#Infineon Diode Module

Explore tagged Tumblr posts

Text

youtube

Power Up Your System with the Eupec/Infineon SR100C-24 Diode Module – Available at USComponent

Visit: https://www.uscomponent.com/buy/Eupec-Infineon/SR100C-24

Looking for a robust and reliable diode module for high-voltage, high-current applications? The Eupec/Infineon SR100C-24 offers dependable rectification performance in a compact and efficient design—now available at USComponent, your official and trusted Infineon distributor. This fast-recovery diode module is ideal for use in industrial power supplies, motor drives, and various power conversion systems where thermal efficiency, reliability, and long service life are essential.

With a current rating of 100A and a voltage capacity of 1200V, the SR100C-24 is engineered to deliver low forward voltage drop and excellent reverse recovery characteristics. Whether you’re upgrading an existing system or designing new equipment, this Infineon diode module ensures stable performance even under the most demanding operating conditions.

Professionals worldwide choose USComponent to buy Eupec/Infineon SR100C-24 online, thanks to their commitment to providing only 100% genuine and fully tested components, expert technical support, and fast international shipping. Backed by Infineon’s proven semiconductor technology, this module is an essential part of any efficient and durable power system design.

Order the SR100C-24 from USComponent today and keep your critical systems running smoothly with top-tier Infineon power modules.

#Infineon Diode Module#Infineon SIC Diodes#SiC Diode Infineon#Infineon Diode#Diode Module#Infineon Technologies Authorized Distributors#Infineon Authorized Distributors List#Infineon Technologies Distributors#Infineon Authorized Distributors#Infineon Distributor#Distributor Infineon#SR100C 24 Datasheet#Infineon SR100C 24#Youtube

1 note

·

View note

Text

Semiconductor Rectifiers Market Size Strategic Trends in End-Use Applications

The Semiconductor Rectifiers Market Size is expanding steadily with global demand set to reach USD 9.8 billion by 2032, growing at a CAGR of 12.3%. Increasing reliance on electronic control systems and efficient power supplies across sectors is the primary growth catalyst.

Size Drivers Widespread application in EV charging systems, renewable energy, and consumer electronics continue to shape market volume. Additionally, public investments in grid modernization are expanding high-current rectifier deployments.

Segment Insights The medium-current segment leads due to balanced cost-performance ratio. Schottky and SiC rectifiers are accelerating growth in high-frequency, low-loss applications.

End-Use Applications Consumer gadgets, automotive powertrains, and industrial robotics drive high-volume adoption. In addition, telecom infrastructure and smart city systems are contributing to steady volume growth.

Regional Size Distribution Asia-Pacific leads in volume and growth rate, while North America and Europe remain strong markets due to EV adoption and green energy investments.

Key Players Companies investing in advanced packaging, temperature resilience, and integration into power modules are gaining a competitive edge—Infineon and STMicroelectronics top the list.

Trending Report Highlights

United States LED Light Emitting Diode Market

Asia Pacific Battery ESS Market

Middle East & Africa Smart Cities Market

Wearable AI Market

Model Based Enterprise Market

0 notes

Text

Automotive and Renewable Energy Sectors Power Global SiC Device Market Expansion

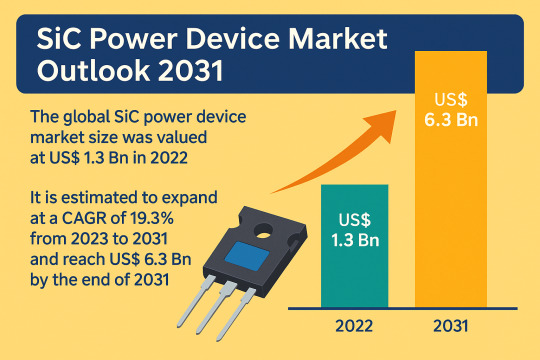

The global silicon carbide (SiC) power device market was valued at US$ 1.3 billion in 2022 and is projected to expand at a robust CAGR of 19.3% from 2023 to 2031, reaching an estimated US$ 6.3 billion by the end of 2031, according to the latest industry analysis. SiC devices, known for their high efficiency, low power loss, and durability in high-voltage and high-temperature conditions, are increasingly being adopted across automotive, industrial, renewable energy, and consumer electronics sectors.

Market Overview

SiC power devices have emerged as a critical solution for next-generation power electronics, offering significant improvements over traditional silicon-based components. With the ability to reduce power loss, increase switching speed, and operate under higher temperatures and voltages, SiC semiconductors are transforming industries that demand high reliability and energy efficiency.

Their unique material characteristics are particularly beneficial in wide bandgap applications, where reducing system size, weight, and cost are essential. The automotive industry, especially the electric vehicle (EV) segment, is a primary adopter, leveraging SiC to improve vehicle performance and energy efficiency.

Market Drivers & Trends

The growing push toward electrification, decarbonization, and energy efficiency is propelling the demand for SiC power devices globally. Key market drivers include:

Rising demand for high-efficiency power systems in industrial and renewable energy applications.

Accelerated EV adoption, requiring robust power electronics for traction inverters, battery chargers, and onboard systems.

Reduction in system size and complexity, thanks to superior properties of SiC MOSFETs and diodes.

Government incentives and mandates for cleaner transportation and energy storage systems.

These trends align with global sustainability goals, where power efficiency and reduced carbon footprint are paramount.

Latest Market Trends

SiC MOSFETs Dominate the Market: Representing over 32% of global share in 2022, the MOSFET segment continues to gain traction due to its high reliability, critical breakdown strength, and thermal performance.

600V–1000V Segment Leading by Voltage Range: With 31.89% share in 2022, this voltage range supports applications such as solar inverters, UPS systems, EV charging, and industrial drives.

High Power Modules in EV Applications: Companies like STMicroelectronics and WOLFSPEED have introduced SiC modules aimed at improving the driving range and energy management of electric vehicles.

Download Sample PDF Copy Now: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=22034

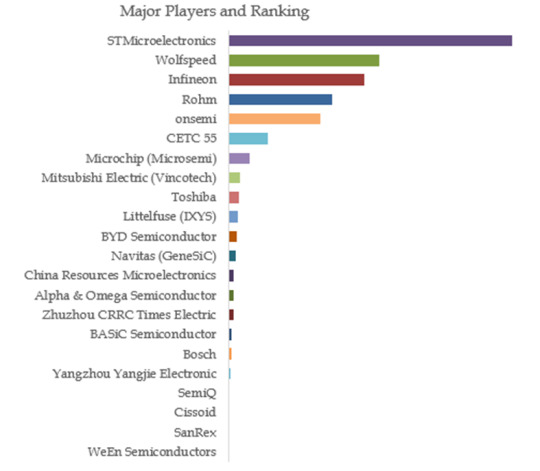

Key Players and Industry Leaders

The SiC power device market is consolidated, with a few dominant players accounting for a majority of the market share. These include:

Coherent Corp.

Fuji Electric Co., Ltd

Infineon Technologies AG

Microchip Technology Inc.

Mitsubishi Electric Corporation

ON Semiconductor Corp

Renesas Electronics Corporation

ROHM Co., Ltd

Toshiba Electronic Devices & Storage Corporation

WOLFSPEED, INC.

These companies are investing heavily in R&D, expanding wafer production capabilities, and launching new product lines to meet surging demand.

Recent Developments

Mitsubishi Electric (March 2023): Constructed a new wafer facility to meet soaring demand for SiC power semiconductors.

Toshiba (December 2022): Developed advanced SiC MOSFETs with enhanced reliability and low resistance.

Microchip Technology (March 2022): Unveiled 3.3 kV SiC power devices for next-generation renewable energy and transportation solutions.

STMicroelectronics: Launched SiC high-power modules for EV traction systems in December 2022.

Market Opportunities

Emerging opportunities include:

Electrification of transportation: As EV adoption scales, SiC’s role becomes more critical in powertrain efficiency.

Expansion in renewable energy and grid infrastructure: Solar and wind energy systems benefit from SiC’s efficiency and reliability.

Adoption in aerospace and defense sectors: Where lightweight, high-performance power systems are increasingly necessary.

High-growth emerging economies in Asia-Pacific and Latin America provide untapped potential for SiC deployment.

Future Outlook

By 2031, the SiC power device market will be defined by:

Continued penetration into mainstream automotive platforms, including hybrid and electric vehicles.

Broad industrial adoption of SiC for high-efficiency motor drives, UPS, and energy storage.

Increased investment in supply chain capacity and localized SiC wafer manufacturing, especially in Asia and North America.

Analysts emphasize the role of SiC in enabling sustainable energy systems and expect the technology to be foundational to next-gen power semiconductors.

Market Segmentation

By Product Type:

Diode

Power Module

MOSFETs

Gate Driver

By Voltage:

Up to 600V

600V – 1000V

1000V – 1500V

Above 1500V

By Application:

Inverter / Converter

Power Supply

Motor Drive

Photovoltaic / Energy Storage Systems

Flexible AC Transmission Systems (FACTs)

RF Devices & Cellular Base Stations

Others (Traction Systems, Induction Heating)

By End-use Industry:

Automotive & Transportation

Aerospace & Defense

Consumer Electronics

IT & Telecommunication

Others (Healthcare, Energy & Utility)

Regional Insights

Asia Pacific held the largest market share (44.23%) in 2022 due to high demand from the electronics, automotive, and industrial sectors in countries like China, Japan, and India. Government policies supporting EV adoption and renewable energy integration are also fostering market growth.

North America (26.12% share) is poised for strong growth, with major semiconductor companies investing in product innovation and strategic partnerships. The U.S. remains a hub for electric vehicle innovation and renewable power generation.

Europe continues to strengthen its position through green energy mandates and rapid EV expansion in countries like Germany and the U.K.

Why Buy This Report?

Comprehensive Market Coverage: Includes qualitative and quantitative analysis with segment-wise and region-wise forecasts.

Strategic Insights: Covers key drivers, trends, and market dynamics shaping the SiC power device industry.

Competitive Intelligence: Profiles leading companies and details on recent innovations, partnerships, and expansions.

Decision-Making Support: Aids industry stakeholders in understanding growth opportunities and market trajectories to align their strategies accordingly.

Customizable Format: Available in PDF and Excel with deep-dive access to historical and projected data.

0 notes

Text

Bipolar Discrete Semiconductor Market Size, Share, Trends, Demand, Growth and Opportunity Analysis

Bipolar Discrete Semiconductor Market – Industry Trends and Forecast to 2029

Global Bipolar Discrete Semiconductor Market, By Type (Diode, General-Purpose Rectifiers, High-Speed Rectifiers, Switching Diodes, Zener Diodes, Electrostatic Discharge (ESD) Protection Diodes, Variable-Capacitance Diodes, Transistor, Metal-Oxide-Semiconductor Field-Effect Transistor (MOSFET), BIPOLAR, Thyristor, Modules), End Users Vertical (Automotive, Consumer Electronics, Communication, Industrial, Others) – Industry Trends and Forecast to 2029.

Access Full 350 Pages PDF Report @

**Segments**

- **Type**: The bipolar discrete semiconductor market can be segmented based on the type of devices, including bipolar transistors, diodes, and thyristors. Bipolar transistors are widely used in various applications such as amplification, switching, and regulation. Diodes are essential components for rectification and signal modulation in electronic circuits. Thyristors, on the other hand, are used for controlling large electrical currents.

- **Application**: Another key segment is based on the applications of bipolar discrete semiconductors. This includes segments such as automotive, industrial, consumer electronics, telecommunications, and aerospace & defense. The automotive sector is a significant consumer of bipolar discrete semiconductors for applications like engine control units, airbags, and traction control systems. Industrial applications cover a wide range of devices used in manufacturing, power distribution, and automation systems. Consumer electronics rely on bipolar discrete semiconductors for products like smartphones, laptops, and TVs. The telecommunications sector uses these semiconductors in network infrastructure equipment. The aerospace & defense segment requires high-performance bipolar discrete semiconductors for mission-critical applications.

- **End-User**: The market can also be segmented based on end-users, which includes segments like original equipment manufacturers (OEMs), electronic manufacturing services (EMS) providers, and distributors. OEMs are the primary users of bipolar discrete semiconductors, integrating them into their products across various industries. EMS providers offer manufacturing services to OEMs and play a crucial role in the supply chain. Distributors act as intermediaries between semiconductor manufacturers and end-users, providing efficient distribution channels for bipolar discrete semiconductors.

**Market Players**

- **Infineon Technologies AG**: Infineon is a key player in the bipolar discrete semiconductor market, offering a wide range of products such as bipolar transistors and diodes. The company focuses on innovation and strategic partnerships to maintain its competitive edge in the market.

- **ON Semiconductor**: ON Semiconductor is another major player, providing high-quality bipolar discrete semiconductors for various applications. The company's product portfolio includes bipolar transistors, diodes, and thyristors that cater to the growing demand in the market.

- **NXP Semiconductors**: NXP Semiconductors is a leading semiconductor manufacturer, known for its advanced bipolar discrete semiconductor solutions. The company's products find applications in automotive, industrial, and consumer electronics sectors, driving its presence in the market.

- **STMicroelectronics**: STMicroelectronics is a prominent player offering a diverse range of bipolar discrete semiconductor products. The company's innovative technologies and global presence contribute to its strong position in the market.

The bipolar discrete semiconductor market is competitive, with key players focusing on product development, strategic collaborations, and expansion into new markets to gain a competitive advantage. The market is driven by increasing demand for electronic devices across various industries, technological advancements, and the growing trend of automation. As the need for efficient power management and high-performance electronic systems continues to rise, the bipolar discrete semiconductor market is expected to witness significant growth in the coming years.

https://www.databridgemarketresearch.com/reports/global-bipolar-discrete-semiconductor-marketThe global bipolar discrete semiconductor market is experiencing substantial growth driven by the increasing adoption of electronic devices across diverse industries. The market segmentation based on type allows for a targeted approach towards catering to the specific needs of applications such as amplification, rectification, and control of electrical currents. Within the application segment, the automotive sector stands out as a significant consumer of bipolar discrete semiconductors for essential functions like engine control and safety systems. The industrial segment also plays a crucial role, employing these semiconductors in manufacturing processes, power distribution systems, and automation technologies. Consumer electronics, telecommunications, and aerospace & defense sectors further contribute to the market demand, highlighting the versatile applications of bipolar discrete semiconductors across industries.

In terms of end-users, original equipment manufacturers (OEMs) are major consumers of bipolar discrete semiconductors, integrating them into a wide range of products. Electronic manufacturing services (EMS) providers offer valuable manufacturing services to OEMs, further driving the adoption of these semiconductors. Distributors play a significant role in providing efficient distribution channels for bipolar discrete semiconductors, ensuring a seamless supply chain for end-users.

Key market players such as Infineon Technologies AG, ON Semiconductor, NXP Semiconductors, and STMicroelectronics are driving innovation and competitiveness in the bipolar discrete semiconductor market. These companies focus on developing advanced semiconductor solutions, forming strategic partnerships, and expanding into new markets to gain a competitive edge. With a focus on product development, collaborations, and market expansion, these players are poised to capitalize on the growing demand for efficient power management and high-performance electronic systems.

The competitive landscape of the bipolar discrete semiconductor market is shaped by factors such as technological advancements, increasing automation trends, and the rising demand for electronic devices across industries. As the market continues to evolve, players are expected to leverage innovation and strategic initiatives to meet the diverse needs of end-users in automotive, industrial, consumer electronics, and aerospace & defense sectors. The market outlook remains optimistic, with significant growth opportunities on the horizon as the demand for efficient and high-performance semiconductor solutions continues to rise.**Segments**

- Global Bipolar Discrete Semiconductor Market, By Type (Diode, General-Purpose Rectifiers, High-Speed Rectifiers, Switching Diodes, Zener Diodes, Electrostatic Discharge (ESD) Protection Diodes, Variable-Capacitance Diodes, Transistor, Metal-Oxide-Semiconductor Field-Effect Transistor (MOSFET), BIPOLAR, Thyristor, Modules) - End Users Vertical (Automotive, Consumer Electronics, Communication, Industrial, Others) – Industry Trends and Forecast to 2029.

The global bipolar discrete semiconductor market is witnessing significant growth due to the increasing adoption of electronic devices across various industries. The market segmentation based on types such as diodes, transistors, and thyristors allows for a targeted approach in catering to specific application needs like rectification, amplification, and current control. The automotive sector stands out as a prominent consumer of bipolar discrete semiconductors, utilizing them in critical functions such as engine control units and safety systems. The industrial segment also plays a vital role, incorporating these semiconductors in manufacturing processes, power distribution, and automation systems. Additionally, the consumer electronics, telecommunications, and aerospace & defense sectors contribute to the market demand, showcasing the versatile applications of bipolar discrete semiconductors across a wide range of industries.

Original Equipment Manufacturers (OEMs) are key end-users of bipolar discrete semiconductors, integrating them into various products across industries. Electronic Manufacturing Services (EMS) providers play a crucial role in offering manufacturing services to OEMs, further boosting the adoption of these semiconductors. Distributors serve as essential intermediaries, ensuring efficient distribution channels for bipolar discrete semiconductors, thus facilitating a seamless supply chain for end-users.

Market leaders like Infineon Technologies AG, ON Semiconductor, NXP Semiconductors, and STMicroelectronics are driving innovation and competitiveness in the bipolar discrete semiconductor market. These companies focus on developing advanced semiconductor solutions, forming strategic partnerships, and expanding into new markets to gain a competitive edge. With an emphasis on product development, collaborations, and market expansion, these players are poised to capitalize on the increasing demand for efficient power management and high-performance electronic systems.

The competitive landscape of the bipolar discrete semiconductor market is influenced by technological advancements, automation trends, and the rising demand for electronic devices across industries. As the market continues to evolve, market players are expected to leverage innovation and strategic initiatives to meet the diverse needs of end-users in automotive, industrial, consumer electronics, and aerospace & defense sectors. The market outlook remains promising, with significant growth opportunities emerging as the demand for effective and high-performance semiconductor solutions continues to surge.

Table of Contents: Bipolar Discrete Semiconductor Market

1 Introduction

2 Global Bipolar Discrete Semiconductor Market Segmentation

3 Executive Summary

4 Premium Insight

5 Market Overview

6 Bipolar Discrete Semiconductor Market, by Product Type

7 Bipolar Discrete Semiconductor Market, by Modality

8 Bipolar Discrete Semiconductor Market, by Type

9 Bipolar Discrete Semiconductor Market, by Mode

10 Bipolar Discrete Semiconductor Market, by End User

12 Bipolar Discrete Semiconductor Market, by Geography

12 Bipolar Discrete Semiconductor Market, Company Landscape

13 Swot Analysis

14 Company Profiles

Countries Studied:

North America (Argentina, Brazil, Canada, Chile, Colombia, Mexico, Peru, United States, Rest of Americas)

Europe (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Russia, Spain, Sweden, Switzerland, United Kingdom, Rest of Europe)

Middle-East and Africa (Egypt, Israel, Qatar, Saudi Arabia, South Africa, United Arab Emirates, Rest of MEA)

Asia-Pacific (Australia, Bangladesh, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Sri Lanka, Thailand, Taiwan, Rest of Asia-Pacific)

Objectives of the Report

To carefully analyze and forecast the size of the Bipolar Discrete Semiconductor market by value and volume.

To estimate the market shares of major segments of the Bipolar Discrete Semiconductor

To showcase the development of the Bipolar Discrete Semiconductor market in different parts of the world.

To analyze and study micro-markets in terms of their contributions to the Bipolar Discrete Semiconductor market, their prospects, and individual growth trends.

To offer precise and useful details about factors affecting the growth of the Bipolar Discrete Semiconductor

To provide a meticulous assessment of crucial business strategies used by leading companies operating in the Bipolar Discrete Semiconductor market, which include research and development, collaborations, agreements, partnerships, acquisitions, mergers, new developments, and product launches.

Browse Trending Reports:

Veterinary Clostridium Vaccine Market Far Field Speech And Voice Recognition Market Farbers Disease Drug Market Dc Motor Control Devices Market Chronic Depressive Personality Disorder Treatment Market Adams Oliver Syndrome Market Cancer Supportive Care Drugs Market n Methyl 6 Pyrrolidone Market Crosslinking Agent Market Molecular Quality Controls Market Paper Band Market Epidermolytic Ichthyosis Market Hemolytic Anemia Market Cortical Necrosis Market Bronchodilators Market Biological Seed Treatment Market Engine And Transmission Thermal Systems Market Antimicrobial Packaging Market Automotive In Wheel Market Bread Improvers Market Antibiotics In Aquaculture Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: [email protected]

0 notes

Text

Power Electronics Market - Forecast(2024–2030)

Switching electronic circuits are used to control the flow of energy in an electronic device. These switches are known as power electronics. Power electronics also helps in the conversion of power through semiconductor devices like diodes, transistors and thyristors. These devices can perform functions such as optimum forward and reverse backing capabilities. The devices are compact and can be used across a number of electronic devices across numerous applications. As of 2015, power electronics has become indispensable for applications related to renewable energy.

As a result of the numerous advancements in technology and R&D in the electronics sector, power electronics is being used across for almost all electronic devise, even more so for those in the industrial sector. The substrate technology used in power electronics plays a significant role in ensuring a more rugged device with a longer life-cycle. Power electronics provide high efficiency, and better electrical properties to withstand numerous life-cycles which is perfectly apt for applications such as aerospace, industrial and power.

Sample Report:

The power electronics market is being fuelled by advancements in the electronics industry and increase R&D spending in the same. As on date, the APAC region contributes the highest to the overall power electronics market with the Americas expected to post the highest growth during the forecast period. The APAC region is fuelled primarily by the number of industrial centers which are located in the region. Further to this, the region is home to almost 80% of all the electronics manufacturing which takes place globally and as such, power electronics are used by the OEMs directly in this region.

Inquiry Before Buying:

The market has been witnessing the onset of a large number of smaller players that are making headway into the market as well as a number of partnerships in terms of technology sharing and application penetration. In spite of the numerous advantages associated with power electronics, there are certain disadvantages which are inhibiting the growth of the market. The first being the high cost f production.

In terms of substrate wafer technology the market has been divided into the following GaN, SiC, and Others. The Power Electronics market has also been segmented by the following devices Power IC, Power Module & Power Discrete, diode rectifiers, ac-dc converters, ac-ac converters, dc-dc converters, dc-ac converters and static switches. The Power electronics market has also been segmented by the following applications Industrial, solar power, wind power, electric cars, aerospace and consumer electronics. The Power electronics market has also been segmented by the following geographies Americas, APAC, Europe and ROW.

Schedule a Call:

Following are just a few of the companies that are operating in the Power Electronics market:

Buy Now:

Fairchild Semiconductor

Hitachi Co

Infineon Technologies AG

Microsemi Corp.

Mitsubishi Electric Corp

For more Electronics related reports, please click here

1 note

·

View note

Text

Electronic Component UAE

Next Power Groups of company, established in 2012 is a leading high service provider Electronics, Electronic Components & Industrial Automation Spare Parts in Dubai-UAE, OMAN and establishing their branches around the GCC.

They are the Manufacturer / Exporters / Service Providers / Suppliers Of IGBT Modules, Stud Thyristors, Diode Modules, Electronic Component Tester, IC Programming System, AC to DC Converter, DC To DC Converter, Limit switch, Electronic Transformer, Power Supply, Ultra cell Battery, Voltage Potentiometer, Stepper Motor, DC Motor, Arduino Starter Kit, Servo Motor, Arduino Uno, Ultrasonic Sensor, Humidity Sensor Module, IR Sensor set, Switches and indicators, Relay, Timer, Relay Sockets, IGBT, Fuse, Fan, Contactors, Breakers etc.

Distributor of electronic, electrical, components, industrial and maintenance, repair & operations (MRO) products – with fast, easy access to over 40,000 stocked products, 24 hours a day, 365 days a year,

Products : Switches, Power Supply, Modules, IC, Diodes, Capacitors, Resistors, indicators, Sensors, Cables, Connectors, SSR, Arduino, Potentiometer, Motors, Relays, Timers, Relay Sockets, IGBT, Fuse, Fan, Contactors, Breakers, Transformers etc.

We supply these electric products to more suppliers in UAE, We have a wide variety of branded products. MEANWELL, AUTONICS, FOTEK, AURDUINO, BOURNS, BUSSMANN, SCHNEIDER ELECTRIC, SIBA, ABB, LONG BATTERY, SUNON FAN, EBM PAPST FAN, CRYDOM, FLUKE, FUJI ELECTRIC, IDEC, EATON, FOTEK, INFINEON, INTERNATIONAL RECTIFIERS, LONG BATTERY, POWER PLUS, SIEMENS, LS ELECTRIC, GENERAL ELECTRIC, FINDER, IXYS, MITSUBISHI, OMRON, PEAK ELECTRONIC, POWEREX, SANREX, SCHRACK, SEMIKRON, XELTEK Etc.

Please send your inquiry to this email

Website : Oncomponents Online electronicstore

[email protected] | For Order +971-567131624

#electronic components#electronics#power supplies#arduino#modules#capacitors#relays#resistor#mean well

1 note

·

View note

Text

Power Discrete and Modules - Competitive Landscape Analysis And Forecast 2024-2033

Modules are self-contained, interchangeable units that can be used to build larger systems. Power modules are modules that convert and distribute electric power. They are used in a variety of applications, including power supplies, UPS systems, and electrical vehicles. Power modules can be either discrete or integrated. Discrete power modules are made up of individual components that are connected together to form a complete module. Integrated power modules are modules that are manufactured as a single unit.

Key Trends

The key trends in power discrete and modules technology are miniaturization, higher efficiency, and higher power density.

Miniaturization:

The trend toward miniaturization is driven by the need for smaller and more compact devices. This trend is enabled by advances in semiconductor manufacturing technology, which allow for smaller and more densely packed devices.

To Know More@ https://www.globalinsightservices.com/reports/power-discrete-and-modules-market/?utm_id=Pranalip

Higher Efficiency:

The trend towards higher efficiency is driven by the need for more efficient devices. This trend is enabled by advances in semiconductor manufacturing technology, which allow for devices with lower power consumption.

Higher Power Density:

The trend toward higher power density is driven by the need for more powerful devices. This trend is enabled by advances in semiconductor manufacturing technology, which allow for devices with higher power output.

Request Sample@https://www.globalinsightservices.com/request-sample/GIS24456

Market Segments

The Power Discrete and Modules Market is segmented on the basis of type, component, material, and region. Based on type, it is classified into power discrete and power module. By component, the market is categorized into thyristor, diode, rectifier, MOSFET, IGBT, and other. By material, it is classified into SiC, GaN, and others. Region-wise, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World.

Key Players

The Power Discrete and Modules Market report includes players such as Infineon Technologies AG, Mitsubishi Electric Corporation, NXP Semiconductor, ON Semiconductor, ROHM Semiconductors, Renesas Electronics, STMicroelectronics, Semtech Corporation, Texas Instruments, and Toshiba Corporation.

0 notes

Text

SiC MOSFET Discrete, Global Market Size, Top 20 Players Ranking and Market Share

SiC MOSFET Discrete Market Summary

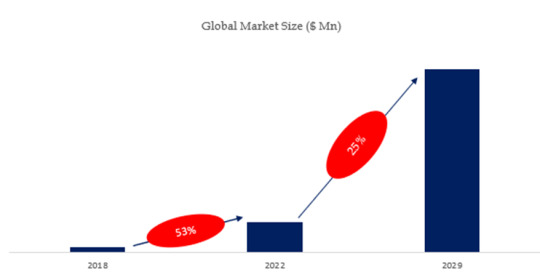

According to the new market research report “Global SiC MOSFET Discretes Market Report 2023-2029”, published by QYResearch, the global SiC MOSFET Discretes market size is projected to grow from USD 805.2 million in 2023 to USD 3190.4 million by 2029, at a CAGR of 25.8% during the forecast period.

Figure. Global SiC MOSFET Discrete Market Size (US$ Million), 2018-2029

Based on or includes research from QYResearch: Global SiC MOSFET Discrete Market Report 2023-2029.

Market Drivers: electric vehicle (EV) is the largest driver of SiC Power Devices, key applications in EV are Main Inverter (Electric Traction), OBC, and DC-DC.

Global EV sales continued strong. A total of 10,5 million new BEVs and PHEVs were delivered during 2022, an increase of +55 % compared to 2021. China and Europe emerged as the main drivers of strong growth in global EV sales. In 2022, the production and sales of new energy vehicles in China reach 7.0 million and 6.8 million respectively, a year-on-year increase of 96.9% and 93.4%, with a market share of 25.6%. The production and sales of new energy vehicles have ranked first in the world for eight consecutive years. Among them, the sales volume of pure electric vehicles was 5.365 million, a year-on-year increase of 81.6%. In 2022, sales of pure electric vehicles in Europe will increase by 29% year-on-year to 1.58 million.

Figure. SiC MOSFET Discrete, Global Market Size, The Top Five Players Hold 80% of Overall Market

Based on or includes research from QYResearch: Global SiC MOSFET Discrete Market Report 2023-2029.

The key players of SiC MOSFET Discrete are STMicroelectronics, Infineon, Wolfspeed, Rohm, and CETC 55, etc.

About The Authors

Junping Yang - Lead Author

Email: [email protected]

Junping Yang is a technology & market senior analyst specializing in semiconductor devices, materials, and equipment. Yang has 9 years’ experience in semiconductor and focuses on ICs, semiconductor materials, package & testing, power semiconductor (IGBT, SiC, diode, MOSFET, modules and discrete), compound semiconductor (SiC, GaN, etc.), power, RF, optoelectronics, ceramic substrates (HTCC, LTCC, DBC, AMB, DPC, DBA), CMP, equipment & parts (wafer transfer robot, EFEM/Sorter, heaters, etc.). He is engaged in the development of technology and market reports and is also involved in custom projects.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

0 notes

Text

Top Electronic Components Brands: A Distributor's Guide

As a distributor navigating the vast landscape of electronic components, aligning with reputable and reliable brands is paramount. This guide aims to highlight some of the top electronic component brands renowned for their quality, innovation, and industry impact. Whether you're procuring components for a specific project or expanding your inventory, these brands offer a solid foundation for sourcing high-quality electronic components.

Texas Instruments (TI):

Overview:

Texas Instruments is a global semiconductor and electronics company.

Renowned for analog and embedded processing solutions.

Key Offerings:

Analog ICs: Amplifiers, power management, data converters.

Microcontrollers: MSP430 and Tiva-C series.

Digital Signal Processors (DSP): Widely used in audio and signal processing.

Applications:

Industrial automation, automotive systems, consumer electronics.

Analog Devices, Inc.:

Overview:

Analog Devices is a leading global high-performance analog technology company.

Specializes in signal processing, power management, and data conversion.

Key Offerings:

Signal Conditioning ICs: Amplifiers, filters, analog switches.

Converters: ADCs (Analog-to-Digital Converters) and DACs (Digital-to-Analog Converters).

Power Management: Voltage regulators, power monitoring.

Applications:

Healthcare, automotive, communication systems.

STMicroelectronics:

Overview:

STMicroelectronics is a global semiconductor company delivering innovative solutions.

Offers a wide range of semiconductor products.

Key Offerings:

Microcontrollers: STM32 series.

Sensors: Accelerometers, gyroscopes, magnetometers.

Power Management ICs: Voltage regulators, motor drivers.

Applications:

Automotive electronics, industrial systems, consumer devices.

NXP Semiconductors:

Overview:

NXP Semiconductors focuses on secure connections and infrastructure.

Offers a diverse portfolio of semiconductor solutions.

Key Offerings:

Microcontrollers: LPC and Kinetis series.

Automotive ICs: In-vehicle networking, security solutions.

RFID Solutions: NFC (Near Field Communication) and UHF RFID.

Applications:

Automotive electronics, IoT solutions, secure identification.

Vishay Intertechnology:

Overview:

Vishay is a leading global manufacturer of discrete semiconductors and passive components.

Known for its extensive range of electronic components.

Key Offerings:

Diodes and Rectifiers: Schottky diodes, rectifiers.

Capacitors and Resistors: Ceramic capacitors, thin film resistors.

Optoelectronics: LEDs, displays, sensors.

Applications:

Power supplies, telecommunications, lighting.

Murata Manufacturing Co., Ltd.:

Overview:

Murata is a global leader in the design and manufacture of electronic components.

Specializes in ceramic capacitors, sensors, and wireless communication modules.

Key Offerings:

Ceramic Capacitors: Multilayer ceramic capacitors (MLCC).

Sensors: Accelerometers, gyroscopes, environmental sensors.

RF Modules: Wi-Fi, Bluetooth, LPWA (Low Power Wide Area) modules.

Applications:

Mobile devices, IoT devices, automotive electronics.

Infineon Technologies AG:

Overview:

Infineon is a German semiconductor manufacturer known for its power semiconductor solutions.

Focuses on power management, security, and automotive applications.

Key Offerings:

Power Semiconductors: MOSFETs, IGBTs, power modules.

Security Solutions: Microcontrollers with integrated security features.

Automotive ICs: Microcontrollers, power management.

Applications:

Power electronics, automotive systems, industrial automation.

ON Semiconductor:

Overview:

ON Semiconductor is a leading supplier of power management and sensor solutions.

Offers a broad portfolio of energy-efficient products.

Key Offerings:

Power Management ICs: Voltage regulators, power switches.

Sensors: Image sensors, proximity sensors.

Discrete Semiconductors: Diodes, transistors.

Applications:

Automotive electronics, imaging applications, industrial systems.

Xecor:

Overview:

A global electronic components trading company based in Japan, dedicated to providing exceptional services to enterprise clients.

1+ Million Users Rely on Xecor Leading Electronic Components Search Engin.

Key Offerings:

Discrete Semiconductor Devices: Diodes, transistors, IBGT modules, field-effect transistors, etc.

Integrated Circuits (ICs) and Memory Chips: Offering diverse integrated circuit solutions, from microprocessors to memory chips.

Sensors and Converters: Supplying various sensors and signal converters to meet diverse application needs.

Applications:

Automotive electronics, I to T device , industrial systems

Conclusion:

Navigating the electronic components market requires partnering with reliable and innovative brands. The featured brands in this guide, including Texas Instruments, Analog Devices, STMicroelectronics, NXP Semiconductors, Vishay, Murata, Infineon, and ON Semiconductor, represent a diverse range of offerings. Whether you're sourcing components for specific applications or aiming to broaden your inventory, these reputable brands ensure you have access to high-quality electronic components for your distribution needs.

0 notes

Text

Silicon Carbide Semiconductor Market Future Trends, Application, Growth, Strategies and Forecast By 2030

The latest market research released by The Insight Partners- “Growth Projections on Silicon Carbide Semiconductor Market - Statistics and Facts” is the one-stop solution for all Silicon Carbide Semiconductor market-related queries. Companies willing to excel in the competitive Silicon Carbide Semiconductor market are foreseen to face some challenges. This report offers a thorough picture of those challenges to prepare businesses to tackle them in the forecast period. This meticulous research is the result of primary and secondary research methods. Investor's viewpoints have been taken into consideration while integrating the scope for products and services in the forecast period. This report presents an unbiased analysis of the Silicon Carbide Semiconductor market to help companies make informed decisions.

Silicon Carbide Semiconductor Market Dynamics Analysis

The supply and demand curves are impacted by market dynamics; therefore, policymakers have to figure out how to effectively employ different financial tools to heat up or cool down the Silicon Carbide Semiconductor market. Our analysts offer unbiased views on the current market situation. This section further includes a forecast of the forces that are likely to influence on prices and behaviors of consumers and manufacturers. In the Silicon Carbide Semiconductor market, forces shape price policies and may result in the fluctuation of supply and demand for products. This further delves into supply-side economics to determine the growth potential for Silicon Carbide Semiconductor market participants.

Competitive Silicon Carbide Semiconductor Market Landscape

In a highly competitive space, companies need to keep discovering new products and features. This chapter on competitive analysis will offer ways in which companies can improve their customer journey. Knowing the advantages and disadvantages of your rivals is a necessary component of comprehending the competitive environment. By learning from an analysis like this, the business can better position itself in the market and comprehend how others have achieved success. Key companies in this market are- GeneSiC, Infineon Technologies AG, Littelfuse, Inc., Microsemi, a wholly owned subsidiary of Microchip Technology Inc., Mitsubishi Electric Corporation, Renesas Electronics Corporation, ROHM CO., LTD., STMicroelectronics, TOSHIBA ELECTRONIC DEVICES AND STORAGE CORPORATION, WOLFSPEED, INC

Silicon Carbide Semiconductor market research report, which contains proof of findings and provides the best opportunity for businesses to fulfill their objectives, might serve as the cornerstone of your business strategy.

Key objectives of this research are:

To uncover factors influencing the business environment.

To analyze the current Silicon Carbide Semiconductor market share, market size, and CAGR

Navigating through opportunities and challenges in the Silicon Carbide Semiconductor market.

To measure the impact of marketing, supply chain, and production strategies.

To gauge consumer behavior to better delivery of products.

To know pioneer profit and identify lucrative growth segments.

What are the Perks for Buyers of this Report?

Cost analysis and performance by regions, customers, and products

Insights on developments in foreign markets, competitor moves, technological changes

Regional market insights for investors

Competitive Analysis

Access to PDF, and PPT formats of this research.

Consultation and customization

Silicon Carbide Semiconductor Market Segmentation Based on Device of Silicon Carbide Semiconductor Market Research report:

JFET

MOSFET

Diode

Module

Others

Based on Voltage of Silicon Carbide Semiconductor Market Research report:

Low Voltage

Medium Voltage

High Voltage

Based on Industry Vertical of Silicon Carbide Semiconductor Market Research report:

Telecommunications

Energy and Power

Automotive

Renewable Power Generation

Defense

Power Electronics

Others

Based on Geography of Silicon Carbide Semiconductor Market Research report:

North America

Europe

Asia Pacific

and South and Central America

Based on Regions:

North America (U.S., Canada, Mexico)

Europe (U.K., France, Germany, Spain, Italy, Central & Eastern Europe, CIS)

Asia Pacific (China, Japan, South Korea, ASEAN, India, Rest of Asia Pacific)

Latin America (Brazil, Rest of Latin America)

The Middle East and Africa (Turkey, GCC, Rest of the Middle East and Africa)

Rest of the World…

0 notes

Text

Optimize High-Power Systems with the FD600R17KF6C_B2 Infineon Diode Module

USComponent is proud to serve as the official distributor of Eupec Infineon diode modules, including the FD600R17KF6C_B2. With competitive pricing and fast delivery, USComponent ensures you have access to high-quality power modules for your applications. For more details or to place an order, visit https://www.uscomponent.com/buy/Eupec/FD600R17KF6C_B2.

The FD600R17KF6C_B2 is a high-performance Infineon diode module designed to meet the demands of modern power systems. With a voltage rating of 1700V and a current capacity of 600A, this module offers reliable energy conversion, efficient power control, and minimal switching losses. It is ideal for applications such as industrial drives, renewable energy installations, electric vehicles, and railway traction, ensuring consistent performance under rigorous conditions.

This diode module is widely used in inverters and power supplies, providing the essential components for energy-efficient systems. Its advanced design supports optimal performance, durability, and cost-effective operation, making it an excellent choice for industries aiming to enhance efficiency and sustainability.

#Diode#IGBT Module#IGBT Transistor Module#Infineon IGBT Modules#Infineon IGBT Module#IGBT Module Infineon#IGBT Power Module#Infineon IGBT#IGBT Power#IGBT Module Price#IGBT Distributor#IGBT Suppliers#Infineon Distributor#FD600R17KF6C_B2

0 notes

Text

Infineon launches new 62 mm package CoolSiC product portfolio to help achieve higher efficiency and power density

【Lansheng Technology News】Infineon Technologies AG recently announced the addition of new industry-standard packaging products to its CoolSiC 1200 V and 2000 V MOSFET module series. It uses a mature 62 mm device half-bridge topology design and is based on the newly launched enhancement-mode M1H silicon carbide (SiC) MOSFET technology. This package enables SiC to be used in mid-power applications above 250 kW, where the power density of traditional IGBT silicon technology has reached its limit. Compared with traditional 62mm IGBT modules, its application scope has now expanded to solar energy, servers, energy storage, electric vehicle charging piles, traction, commercial induction cookers and power conversion systems.

Enhanced M1H technology can significantly widen the gate voltage window, even at high switching frequencies, without any restrictions, ensuring high gate reliability against induced voltage spikes caused by drivers and layout. Additionally, extremely low switching and transmission losses minimize cooling requirements. Combined with high reverse voltage, these semiconductor devices also meet another requirement of modern system design. With Infineon's CoolSiCTM chip technology, the converter design can become more efficient and the power rating of a single inverter can be further increased, thereby reducing the overall system cost.

Featuring a copper base plate and threaded interface, the package features a highly robust mechanical design that increases system availability, lowers service costs and reduces downtime costs. Excellent reliability is achieved through strong thermal cycling capabilities and a continuous operating junction temperature (Tvjop) of 150°C. Its symmetrical internal package design enables the upper and lower switches to have the same switching conditions. Optional pre-applied thermal interface material (TIM) is available to further enhance the module’s thermal performance.

Lansheng Technology Limited, which is a spot stock distributor of many well-known brands, we have price advantage of the first-hand spot channel, and have technical supports.

Our main brands: STMicroelectronics, Toshiba, Microchip, Vishay, Marvell, ON Semiconductor, AOS, DIODES, Murata, Samsung, Hyundai/Hynix, Xilinx, Micron, Infinone, Texas Instruments, ADI, Maxim Integrated, NXP, etc

To learn more about our products, services, and capabilities, please visit our website at http://www.lanshengic.com

0 notes

Text

Silicon Carbide Power Semiconductors Market to Hit $11.7 Billion by 2035

The global silicon carbide (SiC) power semiconductors market was valued at US$ 1.8 billion in 2024 and is projected to expand at a robust compound annual growth rate (CAGR) of 19.0% over the forecast period from 2025 to 2035, reaching US$ 11.7 billion by the end of 2035. This remarkable growth is underpinned by the superior electrical and thermal properties of SiC-based devices, which enable high‐efficiency power conversion, compact form factors, and reliable operation under elevated temperatures and voltages. As industries pivot toward electrification, renewable energy integration, and high‐performance computing, SiC power semiconductors are poised to become foundational components in next‐generation power electronic architectures.

Market Drivers & Trends

Growing Demand for Electric Vehicles (EVs): The surge in global EV sales—from US$ 255.5 billion in 2023 to an estimated US$ 2,108.8 billion by 2033—is a primary catalyst for SiC device uptake. EV powertrains rely heavily on SiC MOSFETs and diodes in traction inverters, onboard chargers, and battery management systems. These components deliver higher power density, faster switching, and reduced thermal management requirements compared to conventional silicon technologies.

Need for Fast Charging Infrastructure: Rapid charging stations require compact, high‑power density converters that can handle high voltages and currents with minimal losses. SiC-based modules offer up to 30% efficiency improvements and significantly lower cooling system complexity, enabling smaller footprints and faster charge times for both public and residential charging units.

Shift Toward Renewable Energy: The integration of solar and wind power into the grid demands inverters capable of operating at high voltages and temperatures with minimal downtime. SiC inverters and power modules are emerging as the technology of choice for utility-scale and distributed renewable installations, driven by national decarbonization targets and favorable government incentives.

Industrial Electrification and Automation: Advanced motor drives, uninterruptible power supplies (UPS), and robotics systems benefit from the fast switching and compact design of SiC devices. This trend is accelerating in manufacturing sectors striving for higher throughput, lower energy costs, and reduced physical plant footprints.

Latest Market Trends

Integration of SiC in 5G Infrastructure: As telecom operators expand 5G networks, the demand for efficient power amplifiers in Base Station Units (BSUs) and power supplies in data centers is driving the adoption of SiC components.

Emergence of Hybrid Silicon–SiC Modules: Manufacturers are introducing hybrid modules that combine SiC devices with conventional silicon circuits to optimize cost and performance, particularly for mid‐voltage applications below 600 V.

Advancements in Packaging and Thermal Management: Innovative packaging solutions such as direct-bonded copper (DBC) substrates and advanced heat sink integrations are enhancing power density and reliability for automotive and industrial modules.

Key Players and Industry Leaders

Leading players in the SiC power semiconductor space include, but are not limited to:

Wolfspeed, Inc.: A pioneer in SiC wafer and device production, focusing on high-performance MOSFETs and diodes.

Infineon Technologies AG: Known for its CoolSiC™ MOSFET portfolio and strategic partnerships in the EV charging domain.

STMicroelectronics N.V.: Developer of the fourth-generation SiC MOSFET technology optimized for traction inverter applications.

ON Semiconductor Corp.: Producer of the EliteSiC™ M3e series targeting automotive on-board chargers and industrial converters.

ROHM Co. Ltd and Renesas Electronics Corp.: Investing heavily in R&D to expand SiC product footprints across voltage and power ranges.

Recent Developments

September 2024: STMicroelectronics unveiled its fourth-generation SiC MOSFET technology, setting new benchmarks for conduction loss and switching performance. The device is purpose-built for high‐voltage traction inverters in electric vehicles.

July 2024: ON Semiconductor launched the EliteSiC M3e family of MOSFETs, delivering up to 20% cost-per-kW reductions and enhanced thermal cycling robustness for industrial and automotive customers.

April 2025: Wolfspeed inaugurated its latest 150 mm SiC wafer fabrication line in North Carolina, USA, aiming to quadruple SiC wafer output by 2026.

Market Opportunities

Emerging EV Markets: Rapid EV adoption in Southeast Asia, Latin America, and Eastern Europe presents greenfield opportunities for SiC suppliers to establish distribution networks and localized manufacturing partnerships.

Grid-Interactive Renewable Installations: Utility-scale solar-plus-storage projects are seeking high-efficiency power modules for energy arbitrage and grid stabilization services.

Aerospace & Defense Electrification: Electrified propulsion systems in drones, aircraft auxiliary power units (APUs), and military ground vehicles are beginning to leverage SiC semiconductors for weight reduction and improved reliability.

Fast Charging Hubs for Logistics Fleets: As last-mile delivery fleets transition to electric, dedicated rapid‐charging depots represent a high‑growth vertical requiring compact, high-power density charging converters.

Discover valuable insights and findings from our Report in this sample -https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86467

Future Outlook

By 2035, silicon carbide power semiconductors will command a significant share of total power electronics supply, with widespread integration across automotive powertrains, renewable energy systems, and industrial automation. Forecasts indicate that the average selling price (ASP) of SiC devices will decrease by 40% from 2024 levels as manufacturing scales and supply chain efficiencies improve. Concurrently, mature ecosystem development spanning wafer fabrication, device packaging, and module assembly will elevate SiC from a premium niche to a mainstream material choice in nearly all power conversion applications.

Market Segmentation

By Product Type:

Diode

Power Module

MOSFETs (37.3% share in 2024, 19.9% CAGR)

Others

By Voltage:

Below 600 V

601 V – 1,000 V

1,001 V – 1,500 V

Above 1,500 V

By End-Use Industry:

Automotive & Transportation (EV powertrains, on-board chargers, PDUs, BMS, thermal management)

Aerospace & Defense (avionics, UAVs, military electrification)

Consumer Electronics (fast chargers, audio amplifiers, TVs, appliances)

IT & Telecommunications (server power, telecom supplies, base stations)

Industrial (motor drives, UPS, welding, induction heating, robotics)

Others (healthcare, utilities)

Regional Insights

East Asia: The largest regional market with a 43.3% share in 2024, driven by China, Japan, and South Korea’s dominance in SiC wafer production, EV manufacturing, and renewable energy deployment. Expected CAGR of 17.6% through 2035.

North America: Rapid expansion in EV infrastructure and defense electrification projects. Recent capacity additions in the USA aim to localize SiC supply chains and reduce import dependency.

Europe: Strong regulatory push for clean energy and vehicle emissions targets is driving SiC adoption in automotive and solar inverter sectors, with Germany, France, and the U.K. as key markets.

Others: Growing interest in Latin America, South Asia, and Middle East for grid modernization and electric mobility opens new growth corridors for SiC products.

Why Buy This Report?

Comprehensive Analysis: In-depth quantitative data spanning 2020–2035, including market size, forecasts, and volume estimations.

Strategic Insights: Detailed coverage of drivers, restraints, opportunities, and Porter’s Five Forces analysis.

Competitive Landscape: Profiles of 20+ leading companies, with market share analysis, recent developments, and strategic roadmaps.

Segmentation & Regional Perspectives: Granular breakdown by product type, voltage, end-use industry, and geography.

Actionable Recommendations: Tailored guidance for investors, OEMs, and suppliers seeking to capitalize on SiC market dynamics.

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

Global Electronic Components Market Is Estimated To Witness High Growth Owing To Increasing Demand for Consumer Electronics

The global electronic components market is estimated to be valued at US$ 498.34 billion in 2023 and is expected to exhibit a CAGR of 6.8% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights. A) Market Overview: Electronic components are the building blocks of various electronic devices and systems. These components include resistors, capacitors, transistors, diodes, integrated circuits, and sensors, among others. They are essential for the functioning of electronic products across various industries such as consumer electronics, automotive, healthcare, and telecommunications. The increasing demand for advanced and energy-efficient devices, along with the rapid growth of the Internet of Things (IoT) and automation technologies, is driving the market for electronic components. These components provide advantages such as miniaturization, increased efficiency, and enhanced performance, thereby fulfilling the need for smaller, faster, and more complex electronic systems. B) Market Key Trends: One key trend in the global General Electronic Components Market is the increasing demand for consumer electronics. With the rapid digitalization and urbanization, there is a growing adoption of smart devices and gadgets such as smartphones, tablets, laptops, and wearable devices. The proliferation of social media platforms, e-commerce websites, and digital content has further boosted the demand for consumer electronics. This trend is expected to continue in the coming years as consumers seek more advanced and technologically advanced products with improved features and functionalities. For example, advancements in display technologies have led to the development of OLED and AMOLED screens that offer higher resolution, better color accuracy, and improved energy efficiency. Similarly, the demand for high-speed processors and memory modules has increased for seamless multitasking and faster data processing. These factors are driving the demand for electronic components in the consumer electronics sector. D) Key Takeaways: - The global electronic components market is expected to witness high growth, exhibiting a CAGR of 6.8% over the forecast period, due to increasing demand for consumer electronics. The adoption of advanced technologies and the growing need for energy-efficient devices are further driving market growth. - Asia Pacific is the fastest growing and dominating region in the electronic components market. The region is witnessing significant growth in consumer electronics, automotive, and manufacturing industries. - Key players operating in the global electronic components market include Panasonic Corporation, Samsung Electronics Co. Ltd., Intel Corporation, Texas Instruments Incorporated, Toshiba Corporation, Sony Corporation, STMicroelectronics N.V., NXP Semiconductors N.V., Infineon Technologies AG, Broadcom Inc., Analog Devices Inc., Murata Manufacturing Co. Ltd., Vishay Intertechnology Inc., ON Semiconductor Corporation, and Renesas Electronics Corporation. In conclusion, the global electronic components market is poised for significant growth in the coming years. The increasing demand for consumer electronics, coupled with advancements in technology, will continue to drive the market. Additionally, Asia Pacific is expected to emerge as a dominant region in terms of market share. Key players in the industry are focusing on research and development activities to introduce innovative and high-performance electronic components to cater to the evolving market demands.

#Semiconductors Market#General Electronic Components Market#General Electronic Components Market Share#General Electronic Components Market Size

0 notes

Text

INFINEON | BD Electronics

Infineon Technologies acquired Eupec who offers various semiconductor products, including IGBT high-power and standard modules, thyristors, and diodes. Eupec, Inc. produces a wide range of semiconductors, such as IGBT high power, standard modules, thyristors, and diodes.

With their unsurpassed technical expertise, quality products and services meet all the semiconductor demands of customers. Being a technology leader in IGBT, Eupec offers a comprehensive portfolio in different voltage and current classes. IGBT products vary from bare dies, discrete components, power modules to even complete stack solutions.

On April 1st, 1999, Siemens Semiconductors became Infineon Technologies. EUPEC (European Power Semiconductor and Electronics Company) is a subsidiary of Infineon Technologies AG, Munich. EUPEC is a well-known manufacturer that develops, produces, and distributes Power Semiconductors worldwide.

For more information, you may visit our website: https://bde-ltd.com/manufacturers/eupec-gmbh-infineon/

#infineon distributor#electronic components#obsolete electronic components suppliers#high standard modules#diodes

0 notes

Text

Produk Komponen Elektronik Thyirsitor Infineon

Thyristor / Diode 34 mm Listrik Blok 1600 V, 180 modul untuk kontrol fase dalam tekanan teknologi kontak menggunakan pelat dasar tembaga yang terisolasi. Teknologi Kontak Tekanan untuk keandalan terbaik. Paket standar industri. Piring isolasi listrik dasar. Kacau pendek. Kekerasan terbesar. Dirancang untuk kebutuhan pemuatan yang berlebihan dan siklus daya. Stabilitas pemblokiran DC tinggi sepanjang masa. Kapasitas lonjakan tinggi terutama untuk peningkatan jaringan pendek. Penyedia untuk beberapa modul blok energi. Jumlah motor listrik terus tumbuh. Peralatan dan persyaratan lingkungan harus diisi dengan komponen dan sumber daya yang tersedia dari penyedia komponen dan, oleh karena itu, mendukung ekosistem. Sebagai penyedia sistem, kami: Kami memfokuskan kegiatan pengembangan kami di sekitar solusi kontrol yang hemat biaya dan penghematan energi TD180N16KOF Infineon sambil menangani standar keselamatan terbaik. Ini mendukung ekosistem lengkap simulasi online, desain referensi untuk sambungan evaluasi, kit yang sulit dan bahkan perkembangan perangkat lunak yang disematkan dengan penggunaan kembali perangkat lunak di berbagai bagian. Kelola kebutuhan desain Anda: dari solusi terpisah ke solusi terintegrasi transparan dengan keunggulan setiap versi. Karena pengurangan CO2 telah menjadi prioritas yang sangat tinggi di bidang industri, konsumen dan mesin mekanik, unit mekanis secara bertahap digantikan oleh motor cerdas yang dikendalikan oleh listrik. Motor listrik sering diaktifkan dan kecepatan terkontrol kecepatan. Infineon menyediakan solusi semikonduktor seperti itu dan terus memperluas portofolio semikonduktor yang dibutuhkan untuk kontrol cerdas dan modern, seperti MOSFET, driver jembatan, jembatan terintegrasi. Motor listrik sering diaktifkan dan kecepatan terkontrol kecepatan. Infineon memberikan solusi semikonduktor ini dan terus memperluas portofolio semikonduktor yang diperlukan untuk kontrol cerdas dan modern (BDC, BDC, induksi, pmsm, servo, langkah demi langkah, asik sakelar), seperti MOSFET, driver jembatan, jembatan terintegrasi. sumber : https://teramitra.com/shop/td180n16kof-infineon/

1 note

·

View note