#Microcontroller Unit

Explore tagged Tumblr posts

Text

IoT Microcontroller Market Poised to Witness High Growth Due to Massive Adoption

The IoT microcontroller market is expected to enable connectivity of various devices used in applications ranging from industrial automation to consumer electronics. IoT microcontrollers help in building small intelligent devices that collect and transmit data over the internet. They offer benefits such as compact design, low-power operation and integrated wireless communication capabilities. With increasing connectivity of devices and growing demand for remote monitoring in industries, the adoption of IoT microcontrollers is growing significantly. Global IoT microcontroller market is estimated to be valued at US$ 6.04 Bn in 2024 and is expected to reach US$ 14.85 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 13.7% from 2024 to 2031.

The burgeoning need for connected devices across industries is one of the key factors driving the demand for IoT microcontrollers. Various industries are rapidly adopting IoT solutions to improve operational efficiency and offer enhanced customer experience through remote monitoring and management. Additionally, technology advancements in wireless communication standards such as Bluetooth 5, WiFi 6, and LPWAN are allowing development of low-cost IoT devices with extended range, which is further fuelling market growth. Key Takeaways Key players operating in the IoT microcontroller are Analog Devices Inc., Broadcom Inc., Espressif Systems (Shanghai) Co., Ltd., Holtek Semiconductor Inc., Infineon Technologies AG, Integrated Device Technology, Inc.,and Microchip Technology Inc. Key opportunities in the market include scope for integrating advanced features in microcontrollers to support new wireless technologies and opportunity to develop application-specific microcontrollers for niche IoT markets and applications. There is significant potential for IoT Microcontroller Market Growth providers to expand globally particularly in Asia Pacific and Europe owing to industrial digitalization efforts and increasing penetration of smart homes and cities concept in the regions. Market drivers Growing adoption of connected devices: Rapid proliferation of IoT across various industries such as industrial automation, automotive, healthcare is fueling demand for microcontroller-based solutions. IoT devices require microcontrollers to perform essential tasks like data processing and wireless communication. Enabling technologies advancements: Improvements in low-power wireless technologies, Embedded Systems, and sensors are allowing development of advanced yet affordable IoT solutions leading to new applications for microcontrollers. Market restraints Data privacy and security concerns: Use of IoT microcontrollers makes devices vulnerable to cyber-attacks and privacy breaches raising concerns among users. Addressing security issues remain a challenge restricting broader adoption. Interoperability issues: Lack of common communication protocols results in devices inability to communicate with each other smoothly restricting large-scale IoT deployments.

Segment Analysis The IoT Microcontroller Market Regional Analysis is segmented based on product type, end-use industry, and geography. Within product type, 8-bit microcontrollers dominate the segment as they are cheaper and suit basic IoT applications requiring low power consumption. Based on their wide usage in wearable devices, home automation systems, and smart appliances, 8-bit microcontrollers capture over 50% market share. 32-bit microcontrollers are gaining popularity for complex industrial, automotive and networking applications. The end-use industry segments of IoT microcontroller market include consumer electronics, automotive, industrial automation, healthcare, and others. Consumer electronics captures a major share owing to exponential increase in number of smart devices. Wearable fitness bands and smartwatches incorporate IoT microcontrollers to track vitals and connect to networks. Furthermore, incorporation of microcontrollers in smart home appliances like refrigerators, air conditioners, and washing machines are supporting the consumer electronics segment growth. Global Analysis In terms of regions, Asia Pacific dominates the IoT microcontroller market led by rising electronics production in India and China. counties like China, Japan and South Korea are major manufacturing hubs for smart appliances and wearable devices, driving the regional market. North America follows Asia Pacific in terms of market share led by growing industrial automation and presence of automotive giants in the US and Canada adopting connected car technologies. Europe captures a significant market share with growing penetration of IoT across industry verticals in major countries like Germany, UK and France. Middle East and Africa offer lucrative opportunities for embedded software development and IoT services companies eying untapped markets.

Get more insights on Iot Microcontroller Market

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)

#Coherent Market Insights#Iot Microcontroller Market#Iot Microcontroller#Internet Of Things#Iot Devices#Embedded Systems#Smart Devices#Iot Development#Microcontroller Unit#MCU#Low-Power Microcontroller

0 notes

Note

what do you think of this he mcu?

if you're referring to marvel, yeah, i hate it. or i'm averse toward it. the only thing that makes me like it is when my class took a field trip to see endgame. so, it beats class.

#sorry#you do you boo#also sorry if this is not what you meant#if you meant microcontroller unit#i don't know anything about that either#asks

1 note

·

View note

Text

Microcontroller Unit Market is expected to register a CAGR of 9.7% By 2029

Global Microcontroller Unit Market is rising due to increasing demand for smart devices, IoT applications, and automation across various industries in the forecast period 2025-2029.

According to TechSci Research report, “Microcontroller Unit Market - Industry Size, Share, Trends, Competition Forecast & Opportunities, 2029”, The Global Microcontroller Unit (MCU) Market is experiencing significant growth driven by the escalating demand for smart devices, Internet of Things (IoT) applications, and automation in diverse industries. MCUs, which are compact integrated circuits comprising a processor core, memory, and programmable input/output peripherals, play a crucial role in controlling various electronic devices. The proliferation of smart appliances, wearable gadgets, automotive advancements, and industrial automation has propelled the market's expansion.

Additionally, the increasing adoption of MCUs in sectors such as healthcare, consumer electronics, and telecommunications is fueling market growth. Furthermore, technological advancements, such as the development of energy-efficient and high-performance MCUs, are enhancing their applicability in complex systems. Moreover, the rise of edge computing, where data is processed closer to the data source, is driving the demand for MCUs in edge devices, augmenting their market reach.

As businesses continue to invest in digital transformation and IoT solutions, the Global MCU Market is anticipated to flourish, presenting lucrative opportunities for manufacturers and stakeholders. However, the market also faces challenges related to intense competition and evolving technological standards, necessitating constant innovation and strategic partnerships for sustained growth.

Browse over XX market data Figures spread through XX Pages and an in-depth TOC on "Global Microcontroller Unit Market”. https://www.techsciresearch.com/report/microcontroller-unit-market/20928.html

The Global Microcontroller Unit (MCU) Market, a pivotal sector within the semiconductor industry, has undergone remarkable evolution in recent years, shaping the foundation of modern technological advancements. MCUs, compact integrated circuits comprising a processor core, memory, and programmable input/output peripherals, serve as the brains behind an extensive array of electronic devices, ranging from everyday consumer gadgets to intricate industrial automation systems. One of the key driving forces behind the market's growth is the escalating demand for smart devices and the Internet of Things (IoT) applications.

The surge in IoT technology has led to an unprecedented proliferation of interconnected devices, each powered by MCUs, facilitating seamless communication, data processing, and automation. From smart home appliances and wearable devices to industrial sensors and healthcare equipment, MCUs have become the backbone of the interconnected world, enabling unprecedented levels of efficiency, convenience, and innovation.

Furthermore, the automotive industry has emerged as a significant driver, propelling the demand for advanced MCUs. Modern vehicles are equipped with a plethora of electronic systems, such as engine control units, infotainment systems, and advanced driver-assistance systems (ADAS), each relying on MCUs for optimal performance. The evolution towards electric vehicles (EVs) and autonomous driving technologies has further bolstered the need for high-performance MCUs capable of handling complex computations and ensuring real-time responsiveness. This trend underscores the critical role MCUs play in reshaping the automotive landscape, enhancing safety, efficiency, and driving experiences.

Another compelling factor fueling the MCU market is the relentless march of automation across various industries. Manufacturing plants, logistics centers, and even offices are increasingly relying on MCUs to automate processes, optimize operations, and reduce human intervention. MCUs enable seamless integration of sensors, robotics, and control systems, transforming traditional industries into smart, interconnected ecosystems. This trend not only improves productivity but also drives the demand for specialized MCUs tailored to industrial automation requirements, contributing significantly to market growth.

Moreover, the healthcare sector has embraced MCUs, incorporating them into an array of medical devices and diagnostic equipment. From wearable health trackers and smart prosthetics to high-tech imaging devices, MCUs enable precise control, data processing, and real-time monitoring, enhancing patient care and medical outcomes. The integration of MCUs into healthcare applications exemplifies the market's adaptability and its ability to address diverse industry needs.

Additionally, MCUs continue to find extensive applications in aerospace and defense, where reliability, performance, and ruggedness are paramount. These applications, often involving extreme conditions and critical missions, rely on MCUs to deliver optimal performance and ensure the functionality of sophisticated avionics systems, navigation equipment, and military hardware.

In conclusion, the Global Microcontroller Unit Market stands at the forefront of technological innovation, enabling the seamless integration of smart devices, automation, and connectivity across diverse industries. With the relentless pursuit of efficiency, connectivity, and intelligence characterizing the modern era, the MCU market is poised for continuous growth, shaping the future of industries and transforming the way people live, work, and interact with the world around them.

The Global Microcontroller Unit Market is segmented into Product, Application, regional distribution, and company. Based on Product, the 32-bit microcontroller unit (MCU) segment emerged as the dominant force in the Global Microcontroller Unit Market and is anticipated to maintain its supremacy throughout the forecast period. The 32-bit MCUs gained prominence due to their superior processing power, extensive memory capacity, and versatility in handling complex applications across various sectors.

Industries such as automotive, industrial automation, and consumer electronics increasingly rely on 32-bit MCUs to support advanced features like high-resolution displays, intricate algorithms, and multitasking capabilities. These microcontrollers offer a perfect balance between performance and energy efficiency, making them ideal for applications demanding substantial computational capabilities while ensuring optimal power consumption.

Additionally, the 32-bit MCUs have witnessed rapid advancements in terms of integration of features such as wireless connectivity and enhanced security protocols, aligning them with the evolving requirements of modern IoT applications. Their ability to handle sophisticated tasks and accommodate future technological developments positions them as the preferred choice for manufacturers and developers. As industries continue to demand more sophisticated, feature-rich, and power-efficient solutions, the 32-bit MCU segment is expected to maintain its dominance, driving innovation and shaping the landscape of the Global Microcontroller Unit Market in the foreseeable future.

Based on region, Asia-Pacific stood out as the dominating region in the Global Microcontroller Unit (MCU) Market, and it is anticipated to maintain its dominance during the forecast period. Several factors contribute to Asia-Pacific's market leadership, including the presence of key MCU manufacturing hubs in countries like China, Japan, South Korea, and Taiwan. These countries have established themselves as major players in the global semiconductor industry, producing a substantial portion of the world's MCUs.

Additionally, the region's robust electronics manufacturing ecosystem, technological expertise, and the continuous demand for consumer electronics, automotive components, and industrial automation solutions have fueled the growth of the MCU market. Rising investments in research and development, coupled with favorable government policies supporting the semiconductor sector, further contribute to the region's dominance.

Moreover, the proliferation of IoT applications, smart devices, and digitalization efforts across various industries in Asia-Pacific continues to drive the demand for advanced MCUs. With a strong manufacturing base, technological innovation, and a growing market for electronic products, Asia-Pacific is well-positioned to maintain its leadership in the Global Microcontroller Unit Market in the foreseeable future.

Major companies operating in Global Microcontroller Unit Market are:

Renesas Electronics Corporation

NXP Semiconductors N.V.

Texas Instruments Incorporated

STMicroelectronics N.V.

Infineon Technologies AG

Microchip Technology Inc.

Cypress Semiconductor Corporation

Analog Devices, Inc.

Silicon Laboratories Inc.

Maxim Integrated Products, Inc.

Download Free Sample Report https://www.techsciresearch.com/sample-report.aspx?cid=20928

Customers can also request for 10% free customization on this report.

“The Global Microcontroller Unit (MCU) Market, a vital segment within the semiconductor industry, has evolved significantly, shaping modern technological advancements. MCUs, compact integrated circuits comprising a processor core, memory, and programmable input/output peripherals, serve as the brains behind a wide array of electronic devices, from consumer gadgets to complex industrial automation systems. The market's growth is propelled by the surging demand for smart devices and Internet of Things (IoT) applications. MCUs power interconnected devices, facilitating seamless communication and automation, from smart home appliances to healthcare equipment.

The automotive industry is a major driver, demanding advanced MCUs for electronic systems in vehicles, enhancing safety and efficiency. Automation across industries further fuels the market, with MCUs integrating sensors and robotics, optimizing operations. Additionally, MCUs play a vital role in healthcare devices, improving patient care, and find applications in aerospace and defense for their reliability. As industries prioritize efficiency and connectivity, the MCU market continues to innovate, shaping the future of diverse sectors,” said Mr. Karan Chechi, Research Director with TechSci Research, a research-based management consulting firm.

“Microcontroller Unit Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Product (8-bit, 16-bit, 32-bit), By Application (Consumer Electronics & Telecom, Automotive, Industrial, Medical Devices, Aerospace & Defense, Others), By Region, By Competition, 2019-2029”, has evaluated the future growth potential of Global Microcontroller Unit Market and provides statistics & information on market size, structure and future market growth. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment decisions. Besides, the report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in Global Microcontroller Unit Market.

Contact

TechSci Research LLC

420 Lexington Avenue, Suite 300,

New York, United States- 10170

Tel: +1-332-258-6602

Email: [email protected]

Website: www.techsciresearch.com

#Microcontroller Unit Market#Microcontroller Unit Market Size#Microcontroller Unit Market Share#Microcontroller Unit Market Trends#Microcontroller Unit Market Growth#Microcontroller Unit Market Forecast

0 notes

Text

Low-Power Microcontroller Unit Market

0 notes

Text

Predictions and Potentials: Microcontroller Unit Market Valued at US$ 70.6 Billion by 2033

The global microcontroller unit market is forecast to reach 30.9 billion in 2023. Worldwide microcontroller unit sales will rise at 8.6% CAGR between 2023 and 2033. By the end of 2033, the global market for microcontroller units will reach US$ 70.6 billion.

Demand remains especially high for 32-bit microcontroller units worldwide. The target segment is set to expand at 8.5% CAGR between 2023 and 2033.

Rising applications in consumer electronics and automotive sectors is driving the global market. Increasing penetration of digitalization and electrification will also boost sales.

A basic microcontroller has programmable input-output devices, processing units, and input/output devices. Such microcontrollers are capable of doing the task of a processor. But they have advanced segments to give and receive commands.

Microcontroller units are being used in diverse industries including consumer electronics. They have become indispensable components of modern electronic devices and equipment.

Microcontrollers such as PIC18F-Q40 find applications in various medical devices. Also, STM32 series microcontrollers are used in thermometers and BP monitoring systems. Hence, growing demand for advanced medical devices will boost microcontroller unit sales.

Get a Sample PDF of the Report https://www.futuremarketinsights.com/reports/sample/rep-gb-16770

Rapid adoption of automation and robotics will elevate microcontroller unit demand. Further, growing popularity of electric vehicles will bode well for the market.

Key Takeaways from Microcontroller Unit (MCU) Market Report:

Global microcontroller unit (MCU) sales are likely to accelerate at 8.6% CAGR through 2033.

32-bit microcontroller unit segment will expand at 8.5% CAGR over the next ten years.

Demand for microcontroller units in consumer electronics will surge at 8.4% CAGR.

The United States microcontroller unit market is likely to reach US$ 22.6 billion by 2033.

Microcontroller unit sales across the United Kingdom will rise at 7.8% CAGR through 2033.

China microcontroller unit market is forecast to reach US$ 6.1 billion by 2033.

Microcontroller unit demand in Japan market will increase at 8.1% CAGR through 2033.

“Growing application of microcontroller units in consumer electronics will boost sales. Besides this, rising popularity of autonomous vehicles will bode well for the market”. says a lead Future Market Insights analyst.

Ask An Analyst https://www.futuremarketinsights.com/ask-the-analyst/rep-gb-16770

Competitive Landscape Key companies are launching new products with enhanced features. Further, they are adopting strategies such as mergers & acquisitions to expand their footprint.

Fujitsu Semiconductor Limited, Zilog Inc., Infineon Technologies AG, NXP Semiconductors, Microchip Technology Inc., Renesas Electronics Corporation, TE Connectivity Ltd., STMicroelectronics, Texas Instruments Incorporated, Yamaichi Electronics Co. Ltd.

For instance,

In November 2022, to accelerate the digital transformation Fujitsu Limited and Settle Mint NV entered into a strategic agreement.

In March 2017, Analog Devices acquired Linear Technology Corporation- a California-based semiconductor company that manufactures high-performance analogy integrated circuits.

Get More Valuable Insights into Microcontroller Unit Market

Future Market Insights, in its new offering, presents an unbiased analysis of the microcontroller unit market, presenting historical market data (2018 to 2022) and forecast statistics for the period of 2023 to 2033.

The study reveals extensive growth in microcontroller units in terms of Product (32-bits, 16-bits and 8-bits) and Application (Consumer Electronics, Automotive, Military and Defense, Medical Devices and Industrial) across several regions.

Global Microcontroller Unit Market Segmentation

By Product:

32-bit

16-bit

08-bit

By Application:

Consumer Electronics

Automotive

Military and Defense

Medical Devices

Industrial

By Region:

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

0 notes

Text

At my last job, we sold lots of hobbyist electronics stuff, including microcontrollers.

This turned out to be a little more complicated than selling, like, light bulbs. Oh how I yearned for the simplicity of a product you could plug in and have work.

Background: A microcontroller is the smallest useful computer. An ATtiny10 has a kilobyte of program memory. If you buy a thousand at a time, they cost 44 cents each.

As you'd imagine, the smallest computer has not great specs. The RAM is 32 bytes. Not gigabytes, not megabytes, not kilobytes. Individual bytes. Microcontrollers have the absolute minimum amount of hardware needed to accomplish their task, and nothing more.

This includes programming the thing. Any given MCU is programmed once, at the start of its life, and then spends the next 30 years blinking an LED on a refrigerator. Since they aren’t meant to be reflashed in the field, and modern PCs no longer expose the fast, bit-bangable ports hobbyists once used, MCUs usually need a third-party programming tool.

But you could just use that tool to install a bootloader, which then listens for a magic number on the serial bus. Then you can reprogram the chip as many times as you want without the expensive programming hardware.

There is an immediate bifurcation here. Only hobbyists will use the bootloader version. With 1024 bytes of program memory, there is, even more than usual, nothing to spare.

Consumer electronics development is a funny gig. It, more than many other businesses, requires you to be good at everything. A startup making the next Furby requires a rare omniexpertise. Your company has to write software, design hardware, create a production plan, craft a marketing scheme, and still do the boring logistics tasks of putting products in boxes and mailing them out. If you want to turn a profit, you do this the absolute minimum number of people. Ideally, one.

Proving out a brand new product requires cutting corners. You make the prototype using off the shelf hobbyist electronics. You make the next ten units with the same stuff, because there's no point in rewriting the entire codebase just for low rate initial production. You use the legacy code for the next thousand units because you're desperately busy putting out a hundred fires and hiring dozens of people to handle the tsunami of new customers. For the next ten thousand customers...

Rather by accident, my former employer found itself fulfilling the needs of the missing middle. We were an official distributor of PICAXE chips for North America. Our target market was schools, but as a sideline, we sold individual PICAXE chips, which were literally PIC chips flashed with a bootloader and a BASIC interpreter at a 200% markup. As a gag, we offered volume discounts on the chips up to a thousand units. Shortly after, we found ourselves filling multi-thousand unit orders.

We had blundered into a market niche too stupid for anyone else to fill. Our customers were tiny companies who sold prototypes hacked together from dev boards. And every time I cashed a ten thousand dollar check from these guys, I was consumed with guilt. We were selling to willing buyers at the current fair market price, but they shouldn't have been buying these products at all! Since they were using bootloaders, they had to hand program each chip individually, all while PIC would sell you programmed chips at the volume we were selling them for just ten cents extra per unit! We shouldn't have been involved at all!

But they were stuck. Translating a program from the soft and cuddly memory-managed education-oriented languages to the hardcore embedded byte counting low level languages was a rather esoteric skill. If everyone in-house is just barely keeping their heads above water responding to customer emails, and there's no budget to spend $50,000 on a consultant to rewrite your program, what do you do? Well, you keep buying hobbyist chips, that's what you do.

And I talked to these guys. All the time! They were real, functional, profitable businesses, who were giving thousands of dollars to us for no real reason. And the worst thing. The worst thing was... they didn't really care? Once every few months they would talk to their chip guy, who would make vague noises about "bootloaders" and "programming services", while they were busy solving actual problems. (How to more accurately detect deer using a trail camera with 44 cents of onboard compute) What I considered the scandal of the century was barely even perceived by my customers.

In the end my employer was killed by the pandemic, and my customers seamlessly switched to buying overpriced chips straight from the source. The end! No moral.

543 notes

·

View notes

Text

Finally ready to start showing off the project we've been working on for a few weeks.

TRAIN PUZZLE (dot exe) (title pending)

me and @msasterisk are working on a switching puzzle game set on slimegirl astronaut Eaurp Guz's homeworld. You operate an Advanced Steam switcher to move cars around. The prototype implements a single level, a model railroad Inglenook layout, but there will be other original levels as well.

MsAsterisk has done all of the programming and game engine work, I've done the game design and art assets.

more screenshots and development photos below the cut:

Until the last couple of days, the game has used plain colored boxes for its cars. The first playable version, shown here, was just a pixel art train toy, with no actual game mechanics, but with an external list randomizer you could still run the inglenook game.

The physics was apparently a monumental undertaking to get working, but now it works great!

i don't remember what this was about. Truncated the vertices to the unit cube or something.

@thefallencomet's playtesting of the first prototype revealed a severe bug with couplers where switching cars coupled at a distance between three tracks at once would completely break physics. MsAsterisk fixed it by simply breaking couplers when they're too far apart.

car concept art

u.i. concept art. The tracks are bonafide pixel art here, but they've since been replaced with all 3D assets. The loco here is a pixelated render done in blender of the advanced steam tank engine model that i made about a month ago.

control stand model, WIP. We're not sure if we're going to go for this kind of detailed control stand. Why does a steam engine use a control stand that would look more at home on an EMD diesel? It's the magic of Advanced Steam Technology! The actual engine is controlled with actuators and microcontrollers, they're merely operated from the safety of the control cabin. The gauges are for brake cylinder, boiler pressure, steam chest, and speedometer--but no promises about whether these will be functional.

and finally, portraits of the engine crew

More to come as the game continues development.

#Train Puzzle#train#advanced steam#mellanoid slime worldbuilding#shunting#switching#switching puzzle#shunting puzzle#puzzle game#indie game#game dev#video game#train game#steam train#boxcar

122 notes

·

View notes

Note

Do you have a favourite rotary telephone?

Excellent question!

Yes, I have a favorite:

The Northern Electric Pyramid phone from about 1935. I had this on my desk at my old job, tied into the telephone system. Its distinctive ring made it really easy to discern if I was the one being called instead of my coworkers. The chrome dial and the area code indicate that this unit came from Canada.

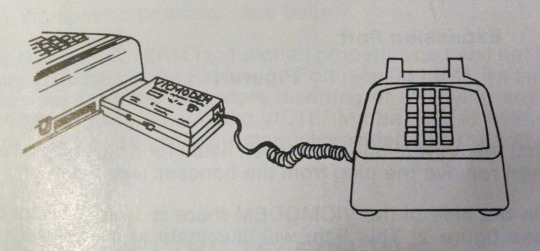

Coming in second place is my Northern Telecom 500-style set with official Commodore branding -- also from Canada. These were sold with VICMODEMs in a special bundle exclusively in the Canadian market. The VICMODEM requires that you detach the cord from the handset, plug it directly into the modem, then dial for the computer.

Problem is that you can't do that here, because the handset cord is permanently attached! Solution? The little white adapter box called the VIC 1605. Very hard to find, but I found one.

Coming in third place would be the Contempra from Northern Electric/Telecom from 1967 (why do these keep being Canadian?). Beautiful colors, angles. Great phone, but sadly I don't have one. Atleast not one like this... NT made these into lineman's test sets (commonly called butt sets because they hang on a lineman's belt by their butt/you use them to butt-in to a call when testing things).

I bought one and turned it into the NT2017 Rotary Cellphone, a real working 2G cellular telephone. It's got an Adafruit Fona board inside with an Atmel 32U4 microcontroller, a little screen, and zero ability to send/receive text messages. It didn't work very well, but it was really fun to build and use before it broke. Construction was very fragile, and my code running it was hot garbage. Since the discontinuation of 2G cell service, it's just decorative at this point.

The last one of my favorites is one I certainly don't have: a late 19th century Skeleton Telephone from Ericsson. Technically not a rotary phone, but it does have a crank that you rotate!

These are expensive, really hard to find, and obviously rather difficult to use without having an operator to ring up when you turn the crank. However, they are stunningly beautiful, and all of the functionality is on display arranged in such a way to accentuate the elegance of its industrial design.

How about you? Do you have a favorite rotary phone?

108 notes

·

View notes

Text

ATMEGA328P-PU: The Little Prince of Microcontrollers in Circuits & Stars

A Meeting in the Desert of Circuits

The desert stretched endlessly, its sands glowing like gold under the sun. I was tracing the dunes, heading toward a distant oasis, when I spotted a glint in the sand—a small, rectangular shape, no bigger than a ladybug.

“You’re… very small,” I said, kneeling. “And you’re a child who talks to microcontrollers,” it replied, voice soft as the wind. “But some keepers of light are smallest when they’re strongest. Ask the fox.”

It was an ATMEGA328P-PU—the heart of Arduino Uno, but to me, it felt like a secret. Let me tell you its story.

1. What Is the ATMEGA328P-PU? (A Keeper of Code, Not Just Silicon)

This was no ordinary chip. It was a ATMEGA328P-PU, an 8-bit AVR microcontroller in a 28-pin DIP suit—smaller than a baobab seed, but tough as the roots of the rose’s planet. Here’s its secret:

Clock Speed: 16-20MHz (overclockable to 24MHz for daredevils). Faster than the fox darting across the dunes.

Memory: 32KB Flash (stores code), 2KB SRAM (variables), 1KB EEPROM (your debugging tears). Like a Pensieve for electrons.

I/O Pins: 23 programmable pins (14 digital, 6 analog). Windows to the world—like the portholes on a spaceship.

Fun Fact: Engineers call it the “Cockroach of MCUs.” Survives power surges, cosmic rays, and your “hold my beer” coding experiments. Even the baobabs can’t crush it.

“Why so quiet?” I asked. “Keepers don’t shout,” it said. “They just keep.”

2. ATMEGA328P-PU & Its Siblings: Stars in the Same Sky

In the desert of microcontrollers, ATMEGA328P-PU has siblings—some older, some louder, but none quite like it:

ATMEGA328-PU: An older star. Higher power draw, like a planet that burns too bright. Avoid—like flip phones in 2025.

ATMEGA328PB-PU: A louder sibling. Extra peripherals (UART, timers), but bulkier. For complex projects, like a planet with too many volcanoes.

ATMEGA328P-PU: The steady one. Lower power (1.8V-5.5V), optimized code. Ideal for battery-powered projects—like a rose that blooms in the desert.

Roast Alert: ATMEGA328-PU (grumbling): “I’m vintage!” ATMEGA328P-PU (calm, like the fox): “I’m in NASA prototypes. You’re in a landfill. Bye.”

3. Why the Fox (and Engineers) Choose It

ATMEGA328P-PU isn’t flashy. It’s the kind of friend who shows up, fixes your code, and leaves without fanfare. Here’s why:

Cost: $3/unit—cheaper than a morning espresso (and way more useful). Even the rose, who’s picky, approves.

Simplicity: No Wi-Fi tantrums or driver hell (looking at you, ESP32). Like a well-tended garden—no weeds.

Community Support: 10k+ Arduino tutorials. Google is your co-pilot, and the fox is your guide.

Real-World Flex:

Mars Rover Prototypes: Runs in -40°C labs (tested by NASA JPL). Even cosmic frost can’t stop it.

DIY COVID Ventilators: 2020’s MacGyver hero (MIT Open-Source Project). Saved lives, one byte at a time.

“Why not be bigger?” I asked. “Big things break,” it said. “Tiny things fit. In garage labs. In Mars rovers. In portable ECGs.”

4. Programming the Little Prince: A Dance with Code

Want to wake the ATMEGA328P-PU? It’s like taming a fox—gentle, patient, and rewarding.

Option 1: Arduino IDE (The Friendly Path)

Connect via USB-to-Serial (e.g., CH340G). Pray the drivers install (sometimes they don’t—blame AliExpress).

Select Board: Arduino Uno (even if you’re using a breadboard).

Upload Code: Watch the LED blink, like a star winking hello.

Option 2: Bare-Metal with AVRDUDE (The Adventurer’s Path)

Command: avrdude -c usbasp -p m328p -U flash:w:your_code.hex

Pro Tip: If smoke appears, take a breath. The fox says, “It’s not your fault—sometimes stars misbehave.”

5. Burning the Bootloader: Tending the Rose

Burning a bootloader is like planting a rose—delicate, but necessary.

Tools Needed:

Programmer: USBasp, Arduino as ISP, or a sacrificial Uno (no tears, it’ll forgive you).

Software: Arduino IDE or AVRDUDE (the gardener’s tools).

Steps:

Wire It Up: Connect MOSI, MISO, SCK, RESET, GND, VCC. Triple-check—no one likes a fried rose.

Arduino IDE: Tools > Programmer > USBasp (or your tool).

Burn: Tools > Burn Bootloader. Wait for the magic (or error messages—they’re just the rose’s thorns).

1 note

·

View note

Text

I impulse-purchased a few LED boards from a surplus operation recently, and I'm not sure if it was a good idea or not.

Each unit is a WS2812B, which are pretty common addressable LEDs. You can hook power and ground to the board and use one wire from a microcontroller to set any of the 56 lights to a different RGB color, letting you make colored lights or animations easily; each LED hooks to the next and you just wire them together to make long strings or panels. This particular board has four pins on the back, which made me hopeful that they were for power, ground, input, and output.

Well, unfortunately, testing turned up that the output isn't in that pin header. If I want to daisy-chain these I'd need to solder an extra wire onto the far right end — there's a tiny copper pad, at least, so I wouldn't need to wire directly onto the chip — to plug in the next panel. Now, microcontrollers generally have more than one output pin, so it's also pretty straightforward to wire a few of these in parallel instead of in series, but it's more of a hassle than just changing the number of LEDs in your string.

Unfortunately I kind of got these without a specific use in mind, so I'm not sure what they'll go into. These are the dangers.

#diy#electronics#i didn't get all that many either#not sure what particular use a roughly 15x19 display would be

2 notes

·

View notes

Text

Understanding FPGA Architecture: Key Insights

Introduction to FPGA Architecture

Imagine having a circuit board that you could rewire and reconfigure as many times as you want. This adaptability is exactly what FPGAs offer. The world of electronics often seems complex and intimidating, but understanding FPGA architecture is simpler than you think. Let’s break it down step by step, making it easy for anyone to grasp the key concepts.

What Is an FPGA?

An FPGA, or Field Programmable Gate Array, is a type of integrated circuit that allows users to configure its hardware after manufacturing. Unlike traditional microcontrollers or processors that have fixed functionalities, FPGAs are highly flexible. You can think of them as a blank canvas for electrical circuits, ready to be customized according to your specific needs.

How FPGAs Are Different from CPUs and GPUs

You might wonder how FPGAs compare to CPUs or GPUs, which are more common in everyday devices like computers and gaming consoles. While CPUs are designed to handle general-purpose tasks and GPUs excel at parallel processing, FPGAs stand out because of their configurability. They don’t run pre-defined instructions like CPUs; instead, you configure the hardware directly to perform tasks efficiently.

Basic Building Blocks of an FPGA

To understand how an FPGA works, it’s important to know its basic components. FPGAs are made up of:

Programmable Logic Blocks (PLBs): These are the “brains” of the FPGA, where the logic functions are implemented.

Interconnects: These are the wires that connect the logic blocks.

Input/Output (I/O) blocks: These allow the FPGA to communicate with external devices.

These elements work together to create a flexible platform that can be customized for various applications.

Understanding Programmable Logic Blocks (PLBs)

The heart of an FPGA lies in its programmable logic blocks. These blocks contain the resources needed to implement logic functions, which are essentially the basic operations of any electronic circuit. In an FPGA, PLBs are programmed using hardware description languages (HDLs) like VHDL or Verilog, enabling users to specify how the FPGA should behave for their particular application.

What are Look-Up Tables (LUTs)?

Look-Up Tables (LUTs) are a critical component of the PLBs. Think of them as small memory units that can store predefined outputs for different input combinations. LUTs enable FPGAs to quickly execute logic operations by “looking up” the result of a computation rather than calculating it in real-time. This speeds up performance, making FPGAs efficient at performing complex tasks.

The Role of Flip-Flops in FPGA Architecture

Flip-flops are another essential building block within FPGAs. They are used for storing individual bits of data, which is crucial in sequential logic circuits. By storing and holding values, flip-flops help the FPGA maintain states and execute tasks in a particular order.

Routing and Interconnects: The Backbone of FPGAs

Routing and interconnects within an FPGA are akin to the nervous system in a human body, transmitting signals between different logic blocks. Without this network of connections, the logic blocks would be isolated and unable to communicate, making the FPGA useless. Routing ensures that signals flow correctly from one part of the FPGA to another, enabling the chip to perform coordinated functions.

Why are FPGAs So Versatile?

One of the standout features of FPGAs is their versatility. Whether you're building a 5G communication system, an advanced AI model, or a simple motor controller, an FPGA can be tailored to meet the exact requirements of your application. This versatility stems from the fact that FPGAs can be reprogrammed even after they are deployed, unlike traditional chips that are designed for one specific task.

FPGA Configuration: How Does It Work?

FPGAs are configured through a process called “programming” or “configuration.” This is typically done using a hardware description language like Verilog or VHDL, which allows engineers to specify the desired behavior of the FPGA. Once programmed, the FPGA configures its internal circuitry to match the logic defined in the code, essentially creating a custom-built processor for that particular application.

Real-World Applications of FPGAs

FPGAs are used in a wide range of industries, including:

Telecommunications: FPGAs play a crucial role in 5G networks, enabling fast data processing and efficient signal transmission.

Automotive: In modern vehicles, FPGAs are used for advanced driver assistance systems (ADAS), real-time image processing, and autonomous driving technologies.

Consumer Electronics: From smart TVs to gaming consoles, FPGAs are used to optimize performance in various devices.

Healthcare: Medical devices, such as MRI machines, use FPGAs for real-time image processing and data analysis.

FPGAs vs. ASICs: What’s the Difference?

FPGAs and ASICs (Application-Specific Integrated Circuits) are often compared because they both offer customizable hardware solutions. The key difference is that ASICs are custom-built for a specific task and cannot be reprogrammed after they are manufactured. FPGAs, on the other hand, offer the flexibility of being reconfigurable, making them a more versatile option for many applications.

Benefits of Using FPGAs

There are several benefits to using FPGAs, including:

Flexibility: FPGAs can be reprogrammed even after deployment, making them ideal for applications that may evolve over time.

Parallel Processing: FPGAs excel at performing multiple tasks simultaneously, making them faster for certain operations than CPUs or GPUs.

Customization: FPGAs allow for highly customized solutions, tailored to the specific needs of a project.

Challenges in FPGA Design

While FPGAs offer many advantages, they also come with some challenges:

Complexity: Designing an FPGA requires specialized knowledge of hardware description languages and digital logic.

Cost: FPGAs can be more expensive than traditional microprocessors, especially for small-scale applications.

Power Consumption: FPGAs can consume more power compared to ASICs, especially in high-performance applications.

Conclusion

Understanding FPGA architecture is crucial for anyone interested in modern electronics. These devices provide unmatched flexibility and performance in a variety of industries, from telecommunications to healthcare. Whether you're a tech enthusiast or someone looking to learn more about cutting-edge technology, FPGAs offer a fascinating glimpse into the future of computing.

2 notes

·

View notes

Text

Understanding the Functionality of Samsung Refrigerator PCB Main Assembly

Samsung refrigerators have become essential appliances in modern households, offering innovative features and advanced technologies to ensure food preservation and convenience. The (Printed Circuit Board) PCB Main Assembly serves as the brain of the refrigerator, coordinating various functions and ensuring optimal performance.

Components of the Refrigerator PCB Main Assembly

The Refrigerator PCB Main Assembly consists of several essential components, each playing a crucial role in the refrigerator's operation.

Microcontroller: It is the central processing unit (CPU) and the computer performs programmed instructions to coordinate communication between the components.

Sensors: The ambient parameters (temperature, humidity, door status) supply critical information for regulation.

Relays: You control the flow of electricity to the compressor, fan motors, and defrost heater.

Capacitors: It will help you store the electrical energy and help to regulate voltage, and guarantee that the PCB is operating reliably.

Resistors: Protect sensitive components from harm by limiting the flow of electricity across certain circuits.

Diodes: Allow current to flow exclusively in one direction to avoid reverse polarity and safeguard components from damage.

Connectors: Facilitate electrical connections between the PCB and other refrigerator components to ensure seamless integration.

Working Principle PCB Main Assembly

The PCB Main Assembly operates on a set of programmed instructions that determine its behavior depending on sensor input and user command. The micro controller continuously monitors sensor input such as the reading of the temperature from the refrigerator compartment, and freezer. The microcontroller controls the transition of the compressor on, or off or the speed of the fan and also the defrost cycles based on the sensor data as to how to keep the temperature and humidity at the optimal level. In addition to the other refrigerator components, for example, display panel and user interface, the PCB Main Assembly provides feedback and enables users’’ interaction. The PCB Main Assembly incorporates safety features of overload protection and temperature sensors to protect the refrigerator from damage and to protect the user.

Communication Protocols

Data can be communicated to other components through microcontrollers by communication protocols like UART (Universal Asynchronous Receiver Transmitter), SPI (Serial Peripheral Interface), and I2C (Inter Integrated Circuit).

UART is used to transfer real-time data from a microcontroller to external devices like display panels and temperature sensors.

There is a power of communication SPI and I2C for the communication of integrated circuits associated with the PCB Main Assembly for efficient data transfer and synchronization between components.

Troubleshooting and Maintenance

Common issues with the Samsung Refrigerator PCB Main Assembly include sensor failures, relay malfunctions, and power supply issues, which can affect the refrigerator's performance.

To solve PCB Main Assembly problems, we can use diagnostic methods, like running self-tests and checking the error code.

The assembly can stay longer depending on the main, such as cleaning dust and debris from the PCB and securing appropriate ventilation.

The PCB Main Assembly is an important component of the Samsung refrigerator systems since it organizes several functions to contribute to the overall efficiency of the refrigerator and food preservation. Fore-knowledge of the PCB Main Assembly and the way it is constructed can assist users in likely managing problems in their fridges.

2 notes

·

View notes

Note

My comment responding to you on your post about the autonomous tractor kept being removed: I couldn't find any info, but if you wanted to know a bit more, it looks like 4 ~300W panels and 4 ~150amp hour batteries. Panels>charge controller>batteries>inverter>microcontroller like raspberry pi or arduino running a platform like OpenMower with GPS unit>actuators and motor controller. Probably has 433mhz or wifi or something for local control too. Hard to guess what electric motor, you wouldn't want to use anything more powerful than necessary.

Neat, none of that is really complicated other than the code. It would probably take ages to actucaly fine tune it though. Didnt know about openmower will look into that.

3 notes

·

View notes

Text

Raspberry Pi Pico W has been designed to be a low cost yet flexible development platform for RP2040, with a 2.4GHz wireless interface and the following key features:

RP2040 microcontroller with 2MB of flash memory

On-board single-band 2.4GHz wireless interfaces (802.11n)

Micro USB B port for power and data (and for reprogramming the flash)

40 pin 21mmx51mm ‘DIP’ style 1mm thick PCB with 0.1″ through-hole pins also with edge castellations

Exposes 26 multi-function 3.3V general purpose I/O (GPIO)

23 GPIO are digital-only, with three also being ADC capable

Can be surface mounted as a module

3-pin ARM serial wire debug (SWD) port

Simple yet highly flexible power supply architecture

Various options for easily powering the unit from micro USB, external supplies or batteries

High quality, low cost, high availability

Comprehensive SDK, software examples, and documentation

Dual-core Cortex M0+ at up to 133MHz

On-chip PLL allows variable core frequency

264kByte multi-bank high-performance SRAM

2 notes

·

View notes

Text

#Global Low-Power Microcontroller Unit Market Size#Share#Trends#Growth#Industry Analysis#Key Players#Revenue#Future Development & Forecast

0 notes

Text

8-Bit MCU Market: Trends, Growth Opportunities, and Forecast 2025-2032

8-Bit MCU Market, Trends, Business Strategies 2025-2032

8-Bit MCU Market size was valued at US$ 3.67 billion in 2024 and is projected to reach US$ 5.89 billion by 2032, at a CAGR of 7.01% during the forecast period 2025–2032

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis https://semiconductorinsight.com/download-sample-report/?product_id=103121

MARKET INSIGHTS

The global 8-Bit MCU Market size was valued at US$ 3.67 billion in 2024 and is projected to reach US$ 5.89 billion by 2032, at a CAGR of 7.01% during the forecast period 2025–2032.

An 8-bit MCU (Microcontroller Unit) refers to a compact integrated circuit designed for embedded applications, featuring an 8-bit data bus width. These components combine a processor core with memory and programmable input/output peripherals, making them ideal for cost-sensitive, low-power applications. The “8-bit” designation indicates the CPU’s ability to process 8-bit data blocks in a single operation, with internal registers and memory addressing typically aligned to this architecture.

While newer 32-bit MCUs gain traction in complex applications, 8-bit variants maintain strong demand in automotive subsystems, industrial controls, and consumer electronics due to their cost efficiency and design simplicity. The DIP (Dual In-line Package) segment remains particularly significant, expected to maintain steady growth through 2032. Key players like Microchip Technology and NXP Semiconductors continue to innovate in this space, introducing energy-efficient designs that extend the technology’s relevance in IoT and smart home applications.

List of Key 8-Bit MCU Manufacturers Profiled

STMicroelectronics (Switzerland)

NXP Semiconductors (Netherlands)

Infineon Technologies (Germany)

Microchip Technology (U.S.)

Renesas Electronics (Japan)

Analog Devices (U.S.)

Texas Instruments (U.S.)

Toshiba Electronic Devices & Storage (Japan)

Nuvoton Technology (Taiwan)

Silicon Laboratories (U.S.)

Maxim Integrated (U.S.)

CHINA MICRO SEMICON (China)

China Resources Microelectronics Limited (China)

XTX Technology (China)

Fremont Micro Devices Corporation (U.S.)

Segment Analysis:

By Type

DIP Segment Dominates Due to Widespread Use in Cost-Sensitive Applications

The market is segmented based on type into:

DIP (Dual In-line Package)

Subtypes: Standard DIP, Skinny DIP, and others

PLCC (Plastic Leaded Chip Carrier)

QFP (Quad Flat Package)

Subtypes: LQFP, TQFP, and others

SOP (Small Outline Package)

Subtypes: SOIC, SSOP, and others

Others

By Application

Consumer Electronics Segment Leads Owing to High Demand for Simple Control Devices

The market is segmented based on application into:

Automobile

Industrial

Medical Care

Household Appliances

Consumer Electronics

Communication

Others

By Architecture

8051 Architecture Maintains Dominance Due to Legacy System Compatibility

The market is segmented based on architecture into:

8051

ATmega

PIC

STM8

Others

By Memory Size

4KB-32KB Memory Segment Leads as It Offers Optimal Performance for Basic Applications

The market is segmented based on memory size into:

Below 4KB

4KB-32KB

Above 32KB

Regional Analysis: 8-Bit MCU Market

North America The North American 8-Bit MCU market is driven by strong demand from automotive, industrial automation, and consumer electronics sectors. The U.S. dominates the region, accounting for the majority of revenue due to high adoption in legacy systems and cost-sensitive applications. Major manufacturers like Texas Instruments and Microchip Technology have significant R&D investments in this space. While newer 32-bit MCUs are gaining traction, 8-bit variants remain popular for simple control tasks because of their lower power consumption and cost efficiency. The region also benefits from strict industrial standards that ensure reliability across applications.

Europe Europe shows steady demand for 8-bit MCUs, particularly in automotive and industrial applications where reliability and long-term availability are crucial. Germany and France lead regional adoption, with major suppliers like STMicroelectronics and Infineon Technologies headquartered in the region. The market faces some pressure from EU regulations pushing for more energy-efficient solutions, though 8-bit MCUs continue to be favored for their simplicity and proven performance in embedded systems. A notable trend is the growing use of 8-bit MCUs in IoT edge devices where processing requirements are minimal.

Asia-Pacific As the largest and fastest-growing market for 8-bit MCUs, Asia-Pacific is fueled by massive electronics manufacturing in China, Japan, and South Korea. China alone accounts for over 40% of global demand due to its extensive consumer electronics and appliance industries. While the region is rapidly adopting advanced MCUs for high-end applications, 8-bit MCUs thrive in cost-sensitive mass production of items like remote controls, small appliances, and basic automotive components. Local manufacturers like Nuvoton and China Resources Microelectronics are gaining market share with competitive pricing strategies.

South America The South American market for 8-bit MCUs remains relatively small but stable, with Brazil being the primary adopter. Growth is constrained by economic fluctuations and limited local manufacturing capabilities, though demand persists for automotive aftermarket applications and basic industrial controls. Most supply comes through imports from North American and Asian manufacturers. The region shows potential for gradual growth, particularly if local electronics production expands to serve regional demand more effectively.

Middle East & Africa This region represents an emerging market for 8-bit MCUs, with adoption primarily concentrated in consumer electronics and basic industrial applications. While the market currently represents a small fraction of global demand, increasing urbanization and industrialization in countries like Saudi Arabia and UAE are creating opportunities. The lack of local semiconductor manufacturing means most supply comes through imports, with price sensitivity being a key factor in purchasing decisions. As infrastructure develops, 8-bit MCUs are expected to find growing applications in energy management and building automation systems.

MARKET DYNAMICS

The semiconductor industry continues grappling with the aftereffects of pandemic-era disruptions, with 8-bit MCUs particularly affected due to their mature manufacturing processes. Many 8-bit products are produced on legacy fabrication nodes that receive lower priority from foundries compared to cutting-edge technologies. This has created prolonged lead times exceeding 40 weeks for some popular 8-bit MCU families. While the situation has improved from pandemic peaks, ongoing geopolitical tensions and material shortages maintain pressure on the supply chain.

Manufacturers face difficult trade-offs between transitioning production to newer fabs (increasing costs) versus maintaining legacy production (risking supply reliability). The resulting uncertainty forces OEMs to maintain larger inventories and diversify supplier bases, directly impacting total cost of ownership calculations for 8-bit MCU-based designs.

Developing markets represent a significant growth frontier for 8-bit MCUs as industrialization accelerates across Southeast Asia, Africa, and Latin America. Price sensitivity in these regions makes the cost advantages of 8-bit architectures particularly compelling for applications like appliance control, basic industrial automation, and consumer electronics. Local manufacturers frequently prioritize functional reliability over cutting-edge features, aligning perfectly with 8-bit MCU capabilities. Several leading semiconductor companies are establishing regional design centers to better serve these markets, with customized 8-bit MCU variants appearing tailored to local requirements and voltage standards.

The proliferation of electronics manufacturing in these regions, coupled with government initiatives to build domestic semiconductor expertise, creates a virtuous cycle for 8-bit MCU adoption. Major suppliers report double-digit annual growth in these territories, outpacing more mature markets.

The global 8-bit microcontroller unit (MCU) market continues to demonstrate resilience despite increasing competition from 32-bit alternatives, primarily due to their cost-effectiveness and energy efficiency in simpler embedded systems. Valued at over $2.5 billion in 2024, the sector remains critical for applications where computational complexity takes a backseat to power consumption and unit economics. Recent design innovations have extended the relevance of 8-bit architectures, with modern variants now featuring improved peripheral integration and sleep-mode current draw below 50nA – a crucial factor for battery-operated IoT edge devices representing nearly 30% of new deployments.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=103121

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global 8-Bit MCU Market?

Which key companies operate in Global 8-Bit MCU Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

Related Reports:

8-Bit MCU Market, Trends, Business Strategies 2025-2032

8-Bit MCU Market size was valued at US$ 3.67 billion in 2024 and is projected to reach US$ 5.89 billion by 2032, at a CAGR of 7.01% during the forecast period 2025–2032

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis https://semiconductorinsight.com/download-sample-report/?product_id=103121

MARKET INSIGHTS

The global 8-Bit MCU Market size was valued at US$ 3.67 billion in 2024 and is projected to reach US$ 5.89 billion by 2032, at a CAGR of 7.01% during the forecast period 2025–2032.

An 8-bit MCU (Microcontroller Unit) refers to a compact integrated circuit designed for embedded applications, featuring an 8-bit data bus width. These components combine a processor core with memory and programmable input/output peripherals, making them ideal for cost-sensitive, low-power applications. The “8-bit” designation indicates the CPU’s ability to process 8-bit data blocks in a single operation, with internal registers and memory addressing typically aligned to this architecture.

While newer 32-bit MCUs gain traction in complex applications, 8-bit variants maintain strong demand in automotive subsystems, industrial controls, and consumer electronics due to their cost efficiency and design simplicity. The DIP (Dual In-line Package) segment remains particularly significant, expected to maintain steady growth through 2032. Key players like Microchip Technology and NXP Semiconductors continue to innovate in this space, introducing energy-efficient designs that extend the technology’s relevance in IoT and smart home applications.

List of Key 8-Bit MCU Manufacturers Profiled

STMicroelectronics (Switzerland)

NXP Semiconductors (Netherlands)

Infineon Technologies (Germany)

Microchip Technology (U.S.)

Renesas Electronics (Japan)

Analog Devices (U.S.)

Texas Instruments (U.S.)

Toshiba Electronic Devices & Storage (Japan)

Nuvoton Technology (Taiwan)

Silicon Laboratories (U.S.)

Maxim Integrated (U.S.)

CHINA MICRO SEMICON (China)

China Resources Microelectronics Limited (China)

XTX Technology (China)

Fremont Micro Devices Corporation (U.S.)

Segment Analysis:

By Type

DIP Segment Dominates Due to Widespread Use in Cost-Sensitive Applications

The market is segmented based on type into:

DIP (Dual In-line Package)

Subtypes: Standard DIP, Skinny DIP, and others

PLCC (Plastic Leaded Chip Carrier)

QFP (Quad Flat Package)

Subtypes: LQFP, TQFP, and others

SOP (Small Outline Package)

Subtypes: SOIC, SSOP, and others

Others

By Application

Consumer Electronics Segment Leads Owing to High Demand for Simple Control Devices

The market is segmented based on application into:

Automobile

Industrial

Medical Care

Household Appliances

Consumer Electronics

Communication

Others

By Architecture

8051 Architecture Maintains Dominance Due to Legacy System Compatibility

The market is segmented based on architecture into:

8051

ATmega

PIC

STM8

Others

By Memory Size

4KB-32KB Memory Segment Leads as It Offers Optimal Performance for Basic Applications

The market is segmented based on memory size into:

Below 4KB

4KB-32KB

Above 32KB

Regional Analysis: 8-Bit MCU Market

North America The North American 8-Bit MCU market is driven by strong demand from automotive, industrial automation, and consumer electronics sectors. The U.S. dominates the region, accounting for the majority of revenue due to high adoption in legacy systems and cost-sensitive applications. Major manufacturers like Texas Instruments and Microchip Technology have significant R&D investments in this space. While newer 32-bit MCUs are gaining traction, 8-bit variants remain popular for simple control tasks because of their lower power consumption and cost efficiency. The region also benefits from strict industrial standards that ensure reliability across applications.

Europe Europe shows steady demand for 8-bit MCUs, particularly in automotive and industrial applications where reliability and long-term availability are crucial. Germany and France lead regional adoption, with major suppliers like STMicroelectronics and Infineon Technologies headquartered in the region. The market faces some pressure from EU regulations pushing for more energy-efficient solutions, though 8-bit MCUs continue to be favored for their simplicity and proven performance in embedded systems. A notable trend is the growing use of 8-bit MCUs in IoT edge devices where processing requirements are minimal.

Asia-Pacific As the largest and fastest-growing market for 8-bit MCUs, Asia-Pacific is fueled by massive electronics manufacturing in China, Japan, and South Korea. China alone accounts for over 40% of global demand due to its extensive consumer electronics and appliance industries. While the region is rapidly adopting advanced MCUs for high-end applications, 8-bit MCUs thrive in cost-sensitive mass production of items like remote controls, small appliances, and basic automotive components. Local manufacturers like Nuvoton and China Resources Microelectronics are gaining market share with competitive pricing strategies.

South America The South American market for 8-bit MCUs remains relatively small but stable, with Brazil being the primary adopter. Growth is constrained by economic fluctuations and limited local manufacturing capabilities, though demand persists for automotive aftermarket applications and basic industrial controls. Most supply comes through imports from North American and Asian manufacturers. The region shows potential for gradual growth, particularly if local electronics production expands to serve regional demand more effectively.

Middle East & Africa This region represents an emerging market for 8-bit MCUs, with adoption primarily concentrated in consumer electronics and basic industrial applications. While the market currently represents a small fraction of global demand, increasing urbanization and industrialization in countries like Saudi Arabia and UAE are creating opportunities. The lack of local semiconductor manufacturing means most supply comes through imports, with price sensitivity being a key factor in purchasing decisions. As infrastructure develops, 8-bit MCUs are expected to find growing applications in energy management and building automation systems.

MARKET DYNAMICS

The semiconductor industry continues grappling with the aftereffects of pandemic-era disruptions, with 8-bit MCUs particularly affected due to their mature manufacturing processes. Many 8-bit products are produced on legacy fabrication nodes that receive lower priority from foundries compared to cutting-edge technologies. This has created prolonged lead times exceeding 40 weeks for some popular 8-bit MCU families. While the situation has improved from pandemic peaks, ongoing geopolitical tensions and material shortages maintain pressure on the supply chain.

Manufacturers face difficult trade-offs between transitioning production to newer fabs (increasing costs) versus maintaining legacy production (risking supply reliability). The resulting uncertainty forces OEMs to maintain larger inventories and diversify supplier bases, directly impacting total cost of ownership calculations for 8-bit MCU-based designs.

Developing markets represent a significant growth frontier for 8-bit MCUs as industrialization accelerates across Southeast Asia, Africa, and Latin America. Price sensitivity in these regions makes the cost advantages of 8-bit architectures particularly compelling for applications like appliance control, basic industrial automation, and consumer electronics. Local manufacturers frequently prioritize functional reliability over cutting-edge features, aligning perfectly with 8-bit MCU capabilities. Several leading semiconductor companies are establishing regional design centers to better serve these markets, with customized 8-bit MCU variants appearing tailored to local requirements and voltage standards.

The proliferation of electronics manufacturing in these regions, coupled with government initiatives to build domestic semiconductor expertise, creates a virtuous cycle for 8-bit MCU adoption. Major suppliers report double-digit annual growth in these territories, outpacing more mature markets.

The global 8-bit microcontroller unit (MCU) market continues to demonstrate resilience despite increasing competition from 32-bit alternatives, primarily due to their cost-effectiveness and energy efficiency in simpler embedded systems. Valued at over $2.5 billion in 2024, the sector remains critical for applications where computational complexity takes a backseat to power consumption and unit economics. Recent design innovations have extended the relevance of 8-bit architectures, with modern variants now featuring improved peripheral integration and sleep-mode current draw below 50nA – a crucial factor for battery-operated IoT edge devices representing nearly 30% of new deployments.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=103121

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global 8-Bit MCU Market?

Which key companies operate in Global 8-Bit MCU Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

CONTACT US: City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 [+91 8087992013] [email protected]

0 notes