#Step-by-Step Guide: How to File Your ITR for AY 2024–25

Explore tagged Tumblr posts

Text

How to File Your ITR for AY 2024–25 Before the Deadline

Hate it or love it—tax season always shows up on time.

As the new financial year is approaching, it’s time to get serious about your Income Tax Return (ITR). Whether you are a salary earner, a freelancer, or a business person, ITR filing is not only a statutory obligation but a financial hygiene check that keeps your money related matters clean and compliant. Here in this blog, we’re going to walk you through all that you must know before you get your ITR filed accurately and fearlessly for FY 2024-25.

#How to File Your ITR for AY 2024–25 Before the Deadline#File Your ITR for AY 2024–25 Before the Deadline#File Your ITR for AY 2024–25#Step-by-Step Guide: How to File Your ITR for AY 2024–25#Step-by-Step Guide: How to File Your ITR

0 notes

Text

How to File Your Income Tax Return in Ahmedabad – A Complete Beginner’s Guide

Introduction

Filing your income tax return is a crucial financial responsibility for every taxpayer in India, including those residing in Ahmedabad. Whether you are a salaried individual, a business owner, or a professional, understanding the process of Income Tax Return Filing in Ahmedabad can save you from penalties and help you claim rightful refunds. This comprehensive beginner’s guide will walk you through every step of filing your Income Tax Return (ITR) efficiently and accurately.

What is Income Tax Return Filing?

Income Tax Return Filing is the process of submitting your income details, tax payments, and deductions to the Income Tax Department of India. This declaration enables the government to assess your tax liability and ensures transparency in your financial dealings. Filing your ITR is mandatory if your income exceeds certain thresholds or if you meet specific criteria set by the tax authorities.

In Ahmedabad, a bustling economic hub, Income Tax Return Filing has become increasingly streamlined due to digital advancements, allowing taxpayers to file returns conveniently online.

Who Needs to File an Income Tax Return in Ahmedabad?

The following categories of taxpayers in Ahmedabad are required to file their Income Tax Returns:

Individuals (residents and NRIs) with a total income above ₹2.5 lakh (below 60 years of age).

Senior citizens aged 60-80 years with an income above ₹3 lakh.

Super senior citizens aged 80 years and above with an income of over ₹5 lakh.

Companies, LLPs, and partnership firms, regardless of income or loss.

Individuals claiming tax refunds.

Residents owning foreign assets or earning foreign income.

Taxpayers who want to carry forward losses under the capital gains or business heads.

Those with significant bank deposits, foreign travel expenses, or high electricity bills, as per the Income Tax rules.

Documents Required for Income Tax Return Filing in Ahmedabad

Proper documentation is essential for hassle-free Income Tax Return Filing in Ahmedabad. The required documents vary depending on your income source:

For Salaried Individuals:

PAN Card (Permanent Account Number)

Aadhaar Card

Form 16 (issued by the employer)

Salary slips

Form 26AS (Tax Credit Statement)

Bank account details

Investment proofs for claiming deductions (e.g., under Section 80C)

For Self-Employed and Business Owners:

Profit and Loss account

Balance sheet

Books of accounts related to transactions

TDS certificates (Form 16A, 16B, or 16C)

Bank statements

GST returns (if applicable)

Step-by-Step Process for Income Tax Return Filing in Ahmedabad

Filing your ITR online is now the most preferred and convenient method. Here’s a detailed step-by-step guide to help you file your return correctly:

Step 1: Register/Login on the Income Tax e-Filing Portal

Visit the official Income Tax Department e-filing website and log in using your PAN as the User ID and your password.

Step 2: Select the Assessment Year

Choose the correct assessment year (for example, AY 2025-26 for FY 2024-25).

Step 3: Choose the Appropriate ITR Form

Select the ITR form based on your income sources. Standard forms for individuals include ITR-1 (Sahaj), ITR-2, ITR-3, etc.

Step 4: Fill in Income and Deduction Details

Enter your income details, tax payments, and deductions accurately. Validate the pre-filled information such as PAN, Aadhaar, and bank details.

Step 5: Validate and Compute Tax

Cross-verify your details with Form 26AS and other tax statements. Compute your tax liability and claim deductions under applicable sections like 80C, 80D, etc.

Step 6: Submit and E-Verify Your Return

Submit the ITR online and complete the verification process using an Aadhaar OTP, net banking, EVC, or by sending a signed physical copy of ITR-V to the CPC, Bengaluru, within 30 days.

Step 7: Download Acknowledgment

After successful submission, download the ITR-V acknowledgment for your records.

Important Deadlines and Penalties

Due Dates for Filing ITR in Ahmedabad:

For individuals and non-audit cases: 31st July of the assessment year.

For taxpayers requiring an audit (businesses with turnover above the threshold): 31st October.

Penalties for Late Filing:

₹1,000 if income is below ₹5 lakh.

₹5,000 if income is above ₹5 lakh (if filed after due date but before 31st December).

Interest under Section 234A on tax due.

Loss of certain tax benefits and inability to carry forward losses.

Possible scrutiny by the Income Tax Department.

Tips for Smooth Income Tax Return Filing

Keep all your documents organized before starting the filing process.

Use the pre-filled data option on the Income Tax e-filing portal to minimize errors.

Double-check all income and deduction details against Form 26AS.

File your return well in advance of the due date to avoid last-minute issues.

If unsure, consult a certified Income Tax Consultant in Ahmedabad for expert guidance.

Conclusion

Filing an Income Tax Return in Ahmedabad is a straightforward process when you understand the requirements and follow the correct steps. Filing your ITRs timely and accurately not only keeps you compliant with the law but also ensures you can claim refunds and carry forward losses efficiently. Whether you are a salaried employee or a business owner, leveraging online portals and expert advice can make your tax filing experience smooth and stress-free.

0 notes

Video

youtube

How to File ITR-1 Online for FY 2024–25 | Senior Citizen | Old vs New Ta...

How to File ITR-1 Online for FY 2024–25 | Senior Citizen | Old vs New Tax Regime|ITR-1 FY24-25LIVE! #itr1 #incometax #cadeveshthakur @cadeveshthakur 📢 Complete Guide to Filing ITR-1 Online for Senior Citizens (FY 2024–25 | AY 2025–26) If you're a senior citizen (aged 60+) or filing ITR for your parents or elders, this video is your one-stop solution to file Income Tax Return using ITR-1 Sahaj form for Assessment Year 2025–26 (Financial Year 2024–25). We also help you choose between the Old Tax Regime and New Tax Regime with a clear, step-by-step comparison of tax liability! ✅ 👇 Follow Playlist for Income Tax Return (ITR) Filing FY 2024-25 | Complete Guide https://www.youtube.com/playlist?list=PL1o9nc8dxF1R4FZlmK-5tIighYB0vxu3L 🎯 What this video covers: 🔹 Who can file ITR-1 Sahaj (eligibility criteria) 🔹 Income details required for senior citizens 🔹 Important documents checklist 🔹 Step-by-step filing on the Income Tax Portal 🔹 Comparison of Tax Liability – Old vs New Regime 🔹 Tax slabs and deductions explained (80C, 80D, 80TTB etc.) 🔹 Common mistakes to avoid 🔹 Which regime is better for senior citizens? 🔹 How to file ITR-1 online correctly with zero errors! Index 00:00 to 00:48 Introduction 00:49 to 03:48 Computation as per New Tax Regime 03:49 to 06:27 Computation as per Old Tax Regime 06:28 to 21:05 How to file ITR1 online for FY 2024-25 🧓 Specially curated for: ✔️ Senior Citizens (60 years and above) ✔️ Super Senior Citizens (80 years and above) ✔️ Children filing ITR on behalf of their parents ✔️ Taxpayers confused between Old & New Regime 📌 Must Watch Before You File ITR This Year! 👉 Don’t forget to LIKE, SHARE & SUBSCRIBE for more tax-saving content! 🔖 Tags / Hashtags for SEO #ITR1Filing2025 #SeniorCitizenTax #IncomeTaxIndia #TaxRegimeComparison #ITRforParents #IncomeTaxReturn #OldVsNewTaxRegime #ITR1FilingStepByStep #IncomeTax2025 #SahajFormITR1 #AY2025_26 #OnlineITRFiling #IndianTaxSystem #TaxTipsIndia #SeniorCitizenFinance #IncomeTaxPortal #TaxDeductionsIndia #Form16Filing #ITRHelp2025 #FileITROnline #TaxPlanningIndia #OldRegimeVsNewRegime Remember, our community is more than just a channel—it’s a family. Let’s connect, learn, and grow together! Hit that Subscribe button, tap the notification bell, and let’s spread financial wisdom one click at a time. 🚀 Remember, knowledge empowers us all! Let’s learn together and navigate the complex world of finance with curiosity and diligence. Thank you for being part of the cadeveshthakur community! 🙌 Disclaimer: The content shared on this channel is purely for educational purposes. As a Chartered Accountant, I strive to provide accurate and insightful information related to GST, income tax, accounting, and tax planning. However, please note that the content should not be considered as professional advice or a substitute for personalized consultation. If you found this video helpful, don’t forget to LIKE 👍, SHARE ↗️ it with your friends, and SUBSCRIBE 🔔 to my channel, cadeveshthakur, for regular updates on GST, accounting, finance, and the latest market insights. ✨ Press the Bell Icon 🔔 so you never miss an update and get notified the moment I upload a new video packed with valuable information just for you! Your support helps me create more content to simplify complex topics and keep you informed. Thank you! 😊

0 notes

Text

A Complete Guide to Income Tax Return Filing Online: Steps, Deadlines, and Login Info

Filing your income tax return (ITR) is not just a legal obligation but also a responsible financial practice. Whether you’re a salaried professional, a business owner, or a freelancer, understanding the process of income tax return filing can help you avoid penalties and even secure tax refunds.

In this detailed blog, we’ll walk you through everything about e-filing of income tax returns, including the income tax return filing last date, how to login to the portal, and a step-by-step guide to file income tax return online.

Income tax return filing is the process of submitting a report of your income and taxes paid during a financial year to the Income Tax Department of India. The purpose is to assess tax liabilities, calculate refunds (if applicable), and remain tax-compliant.

🗓️ Income Tax Return Filing Last Date [FY 2024–25]

One of the most searched queries is about the income tax return filing last date. For the financial year 2024–25 (Assessment Year 2025–26):

For individual taxpayers (non-audit cases): July 31, 2025

For audit cases: October 31, 2025

For transfer pricing cases: November 30, 2025

Late filing of ITR can attract penalties up to ₹5,000 under Section 234F of the Income Tax Act.

To begin with e-filing of income tax return, you need to login to the income tax e-filing portal:

Steps to login:

1. Visit the official income tax e-filing portal.

2. Click on the “Login” button on the top right.

3. Enter your PAN as the user ID.

4. Enter your password and captcha.

5. If you’re a first-time user, click on Register and follow the instructions.

📃 How to File Income Tax Return Online Step by Step

Here’s a step-by-step guide to file income tax return online for salaried and non-salaried individuals:

Step 1: Login to Income Tax e-Filing Portal

Visit incometax.gov.in and use your PAN and password to login.

Step 2: Go to ‘e-File’ → ‘Income Tax Return’

Click on ‘e-File’, then select ‘Income Tax Return’.

Step 3: Select the Assessment Year

Choose the Assessment Year (e.g., AY 2025–26 for FY 2024–25).

Step 4: Choose the Appropriate ITR Form

Based on your income source:

ITR-1 (Sahaj): Salaried individuals with income up to ₹50 lakhs

ITR-2: If you have capital gains or foreign assets

ITR-3: For business or profession income

ITR-4 (Sugam): Presumptive income scheme users

Step 5: Choose Filing Type

Select ‘Online’ as your mode of filing.

Step 6: Fill in the Required Details

Provide details such as:

Salary, interest, rental income

Tax deductions (Section 80C, 80D, etc.)

TDS details (from Form 26AS)

Step 7: Validate Your Return

Use the ‘Validate’ option to check for errors.

Step 8: Submit and Verify Your Return

You can verify your return through:

Aadhaar OTP

Net banking

EVC (Electronic Verification Code)

Or send a signed ITR-V to CPC, Bengaluru

✅ Faster Processing of Refunds

✅ Paperless and Hassle-free Filing

✅ Easy Access to Previous Returns

✅ Helps in Visa Applications and Loan Approvals

✅ Avoid Penalties for Non-Compliance

❗ Common Mistakes to Avoid

Entering incorrect bank details for refund

Not verifying your return after submission

Selecting wrong ITR form

Mismatch in TDS and Form 26AS data

Ignoring exempt incomes like PPF or interest from savings

🧾 Documents Required for ITR Filing

Before starting the filing process, keep the following documents ready:

PAN Card and Aadhaar Card

Form 16 from employer

Form 26AS (tax credit statement)

Interest certificates (FD, savings account)

Capital gains statement (if applicable)

Investment proof for deductions

Bank account details

🤖 New Updates in Income Tax Return Filing for AY 2025–26

Pre-filled ITR forms with salary, interest income, and TDS details

New AIS (Annual Information Statement) for income tracking

Option to choose between old and new tax regimes

Improved user dashboard on the new e-filing portal

📈 Why Timely Income Tax Return Filing Matters

1. Avoid Late Fees: Save yourself from ₹1,000 to ₹5,000 penalty.

2. Claim Refunds: Excess TDS can only be claimed through ITR.

3. Loan & Visa Applications: ITR proofs are often mandatory.

4. Carry Forward Losses: File ITR on time to carry forward losses.

💼 Professional Help for ITR Filing

If you are confused about how to file income tax return online, consider hiring a CA or a tax consultant. Many platforms like ClearTax, Tax2win, and myITreturn also offer expert-assisted filing.

🏁 Conclusion

With digitization, income tax return filing online has become more accessible and faster. Whether you’re a salaried person or a freelancer, it’s crucial to stay informed about the income tax return filing last date and use the correct method to file your return.

If you haven’t filed your ITR yet, now is the time! Don’t wait for the deadline rush. Make use of the easy e filing of income tax return facility and stay compliant.

✅ Frequently Asked Questions (FAQs)

Q1. What is the last date for income tax return filing for AY 2025–26? A: July 31, 2025, for individual taxpayers.

Q2. How do I check my ITR status? A: Login to the e-filing portal, go to Dashboard → View Filed Returns.

Q3. Is it mandatory to verify ITR? A: Yes, ITR is incomplete until it is verified.

Q4. Can I revise my ITR after submission? A: Yes, revised returns can be filed before December 31, 2025.

Q5. Can I file ITR without Form 16? A: Yes, use salary slips and Form 26AS to compute income.

Contact Us

To know more about ITR filing ,pricing, or to book a site visit, get in touch with us today:

📞 Call: 9899767300

📧 Email: [email protected]

🌐 Website: https://realtaxindia.com/

0 notes

Text

Correcting Mistakes in Your Income Tax Returns: A Guide to Filing ITR-U

Mistakes in your Income Tax Return (ITR) or missed income declarations can be rectified through the Updated Income Tax Return (ITR-U). Here's everything you need to know about ITR-U, including eligibility, filing process, and deadlines.

What Is ITR-U?

Introduced in the Union Budget 2022, ITR-U enables taxpayers to amend errors or omissions in their previously filed tax returns. Whether you forgot to file your original return or even a belated one, ITR-U provides a way to correct it. This form can be filed within two years from the end of the relevant Assessment Year.

When Can I Use ITR-U?

Starting from January 1st of the Assessment Year, taxpayers can use ITR-U to correct minor errors or omissions. However, ITR-U cannot be used to:

Reduce your tax liability.

Claim additional refunds.

Enhance losses for future carry forward.

It is solely for errors that result in additional taxes being payable.

Situations Where ITR-U Is Not Allowed

ITR-U cannot be filed in the following cases:

Filing a nil or loss return.

Claiming or increasing a refund.

Reducing previously declared tax liability.

During assessment or reassessment proceedings.

For cases involving search, seizure, or surveys by tax authorities.

Important Deadlines for ITR-U

Here are the filing deadlines for various financial years:

FY 2020-21 (AY 2021-22): March 31, 2024

FY 2021-22 (AY 2022-23): March 31, 2025

FY 2022-23 (AY 2023-24): March 31, 2026

FY 2023-24 (AY 2024-25): March 31, 2027

Plan ahead to avoid missing these critical dates.

Who Can File ITR-U?

ITR-U is designed for taxpayers in the following scenarios:

Missed Returns: If you failed to file your original or belated return.

Omitted Income: If you discovered income not reported earlier.

Errors in Tax Head or Rate: If mistakes were made in choosing the income head or tax rate.

Adjustments: To reduce carried forward losses, unabsorbed depreciation, or specific tax credits (Section 115JB/115JC).

Note: Only one updated return can be filed for each Assessment Year.

Additional Tax Implications

Filing ITR-U involves extra tax payments, depending on when it is filed:

Within 12 months of the Assessment Year: 25% additional tax on due taxes, including interest.

Between 12-24 months: 50% additional tax on the due amount.

This penalty aims to encourage timely compliance.

How to File ITR-U: Step-by-Step Process

Step 1: Download the Utility

Visit the Income Tax e-filing portal and download the appropriate ITR Excel Utility for your Assessment Year.

Step 2: Prepare Updated ITR

Open the Excel Utility, fill in the updated details, and validate the file. Use the pre-fill option for existing data to streamline the process.

Generate the JSON file after completing the form.

Step 3: Calculate and Enter Tax Details

Input the payment details (BSR code, deposit date, serial number, etc.). Validate and finalize the file.

Step 4: Upload the JSON File

Log in to the e-filing portal and navigate to File Income Tax Return.

Select Section 139(8A) as the filing type and upload the validated JSON file.

Step 5: Pay Additional Taxes

Use Challan 280 to pay any additional tax liabilities, and include the payment details in the ITR-U.

Step 6: Complete and Verify

After uploading, verify the return using Aadhaar OTP, EVC, or a Digital Signature Certificate (if applicable).

Once submitted, no further changes can be made. Download the acknowledgment for your records.

Conclusion:

Using ITR-U to update past returns is a proactive step that can save significant future complications, ensuring compliance and peace of mind. Addressing errors early can save you from future penalties and unnecessary complications. This provision empowers taxpayers to make things right on their terms—before any notice arrives.

Disclaimer: Aim of this article is to give basic knowledge about the topic to people who are not in touch with Indian tax norms. When anybody is dealing with these kinds of cases practically, he shall consider all relevant provisions of all applicable Laws like FEMA/Income Tax/RBI /Companies Act etc.

If you have any further questions or need assistance, feel free to reach out to us at [email protected] or [email protected], or contact us via call/WhatsApp at +91 9910075924.

Stay Updated, Stay Compliant!

0 notes

Text

Income Tax Refund - How To Check Income Tax Refund Status For FY 2023-24 (AY 2024-25)?

Missed the ITR deadline? Don't worry! You can still file your Income Tax Return before December 31st, 2024, with a belated return. Need help? Contact us, Taxring experts, and we'll guide you through the process. Avoid penalties and file your belated return with ease. Reach out to us today!

What is an Income Tax Refund?

An income tax refund is a reimbursement from the government when you’ve overpaid your taxes during a financial year. This excess amount is returned to you after the tax authorities review your payments and liabilities.

For example, if a taxpayer pays Rs. 15,000 in taxes for the fiscal year 2023-2024 but has an actual tax burden of just Rs. 10,000, the Income Tax Department will reimburse Rs. 5,000 to the taxpayer. After filing and validating the income tax return, the department will start processing it. Once the return has been processed, the refund is typically credited to the taxpayer's bank account within four to five weeks.

How Does an Income Tax Refund Work?

1. Overpayment:Sometimes, taxpayers end up paying more tax than required through mechanisms such as: - Tax Deducted at Source (TDS) - Advance Tax Payments - Self-Assessment Tax

2. Filing Your Return: When you file your income tax return (ITR), you report your total income, deductions, and the taxes you've already paid.

3. Assessment:The tax authorities then assess your return to determine your actual tax liability. This includes reviewing your claims for deductions, exemptions, and tax credits.

4. Refund Calculation: If the tax authorities determine that your actual tax liability is lower than what you’ve already paid, the excess amount is calculated as your refund.

5. Receiving the Refund:Once your return is processed and approved, the excess amount is refunded to you. Note:To receive your income tax refund, you must complete the e-filing of your return. Ensure that all details are accurately filled out to avoid delays in processing.

If you've paid more taxes than you owe, you can request a refund for the excess amount. To track your refund status, simply use the Income Tax Department's online facility.

Here’s how:

1. Check Your Refund Status: Enter your PAN (Permanent Account Number) and the Assessment Year on the official portal to see the progress of your refund.

2. Refund Timeline: Refunds are usually processed within 4-5 weeks after e-verifying your return.

3. If Delayed:

- Review Your Return: Log in to the e-filing portal, go to "e-File" > "Income Tax Returns" > View Filed Returns to check for discrepancies.

- Check Your Email:Look for notifications from the Income Tax Department regarding your refund status.

- Track Your Refund:Use the online tools provided to monitor your refund progress.

How to Claim Your Income Tax Refund

1. File Your Income Tax Return:Submit your return with details of your income, deductions, and taxes paid.

2. Refund Calculation:The refund amount you’re eligible for will be automatically calculated and shown in your return.

Follow these steps to ensure you receive the refund you're due!

To receive an income tax refund, you must complete the e-filing process. Make sure you e-file this year to receive your tax refund sooner.

How to Easily Calculate Your Income Tax Refund

If you’ve paid more tax than you actually owe, you can get the extra amount back as a refund. Here’s a simple way to figure it out:

Refund Calculation:

Refund = Taxes Paid – Tax Liability

Steps to Calculate Your Refund:

1. Add Up Your Taxes Paid: This includes Advance Tax, TDS (Tax Deducted at Source), TCS (Tax Collected at Source), and Self-Assessment Tax.

2. Find Your Tax Liability:This is the total tax you actually owe for the year.

3. Subtract Your Tax Liability from Taxes Paid:This will give you the amount of your refund.

Example:

Let’s say Mr. Gupta paid ₹3,00,000 as advance tax. At the end of the year, he finds out his total tax liability is only ₹2,00,000. Here’s how to calculate his refund:

₹3,00,000 (Taxes Paid) - ₹2,00,000 (Tax Liability) = ₹1,00,000 (Refund)

What To Do Next:

File your Income Tax Return (ITR). The tax department will check your details, and if everything is correct, they’ll send the ₹1,00,000 refund to your bank account.

It’s that simple! Get started and claim your refund today!

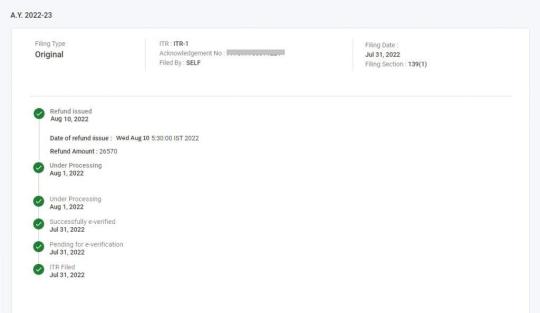

How can I Check My Income tax Refund Status for 2024-25?

1. Use the Income Tax Portal.

Step 1: Access the income tax portal and sign in to your account.

Step 2: Click on 'e-File', choose 'Income Tax Returns' and then select ‘View Filed Returns’

Step 3: You can see the status of your current and past income tax returns.

Step 4: Click on 'View details,' and you'll see the status of your income tax refund, as shown in the picture below.

2. Through NSDL Portal

Step 1: Visit the NSDL Portal

Step 2: Enter your PAN details, select the Assessment Year from the drop-down option for which tax refund is awaited and enter the Captcha Code

Step 3: Click ‘Proceed’ under the ‘Taxpayer Refund (PAN)’ option

You will be directed to a page that displays the ‘Refund Status’.

3. Through TRACES

Step 1: Log in to the income tax portal

Step 2: Click on ‘e-File’, select ‘Income Tax Returns’ and hit ‘View Form 26AS’

Step 3: You will be directed to the TDS Reconciliation Analysis and Correction Enabling System (TRACES) page, and Click on ‘View Tax Credit (Form 26AS/Annual tax statement) at the bottom of the page

Step 4: Select the Assessment Year from the drop-down menu, and select view as ‘text’

You are directed to a page that displays the details of the paid refund

Related Articles:

Old Vs New Tax regime

How to file ITR after the deadline

What are the reasons for Refund Failure?

Income tax Audit under section 44AB

What is a Belated Return & How to file a Belated Return ?

0 notes

Text

Learn how to file your ITR-1 (Sahaj) for Assessment Year 2023-24 in India. This comprehensive guide covers eligibility, documents needed, deductions, common errors, and tax-saving tips, ensuring a smooth and stress-free filing experience.

0 notes

Text

E-filing your Income Tax Return (ITR) for FY 2023-24 (AY 2024-25) has become easier than ever! This comprehensive guide will walk you through the step-by-step process of filing your ITR online. Learn about the benefits of filing on time, understand the required documents, and confidently navigate the Income Tax Department portal.

1 note

·

View note

Video

youtube

ITR-1 Filing FY 2024-25|Salaried Employees के लिए पूरी जानकारी!Form 16 स...

ITR-1 Filing FY 2024-25|Salaried Employees के लिए पूरी जानकारी!Form 16 से ITR-1 कैसे भरें? #incometax #cadeveshthakur #itr1online @cadeveshthakur 📄 ITR-1 Filing FY 2024-25 | Step-by-Step Online Guide in Hindi | CA Devesh Thakur 🔴 इस वीडियो में जानिए ITR-1 कैसे भरें Online Mode में – आसान भाषा में पूरा प्रोसेस Welcome to CADeveshThakur! इस वीडियो में मैंने विस्तार से बताया है कि Financial Year 2024-25 के लिए ITR-1 (Sahaj) फॉर्म को Income Tax Portal पर ऑनलाइन मोड में कैसे सही तरीके से भरा जाए। 🔍 इस वीडियो में कवर किया गया है: ✅ कौन-कौन ITR-1 भर सकता है (Eligibility Criteria) ✅ किन्हें ITR-1 नहीं भरना चाहिए (Ineligible Cases) ✅ Old vs New Tax Regime के तहत मिलने वाली मुख्य Deductions & Exemptions ✅ Multiple Form 16 के मामले में फॉर्म भरते समय किन बातों का रखें ध्यान ✅ Detailed walkthrough – income details, deduction claim, tax calculation & verification 📌 Bonus Tip: वीडियो के अंत में ITR filing से जुड़ी important tips भी शेयर की गई हैं! 📢 Stay Tuned! अगला वीडियो जल्द आने वाला है जिसमें बताएंगे – 👉 ITR-1 को Offline Mode (ITR Utility के ज़रिए) से कैसे फाइल करें – Don't miss it! 🎥 Playlists to Follow: https://www.youtube.com/playlist?list=PL1o9nc8dxF1R4FZlmK-5tIighYB0vxu3L Index 00:00 to 00:35 Introduction 00:36 to 20:10 how to file itr1 fy 24-25 online 20:11 to 47:58 deduction under old tax vs new tax regime 47:59 to 56:50 how to file itr1 ay 25-26 online 👉 ITR FY 2024-25 Series को ज़रूर फ़ॉलो करें जहाँ मिलेंगे सभी Latest और Simplified Videos – Tax Filing अब होगा आसान! 🙏 वीडियो पसंद आए तो Like करें, Share करें और Subscribe करें CADeveshThakur चैनल को, ताकि आप हमेशा अपडेट रहें Tax Filing और Financial Knowledge से जुड़ी जानकारी में। 🎥 Hello, lovely viewers! Welcome back to the @cadeveshthakur channel! 🎉 I’m thrilled to have you here, and I want to connect with you beyond YouTube. Let’s take our journey together to the next level! 😊 LinkedIn: https://www.linkedin.com/in/cadeveshthakur/ Instagram: https://www.instagram.com/cadeveshthakur/ Twitter: https://twitter.com/cadeveshthakur Facebook: https://www.facebook.com/cadevesh Whatsapp Group: https://whatsapp.com/channel/0029Va6GOVE9MF92Ylmo7e0L #cadeveshthakur https://cadeveshthakur.com/ Remember, our community is more than just a channel—it’s a family. Let’s connect, learn, and grow together! Hit that Subscribe button, tap the notification bell, and let’s spread financial wisdom one click at a time. 🚀 Remember, knowledge empowers us all! Let’s learn together and navigate the complex world of finance with curiosity and diligence. Thank you for being part of the cadeveshthakur community! 🙌 Disclaimer: The content shared on this channel is purely for educational purposes. As a Chartered Accountant, I strive to provide accurate and insightful information related to GST, income tax, accounting, and tax planning. However, please note that the content should not be considered as professional advice or a substitute for personalized consultation. ✨ Press the Bell Icon 🔔 so you never miss an update and get notified the moment I upload a new video packed with valuable information just for you! Your support helps me create more content to simplify complex topics and keep you informed. Thank you! 😊 LIVE ITR-1 Filing 2025-26 | ITR-1 Filing AY 2025-26 | ITR-1 New Schedules | ITR कैसे भरें? ITR Filing Online 2025-26 | ITR 1 Filing Online 2025-26 | How to File ITR 1 For AY 2025-26 File ITR - 1 For FY 2024-25, AY 2025-26 || With Offline Excel Utility and Get your TDS Refund ITR filing online 2025-26 | How to file ITR 1 online FY 2024-25(AY 2025-26) | ITR online kaise bhare itr filing online 2025-26,itr 1 filing online ay 2025-26,itr online kaise bhare 2025-26,income tax return filing online 2025-26,itr online filing fy 2024-25,income tax return filing process 2025-26 in hindi,how to file itr 1 online 2025-26,itr 1 kaise file kare,itr 1 for salaried,itr 1 for refund claim,income tax return online 2025-26,itr 1 online filing 2025-26,income tax,how to file itr 2025,how to claim tds refund,income tax e filing portal itr1 filing fy 2024 25,how to file itr1 online,itr 1 filing hindi,itr1 tutorial,itr1 for salaried person,income tax return 2024 25,form 16 itr1,itr1 with multiple form 16,itr 1 online filing hindi,itr 1 step by step guide,itr1 filing income tax portal,itr1 old vs new regime,itr1 deductions,itr 1 eligibility,ineligible for itr1,itr filing hindi,itr1 sahaj form,itr1 tax calculation,itr1 filing for salaried employees,itr1 with standard deduction,itr1 interest income,itr1 80c deductions,itr1 80d 80tta,itr1 80u,itr1 offline mode,itr1 utility filing,itr1 json utility,itr1 excel utility,itr filing playlist,itr fy 2024 25,itr series ca devesh thakur,income tax hindi,itr filing india,itr filing latest update,tax return 2024 25,tax filing step by step,form 16 kya hota hai

0 notes

Video

youtube

Who can file ITR-1 Sahaj? How to file ITR-1 Sahaj AY 2024-25?| Salary ITR AY 24-25|ITR with Form 16|

Dear Viewers, Income Tax Department has issued ITR-1 for AY 2024-25, in this video we have discussed about What is ITR-1? Who can file ITR-1 Sahaj for AY 2024-25 & How to file ITR-1 Sahaj for AY 2024-25 ITR-1 Sahaj AY 2024-25: Your Comprehensive Guide to Income Tax Filing in India" Description: 🔍 Unlock the secrets of ITR-1 Sahaj AY 2024-25 with our detailed YouTube video! 📊 If the world of income tax filing seems daunting, worry not – we've got you covered. 🌐 In this comprehensive guide, we delve deep into the intricacies of ITR-1 Sahaj for the assessment year 2024-25. 💼 Understand who is required to file ITR-1, and learn about the specific criteria that exclude certain individuals. Discover the significance of Form 16 and unravel the mysteries of gross total income, covering income from salaries, house property, and other sources. 🏡 Gain insights into the complexities of income from house property and explore various sources of income that may contribute to your overall financial picture. Navigate the maze of deductions under Chapter VI-A, ensuring you maximize your tax-saving opportunities. 📜 Learn about deduction u/s 87A and how it impacts your tax liability. Get a grip on the nuances of interest u/s 234A, 234B, and 234C, ensuring you stay on top of your financial responsibilities. ⏰ Stay informed about the due dates for filing your Indian income tax return, and understand the crucial steps involved in filing ITR-1 Sahaj for AY 2024-25. Our step-by-step guide will walk you through the entire process, demystifying the jargon and making tax filing a breeze. Whether you're a seasoned taxpayer or a first-timer, our video aims to empower you with the knowledge and confidence needed to navigate the Indian income tax landscape successfully. Subscribe now and embark on a journey to financial empowerment! 💡📈 #incometaxfiling #itr1 #itr1filing #AY202425 #incometaxreturn itr filing online 2024-25,itr 1 filing online 2024-25,itr-1 sahaj ay 2024-25,how to file itr-1 for ay 2024-25,how to file itr1,how to file itr for salary person,how to file itr online,how to file itr with form 16,how to file itr without form 16,itr-1 efiling,itr1 new tax regime,new itr1 form,income tax return,income tax return filing 2024-25 Follow me on: Pinterest: https://in.pinterest.com/cadevesht LinkedIn: https://www.linkedin.com/in/cadeveshthakur/ Instagram: https://www.instagram.com/cadeveshthakur/ Twitter: https://twitter.com/cadeveshthakur Tumblr: https://www.tumblr.com/blog/cadeveshthakur Youtube Channel: https://www.youtube.com/c/cadeveshthakur Reddit: https://www.reddit.com/user/cadeveshthakur E-Commerce Accounting: https://www.facebook.com/groups/ecommerceaccountingsolutions #cadeveshthakur

#youtube#itr1 ay 2024-25#how to file itr1#how to file itr1 ay 2024-25 online#how to file itr1 ay 2024-25#salary itr ay 2024-25#how to file itr1 ay 24-25#how to file itr1 fy 2023-24#how to pay challan#how to pay income tax challan#income tax

0 notes