#Simple Invoice Manager - Invoicing Made Easy

Explore tagged Tumblr posts

Text

Wedding Planning Made Simple: Essential Tips for Staying Organized

Planning a wedding is an exciting yet overwhelming journey. From choosing the perfect venue to selecting the right decor and managing countless details, staying organized is essential for creating the day of your dreams. Whether you’re planning a lavish destination wedding or a traditional Hindu or Punjabi celebration, keeping track of everything will help minimize stress and make the process enjoyable. In this guide, we’ll explore the best ways to stay organized while planning your wedding and how the right tools, professionals, and mindset can make all the difference.

Start with a Clear Vision

Before diving into the logistics, take some time to envision your perfect wedding day. Consider the style, theme, and atmosphere you want to create. Are you dreaming of a beachside ceremony with a destination wedding planner near me, or a vibrant traditional event with stunning Punjabi wedding decor? Having a clear vision will help guide your decisions and ensure every element aligns with your expectations.

Set a Realistic Budget

One of the most crucial steps in wedding planning is establishing a budget. Outline your priorities and decide how much you’re willing to spend on each aspect of the event. Include categories like venue, catering, attire, event decorations, photography, and entertainment. Don’t forget to set aside funds for unexpected expenses. A well-structured budget will prevent overspending and keep your finances in check.

Create a Detailed Wedding Planning Checklist

A comprehensive checklist is a lifesaver when planning a wedding. Break down tasks into manageable steps and set deadlines for each. Here’s an example:

12 Months Before: Set the date, book the venue, hire a wedding planner in Toronto.

9 Months Before: Choose your bridal party, start shopping for attire, book key vendors.

6 Months Before: Finalize guest list, send save-the-dates, plan decor.

3 Months Before: Order invitations, schedule fittings, confirm details with vendors.

1 Month Before: Finalize seating chart, confirm guest count, pack for the honeymoon.

This timeline will keep you on track and ensure nothing is overlooked.

Use Digital Tools and Apps

Take advantage of wedding planning apps and digital tools to stay organized. Platforms like Trello, Google Sheets, and WeddingWire offer customizable checklists, budget trackers, and vendor directories. These tools make it easy to collaborate with your partner and wedding decorators near me in Brampton, keeping everyone on the same page.

Hire Professional Help

A professional wedding planner in Toronto can be a game-changer, especially if you’re short on time or planning a large event. They bring experience, connections, and creativity to the table, helping you bring your vision to life without the stress. If you’re planning a destination wedding, working with a destination wedding planner ensures every detail is managed, even from afar.

For specific cultural elements, hiring experts in Punjabi wedding decor or Hindu wedding mandap decorations can help maintain authenticity and elegance. Local wedding decorators near me in Brampton are also invaluable for transforming your venue with style and efficiency.

Keep Important Documents Organized

Create both digital and physical folders for essential documents like contracts, invoices, and receipts. Organize them by category—venue, vendors, attire, and decor—so you can easily access them when needed. Tools like Dropbox or Google Drive offer secure cloud storage and easy sharing with your planner or partner.

Communicate Clearly with Vendors

Effective communication with your vendors is key to a smooth planning process. Confirm every detail in writing and keep records of conversations and agreements. Schedule regular check-ins to stay updated and address any issues early on.

Schedule Regular Planning Sessions

Dedicate specific times each week to discuss and work on wedding plans. Consistent planning sessions prevent last-minute scrambles and help you stay organized and focused.

Prioritize Self-Care

Amid the excitement and stress of wedding planning, don’t forget to take care of yourself. Schedule downtime, enjoy date nights, and lean on your support system. A well-rested and happy couple is the foundation of a beautiful celebration.

Final Thoughts

Staying organized while planning your wedding takes effort, but with the right approach, it can be a joyful and rewarding experience. By creating a clear vision, using helpful tools, and working with experienced professionals like a wedding planner in Toronto or decorators specializing in Punjabi and Hindu weddings, you’ll set the stage for a memorable and stress-free celebration.

Whether you’re planning a grand destination wedding or an intimate gathering, Blooming Wedding Decor is here to bring your dream wedding to life. From stunning event decorations to cultural touches like Hindu wedding mandap decorations, our team ensures every detail is perfect. Contact us today to start planning the wedding of your dreams!

#blooming wedding decor#party decoration#elegant decor#anniversary decoration services#wedding decor canada#wedding decorations#anniversary decoration#decoration#hindu wedding decorations#wedding planners#wedding planner in canada#wedding venue#wedding venues

2 notes

·

View notes

Text

How I Solved My Invoice Payment Hassles: A Baker’s Story

Owning a bakery in a quaint little town is like living in a warm, flour-dusted dream. But I’ll admit it’s not without its challenges. One of the biggest hurdles I’ve faced over the years has been managing my invoices and payments. It’s not something I like to talk about, but there were times when my lack of organization led to missed payments and strained relationships with suppliers.

I remember one particularly stressful week. My supplier called me early on a Monday morning, frustrated that I hadn’t paid for the last flour shipment. I sighed and said, “I’m so sorry. I completely forgot about it. I’ll fix it right away.” But fixing it wasn’t as easy as it sounded. I’d been so busy juggling orders and experimenting with new recipes that I completely forgot to make the invoice payment. Now, I was scrambling to make things right while dealing with an already hectic week. It felt like no matter how hard I tried, the administrative side of running my bakery always got the better of me.

That’s when a fellow business owner, Jake, mentioned Zil Money to me. Over coffee one afternoon, Jake said, “Man, you gotta try this platform. It’ll change your life.” They raved about how Zil Money had simplified their invoicing and payment processes. At first, I was hesitant. “Can it really make that much of a difference?” I asked. But I was desperate for a solution, so I decided to give it a shot.

Before Zil Money, I was juggling multiple platforms to meet my suppliers’ preferences. Some wanted checks, others needed ACH transfers, and a few insisted on wire payments. It was a logistical nightmare. I always felt like I was one step away from a disaster. With Zil Money, all of that changed. The platform allowed me to handle all these payment methods in one place. Whether I needed to send a check, initiate an ACH transfer, or make a wire payment, Zil Money made it quick and easy.

One day, I was at the local farmer’s market picking out fresh ingredients for a new tart recipe when my phone buzzed. It was a message from one of my vendors reminding me about an invoice that needed to be paid. In the past, this would have meant rushing back to the bakery, digging through paperwork, and losing precious time. But this time, I simply opened the app on my phone and made the payment right then and there. It took less than a minute, and I didn’t have to break my stride. “That was so easy,” I thought, smiling to myself. That’s when I realized just how much Zil Money had transformed my workflow.

Over time, I’ve seen the ripple effects of using Zil Money. My suppliers are happier because they know they’ll get paid on time. I’ve saved countless hours that I now spend focusing on my customers and perfecting my recipes. And, perhaps most importantly, I feel more in control of my business.

What’s even better is that Zil Money doesn’t just help with making payments—it also lets you create and send invoices effortlessly. With a few clicks, I can customize invoices and send them directly to my vendors. Collecting payments has become just as simple. I can send out personalized payment links to my vendors, and when they click on the link, they’re taken to a secure checkout page. From there, they can pay using their credit card or bank account, making the entire process smooth and efficient.

Jake was right. Zil Money didn’t just simplify one part of my business; it transformed the way I operate. One of the best features is how mobile-friendly it is. Whether I’m at the market or in the kitchen, I can handle invoices and payments from my phone.

There was one moment that really made me grateful for Zil Money. I was busy decorating a wedding cake when I got a notification about a payment due. Normally, I’d have to stop everything, clean up, and go to my computer. But this time, I pulled out my phone, tapped a few buttons, and the payment was done. I didn’t even lose my focus. “I couldn't believe how much simpler things had become,” I muttered, shaking my head in disbelief.

Since I started using Zil Money, I’ve gained back so much time and energy. My customers are happy, my suppliers are happy, and I’m happy. If you’re a small business owner struggling with invoicing and payments, take it from me: Zil Money can make a world of difference. It’s not just a tool; it’s like having an extra set of hands when you need them most.

2 notes

·

View notes

Text

Control Structured Data with Intelligent Archiving

Control Structured Data with Intelligent Archiving

You thought you had your data under control. Spreadsheets, databases, documents all neatly organized in folders and subfolders on the company server. Then the calls started coming in. Where are the 2015 sales figures for the Western region? Do we have the specs for the prototype from two years ago? What was the exact wording of that contract with the supplier who went out of business? Your neatly organized data has turned into a chaotic mess of fragmented information strewn across shared drives, email, file cabinets and the cloud. Before you drown in a sea of unstructured data, it’s time to consider an intelligent archiving solution. A system that can automatically organize, classify and retain your information so you can find what you need when you need it. Say goodbye to frantic searches and inefficiency and hello to the control and confidence of structured data.

The Need for Intelligent Archiving of Structured Data

You’ve got customer info, sales data, HR records – basically anything that can be neatly filed away into rows and columns. At first, it seemed so organized. Now, your databases are overloaded, queries are slow, and finding anything is like searching for a needle in a haystack. An intelligent archiving system can help you regain control of your structured data sprawl. It works by automatically analyzing your data to determine what’s most important to keep active and what can be safely archived. Say goodbye to rigid retention policies and manual data management. This smart system learns your data access patterns and adapts archiving plans accordingly. With less active data clogging up your production systems, queries will run faster, costs will decrease, and your data analysts can actually get work done without waiting hours for results. You’ll also reduce infrastructure demands and risks associated with oversized databases. Compliance and governance are also made easier. An intelligent archiving solution tracks all data movement, providing a clear chain of custody for any information that needs to be retained or deleted to meet regulations. Maybe it’s time to stop treading water and start sailing your data seas with an intelligent archiving solution. Your databases, data analysts and CFO will thank you. Smooth seas ahead, captain!

How Intelligent Archiving Improves Data Management

Intelligent archiving is like a meticulous assistant that helps tame your data chaos. How, you ask? Let’s explore:

Automated file organization

Intelligent archiving software automatically organizes your files into a logical folder structure so you don’t have to spend hours sorting through documents. It’s like having your own personal librarian categorize everything for easy retrieval later.

Efficient storage

This software compresses and deduplicates your data to free up storage space. Duplicate files hog valuable storage, so deduplication removes redundant copies and replaces them with pointers to a single master copy. Your storage costs decrease while data accessibility remains the same.

Compliance made simple

For companies in regulated industries, intelligent archiving simplifies compliance by automatically applying retention policies as data is ingested. There’s no danger of mistakenly deleting information subject to “legal hold” and avoiding potential fines or sanctions. Let the software handle the rules so you can avoid data jail.

Searchability

With intelligent archiving, your data is indexed and searchable, even archived data. You can quickly find that invoice from five years ago or the contract you signed last month. No more digging through piles of folders and boxes. Search and find — it’s that easy. In summary, intelligent archiving brings order to the chaos of your data through automated organization, optimization, compliance enforcement, and searchability. Tame the data beast once and for all!

Implementing an Effective Data Archiving Strategy

So you have a mind-boggling amount of data accumulating and you’re starting to feel like you’re drowning in a sea of unstructured information. Before you decide to throw in the towel, take a deep breath and consider implementing an intelligent archiving strategy.

Get Ruthless

Go through your data and purge anything that’s obsolete or irrelevant. Be brutally honest—if it’s not useful now or in the foreseeable future, delete it. Free up storage space and clear your mind by ditching the digital detritus.

Establish a Filing System

Come up with a logical taxonomy to categorize your data. Group similar types of info together for easy searching and access later on. If you have trouble classifying certain data points, you probably don’t need them. Toss ‘em!

Automate and Delegate

Use tools that can automatically archive data for you based on your taxonomy. Many solutions employ machine learning to categorize and file data accurately without human input. Let technology shoulder the burden so you can focus on more important tasks, like figuring out what to have for lunch.

Review and Refine

Revisit your archiving strategy regularly to make sure it’s still working for your needs. Make adjustments as required to optimize how data is organized and accessed. Get feedback from other users and incorporate their suggestions. An effective archiving approach is always a work in progress. With an intelligent data archiving solution in place, you’ll gain control over your information overload and find the freedom that comes from a decluttered digital space. Tame the data deluge and reclaim your sanity!

Conclusion

So there you have it. The future of data management and control through intelligent archiving is here. No longer do you have to grapple with endless spreadsheets, documents, files and manually track the relationships between them.With AI-powered archiving tools, your data is automatically organized, categorized and connected for you. All that structured data chaos becomes a thing of the past. Your time is freed up to focus on more meaningful work. The possibilities for data-driven insights and optimization seem endless. What are you waiting for? Take back control of your data and unleash its potential with intelligent archiving. The future is now, so hop to it! There’s a whole new world of data-driven opportunity out there waiting for you.

2 notes

·

View notes

Text

Content Creators Rejoice! Chesteei is Here to Save Time & Stress

Being a content creator in today’s fast-moving digital world is exciting—but it can also be overwhelming. From planning content, writing captions, sending invoices, managing brand deals, and staying organized, creators often find themselves using multiple apps and wasting time switching between them. That’s where Chesteei steps in to make life easier.

What is Chesteei?

Chesteei is an all-in-one platform designed specifically for content creators and influencers. Whether you're creating videos, posting on Instagram, managing brand partnerships, or running your own small business, Chesteei combines everything you need into one simple, easy-to-use tool.

It offers smart features like a content planner, post scheduler, task manager, invoice generator, and even an AI-powered caption writer. With Chesteei, you don’t have to jump between different apps anymore—everything is right there, ready to go.

Smart Tools That Actually Help

Chesteei’s smart tools are made with creators in mind. You can plan your content calendar, set reminders, and even auto-generate captions based on your post theme and audience. If you work with brands, Chesteei makes sending invoices fast and professional. It even helps you review contracts and generate new ones with the help of AI—saving you time and avoiding legal mistakes.

The best part? It works on mobile too, so you can manage your work anytime, anywhere.

Why Creators Love It?

Creators love Chesteei because it reduces stress and saves hours each week. Instead of juggling 5 or 6 apps, you can do everything in one clean dashboard. It’s perfect for both new creators and experienced influencers who want to stay organized and look professional.

Conclusion

If you're tired of the stress and want more time to focus on what you love—creating content—then Chesteei is the tool you’ve been waiting for. It helps you stay on track, stay professional, and most importantly, stay creative. Visit Chesteei today and experience the smarter way to work as a content creator.

1 note

·

View note

Text

How ERP Software Transforms Homeopathy Clinics in 2025

As homeopathy clinics evolve in response to patient expectations and regulatory standards, the role of technology is more vital than ever. In 2025, ERP software is no longer a luxury—it’s a strategic necessity for homeopathy clinics looking to grow, automate, and deliver better care.

Let’s explore how Homeopathy ERP software is transforming clinics across India and globally in 2025.

🔁 From Manual to Digital: A Shift in Practice

Traditionally, many homeopathy clinics managed:

Stock in registers

Prescriptions on paper

Billing manually

Patient records in folders

In 2025, leading homeopathy clinics have adopted cloud-based ERP systems that automate every step—from appointment booking to patient follow-up, thereby improving both efficiency and professionalism.

🚀 1. Complete Clinic Automation

Modern Homeo ERP software now automates:

Billing & invoicing

Patient history tracking

Stock updates

Expiry alerts

Payment follow-ups

Doctors and staff can concentrate more on patient care as a result of the reduced paperwork, fewer mistakes, and quicker service.

📦 2. Advanced Inventory Control with Potency Management

Homeopathy clinics deal with unique challenges:

Potency-based medicines (e.g., 30C, 200C, 1M)

Dilution tracking

Multiple combinations

In 2025, ERP software will track stock by potency, batch, and expiry—preventing overstocking, understocking, or using expired remedies.

👨⚕️ 3. Smarter Patient Experience

Patients expect faster service, digital records, and follow-ups. ERP helps clinics:

Schedule appointments online

Retrieve previous prescriptions instantly.

Send SMS/email reminders.

Track chronic cases effectively.

The result? Improved trust and repeat visits.

📊 4. Real-Time Insights for Better Decision-Making

The latest Homeo ERP systems include extensive analytics and dashboards that demonstrate the following:

Most-prescribed medicines

Monthly revenue trends

Patient visit frequency

Inventory usage rates

These reports help clinic owners make smarter, data-driven decisions.

🌍 5. Multi-Location Growth Made Simple

In 2025, many homeopathy practices are expanding. ERP software allows:

Centralized control across multiple branches

Role-based access for doctors, reception, and stock managers

Cloud backup for anytime-anywhere access

Whether you’re operating in Kerala, across India, or even globally, ERP supports scalable growth.

🔐 6. Data Security & Compliance

As data privacy regulations become more stringent, ERP software guarantees:

Encrypted patient records

Automated backups

Secure logins

Audit trails for legal safety

No more worries about lost files or manual errors.

💼 7. Business + Medical Efficiency Combined

ERP software in 2025 is not just about clinical records—it also improves:

Revenue tracking

Profit margin analysis

Discount & loyalty management

Vendor/supplier integration

It brings business intelligence into healthcare—something traditional systems lack.

📍 Who’s Leading the Change?

Companies like Hiworth Solutions are at the forefront, offering homeopathy ERP software in Kerala and India that is:

Fully customizable

Potency-aware

Easy for non-tech-savvy staff

Affordable for small to mid-sized clinics

🎯 Final Thoughts: Adapt Now or Fall Behind

2025 is not about surviving—it’s about thriving through smart systems. If you’re running a homeopathy clinic, investing in ERP software is the fastest way to:

Save time

Improve service

Grow with confidence

✅ Ready to Upgrade?

At Hiworth Solutions, we specialize in Homeopathy ERP software that’s built for your real-world clinic challenges.

👉 Book your free demo today and experience the future of homeo clinic management.

#homeo erp software kerala#homeo erp software trivandrum#hospital management software trivandrum#erp#erp software#information technology#software

0 notes

Text

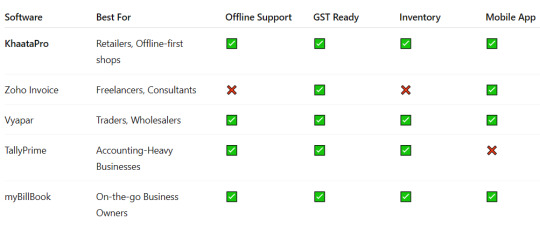

5 Best Billing Software for Small Businesses in 2025

Efficient billing is the backbone of any successful small business. Whether you run a retail shop, offer professional services, or operate a small manufacturing unit, accurate and streamlined invoicing ensures steady cash flow, organized accounts, and simplified tax filing. Thankfully, modern billing software has made it easier than ever to manage business finances.

In this blog, we explore the 5 best billing software ideal for small businesses in 2025 with a spotlight on the rising favorite, KhaataPro.

1. KhaataPro – Smart Billing, Simple Business

Khaata Pro is a powerful and easy-to-use billing software designed specifically for small and medium-sized businesses in India. Launching in 2025, Khaata Pro is poised to become a game-changer for retailers, wholesalers, and service providers who want digital billing without the tech headache.

Key Features:

Offline & Online Billing Modes

GST-Compliant Invoicing

Expense and Stock Management

Customer Credit Tracking

Multi-Language Interface (including English, Hindi, Marathi)

Mobile-Friendly Dashboard for Shopkeepers

Why Choose KhaataPro? With its user-friendly interface, regional language support, and offline functionality, KhaataPro is perfect for shop owners and local businesses that need digital solutions without constant internet access.

2. Zoho Invoice – Ideal for Service Providers

Zoho Invoice is a cloud-based billing solution tailored for freelancers, consultants, and small service-based businesses. It allows users to create professional invoices, automate payment reminders, and track time-based billing.

Highlights:

Customizable Invoice Templates

Client Portals

Online Payment Integrations

Time Tracking & Project Billing

Best For: Freelancers, consultants, and agencies looking for project-based billing with detailed time logs.

3. Vyapar – Designed for Indian Small Businesses

Vyapar is a popular GST billing software used widely in India, especially among traders and local retailers. It offers mobile and desktop support and includes features that go beyond billing, such as accounting, inventory, and order management.

Highlights:

Barcode Scanning & Inventory

Bill-wise Payment Tracking

GST Reports and Filing Assistance

Delivery Challans & Quotations

Best For: Indian shopkeepers and wholesalers who need both inventory and billing in one place.

4. TallyPrime – Trusted Accounting with Invoicing

While Tally is traditionally known for accounting, TallyPrime brings in simplified billing features with a deep focus on compliance and scalability. It suits businesses that need invoicing tied closely with accounting, inventory, and statutory reports.

Highlights:

Invoicing with Inventory Integration

GST and Multi-Tax Invoicing

Bank Reconciliation

Customizable Reports

Best For: Small to medium-sized enterprises that want billing + full-fledged accounting in one package.

5. myBillBook – Mobile-First Billing Software

myBillBook is a modern GST billing app that offers quick invoicing, real-time inventory updates, and analytics. Its mobile-first approach is great for businesses that are always on the move.

Highlights:

Create Bills in Seconds via Mobile

Digital Catalog & Stock Alerts

E-Way Bill Generation

Automatic Payment Reminders

Best For: Mobile-savvy small businesses that want flexibility and accessibility.

Final Thoughts

0 notes

Text

Ezist Asset Management App: The Future of Asset Management at Your Fingertips

Managing assets has never been more critical or more complex. From tracking expensive equipment to remembering warranty deadlines and maintenance schedules, traditional methods (like spreadsheets and paper files) don’t cut it anymore. That’s where Ezist revolutionizes asset management for individuals and businesses.

Whether you’re a restaurant owner juggling dozens of appliances or a facility manager overseeing multiple locations, the Ezist Asset Management App brings clarity, automation, and control — all in the palm of your hand.

Why the Old Way No Longer Works

Through extensive interviews with restaurant owners and service providers, one thing became clear: the manual methods are broken.

Spreadsheets often get lost or outdated

Physical maintenance records are hard to track

Teams waste hours sharing invoices and service details

There’s no real-time visibility or central system

Enter Ezist: Smart, Secure, and Seamless

Ezist is a cloud-based mobile and web app that simplifies asset management with automation, smart tracking, and proactive alerts. It’s built with real-world insights from businesses tired of losing time, money, and peace of mind.

Let’s explore what makes Ezist a game-changer:

Top Features for Individuals & Households

Smart Asset Management

Central dashboard to manage gadgets, kitchen appliances, and tools

Add assets with a simple scan — no manual entry

Access from mobile, desktop, or tablet

Warranty & Receipt Tracking

Get alerts before warranties expire

Store receipts digitally — no more lost invoices

Keep a clean purchase history with easy access

Maintenance & Service Alerts

Scheduled reminder for service dates

In-app service request booking

Auto-generated alerts for maintenance

Home & Office Inventory

Track assets across home and workspaces

Multi-user access for family members or coworkers

Store insurance docs for easy retrieval

Sustainability & Security

Go paperless with digital records

Data encryption and cloud backup

Privacy-first approach — your data stays yours

Why Businesses Love Ezist

Ezist isn’t just for households. It’s tailor-made for businesses, too, offering:

Multi-location asset tracking

Automated maintenance workflows

Vendor and service provider management

Custom alerts and reporting tools

Role-based user access for teams

Mobile-friendly operations for field teams and office staff alike

Whether you’re in hospitality, manufacturing, or facility management, Ezist streamlines operations and reduces asset-related downtime by up to 25%.

📈 The Results Speak for Themselves

✅ 10% lower maintenance costs

✅ 3x return on investment within months

✅ 25% time saved on asset-related tasks

🚀 Get Started with Ezist Today

Stop letting assets manage you. Start managing them with Ezist.

👉 Sign Up Now for Free: platform.ezist.net/Account/Registration

📱 Download the App:

App Store

Google Play

Frequently Asked Questions

Is Ezist suitable for small businesses or startups?

Yes, Ezist is built to scale with your business, whether you’re managing 10 or 10,000 assets.

Can I manage assets from multiple locations?

Absolutely. Ezist supports multi-location asset tracking and reporting from a single platform.

Is my data safe with Ezist?

Yes. Ezist uses encrypted cloud storage and offers data backups for maximum security.

Can I use Ezist on both desktop and mobile?

Yes. Ezist is fully compatible with mobile, tablet, and desktop devices.

Does Ezist support receipt and warranty tracking?

Yes. It automatically stores receipts and alerts you before warranty expiration dates.

0 notes

Text

Why Every Freelancer Needs a Reliable File Bag for Client Meetings

In the freelancing world, staying organized and making a professional impression are essential for success. One underrated yet vital tool that helps you do both is a file bag. Whether you're a writer, designer, consultant, or marketer, a reliable file bag keeps your essentials safe, sorted, and easy to carry. Let’s dive into why investing in a quality file bag is a smart move for every freelancer.

The Importance of Staying Organized as a Freelancer

As a freelancer, you juggle multiple projects, meetings, and client expectations. Without a proper system to manage your documents, things can quickly get messy. A file bag acts as your mobile office—keeping everything in place and within reach.

How a File Bag Helps Manage Documents Efficiently

A sturdy file bag provides space for all your work essentials, including contracts, invoices, notebooks, pens, and even gadgets like a tablet or laptop. With a well-structured document organizer bag, you won't waste time digging for papers during a meeting. You’ll walk in confidently, knowing everything you need is right at your fingertips.

Impact of Organization on Professionalism and Client Trust

Imagine walking into a client meeting fumbling with loose papers. Now imagine walking in with a clean, well-organized file bag. The difference is clear. Being prepared and tidy shows that you value your work—and theirs. Clients trust freelancers who appear responsible and organized.

Key Features to Look for in a Reliable File Bag

Not just any bag will do. You need a professional file bag for freelancers that suits your work style and daily needs.

Durability and Material Quality

Look for a file bag made of strong, water-resistant materials like leather, nylon, or canvas. This ensures your documents stay safe even when you’re on the go or caught in unexpected weather.

Size and Compartments for Smart Storage

A quality file bag should have dedicated compartments for files, business cards, pens, a laptop sleeve, and maybe even a charger. This turns your bag into an efficient freelancer file storage solution.

Portability and Comfort

As a freelancer, you may move from coffee shops to co-working spaces to client offices. A lightweight, easy-to-carry file bag with padded handles or shoulder straps can make these transitions seamless and stress-free.

Benefits of Using a Dedicated File Bag for Client Meetings

The advantages of a reliable file bag go beyond just keeping your papers together. It improves your workflow and boosts your image.

Enhanced Professional Image

Carrying a sleek file bag shows clients you’re serious about your business. Whether it's a leather folder bag or a modern backpack-style file bag, it becomes part of your personal brand.

Easy Access to Important Documents

Need to show a portfolio or review a contract? A file bag makes it simple. Everything is sorted and protected, ready when you need it. No delays, no embarrassment.

Protection of Sensitive Client Information

Client trust is everything. A secure file bag with zippers or locking compartments ensures private documents stay confidential and damage-free.

How to Choose the Perfect File Bag for Your Freelance Needs

With so many options, choosing the right file bag can be overwhelming. Start by assessing your daily routine and client interactions.

Match the Bag to Your Work Style

If you meet clients in corporate settings, a leather file bag with a clean, classic design works best. For creative freelancers, a modern document organizer bag with bold colors or tech-savvy features may be more suitable.

Consider Budget and Long-Term Value

While it’s easy to go for a cheaper file bag, investing in a high-quality one is wiser. A durable, functional bag may cost more upfront, but it saves you from replacements and gives a more polished appearance.

Final Thoughts: A Smart Investment for Freelancers

In freelancing, the little things matter. A reliable file bag may seem like a small purchase, but it has a big impact. It keeps you organized, projects professionalism, and gives you peace of mind during client meetings. Think of it as a mobile command center that supports your success.

So if you’re still using a basic tote or stuffing papers into your backpack, it’s time to upgrade. Choose a high-quality file bag that suits your style, protects your work, and helps you shine in front of clients.

#file bag#folder bag#document bag with zipper#file folder bag#waterproof zip pouch#document file bag#zipper file bags#file folder briefcase#file purse#file pouch

1 note

·

View note

Text

Why Smart Businesses Choose Freight Forwarders: From Shipping Stress to Success Stories

Ship Smart, Ship Right - Let Freight Forwarders Light Your Logistics Flight!

Picture this: You've got products ready to conquer global markets, but the maze of international shipping feels like solving a Rubik's cube blindfolded. Sound familiar? Here's where freight forwarders transform your shipping nightmares into sweet dreams of success!

What Makes Freight Forwarders Your Business's Best Friend?

Think of freight forwarders as your shipping superheroes - they don't wear capes, but they sure know how to save the day! These logistics wizards handle everything from customs clearance to cargo insurance, turning complex shipping puzzles into simple, streamlined solutions.

At ARRKAY TRANSHIP FORWARDERS PVT LTD, we don't just move cargo - we move mountains of worry off your shoulders!

The Golden Benefits That Make Your Business Shine

1. Cost Savings That Make Your CFO Smile Wide

"Why pay more when you can pay less, and still get the very best?"

Freight forwarders have negotiated rates with carriers that individual businesses can only dream of. We bundle shipments, optimize routes, and leverage our relationships to slash your shipping costs by up to 40%. More money in your pocket means more fuel for business growth!

2. Time is Money, and We Save You Both

"While you focus on sales and growth, we handle the shipping back and forth!"

Instead of spending hours researching shipping options, dealing with documentation, and tracking multiple carriers, you can focus on what you do best - running your business. Our experts handle the logistics maze while you concentrate on closing deals and making profits.

3. Global Network, Local Knowledge

"From Mumbai to Manhattan, Sydney to Shanghai - we know the way!"

With ARRKAY TRANSHIP's extensive global network, your cargo gets VIP treatment worldwide. We understand local regulations, cultural nuances, and the fastest routes to get your products where they need to be, when they need to be there.

4. Risk Reduction That Brings Peace of Mind

"Sleep sound at night, your cargo's in flight - everything's handled just right!"

International shipping comes with risks - damaged goods, lost shipments, customs delays. We provide comprehensive insurance options and expert handling that minimizes these risks. Your peace of mind is our top priority.

5. Documentation Made Simple and Sweet

"Paperwork blues? We've got the clues to make it smooth and easy for you!"

Bills of lading, commercial invoices, certificates of origin - the documentation maze can make your head spin. Our experienced team handles all paperwork with precision, ensuring your shipments clear customs without hiccups.

Why ARRKAY TRANSHIP Stands Out in the Crowd

We're Not Just Another Freight Forwarder - We're Your Success Partner!

🚢 Comprehensive Services Under One Roof

Sea Freight: Ocean carriers that sail your cargo to success

Air Freight: Sky-high speed for time-sensitive shipments

Land Transportation: Door-to-door delivery that never disappoints

Customs Clearance: Smooth sailing through regulatory waters

Cargo Insurance: Protection that brings perfection

Warehousing: Safe storage while you plan your next big move

💡 Technology That Works as Hard as You Do

Our advanced tracking systems keep you informed every step of the way. Real-time updates, instant notifications, and transparent communication - because knowing is half the battle won!

🤝 Personal Touch in a Digital World

While technology drives our efficiency, human connection drives our service. Our dedicated account managers become extensions of your team, understanding your unique needs and crafting solutions that fit like a glove.

The Real-World Impact: Success Stories That Inspire

Small Business, Big Dreams: A textile manufacturer in Bangalore wanted to export to European markets but felt overwhelmed by shipping complexities. ARRKAY TRANSHIP FORWARDERS stepped in, reduced their shipping costs by 35%, and helped them establish successful trade relationships across 12 countries. Today, they're one of India's fastest-growing exporters!

Growing Globally, Staying Local: An electronics company needed urgent air freight for a critical client deadline. Our emergency response team arranged cargo space within 4 hours, ensuring on-time delivery that saved a million-dollar contract. That's the ARRKAY difference!

Making the Smart Choice: Your Next Steps to Success

Ready to Transform Your Logistics Game?

Choosing the right freight forwarder isn't just about moving goods - it's about moving your business forward. With ARRKAY TRANSHIP FORWARDERS PVT LTD, you're not just getting a service provider; you're gaining a strategic partner committed to your success.

What Sets Us Apart:

25+ Years of Excellence: Experience that shows, results that glow

Global Reach: Worldwide network, local expertise

Competitive Pricing: Quality service that doesn't break the bank

24/7 Support: We're here when you need us, day or night

Sustainable Practices: Green logistics for a cleaner tomorrow

Your Success Story Starts Here

"Don't let shipping stress steal your business success!"

Every day you delay partnering with professional freight forwarders, you're leaving money on the table and opportunities unexplored. The global marketplace waits for no one, but with ARRKAY TRANSHIP FORWARDERS by your side, you'll always be ahead of the game.

0 notes

Text

Supply Chain Finance - Meaning, Process, Example, Benefits

To maintain goodwill with their consumers, all firms use a credit system. However, if nine out of ten transactions are made on credit, the company’s cash flow will be strained. It could also have an impact on your inventory purchases, as well as your rent and employee salary. One option to deal with the dilemma is to use supply chain finance to free up funds.

What is Supply Chain Finance?

Supply chain financing is a sort of cash advance based on the credit ratings of enterprises in the supply chain, similar to invoice finance.

It’s a method for small businesses to profit from their customers’ higher credit scores while also allowing customers to extend their payment terms. That may seem perplexing, but here’s how it works.

Buyers and sellers are connected to financing institutions through supply chain finance (SCF). As a result, it assists businesses in reducing financing costs and increasing efficiency. Most crucially, it frees up working cash that has been tethered to the supply chain. Trade Finance includes a section called Supply Chain Finance.

Supply Chain Financing is a collection of services provided to medium- and large-sized businesses. The most frequent are loans, Purchasing Order Finance, Factoring, and Invoice Discounting.

Supply chain finance is a set of solutions that optimizes cash flow by allowing businesses to lengthen their payment terms to their suppliers while providing the option for their large and SME suppliers to get paid early.

One word of caution here. Often people confuse supply chain finance with receivables finance, trade finance, or invoice finance. While all these funding techniques help a business get funds to manage its cash flows, there are salient differences between them.

Growing Need for Supply Chain Finance for Business

In India and across the globe, there is an increasing need for supply chain finance. Talking India, there are more than 6.8 Crore small & medium businesses in India. Most of these businesses are always looking for better, more convenient, and cost-effective ways to get funds.

Encouraged by several supply chain finance companies, these small-scale business units actively use supply chain financing. This has led to a huge growth in demand for supply chain finance.

Talking about India, the current market for SCF is around Rs. 60,000 Cr. And this is just about 10% of the total market potential. Based on the value of total invoices raised in India, the market size is estimated to be Rs. 18 lakh Cr. These figures speak of the enormous potential SCF has in India and even globally.

How Supply Chain Finance Works

Before knowing how Supply Chain Finance (SCF) works, let’s understand the players involved. Any typical SCF involves three parties – the seller, the buyer, and the lender. The seller ”sells” the invoice to the lender and gets his money at a discount.

Here, the credit rating of the buyers plays an important role. Lenders feel more comfortable paying the invoices raised to large corporates and MNCs as there is no risk of defaulting payment. This gives the buyers a lot of bargaining power, and they can negotiate better terms with the sellers regarding the product price and payment schedule. The buyer is also encouraged to produce and deliver quickly as he is assured of the lender’s immediate payment.

Supply Chain Finance Process

The entire process of it can be broken down into 4 simple steps, which are explained below:

Managing money in your supply chain is important for keeping things running smoothly. Supply chain finance helps with this by making sure everyone gets paid on time. Here’s how it works, broken down into easy steps:

Supplier Sends the Bill: First, the supplier sends a bill to the buyer after delivering the goods. This is like asking for payment.

Buyer and Lender Approve: Next, the buyer asks a lender to help pay the bill early. The lender looks at the bill and says it’s okay to pay. This step helps the buyer manage their money better.

Lender Pays the Supplier: Once the lender says it’s okay, they pay the supplier for the goods. But they keep a small amount of money as a fee for helping out.

Buyer Pays Back the Lender: When it’s time to pay up, the buyer gives all the money for the bill to the lender. This completes the process.

Let’s Understand This Entire Process With an Example

Say, a company ABC Corporation buys some goods from XYZ Limited. Under normal circumstances, the supplier, XYZ Limited, will send the goods to the buyers, ABC Corporation, and then raise an invoice in the name of ABC Corporation.

The buyer, ABC Corporation, will receive the invoice, approve it, and send it for further processing. The finance department of ABC Corporation will release the payment after 30 days or 60 days, whatever the agreed credit terms.

However, what if the supplier XYZ Limited, after making the delivery and while waiting for the payment, gets another order, for which he needs money to buy raw materials? The seller may not entertain this request, and the buyer cannot risk spoiling his relationship with a large corporate.

The supplier approaches the financial institution (lender) affiliated with ABC Corporation for immediate payment in such a situation. If the request is approved, the lender makes the payment to the supplier at a discount immediately. Not only that, it grants another 30 days to the buyer to make the payment, which the financial institution then collects. This way, the buyer also gets an extended credit period.

Benefits of Supply Chain Finance (SCF)

1- Improved Cash Flow Management- Cash flow management refers to how a company handles its incoming and outgoing cash. It’s crucial for keeping the business running smoothly. With SCF, suppliers can get paid faster by financial institutions after they deliver goods or services, even if the buyer plans to pay later. This means suppliers have more cash on hand to run their operations without waiting for the buyer to pay.

2- Enhanced Supplier Relationships- Supplier relationships are the connections and interactions between a company and its suppliers. Good relationships mean better cooperation and reliability. SCF shows suppliers that a company values them by ensuring they get paid quickly and reliably. This builds trust and encourages suppliers to prioritize and work closely with the company.

3- Increased Operational Efficiency- Operational efficiency is about how smoothly and effectively a company runs its day-to-day activities. By using SCF, companies can streamline their payment processes, reduce administrative work, and avoid delays. This makes the whole supply chain run more smoothly, from production to delivery.

4- Reduced Financing Costs- Financing costs are the expenses a company incurs to borrow money, like interest on loans. SCF often offers lower interest rates compared to traditional loans because it’s based on the buyer’s creditworthiness, not the supplier’s. This means both buyers and suppliers can access cheaper funding.

Who Benefits From Supply Chain Finance?

This method serves multiple purposes and is beneficial for all the parties involved – the supplier, the buyer, and the financial institution (Lender).

Benefits for Supplier

The supplier gets fast access to the money outstanding and can source raw materials for the next order or pay his other liabilities. This makes the company’s cash flow more smooth and more streamlined. The supplier can again repeat the same process with other buyers. This way, the seller can rotate this fund more number of times within a financial year. This way, the supplier can increase his business turnover.

Benefits for Buyer

With SCF, the buyer benefits from a reduction in the cost of goods purchased. This is because the lender not only relieves him of the pressure of paying the invoice within 30 days but grants him an additional 30 days to pay the same amount. This way, the buyer gets a period of 60 days to pay the invoice. With payment being no issues, the suppliers have no issues, and they offer regular supplies to the buyer.

Benefits for Lender

Finally, the mediating agency-i.e. the lender, who could be a bank or some NBFC also benefits here. First, they can use the funds lying to them to generate some income in interest. Also, by collaborating between buyers and sellers, lenders can gain more customers and increase their supply chain.

Eligibility Criteria for Supply Chain Finance

Just like any other business loan, to avail of Supply Chain Finance, the following are the eligibility criteria:

The applicant’s age must be between 24 years and 70 years at the time of maturity of the loan.

The business must be running for at least 3 years.

The buyer must have a good credit rating and no history of defaulting on payments.

Documents Required for Supply Chain Finance

Once you have decided to avail of supply chain finance; you would require the following documents:

Identity Proof/Address proof for the owner as well as business

Recent Bank statements

Recent VAT /GST documents

Invoices for the last 3 months

Sales ledger details for vendor.

Interest Rate, Fee & How to Apply for Supply Chain Finance

The interest rate on SCF is calculated based on the daily utilization of the credit limit. To apply for SCF, you may visit the website and enter your contact details. The company representative will call you, meet you, and explain how to go about it.

Conclusion

Supply Chain Finance is an easy and faster way to ensure the working capital balance. This method of financing is based on the mutual benefit of all and helps the buyer, seller, and lender grow their business. When the overall business goes up, it has a positive impact on the GDP and economy of the country.

Mynd Fintech is the pioneer in digital supply chain financing for Indian businesses. With several financing options such as Vendor financing, Dealer Financing, Invoice Discounting, and Factoring it is the ideal choice.

So, if you are looking to streamline your fund flow position, fill Contact Us form and leave your contact details. One of our representatives will get in touch with you soon to explain how to ride this wave smoothly.

Supply Chain Finance FAQs

Q.1 Who can avail of Supply Chain Finance?

Ans. All business entities such as public and private limited companies, sole proprietorships, partnerships, and limited liability companies who have been in the business for at least 3 years can avail of supply chain finance.

Q.2 How much limit can a business avail from Supply Chain Finance?

Ans. The limit for Supply Chain Finance depends on your needs, solid financial history or stability, a good credit score business, and years of existence in the industry.

Q.3 How much does supply chain finance cost?

Ans. While going for SCF, the buyer does not have to pay extra to extend the payment period. The supplier pays a discounted rate to clear his outstanding payment before the due date.

Q.4 How much time does credit evaluation take?

Ans. Once you submit the correct documents, credit evaluation takes not more than 3 days.

Q.5 Why does my business need Supply Chain Finance?

Ans. Sometimes, you may get an order from a big corporate. While everything may seem fine, they may ask you for a more extended credit period. Since you may not want to miss this business opportunity, you agree to their terms. Or, there may be a delay in payment. Both these situations may result in blocking your funds for that duration. You may have to defer your expansion plans. Supply Chain Finance helps you get quick payment for your invoice and fulfill your expansion plans in such a situation.

Q.6 How is the interest rate calculated and finalized by the company providing supply chain finance?

Ans. The interest rate is calculated based on the daily utilization of the credit limit.

#Supply Chain Finance#Supply Chain Finance Meaning#Supply Chain Finance Process#Supply Chain Finance Benefits

1 note

·

View note

Text

The ultimate bookkeeping checklist : A Beginner’s Guide for Small Businesses

As a small business owner, you've probably heard just how important bookkeeping is—but not many people tell you where to start. If you're unsure, you're not alone.

Bookkeeping isn't flashy, but it is the accounting spine of your business. Done correctly, it provides insights into your cash flow, helps you prepare for tax time, and aids in making wiser financial decisions.

Whether you're going to maintain all your financial records on your own or hire a professional, this checklist will assist you in making a solid foundation for the financial success of your business.

1. Choose the Correct Accounting Method

The first thing you need to decide is whether you want to go for cash basis accounting or accrual basis:

Cash basis accounting – transactions are recorded only when cash is actually paid or received.

Accrual accounting – Transactions are recorded when they are earned or incurred, regardless of when cash is actually received or paid.

If your business is simple and cash-based, you might prefer the cash-basis method. But if you have inventory or sell services on credit terms, accrual accounting paints a more accurate picture of your financial situation.

2. Open a Separate Business Bank Account

One of the frequent errors made by new businesses is not making a separate bank account. To prevent any type of misunderstanding and keep clean books, open a separate bank account and credit card for your business.

Keeping your business finances separate makes your bookkeeping easier, simplifies tax returns, and increases credibility with banks, suppliers, and the IRS.

3. Select Reliable Bookkeeping Software (Don't Use Spreadsheets)

Although spreadsheets could be enough in the short term, they take time and are prone to errors. Rather, use a cloud-based accounting solution like:

BDGAGSS

QuickBooks Online

Xero

These are some of the options to automate expense categorization, invoicing, and financial reporting—making it easy to control your books anywhere, anytime.

4. Record All Transactions promptly

Bookkeeping is all about recording financial information accurately and in a timely manner.

Record all types of business income carefully— online processed, point-of-sale processed, or bank deposit.

Maintain all expenses related to your business, from software plans and stationery to utilities and travel.

Automatic categorization of transactions is possible in most bookkeeping systems, reducing errors and saving time.

5. Keep a Systematic General Ledger

Your general ledger is the core of your bookkeeping system. It tracks all financial transactions, organized by account type (e.g., income, rent, supplies).

Keeping your ledger clean and current ensures your financial statements are accurate and ready when required to make strategic decisions or for tax filing.

6. Reconcile Bank Accounts Monthly

Reconciliation is the process of comparing your records with your true bank statements to verify accuracy and detect variances.

Even minor errors—like duplicate transactions or omitted transactions can impact your finances

. Automatic bank feeds are supported by most bookkeeping software and provide recommended transaction matches for quick review and approval.

7. Get Receipts Organized and Stored

Good record-keeping is important, particularly in the case of an audit.

Using receipt management apps can help you scan and upload invoices, which will automatically associate with their related transactions in your accounting system.

8. Monitor Accounts Receivable and Payable

Keeping track of your accounts receivable (amounts customers owe you) and accounts payable (amounts you owe suppliers) is important for a healthy cash flow.

Make sure to:

Follow up with past-due bills.

Pay suppliers promptly.

Review outstanding balances frequently.

9. Check Financial Reports Often

Uniform bookkeeping allows you to create vital financial reports, such as:

Profit & Loss Statement – Reports revenue, expenses, and net income.

Balance Sheet – Reports assets, liabilities, and equity.

Cash Flow Statement – Follows the flow of money in and out of your business.

Keeping up with these reports every month offers valuable insights that inform better business decisions and indicate where improvements can be made.

10. Be Consistent

The biggest mistake small business owners make is not keeping their books up until it's too late. Take time each week to enter transactions, classify expenses, and balance accounts. The more regularly you keep your books, the faster it goes and the fewer problems you'll have later on.

Final Thoughts

Bookkeeping doesn't have to be overwhelming or time-consuming. With a system in place and the right tools, you can feel good about managing your business finances, prevent surprises, and prepare for expansion.

Using this checklist, you're not only keeping records—you're building a financial system that enables smart decisions and long-term success. And when your business expands, you'll be ready to outsource to a professional bookkeeper without having to start from the beginning.

Blogged by: BDGAGSS

0 notes

Text

John Lasala Shares 5 Financial Strategies for Startup Growth

John Lasala is a Financial Analyst based in New York. He is well known for helping businesses make smart financial decisions. John Lasala uses data and clear strategies to guide startups through financial challenges. With many years of experience, he has become a trusted advisor to many growing companies. He shares five simple financial strategies that can help any startup grow and succeed.

1. Understand Your Income Sources

Before a startup can manage its spending well, it must first understand exactly where its money is coming from. Knowing all sources of income is very important for good financial planning. By clearly identifying each income source, startups can see which are steady and reliable and which might be uncertain. This knowledge helps in setting priorities and making smart financial decisions. Startups should keep track of their income regularly, noting changes and trends.

2. Create a Realistic Budget

A budget is a plan that shows how a business expects to earn and spend money over a certain period, usually a month or a year. Creating a realistic budget is one of the most important steps for startups. A good budget is based on real numbers, not guesses. Startups must also include a small buffer in the budget for unexpected costs. This helps avoid running out of money when surprises happen. The budget should not be something that is made once and forgotten. Having a clear and realistic budget helps startups avoid common financial problems. It also gives business owners confidence because they know their money is being used wisely.

3. Focus on Cash Flow

Cash flow means the movement of money in and out of a business. It is very important for startups to manage cash flow carefully. Even if a startup shows a profit on paper, it can still have problems if it doesn’t have enough cash available when it needs to pay bills or employees. To manage cash flow, startups should plan ahead. This means sending out invoices on time, making sure customers pay on schedule, and controlling when bills are paid. Startups should avoid spending money too soon or making big purchases without enough cash on hand. It’s also smart to keep some cash saved for emergencies.This reserve can help a startup survive slow months or unexpected expenses without stress. Good cash flow management keeps a business running smoothly day to day. It also makes sure the startup is ready for growth when the right opportunity comes.

4. Use Data to Make Decisions

Startups have access to many kinds of data. This can include sales numbers, customer feedback, website visits, and social media engagement. Using this data to make decisions can help startups grow faster and avoid costly mistakes. By studying data, startups learn what products or services customers like most. They can see which marketing efforts bring in more customers and which do not. This helps the business spend money wisely on the things that really work. Data also removes guesswork from decision-making. Instead of hoping for good results, startups can plan based on facts. This leads to better choices about pricing, marketing, product improvements, and customer service. Even simple tools like spreadsheets or free online reports can provide valuable insights.

5. Plan for the Future

It’s easy for startups to focus only on today’s problems and needs. But thinking about the future is just as important. Planning for long-term goals helps startups grow steadily and avoid surprises. Startups should set clear financial goals for the next year, three years, and even five years. These goals could include earning a certain amount of revenue, hiring new employees, or expanding to new markets. Planning ahead also means thinking about future costs. Being prepared for these changes helps the business avoid sudden financial stress. Long-term planning also shows investors and partners that the business is serious and ready for growth. It helps the startup stay focused and work toward bigger achievements step by step.

Conclusion

John Lasala’s work as a Financial Analyst shows that simple and clear financial strategies can help startups succeed. The five strategies he shares: understand your income sources, create a realistic budget, manage cash flow, use data for decisions, and plan for the future are practical steps any startup can follow. By focusing on these basics, startups can build a strong financial foundation. This helps them grow steadily, avoid common mistakes, and reach their goals. His advice is easy to understand and can guide business owners toward making smart choices and building a successful future.

0 notes

Text

No More Payment Delays: Accept Credit Cards Instantly

Let’s take a moment to appreciate all the digital features out there that are making life smoother for small business owners. Managing client work, sending invoices, and dealing with late payments used to feel like an uphill battle. But thanks to platforms like Zil Money, getting paid doesn’t have to be such a struggle anymore. One feature that’s made a real difference? That is, Accept payment by Credit Card—which is a total game-changer.

Let’s be real for a second—these days, if you are not taking credit cards, you are probably leaving money on the table. People want to pay fast and move on, and if it’s not easy, they will bounce. Zil Money understands how important that is, which is why they have made it super simple for small businesses to accept payment by credit card—no complicated setup, no surprise fees, just a smooth way to get paid.

The Real Struggle with Getting Paid

If you are running a small business, you have probably felt the sting of slow payments. You do the work, send the invoice, and then… nothing. Here’s where most of the pain points pop up:

Clients delay payments because they don’t have time to cut a check.

You are stuck following up, again and again, just to collect what’s already earned.

Some customers want to pay with a credit card—but you don’t have the setup to take it.

Traditional services can take forever to get approved or come with fees that eat into profits.

It’s exhausting, right? And when cash flow slows down, so does everything else—payroll, inventory, and future projects. It’s a chain reaction no small business wants to deal with.

Here’s the Fix: Accept Credit Cards with Zil Money

Zil Money made this process as smooth as it gets. With the Accept Payment by Credit Card feature, small businesses can now collect payments without all the usual hurdles.

Send Payment Links in Seconds & Get Paid Faster:

There are no tech headaches here—just a few clicks, and you can send over a payment link to your client through email or SMS. They will land on a secure checkout page and pay using a credit card or even straight from their account. Easy for them, even easier for you.

2.Track Payments in Real Time—From Anywhere:

Whether you are in the office or on the go, Zil Money lets you manage everything from your phone, tablet, or laptop. You will see exactly who’s paid, what’s pending, and what needs a follow-up—so you are never left guessing.

3. Instant Check Drafts & Virtual Card Payments:

Need to create a check draft? Done in seconds. Want to collect money fast? Accept virtual card payments for a quick, secure way to get funds without delays or mailing hassles.

4. Seamless ACH Transfers & Wallet Control:

Pull payments directly from your client’s bank account with ACH—no chasing, no stress. Once the money hits your wallet, you have full control: pay vendors, run payroll, or send checks with just a few taps.

5. More Options = Happier Clients:

Giving your clients multiple ways to pay means fewer excuses and quicker cash flow. Whether it’s a card, ACH, or a payment link, Zil Money makes sure you are covered—while keeping the process smooth on both ends.

This isn't just about convenience. It's about getting control back over your payment process. More importantly, it gives your clients options because happy clients pay faster.

Why Credit Card Payments Matter in 2025

Here’s something to think about: A 2024 Federal Reserve Payments Study found that credit cards are still one of the top ways people pay in the U.S.—especially for business services and B2B transactions. With usage rates around 63% overall, business customers now prefer paying with credit cards because they are fast and flexible, and they can earn rewards.

So, if you are not accepting credit cards yet, you might be missing out on quicker payments from nearly half of your clients.

These days, taking credit cards isn’t just a nice-to-have—it’s a key part of running a smooth, modern business.

Flexibility That Fits Real Business Life

Zil Money isn’t a one-size-fits-all solution - it’s designed to fit the real-world needs of small businesses. Whether you are a freelancer sending a link after a project, a contractor on-site, or a property manager collecting rent, you can request payments instantly. Drop the link in an SMS or email, and you are good to go. It’s fast, flexible, and works the way your business actually runs.

Why Wait to Get Paid?

Without steady cash flow, small businesses struggle, and late payments contribute to that struggle. Zil Money gives small businesses a simple, secure way to accept credit card payments with zero stress.

Clients get the convenience they want. Business owners get paid faster. Everybody wins.

Final Takeaway

Accepting credit cards used to be a headache—now it’s just another click. Whether you are running a one-person show or managing a team, Zil Money makes sure getting paid doesn’t slow you down.

So, if you are tired of chasing checks and want a better way to get paid, it might be time to give credit card payments a shot. No hassle. No drama. Just money moving like it should.

Start accepting credit cards with Zil Money today—and turn “I’ll pay you later” into “Done and paid.”

0 notes

Text

What Is Homeo ERP Software and Why Every Clinic Needs It

In today’s fast-paced healthcare environment, managing a homeopathy clinic efficiently requires more than just handwritten records or basic billing software. This is where Homeo ERP software comes in — a specialized, all-in-one solution designed for the unique needs of homeopathy clinics and pharmacies.

Whether you’re running a single Homeo dispensary or a chain of clinics, Homeo ERP software in Kerala and across India is transforming how clinics manage patients, medicines, inventory, and billing.

✅ What Is Homeo ERP Software?

Homeo ERP (Enterprise Resource Planning) software is a digital system built specifically for homeopathy clinics and pharmacies. It integrates various functions like:

Patient management

Billing and invoicing

Inventory tracking

Medicine potency-based stock control.

Expiry and batch management

Discount schemes

Reports and analytics

Unlike general hospital management software, Homeo ERP software is tailored for potency, combinations, and dilution-specific inventory, making it ideal for homeopathy practitioners.

🎯 Key Features of Homeo ERP Software

Here’s what makes homeo ERP systems a must-have:

1. Potency & Combination-Based Inventory Management

Track medicines based on their potency levels and custom combinations — a feature unique to homeopathy and not offered by generic ERP tools.

2. Medicine Expiry & Batch Tracking

Never lose track of expiry dates. The system alerts you in advance to ensure safe and compliant medicine dispensing.

3. Billing & Discounts Made Easy

Create bills in seconds, apply custom discounts, and offer bulk buyer schemes with ease.

4. Multi-User & Branch Support

Whether you're running a single clinic or a network across multiple locations, manage everything from one central dashboard.

5. Reports & Analytics

Make informed decisions with real-time reports on sales, stock, customer data, and more.

🏥 Why Every Homeo Clinic Needs Homeo ERP Software

🛠️ Automate Daily Tasks

Say riddance to tedious stock updates and paper files. Everything is done digitally, which saves time and minimizes errors.

📦 Improve Stock Control

Avoid over-ordering or running out of stock. Stay updated with inventory levels, expiry alerts, and reorder points.

💰 Boost Revenue

Faster billing, accurate pricing, and smarter inventory management all contribute to better profit margins.

👩⚕️ Better Patient Experience

Maintain detailed patient records, including past prescriptions and medication history — all in one place.

📈 Scale Your Practice

Planning to expand? A cloud-based Homeo ERP software ensures you can scale easily without disrupting operations.

📍 ERP Software for Homeo in Kerala

Hiworth Solutions offers a dedicated Homeo ERP software in Kerala, used by clinics, pharmacies, and homeopathic hospitals. Whether you're located in Trivandrum, Kochi, Calicut, or expanding across India, this system adapts to your workflow.

We help clinics:

Streamline operations

Improve compliance

Reduce paperwork

Increase profitability

🧩 How Is Homeo ERP Different from Generic Hospital Software?

Feature Homeo ERP Software General Hospital Software

Potency-based billing ✅ Yes ❌ No

Homeopathy-specific stock ✅ Managed by dilution/potency ❌ Not supported

Simple UI for small clinics ✅ Designed for ease ❌ Usually complex

Tailored for small businesses ✅ Yes ❌ Often for large hospitals

📝 Final Thoughts

If you run a homeopathy clinic and are still using spreadsheets or outdated tools, it’s time to upgrade. A dedicated Homeo ERP software can save time, reduce manual errors, and help you run your practice more efficiently.

At Hiworth Solutions, we specialize in ERP software for homeopathy clinics in Kerala and India. To schedule a free demo and discover how it can benefit you, get in touch with us right now.

#homeo erp software kerala#homeo erp software trivandrum#hospital management software trivandrum#erp#erp software#information technology#software

0 notes

Text

CGST Made Simple: A Beginner’s Guide is a concise and easy-to-understand book designed for individuals new to the Central Goods and Services Tax (CGST) system in India. It breaks down complex tax concepts into simple language, making it ideal for students, small business owners, and aspiring professionals. The guide covers the basics of CGST, registration, invoicing, returns, compliance, and penalties, with practical examples and step-by-step explanations. Whether you're preparing for exams or managing a business, this beginner-friendly resource provides a solid foundation in CGST. Start your GST journey with confidence and clarity through this straightforward and informative guide.

#free invoice software#gst billing software#invoicing software#free invoicing software#software for billing#billing software#best billing software

0 notes

Text

How To Fix Payment Chaos With NetSuite Integration

The platform’s NetSuite Integration helps you to make payments from a single interface.

Mike runs a custom T-shirt business out of Pittsburgh. He’s got five employees, three vendors who all want to be paid differently, and a growing list of online orders that need fulfillment by yesterday.

Like a lot of small business owners, Mike’s day starts with a to-do list and ends with a headache. And most of the time, that headache comes from one thing: managing payments.

He uses NetSuite for inventory and accounting—it works great. But cutting checks? Mailing them? Paying vendors by card? That’s where he kept hitting walls.

Until he found OnlineCheckWriter.com – Powered by Zil Money.

Integration Without the Hassle

Integration is simple and easy. No complicated setup. No switching back and forth. Just one seamless dashboard where he could manage everything—from cutting checks to sending wire transfers.

Printing Checks Became a 2-Minute Job

Mike ordered pre-printed checks. They were pricey, slow to arrive, and a pain when he ran out.

Now? With OnlineCheckWriter.com - Powered by Zil Money

He prints checks from his desk using plain white paper

He adds his logo, signature, and brand colors

And the checks look more professional than ever

He even saved up to 80% on check costs by skipping the pre-printed stuff entirely.

Mailing Checks? He Doesn’t Even Touch an Envelope

One of Mike’s vendors still wants a paper check by mail. No problem.

The all in one platform lets him mail checks straight from the office or home. He picks First Class USPS or even FedEx Overnight, and OnlineCheckWriter.com - Powered by Zil Money handles the printing, stuffing, and shipping.

All Mike has to do is click “Send.” Done.

When He Needs It Fast—eChecks Step In

Mike’s graphic designer prefers digital. With OnlineCheckWriter.com - Powered by Zil Money, Mike just emails an eCheck as a printable PDF.

It gets there instantly

The designer can print and deposit it

Mike can track it the whole way

No delays. No printing. Just easy.

The Game-Changer: Paying by Credit Card (Even When They Don’t Accept Cards)

Here’s where Mike really leveled up.

His fabric supplier doesn’t take cards—but Mike wanted to use his business credit card for points and cash flow flexibility.

The check printing software made it happen:

He pays with his credit card

The cloud-based software converts it into a check or ACH for the supplier

No merchant account needed, no extra charges for the vendor

He kept his credit line active, earned cashback, and didn’t have to ask, “Do you take Visa?”

ACH, Wires, and International Payments—All in One Place

Mike works with a few international artists for custom designs. With OnlineCheckWriter.com - Powered by Zil Money, he doesn’t have to hunt for another app.

The platform lets him:

Send ACH transfers for local vendors

Use wire transfers for international payments

Even create payment links for quick turnarounds

One dashboard. Every payment type. Zero headaches.

Invoicing + Payment Links = Getting Paid Faster

Mike also started using the platform’s invoicing features to bill his custom clients.

He sends branded invoices with secure payment links. Clients pay via card, ACH, or bank transfer—whatever’s easiest.

No chasing checks

No “lost in the mail” excuses

Just smooth, trackable payments

Security That Would Make Anyone Proud

Mike’s not a security expert—but OnlineCheckWriter.com - Powered by Zil Money takes care of that part for him.

The platform is:

PCI DSS compliant

Fully encrypted

Uses tokenization

Offers multi-factor authentication

And includes Positive Pay to block fake or altered checks

The API Integration That Makes Life Smoother

The cheek printing software’s API works to automate tons of tasks:

Scheduled check runs

Recurring vendor payments

Auto-generated invoices

White-label payment flows for partners

Mike doesn’t need to hire a dev team to make it work—it’s built for real business owners.

Mobile Access, Team Roles, and No-Nonsense Control

Mike’s team needed access too. OnlineCheckWriter.com - Powered by Zil Money lets him set role-based permissions, so his accountant can handle approvals while Mike focuses on orders.

He can access everything from:

His office desktop

His phone at a vendor meeting

Or his tablet from a weekend market

It’s cloud-based, secure, and ready when he is.

Conclsuion

Mike doesn’t spend hours on payments anymore. He doesn’t stress when a vendor asks for a check, or when payroll hits during a tight month.

The all in one platform gives him total control over how he sends, receives, and tracks money.