#Send Bitcoin from Cash App to Coinbase

Explore tagged Tumblr posts

Text

What’s the Maximum Limit to Cash App Bitcoin Transactions?

Cash App has become one of the easiest ways to buy, sell, and send Bitcoin, but many users wonder about its transaction limits. Whether you're a beginner or an experienced trader, understanding these limits is crucial. In this guide, we'll break down everything you need to know about Cash App Bitcoin transaction limits and how you can increase them.

Understanding Cash App Bitcoin Transactions

Cash App allows users to buy, sell, send, and withdraw Bitcoin. Unlike traditional bank transfers, Bitcoin transactions on Cash App involve blockchain processing, which means there are specific rules and limits.

Why Does Cash App Have Bitcoin Transaction Limits?

There are several reasons why Cash App imposes Bitcoin transaction limits:

Regulatory Compliance: To comply with financial regulations.

Fraud Prevention: Limits reduce the risk of fraudulent transactions.

Security Measures: Helps protect users from unauthorized transactions.

Cash App Bitcoin Sending Limits

Cash App sets limits on the amount of Bitcoin users can send. As of 2024:

Cash App Bitcoin Sending Daily Limit: $2,500 worth of Bitcoin

Cash App Bitcoin Sending Weekly Limit: $5,000 worth of Bitcoin

Cash App Bitcoin Sending Monthly Limit: Varies based on account verification status

Cash App Bitcoin Receiving Limits

Unlike sending limits, Cash App does not impose restrictions on receiving Bitcoin. However, transaction confirmations depend on the Bitcoin network.

Cash App Bitcoin Withdrawal Limits

If you want to transfer Bitcoin to an external wallet, you must adhere to Cash App’s withdrawal limits:

Cash App Bitcoin Withdrawal Daily Limit:1 BTC

Cash App Bitcoin Withdrawal Weekly Limit:5 BTC

How to Increase Your Cash App Bitcoin Limits?

To increase your Cash App Bitcoin limits, follow these steps:

Verify Your Identity: Provide your full name, date of birth, and SSN.

Enable Two-Factor Authentication: Adds an extra layer of security.

Increase Account Usage: Regular activity can help raise limits.

Timeframe for Cash App Bitcoin Transactions

Bitcoin transactions on Cash App usually take:

Sending BTC: 10-30 minutes for confirmations

Receiving BTC: Varies based on network congestion

Withdrawing BTC: 24-48 hours, depending on security verification

Cash App Bitcoin Transaction Fees

Cash App charges two types of Bitcoin fees:

Network Fees: Varies based on blockchain traffic

Service Fees: Calculated at the time of transaction

Cash App Bitcoin Limits vs. Other Crypto Platforms

Platform

Daily Sending Limit

Daily Withdrawal Limit

Cash App

$2,500

0.1 BTC

Coinbase

No limit

Varies

Binance

100 BTC

100 BTC

Common Issues with Cash App Bitcoin Transactions

Transaction Pending: Network congestion may delay confirmations.

Transfer Failed: Ensure your account has sufficient balance.

Limit Reached: Upgrade your account verification.

How to Track Your Bitcoin Transactions on Cash App?

You can track your Bitcoin transactions by:

Opening Cash App

Navigating to the "Bitcoin" tab

Selecting "Transaction History"

Is There a Way to Bypass Cash App Bitcoin Limits?

No legitimate method exists to bypass Cash App’s limits. Attempting to do so can lead to account restrictions or bans.

Conclusion

Understanding Cash App Bitcoin transaction limits is essential for managing your crypto assets efficiently. By verifying your account and following the necessary steps, you can increase your limits and optimize your transactions. Stay informed, and always checks for updates on Cash App’s policies.

3 notes

·

View notes

Text

Bolt’s Ryan Breslow pins his hopes on a new app that takes on Coinbase, Zelle, and PayPal

Ryan Breslow is officially back.

While the founder of one-click checkout company Bolt re-assumed its helm as CEO in March, Breslow is unveiling Wednesday a new “superapp” that he hopes will formally mark his return as the fintech’s leader. He describes the new product as “one-click crypto and everyday payments” in a single platform, in an exclusive interview with TechCrunch.

The controversial entrepreneur famously stepped down in January 2022 from the San Francisco-based company he started in 2014 after dropping out of Stanford. In recent years, Breslow has been the target of more than one investor lawsuit and faced allegations that he misled investors and violated security laws by inflating metrics while fundraising the last time he ran the company.

Breslow acknowledges that Bolt’s revenue has not been robust in recent years. But he hopes to change that with this new consumer app, which he ambitiously hopes will serve as “a centralized and personalized hub for financial services.”

The app at once competes with a number of other companies such as crypto exchange Coinbase, payments platform Zelle, and PayPal. Its advantage, Breslow claims, is the ability to do what all these others do from one place via mobile.

For example, the app will allow users to buy, sell, send, and receive major cryptocurrencies such as Bitcoin, Ethereum, USDC, Solana, and Polygon directly within the app. Users are provisioned an on-chain balance powered by Zero Hash and will be able to see their balance in real time, Breslow says.

“I founded Bolt 11 years ago to build the easiest app to buy, sell, and send crypto. I believe this still hasn’t been done well in the marketplace. Today marks a significant day: the return of that original vision,” said Breslow. “We call it ‘Coinbase for the 99%’ who may not be the most technical, but still want to participate in the buying and selling of crypto.” (Bolt in 2022 paid $1.5 billion for cryptocurrency payments company Wyre. It started out as an “easy way to buy, sell, and send crypto” before pivoting to build one-click checkout first.)

Breslow is also hoping to pick up where Zelle left off with the shutdown of its standalone app. With Bolt’s new offering, users can process peer payments “with just a single click” within its app. With Zelle, users can only send payments to peers through banking apps.

On top of that, Bolt has partnered with Midland States Bank to now also offer a debit card that features a rewards program, including up to 3% direct cash back on eligible purchases and up to 7% in Love.com store credits. (Love.com is another startup founded by Breslow in 2023 that is focused on health and wellness. He remains its CEO.)

As Bolt doesn’t offer banking services, users will have to transfer money from another bank account into this one to fund purchases with the debit card.

And lastly, the new app also provides real-time order tracking for users — something other companies such as Klarna offer in their app, as well.

The app is available today in iOS and will soon be available in the Google Play store. Once downloaded, users will be added to a waitlist with iOS users being the first to get off the waitlist.

“Working nights and weekends” The new “superapp” was built within just six months, Breslow claims. Justin Grooms (Bolt’s president and former interim CEO) and Kartik Ramachandran (Bolt’s chief product officer) began work on the app before Breslow was reinstated. Breslow helped advise them during the months prior to his reinstatement.

“Our team has been working nights and weekends to get this ready in time,” Breslow said. Presently, Bolt has about 140 employees.

Despite lackluster revenue growth, Breslow claims that Bolt has managed to still grow in terms of users — with a two-sided network of tens of millions of U.S. shoppers and “hundreds” of merchants such as Revolve and Kendra Scott.

Bolt’s ARR stood at about $28 million with $7 million in gross profit as of the end of March 2024, tech publication Newcomer reported last year.

“Prior to my return, our revenue did not grow much and we haven’t closed as much business as we’d like. We don’t think the company was run as well as it could have been. And that’s something I’m going to change very quickly,” Breslow told TechCrunch. “However, our platform kept on enrolling shoppers and attracting network growth. When I left, it was at 10 million. Now our total shopper network is 80 million in the U.S. and even larger globally.”

He’s hoping to turn that network into revenue for Bolt by earning money from interchange fees for every debit card transaction and charging fees for the purchase and sale of crypto.

“We already have a large trove of data users have provided that has been verified and charged successfully,” he said.

Settling lawsuits The fintech company last year was reportedly trying to raise $450 million in an unusually structured deal that would have valued it at $14 billion. That deal raised questions over its unusual use of $250 million in “marketing credits” and lack of confirmation from an investor mistakenly identified as its lead.

Some of Bolt’s investors, including BlackRock and Hedosophia, sued to block the round, Forbes reported, but that was voluntarily dismissed by all parties, Bolt announced in March.

Today, Bolt is in “early conversations” on a new round that Breslow projects could close “in the mid to near future.”

Breslow was also previously sued by former investor Activant Capital over a $30 million loan that the founder had taken out. Activant claimed Breslow saddled the startup with $30 million in debt by borrowing that amount and then defaulting, with company funds used to pay it back.

The case was eventually settled, with Bolt agreeing to repurchase Activant’s shares for $37 million last year.

Speaking at Fintech Meetup in Las Vegas in March, Breslow defended the loan, framing it as an act of loyalty to Bolt rather than the self-dealing the Activant lawsuit alleged it was.

“I’ve had a tremendous amount of decline over the last three years and have been winning back the trust of judges, investigators, and our team, so it’s been incredibly challenging, but it’s been a remarkable learning experience,” he told TechCrunch. “I’ve learned more in these last three years than in the 10 years prior to that.”

He added: “And even though it’s been challenging, I couldn’t be more excited about the opportunity in front of us. I feel so grateful that our company has weathered the storm.”

Bolt, which provides software to retailers to speed up checkout, raised around $1 billion in total venture-backed funding and at one time was valued at $11 billion. Investors include funds and accounts managed by BlackRock, Schonfeld, Invus Opportunities, CreditEase, H.I.G. Growth, and Moore Strategic Ventures, among others.

0 notes

Text

The Truth about Cash App’s Bitcoin Purchase & Withdrawal Limits in 2025

As Bitcoin continues its mainstream adoption, Cash App remains one of the most accessible platforms for buying, selling, and withdrawing Bitcoin in the United States. In 2025, Cash App has implemented updated limits that affect how users interact with Bitcoin. These changes are crucial for both novice and seasoned crypto users who rely on Cash App for daily transactions and long-term investments.

What Are Cash App’s Bitcoin Purchase Limits in 2025?

Cash App sets clear and defined purchase limits to regulate the buying behaviour of its users while complying with regulatory standards.

Cash App Daily Bitcoin Purchase Limit: As of 2025, users can buy up to $100,000 worth of Bitcoin per 24-hour period. This limit applies to verified users only. If you haven't verified your identity, your limit will be significantly lower, generally capped around $2,500 to $5,000 per day.

Cash App Weekly Bitcoin Purchase Limit: In addition to the daily limit, Cash App enforces a weekly purchase limit of $250,000 for verified accounts. These high limits reflect Cash App’s push towards accommodating more serious investors and crypto traders.

Cash App Monthly Bitcoin Purchase Limit: Cash App enforces a monthly limit of $750,000 for verified accounts. These high limits reflect Cash App’s push towards accommodating more serious investors and crypto traders.

Note: These limits reset on a rolling basis, not a calendar week or month. That means if you hit your limit on a Tuesday, you’ll be able to purchase more the following Tuesday.

Cash App Bitcoin Withdrawal Limits in 2025

Understanding the withdrawal limits is just as crucial as knowing the purchase limits, especially for users who wish to move their Bitcoin to external wallets.

Cash App Daily Bitcoin Withdrawal Limit: Cash App allows up to $10,000 worth of Bitcoin to be withdrawn every 24 hours for fully verified users. This includes sending Bitcoin to another wallet or transferring it to a crypto exchange like Coinbase or Binance.

Cash App Weekly Bitcoin Withdrawal Limit: Users can withdraw up to $50,000 worth of Bitcoin within a 7-day period. These limits are automatically enforced and apply whether you’re transferring Bitcoin to a personal wallet, an exchange, or another user.

How to Increase Your Bitcoin Limits on Cash App?

To access the maximum Bitcoin purchase and withdrawal limits, your Cash App account must be fully verified.

Verification Process Includes:

Providing your full legal name

Submitting your date of birth

Verifying your Social Security Number (SSN)

Uploading a government-issued photo ID

Taking a selfie for identity confirmation

Once verified, most users are upgraded within 24 to 48 hours. Unverified users are limited to much lower thresholds, generally below $1,000 per week for both purchasing and withdrawals.

Why Does Cash App Impose Bitcoin Limits?

There are several reasons behind Cash App’s Bitcoin limits:

Regulatory Compliance: To adhere to U.S. regulations set by FinCEN and other agencies.

Fraud Prevention: To reduce the risk of fraudulent transactions or misuse of accounts.

Liquidity Management: Cash App must ensure it has enough Bitcoin liquidity to process all user transactions smoothly.

Cash App Bitcoin Transaction Fees in 2025

While limits are crucial, so are fees, which can impact how often or how much you buy and sell.

Standard Bitcoin Purchase Fees: Cash App applies a small service fee when you buy or sell Bitcoin. This fee is typically 1.75% to 2.25% of the transaction value, depending on market volatility.

Bitcoin Withdrawal Fees: Cash App charges a network fee when withdrawing Bitcoin, which is dynamically calculated based on blockchain congestion. In 2025, the average network fee ranges between $2 to $8 per transaction.

Can You Withdraw Bitcoin Instantly from Cash App?

Yes, but with conditions. Cash App offers instant Bitcoin transfers to external wallets; however, you may need to enable Lightning Network withdrawals for faster transactions.

Lightning Network withdrawals are:

• Instantaneous

• Low-cost

• Capped at smaller amounts, generally under $999 per transaction

For larger amounts, traditional on-chain withdrawals are used and subject to standard confirmation times.

Tips to Optimize Your Cash App Bitcoin Experience

To get the most out of your Cash App Bitcoin usage, consider the following tips:

Verify Your Identity: Unlock higher limits and faster withdrawals by completing the identity verification process.

Use the Lightning Network: For small, instant payments, the Lightning Network is faster and cheaper.

Plan Larger Transactions: If you're approaching your weekly or daily limits, split your purchases strategically across days.

Monitor Fees: Avoid high network fees by transacting during low-traffic periods, usually late at night or on weekends.

Enable Notifications: Set alerts for price dips or spikes, helping you make informed buying decisions.

Common Issues with Bitcoin Limits on Cash App

Even verified users may encounter issues when trying to purchase or withdraw Bitcoin.

Exceeded Limits: Attempting to go beyond your daily or weekly cap will result in a declined transaction. You’ll need to wait for the limit to reset.

Pending Transactions: Sometimes purchases or withdrawals are delayed due to blockchain congestion or internal reviews.

Verification Delays: Incomplete or unclear identification documents can delay the verification process, keeping you stuck with lower limits.

FAQs about Cash App’s Bitcoin Limits in 2025

Can I raise my Bitcoin limits beyond the maximum stated?

No, the posted limits are absolute caps for each verification level. There are no higher tiers currently available.

Are Bitcoin limits the same for business accounts?

Cash App for Business does not support Bitcoin transactions at this time. All Bitcoin activity must be done through a personal account.

How often do the limits reset?

Limits reset on a rolling basis—24 hours for daily, 7 days for weekly limits.

Can I buy and withdraw Bitcoin in the same day?

Yes, but keep in mind that both purchases and withdrawals are separately capped. You can hit your Cash App Bitcoin purchase limit and still have remaining withdrawal capacity.

Conclusion

Cash App continues to be a powerful and user-friendly platform for Bitcoin transactions. With generous purchase and withdrawal limits for verified users, it competes strongly with traditional exchanges. Staying within the limits, planning your transactions, and verifying your identity are key steps to optimizing your crypto experience on Cash App in 2025.

1 note

·

View note

Text

How to Cash Out from Coinbase: A Comprehensive Guide

In today's digital age, cryptocurrencies have become increasingly popular as a means of investment and financial transactions. Among the various platforms available, Coinbase stands out as one of the leading cryptocurrency exchanges, providing users with a secure and user-friendly interface for buying, selling, and storing digital assets. However, for many individuals, the process of cashing out from Coinbase can seem daunting. Fear not, as we present to you a comprehensive guide on how to navigate the intricacies of cashing out from Coinbase to maximize your returns.

Understanding Coinbase

Before delving into the cash-out process, it is essential to understand the fundamentals of Coinbase. Founded in 2012, Coinbase has emerged as a trusted platform for both novice and experienced cryptocurrency enthusiasts. With its intuitive interface and robust security measures, Coinbase has garnered a large user base, making it a preferred choice for buying, selling, and storing various cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and more.

Creating Your Coinbase Account

The first step towards cashing out from Coinbase is to create an account if you haven't already done so. Simply visit the Coinbase website or download the mobile app, and follow the easy sign-up process. You'll be required to provide some basic information and verify your identity to comply with regulatory requirements.

Verifying Your Identity

As part of Coinbase's commitment to security and regulatory compliance, users are required to verify their identity before engaging in certain transactions, including cashing out. This typically involves uploading a government-issued ID, such as a driver's license or passport, and completing a few additional steps for identity verification.

Securing Your Account

Once your account is set up and verified, it's crucial to take proactive steps to secure your Coinbase account. This includes enabling two-factor authentication (2FA), using a strong and unique password, and regularly monitoring your account for any suspicious activity. By taking these precautions, you can safeguard your funds and personal information from unauthorized access.

Cashing Out from Coinbase

Now that your Coinbase account is set up and secure, it's time to explore the various options for cashing out your cryptocurrency holdings. Coinbase offers several withdrawal methods, including bank transfers, PayPal, and cryptocurrency transfers to external wallets.

Bank Transfers

One of the most common methods for cash out from Coinbase is to initiate a bank transfer. To do this, navigate to the "Withdraw" or "Sell" section of your Coinbase account, select the desired cryptocurrency you wish to cash out, and choose the option to withdraw funds to your linked bank account. Follow the prompts to enter the withdrawal amount and complete the transaction.

PayPal

For users looking for a convenient and speedy cash-out option, Coinbase also offers the ability to withdraw funds to a PayPal account. Simply link your PayPal account to your Coinbase account, select the cryptocurrency you wish to withdraw, and choose the option to withdraw to PayPal. Enter the withdrawal amount and confirm the transaction to initiate the transfer.

Cryptocurrency Transfers

Alternatively, if you prefer to maintain full control over your cryptocurrency holdings, you can transfer your funds from Coinbase to an external wallet. This allows you to store your digital assets securely offline and access them whenever you choose. To initiate a cryptocurrency transfer, simply navigate to the "Send" or "Transfer" section of your Coinbase account, enter the recipient's wallet address, specify the amount to transfer, and confirm the transaction.

Tax Implications

It's important to note that withdrawal money from Coinbase may have tax implications depending on your country of residence and the applicable tax laws. In many jurisdictions, cryptocurrency transactions are subject to capital gains tax, and it's essential to report any gains or losses accurately to avoid potential penalties. Consult with a tax professional or accountant for personalized advice on how cashing out from Coinbase may impact your tax situation.

Conclusion

In conclusion, withdrawaling money from Coinbase can be a straightforward process when approached with the right knowledge and preparation. By understanding the fundamentals of Coinbase, securing your account, and exploring the various cash-out options available, you can maximize your returns and achieve your financial goals. Remember to stay informed about any tax implications and seek professional advice if needed. With these tips in mind, you'll be well-equipped to navigate the world of cryptocurrency and make the most of your investments.

0 notes

Text

Buy Verified Coinbase Account

Buy Verified Coinbase Account

If you have a Coinbase Pro account, then you can buy and sell cryptocurrency. The Coinbase Pro platform has an easy design that makes it easy to use. It also allows users to buy and sell Bitcoin, Ethereum, Litecoin and other cryptocurrencies through their app or website using the same account they use for trading cryptocurrencies on exchanges like Binance or Hudoba.

Coinbase Pro takes security very seriously so they have implemented several measures in order to ensure that your funds remain safe while using their platform: Buy Verified Coinbase Account

Buy US Verified Coinbase Accounts :

Buy Verified Coinbase Account. Buying or selling cryptocurrencies through Coinbase requires a personal account address in one of the supported countries and valid bank account or other payment method. If you live in a country where Coinbase is not available, we recommend purchasing Ethereum Coin (ETH) directly from an exchange site. For selling your Ethereum Coin to us, you can use any supported cryptocurrency such as Bitcoin (BTC), Litecoin (LTC), Ethereum (ETH) or Binance Coin (BNB). You may also make cash deposits at thousands of MoneyGram locations worldwide using dollars only. Buy Verified Coinbase Account

Use this method if you are a coin base pro trader. It is not recommended for everyday traders because it may get banned from coinbase.

What kind of us verified coinbase accounts buy from you?

Coinbase Pro (formerly called “Coinbase Vault”) — This is the most popular option. It lets you buy and sell bitcoins and other cryptocurrencies, but not other digital assets like bitcoin cash or ethereum classic. Buy Verified Coinbase Account

Coinbase Prime — A version of the above, which adds more advanced features and security measures to your account. You can also use this service if you’re an institution or hedge fund wanting to trade large amounts of crypto at low fees — the minimum investment per trade is $10 million worth of coins or tokens.

Coinbase Institutional Accounts — For institutions such as banks and brokerages who want to set up their own cryptocurrency trading desk with access to high-liquidity pools that pool together all currencies being traded on Poloniex exchange; these accounts are unavailable through traditional means (i.e., via a software install) but can be obtained through one of two methods: either signing up for an invitation only program run by select partners who have partnered with reputable firms in this space; OR going through one of these partners directly themselves Buy Verified Coinbase Account

How do you fully verify crypto?

There is no surefire way to fully verify crypto, as the underlying technology is still in its early stages of development. However, there are a few things you can do to ensure that your investment is as safe as possible:

1. Do your research. Make sure you understand the technology behind the crypto you’re interested in, and the potential risks involved. Buy Verified Coinbase Account

2. Use a reputable exchange. Choose an exchange that has a good reputation and is well-regulated.

3. Store your crypto in a secure wallet. This will help protect your investment from hackers and other risks.

How do you get a verified coinbase account?

To get a verified Coinbase account, you will need to provide the following information: Buy Verified Coinbase Account

A verified phone number. This is the only way that Coinbase can confirm your identity and ensure that you are who you say you are.

A verified address. If your name is not on an item (such as a check or credit card), then it’s important for them to have an address so they can send money back out of their account if necessary.

An email address associated with this account (this should be a working one; otherwise, they’ll just send emails back). If something goes wrong with this one at some point in time, it could cause problems down the road when trying to get refunds or help from customer service agents at Coinbase themselves! A good rule of thumb here would be: “If I don’t need my identity verified by someone else before handing over sensitive documents like passports,” then why bother doing so?” Buy Verified Coinbase Account

get verified coinbase account

If you are looking to buy a verified Coinbase account, then this is the perfect place for you. We have been in business since 2017 and we have helped thousands of people buy their first cryptocurrency with usa Verified Coinbase accounts are important for all businesses because they give the impression of legitimacy which increases trust in their brand. This makes it easier for people who know about cryptocurrency to buy from you instead of shopping elsewhere where they might be less informed or skeptical about the merchant’s background or reputation. Buy Verified Coinbase Account

The best part about buying verified coinbase accounts is that they will have a positive impact on your bottom line by increasing sales conversion rates (the percentage of visitors who convert into paying customers).

You can have 2 verified Coinbase accounts at the same time.

For example, if you have an account with verified Coinbase Pros, then it’s possible for you to add another verified account from them and link them together as a team. However, this is not possible with regular accounts as there is no way of linking two regular accounts together (you will only be able to link one).

Yes, you can have 2 verified coinbase accounts. You can have a personal and a business account. Even better, you will be able to use these 2 accounts with the same name!! Buy Verified Coinbase Account

1 note

·

View note

Link

#How to use a Cash App at McDonald’s?#Why is my bank declining my cash app payment?#How to stop recurring payments on cash app#Can you use a cash app card at a gas station?#How to unmerge Cash App accounts#Cash App Web Receipt#Cash App Transaction Failed#trying to add cash to cash app transfer failed#why cash app payment failed#why does cash app keep failing#can you do direct deposit with cash app#direct deposit cash app#cash app direct deposit limit#how do you set up direct deposit on cash app#how to get cash app direct deposit#cash app direct deposit info#what time does cash app deposit#Cash App Security Lock#Send Bitcoin from Cash App to Coinbase#direct deposit for cash app#direct deposit with cash app#how does cash app direct deposit work#how to direct deposit with cash app#can you get direct deposit to cash app#can you use cash app for direct deposit#Cash App Not Working#How To Get A Card On Cash App#How To Receive Money From Cash App#How to Send Bitcoin From Cash App#How to get free money on Cash App

2 notes

·

View notes

Text

How To Send Bitcoin From Cash App To Coinbase?

If you are in the market for a new mobile wallet, you've probably wondered how to use it. This article will explain how to use this app and get the money you've earned in the crypto world. First, make sure you're using an Android or iOS device. Once you've downloaded the app, log in to your Coinbase account. Next, select the "Transactions" tab and select "Send Bitcoin." Follow the on-screen instructions to complete the transaction.

If you're in the U.S., you can use Cash App to purchase bitcoin. It's a simple and secure way to make a payment. You can either scan a QR code or enter your Bitcoin address. After that, you'll need to confirm your social security number, address, birth date, and email address. You'll also need to verify your identity before making a withdrawal. You'll also need to confirm your home address and identify your income.

You can contact Coinbase's customer support team right from the Coinbase app if you have an issue. Fortunately, you can also get help right from the app. You can chat with a customer support representative in real-time. You can also use the Cash App to send bitcoin to Coinbase. Moreover, you can buy more coins on Coinbase's exchange using the same cash. And, if you're using the Cash App with your mobile device, you'll be able to make payments to Coinbase in just a few seconds.

Can I send Bitcoin from Cash App to Coinbase?

In addition to using the Coinbase app, you can send your Bitcoin from Cash App to Coinbase. First, you need to have Bitcoin on your Cash App wallet. You can send your Bitcoin from Cash App to Coinbase through Coinbase or Bittrex. To send your Bitcoin, you need to have the recipient's wallet address. Enter it into the app, and you're good to go! You'll receive a receipt for the amount of your bitcoin.

As for the security of your funds, you should use a hot wallet to store your cryptocurrency. Coinbase has a security system that protects your coins. You can add your card and choose whether or not to allow instant payments. You can also receive your funds through an on-chain wallet via your web browser, mobile device, or home. Then, you can send your bitcoins to your friends and family using any of these methods.

Once you've completed the Cash App bitcoin verification process, you can sell your bitcoins for cash on any cryptocurrency exchange. You can use the funds for more cryptocurrency or use them to transfer them to your bank account. In some cases, you can sell any number of your cryptocurrencies for cash. However, you must make sure that you have enough money to pay the withdrawal fee. If you're still unsure, you should contact a reputable exchange to ensure the transfer smoothly.

Another way to send Bitcoin from Cash App to Coinbase is to link to your Coinbase account. Once you've done this, you can send your Bitcoin from the Cash App to your Coinbase account and receive it in a few minutes. However, you should sign up for a Coinbase account before you start the transfer. To start using Coinbase, go to Wallet on your Cash App and tap the "+" icon.

How to Transfer Bitcoin From Cash App to Coinbase?

If you are unfamiliar with Cash App, it is a cryptocurrency wallet where you can send and receive digital currency. To make the transaction, you first need to verify your account. Then, enter the recipient's name, email address, and Wallet Address to complete the transfer. Once you have confirmed the address, you can send your recipient their bitcoin. If you want to send your bitcoins to friends and family, you can also use the Coinbase app.

You will need to download Coinbase and log in to your Cash App account to make the transaction. After that, log into your Coinbase account and select 'Sell'.

Enter the amount of Bitcoin you want to withdraw and click "Send."

Within a few minutes, the transaction will be confirmed.

The confirmation time will vary depending on the amount of traffic on Coinbase's servers.

Then, you can transfer your Bitcoin to your Coinbase account.

How to Send Bitcoin From Cash App to Another Wallet?

To send Bitcoin from a Cash App to another wallet, first, you have to verify your account. You can do this by entering your bitcoin address or scanning a QR code. Once you verify your account, you can enable blockchain transfers. Once enabled, you can select the amount you want to send and the speed you want. You can also confirm the transaction with a PIN. You will receive a confirmation email when you have successfully sent Bitcoin.

To send Bitcoin from the Cash App to another wallet, follow the steps below.

First, you must verify your identity using the Cash App. After that, you can either scan the QR code or manually enter the external wallet address.

Make sure you have a sufficient amount of bitcoin to send.

After the verification process is complete, you can send bitcoin to the recipient's Wallet.

Remember that this process can take a few days or even weeks.

To purchase bitcoin from Cash App, you need funds. To do this, you can add funds to your account. You will need your Bitcoin address and a valid bank account. Next, you need to confirm your name, social security number, date of birth, and home address. Once you have verified your account, you can start purchasing bitcoin and sending it to your friend. You can even send Bitcoin to your friends using the Cash App.

#Does Coinbase Accept Cash App?#Can I send Bitcoin from Cash App to Coinbase?#Can I transfer Bitcoin from Cash App?#How to send bitcoin from Cash App to another wallet?#How To Send Bitcoin From Cash App To Coinbase?#How To Send Transfer Crypto Bitcoin Cash App Coinbase?

2 notes

·

View notes

Text

Cash App Cash-Out Failed? Here's What to Do?

There are many possible reasons why you may experience Cash App cash-out failed. Your card may be expired, or you might have entered incorrect details. In such a case, you can contact the Cash App customer support team via email, Twitter, or toll-free phone numbers. If your cash-out still doesn't go through, try checking your payment settings manually. If none of these steps fixes your problem, you can try the next solution below.

Insufficient balance: You must first check your Cash App account balance to ensure enough money to make a cash-out. If the balance is low, the cash-out process will fail. The next possible cause is an outdated version of the Cash App. If you cannot locate an update for your Cash App, you can try clearing your cache and resetting your email. Alternatively, you can contact customer support and request a new account.

Debit card pending or declined - You may have to cancel the Cash-out process if the payment fails to clear. It may have been denied due to incorrect account information or a slow internet connection. Also, if you're not sure whether your debit card is pending or not, you should consult your bank. Sometimes, your card is declined because of security reasons. If that's the case, you must contact customer service so they can help you process your Cash-out.

Incorrect recipient details: You may be unable to make a cash out if your recipient's details were incorrect or your linked bank account expired. In this case, contact the Cash App customer support team and ask them to fix your account. If you have enough funds, you may be able to make a Cash App cash-out. If not, there are many ways to resolve the Cash App cash-out failed and make the transaction successful.

Can You Cash Out Bitcoin From Cash App?

If you've been wondering, "Can you cash out Bitcoin from Cash App?" you've come to the right place. You'll learn how to withdraw your bitcoins in a few easy steps. First, you must deposit a small amount of cryptocurrency. The minimum amount is 0.001 bitcoin. You can withdraw bigger amounts, too. Next, you'll enter your Bitcoin address and choose a wallet to withdraw your money.

Once you've signed up, you can start using the Cash App to withdraw your bitcoins. Download the app and log in. You'll be asked to enter your details, PIN, and account number. After logging in, you'll be taken to the bitcoin section, where you can check your balance and watch the market's fluctuation. You can even send money using PayPal. However, be prepared to wait a while before cashing out your Bitcoins.

Another option is to send your bitcoins directly from Cash App to Coinbase. Navigate to the "$" icon in your Cash App's top menu. From there, select "Send Money." This option looks like a paper aeroplane, and you can enter the number of your cash card in the "from" section. It should take only a few minutes. You can even send it to friends through the cash app.

Once you've completed the Cash App bitcoin verification, you'll be given a bitcoin wallet address to withdraw from. You can also enable blockchain transfers in your Cash App account. You'll need to submit your photo ID and other personal information to receive your money. Finally, you can withdraw your Bitcoin from the Cash App by using your Cash App. You can then move your money around through your other cryptocurrency wallets. But if you're not in the mood to transfer money, you can always send it through another cryptocurrency wallet.

How Long Does a Cash App Take to Cash Out When I Have Made a Withdrawal?

Withdrawals can sometimes take more time than expected to settle. To check whether your withdrawal is on its way, open the app and tap on the Activity tab on the home screen. Tap the transaction you want to check and view all the details. If the transaction is still pending, you can contact Cash App support.

Withdrawing money from the Cash App takes one to three business days, depending on your bank. You'll need to wait a couple of days with standard bank transfers, while instant transfers are instant and free. There's also a fee associated with using the Cash App at an ATM, costing up to $2 per transaction. However, the fee is worth it if you don't want to wait that long.

The best way to avoid Cash App cash-out fees is to link your bank account with Cash App. This way, you'll avoid charges when you cash out from the Cash App. Otherwise, select the Standard option when withdrawing money. It may take up to three banking days for your cash to show up in your bank account. If you need your money immediately, you can choose the Urgent option, but be prepared to pay a fee of 1.5% of the cash amount.

When you first start using Cash App, there are limits on how much you can send and receive through the app. You can receive up to $1,000 a week if you have a verified account. After you're verified, you'll have access to higher cash out limits. But it's important to keep in mind that the sending limits are limited to those who have verified their accounts. However, once you've verified your account, you can cash out as much money as you want.

#cash app cash out#cash out cash app#how to cash out on cash app#cash app cash card#cash app cash out fee#cash app cash out limit

2 notes

·

View notes

Text

How to Buy Bitcoin Legally in the U.S.

Despite significant attention in the financial and investment worlds, many people do not know how to buy cryptocurrency bitcoins, but doing so is as simple as signing up for a mobile app. In the news again with cryptocurrency, now is a better time than ever to delve into weeds and learn more about how to invest. To start buying bitcoins here you have a breakdown of everything you need to know.

Key Points

To buy bitcoins, the first step is to download a bitcoin wallet, which will store your bitcoins for future expenses or trading.

Traditional payment methods such as credit card, bank transfer (ACH) or debit card will allow you to buy bitcoins on exchanges, which you can send to your wallet.

Most U.S.-approved bitcoin platforms give you photo I.D. Have to be provided. And other information to ensure that you do not break money laundering laws, or try to cheat on taxes.

Bitcoin is still a new asset class that continues with a great deal of price volatility, and its legal and tax status is questionable in the US and abroad as well.

Steps to Buy Bitcoin

1. Digital Wallet

To conduct transactions on the bitcoin network, participants are required to run a program called "wallet", bitcoin is not technically "coins", so it only seems right that a bitcoin wallet would not actually be a wallet. Bitcoin balances are maintained using public and private "keys", long strings of numbers and letters linked through mathematical encryption algorithms that are used to create them.

The public key is the place from which the transaction is deposited and withdrawn. It is also the key that appears on the block chain ledger as a user's digital signature, not unlike the username on the social media news feed. The private key is the password required to buy, sell and trade bitcoins in a wallet. A private key must be a protected secret and should only be used to authorize bitcoin transmissions. Some users protect their private keys by encrypting a wallet with a strong password and, in some cases, choosing the cold storage option; That is, storing the wallet offline.

2. Personal Documents

The US Securities and Exchange Commission requires users to verify their identities when registering for a digital wallet under their anti money laundering policy.

To buy and sell bitcoins, you must verify your identity using your personal license which includes your driver's license and social security number (SSN).

3. Secure Internet Connection

If you choose to trade bitcoin online, use discretion when and where you access your digital wallet. Trading bitcoins over unsecured or public WiFi networks is not recommended and may make you susceptible to hackers' attacks.

4. Bank account, debit card or credit card

Once you have a bitcoin wallet, you can use a traditional payment method such as a credit card, bank transfer (ACH), or debit card to buy bitcoins on the bitcoin exchange. Bitcoins are then transferred to your wallet. The availability of the above payment methods is subject to the chosen jurisdiction and area of exchange. Below is a screenshot of the bitcoin interface on Coin base showing how to buy and sell bitcoins and also Bitcoin Cash, Ethereum and Litcoin, which are other popular virtual currencies. The user clicks the "Buy" tab to buy the digital currency and the "Sell" tab to sell the digital currency. You choose which currency you are buying / selling and which payment method you want to use (your bank account or credit card).

Depending on the exchange, there may be advantages and disadvantages to paying with a cash, credit or debit card or bank account transfer. For example, while credit and debit cards are among the most user-friendly methods of payment, they require identification and may also impose higher fees than other methods. Bank transfers, on the other hand, usually have lower fees, but they may take longer than other payment methods.

5. Bitcoin Exchange

After setting up your wallet with a payment method, you will actually need a place to buy bitcoins. Users can purchase bitcoins and other cryptocurrencies from online marketplaces that are similar to platforms used by merchants to purchase exchanges. The exchanges connect you directly to the bitcoin marketplace, where you can exchange traditional currencies for bitcoins.

Remember that bitcoin exchange and bitcoin wallet are not the same things. Bitcoin exchanges are similar to foreign exchange markets. Exchanges are digital platforms where bitcoins are exchanged for fiat currency — for example, bitcoin (BTC) for US dollars (USD). While exchanges offer wallet capabilities to users, this is not their primary business. Since the wallet must be secure, exchanges do not encourage large amounts of bitcoin or storage for long periods. Therefore, it is advisable to transfer your bitcoins to a secure wallet. Because security should be your top priority when choosing a bitcoin wallet, choose the option with a multi-signature feature.

There are many well-established exchanges that offer one-stop solutions with high security standards and reporting, but due diligence must be used when selecting a bitcoin exchange or wallet. Apart from Coin base, other popular exchanges include Coinmama, CEX.IO and Gemini.

Alternative ways to buy bitcoins

While one of the most popular ways to buy bitcoin remains an exchange of coinbase, it is not the only way. Below are some additional procedures that bitcoin owners use.

Bitcoin ATMs: Bitcoin ATMs act like bit-in-bit bitcoin exchanges. Individuals can put cash in the machine and use it to buy bitcoins which are then transferred to a secure digital wallet. Bitcoin ATMs have become increasingly popular in recent years; Coin ATM radar can help track the nearest machines.

P2P Exchange: Unlike decentralized exchanges, which match buyers and sellers anonymously and facilitate all aspects of transactions, there are some peer-to-peer (P2P) exchange services that create a more direct between users Provide relationship. Liquid Stockholm is an example of this. Such an exchange. After creating an account, users can request to buy or sell bitcoins, which includes information about payment methods and price.

Users then browse through a list of offers to buy and sell, choosing the business partners with whom they want to transact. Local bitcoins facilitate certain aspects of the business. While P2P exchanges do not offer the same anonymity as decentralized exchanges, they give users the opportunity to shop for the best deal. Many of these also offer exchange rating systems so that users have a way of evaluating potential trading partners before conducting a transaction.

1 note

·

View note

Photo

Enjoy my memes? Subscribe to my Patreon page! https://patreon.com/adollarandameme Send me a tip/donation at: http://buymeacoff.ee/adollarandameme Or if you'd prefer, tips / donations can be sent via PayPal: https://www.paypal.me/mctnoc or Cash App: $mctnoc or send to MezuBox 2068 or send digital photos of receipts from stores to [email protected] I also except donations via Bitcoin: 36eJFAkxzcdBpU84S9Xp2bz4JYf1UQrKmE or Litecoin: MQQNKSfVjn6MnXhou2i1GPSX4w7QjZmLCp or Ethereum: 0xc68eb1BBda0574B6005f84a109A24a397b8E30ae or Bitcoin Cash: qpa8sgu6rmlcx8nylwjr4w34lfrrhz0h8sp7vwsztr or Electroneum: etnjzruCzAFZbBCW1Px6oA3fYCk9yTai9SpMPk499azejAErFoYHNwoEEiSEw2jegw8K7PaNuyUAhdAgMRtekekp6jAERPunTB Or purchase one of our original meme designs on a shirt: https://teespring.com/stores/a-dollar-and-a-meme Can't donate or purchase but still want to help out? ***Share this post*** or Follow us on Facebook: www.facebook.com/adollarandameme Follow me on Instagram: @mctnoc #adollarandameme #meme #memes #memesdaily #memesofinstagram #memestagram #memelife #LOL #LMAO #memedealer #memesforyou #originalcontent #starvingmemeartist #betterlivingthroughcomedy #humor #funnymemes #dankmemes #viral #viralmemes #viralmeme #trendingmemes #Coinbase #Litecoin #litoshi #cryptocurrency #Eminem #drdre #xzibit #TheDifferenceBetweenMeAndYou https://www.instagram.com/p/CAov1wwHFy5/?igshid=14adjk5ibm5yc

#adollarandameme#meme#memes#memesdaily#memesofinstagram#memestagram#memelife#lol#lmao#memedealer#memesforyou#originalcontent#starvingmemeartist#betterlivingthroughcomedy#humor#funnymemes#dankmemes#viral#viralmemes#viralmeme#trendingmemes#coinbase#litecoin#litoshi#cryptocurrency#eminem#drdre#xzibit#thedifferencebetweenmeandyou

1 note

·

View note

Link

#Send Bitcoin from Cash App to Coinbase#Cash App Security Lock#what time does cash app deposit#cash app direct deposit info#how to get cash app direct deposit#how do you set up direct deposit on cash app#cash app direct deposit limit#direct deposit cash app#can you do direct deposit with cash app#set up direct deposit cash app#can i do direct deposit with cash app#cash app direct deposit delay#can you get direct deposit on cash app#what time does cash app deposit money#can you direct deposit to cash app#do you get your direct deposit early with cash app#cash app direct deposit late#cash app early direct deposit#how to set up direct deposit on cash app#how fast is cash app direct deposit#how long does direct deposit take on cash app#does cash app direct deposit work

0 notes

Text

What Is Financial Technology — Fintech and how is it useful in 2020? (with examples)

If you see the pattern then in the 21st-century financial technology which is popularly referred to as fintech has risen dramatically since the last 5 years and is projected to rise more in upcoming days. The sole purpose of Fintech is to modernize traditional financial trading that includes anything from mobile payments applications to cryptocurrency.

‘At the end of the day, customer-centric fintech solutions are going to win.’ — Giles Sutherland, Carta Worldwide

Mobile applications play a major role in fintech with mobile app users can do a variety of financial activities like money transfer, avail mobile banking, invest directly from mobile, get advice on the phone, etc.

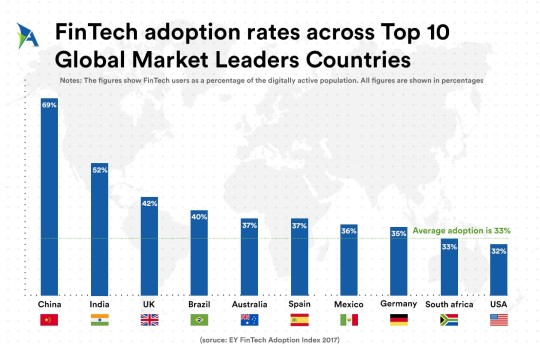

According to EY’s 2017 Fintech Adoption Index, one-third of users utilize at least three to four or more fintech services and those users are also increasingly aware of fintech as a part of their daily lives.

Fintech is also subtly helping cryptocurrency and as the current market tells that cryptocurrency is booming and a lot of development is happening in cryptocurrencies such as bitcoin, Ethereum, Litecoin, Tether (USDT), Libra and many more.

In simple language, if we have to describe what fintech is then any individual or company that uses the internet, mobile phones, cloud services and software technology to connect financial service at one place at any time it resulted in innovation; innovation in financial technology which says FINTECH.

Some of the Factsheet about Fintech

PayPal is one of the most well-known fintech companies, with a transaction volume of US$333.8 billion in 2019 as per Statista

Venmo is another, which reached its first US$1 billion transaction volume in January 2016 as per Venmo

Stripe is the biggest fintech company in the United States and one of PayPal’s biggest competitors, worth US$22.5 billion by Forbes

China’s online payment market is dominated by three services that make up 66% of all digital transactions made in China (Alipay, China pay, and Tenpay), which make up 29%, 19.5%, and 17.6% of the market, respectively according to Bloomberg

Ant Financial is the biggest fintech company globally, with an estimated worth of US$75 billion by Investopedia

Types of Fintech services trends in 2020

At first, fintech was dedicatedly made to function as back-end systems for banks and other financial entities. But as time passed, more and more innovation happened, range of applications increased and Fintech has now taken the front seat of the mainstream business where today, millions of consumers and businesses are using various forms of fintech in their daily financial transactions, usually via a smartphone. So here the gist of how fintech is being used in 2020, along with some of its traditional uses.

Mobile Payments

21st Century is leading by mobile and globally the number of mobile users is increasing. If you look at the facts then With 5.11 billion unique mobile users worldwide, it’s not surprising that global mobile payment transactions will be worth over $1 trillion in 2019. By 2023, that figure is expected to exceed US$4.3 trillion.

If you try to observe the current payment pattern, then at least 64% of smartphone users have used their mobile phone to transfer payment or any kind of financial transaction that includes apple pay, Google Wallet, Paypal, UPI services, etc. These Fintech service providers constantly improve their products and services to serve better to customers.

In fact, you can say that Fintech is helping us all to move towards a cashless society. Check out some of the Top-notch mobile payment offerings

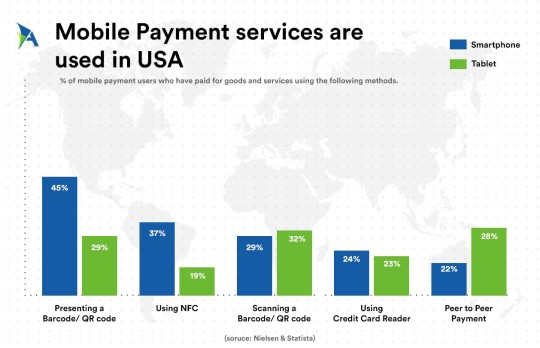

Here are quick stats by Statista about How the mobile payment services are used in U.S

Stock-Trading Apps

In the 1940s no one would have imagined that money can be associated with so many forms like Stock trading to Cryptocurrency and what not. This is the time where stock trading platforms are using digital robotics-based financial advisors to answer the customer about their investment even if they can predict the future by every microsecond as per the market’s situation.

If you look into the past or ask any of the investors then they will tell you that they need to physically go to the stock exchange establishments in order to buy/sell stocks or scripts. Today, the stock trading solutions allow anyone to easily trade stocks at the flick of a finger on their smartphones from anywhere around the corner.

Robotics advising made it like that that it works on specific smart algorithms and other smart calculations that Financial advisers can analyze numerous portfolio options more efficiently, 24/7, simultaneously. No wonder, an increasing number of Robo-advising services continue to emerge.

Another popular and highly innovative fintech contribution is the invention of stock-trading apps.

With cheaper and low-minimum stock-trading apps in the market, investing had never been easier. Thanks to these fintech innovations, making those stock-trading apps can now be done anywhere, without any budgetary constraints.

Budgeting Assitance Applications

Remember there’s one time when our parents were used to sitting once in a month with stacks of bills, future plans, grocery, health policy etc. and trying to figure out how they’ll be allocated funds to react to things. Nowadays all this is just history.

Thanks to budgeting applications that monitor our daily, weekly, monthly expense and plan our budget accordingly to the needs more efficiently. Budgeting apps and fintech apps working like a tag team when it comes to serving the best to consumers.

One of the most common uses of fintech in 2019 is budgeting apps for consumers, which have grown exponentially in popularity over the last few years.

Blockchain and Cryptocurrency

61% of high-profile digital companies worldwide are investing in blockchain, according to a report by identity management firm Okta shared with Cointelegraph on April 2. San Francisco-based enterprise identity provider Okta has released a survey on new trends in technological developments and business opportunities of the world’s largest companies.

In its first “Digital Enterprise Report,” Okta surveyed 1,050 IT, security and engineering decision-makers from global companies with at least $1 billion in revenue. Okta explained that decision-makers were defined as someone at the company who is “responsible for making technology purchasing decisions.”

cryptocurrency and the very famous Blockchain technology helped financial transactions faster and very much secure by days in going. Some cryptocurrency trading platforms include Coinbase, Robinhood, Cash App, Gemini, and Binance.

AI Virtual Assistants

Rise of Artificial Intelligence (AI) has opened new opportunities for every industry and it can be especially helpful for Fintech. AI and digital banking have led to the banks improving their services and offerings in the field of mobile banking. With AI users mobile experience and access to financial services from any financial institution is rapidly increasing and has become so easy as well.

Crowdfunding Platforms

Crowdfunding platforms have the ability to send or receive money from any users around the globe. It allows businesses or any individuals to pool funding from a variety of sources all in the same place. Now it’s possible to go straight to the investors to support a startup or Idea. And while their applications range from family and friends funding to fan and patron funding, the number of crowdfunding platforms have multiplied over the years.

There are many more included in the list whether its Insurance or Payment Gateways, Digital Lending, and Credit card, etc. The matter of fact is that there’s one simple question bugging around anyone’s mind.

But a million-dollar question, who uses fintech?

Who are the other users of fintech? And how is fintech being used in different ways?

Check your smartphone and honestly tell me how many fintech apps are installed in that genius piece of machinery you own? Is it a Banking app, Budgeting App, Stock trading app, Currency Monitoring app or a digital payment application? There are many players in the league who use fintech in their business.

Consumers

B2C for small businesses

B2B for banks

Bank’s business clients

Enough of sci-fi names. Let’s dig in a little deeper to understand the crux of it.

1. B2C (Business to Client)

The range of clients for fintech is rising very vast. Applications like PayPal, Venmo and Apple Pay, Google Pay allow clients or consumers to transfer money via the internet or mobile technology, and budgeting apps like Mint allow customers to manage their finances and expenses.

The Banking industry is paying its focus on B2C B2C applications like transferring payment to pay bills.

2. B2B (Business to Business)

Before the existence of fintech, traditional businesses went to the banks and asked for loans and financial services. But thanks to the revolutionary innovation in the field of fintech, businesses can easily avail loans, financing, and other financial services through mobile & web technology. On top of that, cloud-based platforms and even customer-relationship management services like Salesforce (CRM) — Get Report provides B2B services that allow companies to interact with financial data to help improve their services.

What’s the Catch? Why do you require a Stock Trading App?

More and more people have started trading and investing online nowadays due to easy accessibility. It is more feasible to not rent/buy an office for modern-day brokers since their clients have started opting for a portable solution.

What are the Options? Why hire us?

Our team’s mentors have been in the Stock and Currency Trading market for the past 15 years and so they know the ins and outs of this industry. Discuss with the best and get to know the infinite possibilities that technology can offer you and your clients.

Archisys has developed some Fintech apps and part of their development from scratch to deployment.

Stock Book: Share Market Companion

Stock Book is a smart companion for every investor and stock market trader. Track & analyze favorite company’s financial strength by star rating reviews and technical tools.

It also has an educational section about the stock market (Share Bazar) basic by Mandira Bedi. Stock Book is a smart companion for every investor and stock market trader. Track & analyze favorite company’s financial strength by star rating reviews and technical tools.

visit case study

Find My Trade

A startup company came up with an idea of bringing in all the Trade Advisors together within a common platform for them in order to share their knowledge as well as guide traders (old and new). They named the platform ‘FindMYTrade’

But one of the major challenges was to make the platform engaging for its users. Unlike other social sharing platforms, this wasn’t a content sharing or video sharing platform for entertainment purposes but an entirely information-centric platform. So, making it addictive enough for users to stay hooked onto the app was already challenging.

visit case study

The entire financial world has already entered into an era of evolution. Banks and other financial institutions are also making massive changes to keep up with this transformation towards technology and innovation.

Behind all of these are the collective, powerful disruptions that fintech brings. Fintech companies are trying to push their boundaries in payment, auditing, insurance, blockchain, and other influential financial services. As such, more financial, as well as non-financial institutions, will be forced to invest more and more funds into fintech startups to keep up with the ever-changing digital trends.

Archisys bring their best men on the ground to help startups or any individuals or companies who want to disrupt the financial business whether it’s an idea or a game-changing financial service. Archisys aims to deliver the best this industry has ever seen and we constantly educate everyone to make a difference in their respective domain.

1 note

·

View note

Text

virtual visa or mastercard buy for online purchase

Coinbase Card also offers a range of security and convenience features, including a mobile wallet app, two-factor identification, instant card freezing, spending tracking, and more. Cardholders can use their card to make online and in-store purchases and withdraw cash from any Visa-enabled ATM around the world.

The card supports global transactions. Although there is no cashback feature, users can earn coins through referrals. Referrers give $10 off physical cards and $5 off virtual cards. Referrers, on the other hand, get the same amount in addition to 0.10% of their loaded amount.

Crypto debit cards could be the future of payments, especially if central bank digital currencies become mainstream and compatible with crypto debit cards. Some of the world’s largest cryptocurrency exchanges, including Coinbase and Binance, now offer Visa debit cards. Funding your account is as easy as you might be doing from your crypto wallet. Then you have a fully functional debit card that you can use to convert your digital assets into fiat currency to pay for goods and services or withdraw money.

Your card provider does not purchase products or services in cryptocurrency, but converts your digital currency into fiat currency that you use to complete transactions. Some crypto debit card providers issue two types of cards: virtual cards for online purchases and physical cards for in-store purchases.

0 notes

Text

Coinbase: Buy, sell, hold and trade bitcoin and other cryptos. Easy to use and blockchain secure

Coinbase: the simple, safe way to buy, store, trade and sell your cryptocurrency. The leading cryptocurrency exchange for you to build your portfolio, earn yield, stay up-to-date on crypto news and navigate the crypto market with ease - whether you’re just starting your crypto journey or are a seasoned expert.<!--more-->

SUPPORTED ASSETS

Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Ethereum Classic (ETC), Litecoin (LTC), Dogecoin (DOGE), Shiba Inu (SHIB), Cardano (ADA), Solana (SOL), Tether (USDT), USD Coin (USDC)*, and many more.

We’re the world’s most trusted cryptocurrency exchange, with over 68 million users across 100+ countries worldwide. Coinbase allows you to securely buy, hold and sell cryptocurrencies like Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin and many more on our easy, user-friendly app and web platform.

Here’s a little taste of what our app does:

BUY AND SELL CRYPTO EASILY

- Own crypto in an instant. All it takes is linking a bank account or debit card.

- Buy and sell, convert crypto coins and securely send/receive crypto with external digital wallets.

- Earn yield on cryptocurrency like Ethereum.

- Buy crypto securely: Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Dogecoin, Cardano, Solana, Shiba Inu, Litecoin, USDT and more.

SMART TOOLS TO BECOME A CRYPTO PRO

- Brand new to crypto? We’ve got you covered.

- Crypto news and articles: stay up-to-date on the latest news and build your crypto knowledge.

- Portfolio management: Easy-to-use and customizable, from market insights to automatic buys and price alerts.

- Crypto tracker & dashboard: Clear and user-friendly, helps you see crypto prices and asset values, any time of day, anywhere you are.

- Track prices with our crypto watchlist: Add Bitcoin, Ethereum, and other crypto to your watchlist to see live prices and trends.

- Bitcoin ticker: Track the latest trends in Bitcoin. See which cryptocurrencies have moved the most in the last 24 hours.

SECURE CRYPTOCURRENCY EXCHANGE

- Over 98% of cryptocurrency is stored securely offline and the rest is protected by industry-leading online security.

- Crypto accounts are subject to the same scrupulous safety standards, including multi-stage verification and bank-level security.

- Add a passcode to your crypto profile or remotely disable your phone’s access to the app if it gets lost or stolen.

- Blockchains enable crypto to be bought and sent across the planet quickly and securely.

- Transfer crypto: Safe and secure asset movement to crypto wallets outside of the app.

BEGINNER TO CRYPTO MASTER, WE’RE HERE

- Manage crypto portfolios on Coinbase. Whether you’re just starting your crypto journey, or are a crypto pro, you’ll find everything you need to build your crypto portfolio.

- Learn about blockchain, NFTs and crypto with articles on a breadth of topics: bitcoin mining, Ethereum games, bitcoin trading and more.

Interested in getting into cryptocurrency? Begin your crypto journey with Coinbase.

Coinbase Signup:

#Coinbase

0 notes

Text

virtual visa or mastercard buy for online purchase

virtual visa or mastercard buy for online purchase

Coinbase Card also offers a range of security and convenience features, including a mobile wallet app, two-factor identification, instant card freezing, spending tracking, and more. Cardholders can use their card to make online and in-store purchases and withdraw cash from any Visa-enabled ATM around the world.

The card supports global transactions. Although there is no cashback feature, users can earn coins through referrals. Referrers give $10 off physical cards and $5 off virtual cards. Referrers, on the other hand, get the same amount in addition to 0.10% of their loaded amount.

Crypto debit cards could be the future of payments, especially if central bank digital currencies become mainstream and compatible with crypto debit cards. Some of the world’s largest cryptocurrency exchanges, including Coinbase and Binance, now offer Visa debit cards. Funding your account is as easy as you might be doing from your crypto wallet. Then you have a fully functional debit card that you can use to convert your digital assets into fiat currency to pay for goods and services or withdraw money.

Your card provider does not purchase products or services in cryptocurrency, but converts your digital currency into fiat currency that you use to complete transactions. Some crypto debit card providers issue two types of cards: virtual cards for online purchases and physical cards for in-store purchases.

0 notes

Text

Best Android Finance Apps on FindAPK

If you're looking for the best finance apps for Android, look no further than FindAPK. Here are some of the top finance apps available on FindAPK:

Mint: This free app allows you to track your spending, create budgets, and manage your bills all in one place. It also provides personalized financial advice to help you save money.

PayPal: This popular payment app allows you to easily send and receive money, pay bills, and even make purchases with your phone.

Credit Karma: With this app, you can check your credit score for free, monitor your credit report, and get personalized recommendations to help improve your credit.

Robinhood: This app makes it easy to invest in stocks, ETFs, and cryptocurrencies with no commission fees. You can also track your portfolio and get real-time market data.

Venmo: This social payment app allows you to send and receive money from friends and family, split bills, and make payments at select merchants.

Acorns: This app helps you invest your spare change by rounding up your purchases and investing the difference. You can also set up automatic investments and earn cash back on purchases.

Personal Capital: This app provides a complete picture of your finances by allowing you to track your investments, monitor your net worth, and create a personalized retirement plan.

YNAB (You Need a Budget): This app helps you create a budget and stick to it by allowing you to track your spending, set financial goals, and get real-time updates on your progress.

Google Pay: This payment app allows you to send and receive money, pay bills, and make purchases with your phone. It also offers rewards for using the app at select merchants.

Coinbase: This app makes it easy to buy, sell, and store cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

Conclusion: These finance apps available on FindAPK can help you manage your money, invest wisely, and reach your financial goals. Whether you're looking to track your spending, build your credit, or invest in the stock market, there's an app on FindAPK that can help. So, head over to FindAPK and download the best finance apps for your Android device today.

0 notes