industrial automation systems.

Fuji Electric expanded its production capacity for IGBT modules, which are in high demand for solar power installations and electric vehicles, to address the increasing global demand for energy-efficient solutions.

0 notes

Text

Toshiba MG100Q1JS9 – A Reliable Choice for High-Power Applications

For more details and to place your order, visit https://www.uscomponent.com/buy/Toshiba/MG100Q1JS9 now!

When it comes to power efficiency and reliability, the Toshiba MG100Q1JS9 is a trusted choice for various industrial applications. This IGBT module is designed to handle high-voltage switching, making it ideal for motor controls, power inverters, and energy conversion systems.

Built with advanced IGBT technology (Insulated-Gate Bipolar Transistor), the MG100Q1JS9 ensures low power loss and high switching speed, optimizing the performance of your power systems. Its sturdy construction enhances durability, while its superior heat dissipation minimizes the risk of overheating, ensuring long-term operational stability.

As an official Toshiba distributor of power modules, USComponent guarantees 100% authentic and high-quality semiconductor products. Our commitment to excellence and reliability ensures that you receive only the best power solutions for your industrial needs.

For those in search of a dependable supplier for the MG100Q1JS9 Toshiba IGBT module, USComponent is your go-to source. We offer competitive pricing, fast shipping, and dedicated customer support, making it easy to get the right components for your applications.

Upgrade your system today with the Toshiba MG100Q1JS9 from USComponent and experience enhanced efficiency and performance.

#IGBT#IGBT Module#Toshiba Supplier#IGBT Transistor#Toshiba IGBT Module#IGBT Transistor Module#IGBT Power Module#IGBT Distributor#IGBT Suppliers#IGBT Module Price#IGBT Price#Toshiba IGBT#Toshiba Distributor#MG100Q1JS9

0 notes

Text