#SBA 8(a) Programs

Explore tagged Tumblr posts

Text

#8(a) Firms#NAICS Codes#NAICS Codes in Federal Contracting#8(a) program#SBA#businessstrategy#federal business growth#future of federal procurement#business consultant#fedvital

0 notes

Text

Project Management Consulting Companies | GORCSI

Transform your project management consulting company with GORCSI's proven strategies and expert guidance. Our experienced consultants will work closely with your team to identify opportunities for improvement, implement best practices, and maximize productivity. Let GORCSI empower your business to thrive in today's competitive market.

Click here- https://gorcsi.com/program-and-project-management

#iso certified program and project management#project management consulting companies#8(a) streamlined technology application#(sba) 8(a) business development program#sba-certified application management#it application management#digitalization and digital transformation#it and business consulting services#sba certified companies

0 notes

Text

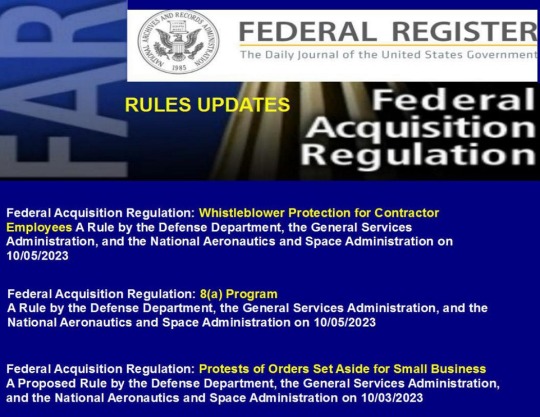

FAR Council Updates Whistle Blower And Small Business Contracting Program Rules

Enhanced Whistle Blower Protections, update and clarification to 8(a) Business Development Program and proposed rule for for protesting Size and Socioeconomic Status categories.”

View On WordPress

0 notes

Text

Things Biden and the Democrats did, this week #7

Feb 23-March 1 2024

The White House announced $1.7 Billion in new commitments from local governments, health care systems, charities, business and non-profits as part of the White House Challenge to End Hunger and Build Healthy Communities. The Challenge was launched with 8 billion dollars in 2022 with the goal of ending hunger in America by 2030. The Challenge also seeks to drastically reduce diet-related diseases (like type 2 diabetes). As part of the new commitments 16 city pledged to make plans to end hunger by 2030, the largest insurance company in North Carolina made nutrition coaching and a healthy food delivery program a standard benefit for members, and since the challenge launched the USDA's Summer EBT program has allowed 37 states to feed children over the summer, its expected 21 million low income kids will use the program this summer.

The US House passed a bill on Nuclear energy representing the first update in US nuclear energy policy in decades, it expands the Nuclear Regulatory Commission and reduces reducing licensing fees. Nuclear power represents America's single largest source of clean energy, with almost half of carbon-free electricity coming from it. This bill will boost the industry and make it easier to build new plants

Vice President Harris announced key changes to the Child Care & Development Block Grant (CCDBG) program. The CCDBG supports the families of a million American children every month to help afford child care. The new changes include capping the co-pay families pay to no more than 7% of their income. Studies show that high income families pay 6-8% of their income in childcare while low income families pay 31%. The cap will reduce or eliminate fees for 100,000 families saving them an average of over $200 a month. The changes also strength payments to childcare providers insuring prompt payment.

The House passed a bill making changes to the Small Business Administration’s 8(a) program. The 8(a) is an intensive 9 year program that offers wide ranging training and support to small business owners who are socially and economically disadvantaged, predominantly native owned businesses. Under the current structure once a business reaches over 6.8 million in assets they're kicked off the program, even though the SBA counts anything under $10 million as a small business, many companies try to limit growth to stay on the program. The House also passed a bill to create an Office of Native American Affairs at the SBA, in order to support Native-owned small businesses.

The White House and HUD announced steps to boost the housing supply and lower costs plans include making permanent the Federal Financing Bank Risk Sharing program, the program has created 12,000 affordable housing units since 2021 with $2 billion and plans 38,000 additional units over ten years. As well as support for HUD's HOME program which has spent $4.35 billion since 2021 to build affordable rental homes and make home ownership a reality for Americans. For the first time an administration is making funds available specifically for investments in manufactured housing, $225 million. 20 million Americans live in manufactured housing, the largest form of unsubsidized affordable housing in the country, particularly the rural poor and people in tribal communities.

The Department of Energy announced $336 million in investments in rural and remote communities to lower energy costs and improve reliability. The projects represent communities in 20 states and across 30 Native tribes. 21% of Navajo Nation homes and 35% of Hopi Indian Tribe homes remain unelectrified, one of the projects hopes to bring that number to 0. Another project supports replacing a hydroelectric dam in Alaska replacing all the Chignik Bay Tribal Council's diesel power with clear hydro power. The DoE also announced $18 million for Transformative Energy projects lead by tribal or local governments and $25 million for Tribal clean energy projects, this comes on top of $75 million in Tribal clean energy projects in 2023

Transportation Secretary Pete Buttigieg put forward new rules to ensure airline passengers who use wheelchairs can travel safely and with dignity. Under the planned rules mishandling a wheelchair would be a violation of the ACAA, airlines would be required to immediately notify the passenger of their rights. Airlines would be required to repair or replace the wheelchair at the preferred vendor of the passenger's choice as well as provide a loaner wheelchair that fits the passenger's needs/requirements

The EPA launched a $3 Billion dollar program to help ports become zero-emission. This investment in green tech and zero-emission will help important transportation hubs fight climate change and replace some of the largest concentrations of diesel powered heavy equipment in America.

the EPA announced $1 Billion dollars to help clean up toxic Superfund sites. This is the last of $3.5 billion the Biden administration has invested in cleaning up toxic waste sites known as Superfund sites. This investment will help finish clean up at 85 sites across the country as well as start clean up at 25 new sites. Many Superfund sites are contained and then left not cleaned for years even decades. Thanks to the Biden-Harris team's investment the EPA has been able to do more clean up of Superfund sites in the last 2 years than the 5 years before it. More than 25% of America's black and hispanic population live with-in 5 miles of a Superfund site.

Bonus: Sweden cleared the final major barrier to become NATO's 32nd member. The Swedish Foreign Minster is expected to fly to Washington to deposit the articles of accession at the US State Department. NATO membership for Sweden and its neighbor Finland (joined last year) has been a major foreign policy goal of President Biden in the face of Russian aggressive against Ukraine. Former President Trump has repeatedly attacked NATO and declared he wants to leave the 75 year old Alliance, even going so far as to tell Russia to "do whatever the hell they want" with European NATO allies

#Thanks Biden#Joe Biden#Politics#US politics#Democrats#Climate change#end hunger#hunger#proverty#disability#native Americans#tribal rights#clean energy#child care#housing#housing crisis

774 notes

·

View notes

Text

“One Beautiful Bill” Would Be a Tragic Setback for Indian Country

Guest Opinion. The name “One Beautiful Bill” might sound harmless, charming, even, but for Indian Country, its passage would be nothing short of a policy earthquake. Behind the rhetoric of fiscal responsibility and government streamlining lies a sweeping assault on the foundational programs that uphold tribal sovereignty, self-determination, and the bare minimum of equitable federal support that Native Nations have fought to establish over generations.Modeled on recent proposals that promote anti-DEI (Diversity, Equity, Inclusion) measures, budget austerity, and bureaucratic consolidation, this bill threatens to gut critical federal programs that support Native communities. It is a direct challenge to the federal trust and treaty obligations owed to tribes, a responsibility that predates the founding of the United States and has been reaffirmed repeatedly in federal law.The Bureau of Indian Affairs (BIA) and Bureau of Indian Education (BIE), already chronically underfunded, are squarely in the crosshairs. The bill targets Tribal Priority Allocations (TPA), flexible funding used for core government services like law enforcement, social services, and road maintenance. The Housing Improvement Program (HIP), which assists Native families in dire housing need, is viewed as duplicative and dispensable. BIE programs for early childhood education and tribal colleges, which struggle under current funding levels, could be further diminished or eliminated altogether.The assault extends far beyond the Department of the Interior. The Indian Health Service (IHS), the most direct manifestation of the federal trust responsibility in healthcare, faces cuts to vital services like Purchased/Referred Care, the Community Health Aide Program, and urban Indian health initiatives. Worse still, advance appropriations that protect IHS from government shutdowns could be reversed, once again jeopardizing lives with every budget crisis.The bill’s impact on tribal housing and economic self-sufficiency would be devastating. It threatens the elimination or downsizing of the Indian Housing Block Grant (IHBG) and the Indian Community Development Block Grant (ICDBG), cornerstones of housing infrastructure across Native communities. Programs that support Native entrepreneurship through the SBA 8(a) program and the Office of Indian Economic Development could be slashed or rationalized out of existence.Education, language revitalization, and cultural preservation efforts face a similar fate. The Office of Indian Education and its work funding tribal education departments and Native language programs could be framed as “non-core” and eliminated. Food security programs like the Food Distribution Program on Indian Reservations (FDPIR), critical to many rural and remote tribal communities, are also at risk, dismissed as duplicative of SNAP without any understanding of their unique implementation in Indian Country.Environmental protections, transportation equity, justice programs, and the very infrastructure for federal-tribal financial relations, every one of these areas would suffer under “One Beautiful Bill.” The Department of Justice’s tribal set-asides, tribal transportation funding formulas, EPA’s General Assistance Program, and even the Treasury’s Tribal Office and ARPA oversight functions are all on the chopping block. These aren’t luxuries, they’re necessities for self-governance, public health, and environmental and cultural survival.The common thread among targeted programs is telling: they are discretionary, equity-based, and uniquely tribal. They are not “wasteful government spending”, they are the instruments through which tribal governments serve their citizens and exercise the rights promised to them by treaty and law.Make no mistake: if passed, this bill would not just cut programs, it would unravel the framework of modern tribal self-determination, a framework built over the past 51 years with bipartisan support. It would erase decades of hard-won pro

45 notes

·

View notes

Text

“One Beautiful Bill” Would Be a Tragic Setback for Indian Country

Guest Opinion. The name “One Beautiful Bill” might sound harmless, charming, even, but for Indian Country, its passage would be nothing short of a policy earthquake. Behind the rhetoric of fiscal responsibility and government streamlining lies a sweeping assault on the foundational programs that uphold tribal sovereignty, self-determination, and the bare minimum of equitable federal support that Native Nations have fought to establish over generations.Modeled on recent proposals that promote anti-DEI (Diversity, Equity, Inclusion) measures, budget austerity, and bureaucratic consolidation, this bill threatens to gut critical federal programs that support Native communities. It is a direct challenge to the federal trust and treaty obligations owed to tribes, a responsibility that predates the founding of the United States and has been reaffirmed repeatedly in federal law.The Bureau of Indian Affairs (BIA) and Bureau of Indian Education (BIE), already chronically underfunded, are squarely in the crosshairs. The bill targets Tribal Priority Allocations (TPA), flexible funding used for core government services like law enforcement, social services, and road maintenance. The Housing Improvement Program (HIP), which assists Native families in dire housing need, is viewed as duplicative and dispensable. BIE programs for early childhood education and tribal colleges, which struggle under current funding levels, could be further diminished or eliminated altogether.The assault extends far beyond the Department of the Interior. The Indian Health Service (IHS), the most direct manifestation of the federal trust responsibility in healthcare, faces cuts to vital services like Purchased/Referred Care, the Community Health Aide Program, and urban Indian health initiatives. Worse still, advance appropriations that protect IHS from government shutdowns could be reversed, once again jeopardizing lives with every budget crisis.The bill’s impact on tribal housing and economic self-sufficiency would be devastating. It threatens the elimination or downsizing of the Indian Housing Block Grant (IHBG) and the Indian Community Development Block Grant (ICDBG), cornerstones of housing infrastructure across Native communities. Programs that support Native entrepreneurship through the SBA 8(a) program and the Office of Indian Economic Development could be slashed or rationalized out of existence.Education, language revitalization, and cultural preservation efforts face a similar fate. The Office of Indian Education and its work funding tribal education departments and Native language programs could be framed as “non-core” and eliminated. Food security programs like the Food Distribution Program on Indian Reservations (FDPIR), critical to many rural and remote tribal communities, are also at risk, dismissed as duplicative of SNAP without any understanding of their unique implementation in Indian Country.Environmental protections, transportation equity, justice programs, and the very infrastructure for federal-tribal financial relations, every one of these areas would suffer under “One Beautiful Bill.” The Department of Justice’s tribal set-asides, tribal transportation funding formulas, EPA’s General Assistance Program, and even the Treasury’s Tribal Office and ARPA oversight functions are all on the chopping block. These aren’t luxuries, they’re necessities for self-governance, public health, and environmental and cultural survival.The common thread among targeted programs is telling: they are discretionary, equity-based, and uniquely tribal. They are not “wasteful government spending”, they are the instruments through which tribal governments serve their citizens and exercise the rights promised to them by treaty and law.Make no mistake: if passed, this bill would not just cut programs, it would unravel the framework of modern tribal self-determination, a framework built over the past 50 years with bipartisan support. It would erase decades of hard-won pro

45 notes

·

View notes

Text

Finding: Lackluster Oversight Resulted in Transnational Criminal Organizations and Fraudsters Stealing U.S. Taxpayer Money from Pandemic Relief Funds

International criminal organizations and foreign government-affiliated actors exploited the urgency of relief programs and orchestrated sophisticated fraud schemes that span multiple countries.

Chinese government-linked hackers stole at least $20 million in U.S. Government COVID-19 relief funds

An USSS investigation revealed that hackers affiliated with the Chinese government, specifically identified as APT41, were implicated in theft of $20 million of U.S. Government COVID-19 relief funds

APT41 has a history of fraudulent activity in the past, specifically traditional unemployment insurance fraud against SBA across dozens of states

APT41 also has a history of espionage activities on behalf of the Chinese government, including attacks on pro-democracy politicians in Hong Kong and data breaches affecting more than 100 organizations

A Nigerian fraud ring stole $10 million in pandemic relief funds

Mr. Abemdemi Rufai, a Nigerian government official, organized a large-scale cyberfraud scheme—named Scattered Canary—targeting COVID-19 relief funds

Scattered Canary, a business email compromise operation, filed at least 174 fraudulent unemployment claims in Washington state and 17 in Massachusetts that were all accepted, all with an expected payout of $5.4 million

An Indian national stole $8 million in a COVID-19 relief fraud scheme

A federal grand jury in Newark, New Jersey indicted an Indian national for submitting fraudulent PPP loan applications totaling more than $8.2 million

The defendant submitted at least 17 applications on behalf non-existent companies, using false information about employees and payroll

He also fabricated tax filings on behalf of a non-existent business to receive more relief payments

He reportedly received $3.3 million in loan proceeds which he then laundered

Domestic and International Fraudsters that Stole from Pandemic Relief Programs were also Connected to Other Organized Crimes

Fraudsters involved with stealing millions of dollars were also involved in other federal crimes including wire fraud and drug smuggling

DOL IG has continued to connect abuse of UI relief funds to organized criminal groups

The National UI Fraud Task Force was created to combat fraud of UI perpetrated by domestic and international criminal organizations, many of which include street-level criminal organizations with ties to illegal guns and drugs

The U.S. Attorney's Office charged six individuals, including two Maryland State Department of Labor subcontractors, with participating in a conspiracy to fraudulently obtain $3.5 million in UI benefits

The lead defendant now faces separate narcotics and firearms charges, including allegations that he unlawfully possessed a machine gun in furtherance of a drug trafficking crime

Another convicted felon charged with CARES Act fraud also committed firearm offenses and possession with the intent to distribute fentanyl

The U.S. Attorney's Office for the District of Maryland targeted cases with connections between COVID-19 fraud and individuals involved with violent crime, organized criminal networks, business email compromise schemes, and narcotics distribution

2 notes

·

View notes

Text

The Financial Breakdown: Understanding the Costs Involved in Opening a Restaurant Franchise

Opening a restaurant franchise can be an exciting and rewarding business move—but it’s not without significant financial investment. Whether you're considering a fast-casual burger chain or a specialty ethnic eatery, understanding the full range of costs involved is essential for making smart decisions and securing adequate funding.

This guide provides a comprehensive look at the key expenses, hidden fees, and ongoing financial commitments required to launch and operate a successful restaurant franchise.

Franchise Fee (Initial Licensing Cost) The franchise fee is the upfront payment made to the franchisor for the right to operate under their brand.

💲 Typical Range: $10,000 – $50,000 ✅ What it covers: Brand rights, training, startup support, initial marketing Example: A well-known fast-food chain might charge $45,000 just for the franchise license.

Startup and Build-Out Costs These include everything needed to get your restaurant up and running: Construction or renovation Furniture, fixtures, and equipment (FF&E) Interior design and branding Signage and decor Kitchen equipment and installation

💸 Estimated Cost: $150,000 – $750,000+ 📍 Varies greatly based on location, restaurant size, and concept complexity.

Real Estate and Lease Costs Renting or buying your restaurant space is often one of the biggest ongoing expenses. Lease deposits Monthly rent (based on square footage and area) Zoning and site approvals

📍 Urban areas or malls = higher rent 🔁 Long-term leases may require significant upfront payment or build-out commitments.

Inventory and Opening Supplies You'll need to stock your restaurant with: Initial food and beverage inventory Packaging and disposables (if applicable Cleaning supplies and operational tools

🛒 Initial Inventory Budget: $10,000 – $50,000+

Staffing and Training Hiring and training your team is crucial for a smooth launch. Wages and salaries for front and back-of-house staff Uniforms and training materials Pre-opening training programs mandated by franchisor

👥 Payroll Prep: $20,000 – $60,000+ before opening 💬 Many franchisors offer operational support and management training as part of the franchise fee.

Marketing and Grand Opening Initial marketing is often required by the franchisor and includes: Local advertising and promotions Digital and print campaigns Launch event or soft opening costs

📣 Opening Marketing Budget: $5,000 – $25,000 🔁 You may also contribute to an ongoing national marketing fund (see below).

Ongoing Royalty and Marketing Fees Most franchises require you to pay a percentage of your monthly revenue. Royalty Fees: 4% – 8% of gross sales Marketing Fees: 2% – 4% of gross sales

💼 These fees support corporate operations, branding, and national advertising efforts.

Technology and Point-of-Sale (POS) Systems Modern restaurant franchises depend on tech systems for operations, ordering, and analytics. POS terminals and software Online ordering integration Inventory tracking, scheduling, and payroll systems

💻 Setup Cost: $10,000 – $30,000+

Permits, Licenses, and Legal Fees You’ll need to comply with local, state, and federal regulations. Business licenses Health and safety inspections Food service permits Liquor licenses (if applicable) Legal review of franchise agreements

📑 Estimate: $5,000 – $20,000+

Emergency/Working Capital Unexpected costs and initial operating shortfalls are common in the early months. Suggested Reserve: 3–6 months of operating costs Used for rent, payroll, inventory replenishment, or repairs

Tips for Managing Franchise Costs Wisely ✅ Work with a financial advisor to build a realistic budget and secure funding ✅ Apply for SBA loans or explore franchisor financing programs ✅ Negotiate lease terms strategically—consider shared spaces or end-cap units ✅ Review the Franchise Disclosure Document (FDD) carefully ✅ Attend discovery days and speak to current franchisees to gauge real-world costs

Conclusion: Invest with Eyes Wide Open Opening a restaurant franchise offers the benefit of brand recognition, proven systems, and ongoing support—but it also requires a significant financial commitment. By fully understanding and preparing for the costs involved, you can approach this venture with confidence and a clear path to profitability.

0 notes

Text

Best Financial Advisory for Small Business In Austraila — Accomate Austraila

How to Secure Funding for Your Startup or Small Business

Starting a business is an exciting journey, but securing funding can be one of the biggest challenges for entrepreneurs. Whether you’re launching a startup or expanding a small business, having the right financial backing is crucial for growth and sustainability. In this article, we’ll explore various ways to secure funding and help your business thrive.

1. Self-Funding (Bootstrapping)

Many entrepreneurs start by investing their personal savings into their business. Self-funding allows you to retain full control over your business and avoid debt. If you have personal savings, consider using them to kickstart your venture. Additionally, you can reinvest profits back into the business for steady growth.

2. Friends and Family

Borrowing from friends and family is another common funding option. Since they know and trust you, they might be willing to invest in your vision. However, it’s important to set clear terms to avoid misunderstandings in the future.

3. Business Loans

Banks and financial institutions offer various types of business loans to startups and small businesses. To secure a loan, you’ll need a solid business plan, good credit history, and proof of your ability to repay the loan. Explore different loan options such as:

Traditional bank loans

Small business administration (SBA) loans

Microloans from nonprofit organizations

4. Venture Capital (VC)

Venture capital is an excellent option for businesses with high growth potential. VCs provide funding in exchange for equity in your company. However, they usually look for businesses with strong scalability and a clear exit strategy. If you believe your startup has the potential to grow rapidly, seeking venture capital investment could be a great choice.

5. Angel Investors

Angel investors are individuals who provide financial backing to startups in exchange for equity. Unlike venture capitalists, angel investors may be more willing to take risks on early-stage startups. Networking events, startup incubators, and online platforms like AngelList can help you connect with potential investors.

6. Crowdfunding

Crowdfunding platforms like Kickstarter, Indiegogo, and GoFundMe allow entrepreneurs to raise money from a large number of small investors. This method not only helps secure funding but also builds a community of supporters who believe in your business idea.

7. Government Grants and Programs

Many governments offer grants, subsidies, and financial programs to support small businesses and startups. In Australia, initiatives like the Research and Development Tax Incentive and the Entrepreneurs’ Programme provide funding opportunities. Research the available grants and apply for those that align with your business needs.

8. Business Competitions and Incubators

Many business competitions and incubator programs offer funding, mentorship, and networking opportunities. Participating in these programs can help you gain financial support and industry connections. Look for startup accelerators and pitch competitions relevant to your industry.

9. Revenue-Based Financing

Revenue-based financing allows businesses to secure funding in exchange for a percentage of future revenue. This is an alternative to traditional loans and is ideal for businesses with steady cash flow. Platforms like Clearco and Lighter Capital offer such funding models.

10. Strategic Partnerships and Corporate Investors

Large companies sometimes invest in startups that align with their business goals. These partnerships can provide not only funding but also access to industry expertise and customer networks. Look for companies that might benefit from your product or service and explore partnership opportunities.

Final Thoughts

Securing funding for your startup or small business requires thorough planning and research. Whether you choose self-funding, loans, investors, or grants, selecting the right funding strategy is essential for your business’s success. Stay persistent, network actively, and refine your pitch to increase your chances of securing financial support. With the right funding in place, you can take your business to new heights and achieve long-term success.

At Accomate Australia, we are committed to supporting entrepreneurs in their business journey. Whether you need guidance on funding or strategic business advice, we are here to help you grow and succeed.

Accomate Global — https://www.accomateglobal.com/

Instagram — https://www.instagram.com/accomateglobal_pty_ltd/

Facebook — https://www.facebook.com/accomateglobalptyltd/

0 notes

Text

0 notes

Text

IT application management | GORCSI

GORCSI is a comprehensive IT application management solution designed to streamline and enhance the efficiency of your organization's software systems. With its user-friendly interface and advanced features, GORCSI empowers IT teams to effectively monitor, analyze, and optimize applications for better performance and productivity.

Click here- https://gorcsi.com/application-management

#iso certified program and project management#8(a) streamlined technology application#project management consulting companies#sba-certified application management#(sba) 8(a) business development program#it application management#digitalization and digital transformation#it and business consulting services#sba certified companies

0 notes

Text

SBA 8(a) Court Ruling Portends Truncated 4th Quarter Spending On Small Business Program

“WASHINGTON TECHNOLOGY” By Nick Wakeman, Editor-in-Chief “Federal spending on 8(a) contracts typically surges during the fourth quarter, but new court-imposed requirements to qualify those small businesses will likely scare off agency buyers.”

View On WordPress

0 notes

Video

youtube

Understanding SBA Loans To Get APPROVED Quickly

Applying for an SBA (Small Business Administration) loan involves several steps. Here’s a step-by-step guide to help you through the process: Step 1: Determine Your Loan Type SBA offers various loan programs, including: 7(a) Loan – General small business loan (most common). 504 Loan – For real estate and equipment purchases. Microloan – Small loans up to $50,000. Disaster Loan – For businesses affected by disasters. Determine which loan best fits your needs. The SBA 7(a) loan is the most common for working capital, refinancing debt, and business expansion. Step 2: Check Eligibility To qualify, your business must: ✅ Be a for-profit business operating in the U.S. ✅ Meet the SBA’s size standards for small businesses. ✅ Have a strong credit history (typically 650+ credit score). ✅ Show ability to repay (financial statements & projections). ✅ Have invested personal equity (owners must contribute some funds). ✅ Not be delinquent on other government loans/taxes. Step 3: Choose a Lender SBA loans are issued by approved lenders, such as: Banks (Chase, Wells Fargo, etc.) Credit unions Online lenders (e.g., SmartBiz) You can use the SBA Lender Match tool to find a lender: 👉 https://www.sba.gov/lendermatch Step 4: Gather Required Documents Lenders will require: 📌 Business Plan (overview, financial projections, market analysis) 📌 Personal & Business Tax Returns (last 2-3 years) 📌 Personal & Business Bank Statements (last 12 months) 📌 Profit & Loss (P&L) Statement 📌 Balance Sheet 📌 Debt Schedule (if you have existing loans) 📌 Collateral Details (for secured loans) 📌 Legal Documents (licenses, entity formation docs, contracts) Step 5: Submit Loan Application Your lender will provide the official SBA loan application forms. Common forms include: 📄 SBA Form 1919 – Borrower Information Form 📄 SBA Form 413 – Personal Financial Statement 📄 SBA Form 159 – Fee Disclosure Form (if applicable) Complete the forms accurately and submit them along with your documents. Step 6: Underwriting & Approval The lender reviews your application, financials, and credit history. They may request additional documentation. If approved, the lender submits the loan for SBA guarantee approval (may take a few weeks). ⏳ Approval Timeline: SBA Express Loans: ~36 hours Standard SBA 7(a): ~30-90 days Step 7: Loan Offer & Closing If approved, you’ll receive a loan offer with terms (interest rate, repayment period, etc.). Review and accept the terms. Sign the loan agreement and complete any final paperwork. Funds are disbursed to your business account. Step 8: Use Funds & Repay Loan Once you receive the loan: ✅ Use funds only for approved purposes (e.g., working capital, expansion, payroll, etc.). ✅ Make on-time monthly payments. ✅ Maintain financial records in case of audits. Final Tips ✔ Improve your credit score before applying (700+ is ideal). ✔ Prepare strong financials & business projections. ✔ Compare multiple lenders for the best rates/terms. ✔ Seek SBA-approved lenders for a smoother process. 💡 Need help? Visit an SBA Small Business Development Center (SBDC) near you for free guidance: 📍 https://www.sba.gov/local-assistance

0 notes

Text

Top Reasons Why Federal Agencies Should Partner with 8(a) Certified Companies

The U.S. Small Business Administration (SBA) 8(a) Business Development Program is a valuable resource for small businesses owned by socially and economically disadvantaged individuals. For federal agencies, partnering with 8(a) certified companies offers numerous advantages, including simplified procurement processes, enhanced diversity, and the ability to support small business growth. Below is a comprehensive guide to the top reasons why federal agencies should collaborate with 8(a) certified businesses.

1. Simplified Contracting Process

One of the most significant benefits of working with 8(a) certified companies is the streamlined contracting process. Federal agencies can:

Award Sole-Source Contracts: The SBA allows agencies to award sole-source contracts to 8(a) firms for projects valued at up to $4 million ($7 million for manufacturing contracts) without undergoing a competitive bidding process.

Expedite Procurement Timelines: By bypassing traditional procurement hurdles, agencies save time and resources.

Utilize Simplified Acquisition Procedures: Agencies can benefit from streamlined requirements for smaller contracts.

Source: U.S. Small Business Administration (SBA)

2. Meeting Small Business Contracting Goals

Federal agencies are mandated to allocate a percentage of their contracting budget to small and disadvantaged businesses. Partnering with 8(a) firms helps agencies:

Fulfill Socioeconomic Contracting Goals: The government has set a target of awarding at least 5% of federal contracting dollars to disadvantaged small businesses.

Enhance Reporting Metrics: Collaborating with 8(a) companies demonstrates commitment to supporting diversity and inclusion in federal procurement.

Source: Federal Acquisition Regulation (FAR)

3. Promoting Diversity and Inclusion

Engaging 8(a) businesses contributes to fostering diversity in federal projects. These firms are often minority-owned, supporting:

Economic Equity: Ensuring equitable opportunities for disadvantaged entrepreneurs.

Innovation and Community Growth: Diverse teams bring fresh perspectives and innovative solutions, benefiting the project and the broader community.

Source: Minority Business Development Agency (MBDA)

4. Access to Specialized Skills and Services

Many 8(a) certified companies offer niche expertise and specialized services that align with federal needs. Agencies benefit from:

Tailored Solutions: Smaller businesses can adapt quickly to project requirements.

Focused Attention: 8(a) firms often provide personalized service and maintain strong client relationships.

Source: SBA’s 8(a) Business Development Program Overview

5. Supporting Small Business Growth

By partnering with 8(a) firms, federal agencies contribute to the growth of small businesses, enabling them to:

Build Capacity: Contracts help 8(a) businesses scale operations and enhance capabilities.

Create Jobs: Supporting small businesses boosts local economies and creates employment opportunities.

Develop Future Partners: Successful partnerships with 8(a) companies can lead to long-term collaboration.

Source: U.S. Department of Commerce

6. Risk Mitigation Through SBA Support

The SBA provides oversight and support to 8(a) certified businesses, reducing risks for federal agencies. Benefits include:

Business Development Assistance: SBA ensures that participating firms receive guidance and training.

Performance Monitoring: The program includes mechanisms for evaluating the performance of 8(a) firms.

7. Encouraging Innovation and Competition

Engaging small businesses through the 8(a) program fosters innovation and increases competition within federal contracting. These businesses:

Introduce New Technologies: Smaller firms often lead in adopting cutting-edge technologies and innovative practices.

Challenge Industry Norms: Their agility and creativity can drive efficiency and effectiveness in federal projects.

Source: National Institute of Standards and Technology (NIST)

Conclusion

Partnering with 8(a) certified companies offers federal agencies a host of benefits, from simplified procurement and enhanced diversity to fostering small business growth and innovation. These partnerships not only meet federal contracting goals but also contribute to building a stronger, more inclusive economy. For agencies seeking reliable and innovative solutions, 8(a) certified companies are an invaluable resource.

#8a certification#federal#government#SBA#small business administration#8a certified#federal agencies

0 notes

Text

The Top Business Resources Every Minority Entrepreneur Should Know

As a minority entrepreneur, accessing the right resources can be the key to overcoming obstacles and achieving success. With growing support from both the private and public sectors, a variety of programs, networks, and funding options are available to help minority-owned businesses thrive. Whether you’re just starting out or looking to expand, understanding which resources can make a real difference is critical. Here’s a detailed look at the top resources every minority entrepreneur should know about.

Minority Business Development Agency (MBDA)

The Minority Business Development Agency (MBDA) is a vital resource for minority entrepreneurs. Operated by the U.S. Department of Commerce, the MBDA provides a wide array of services, including business consulting, access to capital, and market opportunities. One of its key offerings is the MBDA Business Center network, which helps minority-owned businesses access contracts, expand into new markets, and improve operational efficiency.

The MBDA also provides access to grants and networking opportunities, making it easier for minority entrepreneurs to connect with like-minded business owners and potential partners. Their focus on increasing the competitiveness of minority-owned firms ensures that you are set up for success and positioned to grow and thrive in competitive markets.

SBA’s 8(a) Business Development Program

For minority entrepreneurs looking to secure government contracts, the Small Business Administration's 8(a) Business Development Program is an invaluable resource. This program provides a pathway to securing federal contracts by helping minority-owned businesses become certified as 8(a) businesses. Once certified, businesses can compete for set-aside government contracts and access other benefits, such as specialized business training and technical assistance.

The 8(a) program is specifically designed to help socially and economically disadvantaged business owners gain a foothold in federal procurement, making it easier for minority entrepreneurs to break into the lucrative government contracting space.

National Minority Supplier Development Council (NMSDC)

Another critical resource is the National Minority Supplier Development Council (NMSDC). The NMSDC connects minority-owned businesses with corporations looking to diversify their supply chains. Through certification as a Minority Business Enterprise (MBE), entrepreneurs gain access to corporate buyers, contract opportunities, and the NMSDC’s extensive network of over 1,750 corporations.

The NMSDC also offers events, networking opportunities, and business matchmaking services to help minority entrepreneurs build relationships with key corporate decision-makers. If you’re looking to grow your business through corporate contracts, becoming MBE-certified through the NMSDC is a strategic move.

Local and National Grant Programs

Many minority entrepreneurs can benefit from grant programs specifically designed to support underrepresented business owners. Unlike loans, grants do not need to be repaid, making them a desirable source of funding. Both government and private sector organizations offer grants for minority-owned businesses.

The FedEx Small Business Grant and the Comcast RISE grant are examples of corporate grants aimed at minority business owners. These programs provide cash grants and, in some cases, additional resources such as marketing and technology support.

On the government side, the U.S. Department of Commerce’s MBDA offers grant opportunities aimed at helping minority businesses scale and access new markets. While grants can be competitive, with a strong application and a clear business plan, they are an excellent way to secure funding without taking on debt.

Community Development Financial Institutions (CDFIs)

Community Development Financial Institutions (CDFIs) play a crucial role in providing financing to minority entrepreneurs who may not qualify for traditional bank loans. CDFIs are mission-driven institutions that focus on lending to underserved communities, including minority-owned businesses.

CDFIs often offer more flexible loan terms, lower interest rates, and smaller loan amounts than traditional banks, making them a viable option for minority entrepreneurs in need of capital. Additionally, CDFIs often provide business counseling and financial education to help entrepreneurs manage their funds effectively.

Crowdfunding Platforms and Peer-to-Peer Lending

Technology has made it easier for minority entrepreneurs to access funding through crowdfunding and peer-to-peer lending platforms. Websites like Kickstarter, Indiegogo, and GoFundMe allow entrepreneurs to raise money from individuals who believe in their business ideas.

Equity crowdfunding platforms like Republic and SeedInvest enable minority-owned businesses to raise capital in exchange for equity.

Peer-to-peer lending platforms, such as Kiva, also provide a way for minority entrepreneurs to obtain small loans from individuals rather than financial institutions. These platforms often have fewer requirements than traditional lenders, making them an attractive option for entrepreneurs who need capital but face barriers to traditional financing.

Business Incubators and Accelerators

Business incubators and accelerators are excellent resources for minority entrepreneurs looking to grow their businesses quickly. These programs provide mentorship, office space, access to investors, and, in many cases, funding. Several incubators and accelerators focus specifically on minority-owned businesses, providing a supportive environment for entrepreneurs to thrive.

Programs like Backstage Accelerator and the Impact Ventures Accelerator are tailored to help minority and underrepresented entrepreneurs scale their businesses. These programs often culminate in pitch competitions, where entrepreneurs have the opportunity to secure funding from venture capitalists and angel investors.

Participating in an incubator or accelerator program can give minority entrepreneurs the resources, guidance, and connections needed to navigate challenges and grow their businesses more effectively.

Mentorship and Networking Organizations

Having access to experienced mentors and a strong network of peers is essential for minority entrepreneurs. Organizations like SCORE and the Minority Chamber of Commerce offer mentorship and networking opportunities designed to help minority-owned businesses succeed.

SCORE, a nonprofit organization, provides free business mentorship and education through a network of volunteer business experts. Whether you need help with business planning, marketing, or financial management, SCORE mentors can offer invaluable guidance.

The Minority Chamber of Commerce provides networking events, advocacy, and access to business resources specifically aimed at supporting minority entrepreneurs. Building relationships through these organizations can help minority entrepreneurs gain new perspectives and opportunities for collaboration.

Key Resources for Minority Entrepreneurs

MBDA: Offers consulting, market access, and business center support.

SBA 8(a) Program: Provides government contract opportunities.

NMSDC: Links minority businesses to corporate supply chains.

Grants: FedEx, Comcast RISE, and MBDA for funding.

CDFIs: Alternative financing for underserved communities.

Crowdfunding: Kickstarter, GoFundMe for alternative funding.

Incubators/Accelerators: Programs like Backstage Accelerator for scaling.

In Conclusion

Navigating the world of business as a minority entrepreneur comes with unique challenges, but the resources available today are designed to bridge those gaps and set you up for success. From securing funding through grants and loans to leveraging certification programs like those offered by the NMSDC, these resources provide vital support. By tapping into the programs, networks, and financial options highlighted in this article, you can confidently grow and scale your business, knowing that these resources are designed to support minority entrepreneurs every step of the way.

0 notes

Text

SBA Loan Interest Rates in 2024: What You Need to Know

If you’re a small business owner looking to secure funding, SBA (Small Business Administration) loans are one of the most affordable options in 2024. These government-backed loans offer low interest rates and flexible terms, making them an attractive choice for businesses looking to grow, expand, or manage cash flow. Here’s what you need to know about SBA loan interest rates this year.

Types of SBA Loans and Rates

The SBA offers several loan programs, each with its own interest rate structure:

SBA 7(a) Loans This is the most popular program, designed for a wide range of business needs, from working capital to equipment purchases. In 2024, the interest rate for SBA 7(a) loans typically ranges from 10.5% to 12%, depending on the loan amount and terms.

SBA 504 Loans Ideal for businesses looking to purchase real estate or large equipment, the 504 loan combines fixed-rate financing with lower rates. The 2024 interest rates for SBA 504 loans are expected to hover around 6.5% to 7.5% for the long-term portion, with market fluctuations affecting the overall cost.

SBA Microloans Targeting smaller businesses or startups needing less than $50,000, SBA microloans in 2024 come with slightly higher rates, averaging between 8% to 13%, depending on the lender.

Factors Affecting SBA Loan Rates

SBA loan interest rates are influenced by several key factors, including:

Federal Reserve Rates The Federal Reserve has raised rates in recent years to curb inflation. As of 2024, SBA loan rates have adjusted upward accordingly. Any further changes by the Fed will directly affect SBA interest rates.

Loan Term and Amount Shorter-term loans typically have lower interest rates, while larger loans may command slightly higher rates. For example, a $500,000 SBA 7(a) loan may have a different rate compared to a $50,000 microloan.

Borrower’s Creditworthiness Lenders may offer lower rates to businesses with strong credit profiles and proven financial stability. While SBA guarantees reduce risk, your individual financial health still plays a role.

Takeaway

SBA loans remain one of the best financing options for small businesses in 2024, despite slightly higher interest rates compared to previous years. Knowing the loan types and what influences rates will help you find the best deal for your business needs.

0 notes