#invoicing software

Explore tagged Tumblr posts

Text

Annual Return filling- A complete guide

Introduction

From July 1, 2017, India's GST (Goods and Services Tax) has replaced various indirect taxes imposed by the state and federal governments. Every financial year, registered taxpayers must submit a complete GST annual return. According to the Goods and Services Tax Act, a yearly return must be filed with the government. GST aims to convert the entire nation into a single market.

If you are new to GST and eager to know how this new tax will affect you and your business, how to file annual returns, and other related topics, this section will help you understand the basics of annual return filing.

What is the GSTR-9?

GSTR 9 is a yearly return to be filed annually by taxpayers registered under GST and includes details regarding the outward and inward supplies made and received during the relevant financial year under different tax heads, i.e., CGST, SGST & IGST, and HSN codes. Although it is a complex process, this return helps in the extensive data reconciliation for 100% transparent disclosures. The last date to submit the GSTR 9 form is December 31 from the subsequent financial year.

Types of GSTR-9

There are four types of GSTR-9 annual returns under the GST law.

GSTR 9- It comprises registered taxpayers who file GSTR- GSTR-2, GSTR-3, and GSTR 3B

GSTR-9A- Registered and composite dealers come under this.

GSTR-9B- It includes e-commerce dealers

GSTR-9C- It is an audit form that has to be filed by all the companies with a turnover crossing ₹2 Crores in a financial year.

Who should file GSTR-9, the annual return?

All business dealers and owners registered under the GST system must file their GST returns using applicable forms, either online or offline. However, there are some exceptions, and the list includes:

The person who falls under the "Casual Taxable Person".

The person who is not a resident of India.

Any e-commerce website or portal collecting TCS.

Penalty of late filing ITR

Every taxpayer must submit the GSTR 9 form within the given time limit. If he fails to comply with that, there is a considerable GSTR 9 penalty amount of 200 INR per day. This late fee consists of CGST 100 INR per day and SGST 100 INR per day, and there is no late fee payment on IGST. The penalty amount will not exceed the taxpayer's quarter turnover.

How does Eazybills help you file GSTR-9?

Eazybills is an online accounting software that helps you manage your finances and file GST returns.

When you generate a GSTR-9 summary on the GSTN, the transaction details may differ from what you've recorded in your books of accounts. When this happens, you must manually reconcile the information, which can be tedious and error-prone. With Eazybills, you can connect to the GSTN and generate a GSTR-9 summary based on the transactions you've created, then fetch the GSTR-9 summary from the GSTN and compare them to see which fields need to be updated. Once done, you can file the updated summary to the GSTN. This reduces the amount of time you spend updating your returns.

Conclusion

When submitting GST returns, taxpayers encounter technical problems, lengthy processes, and ambiguous regulations.Follow Eazybills for the latest updates, news blogs, and articles related to business tips, income tax, GST, GSTR-9, and GST returns.

#billing software#gst billing software#best billing software#invoice software#free invoice software#invoicing software#free invoicing software#software for billing#GSTR-9

1 note

·

View note

Text

Send professional invoices in 125+ currencies and 15+ languages with Invoicera’s global invoicing solution. Simplify international billing and ensure compliance across borders.

0 notes

Text

Bookkeeping App

Simplify your finances with our smart bookkeeping app – perfect for small businesses, freelancers, and sole traders. Track expenses, send invoices, manage GST, and stay ATO-compliant with ease. Start your free trial today!

0 notes

Text

Master B2B Online Sales with These Top Strategies

Business-to-business online sales are a booming factor in today’s world. Streamline the business operations and set a unique standard.

Read more, https://www.invoicetemple.com/blog/master-b2b-online-sales-with-these-top-strategies

0 notes

Text

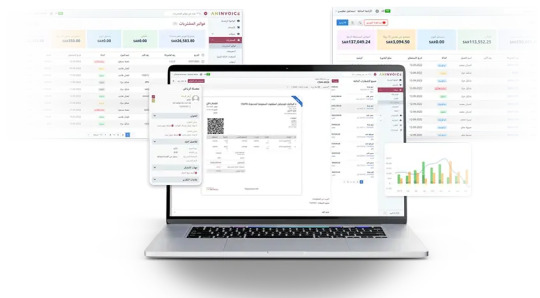

Accounting Software For Business

Boost your business efficiency with Aninvoice, the leading Accounting Software For Business. Designed for all business sizes, it’s the best accounting software to manage finances, invoicing, and reports seamlessly. With online accounting software access, stay on top of your accounts anytime, anywhere. Discover why Aninvoice stands out among top accounting softwares—smart, simple, and secure. Visit Us: https://aninvoice.com/

0 notes

Text

Misleading Claims? A Closer Look at InvoiceTemple.com’s Invoicing Software in Nagercoil

In the digital age, choosing the right invoicing software can be crucial for small businesses and freelancers looking to manage their finances efficiently. With countless options available — Zoho, FreshBooks, QuickBooks, and more — it’s important to evaluate tools based on honest claims and transparent comparisons. However, not all companies play fair in this space. One such example raising eyebrows is InvoiceTemple.com, a software based in Nagercoil, India.

What Is InvoiceTemple?

InvoiceTemple positions itself as an easy-to-use invoicing solution for small businesses. With a clean interface and basic features, it’s marketed toward entrepreneurs who need a lightweight invoicing tool. However, recent scrutiny reveals that some of the claims made on their website — especially regarding payment and time tracking features — may not be entirely accurate.

Features Under the Microscope

InvoiceTemple prominently promotes itself as having built-in payment integration and time tracking capabilities. These are major selling points for freelancers and service-based professionals who need to track hours and get paid on time.

However, users who’ve signed up for the software quickly discover a different reality:

No actual time tracking tool is present. There’s no timer, no way to log billable hours, or convert them directly into invoices.

Payment integrations with popular gateways like Stripe, PayPal, or Razorpay? Also missing. Users are left manually marking invoices as paid, which contradicts the promise of automated or integrated payment features.

The Problem With Misleading Comparisons

Another troubling aspect is InvoiceTemple’s comparison chart displayed on their website. They compare themselves with top-tier platforms like Zoho, FreshBooks, and QuickBooks — some of the most feature-rich tools on the market. The chart suggests InvoiceTemple matches or exceeds these platforms in several areas, including time tracking and payment handling.

In reality, these comparisons don’t hold up:

Zoho Invoice offers extensive automation, integrations, and time tracking.

FreshBooks is known for robust time tracking and payment processing.

QuickBooks goes even further with full accounting, payroll, and tax tools.

InvoiceTemple, meanwhile, only offers basic invoicing and customer management. The comparison is not just misleading — it’s outright incorrect.

Why This Matters

Small business owners rely on honest information to make software choices. Inflated claims not only mislead potential users but also damage trust in the growing SaaS ecosystem in smaller cities like Nagercoil, which is seeing increasing digital entrepreneurship.

Transparency, especially in SaaS, isn’t just good ethics — it’s good business. Overpromising and underdelivering may work in the short term, but savvy users won’t stay quiet for long.

Final Thoughts

If you’re looking for an invoicing solution, be cautious about marketing claims. Always test the features yourself, read real user reviews, and don’t fall for flashy comparison charts that aren’t backed by substance. InvoiceTemple may have potential as a simple invoicing tool, but it’s currently not on par with the major players it claims to compete with.

Until then, honesty is still the best feature any software can have.

#payment integration#time tracking#InvoiceTemple#Invoicing software#Best invoicing software for small businesses#Invoicing tool comparison

0 notes

Text

Create a Free Invoice With mazu In 2025

Mazu makes invoicing easy for retail businesses in India. It provides invoice templates that follow GST rules and can be customized. You can streamline your GST filing, automatically calculate taxes, and improve your brand's professional appearance with Mazu's simple tools.

Create GST-compliant invoices effortlessly.

Customize templates with logos and colours.

Auto-fill GST details and calculate taxes.

Manage GST returns efficiently.

For Further Information Please Visit: https://mazu.in/retail-invoice-bill-generator/

0 notes

Text

Jewellery Billing Software: Streamlining Business Operations with Raseed

In the jewellery business, precision and efficiency are paramount. From managing intricate inventory to generating accurate invoices, the demands of running a jewellery store are unique. This is where Raseed Jewellery Billing Software comes into play, offering tailor-made solutions to simplify your operations and enhance business productivity.

What is Jewellery Billing Software?

Jewellery billing software is a specialized tool designed to cater to the specific needs of jewellery businesses. Unlike generic billing systems, it accommodates complex inventory tracking, varied pricing structures, GST compliance, and even customer relationship management, all in one streamlined solution.

Why Choose Raseed Jewellery Billing Software?

Raseed is a trusted name when it comes to efficient billing and accounting solutions for jewellery businesses. Here’s why:

Easy GST Billing: With built-in GST compliance, Raseed ensures that your invoices are accurate and meet regulatory standards.

Comprehensive Inventory Management: Manage detailed inventory, including karat-wise gold, diamond categories, and other precious metals, with ease.

Customizable Invoice Templates: Impress your customers with professional and personalized invoice designs tailored to your brand.

Real-Time Reporting: Gain insights into sales, profits, and stock levels through user-friendly dashboards and reports.

Seamless Customer Management: Keep track of your loyal customers with features like purchase history and preferences to enhance customer relationships.

Benefits of Using Jewellery Billing Software Like Raseed

Error-Free Transactions: Automate calculations to avoid errors in billing and pricing.

Time Efficiency: Save hours spent on manual billing and focus more on serving customers.

Improved Accuracy: Maintain precise records of inventory and sales, ensuring seamless audits.

Enhanced Customer Experience: Provide quick and efficient service with organized data and easy-to-understand invoices.

Features Tailored for Jewellers

Barcode integration for faster inventory management.

Detailed tracking of gold weight and other materials used.

Flexible pricing options to accommodate discounts or offers.

Backup and cloud storage for secure and reliable data management.

Why Your Business Needs Raseed Jewellery Billing Software

Whether you run a small jewellery shop or a large showroom, Raseed Jewellery Billing Software is designed to adapt to your business size and needs. It’s the ultimate tool to simplify operations, ensure compliance, and provide exceptional service to your customers.

Conclusion

In the competitive world of jewellery, leveraging the right tools can set your business apart. With Raseed Jewellery Billing Software, you can manage your operations seamlessly, leaving you more time to focus on crafting stunning pieces and serving your customers.

Ready to transform your jewellery business? Visit website Raseed and experience the change today!

#billing software#jewellery billing software#invoice software#invoicing software#gst billing software

0 notes

Text

GSTR-9 Filing Made Easy | EAZYBILLS is your hassle-free solution for filing annual GST returns. Designed for regular taxpayers, our platform simplifies the entire GSTR-9 filing process with easy-to-follow steps, smart data validation, and timely reminders. Avoid penalties and ensure 100% compliance with EAZYBILLS’ user-friendly interface and expert support. Whether you're a small business owner or a tax professional, EAZYBILLS helps you file accurately and on time. Stay stress-free during tax season with our secure, reliable, and efficient GST filing service. Make your annual return filing seamless and efficient — trust EAZYBILLS for GSTR-9, the smart way.

#invoicing software#best billing software#invoice software#billing software#online invoicing software

0 notes

Text

Tired of chasing payments and managing invoices manually? Find out how invoicing software for freelancers like Invoicera can automate your billing, track time, and ensure you get paid on time—so you can focus on doing what you love.

0 notes

Text

Freelancer Accounting App

Discover the ultimate freelancer accounting app designed to simplify your finances, track expenses, send professional invoices, and manage taxes with ease. Ideal for self-employed professionals, this user-friendly app helps you stay organized and compliant—all in one place. Start your free trial today and take control of your freelance finances!

0 notes

Text

Rebranding Your Small Business

Rebranding is the process of taking a small business to an enhanced level. Explore the rebranding techniques and achieve success in it.

For more information Read our blog

0 notes

Text

Invoicing software for small business with easy interface

Managing finances is one of the most critical responsibilities for any small business. From creating invoices to tracking payments and managing cash flow, every step must be handled with care and accuracy. However, for small business owners juggling multiple roles, traditional manual invoicing methods can be time-consuming, error-prone, and inefficient.

This is where Otto AI invoicing software for small business needs steps in to transform the way companies handle their finances. Designed specifically for small businesses and entrepreneurs, Otto AI offers an intelligent, automated, and user-friendly platform to manage invoicing seamlessly. In this blog, we will explore how Otto AI simplifies financial tasks, boosts productivity, and provides a cost-effective solution for small business owners.

The Financial Challenges Faced by Small Businesses

Small businesses often face a range of financial management hurdles:

Limited Resources: Many small businesses cannot afford full-time accountants or finance teams.

Manual Invoicing: Creating invoices manually using spreadsheets or word processors is not only slow but increases the risk of errors.

Delayed Payments: Inefficient tracking of pending invoices can lead to delayed payments and affect cash flow.

Compliance Issues: Staying compliant with tax and billing regulations can be tricky without proper invoicing tools.

Lack of Insights: Without proper analytics, it becomes difficult to understand payment trends or identify bottlenecks.

To address these problems, businesses need a smart, scalable, and affordable invoicing software that meets their daily needs—enter Otto AI.

What Is Otto AI Invoicing Software?

Otto AI is an advanced invoicing and finance automation platform tailored for small businesses. It is built with AI-powered features that automate repetitive tasks, enhance accuracy, and give business owners more time to focus on growth. From creating professional invoices to automating payment reminders, Otto AI acts as a virtual assistant for all things invoicing.

Whether you are a freelancer, startup founder, or a small business owner, Otto AI makes financial management easier without needing technical skills or prior accounting knowledge.

Key Features of Otto AI for Invoicing

Here are some of the top features that make Otto AI an excellent invoicing software for small business owners:

1. Automated Invoice Creation

Otto AI allows users to generate professional-looking invoices within minutes. You can customize templates, add business logos, input client details, and include tax or discount fields with ease.

2. Recurring Invoices

For businesses with repeat customers, Otto AI enables recurring invoice scheduling. This ensures that invoices are sent automatically at the right time, improving consistency and reducing manual workload.

3. Smart Payment Reminders

Otto AI helps you maintain steady cash flow by automatically sending payment reminders to clients. These reminders are polite, timely, and effective in reducing overdue payments.

4. Multi-Currency and Tax Support

Whether your business is local or international, Otto AI supports multiple currencies and region-specific tax settings. This makes it ideal for small businesses looking to scale globally.

5. Integration with Business Tools

Otto AI can be integrated with various platforms like Slack, Gmail, Outlook, and accounting tools. This allows seamless data syncing and improves workflow efficiency.

6. Real-Time Analytics

Understand your revenue trends, pending payments, and best-paying clients using Otto AI’s dashboard. With these insights, you can make smarter business decisions.

7. Secure Cloud Storage

All your invoices and client data are securely stored in the cloud, with backup and encryption to protect sensitive information.

Why Otto AI Is the Best Invoicing Software for Small Business Needs

There are many invoicing tools in the market, but Otto AI stands out due to its focus on small business challenges. Here’s why it is the ideal choice:

✅ Ease of Use

Otto AI is designed with simplicity in mind. The intuitive dashboard requires no training and can be used by anyone, regardless of their tech experience.

✅ Time-Saving Automation

From recurring invoices to payment reminders, Otto AI reduces manual tasks, giving you back hours every week.

✅ Affordable Pricing

Unlike enterprise-level invoicing platforms, Otto AI offers budget-friendly plans tailored for small businesses and solopreneurs.

✅ Customizable for Your Business

Whether you are in retail, freelancing, services, or e-commerce, Otto AI offers customization options that suit your industry needs.

✅ Better Cash Flow

By reducing payment delays and offering quick insights into outstanding invoices, Otto AI helps maintain healthy cash flow.

Who Can Benefit from Otto AI?

Otto AI is built to serve a wide range of small business users:

Freelancers who need to send professional invoices and track payments

Startups that require quick, scalable invoicing solutions without hiring a finance team

Agencies and Consultants who manage multiple clients and recurring projects

E-commerce sellers looking to automate invoice generation

Local service providers such as designers, developers, and marketers

No matter your industry, if invoicing is part of your business, Otto AI has you covered.

How to Get Started with Otto AI

Getting started with Otto AI is easy and hassle-free:

Sign up at https://joinotto.com

Set up your business profile by adding company details, logo, and tax settings

Create your first invoice using customizable templates

Automate your workflow with scheduled reminders and recurring invoices

Track payments and insights using the built-in dashboard

Within minutes, you can move from manual invoicing to intelligent automation that saves time and boosts efficiency.

Final Thoughts

In today’s fast-paced business environment, small business owners need more than just basic tools—they need smart, automated solutions that help them stay focused on growth and profitability. Otto AI invoicing software for small business needs provides exactly that.

By eliminating manual processes, reducing errors, and improving cash flow, Otto AI empowers businesses to operate more smoothly and professionally. Whether you are just starting or scaling your operations, Otto AI gives you the invoicing support you need to thrive.

1 note

·

View note

Text

Mastering the GST Invoice Format: A Comprehensive Guide to Create and Manage Your Invoices

Learn how to create and manage GST-compliant invoices with ease. This comprehensive guide covers the essential components of a GST invoice, legal requirements, and best practices to ensure accuracy and compliance. Streamline your billing process and stay tax-ready with actionable tips and expert insights.

0 notes

Text

Invoicing for Small Retail Businesses: Tips and Tricks

Master the art of efficient invoicing for your small retail business with our expert tips and tricks. This blog explores practical strategies to streamline your invoicing process, improve cash flow, and minimize errors.

Introduction

Effective invoicing is crucial for the success of any small retail business. It ensures timely payment, improves cash flow, and enhances customer satisfaction. However, managing invoices can be complex and time-consuming if not done efficiently. Therefore, it is essential for small retail businesses to understand the tips and tricks involved in creating effective invoices. This essay will provide valuable insights into various aspects of invoicing for small retail businesses.

1. Clear and Professional Invoice Design

The first step towards effective invoicing is to create a clear and professional invoice design. A well-designed invoice helps in conveying professionalism and builds credibility with customers. It should include essential information such as the business name, logo, contact details, invoice number, date issued, due date, and itemized list of products or services provided along with their prices and quantities.

2. Accurate Pricing

Accurate pricing plays a vital role in generating correct invoices. Small retail businesses must ensure they have accurate pricing information for each product or service offered. This includes considering factors such as cost price, profit margin, taxes (if applicable), discounts (if any), shipping charges (if applicable), etc. By ensuring accuracy in pricing calculations on each invoice generated, businesses can avoid disputes related to incorrect billing.

3. Timely Issuance of Invoices

Timely issuance of invoices is crucial to maintain healthy cash flow for small retail businesses. The quicker the bills reach customers after completion of a transaction or delivery of goods/services; the sooner they will be paid by customers/vendors/partners/suppliers/etc., thereby reducing outstanding dues or accounts receivable balances.

4. Clear Payment Terms

Small retail enterprises should clearly state payment terms on their invoices to set expectations with clients about when payments are due and which methods are allowed (for example, credit card payments online). Common payment terms include “Net 30” (payment due within 30 days), “Due on Receipt” (payment due immediately upon receipt of the invoice), and any other suitable payment term agreed upon by a business and its consumers.

5. Encourage Timely Payment

Small retail businesses can encourage timely payments by offering incentives for early payment or charging late payment fees. Many small retailers offer discounts, such as a percentage off the total amount, if invoices are paid within a specific time frame. Conversely, imposing late payment fees helps deter payment delays and ensures adherence to agreed-upon terms.

6. Utilize Invoicing Software

For small retail companies, investing in reliable invoicing software may automate and streamline the entire invoicing process. With the help of these software programs, companies can quickly produce invoices that appear professional, monitor unpaid invoices, automatically alert late payers, and provide a variety of financial information required for accounting needs.

7. Maintain Proper Records

Maintaining proper records is crucial for small retail businesses when it comes to tracking invoices and managing accounts receivable efficiently. Keeping digital copies of all issued invoices along with relevant supporting documents like purchase orders or delivery receipts helps prevent confusion or disputes regarding past transactions.

Conclusion

Effective invoicing is critical for small shops because it immediately affects cash flow management and customer satisfaction. Small retailers can significantly improve their invoicing processes by following these tips and tricks, which include creating clear and professional invoice designs, accurate pricing calculations, timely invoice issuance, setting clear payment terms, and encouraging timely payments through incentives or penalties when applicable. Also, investing in reputable invoicing software helps businesses automate processes while keeping accurate records and assures transparency in financial operations. Finally, these efforts contribute to more efficient operations, which leads to more profitability and long-term success.

Happy Invoicing..!

1 note

·

View note

Text

Build Strong Client Relationships with Smart Invoicing Strategies

Strengthen client relationships with smart invoicing strategies. Use personalized messages, timely invoices, clear payment terms, and branded designs to build trust and loyalty. Enhance customer satisfaction, boost sales, and grow your business by turning invoices into a powerful tool for rapport building.

How to Build Rapport with Your Client Through Invoice

How to develop a good rapport with your clients through invoices?

Maintaining a good rapport with your customers helps to improve your reputation and attract more customers….

Are you focusing on building rapport with your clients? Are you maintaining a good relationship with your customers? Why does building rapport with your clients play a vital role in every business?

Every business is aware that the Customer is King. When you do not understand your target audience, it is impossible to build your empire and increase your goodwill in the market. You should maintain quality products or services and gaining customer satisfaction are the two factors behind a successful business.

This article discusses the importance of building rapport with clients and how to make it possible. Let us see this in detail.

How Building Rapport with Customers Are Essential Through Invoices?

Customers play a prime role in the growth of the business. When you get loyal customers, build a rapport with them and turn them into life-long customers for your business.

When you lose your rapport with the customers, they will shift their purchasing power to your competitor's side. Soon, you will face heavy losses in your business. There are many ways to develop a rapport with your clients through invoices:

Attach feedback link in your invoice

Give a solution for their problem via online

Teach them about your products through blogs, youtube, and other social media platforms, and attach the links to invoice

Appoint a personal salesperson during their purchase

Active in customer support

Active on social media to solve their problems

Send a thank you message in the invoice

If there is a delay in payment, provide some time and understand their situation

Provide a fast and supportive payment gateway for customers

Sending reminders two days before the due date

Add your company logo to make your brand memorable

Provide different options for a payment gateway to make transactions simple.

Apply all these strategies and develop a rapport with customers in your business.

Benefits of Building Rapport with Clients

When you show a good rapport with clients, it will create superfast growth in your business:

1. Increase the Reputation

Businesses with great reputations can bring more surprises to the market every day. This helps to bring numerous customers to your business, and existing customers are proud to purchase products or services from your brand.

This reputation is a mouth marketing strategy to attract a larger target audience in your business. So, you should maintain a good rapport with your existing customers, it increases the clients count, purchases products in a repeated mode, and expands your business to the next level.

2. Bring More Loyal Customers

Gaining loyal customers is one of the challenges for the business. They are a great asset to the business. Now, more brands are entering the field and capturing customers' attention in an instant spark.

When you develop a good rapport with your customers, they will trust our brand, make continuous purchases, and recommend your products to others. They provide positive reviews of your products. These reviews attract more loyal customers to your business.

3. Increase in Sales

A business owner can expect 80 to 90% of customers to purchase your products when you build a good rapport with them. They come forward without any hesitation and ask their queries.

By solving their queries you will get ideas related to the products or service improvement. When a business owner combines quality products and loyal customers, it opens the gates of mouth marketing. A mouth marketing strategy helps to increase the customer base, and it creates gradual growth in your sales.

4. Be Unique in The Market

Some businesses focus on the current trends and try unique ways to stand in the market. They do not bother about customer service and developing rapport with them. Some businesses believe that they can increase sales through attractive advertisements and promotions.

But it does not help to withstand the market for the long term. Only customers trust the brand when they provide quality products and maintain a good relationship with them.

5. Brand Trust will Increase

Gaining trust from customers is a crucial part of every business. Understanding their problems through feedback forms and taking immediate actions to solve their problems increases their trust in your brand in the market.

How to Use Invoices in Building Rapport with Your Customers

Here are some of the points to build rapport with your customers through invoices:

1. Send Invoice on Time

The company should send invoices to their customers before the due date. Once the sale is completed with customers, immediately prepare invoices and send them within a day.

Customers will see this as evidence of your company's professionalism. Don't forget to include a thank you note with each customer invoice. Replace it with "Thank you for your purchase, and I hope you like our service". This helps to establish rapport with clients.

And you can suggest other products from your brand at the end of the invoice. Do not push your customers to buy the products. So, be gentle with your approach.

2. Terms and Payment Details Should Be Clear

After preparing invoices, attach the payment gateway link to make your customers payment simple.

As a business owner, you should have more payment options to make the transactions fast. You can add payment options such as debit card, credit card, PayPal, bank transfer, cheques, etc…

After adding a payment gateway you should mention clear terms and conditions of when the customers should pay the invoice due amount, penalties, grace period, etc… This avoids confusion and maintains a good rapport with customers.

3. Add All the Essential Information to the Invoice

The information in the invoice should be visible, and anybody can read it effortlessly. At once, the customer verifies the invoice, and they will get a clear knowledge about their purchases and how much they charge for.

Mention the date, list of products, rate of a single product, total units of products rate, any discount, etc…

4. Add Your Company Logo

In the last stage, send your invoices with your company logo. What will happen when you send invoices without brand colors?

Customers will not remember your brand, and it affects their relationship with them. When you add your company logo to the invoice, customers identify your brand forever. Even if they fail to make payment on time, your logo will remind them.

Add fonts and colors to make your invoice unique and make it memorable. Adding your logo to invoices is one of the best strategies to promote your brand in the market.

Closing Thoughts

From the above article, discuss the importance of building rapport with your customers and how to make it happen in your business.

Now, every business is shifting from manual invoices to invoice software.

0 notes