#QuickBooks Data conversion service

Explore tagged Tumblr posts

Text

Can You Transfer Data From Peachtree to QuickBooks?

Are you ready to streamline your accounting process and make the switch from Peachtree to QuickBooks? Transferring data between these two popular accounting software can seem like a daunting task, but fear not! In this blog post, we will explore why you might want to make the transition, as well as different methods for transferring your important financial information. Whether you’re looking for…

View On WordPress

#conversion service#Data From Peachtree to QuickBooks#QuickBooks conversion service#Switch Data From Peachtree to QuickBooks#Transfer Data From Peachtree to QuickBooks#Transferring Data

0 notes

Text

Bookkeeping vs. Accounting: What is the Difference?

Bookkeeping and accounting are two essential functions that come into play when it comes to the management of financial records and the guaranteeing of a business's ability to operate without hiccups. There are substantial distinctions between the two, despite the fact that they are frequently used interchangeably with one another. In this blog post, we will discuss the fundamental distinctions between bookkeeping and accounting, as well as the contributions that each makes to the overall success of organisations operating in a variety of fields. VNC Global, a prominent bookkeeping services provider in Australia with more than a decade of expertise, is familiar with the complexities of these functions and is here to throw light on the distinctions.

The Essence of Bookkeeping:

The practice of maintaining accurate books and records is essential to any viable accounting system. It entails recording and organising in a methodical manner all of the financial transactions that have taken place. Bookkeepers are accountable for keeping records of a company's income and spending, accounts payable and receivable, along with other types of financial transactions, in a manner that is accurate and up to date. Their primary concern is making certain that all of the financial information is correctly recorded, categorised, and archived so that it can be accessed and analysed at a later time.

Key responsibilities of bookkeepers include:

Recording daily financial transactions

Maintaining general ledgers

Handling payroll processing

Managing bank reconciliations

Issuing and recording invoices

Monitoring accounts payable and receivable

Generating financial reports for management review

The Scope of Accounting:

On the other hand, accounting comprises a wider variety of operations related to financial management. It entails analysing, interpreting, and summarising the financial data that bookkeepers have recorded in the books. Accountants make use of this information in order to offer business owners and those in charge of decision-making important insights and strategic recommendations. Their knowledge is vital for ensuring that one may make well-informed judgements regarding one's finances and remain in accordance with applicable tax legislation.

Key responsibilities of accountants include:

Preparing financial statements like income statements, cash flow statements, balance sheets, etc.

Identify patterns and trends by analyzing the financial data

Providing financial advice and strategic planning

Conducting financial audits and ensuring compliance

Assisting in budgeting and forecasting

Tax planning and preparation

Skills and Qualifications:

Bookkeeping and accounting are two separate but related disciplines that demand distinct skill sets and qualifications. Bookkeepers often have extensive knowledge and experience in the areas of data input, and record keeping, and are conversant with accounting software. Although bookkeepers are not often required to have a formal degree, many do have certifications in their field, such as Xero or QuickBooks, to demonstrate their level of expertise.

On the other hand, it is common for employers to need accountants to have a higher degree of education in addition to certain professional certifications. The majority of accountants have degrees in accounting, finance, or other subjects linked to accounting, in addition to certificates like CPA (Certified Public Accountant) or CMA (Certified Management Accountant). Because of their in-depth understanding of fundamental financial concepts and their extensive experience in this area, they are able to deliver useful financial insights and make strategic recommendations for the company.

Timeframe and Frequency:

In most cases, the responsibilities associated with bookkeeping are completed once per day or once per week. It is essential to keep financial records up to date in order to maintain accuracy and ensure that accounting processes proceed without a hitch. In contrast, accounting duties are more periodic in nature and are typically carried out on a monthly, quarterly, or annual basis, depending on the demands of the company and the regulations imposed by the regulatory authorities.

Focus on Compliance and Strategy:

The primary goals of bookkeeping are to keep accurate records and to adhere to the rules and regulations that govern the industry. It lays the framework for proper financial reporting by ensuring that the financial transactions of the company are correctly recorded and organised. On the other side, accounting places a strong emphasis on decision-making, in addition to strategic planning and financial analysis. Bookkeepers generate financial data, which accountants then analyse in order to assist firms in understanding their current financial health, locating areas in which they may improve, and making long-term growth plans.

Final Thoughts:

Even though bookkeeping and accounting are very closely tied to one another, they are used for very different things when it comes to the management of a company's finances. VNC Global, which is regarded among the best bookkeepers services provider in Australia, is aware of the significance of both roles in ensuring the continued prosperity and financial well-being of a wide range of business sectors. Bookkeepers play a crucial role in the recording and organisation of financial data, while accountants offer useful insights and strategic counsel based on the information provided by bookkeepers. Bookkeepers play a fundamental role in documenting and organising financial data.

It is essential for companies that want to optimise their financial operations and make educated decisions to have a solid understanding of the differences between bookkeeping and accounting. VNC Global is your reliable partner, providing outsourced bookkeeping services in Australia. Whether you require accurate record-keeping or extensive financial analysis, VNC Global can provide both. Get in touch with us as soon as possible to take the financial management of your company to new heights.

2 notes

·

View notes

Text

The Ultimate Shopify Tech Stack for Scaling Your Ecommerce Business

In today’s fast-paced ecommerce environment, scaling a Shopify store takes more than just great products and marketing. It requires a powerful, well-integrated Shopify tech stack that streamlines operations, improves customer experience, and drives growth.

If your team is juggling inventory, order fulfillment, and customer service manually, you’ll soon run into bottlenecks. That’s where tools like Shopify ERP integration come in, allowing you to automate backend processes, reduce human error, and manage business data across systems effortlessly.

Curious about what tech stack does Shopify use or recommend? Let’s dive into the ultimate stack that helps you scale without burning out your team.

What is a Shopify Tech Stack?

A Shopify tech stack is a collection of apps, tools, integrations, and systems that work together to power your online store. These tools handle everything from marketing automation and sales to inventory, support, and analytics.

Think of it as the foundation that holds your ecommerce operations together. Choosing the right stack helps:

Streamline workflows

Automate manual tasks

Improve customer support

Increase conversion and retention

Key Components of the Best Shopify Tech Stack

Here’s a breakdown of the essential categories your tech stack should cover:

1. Backend Operations

Inventory Management: Integrate with tools like TradeGecko or Skubana for real-time inventory sync.

Order Fulfillment: Automate shipping and warehousing using ShipBob or ShipStation.

Accounting & Finance: Use QuickBooks, Xero, or a Shopify ERP Integration solution like NetSuite.

Looking for a seamless backend? Stellar Delivery Date & Pickup helps optimize logistics for local deliveries and pickups—a great addition to your stack if you offer location-based services.

2. Marketing & Sales

Email Marketing: Tools like Klaviyo or Omnisend.

SMS Marketing: Postscript or Attentive for better engagement.

Upsells & Cross-sells: Upsell apps for Shopify is one of the best tools to boost AOV directly from the cart drawer.

3. Front-End & UX

Theme & Page Builders: Shogun, PageFly, or GemPages.

Product Discovery: Add search and filter tools like Searchanise.

Personalization: Recommend product using Icart.

4. Analytics & Insights

Customer Data Platform: Glew.io or Segments.

Heatmaps & Behavior Tracking: Hotjar or Lucky Orange.

Performance Monitoring: Google Analytics 4 and Shopify Analytics.

How to Build the Best Shopify Tech Stack for Your Store

When choosing the best Shopify tech stack, consider these key factors:

Store Size & Scale: Are you a growing D2C brand or a high-volume B2B seller?

Business Model: Subscription-based? International fulfillment?

Budget: Some tools are free; others require long-term investment.

Integration Needs: Will your apps sync with your existing ERP or CRM?

A scalable tech stack should grow with your business and support automation.

Final Thoughts: Build to Scale, Not Just to Start

Your Shopify store’s long-term success depends on more than product-market fit. It depends on having a lean, efficient, and scalable Shopify tech stack that frees up your time and enhances every part of the customer journey.

From backend automation with Shopify ERP integration, to increasing AOV using iCart, the right tech stack turns your store into a high-performing ecommerce engine.

FAQs: What Tech Stack Does Shopify Use?

Q1: What tech stack does Shopify run on internally? Shopify’s own stack includes Ruby on Rails, React.js, MySQL, and Kubernetes. On the merchant side, Shopify recommends a modular approach using best-in-class apps from its App Store.

Q2: How do I choose a tech stack Shopify recommends? Start with Shopify App Store integrations, then scale with third-party tools based on your business needs.

0 notes

Text

How an Audit Trail Removal Service can help reduce file size, improving overall performance and speed of QuickBooks

Kingston, July 20, 2025: An Audit Trail in QuickBooks is a powerful feature that records every transaction made in the system, providing a transparent history of changes, including edits, deletions, and updates to financial data. While this feature is invaluable for tracking activity and ensuring accountability, there are situations where businesses may need an Audit Trail Removal Service.

Businesses that handle sensitive financial data or are required to comply with data protection regulations may find that retaining extensive audit logs creates unnecessary exposure. Removing the audit trail can help businesses ensure that personal or confidential information is not inadvertently accessible, reducing the risk of unauthorized access.

As QuickBooks files grow over time, the audit trail can become quite large, potentially slowing down the system. The Audit Trail Removal Service can help reduce the file size, improving the overall performance and speed of QuickBooks. This is especially useful for businesses dealing with high volumes of transactions and large company files.

Over time, the audit trail can accumulate a significant amount of data that may no longer be necessary for day-to-day operations. In some cases, businesses may no longer need to track every change made to financial records. Removing outdated or irrelevant audit trail data can clean up the system, making it easier to navigate and manage current transactions.

While some businesses may choose to remove the audit trail for privacy or efficiency reasons, it is crucial to understand the regulatory requirements for your industry. Certain businesses may still need to maintain an audit trail for tax reporting or compliance purposes. An Audit Trail Removal Service can ensure that you’re adhering to legal requirements while also clearing unnecessary data from the system.

An over-accumulated audit trail may result in outdated or incorrect data being referenced in reports. By removing obsolete entries or cleaning up the audit trail, businesses can reduce the risk of errors in financial reporting, providing a clearer and more accurate picture of the company’s financial health.

While the Audit Trail feature in QuickBooks is essential for ensuring accountability and transparency, there are valid reasons why businesses might want to remove or clean up their audit trail. Whether it’s for privacy concerns, system performance, compliance, or reducing clutter, an Audit Trail Removal Service can help streamline QuickBooks and ensure that businesses maintain accurate, relevant data.

https://quickbooksrecovery.co.uk/quickbooks-file-data-services/quickbooks-audit-trail-removal-service/ has more information.

About E-Tech

E-Tech is the leading service provider of QuickBooks File Repair, Data Recovery, QuickBooks Conversion and QuickBooks SDK programming in the UK and Ireland. In our 20 years plus of experience with Intuit QuickBooks, we have assisted over a thousand satisfied customers with their requirements.

We offer a range of services for existing QuickBooks users and provide comprehensive solutions for small businesses. Additionally, our expertise covers the US, UK, Canadian, Australian (Reckon Accounts), and New Zealand versions of QuickBooks (PC and Mac platforms).

For media inquiries regarding E-Tech, individuals are encouraged to contact Media Relations Director, Melanie Ann via email at [email protected].

Melanie Ann

Media Relations

ETech

61 Bridge St

Kingston HR5 3DJ

www.quickbooksrecovery.co.uk

0 notes

Text

AI-Powered Automation: The Competitive Advantage for Small Businesses

What is AI-powered automation, and how does it work?

AI-powered automation is when machines use artificial intelligence (AI) to do tasks that normally need human thinking. These tasks include answering customer questions, managing emails, creating reports, scheduling meetings, and even making smart business decisions.

It combines machine learning, natural language processing, and data analytics to automate both simple and complex business processes. For small businesses, this means they can operate faster, smarter, and with fewer resources.

Why should small businesses care about AI automation?

Because AI helps small businesses do more with less. Here’s how:

Time savings: AI can reduce time spent on repetitive tasks by up to 80% (McKinsey & Company).

Cost efficiency: A study by Accenture found AI can lower operating costs by up to 30%.

Growth: Businesses that adopt AI grow revenue 50% faster than those that don’t (Forrester Research).

Competitive edge: In a crowded market, speed and precision matter. AI gives smaller companies tools that used to be available only to large enterprises.

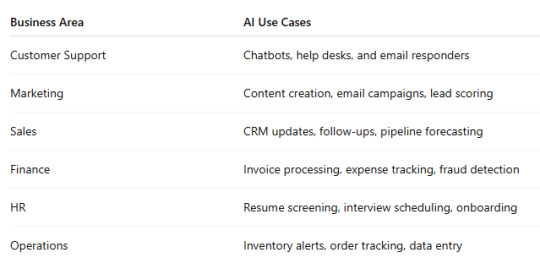

What areas of business can AI automate?

What are the benefits of using AI for small businesses?

Here’s how AI changes the game:

Saves time and resources

Automates repetitive tasks like data entry, scheduling, and follow-ups

Lets your team focus on work that requires real thinking

2. Improves customer service

Chatbots like Tidio or Drift respond 24/7

Personalizes responses based on customer history

3. Boosts marketing performance

AI tools like Mailchimp and ActiveCampaign send smarter emails

Tracks customer behavior and adjusts campaigns in real-time

4. Makes better decisions faster

AI tools can analyze data and show trends that humans might miss

Helps with forecasting sales or choosing the right products to promote

5. Scales with your business

AI doesn’t need a lunch break. As your business grows, it grows with you.

How much does AI automation cost for small businesses?

Good news — it’s more affordable than you think.

AI chatbots like Tidio start at around $29/month

AI email marketing tools like MailerLite start free, then scale up

AI scheduling tools like Calendly offer free tiers for solo users

AI bookkeeping software like QuickBooks with AI features start at $25/month

Even platforms like HubSpot and Zoho CRM have built-in AI tools now, often included in their base plans.

How do I get started with AI automation?

Step 1: Identify repetitive tasks Start with things you or your team do daily: sending emails, answering the same customer questions, or pulling reports.

Step 2: Choose the right tools Here are a few to consider:

CRM automation: Zoho CRM, HubSpot, Salesforce

Marketing AI: Mailchimp, Jasper, Copy.ai

Finance AI: QuickBooks, Xero, FreshBooks

Operations: Zapier, Make, Monday.com

Step 3: Start small Automate one task, track the results, and build from there. For example, use an AI chatbot to handle FAQs, then expand to email automation.

Step 4: Train your team Make sure your team understands the tools and knows how to use them. Choose platforms with good customer support or training videos.

Step 5: Monitor and adjust Check how automation affects your time, customer satisfaction, and budget. Tweak your system as needed.

Are there real-world examples of small businesses using AI?

Yes. Many small businesses are already using AI to succeed:

Coffee shop in Chicago used AI-powered email marketing and saw a 35% increase in repeat customers.

Online craft store in Texas used AI chatbots and reduced customer support response time by 70%.

Digital marketing agency in Florida automated lead scoring with Zoho CRM and boosted conversion rates by 25%.

These are simple use cases with big impact. None of them required full-time IT staff.

What are the risks or downsides of using AI for small businesses?

Like any tool, AI comes with challenges:

Over-automation: Customers still want to talk to humans sometimes.

Data privacy: You need to make sure the tools you use are secure and follow data laws.

Learning curve: Some tools require time to learn or train properly.

Wrong expectations: AI helps — but it doesn’t solve every problem magically.

The key is to use AI where it makes sense, not everywhere.

What should I look for in an AI solution provider?

When choosing a tool or consultant, make sure they:

Understand your industry and business size

Offer setup, support, and training

Work with trusted AI platforms

Can show real examples and results

Help you integrate with tools you already use

Don’t just pick the tool with the flashiest features. Choose the one that solves your problems best.

Final thoughts: Is AI automation worth it for small businesses?

Yes. AI-powered automation is no longer just for big companies. It’s for any business that wants to:

Save time

Lower costs

Serve customers better

Grow smarter

By starting with small changes — like chatbots, email automation, or CRM updates — you can see big returns quickly. And as the tools grow smarter and more affordable, the benefits will only increase.

If you’re unsure where to begin or want expert guidance, AeyeCRM offers personalized support to help small businesses get started with cloud-based AI tools that drive real results.

1 note

·

View note

Text

Best VAT compliance audit service in the UAE

Best VAT Compliance Audit Service in the UAE: Is Your Business Really Covered? Let’s be honest—nobody wakes up excited about VAT compliance. It’s dry, technical, and let’s not sugarcoat it… kind of a headache. But here’s the kicker: ignoring it or brushing it off? That’s a fast track to HMRC knocking at your door—or worse, unexpected penalties that hit harder than a surprise tax bill after a record sales month.

So, what makes a VAT compliance audit service in the UAE the best? And more importantly, how do you know it’s the right fit for your business—whether you’re a scrappy startup, a scaling SME, or a seasoned enterprise juggling multiple VAT registrations?

Let’s break this down.

Why VAT Isn’t Just a ‘Finance Problem’ Anymore You might think VAT lives and dies in your accounting department. But here’s the thing—VAT touches everything: pricing strategies, supply chain decisions, cross-border sales, and even how you market certain offers. One incorrect VAT treatment, and suddenly you’re refunding customers, backpedaling on ad campaigns, or cleaning up a compliance mess.

It’s not just about "getting the numbers right." It’s about risk reduction, business agility, and trust.

Startups often don’t realise this until they’re already under review. Enterprises? They know it—some the hard way.

So What Does a ‘Best’ VAT Compliance Audit Service Actually Look Like? Honestly, it’s not the flashiest website or the slickest pitch deck. The best services quietly do the heavy lifting in the background, and they do it consistently. Here's what sets them apart:

✔️ Deep UAE VAT Expertise (And EU Knowledge Too) They get the quirks of the UAE VAT system. They understand how Brexit changed things. They know when zero-rating applies and when it doesn’t—and they’ve seen what happens when someone thinks they’re exempt but isn’t.

✔️ Custom-Tailored Reviews No cookie-cutter audits. The best providers walk through your operations—from your Shopify plugins to your shipping invoices—so the audit actually means something.

✔️ Tech-Integrated, Human-Led Software is great (love a good automation!), but someone still needs to interpret the data. The best services use tools like Xero, QuickBooks, or Sage integrations, but also offer real conversations with tax professionals.

✔️ Transparent Reporting You shouldn’t need a PhD in finance to read your VAT audit report. Look for services that show red flags clearly, explain fixes, and offer ongoing guidance—not just a spreadsheet of problems.

Rapid Business Solution: A Quiet Giant in VAT Compliance Now, I wouldn’t mention them if they didn’t walk the talk. Rapid Business Solution has carved out a reputation as one of the UAE’s most reliable names in VAT compliance audits—and no, they’re not just for the big dogs.

From boutique e-commerce brands to mid-sized tech firms scaling across the EU, they’ve helped businesses stay compliant without drowning them in jargon. Clients often mention their ability to "speak human," not just tax code. And that's a skill.

What’s refreshing? Their audits are not about pointing fingers. They're about helping businesses stay agile, confident, and ahead of HMRC—not playing catch-up.

Startups, You’re Not Too Small for This We get it. You're bootstrapping, wearing five hats, and VAT is just another annoying admin task that keeps falling down the list. But here's a wild stat—70% of VAT penalties in the UAE could’ve been avoided with basic audit checks.

That’s money you could’ve reinvested in product, ads, or maybe, just maybe, a breather for your team.

Startups benefit most from audits when they’re early—before bad habits set in. Don’t wait for your first HMRC inquiry to scramble for answers.

SMEs and Enterprises: Complexity Isn’t a Badge of Honor As your operations grow, so do the layers: different VAT schemes, industry-specific exemptions, international thresholds, and maybe even group VAT registration. It adds up—fast.

The best audit services don’t just identify errors. They help you build scalable, VAT-compliant systems so you're not rebuilding processes every year. For SMEs on the verge of entering new markets, this is crucial. For enterprises already juggling multiple jurisdictions, it’s non-negotiable.

Honestly, the difference between a decent and a great VAT compliance audit service? The latter will tell you what you didn’t even know to ask.

A Quick Reality Check: Do You Need a VAT Audit? Ask yourself (and answer honestly):

Have you changed your business model recently? Started selling cross-border? Outsourced your bookkeeping? Had more than one staff member handling VAT returns? Applied multiple VAT rates across services? If you nodded to even one, a compliance audit isn’t just nice to have—it’s essential.

Marketing Teams, You’re Part of This Too Strange as it sounds, VAT affects pricing pages, product bundling, shipping promos, and even ad copy. If your team’s running campaigns that cross borders or include mixed-rate goods/services, miscommunication with finance can lead to compliance headaches—or worse, unhappy customers.

Working with a VAT audit partner who gets how departments intersect isn’t a luxury—it’s a huge relief.

How Often Should You Do a VAT Compliance Audit? There’s no one-size-fits-all answer, but a good rule of thumb is:

Annually for steady operations Quarterly if you're rapidly growing, selling internationally, or switching systems Immediately if you’ve had a VAT investigation, late returns, or system overhauls A quick tip? Schedule it like a dentist appointment. Regular checkups beat painful emergencies every time.

Final Thoughts: It’s About Peace of Mind, Not Paperwork The best VAT compliance audit service in the UAE? It isn’t the one with the flashiest slogan. It’s the one that sees your blind spots, speaks your language, and helps you sleep better at night—knowing your business is on the right side of the taxman.

If you're serious about growth and not just surviving the next VAT deadline, give Rapid Business Solution a shout. They’re not just auditors—they’re your early-warning system in disguise.

Follow this website rapid business solution: https://rapidbs.ae/

0 notes

Text

How to Simplify Accounting for Startups with the Right Softwares and Services

Introduction

Managing money is one of the most critical parts of running a startup. Without proper financial tracking, even the best business idea can struggle to survive. Startup founders often wear many hats but ignoring accounting can lead to missed tax deadlines, poor cash flow, and lost investor confidence. That’s why investing early in bookkeeping and accounting services can help set your startup on the path to long-term growth and financial health.Proper accounting isn’t just about staying compliant it’s about making informed decisions, optimizing cash flow, and being ready for investor conversations or funding rounds. Whether you use basic software or partner with small business bookkeeping services, the goal remains the same: gain financial clarity, reduce risk, and build a strong foundation for sustainable business growth.In this guide, we’ll break down everything you need to know from how startup accounting works to the essential steps, softwares, and tips to do it right.

What Is Accounting?

Accounting is the process of recording, organizing, and analyzing financial transactions. For startups, it includes tracking income, expenses, assets, liabilities, and equity. It’s the foundation of financial decision-making. Whether you’re bootstrapping or backed by investors, having clear records through reliable bookkeeping and accounting service ensures transparency and informed planning. Accurate accounting helps you forecast cash flow, prepare for tax season, and demonstrate financial credibility to banks, partners, or stakeholders. It also allows startups to identify areas of overspending, streamline operations, and make smarter, data-backed business choices.

How Startup Accounting Works

Startup accounting typically revolves around two methods: cash-based and accrual-based accounting. Cash-based tracks transactions when money changes hands, while accrual accounting logs income and expenses when they’re incurred regardless of payment timing. Choosing the right method depends on your business model, industry, and reporting needs.

Leveraging professional bookkeeping accounting services ensures your records are accurate, consistent, and aligned with compliance standards. These services also help automate tasks like invoicing, payroll, and tax filing saving valuable time and minimizing errors.In early-stage startups, accounting also plays a key role in budgeting, tracking burn rate, and forecasting runway. With proper financial oversight, founders can allocate resources wisely, attract investors, and pivot faster when needed.

Step-by-Step Guide to Do Accounting for Your Startup

Register Your Business Choose the right legal structure, sole proprietorship, LLP, or Pvt Ltd based on your business goals, liability preferences, and tax implications. This decision impacts how you report income and manage finances from the start.

Open a Business Bank Account Keeping business and personal finances separate is crucial. It simplifies your books, supports cleaner audits, and enhances credibility with investors and lenders. Many small business bookkeeping services recommend this as a top priority.

Set Up Your Chart of Accounts Categorize all financial transactions sales, utilities, salaries, taxes into specific accounts. A well-structured chart helps track business performance and simplifies the process of generating financial statements.

Use Accounting Software softwares like QuickBooks, Zoho Books, and Xero automate data entry, invoicing, reporting, and reconciliation. These softwares integrate easily with other systems and are highly recommended in bookkeeping and accountancy services for startups.

Track Every Transaction Log every payment received and expense made. This includes receipts, bills, payroll, and subscriptions. Detailed tracking is essential for tax deductions and financial accuracy.

Reconcile Monthly Match your internal records with bank statements to ensure everything aligns. Regular reconciliation helps catch discrepancies early and avoids year-end chaos.

Generate Financial Statements Prepare key reports such as the balance sheet, profit & loss statement, and cash flow statement. These documents are vital for understanding your business’s financial health and making informed decisions.

Stay Compliant File your tax returns on time, maintain financial documentation, and adhere to statutory compliance rules. Using bookkeeping and accounting service providers can help you avoid penalties and legal trouble.

By partnering with a reliable business bookkeeping service, many of these steps can be streamlined, allowing you to focus on growing your startup while professionals handle the numbers.

Tips and Softwares used for Better Startup Accounting

Startup accounting is easier with the right habits and softwares. Use cloud-based software like QuickBooks or Wave to automate tasks, track expenses, and stay organized. Separate personal and business finances, digitize records, and review your books regularly. Many startups benefit from small business bookkeeping services to ensure accuracy, compliance, and stress-free financial management.

Start Early Don’t wait for tax season to get your finances in order. From the moment you start spending or earning, implement accounting processes. Early adoption of bookkeeping services reduces the risk of costly mistakes and builds a solid financial foundation.

Use Cloud Accounting Softwares Leverage cloud-based softwares like Xero, Wave, QuickBooks accounting software, and FreshBooks to automate invoicing, expense tracking, payroll, and reporting. These softwares offer scalability and real-time data access perfect for startups with remote or hybrid teams.

Digitize Records Go paperless by using apps that scan and store receipts, bills, and financial documents. This not only saves space but also ensures your data is organized, searchable, and audit-ready core aspects of efficient bookkeeping and accounting service.

Schedule Regular Reviews Don’t wait until year-end to review your finances. Monthly check-ins help you identify red flags, catch irregularities, and make timely decisions to stay within budget. Many bookkeeping and accountancy services offer scheduled reporting and analysis to assist with this.

Separate Finances Always keep personal and business finances distinct. Using a dedicated business bank account and credit card simplifies bookkeeping and makes tax preparation far easier. It also shows professionalism to partners, banks, and investors.

Why Choose Pacexgrowth for Your Startup Accounting Needs?

At Pacexgrowth, we understand the fast-paced, high-pressure environment of startups. That’s why our bookkeeping and accounting services are designed to simplify your financial management so you can focus on building your business, not balancing spreadsheets.

Our team offers a blend of automation and expert support, tailored specifically for startups and growing businesses. Whether you’re looking for small business bookkeeping services, cash flow tracking, or tax-ready financial reporting, Pacexgrowth ensures accuracy, compliance, and total peace of mind.

What sets us apart?

Transparent pricing with no hidden fees

Scalable solutions that grow with your business

Quick onboarding and real-time financial dashboards

Full-service support from setup to compliance

By partnering with our bookkeeping and accountancy services, you’ll gain financial clarity, investor readiness, and operational efficiency without the cost of hiring in-house.

Conclusion

Accounting is more than just a compliance task it’s a business survival tool. Whether you’re bootstrapped or funded, every startup needs solid financial management. Leveraging modern software and partnering with trusted accounting and bookkeeping service providers can give your startup the stability and insight it needs to grow confidently. Don’t wait for a financial mess to start building your accounting foundation today.Strong financial practices not only help you stay compliant but also improve decision-making and investor confidence. Start early, stay consistent, and let bookkeeping services support your business at every stage.

Frequently Asked Questions (FAQs)

1. Do startups really need professional bookkeeping? Ans:Yes. It ensures compliance, avoids errors, and saves time.

2. What’s the best bookkeeping software for startups? Ans: QuickBooks, Zoho Books, and Wave are popular for small businesses.

3. Can I do bookkeeping myself as a founder? Ans: Yes, in the early days. But professional bookkeeping services bring accuracy and efficiency.

4. What records should I maintain? Ans: Invoices, receipts, bank statements, tax filings, and payroll records.

5. How often should I reconcile accounts? Ans: Ideally, monthly. Regular reconciliation prevents discrepancies.

6. What’s the cost of small business bookkeeping services? Ans: It varies based on the volume of transactions and complexity but is often more cost-effective than hiring full-time staff.

7. How does bookkeeping help with taxes? Ans: Accurate records ensure timely tax filing, maximize deductions, and reduce audit risks.

8. Is cloud-based accounting secure? Ans:Yes, most softwares offers bank-grade security and encryption.

9. What’s the difference between bookkeeping and accounting? Ans: Bookkeeping records data, accounting interprets and analyzes it.

10. When should I switch from DIY to hiring a bookkeeping service? Ans: When finances get too complex, or you’re spending too much time managing books instead of growing the business.

0 notes

Text

Unlocking the Power of Automation and AI for Affiliate Marketing Success

In today’s rapidly evolving digital landscape, affiliate marketers and small business owners alike are turning to advanced technologies to stay ahead. The demand for AI tools to boost affiliate marketing success and software for automating small business tasks has never been higher. As the online marketplace becomes more competitive, leveraging the right tech solutions is essential not only for efficiency but also for driving consistent growth and profitability. Whether you are just starting out or looking to scale your affiliate marketing strategy, integrating these technologies is no longer optional—it’s vital.

AI has transformed how marketers approach campaign strategy, content creation, customer engagement, and data analysis. The best AI tools to boost affiliate marketing success go beyond basic analytics; they predict trends, personalize content, and automate outreach in ways that were previously unimaginable. AI-powered platforms can analyze user behavior in real-time, allowing marketers to tailor their messaging for maximum impact. From dynamic content recommendations to chatbot-driven support systems, AI gives affiliate marketers a cutting-edge advantage in audience targeting and conversion optimization.

Meanwhile, small business owners face a daily balancing act—juggling customer service, inventory management, accounting, and marketing. This is where software for automating small business tasks becomes a game-changer. These solutions help reduce human error, streamline operations, and free up time for entrepreneurs to focus on strategy and growth. Automation software can handle everything from invoicing and scheduling to social media posting and customer follow-ups, eliminating repetitive tasks and minimizing operational costs.

One standout approach is integrating AI into automation tools. When these technologies are combined, businesses achieve not only efficiency but also intelligence. Imagine a system that not only sends follow-up emails but learns which messages convert best over time, adapting automatically to boost results. This kind of synergy between AI and automation provides a competitive edge that traditional methods simply can’t match.

What’s more, the accessibility of these tools has significantly improved. Platforms that once required hefty investments are now available on subscription models, putting powerful features within reach of solo entrepreneurs and startups. The simplicity of implementation and user-friendly interfaces means even those with minimal tech knowledge can begin benefiting from these tools almost immediately.

QuickScanReview.com has highlighted the transformative potential of adopting the right digital tools. By focusing on unbiased reviews and thorough comparisons, the site helps users identify which AI and automation platforms align best with their unique business goals. In a crowded market filled with software promises, this guidance is crucial for making informed decisions.

Choosing the right AI tools to boost affiliate marketing success begins with understanding your niche and audience. Tools like Jasper, SEMrush, and Surfer SEO provide content optimization, competitor analysis, and performance tracking—all powered by machine learning. These features help affiliates craft more compelling, SEO-friendly content that resonates with their target demographics.

For those in need of software for automating small business tasks, tools like Zapier, HubSpot, and QuickBooks offer tailored solutions. Whether it's integrating multiple services or automating lead generation, these tools reduce workload and increase consistency. They enable business owners to maintain high levels of customer satisfaction while also scaling operations efficiently.

Another benefit is how these tools foster data-driven decision-making. With advanced reporting features and insights, users can measure the ROI of campaigns, identify weak points in workflows, and make adjustments in real time. This agility is vital in today’s fast-paced market where delays and inefficiencies can result in lost revenue and competitive disadvantage.

QuickScanReview.com once again stands out as a trusted source for entrepreneurs navigating the complexities of tech adoption. With an eye on real-world performance and usability, their recommendations reflect what works in the field, not just what looks good on paper.

In conclusion, bothAI tools to boost affiliate marketing success and software for automating small business tasks are indispensable assets in today’s business environment. Embracing these technologies doesn’t just optimize performance—it transforms how business is done. Whether you’re an affiliate marketer seeking higher conversions or a small business owner aiming to simplify operations, the path to success is clear: automate, optimize, and grow with the help of smart, efficient technology.

0 notes

Text

Payment Reconciliation Software: Simplifying Financial Clarity for Modern Businesses

In today’s multi-channel business environment, handling payments efficiently has become both critical and complex. Whether you're running a retail store, SaaS business, or managing a service-based enterprise, reconciling customer payments from various sources is a vital but often time-consuming process. Enter payment reconciliation software—an intelligent solution designed to automate, streamline, and secure the entire reconciliation lifecycle.

This blog dives deep into how payment reconciliation software works, its benefits, and why Cognizione is becoming the preferred platform for fast-growing and enterprise-level businesses in India and beyond.

What Is Payment Reconciliation?

Payment reconciliation is the process of comparing internal accounting records (like invoices or sales ledgers) with actual payments received in your bank accounts. It ensures that all payments due are accounted for and no transaction is missed, duplicated, or misrecorded.

Traditionally, finance teams rely on spreadsheets and manual checks to match payment entries—often a tedious, error-prone process that slows down closing cycles and introduces risks.

What Is Payment Reconciliation Software?

Payment reconciliation software automates this entire process. It pulls data from your payment gateways, bank accounts, and accounting systems, and automatically matches transactions using smart logic. It flags mismatches, suggests resolutions, and maintains audit trails—all while significantly reducing the time, effort, and human error involved.

Solutions like Cognizione make reconciliation scalable, intelligent, and audit-ready—no matter how complex your payment infrastructure is.

Why Payment Reconciliation Is More Complex Than Ever

Today’s businesses receive payments from a wide range of channels:

UPI, NEFT, RTGS

Payment gateways like Razorpay, Paytm, Stripe, and Cashfree

Credit/debit cards, wallets, and BNPL

Cash-on-delivery and offline POS

International wires and currency conversions

Manually reconciling this volume across multiple systems is not just inefficient—it’s unsustainable. That’s why adopting robust payment reconciliation software is no longer optional for growing businesses—it’s essential.

How Payment Reconciliation Software Works

Here’s a simplified breakdown of how platforms like Cognizione manage reconciliation:

1. Data Import

The software connects with your bank feeds, accounting software (like QuickBooks, Tally, Zoho), payment gateways, and ERP tools to pull real-time transaction data.

2. Automated Matching

It applies custom matching rules (by amount, transaction ID, reference number, customer name, or payment method) to automatically reconcile records.

3. Exception Handling

Mismatches and duplicate transactions are flagged, with workflows to investigate and resolve them.

4. Reporting and Audit Trail

Detailed reconciliation reports and full audit logs are generated and stored securely for internal reviews and statutory audits.

Key Features of Cognizione’s Payment Reconciliation Software

Cognizione offers a next-gen payment reconciliation platform designed for businesses that deal with high transaction volumes, complex payment flows, and multi-entity operations.

Here’s what makes Cognizione stand out:

Intelligent Auto-Matching Engine

Reconcile thousands of transactions in minutes using dynamic and AI-powered matching logic.

Multi-Channel Payment Integration

Connect all major payment gateways, banks, and financial tools through APIs and secure data pipes.

Exception Management Dashboard

View all unmatched transactions, auto-classify them by type, and assign resolutions to relevant team members.

Real-Time Reconciliation Status

Visual dashboards give instant insights into cleared vs. uncleared payments across accounts, teams, or locations.

Audit-Ready Reports

Export detailed reports with a click—ideal for internal compliance teams and statutory auditors.

Secure, Role-Based Access

Grant precise user permissions to manage approvals, view-only access, or reconciliation rights as needed.

Benefits of Payment Reconciliation Automation

⏱️ 1. Save Time and Boost Productivity

Cut down reconciliation efforts by up to 80%. Let your finance team focus on forecasting, not data cleanup.

🧮 2. Eliminate Errors and Missed Entries

No more missed payments, incorrect credits, or duplicated invoices—automation ensures accuracy.

📅 3. Speed Up Financial Closings

Achieve faster month-end and year-end closings without the stress of last-minute mismatches.

📊 4. Real-Time Cash Flow Visibility

Know exactly what’s been paid, what’s pending, and what needs action—across all payment channels.

🧾 5. Improve Audit and Regulatory Compliance

Be always audit-ready with real-time records, digital logs, and traceable approvals.

Who Needs Payment Reconciliation Software?

Cognizione is ideal for businesses across various sectors that deal with complex or high-volume payments:

🛒 E-Commerce & Retail

Match orders, refunds, discounts, COD, and gateway settlements across channels and marketplaces.

💻 SaaS & Subscription-Based Models

Track recurring payments, churn, and international payments across Stripe, Razorpay, and other tools.

🏥 Healthcare & Diagnostics

Reconcile patient payments, third-party insurance settlements, and lab billing.

🏭 Manufacturing & Wholesale

Manage multi-customer B2B payments, credit notes, and distributor account balances.

🏨 Hospitality & Travel

Match OTA payments, customer invoices, POS collections, and offline settlements efficiently.

Key Challenges Solved by Cognizione

⚠️ No more reconciling via spreadsheet formulas

✅ Seamless integration with payment processors and CRMs

🔒 Full control over sensitive financial workflows

📋 Instantly downloadable audit logs

🔁 Ongoing support for scaling teams and operations

How to Choose the Right Payment Reconciliation Software

Here’s a quick checklist to guide your selection:

✅ Integrates with your banks and payment tools

✅ Supports Indian payment gateways and UPI

✅ Customizable matching logic

✅ Handles large-scale transaction volumes

✅ Offers strong data security and audit controls

✅ Provides analytics and dashboards

✅ Offers local support and onboarding assistance

Cognizione checks all the boxes—and then some.

Final Thoughts: Payment Reconciliation Shouldn’t Slow You Down

As businesses scale and payment systems become more fragmented, manual reconciliation can create serious bottlenecks. By adopting a smart, automated system like Cognizione’s payment reconciliation software, you gain accuracy, visibility, and speed—helping you build trust with stakeholders and make confident financial decisions.

📞 Ready to Simplify Your Payment Reconciliation?

It’s time to eliminate manual work, minimize errors, and speed up financial closings with automation built for scale.

🔹 Book your FREE demo now 🌐 Visit: https://cognizione.com

0 notes

Text

Why Accounting & Bookkeeping Are Crucial for Business Success

Effective financial management is essential for any successful company, regardless of size. Accounting & bookkeeping procedures, which include documenting, categorising, and summarising financial transactions, are at the heart of this. These duties assist businesses in keeping correct financial records, which are necessary for deliberative decision-making. Without them, companies run the risk of experiencing financial mismanagement, tax problems, or legal problems. The difference is straightforward: accounting includes the interpretation, analysis, and reporting of those financial records, whereas bookkeeping deals with the daily recording of transactions. They are the foundation of any organization's finances.

The Role of Bookkeeping

The cornerstone of efficient financial management is bookkeeping. The consistent recording of all sales, purchases, receipts, and payments is guaranteed by bookkeepers. Tracking cash flow, figuring out spending patterns, and creating financial statements all depend on this consistency. Costly errors can result from even minor mistakes in record-keeping. In the current digital era, a lot of companies automate and streamline these procedures using software like Xero or QuickBooks. In addition to keeping your company in compliance with legal requirements, accurate bookkeeping also aids in spotting areas for expansion and enhancement.

How Accounting Helps You

Accounting analyses data to produce useful insights, whereas bookkeeping is primarily concerned with data recording. An accountant with training is able to create financial statements, carry out audits, and identify patterns that inform future plans. Here is where accounting & bookkeeping work in tandem to create a coherent financial narrative. Bookkeeping collects the raw data. Business owners can use these insights to forecast revenue, create budgets, and choose wisely what investments to make. Businesses can effectively scale and optimise operations by comprehending cost trends, return on investment, and profit margins.

The Importance of Financial Accuracy

Building credibility and trust is more important than simply avoiding mistakes when it comes to financial accuracy. Your financial records are used by investors, lenders, and tax authorities to evaluate the success of your company. Legal repercussions or missed business opportunities may result from misstated accounts. To make sure that financial reports accurately depict the state of your company, you should regularly reconcile accounts, look for discrepancies, and perform internal audits. Your ability to obtain loans or funding, as well as your tax filings, may be impacted by inaccurate records.

In-House and Outsourced Services

Businesses must choose between outsourcing to experts or maintaining operations internally when handling financial records. Although it can be expensive and time-consuming, hiring in-house employees gives you more control. Conversely, outsourcing lowers overhead expenses and provides you with access to specialists. When making this choice, it is critical to consider your budget, transaction volume, and business needs. As they expand, many startups and small businesses gradually switch from outsourcing to in-house teams. Every option has advantages and disadvantages, so it's critical to select the one that best suits your objectives.

Leveraging Technology

The field of accounting & bookkeeping has undergone a revolution thanks to technology. Businesses can manage their finances in real time, from any location in the world, thanks to cloud-based platforms. Financial reporting, expense tracking, and automated invoicing are among the features provided by programs like FreshBooks, Wave, and Zoho Books. These platforms offer immediate access to financial data and minimise human error. Efficiency is increased through integration with other business apps, such as banking, payroll, and inventory. Businesses can simplify their financial management and concentrate more on strategic expansion by utilising contemporary tools.

Tax Preparation and Compliance

Tax season is one of the most stressful times of the year for any business. However, tax preparation becomes much easier with proper accounting and consistent bookkeeping. You'll be prepared with all the required paperwork, such as balance sheets, expense reports, and income statements. Maintaining compliance with tax laws guarantees timely filings and helps you avoid penalties. Numerous accounting software programs have tax computation tools that adjust rates and regulations automatically according to your location. Speaking with an accountant on a regular basis also enables you to benefit from tax-saving techniques and legal deductions.

Planning for Growth

Planning for future expansion is made possible for business owners by accurate financial data. Predicting future income, costs, and cash flow using historical data and current trends is known as financial forecasting. This aids in the prudent distribution of resources, the detection of possible obstacles, and the development of expansion plans. A sound financial forecast is essential whether you're looking for funding, launching a new product, or breaking into a new market. Through data analysis and scenario modelling, accountants are essential in creating these forecasts. Financial stability and sustainable growth are guaranteed by careful planning.

Common Mistakes to Avoid

When it comes to handling their finances, many business owners make common mistakes. These include putting off financial reviews, disregarding minor transactions, and combining personal and business finances. Over time, such behaviours may cause misunderstandings and mistakes. Not getting professional assistance in a timely manner is another common error. A lack of financial knowledge can lead to major problems even with the best software. Avoiding these pitfalls can be facilitated by setting financial goals, keeping discipline, and routinely reviewing your records. Proactive action is always preferable to responding to financial crises.

Conclusion

Financial management is crucial in the cutthroat business world of today. Accounting & bookkeeping make sure your business stays financially stable, from budgeting to tax compliance. These procedures give you the information and understanding you need to make wise choices and succeed in the long run. Whether your business is new or well-established, making an investment in sound financial management will eventually pay off. You can confidently guide your company towards a prosperous future by appreciating their worth and enlisting the help of the appropriate experts and resources.

0 notes

Text

12 strong customized CRM software boosts business growth

Custom CRM software: the intelligent way to expand your business

Efficiency is the new currency in today's business environment that is dominated by the digital world. Organizations, small firms, or multinational organizations have to work smarter, react faster, and work leaner in order to survive and thrive. Off-the-shelf CRM applications previously provided an opportunity to bring data together, organize leads, and enhance customer care. But with increasingly complicated business requirements, such inflexible platforms are not sufficient anymore.

That is where custom CRM software steps in—a completely customizable, personalized solution that fits the way your business operates, not vice versa. By aligning technology with workflows, custom CRM systems provide phenomenal value — from boosting lead conversions to fine-tuning team communication.

In contrast to generic solutions, custom CRM software lets you create precisely what your organization requires. From automated CRM to lead management, from file sharing to deeper integrations, each feature has a clear function. You don't pay for features you don't need. You have total control.

Let's go in-depth into how customized CRM software provides scalable, adaptable, and strategic advantages for organizations that want to become smarter.

The business-critical advantages of tailored CRM software

Automation that saves manual effort.

Manual data entry, reminder tasks, and tracking schedules consumed dozens of hours. Today, tailored CRM automation replaces these mundane tasks with smart workflows.

For instance, when a prospect submits a form on your website, your CRM can automatically create a contact, route it to the appropriate sales rep, and send a follow-up email.

This saves not only time but also increases consistency. All leads are contacted at the right time, and your staff can do what they excel at—service and sales.

With CRM automation tools integrated right into your custom workflows, you can be sure that your system functions exactly like your teams function.

Smart document management, all in one

A disorganized file system hinders business. CRM, when integrated with document storage, brings all organizational functions under one umbrella.

With a customized CRM solution, you can have folders for contracts, quotes, and onboarding documents, all attached to customer profiles. You can reduce searching through inboxes or shared drives.

And since the document flow is tailored, approval workflows, electronic signatures, and version control are built right in. Rights can be assigned at the user level so that confidential information stays protected.

Effectively capture, qualify, and route leads.

Leads are the lifeblood of any expanding business. A bespoke CRM allows it to be easy to identify, save, and allocate leads following the rules you specify. For instance, leads coming from your landing pages can be automatically scored on activity and then directed to the correct sales rep.

This intelligent routing of leads reduces response times and enables sales teams to prioritize the most valuable prospects. You can also design personalized views of lead journeys, personalize nurturing sequences, and build real-time dashboards to monitor conversion performance.

Integrate your entire tech stack with deep integrations.

Today's companies depend on a range of tools — email platforms, calendars, eCommerce systems, marketing automation tools, ERP systems, and so on. A tailored CRM with third-party integrations serves as a central platform where everything talks to everyone else.

Through APIs and plug-and-play adapters, your CRM works with tools such as Gmail, Outlook, QuickBooks, HubSpot, and Slack. Forget jumping between screens or manually synchronizing data. Such CRM software integration enhances workflow effectiveness and data quality.

Offer multi-channel support for enhanced customer experience.

Customers want quick, personalized service — regardless of the channel. With a bespoke CRM system that provides omnichannel support, you can handle chats, emails, calls, and social media messages from one dashboard. Your staff can view all customer interactions at a glance, including past tickets, purchase history, and preferences.

This not only enhances the quality of service but also enhances brand loyalty. Regardless of whether your staff is working remotely or across time zones, this feature makes everyone aware and ensures that customers feel heard.

You will actually employ personalized reports and dashboards.

Generic CRMs provide out-of-the-box reports. But with a custom-report CRM, you can monitor what truly matters to your business — whether it's close time, customer churn, or employee performance. Custom dashboards can present visual metrics like business velocity, email open rates, and support resolution times.

Your team designs the dashboards, which distill insight. Executives have a bird's-eye view, while frontline teams view their actionable data.

Tailored sales pipeline management

Your sales pipeline can be unique to the next business. Perhaps you have several products, and each of them has a process. A tailored sales pipeline within your CRM allows you to create several pipelines with unique stages, probability percentages, and automated triggers.

Sales managers are able to see the pipeline's real-time state, allocate tasks at every stage, and more accurately forecast monthly sales. Everything makes your team more responsive and attuned to buyer journeys.

Scalability that scales with you

A system that supports you today must also support your future growth. Scalable CRM solutions are designed to handle growing databases, user roles, integrations, and workflows, without slowing down. Whether you’re adding departments, locations, or business models, your CRM adapts.

From small teams to large enterprises, customized CRMs scale in architecture, performance, and ease of use. You don’t have to start from scratch or pay more for features you don’t use.

Minimize business risk with customized permissions and hosting.

Security, compliance, and uptime aren't nice-to-haves —they're necessities. With secure CRM software, you can control who can see what, implement role-based permissions, and host your data on servers of your choice (on-premise or cloud).

This comes in handy, especially in regulated markets like healthcare, law, and finance. With GDPR-compliant CRM platforms, you have total control and visibility.

Get ahead of the game with tailored functions.

Off-the-shelf CRMs are meant for the masses. A tailored CRM platform, on the other hand, is meant to accentuate your strengths — be it expedited customer onboarding, producing complex quotes, or after-sales support. You can build your own modules, automate specialty workflows, and train AI models on your specific data.

Not only does this accelerate processes, but it also makes it hard for competitors to copy your systems.

Launch new products and services to market quicker.

Need to launch a referral program or a quote calculator? You don't have to wait for your CRM vendor to implement this. With agile CRM software, you can add new features, forms, or processes without interfering with your team.

From conception to deployment, your CRM can match the pace of business.

Simple to keep up and to update

You don't require a developer to change anything. With today's no-code CRM developers, teams can customize flows, build forms, and modify fields with drag-and-drop functionality. This approach minimizes reliance on the IT department and makes your processes flexible.

Even better, maintenance is less burdensome. Bugs are resolved sooner, and improvements don't break what already works.

Empower every team member — no technical degree needed.

The largest benefit of bespoke CRM software is that it provides each team the tools they require in language that they comprehend. With intuitive UIs, graphical reports, and streamlined workflows, even those with no technical acumen feel comfortable.

Sales representatives, marketers, HR groups, and support staff all work smarter, not harder. And when your CRM is being utilized eagerly throughout the company, that's when magic happens.

Archiz Solutions: The ideal no-code platform for customized CRM

When it comes to building a CRM without hiring developers or waiting for the IT department, Archiz Solutions is a first-class no-code platform. It combines the power of custom CRM software with the simplicity of visual tools, allowing companies of any size to create customized systems.

Find out how Archiz makes CRM customization fast, cost-effective, and future-proof.

Visual development for instant clarity

Archiz provides an intuitive and robust visual development environment. Rather than coding, users simply drag and drop elements to build forms, workflows, dashboards, and data models. You'll watch your CRM take shape in real-time—similar to building with Lego bricks.

Regardless of whether you're modifying a sales process or creating a feedback form, the visual interface means that your modifications can be applied easily and promptly.

No-code tools that enable teams

Not all teams have a developer — and Archiz doesn't require one, even if they do. The platform is a no-code CRM, which means it's perfect for business users. Sales managers can modify lead scoring logic. Support agents can define new ticket types. Marketers can design campaign triggers.

This democratization of control over CRM eliminates dependency on developers and speeds up innovation across all teams.

Actual application development without waiting

With Archiz, you don't design concepts; you deliver actual applications. Each configuration results in a working CRM module. You can build end-to-end systems for onboarding, order management, partner portals, and more — all from one backend.

And since it's modular, you can deploy updates in phases without interfering with current workflows.

Backend and mobile compatibility

Archiz isn't just for the desktop. The solution is built to provide mobile CRM functionality so your field service reps can access, update, and share on the go. From the field tech updating order status to the sales representative logging a meeting, mobile access keeps everything current.

Simultaneously, strong back-end utilities guarantee that system administrators are able to control performance, track usage, and streamline processes in the background.

The scalability of the system is implemented to address the changing requirements of businesses.

As your customer base grows, so do your data and process requirements. Archiz is designed to scale, from managing thousands of users to processing millions of records without sacrificing performance.

Its elastic infrastructure ensures stability during growth spurts, seasonal peaks, and product expansions.

Whether you’re a startup or scaling to enterprise, your CRM is future-proof.

Affordable pricing for all company sizes

One of the misconceptions regarding customized CRMs is that they are costly. Archiz eliminates this misconception and provides an affordable CRM pricing model. Subscription plans are created to deliver value for companies of all sizes — small enterprises to large companies — without sacrificing features.

You receive high-end tools, customization options, and customer support without overspending.

Frequently asked questions

Why is customized CRM software superior to conventional CRMs?

Tailored CRM software can be ideally suited to your business processes. While off-the-box CRM software makes you conform, you can create features, fields, and workflows to suit your business processes with a customized solution.

May I integrate tailored CRM software with some existing tools such as Gmail or QuickBooks?

Yes. Most bespoke CRM solutions—particularly those based on platforms such as Archiz—can integrate natively with tools such as Gmail, QuickBooks, Google Calendar, and Slack. This provides an interconnected system that eliminates time and enhances accuracy.

Can a CRM be made without coding expertise?

Absolutely. Sites such as Archiz allow businesses to design and develop tailored CRM software using visual tools. You don't require programming expertise, simply a clear idea of your process.

Will my tailored CRM be accessible on mobile devices?

Yes. Contemporary tailored CRM platforms are built for mobile use. You and your staff can access the CRM using smartphones and tablets, enabling remote and field staff to work flexibly.

How do I know my CRM is secure and compliant?

With personalized CRM solutions, you can select your hosting environment, determine access roles, and add encryption. You can make your CRM GDPR compliant or compliant with other regulatory requirements.

Is custom CRM software scalable with me as I grow my business?

Yes. With dynamic systems, a tailored CRM can expand with your team, your customers, and your data. You can add users, add modules, or connect new services without having to start from the beginning.

The bottom line

The worth of tailored custom CRM software is not only in what it is able to accomplish but also in the way that it conforms to you. It's about having a system that functions the way your business operates. Whether it's streamlining tasks, handling sales pipelines, or offering smooth customer service, a well-crafted, tailored CRM offers structure, velocity, and scalability.

And thanks to tools such as Archiz Solutions, having a tailored CRM is no longer a costly or time-consuming procedure. You're provided with an answer that perfectly fits your particular requirements—and adapts to fit your expanding company.

Whether from startups or in growth mode, from digital-only teams or incumbent industries, going for bespoke custom CRM software is more than merely a technical choice; it's an investment in better business performance.

0 notes

Text

How to Scale Your Business Without Wasting Time or Money

Scaling a business isn’t just about growth — it’s about strategic, sustainable, and cost-effective growth. As companies navigate through complex market dynamics, the challenge lies in expanding operations while optimizing both time and financial resources. Below, we present a comprehensive guide to scaling your business efficiently without unnecessary delays or expenditures.

Establish Clear, Scalable Systems from the Start

The first step in scaling without waste is building streamlined systems. Without scalable infrastructure, growth creates chaos rather than results.

Key strategies:

Automate repetitive tasks with tools like Zapier, Asana, and HubSpot to minimize manual work.

Standardize workflows using SOPs (Standard Operating Procedures) for customer service, onboarding, inventory management, and marketing.

Implement cloud-based platforms like Google Workspace, Slack, and Trello for team collaboration that can grow with your company.

Hire Smarter, Not Bigger

Expanding your team should be strategic, not excessive. Every new hire should bring tangible ROI.

Optimize your hiring process:

Prioritize multi-skilled professionals over specialists to cover more ground.

Use freelancers or virtual assistants for non-core tasks like data entry, customer follow-ups, or social media scheduling.

Leverage outsourcing partners for services like payroll, IT support, or HR.

This approach reduces overhead and maintains operational agility.

Use Data-Driven Decision Making

Scaling without wasting money begins with tracking every dollar and analyzing performance metrics relentlessly.

Key areas to monitor:

Customer acquisition cost (CAC) and lifetime value (LTV) to assess marketing effectiveness.

Conversion rates, churn, and upsell opportunities within your sales funnel.

Return on Ad Spend (ROAS) to fine-tune digital advertising.

Tools like Google Analytics, Hotjar, and SEMrush can help you identify bottlenecks and uncover hidden growth opportunities.

Leverage the Power of Lean Marketing

Gone are the days of bloated ad budgets. Today’s successful companies focus on lean, high-ROI marketing tactics.

Top lean marketing strategies:

Focus on organic SEO through high-quality content, keyword research, and backlink building.

Build an email marketing funnel to nurture and convert leads with tools like Mailchimp or ConvertKit.

Maximize visibility through social proof — testimonials, case studies, influencer shout-outs, and user-generated content.

These tactics generate long-term brand equity without constant spending.

Double Down on Core Offerings Before Expanding

Too many businesses waste money by diversifying too early. Focus on what you do best, and dominate your niche before expanding.

Steps to refining your core offerings:

Conduct customer feedback loops to improve your most popular products or services.

Create bundles or tiered pricing to increase average transaction value.

Use cross-selling and upselling strategies that increase revenue without increasing customer acquisition cost.

Scaling is smoother when your core business is profitable, repeatable, and optimized.

Adopt Scalable Technology Solutions

The right technology is your best ally in reducing costs and saving time as you grow.

Key tech tools for scaling efficiently:

CRM platforms like Salesforce or Zoho for managing customer relationships.

ERP software like NetSuite or Odoo for real-time business operations control.

Accounting platforms like QuickBooks or Xero for automating invoicing, payroll, and expense tracking.

Cloud-based, subscription-model software ensures you only pay for what you use, and can scale up as needed.

Focus on Customer Retention Over Acquisition

Customer acquisition is expensive. It’s far more cost-effective to retain and upsell existing customers.

Retention-focused strategies:

Implement loyalty programs to reward repeat business.

Personalize communication using behavioral data and past purchase history.

Offer exceptional customer support to reduce churn and build brand advocates.

The longer a customer stays, the greater their lifetime value — which means more growth, with less marketing cost.

Bootstrap Intelligently When Possible

Bootstrapping isn’t about pinching pennies — it’s about prioritizing investments.

Best bootstrapping practices:

Reinvest revenue into high-yield activities, such as product development and content marketing.

Negotiate with vendors and service providers for long-term deals or performance-based pricing.

Delay fixed overhead expenses like office leases and full-time hires until absolutely necessary.

Being frugal at the right moments creates financial flexibility when it counts.

Use Strategic Partnerships to Accelerate Growth

Collaborations can provide instant scale without the financial strain of building from scratch.

Types of valuable partnerships:

Affiliate programs that reward others to sell for you.

Co-marketing campaigns with complementary businesses to reach broader audiences.

Wholesale or distribution alliances that put your product in more hands without increasing internal logistics.

These partnerships reduce the need for heavy capital investment in growth.

Maintain a Growth-Ready Mindset

Scaling isn’t just about operations — it’s about culture.

Key mindset shifts:

Embrace continuous learning and encourage your team to do the same.

Set aggressive but realistic KPIs, and celebrate incremental wins.

Foster a fail-fast attitude, where experimentation is encouraged and learning is fast.

Culture plays a critical role in sustaining momentum during periods of rapid growth.

Conclusion: Growth Without Waste Is Possible

Scaling your business doesn’t require breaking the bank or burning out your team. With the right systems, strategy, and mindset, you can achieve rapid, efficient, and sustainable growth. Focus on lean processes, data-driven marketing, customer loyalty, and technology-powered scalability. These elements are the foundation of any business that wants to grow smartly, not just quickly.

0 notes

Text

Letter Printing & Mailing

In a digital-first world dominated by emails, push notifications, and social media marketing, it's easy to overlook the enduring power of a printed letter. However, savvy businesses understand that traditional communication methods still hold significant value. Letter printing and mailing services continue to thrive because they offer tangible, trustworthy, and personal ways to connect with customers. In this comprehensive guide, we’ll explore why businesses should embrace letter printing and mailing, and how these services can boost engagement, brand credibility, and ROI.

What Is Letter Printing and Mailing?

Letter printing and mailing is the process of creating personalized or bulk letters for business communication and physically delivering them through postal mail. Companies often outsource this task to professional print and mail services, which handle everything from formatting the document to printing, folding, enveloping, stamping, and mailing.

These services can be fully automated and integrated with your CRM, accounting software, or marketing platforms, allowing you to send thousands of personalized letters with just a few clicks.

Why Printing and Mailing Letters Still Matter in 2025

With the rise of AI-driven marketing and paperless communications, one might wonder if physical mail is still effective. The short answer? Absolutely.

According to the Data & Marketing Association (DMA), direct mail response rates are 5–9 times higher than email, paid search, or social media. Moreover, physical mail has a 90% open rate, compared to about 20–30% for email.

Here’s why letter printing and mailing remains relevant and beneficial:

1. Builds Trust and Credibility

Printed letters offer a level of authenticity that digital channels often lack. When customers receive a physical letter, it signals that your business is established, reliable, and willing to invest time and resources into meaningful communication.

Examples:

Invoices, contracts, and legal documents sent via mail are perceived as more official.

Personalized welcome letters or thank-you notes create a lasting impression.

2. Highly Personalized and Targeted

Modern print and mail platforms allow for mass personalization. You can send thousands of letters, each with customized names, offers, and messages tailored to individual customer profiles.