#BudgetingTips

Explore tagged Tumblr posts

Text

#FreelancerFinance#BudgetingTips#FreelancerLife#MoneyManagement#FreelanceTips#FinancialFreedom#BudgetPlanning#SelfEmployedSuccess#IncomePlanning#TaxTipsForFreelancers#SideHustleBudget#FreelanceBusiness#SmartBudgeting#WorkForYourself#FreelancerMindset

2 notes

·

View notes

Text

The First Rule of Wealth: Pay Yourself First and Master Your Budget

Most people work hard for their money, yet at the end of each month, they find themselves with little to show for it. Bills get paid, expenses pile up, and whatever’s left—if anything—might go into savings. This cycle keeps people in a constant state of financial survival. But what if the script was flipped? What if, instead of making everyone else rich first, you paid yourself first?

Paying yourself first means prioritizing your financial future before anything else. Before paying bills, before shopping, before indulging in life’s luxuries—you take a portion of your earnings and secure it for your future. This isn’t just a suggestion; it’s the fundamental rule of wealth-building. The rich didn’t get wealthy by accident—they did it through discipline, smart financial strategies, and making sure their money worked for them before it worked for anyone else.

A budget isn’t about restriction; it’s about control. It’s about telling your money where to go instead of wondering where it went. When you create a budget with the intention of paying yourself first, you ensure that wealth-building isn’t an afterthought—it’s the priority. Set aside a percentage of your income—whether it’s 10%, 20%, or more—before you even consider your expenses. This money should go directly into savings, investments, or, even better, into an asset that protects your wealth against inflation and central bank manipulation.

Enter Bitcoin. Unlike traditional savings accounts that lose purchasing power over time, Bitcoin is designed to be scarce, decentralized, and resistant to inflation. This is where Dollar-Cost Averaging (DCA) comes into play. Instead of trying to time the market, you simply set up an automatic purchase of Bitcoin at regular intervals—weekly, bi-weekly, or monthly. Whether the price is high or low, you’re consistently accumulating, smoothing out volatility, and ensuring that your wealth grows over time. It’s a ‘set it and forget it’ strategy that aligns perfectly with the pay-yourself-first philosophy.

Think of it like this: every dollar you make is a worker. You can either spend it immediately, letting it disappear into someone else’s pocket, or you can put it to work for you. Paying yourself first means ensuring that a portion of your income goes toward something that will grow, protect, and empower your future.

The difference between those who struggle financially and those who achieve wealth isn’t just income—it’s how that income is managed. Financial freedom isn’t about making more money; it’s about keeping more of what you make and using it wisely. Paying yourself first isn’t just a financial strategy—it’s a mindset shift. It’s about choosing to secure your own future before feeding into a system that thrives on keeping you financially dependent.

Start today. Even if it’s just a small percentage, commit to paying yourself first. Automate it. Treat it like an unbreakable rule. Over time, this small habit compounds into something massive. Your future self will thank you.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#FinancialFreedom#PayYourselfFirst#WealthBuilding#MoneyMindset#BudgetingTips#Investing#PersonalFinance#DCA#BitcoinDCA#CryptoSavings#FinancialIndependence#SmartMoney#WealthMindset#BitcoinEducation#MoneyMatters#StackSats#BitcoinStrategy#LongTermWealth#FutureProof#financial empowerment#digitalcurrency#finance#financial experts#globaleconomy#financial education#blockchain#unplugged financial#cryptocurrency

2 notes

·

View notes

Text

Conquering Debt: Strategies to Pay Off Credit Card Debts

Credit card debt is a financial burden that can weigh heavily on anyone, leading to stress and financial instability. However, with the right strategies, it’s possible to pay off credit card debts and achieve financial freedom. In this article, we will explore effective methods to manage and eliminate credit card debt, providing a comprehensive guide to help you conquer your financial challenges.

Understanding Credit Card Debt

Before diving into strategies to pay off credit card debts, it’s essential to understand what credit card debt entails. Credit card debt occurs when you use a credit card to make purchases and don’t pay off the balance in full by the due date. The remaining balance incurs interest, which can quickly accumulate and lead to significant debt if not managed properly.

The Impact of Credit Card Debt

Credit card debt can have several negative effects on your financial health:

High-Interest Rates: Credit cards often come with high-interest rates, which can make it challenging to pay off the principal balance as interest accumulates rapidly.

Credit Score Damage: Carrying high balances on your credit cards can negatively impact your credit score, affecting your ability to secure loans, mortgages, and even employment opportunities.

Financial Stress: The burden of credit card debt can lead to stress and anxiety, impacting your overall well-being and quality of life.

Strategies to Pay Off Credit Card Debts

Now that we understand the impact of credit card debt, let’s explore various strategies to help you pay off credit card debts effectively.

1. Create a Budget and Stick to It

Creating a budget is the first step in managing your finances and paying off credit card debts. A budget helps you track your income and expenses, ensuring that you allocate enough funds towards debt repayment.

Steps to Create a Budget:

1. List all sources of income.

2. Categorize and list all expenses, including fixed costs (rent, utilities) and variable costs (groceries, entertainment).

3. Identify areas where you can cut back on spending.

4. Allocate a specific amount towards debt repayment each month.

By sticking to a budget, you can ensure that you’re consistently making progress towards paying off your credit card debts.

2. Pay More Than the Minimum Payment

While making the minimum payment on your credit card keeps you in good standing with your creditor, it does little to reduce your overall debt. Paying only the minimum can extend your debt repayment period and increase the total amount of interest you pay.

To effectively pay off credit card debts, aim to pay more than the minimum payment each month. This approach reduces the principal balance faster, decreasing the amount of interest you accrue.

3. Prioritize High-Interest Debts

If you have multiple credit card debts, it’s essential to prioritize them based on interest rates. The “avalanche method” is a strategy where you focus on paying off the debt with the highest interest rate first while making minimum payments on other debts.

Steps for the Avalanche Method:

1. List all your credit card debts along with their interest rates.

2. Allocate extra funds towards the debt with the highest interest rate.

3. Once the highest interest debt is paid off, move to the next highest, and so on.

By targeting high-interest debts first, you can save money on interest payments and accelerate your debt repayment process.

4. Consider the Snowball Method

Another popular strategy to pay off credit card debts is the “snowball method.” This approach involves paying off the smallest debt first, then moving to the next smallest, and so on. The snowball method provides psychological motivation by giving you quick wins and a sense of accomplishment.

Steps for the Snowball Method:

1. List all your credit card debts from smallest to largest balance.

2. Allocate extra funds towards the smallest debt while making minimum payments on others.

3. Once the smallest debt is paid off, move to the next smallest, and repeat the process.

The snowball method can be particularly effective for those who need motivation to stay committed to their debt repayment plan.

5. Balance Transfer Credit Cards

A balance transfer credit card allows you to transfer your existing credit card debt to a new card with a lower interest rate or an introductory 0% APR period. This strategy can help you save money on interest and pay off credit card debts faster.

Steps to Utilize a Balance Transfer Card:

1. Research and compare balance transfer credit cards to find the best offer.

2. Apply for the card and transfer your existing credit card balances.

3. Pay off the transferred balance before the introductory period ends to avoid high interest rates.

Keep in mind that balance transfer cards may come with fees, so it’s essential to weigh the cost against the potential interest savings.

6. Debt Consolidation

Debt consolidation involves combining multiple credit card debts into a single loan with a lower interest rate. This strategy simplifies your payments and can reduce the overall interest you pay.

Steps for Debt Consolidation:

1. Assess your total credit card debt and research consolidation loan options.

2. Apply for a consolidation loan that offers a lower interest rate than your current debts.

3. Use the loan to pay off your credit card balances.

4. Make consistent payments on the consolidation loan until it’s paid off.

Debt consolidation can be an effective way to manage and pay off credit card debts, but it’s crucial to avoid accumulating new debt while paying off the consolidation loan.

7. Negotiate with Creditors

In some cases, you may be able to negotiate with your creditors to lower your interest rates or settle your debt for less than the full amount owed. Creditors may be willing to work with you if you’re experiencing financial hardship or if you have a history of making timely payments.

Steps to Negotiate with Creditors:

1. Contact your creditors and explain your financial situation.

2. Request a lower interest rate, a payment plan, or a debt settlement.

3. Get any agreement in writing to ensure clarity and protection.

Negotiating with creditors can provide immediate relief and make it easier to pay off credit card debts.

8. Increase Your Income

Finding ways to increase your income can provide additional funds to put towards debt repayment. Consider taking on a part-time job, freelancing, or selling unused items to generate extra cash.

Ideas to Increase Income:

1. Offer services such as tutoring, pet sitting, or house cleaning.

2. Sell items online through platforms like eBay or Facebook Marketplace.

3. Take on freelance work in your area of expertise.

Increasing your income can accelerate your ability to pay off credit card debts and achieve financial freedom sooner.

9. Use Windfalls Wisely

If you receive a windfall, such as a tax refund, bonus, or inheritance, consider using it to pay off credit card debts. Applying these unexpected funds directly to your debt can significantly reduce your balance and save you money on interest.

Steps to Use Windfalls Wisely:

1. Assess the total amount of the windfall.

2. Allocate the funds towards the highest-interest debt or the smallest balance.

3. Continue making regular payments to maintain momentum.

Using windfalls wisely can provide a substantial boost to your debt repayment efforts.

10. Seek Professional Help

If you’re struggling to manage your credit card debt, seeking professional help from a credit counseling agency or financial advisor can provide valuable guidance and support. Credit counselors can help you create a debt management plan and negotiate with creditors on your behalf.

Steps to Seek Professional Help:

1. Research reputable credit counseling agencies or financial advisors.

2. Schedule a consultation to discuss your financial situation.

3. Follow their recommendations and stick to the debt management plan.

Professional help can provide the expertise and resources you need to effectively pay off credit card debts and regain control of your finances.

Maintaining a Debt-Free Lifestyle

Once you’ve successfully paid off credit card debts, it’s essential to maintain a debt-free lifestyle to prevent future financial challenges. Here are some tips to help you stay on track:

1. Build an Emergency Fund

An emergency fund provides a financial cushion for unexpected expenses, reducing the need to rely on credit cards. Aim to save three to six months’ worth of living expenses in a separate, easily accessible account.

2. Use Credit Cards Wisely

If you continue to use credit cards, do so responsibly by paying off the balance in full each month. Avoid carrying a balance to prevent accruing interest and falling back into debt.

3. Live Within Your Means

Living within your means involves spending less than you earn and avoiding unnecessary debt. Stick to your budget, prioritize savings, and make mindful spending decisions.

4. Monitor Your Credit

Regularly monitoring your credit report and score can help you stay aware of your financial health and catch any errors or potential fraud early. Use free credit monitoring services and review your credit report annually.

5. Set Financial Goals

Setting financial goals provides direction and motivation to maintain a debt-free lifestyle. Whether it’s saving for a home, investing for retirement, or planning a vacation, having clear goals can help you stay focused and disciplined.

Conclusion

Conquering debt and paying off credit card debts is a challenging but achievable goal. By implementing the strategies outlined in this article, you can take control of your finances, reduce your debt burden, and work towards a financially secure future. Remember, the key to success is consistency, discipline, and a commitment to making positive financial choices. Start your journey today and take the first step towards a debt-free life.

2 notes

·

View notes

Text

#sutta stories#budgeting101#budgetingadvice#budgetingtips#new beginnings#money saving#money#financialplanning#finance

3 notes

·

View notes

Text

🚀 Hey everyone! Let's talk about something super important today – LIFE INSURANCE! 🛡️ Did you know it's not just about protecting your loved ones? It's a game-changer for your financial future! 💰 Here's why YOU, especially if you're over 30, should seriously consider getting covered:

Financial Security: Life insurance ensures your loved ones are taken care of financially if something were to happen to you. 💼 Debt Protection: Don't leave your debts behind! Life insurance can cover mortgage payments, loans, and other debts. 🏡 Income Replacement: Ensure your family maintains their standard of living with a steady income stream even if you're not around. 💸 Peace of Mind: Sleep better at night knowing your family's financial future is secure. ☁️ Tax Benefits: Yup, you heard it right! Life insurance can offer tax advantages too. 📊 Long-Term Savings: Some policies even accumulate cash value over time. It's like a financial safety net for your future. 🌟 Affordable Rates: Contrary to popular belief, life insurance doesn't have to break the bank! 💳 Professional Guidance: Don't DIY this crucial decision! Get expert advice from a qualified financial advisor. 🎓 Canadian Regulations: Understand the unique benefits and regulations of life insurance in Canada. 🍁 Plan for the Unexpected: Life is unpredictable. Be prepared for whatever comes your way. ⚡

Ready to take charge of your financial future? Contact me today to explore your options and secure peace of mind for you and your loved ones! 💼🌟🚀

Tejinder Pal Singh: +17786823036 Manmeet Kour: +17789899401

#financialadvisor#finance#bracefinancialservices#financialfreedom#surrey#financialplanning#canada#financial services#life insurance#britishcolumbia#retirementplanning#investmentplanning#butchartgarden#victoria#vancouverisland#malahat#millbay#insuranceadvice#canadafinance#financialsolutions#budgetingtips#healthcare#healthcoverage#healthinsurance#insurancebenefits#lifeinsurance#taxadvantages

3 notes

·

View notes

Text

3 Simple Tips To Save Your Retirement: Strategies For Financial Security! Retirement Planning Canada

youtube

Are you worried about your retirement? Don’t stress! In this video, we share 3 simple tips to save your retirement and ensure financial security. Whether you’re just starting to plan or already close to retirement, these strategies can make a big difference. Please visit my website to get more information: https://www.godfroyfinancial.com/

🔔 Achieve financial freedom in retirement! Subscribe now for proven tax planning strategies, wealth-building insights, & financial tips to reduce your tax burden! / @alynngodfroy

✅ Important Link to Follow

📅 Click here to book an appointment : https://www.godfroyfinancialgroup.com...

✅ Stay Connected With Me.

👉 Facebook: / godfroyfinancialgroup

👉 Linkedin: / alynngodfroy

👉 Website: https://www.godfroyfinancial.com/

📩 For Business Inquiries: [email protected]

==============================

#retirementplanning #canadianfinance #cppbenefits #budgetingtips #investmentstrategies #retirementsecurity

© The Financial Architect for Canadians

#retirementplanning#canadianfinance#cppbenefits#budgetingtips#investmentstrategies#retirementsecurity#Youtube

1 note

·

View note

Text

Mastering Your Finances: A Step-by-Step Guide on How to Create a Budget

Creating a budget is a foundational step towards achieving financial stability and realizing your financial goals. Whether you’re aiming to save for a major purchase, pay off debt, or simply gain better control over your finances, a well-crafted budget is an invaluable tool. This comprehensive guide will take you through the essential steps on how to create a budget, empowering you to make informed financial decisions and secure a more secure financial future.

How to Create a Budget?

1. Set Clear Financial Goals

Before diving into the budgeting process, define your financial goals. Whether it’s building an emergency fund, saving for a vacation, or paying off student loans, having specific and measurable goals will guide your budgeting decisions.

2. Gather Financial Information

Collect information about your income, expenses, and debts. Compile pay stubs, bank statements, bills, and any other relevant financial documents. This step provides a comprehensive overview of your financial situation.

3. Categorize Your Expenses

Divide your expenses into fixed and variable categories. Fixed expenses, such as rent or mortgage payments and insurance, remain consistent each month. Variable expenses, like groceries and entertainment, can fluctuate. Categorizing expenses helps identify areas for potential savings.

4. Calculate Your Monthly Income

Determine your total monthly income, including salary, bonuses, freelance income, or any other sources of income. Understanding your monthly income is crucial for establishing a realistic budget.

5. List Your Fixed Expenses:

Write down all fixed expenses, such as rent or mortgage, utilities, insurance, and loan payments. These are recurring costs that remain relatively constant each month.

6. Identify Variable Expenses

Make a list of variable expenses, including groceries, dining out, entertainment, and transportation. Variable expenses can be adjusted based on your financial goals and priorities.

7. Include Savings and Debt Repayment

Prioritize saving and debt repayment in your budget. Allocate a portion of your income to an emergency fund, or retirement savings, and pay off outstanding debts. Treating savings as a non-negotiable expense ensures consistent progress toward financial goals.

8. Factor in Irregular Expenses

Account for irregular or annual expenses, such as insurance premiums, property taxes, or holiday spending. Divide these expenses by 12 to incorporate them into your monthly budget, preventing unexpected financial strain.

9. Subtract Expenses from Income

To better understand how to create a budget, subtract your total expenses from your total income. The result should ideally be a positive number, indicating that your income covers all your expenses. If the result is negative, adjustments may be needed to align your budget with your income.

10. Adjust and Prioritize

If your expenses exceed your income, revisit your budget and identify areas where you can cut back. Prioritize essential expenses and savings goals while minimizing non-essential spending. Adjusting your budget ensures financial sustainability.

11. Embrace the 50/30/20 Rule

Consider following the 50/30/20 rule, where 50% of your income goes to needs (housing, utilities), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. This rule provides a simple guideline for balanced budgeting.

12. Use Budgeting Tools

Leverage technology to simplify budgeting. Numerous apps and online tools can help you track spending, set financial goals, and visualize your budget in real-time. Choose a tool that aligns with your preferences and makes budgeting more accessible.

13. Track and Review Regularly

Budgeting is an ongoing process, and the answer to “how to create a budget” might differ from person to person. Regularly track your spending against your budget, making adjustments as needed. Reviewing your budget ensures that it remains aligned with your financial goals and adapts to changes in your income or expenses.

14. Emergency Fund Planning

Prioritize building and maintaining an emergency fund within your budget. Having a financial safety net provides peace of mind and protects against unexpected expenses.

15. Seek Professional Advice

If you find budgeting challenging or have complex financial situations, consider seeking advice from financial professionals. Financial advisors can offer personalized guidance to help you achieve your financial objectives.

16. Mindful Spending Habits

Cultivate mindful spending habits as a key aspect of budgeting. Regularly assess your discretionary expenses and identify areas where you can make conscious choices to reduce unnecessary spending. This might include packing lunch instead of dining out or opting for cost-effective entertainment options.

17. Cash Flow Management

Effective budgeting involves managing cash flow strategically. Ensure that you have sufficient funds available for essential expenses and prioritize payment of bills to avoid late fees. Understanding your cash flow cycle helps prevent financial stress and keeps your budget on track.

18. Automate Savings Contributions

Simplify your savings strategy by automating contributions to savings accounts. Setting up automatic transfers ensures that a portion of your income is consistently directed towards savings goals, reinforcing the habit of saving.

19. Celebrate Financial Milestones

Acknowledge and celebrate financial milestones within your budget. Whether it’s reaching a savings goal, paying off a significant portion of debt, or achieving a specific financial target, celebrating successes reinforces positive financial habits and motivates continued progress.

20. Financial Education and Literacy

Invest time in expanding your financial education. Understanding financial principles, investment options, and economic trends empowers you to make informed decisions. Numerous resources, including books, online courses, and workshops, can enhance your financial literacy and contribute to long-term financial success.

Conclusion

Knowing how to create a budget is a fundamental step toward financial empowerment and security. By following these comprehensive steps, you can gain better control over your finances, make informed decisions, and work towards achieving your financial goals. Remember, budgeting is a dynamic process that evolves with your financial journey, so stay committed, stay flexible, and enjoy the benefits of financial well-being.

#BudgetingTips#moneymanagement#SmartSpending#financialwellness#moneymatters#financialliteracy#financialgoals#MoneySmart#wealthbuilding

2 notes

·

View notes

Text

"Mastering Finances: Unlocking Wealth with Our Money-Making Tutorials" ------------------------------------------------------------------------ DM ME (instagram: z3tko) SAME MONEY ONLY FOR 20$ 💳💸

#FinanceTips#MoneyTutorials#FinancialSuccess#WealthBuilding#IncomeBoost#MoneyManagement#FinancialFreedom#InvestingAdvice#BudgetingTips#FinancialEducation#PersonalFinance#MoneyMatters#FinancialEmpowerment#FinancialGoals#MoneySkills#FinancialWisdom#MoneySavvy#MoneyTalks#EconomicEmpowerment#FinancialResources#FinancialJourney

2 notes

·

View notes

Text

💸 Think you're doing okay with money? You might be making these 10 sneaky money mistakes… without even realizing it.

🧠 From invisible spending to mindset traps — these habits are silently draining your wallet.

💥 Ready to break the cycle and finally breathe financially?

👉 Read it now on Medium: https://medium.com/@nbh1370/10-money-habits-that-secretly-keep-you-broke-992bc42eadbf

Read it on Thefinancepen.com https://thefinancepen.com/10-tiny-money-habits-that-are-secretly-keeping-you-broke-and-how-to-break-them/

#MoneyTips#BadMoneyHabits#FinancialFreedom#BudgetingTips#MoneyMindset#StopOverspending#WealthBuilding#MillennialMoney#DebtFreeJourney#SmartSpending#MediumBlog#FinanceAdvice#TheFinancePen#MoneyTruths

0 notes

Text

Unlocking Financial Freedom with WealthGenix: Your Roadmap to Smart Wealth Building

What Is WealthGenix?

WealthGenix is not just another financial planning tool—it’s an intelligent, user-friendly system designed to empower individuals with the strategies and insights necessary to take control of their financial destiny. From budgeting advice and investment education to goal tracking and wealth optimization, it provides a 360-degree approach to building and managing wealth.

The platform is tailored for beginners and seasoned investors alike, offering tools that are intuitive yet powerful enough to yield meaningful results.

💸 Why Building Wealth Is No Longer Optional

With inflation on the rise and the cost of living skyrocketing globally, relying solely on earned income is becoming increasingly risky. Building passive income streams through investing, saving wisely, and leveraging digital assets is no longer a luxury—it’s a necessity.

That’s where WealthGenix steps in. It simplifies complex financial topics like:

Diversified portfolio building

Smart budgeting techniques

Emergency fund strategies

Passive income generation

Long-term retirement planning

All this is delivered through digestible lessons, calculators, and real-time strategy recommendations.

🧠 Education First: Learn Before You Earn

One of the key principles behind WealthGenix is financial literacy. Too many people jump into investments or financial products without fully understanding the risks or potential rewards. WealthGenix offers an in-depth educational library and interactive learning tools that ensure users are informed before making financial decisions.

Whether you're curious about compound interest, stock market fundamentals, or crypto investing, WealthGenix provides reliable and unbiased knowledge.

📈 Tools That Empower, Not Confuse

One of the standout features of WealthGenix is its clear, actionable dashboards. Instead of overwhelming users with jargon and charts, the platform uses AI-driven tools to present tailored recommendations based on your income, spending patterns, and goals.

Users can set financial goals like:

Buying a home

Starting a business

Paying off student loans

Retiring early

And receive customized roadmaps to reach them efficiently.

🛡️ Built with Security & Trust in Mind

When dealing with financial tools, security and transparency are essential. WealthGenix is committed to protecting user data with bank-level encryption and never sells your information to third parties. It’s a platform built on trust, value, and user success.

🌐 The Community Advantage

What makes WealthGenix stand out is its growing community of like-minded wealth builders. From peer insights and success stories to group challenges and accountability partners, it creates a culture of support and empowerment. You don’t have to walk the path to wealth alone.

Many users report a significant mindset shift after joining the platform—thinking long-term, making more strategic choices, and staying motivated by measurable progress.

🏁 Ready to Transform Your Financial Future?

Wealth isn’t built overnight, but with consistent action and the right tools, it’s absolutely achievable. WealthGenix is your partner in that journey, helping you go from confusion to clarity, and from stress to stability.

Start today. Your wealth journey is one smart decision away.

1 note

·

View note

Text

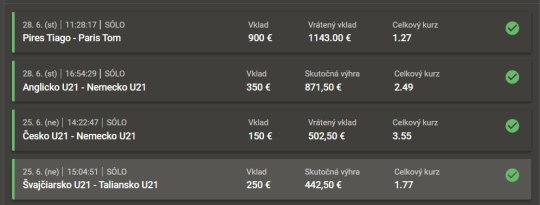

The Emergency Income Kit Review: Need Money Now? Not a Problem

Introduction: The Emergency Income Kit Review

Financial emergencies happen unexpectedly. The need for quick money sources arises from unexpected bills along with medical expenses and typical money shortages. The Emergency Income Kit exists to help users solve such financial problems. Through easy entertainment-based online methods this system promotes its users to earn a minimum daily income of $100. But does it really work? Let’s find out.

Overview: The Emergency Income Kit Review

Vendor: Jono Armstrong

Product: The Emergency Income Kit

Front-end price: $9.97 (one-time payment)

Launch Date: 2025-Apr-02

Niche: Affiliate Marketing, Make Money Online, Coaching / Consulting, Money Making Method

Guarantee: 30-days Money Back Guarantee

Recommendation: Highly recommended

Contact Info: Check

What is The Emergency Income Kit?

The kit provides easy money-making techniques through 28 no-experience-and-investment methods which also have no technical requirement. Users get instant earning results according to the creators through these methods which allow users to make money the same day.

#EmergencyIncomeKit#MoneyNow#FinancialFreedom#QuickCash#IncomeSolutions#EmergencyFunds#MoneyManagement#FinancialHelp#SideHustle#CashFlow#BudgetingTips#IncomeBoost#FinancialLiteracy#MoneyMakingIdeas#EmergencySavings#WealthBuilding#PersonalFinance#FinancialPlanning#IncomeReview#MoneyTips#FinancialSecurity#EmergencyKit#InstantIncome

1 note

·

View note

Text

#FreelancerFinance#BudgetingTips#FreelancerLife#MoneyManagement#FreelanceTips#FinancialFreedom#BudgetPlanning#SelfEmployedSuccess#IncomePlanning#TaxTipsForFreelancers#SideHustleBudget#FreelanceBusiness#SmartBudgeting#WorkForYourself#FreelancerMindset

0 notes

Text

2 notes

·

View notes

Text

Buy Now Pay Later Laptops in San Jose, CA

Need a new laptop in San Jose but short on cash? Try BNPL options with low weekly payments, brand names, and $5,000 limits.

0 notes

Text

🎆 Financial Independence Day: How to Break Free from Debt in 2025

TL;DRDebt freedom isn’t just a dream—it can be your declaration of independence. In this piece, I’ll show you how to break free from debt in 2025 using smart strategies and resources like CuraDebt (Sponsor). Get ready to claim your Financial Independence Day. Ready? It’s Time to Set Yourself Free from Debt Picture this: It’s July 4th. Fireworks are bursting in the sky, but inside, you’re…

#breakfreefromdebt#BudgetingTips#creditrelief#curadebt#debtsettlement#FinancialPlanning#PersonalLoans

0 notes

Text

🏡 Considering a new home or house & land package? Here’s a quick tip to save you stress and costs later: Always confirm what’s included in the price.

It's easy to be charmed by a stunning display home, but the listed price might not cover everything. Are landscaping, fencing, driveways, flooring, or light fittings included? Or will these cost extra after signing? 🤔

Requesting a full price breakdown upfront eliminates hidden fees and surprises. It helps with budgeting and ensures peace of mind about your purchase. ✅

If you're searching for a new home or house & land package and want clarity on costs, we’re here to assist! 🙌

📩 Ready for your next home? DM us today for an accurate price breakdown and honest advice—no surprises later! 💬

#TipThursday#tipthursday#homebuyingtips#houseandland#houseandlandpackages#NewHomeJourney#newhomejourney#NoHiddenCosts#nohiddencosts#firsthomebuyer#BuildSmart#buildsmart#dreamhome#homesweethome#realestateadvice#propertyinvestment#househunting#budgetingtips#homeownership#FutureHomeowners#futurehomeowners#TransparentPricing#transparentpricing#homebuyers#homebuying#firstimehomebuyer#firstimehomeowner#newbuilds#newbuildsaustralia

0 notes