#PCM cold chain

Explore tagged Tumblr posts

Text

How PCM is Making Shipping Containers Smarter, Cheaper, and Cooler

Introduction:

Moving goods like food, medicines, and frozen items from one place to another requires a strong cold chain. Shipping containers are a big part of this system. They keep products fresh during long journeys.

But there’s a problem: Keeping containers cold costs a lot of money. Especially during the time when containers are waiting, either at warehouses, loading docks, or ports.

That’s where a smart cooling solution called Phase Change Material (PCM) can make a big difference. PCM helps shipping companies save money, use less fuel, and keep products safe, even when power is not available.

Let’s see how.

The Hidden Costs in Shipping Cold Products

Most people think the real cost of shipping comes from the long ocean journey. But the truth is, a lot of money is spent before and after the ship moves.

We call this the first mile (pickup to port) and the last mile (port to destination).

Here’s why these two parts are expensive:

Waiting Time: Containers can sit for hours at loading docks or ports.

Generators Running: To keep things cold, trucks and containers keep engines running, burning diesel.

Fuel Costs: Diesel is expensive. Long waiting times = big fuel bills.

Temperature Risk: If the power stops, the products can spoil very quickly.

All these problems make cold shipping very costly.

But PCM can help fix this.

What is PCM and How Does It Work?

PCM (Phase Change Material) is a special material that stores cooling energy. It freezes and melts at specific temperatures.

Here’s how it works:

When the container is plugged into power, the PCM freezes and stores cold energy.

When the power is cut off, the PCM slowly melts and releases the cold energy, keeping the inside temperature steady.

Think of it like a cooling battery.

Depending on what you are shipping, you can use different types of PCM:

PCM Type

Temperature Range

Used For

+/- 1°C PCM

1°C to 5°C

Fresh food, medicine

-4°C PCM

-4°C to 0°C

Frozen seafood, ice cream

Key Benefits:

✅ Fuel Savings By reducing the need for continuous diesel generator operation, PCM can lower fuel consumption during transport or at idle points, cutting operational costs significantly.

✅ Stable Temperature Maintenance PCM ensures that containers maintain the required temperature range even during power failures, loading/unloading delays, or customs clearance periods.

✅ Lower Carbon Footprint Reduced reliance on diesel generators decreases greenhouse gas emissions, supporting sustainability goals.

✅ Extended Backup Time PCM panels can maintain ideal temperatures for 6 to 10 hours without any active cooling, depending on ambient conditions and container insulation.

Comparative Overview: With and Without PCM

Parameter

Without PCM

With PCM

Power Dependency

High (continuous)

Low (only during recharge)

Diesel Consumption

High

Reduced by 30–35%

Temperature Stability During Delays

Low

High

Risk of Product Spoilage

Higher

Lower

Carbon Emissions

High

Reduced

Practical Application: PCM Integration in Shipping Operations

Shipping companies and logistics providers can incorporate PCM technology in several ways:

Lining container walls or ceilings with PCM panels.

Using PCM boxes or inserts inside containers for specific high-value shipments like pharmaceuticals, frozen foods, and seafood.

Installing modular PCM units that can be charged during pre-cooling stages and then maintain temperatures passively during transit.

Such integrations ensure that even if containers are disconnected from external power during movements or hold-ups, the cargo remains protected.

Measurable Impact

Field studies show that containers equipped with PCM experience:

30%–35% savings in diesel costs during first-mile and last-mile movements.

Higher cargo protection rates with reduced spoilage incidents.

Lower operational downtime related to cooling failures during port or warehouse delays.

These operational improvements lead to better profit margins and enhanced reliability in supply chains.

Conclusion

Integrating Phase Change Material (PCM) technology in shipping containers provides a strategic advantage by reducing fuel consumption, stabilising temperatures, and lowering carbon emissions. For businesses engaged in cold chain logistics, PCM offers a practical, scalable, and cost-effective solution to improve operational efficiency across the first and last miles of delivery.

As the logistics industry moves towards sustainable and efficient operations, PCM-based solutions are set to play an increasingly critical role in shaping the future of cold chain management.

#caas#cold chain solutions#cooling as a service#caas model works#cold chain#cold chain market#cold storage#cooling solutions#phase change materials#pcm cold chain solution india#PCM cold chain

0 notes

Text

Transforming Industries: Phase Change Materials Market Insights

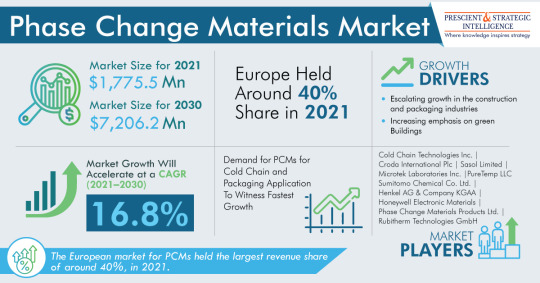

As stated by P&S Intelligence, the total revenue generated by the phase change materials market was USD 1,775.5 million in 2021, which will power at a rate of 16.8% by the end of this decade, to reach USD 7,206.2 million by 2030.

This has a lot to do with the increasing growth in the construction and packaging sectors and increasing importance on green buildings.

Cold chain and packaging category will grow at the highest rate, of above 17%, in the years to come. This can be mostly because of the surge in PCM requirement to sustain precise temperatures through the supply chain while lowering the emissions of carbon dioxide. Using ACs and electric fans to stay cool contributes to approximately 20% of the total electricity employed in buildings globally. The increasing requirement for space cooling is straining quite a few countries' power infrastructure, along with bringing about increased emissions.

With the enormous increase in the requirement for energy-efficient ACs, the requirement for PCMs will soar, as the electrical consumption of modified ACs with PCMs could be brought down by 3.09 kWh every day.

Europe dominated the industry with a share, of about 40%, in the recent past. The predisposition toward the acceptance of eco-friendly materials will power the PCM industry in the region. European regulatory associations, such as the SCANVAC, took more than a few initiatives for developing and promoting and effective building mechanical solutions and increase awareness pertaining to PCM applications.

The convenience of paraffin at a wide range of temperatures is a major reason for its appropriateness as an energy storage medium. Likewise, paraffin-based PCM is called a waxy solid paraffin, safe, dependable, noncorrosive, and economical material.

HVAC systems had the second-largest share, of about 30%, in phase change materials market in the recent past. This has a lot to do with the fact that PCM installation decreases fluctuations of temperature. HVAC with PCM supports in maintaining a steadier temperature and eliminating thermal uneasiness caused by alterations in temperature. It is because of the emphasis on green buildings, the demand for phase change materials will continue to rise considerably in the years to come.

#Phase Change Material Market#Phase Change Material Market Size#Phase Change Material Market Share#Phase Change Material Market Growth#Phase change materials (PCMs)#Thermal energy storage#Energy efficiency solutions#Heat management technology#Sustainable materials#Building insulation#HVAC systems#Thermal regulation#Cold chain logistics#Renewable energy storage#Temperature-sensitive packaging

0 notes

Text

The Billion-Dollar Secret: How Styrofoam Shipping Boxes Dominate the Cold Storage Market

Insulated Styrofoam Shipping Boxes Market Outlook and Projected Expansion

The GlobalInsulated Styrofoam Shipping Boxes Market is undergoing a transformative evolution, expected to grow from USD 5.8 billion in 2024 to over USD 9.8 billion by 2035, marking a 5.1% CAGR. This expansion is underpinned by surging demand for temperature-controlled logistics, particularly in pharmaceuticals, biotechnology, food & beverage, and chemical sectors. As global trade intensifies and e-commerce logistics demand highly effective cold chain packaging, insulated Styrofoam shipping boxes are becoming indispensable in ensuring thermal stability and minimizing spoilage.

Request Sample Report PDF (including TOC, Graphs & Tables): https://www.statsandresearch.com/request-sample/40651-global-insulated-styrofoam-shipping-boxes-market

Drivers of Insulated Styrofoam Shipping Boxes Market Momentum:

Cold Chain Logistics: Fueling Demand

Accelerated by global vaccine distribution and increasing biologics shipments, cold chain infrastructure investment is expanding rapidly. Logistics providers are integrating EPS-based shipping boxes due to their light weight, thermal resistance, and low cost. Emerging economies across Asia-Pacific and Latin America are establishing cold storage nodes, elevating regional adoption of EPS and its alternatives.

Thermally Sensitive E-Commerce Fulfillment

With the explosion of direct-to-consumer delivery models, including meal kits, frozen groceries, and pharmaceutical subscription services, packaging solutions must now perform at a higher thermal standard. Styrofoam boxes excel in preserving contents during last-mile delivery, particularly in high-temperature regions or extended transit windows.

Get up to 30%-40% Discount: https://www.statsandresearch.com/check-discount/40651-global-insulated-styrofoam-shipping-boxes-market

Industry Trends Reshaping the Insulated Styrofoam Shipping Boxes Market Landscape:

Eco-Friendly Insulation Innovation

Environmental scrutiny around traditional Expanded Polystyrene (EPS) has prompted industry leaders to introduce biodegradable EPS, Expanded Polypropylene (EPP), and Expanded Polyurethane (EPU). These innovations aim to balance thermal efficiency with recyclability and biodegradability, addressing both regulatory pressure and consumer sustainability demands.

Integration of IoT and Smart Packaging

Innovations such as IoT-based sensors, real-time temperature tracking, RFID chips, and blockchain-enabled traceability are redefining product integrity. Advanced boxes now feature embedded condition-monitoring solutions, allowing logistics providers to react in real-time to temperature breaches, critical in pharmaceuticals and biologics.

Rise of Vacuum Insulated Panels (VIPs) and Phase Change Materials (PCMs)

Next-gen thermal packaging increasingly utilizes VIPs and PCMs to ensure temperature stability in extreme conditions. These materials enhance insulation with minimal volume, optimizing space efficiency in shipping containers and reducing fuel consumption in transport.

Product Segmentation and Performance:

Hinged vs. Un-Hinged Boxes

Hinged boxes dominate the product landscape, capturing 68.5% market share in 2024. Their popularity stems from ease of use, secure sealing, and durability. Un-hinged variants, while less prevalent, continue to grow steadily due to their customization potential and lower unit cost, catering to niche applications.

Material Performance

EPS (55.3% share) remains the workhorse due to its cost-effectiveness and thermal balance.

EPP, growing at 6.3% CAGR, offers superior mechanical resilience and reusability, ideal for pharmaceutical supply chains.

EPU, though costlier, provides unmatched insulative performance, suited for ultra-cold shipments and perishable biotech products.

Insulated Styrofoam Shipping Boxes Market by End-Use Applications:

Food & Beverage

Holding a 50.4% share, the food industry leverages insulated boxes for frozen meal kits, seafood, dairy, and fresh produce. The rise of online grocery and farm-to-table delivery models is spurring demand for custom-sized, recyclable packaging.

Pharmaceuticals & Healthcare

With a projected 6.6% CAGR, this sector is the fastest-growing, driven by vaccine distribution, clinical trials, and the rise in biologic and personalized medicines. EPS and EPU boxes are the backbone of cold chain assurance in these high-stakes deliveries.

Electronics and Specialty Chemicals

Thermally sensitive semiconductors, batteries, and temperature-reactive chemicals require rigid, vibration-absorbing packaging. EPP's impact resistance and insulation are pivotal in ensuring transit safety.

Sales Channel Dynamics

Distributors lead at 59.8%, leveraging bulk procurement networks and established B2B logistics relationships.

Online retailers, fueled by D2C models, are the fastest growing, benefiting from the scalability of e-commerce fulfillment.

Specialty stores, though niche, serve high-margin segments like biotech R&D and small-batch gourmet shipping.

Insulated Styrofoam Shipping Boxes Market Regional Insights:

North America

Dominates at 38% insulated styrofoam shipping boxes market share, underpinned by mature cold chains, stringent FDA and EPA compliance norms, and leading e-commerce networks.

Asia-Pacific

Experiencing 6.8% CAGR, propelled by urbanization, rising disposable income, and massive investments in infrastructure modernization across China, India, and Southeast Asia.

Europe

With a 29.2% share, Europe is pushing the envelope in green packaging mandates, accelerating the transition to biodegradable EPS alternatives and reusable systems in the EU market.

Competitive Landscape and Innovation Leadership

Key Insulated Styrofoam Shipping Boxes Market Players and Strategic Movements

Sonoco Products Company: Launched a biodegradable EPS line, targeting regulated markets and reducing landfill contributions.

Cryopak: Acquired a PCM technology firm, expanding its thermal innovation pipeline.

Topa Thermal: Introduced IoT-enabled boxes through a logistics partnership, merging smart technology with cold chain essentials.

These firms are doubling down on research, mergers, and IP acquisition to maintain a competitive edge, particularly in high-growth verticals like personalized medicine and frozen food delivery.

Future Insulated Styrofoam Shipping Boxes Market Pathways and Strategic Recommendations

Invest in Material R&D: Prioritize hybrid packaging that combines VIPs, biodegradable EPS, and PCM layers.

Adopt Smart Packaging: Enable supply chain visibility through IoT and blockchain integrations.

Target Emerging Markets: Capitalize on growth corridors in Asia-Pacific and Latin America, focusing on urban logistics hubs.

Align with ESG Goals: Offer certified carbon-neutral packaging solutions, appealing to conscious B2B buyers and regulators alike.

Modularize Offerings: Provide scalable and custom-fit designs for cross-sector applicability, from biopharma to gourmet.

Purchase Exclusive Report: https://www.statsandresearch.com/enquire-before/40651-global-insulated-styrofoam-shipping-boxes-market

Conclusion

The Global Insulated Styrofoam Shipping Boxes Market is entering an era defined by thermal innovation, sustainability, and digital integration. As industries escalate their demand for high-performance cold chain packaging, the market's future hinges on material advancements, real-time monitoring capabilities, and responsible manufacturing. Businesses that integrate eco-conscious design with smart logistics compatibility will lead the next wave of global cold chain excellence.

Our Services:

On-Demand Reports: https://www.statsandresearch.com/on-demand-reports

Subscription Plans: https://www.statsandresearch.com/subscription-plans

Consulting Services: https://www.statsandresearch.com/consulting-services

ESG Solutions: https://www.statsandresearch.com/esg-solutions

Contact Us:

Stats and Research

Email: [email protected]

Phone: +91 8530698844

Website: https://www.statsandresearch.com

1 note

·

View note

Text

How We Handle Pharma Cold-Chain Shipments End-to-End

By G. JEEVAN RAOSAHIB

Transporting pharmaceuticals is not like moving furniture or electronics. The stakes are higher, the margins for error tighter. And when temperature control enters the picture, every degree matters. Literally.

I remember one of our earliest pharma cold-chain shipments at Indelox Service Private Limited. It was a biologic drug—sensitive to temperature shifts as small as 2°C. We were tasked with moving it from a facility in Hyderabad to a hospital in Dubai, end-to-end. What followed was a lesson in precision, communication, and contingency planning. Since then, we’ve fine-tuned a process that we now apply across all pharma cold-chain logistics we handle.

It’s not magic. But it is meticulous.

Understanding the Product First

Not all pharmaceuticals require refrigeration, but when they do, they demand clarity. So our process begins not with packing, but with listening.

We sit down with the client’s quality and regulatory teams. What is the exact temperature band—2–8°C? 15–25°C? Frozen? What are the critical stability points? How long can the product tolerate excursions? Is the packaging pre-qualified? Are there stability studies we should see?

No two products are identical. Even a minor difference in formulation can change how it must be handled. We don’t assume. We ask.

Pre-Planning: Routes, Partners, and Timing

Once we know the product profile, we map the route—not just by geography, but by risk. Airports, customs, road transfers, weekends, public holidays. We factor it all in.

Then we identify cold-chain capable carriers, handling agents, and lane-tested partners. If even one link in the chain lacks proper cold storage or SOPs for pharma cargo, we look elsewhere. We've walked away from seemingly lucrative contracts simply because the risk didn’t justify the reward.

For a recent vaccine shipment from India to East Africa, we chose a route with a longer flight time but fewer handovers—reducing the risk of temperature excursions. It wasn’t the fastest way. But it was the safest.

Packaging: It Begins with the Box

We’re strong believers in passive packaging for many shipments. These are insulated boxes with phase change materials (PCM) or dry ice that maintain temperature without an external power source.

But not all passive solutions are created equal. We only use pre-qualified packaging, validated for the duration and route in question. Some shipments require active containers (powered units with refrigeration), especially for bulk movements or long transits.

We test-run packaging under simulated conditions, using temperature probes to validate duration. A shipment labeled “72-hour hold” needs to hold for 80+ in our books. Because delays happen.

Data Logging: Proof and Peace of Mind

Every pharma cold-chain shipment we handle includes real-time GPS and temperature monitoring. These aren’t just for the client. They’re for us too.

We monitor temperature data from our control tower. If an alert triggers—say, a container’s internal temp hits 9°C—we act. Sometimes it’s a warehouse reroute. Sometimes, a rapid customs intervention. Sometimes, just a call to a driver sitting too long under the sun.

A few months ago, we had a shipment headed to Europe flagged at an airport tarmac in the Middle East. The crate was sitting in direct sunlight longer than planned. Our monitoring platform picked up the spike. We triggered an on-ground move via our local agent—and prevented a full load loss.

Every alert doesn’t lead to disaster. But the ones we ignore do.

Customs Clearance: Cold Doesn’t Wait

Clearing pharma cargo isn’t like clearing textile goods. Many cold-chain shipments are shipped under time-sensitive import permits. Some need pre-inspection. Others face random customs exams that can add hours of delay.

That’s why we prepare documentation down to the last comma. Certificates of analysis. Temperature logs. Product information sheets. Importer registration. And more.

We also proactively notify customs brokers in the receiving country—whether it’s Ghana, the UAE, or the EU. Because a customs officer working on a Friday afternoon needs more than documents—they need context. We provide both.

Last-Mile Delivery: The Final 5%

The product’s made it through multiple airports, warehouses, and inspections—but the job isn’t over.

Final-mile cold-chain delivery requires trained staff, temperature-controlled vehicles, and, in many cases, delivery to hospitals, pharmacies, or research labs that don’t operate on logistics schedules.

We once delivered a clinical trial drug to a research center in northern India—after hours, during monsoon rains, in a van that had to be re-routed because of flooding. But the cargo arrived, temperature intact, within the protocol window.

Why? Because we had a driver trained not just in routing, but in responsibility.

Audit Trails and SOP Reviews

Every shipment ends with a report—not just a “Proof of Delivery,” but a post-mortem. Did we stay within temperature limits? Were there alarms? What was the total time in transit? What lessons can we apply next time?

Pharma clients expect this. And frankly, we do too. Because the job isn’t just about one shipment. It’s about trust.

The Go Global Perspective

This year, Indelox Service Private Limited is proud to be a nominee for the 2025 Go Global Awards, being held in London on November 18–19. Hosted by the International Trade Council, the event gathers leaders across industries to share, learn, and connect.

Why mention that here?

Because pharma logistics, like global business, is built on collaboration. No one firm can claim to control every risk. But together—with regulators, manufacturers, carriers, and partners—we create a cold-chain ecosystem that actually works.

And when the product is life-saving, it’s not just logistics. It’s a responsibility.

#PharmaLogistics#ColdChainShipping#Indelox#GJeevanRaosahib#GoGlobalAwards#TemperatureControlled#PharmaceuticalTransport#EndToEndLogistics#ClinicalTrialsLogistics#IndiaExports#SupplyChainIntegrity#LastMileDelivery

0 notes

Text

Cold Chain Packaging Market Poised for Transformation with Emerging Technologies and Eco-Friendly Materials

The cold chain packaging market is experiencing robust growth as industries demand more efficient and reliable temperature-sensitive logistics solutions. Cold chain packaging refers to systems and materials used to maintain a consistent low-temperature range for perishable products during storage and transportation. It plays a pivotal role in preserving the integrity of products such as pharmaceuticals, food and beverages, chemicals, and biological samples.

Rising Demand in Key Industries

The primary driver behind the growth of the cold chain packaging market is the increasing global demand for temperature-controlled pharmaceuticals and biologics. With the rise in chronic diseases and the expansion of biopharmaceuticals, there is a pressing need for secure and reliable cold chain systems to maintain product efficacy and safety. The COVID-19 pandemic further amplified this need, showcasing the importance of efficient cold chain logistics in vaccine distribution.

In the food and beverage industry, globalization of trade and shifting consumer preferences toward fresh and organic products have necessitated high-performance cold chain packaging. Perishable foods like dairy, meat, seafood, and frozen goods require stable temperature environments to prevent spoilage, maintain quality, and comply with stringent food safety regulations.

Innovation in Packaging Materials and Technology

Technological advancements are playing a crucial role in the evolution of cold chain packaging. The development of phase change materials (PCMs), vacuum insulated panels (VIPs), and smart packaging with temperature indicators and GPS tracking have revolutionized the way sensitive goods are stored and transported. These technologies help companies monitor temperature in real-time and mitigate risks during transit, ensuring product safety and reducing losses.

Sustainable and reusable cold chain packaging solutions are also gaining traction. With increasing environmental concerns and regulations on plastic use, companies are adopting eco-friendly packaging materials made from recycled content or biodegradable polymers. Reusable insulated containers, along with active and passive refrigeration systems, are becoming standard in many cold chain operations to minimize waste and optimize cost-efficiency.

Market Segmentation and Regional Insights

The cold chain packaging market can be segmented by product type, material, application, and geography. Popular product types include insulated containers and boxes, refrigerants (such as gel packs and dry ice), labels, and temperature monitoring devices. Materials used range from polystyrene foam and polyurethane to corrugated fiberboard and advanced insulation films.

Geographically, North America holds a significant share of the market due to its established pharmaceutical and processed food industries, along with a strong regulatory framework. Europe follows closely, driven by stringent quality and safety standards. However, the Asia-Pacific region is projected to grow at the highest CAGR, owing to rising healthcare investments, increasing food exports, and expanding cold storage infrastructure in countries like China and India.

Challenges and Opportunities

Despite the promising outlook, the cold chain packaging market faces several challenges. High initial investment and maintenance costs for temperature-controlled packaging systems can deter small and medium-sized enterprises. Inconsistent infrastructure in developing economies, along with varying regulations across regions, also hinders market expansion.

However, these challenges present opportunities for innovation and collaboration. Companies are investing in R&D to develop low-cost, high-efficiency packaging alternatives. Partnerships between packaging manufacturers, logistics providers, and technology firms are creating integrated cold chain ecosystems. Furthermore, digitalization and automation are enhancing traceability and compliance, thereby improving overall supply chain efficiency.

Future Outlook

The future of the cold chain packaging market looks promising, with projections indicating consistent growth through 2030. Increasing globalization, urbanization, and online grocery and pharmaceutical deliveries are expected to further drive demand. As companies strive to meet regulatory compliance, reduce waste, and improve sustainability, innovation in materials and smart packaging technologies will remain at the forefront.

Emerging trends such as blockchain for enhanced traceability, AI for demand forecasting, and the use of IoT sensors for real-time monitoring will likely shape the next generation of cold chain packaging. Governments and private sector players must work collaboratively to strengthen infrastructure and standardize practices globally.

In summary, the cold chain packaging market is evolving rapidly in response to changing industry needs, consumer expectations, and environmental concerns. By embracing technological advancements and sustainable practices, the industry is set to meet the growing demand for safe and efficient cold chain logistics worldwide.

#ColdChain#ColdChainPackaging#ColdChainLogistics#TemperatureControlled#PharmaLogistics#FoodLogistics

0 notes

Text

0 notes

Text

The Critical Role of Isothermal Bags in Pharmaceutical Transportation

The isothermal bags and containers market is entering a significant growth phase, fueled by heightened demand for perishable goods and the expansion of clinical research. Valued at US$ 913.7 million in 2023, the global market is projected to grow at a CAGR of 5.1%, reaching US$ 1.4 billion by 2032. This growth reflects broader trends in healthcare, food delivery, and pharmaceutical logistics, where temperature-sensitive products are increasingly the norm.

Request a Sample Report Copy

Why Isothermal Solutions Matter

Isothermal bags and containers are engineered to maintain consistent internal temperatures, ensuring the safety and integrity of goods across the supply chain. Whether used in transporting fresh produce, biologics, or temperature-sensitive drugs, these products are vital to preserving product quality.

With temperature ranges typically from -80°C to +25°C, these bags and containers are designed to offer insulation over periods of 2 to 6 days, effectively bridging the critical cold chain gap. This durability has made them essential in sectors like pharmaceuticals, food & beverage, agriculture, and chemicals.

Driving Forces Behind Market Growth

Two major trends are propelling the growth of the isothermal packaging sector:

Rise in Demand for Perishable Food Products As consumers increasingly turn to online food delivery and quick-service restaurants (QSRs), particularly in Tier 2 and 3 cities, the need for reliable thermal packaging has soared. Insulated bags help ensure that meals arrive hot (or cold) and fresh, enhancing customer satisfaction and reducing food waste.

Growth in Clinical Trials and New Drug Development The pharmaceutical industry requires rigorous temperature control to preserve the efficacy of vaccines and biologic drugs. As global clinical trials expand, especially post-pandemic, the use of isothermal containers for drug storage and transport has intensified. For instance, vaccines like mRNA-based COVID-19 treatments necessitate extremely precise thermal environments throughout the supply chain.

Technology and Innovation at the Core

To stay competitive, manufacturers are investing heavily in R&D to create more effective and sustainable thermal solutions. Innovations include advanced insulation materials such as vacuum panels, phase-change materials (PCMs), and improved polymer composites.

Moreover, companies like Pelican BioThermal have embraced digital transformation. Their “School of Cool” online training platform, launched in 2020, supports customers and distributors in building expertise in temperature-controlled logistics—a crucial step in building operational proficiency across the value chain.

Strategic Acquisitions Expanding Market Reach

Mergers and acquisitions have become a key growth strategy in the industry. A notable example includes Sonoco’s acquisition of Thermoform Engineered Quality and Plastique Holdings for US$ 187 million, which broadened its capabilities in medical and consumer packaging.

Similarly, in September 2023, logistics giant UPS acquired Transports Chabas Santé’s healthcare unit to strengthen its position in temperature-controlled pharmaceutical transportation across Southern France. These moves highlight the increasing importance of specialized logistics in global healthcare delivery.

North America Leading the Charge

Geographically, North America dominated the market in 2023, and it is expected to maintain its lead through 2032. The U.S. and Canada boast well-established biomedical research ecosystems and innovative packaging industries, making them prime consumers of high-performance isothermal solutions.

The region also benefits from a robust logistics infrastructure, which is crucial for temperature-sensitive deliveries. Investments such as Cascades’ new isothermal packaging facility in Tacoma, Washington, are further enhancing regional capabilities.

Key Players and Competitive Landscape

The isothermal bags & containers market is characterized by a mix of global giants and specialized firms. Prominent players include:

Cryopak Europe

Sofrigam SA Ltd.

Pelican Biothermal LLC

va-Q-tec AG

Cold Chain Technologies

Tempack Packaging Solutions, S.L.

These companies are focusing on product innovations, sustainability, and partnerships to stay ahead in a competitive market. The focus on biodegradable materials, reusability, and smart temperature-monitoring technologies is redefining the product landscape.

The Road Ahead

The future of the isothermal packaging market lies in the convergence of sustainability, technology, and global logistics. As cold chain requirements become more stringent and global trade in perishable goods continues to rise, isothermal solutions will play an even more critical role.

Moreover, the integration of IoT and real-time monitoring into thermal containers will likely become standard practice, ensuring end-to-end visibility for high-value shipments in healthcare and food sectors alike.

Conclusion The isothermal bags and containers market is no longer just a niche segment—it’s a cornerstone of modern logistics. With rising demand across healthcare, food, and chemical industries, and strong innovation in packaging technologies, the market is poised for robust growth. For businesses involved in temperature-sensitive product logistics, staying informed and agile in this dynamic sector will be key to long-term success.

0 notes

Text

Temperature Controlled Packaging Market Developments: Innovations in Insulated Containers and Refrigerants

The Temperature Controlled Packaging Market is undergoing a transformative phase, driven by innovations in insulated containers and refrigerants. These advancements are reshaping cold chain logistics, ensuring the safe and efficient transport of temperature-sensitive goods across various industries.

Innovations in Insulated Containers

1. Vacuum Insulated Panels (VIPs)

VIPs represent a significant leap in insulation technology. By creating a vacuum between layers, these panels drastically reduce heat transfer, maintaining desired temperatures for extended periods. Their slim profile allows for more storage space within containers, making them ideal for transporting high-value, temperature-sensitive products over long distances.

2. Aerogel Insulation

Aerogels, known for their exceptional thermal resistance and lightweight properties, are being integrated into packaging solutions. Their ability to maintain stable internal environments, even under extreme external temperatures, makes them suitable for long-haul refrigerated containers, especially in regions with fluctuating climates.

3. Phase Change Materials (PCMs)

PCMs absorb or release heat as they change states, helping to maintain consistent temperatures within packaging. This is vital for the safe transportation of products like fresh produce and pharmaceuticals.

4. Sustainable Materials

The industry is shifting towards eco-friendly insulation materials. Innovations include recyclable corrugated cardboard with specialized insulating layers and biodegradable options derived from plant-based sources. Reusable insulated containers are also gaining traction, offering a sustainable alternative to single-use packaging.

Advancements in Refrigerants

1. Natural Refrigerants

The move towards environmentally friendly refrigerants has led to the adoption of natural options like hydrocarbons (e.g., propane, isobutane) and carbon dioxide. These refrigerants have low global warming potential and are energy-efficient, making them favorable alternatives to traditional synthetic refrigerants.

2. Thermoelectric Cooling

Thermoelectric cooling systems, which utilize the Peltier effect, offer precise temperature control without the need for traditional refrigerants. Their solid-state nature means fewer moving parts, leading to increased reliability and reduced maintenance.

3. Electrocaloric Cooling

Emerging electrocaloric cooling technologies use electric fields to induce temperature changes in specific materials. These systems promise energy-efficient cooling solutions without harmful refrigerants, though they are still in developmental stages.

Integration of Smart Technologies

1. IoT-Enabled Monitoring

The integration of Internet of Things (IoT) devices into packaging allows for real-time monitoring of temperature, humidity, and location. This ensures the integrity of temperature-sensitive products throughout the supply chain and enables proactive management of potential issues.

2. Time-Temperature Indicators (TTIs)

TTIs provide visual cues about a product's exposure to temperature variations over time. These indicators help in assessing product quality upon delivery and are crucial for perishable goods.

Conclusion

Innovations in insulated containers and refrigerants are revolutionizing the temperature-controlled packaging market. By embracing advanced materials, sustainable practices, and smart technologies, the industry is better equipped to meet the growing demands of global logistics, ensuring product safety, efficiency, and environmental responsibility.

0 notes

Text

Cold‑Chain Reinvented: Dry Ice Packaging Market to Chill at $1.4 Billion by 2035

The global Dry Ice Packaging market is on track to expand from USD 640 million in 2024 to over USD 1.4 billion by 2035, registering a CAGR above 7% over the forecast period hallbook social network. This surge is rooted in explosive growth across pharmaceutical logistics, frozen food delivery, biotechnology, and laboratory research, each demanding ever‑more reliable cold‑chain solutions.

Market Context & Scope

While Dry Ice Packaging specifically targets insulated shippers and containers, the broader Dry Ice market itself is projected to climb from USD 1.54 billion in 2024 to USD 2.73 billion by 2032, at a 7.4% CAGR Fortune Business InsightsGlobeNewswire. Within that, packaging solutions alone were valued at USD 642.2 million in 2024 and are expected to hit USD 1.0 billion by 2030, reflecting the premium placed on safety and reliability in cold‑chain delivery DataString Consulting.

Key Growth Drivers

Pharmaceutical Cold Chain

The boom in biologics and mRNA‑based vaccines has made ultra‑cold transport non‑negotiable, embedding dry ice packaging at the heart of global vaccine distribution networks

Frozen & Perishable Foods

Direct‑to‑consumer meal kits, specialty seafood shipping, and grocery delivery all lean on extended cold‑retention systems—dry ice packaging volumes jumped 8.5% year‑over‑year in 2024 to meet online grocery demand

Biotech & Laboratory Research

Sensitive reagents, cell cultures, and diagnostic kits require controlled cooling; specialized packaging ensures temperature excursions remain within strict ±2 °C tolerances

Innovation & Sustainability Trends

Multi‑Layer Insulation: Advanced foams and vacuum panels extend hold‑times by 20–30% over traditional EPS

Modular Container Systems: Interlocking designs allow scalable payloads and faster turnaround in rental fleets

Eco‑Friendly Materials: Adoption of recyclable liners and bio‑based insulating inserts is rising in line with broader temperature‑controlled packaging trends

Digital Temperature Tracking: IoT‑enabled sensors embedded in inserts provide real‑time monitoring and automated alerts for shipments in transit

Competitive Landscape

Leading cold‑chain packaging firms are expanding their dry ice portfolios through technology partnerships and geographic expansion:

Cold Chain Technologies Inc.

Cryopak Industries Inc.

Sofrigam SA

CCL Industries Inc.

Sealed Air Corporation

These players focus on automated filling systems, sustainable design, and integrated digital monitoring to differentiate in a market where reliability is paramount.

Broader Cold‑Chain Packaging Outlook

The overall Cold‑Chain Packaging segment (including gel packs, PCM, and others) is forecast to surge from USD 4.33 billion in 2024 to USD 63.48 billion by 2029, at a ~19.8% CAGR SkyQuest. Dry ice solutions will remain a critical high‑performance niche within this expansive market.

Regional Dynamics

Asia‑Pacific dominates the Dry Ice market with a 32.5% share in 2024, driven by rapid urbanization and cold‑chain investments in China and India

North America follows, buoyed by its mature pharma sector and stringent FDA cold‑chain regulations

Future Outlook

Looking ahead, the Dry Ice Packaging market will continue to evolve around:

Smart Coatings & Inserts that actively regulate temperature via embedded phase‑change materials.

Reusable, Circular‑Economy Systems to reduce waste in high‑volume shipment corridors.

AI‑Driven Route Optimization for minimized freeze‑time losses during transit.

For an in‑depth strategic roadmap and full market data, explore the comprehensive report at DataString Consulting.

0 notes

Text

Phase Change Materials Market: Trends, Challenges, and Growth Opportunities - UnivDatos

According to a new report by UnivDatos, the Global Phase Change Material Market is expected to reach USD 6,934.49 million in 2032, growing at a CAGR of 20.45%. The market is driven by the rising application in building and construction, increasing demand for HVAC systems, and the growing need for energy-efficient solutions in various industries.

The Phase Change Materials Market is growing globally, which can be attributed to several factors increasing the demand for PCM. Firstly, the market has been highly affected by the demand to embrace energy efficiency and sustainability in the construction of buildings. Enhancing the use of PCM in building materials has the following benefits: It enables the control of indoor temperatures, thus espousing heating and cooling, leading to energy conservation. This corresponds to the worldwide practice of promoting sustainable building to maintain green certifications.

Get Access to Sample PDF Here- https://univdatos.com/reports/phase-change-material-market?popup=report-enquiry

Also, with the increasing reliability of the electronics and transport sector, the need for enhanced thermal management has increased. PCMs can be utilized in electronics where miniaturization may lead to the generation of heat and thus aid in reducing heat and possibly improving the efficiency and durability of the devices. In the case of automobiles, the PCMs can be employed in batteries and the climate control of cabins and car interiors to make them more energy-friendly.

Applications:

The market for PCMs is active due to their versatility and ability to be used across many industries. In the building and construction field, they are incorporated into the wallboards, floor, and ceiling to act as thermal mass control of internal environment temperatures. Some benefits of this application include the ability to minimize energy expenses while improving occupant comfort.

In the heating refrigeration and ventilation industry, PCMs are utilized in refrigeration systems by depositing and liberating thermal energy in air conditioning. PCMs render cold chain logistics a convenient way of transferring temperature-sensitive commodities like pharmaceuticals and foods to their intended destinations while maintaining the set temperatures.

In the construction sector, they are used for HVAC systems, building insulation, and energy storage, as well as thermal management solutions applied in electronics like laptops, smartphones, and data centers. Furthermore, in the automobile segment, PCMs are also employed in battery thermal management and cabin thermal regulation, which leads to fuel productivity and a cozy climate for the passengers.

Technological Advancements:

There is increased research on the PCM market and the development of technologies by many industry players for new, innovative, and green products. The following are some of the new directions that are worth mentioning: bio-based and non-toxic PCMs. Industry players are using funds to work on PCMs that are bio-based. This is in a bid to meet sustainable development goals.

For instance, Rubitherm Technologies recently launched an enhanced PCM range made from natural oils, a better option than petroleum-based PCMs. These bio-based PCMs have thermal characteristics comparable to those of more conventional materials but with much regard for the environment.

For More Detailed Analysis, Please Visit- https://univdatos.com/reports/phase-change-material-market

Conclusion:

PCM industry remains highly promising for considerable growth in the future because of the growing requirements for energy-saving and efficient solutions in various sectors. The increasing demand for better thermal management in building and construction, electronics, and automotive industries will drive the growth of the PCM market. Manufacturers are still focusing on new opportunities and increasing their product offerings to better serve the needs of these sectors. The growth of new technologies and the invention of environmentally friendly PCMs also continue to fuel product demand in line with global progress.

0 notes

Text

Global Cold Chain Packaging Market: Key Drivers, Challenges, and Opportunities

Growing Demand for Temperature-Sensitive Logistics Drives Expansion in the Cold Chain Packaging Market.

The Cold Chain Packaging Market size was USD 25.8 Billion in 2023 and is expected to reach USD 70.4 Billion by 2032 and grow at a CAGR of 11.82% over the forecast period of 2024-2032.

The Cold Chain Packaging Market is driven by the increasing demand for temperature-sensitive product transportation in industries such as pharmaceuticals, food & beverages, and biotechnology. Cold chain packaging ensures the safe storage and transportation of perishable goods, vaccines, biologics, and frozen foods by maintaining optimal temperature conditions. With the rising global focus on food safety, pharmaceutical advancements, and e-commerce-driven grocery deliveries, the demand for innovative and sustainable cold chain packaging solutions continues to rise.

Key Players

Cascades Inc.

Cold Chain Technologies

Creopack

Orora Group

Cryopak

TCP Company

Intelsius

Pelican Products, Inc.

Softbox

Sofrigam

Emerging Trends and Future Scope

The Cold Chain Packaging Market is evolving with a growing emphasis on sustainability, efficiency, and technology integration. Manufacturers are focusing on biodegradable and reusable packaging materials to reduce environmental impact. The rise of biopharmaceuticals and precision medicine has heightened the need for advanced temperature-controlled packaging solutions with real-time monitoring capabilities. IoT-enabled smart packaging is emerging as a game-changer, allowing companies to track temperature, humidity, and location in real-time, ensuring compliance with strict regulatory requirements. The increasing adoption of phase change materials (PCMs), vacuum-insulated panels (VIPs), and gel-based refrigerants is also enhancing packaging performance and energy efficiency.

Key Market Points

Growing demand for pharmaceutical cold chain solutions, especially for vaccines and biologics

Expansion of e-commerce-driven grocery and meal kit deliveries, boosting refrigerated packaging needs

Rising adoption of biodegradable and reusable cold chain packaging to promote sustainability

Integration of IoT, RFID, and AI-driven smart packaging for real-time tracking and monitoring

Increasing regulatory standards for food and pharmaceutical temperature-sensitive shipments

Conclusion

The Cold Chain Packaging Market is set for robust growth, fueled by technological advancements, regulatory compliance, and the rising demand for efficient cold chain logistics. As industries continue to seek sustainable, high-performance packaging solutions, companies investing in smart technology, eco-friendly materials, and advanced insulation techniques will gain a competitive edge. The future of cold chain packaging lies in innovation, efficiency, and sustainability, ensuring the safe and reliable delivery of temperature-sensitive goods worldwide.

Read Full Report: https://www.snsinsider.com/reports/cold-chain-packaging-market-2694

Contact Us:

Jagney Dave — Vice President of Client Engagement

Phone: +1–315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Cold Chain Packaging Market#Cold Chain Packaging Market Size#Cold Chain Packaging Market Share#Cold Chain Packaging Market Report#Cold Chain Packaging Market Forecast

0 notes

Text

Caas for Modern Trade: How Phase Shields Ensure Reliable Frozen Food Deliveries

Introduction:

In the fast-growing modern trade sector, ensuring the safe and efficient movement of frozen food products is critical. Ice creams, frozen foods, and desserts must maintain strict temperature requirements while travelling from central warehouses to supermarkets, cafés, and retail stores.

Traditionally, refrigerated trucks have been the preferred solution. However, they come with challenges such as high operational costs, maintenance issues, and carbon emissions.

Tan90’s Cooling as a Service (Caas) Model, using Phase Shields, offers a smarter, more flexible way to maintain temperature integrity during frozen food deliveries, without the need for costly refrigerated trucks.

Challenges in Frozen Food Logistics

Transporting frozen products, especially in cities and urban centres, faces several hurdles:

High fuel and maintenance costs are associated with refrigerated vehicles.

Temperature fluctuations are caused by frequent door openings during multi-stop deliveries.

Limited availability of refrigerated trucks leads to scheduling delays.

Higher carbon footprint, conflicting with sustainability goals.

Modern trade businesses need a more efficient and scalable solution that can maintain product quality without inflating logistics costs.

How Caas with Phase Shields Solves These Challenges

Tan90’s Phase Shields are specially engineered panels that absorb and release thermal energy, ensuring stable low temperatures during product movement.

Here’s how the Caas model works for frozen food logistics:

Pre-conditioned Phase Shields are frozen at the central warehouse.

Frozen goods and Phase Shields are loaded into insulated containers or vans.

Passive cooling maintains the required temperature throughout the delivery process.

No active refrigeration is needed during transportation, even across multiple delivery points.

Key Benefits of Using Phase Shields for Modern Trade Deliveries

✅ Cost-Effective Logistics

Reduces diesel consumption as insulated vans can replace refrigerated trucks.

Cuts down maintenance and operational costs significantly.

✅ Temperature Stability

Maintains the required temperature range (-18°C to -20°C) even during multiple stops.

Reduces spoilage and ensures better product quality upon arrival.

✅ Flexibility and Scalability

Enables the use of different vehicle types, not just specialised reefer trucks.

Suitable for small, medium, and large delivery loads.

✅ Environmentally Sustainable

Cuts down greenhouse gas emissions by minimising reliance on diesel generators and refrigeration units.

Operational Impact: With vs Without Phase Shields

Parameter

Traditional Refrigerated Truck

Caas with Phase Shields

Fuel Consumption

High

Low

Maintenance Costs

High

Minimal

Temperature Stability

Moderate

High

Delivery Flexibility

Limited

High

Environmental Impact

High

Low

Use Cases for Modern Trade Businesses

Central Warehouse to Supermarkets: Reliable frozen product movement without heavy logistics costs.

Last-Mile Deliveries: Flexibility to deliver to multiple stores, mini-marts, and cafés efficiently.

Cold Chain for Online Grocery Platforms: Enhances speed and temperature control for e-commerce frozen deliveries.

Conclusion

Tan90’s Cooling as a Service (Caas), powered by Phase Shields, provides a modern, efficient, and scalable solution for frozen food logistics in the modern trade sector. It addresses the high costs, rigid operations, and sustainability concerns of traditional refrigerated transportation.

By leveraging Phase Shields, businesses can maintain product integrity, lower operational expenses, and contribute to a greener supply chain, making frozen food logistics simpler, smarter, and more sustainable.

#caas#cold chain solutions#cooling as a service#caas model works#cold chain#cooling solutions#cold chain market#phase change materials#pcm cold chain solution india#cold storage

0 notes

Text

Top 7 innovations in cold chain technology

The introduction of new technologies and the growing number of temperature-sensitive goods have brought about a revolution in the cold chain supply industry. It is expected that cold chain logistics and operations would radically transform with the approaching new ideas that would significantly impact the near-year transformation in 2024.

Here are the seven salient cold chains expected to make great changes in the year 2024:

1. IoT-based Temperature Monitoring

It is the most important requirement of Cold-Chain Logistics to maintain optimum conditions to temperature-sensitive goods.The Internet of Things (IoT) is disseminating transformative effects within temperature management through timely alert mechanisms concerning deviations from any accepted temperature range. Wirelessly operated temperature sensors in both storage and transfer mechanisms measure temperature together with other critical parameters and stream this information continuously to the cloud. Cold chain innovations such as CIA technology employ the Internet of Things (IoT) to ensure temperature integrity at different points around the level of +25 to -15 degrees Celsius.

2. Blockchain for Enhanced

Traceability Blockchain technology is now becoming the way forward in the cold chain sector as it made traceability and visibility within the cold chain better. The upshot of blockchain technology lets every stakeholder in the supply chain access that immutable document that shows how the product has moved along its journey, from origin to end user. The product is ensured to be stored and transported properly in the right conditions, and reduced fraud, as well as consumer trust, is established. It is predicted that, by 2024, there will be more cold chain operators adopting blockchain for integrity strengthening and compliance within their supply chains.

3. Smart Packaging

Temperature Control Smart packaging solution continues to advance into perfecting a product for transit. Its in-house design employs innovative and advanced materials, among which are Phase Change Materials (PCMs) and Vacuum Insulated Panels (VIPs) assimilated into temperature-regulating features. PCMs are heat absorbers and thermally emitted according to varying states of temperature ranges; VIPs are superior thermal insulations. With these technologies, sensitive products remain insulated throughout the entire journey and arrive in their best accepted conditions.

4. AI and Predictive Analytics

Artificial Intelligence (AI) and predictive analytics are playing a crucial role in optimizing cold chain logistics. AI-driven analysis processes vast amounts of data to improve demand forecasting, assess risk, and enhance route planning. This innovation minimizes disruptions, reduces energy consumption, lowers operational costs, and boosts overall efficiency in temperature-controlled supply chains.

5. Sustainable Refrigeration Technologies

The shift towards sustainability is influencing cold chain temperature management, with businesses adopting eco-friendly solutions to cut costs and comply with environmental regulations. Technologies such as solar-powered refrigeration, hydrocarbon refrigerants, and energy-efficient cooling systems are gaining popularity. These innovations not only reduce electricity consumption but also contribute to a greener and more cost-effective cold chain.

6. Automated Warehouses and Drone Deliveries

Automation is transforming cold chain warehouses, streamlining sorting, packing, and temperature monitoring processes. Automated warehouses enhance efficiency by reducing processing times and minimizing human errors. Additionally, drone deliveries are being explored for last-mile distribution of temperature-sensitive goods, particularly in areas where conventional logistics face challenges. These advancements ensure faster delivery times and maintain required temperature conditions throughout transit.

7. Cold Chain as a Service (CCaaS)

Cold Chain as a Service (CCaaS) is an emerging business model where companies outsource their cold chain logistics to specialized service providers. This allows businesses to focus on core operations while experts manage temperature-controlled storage and distribution. CCaaS providers handle warehousing, transportation, and last-mile delivery, ensuring that sensitive products meet safety and quality standards.

Conclusion

These seven innovations are set to redefine the cold chain industry, driving efficiency and reducing costs without compromising the safety of temperature-sensitive products. By leveraging IoT, blockchain, AI, smart packaging, and sustainable technologies, businesses can enhance their operations and stay competitive in the evolving market.

For those seeking to stay ahead of these advancements, Refcold India offers a valuable platform to explore the latest cold chain solutions. With over 200 participating companies showcasing cutting-edge equipment and innovations, this event provides insights into the future of cold chain management and logistics.

0 notes

Text

Disposable Ice Packs Market Strategic Moves Driving Global Industry Growth

The disposable ice packs market is expanding rapidly, driven by demand across industries such as healthcare, food delivery, pharmaceuticals, and sports therapy. With increasing consumer expectations for convenience, sustainability, and performance, companies in the industry must adopt strategic moves to stay competitive. This article explores key strategies shaping the disposable ice packs market, from innovation and sustainability to supply chain enhancements and regulatory compliance.

1. Sustainability and Eco-Friendly Packaging

As environmental concerns grow, businesses are focusing on sustainable materials for disposable ice packs. Companies are developing biodegradable gel packs, recyclable outer packaging, and plant-based cooling agents. The shift toward eco-friendly alternatives helps brands meet regulatory requirements and cater to environmentally conscious consumers.

2. Advanced Cooling Technologies

Innovations in cooling technology are driving market growth. Companies are investing in phase change materials (PCMs), non-toxic cooling gels, and longer-lasting ice packs to enhance performance. These advancements are particularly beneficial in the medical and food industries, where temperature consistency is critical.

3. Supply Chain Optimization and Cost Efficiency

To reduce costs and improve efficiency, manufacturers are adopting lean production techniques and AI-driven logistics solutions. Improved supply chain management ensures faster delivery, lower transportation costs, and minimal product wastage, contributing to better profit margins and customer satisfaction.

4. Expansion into Emerging Markets

The growing demand for cold chain solutions in emerging economies presents a significant opportunity. Companies are expanding their presence in Asia-Pacific, Latin America, and Africa by offering cost-effective, high-performance disposable ice packs tailored to local needs.

5. Customization and Branding Strategies

Brand differentiation is a key success factor in the industry. Companies are offering customizable ice packs with logo printing, unique shapes, and tailored cooling durations to meet specific industry requirements. This strategy helps businesses stand out in the competitive market.

6. Smart Packaging and Digital Integration

The integration of smart packaging solutions, such as temperature-sensitive indicators and QR codes for tracking, is transforming the industry. These innovations allow businesses to monitor temperature fluctuations, ensuring quality and compliance in medical and food applications.

7. Strategic Partnerships and Collaborations

Companies are forming partnerships with healthcare providers, food delivery services, and logistics firms to expand their reach. Collaborations with packaging companies and material scientists also help develop next-generation ice packs that offer superior performance and environmental benefits.

8. Compliance with Regulatory Standards

Adhering to FDA, EPA, and international packaging regulations is essential for market success. Companies are investing in rigorous testing and quality control to ensure compliance with safety and sustainability guidelines. Compliance enhances brand credibility and minimizes legal risks.

9. Diversification Across Industries

The demand for disposable ice packs extends beyond healthcare and food industries to sports therapy, emergency medical response, and personal cooling solutions. Companies are diversifying product lines to capture new market segments and maximize revenue opportunities.

10. E-commerce and Direct-to-Consumer Sales Growth

With the rise of online shopping, businesses are leveraging e-commerce platforms and direct-to-consumer models to increase sales. Subscription-based ice pack services, bulk purchase discounts, and optimized packaging for online shipping are driving revenue growth in the sector.

Conclusion

The disposable ice packs market is evolving through innovation, sustainability, and supply chain advancements. Companies that focus on eco-friendly solutions, smart packaging, market expansion, and regulatory compliance will gain a competitive edge. By implementing strategic moves, businesses can ensure long-term growth and industry leadership.

0 notes

Text

Battery Thermal Management Systems: The Key to EV Battery Efficiency and Longevity

As electric vehicles (EVs) gain in popularity, ensuring that their battery systems remain efficient and safe becomes a primary concern. One of the critical aspects of this is battery thermal management systems (BTMS), which are designed to regulate the temperature of the battery pack. Efficient thermal regulation is necessary to maintain optimal performance, prolong battery life, and ensure safety, especially in high-performance EVs or those that operate in extreme climates. This article explores the importance of these systems and highlights the latest innovations in battery temperature management.

Why Battery Temperature Control is Crucial for EVs

Batteries, particularly lithium-ion batteries used in EVs, perform best within a narrow temperature range. Operating outside this range can lead to a range of issues, including reduced power output, shorter lifespan, and even catastrophic failure in extreme cases. A well-designed battery thermal management system ensures that the battery operates within this ideal range, thereby optimizing both performance and safety.

Thermal regulation plays an even more critical role in modern EVs, where high-performance batteries are subjected to intense charging and discharging cycles. As the demand for longer driving ranges, faster charging, and better overall performance increases, managing the temperature of these high-density batteries becomes increasingly complex.

The Role of Battery Thermal Management Systems in EV Safety

Overheating is a significant safety risk for EV batteries. Excessive heat buildup can lead to thermal runaway, a chain reaction where the battery’s internal temperature rises uncontrollably, potentially causing fires or explosions. Conversely, if the battery becomes too cold, its ability to charge and discharge efficiently is compromised. This is especially problematic in regions with extreme temperatures, where battery thermal management systems play an even more essential role in maintaining safe operations.

Advanced systems are designed to monitor the battery's temperature in real time, adjusting cooling or heating systems as necessary to ensure the battery is operating within safe parameters. Some of the most common techniques include active cooling, passive cooling, and the use of phase-change materials to absorb heat.

How Do Battery Thermal Management Systems Work?

Battery thermal management systems employ a variety of methods to control battery temperatures, each offering distinct advantages and trade-offs.

Active Cooling Systems One of the most commonly used systems is active cooling, which uses external devices like pumps, fans, and radiators to dissipate heat generated within the battery pack. These systems are more efficient in managing temperature spikes and are commonly found in high-performance EVs that require frequent charging or high power output.

Active cooling often relies on liquid cooling, where coolant circulates through tubes embedded within the battery pack, carrying heat away from the cells and releasing it into the surrounding environment. This method is particularly useful for EVs designed for high-performance applications, such as those with long driving ranges or for those used in racing.

Passive Cooling Systems In contrast, passive cooling systems do not rely on external power sources to regulate temperature. Instead, they use natural processes, such as heat dissipation through thermal conduction and radiation, to maintain the battery's temperature. These systems are simpler and require less maintenance but are less effective in extreme conditions or under heavy load.

Some passive cooling techniques involve the use of phase-change materials (PCMs), which absorb and release heat during the transition between solid and liquid states. These materials help smooth out temperature fluctuations and prevent sudden overheating or cooling.

Hybrid Systems To achieve the best of both worlds, many modern EVs employ hybrid thermal management systems that combine both active and passive methods. These systems dynamically switch between active cooling and passive heat retention techniques based on real-time temperature data, optimizing efficiency while reducing energy consumption.

Innovations in Battery Thermal Management

As the EV market grows, so does the need for better battery thermal management systems. Several innovations are emerging to improve the efficiency, performance, and cost-effectiveness of these systems.

Immersion Cooling One promising development is immersion cooling, where the battery cells are submerged in a dielectric fluid that can directly absorb the heat generated by the cells. This method eliminates the need for complex cooling channels and reduces the risk of thermal hotspots. Researchers are continually working to improve this technology, which could significantly reduce the size and complexity of cooling systems.

Advanced Cooling Channels The design of cooling channels plays a significant role in the overall effectiveness of the thermal management system. Engineers are constantly refining cooling channel designs to enhance airflow and thermal efficiency. Some of the latest systems feature specialized Z-type airflow channels that promote better heat distribution across the battery pack.

Phase-Change Materials (PCMs) The use of phase-change materials has gained attention as a means to regulate temperature without relying on active cooling methods. PCMs absorb excess heat when temperatures rise and release it as the battery cools down. This self-regulating capability makes PCMs a highly effective addition to thermal management systems in EVs. They help maintain stable temperatures, which in turn, protects the battery from degradation.

Challenges in Battery Thermal Management Systems

Despite the advancements in thermal management technology, several challenges remain in ensuring the optimal performance of EV batteries:

Increased Power Density: As EV manufacturers push for batteries with higher power density (for longer range and faster charging), the amount of heat generated during operation also increases. Designing systems that can handle this additional heat load without compromising performance is a significant engineering challenge.

Environmental Variability: EVs are used in diverse environmental conditions, from scorching hot deserts to frigid northern climates. A battery thermal management system must be adaptable to a wide range of temperatures, ensuring the battery performs optimally regardless of external conditions.

Energy Efficiency: Thermal management systems themselves consume energy, which can affect the overall range of the vehicle. While active cooling systems are highly effective, they also consume power, which must be carefully balanced against the benefits they offer.

The Future of Battery Thermal Management Systems

Looking forward, battery thermal management systems are likely to continue evolving as new technologies and materials emerge. For example, the integration of artificial intelligence (AI) and machine learning (ML) into these systems could allow for real-time adjustments, optimizing cooling strategies based on various parameters such as driving conditions, battery load, and ambient temperature.

The future of EV batteries also includes the development of solid-state batteries, which are expected to offer better thermal stability than current lithium-ion batteries. Solid-state batteries could potentially reduce the need for complex thermal management systems, making them simpler, safer, and more energy-efficient.

Conclusion

In conclusion, battery thermal management systems are critical for the safe and efficient operation of electric vehicles. As the technology behind EVs continues to advance, so too will the need for more efficient and reliable thermal management solutions. Whether through active cooling, passive cooling, or hybrid systems, the ability to maintain an optimal temperature range is essential for performance, longevity, and safety. With ongoing research and innovation, the future of thermal management in EVs looks bright, paving the way for more efficient, high-performance electric vehicles. Contact Liquid Plates for expert solutions in battery thermal management.

0 notes

Text

Cold Chain Packaging Market Innovations Shaping the Future of Temperature Controlled Logistics

The cold chain packaging market is a critical segment of the global supply chain ecosystem, playing an essential role in maintaining the quality and safety of temperature-sensitive products. This market encompasses the packaging materials and technologies used to preserve goods at controlled temperatures throughout storage and transportation. With the rising demand for pharmaceuticals, perishable food products, and biologics, the cold chain packaging market has witnessed significant growth, driven by technological innovations and stricter regulatory frameworks.

Overview of Cold Chain Packaging

Cold chain packaging involves specialized containers, insulated boxes, refrigerants, and temperature monitoring devices that help maintain specific temperature ranges required for sensitive products. These products include vaccines, blood samples, fresh fruits and vegetables, dairy products, seafood, and certain chemicals that degrade if exposed to temperature fluctuations.

The importance of cold chain packaging became particularly evident during the COVID-19 pandemic when vaccines requiring ultra-low temperatures were distributed globally. This event highlighted the need for reliable packaging solutions capable of maintaining temperatures as low as -70°C, emphasizing the market’s growth potential and innovation opportunities.

Market Drivers

Several factors are propelling the growth of the cold chain packaging market:

Rising Demand for Pharmaceuticals and Biologics: The pharmaceutical industry, especially biologics and vaccines, requires stringent temperature control to ensure product efficacy and safety. With the increase in chronic diseases and the development of personalized medicine, the need for cold chain packaging has surged.

Growth in Perishable Food Industry: Increasing consumer preference for fresh and organic food has led to a rise in cold storage and transportation requirements. The expansion of e-commerce and online grocery delivery services also fuels demand for reliable cold chain solutions.

Stringent Regulatory Standards: Governments and international bodies have implemented strict regulations around the handling and transportation of temperature-sensitive products. Compliance with these regulations necessitates the use of advanced packaging technologies, further driving market growth.

Technological Advancements: Innovations such as phase change materials (PCMs), vacuum insulated panels (VIPs), smart packaging with IoT-enabled temperature sensors, and eco-friendly insulation materials are revolutionizing cold chain packaging, making it more efficient and sustainable.

Market Challenges

Despite strong growth prospects, the market faces certain challenges:

High Costs: Advanced cold chain packaging solutions can be expensive, limiting adoption, especially in developing regions.

Logistical Complexities: Maintaining an unbroken cold chain across long distances, especially in countries with poor infrastructure, is challenging.

Environmental Concerns: Many cold chain packaging materials are non-biodegradable, raising sustainability issues.

Key Market Segments

The cold chain packaging market is segmented based on material type, application, end-user, and region:

Material Type: Includes insulated containers, gel packs, dry ice, phase change materials, and refrigerants.

Application: Pharmaceuticals, food and beverages, chemicals, and others.

End-User: Hospitals and clinics, food distributors, research laboratories, and logistics companies.

Region: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Among these, the pharmaceutical segment is one of the fastest-growing due to the increasing need for vaccines and biologics. Asia Pacific is expected to witness rapid growth driven by expanding healthcare infrastructure and rising demand for fresh food products.

Future Trends and Opportunities

The future of the cold chain packaging market looks promising with several emerging trends:

Sustainable Packaging Solutions: Growing environmental awareness is pushing manufacturers to develop biodegradable and recyclable cold chain packaging materials.

Digital Integration: The integration of IoT and blockchain technology in cold chain packaging enhances real-time temperature monitoring and traceability, improving transparency and reducing product loss.

Customized Solutions: Demand for tailor-made packaging solutions that cater to specific temperature ranges and product types is increasing.

Expansion in Emerging Markets: Increasing healthcare spending and food consumption in regions like Asia, Latin America, and Africa present vast opportunities for market players.

Conclusion

The cold chain packaging market is at a pivotal stage of growth, driven by increasing demand for temperature-sensitive pharmaceuticals and perishable food products. Technological innovations and rising regulatory standards are shaping the market’s trajectory, pushing for more efficient, sustainable, and smarter packaging solutions. While challenges such as cost and logistics remain, the opportunities offered by digital integration and expanding markets make cold chain packaging an exciting and dynamic industry to watch in the coming years.

#ColdChainPackaging#ColdChainMarket#TemperatureControlledLogistics#PharmaceuticalPackaging#PerishableGoods#SupplyChainInnovation

0 notes