#SecurePayment

Explore tagged Tumblr posts

Text

#GraniteExport#MarbleShipment#IndiaToDubai#StoneExport#GlobalLogistics#Coneio#SeaOne#CrossBorderTrade#ConstructionMaterials#GraniteIndia#MarbleIndia#DubaiImports#SecurePayment#RegulatoryCompliance#InternationalShipping#ExportBusiness#GlobalSupplyChain

0 notes

Text

What is a Proforma Invoice? How to Use It: A Comprehensive Guide for Indian Exporters and Freelancers.

click the link below to learn more

#securepayment#skyeepayment#lowcost#onestopplatform#lessfee#internationalpaymentsolutions#easyinternationalpayment#beonline#entrepreneur#fintech#finance#payments#saas#smb#infinity#skydo#wise

0 notes

Text

🌍✨ Unlock the benefits of the Cameroon e-visa! ✨🌍

Say goodbye to long embassy visits and paperwork hassles! The Cameroon e-visa offers: ✅ Faster processing time – Quick approvals compared to traditional methods 📄 Simplified documentation – Upload your documents online effortlessly 💳 Secure payment system – Make safe payments through a trusted platform 🌍 Convenient online application – Apply anytime, anywhere! 🔄 Multiple entry options – Choose between single or multiple entries

Get your Cameroon e-visa today and enjoy a seamless travel experience! ✈️🌟

#cameroonevisa#evisa#travelcameroon#visafree#onlinevisa#applyevisa#travelwithoutlimits#digitalvisa#traveldocument#easytravel#hasslefreevisa#securepayment#multipleentryvisa#visaapplication#travelguide#quickvisa#touristvisa#businessvisa#africatravel#visasimplified#explorecameroon

0 notes

Text

The Impact of Payment Gateways for E-commerce Websites on Business Scalability

In the rapidly evolving landscape of e-commerce, businesses must leverage every available tool to stay competitive and scalable. One of the most critical components in this toolkit is the payment gateway. Understanding the impact of payment gateways for e-commerce websites on business scalability is essential for any online retailer aiming for growth and success.

What is a Payment Gateway?

A payment gateway is a technology that captures and transfers payment data from the customer to the acquiring bank. It authorizes payments for e-commerce websites, ensuring the transaction is processed securely and efficiently. Payment gateways are pivotal in providing a seamless shopping experience, influencing customer satisfaction and business scalability.

Enhancing Customer Trust and Satisfaction

A robust payment gateway significantly enhances customer trust and satisfaction, which are crucial for business scalability. When customers feel secure about their transactions, they are more likely to complete purchases and return for future transactions.

Secure Transactions

Security is a top priority for online shoppers. Payment gateways ensure that sensitive information, such as credit card details, is encrypted and transmitted securely. This reduces the risk of data breaches and fraud, fostering a trustworthy shopping environment.

Diverse Payment Options

Offering a variety of payment options through a payment gateway caters to different customer preferences, improving the likelihood of completed transactions. This flexibility is essential for attracting a broader customer base, directly impacting the scalability of the e-commerce business.

Streamlining Business Operations

Payment gateways not only enhance customer experience but also streamline business operations, a key factor in scalability. Efficient transaction processing and management systems reduce the workload for business owners and improve overall operational efficiency.

Automated Processes

Payment gateways automate many aspects of the transaction process, such as payment authorization, data encryption, and transaction recording. This automation minimizes errors and saves time, allowing businesses to focus on other critical areas like marketing and customer service.

Simplified Accounting

Integrating a payment gateway with the e-commerce platform simplifies accounting processes. It provides detailed transaction records and reports, making it easier to track sales, manage refunds, and reconcile accounts. Efficient accounting practices are vital for scaling the business smoothly.

Facilitating Global Expansion

The impact of payment gateways for e-commerce websites on business scalability is particularly evident when considering global expansion. A payment gateway enables businesses to accept payments from customers worldwide, breaking down geographical barriers and opening up new markets.

Multi-Currency Support

Payment gateways that support multiple currencies allow businesses to cater to international customers. This capability is crucial for scaling globally, as it simplifies the purchasing process for customers from different regions, increasing the chances of successful transactions.

Compliance with Global Standards

A reliable payment gateway ensures compliance with international payment standards and regulations. This compliance is essential for conducting business across borders, reducing legal risks, and ensuring smooth operations in new markets.

Boosting Sales and Revenue

Ultimately, the impact of payment gateways for e-commerce websites on business scalability translates into increased sales and revenue. By improving customer experience, streamlining operations, and facilitating global reach, payment gateways help businesses grow sustainably.

Reduced Cart Abandonment

A significant issue for e-commerce websites is cart abandonment. A payment gateway that offers a smooth and quick checkout process can reduce cart abandonment rates, directly impacting sales. Features like saved payment information and one-click payments make the purchasing process more convenient for customers.

Increased Conversion Rates

Payment gateways contribute to higher conversion rates by ensuring a secure and efficient transaction process. Customers are more likely to complete their purchases when they trust the payment process and have multiple payment options. Higher conversion rates lead to increased revenue, supporting business scalability.

Conclusion

In conclusion, the impact of payment gateways for e-commerce websites on business scalability cannot be overstated. From enhancing customer trust and streamlining operations to facilitating global expansion and boosting sales, a robust payment gateway is indispensable for any e-commerce business aiming for growth. To stay competitive and scale effectively, e-commerce businesses should invest in a reliable payment gateway solution.

At Shopperbuild, we understand the importance of integrating the right payment gateway to support your e-commerce business’s scalability and success. Learn more about how our solutions can help you achieve your business goals by visiting Shopperbuild.

By prioritizing a reliable payment gateway, you can ensure a seamless, secure, and scalable operation for your e-commerce business, paving the way for sustained growth and success.

0 notes

Text

💻 Need to pay your landline bill online? Look no further than Gotraav's website! 📞💳

👉 Skip the hassle of traditional payment methods and conveniently settle your landline bill with just a few clicks on Gotraav's user-friendly platform. www.gotraav.com

🌟 Secure, reliable, and hassle-free payment experience awaits you at Gotraav. Say goodbye to long queues and hello to convenience!

💻 Visit Gotraav's website today to make your payment and enjoy peace of mind. #OnlinePayment #LandlineBill #Convenience #EasyPayment #Gotraav #SecurePayment #HassleFree #DigitalPayment #BillingSolution #UtilityPayment #QuickPayment #UserFriendly #OnlineTransaction #SaveTime #PayWithEase #TechSavvy #DigitalAge #StayConnected #BillPayment #SmoothExperience #Effortless #OnlineConvenience

#GotraavExperience #DigitalSolution #PaymentPortal #StayConnected #CustomerSatisfaction #TechInnovation #DigitalTransformation #UtilityBills #ConvenientPayment #EasyBilling #EfficientService #TimeSaving

#EasyPayment#Gotraav#SecurePayment#HassleFree#DigitalPayment#BillingSolution#UtilityPayment#QuickPayment#UserFriendly#OnlineTransaction#SaveTime#PayWithEase#TechSavvy#DigitalAge#StayConnected#BillPayment#SmoothExperience#Effortless#OnlineConvenience#GotraavExperience#DigitalSolution#PaymentPortal#CustomerSatisfaction#TechInnovation#DigitalTransformation#UtilityBills#ConvenientPayment#EasyBilling#EfficientService#TimeSaving

0 notes

Text

Heute dürfen Sie bei der ersten Zahlung mit dem revolutionären Zahlungssystem – der „goldgedeckten“ Kreditkarte von EMAS-Technology, in Kooperation mit Mastercard – dabei sein.

Zahlen Sie zukünftig einfach, sicher und international mit Ihrem Golddepot.

Ein besonderes Dankeschön geht heute an unseren neuen Nachbar Peter von #hairbypeter und seinem Team! hairbypeter, Johannesgasse 17, 1010 Wien

0 notes

Text

instagram

#FintechSolutions 💻#B2BSoftware 🚀#SecurePayments 🔒#DigitalFinance 💰#BusinessGrowth 📈#PaymentProcessing ⚡#PayoutManagement 🏦#TechForBusiness 💼#OmegaSoftwares 🔥#InnovationInFintech 💡#FutureOfPayments 🌐#softwarecompany#fintechsoftware#itcompany#softwaresolutions#softwaredeveloper#SoftwareDevelopment#softwareengineering#softwaretesting#Instagram

1 note

·

View note

Text

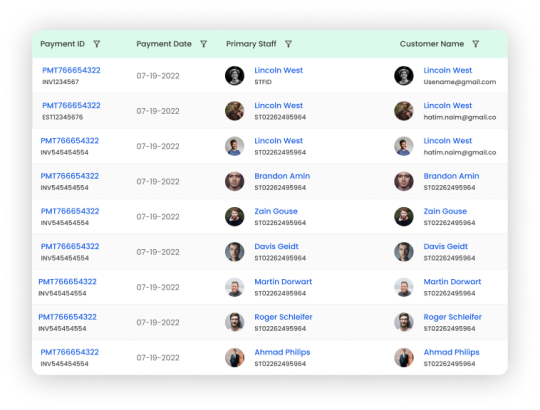

Experience hassle-free payments on TopProz VanLynk. Manage, track, and secure your transactions with ease, all in one convenient platform.

5 notes

·

View notes

Text

Real time payments are here! Say goodbye to waiting! Embrace the future of instant transactions with LightSpeedPay. Get in touch : https://forms.gle/syqTjuJrypPqQ4Ff8

#fintech#paymentsolutions#smallbusiness#instantpayments#businessgrowth#securepayments#entrepreneurlife#digitalpayments#techforgood#paymentgateway#startup#onlinesolutions#businesstips#easytransactions#saas#cashflow#businessowners#innovation#businesssuccess#securetransactions

2 notes

·

View notes

Text

www.peunique.com

Providing Secure & Reliable Payment Gateway Solutions for Every Business

Looking for secure and reliable payment gateway solutions? We provide comprehensive services tailored to your business needs! Whether you're managing an e-commerce store, retail outlet, or offering app-based services, our solutions ensure seamless transactions with maximum security.

Our Payment Services Include: Payment Gateways: Fast, secure, and scalable for online and offline businesses. Payment Links: Easily collect payments through shareable links. API Integration: Streamlined and customizable API solutions for efficient payment processing. Wallet Solutions: Manage payments, recharges, and transfers effortlessly. Retail Payment Solutions: Designed for grocery stores, clothing outlets, department stores, and more. E-Commerce Payment Services: Enhance your customers' experience with faster, secure transactions. Education Payment Gateways: Simplify fee collection and manage academic payments efficiently. App Payment Solutions: Smooth UI/UX and multiple payment modes for app-based businesses. Get started now to boost your business potential with our fast, secure, and trusted payment solutions!

Visit our website: www.peunique.com

1 note

·

View note

Text

Essential features for automotive e-commerce websites include a detailed product catalog with compatibility information and advanced search functionality. Secure payment gateways ensure safe transactions, while integration with inventory management provides real-time stock updates. User accounts offer personalized experiences, and customer reviews and ratings help build trust and inform purchase decisions.

#AutoParts#CarAccessories#Ecommerce#OnlineShopping#AutoRepair#VehicleParts#SecurePayments#CustomerReviews#InventoryManagement#AutoShop#CarMaintenance#AutoEcommerce#CarPartsOnline#ShoppingMadeEasy#PersonalizedExperience

1 note

·

View note

Text

Seamless Granite & Marble Export from India to Dubai with Coneio

Description

Coneio simplifies your granite and marble shipments from India to Dubai with seamless cross-border logistics, global market access, and secure payments. With SeaOne, enjoy hassle-free exports, regulatory compliance, and timely deliveries.

SIGNATURE MEDIA LLC, P.O Box: 49784,DUBAI, UNITED ARAB EMIRATES

9030689222

#GraniteExport#MarbleShipment#IndiaToDubai#StoneExport#GlobalLogistics#Coneio#SeaOne#CrossBorderTrade#ConstructionMaterials#GraniteIndia#MarbleIndia#DubaiImports#SecurePayment#RegulatoryCompliance#InternationalShipping#ExportBusiness#GlobalSupplyChain

0 notes

Text

What is a Proforma Invoice? How to Use It: A Comprehensive Guide for Indian Exporters and Freelancers.

In the fast-evolving world of cross-border business, especially for Indian exporters, freelancers, and startups, clarity and professionalism in transactions are crucial. One of the most important documents in international trade and services is the proforma invoice. If you’re using platforms like Infinity to manage global payments, understanding proforma invoices can help streamline your business, ensure transparency, and build trust with international clients.

What is a Proforma Invoice?

Key Features:

Not a demand for payment: It’s not a payment request or a tax invoice.

Non-binding: It does not have legal standing for accounting or customs purposes.

Details transaction terms: Lists items, quantities, prices, shipping, and payment terms.

Facilitates approvals: Helps buyers arrange for import licenses, foreign exchange, or internal approvals.

Why is a Proforma Invoice Important?

1. Clarity & Transparency

A proforma invoice lays out all the terms of the sale, reducing the risk of misunderstandings between buyer and seller.

2. Facilitates International Trade

Many countries require a proforma invoice to initiate import procedures, open Letters of Credit, or secure foreign currency.

3. Professionalism

Sending a proforma invoice signals to your client that you run a structured, professional business.

4. Smooth Payment Process

Platforms like Infinity allow you to create, manage, and track invoices — including proforma invoices — ensuring a seamless workflow from quotation to payment.

When Should You Use a Proforma Invoice?

Before a Sale is Finalized: When a client requests a quote for goods or services.

For International Shipments: When the buyer needs documentation for import/export clearance.

To Initiate Payment: Some clients require a proforma invoice to process advance payments or open a Letter of Credit.

For Internal Approvals: Large organizations may need a proforma invoice for budgeting or purchase approvals.

What Should a Proforma Invoice Include?

A well-crafted proforma invoice typically contains:

Seller’s and Buyer’s Details: Company name, address, GSTIN (if applicable), contact info.

Invoice Number & Date

Description of Goods/Services: Clear, itemized list with quantities.

Unit Price & Total Price

Currency: Especially important for international transactions (e.g., USD, EUR, GBP).

Delivery Terms: Incoterms (FOB, CIF, etc.), delivery date, shipping method.

Payment Terms: Advance, partial, or after delivery; payment methods.

Validity Period: How long the offer is valid.

Signature/Stamp: For authenticity.

How to Create and Use Proforma Invoices with Infinity

Infinity is designed for Indian businesses, freelancers, and exporters who want to manage international payments and invoicing efficiently. Here’s how you can leverage Infinity for proforma invoices:

1. Effortless Invoice Creation

Infinity’s dashboard allows you to create professional proforma invoices in minutes. You can customize templates, add your branding, and include all necessary transaction details.

2. Multi-Currency Support

With support for 160+ currencies, you can issue proforma invoices in your client’s preferred currency, making it easier for them to process payments and for you to receive funds at competitive FX rates.

3. Seamless Payment Tracking

Once your client accepts the proforma invoice and is ready to pay, Infinity enables you to track payment status in real-time. This transparency helps you plan your deliveries and cash flow.

4. Compliance Made Easy

Infinity ensures all your transactions, including those initiated via proforma invoices, are FIRA-compliant and routed through RBI-authorized banks, making your cross-border business safe and audit-ready.

5. Integrated Workflow

From proforma invoice to payment collection and final commercial invoice, Infinity provides an end-to-end solution — no more juggling spreadsheets or emails.

Step-by-Step: Using a Proforma Invoice on Infinity

Log in to your Infinity account.

Navigate to the Invoicing section.

Select ‘Create Proforma Invoice’.

Fill in client details, item descriptions, pricing, and terms.

Choose the currency and delivery terms.

Preview and send the proforma invoice directly to your client via email or download as PDF.

Track client acceptance and payment status from your Infinity dashboard.

Once payment is received, convert the proforma invoice to a commercial invoice for shipping and compliance.

Best Practices for Proforma Invoices

Be Clear and Detailed: Avoid ambiguity in descriptions and terms.

Set Validity Periods: Prevents confusion about pricing if the deal is delayed.

Use Professional Templates: Enhances your brand image.

Follow Up: After sending, check in with your client to address queries or negotiate terms.

Keep Records: Maintain digital copies for reference and compliance.

Conclusion

A proforma invoice is more than just a quote — it’s a vital tool in international trade and freelance business. With platforms like Infinity, you can create, manage, and track proforma invoices effortlessly, ensuring you get paid faster and with full transparency. Whether you’re a freelancer, exporter, or startup, mastering the use of proforma invoices will help you scale globally, reduce payment friction, and build lasting client relationships.

Ready to streamline your global invoicing and payments? Get started with Infinity today!

#securepayment#skyeepayment#lowcost#onestopplatform#lessfee#internationalpaymentsolutions#easyinternationalpayment#beonline#entrepreneur#fintech#finance#payments#saas#smb#freelancer#Proforma Invoice

0 notes

Text

NOIRE is a payment services and risk management company offering comprehensive merchant services, alternative payment methods and worldwide payment solutions.

#Fintech#DigitalPayments#OnlinePayments#PaymentGateway#MerchantServices#PaymentProcessing#MobilePayments#FintechRevolution#PaymentSolutions#Transaction#SecurePayments#DigitalWallet#CryptoPayments#PaymentInnovation#FintechTrends#Ewallet#ContactlessPayments#PaymentSecurity#OnlineTransactions#DigitalBanking#PaymentGatewayIntegration#GlobalPayments#SeamlessPayments#FintechIndustry#PaymentsIndustry#PaymentTech#PaymentSystem#DigitalFinance

1 note

·

View note

Text

Accepting Electronic Checks in Your Small Business: A Comprehensive Guide

Introduction:

In the ever-evolving landscape of business and finance, staying adaptable and responsive to emerging payment trends is crucial for the success of small businesses. One such trend that has gained traction and offers an array of benefits is the acceptance of electronic checks, commonly referred to as eChecks. If you're a small business owner looking to broaden your horizons and enhance your payment options, this comprehensive guide is here to demystify eChecks, providing insights into what they are and, most importantly, how to seamlessly integrate them into your business operations.

What is an eCheck?

An electronic check, or eCheck, is a digital version of a traditional paper check. It enables businesses and customers to conduct transactions electronically, making it a convenient and cost-effective payment method. Instead of writing a physical check, the payer enters their banking information online, and the funds are transferred directly from their bank account to the recipient's account.

Why Accept eChecks?

Cost-Effective: eChecks are often cheaper than credit card transactions because they have lower processing fees, making them an attractive option for small businesses.

Reduced Fraud Risk: Electronic checks are more secure than paper checks as they involve encryption and authentication processes, minimizing the risk of fraud.

Faster Settlement: eChecks typically clear faster than paper checks, improving your cash flow.

Convenience: eChecks are convenient for both you and your customers, as they can be processed online, reducing the need for physical paperwork.

How to Accept eChecks in Your Small Business:

Now that you understand the benefits of accepting eChecks, let's explore how to implement this payment method in your small business.

1. Choose an eCheck Service Provider:

Start by researching eCheck service providers. Look for companies that offer competitive pricing, robust security features, and user-friendly interfaces. Some popular eCheck service providers include:

Compare the fees, features, and compatibility with your existing systems to make an informed choice.

2. Set Up Your Business Account:

Once you've selected an eCheck service provider, create a business account. You'll need to provide your business information, banking details, and contact information.

3. Integrate eCheck Payment:

Depending on your chosen provider, you may need to integrate eCheck payment into your website or point-of-sale system. Many providers offer plugins or APIs to facilitate this integration. Ensure that the payment process is user-friendly and straightforward for your customers.

4. Educate Your Customers:

Inform your customers that you now accept eChecks as a payment option. Include this information on your website, invoices, and any other customer-facing materials. Provide clear instructions on how they can make payments using eChecks.

5. Test the Process:

Before fully launching eCheck payments, conduct a few test transactions to ensure everything is functioning correctly. Verify that funds are deposited into your business account as expected.

6. Monitor Transactions:

Regularly monitor your eCheck transactions and reconcile them with your accounting records. This will help you stay on top of your finances and quickly identify any discrepancies.

7. Maintain Security:

Security is paramount when dealing with electronic payments. Ensure that your eCheck service provider has robust security measures in place to protect sensitive customer data and financial information.

8. Provide Excellent Customer Support:

Offer reliable customer support for any payment-related inquiries or issues. Promptly address customer concerns to build trust and confidence in your eCheck payment process.

Conclusion:

Embracing eChecks as a payment option in your small business can enhance your payment processing capabilities, reduce costs, and improve customer satisfaction. By following these steps and choosing a reputable eCheck service provider, you can seamlessly integrate eCheck payments into your business operations and provide added convenience to your customers. Stay up to date with the latest payment

#echeck#high risk merchant account#payment processor#echecks#echeck payment processing solutions#echeck payment#credit card#merchant account#merchant services#electronic#ECheckPayments#SmallBizPayments#ElectronicChecks#PaymentProcessing#DigitalChecks#SmallBusinessFinance#SecurePayments#BusinessPayments#FintechSolutions#ConvenientPayments#MoneyManagement#PaymentSolutions#ECommercePayments#CashlessTransactions#BusinessTransactions#FinancialTech#PaymentSecurity#CustomerPayments#OnlinePayments

4 notes

·

View notes

Text

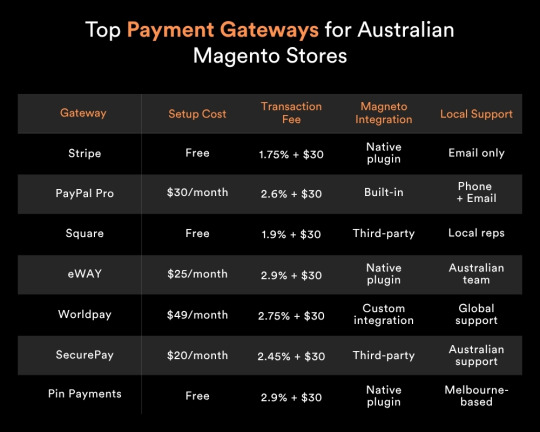

Top Payment Gateways for Australian Magento Stores

#magento#magento payment#payment gateway#paypal#square#eWAY#stripe#worldpay#securepay#pin payments#securepayments

0 notes