#InsurTech

Explore tagged Tumblr posts

Text

Nightshift CCTV Operator

Job title: Nightshift CCTV Operator Company: Corps Security Job description: of ‘loyalty, integrity, service’, we have become the UK’s most established and respected specialist security services provider… Assignment Instructions. Record all events and actions monitored from within the control room. Respond and react… Expected salary: £13.1 per hour Location: Paisley Job date: Fri, 27 Jun 2025…

#Aerospace#audio-dsp#Automotive#Blockchain#Crypto#Cybersecurity#DevOps#full-stack#govtech#insurtech#iOS#legaltech#low-code#Machine learning#metaverse#power-platform#prompt-engineering#Python#quantum computing#React Specialist#regtech#robotics#rpa#scrum#site-reliability#SoC#solutions-architecture#technical-writing#telecoms

3 notes

·

View notes

Text

Big Data + AI = Future of Insurance! See how tech is changing insurance technology solutions. Are you ready to lead, follow, or be left behind?

2 notes

·

View notes

Text

#KeepExploring#ProtectedJourneys#gadgettravelinsurance#app#bestinsurancedeals#customerservice#gadgets#gadgetinsurance#Insurance#newblogflo#secretstime#InsurTech#iPhone#laptop#laptops#mycovergenius#partnerships#smartphone#tourism#travel#travelinsurance#AllianzTravelInsurance#ApplyForTravelInsurance#BestTravelInsurance#BestTravelInsurance2023#BestTravelInsuranceCompanies#Business#BuyTravelInsurance#CheapTravelInsurance#CheapestTravelInsurance

2 notes

·

View notes

Text

#affordability#BharatSure#BatterySmart#EVInsurance#Insurtech#StartupIndia#FundingNews#ElectricVehicles#MobilityInnovation#NishantJain#TechForEVs#Timestech#electronicsnews#technologynews

0 notes

Text

#InsurTech#DigitalTransformation#InsuranceTech#AI#MachineLearning#CustomSoftware#InsuranceSolutions#TechForBusiness

0 notes

Text

#EVInsurance#BatterySmart#BharatSure#Insurtech#EVIndia#ElectricVehicles#BatterySwapping#EVFleets#CleanMobility#SustainableTransport#AutoEVTimes#StartupFunding#MobilitySolutions#EVPartnerships#electricvehiclesnews#evtimes#autoevtimes#evbusines

0 notes

Text

Travel Insurance Market Growth Drivers and Competitive Landscape Analysis in 2025

The Travel Insurance Market is experiencing steady expansion due to a rise in international travel, evolving consumer expectations, and growing awareness about financial protection while abroad. As the demand for tailored and technology-driven insurance solutions increases, companies are shifting strategies to stay competitive. This article explores the major growth drivers and examines the competitive landscape shaping the industry in 2025.

Key Growth Drivers Boosting the Travel Insurance Market

Several crucial factors are propelling the travel insurance market forward in 2025. Among these, the most influential drivers include:

1. Rebound of Global Travel

After a period of stagnation during the pandemic, global tourism has made a strong comeback. People are more eager to travel internationally, with many planning long-haul or multi-country trips. This surge in tourism directly translates to higher demand for travel insurance, especially policies offering emergency medical coverage, trip cancellations, and delay protection.

2. Rising Awareness and Risk Aversion

Travelers today are more cautious than ever. Experiences from the pandemic, along with rising incidents of geopolitical unrest, natural disasters, and airline disruptions, have heightened risk awareness. Insurance is no longer seen as optional; it is now a critical part of travel planning.

3. Digitalization and Easy Policy Access

Digital transformation across the insurance sector has made it easier for consumers to access, compare, and purchase travel insurance. Insurtech platforms and mobile apps now allow users to explore customized plans within minutes, fueling customer acquisition for insurers. This convenience is a key growth enabler.

4. Demand for Customization

From backpackers and students to families and corporate travelers, today’s consumers want policies that reflect their specific travel needs. Insurance providers are developing products for niche segments like adventure travel, luxury travel, and senior travelers, helping to expand their customer base.

Competitive Landscape and Major Players

The competitive landscape of the travel insurance market in 2025 is marked by rapid innovation, mergers, and the emergence of digital-first players. Traditional insurance giants and new-age startups are both trying to capture market share through product differentiation, partnerships, and technology investments.

1. Global Insurance Giants

Established companies like Allianz, AXA, and Zurich Insurance continue to dominate the market. These firms benefit from strong brand recognition, robust financial backing, and global claim networks. In 2025, they are focusing on expanding direct-to-consumer models, improving customer experience, and enhancing claim processing through AI.

2. Digital-First Insurtech Startups

Insurtech startups such as SafetyWing, Battleface, and Faye are quickly gaining traction. With a mobile-first approach, these companies offer simplified policy options, instant claim settlements, and transparent pricing. They appeal strongly to younger and tech-savvy travelers who prioritize flexibility and control.

3. Regional Specialists

Several regional players are also rising to prominence by offering highly localized policies that align with specific geographic travel trends. These insurers understand cultural and legal nuances, giving them a competitive edge in home regions.

Strategies for Gaining Competitive Advantage

To stand out in this increasingly crowded space, companies are implementing focused strategies. These include:

1. Leveraging Artificial Intelligence

AI is transforming how insurers underwrite policies, detect fraud, and process claims. Companies using AI-powered chatbots and predictive analytics can enhance operational efficiency while delivering a smoother user experience.

2. Building Partnerships with Travel Ecosystem Players

Travel insurers are increasingly partnering with airlines, travel booking platforms, and credit card companies to embed insurance offerings into existing services. These partnerships expand reach and offer seamless integration into the customer journey.

3. Investing in Customer Experience

User experience is a key differentiator in 2025. Companies are optimizing their websites and mobile apps to provide self-service tools, policy education, and real-time claim tracking. Simpler policy terms and transparent pricing also play a role in building trust and loyalty.

4. Offering Sustainable and Ethical Insurance Products

A growing number of travelers are concerned with sustainability and ethics. Some insurers now offer eco-conscious policies or contribute a portion of profits to climate causes. These initiatives resonate with responsible travelers and can improve brand perception.

Challenges in a Competitive Environment

While the travel insurance market shows robust growth, competition brings its own set of challenges:

Price wars are becoming common, especially among digital players offering ultra-low premiums.

Customer loyalty remains low, as many consumers treat insurance as a one-time purchase.

Regulatory complexity, particularly for international policies, creates hurdles for cross-border operations.

Overcoming these challenges requires agility, innovation, and a deep understanding of consumer behavior.

Conclusion

The travel insurance market in 2025 is undergoing rapid evolution. With global travel back on the rise, risk awareness increasing, and technology simplifying policy access, the industry is set for continued growth. However, the playing field is becoming increasingly competitive. Success in this environment will depend on a company's ability to embrace innovation, forge meaningful partnerships, and stay responsive to shifting customer needs.

#travelinsurance#insuranceindustry#markettrends2025#insurtech#digitalinsurance#travelrisk#consumerbehavior#globaltravel#insuranceinnovation#marketresearch

0 notes

Text

💊 Life insurers are getting duped by “mirage” wellness—thanks to GLP-1s. Retention is the new underwriting. Whoever cracks it first will own the future of mortality risk. #Insurtech #GLP1

🔻

How GLP-1s Are Breaking Life Insurance

Patients look healthy on paper. Two years later, they’re high-risk again.

https://www.glp1digest.com/p/how-glp-1s-are-breaking-life-insurance @ennovance @PennInnovation @VentureBeat #vc #insurtec @StartupGrind @ijournal

https://x.com/mohossain/status/1946744289586995391?s=46

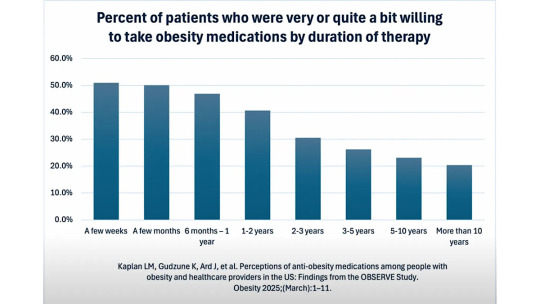

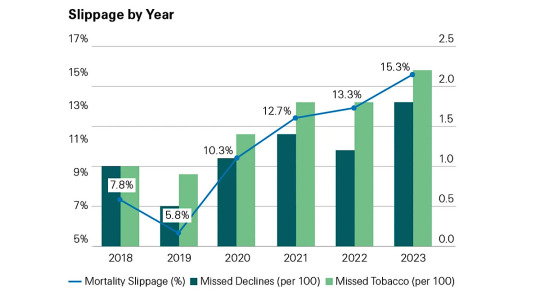

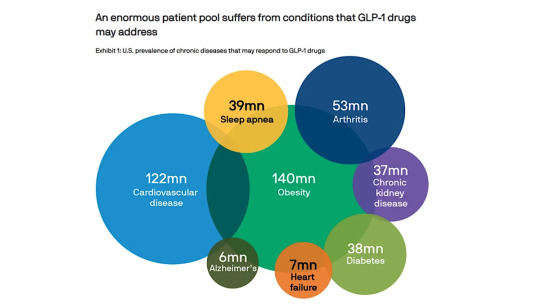

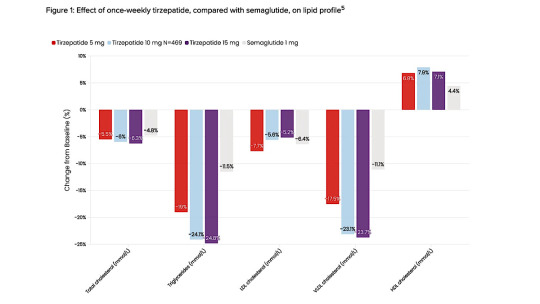

GLP-1 medications, while revolutionizing metabolic health, are wreaking havoc on life insurance underwriting. Insurers rely on metrics like BMI, blood pressure, and cholesterol—precisely the markers GLP-1s improve—to assess mortality risk. Patients appear low-risk during treatment, but when they quit (as ~65% do within a year), these health gains often reverse, creating a “mirage” of wellness and leading to costly misclassifications known as “mortality slippage.” This has tripled since 2019, forcing insurers to rethink how they evaluate applicants. Some now demand proof of sustained weight loss or apply risk buffers. But the article argues the real opportunity lies in retention—keeping patients on GLP-1s long-term reduces future claims. Like the statin playbook, simple interventions (longer refills, fewer hurdles) may outperform costly wrap-around care. Insurers that crack retention stand to profit—and whoever solves it first could reshape the market.

0 notes

Text

#MintYourLife

0 notes

Text

Embedded Insurance: A $950 Billion Opportunity by 2030

Buying a flight ticket? Shopping for a new gadget? You’re likely experiencing embedded insurance—a seamless, built-in coverage model that’s reshaping how protection is offered and purchased.

📊 The embedded insurance market is forecasted to reach $950 billion by 2030, transforming industries like travel, eCommerce, automotive, and more.

At MetaBetter, we track the trends and technologies driving this surge—helping insurers and businesses innovate with smarter, embedded solutions.

#Insurtech#EmbeddedInsurance#DigitalInsurance#FutureOfInsurance#MetaBetterTrends#Fintech#InsuranceInnovation#TechTrends#InsuranceTech

0 notes

Text

Interface Engineer En & EW

Job title: Interface Engineer En & EW Company: Mactech Energy Group Job description: Interface Engineer – En & EW 1210ADS Based in our London office with hybrid working available Closing date: 8th… on from the success of Hinkley Point C (HPC), the SZC Project is a nuclear new build project in Suffolk, which has obtained… Expected salary: £620 per day Location: London Job date: Fri, 27 Jun 2025…

#audio-dsp#Azure#cloud-native#CRM#Crypto#DevOps#digital-twin#dotnet#fintech#full-stack#generative AI#GIS#healthtech#HPC#HPC Engineer#hybrid-work#insurtech#low-code#marine-tech#metaverse#no-code#project-management#qa-testing#rpa#scrum#SEO#software-development#telecoms#uk-jobs

2 notes

·

View notes

Text

AI Agent for insurance

Insurance Agents: Want More Time to Sell? Let AI Handle the Rest.

Tired of spending hours making follow-up calls, collecting documents, and answering the same questions every day?

Meet your new assistant: the AI agent for insurance. ✅ Qualifies leads automatically ✅ Answers client FAQs 24/7 ✅ Sends document reminders ✅ Works non-stop, even when you don’t

With Deligence’s AI solutions, you can finally focus on what really matters—closing deals and serving clients.

🧠 Smart. ⚙️ Simple. 📈 Built for insurance professionals

#InsuranceA#AIAgentForInsurance#InsurTech#Deligence#InsuranceAutomation#SmartSelling#TimeSaver#LeadGeneration

1 note

·

View note

Text

Book featured on Fintechview360

Fintechview360 featured my new book on Fintech and the emerging ecosystems. We spoke about the competing centralised and decentralised visions for the future of finance: https://fintechview360.com/new-research-on-fintech-emerging-ecosystems-southampton-university/

Reference

Zarifis A. & Cheng X. (eds.) (2025) ‘Fintech and the Emerging Ecosystems – Exploring Centralised and Decentralised Financial Technologies’, Springer: Cham. https://doi.org/10.1007/978-3-031-83402-8

1 note

·

View note

Text

La visión de Aseguralo sobre el futuro del seguro digital en Latinoamérica

Aseguralo, el broker de seguros 100% digital de Hawk Group, estuvo presente en el encuentro anual organizado por la Cámara Insurtech Argentina, donde tuvo una activa participación en los espacios de networking con el objetivo de fortalecer alianzas estratégicas y seguir impulsando la transformación digital del sector asegurador. El MeetDay – Insurted Round 2025 es el principal punto de encuentro…

0 notes

Text

Usage-Based Insurance Market Adapts to Technology Trends and Consumer Preference for Fair Pricing

The Usage-Based Insurance Market is undergoing a transformative shift as technology, telematics, and data analytics redefine traditional insurance models. Known for its ability to personalize premiums based on driving behavior, mileage, and vehicle usage, usage-based insurance (UBI) has become a game-changer in the automotive and insurance sectors. This model empowers both insurers and policyholders by promoting transparency, encouraging safer driving habits, and offering cost-effective solutions.

UBI solutions primarily leverage telematics devices, smartphone apps, and onboard diagnostic tools to gather real-time data. The data collected includes speed, braking habits, acceleration patterns, distance traveled, and even time of travel. This information is then analyzed to determine insurance premiums tailored to individual risk profiles, leading to fairer pricing models. As a result, low-risk drivers are rewarded with lower premiums, while risky behaviors are identified and appropriately priced.

One of the key factors propelling the growth of the usage-based insurance market is the widespread adoption of connected vehicles. With the integration of advanced GPS tracking systems and IoT devices, insurers can now access accurate and real-time driving data. Furthermore, the increasing demand for vehicle safety and driver behavior monitoring has encouraged original equipment manufacturers (OEMs) to offer built-in telematics solutions, making UBI more accessible to a broader consumer base.

Governments around the world are also playing a significant role in promoting UBI. Regulatory support in terms of data usage policies and safety regulations is helping insurers expand their offerings. For instance, in several European countries and the U.S., government incentives are pushing for eco-friendly driving and reduction of traffic congestion—both of which align well with the goals of UBI. These regulations are further supported by insurers looking to meet the demands of a tech-savvy and safety-conscious clientele.

Moreover, UBI helps reduce fraudulent claims by providing accurate incident reports through data recording. In the event of an accident, insurers can review driving behavior and circumstances leading up to the incident, which speeds up claim processing and improves fraud detection. This technological transparency increases trust between the insurer and policyholder.

The market is also witnessing a diversification in UBI models, such as pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), and manage-how-you-drive (MHYD). PAYD focuses on the mileage driven, offering savings for low-mileage drivers. PHYD takes into account individual driving behavior, and MHYD involves active feedback and coaching to improve driving habits over time. This variety allows insurers to target a wide demographic, from low-mileage urban drivers to commercial fleet operators.

Fleet operators, in particular, are reaping the benefits of usage-based insurance. With fleet management solutions already in place, integrating UBI helps monitor driver performance, reduce accidents, and optimize operational costs. The commercial vehicle segment has shown increased adoption, especially in logistics and delivery services where real-time monitoring is critical.

However, the UBI market also faces challenges. Concerns about data privacy and the misuse of personal information remain significant barriers to adoption. Consumers are increasingly cautious about sharing location and behavioral data, and insurers must address these concerns with clear privacy policies and secure data management systems. Additionally, while technology enables better risk assessment, it also introduces the challenge of interpreting vast amounts of data accurately and ethically.

Another challenge lies in market education. Many consumers still prefer traditional insurance models due to familiarity and uncertainty around how UBI works. For UBI to achieve mass-market appeal, insurers must invest in awareness campaigns and transparent communication about the benefits and functioning of the system.

Looking forward, the usage-based insurance market is expected to grow at a steady pace. Innovations in artificial intelligence (AI) and machine learning will enable even more accurate risk profiling and predictive analytics. These technologies will help insurers not only price policies more precisely but also offer proactive risk management and personalized feedback to drivers.

In conclusion, the Usage-Based Insurance Market is positioned for significant expansion, driven by advancements in telematics, consumer demand for fair pricing, and regulatory support. As the automotive and insurance industries converge through digital transformation, UBI will play a vital role in creating smarter, safer, and more cost-efficient mobility solutions.

0 notes

Text

The Psychology of Trust

In a world dominated by digital interfaces, trust has become the most valuable currency for user experience. Whether sharing personal information or completing payments, users don't just interact—they commit. Understanding this psychology is crucial across finance and tech-driven services.

First Impressions Build Trust

We often associate trust with security certifications or data protection policies. While important, most users never scroll that far. Trust begins through simple layouts, predictable flows, and a clear sense of user control. When interfaces respond clearly, users feel the system understands them. Even in highly regulated domains like Insurtech, design plays a decisive role. Streamlined onboarding experiences, clear policy language, and responsive claim tools build user confidence more effectively than lengthy coverage descriptions.

Familiarity Breeds Confidence

Successful platforms leverage familiar patterns—such as swipe gestures, progress bars, and standard navigation. When users feel comfortable in new apps, they engage more deeply. This principle works exceptionally well in hybrid service models where human guidance complements digital convenience. When an insurance expert guides clients through digital tools, intuitive interfaces reduce friction and allow professionals to focus on value-added consultation.

Micro-interactions Matter

Every button label, alert message, and confirmation screen contributes to trust. Just like an experienced insurance expert simplifies complex jargon for clients, intuitive design should demystify digital interactions for users. Well-placed micro-copy like "You can change this later" instantly reduces anxiety. Conversely, aggressive marketing language or confusing disclaimers erode credibility quickly. Insurtech platforms increasingly prioritize clarity over formality in everything from policy selection tools to customer service chatbots.

Consistency Over Perfection

Users expect consistency, not perfection. The key is avoiding surprises—unexpected redirects, hidden charges, or unexplained interface changes. Transparency builds loyalty. While technology handles complex processes, it's often an insurance expert who reassures customers that expectations align with reality.

Trust as an OutcomeTrust isn't a feature—it's an outcome of hundreds of small design decisions. Typography choices and error recovery flow all signal intent. When intent aligns with user expectations, trust develops naturally. Whether developing lifestyle apps or complex insurtech platforms, the lesson remains clear: build for trust, and engagement follows. Success comes from feeling right, not just being functionally correct. The most effective digital experiences work like skilled professionals: calm, clear, and always a step ahead of user needs.

0 notes