#MaximizeRefunds

Explore tagged Tumblr posts

Text

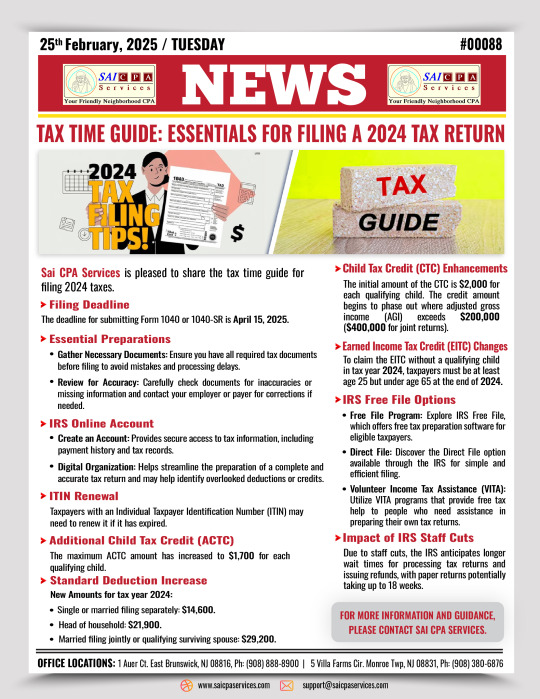

"SAI CPA Services’ 2024 Tax Guide: Key Tips for a Hassle-Free Filing"

Tax season is here, and ensuring a smooth filing process is crucial for avoiding penalties and maximizing your return. At SAI CPA Services, we help individuals and businesses navigate tax season with confidence. Here’s what you need to know for filing your 2024 tax return efficiently.

Key Deadlines & Preparations

📌 Filing Deadline: April 15, 2025 – Mark your calendar to avoid late fees. 📌 Organize Documents: Gather W-2s, 1099s, receipts, and tax-related records in advance. 📌 Verify Accuracy: Ensure your details are correct to prevent IRS processing delays.

Maximizing Deductions & Credits

💰 Standard Deduction Increase: The new deduction is $14,600 for individuals and $29,200 for married couples filing jointly. 👶 Child Tax Credit (CTC) Updates: Claim up to $2,000 per qualifying child, with phase-outs for higher incomes. 💼 Earned Income Tax Credit (EITC): Eligibility criteria have been updated—check if you qualify.

Filing Smarter with SAI CPA Services

✔ IRS Free File & Direct File: Explore free options for eligible taxpayers. ✔ ITIN Renewal: Ensure your ITIN is valid before filing. ✔ Proactive Tax Planning: Our experts help you reduce tax burdens and plan for financial success.

At SAI CPA Services, we simplify tax season so you can focus on what matters most. Need expert assistance? Contact us today for stress-free tax filing!

Contact Us :

Facebook: AjayKCPA Instagram: sai_cpa_services Twitter: SaiCPA LinkedIn: Sai CPA Services WhatsApp: Sai CPA Channel Phone: (908) 380-6876

(908) 888-8900

1 Auer Ct, East Brunswick, NJ 08816

0 notes

Text

Get your taxes done accurately and on time with Syriac CPA Tax And Accounting Services Inc.! Let our experts handle the numbers while you focus on what matters most. ✅ 🔹 Maximize Deductions & Credits – Keep more of your hard-earned money! 🔹 IRS Compliance Guaranteed – Stay stress-free with accurate filings. 🔹 Fast & Efficient Filing – Beat the deadline without the hassle. 🔹 Personal & Business Taxes – Customized solutions for individuals and businesses. 🔹 Expert Guidance & Support – Get the answers you need from experienced professionals. 📞 Call us (562) 202-9697, (949) 397-2337 today! Let’s make tax season easy. Visit: www.syriaccpa.com

📝 𝐇𝐚𝐬𝐬𝐥𝐞-𝐅𝐫𝐞𝐞 𝐓𝐚𝐱 𝐏𝐫𝐞𝐩𝐚𝐫𝐚𝐭𝐢𝐨𝐧 𝐰𝐢𝐭𝐡 𝐒𝐲𝐫𝐢𝐚𝐜 𝐂𝐏𝐀! 📊💰

#TaxPreparation#CPAExperts#MaximizeRefunds#TaxSeason#IRSCompliance#AccountingServices#TaxSavings#FileYourTaxes#SyriacCPA

0 notes

Text

Get your taxes done accurately and on time with Syriac CPA Tax And Accounting Services Inc.! Let our experts handle the numbers while you focus on what matters most. ✅ 🔹 Maximize Deductions & Credits – Keep more of your hard-earned money! 🔹 IRS Compliance Guaranteed – Stay stress-free with accurate filings. 🔹 Fast & Efficient Filing – Beat the deadline without the hassle. 🔹 Personal & Business Taxes – Customized solutions for individuals and businesses. 🔹 Expert Guidance & Support – Get the answers you need from experienced professionals. 📞 Call us (562) 202-9697, (949) 397-2337 today! Let’s make tax season easy.

📝 𝐇𝐚𝐬𝐬𝐥𝐞-𝐅𝐫𝐞𝐞 𝐓𝐚𝐱 𝐏𝐫𝐞𝐩𝐚𝐫𝐚𝐭𝐢𝐨𝐧 𝐰𝐢𝐭𝐡 𝐒𝐲𝐫𝐢𝐚𝐜 𝐂𝐏𝐀! 📊💰

#TaxPreparation#CPAExperts#MaximizeRefunds#TaxSeason#IRSCompliance#AccountingServices#TaxSavings#FileYourTaxes#SyriacCPA

0 notes

Photo

how to maximize your refunds and navigate tax laws like a pro. Stay ahead with our expert tips and local insights. Dial +1 (813) 322-3936 or Visit skfinancial.com for expert guidance

0 notes

Text

Online Income Tax Returns Services Delhi

Taxgoal offers top-notch online income tax return services in Delhi. With our expert team of tax professionals, we ensure a hassle-free tax filing experience. Our services are efficient, accurate, and tailored to meet your specific needs. Whether you're an individual, a business owner, or a freelancer, we've got you covered. Let us help you navigate the complexities of income tax returns, so you can focus on what matters most. Choose Taxgoal for a stress-free tax season. To know more visit here: https://taxgoal.in/services/e-filing-income-tax-return-online/

0 notes

Photo

Did you know your tax returns can be reviewed, even if someone besides us prepared them? We can often find mistakes made by software or other preparers -- and amend your return for a more favorable outcome. Did you leave money on the table? Schedule a time today for a complimentary review of your last tax return. https://www.afitonline.com/appointments

#TaxReturns#TaxReview#TaxMistakes#AmendYourReturn#MaximizeRefund#TaxPreparation#FinancialAdvice#TaxSavings#TaxPlanning#IRSHelp#TaxSoftware#ExpertTaxAdvice#GetYourMoneyBack#TaxConsultation#HiddenDeductions#TaxSeason2023#AffordableTaxHelp#ClientFocused#ScheduleYourReview#FinancialWellness#MoneyMatters#ProfessionalTaxService#PeaceOfMind#FreeConsultation#TaxStrategy#LeaveNoMoneyBehind#OptimizeYourTaxes#TaxExperts#TaxReturnReview#AfitOnline

0 notes

Text

How to Use Self-Assessment to Optimize Your Tax Refund?

When it comes to maximizing tax refunds through self-assessment in the UK, there are numerous strategies to ensure you’re claiming all eligible deductions and expenses. However, navigating these tax rules can be complex, and professional assistance can help you optimize your self-assessment tax filing, making sure you’re refunded what you’re entitled to.

Identifying Eligible Expenses and Deductions

One of the key ways to optimize your Self-Assessment Tax Return is by claiming all allowable expenses. These deductions can vary widely based on employment type, industry, and specific financial circumstances. For example, self-employed individuals can deduct business-related expenses, such as office supplies, professional fees, travel costs, and even portions of utility bills if they work from home. Without expert guidance, it’s easy to miss out on deductions that could significantly increase your tax refund.

The Role of Professional Advice in Maximizing Tax Reliefs

Tax reliefs and allowances, such as Marriage Allowance or Personal Savings Allowance, can further boost your tax refund. Yet, understanding the eligibility criteria and knowing how to apply these reliefs correctly often requires expertise. Professional tax filers are trained to identify all applicable reliefs, ensuring that no opportunity for savings is missed. By carefully reviewing your unique situation, tax professionals help minimize liabilities and maximize refunds.

Reducing Taxable Income with Contributions and Investments

Contributing to pension schemes or donating to charity are effective ways to reduce your taxable income, potentially leading to a higher refund. Pension contributions, for example, can qualify for tax relief, effectively lowering your taxable income. Likewise, donations to registered charities may qualify for Gift Aid, which can also impact your tax refund positively. A self-assessment tax filing professional will know how to accurately report these contributions, ensuring they’re fully reflected in your final tax assessment.

Why Professional Help Is Essential for Accuracy and Compliance

DIY tax filing can lead to overlooked opportunities, errors, and potential penalties. Tax professionals ensure that every aspect of the Self-Assessment Tax Return process is handled accurately, reducing the chances of an HMRC inquiry or penalty. By leveraging their expertise, you gain peace of mind that your return is optimized for the maximum refund while staying fully compliant.

Conclusion

Navigating the self-assessment process for a tax refund requires a keen eye for detail and thorough knowledge of tax rules. Professional assistance can streamline the process, ensuring that you’ve maximized every deduction, relief, and allowance. For tailored guidance on optimizing your self-assessment for a better refund, explore the support available at tax-self-assessment.co.uk.

#TaxRefund#SelfAssessment#TaxFiling#TaxRelief#TaxAdvisor#TaxTips#UKTax#ProfessionalHelp#MaximizeRefund#TaxDeductions

0 notes

Text

Affordable Tax Services in Stone Mountain

youtube

📢 Tax season is here! 📢 Maximize your refund and minimize stress with our expert tax services in Stone Mountain. Our team provides fast, accurate, and affordable solutions tailored to your needs. Tax services Stone Mountain Don't wait—let us handle your taxes so you can focus on what matters most! 💼💰

0 notes

Text

What are the tax brackets for tax years 2024 and 2025? What to know ahead of filing season....Read more

With January just weeks away and inflation still impacting the wallets of Americans, taxpayers across the country are preparing to file in 2025.

To ease the transition, the Internal Revenue Service announces inflation adjustments each year, noting adjustments for more than 60 tax provisions.

#TaxBrackets2024 #TaxBrackets2025 #FilingSeason #TaxFilingTips #TaxInfo #IRSUpdates #WhatToKnow #TaxPlanning #FinancialAdvice #TaxSeason #TaxPreparation #MaximizeRefund #TaxStrategies #PersonalFinance #WealthBuilding #UnderstandingTaxes #2024Taxes #2025Taxes #SaveOnTaxes #GetTaxReady

#jay#taxbrackets2024#2.#taxbrackets2025#3.#filingseason2024#4.#filingseason2025#5.#taxtips2024#6.#taxtips2025#7.#incomebrackets2024#8.#incomebrackets2025#9.#filingdeadline2024#10.#filingdeadline2025

2 notes

·

View notes

Text

📊✨ Get your taxes done right with Syriac CPA! Our expert tax preparation services ensure accuracy and maximize your refunds. 💼💸 Contact us today for stress-free tax filing! 📞

#TaxPreparation#TaxFiling#MaximizeRefunds#SyriacCPA#TaxExperts#CPAProfessionals#TaxSeason#FinancialPlanning

0 notes

Text

📊✨ Get your taxes done right with Syriac CPA! Our expert tax preparation services ensure accuracy and maximize your refunds. 💼💸 Contact us today for stress-free tax filing! 📞

#TaxPreparation#TaxFiling#MaximizeRefunds#SyriacCPA#TaxExperts#FinancialPlanning#TaxSeason#CPAProfessionals

0 notes

Text

Syriac CPA offers professional tax preparation and consulting services to help you maximize your refunds, minimize liabilities, and stay compliant.

#TaxPreparation#TaxConsulting#MaximizeRefunds#MinimizeLiabilities#StayCompliant#SyriacCPA#TaxSeason#FinancialPlanning

0 notes

Text

Syriac CPA offers professional tax preparation and consulting services to help you maximize your refunds, minimize liabilities, and stay compliant.

#TaxPreparation#TaxConsulting#MaximizeRefunds#MinimizeLiabilities#StayCompliant#SyriacCPA#TaxSeason#FinancialPlanning

0 notes

Text

Syriac CPA Tax And Accounting Services Inc

Syriac CPA offers professional tax preparation and consulting services to help you maximize your refunds, minimize liabilities, and stay compliant. 💼📊 Let our experts handle the complexities of your taxes with personalized care and precision. ✅💡

#TaxExperts#SyriacCPA#MinimizeLiabilities#FinancialPlanning#TaxServices#MaximizeRefunds#TaxCompliance#TaxHelp#TaxConsulting#TaxPreparation

0 notes

Text

Secure Your Financial Future with Expert Tax Consulting from SyriaCCPA!

We specialize in providing tailored tax consulting services to help you navigate the complexities of tax regulations and maximize your financial benefits. Our experienced team offers strategic tax planning, compliance support, and personalized advice to ensure you stay ahead of tax obligations and make informed financial decisions. Partner with us to protect your earnings and achieve long-term financial success. Contact us today to learn how we can assist you!

#TaxConsulting#SyriaCCPA#TaxPlanning#FinancialSuccess#TaxExperts#TaxAdvice#TaxPreparation#CPA#TaxStrategy#TaxCompliance#MaximizeRefunds#TaxServices#FinancialPlanning#TaxHelp#BusinessTaxes#IndividualTaxes#TaxConsultants#TaxSolutions#TaxSavings#TaxSeason

0 notes

Text

Why do you need a tax professional?

#TaxProfessional 🧾#TaxSavings 💰#SmartFinances 📊#TaxHelp ✅#FinancialPlanning 💼#TaxExpert 📄#MaximizeRefund 💵#StayCompliant ⚖️#TaxTips 💡#MoneyMatters 🚀

0 notes