#high voltage sic module

Explore tagged Tumblr posts

Text

https://www.futureelectronics.com/p/semiconductors--discretes--transistors--silicon-carbide-mosfets-sic-mosfets/sct2750nytb-rohm-1080295

ROHM, SCT2750NYTB, Transistors, Silicon Carbide MOSFETs (SiC MOSFETs)

N-Channel 1700 V 0.75 Ohm Surface Mount SiC Power Mosfet - TO-268-2

#ROHM#SCT2750NYTB#Transistors#Silicon Carbide MOSFETs (SiC MOSFETs)#sic mosfet module#high voltage sic module#igbt#Power MOSFET#mosfet Transistors#Surface Mount SiC Power Mosfet#Transistors mosfet

1 note

·

View note

Text

SiC Crystal Substrate Market : Emerging Trends, and Global Forecast (2025 - 2032)

Global SiC Crystal Substrate Market size was valued at US$ 1,840 million in 2024 and is projected to reach US$ 4,290 million by 2032, at a CAGR of 12.5% during the forecast period 2025-2032.

Silicon carbide (SiC) substrates are wide bandgap semiconductor materials essential for manufacturing high-performance electronic devices. These crystalline substrates enable power electronics with superior thermal conductivity, high breakdown voltage, and energy efficiency compared to traditional silicon. The market offers both conductive (for power devices) and semi-insulating (for RF devices) wafer types, typically in 4-inch, 6-inch, and emerging 8-inch diameters.

Market growth is primarily driven by accelerating adoption in electric vehicles, where SiC components improve range and charging efficiency. The automotive sector accounted for over 60% of demand in 2023, with Tesla’s vehicle production alone contributing significantly to market penetration. Furthermore, renewable energy applications in solar inverters and industrial power systems are creating new growth avenues. Key technological advancements include the transition to 8-inch wafers, which improves production economics by approximately 35% through better material utilization.

Get Full Report : https://semiconductorinsight.com/report/sic-crystal-substrate-market/

MARKET DYNAMICS

MARKET DRIVERS

Accelerated Adoption in Electric Vehicles Fuels Market Expansion

The rapid electrification of automotive powertrains is creating unprecedented demand for silicon carbide (SiC) substrates. With electric vehicles requiring power electronics that operate at higher voltages, frequencies, and temperatures than traditional silicon components can handle, SiC’s superior thermal conductivity (3-5 times higher than silicon) and breakdown voltage (10x greater) make it the material of choice. In 2023 alone, SiC adoption in pure electric passenger vehicles reached 25% penetration, with Tesla’s Model 3 and Model Y accounting for 60-70% of this market. Automotive OEMs are aggressively transitioning to 800V architectures, where SiC’s efficiency advantages become even more pronounced, offering 5 7% improvement in range compared to silicon-based solutions.

Renewable Energy Boom Creates New Growth Vectors

Global investments in renewable energy infrastructure are driving significant demand for SiC power modules in solar inverters and wind turbine systems. The technology’s ability to handle high-power conversion with minimal energy loss (up to 50% reduction in switching losses compared to silicon IGBTs) makes it ideal for renewable applications where efficiency directly impacts return on investment. In photovoltaic systems, SiC-based inverters demonstrate 2 3% higher conversion efficiency, which translates to substantial energy output gains over a plant’s lifetime. With the solar inverter market projected to grow at 8% CAGR through 2030, this represents a sustainable growth engine for the SiC substrate industry.

➤ The transition to 8-inch wafers presents a potential 35% cost reduction opportunity compared to current 6-inch standards, significantly improving manufacturability.

Furthermore, industrial power applications are increasingly adopting SiC solutions for motor drives and UPS systems, where the combination of higher switching frequencies and reduced cooling requirements enables more compact, energy-efficient designs. This broadening of application segments provides diversified growth pathways beyond the automotive sector.

MARKET RESTRAINTS

Material Defects and Yield Challenges Impede Production Scalability

While demand for SiC substrates grows exponentially, manufacturing challenges continue to constrain supply. The crystal growth process remains notoriously difficult, with micropipe defects and crystal dislocations causing yield rates that are significantly lower than silicon wafer production. Typical defect densities for commercial 6-inch SiC wafers range from 0.5 1.0 cm², compared to silicon’s near-perfect crystalline structure. These material imperfections not only limit production volumes but also impact device performance and reliability downstream.

High Manufacturing Costs Create Adoption Barriers

SiC substrate production involves energy-intensive processes, with boule growth requiring temperatures exceeding 2,000°C and taking 1-2 weeks per batch, compared to silicon’s lower temperature and faster crystallization. This results in production costs that are 5 10x higher than equivalent silicon wafers. While 8-inch wafer conversion promises cost reductions, the capital expenditure required for retooling fabrication facilities creates financial hurdles, particularly for smaller manufacturers. These cost factors trickle down to end products, where SiC power modules currently command 3x the price of silicon alternatives, slowing adoption in price-sensitive applications.

Additional Constraints

Epitaxial Growth Complexity The subsequent epitaxial layer growth process requires precise control of temperature gradients and gas flows, with typical growth rates of just 3 10 μm/hour. Any deviation from optimal conditions can introduce defects that compromise device performance, requiring expensive quality control measures.

Standardization Gaps Lack of standardized specifications across the supply chain creates integration challenges for downstream manufacturers. Variations in wafer thickness, bow, and warp tolerances between suppliers necessitate customized handling equipment and process adjustments.

MARKET OPPORTUNITIES

Strategic Partnerships Accelerate Supply Chain Development

The industry is witnessing a wave of vertical integration as device manufacturers secure substrate supply through long-term agreements and joint ventures. Several leading semiconductor companies have entered into multi-year offtake agreements with substrate producers, with contract volumes exceeding $2 billion collectively. These partnerships not only ensure supply security but also facilitate co-development of next-generation materials, with several collaborations specifically targeting the 8-inch wafer transition. Such alliances create substantial opportunities for technology sharing and production optimization across the value chain.

Emerging Applications Open New Frontiers

Beyond power electronics, SiC substrates are gaining traction in RF devices for 5G infrastructure and aerospace applications. The material’s high electron mobility and thermal stability make it ideal for high-frequency power amplifiers operating in harsh environments. In aerospace, SiC-based systems are being adopted for more electric aircraft architectures, where weight reduction and reliability are critical. The RF SiC device market is projected to grow at 12% CAGR through 2030, presenting a complementary growth avenue to the power electronics segment. Additionally, the increasing demand for fast-charging infrastructure creates opportunities in EV charging stations, where SiC enables compact, high-power chargers with superior thermal performance.

➤ Government initiatives worldwide are providing substantial funding for domestic SiC supply chain development, with incentives exceeding $500 million across North America, Europe, and Asia.

The photonics and quantum computing sectors are also exploring SiC for its unique optoelectronic properties, though these applications remain in earlier development stages. As material quality improves and production costs decrease, these emerging use cases could become significant demand drivers in the latter half of the decade.

SIC CRYSTAL SUBSTRATE MARKET TRENDS

Transition to 8-Inch SiC Wafers Accelerates Market Growth

The silicon carbide (SiC) crystal substrate market is witnessing a significant shift toward larger diameter wafers as manufacturers increasingly adopt 8-inch production lines. While 6-inch wafers currently dominate with over 70% market share, the transition to 8-inch substrates is gaining momentum due to their ability to reduce production costs by approximately 40% while improving yield efficiency. Industry leaders like Wolfspeed and Coherent have already begun volume production of 8-inch wafers, with others rapidly following suit to meet escalating demand from power electronics and electric vehicle sectors.

Other Trends

Electric Vehicle Adoption Drives Demand Surge

The proliferation of electric vehicles continues to be the primary growth catalyst for SiC substrates, with penetration in EV power modules reaching 35% in 2024. Automotive OEMs are accelerating SiC adoption as demonstrated by Tesla’s Model 3 and Model Y accounting for nearly 60% of global automotive SiC demand. Beyond Tesla, emerging Chinese EV manufacturers like BYD and NIO are rapidly incorporating SiC-based traction inverters, creating additional demand pressure on substrate suppliers. The average SiC content per EV has tripled since 2020 as automakers recognize the material’s superior thermal performance and energy efficiency advantages.

Renewable Energy Integration Expands Application Horizons

The renewable energy sector is emerging as a substantial consumer of SiC power devices, particularly in solar inverters and wind energy systems. Solar installations utilizing SiC-based power converters demonstrate 3-5% higher energy conversion efficiency than conventional silicon solutions—a critical advantage as global PV capacity is projected to exceed 2.5 TW by 2030. This efficiency gain, coupled with the ability to operate at higher voltages and temperatures, is driving accelerated adoption in utility-scale renewable projects. Simultaneously, energy storage applications are adopting SiC for bidirectional power conversion systems where fast switching capabilities are paramount.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Expansion Define the Race for SiC Substrate Dominance

The global SiC crystal substrate market features a dynamic mix of established semiconductor leaders and emerging regional players competing for technological supremacy. Wolfspeed, a pioneer in SiC technology, maintains a dominant position in 2024 with approximately 32% market share – leveraging its vertically integrated production capabilities and multi-year supply agreements with major automakers like GM and Renault. The company’s recent $6.5 billion expansion of its North Carolina facility signals its commitment to maintaining leadership in both 150mm and emerging 200mm wafer production.

Coherent (formerly II-VI) and ROHM Group’s SiCrystal division follow closely, collectively accounting for nearly 40% of 2023’s substrate shipments. Their strength lies in specialized product portfolios catering to both power electronics (dominated by electric vehicles) and RF applications (crucial for 5G infrastructure). Both companies have accelerated their transition from 6-inch to 8-inch wafer production, with Coherent achieving full qualification of 200mm substrates in Q2 2023.

While traditional players maintain strongholds, Asian manufacturers are making significant inroads. TankeBlue Semiconductor has emerged as China’s largest domestic supplier, capturing 12% of the regional market in 2023 through strategic partnerships with BYD and Huawei. Similarly, SICC (Shandong Institute of Industrial Technology) has demonstrated remarkable yield improvements, reducing defect densities to <30 cm² in their latest production batches.

Looking ahead, the competitive landscape will hinge on three critical factors: yield optimization (particularly for 8-inch wafers), supply chain localization strategies, and the ability to meet the automotive industry’s stringent quality requirements. The recent joint venture between STMicroelectronics and San’an Optoelectronics exemplifies how cross-border collaborations are becoming essential for technology transfer and market access.

List of Key SiC Crystal Substrate Manufacturers

Wolfspeed, Inc. (U.S.)

Coherent Corp. (U.S.)

ROHM Group (SiCrystal GmbH) (Japan/Germany)

Resonac (formerly Showa Denko) (Japan)

SK Siltron (South Korea)

STMicroelectronics (Switzerland)

TankeBlue Semiconductor (China)

SICC Materials (China)

Hebei Synlight Crystal (China)

CETC (China Electronics Technology Group) (China)

San’an Optoelectronics (China)

Segment Analysis:

By Type

6-Inch Segment Dominates the Market Due to Widespread Industrial Adoption and Established Supply Chains

The market is segmented based on type into:

4 Inch

6 Inch

8 Inch

By Application

Power Device Segment Leads Due to High Demand in Electric Vehicles and Energy Infrastructure

The market is segmented based on application into:

Power Device

Electronics & Optoelectronics

Wireless Infrastructure

Others

By Electrical Property

Conductive SiC Wafers Segment Dominates Owing to Power Electronics Applications

The market is segmented based on electrical properties into:

Semi-Insulating SiC Wafers

Conductive SiC Wafers

Regional Analysis: SiC Crystal Substrate Market

North America The North American SiC crystal substrate market is driven by robust R&D investments and strong demand from the electric vehicle (EV) and renewable energy sectors. The U.S. Department of Energy has earmarked significant funding for next-generation semiconductor materials, with companies like Wolfspeed leading 8-inch wafer production. Tesla’s dominance in EV adoption has accelerated the transition to SiC-based power electronics, particularly for fast-charging infrastructure. However, higher production costs compared to Asia remain a challenge, prompting collaborations between automakers and substrate suppliers to localize supply chains. Government initiatives like the CHIPS Act are expected to bolster domestic manufacturing capabilities in the coming years.

Europe Europe’s market growth is propelled by stringent emissions regulations and the automotive industry’s shift toward electrification. Germany and France are at the forefront, with automotive OEMs like BMW and Volkswagen integrating SiC modules into their next-gen EVs. The EU’s 2030 Climate Target Plan creates additional momentum, particularly for renewable energy applications where SiC enables more efficient solar inverters. STMicroelectronics’ partnership with Tesla exemplifies the region’s technological leadership, though dependence on imported raw materials poses supply chain risks. Research institutions across Europe are actively developing novel crystal growth techniques to improve yield rates and reduce production costs.

Asia-Pacific As the largest and fastest-growing market, Asia-Pacific consumes over 60% of global SiC substrates, driven by China’s aggressive EV adoption and massive semiconductor investments. Chinese manufacturers like TankeBlue and SICC have achieved 6-inch wafer mass production, with 8-inch development progressing rapidly. Japan’s ROHM and South Korea’s SK Siltron maintain technological advantages in epitaxial quality, while India is emerging as a new growth hotspot for power electronics. Price sensitivity remains a key characteristic of the region, with tier-2 automotive suppliers gradually transitioning from silicon to SiC solutions. The proliferation of 5G infrastructure is additionally fueling demand for semi-insulating substrates in RF applications.

South America Market development in South America is in nascent stages, primarily serving industrial and renewable energy applications. Brazil shows potential as automotive manufacturers begin local EV production, though economic instability delays large-scale adoption. Argentina has witnessed pilot projects for SiC-based solar inverters, leveraging the country’s expanding renewable energy capacity. The lack of local substrate production facilities means the region remains dependent on imports from North America and Asia, resulting in longer lead times and higher costs. Government incentives for clean energy could stimulate future demand, particularly for wind power conversion systems.

Middle East & Africa This region demonstrates niche opportunities in oil/gas and telecommunications sectors where SiC’s high-temperature tolerance provides operational advantages. The UAE and Saudi Arabia are investing in smart city infrastructure that incorporates SiC power modules, while Israel’s strong semiconductor ecosystem supports RF applications. African growth is constrained by limited electrification rates, though South Africa shows early adoption in mining equipment. The absence of local manufacturing means the market relies entirely on imports, with distribution channels still developing. Long-term potential exists as renewable energy projects gain traction across the region.

Get A Detailed Sample Report : https://semiconductorinsight.com/download-sample-report/?product_id=97779

Report Scope

This market research report provides a comprehensive analysis of the global and regional SiC Crystal Substrate markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global SiC Crystal Substrate market was valued at USD 1,112 million in 2024 and is projected to reach USD 3,070 million by 2032, growing at a CAGR of 16.0%.

Segmentation Analysis: Detailed breakdown by product type (4-inch, 6-inch, 8-inch wafers), application (power devices, electronics & optoelectronics, wireless infrastructure), and end-user industries to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with country-level analysis of key markets like China, US, Japan, and Germany.

Competitive Landscape: Profiles of 11 leading market participants including Wolfspeed, SK Siltron, ROHM Group (SiCrystal), Coherent, and emerging Chinese players like TankeBlue and SICC, covering their market shares, strategies, and recent developments.

Technology Trends & Innovation: Assessment of 8-inch wafer adoption (35% cost reduction potential), wide bandgap semiconductor applications, and manufacturing process improvements.

Market Drivers & Restraints: Evaluation of factors like EV adoption (25% penetration in pure electric vehicles in 2023), renewable energy demand, against challenges like high production costs and technical barriers.

Stakeholder Analysis: Strategic insights for substrate manufacturers, device makers, foundries, investors, and policymakers regarding the evolving SiC ecosystem.

Research methodology combines primary interviews with industry experts and analysis of verified market data from manufacturers, trade associations, and financial reports to ensure accuracy.

Customisation of the Report

In case of any queries or customisation requirements, please connect with our sales team, who will ensure that your requirements are met.

Related Reports :

Contact us:

+91 8087992013

0 notes

Text

SiC EPI Wafer Market: Innovations, Applications, and Market Penetration 2025–2032

MARKET INSIGHTS

The global SiC EPI Wafer Market size was valued at US$ 1.89 billion in 2024 and is projected to reach US$ 4.67 billion by 2032, at a CAGR of 12.0% during the forecast period 2025-2032.

Silicon Carbide (SiC) epitaxial wafers are engineered substrates used in high-power and high-frequency semiconductor devices. These wafers are produced through chemical vapor deposition (CVD), a process that creates precise crystalline layers with controlled thickness and doping levels. SiC EPI wafers enable superior performance in power electronics due to their wide bandgap, high thermal conductivity, and excellent breakdown voltage characteristics.

The market is experiencing robust growth due to accelerating adoption in electric vehicles, 5G infrastructure, and renewable energy systems. While 6-inch wafers currently dominate production, industry leaders are transitioning to 8-inch wafers to improve cost efficiencies. Key challenges include yield improvement and defect reduction, however, manufacturers are investing heavily in R&D to address these limitations. Major players like Wolfspeed and II-VI are expanding production capacity to meet the surging demand from automotive and industrial sectors.

MARKET DYNAMICS

MARKET DRIVERS

Electric Vehicle Boom to Accelerate SiC EPI Wafer Demand

The global shift toward electric vehicles (EVs) represents the most significant growth driver for silicon carbide (SiC) epitaxial wafers. Automotive manufacturers increasingly adopt SiC-based power electronics due to their superior performance in high-temperature, high-voltage environments - delivering 50% lower energy losses than silicon alternatives. With EV production projected to exceed 25 million units annually by 2030, tier-1 suppliers are rapidly transitioning to SiC solutions. Major automotive players have already committed to complete electrification, creating unprecedented demand for reliable, high-volume SiC epi wafer supply chains. The inherent material advantages of SiC enable smaller, lighter, and more efficient power modules critical for extending EV range while reducing charging times.

Energy Infrastructure Modernization Creates New Application Frontiers

Growing investments in smart grid technologies and renewable energy systems are generating substantial demand for SiC power devices. Solar inverters utilizing SiC MOSFETs demonstrate 30% higher efficiency than conventional silicon-based solutions, directly translating to improved energy yields. Governments worldwide are implementing aggressive carbon neutrality targets, with renewable energy capacity expected to double within the next decade. This infrastructure expansion requires power electronics capable of handling higher voltages and frequencies - precisely where SiC epi wafers provide distinct advantages. The superior thermal conductivity and breakdown voltage characteristics of SiC make it indispensable for next-generation energy conversion systems.

5G Infrastructure Rollout Demands High-Frequency Capabilities

The ongoing global deployment of 5G networks represents another critical growth vector for SiC epi wafer manufacturers. Base station power amplifiers require materials capable of operating at millimeter-wave frequencies while maintaining thermal stability. SiC's wide bandgap properties enable these demanding performance parameters, with adoption rates in RF power devices growing at 40% annually. Network operators prioritizing energy efficiency increasingly specify SiC-based solutions that reduce power consumption by up to 25% compared to legacy technologies. With over 3 million 5G base stations expected to be operational by 2027, the communications sector is becoming a major consumer of high-quality SiC epitaxial layers.

MARKET RESTRAINTS

High Manufacturing Costs and Yield Challenges Limit Market Penetration

Despite compelling technical advantages, SiC wafer production faces significant cost barriers compared to mature silicon technologies. Crystal growth remains exceptionally demanding, with defect densities directly impacting device yields and reliability. Current 6-inch SiC epi wafer prices remain 5-8 times higher than equivalent silicon wafers, creating adoption resistance in price-sensitive applications. The specialized equipment and controlled environment requirements for defect-free epitaxy contribute substantially to these cost premiums. While economies of scale are gradually improving, the complex thermodynamics of SiC deposition continue to challenge throughput optimization efforts across the industry.

Material Defects Impact Device Performance and Reliability

Crystal imperfections present persistent quality challenges throughout the SiC value chain. Micropipes, basal plane dislocations, and elementary screw dislocations can propagate through epitaxial layers, degrading the performance and longevity of power devices. While recent advancements in substrate preparation and CVD processes have reduced defect densities to < 0.5/cm² for premium wafers, maintaining consistency across production batches remains problematic. These material challenges become particularly acute for high-voltage applications exceeding 1.2kV, where even microscopic defects can cause catastrophic device failures under operational stress.

Limited Manufacturing Expertise Constrains Production Scalability

The specialized nature of SiC epitaxy creates talent bottlenecks that impede rapid capacity expansion. Unlike conventional silicon processing, SiC requires intimate knowledge of high-temperature CVD systems and unique process chemistries. Industry estimates suggest a shortage exceeding 3,000 qualified SiC process engineers globally, slowing new production line commissioning. This skills gap becomes particularly acute for 8-inch wafer transitions, where thermal management and uniformity control demand even more specialized expertise. The resulting human resource constraints add 12-18 months to typical fab qualification timelines, delaying market responsiveness to surging demand.

MARKET OPPORTUNITIES

8-Inch Wafer Transition to Revolutionize Cost Structures

The industry's transition from 6-inch to 8-inch SiC wafers represents perhaps the most significant near-term opportunity for market expansion. Early adopters demonstrate 30-40% die cost reductions through increased substrate utilization efficiency, with projections suggesting 8-inch wafers will dominate production by 2028. Equipment suppliers are rapidly developing specialized epitaxial reactors capable of handling larger diameters while maintaining thickness uniformity below 5% variance. This generational shift will particularly benefit automotive applications, where cost competition intensifies as EV production scales beyond 15% of total vehicle output. Strategic partnerships between substrate suppliers and device manufacturers are accelerating qualification timelines.

Emerging Applications in Aerospace and Defense Sectors

Military and aerospace programs present new high-value opportunities for SiC technology providers. Next-generation radar systems, directed energy weapons, and hybrid-electric propulsion systems all require power electronics capable of extreme environment operation. SiC's inherentradiation hardness and temperature stability make it ideal for these mission-critical applications, where performance outweighs cost considerations. Defense budgets globally are allocating increasing portions to electronics modernization, with SiC content expected to grow 25% annually in these specialized sectors. The ability to operate reliably at junction temperatures exceeding 200°C unlocks previously unattainable system architectures for unmanned platforms and space applications.

Vertical Integration Strategies Create Competitive Advantages

Leading manufacturers are capitalizing on opportunities through comprehensive vertical integration - from substrate production to finished power modules. This approach minimizes quality variability while improving supply chain security amid growing geopolitical tensions. Companies controlling their entire SiC value chain demonstrate 15-20% faster time-to-market for new product introductions and superior yield management capabilities. The strategy proves increasingly valuable as automotive OEMs seek long-term supply agreements with guaranteed quality metrics. Recent industry investments exceeding $4 billion in new SiC fabrication facilities underscore the strategic prioritization of integrated manufacturing ecosystems.

MARKET CHALLENGES

Geopolitical Factors Disrupt Supply Chain Stability

The concentration of critical SiC manufacturing capabilities in specific geographic regions introduces vulnerabilities to trade policies and export controls. Over 70% of substrate production capacity currently resides in just three countries, creating single points of failure for global supply networks. Recent trade restrictions on advanced semiconductor technologies have extended to include specialized SiC processing equipment, complicating capacity expansion plans. These geopolitical realities force manufacturers to develop duplicate supply chains and inventory buffers, adding 10-15% to operational costs while reducing working capital efficiency.

Technology Migration Risks in Transition Period

The industry's concurrent transitions - from 6-inch to 8-inch wafers, from planar to trench device architectures, and from Si IGBT replacement to SiC-native designs - create compounded technology risks. Each migration requires substantial capital investment and carries potential yield ramping challenges that can delay revenue recognition. Fab operators face difficult decisions regarding equipment lifespans, with next-generation epitaxial reactors representing $15-20 million per unit investments. The timing mismatch between technology cycles and automotive qualification schedules (typically 3-5 years) introduces substantial opportunity costs during transition periods.

Intellectual Property Complexities in Emerging Markets

As Chinese manufacturers rapidly expand their SiC production capabilities, concerns regarding IP protection and technology transfer continue escalating. Patent litigation involving crystal growth techniques and epitaxial processes has increased 300% since 2020, reflecting intensifying competition. The specialized nature of SiC manufacturing makes reverse engineering particularly challenging yet simultaneously increases the value of process know-how. These IP conflicts create uncertainty for cross-border collaborations and joint ventures, potentially slowing overall market growth through redundant development efforts and restrictive licensing regimes.

SiC EPI WAFER MARKET TRENDS

Transition to 8-Inch Wafer Production Reshaping Market Dynamics

The silicon carbide (SiC) epitaxial wafer market is undergoing a significant transformation with the gradual shift from 6-inch to 8-inch wafer production. While 6-inch wafers currently dominate over 80% of the market share, major manufacturers are investing heavily in 8-inch capabilities to achieve better economies of scale. This transition is particularly crucial as demand from electric vehicle manufacturers surges, with projections indicating that EV applications will account for nearly 60% of SiC wafer consumption by 2027. However, the transition presents technical challenges in maintaining crystalline quality and defect control at larger diameters, requiring substantial R&D investments from industry players.

Other Trends

Automotive Industry Driving Demand Growth

The rapid adoption of SiC-based power electronics in electric vehicles is creating unprecedented demand for high-quality epi wafers. Automotive applications require exceptionally low defect densities, pushing manufacturers to refine their chemical vapor deposition (CVD) processes. With leading EV makers transitioning their powertrains to 800V architectures, the need for thick epitaxial layers capable of withstanding voltages exceeding 1200V has become particularly acute. This sector's growth is further propelled by government mandates for vehicle electrification, with several major economies targeting 30-50% EV penetration by 2030.

Emerging Applications in 5G Infrastructure

Beyond automotive applications, the rollout of 5G networks worldwide is creating new opportunities for SiC epi wafers in RF power amplifiers and microwave devices. The unique material properties of silicon carbide, including its high thermal conductivity and wide bandgap, make it ideal for base station applications operating at higher frequencies. As telecom operators expand mmWave deployments, the market for high-frequency SiC components is projected to grow at over 25% CAGR through 2030. This emerging application segment is attracting new entrants to the epi wafer market while prompting established players to diversify their product portfolios.

Geographic Shifts in Manufacturing Capacity

The global production landscape for SiC epi wafers is undergoing significant changes, with Asia-Pacific emerging as a major manufacturing hub. While North America and Japan currently lead in technological innovation, China's aggressive investments in domestic SiC production capacity are reshaping market dynamics. Recent analysis indicates Chinese manufacturers could capture over 30% of global SiC wafer supply by 2025, up from less than 15% in 2020. This geographic rebalancing is prompting established players to form strategic partnerships and accelerate their own capacity expansions to maintain competitive positions.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Capacity Expansion Drive Competition in the SiC EPI Wafer Market

The competitive landscape in the silicon carbide (SiC) epitaxial wafer market is moderately consolidated, with established semiconductor leaders dominating alongside emerging regional players. Wolfspeed (formerly Cree) maintains a dominant position, leveraging its vertically integrated production capabilities and technological expertise in wide-bandgap semiconductors. The company accounted for over 30% of global SiC wafer revenue in 2024.

II-VI Advanced Materials and Showa Denko K.K. represent other major competitors, capitalizing on their specialized materials engineering capabilities and strong partnerships with device manufacturers. These leaders are actively expanding 150mm and 200mm wafer production to meet surging electric vehicle demand, with II-VI investing $1 billion in SiC substrate capacity expansion through 2025.

Strategic moves among competitors focus on two key fronts: technology differentiation through defect reduction and thickness control, and supply chain security via long-term agreements with automotive OEMs. For example, STMicroelectronics recently secured a multi-year supply contract worth $890 million with a leading EV manufacturer.

Meanwhile, Chinese players like DongGuan TIAN YU Semiconductor are rapidly gaining market share through aggressive capacity expansions and government-supported R&D initiatives. The competitive intensity is further amplified by new entrants focusing on specialty applications such as 5G infrastructure and military radar systems.

List of Key SiC EPI Wafer Companies Profiled

Wolfspeed, Inc. (U.S.)

II-VI Advanced Materials (U.S.)

Showa Denko K.K. (Japan)

Epiworld International (China)

SK siltron css (South Korea)

Siltronic AG (Germany)

SweGaN AB (Sweden)

GlobalWafer Japan CO.Ltd. (Japan)

DongGuan TIAN YU Semiconductor Technology Co., Ltd. (China)

STMicroelectronics (Switzerland)

Rohm Semiconductor (Japan)

Segment Analysis:

By Type

N-Type SiC EPI Wafers Lead the Market Due to Superior Performance in High-Power Applications

The market is segmented based on type into:

N-Type

P-Type

Others

By Application

Electric Vehicle Segment Dominates Driven by Growing Demand for Efficient Power Electronics

The market is segmented based on application into:

Radar

5G

Electric Vehicle

Solid State Lighting

Others

By Diameter

6-Inch Wafers Currently Dominate While 8-Inch Segment Shows Rapid Growth Potential

The market is segmented based on diameter into:

150mm (6-inch)

200mm (8-inch)

Others

By Technology

CVD Technology Remains Preferred Choice for High-Quality Epitaxial Growth

The market is segmented based on technology into:

Chemical Vapor Deposition (CVD)

Molecular Beam Epitaxy (MBE)

Others

Regional Analysis: SiC EPI Wafer Market

North America The North American SiC EPI wafer market is experiencing rapid growth, driven by strong demand from electric vehicle manufacturers and significant government investments in semiconductor infrastructure. The U.S. accounts for over 80% of the region's market share, with companies like Wolfspeed and II-VI Advanced Materials leading production. The CHIPS Act, providing $52 billion in semiconductor funding, is accelerating domestic SiC wafer capacity expansion. While 6-inch wafers dominate current production, major players are transitioning to 8-inch wafers to meet growing EV power module requirements. Supply chain localization efforts and defense applications (particularly radar systems) further contribute to market expansion.

Europe Europe's SiC EPI wafer market is characterized by strong R&D focus and automotive industry adoption. Germany and Italy are key markets, housing major manufacturers like STMicroelectronics and Siltronic AG. The European Chips Act allocates €43 billion to strengthen semiconductor sovereignty, with significant portions directed toward wide-bandgap materials like SiC. While local production capacity remains limited compared to demand, partnerships between automakers and wafer suppliers are driving innovation in high-performance applications. Environmental regulations favoring energy-efficient power electronics are creating additional growth opportunities, though the market faces challenges from high production costs and dependence on imported raw materials.

Asia-Pacific Asia-Pacific dominates global SiC EPI wafer production and consumption, with China accounting for approximately 40% of regional market share. Rapid EV adoption and government semiconductor self-sufficiency policies are driving unprecedented investment - China's semiconductor fund has committed over $50 billion to SiC-related projects. Japan remains a technology leader through companies like Showa Denko, while South Korea focuses on automotive and 5G applications. Although price sensitivity remains a challenge for widespread adoption, production scale-up and vertical integration strategies by Chinese firms are making SiC more accessible. The region is also leading the transition from 6-inch to 8-inch wafer production, with multiple fabrication facilities coming online by 2025.

South America The South American SiC EPI wafer market is in nascent stages, with Brazil showing the most promising growth potential. Limited local manufacturing exists, creating dependence on imports primarily from North America and Asia. While EV adoption is increasing, particularly in fleet vehicles, infrastructure limitations and economic volatility constrain broader market development. Some progress is evident through technology transfer agreements with international manufacturers, but the region faces challenges in developing a complete SiC value chain. Government incentives for renewable energy projects could drive future demand for SiC-based power electronics, though significant market expansion remains several years away.

Middle East & Africa The Middle East represents an emerging opportunity for SiC EPI wafers, particularly in UAE and Saudi Arabia where investments in smart cities and renewable energy are increasing demand for efficient power electronics. Israel's strong semiconductor design capabilities create specialized demand for high-performance SiC solutions. Africa's market remains largely untapped, though South Africa shows nascent activity in power infrastructure upgrades. While the region currently accounts for less than 2% of global SiC wafer consumption, strategic partnerships with technology providers and local research initiatives could establish foundation for future growth, particularly as EV adoption gradually increases across Middle Eastern markets.

Report Scope

This market research report provides a comprehensive analysis of the global and regional SiC EPI Wafer markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global SiC EPI Wafer market was valued at USD 750 million in 2024 and is projected to grow significantly by 2032, driven by demand from electric vehicles and 5G applications.

Segmentation Analysis: Detailed breakdown by product type (N-Type, P-Type), technology (CVD epitaxy), application (EV, 5G, radar), and end-user industry to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Asia-Pacific currently leads in market share, with China emerging as a key manufacturing hub.

Competitive Landscape: Profiles of leading participants including Wolfspeed, II-VI Advanced Materials, and Showa Denko, covering their product offerings, R&D investments, and recent developments.

Technology Trends & Innovation: Assessment of 8-inch wafer transition, low-defect epitaxy techniques, and integration with power semiconductor manufacturing.

Market Drivers & Restraints: Evaluation of EV adoption, renewable energy demands, versus challenges in manufacturing yield and material costs.

Stakeholder Analysis: Strategic insights for wafer manufacturers, device makers, and investors regarding supply chain dynamics and growth opportunities.

Research methodology combines primary interviews with industry experts and analysis of verified market data from semiconductor industry reports and financial disclosures.

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global SiC EPI Wafer Market?

-> SiC EPI Wafer Market size was valued at US$ 1.89 billion in 2024 and is projected to reach US$ 4.67 billion by 2032, at a CAGR of 12.0% during the forecast period 2025-2032.

Which key companies operate in Global SiC EPI Wafer Market?

-> Key players include Wolfspeed (Cree), II-VI Advanced Materials, Showa Denko, SK Siltron, and STMicroelectronics.

What are the key growth drivers?

-> Primary drivers include electric vehicle adoption, 5G infrastructure rollout, and renewable energy applications requiring high-efficiency power devices.

Which region dominates the market?

-> Asia-Pacific leads in both production and consumption, with North America maintaining strong R&D capabilities.

What are the emerging trends?

-> Emerging trends include transition to 8-inch wafers, development of low-defect epitaxy processes, and vertical integration among device manufacturers.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/binary-gas-analyzer-market-size-share.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/inverted-light-microscopy-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/insulating-functional-devices-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/multi-core-computer-processors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/power-factor-correction-choke-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/tunable-ultrafast-source-market-key.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/solid-state-remote-power-controller.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/panel-interface-connector-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/semiconductor-process-components-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/automotive-high-mount-stop-light-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/indium-antimonide-detector-alarm-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/din-rail-mounted-thermocouple-terminal.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/hbm2-dram-market-competitive-landscape.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/aptamer-based-quartz-crystal.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/helium-neon-laser-tubes-market-analysis.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/semiconductor-structural-components.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/optical-power-and-energy-market-size.html

0 notes

Text

Intelligent Power Module Market Size Empowering High-Efficiency Power Solutions

The Intelligent Power Module Market Size is rapidly transforming the power electronics landscape by integrating power switches, gate drivers, protection circuits, and thermal sensors into compact, high-performance modules. These modules play a critical role in smart power conversion, renewable energy systems, electric vehicles, industrial automation, and consumer electronics—offering efficiency, reliability, and simplified system design.

According to Market Size Research Future, the global intelligent power module sector is projected to reach USD 12.2 billion by 2030, advancing at a CAGR of 10.8% between 2023 and 2030. This surge is driven by the increasing demand for energy-efficient technologies, regulatory pressure on emissions, and broadening adoption in high-growth verticals like EVs and Market Size 4.0.

Market Size Overview

Intelligent Power Modules (IPMs) combine insulated gate bipolar transistors (IGBTs) or MOSFETs with integrated control circuitry—enabling precise switching, fault protection, and thermal management in compact packages. These features simplify power system design while enhancing performance and robustness.

Key applications span motor drives for HVAC and industrial automation, inverter systems for solar and UPS installations, EV powertrains, and power supplies for telecommunications. With growing complexity in power requirements, IPMs serve as essential building blocks for modern electronic systems.

Major Market Size Drivers

1. Electric Vehicle Proliferation

The shift toward electric and hybrid vehicles is a major growth driver. IPMs are vital for efficient drivetrain control, onboard chargers, and powertrain cooling systems.

2. Renewable Energy Integration

IPMs are integral to solar inverters and wind power systems, providing high-volume, high-frequency switching with reduced switching losses and enhanced thermal handling.

3. Industrial Automation

Factories and robotics systems demand reliable motor control solutions with built-in protection. IPMs simplify system design and improve uptime.

4. Compliance and Regulations

Global energy efficiency standards and emission norms (such as MINER Act, EU Tier regulations) are pressuring OEMs to implement efficient power electronics—boosting IPM usage for compliance.

Market Size Segmentation

By Device Type:

IGBT-Based IPMs

MOSFET-Based IPMs

By Power Rating:

Below 1 kW

1 kW–10 kW

Above 10 kW

By Application:

EV Motor Drives

Solar and Wind Inverters

UPS and Power Supplies

HVAC Systems

Robotics and Industrial Motors

By Distribution Channel:

Direct OEM Sales

Aftermarket Suppliers

Regional Snapshot

Asia-Pacific

Leading the charge, China, Japan, and South Korea are major producers and adopters—driven by EV manufacturing and renewable energy projects.

North America

The U.S. and Canada emphasize industrial automation and EV infrastructure growth, supported by technology incentives and a robust semiconductor industry.

Europe

European IPM adoption is bolstered by energy-efficient factory mandates, EV deployments, and green building certifications in Germany, the UK, and France.

Competitive Landscape

Leading semiconductor and module manufacturers are focusing on thermal performance, higher switching frequencies, and greater system integration:

Infineon Technologies AG

STMicroelectronics NV

Infineon Technologies AG

Mitsubishi Electric Corporation

Fuji Electric Co. Ltd.

TDK Corporation

Rohm Semiconductor

ON Semiconductor

Texas Instruments

Fuji Electric Co.

These players are developing high-voltage, compact IPMs with embedded sensing, diagnostics, and robust protection features.

Trends to Watch

SiC and GaN Adoption: Innovations in silicon carbide (SiC) and gallium nitride (GaN) materials are enabling higher switching speeds, greater efficiency, and smaller IPM footprints.

Smart Monitoring: Embedded thermistors and current sensors enable real-time data logging and predictive maintenance.

Modular Architectures: Stackable IPMs are simplifying power system scalability and serviceability in industrial fleets and energy storage systems.

Automotive-Grade Solutions: IPMs certified with AEC-Q standards are gaining traction in EVs and automotive applications.

Challenges and Opportunities

Challenges:

High initial cost of wide-bandgap-based IPMs

Intense competition from power discrete solutions

Design complexity in integrating custom power topologies

Opportunities:

Rising adoption in fast-growing sectors such as EV charging and smart grids

Retrofitting industrial motors with upgraded IPMs for energy savings

Development of AI-driven energy management solutions combining IPMs with edge computing

Future Outlook

The future of IPMs lies in greater intelligence, material advancement, and standardization. Modules incorporating SiC/GaN, compact packaging, embedded diagnostics, and 5G-enabled data exchange will become standard. The emerging IPM ecosystem will extend energy resilience from smart homes to smart cities, and from EV fleets to green manufacturing.

Trending Report Highlights

Explore related high-tech segments influencing IPM adoption:

Flash Field Programmable Gate Array Market Size

Fluid Pressure Sensor Market Size

Communication Standard Logic IC Market Size

Gallium Arsenide GaAs Radio Frequency RF Semiconductor Market Size

Thin Film Deposition Equipment Market Size

Audio Power Amplifier Market Size

Semiconductor Bonding Equipment Market Size

Semiconductor Diode Market Size

Surveillance Digital Video Recorder Market Size

Transportation Lighting Market Size

Ultrasonic Gas Leak Detector Market Size

Wireless Flow Sensor Market Size

0 notes

Text

Silicon Carbide (SIC) Power Modules Market, Report Industry, Trends, Share 2025-2033

The Reports and Insights, a leading market research company, has recently releases report titled “Silicon Carbide (SIC) Power Modules Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033.” The study provides a detailed analysis of the industry, including the global Silicon Carbide (SIC) Power Modules Market share, size, trends, and growth forecasts. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How big is the Silicon Carbide (SIC) Power Modules Market?

The global silicon carbide (SIC) power modules market was valued at US$ 956.6 million in 2024 and is expected to register a CAGR of 16.8% over the forecast period and reach US$ 3,870.1 million in 2033.

What are Silicon Carbide (SIC) Power Modules?

Silicon Carbide (SiC) power modules are advanced semiconductor devices used for power conversion in various applications like electric vehicles, renewable energy systems, and industrial equipment. These modules employ SiC, a compound known for its superior electrical properties compared to traditional silicon-based semiconductors, enabling higher efficiency, temperature operation, and lower switching losses. SiC power modules typically comprise SiC chips mounted on a substrate, along with driver and protection circuitry, all enclosed in a module package. They offer benefits such as reduced size, weight, and cooling requirements compared to silicon-based modules, making them ideal for high-performance, compact, and energy-efficient power electronics systems.

Request for a sample copy with detail analysis: https://www.reportsandinsights.com/sample-request/1857

What are the growth prospects and trends in the Silicon Carbide (SIC) Power Modules industry?

The silicon carbide (SiC) power modules market growth is driven by various factors and trends. The market for Silicon Carbide (SiC) power modules is rapidly expanding, driven by the increasing demand for efficient power electronics across industries like automotive, renewable energy, and telecommunications. SiC power modules offer advantages such as higher efficiency, faster switching speeds, and reduced size and weight compared to traditional silicon-based modules. Growth is fueled by factors like the growing adoption of electric vehicles, increasing demand for renewable energy sources, and the need for higher power density and efficiency in industrial applications. However, challenges such as high initial costs and limited availability of SiC materials may pose constraints on market growth. Hence, all these factors contribute to silicon carbide (SiC) power modules market growth.

What is included in market segmentation?

The report has segmented the market into the following categories:

By Power Module Type:

Full SiC Modules

Hybrid SiC Modules

By Voltage Range:

Low Voltage (600V and Below)

Medium Voltage (601V - 1200V)

High Voltage (Above 1200V)

By Sales Channel:

Direct Sales

Distributor Sales

By End-Use:

OEMs (Original Equipment Manufacturers)

Aftermarket

By Industry Vertical:

Automotive and Transportation

Industrial Automation

Energy and Power

Telecommunication

Consumer Electronics

Others

Market Segmentation By Region:

North America:

United States

Canada

Europe:

Germany

United Kingdom

France

Italy

Spain

Russia

Poland

BENELUX

NORDIC

Rest of Europe

Asia Pacific:

China

Japan

India

South Korea

ASEAN

Australia & New Zealand

Rest of Asia Pacific

Latin America:

Brazil

Mexico

Argentina

Rest of Latin America

Middle East & Africa:

Saudi Arabia

South Africa

United Arab Emirates

Israel

Rest of MEA

Who are the key players operating in the industry?

The report covers the major market players including:

Infineon Technologies AG

ROHM Semiconductor

Cree, Inc.

Mitsubishi Electric Corporation

Wolfspeed (a Cree Company)

ON Semiconductor

STMicroelectronics

Fuji Electric Co., Ltd.

GeneSiC Semiconductor Inc.

United Silicon Carbide Inc.

Microsemi Corporation (Microchip Technology Inc.)

Monolith Semiconductor Inc.

SEMIKRON International GmbH

Littelfuse, Inc.

Power Integrations, Inc.

View Full Report: https://www.reportsandinsights.com/report/Silicon Carbide (SIC) Power Modules-market

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

Reports and Insights consistently mееt international benchmarks in the market research industry and maintain a kееn focus on providing only the highest quality of reports and analysis outlooks across markets, industries, domains, sectors, and verticals. We have bееn catering to varying market nееds and do not compromise on quality and research efforts in our objective to deliver only the very best to our clients globally.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

Reports and Insights Business Research Pvt. Ltd. 1820 Avenue M, Brooklyn, NY, 11230, United States Contact No: +1-(347)-748-1518 Email: [email protected] Website: https://www.reportsandinsights.com/ Follow us on LinkedIn: https://www.linkedin.com/company/report-and-insights/ Follow us on twitter: https://twitter.com/ReportsandInsi1

0 notes

Text

Renewable Energy Surge Elevates Demand for Power Modules

The global power semiconductor market reached US$ 56,155 million in 2022 and is projected to grow to US$ 171,709 million by 2031, at a CAGR of 15.0% during 2024–2031, fueled by rising demand across automotive, industrial, consumer electronics, and defense sectors. Asia Pacific leads the surge, driven by booming EV adoption and industrial automation. Power semiconductors like MOSFETs, IGBTs, and diodes are critical for efficient energy conversion, while key players such as STMicroelectronics, Toshiba, and Texas Instruments drive innovation in the competitive landscape.

Unlock exclusive insights with our detailed sample report :

Key Market Drivers

1. Electrification of Transportation

With EVs gaining global momentum, power semiconductors are essential in managing electric drive systems, inverters, DC/DC converters, and battery management systems. Their role in achieving efficiency and thermal control is critical in both vehicles and EV charging stations.

2. Renewable Energy Integration

Power semiconductors are pivotal in solar inverters, wind power systems, and energy storage solutions. These devices ensure efficient energy conversion, grid synchronization, and load balancing, essential for stable and sustainable energy infrastructure.

3. Wide Bandgap Material Adoption

The shift from silicon to SiC (Silicon Carbide) and GaN (Gallium Nitride) semiconductors is transforming power electronics. These materials offer superior switching speeds, thermal resistance, and power density, critical for next-gen EVs, 5G, and aerospace.

4. Smart Grids and Industrial Automation

As smart cities and Industry 4.0 evolve, power semiconductors underpin intelligent energy management, motor control, and automation systems, allowing real-time efficiency in manufacturing and smart infrastructure.

5. 5G Network Expansion

The rapid deployment of 5G networks requires high-performance RF components, power amplifiers, and energy-efficient base stations, creating robust demand for advanced power semiconductor devices.

Regional Insights

United States

The U.S. remains a major consumer and innovator in power semiconductors due to:

Massive investment in semiconductor manufacturing (CHIPS and Science Act).

Booming EV market led by Tesla, GM, and Ford, all reliant on SiC and GaN power components.

High demand for data center power solutions to support AI, cloud computing, and 5G networks.

U.S. companies such as Texas Instruments, ON Semiconductor, and Wolfspeed are leading domestic innovation in wide bandgap technologies.

Japan

Japan is renowned for its expertise in high-efficiency, compact power electronics. Key developments include:

Leadership in SiC development with companies like ROHM, Mitsubishi Electric, and Fuji Electric.

Advanced integration of power semiconductors in robotics, railway systems, and renewables.

Government-backed efforts to secure local chip production and reduce import dependency.

Japanese innovation focuses on packaging technology, ultra-low-loss switching, and EV-grade reliability.

Speak to Our Senior Analyst and Get Customization in the report as per your requirements:

Market Segmentation

By Device Type:

Power MOSFET

IGBT

Diode & Rectifier

Thyristor

Bipolar Junction Transistor (BJT)

By Material:

Silicon

Silicon Carbide (SiC)

Gallium Nitride (GaN)

Others

By Application:

Automotive & Transportation

Consumer Electronics

Industrial

ICT (5G, IoT, Cloud)

Energy & Utilities (Solar, Wind, Smart Grid)

By Packaging Type:

Surface Mount Devices (SMD)

Through-Hole Devices

Chip-scale Packages

Wafer-Level Packages

Latest Industry Trends

Shift Toward Wide Bandgap (WBG) Devices Automakers and energy firms increasingly shift to SiC and GaN to reduce energy losses and improve high-voltage application efficiency.

Integration of AI in Power Management Systems AI-enabled power modules allow predictive control in electric grids, optimizing load sharing, energy storage, and consumption.

Advancements in Thermal Management and Packaging New materials like copper sintering, ceramic substrates, and 3D packaging enhance heat dissipation and longevity.

Collaborative R&D Projects Between U.S. and Japan Research alliances focus on compound semiconductor scalability, reliability testing, and supply chain development.

Miniaturization and Integration for Consumer Devices Compact, high-efficiency power semiconductors are being integrated into smartphones, wearables, and VR systems to manage battery and power usage.

Buy the exclusive full report here:

Growth Opportunities

Fast-Growing EV Ecosystem: Demand for SiC-based inverters and DC/DC converters in EVs and charging stations.

Offshore Wind and Solar Energy: New power conversion architectures using WBG devices to improve offshore energy output efficiency.

Asia-Pacific Smart Grid Projects: Growth in APAC utilities deploying next-gen power modules for smart metering and substation automation.

Defense and Aerospace Applications: Lightweight, ruggedized power semiconductors essential for drones, satellites, and avionics.

Data Center Electrification: Rising need for high-efficiency power supplies to handle AI and cloud computing workloads.

Competitive Landscape

Major players include:

Infineon Technologies AG

Texas Instruments Inc.

ON Semiconductor

STMicroelectronics

Mitsubishi Electric Corporation

Toshiba Corporation

Wolfspeed, Inc.

ROHM Semiconductor

Vishay Intertechnology

Renesas Electronics Corporation

These companies are:

Expanding SiC and GaN production lines.

Collaborating with automotive OEMs for integrated solutions.

Investing in next-gen fabrication plants and foundries across the U.S. and Japan.

Stay informed with the latest industry insights-start your subscription now:

Conclusion

The power semiconductor market is experiencing a major growth phase as global industries shift toward electrification, renewable energy, and smart technologies. Driven by advances in wide bandgap materials, packaging, and AI integration, power semiconductors are becoming essential to energy-efficient design across sectors.

With ongoing support from governments, rising sustainability mandates, and transformative innovations in the U.S. and Japan, the market is set to play a central role in the next wave of global industrial and technological progress.

About us:

DataM Intelligence is a premier provider of market research and consulting services, offering a full spectrum of business intelligence solutions—from foundational research to strategic consulting. We utilize proprietary trends, insights, and developments to equip our clients with fast, informed, and effective decision-making tools.

Our research repository comprises more than 6,300 detailed reports covering over 40 industries, serving the evolving research demands of 200+ companies in 50+ countries. Whether through syndicated studies or customized research, our robust methodologies ensure precise, actionable intelligence tailored to your business landscape.

Contact US:

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: [email protected]

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

#Power semiconductor market#Power semiconductor market size#Power semiconductor market growth#Power semiconductor market share#Power semiconductor market analysis

0 notes

Text

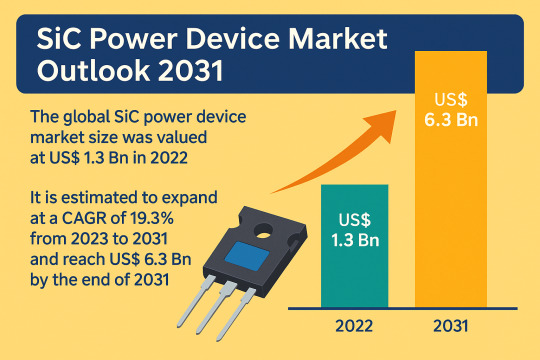

Automotive and Renewable Energy Sectors Power Global SiC Device Market Expansion

The global silicon carbide (SiC) power device market was valued at US$ 1.3 billion in 2022 and is projected to expand at a robust CAGR of 19.3% from 2023 to 2031, reaching an estimated US$ 6.3 billion by the end of 2031, according to the latest industry analysis. SiC devices, known for their high efficiency, low power loss, and durability in high-voltage and high-temperature conditions, are increasingly being adopted across automotive, industrial, renewable energy, and consumer electronics sectors.

Market Overview

SiC power devices have emerged as a critical solution for next-generation power electronics, offering significant improvements over traditional silicon-based components. With the ability to reduce power loss, increase switching speed, and operate under higher temperatures and voltages, SiC semiconductors are transforming industries that demand high reliability and energy efficiency.

Their unique material characteristics are particularly beneficial in wide bandgap applications, where reducing system size, weight, and cost are essential. The automotive industry, especially the electric vehicle (EV) segment, is a primary adopter, leveraging SiC to improve vehicle performance and energy efficiency.

Market Drivers & Trends

The growing push toward electrification, decarbonization, and energy efficiency is propelling the demand for SiC power devices globally. Key market drivers include:

Rising demand for high-efficiency power systems in industrial and renewable energy applications.

Accelerated EV adoption, requiring robust power electronics for traction inverters, battery chargers, and onboard systems.

Reduction in system size and complexity, thanks to superior properties of SiC MOSFETs and diodes.

Government incentives and mandates for cleaner transportation and energy storage systems.

These trends align with global sustainability goals, where power efficiency and reduced carbon footprint are paramount.

Latest Market Trends

SiC MOSFETs Dominate the Market: Representing over 32% of global share in 2022, the MOSFET segment continues to gain traction due to its high reliability, critical breakdown strength, and thermal performance.

600V–1000V Segment Leading by Voltage Range: With 31.89% share in 2022, this voltage range supports applications such as solar inverters, UPS systems, EV charging, and industrial drives.

High Power Modules in EV Applications: Companies like STMicroelectronics and WOLFSPEED have introduced SiC modules aimed at improving the driving range and energy management of electric vehicles.

Download Sample PDF Copy Now: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=22034

Key Players and Industry Leaders

The SiC power device market is consolidated, with a few dominant players accounting for a majority of the market share. These include:

Coherent Corp.

Fuji Electric Co., Ltd

Infineon Technologies AG

Microchip Technology Inc.

Mitsubishi Electric Corporation

ON Semiconductor Corp

Renesas Electronics Corporation

ROHM Co., Ltd

Toshiba Electronic Devices & Storage Corporation

WOLFSPEED, INC.

These companies are investing heavily in R&D, expanding wafer production capabilities, and launching new product lines to meet surging demand.

Recent Developments

Mitsubishi Electric (March 2023): Constructed a new wafer facility to meet soaring demand for SiC power semiconductors.

Toshiba (December 2022): Developed advanced SiC MOSFETs with enhanced reliability and low resistance.

Microchip Technology (March 2022): Unveiled 3.3 kV SiC power devices for next-generation renewable energy and transportation solutions.

STMicroelectronics: Launched SiC high-power modules for EV traction systems in December 2022.

Market Opportunities

Emerging opportunities include:

Electrification of transportation: As EV adoption scales, SiC’s role becomes more critical in powertrain efficiency.

Expansion in renewable energy and grid infrastructure: Solar and wind energy systems benefit from SiC’s efficiency and reliability.

Adoption in aerospace and defense sectors: Where lightweight, high-performance power systems are increasingly necessary.

High-growth emerging economies in Asia-Pacific and Latin America provide untapped potential for SiC deployment.

Future Outlook

By 2031, the SiC power device market will be defined by:

Continued penetration into mainstream automotive platforms, including hybrid and electric vehicles.

Broad industrial adoption of SiC for high-efficiency motor drives, UPS, and energy storage.

Increased investment in supply chain capacity and localized SiC wafer manufacturing, especially in Asia and North America.

Analysts emphasize the role of SiC in enabling sustainable energy systems and expect the technology to be foundational to next-gen power semiconductors.

Market Segmentation

By Product Type:

Diode

Power Module

MOSFETs

Gate Driver

By Voltage:

Up to 600V

600V – 1000V

1000V – 1500V

Above 1500V

By Application:

Inverter / Converter

Power Supply

Motor Drive

Photovoltaic / Energy Storage Systems

Flexible AC Transmission Systems (FACTs)

RF Devices & Cellular Base Stations

Others (Traction Systems, Induction Heating)

By End-use Industry:

Automotive & Transportation

Aerospace & Defense

Consumer Electronics

IT & Telecommunication

Others (Healthcare, Energy & Utility)

Regional Insights

Asia Pacific held the largest market share (44.23%) in 2022 due to high demand from the electronics, automotive, and industrial sectors in countries like China, Japan, and India. Government policies supporting EV adoption and renewable energy integration are also fostering market growth.

North America (26.12% share) is poised for strong growth, with major semiconductor companies investing in product innovation and strategic partnerships. The U.S. remains a hub for electric vehicle innovation and renewable power generation.

Europe continues to strengthen its position through green energy mandates and rapid EV expansion in countries like Germany and the U.K.

Why Buy This Report?

Comprehensive Market Coverage: Includes qualitative and quantitative analysis with segment-wise and region-wise forecasts.

Strategic Insights: Covers key drivers, trends, and market dynamics shaping the SiC power device industry.

Competitive Intelligence: Profiles leading companies and details on recent innovations, partnerships, and expansions.

Decision-Making Support: Aids industry stakeholders in understanding growth opportunities and market trajectories to align their strategies accordingly.

Customizable Format: Available in PDF and Excel with deep-dive access to historical and projected data.

0 notes

Text

WBG Semiconductors OSAT Market Future Trends Shaping Innovation and Packaging Technologies Worldwide

The WBG semiconductors OSAT market is witnessing significant transformation as the demand for high-performance and energy-efficient electronics continues to rise. Wide Bandgap (WBG) semiconductors such as silicon carbide (SiC) and gallium nitride (GaN) are revolutionizing various industries, particularly in power electronics, electric vehicles, 5G, and renewable energy systems. As these advanced semiconductors gain momentum, the outsourced semiconductor assembly and test (OSAT) segment is emerging as a critical enabler of their large-scale deployment.

Rising Importance of WBG Semiconductors

WBG semiconductors are valued for their ability to operate at higher voltages, frequencies, and temperatures compared to traditional silicon-based semiconductors. These capabilities make them ideal for applications where performance and efficiency are crucial. As industries transition toward more compact and power-dense systems, the role of WBG technologies becomes indispensable. This transition, in turn, is increasing the complexity and requirements of packaging and testing solutions, boosting the demand for advanced OSAT services.

Advanced Packaging Solutions Driving Growth

The future of the WBG semiconductors OSAT market heavily depends on the evolution of packaging technologies. Advanced packaging techniques such as system-in-package (SiP), fan-out wafer-level packaging (FOWLP), and flip-chip packaging are gaining prominence due to their ability to support miniaturization and enhance performance. These techniques allow multiple functions to be integrated into a single module, which is crucial for applications in electric vehicles, power grids, and industrial automation systems.

The OSAT providers are investing significantly in research and development to cater to these evolving packaging needs. As WBG semiconductors require specialized handling due to their unique material properties, traditional packaging methods are becoming less effective. Future trends show a clear shift toward custom and hybrid packaging solutions specifically designed for SiC and GaN components.

Automation and Smart Manufacturing Integration

Another future trend influencing the WBG semiconductors OSAT market is the growing adoption of automation and smart manufacturing systems. AI-driven quality control, robotics in assembly lines, and data-driven test processes are streamlining OSAT operations. These innovations are essential for maintaining accuracy and consistency while handling sensitive WBG semiconductor materials.

Automation also supports the industry’s move toward higher throughput and faster time-to-market. OSAT companies that incorporate smart factory elements will gain a competitive edge by offering reliable, scalable, and efficient services to semiconductor manufacturers.

Demand Surge from Electric Vehicles and 5G

The rise of electric vehicles (EVs) and 5G technology is playing a significant role in shaping the future of the WBG semiconductors OSAT market. EV manufacturers are increasingly adopting SiC-based components for onboard chargers and power inverters due to their energy efficiency and compact size. These components require precise assembly and rigorous testing, which enhances the value of advanced OSAT services.

Similarly, 5G base stations and mobile devices benefit from GaN semiconductors for their high-frequency capabilities. As the global rollout of 5G continues, OSAT providers must scale their capacities and adopt new testing protocols to meet stringent quality standards.

Regional Expansion and Strategic Collaborations

Future market trends also suggest a notable regional expansion of OSAT services, particularly in Asia-Pacific. Countries like China, Taiwan, and South Korea are investing heavily in semiconductor ecosystems, including advanced packaging and testing infrastructure. This regional growth is helping mitigate supply chain risks and fulfill the localized demand for WBG semiconductor products.

Strategic partnerships between semiconductor manufacturers and OSAT companies are becoming more common. These collaborations aim to accelerate time-to-market, reduce development costs, and improve overall production quality. As WBG semiconductors continue to evolve, long-term partnerships will be crucial to ensure technological alignment and business scalability.

Sustainability and Eco-Efficiency in Focus

With growing awareness around environmental impact, sustainability is emerging as a core trend in the WBG semiconductors OSAT market. OSAT companies are adopting eco-friendly materials, energy-efficient equipment, and low-waste manufacturing processes. These efforts align with the global push for greener supply chains and sustainable innovation.

Moreover, WBG semiconductors themselves support energy-saving solutions across industries, and their widespread use contributes to a more sustainable technology ecosystem. OSAT providers that integrate green practices into their operations will be better positioned to attract environmentally conscious clients and partners.

Conclusion

The WBG semiconductors OSAT market is on the cusp of remarkable growth, powered by advancements in materials, packaging technologies, and smart manufacturing systems. As industries demand more compact, efficient, and reliable semiconductor solutions, the role of OSAT providers will become increasingly critical. With electric vehicles, 5G, and renewable energy sectors fueling the demand for WBG semiconductors, the future of OSAT services promises innovation, collaboration, and sustainable progress.

0 notes

Text

Power Without Noise: The Elegant Intelligence Behind the DC-DC Converter

We live in a world powered by invisible rivers of energy. Whether it’s your phone charging on the desk, an EV gliding silently down the highway, or a satellite stabilizing its orbit above Earth, all of it depends on a quiet and tireless guardian: the DC-DC converter.

It doesn’t have a flashing screen or make mechanical sounds. But it’s doing something profound—transforming power with precision. If you’ve ever wondered how today’s electronics, vehicles, and machines stay so compact, efficient, and smart, the answer often lies in the humble DC-DC converter.

A Quiet Transformer in the Digital Age

Electricity isn’t always one-size-fits-all. Devices and systems require varying voltage levels, depending on the task. A processor might need 1.2V, a motor controller 12V, and a battery bank 48V. But if all you have is a 24V supply, how do you cater to such variety without loss?