#OptionTrading

Explore tagged Tumblr posts

Text

Have you ever been tracking a stock, watching its price climb or fall rapidly, only for trading to suddenly halt? That's a Traders' Circuit in action. It's a mechanism built into our stock exchanges, like the NSE and BSE, to manage extreme volatility and protect investors from sharp, unchecked price movements. Think of it as the market's own circuit breaker, designed to prevent a fuse from blowing when the voltage gets too high or too low.

0 notes

Text

Unveiling 7 Best Option Trading Course in India 2025

Option Trading Tick has emerged as a lucrative avenue for investors seeking to maximize profits and manage risks effectively in the dynamic world of financial markets. In India, the demand for comprehensive options trading courses has surged, catering to both novice traders and seasoned investors. So, Best Option Trading Course in India is comprehensive guide, we delve into the top 7 option trading courses available in India for 2024, offering a detailed analysis of each course’s features, curriculum, and value proposition.

What Is Option Trading?

Option trading refers to the buying and selling of options contracts, which give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price (known as the strike price) within a predetermined time frame. Option trading allows investors to profit from price movements in the underlying asset without having to own the asset itself, offering flexibility and leverage in their investment strategies.

7 Best Option Trading Course in India:

1. Advanced Options Trading Mastery

Option trading course offers a deep dive into advanced option trading strategies, focusing on complex concepts such as butterfly spreads, iron condors, and straddles. With a blend of theoretical insights and practical application, students gain a comprehensive understanding of risk management and profit generation in volatile market conditions. One of 7 best option trading course in India.

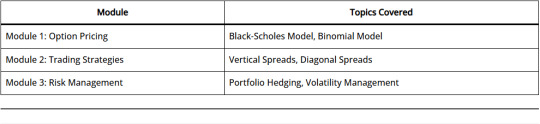

Table: Sample Curriculum Overview

2. Options Trading Bootcamp

Geared towards beginners, option trading course provides a foundational understanding of options trading, covering essential topics such as option pricing, strategies for income generation, and risk mitigation techniques. Through interactive sessions and real-life case studies, participants gain the confidence to execute trades effectively in diverse market conditions. Second best option trading course in India.

Table: Key Learning Objectives

3. Technical Analysis for Options Trading

Best Option Trading course in India focuses on leveraging technical analysis techniques to identify profitable options trading opportunities. Through in-depth chart analysis and trend identification, participants learn to make informed decisions while executing option trades, enhancing their probability of success in the market. Third and best option trading course in India.

Table: Sample Course Modules

4. Options Trading Fundamentals

Option trading course are designed for beginners and intermediate traders, this course provides a comprehensive overview of options trading fundamentals, including option pricing models, volatility analysis, and popular trading strategies. With a focus on practical application, participants develop a strong foundation to navigate the complexities of the options market confidently. Fourth best option trading course in India.

Table: Curriculum Highlights

5. Options Trading Masterclass

Option trading course with comprehensive masterclass covers a wide range of topics, including advanced options trading strategies, risk management techniques, and portfolio optimization strategies. With personalized coaching and interactive sessions, participants gain practical insights into executing profitable trades in the options market. Fifth best option trading course in India.

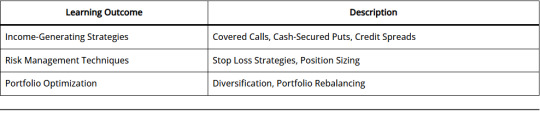

Table: Course Overview

6. Options Trading for Income

Option trading course are targeted towards investors seeking to generate consistent income through options trading, this course explores various income-generating strategies such as covered calls, cash-secured puts, and credit spreads. Participants learn to capitalize on market volatility while minimizing downside risks, thereby enhancing their overall portfolio returns. Sixth best option trading course in India.

Table: Key Takeaways

7. Options Trading Certification Program

Option trading course are comprehensive certification program covers a wide spectrum of topics, including option pricing models, advanced trading strategies, and risk management techniques. With a focus on hands-on learning and practical application, participants develop the skills and expertise required to navigate the complexities of the options market confidently. Seventh best option trading course in India.

Table: Program Highlights

Option Trading Books:

Some best option trading course books in India that are certainly highly regarded:

“Option Trading: Bear Market Strategies” by Ajay Jain: This book focuses on strategies specifically designed for bearish market conditions, which can be particularly useful in volatile markets like those often found in India.

“Options as a Strategic Investment” by Lawrence G. McMillan: This is often considered the bible of options trading. It covers a wide range of strategies and provides comprehensive insights into the world of options.

“Option Volatility and Pricing: Advanced Trading Strategies and Techniques” by Sheldon Natenberg: This book is great for understanding the theoretical aspects of options pricing and volatility. It’s well-regarded for its clear explanations and practical examples.

“Trading Options Greeks: How Time, Volatility, and Other Pricing Factors Drive Profits” by Dan Passarelli: This book focuses on understanding the Greeks (Delta, Gamma, Theta, Vega) and how they affect option pricing and trading strategies.

“The Bible of Options Strategies: The Definitive Guide for Practical Trading Strategies” by Guy Cohen: This book offers a wide array of strategies, ranging from basic to advanced, with detailed explanations and real-world examples.

“Options Trading: The Hidden Reality” by Charles M. Cottle: Cottle, also known as Risk Doctor, provides insights into the realities of options trading, emphasizing risk management and practical strategies.

“A Beginner’s Guide to Options Trading: Unlocking the Secrets of the World’s Most Versatile Investment Strategy” by Matthew R. Kratter: As the title suggests, this book is great for beginners, offering a straightforward introduction to options trading concepts and strategies.

Remember, while books are excellent resources, practical experience and ongoing learning are key to mastering options trading. It’s also advisable to complement book knowledge with real-world trading experience and staying updated with market trends and developments.

Option Trading Strategies:

Option trading strategies encompass a wide range of approaches aimed at achieving specific investment objectives while managing risk effectively. Some popular strategies include:

Covered Call Strategy: Involves selling call options on a stock while simultaneously holding a long position in the underlying asset.

Protective Put Strategy: Involves purchasing put options to hedge against potential downside risk in an existing stock position.

Bullish Spread Strategies: Include strategies such as bull call spreads and bull put spreads, designed to profit from upward price movements in the underlying asset.

Bearish Spread Strategies: Include strategies such as bear call spreads and bear put spreads, aimed at profiting from downward price movements in the underlying asset.

Straddle and Strangle Strategies: Involve purchasing both call and put options simultaneously to profit from significant price movements in either direction.

CONCLUSION:

In conclusion, mastering best option trading course in India requires a combination of theoretical knowledge, practical skills, and hands-on experience. By enrolling in one of the top 7 option trading courses outlined above, investors and traders in India can gain the expertise and confidence needed to navigate the complexities of the options market successfully. Whether you’re a beginner looking to build a strong foundation or an experienced trader seeking for best option trading course in India must join ISMT.

By ENQUIRE in a reputable ISMT Best Stock Market Course In India (Varanasi) provides both Online & Offline courses to gain knowledge and skills in the world of trading and investment.

#optiontrading#stockmarketindia#tradingcourse#learntrading#indiainvesting#financialliteracy#tradingtips#investmenteducation#stocktradingcourse#optionsstrategies#learnfromismt#ismtinstitute

0 notes

Text

Global Market Update's 2 Aug 2024 #equinivesh #lalhai #gapdown #GIFTNIFTY #Zomato #worldmarket

0 notes

Text

0 notes

Text

Common Options Trading Mistakes to Avoid

If it has its limitation Options Trading can prove to be an extremely lucrative endeavor. Whether you're a beginner or experienced trader and your success can be greatly affected by avoiding frequent mistakes. Here are seven frequent mistakes in options trading to stay away from. Ø Limited vocabulary

Stepping into options trading without an in-depth comprehension about the way they operate is one of the worst blunders one can make. Understanding the basic elements of options, like the variations in calls and puts, strike prices, and expiration dates, is essential before start a trade. The Lack of understanding can result in incorrect decisions & large loss Ø Disregarding the Greeks For options investors, the Greeks—Delta and Gamma and Theta & Vega & Rho—are crucial resources. They aid in calculating risk and possible gain. Ignoring these measures can allow you to mistake how time decay, volatility and price variations will affect your options positions. You may effectively oversee your portfolio and make decisions with greater accuracy if you understand the Greeks.

Ø Excessive Leverage Overleveraging is a typical practice that may escalate losses. Leverage boosts the prospect of serious losses even though it might add up benefits. It's necessary to practice cautious when utilizing leverage and making sure there's a risk management plan in place. Overleveraging may end up in margin calls and an immediate theft of trading capital.

Ø Inadequate Risk Taken Care of One major blunder that people make when trading options is not minimizing risk. Make sure are aware exactly how much risk one is willing to take on each deal. This entails establishing and following stop-loss orders. Effective risk management safeguards your assets safe and insures that no trade is going to have a catastrophic effect on your portfolio. Ø Surviving Losses It is always certain to make more riskier trades in an attempt to recoup losing capital—a technique known as "chasing losses." The emotional reaction has the potential to quickly spiral out of hand and cause even worse losses and Rather & admit that losses are a part of trading & follow to your risk management and trading approach.

Ø Excessive Trading Another classic fault that can reduce earnings and enhance transaction costs is overtrading. Having the weak trading plan or being anxious are common causes of trading too frequently. the transaction need to be supported by a well-defined strategy and extensive study. Excessive trading might end in major financial losses and burnout. Ø Refusing the Examination of Trades

You could risk not being able to learn from your setbacks and success if you neglect to look back and study your deals. and Establishing a trading log facilitates tracking of results of identifying trends, & method refinement. Reviewing your trades on occasion helps you become a more disciplined and profitable trader by offering you substantial insight into when's functioning and what isn't.

Conclusion

The Trading Options can be effective but it's vital to stay steer clear of prevalent faults that could ruin your chances of success. You can raise your chances of succeeding in trading by learning more, and reducing risk Recall how successful options trading desires regular training and adjustments. If you stay away from these seven usual blunders, you will likely have no problem advancing as an options trader.

click > #Open Option Trading Account

#stockmarket#best stock market advisor#motilal oswal#investment#india#invest#broking firm#best stock trading apps in india#news#best stock market in rajasthan#Stocktrading#optiontrading#newsarticle

1 note

·

View note

Text

#nifty#backtesting#nifty50#banknifty#free nifty backtesting#option backtesting#optiontrading#option trading tips#option trading strategy#option trading for beginners#option trading in hindi

1 note

·

View note

Text

Best Option Trading Telegram Channels

If you’re confused about which skills to learn in 2024 to earn up to Rs 50,000 a day, trading can be a great way to make good money. You might be wondering how to learn trading. This article has the solution for you! I’ve put together a list of the Best Telegram channels for option trading in 2024.

Top 10 Telegram channels for Option Trading

1.Honest Stock Traders 2. Trading Master 3. Trade Onomics 4. Ghanshyam tech Analysis 5. Option Trading Masters 6. Option Tradex 7. NSE STOCK PRO 8. Mehul Option Trading 9. Stock market Ninjas 10. Stockpro Official

Best Telegram Channels for Option Trading in 2024 (Free Calls)

Honest Stock Traders

If you’re not very familiar with option trading but still want to make money from it, consider joining the Honest Stock Traders channel. Here, you’ll get free option trading calls, trading setups, and chart analysis for Bank Nifty and Nifty. With over 31k subscribers, this channel provides valuable insights at no cost.

Option Trading Bulls

Option Trading Bulls is a legit Telegram channel that offers investment ideas, free Banknifty option calls, and detailed information on stock, equity, future, and options trading. With over 20k members, this channel can help you recover your losses.

Stock Market Ninjas

Stock Market Ninjas is a SEBI-registered Telegram channel that offers trading tips for option trading, crypto trading, intraday trading, and swing trading. The owner has a lot of experience in trading, making it a great resource if you want to learn how to make money from trading.

Bull vs Bears Traders

Bull vs Bears Traders helps you set targets and achieve daily profits of Rs 3000 to 5000+. It offers live chart analysis, ideal setups for trading, buying, and selling ideas, along with free Bank Nifty calls. Join now to increase your profits.

Trading Wallah

Trading Wallah is famous for option trading. It provides stock market views, Nifty investment calls, chart indicators, and free trading calls. There’s also a premium membership plan available.

Stock Gainers

Stock Gainers is a popular SEBI-registered Telegram channel offering free materials on stock market and option trading calls. You get 1–2 intraday option trading calls with proper strategies. With over 80k members, this channel can help you make over 10k profit daily.

Option Trading Hub

This channel provides free stock market tips, trading tips, and free intraday calls. They also offer premium services like live training and free webinars. If you want to invest your money wisely in 2024.

StockPro®Official (SEBI Registered)

StockPro Official, run by Seema Jain, is a trusted SEBI-registered channel. It offers free Bank Nifty training and free videos on share market and trading on YouTube. With over 300k members, it’s a great community to join if you want to learn and trade.

Growth Trading

Growth Trading is a great channel to learn about investing in trading. It offers regular intraday trading tips on equity, futures, options trading, and stock market news. If you want 1–2 free calls daily with 90% accuracy.

Trading Phoenix

Trading Phoenix covers option trading, intraday, crypto, and swing trading. It’s one of the fastest-growing channels, offering investment and financial advice.

Option Trading Masters

Option Trading Masters is an authentic channel focused on educating beginners. It provides detailed information on stock market and trading, along with free trading calls, Bank Nifty calls, chart analysis, and risk management services.

GHANSHYAM TECH ANALYSIS

GHANSHYAM TECH ANALYSIS provides free Bank Nifty, intraday, and option trading calls. It also offers free YouTube videos for beginners to learn trading in simple language. For stock market tips, free trading knowledge, and more

Elite Traders

Elite Traders offers information on the stock market, trading, business news, and investment ideas. It provides Nifty and Bank Nifty calls, intraday calls, and stock options calls.

Option Trade Order

Option Trade Order is a great channel for short-term or long-term investment ideas. It provides fundamental stock market analysis, free investment ideas, risk management, and chart analysis. With over 40k active members, this channel is worth joining.

Option Trading Gainers

If you want to build a career in the stock market and trading, this channel offers online trading classes. It covers chart analysis, risk management, and more. Join today to learn trading from start to finish.

Bull’s Thrive

Bull’s Thrive is a fast-growing channel known for its option trading tips and tricks, free live chart analysis, and ideal setups for trading. Join this channel in 2024 to make money from trading.

Market Master

Market Master is a SEBI-certified channel that helps you become financially free. It offers various investment ideas, stock market research, Bank Nifty, expiry levels, breakouts, and more.

0 notes

Text

2023's Top Large Cap Gainers Revealed! See the biggest winners and their explosive returns!

0 notes

Text

Top Gainers and Losers today on 13 March, 2024: ITC, ICICI Bank, Power Grid Corporation Of India, Coal India among most active stocks; Check full list here

Top Gainers And Losers in the stock market today were as follows: The Nifty closed at 22335.7, down by 1.51%. Throughout the day, the Nifty reached a high of 22446.75 and a low of 21905.65. Similarly, the Sensex traded between 74052.75 and 72515.71, closing 1.23% down at 73667.96, which was 906.07 points below the opening price. The midcap index underperformed the Nifty 50, with the Nifty Midcap 50 closing 3.86% down. Additionally, small cap stocks also underperformed the Nifty 50, as the Nifty Small Cap 100 ended at 15092.1, down by 797.05 points and 5.28% lower. The Nifty 50 has provided the following returns:

In the last 1 week: -2.21%

In the last 1 month: 1.08%

In the last 3 months: 5.02%

In the last 6 months: 9.5%

In the last 1 year: 28.11%

www.optionperks.com

0 notes

Text

Pre Opening Session Updates 24 JULY 2024 #Equinivesh Mostly Indices In Red #equinivesh#GIFTNIFTY#Budget2024#sharemarket#TaxTerrorism, #nirmalasitharamanspeech#nirmalasitharaman शेयर मार्केट निर्मला ताई #GOLD

0 notes

Text

Trading is not just a skill; it's an art. Learn the art of trading from our experienced professionals and elevate your trading game! 🎨💹

#TradingArt#ForexSkills#ExpertTraders#great#fuel#journey#optiontrading#Bettelful#sushi#AsLaz#lifeskills#life lessons#connection#thinking#existence#life series#secret life#lifestyle#life#life quotes#reality#home & lifestyle#heal#motivation#experience#focus#spiritual journey#journey to the west#frieren: beyond journey's end#a journey to love

0 notes

Text

#nifty50#nifty#banknifty#Backtesting#free backtesting#option backtesting#free option backtestng#nifty backtesting#nifty option backtesting#free nifty backtesting#optiontrading#option trading tips

0 notes

Text

What is a bear market?

A bear market is a financial market condition characterized by falling prices for a particular asset class or a group of assets, such as stocks, bonds, or real estate. It is typically associated with pessimism, investor anxiety, and expectations of future price declines.

In a bear market:

Falling Prices: The prices of securities or assets are generally trending downward over an extended period. This can be driven by factors such as economic recession, rising interest rates, or negative market sentiment.

Investor Caution: Investors are often concerned about the future of the market and may sell assets or refrain from buying, expecting that prices will continue to fall.

Reduced Trading Activity: Bear markets can see reduced trading volumes as investors become more risk-averse and less willing to participate in the market.

Economic Challenges: Bear markets are often associated with economic challenges, including high unemployment rates, declining corporate earnings, and economic uncertainty.

Bearish Sentiment: Financial news and commentary tend to be negative, and there is a general belief that the market will continue to decline.

Bear markets can last for varying durations, ranging from several months to several years. They can be triggered by a variety of factors, including economic downturns, financial crises, geopolitical events, or shifts in investor sentiment. Bear markets can result in significant losses for investors, which is why it's important for investors to have a diversified portfolio and a well-thought-out investment strategy that includes risk management.

It's worth noting that the term "bear market" is most commonly used in reference to stock markets, but it can be applied to other asset classes as well. Eventually, bear markets may transition back into bull markets as economic conditions and investor sentiment improve.

#stockstowatch#StockMarket#StockMarketIndia#StockMarketCrash#Nifty#BankNifty#SGXNIFTY#Sensex#ShareTrading#OptionTrading#FnoTrading#StockUpdate#MarketUpdate

0 notes

Text

youtube

10 Golden Rules of Option Psychology with Bharti Share Market.

0 notes

Text

Formulating Market Strategy: Key Points for TraderPearl

In the ever-changing world of stock markets, traders like TraderPearl are always on the lookout for winning strategies to deal with the complexities and make smart decisions. To help marketers like you succeed, we've compiled a list of essential product marketing strategies and key points to keep in mind. 1. Understand your risk tolerance:

Before investing in the stock market, evaluate your risk tolerance. This will help you decide your investment style, whether you are a conservative investor or a risk taker like TraderPearl. 2. Diversification is key:

Spread your investments across different sectors and asset classes to reduce risk. Diversification can help protect your portfolio during market downturns. 3. Stay informed: Follow financial reports and market trends regularly. TraderPearl's success is often attributed to its keen awareness of market development. 4. Set clear goals:

Define your financial goals and time limits. Are you looking for short-term gains or long-term wealth accumulation? Your goals will shape your business strategy. 5. Risk Management:

Use stop-loss orders to limit potential losses. TraderPearl is the owner of risk management, ensuring that no single trade can delete an important part of its portfolio. 6. Technical Analysis:

Learn the basics of technical analysis, such as charting patterns, support and barrier levels. TraderPearl often relies on these factors to make entry and exit decisions. 7. Basic analysis:

Understand the financial health of the companies you are investing in. Analyze factors such as benefits, cost levels and competitive conditions. 8. Patience Pays: Success in marketing is not a sprint but a marathon. TraderPearl's persistence in maintaining winning positions is a hallmark of its strategy. 9. Keep your feelings:

Emotional decisions can lead to destruction. Stick to your marketing plan and avoid aggressive behavior. 10. Learn from mistakes: - Mistakes are part of the learning process. Review your losses so you don't do the same thing. 11. A major accident turns: - calculate the dangerous story before entering the business. Good description supports those who can tolerate the disadvantages. 12. Stay hydrated: - Always have money for opportunities that may arise. TraderPearl is known for its ability to enter undervalued stocks. 13. Next step: - Consider the process that follows the plan. Marketing with practice can increase your chances of success. 14. Continuing education: - The product market evolves, and you do. Invest in your education and update yourself with new business techniques. 15. Beware of over-selling: - Overtrading can result in excessive work and losses. TraderPearl avoids this by carefully selecting its trades. 16. Taxation: - Understand the tax implications of your business. Effective tax planning can save you money in the long run. 17. Manage Business Journals: - Record your transactions, plans and results. This will help you identify trends and improve your decisions over time. 18. Review your portfolio regularly: - Review the performance of your portfolio periodically. Adjust your strategy as necessary to achieve your goals. 19. Long term investment: - Consider part of your portfolio for long-term investment. TraderPearl handles short-term trading and solid long-term investment strategies. 20. Network and learn from others: - Connect with other customers, attend conferences and join online forums to exchange ideas and get information. TraderPearl's success in the market is not just about luck; it is the result of a well-thought-out strategy and commitment to continuous improvement. By integrating these points into your trading strategy, you can increase your chances of achieving your financial goals and become a successful trader like TraderPearl.

#TradingStrategies#StockMarketTrading#OptionTrading#SwingTrading#WinningStrategies#TraderPearl#MarketStrategy#StockMarketStrategy#ComplexMarkets#EverchangingTrading#Please

1 note

·

View note