#Reside Portland Recap 2018

Explore tagged Tumblr posts

Video

youtube

Recap from Sneaker Week PDX 2018

Portland, Oregon is known to locals as: Sneaker City. The area plays host to the Nike, Adidas, Under Armour, and Keen headquarters. With all of the staple brands residing in the Northwest the creative activity naturally is higher than anywhere else. From shoe design to the technology that surrounds the design process, Sneaker Week takes aim at it all. In collaboration with Pensole Footwear Design Academy, Better, Never Home Music, and many others Sneaker Week curates a week long event focused on the community that surrounds the footwear industry.

#sneaker city#sneakerheads#sneakercommunity#sneakerweekpdx#sneaker week pdx#nike#adidas#under armour#sneaker blog#sneaker design#footwear blog#Pensole Footwear Design Academy

1 note

·

View note

Text

Reside Portland Recap 2018

On May 5th, 2018 women gathered in Portland, Oregon for a packed day of community, worship and teaching on how to reside more fully in the Kingdom of God. Read on for a recap of the event (photos included!)

The Holy Spirit chills were happening before the very first worship song even began. Sometimes, you just have this feeling that something big is on the horizon when you step into a space or an event, and we were all feeling that way that morning at Westside: A Jesus Church in Beaverton, Oregon. The crowd was diverse in age, in color and in walks of life. There were women in that room from as young as 15 all the way up to women in their 50’s, and were women who were Black, Latino, Asian, and White. It felt like a glimpse of what Heaven is going to be like.

Throughout the day, we discussed the precious gift of time and how to make the most of it while keeping an eternal perspective. We talked about how emotions are indicators not dictators. We talked about how the most important question you can ask is, “God, what do you want me to know about this?” We talked about the importance of community and standing FOR your sisters and not against them. And finally we talked about how we cannot just hear these truths and sit with them, but rather need to GET OUT and do something. God has called us to a life of adventure and action, and we need to apply these truths and WALK THEM OUT.

We are thanking and praising our Father for what He did, and what He will continue to do in the lives of the women who attended, those who volunteered, and those who were part of the inner team. When you work and do life with God, EVERYONE benefits from it!

Take a look below at some of our favorite memories from the event as well as click the link for the full photo album!

CLICK FOR FULL ALBUM

from Reside Portland Recap 2018

0 notes

Text

KEELEY: MARINERS WEEKLY: 2019-20 SEASON RECAP

BY: Michael Keeley, Maine Mariners PORTLAND, ME: Here is a recap of key dates and events from the 2019-2020 season. Mar. 24, 2020 – Regardless of the hockey team one played, worked, or rooted for in 2019-20, it will be a season they’ll never forget. An abrupt end to the ECHL season cut down the Maine Mariners schedule to 62 games and took away what looked to be the first postseason appearance in franchise history. While we’ll never know how the 2019-20 season would have turned out in the end, the second season of Mariners hockey brought many exciting moments to the Cross Insurance Arena and the great hockey fans of Maine. Here are some significant moments that marked the shortened, but a memory-filled season that was. October 11th, 2019 vs. ADK: The Mariners open the season at home against the Adirondack Thunder, just as they did in their inaugural campaign. Unfortunately, history repeats itself and the Mariners suffered a 5-2 loss. Taylor Cammarata scores both Maine goals, attempting to bring them back from a 3-0 deficit late. October 19th, 2019 @ REA: The Mariners get their first win of the season, spoiling the Reading Royals home opener. Tom McCollum(who would ironically become a Royal later in the season), makes 44 saves, and the Mariners put up 5 goals in a 5-3 victory. This would turn out to be their lone win in Reading for the season. November 9th, 2019 vs. ADK: In front of the largest crowd of the season (4,588) on Military Appreciation Night, Jake Elmer nets the first of four Mariners hat tricks, leading the Mariners to a 5-1 win over Adirondack. November 11th, 2019 vs. REA: With Gritty in the building, the Mariners defeat the Reading Royals, 4-3 in overtime. Alex Kile scores the game-winning goal just 23 seconds into the extra period, his first goal of the season. Kile would prove to be a clutch OT player for the Mariners all season long. November 15th, 2019 vs. BRM: The Mariners honor NHL refereeing great, Maine Sports Hall of Fame inductee, and South Portland resident Wes McCauley, as they defeat the Brampton Beast, 6-3 despite letting a 3-0 lead slip away quickly late in the 2nd period. The win is the Mariners’ fourth in a row. November 26th, 2019 vs. WOR: After losing two of three in Norfolk, the Mariners return home before Thanksgiving to win a wild one in overtime, 5-4 in their first home meeting of the season with the Worcester Railers. Ryan Gropp scores two goals while Kile gets his second overtime winner in the span of 15 days. This turns out to be the final game for Railers head coach Jamie Russell, who is relieved of his duties the following day. December 6th, 2019 @ ADK: Jake Elmer registers his second hat trick against Adirondack in less than a month, capping it with the overtime winner to rescue the Mariners, who had blown a 4-1 lead. It was only Maine’s second-ever win at the Cool Insuring Arena but would turn out to be the start of a remarkable Mariners run in Glens Falls. December 7th, 2019 vs. ADK: Elmer continues his dominance of the Thunder, scoring the Teddy Bear Toss goal early, and adding his fifth goal of the weekend to later tie the game at 4 in the third period. Ty Ronning’s shorthanded goal is the game-winner and Elmer goes on to win ECHL Player of the Week honors. December 10th, 2019 vs. ADK: Francois Brassard makes his season debut and gets the win as Dillan Fox tips home a Brandon Crawley pass in the final minute of overtime to give the Mariners a 3-2 win and a three-game sweep of Adirondack. December 21st, 2019 @ ADK: The Mariners finish off back-to-back pre-Christmas 4-3 shootout wins in Adirondack when Taylor Cammarata scores in the fifth round to end it. Each game featured the Thunder tying it up late, but the Mariners getting the shootout bonus point. Maine goes into holiday break in sole possession of the fourth and final playoff spot in the North Division and a season-high four games above .500. January 3rd, 2020 vs. JAX: The Mariners and the Jacksonville IceMen meet for the first time ever, and Maine rallies from down 3-2 late in the 2nd to get a 5-3 win. Terrence Wallin’s first career hat trick leads the way as he scores one in each period, including the game-winner in the third. January 14th, 2020 vs. WOR: The Mariners snapped a five-game losing streak with a 3-2 win over Worcester at home. Rookie forward Mikael Robidoux enters the scene, stirring up physical play and drawing the Railers into penalties, ultimately allowing the Mariners to score back-to-back power play goals late in the 3rd to flip the score in their favor. January 24th, 2020 vs. WOR: Returning from the All-Star break after playing eight games in ten days, the Mariners explode for a franchise-best eight goals – three by Ty Ronning. They score three goals in a 58-second span in the 2nd period to pull away. Adam Huska makes his Mariners debut in between the pipes and makes 43 saves. January 29th, 2020 @ ADK: The Mariners win yet again in Glens Falls 3-0, as Connor LaCouvee picks up his third shutout in a span of 10 starts and his second in a row. Their win two nights later makes it six consecutive road victories over Adirondack. The streak goes to seven with another win in mid-February. February 1st, 2020 vs. ADK: In a partnership with Agren and Make-A-Wish Maine, the Mariners wear jerseys designed by 11-year-old “Wish Kid” Ellie LaBree, and take down the Thunder, 3-2 in OT. Michael McNicholas scores the golden goal, which improves the franchise’s all-time “extra time” record to 20-3-2 (W-OTL-SOL). February 7th, 2020 vs. WOR: LaCouvee makes 45 stops to lead the Mariners to a season-high five wins in a row, squeezing out a 2-1 victory over Worcester. The streak ends the following night, with a 3-2 OT loss to Brampton, but the point streak gets to six. February 11th, 2020 vs. BRM: The Mariners salvage the last of a three-game home set with the Brampton Beast when Alex Kile gets his third OT winner of the season with less than a minute remaining. This would turn out to be the final win on home ice for the Mariners in 2019-20. February 14th, 2020 @ NFL: The Mariners are on the wrong side of some ECHL history when the Newfoundland Growlers win their 19th consecutive home game, 5-1. The Mariners fall to 0-5-0-0 all-time at Mile One Centre, but the best is yet to come. February 15th, 2020 @ NFL: Morgan Adams-Moisan scores a late power play goal to break a 1-1 tie and end the Growlers’ streak before it can reach 20. Francois Brassard gets his first of consecutive wins in between the pipes as the Mariners go on to take three in a row in St. John’s, becoming the first team to ever do so against the Growlers. February 26th, 2020 @ REA: The Royals crush the Mariners, 8-0, the largest margin of defeat in franchise history. The Mariners play the game with just four defensemen due to injuries and the last moment illness to captain Zach Tolkinen. February 28th, 2020 @ WHE: The franchise’s first trip to Wheeling marks a homecoming for Mariners Head Coach Riley Armstrong, who was an assistant for the Nailers from 2016-18. Terrence Wallin scores a pair – including the beneficiary of a Nailers' “own goal,” and Greg Chase scores the game-winner in the 3rd. This becomes Maine’s final victory of the season. March 10th, 2020 vs. NOR: The fateful final game of the season, unbeknownst to anyone. The Mariners battled back from a pair of one-goal deficits but Norfolk’s J.C. Campagna scores on a breakaway with 2:05 left to hand the Mariners a 3-2 loss. The final goal of the Mariners’ season belongs to Cumberland native, Ted Hart. The Mariners' final record will read 32-26-3-1. They went 16-15-2-0 on home ice and 16-11-1-1 on the road (they had only 15 road wins in all of 2018-19). When the season halted, the Mariners were 11 points ahead of Adirondack for the fourth and final playoff spot in the North Division, and three points behind Brampton for third place. They had seven games remaining with Worcester, two with Adirondack, and one with Reading. CLICK HERE for a video recap of the 2019-20 season! 2019-20 Records: Overall: 32-26-3-1 Home: 16-15-2-0 Road: 16-11-1-1 vs. ADK: 12-4-0-0 vs. WOR: 7-2-1-1 vs. NFL: 5-6-0-0 vs. BRM: 3-2-2-0 vs. REA: 2-6-0-0 The Mariners used 42 different players this season: 23 forwards, 15 defensemen, and 4 goaltenders. 2019-20 Team Leaders: Points: Alex Kile (51) Goals: Terrence Wallin/Dillan Fox (23) Assists: Alex Kile (35) Games Played: Michael McNicholas (60) PIM: Mikael Robidoux (80) PPG: Terrence Wallin/Dillan Fox (5) SHG: Michael McNicholas (2) GWG: Terrence Wallin (7) Wins: Connor LaCouvee (20) GAA: Connor LaCouvee (2.75) SV%: Connor LaCouvee (.915) Notable League Ranks (Individual): Terrence Wallin – T-2nd, game-winning goals (7) Alex Kile – T-2nd, longest road point streak (12 games, 11/22/19-1/7/20) Connor LaCouvee – 4th, saves (1060), 4th, shootout SV% (.833), 13th, GAA (2.75) Ryan Culkin – 16th, points by a defenseman (33) Notable League Ranks (Team): Team, shorthanded goals against – T-3rd (4) Team, penalty kill – 6th (83.7%) Team, road penalty kill – 6th (85.5%) Read the full article

#AdamHuska#AdirondackThunder#AlVictor#AlexKile#BramptonBeast#BrandonCrawley#ConnorLaCouvee#CrossInsuranceArena#DillanFox#ECHL#GregChase#JacksonvilleIcemen#MaineMariners#MichaelKeeley#MichaelMcNicholas#MileOneCentre#MorganAdams-Moisan#NewfoundlandGrowlers#NHL#ReadingRoyals#RileyArmstrong#RyanCulkin#RyanGropp#TeddyBearToss#TerrenceWallin#TyRonning#WHA#WorcesterRailers#ZachTolkinen

0 notes

Text

9 Healthcare Companies Who Changed the 2010s

By ANDY MYCHKOVSKY

In order to celebrate the next decade (although the internet is confused whether its actually the end of the decade…), we’re taking a step back and listing our picks for the 9 most influential healthcare companies of the 2010s. If your company is left off, there’s always next decade… But honestly, we tried our best to compile a unique listing that spanned the gamut of redefining healthcare for a variety of good and bad reasons. Bon appétit!

1. Epic Systems Corporation

The center of the U.S. electronic medical record (EMR) universe resides in Verona, Wisconsin. Population of 13,166. The privately held company created by Judith “Judy” Faulkner in 1979 holds 28% of the 5,447 total hospital market in America. Drill down into hospitals with over 500-beds and Epic reigns supreme with 58% share. Thanks to the Office of the National Coordinator for Health Information Technology (ONC) and movement away from paper records (Meaningful Use), Epic has amassed annualized revenue of $2.7 billion. That was enough to hire the architects of Disneyland to design their Google-like Midwestern campus. The other amazing fact is that Epic has grown an average of 14% per year, despite never raising venture capital or using M&A to acquire smaller companies.

Over the years, Epic has been criticized for being expensive, non-interoperable with other EMR vendors, and the partial cause for physician burnout. Expensive is probably an understatement. For example, Partners HealthCare (to be renamed Mass General Brigham) alone spent $1.2 billion to install Epic, which included hiring 600 employees and consultants just to build and implement the system and onboard staff. With many across healthcare calling for medical record portability that actually works (unlike health information exchanges), you best believe America’s 3rd richest woman will have ideas how the country moves forward with digital medical records.

My very first interview out of undergrad was for a position at Epic. I chose a different path, but have always respected and followed the growth of the company over the past decade. In a world where medical data seems like tomorrow’s oil, a number of articles have speculated whether Apple or Alphabet would ever acquire Epic? I don’t buy it. I’m thinking it’s much more likely that 2020 is the first year they acquire a company. How you doing Athenahealth?

2. Theranos

No one can argue Theranos didn’t change the game in healthcare forever… for the worse. I do my best to give all healthcare founders the benefit of a doubt, but Elizabeth Holmes and Ramesh Balwani make that nearly impossible. Turns out that an all-star cast of geopolitical juggernauts on your Board of Directors and the black turtleneck of Steve Jobs is not the recipe for success. Founded by 19-year Elizabeth Holmes, Theranos raised over $700 million at a peak valuation of $9 billion. In retrospect, they have become the poster-child for Silicon Valley’s over-promise and under-deliver mantra. The only problem is that instead of food delivery, their failures resulted in invalid blood testing that could’ve really hurt people.

Despite this failure, the mission and purpose would’ve been tremendously impressive. Cheaper blood tests that require only 1/100 to 1/1,000 the amount of blood that LabCorp or Quest Diagnostics needed. I think the craziest part of the whole saga was that seemingly sophisticated healthcare leaders thirsted for the new technology to beat competitors and improve patient convenience. Before the technology was proved defunct, Theranos convinced Safeway to invest $350 million to retrofit 800 locations with clinics that would offer in-store blood tests. Theranos convinced Walgreens to invest $140 million to develop a partnership that would help beat CVS. Theranos partnered with Cleveland Clinic to test its technology and was working with AmeriHealth Caritas and Capital BlueCross to become their preferred lab provider.

To be clear, they weren’t the first, and won’t be the last healthcare company to fail. I only hope that this extremely well documented (thanks Hollywood) experience has re-focused founders and investors towards building sustainable growth companies that actually help patients live higher quality lives, not just make people money as quickly as possible.

3. One Medical

Thanks to Tom Lee and the One Medical crew, primary care is now investable. Whether you’re talking about private equity or venture capitalists, many have dived head first into the space in search of value-based care treasure. One Medical is the most well-known tech-enabled primary care practice, with 72 clinic locations across seven states, and new locations opening in Portland, Orange County, and Atlanta. The Carlyle Group liked the company so much that it invested $350 million in August 2018, at a reported $1.5 billion valuation. This has led to a number of primary care focused companies (ChenMed, Iora Health, Forward) to amass significant valuations that historically would’ve seemed optimistic. However, the elevation of the primary care provider from the “punter” to the “quarterback” of a patient’s medical journey has lifted all boats.

Interestingly, One Medical has unique differentiators over the traditional primary care competitors. For example, One Medical limits doctors to seeing 16 patients a day, versus the average physician seeing 20-30 patients a day. One Medical also built its own medical records in hopes of a more user friendly experience, instead of outsourcing to practice-based EMRs. One Medical charges $199 annually to each patient to help make up for lower volume, and in return provides same-day appointments, onsite lab draws, and a slick app that allows online appointment scheduling and telehealth consults with providers 24/7. They are also adding capabilities and services to cover mental health and pediatric services to increase revenue.

This change is remarkable. Historically, primary care has been a low-margin business with high administrative and staffing costs, along with physician burnout and regulatory burden. One Medical pioneered the concept of a more modern primary care experience, and I am looking forward to their initial public offering (IPO) targeted for early 2020 and whatever Tom Lee is cooking up at Galileo.

4. Centene

Centene is my favorite health plan to study over the past decade. You would never know that the second largest publicly-traded company headquartered in Missouri was originally started by Elizabeth “Betty” Brinn in Milwaukee, Wisconsin. Under-hyped, which is rare in healthcare nowadays, Centene has quietly grown to become the largest player in both the Medicaid managed care and Affordable Care Act (ACA) exchanges. Under Michael Neidorff’s leadership, Centene now serves 32 states with over 15 million lives and 53,600 employees. They were most recently ranked #51 on the Fortune 500 list. In addition, they are about to grow with the $17.3 billion acquisition of WellCare. Here’s a brief rundown of some major events that demonstrate why I’m so bullish on Centene dominating another decade:

April 2018: WellCare and Centene awarded Medicaid managed care contracts in Florida.

July 2018: Centene acquires Fidelis Care and their 1.6 million New Yorkers for $3.75 billion. This single-handedly gives Centene the leading Medicaid share in the state.

September 2018: WellCare acquires Meridian Health Plan and their 1.1 million lives in Michigan, Illinois, Indiana, and Ohio, for $2.5 billion.

February 2019: Centene and WellCare awarded Medicaid managed care contracts in North Carolina.

December 2019: WellCare awarded Medicaid managed care contract in WellCare (re-procurement underway)

In addition, Texas Medicaid is set to award their STAR contracts for 3.4 million lives between Medicaid and CHIP, of which Centene already won a contract to serve the STAR+PLUS (aged, blind, and disabled population). Seems like a pretty solid guess that Centene will fair pretty well in the STAR RFP rankings. Next decade, I look for Centene to significantly increase their efforts to recruit Medicare Advantage (MA) lives, and I wouldn’t bet against them.

5. Mylan

One word. EpiPen. Mylan, the $10 billion market cap pharmaceutical manufacturer and producer of the epinephrine auto-injector product, EpiPen, became the lightning rod in a consumer and political drug pricing debate in 2016. For those who were living under a rock, here’s the quick recap. Epinephrine auto-injectors are used to treat anaphylaxis (severe allergic reaction). Prior to 2016, Mylan held absolute dominant share of the auto-injector market, hovering around 90% for the first half of the 2010s. The only real competitor was Adrenaclick, produced by Lineage Therapeutics, but they were barely considered a competitor despite having cheaper prices. In 2016, news outlets caught wind of Mylan’s 500% list price increase over a decade ($100 to $600) and a nationwide discussion about drug prices began.

If you asked the Mylan CEO, Heather Bresch, she would tell you that the reason brand EpiPen’s list price increased 500 percent over 7 years is because they invested billions of dollars to significantly increase access in schools and employers across America. These efforts increased the number of EpiPen prescriptions in the U.S. from 2.5 million to more than 3.5 million between 2011 and 2015. She would also tell you that there is a big difference between wholesale acquisition cost price (list price) and net price. This part is often misunderstood by media. The net price takes into account discounts, prescription savings cards, and rebates that Mylan provides to purchasers (PBMs, Employers, Plans). The exact negotiated rebate or discount is different by line of business and organization. However, safe to say that Mylan made a good amount of profit with increasing volume.

At the end of the day, Mylan settled with the U.S. Justice Department for $465 million over claims it overcharged the government. Mylan kept their $600 list price brand EpiPen product with rebates, and added a generic version of EpiPen for $300 list price without rebates and requiring commercial insurance. According to a GoodRx analysis in 2018, the epinephrine auto-injector market now looks much different, with 60% of the market moving to the generic version of EpiPen, 10% of the market remaining with brand EpiPen, and 30% of the market switching to the generic version of Adrenaclick. However, whether generic or brand EpiPen, Mylan makes strong profits and American will continue to discuss the best strategy forward to control drug spend.

6. Evolent Health

First let me caveat. I’ve worked for Evolent Health for the past 5 years and seen it grow from a Series B startup to a publicly-traded company (NSYE: EVH). However, the reason they’re on this list is because Evolent Health has forever changed the game for future value-based care startups. When Frank Williams, Seth Blackley, and Tom Peterson founded the company in 2011 with the help of UPMC Health Plan and The Advisory Board Company, concepts like the Medicare Shared Savings Program (MSSP) did not even exist. Fast forward a decade later, and Evolent Health now serves approximately 3.7 million lives across 35 different U.S. healthcare markets. The mission of Evolent Health is to, “Change the health of a nation, by changing the way healthcare is delivered.” To do this, you need both the technology, clinical, financial, and operational capacity to empower providers to confidently move away from fee-for-service towards fee-for-value.

With the implementation of MACRA and the continued perseverance of CMS under this new administration, value-based care is still full steam ahead (good luck incoming CMMI Director, Brad Smith). Despite the naysayers of value-based care, find me a better way to control medical inflation that is accepted by nearly all healthcare institutions and doesn’t negatively impact patient outcomes, and we can talk. I will mention the importance of “significant” downside risk to actually change provider culture, strategy, and operations. I don’t want the primary purpose of setting up a clinically integrated network (CIN) to be negotiating higher fee-for-service commercial rates for independent physicians aligned to tertiatiary academic medical centers.

I wholeheartedly believe that providers will continue to seek partner options (not vendors with high fees independent of performance) who are not wholly-owned by the large for-profit health plans (Optum…). Of all the available options, Evolent Health is the market leader across a variety of areas. In 2020, I look forward to watching how the 3,000+ Evolenteers push the boundaries of downside risk value-based care with both payers and providers.

7. Livongo

To me, Livongo represents Daenerys Targaryen in Game of Thrones. Not the blood-thirsty character towards the end, but the only person to bring back dragons to the world of Westeros. Except in this example, the dragon is a successful digital health IPO. This was a big deal. Going public rewarded early investors who believed in the nascent digital health and chronic condition space. It allowed public investors an opportunity to peak under the hood of the financials and get comfortable with future economics of the industry. And it provided a legitimacy and a peer valuation to other leading digital health companies like Omada Health. All-in-all, 207,000 members use Livongo for Diabetes management solutions, including a connected glucose monitor, unlimited test strips, and personalized health coaching. This number is expected to grow significantly, with the announcement of a new, two-year diabetes contract with the BlueCross BlueShield Federal Employee Program (FEP). They anticipate the partnership will add an additional $50-60 million in revenue across 2020 and 2021

Livongo has done a brilliant job marketing itself as building a full-stop solution for the 147 million Americans with a chronic condition. According to their estimates, their immediately addressable markets for managing diabetes and hypertension represents a $46.7 billion opportunity. Digging into the unit economics, Livongo estimates that diabetes is worth $900 per patient per year and $468 per patient per year. Since they’re focused on chronic conditions, the business model is subscription-based. In the Q3 quarterly report, Livongo provided full year guidance of $168.5 million on the low end and $169 million on the high end. In either scenario, FY2019 Adjusted EBITDA is projected to lose around $26 million for the year.

Livongo has smartly started with addressing diabetes, given the downstream health impacts of mismanagement of blood sugar and the ability to impact spend with regular insulin, diet, and exercise. They also are very smart to efficiently sell into self-funded large employers using existing channel partners like Express Scripts, CVS, Health Care Services Corporation (HCSC), Anthem, and Highmark BCBS. I know that the stock is down 35% since IPO, but I fundamentally believe chronic conditions are not going away and over time, Livongo will add supplementary clinical programs to expand revenue growth.

8. Optum

UnitedHealth Group is the single largest healthcare company in the world with a $280 billion market cap. It owns UnitedHealthcare, the country’s largest private insurer serving Medicare Advantage, managed Medicaid, employer-sponsored insurance, and ACA exchanges. And yet in 2020, more than 50% of the company’s earning and $112 billion in revenue will come from the lesser known side of the business, Optum. It is difficult to describe Optum because they do so much, but they technically split their business into three units: OptumHealth, OptumInsight and Optum Rx. OptumHealth provides care delivery (primary, specialty, urgent care) and care management to address chronic, complex, and behavioral health needs. OptumInsight utilizes data, analytics, and clinical information to support software, consulting, and managed services programs. OptumRx is a pharmacy benefit management (PBM) to create a more streamlined pharmacy system. In total Optum estimates the U.S. addressable market for its services to exceed $850 billion. If that wasn’t enough, here’s some fun facts why they made the list:

Works with 9 out of 10 U.S. hospitals, more than 67,000 pharmacies, and more than 100,000 physicians, practices, and other providers.

Added 10,000 physicians in the past year, growing its network to 46,000 physicians.

Includes 180,000 team members and serves 120 million customers.

Serves 80% of health plans to reduce total cost of care.

Works with 9 out of 10 Fortune 100 companies.

Pretty remarkable for a business unit that was only technically created in 2011, by merging existing pharmacy and care deliver services into one brand. As chronic disease increases and value-based care is here to stay, Optum is focused on comprehensively treating patients and coordinating their care to improve quality and lower costs. With UnitedHealthcare under the corporate umbrella, Optum has the adequate scale to test any new clinical initiatives before rolling out to other health plans.

9. Purdue Pharma

Purdue Pharma is a privately owned drug company owned by the Sackler Family and most well known for creating OxyContin in 1996. OxyContin represents 90% of Purdue Pharma’s revenue and was aggressively marketed to doctors for use in patients with chronic pain. According to court records, Purdue Pharma has grossed an estimated $35 billion. This is the same prescription painkiller that many experts say fueled the U.S. opioid crisis that has resulted in more than 130 deaths each day after overdosing on opioids. To be clear, the deaths are caused by prescription pain relievers, heroin, and synthetic opioids (fentanyl), however, the initial addiction to opioids is often caused by OxyContin and other prescription drugs. All but two U.S. states and 2,000 local governments have taken legal action against Purdue, other drug makers and distributors.

The Sackler family is the 19th richest family and is well known for supporting the fine arts, including the Sackler Wing at the Metropolitan Museum of Art in New York City where the Ancient Egyptian Temple of Dendur sits. I’ve seen a number of articles persecuting the entire Sackler family, but I want to be a little more nuanced. In 1952, three Sackler brothers (Arthur, Raymond, and Mortimer) bought a drug company called Purdue Frederick. Arthur’s branch of the family got out of the company after his death in 1987. The Raymond and Mortimer branches of Sacklers, who own it, founded affiliate Purdue Pharma in the early 1990s. According to a 2017 article from The New Yorker, there are 15 Sackler children in the generation following the founders of Purdue. Some family members have served on the Board of Directors, while others (most notably descendants from Arthur Sackler who died before OxyContin was invented), have distanced themselves from the company and condemned the OxyContin-based wealth.

Purdue Pharma filed for bankruptcy in September 2019 as part of a tentative settlement related to misleading marketing of the controversial painkiller. The settlement requires the owners of Purdue Pharma and the Sackler family to pay out $3 billion of their own fortune in cash over the next seven years. The only problem is that some family members have reportedly moved $10.7 billion from Purdue Pharma to trusts and holding companies across the world between 2008 and 2017. And all we’re left with is a complicated web of holding companies and offshore bank accounts, ravaged communities, and the leading cause of injury-related death in the U.S.

Andy Mychkovsky is a Director at Evolent Health and the Founder of a healthcare startup and innovation blog, Healthcare Pizza. This post originally appeared on Healthcare Pizza here.

The post 9 Healthcare Companies Who Changed the 2010s appeared first on The Health Care Blog.

9 Healthcare Companies Who Changed the 2010s published first on https://venabeahan.tumblr.com

0 notes

Text

9 Healthcare Companies Who Changed the 2010s

By ANDY MYCHKOVSKY

In order to celebrate the next decade (although the internet is confused whether its actually the end of the decade…), we’re taking a step back and listing our picks for the 9 most influential healthcare companies of the 2010s. If your company is left off, there’s always next decade… But honestly, we tried our best to compile a unique listing that spanned the gamut of redefining healthcare for a variety of good and bad reasons. Bon appétit!

1. Epic Systems Corporation

The center of the U.S. electronic medical record (EMR) universe resides in Verona, Wisconsin. Population of 13,166. The privately held company created by Judith “Judy” Faulkner in 1979 holds 28% of the 5,447 total hospital market in America. Drill down into hospitals with over 500-beds and Epic reigns supreme with 58% share. Thanks to the Office of the National Coordinator for Health Information Technology (ONC) and movement away from paper records (Meaningful Use), Epic has amassed annualized revenue of $2.7 billion. That was enough to hire the architects of Disneyland to design their Google-like Midwestern campus. The other amazing fact is that Epic has grown an average of 14% per year, despite never raising venture capital or using M&A to acquire smaller companies.

Over the years, Epic has been criticized for being expensive, non-interoperable with other EMR vendors, and the partial cause for physician burnout. Expensive is probably an understatement. For example, Partners HealthCare (to be renamed Mass General Brigham) alone spent $1.2 billion to install Epic, which included hiring 600 employees and consultants just to build and implement the system and onboard staff. With many across healthcare calling for medical record portability that actually works (unlike health information exchanges), you best believe America’s 3rd richest woman will have ideas how the country moves forward with digital medical records.

My very first interview out of undergrad was for a position at Epic. I chose a different path, but have always respected and followed the growth of the company over the past decade. In a world where medical data seems like tomorrow’s oil, a number of articles have speculated whether Apple or Alphabet would ever acquire Epic? I don’t buy it. I’m thinking it’s much more likely that 2020 is the first year they acquire a company. How you doing Athenahealth?

2. Theranos

No one can argue Theranos didn’t change the game in healthcare forever… for the worse. I do my best to give all healthcare founders the benefit of a doubt, but Elizabeth Holmes and Ramesh Balwani make that nearly impossible. Turns out that an all-star cast of geopolitical juggernauts on your Board of Directors and the black turtleneck of Steve Jobs is not the recipe for success. Founded by 19-year Elizabeth Holmes, Theranos raised over $700 million at a peak valuation of $9 billion. In retrospect, they have become the poster-child for Silicon Valley’s over-promise and under-deliver mantra. The only problem is that instead of food delivery, their failures resulted in invalid blood testing that could’ve really hurt people.

Despite this failure, the mission and purpose would’ve been tremendously impressive. Cheaper blood tests that require only 1/100 to 1/1,000 the amount of blood that LabCorp or Quest Diagnostics needed. I think the craziest part of the whole saga was that seemingly sophisticated healthcare leaders thirsted for the new technology to beat competitors and improve patient convenience. Before the technology was proved defunct, Theranos convinced Safeway to invest $350 million to retrofit 800 locations with clinics that would offer in-store blood tests. Theranos convinced Walgreens to invest $140 million to develop a partnership that would help beat CVS. Theranos partnered with Cleveland Clinic to test its technology and was working with AmeriHealth Caritas and Capital BlueCross to become their preferred lab provider.

To be clear, they weren’t the first, and won’t be the last healthcare company to fail. I only hope that this extremely well documented (thanks Hollywood) experience has re-focused founders and investors towards building sustainable growth companies that actually help patients live higher quality lives, not just make people money as quickly as possible.

3. One Medical

Thanks to Tom Lee and the One Medical crew, primary care is now investable. Whether you’re talking about private equity or venture capitalists, many have dived head first into the space in search of value-based care treasure. One Medical is the most well-known tech-enabled primary care practice, with 72 clinic locations across seven states, and new locations opening in Portland, Orange County, and Atlanta. The Carlyle Group liked the company so much that it invested $350 million in August 2018, at a reported $1.5 billion valuation. This has led to a number of primary care focused companies (ChenMed, Iora Health, Forward) to amass significant valuations that historically would’ve seemed optimistic. However, the elevation of the primary care provider from the “punter” to the “quarterback” of a patient’s medical journey has lifted all boats.

Interestingly, One Medical has unique differentiators over the traditional primary care competitors. For example, One Medical limits doctors to seeing 16 patients a day, versus the average physician seeing 20-30 patients a day. One Medical also built its own medical records in hopes of a more user friendly experience, instead of outsourcing to practice-based EMRs. One Medical charges $199 annually to each patient to help make up for lower volume, and in return provides same-day appointments, onsite lab draws, and a slick app that allows online appointment scheduling and telehealth consults with providers 24/7. They are also adding capabilities and services to cover mental health and pediatric services to increase revenue.

This change is remarkable. Historically, primary care has been a low-margin business with high administrative and staffing costs, along with physician burnout and regulatory burden. One Medical pioneered the concept of a more modern primary care experience, and I am looking forward to their initial public offering (IPO) targeted for early 2020 and whatever Tom Lee is cooking up at Galileo.

4. Centene

Centene is my favorite health plan to study over the past decade. You would never know that the second largest publicly-traded company headquartered in Missouri was originally started by Elizabeth “Betty” Brinn in Milwaukee, Wisconsin. Under-hyped, which is rare in healthcare nowadays, Centene has quietly grown to become the largest player in both the Medicaid managed care and Affordable Care Act (ACA) exchanges. Under Michael Neidorff’s leadership, Centene now serves 32 states with over 15 million lives and 53,600 employees. They were most recently ranked #51 on the Fortune 500 list. In addition, they are about to grow with the $17.3 billion acquisition of WellCare. Here’s a brief rundown of some major events that demonstrate why I’m so bullish on Centene dominating another decade:

April 2018: WellCare and Centene awarded Medicaid managed care contracts in Florida.

July 2018: Centene acquires Fidelis Care and their 1.6 million New Yorkers for $3.75 billion. This single-handedly gives Centene the leading Medicaid share in the state.

September 2018: WellCare acquires Meridian Health Plan and their 1.1 million lives in Michigan, Illinois, Indiana, and Ohio, for $2.5 billion.

February 2019: Centene and WellCare awarded Medicaid managed care contracts in North Carolina.

December 2019: WellCare awarded Medicaid managed care contract in WellCare (re-procurement underway)

In addition, Texas Medicaid is set to award their STAR contracts for 3.4 million lives between Medicaid and CHIP, of which Centene already won a contract to serve the STAR+PLUS (aged, blind, and disabled population). Seems like a pretty solid guess that Centene will fair pretty well in the STAR RFP rankings. Next decade, I look for Centene to significantly increase their efforts to recruit Medicare Advantage (MA) lives, and I wouldn’t bet against them.

5. Mylan

One word. EpiPen. Mylan, the $10 billion market cap pharmaceutical manufacturer and producer of the epinephrine auto-injector product, EpiPen, became the lightning rod in a consumer and political drug pricing debate in 2016. For those who were living under a rock, here’s the quick recap. Epinephrine auto-injectors are used to treat anaphylaxis (severe allergic reaction). Prior to 2016, Mylan held absolute dominant share of the auto-injector market, hovering around 90% for the first half of the 2010s. The only real competitor was Adrenaclick, produced by Lineage Therapeutics, but they were barely considered a competitor despite having cheaper prices. In 2016, news outlets caught wind of Mylan’s 500% list price increase over a decade ($100 to $600) and a nationwide discussion about drug prices began.

If you asked the Mylan CEO, Heather Bresch, she would tell you that the reason brand EpiPen’s list price increased 500 percent over 7 years is because they invested billions of dollars to significantly increase access in schools and employers across America. These efforts increased the number of EpiPen prescriptions in the U.S. from 2.5 million to more than 3.5 million between 2011 and 2015. She would also tell you that there is a big difference between wholesale acquisition cost price (list price) and net price. This part is often misunderstood by media. The net price takes into account discounts, prescription savings cards, and rebates that Mylan provides to purchasers (PBMs, Employers, Plans). The exact negotiated rebate or discount is different by line of business and organization. However, safe to say that Mylan made a good amount of profit with increasing volume.

At the end of the day, Mylan settled with the U.S. Justice Department for $465 million over claims it overcharged the government. Mylan kept their $600 list price brand EpiPen product with rebates, and added a generic version of EpiPen for $300 list price without rebates and requiring commercial insurance. According to a GoodRx analysis in 2018, the epinephrine auto-injector market now looks much different, with 60% of the market moving to the generic version of EpiPen, 10% of the market remaining with brand EpiPen, and 30% of the market switching to the generic version of Adrenaclick. However, whether generic or brand EpiPen, Mylan makes strong profits and American will continue to discuss the best strategy forward to control drug spend.

6. Evolent Health

First let me caveat. I’ve worked for Evolent Health for the past 5 years and seen it grow from a Series B startup to a publicly-traded company (NSYE: EVH). However, the reason they’re on this list is because Evolent Health has forever changed the game for future value-based care startups. When Frank Williams, Seth Blackley, and Tom Peterson founded the company in 2011 with the help of UPMC Health Plan and The Advisory Board Company, concepts like the Medicare Shared Savings Program (MSSP) did not even exist. Fast forward a decade later, and Evolent Health now serves approximately 3.7 million lives across 35 different U.S. healthcare markets. The mission of Evolent Health is to, “Change the health of a nation, by changing the way healthcare is delivered.” To do this, you need both the technology, clinical, financial, and operational capacity to empower providers to confidently move away from fee-for-service towards fee-for-value.

With the implementation of MACRA and the continued perseverance of CMS under this new administration, value-based care is still full steam ahead (good luck incoming CMMI Director, Brad Smith). Despite the naysayers of value-based care, find me a better way to control medical inflation that is accepted by nearly all healthcare institutions and doesn’t negatively impact patient outcomes, and we can talk. I will mention the importance of “significant” downside risk to actually change provider culture, strategy, and operations. I don’t want the primary purpose of setting up a clinically integrated network (CIN) to be negotiating higher fee-for-service commercial rates for independent physicians aligned to tertiatiary academic medical centers.

I wholeheartedly believe that providers will continue to seek partner options (not vendors with high fees independent of performance) who are not wholly-owned by the large for-profit health plans (Optum…). Of all the available options, Evolent Health is the market leader across a variety of areas. In 2020, I look forward to watching how the 3,000+ Evolenteers push the boundaries of downside risk value-based care with both payers and providers.

7. Livongo

To me, Livongo represents Daenerys Targaryen in Game of Thrones. Not the blood-thirsty character towards the end, but the only person to bring back dragons to the world of Westeros. Except in this example, the dragon is a successful digital health IPO. This was a big deal. Going public rewarded early investors who believed in the nascent digital health and chronic condition space. It allowed public investors an opportunity to peak under the hood of the financials and get comfortable with future economics of the industry. And it provided a legitimacy and a peer valuation to other leading digital health companies like Omada Health. All-in-all, 207,000 members use Livongo for Diabetes management solutions, including a connected glucose monitor, unlimited test strips, and personalized health coaching. This number is expected to grow significantly, with the announcement of a new, two-year diabetes contract with the BlueCross BlueShield Federal Employee Program (FEP). They anticipate the partnership will add an additional $50-60 million in revenue across 2020 and 2021

Livongo has done a brilliant job marketing itself as building a full-stop solution for the 147 million Americans with a chronic condition. According to their estimates, their immediately addressable markets for managing diabetes and hypertension represents a $46.7 billion opportunity. Digging into the unit economics, Livongo estimates that diabetes is worth $900 per patient per year and $468 per patient per year. Since they’re focused on chronic conditions, the business model is subscription-based. In the Q3 quarterly report, Livongo provided full year guidance of $168.5 million on the low end and $169 million on the high end. In either scenario, FY2019 Adjusted EBITDA is projected to lose around $26 million for the year.

Livongo has smartly started with addressing diabetes, given the downstream health impacts of mismanagement of blood sugar and the ability to impact spend with regular insulin, diet, and exercise. They also are very smart to efficiently sell into self-funded large employers using existing channel partners like Express Scripts, CVS, Health Care Services Corporation (HCSC), Anthem, and Highmark BCBS. I know that the stock is down 35% since IPO, but I fundamentally believe chronic conditions are not going away and over time, Livongo will add supplementary clinical programs to expand revenue growth.

8. Optum

UnitedHealth Group is the single largest healthcare company in the world with a $280 billion market cap. It owns UnitedHealthcare, the country’s largest private insurer serving Medicare Advantage, managed Medicaid, employer-sponsored insurance, and ACA exchanges. And yet in 2020, more than 50% of the company’s earning and $112 billion in revenue will come from the lesser known side of the business, Optum. It is difficult to describe Optum because they do so much, but they technically split their business into three units: OptumHealth, OptumInsight and Optum Rx. OptumHealth provides care delivery (primary, specialty, urgent care) and care management to address chronic, complex, and behavioral health needs. OptumInsight utilizes data, analytics, and clinical information to support software, consulting, and managed services programs. OptumRx is a pharmacy benefit management (PBM) to create a more streamlined pharmacy system. In total Optum estimates the U.S. addressable market for its services to exceed $850 billion. If that wasn’t enough, here’s some fun facts why they made the list:

Works with 9 out of 10 U.S. hospitals, more than 67,000 pharmacies, and more than 100,000 physicians, practices, and other providers.

Added 10,000 physicians in the past year, growing its network to 46,000 physicians.

Includes 180,000 team members and serves 120 million customers.

Serves 80% of health plans to reduce total cost of care.

Works with 9 out of 10 Fortune 100 companies.

Pretty remarkable for a business unit that was only technically created in 2011, by merging existing pharmacy and care deliver services into one brand. As chronic disease increases and value-based care is here to stay, Optum is focused on comprehensively treating patients and coordinating their care to improve quality and lower costs. With UnitedHealthcare under the corporate umbrella, Optum has the adequate scale to test any new clinical initiatives before rolling out to other health plans.

9. Purdue Pharma

Purdue Pharma is a privately owned drug company owned by the Sackler Family and most well known for creating OxyContin in 1996. OxyContin represents 90% of Purdue Pharma’s revenue and was aggressively marketed to doctors for use in patients with chronic pain. According to court records, Purdue Pharma has grossed an estimated $35 billion. This is the same prescription painkiller that many experts say fueled the U.S. opioid crisis that has resulted in more than 130 deaths each day after overdosing on opioids. To be clear, the deaths are caused by prescription pain relievers, heroin, and synthetic opioids (fentanyl), however, the initial addiction to opioids is often caused by OxyContin and other prescription drugs. All but two U.S. states and 2,000 local governments have taken legal action against Purdue, other drug makers and distributors.

The Sackler family is the 19th richest family and is well known for supporting the fine arts, including the Sackler Wing at the Metropolitan Museum of Art in New York City where the Ancient Egyptian Temple of Dendur sits. I’ve seen a number of articles persecuting the entire Sackler family, but I want to be a little more nuanced. In 1952, three Sackler brothers (Arthur, Raymond, and Mortimer) bought a drug company called Purdue Frederick. Arthur’s branch of the family got out of the company after his death in 1987. The Raymond and Mortimer branches of Sacklers, who own it, founded affiliate Purdue Pharma in the early 1990s. According to a 2017 article from The New Yorker, there are 15 Sackler children in the generation following the founders of Purdue. Some family members have served on the Board of Directors, while others (most notably descendants from Arthur Sackler who died before OxyContin was invented), have distanced themselves from the company and condemned the OxyContin-based wealth.

Purdue Pharma filed for bankruptcy in September 2019 as part of a tentative settlement related to misleading marketing of the controversial painkiller. The settlement requires the owners of Purdue Pharma and the Sackler family to pay out $3 billion of their own fortune in cash over the next seven years. The only problem is that some family members have reportedly moved $10.7 billion from Purdue Pharma to trusts and holding companies across the world between 2008 and 2017. And all we’re left with is a complicated web of holding companies and offshore bank accounts, ravaged communities, and the leading cause of injury-related death in the U.S.

Andy Mychkovsky is a Director at Evolent Health and the Founder of a healthcare startup and innovation blog, Healthcare Pizza. This post originally appeared on Healthcare Pizza here.

The post 9 Healthcare Companies Who Changed the 2010s appeared first on The Health Care Blog.

9 Healthcare Companies Who Changed the 2010s published first on https://wittooth.tumblr.com/

0 notes

Text

WNLA’s 100th Anniversary Honored With Proclamation From Governor: This Week’s Industry News

Want to keep up with the latest news in lawn care and landscaping? Check back every Thursday for a quick recap of recent happenings in the green industry.

Governor Issues Proclamation Honoring WNLA’s 100th Anniversary Commemorating its 100th Anniversary, Governor Scott Walker issued a State of Wisconsin Gubernatorial Proclamation on January 3, 2018 officially declaring it as Wisconsin Nursery & Landscape Association Day (WNLA). Governor Walker presented the Proclamation to WNLA President Ross Swartz in a ceremony at the State Capitol in Madison, Wisconsin. Also on hand were WNLA Board members and officers, Executive Director Brian Swingle, Representative Paul Tittl of Wisconsin’s 25th Assembly District, and Representative Amy Loudenbeck of the 31st Assembly District. The Proclamation recognizes the economic impact of WNLA and acknowledges the environmental and social impact of nursery plants and landscaping, mentioning the benefits of erosion control, noise abatement, water filtration and purification, air quality improvement, oxygen production, energy savings, community beautification and pride, plus the advantage to wildlife and pollinators that a robust landscape provides. The Wisconsin Nursery and Landscape Association serves the Green industry and its 225 members, which include growers, landscapers, and industry suppliers. WNLA is celebrating its 100th Anniversary with events in 2018.

MGIX Kicks Off January 15 with Powerhouse Lineup The Ohio Nursery and Landscape Association’s regional conference, Midwest Green Industry Experience (MGIX) takes place January 15-17 at the Columbus Convention Center. Featured presenters include Marty Grunder (Attain, Train, Retain and Entertain a Modern Day Green Industry Workforce), Jeffrey Scott (Nine Proven Profit Strategies for Tree Lawn and Landscape Contractors). In addition to business education, the MGIX is loaded with courses on pruning, plant maintenance, identifying weeds and planning pest management strategies. It also includes a State of the Industry report by Craig Regelbrugge, AmericanHort.

Portland’s New Pesticide Ban Expected to be Costly Beginning July 1, 2019, residents and city workers will no longer be able to freely use synthetic pesticides in Maine’s largest city, except in a few limited cases, reports the Portland Press Herald. The City Council on January 3 unanimously passed an ordinance regulating pesticide use in Portland. Advocates say it’s one of strongest anti-pesticide ordinances in the country, with scofflaws facing potential fines ranging from $100 to $500. Portland will start using organic pesticides on all city-owned properties beginning this summer. The only exempt properties will be Hadlock Field, Riverside Golf Course and five high-use athletic fields that remain exempt until 2021. City staff estimates that the ordinance could cost up to $700,000 to implement. Those costs would cover new employees, equipment and up to a $250,000 set-aside to replace the turf on athletic fields.

WaterSmart Innovations Conference Issues Call for Abstracts Experts in the field of urban water efficiency are invited to submit abstracts for the 11th annual WaterSmart Innovations Conference and Exposition (WSI), slated for October 3-5 in Las Vegas. Abstracts must be submitted to speakers no later than Monday, February 26. Professionals, scientists, government employees, organizations, public and private institutions, policy makers, students and all others working in an industry related to water efficiency are invited to submit an abstract for an oral presentation, panel discussion or workshop. A complete list of topics and submittal guidelines is available at the WSI website. Candidates chosen as presenters will be notified by email and postal mail no later than Monday, April 30.

Industry Consultant Dan Pestretto Forming Peer Groups Landscape business consultant/coach Dan Pestretto is forming “Mastermind Peer Groups” focused on helping owners build businesses that work for them. The groups will be based on honesty, accountability and the sharing of diverse perspectives in a safe haven of confidentiality. Group members will learn how to implement the “Seven Step Business Systemization” plan along with developing a complete operations manual specific to their own company and brand. Pestretto says affordable groups (no more than six members each) are being formed for different revenue-range companies, including companies of $500,000.

CASE Announces “Kickstart” Landscape Business Development Contest CASE Construction Equipment is now accepting entries for the CASE Kickstart Contest, a business development contest where landscaping contractors can win a suite of prizes designed to take their company to the next level. Business owners are encouraged to enter the contest online by answering basic questions about their operation, and describing how they would evolve their services by winning the contest. The deadline for entry is March 30, 2018

Six Landscape Pros Earn Jeffrey Scott’s 2017 Mighty Oak Awards Six outstanding lawn and landscape companies earned business consultant and author Jeffrey Scott’s 2017 Mighty Oak, based on their performance as a business leaders. Scott announced the awards at his Leader’s Edge peer group meetings. The award winners: Seth Kehne, The Lawn Butler, Knoxville, Tenn.; Loriana Harrington Beautiful Blooms Landscape & Design, Menomonee Falls, Wis.; Douglas McIntosh, McIntosh Grounds Maintenance, Milan, Mich.; Bob Drost, Drost Landscape, Petoskey, Mich.; Sean Baxter, Lawn & Landscape Solutions, Olathe, Kan.; and Chris Cotoia, Executive Landscaping, South Yarmouth, Ma.

Website Launch for Drought Tolerant TamStar St. Augustinegrass TamStar St. Augustine is a new drought tolerant, low water use grass developed by turfgrass breeders at Texas A&M University. A new website dedicated to TamStar at tamstargrass.com, was launched recently by the Turfgrass Producers of Texas to serve as a resource for industry professionals and homeowners. The site offers research and information about TamStar’s benefits, installation, maintenance and where to purchase this scientifically advanced sod. TamStar St. Augustine is the result of more than a decade of research at Texas A&M AgriLife Research and Extension Center in Dallas. It was bred to stand up to drought and specifically meet the demands of commercial and residential lawns and landscapes in Texas.

LiveWall Installed To Bring Comapny’s Corporate Values To Life Applied Imaging installed a 198-square-foot LiveWall Living Wall as the main design element in the lobby of its new corporate headquarters in Grand Rapids, Michigan. Applied Imaging is an independently owned provider of document imaging technology and managed IT and network services. LiveWall is the developer and supplier of the green industry’s most sustainable, durable and low-maintenance living wall system. The 198-square-foot living wall is 9 feet tall and 22 feet long. In total, it includes 98 LiveWall modular planters, which contain inserts that hold the growing medium and a mix of six different tropical plants, chosen for their ability to thrive indoors. The integrated irrigation components use drip stake assemblies, which inject water into the growing medium. The light fixtures above the green wall use LiveWall Norb (Nutri-Orb) bulbs, a specialized white-light LED grow bulb that provides the light spectrum and light nutrition plants need while giving off a white light like regular indoor lighting.

Greenworks Commercial And Carswell Establish Partnership Greenworks Commercial, producers of battery-powered outdoor equipment for landscaping and turf management professionals, and Carswell Distributing Company have announced an exclusive partnership to benefit independent lawn and landscape dealers throughout 13 southern states. Through the arrangement, Carswell and Carswell OEI will provide distribution, logistics, service and sales support for both the Greenworks Commercial 82-Volt line of tools and the newly launched Greenworks Elite 40-Volt line of tools, among independent dealers in Virginia, North Carolina, South Carolina, Georgia, Florida, Alabama, Louisiana, Arkansas, Tennessee, Oklahoma, Texas and Missouri.

Ruppert Landscape Announces New Branch in Southern Richmond Ruppert Landscape has expanded its Virginia landscape management operations to include a new branch in southern Richmond. This branch joins four existing landscape management branch offices in Virginia located in northern Richmond, Gainesville, Alexandria, and Fredericksburg. Dave Sharry has been promoted to branch manager and tasked with overseeing the new branch. As branch manager, he will be responsible for the overall welfare of the branch, including the safety and development of his team, strategic planning and budgeting, training, and day-to-day operations.

Douglas Dynamics’ Doug Clark Receives Certified Snow Professional Designation Douglas Dynamics LLC, has announced that Doug Clark, product manager for Western Products, has earned his Certified Snow Professional (CSP) designation from the Snow and Ice Management Association (SIMA). Clark joins fellow Douglas Dynamics CSP employees, including Andy McArdle, director of product marketing for Douglas Dynamics, and Daniel Gilliland, training manager for SnowEx. SIMA’s Certified Snow Professional certification was developed for owners, operators, and executives within the snow and ice industry. It focuses on the critical elements of running a professional snow business and recognizes a level of service, quality and value to customers.

The post WNLA’s 100th Anniversary Honored With Proclamation From Governor: This Week’s Industry News appeared first on Turf.

from RSSMix.com Mix ID 8230377 http://ift.tt/2DkcDPB via IFTTT

0 notes

Text

Minimum Wage Balderdash -> Proposed ballot question would hike Massachusetts’ minimum wage to $15

15-dollar-hour HoaxAndChange.com

bernie sanders $15 wage – Old Guard Audio.com

Western Massachusetts

Massachusetts coalition launches petition to raise minimum wage

A petition launched today would let Massachusetts voters decide about a higher minimum wage and required paid leave. The “Raise Up Massachusetts” coalition has started collecting signatures for the two proposed 2018 ballot questions. Massachusetts …

westernmassnews.com18m

Ballot Question

Proposed ballot question would hike Massachusetts’ minimum wage to $15

BOSTON — Proposed questions being offered for next year’s state ballot would gradually raise the minimum wage to $15 an hour and guarantee that workers have access to paid family and medical leave from their employers. Raise Up Massachusetts, a …

Portland Press Herald42m

Calumet City

Calumet City voters, activists frustrated with pace of minimum wage discussion

Nearly four months since Calumet City voters overwhelmingly supported a nonbinding ballot referendum in favor of a minimum wage increase, residents are frustrated with the city council’s recent decision …

Chicago Tribune1h

More from Bing News

Blowing Out Candles UPS Bacteria

Pudge, Raines Inducted Into HOF

Discovery To Acquire Scripps

“Dunkirk” Defeats “Emoji Movie”

China Hits Back At Trump

iPhone 8 Design Leaks

Alabama Inmates Escape

Lahren Benefits From Obamacare

Tesla Model 3 Arrives

Boston

Questions on minimum wage, paid leave proposed for 2018 ballot

Proposed questions being offered for next year’s state ballot would gradually raise the minimum wage in Massachusetts to $15 an hour and require that workers have access to paid family and medical …

fox25boston.com1h

Ireland

Taoiseach rejects minister’s €13-an-hour minimum wage call

The taoiseach has slapped down John Halligan after the junior jobs minister called for the national minium wage to be at least €13 an hour. Mr Halligan described the forthcoming 30c increase to …

The Times3h

Minimum Wage Hike

The economic case for a higher minimum wage: Editorial

The public hearings on Ontario’s proposed minimum-wage hike, which wrapped up last week, produced predictable clashes. Unions and social-justice advocates pointed out, among other things, …

Toronto Star3h

Minimum Wage Questions

Push to get paid leave, minimum wage questions on ballot begins

Raise Up Massachusetts on Monday kicked off its signature-gathering campaign to get paid family and medical leave and a $15-an-hour minimum wage on the November 2018 ballot. The coalition of community, labor, and religious groups has to collect at least …

The Boston Globe3h

Questions Proposed

$15 Minimum Wage And Paid Leave Questions Proposed For 2018 Mass. Ballot

Proposed questions being offered for next year’s state ballot would gradually raise the minimum wage in Massachusetts to $15 an hour and require that workers have access to paid family and medical …

WBUR3h

Cook County

80% of Cook County municipalities have opted out of minimum wage, sick leave ordinances

The number of Cook County municipalities that have opted out of both ordinances has climbed to …

www.illinoispolicy.org4h

Minimum Wage

Grocer ‘offended’ by minister’s minimum wage response

Labour Minister Kevin Flynn told a Fergus grocer concerned about rapid increases in the minimum wagethat most “decent, law-abiding Ontario businesses will be largely unaffected” by the …

Toronto Sun4h

Rush

RUSH: Democrats Quest For Minimum Wage Results In The Rapid Increase In Robotics In The Workforce

RUSH: How about this concept? I’m gonna get to this in detail in a minute. I just want to throw the subject out there. Robots as teachers. (interruption) I know it’s dependent on who’s programming them, but that’s not the point. It is the Democrat …

dailyrushbo.com4h

Working Journalists

Working journalists complain for not getting minimum wages

KATHMANDU, July 31: Journalists have bemoaned for not getting minimum wage of the last fiscal year. At a program organized by Nepal Press Union in honour of newly-appointed Information and Communications Minister Mohan Bahadur Basnet, the journalists made …

Republica6h

Seattle

Emails reveal that Seattle council sabotaged its own minimum wage study

The controversy over Seattle’s $15 per hour minimum wage continues. To recap, in 2015, Seattle’s council raised the minimum wage from $9.47 to $11 per hour in 2015. A further increase to $13 per …

americanexperiment.org6h

University Of California, Berkeley

Union PR Firm, Seattle Mayor Coordinated on Pro-$15 Minimum Wage Berkeley Study

Newly published emails reveal that the Seattle mayor’s office coordinated with academics and a union public relations firm to rush a study purporting to downplay job and wage losses associated with a …

The Washington Free Beacon7h

Massachusetts

The Latest: Petitions Seek Minimum Wage Hike, Paid Leave

BOSTON (AP) — The Latest on proposed ballot questions calling for an increase in the minimum wage and paid family and medical leave in Massachusetts. (all times local): 2:25 p.m. The Raise Up Massachusetts coalition says it will begin gathering …

U.S. News & World Report7h

Minimum Wage

TD calls for minimum wage of €13 per hour

Plans to increase the current minimum wage of €9.25 an hour by 30cent have received a very mixed reaction. Some people feel it’s not enough while others don’t think there should be any increase at …

buzz.ie7h

Workers

Belize – Should the minimum wage be increased?

Prior to that it was set at BZ$3.10 per hour in 2010, and BZ$2.50 in 2007. In 1992, minimum wage was set at BZ$2.25 per hour for manual workers, BZ$2.00 per hour for agricultural and export industries …

patrickjonesbelize.com7h

Local News

Businesses weigh proposed changes to minimum wage changes

How a local minimum wage ordinance in Redwood City might be implemented to make the city more affordable for those working two or three jobs and affect the availability of trained workers are …

San Mateo Daily Journal8h

SeaTac

Hotel Boom in SeaTac Is Unfettered by $15 Minimum Wage

When SeaTac, Wash., became the first city in the nation to pass a $15-an-hour minimum wage in 2013, Jeff Robinson, the city’s director of community and economic development, said critics warned him …

New York Times8h

Labour Reforms

Ontario Liberals looking at ways to offset costs of min. wage hike, labour reforms

Many businesses and business groups have voiced opposition to the changes, in particular a plan to boost the minimum wage to $14 on Jan. 1 and to $15 in 2019. They have said a 32 per cent …

Canadian Manufacturing9h

WBZ-TV

Minimum Wage, Paid Leave Questions Proposed For 2018 Ballot

BOSTON (AP) — Proposed questions being offered for next year’s state ballot would gradually raise the minimum wage in Massachusetts to $15 an hour and require that workers have access to paid …

CBSBoston9h

Boston

Boston: Minimum Wage, Paid Leave Questions Proposed for 2018 Ballot

Massachusetts voters could decide ballot questions next year that call for raising the minimum wage to $15 an hour and requiring that workers have access to paid family and medical leave from their employers. Raise Up Massachusetts plans to announce on …

95.9 WATD-FM9h

Massachusetts

Group to push for expanded paid-leave, $15 minimum wage on 2018 ballot

A union-backed group will push to put both a $15 per hour minimum wage and new paid-leave requirements before Massachusetts voters as ballot initiatives in November 2018, it said Monday. …

The Business Journal9h

Mass

Group looking to raise Mass. minimum wage to $15

The left-leaning coalition that used used the initiative petition process to get an earned sick time law on the books in 2014 is now looking to pair its proposed income tax increase on high earners with proposed laws guaranteeing paid family medical leave …

Worcester Business Journal10h

Massachusetts

$15 minimum wage, paid family and medical leave requirement likely to highlight 2018 Massachusetts ballot

A coalition of labor, faith and community organizations on Monday plans to announce concurrent signature drives to get two prominent social justice issues on to the Massachusetts ballot in 2018. The issues being targeted by Boston-based nonprofit Raise Up …

trueviralnews.com11h

The Today Show

Halligan says minimum wage hike of 30 cent ‘pathetic’

A Minister of State has described plans to increase the minimum wage by 30 cent as “pathetic”. John Halligan says the plans to up the rate from €9.25 to €9.55 per hour don’t go far enough. It comes as …

sligotoday.ie13h

Fallout from minimum wage hike spreading

President Moon Jae-in’s administration is pushing for a steep increase in the minimum wage as a key stepping stone for its income-led growth policy. But critics say sharp pay increases detached from …

m.koreaherald.com18h

Power

Purchasing Power Of Minimum Wage Is Still Eroding

From David Cooper at the Economic Policy Institute: This week marks the eighth anniversary of the last time the federal minimum wage was raised, from $6.55 to $7.25 on July 24, 2009. Since then, the purchasing power of the federal minimum wage has fallen …

jobsanger.blogspot.com20h

Minimum Wage

My Turn: Minimum wage no longer offers even a minimal lifestyle

“Wages are too high,” stated our president at the Milwaukee debate. Well, Mr. Trump, in North Carolina, even if you work full time for minimum wage, $7.25 an hour, you will still be living in poverty. If you are in college attempting to work to pay for …

Salisbury Post22h

Seattle

Emails show Seattle’s coordination with activists in minimum wage research

Last month, researchers from the University of Washington informed the city of Seattle that despite the best efforts of the Service Employees International Union they had failed to repeal the law of supply …

iotwreport.com23h

Medical Community

Medical community in conflict over minimum wage

The medical community is reeling from the planned minimum wage hike next year, with small neighborhood clinics and hospitals appealing for at least a matching hike in billing rates, industry …

m.koreaherald.com1d

Ontario Businesses

Wynne pledges relief for Ontario businesses amid planned minimum wage hikes

Premier Kathleen Wynne said Friday she is working on ideas to support Ontario businesses through major labour reforms, suggesting she is looking more at offsetting unrelated costs than pulling back …

blazingcatfur.ca1d

Minimum Wages

See List Of Minimum Wages By Countries Of The World.

In Luxemburg where minimum wage is $2,500, their lawmakers are paid $7,400. In Libya where minimum wage is $430, law-makers earn $3000. In Nigeria where minimum wage is $38 (N18,000), …

nairanaijanews.com1d

Federal Minimum

U.S. can’t support raising minimum wage to $15

According to news reports and other sources, there is a political movement to raise the federal minimum hourly wage to $15. The current rate is $7.25, set in July 2009. While it may appear the current rate is too low, it is also apparent a raise to $15 is …

Victoria Advocate1d

Federal Minimum Wage

Will a $15 Federal Minimum Wage Really Help Low-Income Workers?

Last week, Democrats announced an economic plan that Sen. Chuck Schumer (D-N.Y.) referred to as “a better deal for American workers.” The proposal included a number of provisions, including calls to …

Pantagraph1d

Minimum wage inflames TC unions

The Turkish Cypriot Social Security and Labour office has announced that the minimum wage in the north will rise from 2,020 Turkish Lira to 2,175 (€524), amid heavy criticism that the increase is not …

in-cyprus.com1d

Low Minimum Wage

Low minimum wage hurts businesses, workers

Pennsylvania’s minimum wage is stuck in the past and that’s bad for business. Set at $7.25 an hour since 2009, Pennsylvania’s minimum wage is lower than all six of our neighboring states. Our state …

The Times Tribune1d

Welfare

States Where Welfare Recipients Are Paid More Than Minimum Wage

Is a low income or prolonged unemployment truly cause for financial stress? According to one study, not really. In some states, public assistance programs, or welfare, could pay more than full-time, …

cheatsheet.com1d

Minimum Wage Hike

Major Grocery Chain Says Minimum Wage Hike Will Hurt Company

The Ontario government’s move to increase minimum wage to $15 an hour has solicited numerous reactions, with some workers celebrating the initiative and others fretting that the hike will hurt …

insauga.com1d

Care Employers

Tory amnesty for social care employers is bid to help them avoid back-paying minimum wage

The minority Tory government’s amnesty for social care companies that have not paid carers properly …

voxpoliticalonline.com2d

best minimum wage job a middle aged guy ever had

This has been a long fruitful journey. I had no idea. None. I’ve written a lot of books. I’ve always kind of obfuscated this fact, figuring no one would take me seriously if they really knew. After writing 7 books, the first 3 of which were published, I …

pegasus-dunc.blogspot.com2d

Regional Minimum Wage

Regional minimum wage hike debate falls through

At the second debate on regional minimum wage for next year, held by the National Salary Council in Hanoi yesterday, the Vietnam General Confederation of Labour (VGCL), which represented employees, and the Vietnam Chamber of Commerce and Industry (VCCI …

www.vietnambreakingnews.com2d

Minimum Wage Experiment

The Weird Twist in Seattle’s $15 Minimum Wage Experiment

Seattle made waves a couple of years ago by forging ahead with an ambitious new policy: the $15 minimum wage. Now, Seattle’s no stranger to pushing the envelope when it comes to progressive …

Minimum Wage Balderdash -> Proposed ballot question would hike Massachusetts’ minimum wage to $15 Minimum Wage Balderdash -> Proposed ballot question would hike Massachusetts’ minimum wage to $15 Western Massachusetts…

0 notes

Text

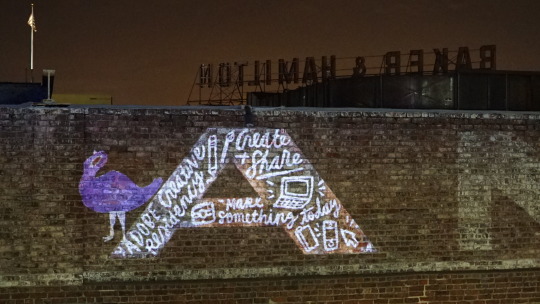

Adobe Creative Residency Complete ✅

Over the past year it’s been a complete dream job to work, fully funded, pursuing my passion projects. I’ve found a new confidence in myself, in my work, and what I’m capable of moving forward. This residency pushed me to push myself, and as I usually do— I set the bar for myself high.

As it turns out, one year really isn’t as long as you think it is. 52 weeks went by really quick.

With my time as a resident officially over, it’s time for me to pass the torch to a fresh new set of residents, and offer what I learned along the way!

Here’s what I did with a year as Adobe Creative Resident:

(Bold = I made a thing!)