#SaveSmart

Explore tagged Tumblr posts

Text

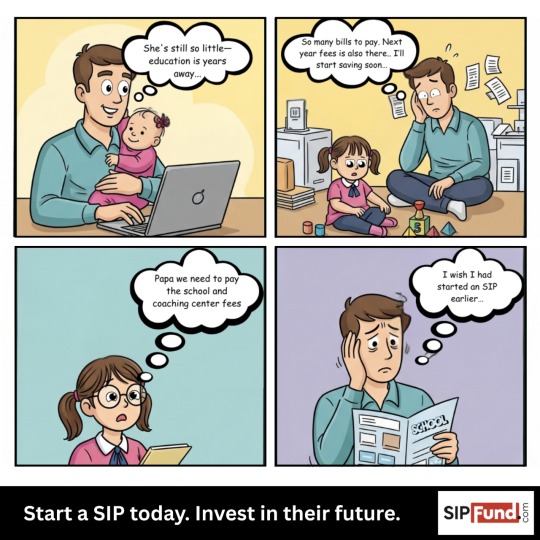

Start a SIP Today. Invest in Their Future with SIPfund.com – Smart Plans for Bright Tomorrows.

Secure your loved one’s future with small monthly investments. Start a SIP with SIPfund.com today — for education, marriage, or life goals.

Start a SIP for your child’s education

💍 Plan ahead for your daughter’s wedding

🧒 Invest early, watch wealth grow over time

💰 Compounding turns small savings into big funds

🚀 SIPfund = Simple, Smart, Secure Investing

#Smart#Secure Investing#StartASIP#SIPfund#InvestFuture#ChildEducation#Fund#FuturePlanning#SmartParenting#SIPForKids#Secure#Future#SmartInvesting#MutualFundSIP#DreamBig#SaveSmart#PlanForFuture#PowerOfCompounding#GoalBased#Investing#ChildGoals#EducationFund#WeddingPlanning

0 notes

Text

Loan Prepayment: Smart Move or Missed Opportunity?

Myth-busting time! Prepaying your loan early can save you a lot on interest—but timing matters. While early prepayment helps reduce your interest burden, doing it later in the tenure might not give the same benefit. Know when it’s smart to prepay and when it’s better to hold back. Make informed financial decisions!

#PSB59#PSBLoansIn59Minutes#FinanceTips#LoanAdvice#MoneyManagement#FinancialLiteracy#SmartFinance#MoneyMoves#LoanPrepayment#FinanceFacts#MoneySaver#InterestRates#LoanMyths#DebtFreeJourney#SaveSmart#PersonalFinanceTips#MoneyGoals#SmartInvesting#FinancialFreedom#BudgetWisely#WealthBuilding#LoanPlanning

0 notes

Text

How Simple and Compound Interest Affect Your Money

When comparing Simple Interest vs. Compound Interest, it’s important to understand how each affects your money. Simple interest is calculated only on the principal amount of a loan or investment. It remains fixed over time, making it predictable and easier to manage. For example, if you borrow or invest $1,000 at 5% simple interest annually for 3 years, you’ll pay or earn $150 in total interest.

In contrast, compound interest is calculated on both the principal and the accumulated interest. This means your interest earns interest, leading to faster growth over time. Compound interest is commonly used in savings accounts, investments, and long-term loans. For example, the same $1,000 at 5% compounded annually would grow to more than $1,157 over 3 years.

The key takeaway in the debate of Simple Interest vs. Compound Interest is that simple interest works well for short-term borrowing, while compound interest is ideal for long-term investing. Understanding the difference can help you make better decisions about saving, borrowing, and managing your finances more effectively. Always consider which type of interest applies before choosing a financial product.

#SimpleInterest#CompoundInterest#InterestRates#FinancialEducation#MoneyMatters#InvestingBasics#LoanTips#InterestComparison#FinancialLiteracy#SmartInvesting#PersonalFinance#FinanceTips#InterestExplained#WealthBuilding#SaveSmart

0 notes

Text

🎊 அட்சய திருதியை சிறப்பாக கொண்டாட KAS Jewellery Gold Chit-இல் இன்று சேருங்கள்! 🎊

💫 Gold Chit-இல் சேரும் உங்கள் முதலீட்டுக்கு இனிய பரிசு – இலவச வெள்ளி நாணயம்!

📲 இப்போதே KKAS Jewellery DigiGold Savings App-ஐ பதிவிறக்கம் செய்யுங்கள் மற்றும் உங்கள் Gold Chit-ஐ இன்றே தொடங்குங்கள்!

🔗 Android App: https://play.google.com/store/apps/details?id=com.kascustomer.app

🔗 iOS App: https://apps.apple.com/in/app/kas-jewellery-digigold-savings/id6741509982

#KASJewellery#GoldChit#AkshayaTritiya2025#SilverCoinOffer#GoldSavings#JewelleryOffer#TamilPromo#InvestInGold#SaveSmart#FestivalOffer#AkshayaTritiyaSpecial#SmartInvestment#GoldPlan#GoldInvestmentPlan#IndianJewellery#JewellerySavingsPlan#SaveGoldEarnSilver#LimitedTimeOffer#GoldForFuture#GoldChitPlan#DownloadNow#StartSavingToday#KASDigiGold

0 notes

Text

💸 99% Log Paisa Waste Karte Hain – Tum Toh Nahi? Har mahine ₹5000-₹10000 ka chhupa-kharcha hota hai! 🤯 Yeh 3 expenses avoid karo aur paise bachana shuru karo. Koi aisa friend hai jo bina soche udta hai? Usko tag karo! 😂👇 #DiscoverAndRise

#MoneyMatters #SmartSpending #SaveMoney #GenZFinance #PersonalFinance #MoneyTips #FinancialFreedom #InvestWisely #MoneyManagement #IndiaFinance #SpendSmart #RichMindset #FinanceForGenZ #FrugalLiving #FinancialLiteracy #MoneyGoals #WealthBuilding #SaveSmart #BudgetingTips #StopWastingMoney #WealthCreation #MoneyHacks #SaveInvestRepeat #MinimalistLiving #MoneyWisdom #FinancialIndependence #SmartChoices #BachatTips #InvestEarly #DiscoverAndRise

#MoneyMatters#SmartSpending#SaveMoney#GenZFinance#PersonalFinance#MoneyTips#FinancialFreedom#InvestWisely#MoneyManagement#IndiaFinance#SpendSmart#RichMindset#FinanceForGenZ#FrugalLiving#FinancialLiteracy#MoneyGoals#WealthBuilding#SaveSmart#BudgetingTips#StopWastingMoney#WealthCreation#MoneyHacks#SaveInvestRepeat#MinimalistLiving#MoneyWisdom#FinancialIndependence#SmartChoices#BachatTips#InvestEarly#DiscoverAndRise

0 notes

Text

Saving today is the foundation for a better tomorrow. Start small, think big, and let your money work for you

#SaveSmart#FinancialFreedom#WealthBuilding#StartSaving#MoneyMindset#SecureYourFuture#SavingsJourney#InvestInYourself#PiggyVest#MoneyGoals#FinancialGrowth#BudgetingTips#FuturePlanning#SmartInvesting

0 notes

Text

6 Money Tips for Freelancers to Increase Your Income Stream.

#business#BuildLastingWealth#FinancialFreedom#WealthBuildingJourney#FinancialGoals#InvestWisely#FinancialLiteracy#BudgetingBasics#SaveSmart#EmergencyFund#CutExpenses#TrackYourSpending

0 notes

Text

Effortless Style: Solid Color Skirt Set ✨

Stay effortlessly chic with this Solid Color Long Sleeve Top & Skirt Set. Perfect for any occasion, this combo offers both comfort and style. Elevate your wardrobe with this versatile outfit! 🔥✨

#FashionTrends#OOTD#SkirtSet#StylishOutfits#FallFashion#TrendingNow#WardrobeEssentials#ChicLooks#FashionInspo#SaveSmart

0 notes

Text

Jordon Bevan Explains How to Build a Practical Budget for Any Income

Managing your finances effectively is essential for living a stress-free life, no matter how much or how little you earn. Building a practical budget that works for any income level can help you stay on top of your expenses, save for the future, and achieve your financial goals. Jordon Bevan, a skilled entrepreneur and experienced financial advisor, has helped countless individuals take control of their money. Here, he shares simple and effective strategies on how to create a budget that works for you, regardless of your income.

Start by Understanding Your Income and Expenses

Before you can build a budget, it’s important to have a clear picture of how much money is coming in and where it’s going out. According to Jordon Bevan, the first step is to track your income and expenses. Write down all sources of income, including your salary, freelance work, or any side hustles. Then, list all your monthly expenses, such as rent or mortgage, utilities, groceries, transportation, and entertainment.

Jordon advises using a budgeting app or a simple spreadsheet to make this process easier. “It’s not about complicating things, but about creating awareness of your financial situation,” he says. Once you see how much you’re earning and spending, you’ll be in a better position to make informed decisions.

Categorize Your Expenses: Needs vs. Wants

A practical budget starts by differentiating between needs and wants. Needs are the essential expenses that you must cover to live, like housing, food, and utilities. Wants are things you enjoy but don’t necessarily need, such as dining out, subscriptions, or new clothes.

Jordon Bevan suggests using the 50/30/20 rule to allocate your income effectively:

50% of your income goes toward needs.

30% is for wants.

20% should be set aside for savings or paying off debt.

This rule is a great starting point, but feel free to adjust the percentages to suit your individual needs. The key is to make sure that your needs are covered first before spending money on wants.

Set Clear Financial Goals

“Budgeting isn’t just about paying bills and getting by—it’s about planning for the future,” Jordon explains. Setting clear financial goals is crucial to keeping you motivated and on track. These goals could include building an emergency fund, saving for a vacation, paying off debt, or investing in your retirement.

Once you’ve identified your goals, assign a portion of your budget to help you achieve them. Even if your income is limited, starting small can still make a big difference. For example, saving $50 a month may not seem like much, but it can grow into a significant amount over time.

Cut Back on Unnecessary Spending

As you review your budget, look for areas where you can cut back on non-essential spending. “Small changes can lead to big savings,” says Jordon. Simple actions like making coffee at home instead of buying it every day or canceling unused subscriptions can free up extra money that can be used for your financial goals.

Jordon advises avoiding drastic cuts that make life miserable. “It’s important to strike a balance between saving and enjoying life,” he adds. Instead of cutting out all the things you enjoy, find ways to reduce costs in those areas. For instance, if you love dining out, consider limiting it to once a week or trying cheaper restaurants.

Automate Your Savings

Saving money consistently is often one of the biggest challenges people face, but Jordon Bevan emphasizes the importance of making savings automatic. Set up an automatic transfer from your checking account to your savings account each month, ideally on the day you receive your paycheck. “This way, you’re paying yourself first,” Jordon explains.

Even if it’s a small amount, like $20 or $30 a month, automated savings can add up over time. Plus, by treating savings as a fixed expense, you’re more likely to stick to your budget and build a financial cushion for the future.

Review and Adjust Regularly

A budget isn’t something you set once and forget about—it’s a living plan that should be reviewed and adjusted regularly. Jordon suggests checking in with your budget at least once a month. “Life changes, and your budget should change with it,” he says.

Maybe you got a raise at work, or perhaps an unexpected expense came up. Regularly reviewing your budget will help you stay on top of your finances and make adjustments as needed. If you find that your current budget isn’t working, don’t be afraid to tweak it until it fits your lifestyle and financial situation.

Conclusion

Building a practical budget for any income doesn’t have to be complicated. By tracking your income and expenses, setting financial goals, and making small but effective changes, you can take control of your money and create a more secure financial future. As Jordon Bevan reminds us, budgeting is a tool that gives you the power to manage your finances with confidence and ease.

Remember, it’s not about perfection—it’s about progress. Start today, and you’ll be well on your way to achieving financial peace of mind.

#BudgetingTips#FinancialFreedom#MoneyManagement#SmartSpending#PersonalFinance#SaveSmart#FinancialGoals#IncomePlanning#BudgetForSuccess#MoneyMatters

0 notes

Text

Financial Education

Most employed individuals aim to be regularized in their respective jobs Regular employees aim to get promotion / be promoted to their respective jobs

Promoted employees must come to work early sometimes must be at work before the sun rise to begin tasks and must leave the office late and assure that every job in the given timeline will be on time

Most regular and promoted employees look forward to applying cards for financial assistance

Application for a credit card is not as easy as opening a bank account

Giving time to know learn and be educated on your financial needs will make you understand you don't actually need to have this stuff

ITS BETTER TO FAIL THAN YOURS FAIL

there is a verse in the bible where Jesus said, " Remember to number your days for you do not know the time " This simply means you will grow tired and if you haven't prepared what you really need Your job will expire you

Health is wealth. Let not these passing days make you grow weary while you work towards progress

Always remember WORK SMART is better than HARDWORK / WORKING HARD

Needs for labourers / workers don't stop but your ability / capability / knowledge and strength has its limit

0 notes

Text

💰 Happy National Savings Day! 💰

Money isn't just paper and coins; it's the thread that weaves through the fabric of our lives. Our relationship with money influences the choices we make, the dreams we chase, and the security we seek. 💭💸

On this National Savings Day, let's reflect on the importance of financial well-being. Here are a few reminders and tips to celebrate this day:

Remember, it's not about hoarding money; it's about using it as a tool to create the life you want. Let's make wise financial decisions today for a brighter, more secure tomorrow. 💡💪

#NationalSavingsDay#FinancialWellBeing#MoneyMatters#SaveSmart#InvestWisely#blossomlifestylehub#followme#special days#empowerment#savings#money#moneymanagement#moneysavingtips

0 notes

Text

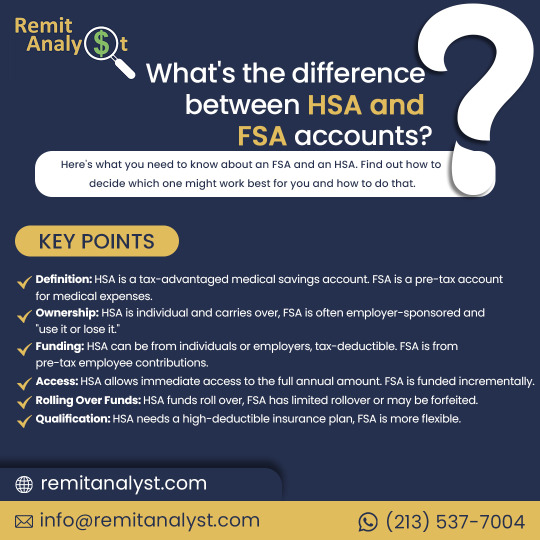

What's the difference between HSA and FSA accounts?

HSA (Health Savings Account) and FSA (Flexible Spending Account). Let's break down the differences between these options and help you make informed choices!

Health Savings Account (HSA)

🔹 Imagine it like a healthcare piggy bank - money goes in tax-free!

🔹 You control it, and it stays with you, even if you change jobs or health plans.

🔹 Contributions are tax-deductible, which is like giving yourself a little financial boost.

🔹 The funds in your HSA can grow over time, providing a nest egg for future medical expenses.

🔹 You need a high-deductible health plan (HDHP) to be eligible for an HSA.

Flexible Spending Account (FSA) 🔸 Think of it as a yearly budget for medical expenses - you plan ahead.

🔸 Funded by pre-tax dollars from your paycheck, reducing your taxable income.

🔸 Use it or lose it - generally, you need to spend the funds within the plan year or a grace period.

🔸 Great for predictable, planned medical expenses like copayments, deductibles, or prescriptions.

🔸 Typically, your employer offers FSA options as part of your benefits package.

difference between HSA and FSA accounts depends on your health needs and financial situation. If you anticipate high medical expenses, an HSA could be a great long-term savings tool. If you have predictable costs and want to save on taxes, an FSA might be your best bet!

Remember, it's your healthcare and your money - understanding these options can put you in the driver's seat. Choose wisely and stay financially healthy! 💪🏥

Discover the Best Rates! Send money to India hassle-free from the USA with RemitAnalyst. Get the top exchange rates and seamless online money transfers. Convert USD to INR effortlessly. Start saving on every transfer now!

#HealthcareSavings#FinancialWellness#HSAExplained#FSAInsights#MoneyMatters#MedicalExpenses#BudgetingTips#HealthcareEducation#SaveSmart#EmpowerYourWallet#HSA#FSA#HealthcareFinance101

0 notes

Text

உங்கள் மாத சம்பளத்தை 📅 புத்திசாலித்தனமாக சேமித்து 💰 தங்கமாக மாற்றுங்கள்! 🪙✨

KAS Jewellery-யின் விருட்சம் கோல்ட் சிறுசேமிப்பு திட்டம் – செய்கூலி ❌ சேதாரம் ❌ இல்லாமல், சந்தை விலைக்கே 💸 தங்க நகைகளை வாங்க ஒரு அரிய வாய்ப்பு! 💍🎉

📲 இப்போதே டவுன்லோட் செய்யுங்கள் KAS KAS Jewellery DigiGold Savings App 👉 https://play.google.com/store/apps/details?id=com.kascustomer.app

#KASJewellery#VirutchamGoldScheme#GoldSavingsPlan#MonthlySavings#SaveSmart#BuyGoldSmart#GoldJewellery#SmartInvestment#NoMakingCharges#NoWastage#GoldAtMarketPrice#JewelleryOffers#GoldLovers

0 notes

Text

💰Financial Independence: Small Steps, Big Rewards!💡

Are you ready to take control of your financial future? Here are 3 simple steps to get started! 💪 #FinancialIndependence

#MoneyGoals#SaveSmart#InvestNow#DiscoverAndRise#FinancialFreedom#GenZFinance#GrowthMindset#Budgeting#IndianGenZ#WealthBuilding#StepByStep#SmartMoneyMoves#FinancialTips#GoalSetting#PersonalGrowth#FinancialLiteracy#MoneyMindset#DreamBig#Independence#TakeAction#InvestInYourself#FutureReady

0 notes

Text

💰 Not sure how much to save for the future? It’s more than “whatever’s left.” Use the 25x rule (expenses × 25), automate your savings, and start early to let compounding do the work. Define your goals, reverse-engineer the math, and build your freedom fund. 🧠Read the full article to find out more ✨#SaveSmart #MoneyGoals #FinancialFreedom #LongTermWealth

#FinancialFreedom SavingTips MoneyGoals PersonalFinance WealthMindset RetirementPlanning MoneyManagement SmartMoney FutureReady Lin#budgeting#finance#investing#money#personal finance

0 notes

Text

Set one small, clear financial goal just for July. Keep it realistic, trackable, and focused! 💡💸

Small wins lead to big results—start now, not later. 💪📊

💡 Ready to take your finances to the next level? Get tailored capital solutions — no hidden fees, no delays, just a team that puts your business first. 🙌

👉 Start Your FREE Funding Application Today at Titan Finance LLC! Book your appointment now at https://titanfinancellc.com/

#TitanFinanceLLC #FinanceTips #JulyFinanceGoals #MoneyMindset #SmartMoneyMoves #MidYearReset #BudgetTips #SaveSmarter #FinancialWellness #TrackYourGoals #PinoyFinance #GoalGetter2025

0 notes