#Market dynamics

Explore tagged Tumblr posts

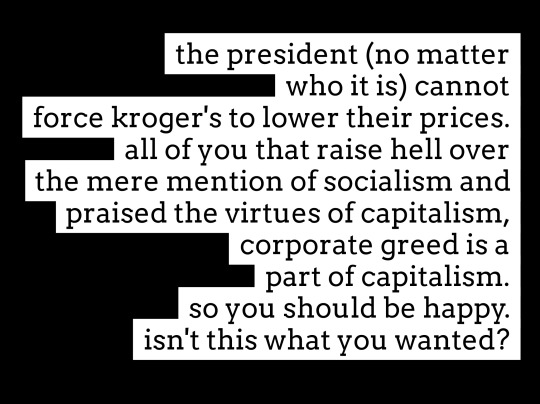

Text

#political commentary#capitalism#corporate power#consumerism#economic policy#socialism#government intervention#market dynamics

135 notes

·

View notes

Text

Bangladesh QSR Market Report: Trends, Analysis, and Growth Insights | P&S Intelligence

The value of the Bangladeshi quick-service restaurants market stood at USD 1,712.4 million in 2023, and this number is projected to reach USD 2,653.4 million by 2030, advancing at a CAGR of 7.1% during 2023–2030. This growth can be credited to the developing lifestyle of the adult populace, the increasing count of QSRs in the nation, the growing demand for fast food among the urban populace, and the rising working populace in the city and semi-urban areas of the country.

The demand for easy foods is increasing quickly among customers in Bangladesh, due to the parallel variations in the working and social lives and the mounting habit of dining out. People these days like to socialize over good food, away from the house. Therefore, because of the shortage of time, numerous contemporary nuclear families tend to choose convenient, quick meals over old-style meals.

American cuisine is likely to advance at the highest rate during this decade. This is because of the high requirement for fries, pizzas, and burgers among the young populace as well as the busy lifestyle of adults, which makes a requirement for convenience foods. Furthermore, other cuisines like Italian, Mexican, and Chinese, are also broadly prevalent among Bangladeshi citizens.

Moreover, the rising purchasing power of customers with their increasing per capita income, particularly in Dhaka, has boosted the sale of prepared food from QSRs in this nation. Bangladesh's economy is facing an era of low inflation, rising household income, and speedy progress.

As per the World Bank, Bangladesh has a purchasing power parity of 32.1 LCU per international dollar in 2021, in comparison to 16.3 LCU in 2002, advancing at a 3.63% average annual rate.

Furthermore, people, now, socialize with friends, neighbors, or colleagues, as compared to before for social or business purposes. This led to the increasing consumption of meals in fast food settings, which further boosted the industry.

#Bangladesh QSR Market#Market Report#P&S Intelligence#Fast Food Industry#Trends#Analysis#Growth Insights#Quick Service Restaurants#Market Dynamics#Food and Beverage Market#Market Research#Industry Overview#Competitive Analysis#Regional Analysis#QSR Market Size#Market Outlook#Dining Trends

2 notes

·

View notes

Text

New York Listings Crash 30%, Bidding Wars Return

Inventory Decline Sparks Competitive TensionsWhy is the New York real estate market sending shockwaves through investor circles?The dramatic decline in inventory levels has intensified competitive bidding trends.In February 2025, New York's housing inventory plummeted to a staggering 22,518 units. This marks a 5.3% drop from the previous year.This supply squeeze has fueled aggressive bidding wars. Buyers are thrust into fierce competition as they scramble for dwindling options.Investors are closely examining inventory strategies to navigate the volatile environment.With inventory reductions across various bedroom categories, from 1-bedroom to 3-bedroom homes, strategic planning has become essential.The continuous drop in available homes, especially in upstate markets, underscores severe scarcity.Despite this pressure, the NYC housing market shows balanced activity with negotiations between buyers and sellers as homes are selling faster than new listings being added.As supply tightens, understanding bidding trends becomes vital in anticipating market shifts.Navigating these tensions requires insight into the complex dynamics of a constricted market.Regional Disparities Highlight Unique ChallengesRegional disparities in New York's real estate environment are becoming more pronounced. Inventory pressures are pushing competitive boundaries to new extremes. Queens County has the highest median land valuation, around $6.1 million per acre. This is driven by a surge in urban development urgency. In contrast, suburban Nassau and Suffolk Counties have noticeably lower land prices. These prices peak near $860,000 per acre. Urban areas exhibit considerably higher price premiums, with NYC urban land costs being 15-20 times more costly than their suburban counterparts. The financial impact on vulnerable victims in real estate is evident even outside of direct fraudulent activities, where market dynamics challenge individual homeowner prospects. Rural areas like Chenango and Allegany offer a stark contrast with land valuations as low as $4,400 per acre. These regions invite agricultural pursuits due to their affordability. This pronounced disparity highlights diverse market dynamics. Urban areas face greater valuation pressures linked to development needs. Meanwhile, rural regions present affordability, showcasing unique geographic challenges. Each area's financial framework shapes strategic decisions for investors and developers navigating this complex landscape.Home Prices Surge Amid Supply ConstraintsThe New York City housing market is experiencing relentless price surges driven by profound supply constraints.Recent data shows median home prices reaching approximately $881,252 in June 2025, a 3.4% increase from the previous year. This follows an 18% decline in building permits, exacerbating limited supply conditions.Price adjustments reflect sellers grappling with buyer affordability, as seen in a 2.1% drop in median asking prices year-over-year.In response, renovation trends are pivoting toward office-to-residential conversions, rising by 34%.Amid logistics issues, delivery timelines have been extended by roughly 7.5 months, further straining inventory availability.The scarcity is intensified by a 4.3% drop in total homes listed, fueling competitive conditions and sustaining upward pressure on prices.A median multiple increase to 4.8 highlights worsening affordability as escalating home prices outpace income growth, reflecting broader U.S. market trends.Impact on Buyer and Seller DynamicsMarket volatility grips the New York housing sector. Plunging new listings add layers of complexity to buyer and seller dynamics.A 30% drop in listings compounds tight inventory issues. This intensifies market trends of competition and bidding wars.Sellers benefit greatly from scarce inventory. They leverage it to strengthen pricing strategies and attract multiple offers promptly.Upstate New York's drastic inventory declines fuel fast-paced seller advantages.

This results in heightened buyer competition, particularly in properties under $2 million.Buyer challenges escalate with increasing home prices. Mortgage pressure mounts despite pursuing limited listings.In Manhattan, contract activities surge despite inventory scarcity. This highlights buyer demand strength amid complexities in pricing strategies.The prominence of prime housing prices in NYC highlights the city's ongoing allure as a global real estate investment hotspot.Differing regional market dynamics require careful navigation. Participants seek advantageous positions tailored to these variations.Future Market Predictions and ChallengesAn anticipated surge in new apartment constructions is expected to significantly reshape New York's real estate market by 2025. Market forecasts indicate that the introduction of 35,000 new units will lead to considerable demand fluctuations. While rent stabilization might become a reality, it remains uncertain due to supply chain delays. Limited inventories continue to exert price pressure, leading to bidding wars. Economic conditions, including fluctuating interest rates and inflation, will significantly impact market dynamics. Balancing supply against demand is critical to mitigate price surges and maintain market stability. Housing inventory shortage in major markets is contributing to the tight market conditions.YearNew UnitsPrice Trend (%)202535,0003.82026TBD3.62027TBDTBD2028TBDTBDContinuously adapting to evolving economic pressures is essential for sustaining the market's equilibrium.AssessmentThe New York real estate market is currently facing intense volatility. Inventory has declined by 30%, reigniting bidding wars and pushing home prices higher.Regional disparities are presenting unique challenges for both buyers and sellers. This reshapes their strategies amid tight supply constraints.Market experts foresee continued fluctuations. They emphasize the precarious balance between demand and availability.The complex dynamics from these shifts pose significant challenges for future predictions. Investors must navigate both opportunities and uncertainties during these turbulent times.

0 notes

Text

Comprehensive Insight into Terephthalic Acid Price Trend, Market Dynamics, and Forecast

Terephthalic Acid (PTA) is a vital raw material in the production of polyethylene terephthalate (PET) resins, polyester fibers, and films. With its extensive application across packaging, textiles, automotive, and construction sectors, the Terephthalic Acid price trend is closely monitored by manufacturers, traders, and procurement professionals.

In this article, we delve deep into the historical performance, current market scenario, and future projections for PTA prices globally. This comprehensive coverage includes real-time updates, market drivers, regional insights, price chart analytics, and strategic inputs for procurement teams.

Latest Price Overview

Over the last quarter, the market has witnessed significant volatility in the pricing of Terephthalic Acid. Influenced by fluctuating crude oil prices, supply chain bottlenecks, and shifts in downstream demand, the PTA market remains dynamic.

To stay ahead, stakeholders must monitor real-time changes in PTA values. The availability of reliable market intelligence and timely data insights is essential for effective decision-making, especially in procurement and long-term contract negotiations.

Terephthalic Acid Price Trend Analysis

Historical Price Trends

Historically, PTA prices have been tightly linked to crude oil and paraxylene costs, the primary feedstock in its production. Over the past five years, the global market has seen alternating cycles of price surges and corrections due to:

Oil price fluctuations.

Changes in polyester demand.

Trade restrictions and tariffs.

Regional production shutdowns due to environmental policies.

During global disruptions such as the COVID-19 pandemic, Terephthalic Acid prices experienced both steep drops and rapid rebounds, reflecting unpredictable demand cycles in textiles and packaging sectors.

Market Drivers Influencing PTA Prices

Several macro and microeconomic factors influence the Terephthalic Acid price trend:

Crude Oil Prices: Since PTA production begins with paraxylene derived from oil, crude oil fluctuations directly impact PTA cost.

Polyester Demand: As polyester demand grows in packaging and fashion, the demand for PTA increases, pushing up prices.

Geopolitical Tensions: Sanctions, trade wars, or regional conflicts affect supply routes and production costs.

Technological Advancements: Innovations in recycling technologies and bio-based PTA can introduce supply-side changes, influencing pricing.

Environmental Regulations: In regions like China and the EU, environmental compliance costs can affect PTA production economics.

Request for the Real Time Prices : https://www.procurementresource.com/resource-center/terephthalic-acid-price-trends/pricerequest

Regional Insights and Analysis

Asia-Pacific

The Asia-Pacific region, particularly China and India, dominates the PTA market in terms of production and consumption. In China, market prices are influenced by domestic policy changes, local supply-demand scenarios, and international trade flows.

India’s demand, on the other hand, is closely tied to its robust textile industry. Any disruption in polyester production directly affects PTA consumption and prices.

North America

In North America, PTA prices are significantly shaped by raw material availability and demand from the PET packaging industry. The region has seen moderate price growth, driven by steady consumption and minimal supply disruptions.

Europe

European markets often face higher operational costs due to stringent environmental regulations and energy expenses. Price trends in this region are largely impacted by imports from Asia and shifts in energy policy.

Middle East & Africa

These regions are emerging players in the PTA market, leveraging their access to petrochemical feedstock and investments in infrastructure. However, pricing can be volatile due to limited local consumption and heavy reliance on exports.

Market Insights: Demand-Supply Dynamics

The global Terephthalic Acid market is characterized by a delicate balance between supply chain efficiency and end-use sector demand. Any mismatch — such as polyester plant shutdowns or oversupply in feedstock — can create immediate impacts on price levels.

Recent market intelligence reports indicate growing capacity expansions in Asia, aiming to meet rising demand from the textile and packaging industries. However, logistical constraints and port congestion continue to cause regional pricing disparities.

Chart: Terephthalic Acid Historical Price Data

To better understand the market movements, it’s useful to review the historical data through price charts. A well-structured Terephthalic Acid price chart can reveal seasonal patterns, reaction to geopolitical events, and shifts in consumer demand.

Data from the past 10 years illustrates:

Price peaks during oil rallies.

Dips during global recessions or pandemic-led slowdowns.

Stabilization during periods of supply-demand balance.

Integrating these insights into procurement planning can lead to significant cost savings and improved supplier negotiations.

Forecast: What to Expect Ahead?

Looking forward, analysts forecast a cautious but optimistic outlook for the PTA market. The global polyester market is projected to grow at a compound annual growth rate (CAGR) of over 5% in the coming years. This upward trend will likely support a steady rise in PTA demand.

Key Forecasting Indicators:

Oil Market Stability: A return to stable oil prices may normalize PTA production costs.

Emerging Markets Growth: Countries like Vietnam, Bangladesh, and African nations are increasing their polyester production capacity, boosting PTA demand.

Sustainability Push: Recycling and bio-based PTA alternatives may challenge traditional PTA but could also create price differentiation.

Monsoon Effects (in India): Seasonal textile demand patterns will continue to affect regional PTA consumption cycles.

Procurement professionals should incorporate these variables into their long-term sourcing and budgetary strategies.

Industry News & Developments

Several recent developments are reshaping the Terephthalic Acid market landscape:

China’s Anti-Dumping Policies: Tariffs on imported PTA from countries like South Korea and the U.S. are creating pricing imbalances.

New PTA Plants: Major chemical producers are expanding PTA manufacturing facilities in Southeast Asia.

Circular Economy Focus: The growing demand for rPET (recycled PET) could influence virgin PTA demand.

Energy Costs: Escalating energy prices across Europe and parts of Asia are adding pressure on production margins.

Keeping track of such market-moving news is crucial for any organization involved in PTA procurement or trading.

Database Access and Market Tools

Having access to a real-time, well-maintained Terephthalic Acid price database is essential for procurement and supply chain teams. These databases not only provide raw pricing data but also deliver:

Trend analysis reports.

Historical comparisons.

Market forecasts.

Regional breakdowns.

Platforms like Procurement Resource specialize in offering such services, helping companies navigate complex commodity markets with confidence and agility.

Procurement Strategies and Recommendations

Effective procurement in the PTA market demands a proactive, informed approach. Here are some strategic recommendations:

Diversify Supply Sources: Reduce risk by sourcing PTA from multiple geographic regions.

Leverage Data Tools: Use predictive analytics from industry platforms for better timing of purchases.

Contract Flexibility: Include clauses that allow adjustments based on crude or paraxylene indexation.

Sustainability Considerations: Explore bio-based and recycled PTA options for ESG alignment.

Vendor Collaboration: Build long-term relationships with suppliers to gain priority access during high-demand cycles.

Contact Information

Company Name: Procurement Resource Contact Person: Ashish Sharma (Sales Representative) Email: [email protected] Location: 30 North Gould Street, Sheridan, WY 82801, USA Phone: UK: +44 7537171117 USA: +1 307 363 1045 Asia-Pacific (APAC): +91 8850629517

0 notes

Text

#link#AI Disruption#Economic Shifts#investment strategies#market dynamics#Planet Money#podcasts#Tech Innovation

0 notes

Text

Long-Term Bitcoin Sales: Bullish Signal Ahead?

Analysts suggest that long-term Bitcoin holders selling could signal a bullish market shift, with ETF dynamics altering supply and demand. #bitcoin #coin #crypto #etf #btc #solana #dogecoin #memecoin #dolar

According to analysts, the ongoing trend of long-term Bitcoin holders offloading their coins, despite owning them for at least 155 days, signals bullish behavior. Historical data shows that when wallets that have held Bitcoin for extended periods start selling, it often indicates increased market confidence, rather than an impending downturn. Currently, the total supply of Bitcoin held by…

0 notes

Text

Navigating the Real Estate Rollercoaster: How Interest Rates Shape Your Investments

Unpacking Financing Costs: The Borrowing Dilemma Interest rates wield significant influence over various elements of the real estate market, particularly when it comes to financing costs. Understanding how these changes affect both buyers and investors can empower you to make more informed decisions in your real estate ventures. Let’s dive deep into the intricate relationship between interest…

0 notes

Text

FTC Releases Controversial Interim Staff Report on PBMs’ Purported Impact on Drug Prices

At an Open Commission Meeting on August 1, 2024, the Federal Trade Commission (FTC) presented a report prepared by its staff entitled Pharmacy Benefit Managers: The Powerful Middlemen Inflating Drug Costs and Squeezing Main Street Pharmacies. Although characterized as “interim,” the report posits the following observations about pharmacy benefit managers (PBMs): “PBMs have gained significant…

#bargaining#Biosimilar#brand drug manufacturer#competing products#drug prices#Drug Pricing#Federal Trade Commission#FTC#market dynamics#Open Commission Meeting#PBMs#Pharmacy Benefit Managers#prescription drug access

0 notes

Text

Mastering Sinohara Intensity Ratio: A Comprehensive Guide to Trading Success

In the vast landscape of financial markets, traders are constantly seeking new strategies and tools to gain an edge. One such tool that has gained traction among seasoned traders is the Sinohara Intensity Ratio. Developed by Japanese trader Hiromitsu Sinohara, this ratio offers a unique perspective on market momentum and trend strength. In this comprehensive guide, we will delve deep into the…

View On WordPress

#Counter-trend trading#Divergence analysis#Financial Markets#Market Dynamics#Market momentum#Overbought#Oversold#Price movements#Prudent risk management#Risk Management#Sinohara Intensity Ratio#Technical indicator#Trading edge#Trading performance#trading signals#Trading Strategies#Trading Volume#Trend confirmation#Trend Following#Trend strength

0 notes

Text

Market Recap: Dow Jones Gains, S&P 500 Holds Steady, NASDAQ Edges Lower

In the ever-fluctuating landscape of the stock market, today's trading session saw a mixed bag of results, with the Dow Jones Industrial Average leading the charge with a 0.2% rise, marking a gain of 78 points. Meanwhile, the S&P 500 maintained relative stability, experiencing a marginal decline of 0.02%, and the NASDAQ Composite edged lower by 0.1%.

The Dow Jones, a benchmark index known for its representation of 30 significant stocks across various sectors, demonstrated resilience as it climbed modestly, buoyed by optimism in certain key industries. Investors found solace in the steady progress of companies within sectors such as industrials and financials, contributing to the index's upward trajectory.

Conversely, the broader market sentiment, as reflected by the S&P 500, exhibited a more subdued tone, hovering near its previous close. While certain sectors displayed strength, others faced headwinds, resulting in a balanced performance overall. This nuanced movement underscores the intricate interplay of factors influencing investor sentiment, ranging from economic data releases to geopolitical developments.

Amidst this backdrop, the NASDAQ Composite experienced a slight setback, dipping by 0.1% during today's trading session. This decline comes amidst ongoing concerns surrounding inflationary pressures and the potential impact on high-growth technology stocks, which often populate the NASDAQ index.

As investors navigate through a landscape marked by both opportunities and challenges, it becomes imperative to adopt a diversified approach and remain vigilant in assessing market dynamics. While certain sectors may outperform in the short term, maintaining a long-term perspective is essential in achieving sustainable investment outcomes.

Looking ahead, market participants will continue to monitor key economic indicators, corporate earnings reports, and geopolitical developments for insights into future market movements. In a market characterized by its dynamism and unpredictability, adaptability and informed decision-making remain paramount for investors seeking to navigate the ever-evolving landscape of the stock market.

#Stock Market Analysis#Dow Jones Industrial Average#S&P 500#NASDAQ Composite#Market Sentiment#Investor Sentiment#Economic Indicators#Geopolitical Developments#Market Dynamics#Investment Strategies#Diversified Portfolio#Long-term Investing#Economic Data Releases#Corporate Earnings#Inflationary Pressures#High-growth Technology Stocks#Market Volatility#Market Trends#Financial Markets#Investment Opportunities

0 notes

Text

Navigating the Evolving Pen Needles Market: A Deep Dive into the Factors Influencing Market Size, Growth, and Regional Dynamics

Pen Needles Market: Trends, Growth, and Future Outlook

The global pen needles market is poised for significant growth, driven by the increasing prevalence of diabetes and the demand for convenient and safe insulin delivery methods. Pen needles are small, disposable medical devices used with insulin pens to administer medication to individuals with diabetes. The market is expected to reach USD 10 billion by 2033, growing at a compound annual growth rate (CAGR) of 10.9% from 2024 to 2033.

Market Size and Growth

The global pen needles market size was valued at USD 3.5 billion in 2023 and is projected to reach USD 10 billion by 2033, growing at a CAGR of 10.9% from 2024 to 2033. Another report estimates the market size to be USD 1.6 billion in 2023 and is expected to reach USD 2.5 billion by 2028, growing at a CAGR of 9.1% from 2023 to 2028. The market size is expected to reach USD 4.5 billion by 2032, growing at a CAGR of 10.3% from 2023 to 2032.

Market Segmentation

The pen needles market is segmented based on product type, application, length, and distribution channel. The standard pen needles segment dominated the market in 2022, accounting for around USD 1.8 billion revenue. The insulin segment accounted for over 82% business share in 2022 and is anticipated to witness significant growth during the forecast period. The 8 mm segment accounted for over 29% business share in 2022, and the retail pharmacies segment accounted for around USD 1.2 billion revenue size in 2022.

Market Drivers and Challenges

The growth of the pen needles market is driven by the increasing prevalence of diabetes, the surge in demand for self-administration of injectable drugs, and the availability of a wide range of pen needles to meet individual patient needs. Additionally, technological advancements in pen needle manufacturing and safety features, as well as the rise in focus on home healthcare and self-care, are contributing to the market growth. However, safety concerns, such as the risk of accidental needle stick injuries, are a significant restraint of the pen needle market. Proper disposal of used pen needles is crucial to minimize the risk of accidental needle stick injuries and prevent the spread of infectious diseases.

Regional Analysis

The European region dominated the pen needles market in 2023, driven by robust healthcare infrastructure and regulatory excellence. The Asia Pacific region is expected to witness significant growth due to the increasing prevalence of diabetes and the growing demand for insulin delivery devices.

Competitive Landscape

The pen needles market is highly competitive, with several key players focusing on improving awareness regarding insulin delivery devices and their home use. Companies such as Owen Mumford are investing in the development of advanced pen needles with safety features, which is expected to drive the market growth.

Future Outlook

The pen needles market is expected to continue growing as the demand for convenient and safe insulin delivery methods increases. The market is expected to reach USD 10 billion by 2033, driven by technological advancements and government support. The increasing focus on home healthcare and self-care, as well as the growing awareness of diabetes and its risk factors, are expected to contribute to the market growth.

#Pen Needles#Insulin Delivery Devices#Diabetes#Medical Devices#Healthcare#Market Trends#Market Analysis#Market Size#Market Growth#Market Forecast#Market Segmentation#Product Innovation#Regulatory Landscape#Competitive Landscape#Home Healthcare#Self-Care#Safety Concerns#Technological Advancements#Market Drivers#Market Challenges#Market Opportunities#Market Insights#Market Outlook#Market Dynamics#Market Forecast 2024-2033#Market Size 2023#Market Size 2033#Market CAGR#Market Growth Rate#Market Share

1 note

·

View note

Text

Montgomery Property Sales Rise 58%, Investors Dominate

Inventory Expansion and Buyer AdvantagesAs housing inventory in Montgomery County skyrockets, real estate dynamics are shifting dramatically. June 2025 saw a surge to 2,658 homes, showcasing unprecedented market opportunities for prospective buyers. This sharp increase significantly lessened competition and intense bidding wars that plagued prior periods. Higher inventory provides more options for prospective buyers, potentially reducing the intensity of bidding wars compared to prior years. Buyers now encounter broader selections aligning with evolving preferences. It's now feasible to secure properties matching specific needs. With diverse bedroom options available, the market caters to varied budgets, including starters and smaller homes for first-time buyers. The rise in housing inventory echoes a broader trend across the U.S. where alternative housing solutions like tiny homes are being adopted to combat affordability issues. Additionally, expanded choices across suburban and rural areas align with lifestyle shifts, including remote work. This inventory growth empowers buyers, facilitating more deliberate purchasing decisions without immediate pressure. This marks a pivotal change in Montgomery County's real estate scenery.Investor Impact on Market DynamicsInvestor influence on real estate markets is increasingly pronounced as environmental factors shift. Their behavior is intensifying market fluctuations, ultimately driving key dynamics. Investment activity is accelerating both real estate purchases and sales. By early 2025, investors command a larger share of acquisitions, while home sales by investors rose by 5.2% year-over-year in 2024. The rising housing cost burdens across the U.S. are creating new investment dynamics as investors eye properties in distressed regions for potential returns. The anticipated economic growth in 2025 is expected to further fuel real estate investment activity, providing new opportunities for returns. Despite the increased frequency of sales, buying activity continues to outpace selling. This indicates a net accumulation of properties by investors. As investors focus on rent and purchase trends, we see impacts on vacancy rates and residential market shifts. These shifts are altering traditional market dynamics. The compression of capitalization rates enhances the potential for long-term returns. This encourages fierce competition for acquiring properties.Regional Variations and Growth TrendsIn a dramatic shift, Montgomery Counties across the United States are experiencing divergent growth trends and price dynamics.The regional comparisons highlight varying market sustainability across these counties.Montgomery County, PA, exhibits a significant inventory rise of 40.6% between February and March 2025. Despite this, the county maintains notable price stability at a median of $499,995.Montgomery County, TN, sustains moderate price growth at 1.1% annually. The inventory and sales dynamics indicate a balanced market.Montgomery County, OH, faces strong demand with a 7.0% increase in median home price. This occurs despite slightly reduced sales.Comparison insights reveal that Pennsylvania leads in pricing near $500K. Meanwhile, Tennessee and Ohio reflect different price growth rates and market conditions.These variations underscore the complex tapestry of regional factors shaping property trends.AssessmentMontgomery's property sales surge signifies a notable shift. This is driven by robust inventory growth and competitive buyer conditions.Investors are reshaping market dynamics. They are steering demand and accelerating price trends.Regional disparities underscore uneven growth. This spotlights areas of both opportunity and caution.The evolving terrain demands vigilance from stakeholders. They must steer through emerging patterns and leverage potential gains.Understanding these shifts is essential. It helps in anticipating future developments in this high-stakes real estate market.

0 notes

Text

AI’s Role in Redefining Corporate Strategy: Insights from Xp

Corporate strategy has never been more critical. Companies must navigate an array of challenges, from shifting consumer preferences and global competition to technological disruptions and regulatory changes. In this environment, the role of artificial intelligence (AI) in redefining corporate strategy has become increasingly pronounced. Leveraging AI-driven insights, companies can gain a competitive edge, anticipate market trends, and make informed decisions that drive long-term success. In this blog, we’ll explore the transformative impact of AI on corporate strategy and draw insights from Xp.

#market analysis#online survey#market research#market research surveys#consumerbehavior#ai survey#corporatestrategy#datainsights#market trends#market growth#deeper insights#actionable insights#ai driven decision making processes#consumer preferences#AI-powered risk management tools#AI-driven market segmentation#market dynamics#california news

0 notes

Text

What are the Different Types of Digital Business Models?

The modern era has changed the way businesses operate and generate revenue. Digital business models and strategies now leverage the changing market to create value, reach customers and drive growth. Before, these models used to be traditional, but now they use the power of the internet, data analytics and emerging technologies to create a niche in their industries. Understanding the different types of digital business models and their evolution is crucial for businesses seeking to thrive in today's digital economy. Let’s deep dive into the different business models and how they impact business decisions.

E-Commerce:

One of the most well-known types of digital business models is E-commerce. This involves using the internet as the marketplace to buy and sell goods. It skips the concept of physical stores and allows businesses to reach from anywhere to anywhere, barring geography. Businesses enjoy the lack of geographical or time barriers when it comes to selling their products. Amazon, eBay, Etsy, etc., pioneered and steered this digital business model and strategy by offering a huge online marketplace where customers can purchase what they want, when they want and wherever they want.

Subscription-based Model:

This type of digital business model offers products and services in exchange for a subscription fee. This approach prioritises a recurring and sustainable customer base, thereby ensuring a predictable revenue stream for businesses. There is convenience to the value-add. Examples of the subscription-based model include streaming services like Netflix and Spotify (for entertainment), and software like Adobe Creative Cloud, Microsoft Office 365 (for career development) and so on.

Freemium:

This is a model adjacent to the subscription-based model where some aspects of the services are free while premium functions might be charged. This digital business model and strategy offer two different ways of generating revenue. It attracts a larger user base with the free offering (which can be monetised by ad revenue) and deeper penetration with upgrades and subscriptions. Freemium mobile apps with in-app purchases are the best examples, like the New York Times games. Another common example is Google, which offers limited storage for free and additional storage for a fee.

Platform-based:

Platform-based types of digital business models create value by facilitating interactions between different groups of users. These platforms typically connect producers and consumers, service providers and customers in a networked ecosystem. Examples include ride-hailing platforms like Uber and Ola, which connect drivers with passengers, and accommodation platforms like Airbnb, which connect hosts with travellers.

On-demand:

On-demand digital business models prioritise instant gratification and comfort, catering to the urgent needs of consumers. They provide goods and services via app-based communication. For example, ordering food on Swiggy or Zomato and even availing transportation like Ola.

P2P or Peer-to-Peer:

P2P is a digital business model and strategy that enables individuals to transact based on the products or services they provide. For example, Pepper Content works as a space where individuals can connect and exchange digital marketing services. Ride-sharing apps also fall under this category.

The emergence of digital models and strategy has shifted the way businesses look at consumers. It has allowed them to gather and analyse vast amounts of data on customer preferences, demographics and purchase patterns. This data can be analysed to gain actionable insights and optimize various aspects of the business, including marketing, product development, and customer service. They also have immediate access to what their customer thinks of their products or services, allowing them to engage in dialogue via digital channels to mould the product to fit their needs.

The biggest advantage of knowing the types of digital business models is the ability to see the bigger picture. It opens paths to scale up the business and carve a niche in the market. Professionals with a better understanding of the digital impact can help their companies adapt quickly to changing market conditions. Cloud computing, artificial intelligence, and automation enable businesses to scale operations efficiently, reduce costs, and innovate rapidly. By embracing digital transformation, businesses can unlock new revenue streams, enter new markets, and differentiate themselves from competitors. Businesses are constantly on the lookout for professionals who can contribute their skills in the digital environment to transform their business. The right education can open up a new world of opportunities for professionals in the business world. This is where online certification courses can help upskill and be abreast with current digital trends. The Professional Certificate Programme in Strategic Sales Management and New Age Marketing, offered by IIM Kozhikode provides in-depth knowledge to mid and senior-level professionals who are looking to level up their skills and unlock bigger opportunities for their businesses.

In a nutshell, the evolution from traditional to digital business models has been driven by advancements in technology, changes in consumer behaviour, and shifts in market dynamics. Traditional business models focused more on manual processes, smaller market reach and face-to-face interactions to achieve business targets. The different types of digital business models go beyond traditional paths and explore the bigger potential a business is capable of. It leverages the internet, communication devices and data-driven insights to reach anyone, anywhere, at any time. This allows space for better market understanding and personalised customer experiences.

0 notes

Text

Understanding the Landscape of China Compressor Industry

The advancing automotive as well as construction sectors in China have boosted the need for compressors in this nation, aiding these advancements. Moreover, compressors also play a key role across different sectors in this nation. In this blog, we’ll be exploring the reasons for the increasing demand for compressors in China: Increasing Industrialization It is no secret that China’s extremely…

View On WordPress

#China Compressor Market#competitive environments#Construction#industrial processes#Manufacturing#Market dynamics#market trends#regulatory landscapes#strategic decisions#Technological advancements

0 notes