#QuickBooks Conversion tool

Explore tagged Tumblr posts

Text

27 Must-Have Productivity Apps for Entrepreneurs

Entrepreneurs are usually looking for methods to maximise their time and performance. Whether you're coping with initiatives, collaborating with a group, or truly trying to stay organized, the right productiveness apps could make all the distinction. Here are some of the quality productiveness apps for marketers in 2024, categorized with the aid of their capabilities.

Best productivity apps for busy entrepreneurs

Task and Project Management Apps

1. Trello

Trello is a visually attractive and consumer-friendly venture control device that uses a board-and-card machine to help you arrange obligations. It lets in you to create distinctive forums for numerous tasks, set due dates, and collaborate along with your team in actual time. Trello’s drag-and-drop functionality makes coping with projects convenient.

2. Asana

Asana is an exceptional preference for marketers managing more than one projects right away. It helps song obligations, assign obligations, and set time limits. With a established list or board view, Asana guarantees that not anything falls thru the cracks.

Three. Monday.Com

Monday.Com is an all-in-one paintings running device that provides customizable workflows, automation, and integrations. Entrepreneurs can track mission development, manage their group’s workload, and automate repetitive responsibilities, making it an invaluable tool for productivity.

Time Management Apps

four. Toggl Track

Toggl Track is an tremendous app for monitoring the time spent on one of a kind duties and projects. Entrepreneurs can use it to pick out where their time is going, enhance productivity, and make sure they're billing customers accurately.

5. RescueTime

RescueTime facilitates you recognize your each day behavior with the aid of monitoring how a lot time you spend on numerous apps and web sites. It offers insights into your most effective hours and offers features like computerized time tracking and aim setting.

6. Clockify

Clockify is some other extraordinary time-monitoring device, especially for entrepreneurs running with groups. It presents specific reviews on work hours and productivity, making it simpler to manage tasks efficaciously.

Note-Taking and Documentation Apps

7. Evernote

Evernote is a powerful be aware-taking app that lets in entrepreneurs to put in writing thoughts, clip internet pages, and prepare thoughts into notebooks. With a sturdy search feature and the ability to sync throughout devices, Evernote is a must-have for business proprietors who need to preserve music in their ideas.

8. Notion

Notion is a flexible workspace that mixes observe-taking, task control, databases, and collaboration tools. Entrepreneurs can create dashboards, record processes, and collaborate with their crew in a single platform.

9. OneNote

Microsoft OneNote is some other superb notice-taking device with a virtual notebook interface. It’s exceptional for marketers who decide on a extra conventional, paper-like experience at the same time as taking notes.

Communication and Collaboration Apps

10. Slack

Slack is a famous communication device that makes group collaboration seamless. With channels, direct messages, and integrations with different equipment like Trello and Google Drive, Slack guarantees that conversation stays green and prepared.

Eleven. Microsoft Teams

For marketers the use of Microsoft 365, Microsoft Teams is an notable alternative for conversation and collaboration. It gives chat, video conferencing, and file sharing, making far off teamwork easy.

12. Zoom

Zoom is the cross-to video conferencing device for entrepreneurs who need to host meetings, webinars, and virtual events. With notable video and audio, display screen sharing, and recording options, Zoom is a need to-have.

Finance and Accounting Apps

13. QuickBooks

QuickBooks is one of the fine accounting software program for entrepreneurs. It allows song earnings and fees, manage invoices, and generate financial reports, making it easier to address enterprise finances.

14. FreshBooks

FreshBooks is another extraordinary accounting device, mainly for freelancers and small commercial enterprise proprietors. It gives invoicing, expense monitoring, and time tracking functions, making sure easy economic control.

15. Wave

Wave is a free accounting and invoicing tool designed for marketers and small business owners. It’s brilliant for managing coins drift without incurring excessive prices.

Automation and Workflow Apps

sixteen. Zapier

Zapier is an automation tool that connects extraordinary apps to create workflows, saving entrepreneurs hours of manual paintings. With Zapier, you can automate responsibilities like sending emails, updating spreadsheets, and managing consumer data.

17. IFTTT

IFTTT (If This Then That) permits entrepreneurs to create automation between special apps and devices. For instance, you could automate social media posting or set reminders primarily based on certain triggers.

Marketing and Social Media Management Apps

19. Buffer

Buffer is a social media scheduling device that lets in entrepreneurs to devise and put up posts throughout one of a kind systems. It also presents analytics to assist song engagement and overall performance.

20. Hootsuite

Hootsuite is every other effective social media control device that helps agenda posts, display brand mentions, and analyze social media overall performance.

21. Canva

Canva is a photograph layout tool that allows marketers to create marketing substances, social media posts, and displays without difficulty. With customizable templates and drag-and-drop features, it simplifies the design technique.

Cloud Storage and File Management Apps

22. Google Drive

Google Drive presents stable cloud storage and smooth record sharing. Entrepreneurs can store, get right of entry to, and collaborate on files, spreadsheets, and shows in real time.

23. Dropbox

Dropbox is some other cloud garage solution that makes it easy to save and share documents securely with a crew. It integrates with various productiveness apps to streamline workflows.

24. OneDrive

For marketers using Microsoft products, OneDrive is an splendid cloud storage solution that seamlessly integrates with Office apps.

Mindfulness and Focus Apps

25. Headspace

Entrepreneurship can be stressful, and Headspace facilitates entrepreneurs exercise mindfulness and meditation to live targeted and reduce strain.

26. Forest

Forest is a focal point app that encourages marketers to stay off their phones by means of growing a digital tree at the same time as they work. If they go away the app, the tree dies—motivating them to live focused.

27. Noisli

Noisli provides heritage sounds to enhance cognizance and productivity. Whether you opt for white noise, rain sounds, or a coffee store atmosphere, Noisli facilitates create the proper paintings environment.

2 notes

·

View notes

Text

Your Guide to Choosing the Right AI Tools for Small Business Growth

In state-of-the-art speedy-paced international, synthetic intelligence (AI) has come to be a game-changer for businesses of all sizes, mainly small corporations that need to stay aggressive. AI tools are now not constrained to big establishments; less costly and available answers now empower small groups to improve efficiency, decorate patron experience, and boost revenue.

Best AI tools for improving small business customer experience

Here’s a detailed review of the top 10 AI tools that are ideal for small organizations:

1. ChatGPT by using OpenAI

Category: Customer Support & Content Creation

Why It’s Useful:

ChatGPT is an AI-powered conversational assistant designed to help with customer service, content creation, and more. Small companies can use it to generate product descriptions, blog posts, or respond to purchaser inquiries correctly.

Key Features:

24/7 customer service via AI chatbots.

Easy integration into web sites and apps.

Cost-powerful answers for growing enticing content material.

Use Case: A small e-trade commercial enterprise makes use of ChatGPT to handle FAQs and automate patron queries, decreasing the workload on human personnel.

2. Jasper AI

Category: Content Marketing

Why It’s Useful:

Jasper AI specializes in generating first rate marketing content. It’s ideal for creating blogs, social media posts, advert reproduction, and extra, tailored to your emblem’s voice.

Key Features:

AI-powered writing assistance with customizable tones.

Templates for emails, advertisements, and blogs.

Plagiarism detection and search engine optimization optimization.

Use Case: A small enterprise owner uses Jasper AI to create search engine optimization-pleasant blog content material, enhancing their website's visibility and traffic.

Three. HubSpot CRM

Category: Customer Relationship Management

Why It’s Useful:

HubSpot CRM makes use of AI to streamline purchaser relationship control, making it less difficult to music leads, control income pipelines, and improve consumer retention.

Key Features:

Automated lead scoring and observe-ups.

AI insights for customized purchaser interactions.

Seamless integration with advertising gear.

Use Case: A startup leverages HubSpot CRM to automate email follow-ups, increasing conversion costs without hiring extra staff.

Four. Hootsuite Insights Powered by means of Brandwatch

Category: Social Media Management

Why It’s Useful:

Hootsuite integrates AI-powered social media insights to help small businesses tune tendencies, manipulate engagement, and optimize their social media method.

Key Features:

Real-time social listening and analytics.

AI suggestions for content timing and hashtags.

Competitor evaluation for a competitive aspect.

Use Case: A nearby café uses Hootsuite to agenda posts, tune customer feedback on social media, and analyze trending content material ideas.

Five. QuickBooks Online with AI Integration

Category: Accounting & Finance

Why It’s Useful:

QuickBooks Online automates bookkeeping responsibilities, rate monitoring, and economic reporting using AI, saving small agencies time and reducing mistakes.

Key Features:

Automated categorization of costs.

AI-driven economic insights and forecasting.

Invoice generation and price reminders.

Use Case: A freelance photo designer uses QuickBooks to simplify tax practise and hold tune of assignment-primarily based earnings.

6. Canva Magic Studio

Category: Graphic Design

Why It’s Useful:

Canva Magic Studio is an AI-more advantageous design tool that empowers non-designers to create stunning visuals for marketing, social media, and presentations.

Key Features:

AI-assisted layout guidelines.

One-click background elimination and resizing.

Access to templates, inventory pictures, and videos.

Use Case: A small bakery makes use of Canva Magic Studio to create pleasing Instagram posts and promotional flyers.

7. Grammarly Business

Category: Writing Assistance

Why It’s Useful:

Grammarly Business guarantees that each one written communications, from emails to reviews, are expert and blunders-unfastened. Its AI improves clarity, tone, and engagement.

Key Features:

AI-powered grammar, spelling, and style corrections.

Customizable tone adjustments for branding.

Team collaboration gear.

Use Case: A advertising company makes use of Grammarly Business to make sure consumer proposals and content material are polished and compelling.

Eight. Zapier with AI Automation

Category: Workflow Automation

Why It’s Useful:

Zapier connects apps and automates workflows without coding. It makes use of AI to signify smart integrations, saving time on repetitive tasks.

Key Features:

Automates responsibilities throughout 5,000+ apps.

AI-pushed recommendations for green workflows.

No coding required for setup.

Use Case: A small IT consulting corporation makes use of Zapier to routinely create tasks in their assignment management device every time a brand new lead is captured.

9. Surfer SEO

Category: Search Engine Optimization

Why It’s Useful:

Surfer SEO uses AI to assist small businesses improve their internet site’s seek engine scores thru content material optimization and keyword strategies.

Key Features:

AI-pushed content audit and optimization.

Keyword studies and clustering.

Competitive evaluation equipment.

Use Case: An on-line store uses Surfer search engine marketing to optimize product descriptions and blog posts, increasing organic site visitors.

10. Loom

Category: Video Communication

Why It’s Useful:

Loom lets in small groups to create video messages quick, which are beneficial for group collaboration, client updates, and customer service.

Key Features:

Screen recording with AI-powered editing.

Analytics for viewer engagement.

Cloud garage and smooth sharing hyperlinks.

Use Case: A digital advertising consultant makes use of Loom to offer video tutorials for customers, improving expertise and lowering in-man or woman conferences.

Why Small Businesses Should Embrace AI Tools

Cost Savings: AI automates repetitive duties, reducing the need for extra group of workers.

Efficiency: These equipment streamline operations, saving time and increasing productiveness.

Scalability: AI permits small organizations to manipulate boom with out full-size infrastructure changes.

Improved Customer Experience: From personalized tips to 24/7 help, AI gear help small groups deliver superior customer service.

3 notes

·

View notes

Text

Revolutionizing Transactions with PayWint Digital Wallet

In a world where convenience and efficiency dominate, the demand for reliable and feature-rich digital wallets has skyrocketed. Enter PayWint, the ultimate digital wallet solution designed to streamline your financial transactions while ensuring security and ease of use. Whether you're a student, traveler, freelancer, or small business owner, PayWint is here to revolutionize how you manage, send, and receive money.

Why Choose PayWint?

PayWint stands out in the crowded digital wallet space with its seamless features tailored to meet diverse user needs. From real-time alerts to AI-powered fraud detection, PayWint ensures your transactions are not just swift but also highly secure.

Key Features at a Glance:

Instant Money Transfers: Request, send, and receive money in real-time, making it the perfect companion for personal and professional needs.

Multi-Currency & Multi-Language Support: Operate effortlessly across borders, thanks to PayWint's global usability.

Shared Wallets: Split bills or manage group expenses with family, friends, or business partners through shared wallets.

Virtual & Physical Cards: Open a digital bank account and enjoy the convenience of virtual or physical cards.

Perfect for Everyone

PayWint caters to a diverse audience, ensuring inclusivity and functionality for all.

Students and Freelancers can use PayWint to manage international payments, ensuring they can receive funds from clients or family abroad without delays.

Small Business Owners can streamline payroll, vendor payments, and even customer transactions, all from one centralized platform.

Travel Enthusiasts can enjoy hassle-free currency conversions and transactions no matter where they are.

Unparalleled Integrations

One of PayWint's standout features is its ability to integrate with leading financial and payment platforms such as Apple Pay, Google Pay, PayPal, CashApp, and Venmo. Users can also link multiple bank accounts or credit and debit cards for effortless transactions. Moreover, businesses can integrate accounting platforms like QuickBooks, Zoho, or FreshBooks to simplify bookkeeping.

Enhanced Security & Real-Time Updates

Security is at the heart of PayWint. With encryption and AI-powered fraud detection, users can trust their financial data is always safe. Real-time alerts via text, email, or push notifications ensure you stay informed about every transaction.

Beyond Payments

PayWint isn't just a digital wallet; it's a comprehensive financial management tool. The AI-powered budget planner helps users track expenses and set financial goals. For businesses, the ability to schedule recurring payments and integrate payment widgets into websites adds unparalleled convenience.

Always There for You

With 24/7 customer support available via phone, email, text, and chat, help is always just a call or message away. You can reach us at (408) 516-1413 for any assistance. Whether it's a quick query or a technical issue, PayWint ensures you're never left in the dark.

Get Started with PayWint

Ready to transform how you handle money? Download the PayWint Digital Wallet Mobile App today from the Apple Store or Google Play Store. Alternatively, visit PayWint.com to access your financial world instantly.

2 notes

·

View notes

Text

The Ultimate Shopify Tech Stack for Scaling Your Ecommerce Business

In today’s fast-paced ecommerce environment, scaling a Shopify store takes more than just great products and marketing. It requires a powerful, well-integrated Shopify tech stack that streamlines operations, improves customer experience, and drives growth.

If your team is juggling inventory, order fulfillment, and customer service manually, you’ll soon run into bottlenecks. That’s where tools like Shopify ERP integration come in, allowing you to automate backend processes, reduce human error, and manage business data across systems effortlessly.

Curious about what tech stack does Shopify use or recommend? Let’s dive into the ultimate stack that helps you scale without burning out your team.

What is a Shopify Tech Stack?

A Shopify tech stack is a collection of apps, tools, integrations, and systems that work together to power your online store. These tools handle everything from marketing automation and sales to inventory, support, and analytics.

Think of it as the foundation that holds your ecommerce operations together. Choosing the right stack helps:

Streamline workflows

Automate manual tasks

Improve customer support

Increase conversion and retention

Key Components of the Best Shopify Tech Stack

Here’s a breakdown of the essential categories your tech stack should cover:

1. Backend Operations

Inventory Management: Integrate with tools like TradeGecko or Skubana for real-time inventory sync.

Order Fulfillment: Automate shipping and warehousing using ShipBob or ShipStation.

Accounting & Finance: Use QuickBooks, Xero, or a Shopify ERP Integration solution like NetSuite.

Looking for a seamless backend? Stellar Delivery Date & Pickup helps optimize logistics for local deliveries and pickups—a great addition to your stack if you offer location-based services.

2. Marketing & Sales

Email Marketing: Tools like Klaviyo or Omnisend.

SMS Marketing: Postscript or Attentive for better engagement.

Upsells & Cross-sells: Upsell apps for Shopify is one of the best tools to boost AOV directly from the cart drawer.

3. Front-End & UX

Theme & Page Builders: Shogun, PageFly, or GemPages.

Product Discovery: Add search and filter tools like Searchanise.

Personalization: Recommend product using Icart.

4. Analytics & Insights

Customer Data Platform: Glew.io or Segments.

Heatmaps & Behavior Tracking: Hotjar or Lucky Orange.

Performance Monitoring: Google Analytics 4 and Shopify Analytics.

How to Build the Best Shopify Tech Stack for Your Store

When choosing the best Shopify tech stack, consider these key factors:

Store Size & Scale: Are you a growing D2C brand or a high-volume B2B seller?

Business Model: Subscription-based? International fulfillment?

Budget: Some tools are free; others require long-term investment.

Integration Needs: Will your apps sync with your existing ERP or CRM?

A scalable tech stack should grow with your business and support automation.

Final Thoughts: Build to Scale, Not Just to Start

Your Shopify store’s long-term success depends on more than product-market fit. It depends on having a lean, efficient, and scalable Shopify tech stack that frees up your time and enhances every part of the customer journey.

From backend automation with Shopify ERP integration, to increasing AOV using iCart, the right tech stack turns your store into a high-performing ecommerce engine.

FAQs: What Tech Stack Does Shopify Use?

Q1: What tech stack does Shopify run on internally? Shopify’s own stack includes Ruby on Rails, React.js, MySQL, and Kubernetes. On the merchant side, Shopify recommends a modular approach using best-in-class apps from its App Store.

Q2: How do I choose a tech stack Shopify recommends? Start with Shopify App Store integrations, then scale with third-party tools based on your business needs.

0 notes

Text

AI's Quiet Coup: 5 Industries That Won’t Survive the Shift by 2026

It’s Not Hype Anymore — The Takeover Has Already Begun

The robots didn’t just arrive — they’ve been here for a while.

What started as a slow wave of automation has now turned into a silent tsunami. In 2025 alone, over 76,000 jobs were erased by artificial intelligence. Not restructured. Not moved offshore. Just… gone.

I recently spoke to a software engineer whose sister — a legal assistant at a boutique firm — was let go with no explanation beyond “AI is handling it now.” In another case, a friend in finance watched a third of his department disappear after their firm integrated a generative AI platform.

This isn’t theoretical. This isn’t sci-fi. It’s real, it’s happening now, and it’s moving fast. While tech headlines are still busy debating “what AI might do,” the reality is that it’s already doing it — and five industries are squarely in the crosshairs.

Here’s where the quiet takeover is already well underway.

Customer Support: Replaced by Scripts That Learn Faster Than Humans Remember long wait times with support centers? Soon, that might sound as outdated as dial-up. AI-powered chatbots like GPT-4.5 and Anthropic’s Claude are already running 24/7 support desks — answering queries, resolving issues, even handling refunds.

Companies like Shopify, Delta, and banks worldwide have quietly begun replacing entire tiers of customer service reps with conversational AI. The bots don’t sleep, don’t unionize, and — with reinforcement learning — they get smarter every week.

If your job involves reading off a script or solving FAQs, the script has already moved into the cloud.

Legal & Paralegal Services: Case Law Meets Code AI isn't arguing in court yet — but it’s doing everything up to that point. Contract analysis, compliance checks, research summaries, legal document generation — tools like Harvey AI and Lexis+ AI are handling it all in seconds.

Law firms have slashed junior roles and entry-level paralegal positions, replacing them with AI assistants that don’t need coffee breaks or billing hours. In some firms, AI now drafts 90% of boilerplate contracts.

If you���re fresh out of law school and hoping to cut your teeth on discovery work — AI already beat you to it.

Accounting & Bookkeeping: Excel Just Got Smarter Think your spreadsheet skills will protect you? Think again. Accounting, once considered a stable career path, is being unbundled by AI platforms that can categorize expenses, reconcile books, and flag anomalies in real-time.

QuickBooks and Xero already offer built-in AI features that cut the need for junior accountants by half. Entire departments that once ran payroll or handled invoicing are now managed by a single person and a smart algorithm.

It’s not that your job is being outsourced. It’s being out-thought.

Content Creation: The Rise of the Robot Writer Blog posts, ad copy, press releases, video scripts — AI can now generate all of it in seconds. Companies used to hire teams of copywriters. Now they license tools like Jasper, Copy.ai, or just tap into GPT-based systems.

What used to take a week now takes 10 minutes. Worse, it’s not just text. AI is generating images, editing video, and even making music — often indistinguishable from human output.

If you write for a living, you're no longer just competing with other writers. You're competing with a machine that doesn’t need royalties.

Education & Tutoring: Personalized Learning at Scale AI tutors are now outperforming their human counterparts in both engagement and results. Khan Academy’s “Khanmigo” and platforms like Sora are building personalized learning journeys, tailored in real-time to each student’s pace and level.

While teachers are still essential for emotional intelligence and guidance, administrative tasks — grading, lesson planning, student analytics — are rapidly becoming automated. And for many students worldwide, AI tutors are the classroom.

In developing nations, this shift isn’t just replacing teachers — it’s bypassing them altogether.

What Comes Next? This isn’t a doomsday prediction. But it is a reality check.

Goldman Sachs predicts that up to 300 million jobs could be affected by AI. The early tremors are here — the layoffs, the restructures, the quiet departures. But this wave isn’t random. It’s targeted. Predictable. Strategic.

If you work in a repetitive, rule-based role in any of the industries above, now’s the time to act. Reskilling, adapting, and learning to work with AI is no longer optional. It’s the difference between staying relevant and being quietly replaced.

The takeover isn’t coming. It’s here. And it’s accelerating.

#AI takeover#future of jobs#machine learning#job loss#AI in business#automation revolution#AI and work#robotic disruption#tech trends#industries at risk

0 notes

Text

QuickBooks File Repair helps prevent significant disruptions by addressing issues before they escalate

Brandon, MB- June 20, 2025: QuickBooks is an essential tool for businesses, helping to manage finances, track expenses, and create financial reports. However, like any software, QuickBooks files can experience issues over time, which can affect your workflow, lead to data inconsistencies, or even result in system crashes. This is where QuickBooks File Repair comes into play. QuickBooks File Repair is a critical service that can help resolve these issues, ensuring your accounting system runs smoothly and your business operations remain uninterrupted.

Data corruption can happen for various reasons—whether from software crashes, improper shutdowns, or issues during file transfers. When QuickBooks files become corrupted, they may show incorrect data, errors in reports, or even prevent you from accessing your financial records altogether. File repair tools in QuickBooks, such as the Rebuild Data tool, help fix corrupted data, ensuring your files are healthy and your business information is accurate.

As QuickBooks files grow larger, they can become slow and inefficient. Over time, system lag may occur when running reports, invoicing clients, or reconciling accounts. Repairing and optimizing the company file helps improve the overall performance, reducing delays and making QuickBooks more responsive. This can save you time and frustration, improving your productivity.

Your QuickBooks files contain important financial data such as sales, expenses, payroll, and inventory. Without proper maintenance and timely repairs, there’s a risk of losing this crucial data, which can impact business decisions and tax filing. QuickBooks File Repair ensures that your files remain intact, minimizing the chances of data loss and helping you maintain accurate financial records.

As QuickBooks continues to release updates and new features, repairing and maintaining your QuickBooks file is essential to ensure smooth installation and operation of these updates. A damaged file may prevent updates from installing correctly, leading to further technical problems. File repair helps prepare your system for future updates, ensuring that your software continues to run efficiently.

For small businesses, any downtime due to accounting issues can be costly. QuickBooks File Repair helps prevent significant disruptions by addressing issues before they escalate. Whether it’s fixing corrupted files, repairing data integrity problems, or resolving performance issues, timely repairs can reduce the amount of time your business spends dealing with technical issues.

QuickBooks File Repair is a crucial service for ensuring the accuracy, performance, and integrity of your financial data. Regular maintenance and timely repairs can prevent data corruption, improve system performance, and help your business stay on track. If you’re facing issues with QuickBooks, using the file repair tools can help you resolve problems quickly, keeping your accounting system running smoothly and reducing the risk of downtime or data loss.

If you encounter persistent issues or file corruption that cannot be fixed through QuickBooks’ built-in tools, it’s recommended to seek expert assistance to restore the functionality of your QuickBooks files. Regularly repairing and optimizing your files is key to maintaining a reliable, efficient accounting system.

About E-Tech

Founded in 2001, E-Tech is the leading file repair, data recovery, and data conversion services provider in the United States and Canada. The company works to stay up to date on the latest technology news, reviews, and more for their customers.

For media inquiries regarding E-Tech, individuals are encouraged to contact Media Relations Director, Melanie Ann via email at [email protected].

To learn more about the company, visit: www.e-tech.ca

Melanie Ann

Media Relations

E-Tech

136 11 th St

Brandon, MB R7A 4J4

www.e-tech.ca

0 notes

Text

AI-Powered Automation: The Competitive Advantage for Small Businesses

What is AI-powered automation, and how does it work?

AI-powered automation is when machines use artificial intelligence (AI) to do tasks that normally need human thinking. These tasks include answering customer questions, managing emails, creating reports, scheduling meetings, and even making smart business decisions.

It combines machine learning, natural language processing, and data analytics to automate both simple and complex business processes. For small businesses, this means they can operate faster, smarter, and with fewer resources.

Why should small businesses care about AI automation?

Because AI helps small businesses do more with less. Here’s how:

Time savings: AI can reduce time spent on repetitive tasks by up to 80% (McKinsey & Company).

Cost efficiency: A study by Accenture found AI can lower operating costs by up to 30%.

Growth: Businesses that adopt AI grow revenue 50% faster than those that don’t (Forrester Research).

Competitive edge: In a crowded market, speed and precision matter. AI gives smaller companies tools that used to be available only to large enterprises.

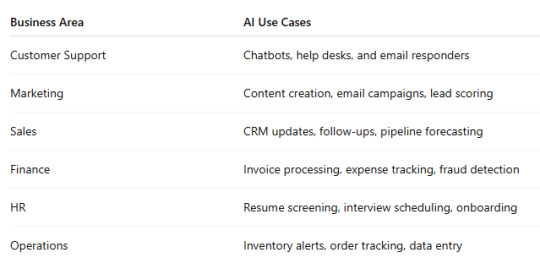

What areas of business can AI automate?

What are the benefits of using AI for small businesses?

Here’s how AI changes the game:

Saves time and resources

Automates repetitive tasks like data entry, scheduling, and follow-ups

Lets your team focus on work that requires real thinking

2. Improves customer service

Chatbots like Tidio or Drift respond 24/7

Personalizes responses based on customer history

3. Boosts marketing performance

AI tools like Mailchimp and ActiveCampaign send smarter emails

Tracks customer behavior and adjusts campaigns in real-time

4. Makes better decisions faster

AI tools can analyze data and show trends that humans might miss

Helps with forecasting sales or choosing the right products to promote

5. Scales with your business

AI doesn’t need a lunch break. As your business grows, it grows with you.

How much does AI automation cost for small businesses?

Good news — it’s more affordable than you think.

AI chatbots like Tidio start at around $29/month

AI email marketing tools like MailerLite start free, then scale up

AI scheduling tools like Calendly offer free tiers for solo users

AI bookkeeping software like QuickBooks with AI features start at��$25/month

Even platforms like HubSpot and Zoho CRM have built-in AI tools now, often included in their base plans.

How do I get started with AI automation?

Step 1: Identify repetitive tasks Start with things you or your team do daily: sending emails, answering the same customer questions, or pulling reports.

Step 2: Choose the right tools Here are a few to consider:

CRM automation: Zoho CRM, HubSpot, Salesforce

Marketing AI: Mailchimp, Jasper, Copy.ai

Finance AI: QuickBooks, Xero, FreshBooks

Operations: Zapier, Make, Monday.com

Step 3: Start small Automate one task, track the results, and build from there. For example, use an AI chatbot to handle FAQs, then expand to email automation.

Step 4: Train your team Make sure your team understands the tools and knows how to use them. Choose platforms with good customer support or training videos.

Step 5: Monitor and adjust Check how automation affects your time, customer satisfaction, and budget. Tweak your system as needed.

Are there real-world examples of small businesses using AI?

Yes. Many small businesses are already using AI to succeed:

Coffee shop in Chicago used AI-powered email marketing and saw a 35% increase in repeat customers.

Online craft store in Texas used AI chatbots and reduced customer support response time by 70%.

Digital marketing agency in Florida automated lead scoring with Zoho CRM and boosted conversion rates by 25%.

These are simple use cases with big impact. None of them required full-time IT staff.

What are the risks or downsides of using AI for small businesses?

Like any tool, AI comes with challenges:

Over-automation: Customers still want to talk to humans sometimes.

Data privacy: You need to make sure the tools you use are secure and follow data laws.

Learning curve: Some tools require time to learn or train properly.

Wrong expectations: AI helps — but it doesn’t solve every problem magically.

The key is to use AI where it makes sense, not everywhere.

What should I look for in an AI solution provider?

When choosing a tool or consultant, make sure they:

Understand your industry and business size

Offer setup, support, and training

Work with trusted AI platforms

Can show real examples and results

Help you integrate with tools you already use

Don’t just pick the tool with the flashiest features. Choose the one that solves your problems best.

Final thoughts: Is AI automation worth it for small businesses?

Yes. AI-powered automation is no longer just for big companies. It’s for any business that wants to:

Save time

Lower costs

Serve customers better

Grow smarter

By starting with small changes — like chatbots, email automation, or CRM updates — you can see big returns quickly. And as the tools grow smarter and more affordable, the benefits will only increase.

If you’re unsure where to begin or want expert guidance, AeyeCRM offers personalized support to help small businesses get started with cloud-based AI tools that drive real results.

1 note

·

View note

Text

Best VAT compliance audit service in the UAE

Best VAT Compliance Audit Service in the UAE: Is Your Business Really Covered? Let’s be honest—nobody wakes up excited about VAT compliance. It’s dry, technical, and let’s not sugarcoat it… kind of a headache. But here’s the kicker: ignoring it or brushing it off? That’s a fast track to HMRC knocking at your door—or worse, unexpected penalties that hit harder than a surprise tax bill after a record sales month.

So, what makes a VAT compliance audit service in the UAE the best? And more importantly, how do you know it’s the right fit for your business—whether you’re a scrappy startup, a scaling SME, or a seasoned enterprise juggling multiple VAT registrations?

Let’s break this down.

Why VAT Isn’t Just a ‘Finance Problem’ Anymore You might think VAT lives and dies in your accounting department. But here’s the thing—VAT touches everything: pricing strategies, supply chain decisions, cross-border sales, and even how you market certain offers. One incorrect VAT treatment, and suddenly you’re refunding customers, backpedaling on ad campaigns, or cleaning up a compliance mess.

It’s not just about "getting the numbers right." It’s about risk reduction, business agility, and trust.

Startups often don’t realise this until they’re already under review. Enterprises? They know it—some the hard way.

So What Does a ‘Best’ VAT Compliance Audit Service Actually Look Like? Honestly, it’s not the flashiest website or the slickest pitch deck. The best services quietly do the heavy lifting in the background, and they do it consistently. Here's what sets them apart:

✔️ Deep UAE VAT Expertise (And EU Knowledge Too) They get the quirks of the UAE VAT system. They understand how Brexit changed things. They know when zero-rating applies and when it doesn’t—and they’ve seen what happens when someone thinks they’re exempt but isn’t.

✔️ Custom-Tailored Reviews No cookie-cutter audits. The best providers walk through your operations—from your Shopify plugins to your shipping invoices—so the audit actually means something.

✔️ Tech-Integrated, Human-Led Software is great (love a good automation!), but someone still needs to interpret the data. The best services use tools like Xero, QuickBooks, or Sage integrations, but also offer real conversations with tax professionals.

✔️ Transparent Reporting You shouldn’t need a PhD in finance to read your VAT audit report. Look for services that show red flags clearly, explain fixes, and offer ongoing guidance—not just a spreadsheet of problems.

Rapid Business Solution: A Quiet Giant in VAT Compliance Now, I wouldn’t mention them if they didn’t walk the talk. Rapid Business Solution has carved out a reputation as one of the UAE’s most reliable names in VAT compliance audits—and no, they’re not just for the big dogs.

From boutique e-commerce brands to mid-sized tech firms scaling across the EU, they’ve helped businesses stay compliant without drowning them in jargon. Clients often mention their ability to "speak human," not just tax code. And that's a skill.

What’s refreshing? Their audits are not about pointing fingers. They're about helping businesses stay agile, confident, and ahead of HMRC—not playing catch-up.

Startups, You’re Not Too Small for This We get it. You're bootstrapping, wearing five hats, and VAT is just another annoying admin task that keeps falling down the list. But here's a wild stat—70% of VAT penalties in the UAE could’ve been avoided with basic audit checks.

That’s money you could’ve reinvested in product, ads, or maybe, just maybe, a breather for your team.

Startups benefit most from audits when they’re early—before bad habits set in. Don’t wait for your first HMRC inquiry to scramble for answers.

SMEs and Enterprises: Complexity Isn’t a Badge of Honor As your operations grow, so do the layers: different VAT schemes, industry-specific exemptions, international thresholds, and maybe even group VAT registration. It adds up—fast.

The best audit services don’t just identify errors. They help you build scalable, VAT-compliant systems so you're not rebuilding processes every year. For SMEs on the verge of entering new markets, this is crucial. For enterprises already juggling multiple jurisdictions, it’s non-negotiable.

Honestly, the difference between a decent and a great VAT compliance audit service? The latter will tell you what you didn’t even know to ask.

A Quick Reality Check: Do You Need a VAT Audit? Ask yourself (and answer honestly):

Have you changed your business model recently? Started selling cross-border? Outsourced your bookkeeping? Had more than one staff member handling VAT returns? Applied multiple VAT rates across services? If you nodded to even one, a compliance audit isn’t just nice to have—it’s essential.

Marketing Teams, You’re Part of This Too Strange as it sounds, VAT affects pricing pages, product bundling, shipping promos, and even ad copy. If your team’s running campaigns that cross borders or include mixed-rate goods/services, miscommunication with finance can lead to compliance headaches—or worse, unhappy customers.

Working with a VAT audit partner who gets how departments intersect isn’t a luxury—it’s a huge relief.

How Often Should You Do a VAT Compliance Audit? There’s no one-size-fits-all answer, but a good rule of thumb is:

Annually for steady operations Quarterly if you're rapidly growing, selling internationally, or switching systems Immediately if you’ve had a VAT investigation, late returns, or system overhauls A quick tip? Schedule it like a dentist appointment. Regular checkups beat painful emergencies every time.

Final Thoughts: It’s About Peace of Mind, Not Paperwork The best VAT compliance audit service in the UAE? It isn’t the one with the flashiest slogan. It’s the one that sees your blind spots, speaks your language, and helps you sleep better at night—knowing your business is on the right side of the taxman.

If you're serious about growth and not just surviving the next VAT deadline, give Rapid Business Solution a shout. They’re not just auditors—they’re your early-warning system in disguise.

Follow this website rapid business solution: https://rapidbs.ae/

0 notes

Text

Top ERP & CRM Features You Can’t Afford to Miss in 2025

In the dynamic theatre of modern enterprise, where decisions must be data-backed and operations flawlessly synchronized, two titans reign supreme: ERP and CRM. As we cruise into 2025, these systems are no longer back-office utilities — they’re the pulse of innovation, insight, and intelligent growth.

So, what separates a good platform from a game-changer? Let’s explore the most coveted ERP and CRM features redefining how the world works.

2025: The Year of Smart, Seamless Systems

Digital transformation is no longer an ambition; it’s a necessity. With customer journeys evolving and operations scaling across continents, the demand for intuitive, cloud-first, AI-infused platforms are at an all-time high.

From CFOs to CXOs, everyone wants the same thing: clarity, speed, and control. And that’s exactly what the following features promise.

Feature #1: Cloud-First Infrastructure

The rule of thumb? If it’s not cloud-native, it’s not future-proof.

A robust ERP or CRM in 2025 must:

Be accessible from anywhere, on any device

Offer elastic scalability and real-time updates

Enable seamless collaboration across departments and geographies

Why it matters: Because your team isn’t bound by four walls and your tech stack shouldn’t be either.

Feature #2: Embedded AI and Machine Learning

Say goodbye to gut decisions and hello to predictive precision. AI isn’t just a “nice to have” — it’s the new business brain.

Look for:

Automated sales forecasting and demand planning

Chatbots for instant customer engagement

Smart alerts, pattern recognition, and anomaly detection

Why it matters: Because guessing is expensive and intelligence is profitable.

Feature #3: Unified Dashboards & Real-Time Analytics

Static spreadsheets? So last decade.

Modern systems serve real-time, visually stunning dashboards that offer:

Department-specific KPIs at a glance

Drill-down analytics with zero lag

Instant reports that actually make sense

Why it matters: Because power lies in knowing — now.

Feature #4: Modular Architecture for Infinite Scale

Think Lego, not legacy.

Today’s ERP/CRM systems must allow:

Plug-and-play modules: add HR, finance, inventory as needed

Custom user roles and permissions

Easy scaling without a tech team meltdown

Why it matters: Because your business won’t stop growing and your tech must keep up.

Feature #5: Omnichannel Communication Suite

A single source of truth for all customer interactions? Yes, please.

Look for:

Integrated chat, email, voice, and social media

Unified contact timelines

Trigger-based workflows based on user actions

Why it matters: Because conversations happen everywhere and you need to be listening everywhere.

Feature #6: Intelligent Workflow Automation

Speed meets precision with drag-and-drop automation tools built right into your ERP and CRM.

Expect:

Rule-based automation (e.g., auto-approve invoices under $5K)

Smart reminders and escalations

No-code tools for non-tech users

Why it matters: Because manual work slows you down and costs you more.

Feature #7: Seamless API Integrations

Your ERP and CRM should play nice with everything else in your stack.

The best platforms offer:

RESTful APIs

Prebuilt integrations with top tools (Slack, QuickBooks, Shopify)

Smooth third-party sync without drama

Why it matters: Because disconnected systems = disconnected teams.

Feature #8: Mobile-Optimized UX

From sales teams on the move to field ops in remote regions, your system must be pocket-friendly.

Expect:

Responsive design on iOS and Android

Biometric login, offline access, push notifications

Actionable insights on the go

Why it matters: Because business doesn’t clock out and neither should your tech.

Feature #9: Role-Based Access Control & Governance

Security isn’t just IT’s job; it’s everyone’s responsibility. Your ERP/CRM must offer:

Layered permissions by role, department, or project

Comprehensive audit trails

Compliance tools (GDPR, HIPAA, SOX)

Why it matters: Because trust is currency and breaches bankrupt it.

Feature #10: Personalized User Experience

Forget cookie-cutter dashboards. The platforms of 2025 learn how you work and adapt accordingly.

Expect:

AI-driven UI personalization

Smart recommendations and shortcuts

Voice commands, dark mode, and accessibility settings

Why it matters: Because tools should adapt to people, not the other way around.

Bonus Power Moves: Features on the Rise

Here’s what’s bubbling just beneath the surface and set to go mainstream:

Blockchain-enabled audit trails

Augmented reality in CRM field services

IoT integrations in ERP for supply chain

Voice-enabled dashboards and controls

Future-ready brands are already exploring these, are you?

Final Word: It’s Time to Upgrade, Elegantly

2025 isn’t about stacking features. It’s about crafting an intelligent, fluid, and secure digital ecosystem that scales with you.

Choose ERP and CRM systems that are:

Elegant in experience

Effortless in adoption

Exponential in impact

Because mediocre tech costs more than money, it costs momentum.

0 notes

Text

Unlocking the Power of Automation and AI for Affiliate Marketing Success

In today’s rapidly evolving digital landscape, affiliate marketers and small business owners alike are turning to advanced technologies to stay ahead. The demand for AI tools to boost affiliate marketing success and software for automating small business tasks has never been higher. As the online marketplace becomes more competitive, leveraging the right tech solutions is essential not only for efficiency but also for driving consistent growth and profitability. Whether you are just starting out or looking to scale your affiliate marketing strategy, integrating these technologies is no longer optional—it’s vital.

AI has transformed how marketers approach campaign strategy, content creation, customer engagement, and data analysis. The best AI tools to boost affiliate marketing success go beyond basic analytics; they predict trends, personalize content, and automate outreach in ways that were previously unimaginable. AI-powered platforms can analyze user behavior in real-time, allowing marketers to tailor their messaging for maximum impact. From dynamic content recommendations to chatbot-driven support systems, AI gives affiliate marketers a cutting-edge advantage in audience targeting and conversion optimization.

Meanwhile, small business owners face a daily balancing act—juggling customer service, inventory management, accounting, and marketing. This is where software for automating small business tasks becomes a game-changer. These solutions help reduce human error, streamline operations, and free up time for entrepreneurs to focus on strategy and growth. Automation software can handle everything from invoicing and scheduling to social media posting and customer follow-ups, eliminating repetitive tasks and minimizing operational costs.

One standout approach is integrating AI into automation tools. When these technologies are combined, businesses achieve not only efficiency but also intelligence. Imagine a system that not only sends follow-up emails but learns which messages convert best over time, adapting automatically to boost results. This kind of synergy between AI and automation provides a competitive edge that traditional methods simply can’t match.

What’s more, the accessibility of these tools has significantly improved. Platforms that once required hefty investments are now available on subscription models, putting powerful features within reach of solo entrepreneurs and startups. The simplicity of implementation and user-friendly interfaces means even those with minimal tech knowledge can begin benefiting from these tools almost immediately.

QuickScanReview.com has highlighted the transformative potential of adopting the right digital tools. By focusing on unbiased reviews and thorough comparisons, the site helps users identify which AI and automation platforms align best with their unique business goals. In a crowded market filled with software promises, this guidance is crucial for making informed decisions.

Choosing the right AI tools to boost affiliate marketing success begins with understanding your niche and audience. Tools like Jasper, SEMrush, and Surfer SEO provide content optimization, competitor analysis, and performance tracking—all powered by machine learning. These features help affiliates craft more compelling, SEO-friendly content that resonates with their target demographics.

For those in need of software for automating small business tasks, tools like Zapier, HubSpot, and QuickBooks offer tailored solutions. Whether it's integrating multiple services or automating lead generation, these tools reduce workload and increase consistency. They enable business owners to maintain high levels of customer satisfaction while also scaling operations efficiently.

Another benefit is how these tools foster data-driven decision-making. With advanced reporting features and insights, users can measure the ROI of campaigns, identify weak points in workflows, and make adjustments in real time. This agility is vital in today’s fast-paced market where delays and inefficiencies can result in lost revenue and competitive disadvantage.

QuickScanReview.com once again stands out as a trusted source for entrepreneurs navigating the complexities of tech adoption. With an eye on real-world performance and usability, their recommendations reflect what works in the field, not just what looks good on paper.

In conclusion, bothAI tools to boost affiliate marketing success and software for automating small business tasks are indispensable assets in today’s business environment. Embracing these technologies doesn’t just optimize performance—it transforms how business is done. Whether you’re an affiliate marketer seeking higher conversions or a small business owner aiming to simplify operations, the path to success is clear: automate, optimize, and grow with the help of smart, efficient technology.

0 notes

Text

How to Print and Mail Documents Efficiently: A Complete Guide for Businesses

In the digital age, businesses often overlook the importance of physical mail—but statistics continue to show its power in communications, compliance, and conversions. Whether you’re sending invoices, marketing materials, legal notices, or employee communications, knowing how to print and mail documents efficiently can save your business time, money, and stress.

This complete guide walks through best practices, tools, and strategies to streamline your business’s print and mail workflows.

Section 1: Understand What You Need to Print and Mail

Start by identifying the document types you’ll handle:

Transactional Mail: Invoices, billing statements, receipts.

Legal Mail: Contracts, compliance documents, notices.

Marketing Mail: Postcards, brochures, letters.

Internal Mail: HR letters, payroll, W-2s.

Knowing your document categories helps determine whether to automate, outsource, or manage internally.

Section 2: In-House vs Outsourced Printing and Mailing

In-House Pros:

Full control over design and production.

Instant access to documents.

In-House Cons:

Expensive hardware and maintenance.

Manual labor and room for error.

Poor scalability.

Outsourcing Pros:

Cost-efficient for volume.

Automation-ready with APIs.

Higher mailing speed and tracking.

Section 3: Tools and Software to Automate Print and Mail

Use these tools for greater efficiency:

Print-to-Mail APIs like Lob, Click2Mail, PostGrid

Document Generation Software like DocuSign, PandaDoc, Microsoft Word + Mail Merge

Customer Relationship Management (CRM) with built-in mailing tools

Accounting Platforms with print/mail integrations (QuickBooks, Xero)

Automation ensures accurate recipient data, consistent branding, and reduced printing errors.

Section 4: Best Practices for Printing Documents

Use Templates:

Standardize layouts for speed and accuracy.

Opt for Monochrome Where Possible:

Reduces print costs by 30–40%.

Print in Batches:

Schedule large print jobs to minimize setup times.

Use High-Efficiency Printers:

Laser printers work best for sharp, professional documents.

Section 5: Best Practices for Mailing Documents

Address Verification:

Use address validation tools to avoid undeliverable mail.

Choose the Right Envelope Size:

Avoid excess postage by sizing correctly.

Presort Mail:

Qualify for USPS or Canada Post discounts.

Add Tracking:

Track legal or high-priority documents.

Section 6: Eco-Friendly Printing and Mailing

Use recycled paper and vegetable-based inks.

Print double-sided by default.

Partner with providers offering carbon-neutral mailing.

Sustainability is increasingly important to consumers and regulators.

Section 7: How to Cut Mailing Costs

Reduce Paper Use:

Offer digital opt-ins for statements and newsletters.

Use Bulk Mail Discounts:

USPS and Canada Post offer savings for presorted mailings.

Outsource High-Volume Jobs:

External providers offer economies of scale.

Consider Hybrid Mail:

Print digitally, but deliver physically.

Section 8: Document Security and Compliance

When handling sensitive information (financial, legal, or health data):

Ensure encryption in transit.

Use locked bins for disposal.

Implement role-based access to printers and software.

Ensure compliance with regulations like HIPAA, GDPR, or PCI-DSS.

Section 9: Integrating Print and Mail into Business Workflows

Smart integrations save time:

CRM Integration: Automate thank-you notes, invoices.

E-commerce Integration: Auto-send packing slips, return forms.

HR Integration: Mail W-2s, employment letters automatically.

APIs allow "trigger-based" mailing workflows tied to customer or employee actions.

Section 10: Measuring Success: KPIs for Print and Mail Campaigns

Delivery Time

Undeliverable Mail Rate

Customer Response Rate

Printing Costs per Unit

Time Spent per Document

Tracking KPIs reveals optimization opportunities and proves ROI.

Conclusion: Streamlined Print and Mail = Smarter Business

Efficient printing and mailing aren’t just about logistics—they’re essential to brand credibility, compliance, and cost savings. Whether you're a small business or an enterprise, following this guide will help you maximize your efficiency, reduce errors, and ensure your messages land where and when they matter most.

youtube

SITES WE SUPPORT

Mail HIPAA Software – Wix

0 notes

Text

Payment Reconciliation Software: Simplifying Financial Clarity for Modern Businesses

In today’s multi-channel business environment, handling payments efficiently has become both critical and complex. Whether you're running a retail store, SaaS business, or managing a service-based enterprise, reconciling customer payments from various sources is a vital but often time-consuming process. Enter payment reconciliation software—an intelligent solution designed to automate, streamline, and secure the entire reconciliation lifecycle.

This blog dives deep into how payment reconciliation software works, its benefits, and why Cognizione is becoming the preferred platform for fast-growing and enterprise-level businesses in India and beyond.

What Is Payment Reconciliation?

Payment reconciliation is the process of comparing internal accounting records (like invoices or sales ledgers) with actual payments received in your bank accounts. It ensures that all payments due are accounted for and no transaction is missed, duplicated, or misrecorded.

Traditionally, finance teams rely on spreadsheets and manual checks to match payment entries—often a tedious, error-prone process that slows down closing cycles and introduces risks.

What Is Payment Reconciliation Software?

Payment reconciliation software automates this entire process. It pulls data from your payment gateways, bank accounts, and accounting systems, and automatically matches transactions using smart logic. It flags mismatches, suggests resolutions, and maintains audit trails—all while significantly reducing the time, effort, and human error involved.

Solutions like Cognizione make reconciliation scalable, intelligent, and audit-ready—no matter how complex your payment infrastructure is.

Why Payment Reconciliation Is More Complex Than Ever

Today’s businesses receive payments from a wide range of channels:

UPI, NEFT, RTGS

Payment gateways like Razorpay, Paytm, Stripe, and Cashfree

Credit/debit cards, wallets, and BNPL

Cash-on-delivery and offline POS

International wires and currency conversions

Manually reconciling this volume across multiple systems is not just inefficient—it’s unsustainable. That’s why adopting robust payment reconciliation software is no longer optional for growing businesses—it’s essential.

How Payment Reconciliation Software Works

Here’s a simplified breakdown of how platforms like Cognizione manage reconciliation:

1. Data Import

The software connects with your bank feeds, accounting software (like QuickBooks, Tally, Zoho), payment gateways, and ERP tools to pull real-time transaction data.

2. Automated Matching

It applies custom matching rules (by amount, transaction ID, reference number, customer name, or payment method) to automatically reconcile records.

3. Exception Handling

Mismatches and duplicate transactions are flagged, with workflows to investigate and resolve them.

4. Reporting and Audit Trail

Detailed reconciliation reports and full audit logs are generated and stored securely for internal reviews and statutory audits.

Key Features of Cognizione’s Payment Reconciliation Software

Cognizione offers a next-gen payment reconciliation platform designed for businesses that deal with high transaction volumes, complex payment flows, and multi-entity operations.

Here’s what makes Cognizione stand out:

Intelligent Auto-Matching Engine

Reconcile thousands of transactions in minutes using dynamic and AI-powered matching logic.

Multi-Channel Payment Integration

Connect all major payment gateways, banks, and financial tools through APIs and secure data pipes.

Exception Management Dashboard

View all unmatched transactions, auto-classify them by type, and assign resolutions to relevant team members.

Real-Time Reconciliation Status

Visual dashboards give instant insights into cleared vs. uncleared payments across accounts, teams, or locations.

Audit-Ready Reports

Export detailed reports with a click—ideal for internal compliance teams and statutory auditors.

Secure, Role-Based Access

Grant precise user permissions to manage approvals, view-only access, or reconciliation rights as needed.

Benefits of Payment Reconciliation Automation

⏱️ 1. Save Time and Boost Productivity

Cut down reconciliation efforts by up to 80%. Let your finance team focus on forecasting, not data cleanup.

🧮 2. Eliminate Errors and Missed Entries

No more missed payments, incorrect credits, or duplicated invoices—automation ensures accuracy.

📅 3. Speed Up Financial Closings

Achieve faster month-end and year-end closings without the stress of last-minute mismatches.

📊 4. Real-Time Cash Flow Visibility

Know exactly what’s been paid, what’s pending, and what needs action—across all payment channels.

🧾 5. Improve Audit and Regulatory Compliance

Be always audit-ready with real-time records, digital logs, and traceable approvals.

Who Needs Payment Reconciliation Software?

Cognizione is ideal for businesses across various sectors that deal with complex or high-volume payments:

🛒 E-Commerce & Retail

Match orders, refunds, discounts, COD, and gateway settlements across channels and marketplaces.

💻 SaaS & Subscription-Based Models

Track recurring payments, churn, and international payments across Stripe, Razorpay, and other tools.

🏥 Healthcare & Diagnostics

Reconcile patient payments, third-party insurance settlements, and lab billing.

🏭 Manufacturing & Wholesale

Manage multi-customer B2B payments, credit notes, and distributor account balances.

🏨 Hospitality & Travel

Match OTA payments, customer invoices, POS collections, and offline settlements efficiently.

Key Challenges Solved by Cognizione

⚠️ No more reconciling via spreadsheet formulas

✅ Seamless integration with payment processors and CRMs

🔒 Full control over sensitive financial workflows

📋 Instantly downloadable audit logs

🔁 Ongoing support for scaling teams and operations

How to Choose the Right Payment Reconciliation Software

Here’s a quick checklist to guide your selection:

✅ Integrates with your banks and payment tools

✅ Supports Indian payment gateways and UPI

✅ Customizable matching logic

✅ Handles large-scale transaction volumes

✅ Offers strong data security and audit controls

✅ Provides analytics and dashboards

✅ Offers local support and onboarding assistance

Cognizione checks all the boxes—and then some.

Final Thoughts: Payment Reconciliation Shouldn’t Slow You Down

As businesses scale and payment systems become more fragmented, manual reconciliation can create serious bottlenecks. By adopting a smart, automated system like Cognizione’s payment reconciliation software, you gain accuracy, visibility, and speed—helping you build trust with stakeholders and make confident financial decisions.

📞 Ready to Simplify Your Payment Reconciliation?

It’s time to eliminate manual work, minimize errors, and speed up financial closings with automation built for scale.

🔹 Book your FREE demo now 🌐 Visit: https://cognizione.com

0 notes

Text

Mastering Currency Management: A Must-Have Skill for Small Businesses & Corporates

In today’s fast-paced global economy, managing money across borders isn't just a big business problem anymore. Whether you're a local retailer sourcing products from overseas or a multinational with global branches, currency management is now a make-or-break skill.

Yet, many small businesses and corporate teams still rely on guesswork or outdated practices to deal with currency fluctuations, conversions, and international transfers. If this sounds familiar, you're not alone — and you’re definitely not powerless.

This blog breaks down everything you need to know about effective currency management, why it matters, how to get it right, and how you can master currency management for small businesses & corporates with ease through accessible online learning.

Why Currency Management Isn’t Just for CFOs Anymore

Once upon a time, only large conglomerates and finance heads obsessed over exchange rates and currency risk. Fast forward to now — even a small design agency outsourcing work to a freelancer in another country has to think about conversion charges, exchange rate volatility, and payment settlement times.

Here’s why currency management matters at every level:

International Payments: The world is your marketplace, but with that comes fees, delays, and risks tied to currency.

Supplier & Vendor Relationships: Stable pricing is critical. Poor currency planning can lead to mistrust and loss.

Profit Margins: Even a 1% change in exchange rate can seriously dent your margins.

Cash Flow Planning: If your invoices are in multiple currencies, you need a plan to track and convert them efficiently.

Compliance & Reporting: Taxation, documentation, and financial statements become more complex without a currency system in place.

Real Talk: What Happens When You Ignore Currency Management?

Let’s play out a scenario:

You run an e-commerce store in the U.S. and source eco-friendly clothing from India. You’ve got a sweet supplier relationship going. Your monthly invoice is INR 400,000, and you’re paying in USD.

In April, the exchange rate is 1 USD = 83 INR → You pay $4,819 In May, the rate jumps to 1 USD = 79 INR → Now, you’re paying $5,063

That’s a $244 increase, without any change in order volume.

Now multiply this by 12 months, or by 10 suppliers — you’re losing thousands.

This is why currency risk management is not optional — it’s essential.

What Exactly Is Currency Management?

Currency management is the art and science of managing transactions involving different currencies. It involves:

Monitoring exchange rate movements

Making strategic decisions on when to convert

Using financial instruments to hedge risk

Managing fees and optimizing foreign payments

Planning long-term financial goals in a multi-currency environment

In short: It’s how smart businesses protect their profits when money crosses borders.

Key Components of Successful Currency Management

1. Exchange Rate Tracking

Tools like Google Finance, XE.com, and Forex platforms allow you to monitor live rates. But smart tracking goes beyond checking numbers — it’s about forecasting trends and planning conversions proactively.

2. Multi-Currency Accounting

If you’re juggling multiple currencies, traditional spreadsheets just won’t cut it. Accounting software like Xero, QuickBooks, and Zoho Books offer multi-currency support.

3. Hedging Strategies

Businesses often use financial instruments like forward contracts or options to lock in exchange rates and reduce future risk. Even small businesses can use basic forms of hedging through bank programs or fintech apps.

4. Payment Gateways with Currency Conversion

When choosing payment processors (like Stripe, PayPal, or Wise), compare:

Fees

Settlement time

Supported currencies

Transparency of exchange rates

5. Banking Relationships

Some banks offer multi-currency accounts, which let you hold and convert funds when rates are favorable. These tools are essential to limit loss from unnecessary conversions.

The Game Changer: Learning Currency Management Online

Let’s be honest — managing all this can sound intimidating, especially if you don’t have a finance background.

But guess what?

You don’t need an MBA or a finance team to master it. You just need the right guide — like this easy-to-follow, practical Currency Management for Small Businesses & Corporates course.

It’s designed for entrepreneurs, finance teams, and decision-makers who want to:

Avoid costly exchange mistakes

Build a robust currency strategy

Improve cash flow and vendor confidence

Understand hedging without getting a headache

Become confident in using currency tools and forecasts

Who Is This Course For?

This isn’t your typical dry finance lecture. It’s tailor-made for:

✅ Startup founders and entrepreneurs ✅ Small business owners going global ✅ Finance and operations teams in corporates ✅ Freelancers & agencies working internationally ✅ eCommerce sellers sourcing products abroad

If any part of your business deals with international transactions — this course is your shortcut to clarity and control.

What You’ll Learn Inside the Course

The course is packed with practical tips and hands-on tools, including:

🎯 Understanding the impact of exchange rate fluctuations 🎯 Using smart banking and fintech solutions 🎯 Best practices for international payment workflows 🎯 Tools to forecast and protect against currency risks 🎯 How to choose between payment providers 🎯 Real-world business scenarios and strategies

The best part? It’s self-paced, beginner-friendly, and gives you lifetime access.

👉 Start here: Currency Management for Small Businesses & Corporates

Smart Currency Management in Action: Real-Life Scenarios

🌍 Case Study 1: An Import Business in the UK

A small London-based gourmet store was importing cheese from France and Spain. Currency swings caused pricing inconsistencies — upsetting customers.

Fix: They started using forward contracts and adjusted their pricing windows with supplier cooperation. The result? Stable margins, happier customers.

📦 Case Study 2: A SaaS Startup in Canada

They had clients in 10 countries, receiving payments in CAD, USD, GBP, and INR.

Fix: Switched to a multi-currency Stripe setup and automated reporting with cloud accounting software.

They now save 3-5% per transaction and project cash flows more accurately.

Tips to Improve Your Currency Game — Starting Today

Here are 7 actionable tips you can implement right now:

Review your currency exposure — Know where you’re vulnerable.

Pick a payment platform that saves money — Not just the default one.

Negotiate with vendors in a mutually beneficial currency.

Open a multi-currency account — Many neobanks offer this feature.

Set up exchange alerts to convert when the rate is favorable.

Take a professional course to build a system instead of patchwork fixes.

Plan quarterly currency reviews to adjust strategy based on trends.

Why This Skill Will Only Grow in Importance

Remote work, global supply chains, and digital payments have made cross-border transactions common — even for hyperlocal businesses. That trend is only accelerating.

Businesses that adopt strong currency management practices will:

Outperform on profitability

Build trust with global partners

Navigate inflation and economic shocks more confidently

Be seen as professional and reliable by clients and vendors alike

It’s Time to Level Up

Here’s the truth: Currency management doesn’t have to be complicated. But ignoring it? That’s expensive.

By understanding the basics, applying the right tools, and taking action through practical training, you can avoid hidden costs, safeguard your cash flow, and set your business up for sustainable success.

🎓 Ready to get started?

👉 Explore the full course here: Currency Management for Small Businesses & Corporates

Learn on your terms. Apply instantly. Save money — and sanity — in the process.

Final Thoughts

If your business touches another currency — even once — you need a strategy. And thanks to accessible learning tools like the one linked above, you don’t need a finance degree or a team of analysts. You just need the right direction.

Give your business the edge it deserves. Start mastering your money across borders — today.

0 notes

Text

Essential Business Bookkeeping Tips to Keep Your Finances on Track

Mastering Business Bookkeeping: The Key to Financial Success

Business bookkeeping is the foundation of effective financial management for any organization, regardless of size or industry. It involves recording, organizing, and maintaining a company's financial transactions in a systematic way. Proper bookkeeping not only ensures regulatory compliance but also empowers business owners with accurate financial insights to make informed decisions. In today’s competitive market, efficient business bookkeeping can be the difference between growth and stagnation.

Why Business Bookkeeping Matters

At its core, business bookkeeping helps track the money flowing in and out of your company. Every sale, expense, payroll transaction, and vendor payment must be recorded accurately. Without proper records, it becomes nearly impossible to evaluate performance, forecast future revenue, or prepare for tax season.

Inaccurate or inconsistent bookkeeping can lead to issues such as missed payments, tax penalties, and an unclear picture of a business’s financial health. Conversely, maintaining a consistent bookkeeping system provides transparency and control over business finances, which is critical for long-term sustainability.

Key Elements of Business Bookkeeping

Several components are essential in the business bookkeeping process:

Recording Transactions Every financial activity, whether it's receiving customer payments or buying supplies, should be recorded promptly. This can be done manually or through accounting software, ensuring nothing slips through the cracks.

Categorizing Expenses All income and expenses should be categorized appropriately. This practice makes it easier to analyze financial statements, track spending trends, and identify areas for cost savings.

Reconciling Bank Statements Regular reconciliation ensures that your business books match your bank statements. Any discrepancies can be identified and corrected early, preventing potential fraud or costly errors.

Generating Financial Reports Monthly or quarterly reports such as profit and loss statements, balance sheets, and cash flow reports give business owners a clear picture of their financial standing.

Preparing for Taxes Keeping accurate records throughout the year simplifies the process of tax preparation. Business bookkeeping ensures you’re always ready for audits or filing deadlines with the necessary documentation on hand.

Choosing the Right Tools for Business Bookkeeping

Technology has revolutionized bookkeeping with user-friendly software and cloud-based platforms. Solutions like QuickBooks, Xero, and FreshBooks allow businesses to automate routine tasks, generate real-time financial reports, and ensure data accuracy. These tools are particularly beneficial for small businesses, as they reduce the time and effort required to maintain up-to-date books.

Moreover, many platforms integrate with banking and point-of-sale systems, making data entry and reconciliation more seamless. Cloud-based software also offers the advantage of accessibility from anywhere, which is especially helpful for remote teams and business owners on the go.

DIY vs. Outsourced Bookkeeping

Business owners often face the choice between handling bookkeeping in-house or outsourcing to a professional. Doing it yourself can be cost-effective, especially in the early stages of a business. However, as the business grows and financial activities become more complex, the risk of errors increases.

Outsourcing business bookkeeping to experienced professionals can save time, reduce errors, and offer expert insights. Professionals stay updated on tax laws and accounting best practices, ensuring compliance and helping optimize financial strategies. This frees up business owners to focus on core operations and growth.

Common Business Bookkeeping Mistakes to Avoid

Even with the best intentions, bookkeeping errors can happen. Some of the most common include:

Mixing personal and business finances

Failing to back up records

Neglecting to reconcile accounts regularly

Not keeping receipts or supporting documentation

Delaying data entry, leading to forgotten transactions

Avoiding these mistakes starts with consistency, attention to detail, and leveraging the right tools or services.

Final Thoughts

Effective business bookkeeping is more than just data entry—it's a strategic tool that enables financial clarity, stability, and growth. Whether you manage your books yourself or hire a professional, ensuring your financial records are accurate and up to date is non-negotiable for business success.