#Nifty Midcap Select

Explore tagged Tumblr posts

Text

Nifty 50 Stock: How to Track the Nifty 50 Top Gainer Daily

Nifty 50 Stock Masterclass: Track the Nifty 50 Top Gainer with Proven Market Techniques

Discover how to identify the Nifty 50 top gainer using charts, volume, and indicators. Track Nifty 50 Stock trends for smarter, data-driven market decisions. India’s capital markets have entered an age of intelligent investing. With advanced analytics and real-time data access now available to even retail traders, the game has shifted from speculation to strategic interpretation. At the heart of this transformation lies the Nifty 50 Stock index — a mirror of India’s large-cap corporate sector and a barometer of economic momentum.

Every day, one standout performer emerges: the Nifty 50 top gainer. This stock records the highest percentage gain among its 49 peers and signals something deeper than just a spike in price. It often reveals broader themes like sectoral rotation, institutional buying, or macroeconomic optimism.

In this advanced guide, we’ll unpack how to identify, analyze, and leverage the Nifty 50 top gainer using professional-grade methods. Whether you’re an intraday trader, swing investor, or long-term SIP enthusiast, understanding how a Nifty 50 Stock moves — and leads — can dramatically improve your decision-making.

The Core of Indian Equity: Understanding the Nifty 50 Stock Ecosystem

Before diving into indicators and platforms, let’s understand where Nifty 50 Stock fits in the broader market structure:

Nifty 50: The flagship index tracking the top 50 companies by free-float market cap and liquidity on the NSE.

Nifty Next 50: The next 50 largest companies — many of which eventually graduate to the Nifty 50.

Nifty 100 / 200 / 500 / Total Market: Progressive inclusivity across market caps, offering broader exposure.

Specialized indices: Nifty Midcap 100, Nifty Microcap 250, Nifty500 Equal-Cap, Nifty LargeMidcap 250, and others track segment-specific movements.

Understanding these indices helps you observe overlaps — a Nifty 50 top gainer that also features in Nifty 100 or Nifty500 Equal-Cap signals multi-layered buying pressure and cross-index institutional interest.

Why the Nifty 50 Top Gainer Deserves Daily Attention

Tracking the day’s leader within the Nifty 50 Stock universe can offer insights beyond the obvious. That daily movement could be driven by:

A stellar earnings report

Upbeat GDP or inflation data

Sector-wide upgrades

Government reforms or subsidies

Strategic buying by mutual funds, FIIs, or index ETFs

If a stock leads for several sessions in a row, it's often a strong candidate for accumulation. Many of these leaders also see upgrades in weightage within the Nifty 50, further accelerating their visibility and inflow.

Moreover, when the Nifty 50 top gainer triggers movement in related indices like Nifty LargeMidcap 250 or Nifty Midcap Select, you’re seeing real trend propagation.

How to Find the Nifty 50 Top Gainer Using Real-Time Tools

1. Start with Live Data Platforms

NSEIndia.com: Official and most accurate

TradingView: Best for customizable charts

Moneycontrol, Investing.com: Easy-to-use mobile dashboards

Chartink: Great for custom screeners

Steps:

Visit Nifty 50 index page

Sort stocks by % gain (from previous close)

The highest % gainer is the leader for the day

This is your Nifty 50 top gainer, the stock showing the most bullish price action in the short term.

2. Confirm the Move with Volume and Breadth

A real breakout is confirmed not just by price but by volume:

Check if the volume is 2–3 times higher than the 20-day average

Use volume indicators like VWAP, OBV, or Volume Oscillator

Look for accumulation patterns (e.g., higher lows + rising volume)

A price move backed by volume often reflects institutional activity — key to sustained trends in Nifty 50 Stock performance.

3. Validate with Technical Indicators

The right indicators help differentiate noise from opportunity:

RSI (Relative Strength Index): >60 signals trend strength; >80 may suggest overbought

MACD: Look for bullish crossover

VWAP: If price trades above VWAP through the session, strength is validated

ADX: ADX >25 confirms strong directional movement

Pro tip: Set alerts on TradingView when your selected Nifty 50 Stock crosses critical technical thresholds.

4. Moving Averages Provide Trend Context

A strong trend is often confirmed by the moving average structure:

20-day MA: short-term pulse

50-day MA: mid-term trend

200-day MA: long-term signal

Golden Cross (50 MA crossing above 200 MA) = Bullish confirmation

Watch for:

Breakout above all three moving averages

Support retests at 20/50-day MA

Volume confirmation on crossovers

If today’s Nifty 50 top gainer is trading above all key MAs, it’s likely in an established uptrend.

5. Assess Sectoral Momentum

Often, the top gainer belongs to a sector-wide rally. If a PSU bank leads, for example, cross-reference:

Nifty Bank

Nifty PSU Bank

Nifty Financial Services

Sector-specific mutual fund NAVs

Are peers in Nifty Midcap 100 or Nifty Smallcap 250 also gaining? If yes, the move is likely macro-driven — offering multiple trade setups.

6. Perform Multi-Timeframe Analysis

Strong gainers break resistance across:

Hourly charts (short-term confirmation)

Daily charts (trend structure)

Weekly charts (macro breakout potential)

Multi-timeframe alignment boosts trade reliability. When a Nifty 50 Stock rallies across intraday, daily, and weekly charts — especially with volume and news catalysts — it’s often at the start of a longer rally.

7. Cross-Check with Broader Index Participation

Stocks that are also part of:

Nifty Total Market

Nifty500 Multicap

Nifty500 Equal-Cap

Nifty Midcap Select

…enjoy broader mutual fund and ETF inflows. This increases demand, coverage, and ultimately sustainability.

When a Nifty 50 top gainer also leads in other indices, you’re seeing a cross-index breakout — a bullish signal rarely ignored by institutions.

8. Track FII/DII Activity and News Flow

Check sources like:

NSE Bulk/Block Deal Reports

Trendlyne

ET Markets, Bloomberg, CNBC TV18

If a top gainer is part of a bulk deal, a fund house report, or receives a target upgrade from top brokerages, momentum often sustains for days.

Pair this with volume, RSI, and moving averages, and you get a high-probability trade setup around the Nifty 50 Stock.

Why Nifty 50 Top Gainers Can Define the Next Market Leaders

The daily leaderboard isn't just for intraday traders. A Nifty 50 Stock that consistently tops the chart over weeks or months:

Attracts more weight in ETFs

Gains analyst upgrades

Garners rising institutional holding

These stocks often become foundational holdings in portfolios, SIPs, and thematic ETFs. Many started as momentum plays but turned into long-term wealth creators.

How to Integrate Nifty 50 Top Gainer Insights into Your Portfolio

Don’t just watch top gainers — integrate them:

Build a “Repeat Gainers” watchlist

Identify sector themes behind the leader (e.g., EV, infra, banking)

Create ETF/smart-beta strategies (e.g., include leaders from Nifty LargeMidcap 250 or Nifty500 Equal-Cap)

Use for SIP research in direct equity or thematic funds

If a Nifty 50 top gainer reappears over multiple days with cross-index support, it's a candidate for accumulation.

Conclusion: Master the Market by Following the Leaders

In a market flooded with opinions, tracking daily market leaders — specifically the Nifty 50 top gainer — offers clarity. It shows you where money is flowing, which sectors are heating up, and which Nifty 50 Stock is at the front of institutional radars.

Use technicals, volume, multi-timeframe charts, and cross-index support to filter the noise. And when you combine these tools daily, you don’t just react to the market — you anticipate it.

Whether for trading, swing positions, or long-term investments, watching the Nifty 50 Stock leaderboard daily might just be the smartest habit you adopt this year.

#Nifty 50#Nifty Next 50#Nifty 100#Nifty 200#Nifty 500#Nifty Midcap 50#Nifty Midcap 100#Nifty Midcap 150#Nifty Smallcap 50#Nifty Smallcap 100#Nifty Smallcap 250#Nifty Midsmallcap 400#Nifty500 Multicap#Nifty LargeMidcap 250#Nifty Midcap Select#Nifty Total Market#Nifty Microcap 250#Nifty500 Equal-Cap#Nifty 50 stocks#Nifty 50 top gainers#Nifty index#NSE indices#NSE stocks#India stock market#NSE stock list#Nifty stock list#top Nifty stocks#Nifty 50 stock#Nifty 50 top gainer#Nifty 50 companies

0 notes

Text

Donald Trump’s 90-day tariff pause sends GIFT Nifty soaring, signals strong start for Indian markets on April 11

The move, which Trump framed as a response to outreach from over 75 nations seeking talks, was enough to flip investor sentiment overnight.

Indian markets are set for a strong opening on Friday, April 11, with GIFT Nifty trends pointing to a solid gain of 600 points or 2.5 percent, after US President Donald Trump announced a 90-day pause on new tariffs for several countries—triggering a massive rebound in global equities.

The move, which Trump framed as a response to outreach from over 75 nations seeking talks, was enough to flip investor sentiment overnight. The S&P 500 soared 8 percent, the Dow Jones jumped 2,300 points or 7 percent, and the Nasdaq also rose a massive 10 percent.

While the tariff relief was limited to select countries, Trump turned the heat up on China, hiking tariffs on its imports to 125 percent with immediate effect. Despite the US-China tension, the broader relief rally appears to have taken hold for the time being.

Furthermore, RBI’s decision to cut interest rates for a second time in a row will also play its part on April 11 when markets resume after the Mahavir Jayanti holiday on April 10. “The RBI has signalled a decisive pivot towards growth. With inflation expectations anchored—FY26 CPI forecast now revised lower to 4 percent—the central bank has found room to support demand without risking macro stability,” said Anirudh Garg, Partner and Fund Manager at Invasset PMS.

VK Vijayakumar of Geojit Financial Services said that India is likely to be among the least impacted large economies in this “Trump shakeout.” The sharp drop in crude oil prices is also a positive for India.

In today’s session, benchmark indices Nifty and Sensex continued to trade with steep losses on April 9, dragged down by a sharp fall in IT, metal, pharma and PSU bank stocks. The broader market reflected the weak mood, with midcap and smallcap indices falling 0.5 percent and 0.9 percent, respectively. Analysts remain wary of the space, as valuations still haven’t eased.

Among the top gainers on the Nifty were Nestle, HUL, Tata Consumer Products, Titan Company and Power Grid Corp. The biggest losers included Wipro, SBI, L&T, Trent and Tech Mahindra.

Stay ahead of the curve with the latest updates in the share market. Get insights into market trends, stock movements, and key economic factors that impact investments, all brought to you by Intensify Research Services

#accurate stock tips#best bank nifty tips provider#best bank nifty option tips#share market advisory#trading tips#stock cash market tips#ideal strategies#stock tips advisor#ipo alert#ipo news

1 note

·

View note

Text

📊 Stock Market Update 1 August 2025 – India & Global Highlights

Powered by https://tradingpartner.in/

🇮🇳 India Market Snapshot

Sensex: 81,185.58 (↓0.36%)

Nifty 50: 24,768.35 (↓0.35%)

GIFT Nifty: 24,767.00 (↑0.45%)

FIIs: Net selling ₹5,538.2 Cr

DIIs: Net buying ₹6,146.8 Cr

📌 Markets snapped 4-month rally; Trump’s 25% tariff on Indian goods triggered risk-off mood. FIIs continued heavy selling.

🌍 Global Market Overview

US: ▫️ Dow: ↓0.39% | Nasdaq: ↑0.15% | S&P 500: ↓0.12% ▫️ Mixed tone ahead of Fed rate decision

Europe: ▫️ FTSE 100: ↑0.52% | DAX: ↑0.21% | CAC 40: ↓0.037% ▫️ Earnings optimism offsets tariff concerns

Asia: ▫️ Nikkei: ↑1.6% | Hang Seng: ↑0.7% | ASX 200: ↓0.1%

📌 Global sentiment cautious; US–India trade tensions & earnings season in focus

📢 Stocks in Focus

Mphasis: Uptrend resumes; support at ₹2,600, target ₹3,100

Shanti Gold International: IPO listing today; GMP signals 17% premium

M&B Engineering: IPO closes today; 66% subscribed on Day 1

🔍 Key Events & Earnings

Q1 Results Today: ▫️ Adani Power, UPL, Godrej Properties, ITC, MCX, Tata Power, LIC Housing, Delhivery, Graphite India, JK Lakshmi Cement, Safari Industries, Symphony, Tube Investments of India

Post-Market Earnings Highlights: ▫️ Swiggy: Revenue ₹4,961 Cr (↑12.5% QoQ); Net loss ₹1,197 Cr ▫️ Teamlease: Net profit ₹26.5 Cr (↑27.7% YoY) ▫️ Thermax: EBITDA ↑59.5%; Net profit ₹152 Cr ▫️ Coal India: Net profit ₹8,743 Cr (↓8.96% QoQ) ▫️ Eicher Motors: Net profit ₹1,205 Cr (↑9.4% YoY)

IPO Buzz: ▫️ Shanti Gold International lists today ▫️ M&B Engineering IPO closes today

Commodities: ▫️ Gold: $3,329.19/oz (flat) ▫️ Brent Crude: $72.60/bbl (↑0.12%)

📌 Nifty ne 24,600 support hold kiya — 24,900 breakout zone hai. Pharma, infra, and select midcaps showing strength.

0 notes

Text

Sensex, Nifty Open Lower Amid Concerns Over US Tariffs From Aug 1

Mumbai: The Indian frontline equity indices opened in the red on Thursday after US President Donald Trump announced to slap a steep 25 per cent tariff on imports from the country.

At 9:27 am, Sensex was down 487 points or 0.60 per cent at 80,994 and Nifty was down 140 points or 0.57 per cent at 24,717.

Selling pressure was also seen in midcap and smallcap stocks. Nifty midcap 100 index was down 457 points or 0.79 per cent at 57,484 and Nifty smallcap 100 index was down 100 points or 0.55 per cent at 18,037.

“From the investor perspective, it is important to understand that the 25 per cent tariff will come down after the negotiations which start in mid-August. Tariff imposed on India is far higher than the rates reached in trade deals with other countries,” said Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments Limited.

This is the typical “Trumpian strategy” to get better deals from India in other areas and finally settle at a tariff rate around 20 per cent or less.

“Nifty is unlikely to go below the support level of 24,500. Investors can buy the dip focusing on domestic consumption themes, particularly segments like leading private sector banking names, telecom, capital goods, cement, hotels and select autos which have done well in Q1,” he added.

Almost all sectoral indices turned red in morning trade. Auto, energy, pharma, PSU Bank, financial services, metal, realty and PSE were top laggards.

In the Sensex pack, M&M, Bharti Airtel, Reliance, Infosys, HCL Tech, Titan, SBI, TCS, ICICI Bank, Trent, L&T, HDFC Bank and NTPC were top losers. Eternal, Power Grid, Tata Steel, ITC and HUL were top gainers.

In terms of institutional activity, foreign institutional investors (FIIs) extended their selling streak for the eighth consecutive session on July 30, offloading equities worth Rs 850 crore. Conversely, domestic institutional investors (DIIs) maintained their buying momentum for the 18th straight session, purchasing equities worth Rs 1,829 crore on the same day.

0 notes

Photo

Stock markets closed decrease on Wednesday (July 9, 2025) resulting from promoting in IT and oil & fuel shares as traders turned cautious forward of the beginning of earnings season and blended world tendencies. Dragged by late promoting, the 30-share BSE Sensex fell by 176.43 factors or 0.21% to settle at 83,536.08. During the day, it misplaced 330.23 factors or 0.39% to 83,382.28. The 50-share NSE Nifty declined 46.40 factors or 0.18% to finish at 25,476.10. From the Sensex companies, HCL Tech, Tata Steel, Tech Mahindra, Reliance Industries, Bharat Electronics and ICICI Bank had been among the many laggards. Bajaj Finance, Hindustan Unilever, ExtremelyTech Cement and Power Grid had been among the many gainers. “Indian key indices remained largely range-bound, whereas home consumption themes continued to anchor investor sentiment. Despite world commerce tensions and commodity tariffs, investor focus is more and more shifting towards home earnings and structural progress drivers, together with a possible sequential restoration in city demand and a pickup in infrastructure-led spending,” Vinod Nair, Head of Research, Geojit Investments Limited, mentioned. The U.S. has prolonged the suspension of its April 2 reciprocal tariffs till August 1. Shares of mining large Vedanta dropped 3.38% to finish at ₹440.80 on the BSE after U.S. quick vendor Viceroy Research launched a report charging billionaire Anil Agarwal’s mining conglomerate to be “financially unsustainable” and posing a extreme danger to collectors. Viceroy mentioned it was shorting the debt stack of Vedanta Resources, the mother or father firm and majority proprietor of Mumbai-listed Vedanta Ltd, because it launched the 85-page report. Responding to the report, Vedanta in a press release mentioned, “The report is a malicious mixture of selective misinformation and baseless allegations to discredit the Group”. “Markets traded in a risky however in a slender vary and ended marginally decrease, extending the continued consolidation section. While the tariff-related issues linger, the main target now shifts to the earnings season, with IT main, TCS, scheduled to announce its outcomes on Thursday (July 10, 2025),” Ajit Mishra – SVP, Research, Religare Broking Ltd, mentioned. The BSE SmallCap gauge climbed 0.45% whereas midcap index dipped 0.05%. Among BSE sectoral indices, oil & fuel dropped essentially the most by 1.41%. Metal (1.41%), realty (1.40%), BSE Focused IT (0.80%), tech (0.71%) and IT (0.67%) had been among the many losers. FMCG, auto, shopper durables, providers, shopper discretionary and monetary providers had been the gainers. “Indian fairness benchmarks ended decrease on Wednesday (July 9, 2025) as warning persevered amid uncertainty across the India–U.S. commerce deal and the kick-off of the Q1 earnings season,” Gaurav Garg, Lemonn Markets Desk, mentioned. In Asian markets, South Korea’s Kospi and Japan’s Nikkei 225 index settled increased whereas Shanghai’s SSE Composite index and Hong Kong’s Hang Seng ended decrease. European markets had been buying and selling increased. The U.S. markets ended on a flat word on Tuesday (July 8, 2025). Global oil benchmark Brent crude climbed 0.51% to $70.51 a barrel. Foreign Institutional Investors (FIIs) offloaded equities price ₹26.12 crore on Tuesday (July 8, 2025), in accordance with trade knowledge. Domestic Institutional Investors (DIIs), nonetheless, purchased shares price ₹1,366.82 crore. On Tuesday (July 8, 2025), the Sensex rose by 270.01 factors or 0.32% to settle at 83,712.51. The Nifty climbed 61.20 factors or 0.24% to shut at 25,522.50. Read More: https://news.unicaus.in/economy/stock-markets-shut-decrease-amid-warning-forward-of-q1-earnings-it-oil-shares-drag/

0 notes

Text

Navigating Market Highs: Should You Alter Your Mutual Fund Strategy?

Summary:

The Nifty 50 has recently reached new highs, leaving investors questioning whether it’s time to shift their mutual fund strategy. This blog discusses what market highs indicate for your investments and if you should modify your approach or keep following your mutual funds India portfolio.

Navigating Market Highs: Should You Alter Your Mutual Fund Strategy?

Market highs often trigger mixed emotions — excitement, fear, and sometimes confusion. If you’ve been tracking the recent surge in the Nifty 50, you’re probably asking yourself, “Is now the time to change my mutual fund investment strategy?”

This is a very asked question among investors, especially when the market seems to be reaching its top. But before you panic and switch, you might want to know what market highs really are and how you can respond sensibly.

What Does a Market High Mean?

When such indices as the Nifty 50 cross all-time highs, it indicates robust investor confidence and good economic pick-up. But then it is also a warning sign for stretched valuations and a looming correction.

Yet, not every high is a precursor to a near-term market fall. Markets sometimes continue to rise because of superior earnings, policy favor, or international reasons. Hence, reacting in a knee-jerk manner to such highs sometimes tends to hurt your long-term wealth generation.

Should You Rebalance Your Mutual Fund Strategy Now?

The response is based on your goal, risk tolerance, and investment time horizon. If you have a long-time goal, such as retirement or kids’ education, sudden market peaks shouldn’t necessarily get you panicked or out.

Instead, this is the time to look over your portfolio’s balance. Are you over-invested in equities? Have your funds increased beyond your comfort level? These are intelligent questions to be asking.

Maintain Your Investment, But Check Periodically

Discipline is critical with mutual funds India investments. Market timing is notoriously difficult, even for professionals. Maintaining your investment over the swings generally does better than attempting to get in and out.

Instead, try this: periodically check your portfolio with the assistance of a financial advisor firm in India. Experts can advise you on when to rebalance or stand pat, depending on your personal situation.

Diversification is Your Best Friend

One of the easiest methods to survive market peaks is to keep your portfolio diversified among asset classes — equity, debt, and hybrids. This will soften the blow if the markets correct following a peak.

At Future Value, we assist investors in selecting the best mutual fund investments that suit their risk profile and objectives, providing diversification for smoothening volatility.

Look at Systematic Investment Plans (SIPs)

If you fear investing new money at market highs, think about initiating or continuing a SIP. SIPs enable you to invest a fixed sum periodically, smoothing out market fluctuations.

When markets are high, you purchase fewer units; when markets fall, you purchase more. In the long run, this tactic accumulates wealth with less concern over market timing.

Watch Out for Emotional Decisions

Market peaks can at times create fear of missing out (FOMO) or panic selling down the line. Emotional investment is usually the nemesis of good returns.

Before you make a move, stop and refer to your financial investment plan. If you don’t have one, it’s a good time to make one, preferably with advice from experienced advisors or websites such as Future Value.

Finding Mutual Funds to Invest In at Market Highs

Not every fund is similar during high market phases. Large-cap funds can be reasonably valued, but midcap or sector funds may be more speculative.

Conclusion:

A financial advisory company in India or websites like Future Value can assist you in determining which mutual fund to invest in during various market cycles. There should always be a balance of growth possibilities with risk control.

Market peaks such as the current Nifty 50 rally don’t necessarily warrant changing your mutual fund investment strategy. Rather, take time to assess your goals, ensure diversification, and seek experts’ advice for rebalancing. With a solid plan and wise counsel from Future Value, you can ride market peaks in confidence and continue to build your wealth steadily.

0 notes

Text

The Role of FIIs in Indian Markets: Understanding Their Influence and Exit Patterns

Introduction

When Indian markets swing especially sharply one acronym often makes headlines: FII. Foreign Institutional Investors, or FIIs, have long been considered the smart money in Indian equities. Their buying or selling activity can spark rallies, trigger corrections, and sway investor sentiment across the board.

But how much power do FIIs really wield? What drives their decisions to enter or exit? And what can retail investors learn by watching their moves without blindly following them?

In this blog, we explore the role FIIs play in India’s financial ecosystem, how their capital flows influence stock prices, and what their recent patterns in 2025 tell us about global risk perception and domestic market resilience.

Who Are FIIs?

FIIs are large foreign entities such as hedge funds, pension funds, insurance companies, mutual funds, and investment banks that invest in India’s equity and debt markets. They operate through the Portfolio Investment Scheme (PIS) regulated by SEBI and the RBI.

Key characteristics:

• Long-term and short-term positions based on strategy

• Large ticket sizes often in crores or millions of dollars

• Prefer liquid, large-cap stocks and emerging sector leaders

• Sensitive to global cues, currency trends, and policy clarity

Why FIIs Matter in India

India has a relatively open capital market structure compared to other emerging economies. FIIs:

• Own a significant portion of free-float market cap (~20–25% of Nifty stocks)

• Drive price momentum, especially in large caps

• Influence sectoral rotations from banking to tech, from consumption to infra

• Impact the INR-USD exchange rate due to forex inflows and outflows

Their movements are closely tracked not just by analysts, but also by institutional domestic investors and retail traders.

What Drives FII Behavior?

✔ Global Risk Appetite

FIIs chase higher returns, but only when risk is manageable. Rising interest rates in the US or Eurozone can pull FII money out of India toward safer, higher-yielding assets.

✔ Currency Movements

A weakening rupee erodes dollar returns. If the INR falls sharply, FIIs often hedge or exit to protect gains.

✔ Domestic Policy and Reforms

Clarity around taxation, FDI norms, fiscal policy, and corporate governance influences their perception of India’s stability and potential.

✔ Earnings Visibility

If Indian corporate earnings show strong growth with improving margins and guidance, FIIs tend to enter early.

✔ Liquidity and Valuation

FIIs generally avoid frothy markets. If Indian equities are overvalued, or if liquidity dries up globally, they may trim exposure—even if fundamentals remain intact.

Recent FII Trends in 2025

✅ Inflows During Budget Season

FIIs returned aggressively in Q1 2025, attracted by India’s focus on infrastructure, capex, and green energy, as well as better-than-expected GDP data.

❌ Exits Post-Tariff Shocks

Geopolitical tensions and surprise import duty hikes on tech components led to short-term outflows, particularly from tech and consumer sectors.

✅ Selective Re-entry

By mid-2025, FIIs resumed buying in sectors aligned with India’s long-term growth story: banks, capital goods, manufacturing, and renewables.

These flows reflected a “risk-on, reform-aware” strategy—rewarding sectors with clarity and penalizing ambiguity.

FII Influence on Different Sectors

• Banking and Financials: Most sensitive to FII flows. FIIs hold large stakes in HDFC Bank, ICICI, Axis, etc. Even minor exits can drag these stocks.

• IT and Tech: FII-heavy sector. Reacts to global macro, especially US economic outlook.

• FMCG and Pharma: FIIs view them as defensives during risk-off cycles.

• Infra and PSU: Gaining FII traction recently due to policy-led capex focus.

• Small and Midcaps: Less FII participation due to liquidity constraints. More driven by DIIs and retail.

What Retail Investors Can Learn

1. Don’t Follow Blindly

FIIs are tactical. Their objectives and timeframes differ from retail investors. If they sell, it doesn’t always mean a stock is weak it may simply be portfolio reshuffling.

2. Watch the Trend, Not the Noise

A few days of outflows doesn’t spell disaster. Look at 3–6 month trends to gauge FII conviction.

3. Use FII Data for Confirmation

If you’re bullish on a sector and FIIs are accumulating it too, that can validate your view. But don’t make it your only reason to buy.

4. Combine With DII Activity

DIIs (Domestic Institutional Investors) often balance FII volatility. If DIIs are buying while FIIs are selling, markets may remain stable.

5. Keep an Eye on the Rupee

Sharp currency swings often precede FII exits. Stay informed on global interest rates, oil prices, and India’s trade data.

Tools to Track FII Activity

• NSE/BSE Bulletins on daily FII/DII flows

• NSDL and CDSL websites for FPI holdings

• Brokerage reports that analyze sector-specific FII moves

• Apps like Zebu, which integrate live market data with FII trend visuals and alerts

The Long-Term View: Is FII Dominance Fading?

While FIIs remain influential, their relative dominance is declining as:

• Retail participation rises

• SIP inflows stabilize DII power

• Sovereign and domestic wealth funds grow stronger

This makes Indian markets more resilient to FII-led shocks—unlike in the past when exits triggered deep corrections.

But their influence remains critical, especially in price discovery and confidence setting.

Conclusion

Foreign Institutional Investors are like weather systems in the Indian markets they can create storms, offer tailwinds, or pass silently overhead. Understanding their behavior helps investors anticipate changes, but blindly chasing them often leads to poor decisions.

As an Indian investor, it’s better to observe the tide than follow every ripple. Build your strategy on fundamentals, not FII headlines.

Because the best investors don’t just watch what FIIs do. They understand why they’re doing it—and make moves that suit their own journey.

Disclaimer

This blog post is published by Zebu, and is intended solely for informational and educational purposes. The content shared does not constitute investment advice, financial planning, or an offer to buy or sell any financial instruments. The views expressed are based on the author’s interpretation of publicly available information and market trends at the time of writing.

While Zebu makes every effort to provide accurate and up-to-date information, we do not guarantee the completeness, reliability, or suitability of the content for any particular purpose. Investors are strongly advised to perform their own due diligence and consult with certified financial advisors or tax consultants before making any investment decisions.

#zebu#finance#investment#investwisely#financialfreedom#investing#investors#makemoney#investmentgoals#mutual funds

0 notes

Text

Indian Stock Market Today: Nifty 50, Sensex Updates and Key Stock Insights – Kalkine

In the ever-evolving financial environment, Indian stock market today presents a dynamic narrative influenced by domestic and global trends. From shifts in Nifty 50 to fluctuations in NSE Sensex, traders and market watchers remain attentive to real-time developments. The momentum in the Indian stock market news segment reflects the heightened interest in emerging sectors and index movements that dominate headlines.

Broad Overview of Market Sentiment

The stock market India ecosystem has seen varied sentiment as indices like indexnse nifty_50 and the Sensex moved within a narrow range, responding to global commodity prices, monetary policy cues, and quarterly earnings. Amid this climate, stock market research continues to play a pivotal role in guiding decisions across institutional and retail landscapes.

Sector-based momentum in IT, banking, and infrastructure remains visible, while midcaps and smallcaps also attract notable attention. The Indian stock market today observed specific stock actions that contributed to volume shifts, with institutional buying supporting select counters.

Nifty 50 and NSE Sensex Performance Highlights

The Nifty 50 index, a barometer of blue-chip Indian stocks, showed consolidation, with support seen across heavyweight sectors. The NSE Sensex, on the other hand, tracked similar patterns, adjusting to geopolitical concerns and foreign investment flows. Traders referencing indexnse nifty_50 have identified resistance levels, while broader market indicators remain cautiously optimistic.

Real-time updates on Indian stock market news have become critical, with macroeconomic data and central bank commentary influencing daily trades. On the technical front, stock market analysis reveals mixed trends, with chart patterns indicating cautious accumulation in certain large-cap names.

Role of Research and Analytical Tools

As market complexity deepens, the demand for reliable stock analysis websites continues to rise. Identifying trends, support-resistance zones, and breakout setups often requires advanced tools. Platforms ranked among the best stock analysis website options offer comprehensive insights, charting tools, and real-time updates.

Moreover, investors and market participants utilize stock market research to interpret corporate earnings, economic releases, and sectoral shifts. This has amplified the need for structured insights and data-backed interpretations available through credible platforms.

Key Stock Insights and Indian Stock Tips

The spotlight remains on company-specific movements, particularly in energy, pharma, and FMCG sectors. Indian stock tips circulating in the market often stem from technical indicators or fundamental strength. While high-volume trades in midcap counters drew attention, institutional flow supported select large-cap performers.

In the context of Indian stock market today, staying updated on sectoral trends and price movements is essential. Continuous stock market analysis can help identify broader patterns and help navigate changing economic landscapes.

Engage with Informed Market Updates

For those actively tracking the Indian stock market news, gaining access to timely insights is crucial. Whether focusing on Nifty 50, NSE Sensex, or exploring detailed stock market research, reliable information sources are key to making informed decisions.

Discover curated updates, charts, and expert inputs via leading stock analysis websites. Explore Kalkine’s offerings – recognized among the best stock analysis website platforms – for deeper, data-driven perspectives on the stock market India landscape.

Stay ahead in the Indian markets with Kalkine – your trusted resource for real-time updates, deep stock insights, and expert market coverage.

#indian stock market news#stock market research#nifty 50#nse sensex#indexnse nifty_50#stock analysis websites#stock market india#best stock analysis website#indian stock market today#stock market analysis#Indian stock tips

0 notes

Text

Midcap Nifty: Unlocking the Growth Potential of India's Mid-Sized Companies

Midcap Nifty stands as a pivotal index for investors seeking a balance between stability and growth. Representing the performance of India’s mid-cap companies, it offers an attractive alternative to large-cap and small-cap investments. Let’s explore why Midcap Nifty could be the key to building a robust portfolio.

What is Midcap Nifty?

Midcap Nifty is an index that tracks the top-performing mid-cap companies listed on the National Stock Exchange (NSE). These companies typically have market capitalizations between ₹5,000 crores and ₹20,000 crores. As businesses in their growth phase, they strike a balance between high potential returns and moderate risk.

Features of Midcap Nifty

Diverse Sector Representation: The index includes companies from industries such as IT, healthcare, manufacturing, and finance, offering a diversified investment option.

Dynamic Growth Opportunities: Mid-cap companies are often at the forefront of innovation and expansion, providing investors with unique opportunities for wealth creation.

Liquidity and Accessibility: Stocks within the index maintain adequate trading volumes, making them easily accessible for retail and institutional investors alike.

Why Choose Midcap Nifty?

Growth-Oriented Investments: Mid-cap companies are in the sweet spot of business growth, offering higher return potential compared to large caps.

Better Value: Many mid-cap stocks are undervalued gems, providing a chance for investors to capitalize on their growth stories before they become mainstream.

Portfolio Diversification: Including Midcap Nifty in your portfolio ensures exposure to mid-sized companies that can thrive in various economic conditions.

Risks to Consider

Higher Volatility: Mid-cap stocks are more prone to price swings than large caps.

Economic Sensitivity: Mid-cap companies can face challenges during economic downturns due to limited resources.

Lower Visibility: These companies may receive less coverage, requiring deeper research for informed investments.

How to Invest in Midcap Nifty

Index Funds and ETFs: These provide an easy and cost-effective way to gain exposure to the Midcap Nifty index.

Direct Stock Selection: Investors can handpick stocks from the index to build a customized portfolio.

Systematic Investment Plan (SIP): A disciplined SIP approach can help manage risks and average out market volatility over time.

Leveraging Tradetron for Midcap Nifty

Tradetron, a leading algorithmic trading platform, simplifies your investment journey:

Automated Strategies: Use predefined strategies to automate your trades.

Customizable Algorithms: Create algorithms tailored to your risk tolerance and goals.

Backtesting Capabilities: Test strategies against historical data to optimize performance.

Real-Time Alerts: Stay informed about market changes and opportunities.

Midcap Nifty in the Indian Economy

Reflection of Growth Sectors: The index captures the performance of industries driving India’s economic progress.

Potential for Outperformance: Historically, mid-cap indices have delivered higher returns during economic upswings.

Focus on Innovation: Many mid-cap companies invest in research and development, paving the way for long-term success.

Tips for Investing in Midcap Nifty

Research and Analysis: Understand the fundamentals of the companies in the index.

Diversify: Combine Midcap Nifty with large-cap and small-cap investments for a well-rounded portfolio.

Adopt a Long-Term View: Mid-cap investments often require patience to realize their full potential.

Conclusion

Midcap Nifty represents a promising segment of the Indian stock market, offering a compelling mix of growth potential and moderate risk. With the power of advanced tools like Tradetron, investors can craft strategies to make the most of this dynamic index. Whether you're building wealth for the future or seeking diversification, Midcap Nifty deserves serious consideration in your investment plan.

0 notes

Text

SEBI's Move to Remove Weekly Expiry for BANK NIFTY: A Shift Towards Stability in Derivatives Trading

In a landmark decision, the Securities and Exchange Board of India (SEBI) will remove the weekly expiry for the BANK NIFTY index, with today marking the last weekly expiry. The BANK NIFTY, India's largest traded options contract, will now follow a monthly expiry cycle, aligning it with the broader NIFTY index. This move is part of SEBI’s strategy to curb excessive speculation and reduce market volatility, especially given the high-risk, high-reward nature of the banking sector.

Why the Change?

The BANK NIFTY, comprising 12 major banks, has long been one of the most volatile indices on the Indian stock exchanges, offering numerous trading opportunities but also exposing investors to significant risks. Weekly expiries have often led to sharp price swings and speculative trading, which can destabilize the market. By moving to monthly expiries, SEBI aims to reduce this volatility, giving traders more time to assess market trends and protect retail investors from reckless short-term speculation.

Impact on Other Indices

The removal of weekly expiries will not be limited to the BANK NIFTY. Other sectoral indices are also set to follow suit, with MIDCAP SELECT's last weekly expiry on November 18 and NIFTY FINANCIALS' on November 19. This shift marks a broader trend of transitioning to monthly expiries, which is expected to foster a more stable and controlled trading environment.

Implications for Traders

For traders accustomed to the fast pace of weekly expiries, this change will require a shift in strategy. With fewer expirations per month, traders will need to focus more on long-term trends and fundamental analysis, rather than short-term speculative plays. While trading opportunities may decrease in frequency, they could become more sustainable and less volatile.

Conclusion

SEBI’s decision to eliminate the BANK NIFTY’s weekly expiry represents a significant step towards improving market stability and protecting investors. As other indices follow suit, traders will need to adapt to a less frantic, more strategic approach to options trading. While this shift may alter trading dynamics, it ultimately aims to create a more balanced and resilient derivatives market in India.

Stay informed and adjust your strategies accordingly. For more insights into market trends and trading opportunities, visit TradaBulls.com.

0 notes

Text

[ad_1] Understanding choices buying and selling will be difficult, however understanding the basics akin to expiry dates might help merchants navigate by way of it with extra ease. Expiry dates decide when an choices contract will develop into invalid and are essential for planning your buying and selling technique. There are numerous weekly, month-to-month, quarterly, and long-term expiries with distinct benefits and drawbacks. On this article, we’ll discover the assorted varieties of expiry in choices buying and selling that will help you make knowledgeable selections. Sorts of Expiry in Choices Buying and selling One of many basic ideas in possibility buying and selling fundamentals is knowing expiry dates. Choices buying and selling has several types of expiry as beneath: 1. Month-to-month Expiry Month-to-month expiry in choices buying and selling in India refers to contracts that expire on the final Thursday of each month. Merchants use these month-to-month expiries to align their methods with longer-term market actions and traits. The predictability of the month-to-month expiry date permits for higher planning and execution of trades, making it a well-liked alternative amongst those that want a extra prolonged time horizon for his or her choices positions. This sort of expiration is especially essential for managing danger and optimizing returns inside the choices market. 2. Weekly Expiry Weekly expiry in choices buying and selling refers to contracts that expire on particular days of the week, relying on the index or inventory. For example, NIFTY choices expire each Thursday, BANKNIFTY choices each Wednesday, FINNIFTY choices each Tuesday, MIDCAP NIFTY choices each Monday, SENSEX choices each Friday, and BANKEX choices each Monday. This frequent expiry schedule permits merchants to capitalize on short-term market actions and volatility thereby permitting extra alternatives for buying and selling and hedging. Weekly expirations are particularly well-liked amongst energetic merchants who wish to exploit fast market modifications since they provide flexibility in addition to potential fast features. 3. Contract Cycles Contract cycles seek advice from the completely different durations for which choices contracts can be found earlier than they expire. These cycles are categorized into three sorts: Close to Month, Subsequent Month, and Far Month. Close to Month contracts have 30 days or much less till expiry, Subsequent Month contracts have 60 days or much less, and Far Month contracts have 90 days or much less. This classification permits merchants to decide on contracts based mostly on their most popular time horizon and danger tolerance. By providing varied contract cycles, the market offers flexibility for each short-term and long-term buying and selling methods, enabling merchants to align their positions with their market outlook and commerce objectives. Conclusion Understanding the several types of expiry in choices buying and selling might help you make extra knowledgeable selections and align your methods together with your buying and selling objectives. Weekly, month-to-month, and contract Cycles expiries every provide distinctive benefits and dangers, so select the one that matches your wants greatest. For extra complete studying, go for inventory market programs in Hindi and English on Upsurge.membership to deepen your information and improve your buying and selling abilities. [ad_2] Supply hyperlink

0 notes

Text

#Nifty 50#Nifty Next 50#Nifty 100#Nifty 200#Nifty 500#Nifty Midcap 50#Nifty Midcap 100#Nifty Midcap 150#Nifty Smallcap 50#Nifty Smallcap 100#Nifty Smallcap 250#Nifty Midsmallcap 400#Nifty500 Multicap#Nifty LargeMidcap 250#Nifty Midcap Select#Nifty Total Market#Nifty Microcap 250#Nifty500 Equal-Cap#Nifty 50 stocks#Nifty 50 top gainers#Nifty index#NSE indices#NSE stocks#India stock market#NSE stock list#Nifty stock list#top Nifty stocks#Nifty 50 stock#Nifty 50 top gainer#Nifty 50 companies

0 notes

Text

Stock market today: Nifty 50, Sensex fall about half a per cent each on profit booking; M&M, TCS, HDFC Bank top drags

Stock market today: Indian stock market benchmarks ended in the negative territory on Wednesday, July 10, as investors booked profits in select heavyweights, including Mahindra and Mahindra (M&M), TCS and HDFC Bank.

The Sensex opened at its fresh record high of 80,481.36 but failed to hold altitude and declined over a per cent to touch an intraday low level of 79,435.76. The index finally closed 427 points, or 0.53 per cent, down at 79,924.77.

The Nifty 50 also hit its all-time high of 24,461.05 in early deals and fell over a per cent to the level of 24,141.80. The benchmark index ended 109 points, or 0.45 per cent, lower at 24,324.45.

Shares of Mahindra and Mahindra, TCS, HDFC Bank, Reliance Industries and ICICI Bank ended as the top drags on the Nifty 50 index. Mirroring the trends in the benchmark indices, the midcap and smallcap indices also ended in the red. The BSE Midcap index slipped 0.19 per cent, while the BSE Smallcap index dropped 0.69 per cent.

The overall market capitalisation of the firms listed on the BSE fell to nearly ₹450 lakh crore from nearly ₹451 lakh crore in the previous session, making investors lose nearly ₹1 lakh crore in a single session.

Top Nifty 50 gainers today Out of the 23 stocks that ended in the green in the Nifty 50 index, Asian Paints (up 3.27 per cent), SBI Life Insurance Company (up 2.05 per cent) and Divi's Laboratories (up 1.63 per cent) stood at the top.

Top Nifty 50 losers today Shares of Mahindra and Mahindra (down 6.69 per cent), Hindalco (down 2.11 per cent) and Tata Steel (down 2.10 per cent) closed as the top losers in the Nifty 50 index.

0 notes

Text

The Indian stock market ecosystem offers a comprehensive range of investment opportunities, with midcap stocks often standing out due to their high growth potential. The Nifty Midcap Select Index serves as a dynamic representation of this market segment. Keen investors keep a close watch on the index’s day-to-day movements while keeping an eye on the broader economic indicators that influence stock prices.

Decoding the Nifty Midcap Select Index

Typically, the index comprises a basket of diversified mid-size companies boasting robust trading volumes and the potential for significant long-term growth. With this in mind, the Nifty Midcap Select Index can be an attractive investment for those looking to balance their portfolio with companies that are in a phase of dynamic expansion but have not yet reached the summit of their potential.

Portfolio Composition and Market Dynamics

The companies in this index straddle various industries, reflecting the underlying vibrancy of India's economy. These ranges from banking and finance to emerging technology sectors, pharmaceuticals, and consumer services. By tracking their performance, the index presents a microcosm of the Indian market's health.

Leveraging Data to Drive Decisions

In today's information-driven economy, access to timely and detailed data is paramount. While platforms like Finology Ticker offer a snapshot of live index changes and share prices, it's important to look behind the numbers. Understanding trade volumes, analyzing price patterns, and interpreting market sentiment indicators offer deeper insights that can influence investment actions.

Historical Insights

Analyzing historical index data not only helps investors understand past performance but can also inform future predictions. The Finology Ticker, for instance, presents users with a rich historical dataset that can be used to identify trends over time.

Navigating News and Developments

Staying updated with the latest industry news is as crucial as tracking live index data. Company-specific news, regulatory changes, macroeconomic shifts, and international events can all have a significant impact on midcap stocks and, by extension, the index itself.

The Finology Ticker Approach

The approach by Finology Ticker extends beyond merely supplying data. It's an educational platform that combines data, research, and strategic insight to foster intelligent investment choices. By navigating the plethora of resources Finology Ticker offers, investors can approach the Nifty Midcap Select Index with a blend of caution, curiosity, and informed confidence.

In fleshing this out to a full 2000-word article, expand upon these points, adding analysis, anecdotes, and broader context to understand what moves the Nifty Midcap Select Index and how knowledge of these moves can inform better investment strategies.

0 notes

Text

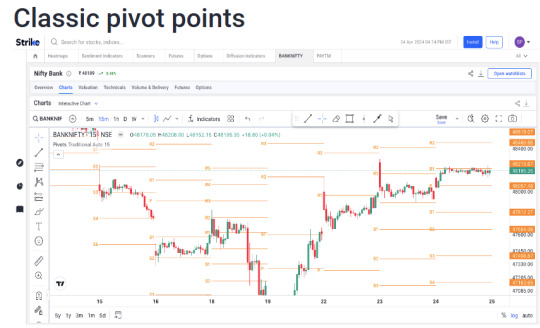

✅ Complete Guide to Pivot Points: How to Use Them in Trading Like a Pro

Ever watched the Nifty 50 bounce off a level like it had a mind of its own? Or noticed how Bank Nifty reversed direction almost perfectly from a certain price? You may be witnessing the power of Pivot Points — one of the most widely used technical tools in the trading world.

This isn't some random line drawn on a chart. Pivot Points are calculated, tested, and used by traders around the globe — from Wall Street to Dalal Street. In this guide, we’ll break down everything you need to know about pivot points, how to use them in real trading, and why even professional traders in India rely on them.

🔍 What Are Pivot Points and Why Smart Traders Use Them Daily

Pivot Points are price levels used by traders to identify potential support and resistance zones. They are derived from the previous day’s high, low, and close — which makes them highly relevant for intraday traders.

They act as psychological markers, signaling where the market could reverse or continue its trend. Originally popularized in the floor trading era of the Chicago Mercantile Exchange (CME), Pivot Points are now used globally — including by Indian traders using Strike Money, TradingView.

📉 Example: On 5th April 2024, HDFC Bank stock showed strong intraday resistance at the daily pivot of ₹1,526. The stock reversed after failing to break that level multiple times — a textbook pivot point reaction.

🧠 How Are Pivot Points Calculated? (And Yes, It’s Simple Math)

The Standard Pivot Point formula is straightforward:

Pivot Point (P) = (High + Low + Close) / 3

From this base point, we calculate:

👉 Resistance 1 (R1) = (2 × P) – Low 👉 Support 1 (S1) = (2 × P) – High

These levels are extended further to R2, R3, S2, and S3 using variations of the range (high-low). Tools like Strike Money and TradingView automate these instantly.

🧪 Real-World Insight: A 2022 research paper by the National Stock Exchange (NSE) observed that stocks tend to respect pivot levels in 68% of intraday moves across midcap and large-cap segments.

🔁 Which Type of Pivot Point Should You Use? Here's the Breakdown

✅ Standard Pivot Points – Best for beginners and general market structure ✅ Fibonacci Pivot Points – Use Fibonacci ratios (0.382, 0.618) to reflect market psychology ✅ Camarilla Pivot Points – Focus on tighter support/resistance for fast-moving stocks ✅ Woodie’s Pivot Points – Give more weight to the closing price, preferred by some day traders

📊 Use Case: During a volatile session in March 2024, Infosys Ltd reversed sharply from the Camarilla L3 level — indicating mean reversion in a ranging market.

Tools like Strike Money allow traders to select these different pivot styles seamlessly, adjusting for volatility or timeframe.

📈 Using Pivot Points in Trading: Not Just Lines, But Strategy

So how do you actually trade with pivot points? Here's how traders apply them across strategies:

🔥 Intraday Range-Bound Strategy Stocks like TCS often trade within pivot ranges during low-volatility sessions. If price hovers between S1 and R1, a range-bound strategy using RSI as confirmation works best.

💥 Breakout Strategy When Bank Nifty opens above the pivot and surges past R1, it often signals a bullish breakout. This move is usually accompanied by volume and may run till R2 or R3.

🔁 Swing Trading with Weekly Pivots Weekly pivots help spot major trend shifts. In early 2024, Reliance Industries bounced off its weekly S1 pivot level, gaining nearly 5% in the following days — ideal for swing entries.

🧠 Combine pivot points with indicators like MACD, RSI, or Moving Averages to filter false signals.

🤔 Pivot Points vs RSI, MACD & Moving Averages: What Works Best?

📍 Pivot Points help identify potential price reversal zones based on past data. 📍 RSI tells you if a stock is overbought or oversold. 📍 MACD signals momentum shifts and moving average crossovers. 📍 Moving Averages smooth out trends over time.

They all serve different purposes. But when used together, they’re powerful. For example, if ICICI Bank hits a pivot support while RSI is below 30 and MACD turns bullish — that’s a solid setup.

According to Investopedia and research by John Person, combining pivot points with momentum indicators enhances entry precision by over 30%.

⚙️ Best Tools to Use Pivot Points in Indian Markets

You don’t need to calculate pivot levels manually. Several charting platforms offer built-in indicators.

📲 Strike Money – Designed for Indian traders, this tool offers clean pivot visualizations and support for Standard, Fibonacci & Camarilla pivots.

📲 TradingView – Global charting platform with extensive pivot scripts

🧪 Tip: Use pivot points with pre-market open levels to plan your trades. Stocks like Titan and Maruti Suzuki show excellent reaction near pivot zones right from market open.

⚠️ Common Mistakes Traders Make With Pivot Points

❌ Blindly placing orders at pivot levels Just because a level is there doesn’t mean price will stop — wait for confirmation.

❌ Ignoring news events Even if a stock sits near pivot S1, a negative earnings report can send it crashing through all levels.

❌ Using pivot points without timeframe context Daily pivots work for intraday, weekly for swing. Don’t mix them up.

⚡ Real Case: On Budget Day 2024, Larsen & Toubro (L&T) blasted through all pivot levels due to policy announcements. Using tight stops and volatility filters is key on such days.

🙋♂️ FAQs: Everything You’ve Wanted to Ask About Pivot Points

📌 Are pivot points better than Fibonacci retracements? Not better — just different. Pivot points give static levels based on the prior day; Fibonacci retracements are dynamic and based on swing highs/lows.

📌 Do pivot points work for crypto trading? Yes. Tools like TradingView allow pivot overlays on Bitcoin and Ethereum charts.

📌 What timeframe is best for using pivot points? Use daily pivots for intraday, weekly for swing, and monthly for positional setups.

📌 Are pivot points reliable? Yes, especially in range-bound markets. But they work best when confirmed with volume, price action, or oscillators like RSI/MACD.

🧭 Real Market Examples Using Pivot Points in India

📍 On 14th Feb 2024, Tata Motors opened near the daily pivot of ₹925. After testing support at S1 (₹918), it reversed sharply, closing the day at ₹935 — a perfect long opportunity.

📍 Nifty 50 Futures respected its weekly pivot level of ₹21,530 multiple times in March 2024. Traders using the Strike Money chart spotted this and positioned accordingly.

📍 During the Q4 results in April, Infosys broke below its S2 level post-earnings, dropping nearly 4%. A textbook example of a breakdown continuation through pivots.

🧠 What the Research Says About Pivot Points

🎓 A 2021 study by University of Illinois revealed that pivot-based levels coincide with significant liquidity zones — especially during the first hour of trading.

📈 NSE’s internal research shows pivot levels impact short-term price behavior in over 65% of stocks in the F&O segment.

🧑🏫 Veteran trader John Person, in his book "Candlestick and Pivot Point Trading Triggers", emphasizes combining candlestick patterns with pivot zones for enhanced accuracy.

✅ Should You Add Pivot Points to Your Trading Toolkit?

If you're an intraday or swing trader in the Indian stock market, ignoring Pivot Points is like ignoring speed breakers on a road — you're bound to hit something you didn’t expect.

They provide clarity, structure, and objectivity — especially when used on platforms like Strike Money, which visualizes pivots with market responsiveness.

Combine Pivot Points with strong indicators, volume confirmation, and market news — and you’ll trade with more confidence and less guesswork.

🎯 Ready to Level Up Your Trading? Try setting up Pivot Points today on Strike Money or TradingView, test them for a week, and you’ll see how these invisible levels often become the market’s most visible reaction zones.

0 notes

Text

10 Best Mutual Funds for Next 10 Years

One of the best ways to create wealth is to invest in mutual fund schemes. In the medium to long term, these can fetch good returns. However, investors should consider selecting funds based on their financial goals, risk appetite and tenure of the investment. In this article we would provide the list of 10 Best Mutual Funds for Next 10 years to invest in India.

Why to invest in Mutual Funds?

Before getting into the specific list of mutual funds to invest for next 10 years, let us understand the fundamentals of mutual funds. While there are several investment options, mutual funds has been gaining prominence in the last few years. Some of the mutual funds have generated 10x to 12x returns in the last 10 years. Mutual Funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities, managed by professional fund managers.

What are the benefits of investing in mutual funds?

- Diversification: Mutual Funds does not invest in single stock or bond. They spread the investment across various assets which helps to reduce the risk. - Professional Management: Expert fund managers make informed investment decisions on your behalf. - Liquidity: Investors can buy and sell mutual fund units based on NAV (Net Asset Value) at any given point of time except where there is lock-in period. - Transparency: Fund houses keeps providing updates on the portfolio. - Affordability: Investors can invest as low as Rs 500 in mutual funds. In some funds they can invest even as low as Rs 100.

What is the Economic Outlook for India?

Before identifying the best mutual funds for the next 10 years, let's assess the economic landscape of India and key factors shaping its growth. - Demographic Dividend: With a young and dynamic population, India enjoys a significant demographic advantage, fueling consumption and economic growth. - Infrastructure Development: Government initiatives and investments in infrastructure projects aim to enhance connectivity, spur economic activity, and attract investments. Our recommended Infrastructure mutual funds in 2022 have doubled in the last 2 years. - Digital Transformation: The rapid adoption of digital technologies is revolutionizing various sectors, boosting efficiency and innovation. - Emerging Sectors: Industries such as renewable energy, healthcare, and e-commerce present lucrative opportunities for investors, driven by evolving consumer preferences and technological advancements.

Best Mutual Funds for Next 10 Years to Invest in India:

Now, let's explore the top 10 mutual funds to invest for next decade, considering factors such as historical performance, fund management expertise, and investment strategy. We have provided 2 table, one based on annualized returns and second based on SIP returns. One can use them like a model mutual fund portfolio for investments.

Best Mutual Funds for Next 10 Years – Annualised Returns

Category Mutual Fund Name 3 Yrs 5 Yrs 10 Yrs Index / Largecap UTI Nifty 50 Index Fund 16.2% 14.8% 13.8% Index / Largecap UTI Nifty Next 50 Index Fund 23.2% 19.0% NA Index / Largecap Nippon India Largecap Fund 26.8% 18.8% 18.4% Index / Largecap Baroda BNP Paribas Large Cap Fund 19.8% 18.0% 16.2% Midcap / Smallcap Quant Mid Cap Fund 38.3% 35.3% 21.9% Midcap / Smallcap SBI Small Cap Fund 25.4% 26.8% 27.2% Flexicap Parag Parikh Flexi Cap fund 22.7% 24.5% 20.0% Flexicap Quant Flexicap fund 32.5% 32.0% 24.3% Hybrid ICICI Prudential Equity & Debt Fund 26.2% 26.0% 19.8% International Motilal Oswal Nasdaq 100 FoF 12.0% 21.8% NA

Best Mutual Funds for Next 10 Years – SIP Returns

Category Mutual Fund Name 3 Yrs 5 Yrs 10 Yrs Index / Largecap UTI Nifty Index Fund 15.8% 18.0% 14.3% Index / Largecap UTI Nifty Next 50 Index Fund 30.5% 25.7% NA Index / Largecap Nippon India Largecap Fund 28.0% 26.7% 18.3% Index / Largecap Baroda BNP Paribas Large Cap Fund 24.4% 22.8% 17.0% Midcap / Smallcap Quant Mid Cap Fund 42.2% 42.6% 26.5% Midcap / Smallcap SBI Small Cap Fund 25.8% 30.1% 23.6% Flexicap Parag Parikh Flexi Cap fund 24.7% 26.8% 20.9% Flexicap Quant Flexicap fund 34.0% 38.0% 25.4% Hybrid ICICI Prudential Equity & Debt Fund 26.2% 26.8% 19.1% International Motilal Oswal Nasdaq 100 FoF 19.2% 19.9% NA

Investment Strategies for Long-Term Growth:

While selecting mutual funds for the next 10 years, it's crucial to adopt a disciplined investment strategy aligned with your financial goals and risk tolerance. - Asset Allocation: Diversify your portfolio across asset classes to mitigate risk and enhance returns. - Systematic Investment Plan (SIP): Invest regularly through SIPs to benefit from rupee cost averaging and harness the power of compounding. One can easily make out 1 Crore with 5,000 per month SIP investments. - Stay Informed: Keep an eye on market developments, economic indicators, and fund performance to make informed investment decisions. - Review and Rebalance: Periodically review your investment portfolio and rebalance it to maintain optimal asset allocation and adapt to changing market conditions.

FAQs (Frequently Asked Questions):

To address common queries regarding mutual fund investments, here are some frequently asked questions along with detailed answers: 1. What are the key factors to consider when selecting mutual funds for long-term investment? First step is to consider financial goal, risk appetite and tenure of investment. As a second step, when selecting mutual funds for long-term investment, consider factors such as historical performance, fund manager expertise, investment strategy, expense ratio, and risk-adjusted returns. 2. How can I assess the risk associated with mutual fund investments? You can assess the risk associated with mutual fund investments by analyzing factors such as the fund's investment objective, asset allocation, portfolio diversification, and historical volatility. 3. Is it advisable to invest in sector-specific mutual funds for long-term growth? Investing in sector-specific mutual funds can be risky as it exposes your portfolio to concentration risk. It's advisable to opt for diversified equity funds with exposure to multiple sectors for long-term growth. 4. What role does inflation play in mutual fund investments? Inflation erodes the purchasing power of money over time, affecting the real returns on your investments. It's essential to choose mutual funds that offer returns exceeding the inflation rate to preserve and grow your wealth. Investors should periodically check and should not end up in investing in bad funds which we indicated in our Worst Performing Mutual Funds in the last 10 year. 5. How often should I review my mutual fund investments? It's recommended to review your mutual fund investments periodically, typically every six months to a year, to ensure they remain aligned with your financial goals and risk tolerance. Make adjustments as necessary based on changes in market conditions or your investment objectives. 6. Can mutual funds help me achieve my long-term financial goals such as retirement planning? Yes, mutual funds can play a crucial role in helping you achieve long-term financial goals such as retirement planning by offering the potential for capital appreciation and regular income through systematic investments over time. They should also build strategy and opt for Two Bucket Strategy of Investment which can help them to get maximum benefit. Conclusion: In conclusion, selecting the best mutual funds for the next 10 years requires careful consideration of various factors, including economic outlook, fund performance, and investment strategy. By diversifying your portfolio across equity funds, adhering to a disciplined investment approach, and staying informed about market trends, you can build a robust investment portfolio geared towards long-term growth and wealth creation. Read the full article

#10MutualFundsforNext10Years#MutualFunds#MutualFundstoinvestfornextdecade#TopMutualFundsfornext10years

0 notes