#Pump and Dump

Explore tagged Tumblr posts

Text

Talisman / Cipher - Angel of Emmeria & The Demon of Ustio. Concept sketches of a what-if AU where they flew together (for a while).

#ace combat#ace combat zero#ace combat 6#cipher#talisman#woo fire and forget#pump and dump#turn and burn#lock and load#these guys sometimes take up my whole mind#theres a reason they crossed paths but they belong to different people#Ace Combat AU#musings#test test test

44 notes

·

View notes

Text

Quinque gazump linkdump

On OCTOBER 23 at 7PM, I'll be in DECATUR, presenting my novel THE BEZZLE at EAGLE EYE BOOKS.

It's Saturday and any fule kno that this is the day for a linkdump, in which the links that couldn't be squeezed into the week's newsletter editions get their own showcase. Here's the previous 23 linkdumps:

https://pluralistic.net/tag/linkdump/

Start your weekend with some child's play! Ada & Zangemann is a picture book by Matthias Kirschner and Sandra Brandstätter of Free Software Foundation Europe, telling the story of a greedy inventor who ensnares a town with his proprietary, remote-brickable gadgets, and Ada, his nemesis, a young girl who reverse engineers them and lets their users seize the means of computation:

https://fsfe.org/activities/ada-zangemann/index.en.html

Ada & Zangemann is open access – you can share it, adapt it, and sell it as you see fit – and has been translated into several languages. Now, there's a cartoon version, an animated adaptation that is likewise open access, with digital assets for your remixing pleasure:

https://fsfe.org/activities/ada-zangemann//movie

Figuring out how to talk to kids about important subjects is a clarifying exercise. Back in the glory days of SNL, Eddie Murphy lampooned Fred "Mr" Rogers style of talking to kids, and it was indeed very funny:

https://snl.fandom.com/wiki/Mr._Robinson

But Mr Rogers' rhetorical style wasn't as simple as "talk slowly and use small words" – the "Fredish" dialect that Mr Rogers created was thoughtful, empathic, inclusive, and very effective:

https://memex.craphound.com/2019/07/09/the-nine-rules-of-freddish-the-positive-inclusive-empathic-language-of-mr-rogers/

Lots of writers have used the sing-songy fairytale style of children's stories to make serious political points (see, e.g. Animal Farm). My own attempt at this was my 2011 short story "The Brave Little Toaster," for MIT Tech Review's annual sf series. If the title sounds familiar, that's because I nicked it from Tom Disch's tale of the same name, as part of my series of stolen title stories:

https://locusmag.com/2012/05/cory-doctorow-a-prose-by-any-other-name/

My Toaster story is a tale of IoT gone wild, in which the nightmare of a world of "smart" devices that exert control over their owners is shown to be a nightmare. A work colleague sent me this adaptation of the story as part of an English textbook, with lots of worksheet-style exercises. I'd never seen this before, and it's very fun:

http://ourenglishclass.net/wp-content/uploads/sites/6/2024/09/bravetoaster.pdf

If you like my "Brave Little Toaster," you'll likely enjoy my novella "Unauthorized Bread," which appears in my 2019 collection Radicalized and is currently being adapted as a middle-grades graphic novel by Blue Delliquanti for Firstsecond:

https://arstechnica.com/gaming/2020/01/unauthorized-bread-a-near-future-tale-of-refugees-and-sinister-iot-appliances/

Childlike parables have their place, but just because something fits in a "just so" story, that doesn't make it true. Cryptocurrency weirdos desperately need to learn this lesson. The foundation of cryptocurrency is a fairytale about the origin of money, a mythological marketplace in which freely trading individuals who struggled to find a "confluence of needs." If you wanted to trade one third of your cow for two and a half of my chickens, how could we complete the transaction?

In the "money story" fairy tale, we spontaneously decided that we would use gold, for a bunch of nonsensical reasons that don't bear even cursory scrutiny. And so coin money sprang into existence, and we all merrily traded our gold with one another until a wicked government came and stole our gold with (cue scary voice) taaaaaaxes.

There is zero evidence for this. It's literally a fairy tale. There is a rich history of where money came from, and the answer, in short is, governments created it through taxes, and money doesn't exist without taxation:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

The money story is a lie, and it's a consequential one. The belief that money arises spontaneously out of the needs of freely trading people who voluntarily accept an arbitrary token as a store of value, unit of account, and unit of exchange (coupled with a childish, reactionary aversion to taxation) inspired cryptocurrency, and with it, the scams that allowed unscrupulous huxters to steal billions from everyday people who trusted Matt Damon, Spike Lee and Larry David when they told them that cryptocurrency was a sure path to financial security:

https://pluralistic.net/2024/02/15/your-new-first-name/#that-dagger-tho

It turns out that private money, far from being a tool of liberation, is rather just a dismal tool for ripping off the unsuspecting, and that goes double for crypto, where complexity can be weaponized by swindlers:

https://pluralistic.net/2022/03/13/the-byzantine-premium/

We don't hear nearly as much about crypto these days – many of the pump-and-dump set have moved on to pitching AI stock – but there's still billions tied up in the scam, and new shitcoins are still being minted at speed. The FBI actually created a sting operation to expose the dirtiness of the crypto "ecosystem":

https://www.theverge.com/2024/10/10/24267098/fbi-coin-crypto-token-nexgenai-sec-doj-fraud-investigation

They found that the exchanges, "market makers" and other seemingly rock-ribbed institutions where suckers are enticed to buy, sell, track and price cryptos are classic Big Store cons:

http://www.amyreading.com/the-9-stages-of-the-big-con.html

When you, the unsuspecting retail investor, enter one of these mirror-palaces, you are the only audience member in a play that everyone else is in on. Those vigorous trades that see the shitcoin you're being hustled with skyrocketing in value? They're "wash trades," where insiders buy and sell the same asset to one another, without real money ever changing hands, just to create the appearance of a rapidly appreciating asset that you had best get in on before you are priced out of the market.

This scam is as old as con games themselves and, as with other scams- S&Ls, Enron, subprime – the con artists have parlayed their winnings into social respectability and are now flushing them into the political system, to punish lawmakers who threaten their ability to rip off you and your neighbors. A massive, terrifying investigative story in The New Yorker shows how crypto billionaires stole the Democratic nomination from Katie Porter, one of the most effective anti-scam lawmakers in recent history:

https://www.newyorker.com/magazine/2024/10/14/silicon-valley-the-new-lobbying-monster

Big Tech – like every corrupt cartel in history – is desperate to conjure a kleptocracy into existence, whose officials they can corrupt in order to keep the machine going until they've maximized their gains and achieved escape velocity from consequences.

No surprise, then, that tech companies have adopted the same spin tactics that sowed doubt about the tobacco-cancer link, in order to keep the US from updating its anemic privacy laws. The last time Congress gave us a new consumer privacy law was 1988, when they banned video store clerks from disclosing our VHS rental history to newspapers:

https://en.wikipedia.org/wiki/Video_Privacy_Protection_Act

By preventing confining privacy law to the VCR era, Big Tech has been able to plunder our data with impunity – aided by cops and spies who love the fact that there's a source of cheap, off-the-books, warrantless surveillance data that would be illegal for them to collect.

Writing for Tech Policy Press, the Norcal ACLU's Jake Snow connects the tobacco industry fight over "pre-emption" to the modern fight over privacy laws:

https://www.techpolicy.press/big-tech-is-trying-to-burn-privacy-to-the-ground-and-theyre-using-big-tobaccos-strategy-to-do-it/

In the 1990s, Big Tobacco went to war against state anti-smoking laws, arguing that the federal government had the right – nay, the duty – to create a "harmonized" national system of smoking laws that would preempt state laws. Strangely, politicians who love "states' rights" when it comes to banning abortion, tax-base erosion and "right to work" anti-union laws suddenly discovered federal religion when their campaign donors from the Cancer-Industrial Complex decided that states shouldn't use those rights to limit smoking.

This is exactly the tack that Big Tech has taken on privacy, arguing that any update to federal privacy law should abolish muscular state-level laws, like Illinois's best-in-class biometric privacy rules, or California's CPPA.

Like Big Tobacco, Big Tech has "funded front groups, hired an armada of lobbyists, donated millions to campaigns, and opened a firehose of lobbying money," with the goal of replacing "real privacy laws with fake industry alternatives as ineffective as non-smoking sections."

Whether it's understanding the origin of money or the Big Tobacco playbook, knowing history can protect you from all kinds of predatory behavior. But history isn't merely a sword and shield, it's also just a delight. Internet pioneer Ethan Zuckerman is road-tripping around America, and in August, he got to Columbus, IN, home to some of the country's most beautiful and important architectural treasures:

https://ethanzuckerman.com/2024/08/29/road-trip-the-company-town-and-the-corn-fields/

The buildings – clustered in within a few, walkable blocks – are the legacy of the diesel engine manufacturing titan Cummins, whose postwar president J Irwin Miller used the company's wartime profits to commission a string of gorgeous structures from starchitects like the Saarinens, IM Pei, Kevin Roche, Richard Meier, Harry Weese, César Pelli, Gunnar Birkerts, and Skidmore. I had no idea about any of this, and now I want to visit Columbus!

I'm planning a book tour right now (for my next novel, Picks and Shovels, which is out in February) and there's a little wiggle-room in the midwestern part of the tour. There's a possibility that I'll end up in the vicinity, and if that happens, I'm definitely gonna find time for a little detour!

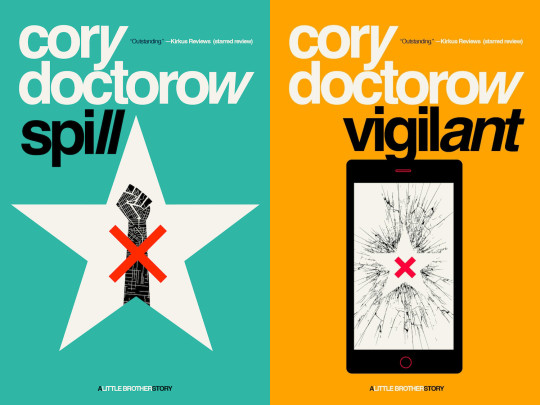

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

#pluralistic#linkdump#linkdumps#iot#internet of shit#brave little toaster#drm#copyfight#fsfe#big tobacco#denialism#Ada and Zangemann#Matthias Kirschner#ethan zuckerman#columbus#ohio#road trips#architecture#fbi#sting operations#pump and dump#scams#crypto#cryptocurrency#wash trading#ethereum

49 notes

·

View notes

Text

#trump smells#phuk elon#trump criminal organization#pump and dump#insider trading#bankrupt Tesla#vote blue#fuck trump#evil gop

6 notes

·

View notes

Text

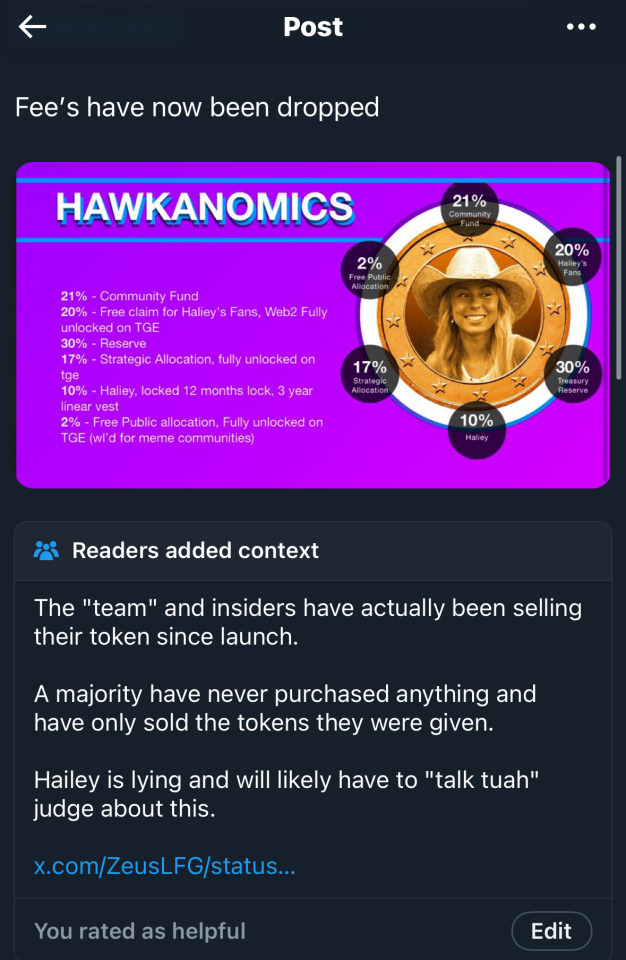

How anybody is surprised at Hawk Tuah girl’s crypto scam is beyond me. Anytime some new dumb ‘iNfLuEnCeR’ starts one of those it’s almost always some rug pull. People buy into it thinking it won’t happen to them like bro these people don’t care about u

Lmao COFFEEZILLA

10 notes

·

View notes

Photo

5 notes

·

View notes

Text

In July 2026, a new regime will take effect in California, where Biesk’s family lives, requiring residents to obtain a license to take part in “digital financial asset business activity,” including exchanging, transferring, storing or administering certain crypto assets. President-elect Donald Trump has also promised new crypto regulations. But for now, there are no crypto-specific laws in place.

“We are in a legal vacuum where there are no clear laws,” says Andrew Gordon, partner at law firm Gordon Law. “Once we know what is ‘in bounds,’ we will also know what is ‘out of bounds.’ This will hopefully create a climate where rug pulls don't happen, or when they do they are seen as a criminal violation.”

On November 19, as the evening wore on, angry messages continued to tumble in, says Biesk. Though some celebrated his son's antics, calling for him to return and create another coin, others were threatening or aggressive. “Your son stole my fucking money,” wrote one person over Instagram.

Biesk and his wife were still trying to understand quite how their son was able to make so much money, so fast. “I was trying to get an understanding of exactly how this meme crypto trading works,” says Biesk.

Some memecoin traders, sensing there could be money in riffing off the turn of events, created new coins on Pump.Fun inspired by Biesk and his wife: QUANT DAD and QUANTS MOM. (Both are now practically worthless.)

Equally disturbed and bewildered, Biesk and his wife formed a provisional plan: to make all public social media accounts private, stop answering the phone, and, generally, hunker down until things blew over. (Biesk’s account is active at the time of writing.) Biesk declined to comment on whether the family made contact with law enforcement or what would happen to the funds, saying only that his son would “put the money away.”

A few hours later, an X account under the name of Biesk’s son posted on X, pleading for people to stop contacting his parents. “Im sorry about Quant, I didnt realize I get so much money. Please dont write to my parents, I wiill pay you back [sic],” read the post. Biesk claims the account is not operated by his son.

Though alarmed by the backlash, Biesk is impressed by the entrepreneurial spirit and technical capability his son displayed. “It’s actually sort of a sophisticated trading platform,” he says. “He obviously learned it on his own.”

That his teenager was capable of making $50,000 in an evening, Biesk theorizes, speaks to the fundamentally different relationship kids of that age have with money and investing, characterized by an urgency and hyperactivity that rubs up against traditional wisdom.

“To me, crypto can be hard to grasp, because there is nothing there behind it—it’s not anything tangible. But I think kids relate to this intangible digital world more than adults do,” says Biesk. “This has an immediacy to him. It’s almost like he understands this better.”

On December 1, after a two-week hiatus, Biesk’s son returned to Pump.Fun to launch five new memecoins, apparently undeterred by the abuse. Disregarding the warnings built into the very names of some of the new coins—one was named test and another dontbuy—people bought in. Biesk’s son made another $5,000.

#A Kid Made $50K#Dumping Crypto He’d Created. Then Came the Backlash#Joel Khalili#crypto crooks#leon#pump and dump#pirates

2 notes

·

View notes

Photo

Hinge presents an anthology of love stories almost never told. Read more on https://no-ordinary-love.co

2K notes

·

View notes

Text

#bluesky#bluesky out of context#overheard#callahan.bsky.social#hawk tuah#talk tuah#crypto#cryptocurrency#hawk tuah coin#rug pull#pump and dump

5 notes

·

View notes

Text

I'm investigating a scam.

I have been put into these massive WhatsApp group chats ~200 - 500 members. There are a few group admins, the country codes include +1(US), +44(UK), +7(RU/KZ). The majority of the people included in the group have +1 country code.

These chats are named something along the lines of "AI Automation wealth train". Generally the admins only allow admins to message the group. The chat also has these "bots". They personify a public figure related to finance. These "bots" are not admins, so periodically all members are allowed to comment. I've checked the messages to see if they were created by an AI like ChatGPT and etc., it seems like they were not.

I'm still trying to figure out how exactly these bots work. I noticed that at least one had a WhatsApp business account. It seems like the messaging is automated.

The messages are emoji filled, but seems to be "garbage". They want us to buy gold, silver and crypto. The messages tell us to buy crypto, one explicitly said etherium. They haven't posted an exchange or anything to use. I'm waiting for the scam angle (aside from the possible pump n' dump).

If you have been added to any chats like this and want to help me out, feel free to comment below or DM me.

#scam#hackers#investigative journalism#whatsapp#spam bots#crypto scam#pig butchering#pump and dump#ftc#fbi

7 notes

·

View notes

Photo

(via Trump Media shares halted repeatedly as DJT whipsaws in volatile trading)

something very funny going on here...

2 notes

·

View notes

Text

Daddy knows when to pump and when to dump, so he knew exactly what my mouth was for and made full use of it.

Well, he is the boss and so can do what he likes.

#he's the boss#police chief#chief of police#top dog#daddy has needs#any time he wants#whenever he wants#pump and dump#daddy came in my mouth#daddy doesn't pull out#dumped his load in my mouth#came balls deep#came without warning#made me swallow

172 notes

·

View notes

Text

Lol my old birdapp account got invited to literal crime what a dumpster fire platform.

2 notes

·

View notes

Text

[Silicon Valley ideology is] hyping specific technologies as universal, structural game-changers in accelerating hype cycles designed to fleece their marks quickly enough to drive growth and cash out before most people realise the technology simply doesn’t work as they were told. Bonus points for damaging trusted institutions (crypto) or labour (AI) along the way.

-Maria Farrell

234 notes

·

View notes

Text

🚨 Pump.fun Suspended? What We Know So Far

If you’ve been checking Pump.fun or scrolling through Crypto Twitter today, you probably noticed something’s off. Both the official Pump.fun X account (@pumpdotfun) and co-founder Alon Cohen’s account have been suspended as of June 16, 2025. No official explanation has been posted—but this isn’t an isolated incident. It’s just the latest chapter in a growing list of problems for the meme coin…

0 notes

Text

Trump/Musk Pump & Dump Scheme

youtube

#us politics#us stock market#pump and dump#securities#securities fraud#sec#donald trump#elon musk#fraudsters#thom hartmann

1 note

·

View note

Text

The Hall of Clowns: Exposing the Biggest Hype-Driven Fools

A chaotic circus of internet clowns, each one representing a different type of hype-driven fool—fake gurus flashing monopoly money, angry Twitter mobs with pitchforks, and crypto scammers running off with bags of cash. In the age of viral trends and instant outrage, there’s no shortage of hype-driven fools who blindly follow whatever’s trending—whether it’s fake gurus selling overpriced courses,…

View On WordPress

#Cancel Culture#Clout Chasers#critical thinking#Fake Gurus#Mob Mentality#Pump and Dump#Scammers#Social Media Hype

0 notes